DIS trade ideas

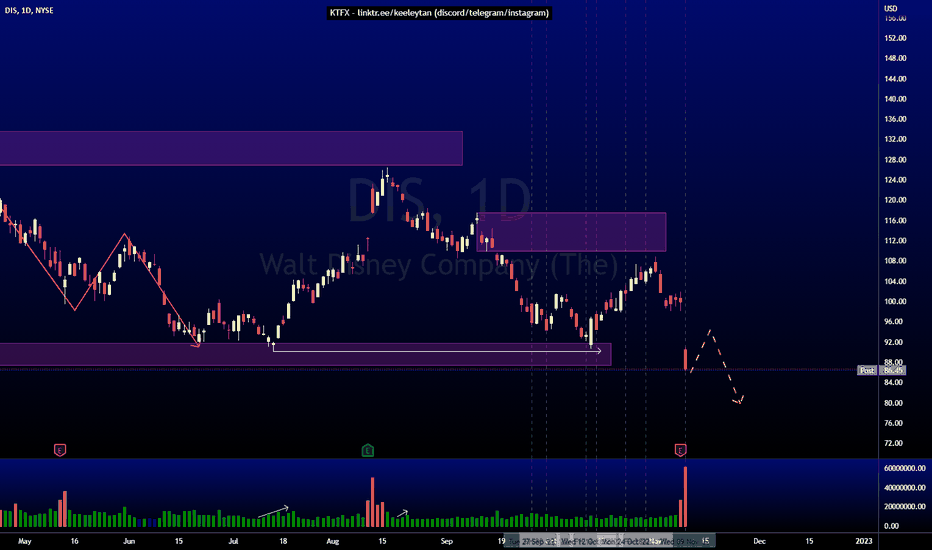

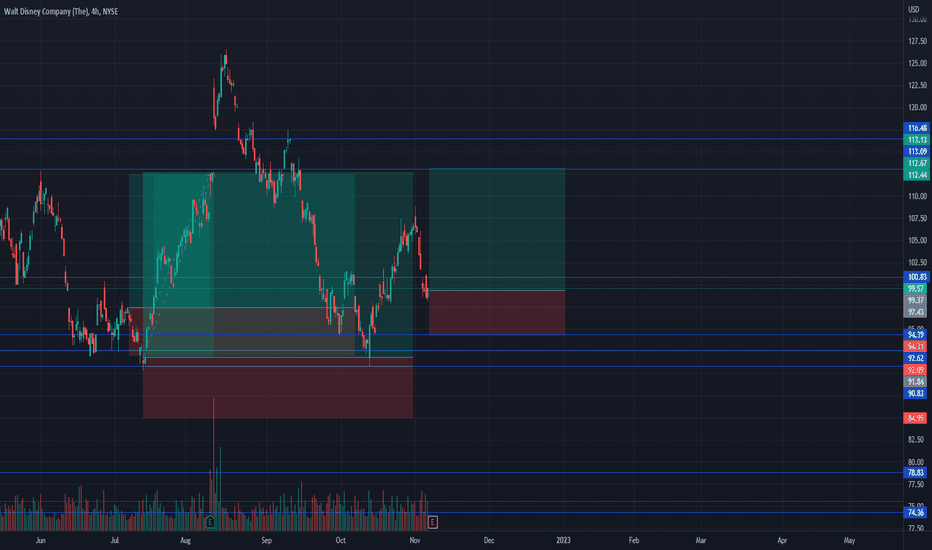

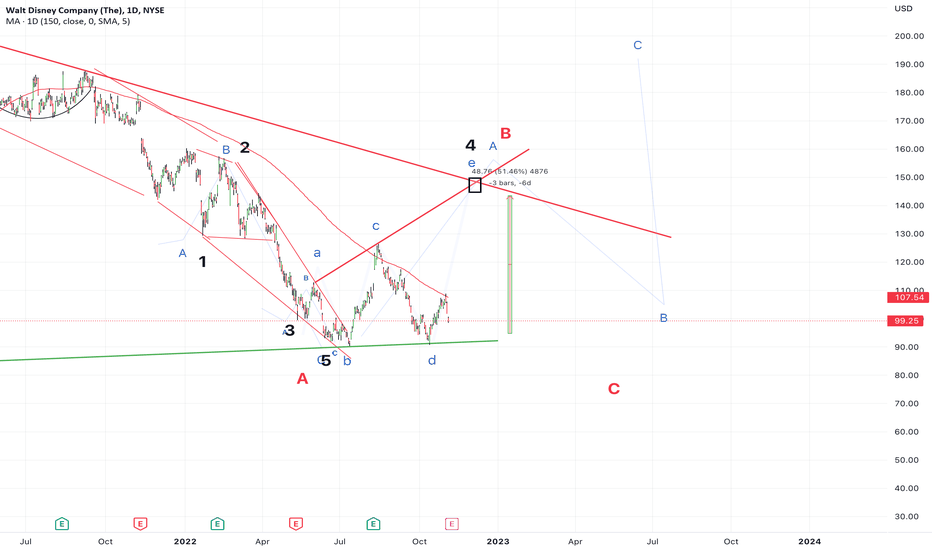

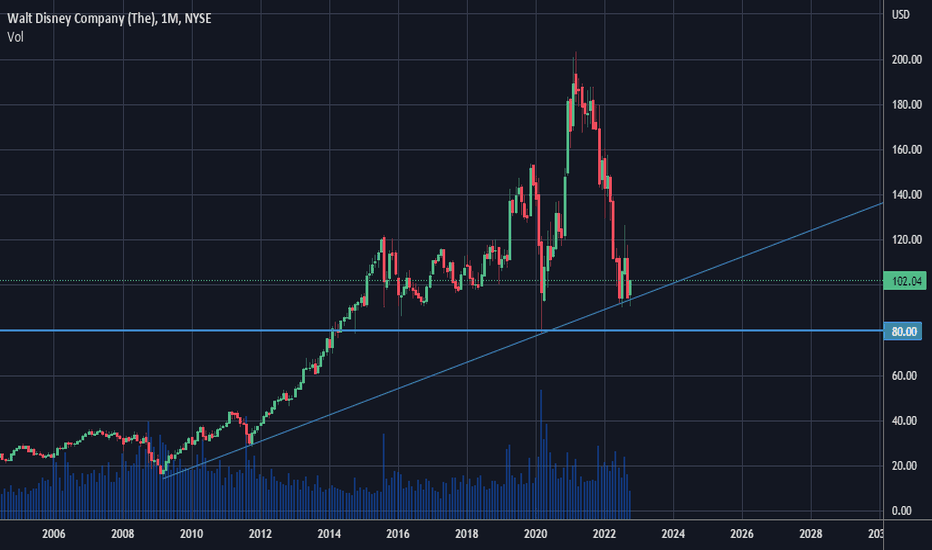

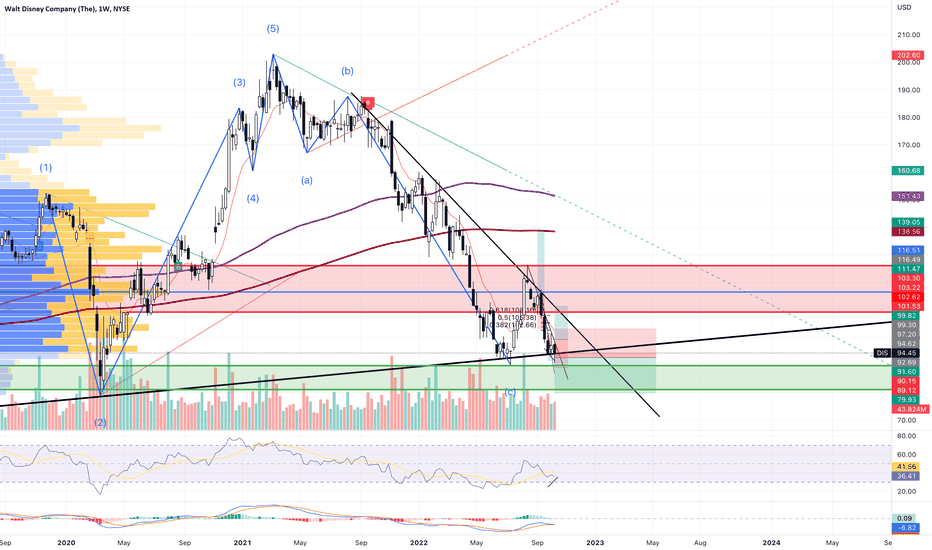

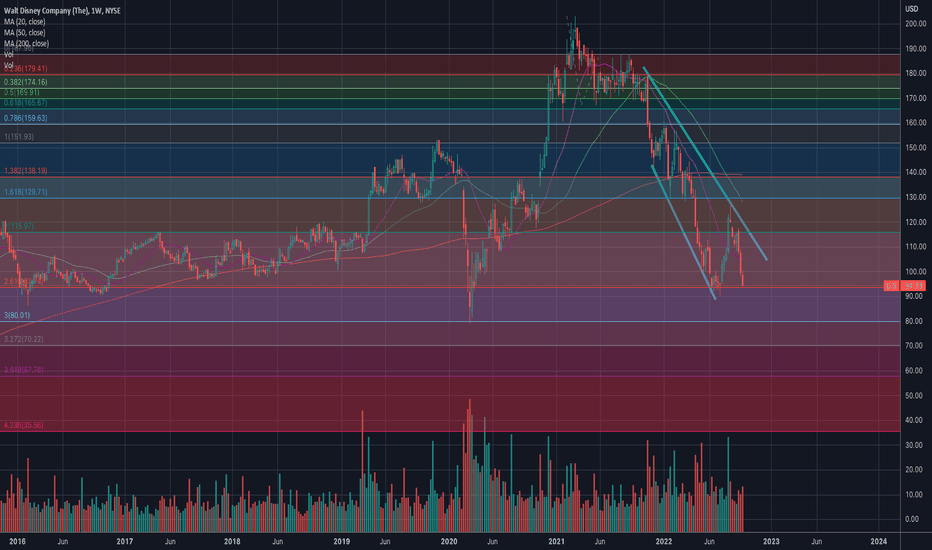

$DIS Is Disney Headed to the Low 80's?I'm open to anything here on $DIS I just went back to see where the next area of support might come into play... Looks to me to be the low $80's. Only time will tell. But, I'm thinking when it starts basing might be a good time to get a "value" stock. TBD. I'm not ready to buy just yet and it's too late to short for me. Ideas, not trading / investing advice.

