DIS trade ideas

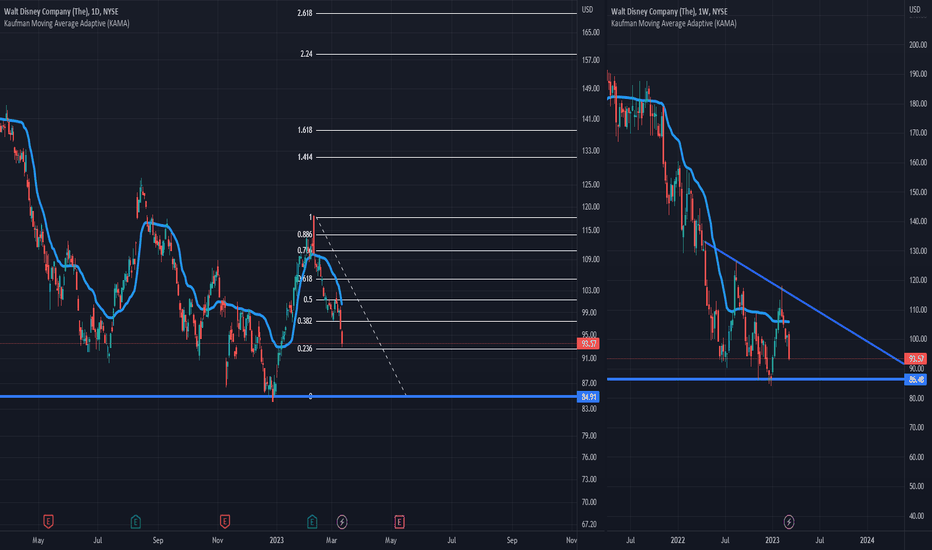

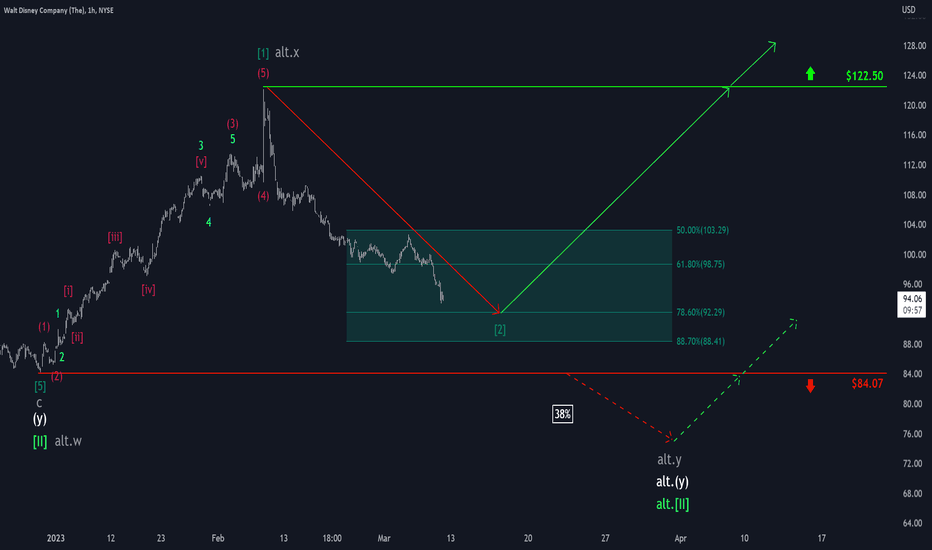

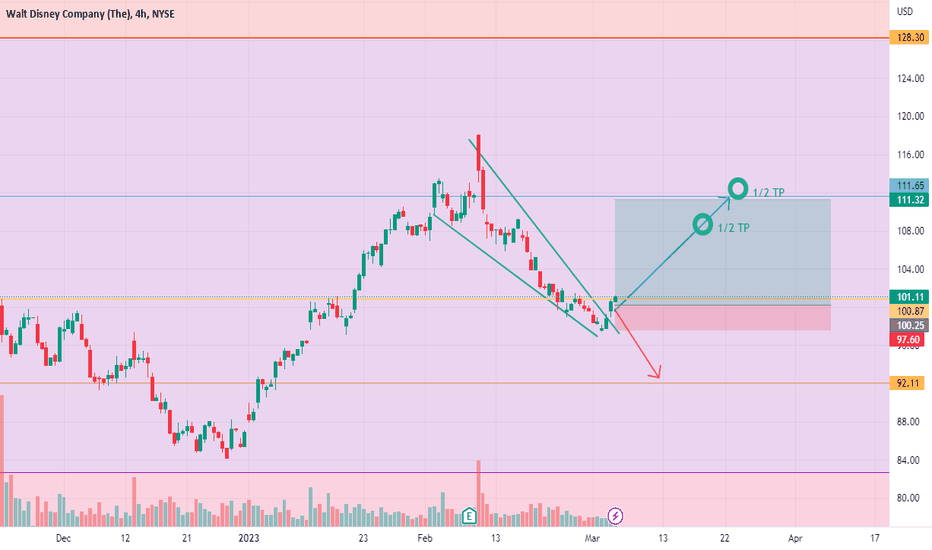

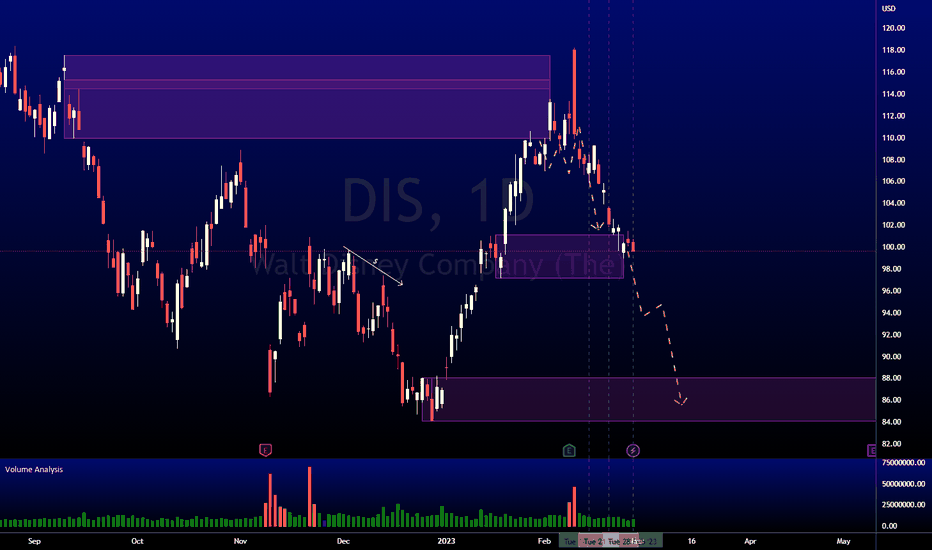

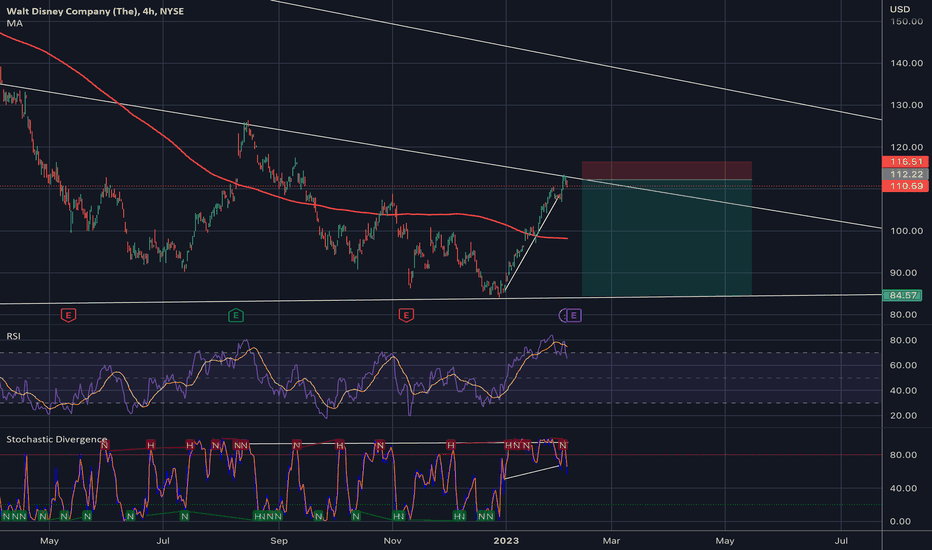

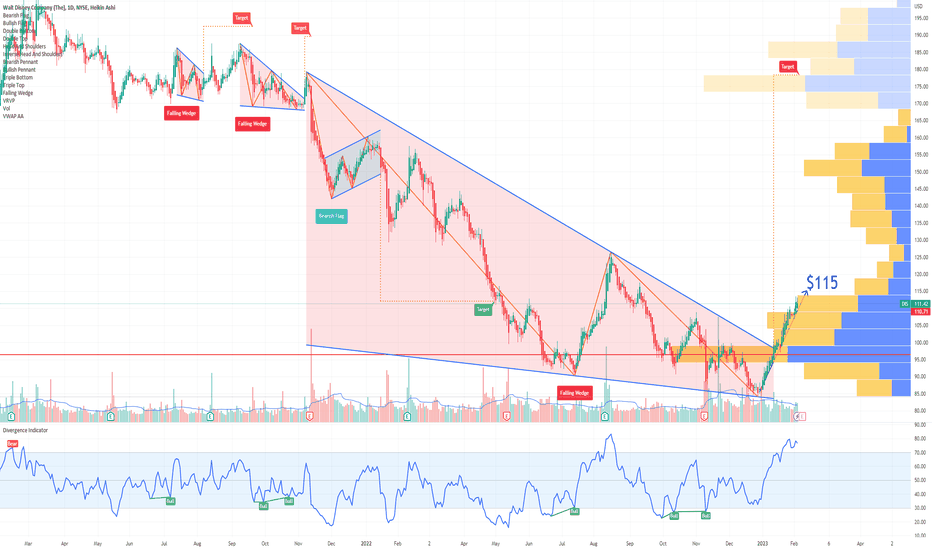

Disney: Fairy Tale Forest 🌲🌳🪄Disney is currently strolling through the dark green fairy tale forest between $103.29 and $88.41, where it should soon finish wave 2 in dark green. Afterward, the share should be enchanted enough to conjure a convincing upwards movement above the resistance at $122.50. There is a 38% chance, though, for Disney to leave the forest on the southern side, dropping below the support at $84.07. In that case, the course would develop a new low in the form of wave alt.II in light green first before starting the ascent.

