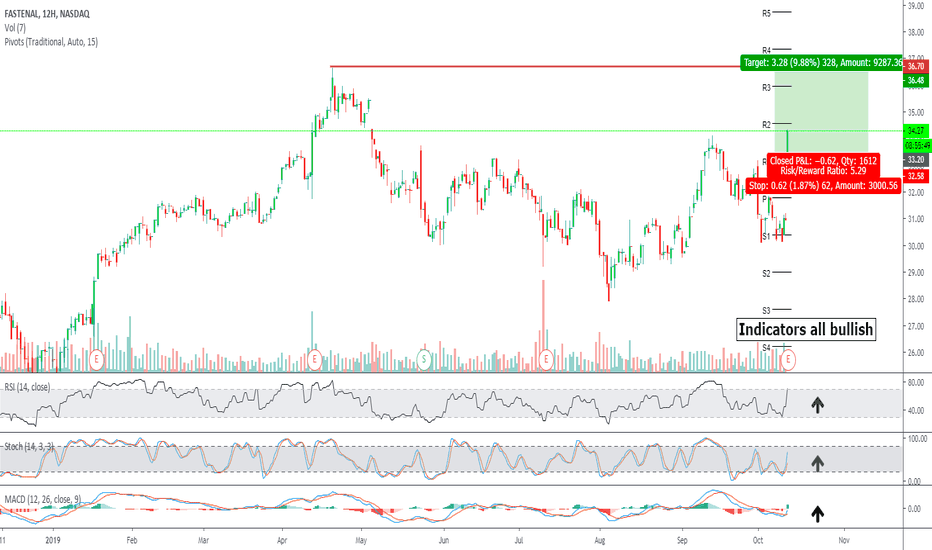

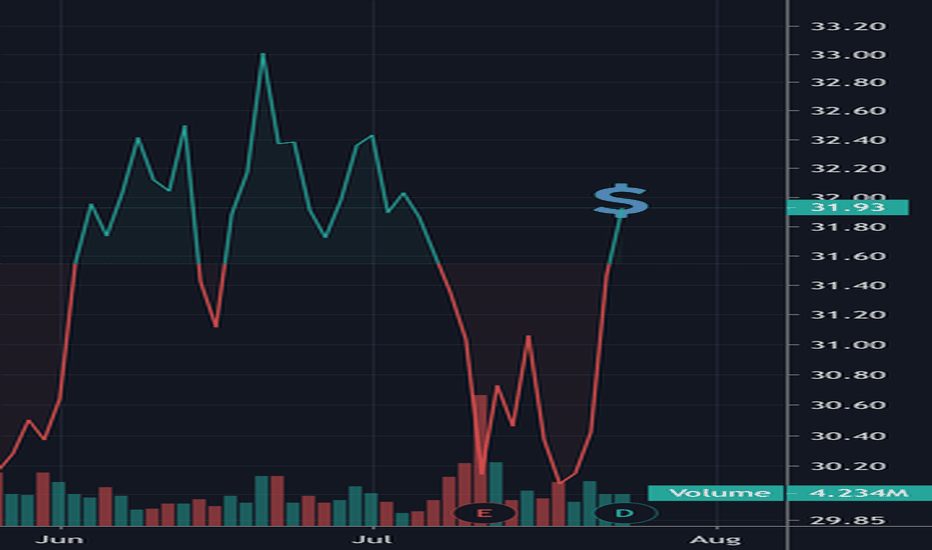

$FAST is going to rise todayEarnings intraday trading strategy signal.

Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies.

Today the company announced it had beat sales (1.509B, est. 1.47B) and EPS (0.42, est. 0.36) estimates.

I suppose many traders will close their short positions today due to the good earnings report and potentially upside trend.

So I hypothesize that $FAST price will be rising from the market open to market close.

Due to strategy, the long buy can be from the market open price,

stop-loss — - $1,03 per share

take-profit — market close price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