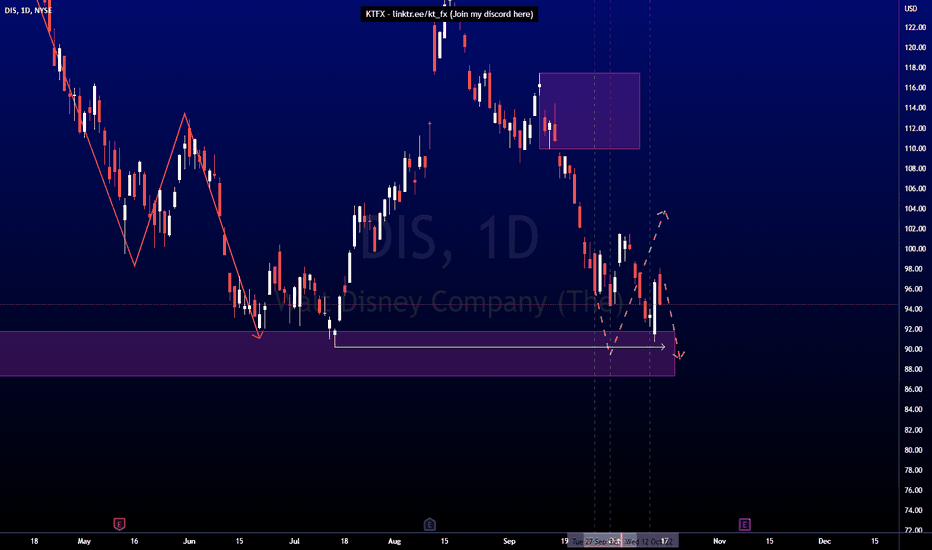

DIS - BEARISH SCENARIODisney`s Q4 report released yesterday was a little nightmare for the investors. The company reported EPS of $0.30, $0.29 worse than the analyst estimates of $0.59. Revenue for the quarter came in at $20.15B versus the consensus estimate of $21.38B.

One of the reasons for the worse results is the additional spending to grow their streaming services.

Although Disney+, reported 164.2 million subscribers in the fiscal fourth quarter, surpassing the estimates of 161 million. The streaming unit lost $1.5 billion during the period.

The next two price targets are:

$92 support level

$82 support level

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

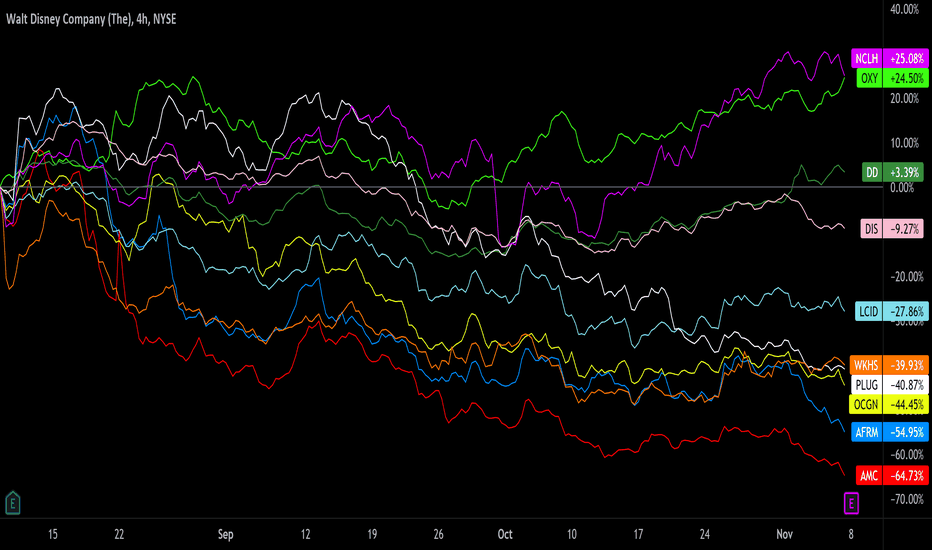

Earnings watch 11/8Earnings watch 11/8:

NCLH

OXY

DD

DIS

LCID

WKHS

PLUG

OCGN

AFRM

AMC

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com

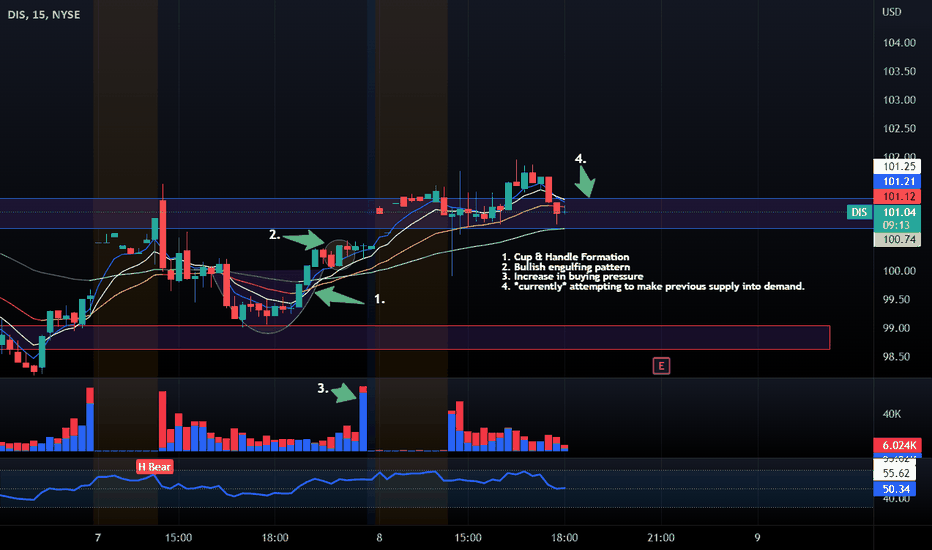

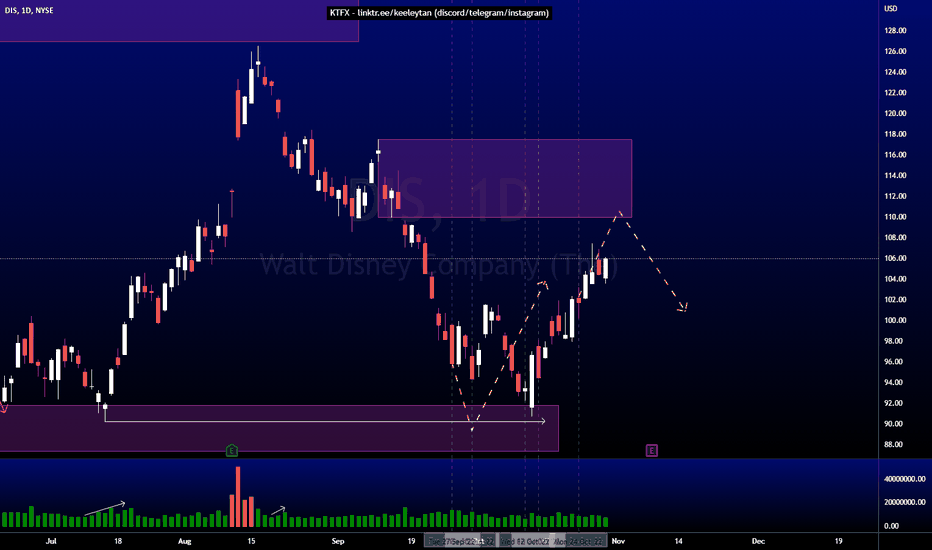

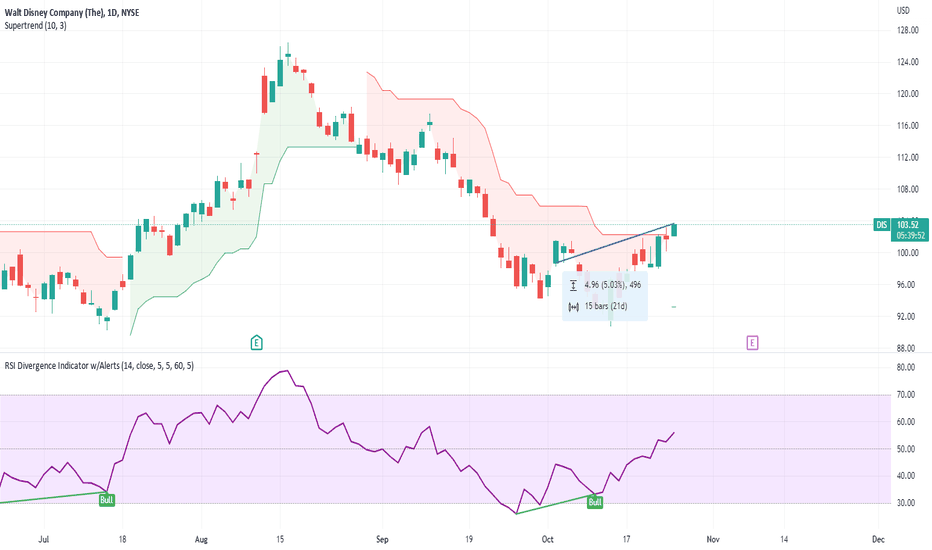

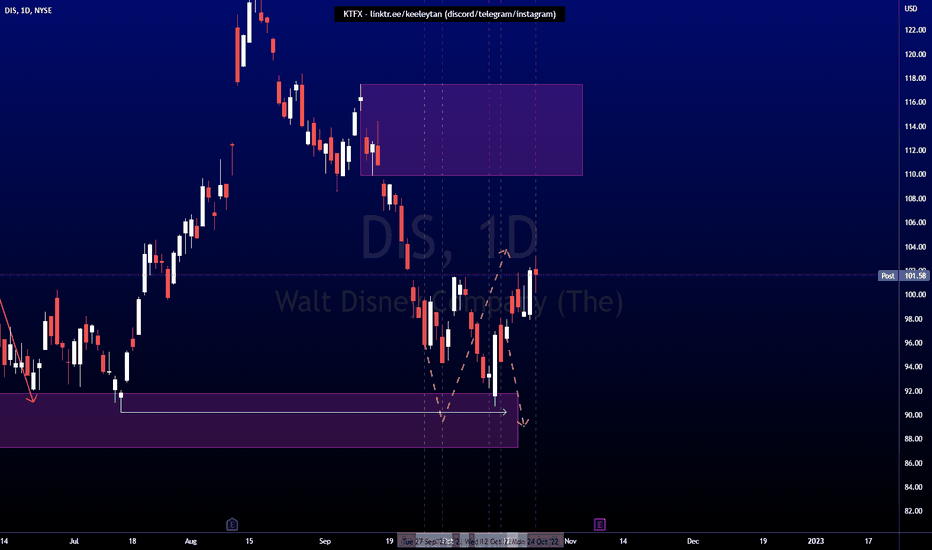

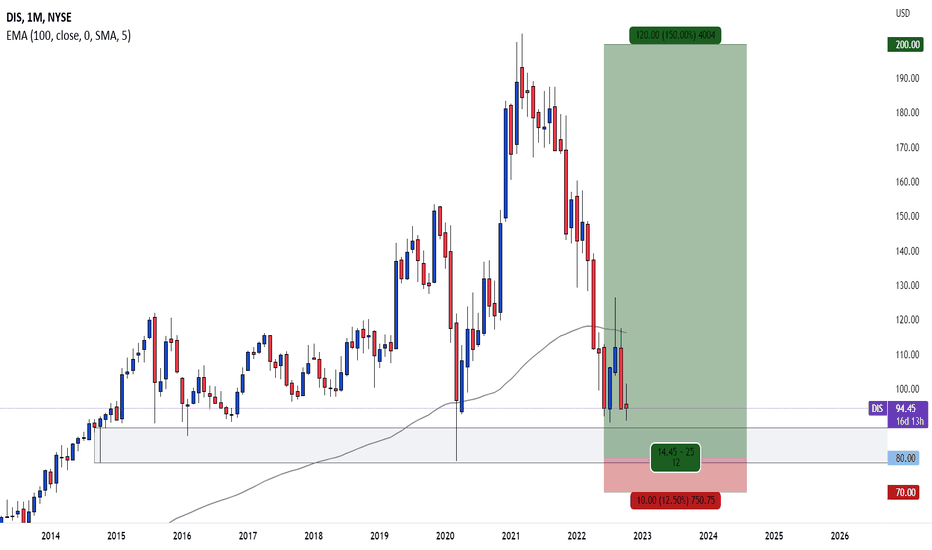

October Gainers (DIS, account up 1%)Fifth gainer in October is DIS . Holding period is 21 days (10/4/22-10/25/22). Account up 1%.

This year, my account is up 78.9%, average holding period is 13 days.

My trading method is mostly short term and is independent of market swings.

Will keep updating on my trades.

