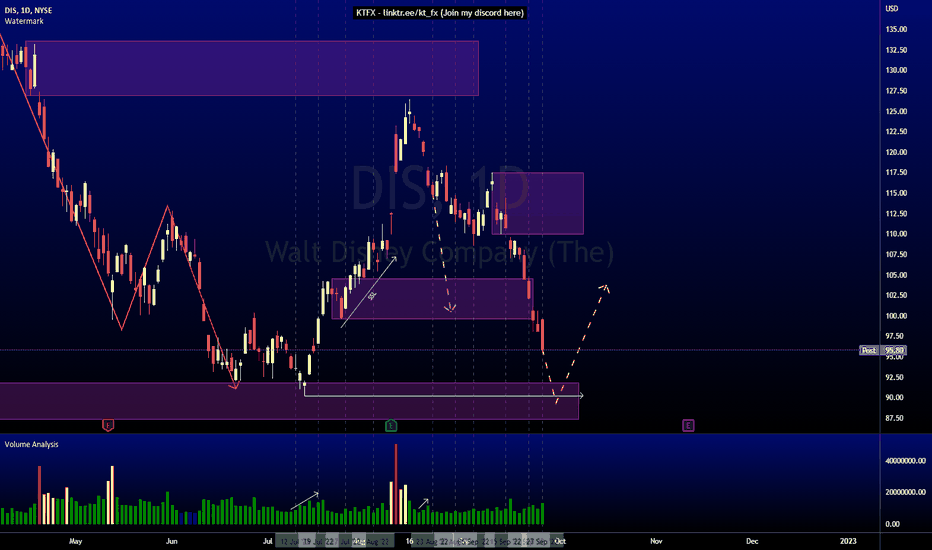

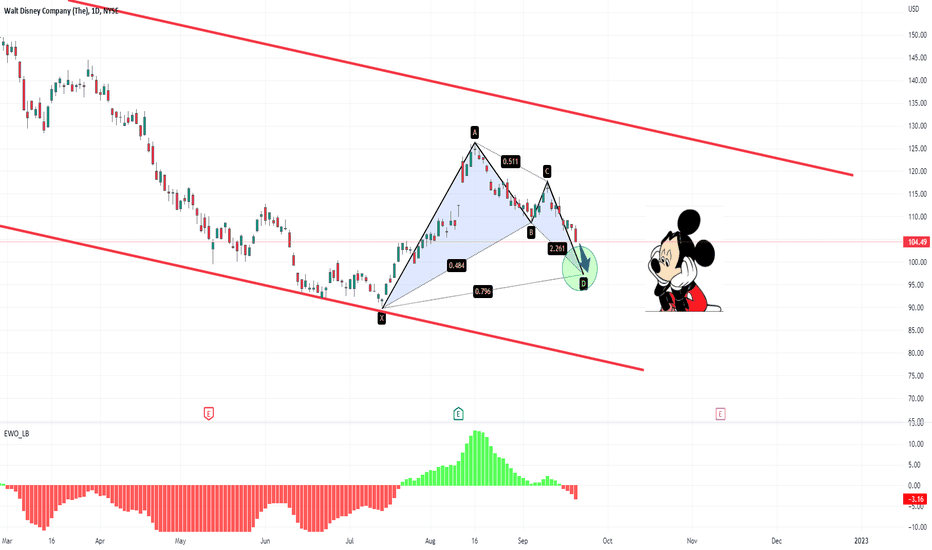

DIS AnalysisPrice did not play out as analyzed last week. I was expecting price to rally into the bearish POI at 109.88 before going lower. Price went lower without any mitigation. The bullish POI at 104.57 was invalidated straight away. Right now, the target for this down move should be a deeper mitigation of the bullish POI at 91.80, and potentially the lows at 90.23 before we see any bullish retracement.