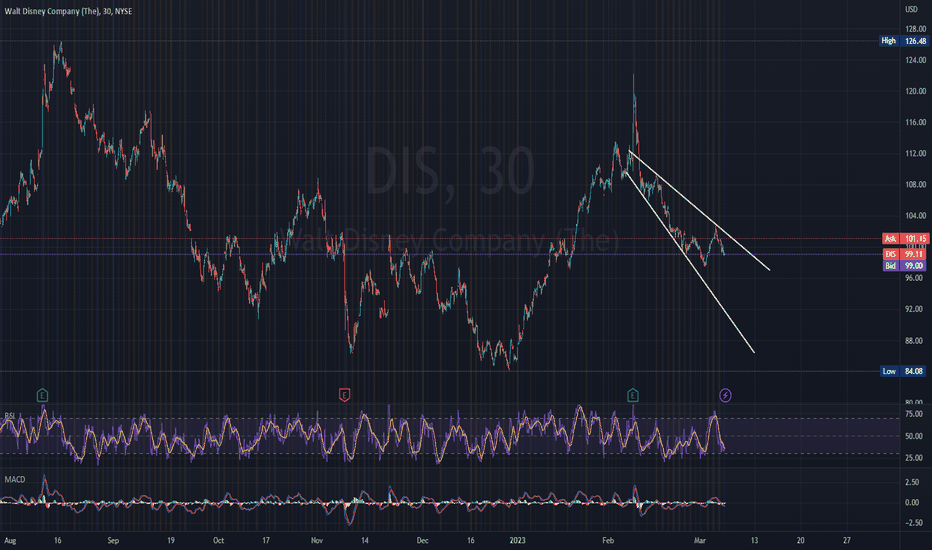

DISNEY - BEARISH CHANNELThe Walt Disney Company, one of the largest media corporations in the world, has been the subject of a wide variety of criticisms of its business practices, executives, and content. Currently having serious pressure in Florida from Governor De Santy's office, Disney might suffer a chain reaction of investors liquidating and limiting further losses. As politics drive the markets with the highest impact the asset might continue falling. The widening downtrend channel also confirms similar developments.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

An Introduction to Trading the Markets Part 3 - MANAGING YOUPart 3 of a 3 part Tutorial - Managing You. In this tutorial I help the beginner understand the different types of personality and to put in some tools to allow you to become a better trader. It's not an exact science, but if you can learn when to trade (and when not), if you learn how to manage the trade then you should have removed most of the 'noise' that can tempt the amateur to run their losses/cut their gains! But knowing your personality type can help enormously in generating consistent returns! Happy Trading

An Introduction to Trading the Markets Part 2 - MANAGING TRADESPart 2 of a 3 part Tutorial - Managing Trades. In this tutorial I help the beginner understand how to enter a trade; how to manage the trade and how to exit the trade. I cover stop buys and stop sells; stop losses and trailing stops. If you know when to trade (and when not), you'll learn how to run your gains whilst cutting your losses and generate consistent returns! Happy Trading