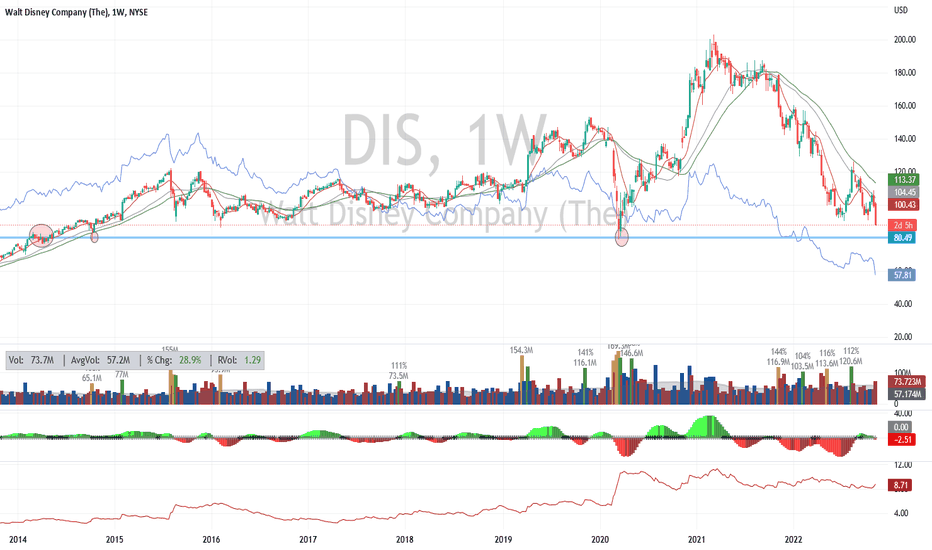

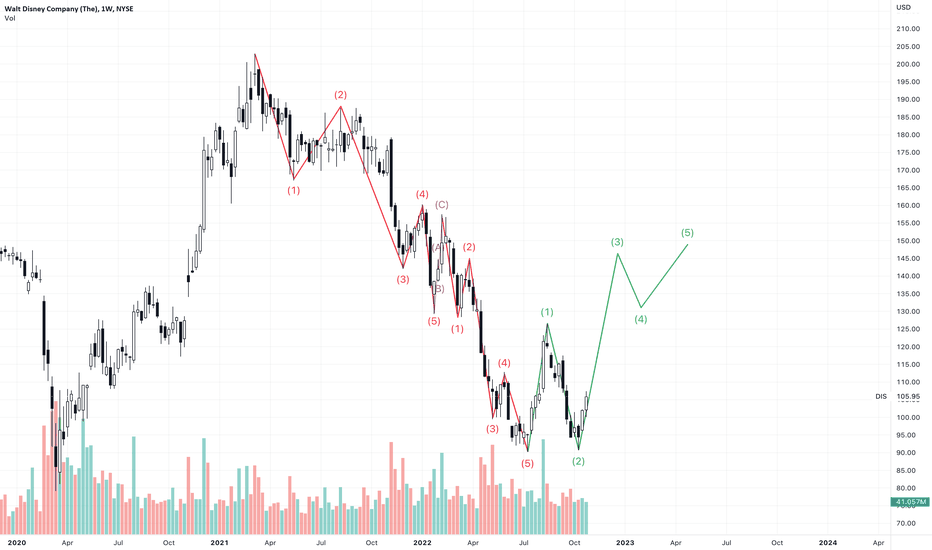

DIS weekly bullish hammer at a monthly buying zoneOrder BUY DIS NYSE Stop 99.30 LMT 99.30 will be automatically canceled at 20230401 01:00:00 EST

DIS bullish hammer at a monthly support buying zone maybe that's it for the downtrend except for we didn't have exhaustion volume / capitulation / panic event.