DIS trade ideas

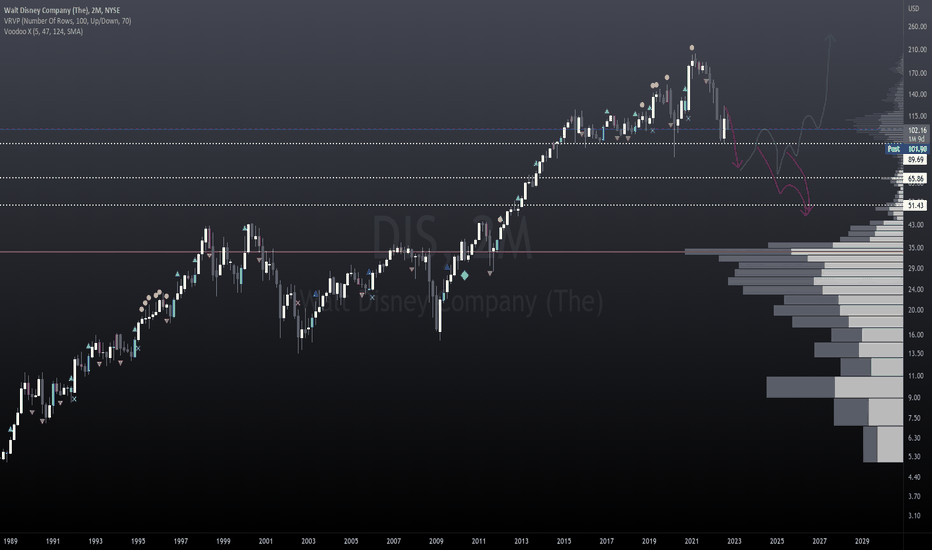

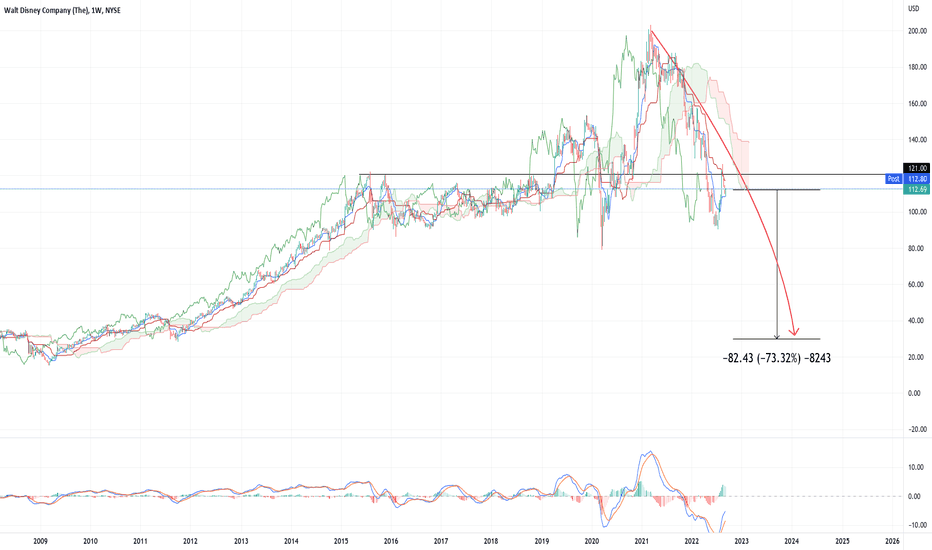

Good Chance of Disney Capitulation (fire sale!)Disney showing order absorption price structure at its major support zone on the 2-Month chart indicates a better than 50% chance of at least a bull-spring formation under the support or a markdown below it.

I'm certainly going to be setting limit buy orders around $70 and $50 a share to hold for the next few decades.