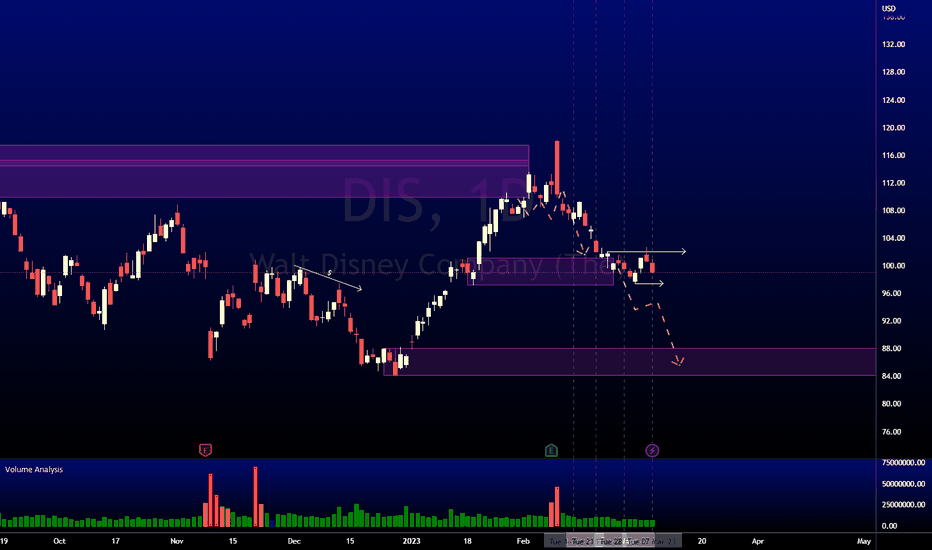

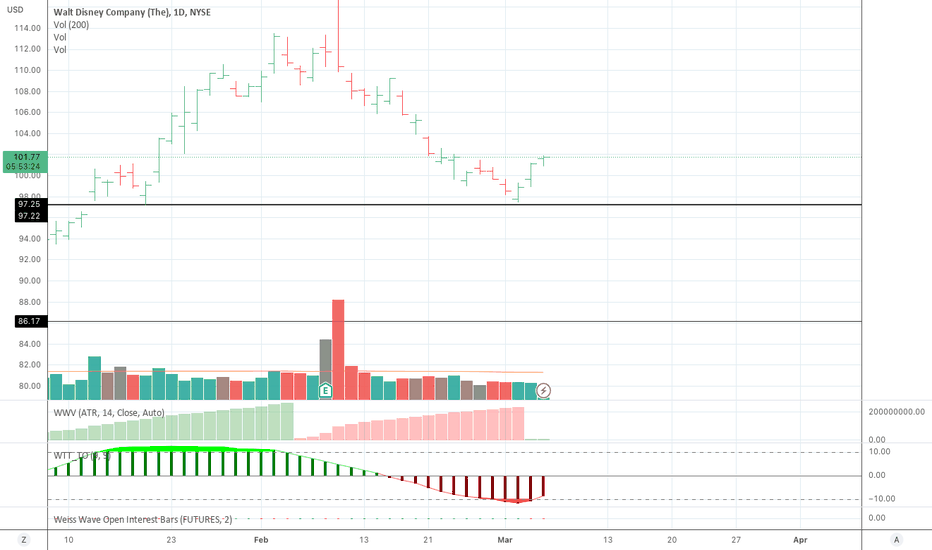

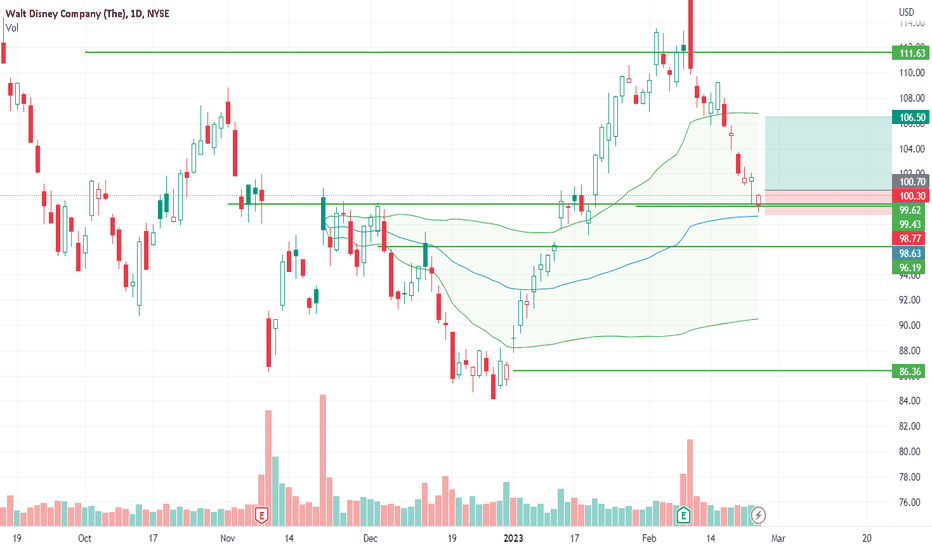

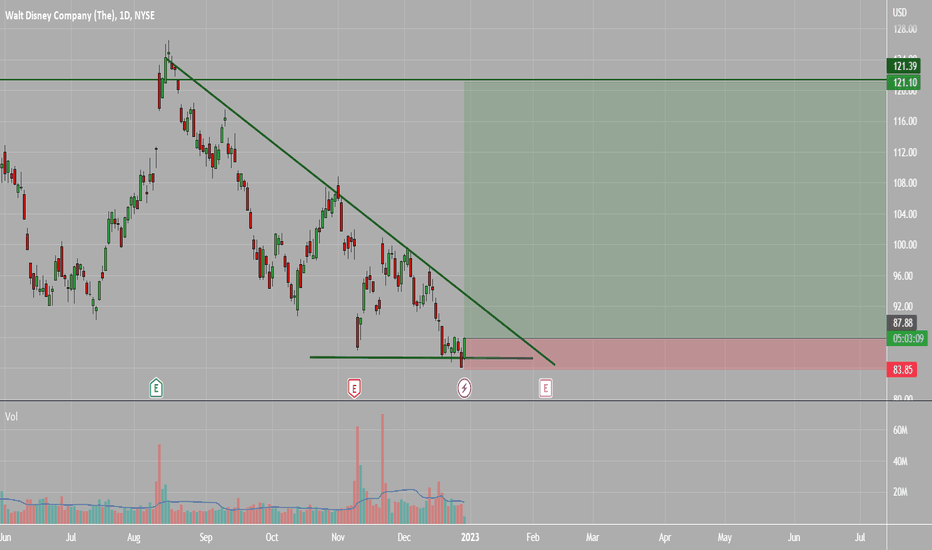

DISNEY BUYHi everyone, I hope this video helps explain my long trade in Disney. Support at 97.25 - so put in stop buy @99.30 with SL of 97.45 and Target of 110.15 with 1% equity at risk (so long of 456 shs). This isn't financial advice - please seek your own advice - just sharing my trade idea - safe trading!

