DIS trade ideas

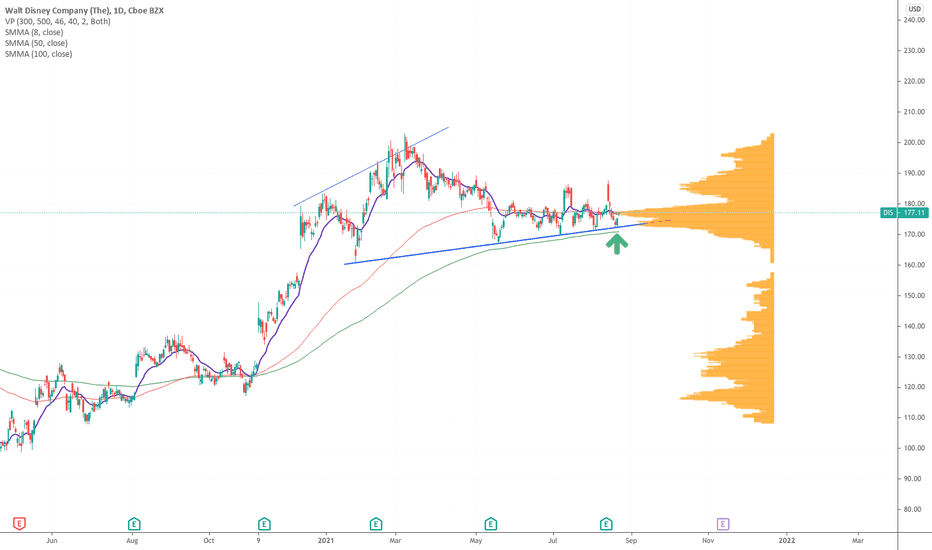

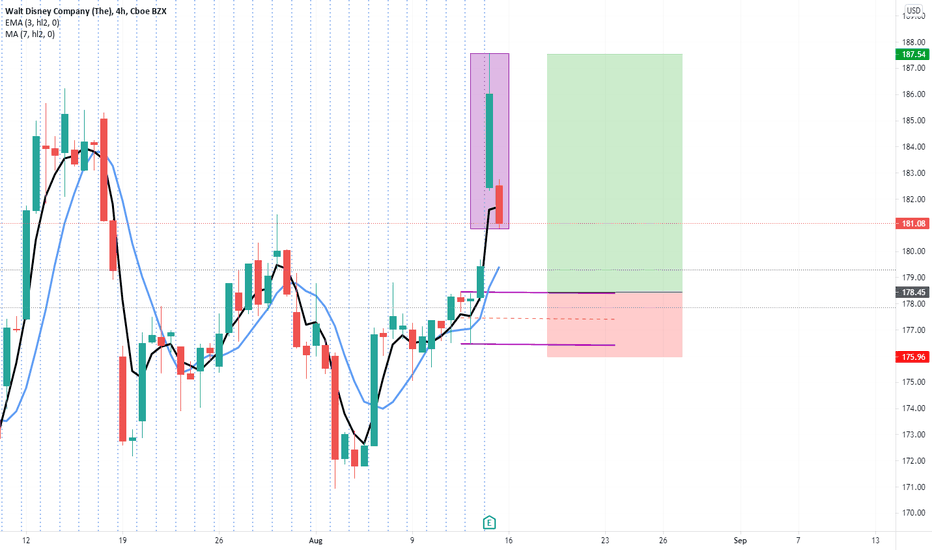

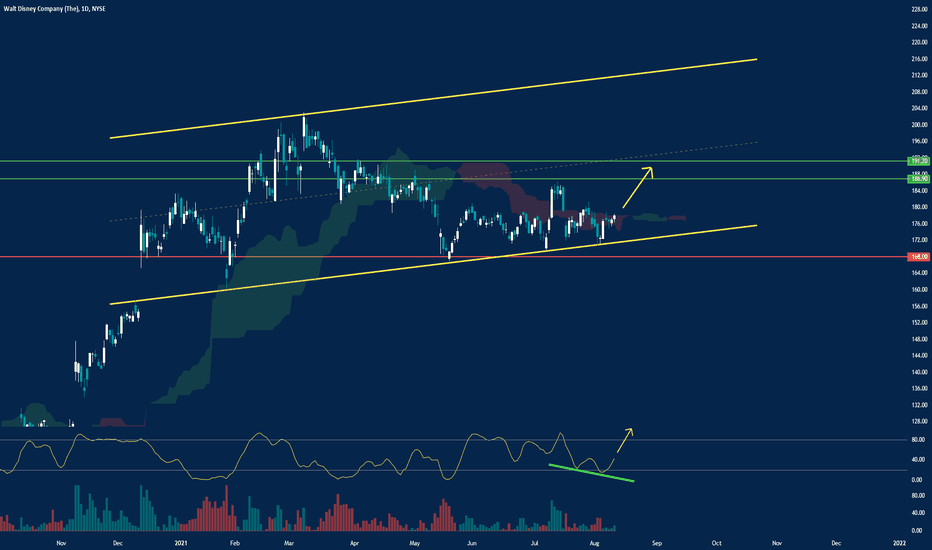

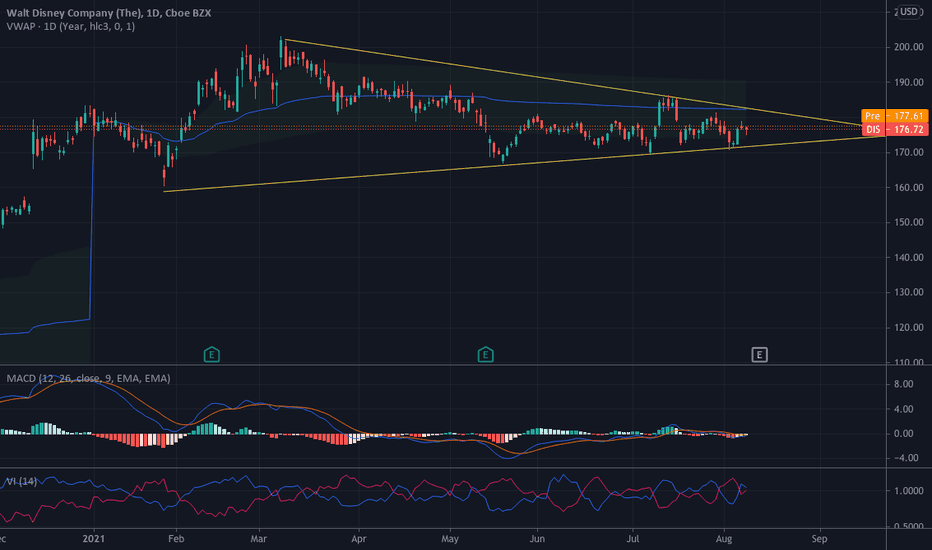

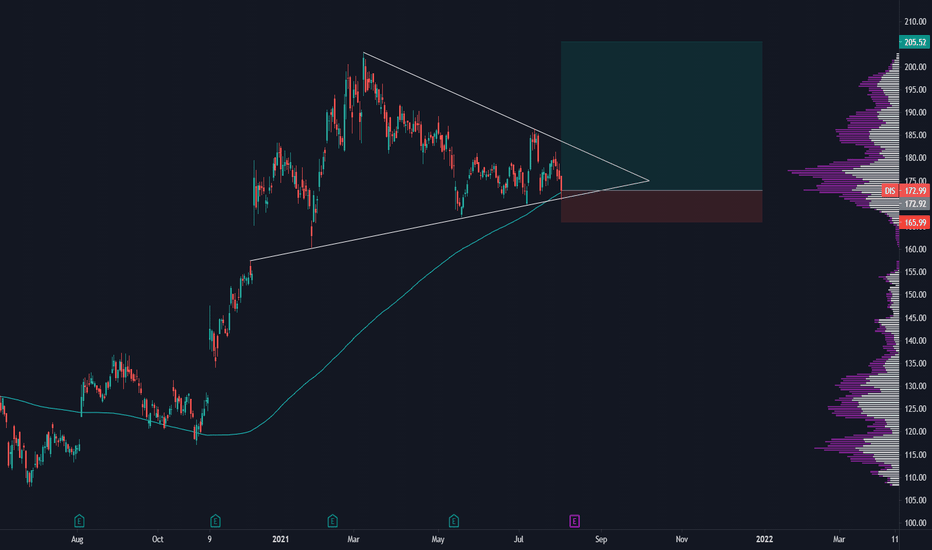

DIS - 8.23.21 - Possible ScenerioDisney may rise here off the purple support line, but may not rise higher than the previous high. I am looking for a pullback from the 180/190 area to the BLACK mid-line. Price may trend here between yellow, and green.

