DIS trade ideas

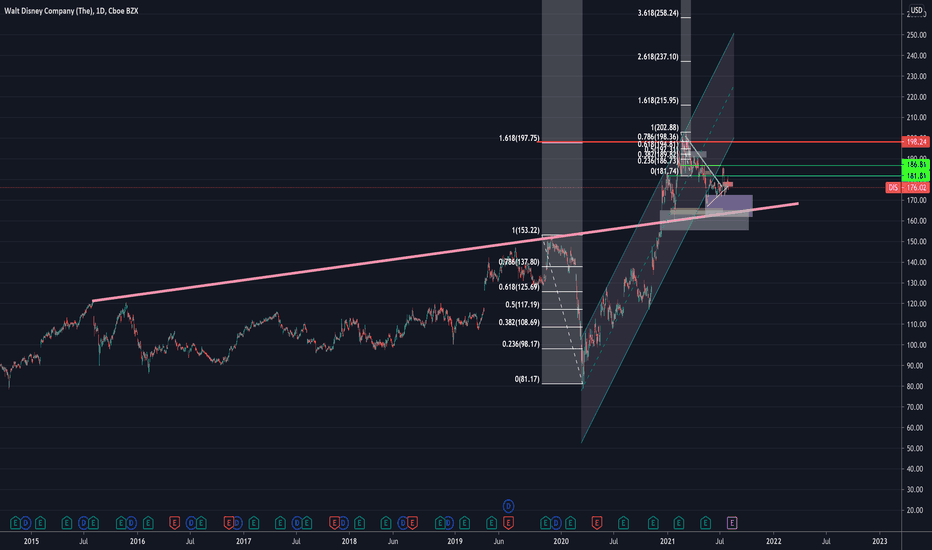

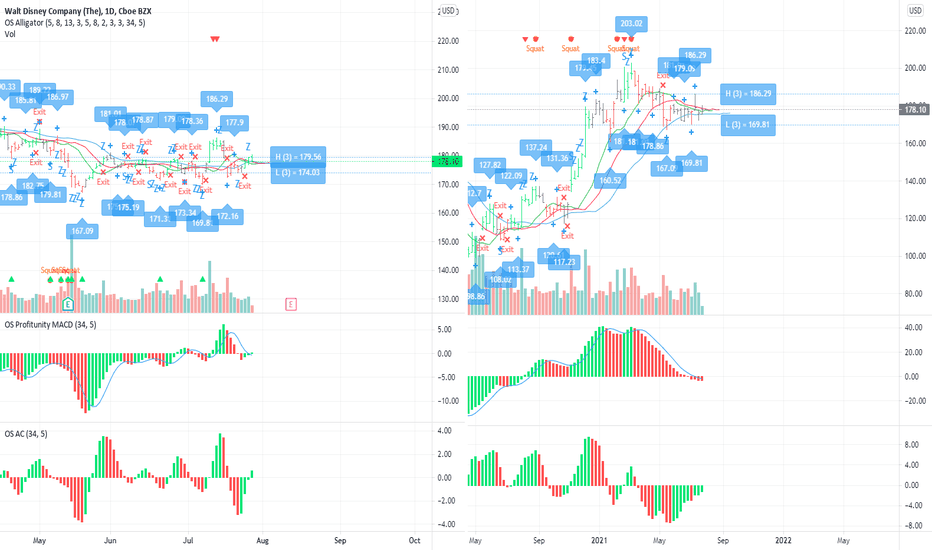

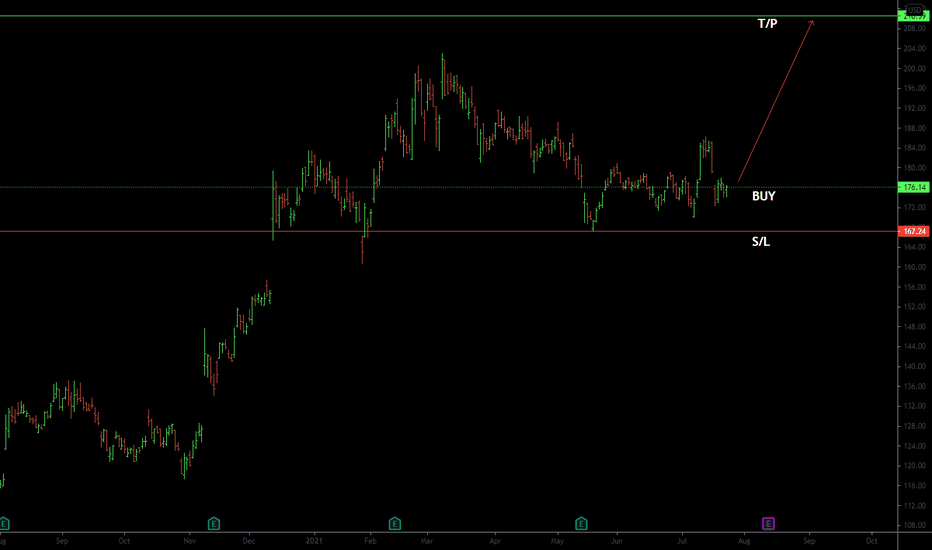

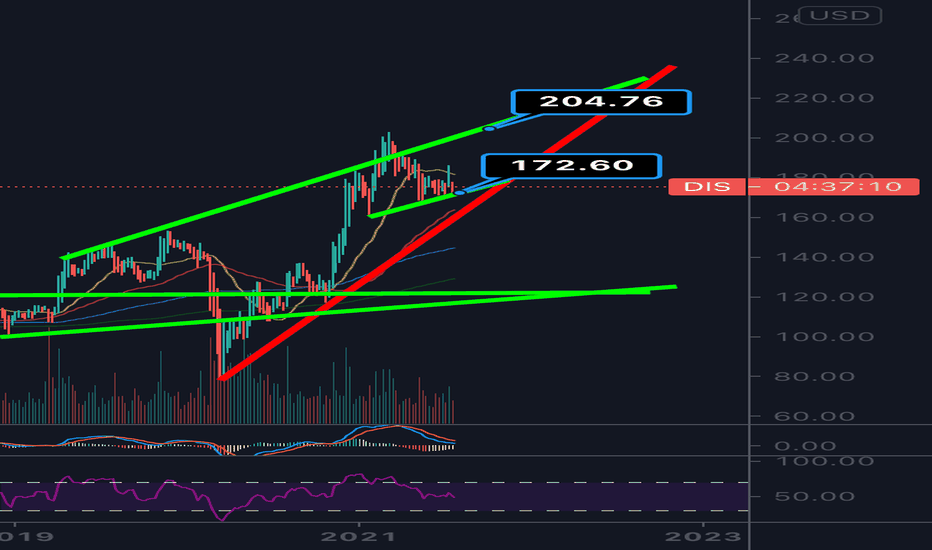