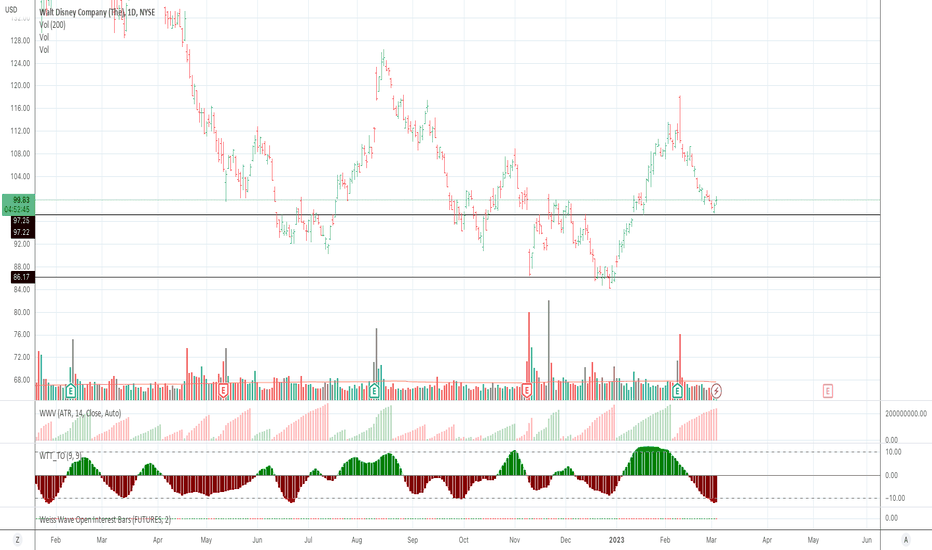

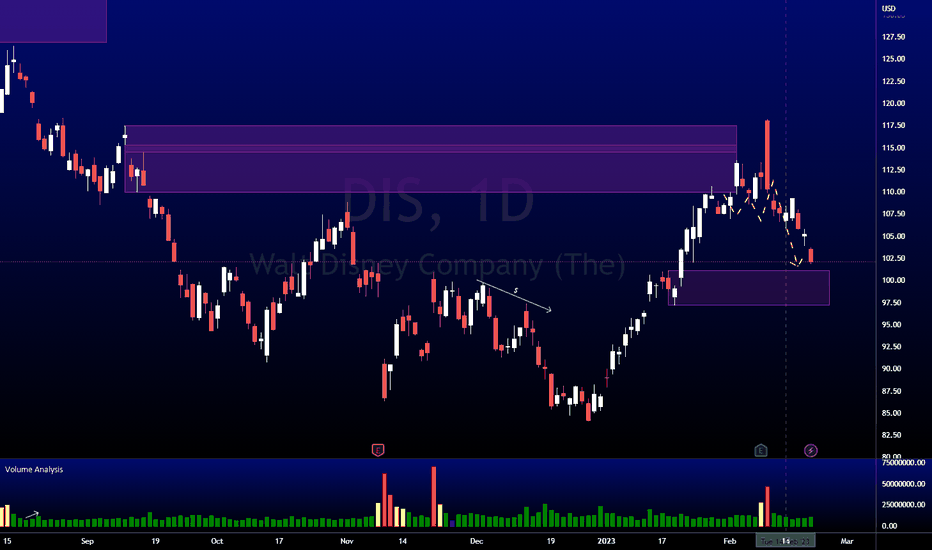

DIS AnalysisPrice playing out according to my analysis last week, giving us a -2.47% change in price. We get a small reaction at the bullish POI at 101.13, but price is unable to break market structure to the upside. I'm expecting price to continue lower, following the lower timeframe order flow. Potential target for this down move is the bullish POI at 88.07.