Target area is highlighted in illustration (160-175 area)

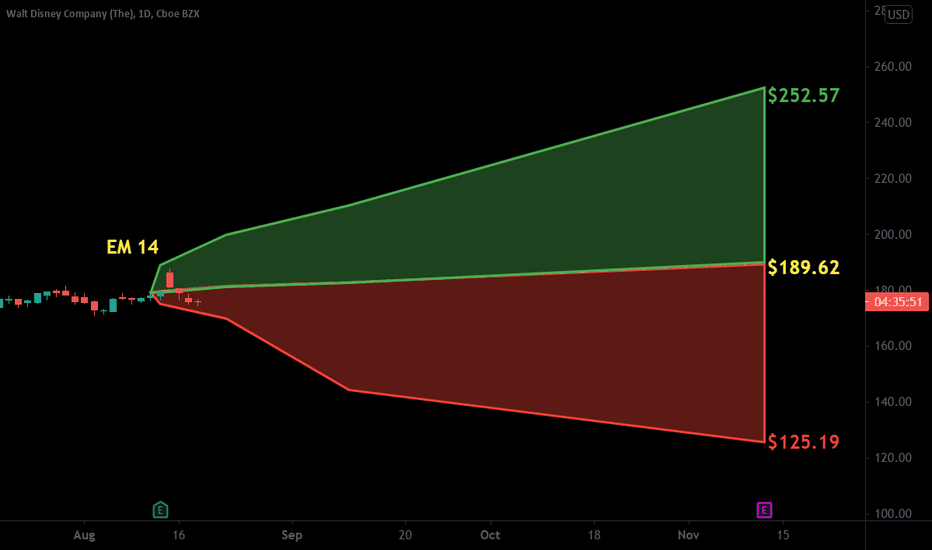

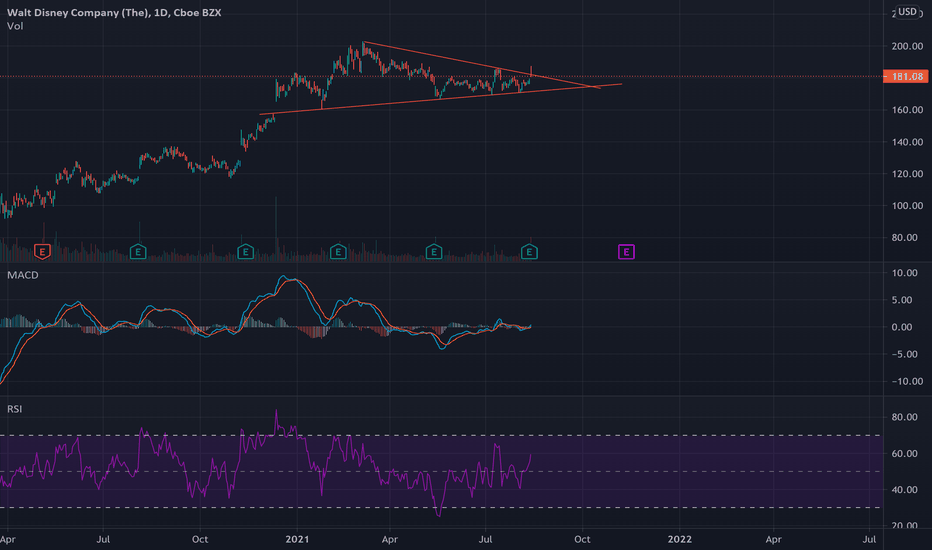

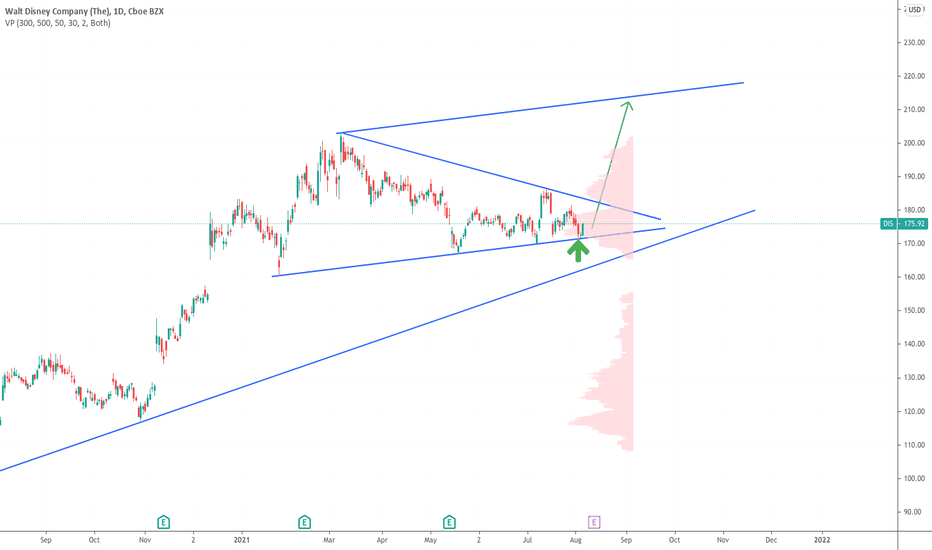

$DIS with a Bullish outlook following its earnings #Stocks The PEAD projected a Bullish outlook for $DIS after a Positive over reaction following its earnings release placing the stock in drift B with an expected accuracy of 61.54%.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