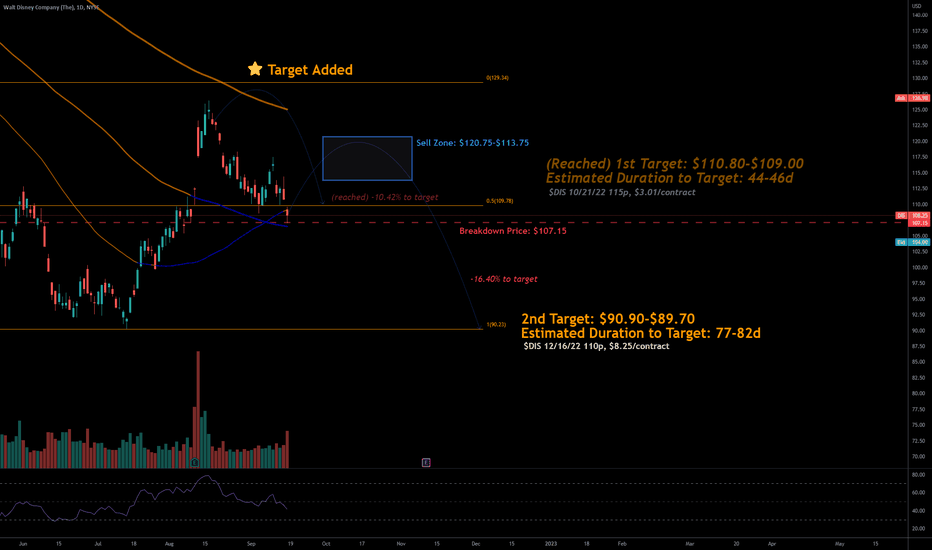

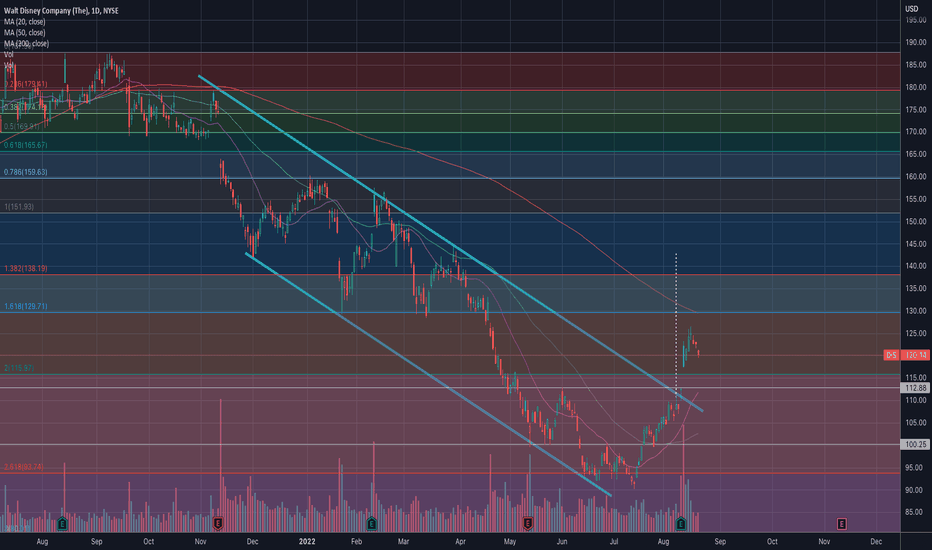

9/18/22 DISThe Walt Disney Company ( NYSE:DIS )

Sector: Consumer Services (Cable/Satellite TV)

Market Capitalization: $197.346B

Current Price: $108.25

Breakdown Price: $107.15

Sell Zone: $120.75-$113.75

Price Target: $90.90-$89.70 (2nd)

Estimated Duration to Target: 77-82d

Contract of Interest: $DIS 12/16/22 110p

Trade price as of publish date: $8.25/contract

DIS Buy signalDisney has come out on top from its competition with Netflix in the movie streaming industry. Q2 was a pleasant surprise for investors of Wall Street, and as the economy is recovering because of the large amounts of capital movement from Europe to the US, Q3 is likely to have a positive uplook. Retaliatory spending by consumers on theme parks and Disney+ subscriptions will push the price of the stock. Strong support at $100-$110, some resistance at $120. Suitable for short term investment. Wall street analysts show a Strong Buy.