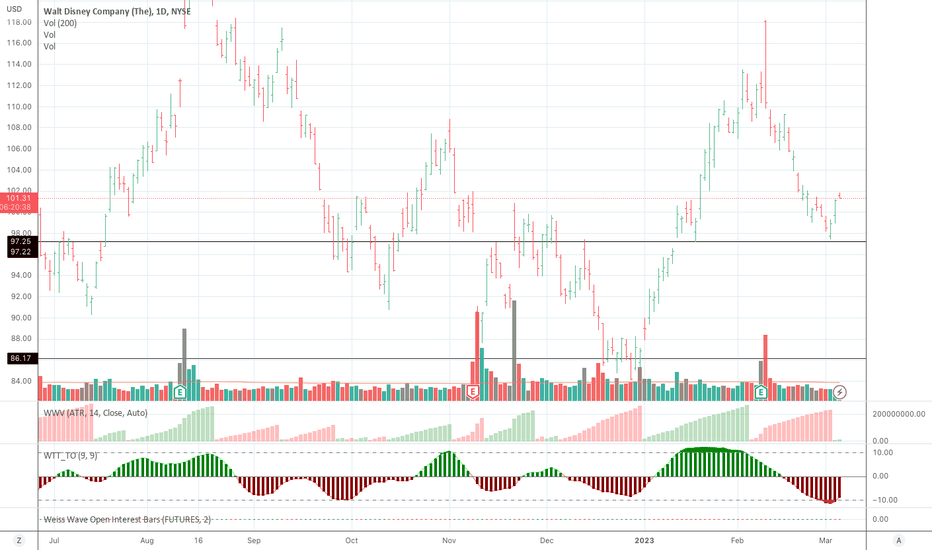

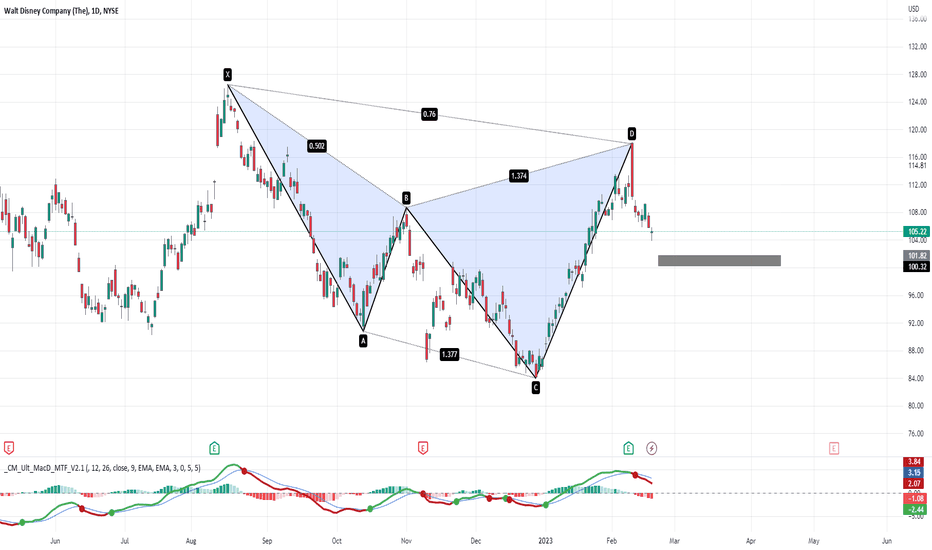

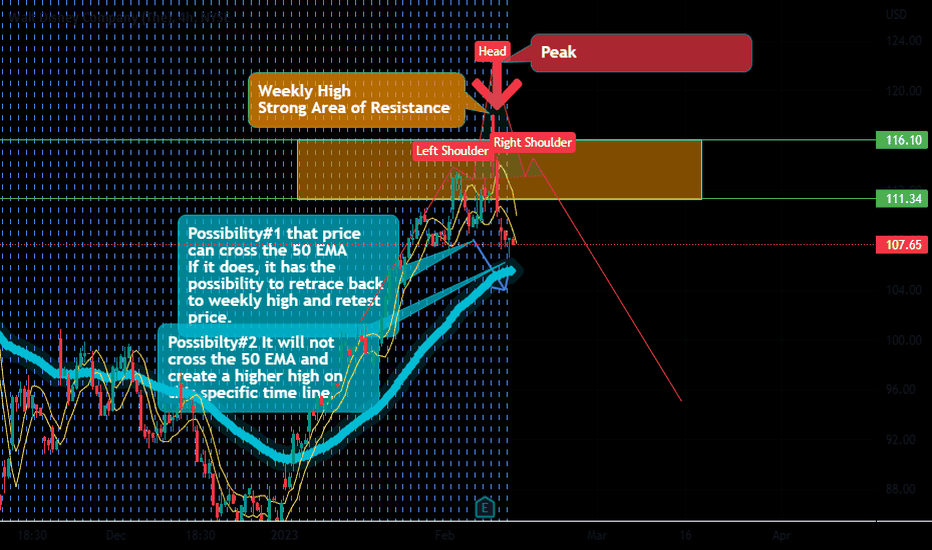

dis blow off top? | daily bear div presentdisney with a potential blow off top here. last 3 times we've tapped overbought, it's led to significant sell offs.

been in over bought territory since the 23rd. now have a second daily bear div present. expecting a pull back to daily rsi eq. $100 