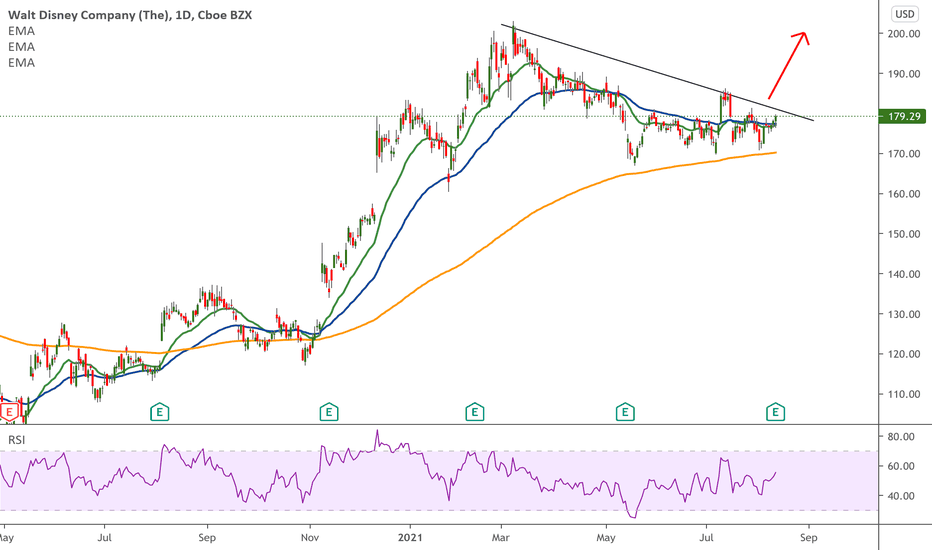

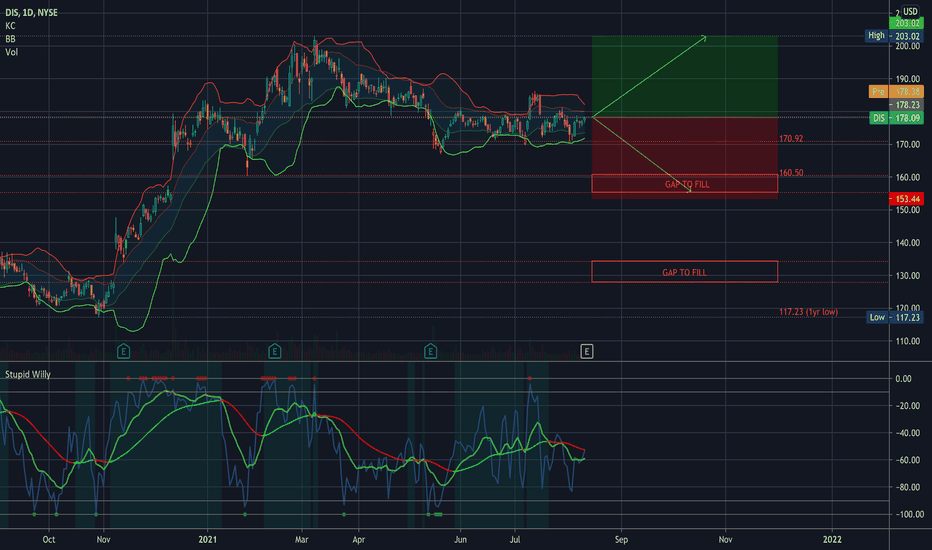

WATCHING $DIS Pre-earnings Analysis $DIS Analysis Target 203.02 for 13.91%

This is normally where I would start my position but those two gaps below have me hesitating at the moment… so let’s see what happens after earnings… I'm definitely keeping an eye on the bottom of that first gap.