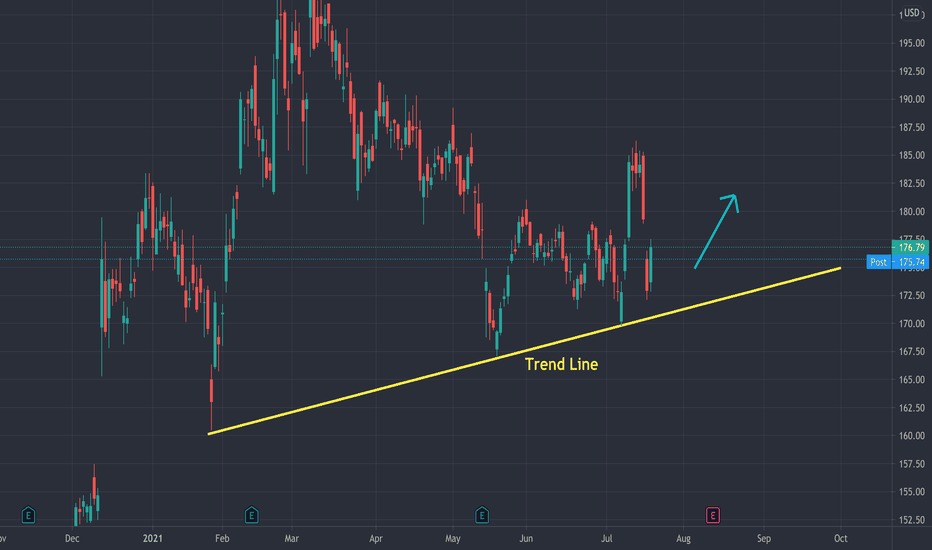

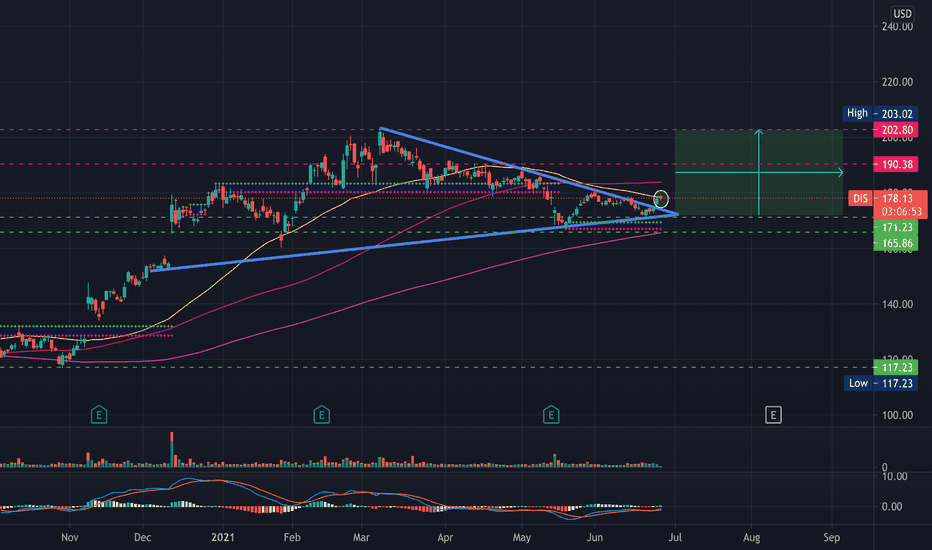

DIS LongDIS is forming a Bullish wedge and will soon to break.