seems reasonable, but long trigger should be the rsi eq tap.

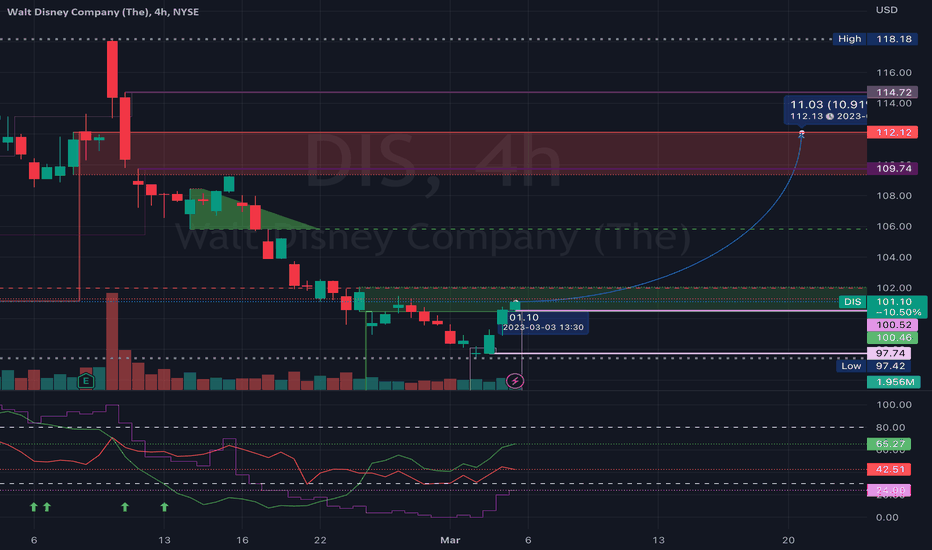

DIS MAR10 110/MAR3 114 DIAGONAL CALLBull Pull Back Set Up:

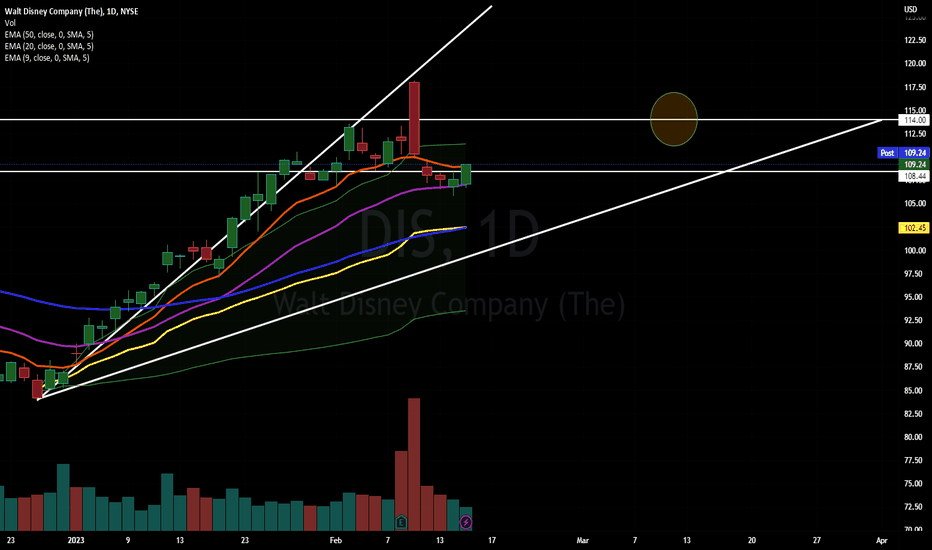

Disney made a new swing high on the 9th of this month and has since then pull backed to the 20 day with lower volume. 50 day is also rising and with the candlestick we had today, it triggered my entry.