Quick countertrend 1.2R

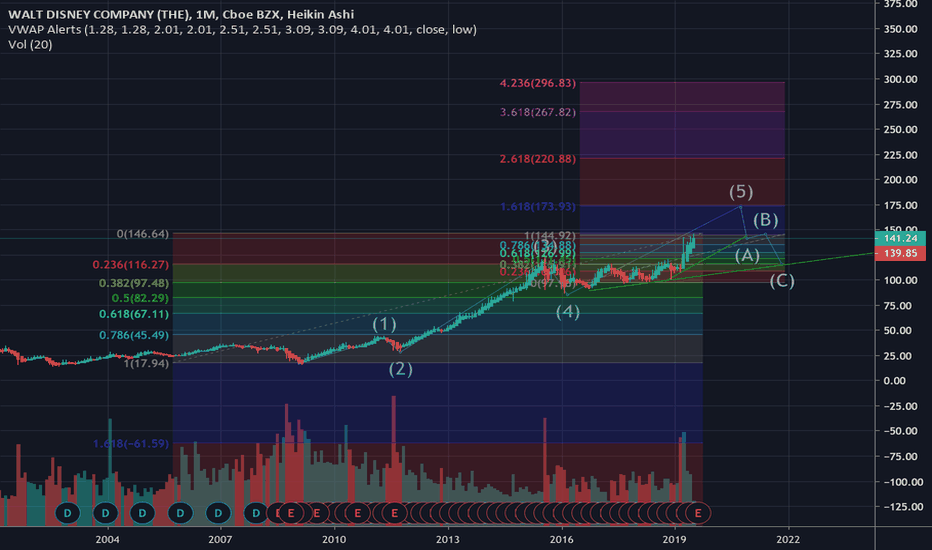

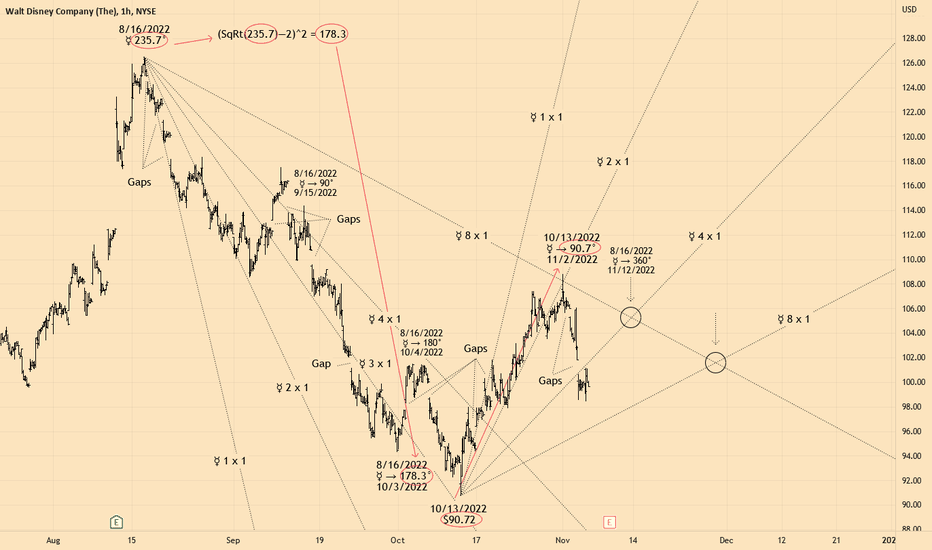

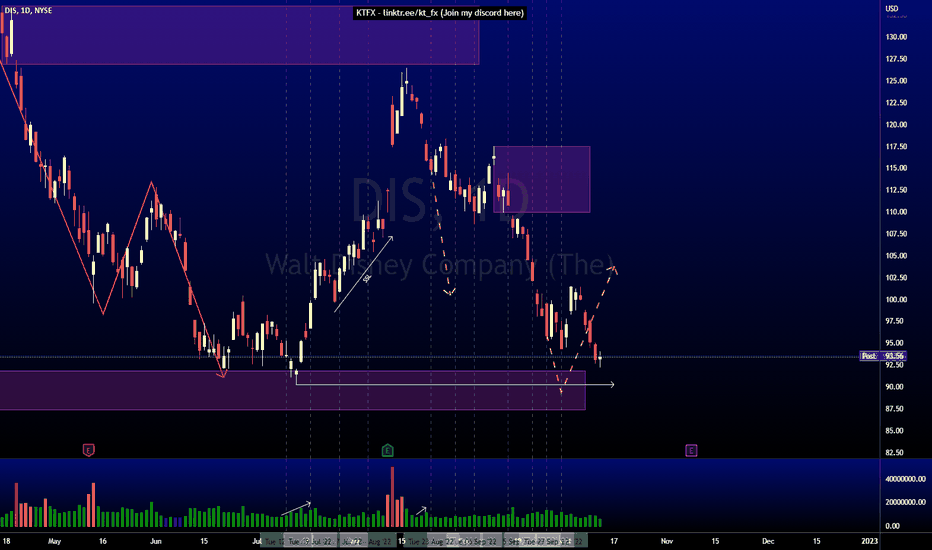

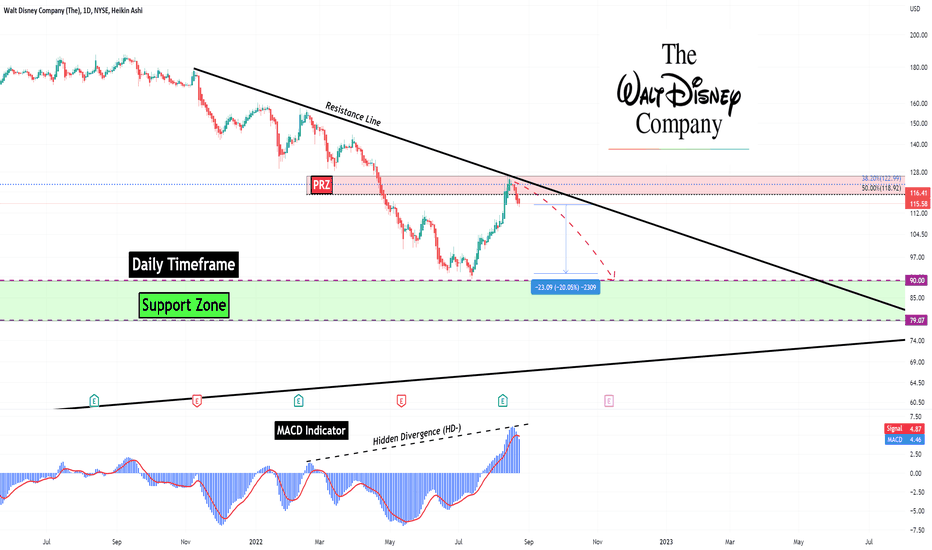

Walt Disney Company Analyze🐭 !!!The Walt Disney Company, commonly known as Disney, is an American multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California.