200 MA is at 172.00 range and will be strong support.

Would be an EWT Wave 3 on a weekly view if it breaks up.

Entry level near $175.19 or $172.25

Stop Loss: $170.30

Upside Target # 1 (Resistance): $182.99 (Risk/Reward 5.5X, dollars at risk $2K)

Upside Target #2 (1.6 Fib): $253.08 (Risk/Reward 41X ; dollars at risk $2K)

$2,000 at risk on a $176K purchase

If 170 breaks, fill the gap at $130 target. Actually 2 gaps below.

Alternatively buy DIS 178 Calls time interval based on pivots and VOL

tradingview.sweetlogin.com

tradingview.sweetlogin.com

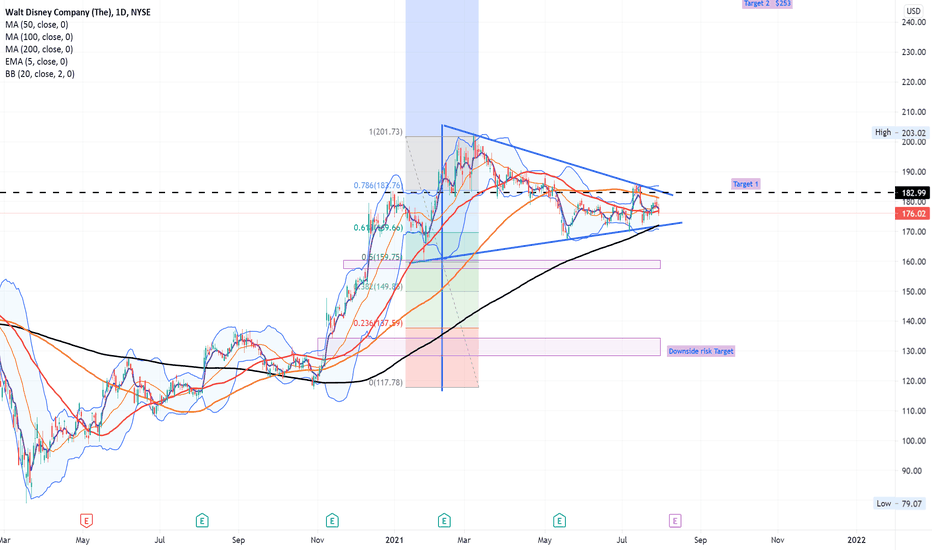

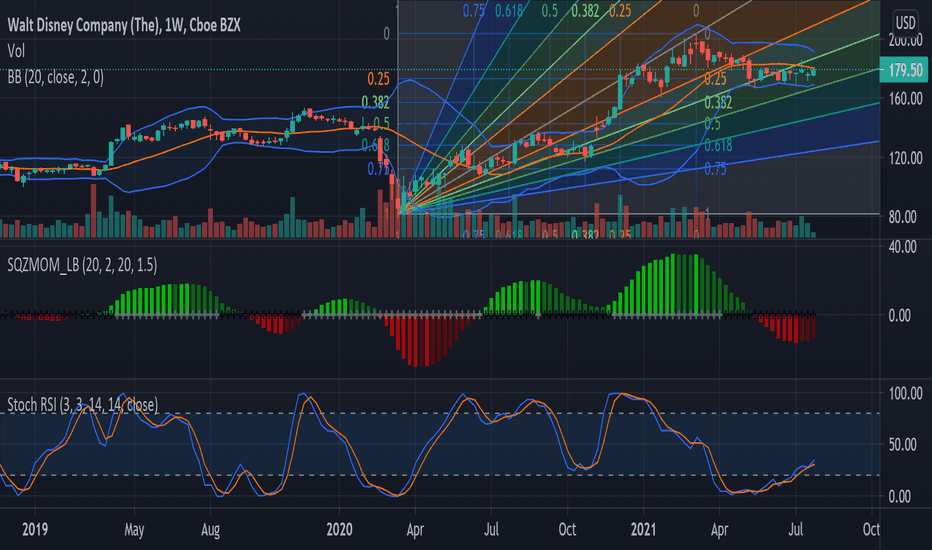

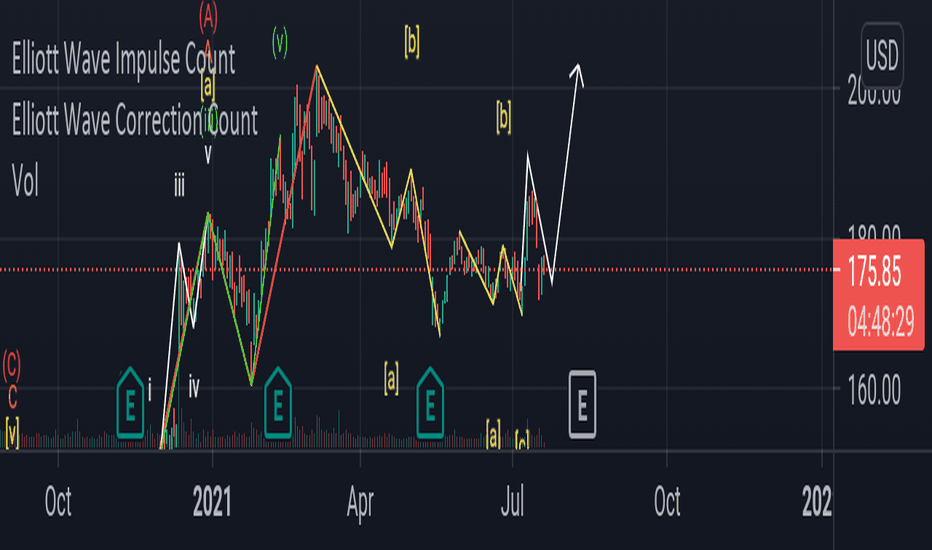

Disney Setting up for something large Disney is to be slowly increasing regarding its Stoch Oscillator, indicating gradual bullishness. Not only is the Stoch indicating bullishness, but the squeeze indicator shows decreasing bearish momentum. My Price Targets are 190 and 200 if we get the squeeze that is to be expected.