FAST trade ideas

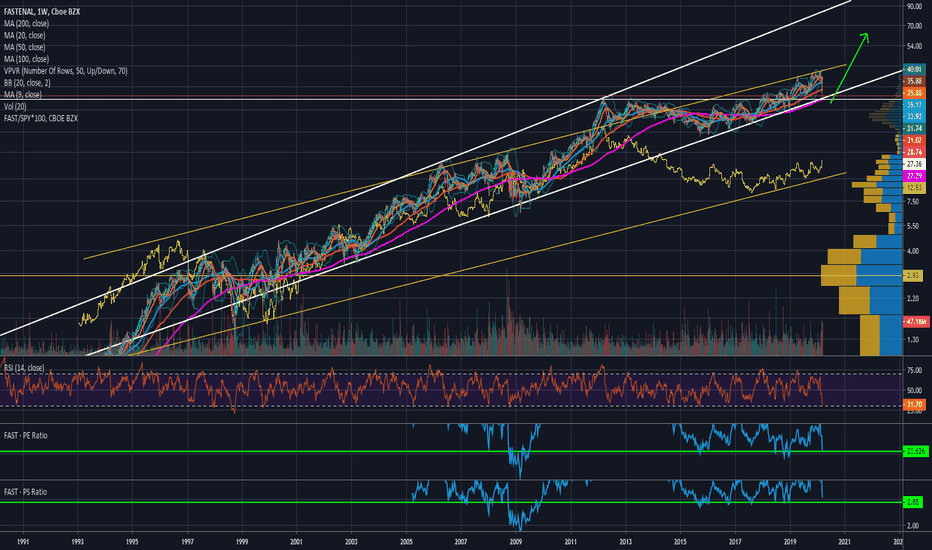

FAST looking constructive $FAST is now quite attractively valued and has been outperforming the spy as shown by the yellow fast/spy ratio. Looks like a good support zone down to about $25. Once the market reverses should see strong outperformance. $FAST is another company with a very strong balance sheet with little debt and is consistently profitable.