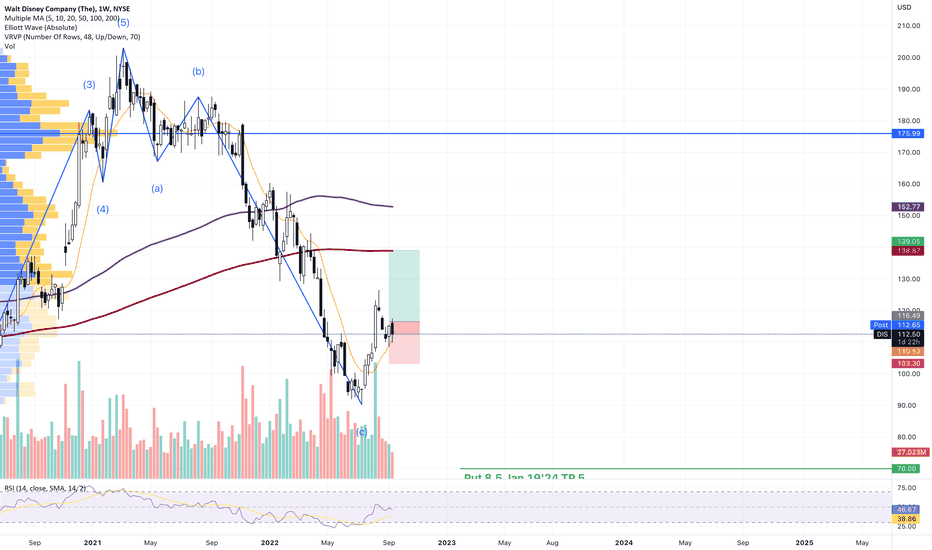

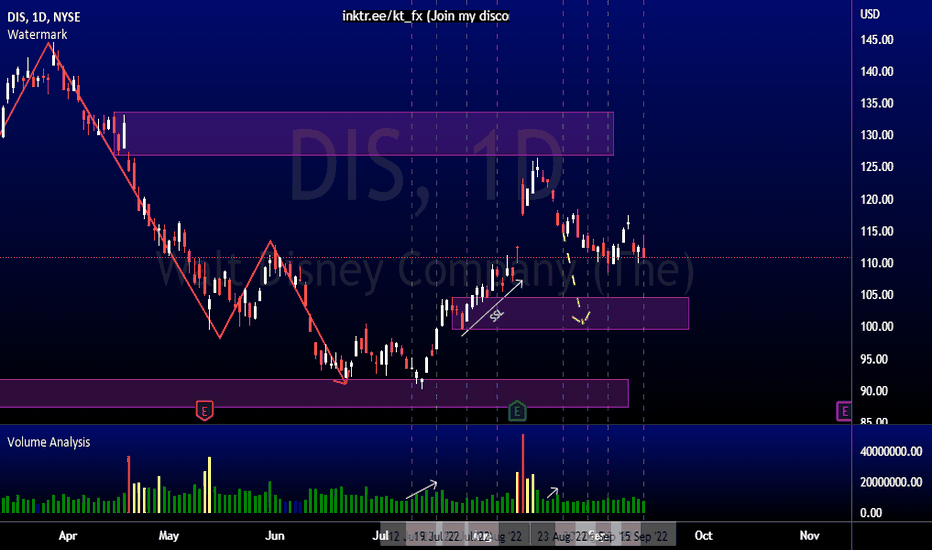

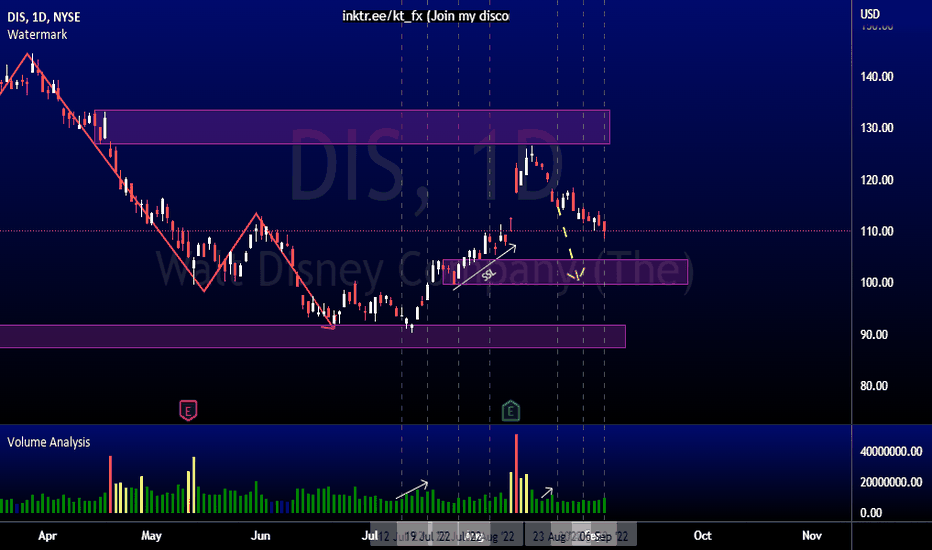

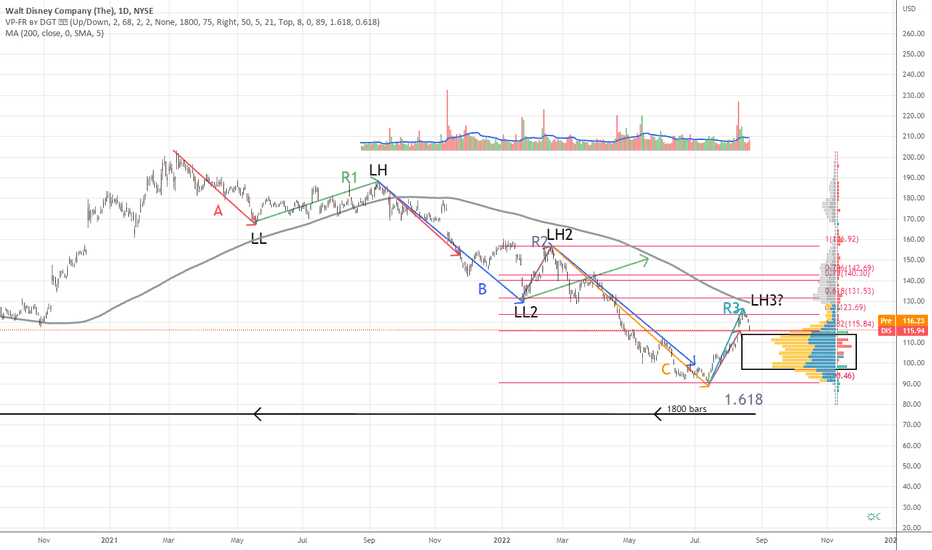

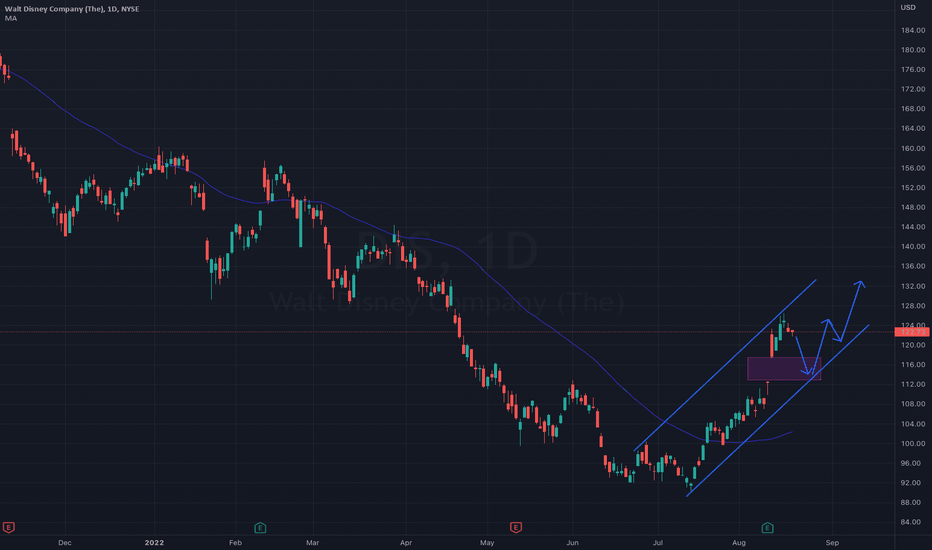

Where to find Disney Reversal to Long?Disney. We are exposed to Disney almost instantly we are born into this world. The cartoon we are exposed to , the posters, the gifts, the soft toys we had. Disney, the creator of our "Fantasy", can their strong moat stop the downtrend of its stock price?

Sign of downtrend

-Candle sticks moving below MA200 . Fail to even get near the MA200 trendline for the past 200 days.

-Downtrend line B : 2 Fib extension of downtrend line A , magnitude much stronger than of line A

-Downtrend line C: 1.618 Fib extension of downtrend line B , magnitude abit strong than of line B

Reversal in progress?

-Retracement R2 magnitude is almost similar to R1 , but took much shorter time(26 days vs 116days) to retrace the same amount

-Retracement R3 magnitude is strong than of R2 .

-Thus the upward trend is getting strong: R3 > R2 > R1

Take a look at the horizontal volume indicator. The volume indicator sums up the volume traded at the prices for the past 1800 bars/1800 days . Bulk of the trading occurs between 97 to 115

The price range of 97 to 115 probably is the strongest support Disney can have. If the candlesticks plunge below 97 , the next area to have such high trading volume will be around 50 .