Bullish Signals

-Stoch Oscillator

-Squeeze Indicator

Price Targets

-1st 190

-2nd 200

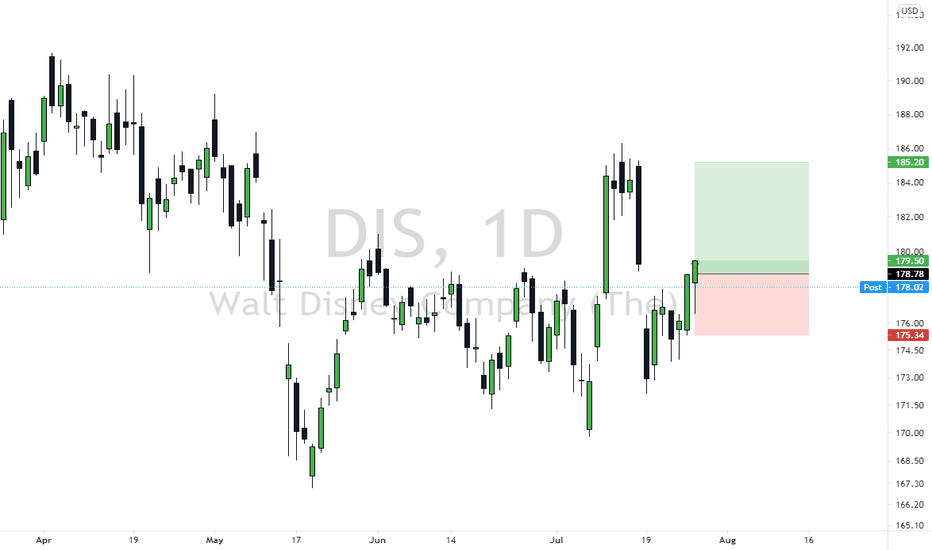

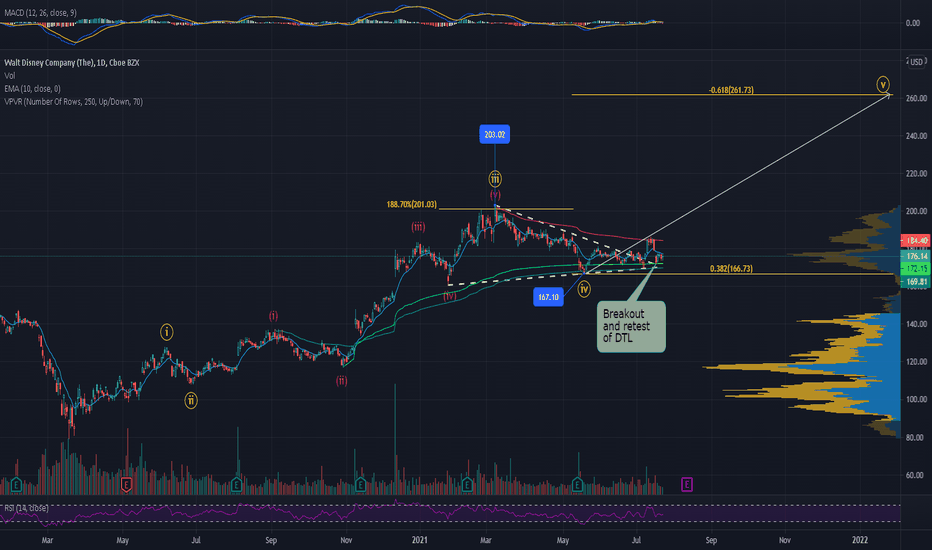

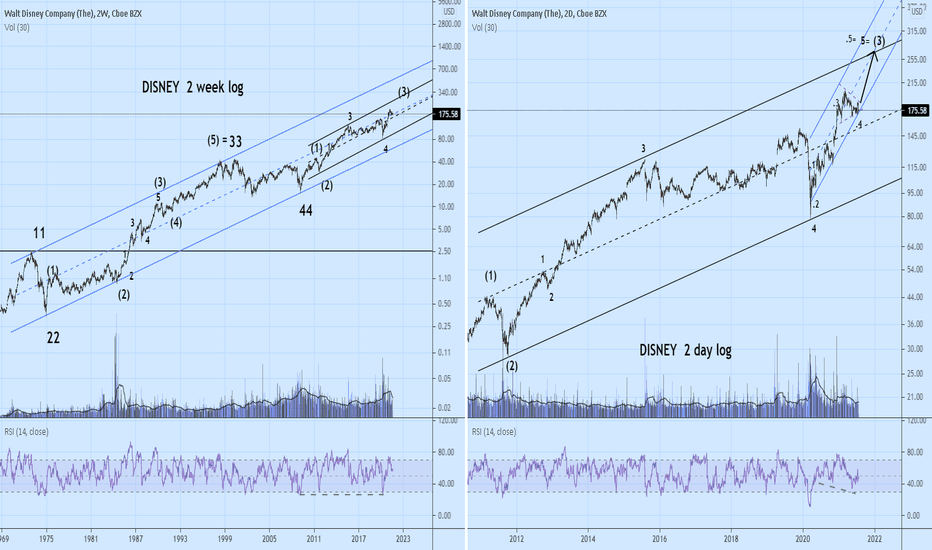

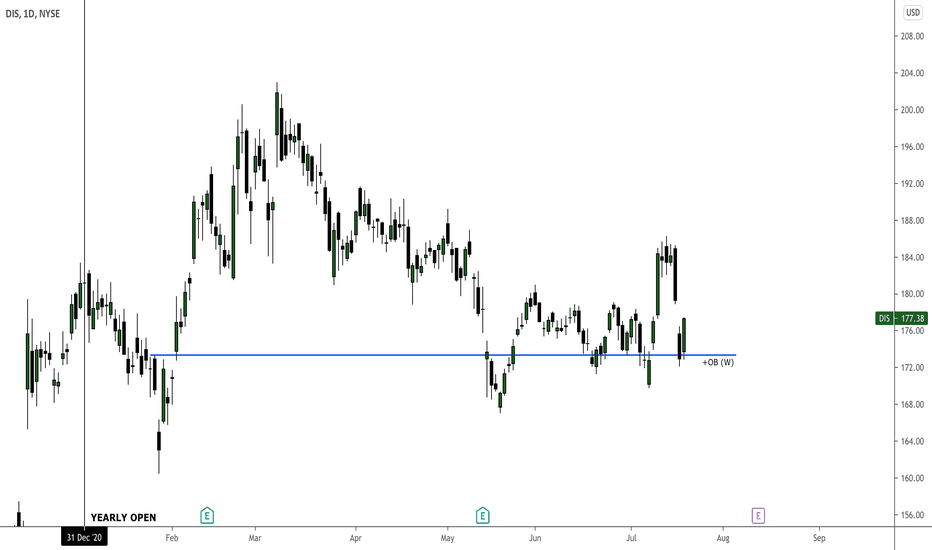

$DIS - Getting ready for its final move?Disney is on wave 5 from the covid lows. Its sitting on 2 AVWAPs and was rejected off another AVWAP. It tested the DTL from the wave 3 high after being rejected at the AVWAP of the wave 3 highs. There's currently a volume shelf at 175-176 where it has been consolidating.

All signs point to a large move up, especially with Marvel phase 4 starting up, the charismas movie season coming and Disney plus showing strength in programing.

Invalidation below a daily close of 167, confirmation above daily close of 202.