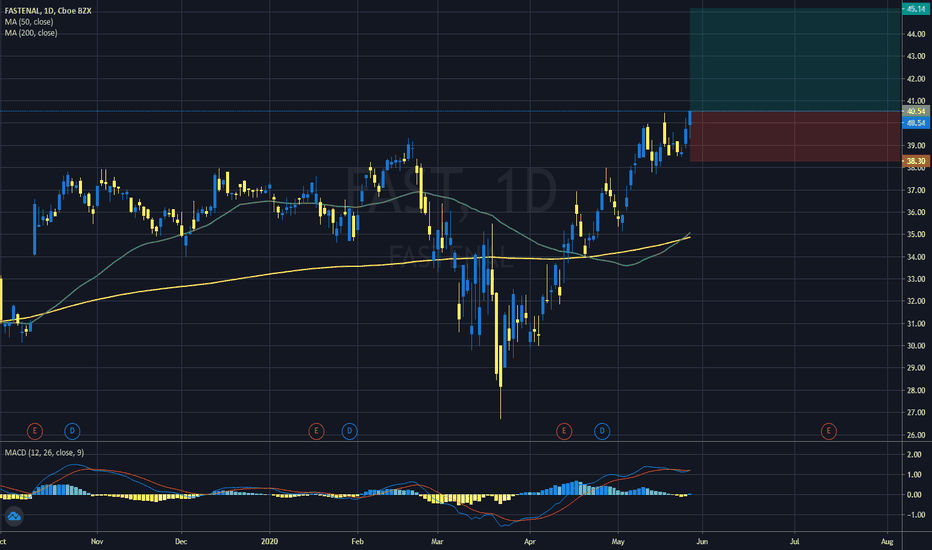

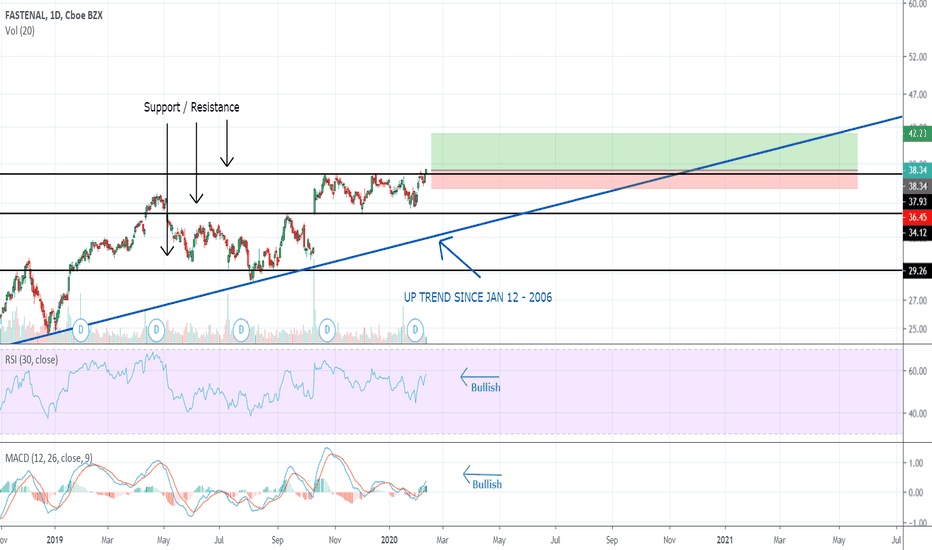

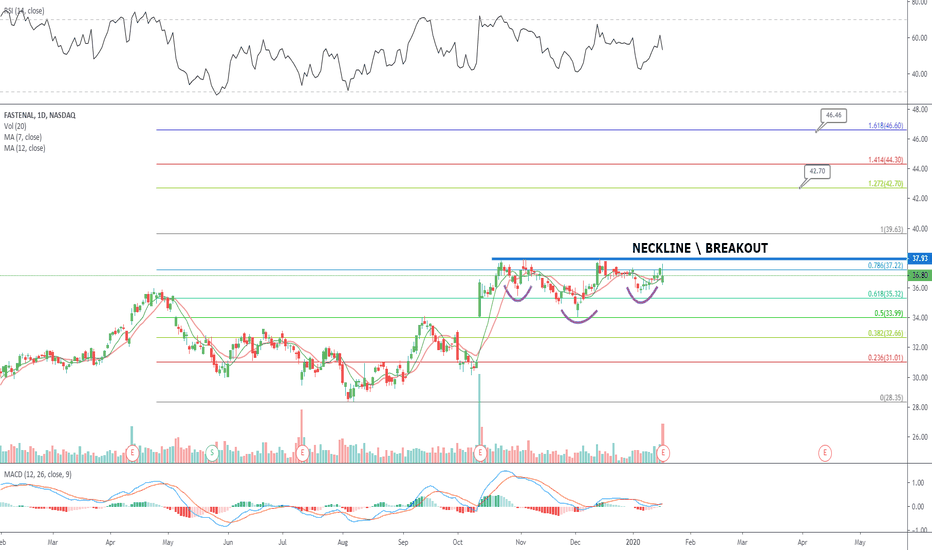

Broke resistance BUT - might jump back under Just making this update on my previous cart i link below.

Yesterday it broke the 38,02 support and ended at 38,34 - so here was my "buy pos"

but i cancelled it becouse it didnt go further thwn it did , this was a good call, for this morning the Corona Virus came with more bad newa

and that can have impact on the stock market - just looked at the pre-market and so fare in down 0,85 % and that makes it jump under the resistance line again.

i have made this new pre-order

Open trade : 38.34

Set TP : 42.23

Set SL : 36.45

Risk/Reward : 2,06 / 9,45 % gain

This is NOT an investment advice , remember always to do your own reseach.