Watch out for reversal such as double bottom within the price range of 97 to 115

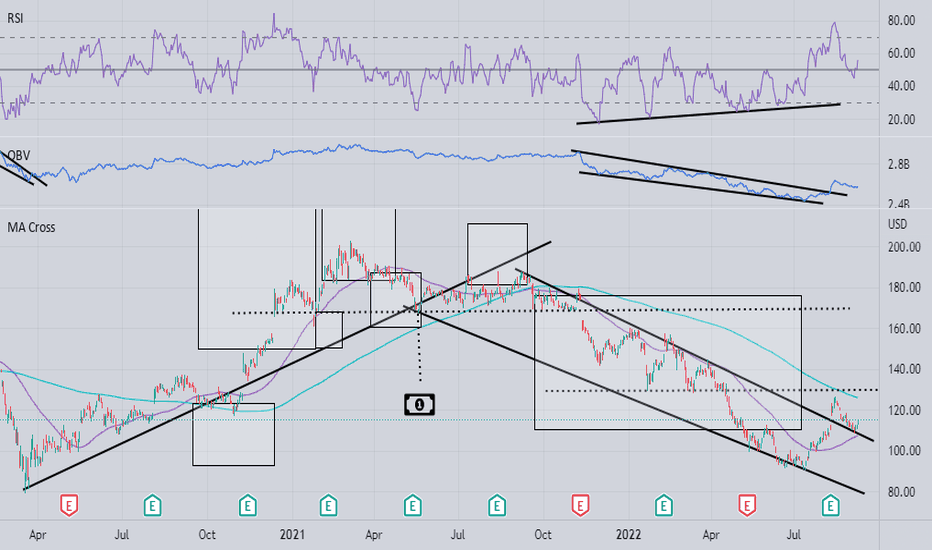

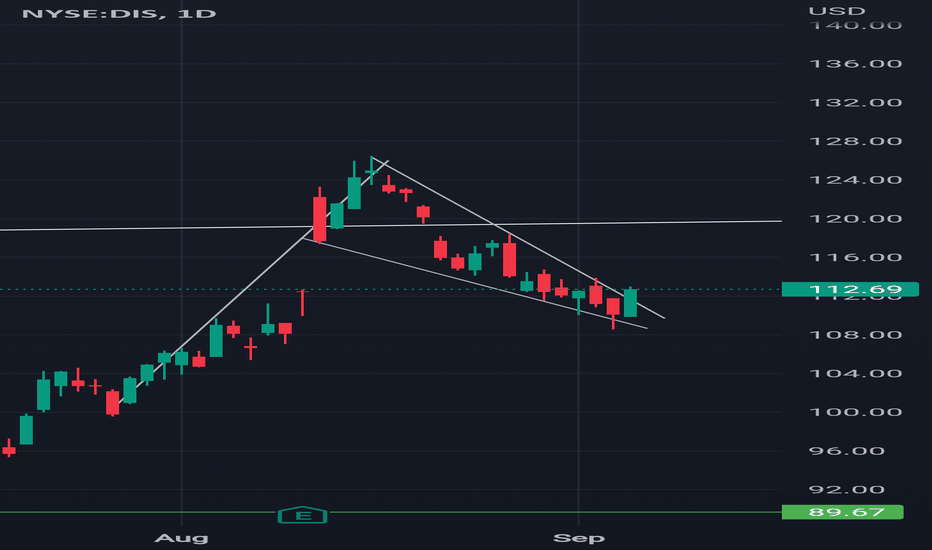

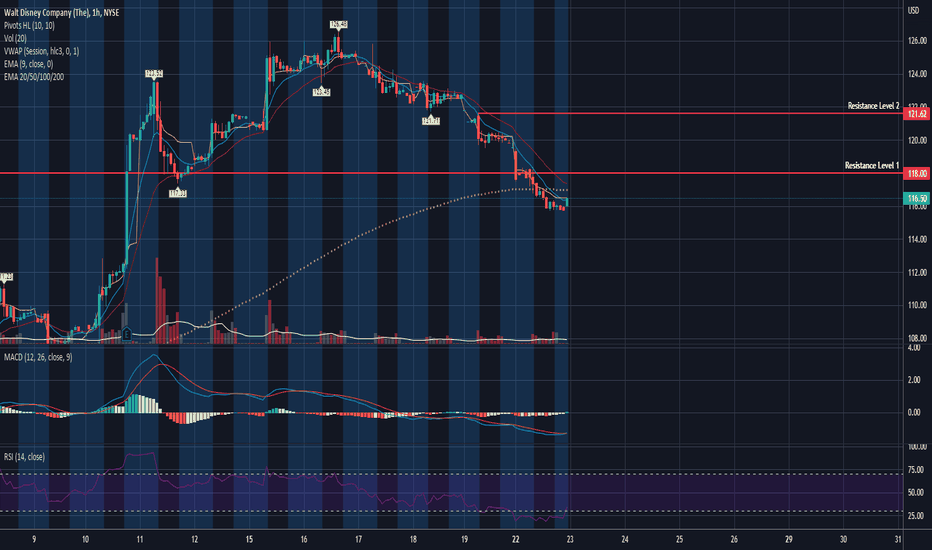

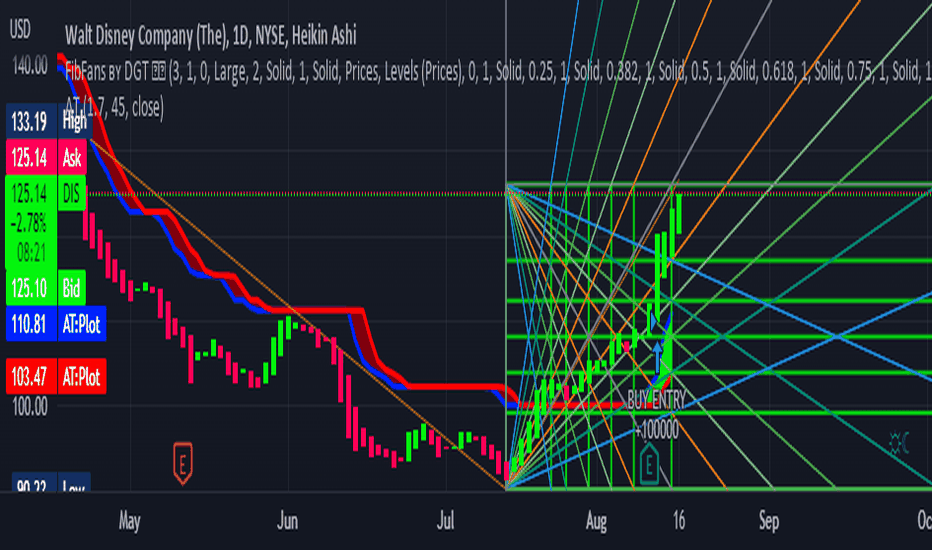

$DIS - Can it close the gap at $122.67?Disney broke out of the down trend channel. However, the price has retreated from 50% of breakout measured move target. Which is normal for breakouts.

There is a chance that it can back fill the gap at $112.67 area, if the price breaks below the support at $116 .

If the price bounce from $117 area, it could retrace back to $126 to $130 area.

Breakdown targets -

Target 1 - $116

Target 2 - $112.67

Risk - reversal from $117 area

Disclaimer: Not investment advice.

If you like this post, follow me and subscribe to my posts for more technical analysis charts (FREE).