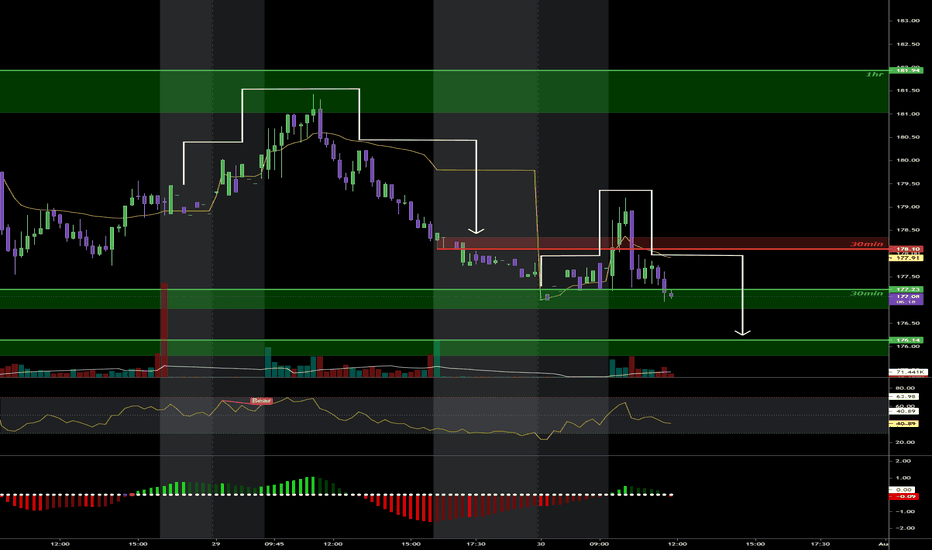

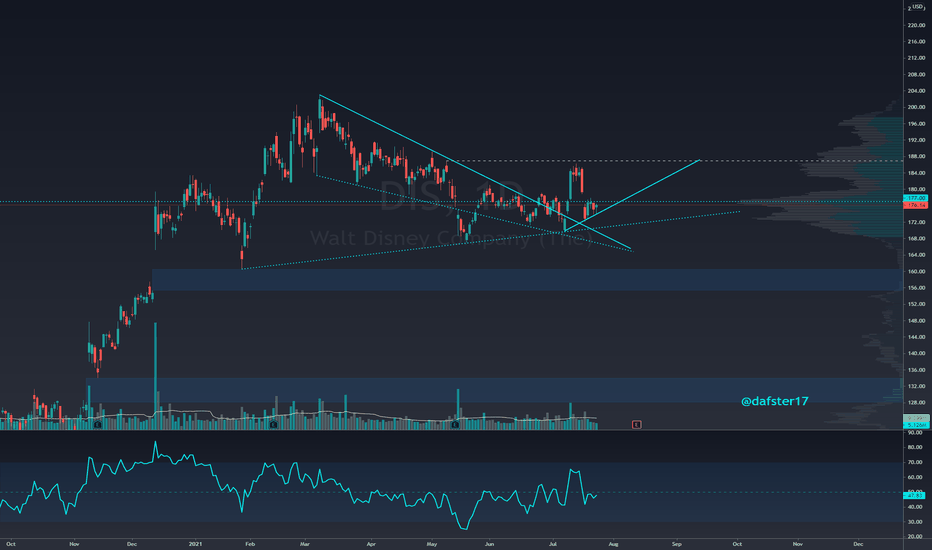

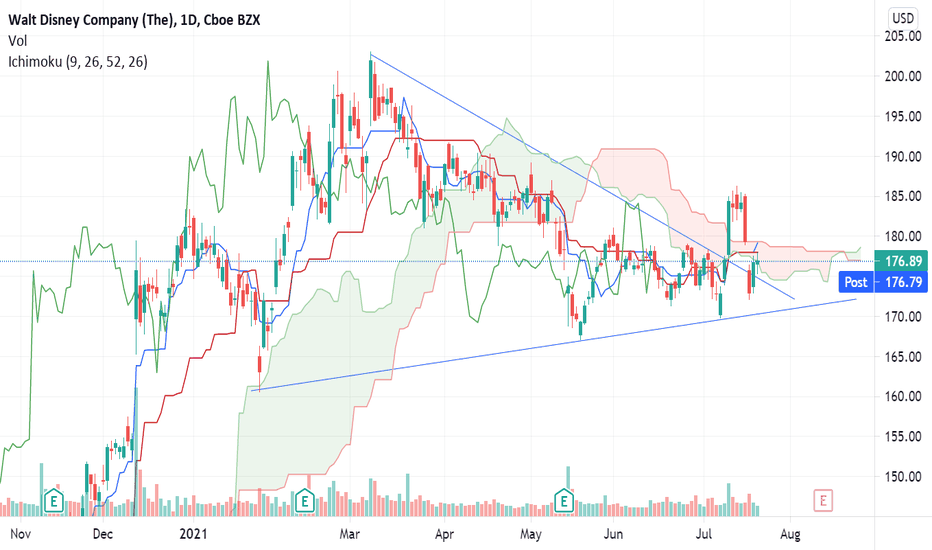

DisneyWhat a great run. Although we could be sitting at support. It’s possible we are creating a bear flag here. I see a rising wedge in Disney we have been respecting quite a bit. If we were to lose 170$ and close below we could