-----

—

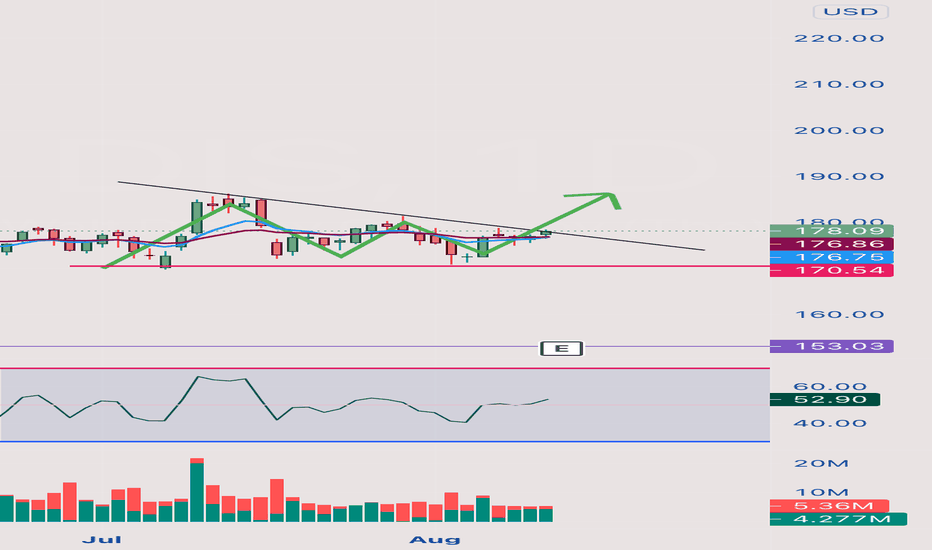

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

ONLY ADD at support levels & FIB levels… labeled

I start every position with .5 - 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

WALT DISNEY:FUNDAMENTAL ANALYSIS+PRICE ACTION|NEXT TARGET|LONG🔔Over the past 18 months, investments in the Walt Disney Company have been very risky. Virtually every aspect of the company's business has been severely limited or even halted at various points because of the pandemic. At present, it appears that Disney's recovery will be a mixed success.

Disney management made the right decisions early in the crisis when it took steps to shore up its balance sheet by suspending dividends and raising new capital and accelerating the expansion of its Disney+ streaming TV service. But risks remain, and it's worth examining whether they can be overcome to help the stock outperform the S&P 500 index over the next 10 years, as it has in the past.

The irony of the recent conflict between Disney and "Black Widow" star Scarlett Johansson has not gone unnoticed by investors. The award-winning actress sued Disney, claiming that her contract was breached when the company released the long-awaited movie for purchase on Disney+ at the same time as the theaters.

Since the lawsuit was announced, Disney's stock price has fallen for five straight days, dropping nearly 4 percent, a far greater potential blow to profits than what Johansson claims she did not receive in compensation for her work. The company's streaming service, considered the only shining star during a painful pandemic when user numbers exceeded expectations, has suddenly become a new and very public risk.

In the first six months of 2021, Disney's share of the direct-to-consumer media and entertainment segment grew 65% year over year. This was driven in large part by growth in the Disney+ segment. As of April 3, the company had increased the service's paid subscribers to 103.6 million in just 18 months after its launch. However, growth began to slow in the last quarter, which disappointed investors.

Now the situation has become even more complicated as Disney argues that the lawsuit has no merit. But even if the company wins the dispute on legal grounds, it could cause negative publicity among movie fans and also change the company's film distribution strategy.

The streaming strategy and its potential to boost future profits have received much publicity since the launch of Disney+, but the overall business still relies heavily on Disney theme park operations. Before the pandemic, the parks segment generated 38% of revenue in the fiscal year ended Sept. 28, 2019. In the first six months of 2021, that share of total revenue dropped to 21% as the parks opened slowly and with some capacity constraints.

Now the delta variant is causing a new spike in COVID-19 cases. As a result, Disney has reinstated the mandatory use of masks for all theme park visitors in the U.S. over the age of 2, and business recovery in the parks has become more uncertain. Another area of the company's business affected by the pandemic condition is, of course, Disney's cruise business. Undoubtedly, the risks to the company remain as long as the pandemic continues.

Investing in any stock involves risks, and those risks are unique. The company currently believes it will operate at a Disney+ profit in the fiscal year 2024, but this is not a given. Without knowing how the rest of the business will evolve, it is difficult to determine a short- or even medium-term stock valuation.