$DIS or Disney is over extended $DIS is over extended. Waiting for the shift of momentum to change. On the Trendsi indicators, the money momentum (White Line) is over extended into the upper red band area, indicating an over extension. Being patience with the rest of the indicators to verify momentum. When the middle band shifts to red (indicating a bear market momentum), as well when a sell signal appears will let me know when Disney has shifted to a downward trend.

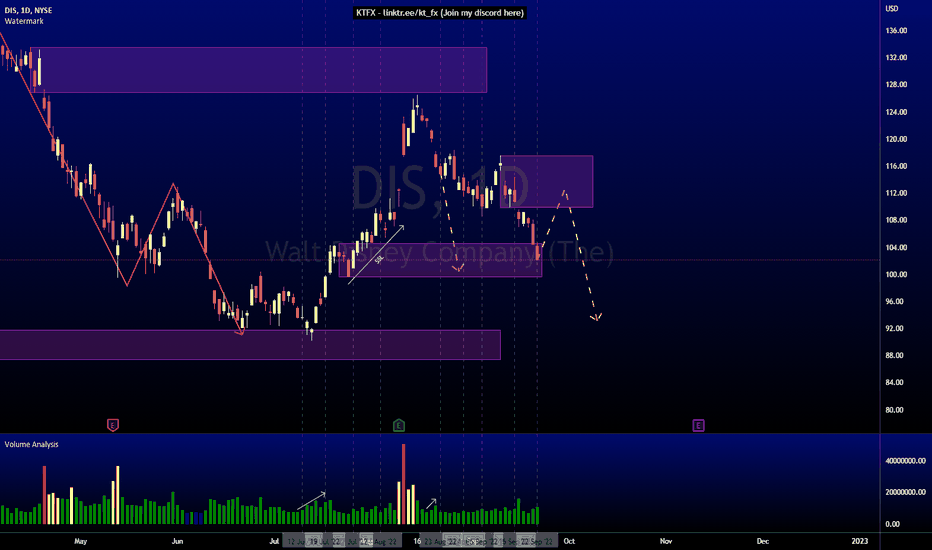

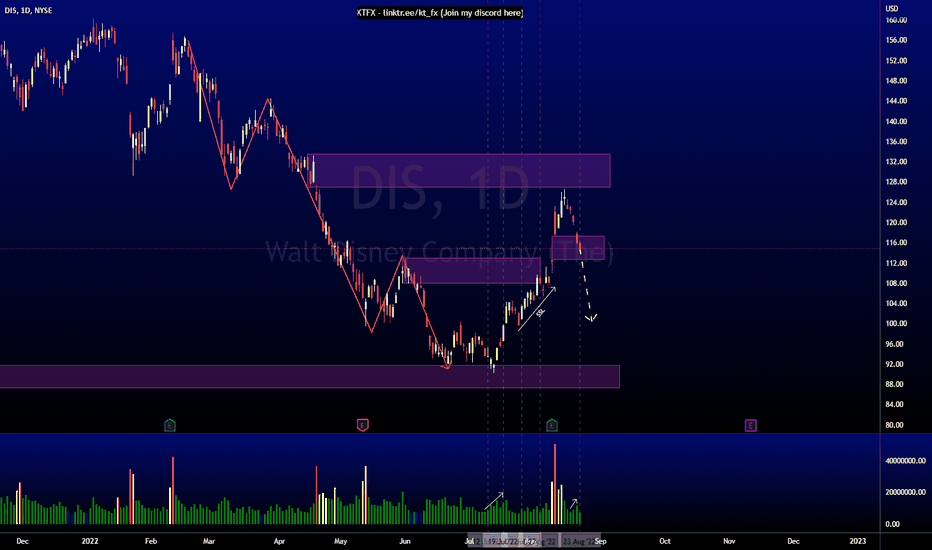

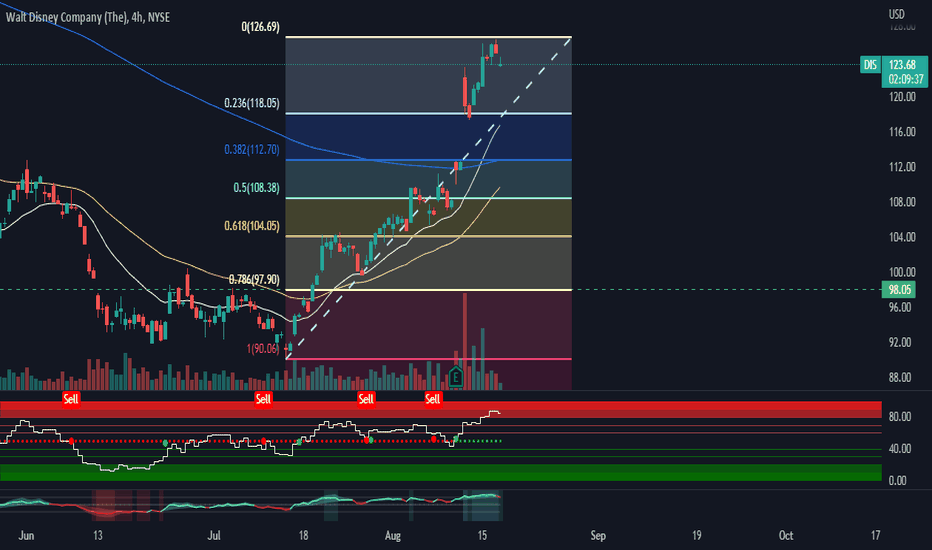

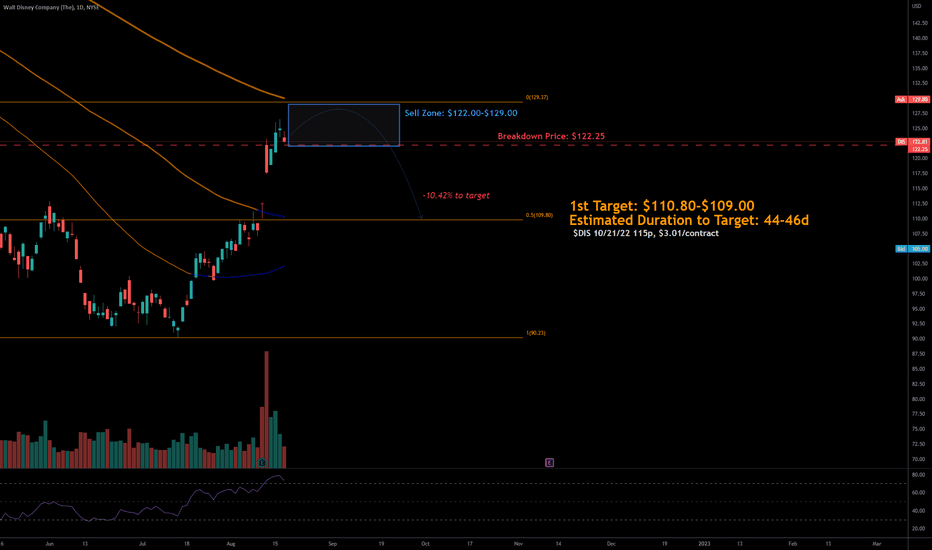

8/17/22 DISThe Walt Disney Company ( NYSE:DIS )

Sector: Consumer Services (Cable/Satellite TV)

Market Capitalization: $223.696B

Current Price: $122.81