Be looking at some serious downside. 161$ would be rising wedge support line If we bounce here we have 21 weekly EMA resiatnce at 181-182 with the upper rising wedge resiatnce around 204 If a long was to be placed here, we need stoplosses below 169. Could open shorts if we lose 169 ANd CLOSe CANDLE BODIES BELOW

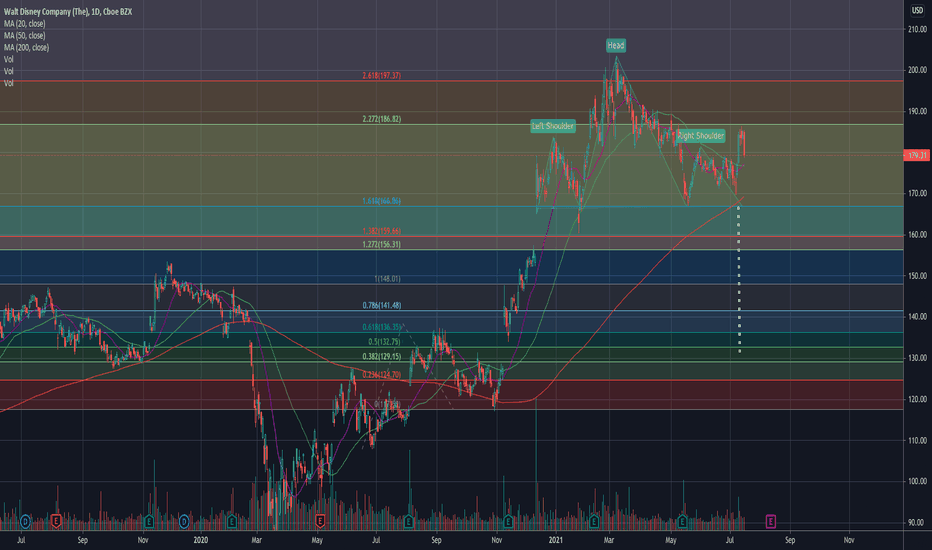

$DIS - Trying to break free (invalidate) from head & shoulderTrying to invalidate or break free from head & shoulder.

Neckline - $166 - $167

Break above, $186 is bullish

Break below $166 is bearish and it could lead to $156.

———————————————————

How to read my charts?

- Matching color trend lines shows the pattern. Sometimes a chart can have multiple patterns. Each pattern will have matching color trend lines.

- The yellow horizontal lines shows support and resistance areas.

- Fib lines also shows support and resistance areas.

- The dotted white lines shows price projection for breakout or breakdown target.

Disclaimer: Do your own DD. Not an investment advice.