However, the company has proven that it can succeed over the long term. As mentioned earlier, it has significantly outperformed the S&P 500 Index over the past decade.

At some point, the pandemic will officially end. Also, at some point, Disney will feel confident enough to either recover its dividend or use its excess cash flow to invest in the business -- or a combination of both.

Long-term investors should feel confident that the brand will remain strong enough to support any future direction of the business. That brand and the diverse businesses built around it are what make an investment in Disney worth the risk in a portfolio built for the long term. The company will report its fiscal third-quarter earnings today, and then investors will have an update on the success of all segments of the company.

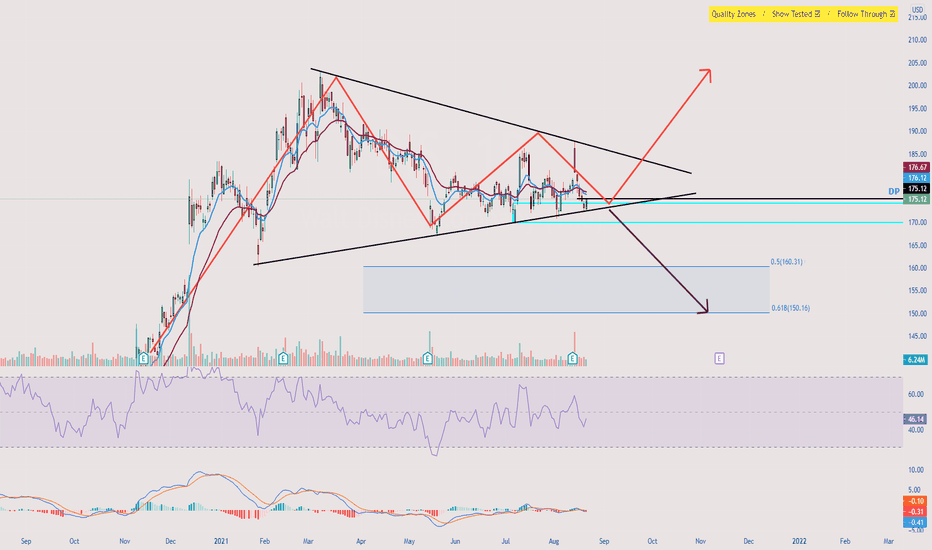

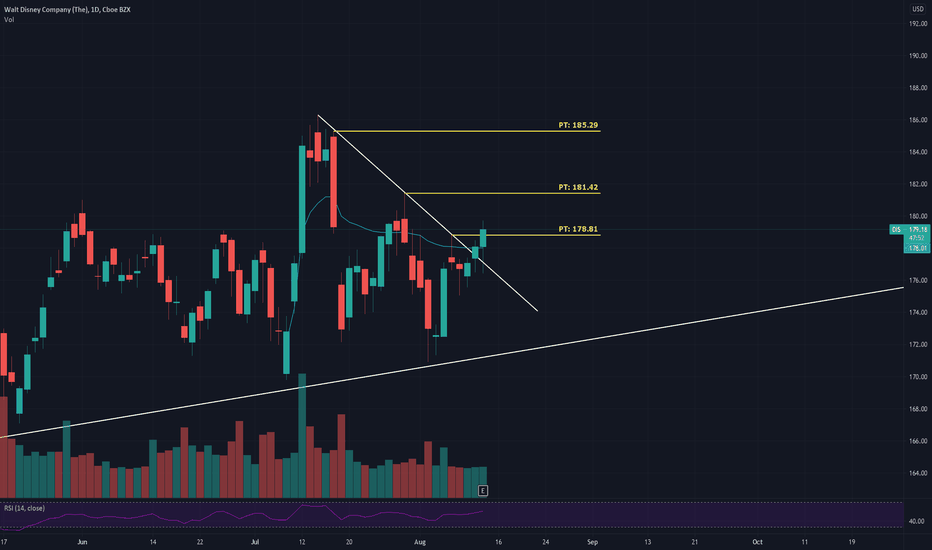

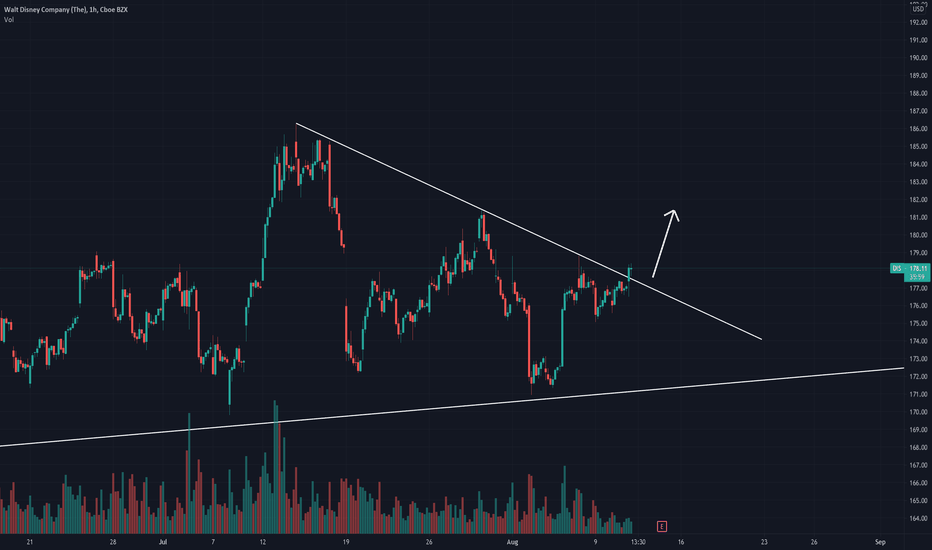

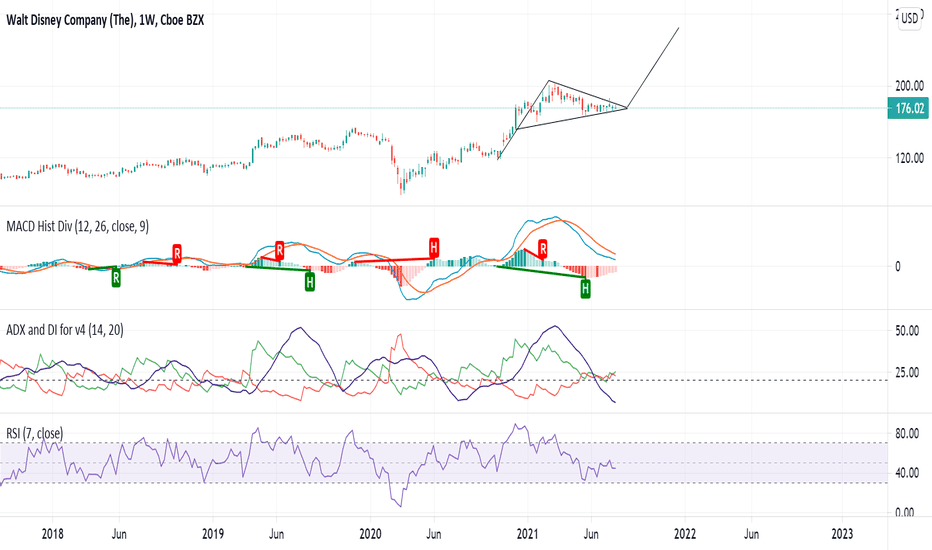

DIS ANALYSIS 12.08.2021Hello Traders, here is a full analysis for this asset. The entry will be taken only, if all rules of your trading plan are satisfied.

Therefore I suggest you keep this pair on your watchlist and see if all of your rules are satisfied.

Leave your thoughts in the comment section, I will reply to every single one of them.

_____________________________________________________________________________________________________________________________________________________________________