Gonna give this 3 weeks to hit my target of 114. I'm thinking it's going to want to go test 113.50 again and possibly break through it.

So if it gets to 114 before the 3rd, I'll take off 50% of my position.

Come expiration date, if this trading at 114 or higher I'll close out the entire combo. If we are below 114 come the 3rd, I'll manage the 110 call.

If this falls lower, I'm set up for max loss risking only 2%.

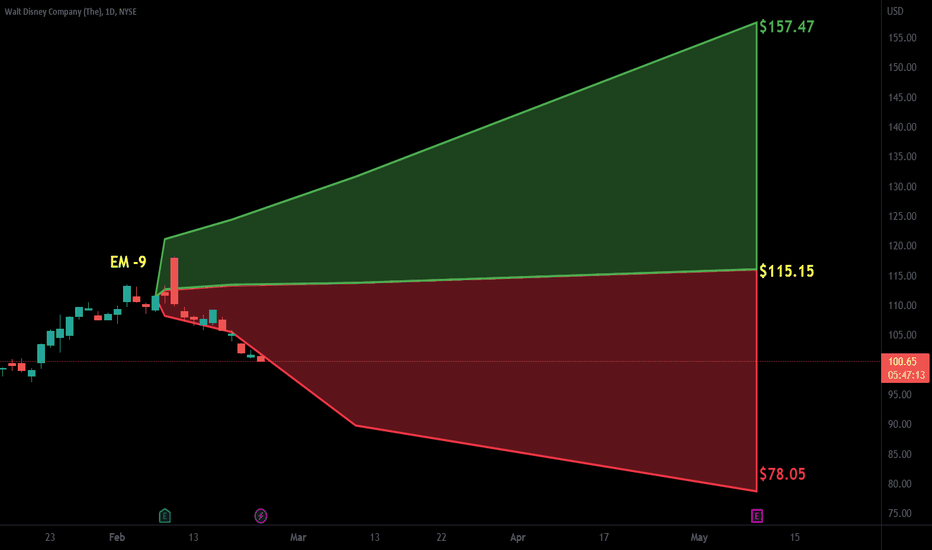

DIS Disney Options Ahead of EarningsLooking at theDIS Disney options chain ahead of earnings , I would buy the $115 strike price Calls with

2023-3-17 expiration date for about

$4.05 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

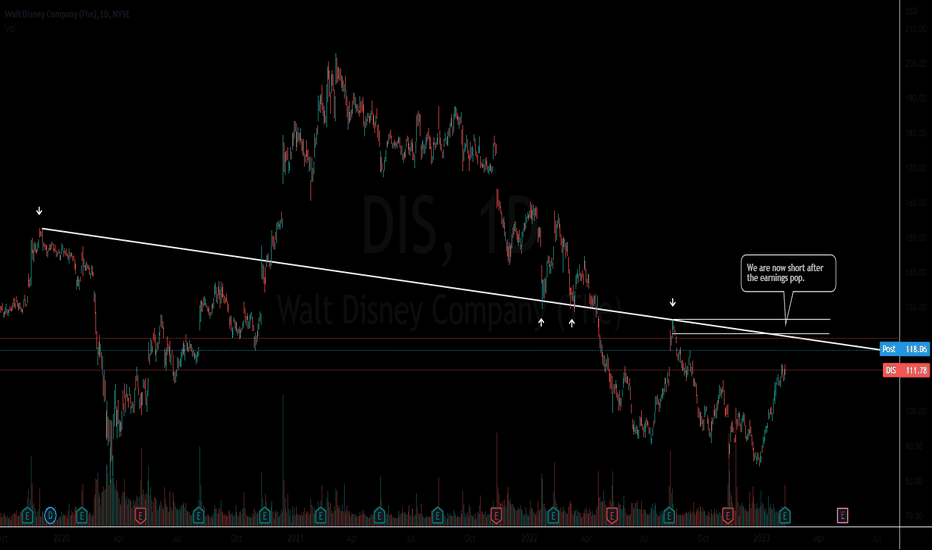

Disney pops on earningsDisney had a nice rally. Its the rally we have been waiting for.

Finally hitting and fulfilling our upside target we are now accumulating a swing short on Disney.

The level was hit in the post market session and has pulled off the highs nicely.

We telegraphed this trade to our subscribers and were already in the money.