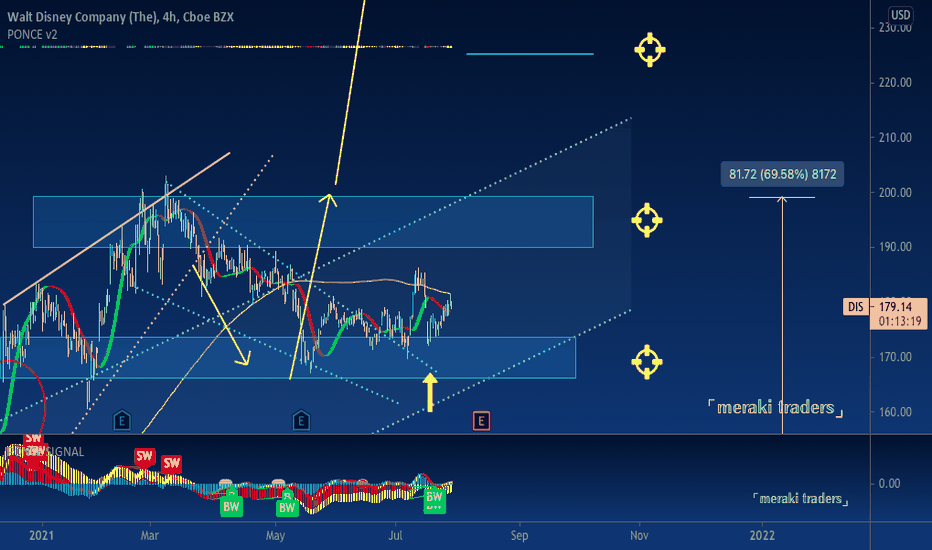

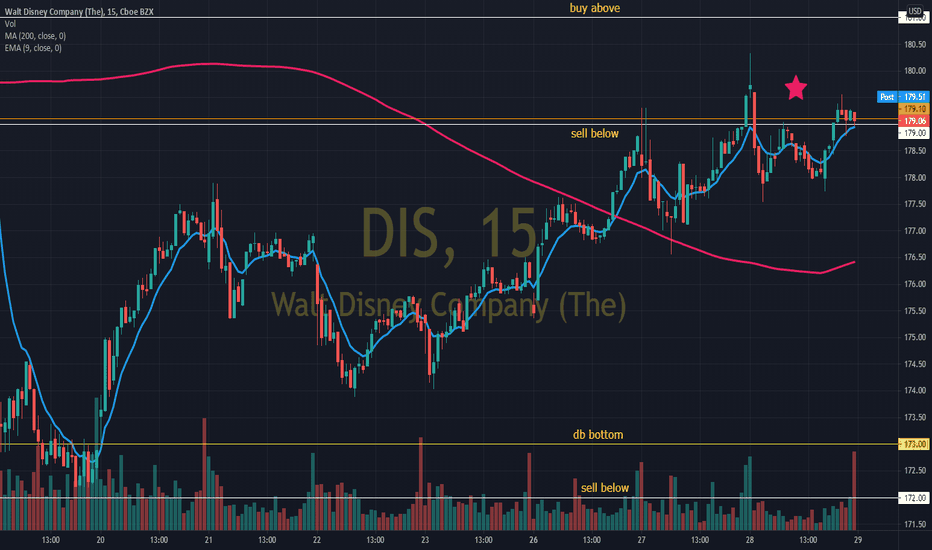

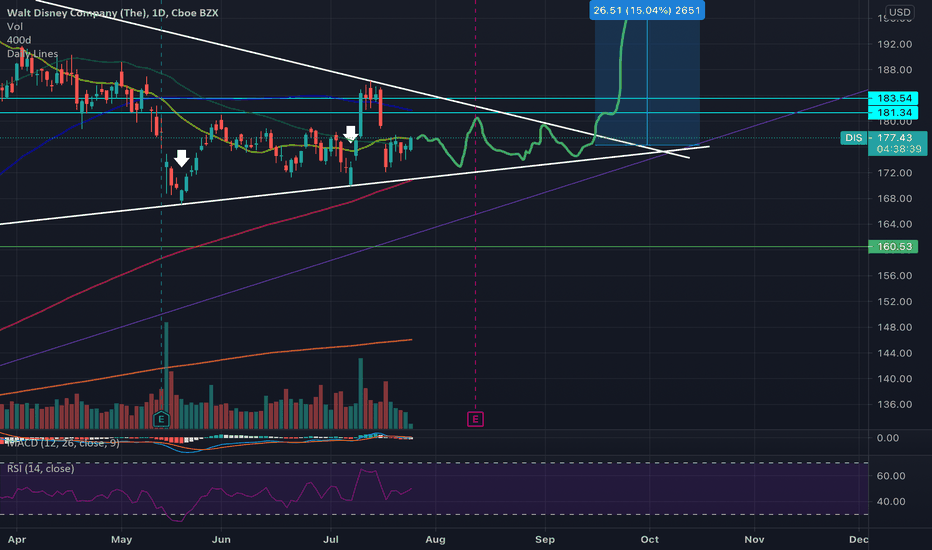

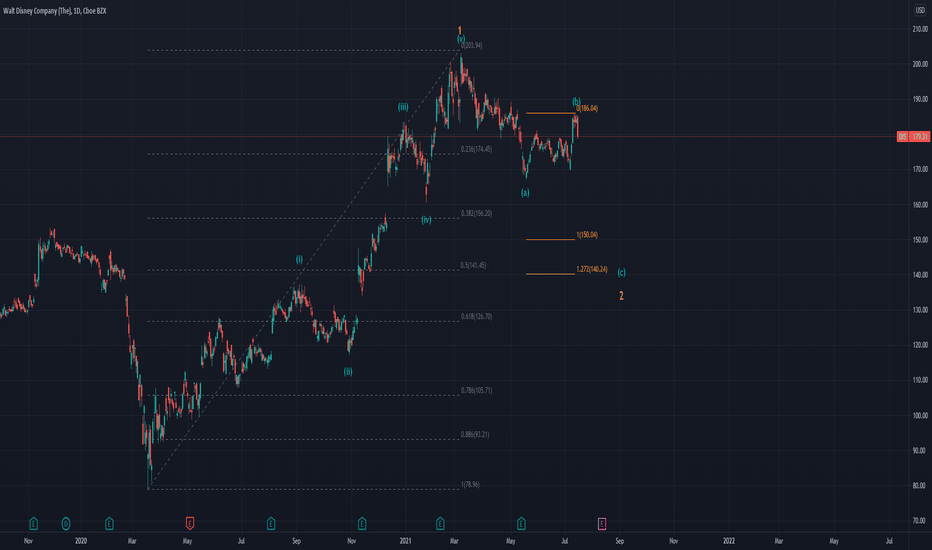

Breakout- watching closelyWatching DIS closely here and looking for a breakout-

- Starting to break above a long-term downtrend and forming somewhat of a triangle

- Bollinger Bands squeezing (not pictured)

- Falling wedge on shorter timeframes (not pictured)

- Buyer volume starting to pick up

- Earnings on 8/10'