Breakdown Price: $122.25

Sell Zone: $122.00-$129.00

Price Target: $110.80-$109.00

Estimated Duration to Target: 44-46d

Contract of Interest: $DIS 10/21/22 115p

Trade price as of publish date: $3.01/contract

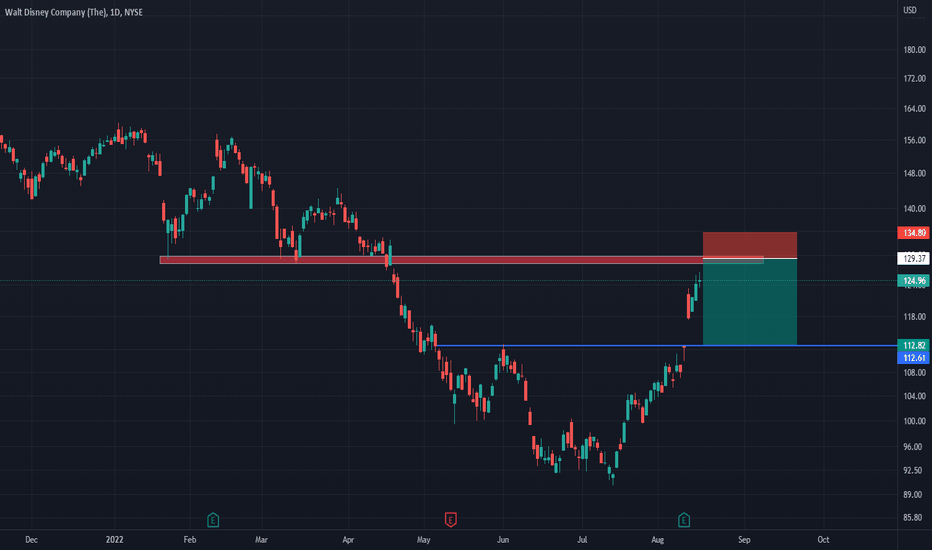

Disney over-extended? Disney

Short Term

We look to Sell at 129.37 (stop at 134.80)

Upward pressure has continued and we are assessed as being in the corrective leg before the next selloff. Preferred trade is to sell into rallies. Our outlook is bearish. There is scope for mild buying at the open but gains should be limited. News events could adversley affect the short term technical picture.

Our profit targets will be 112.82 and 102.30

Resistance: 130.00 / 144.00 / 155.00

Support: 110.00 / 100.00 / 90.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.