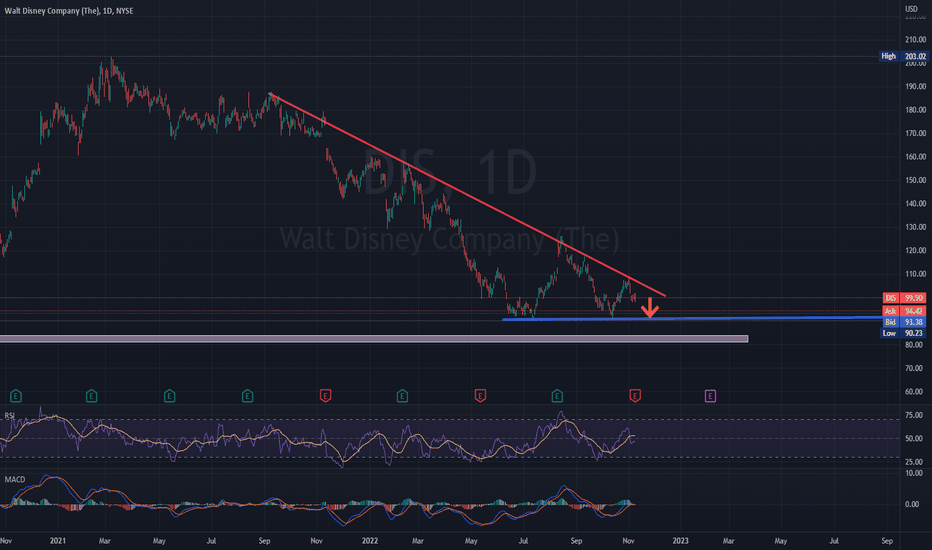

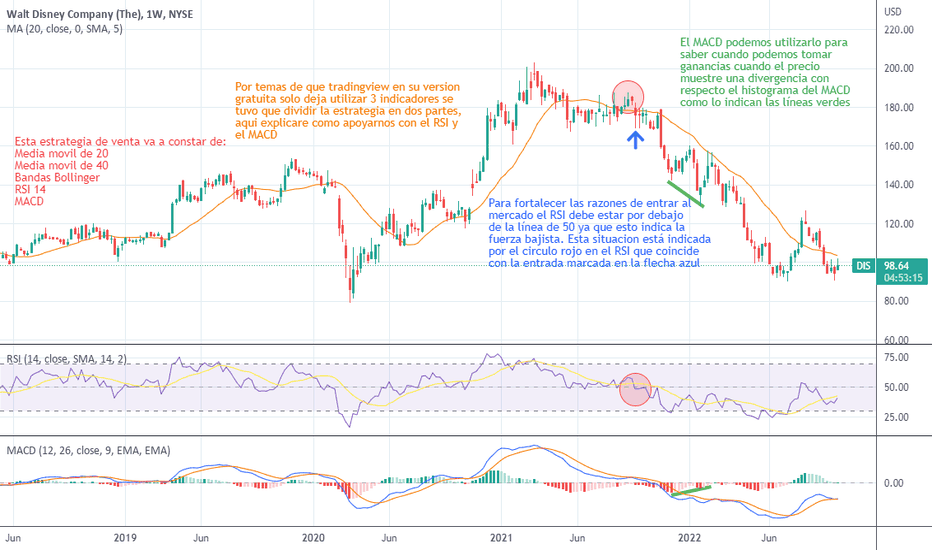

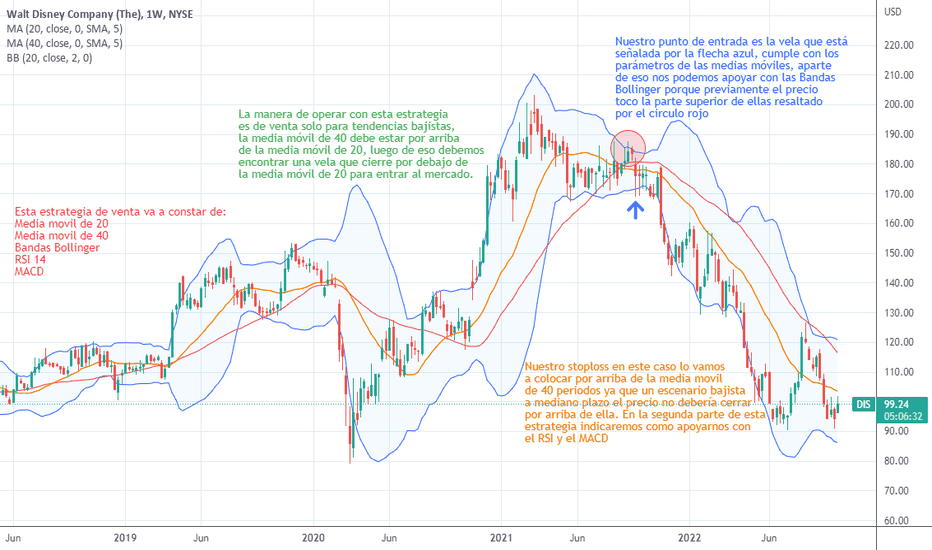

Walt Disney Company runs near the Resistance line and my PRZ(Price Reversal Zone).

Also, we can see Heavy Hidden Divergence(HD-) between Price and MACD Indicator.

I expect Walt Disney Company can lose ❗️20%❗️of its value.

Walt Disney Company Analyze (DISUSD), Daily Timeframe (Log Scale /Heikin Ashi)⏰.

Do not forget to put Stop loss for your positions (For every position that you want to open).

Please follow your strategy, this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

$DIS - At critical support $DIS is at critical support. If $93 breaks, $80 is possible which is pandemic low. RSI and Stochastic are in oversold territory.

If $93 support hold, it can bounce to $100 which will act as resistance.

Bearish target - $80

Bullish target - $100

Remember $80 is when parks were shut down and no one knew when they can reopen!

NOW, with all the parks opened and increased Dis+ subscribers, espn with all sports playing and soon betting option, are investors giving the same value as when the company had zero income during covid.

Negativity has become too extreme!

----------------------

Disclaimer: Not investment advice.

If you like this post, follow me and subscribe to my posts for more technical analysis charts (FREE).