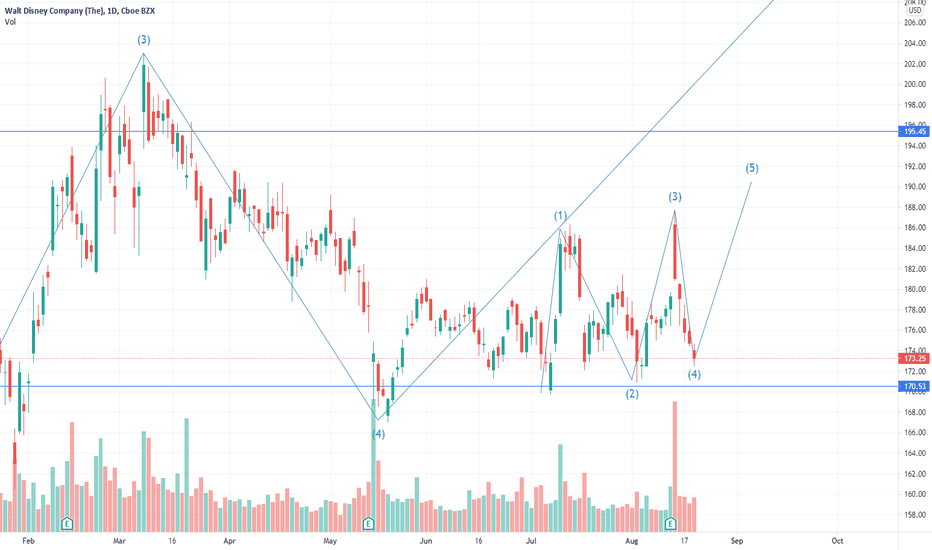

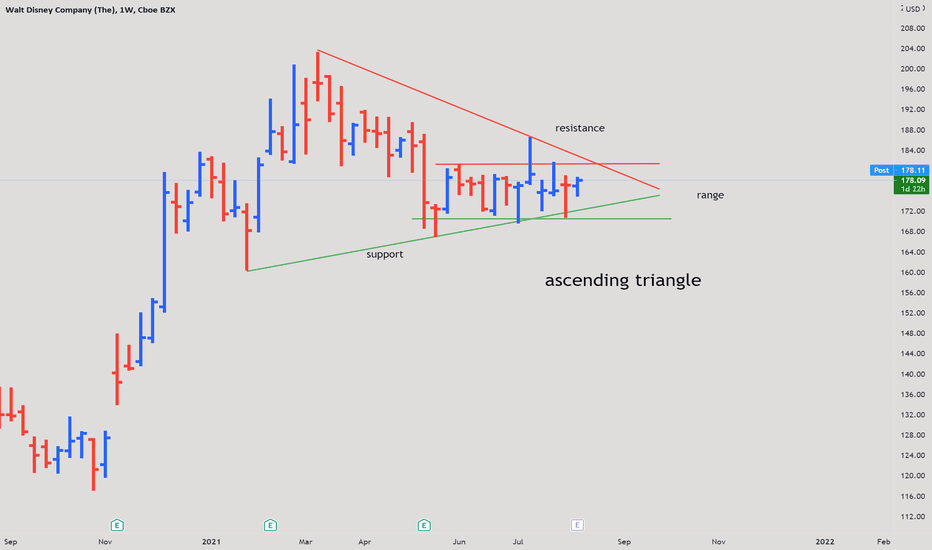

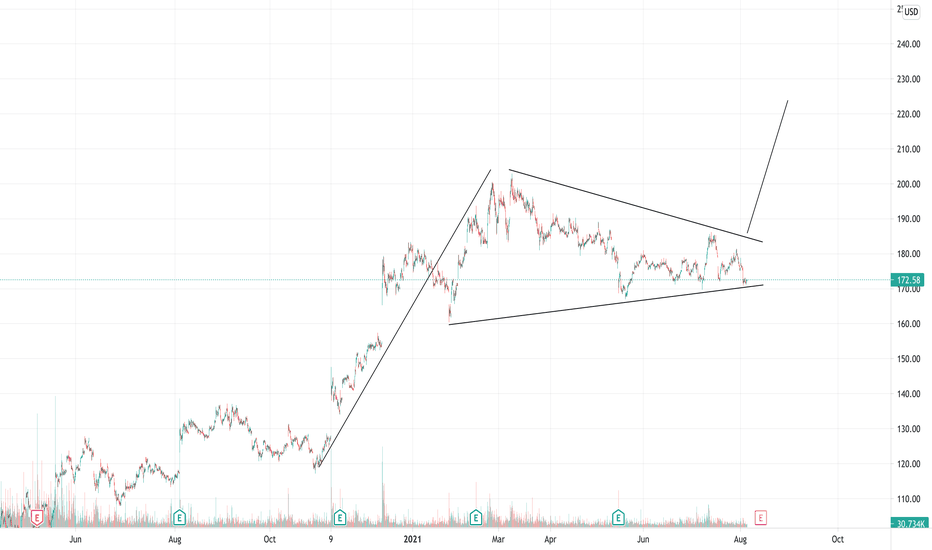

DIS stoch

Parham

DIS shares

The trend of these stocks in the long run is quite upward

There was a conscious failure in this share

Conscious failure means that in an uptrend we cross a resistance range and return twice below the resistance range. This movement breaks consciously and if the chart can regain the conscious failure range (resistance range) in a short time, we can make a low risk purchase.

Now in time H4 we see that the conscious back failure has been created and the chart is again approaching the conscious failure range (resistance range) and it is possible to take back this range with a strong candlestick and enter this range by retrieving it.

Sl = 170.00

Tp1 = 198.78

Tp2 = 210.00

Thanks