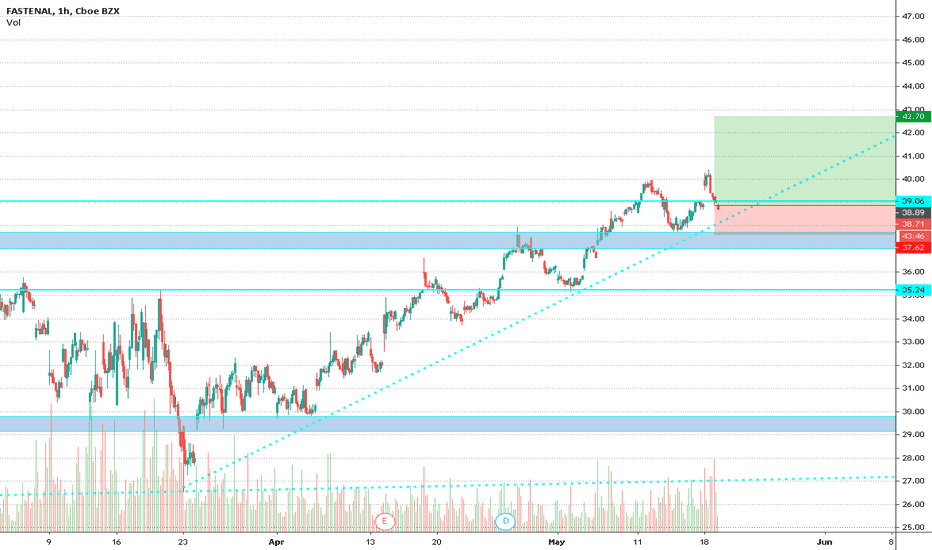

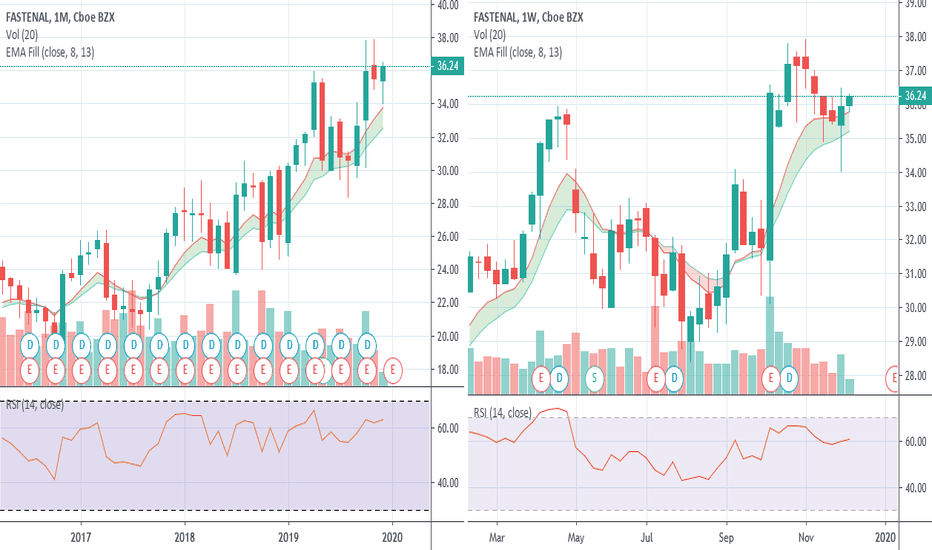

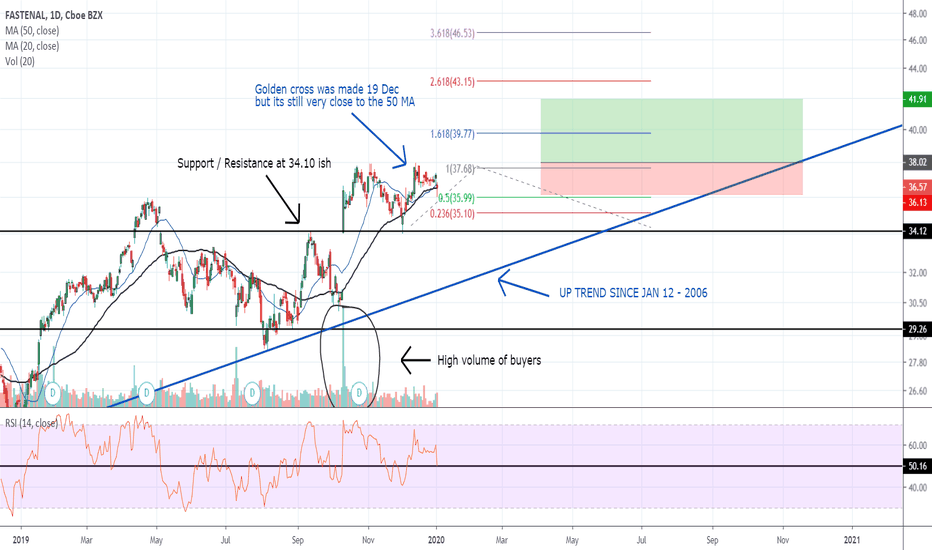

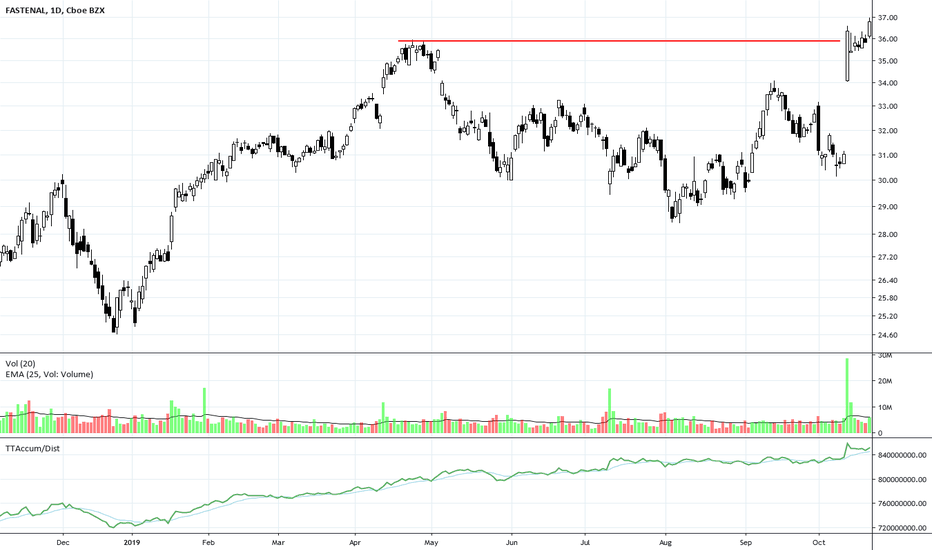

looking for my buy signal Looking for my buy signal

Golden cross is made 19 Dec

Up trend since jan 2006

Holding the 50 MA / 200 MA

RSI is 50.50 after the small drop this friday.

High volume on the 18 okt 19 befor earnings.

Fundamental analyse :

Positive 3Q earnings

Went from +0,33 in 2018 to +0,37 in 2019

Link : s23.q4cdn.com

Fastenal is many things to many different customers: an expert consultant, a logistics company, a technology provider, and more generally, a distributor of wide-ranging industrial and construction products.

Disclamier :

im waiting for the break up of last resistance at 37.90 befor putting on a buy pos.

open trade : 38

Set TP : 42

Set SL : 35.80

Risk / Reward Ratio : 2,06

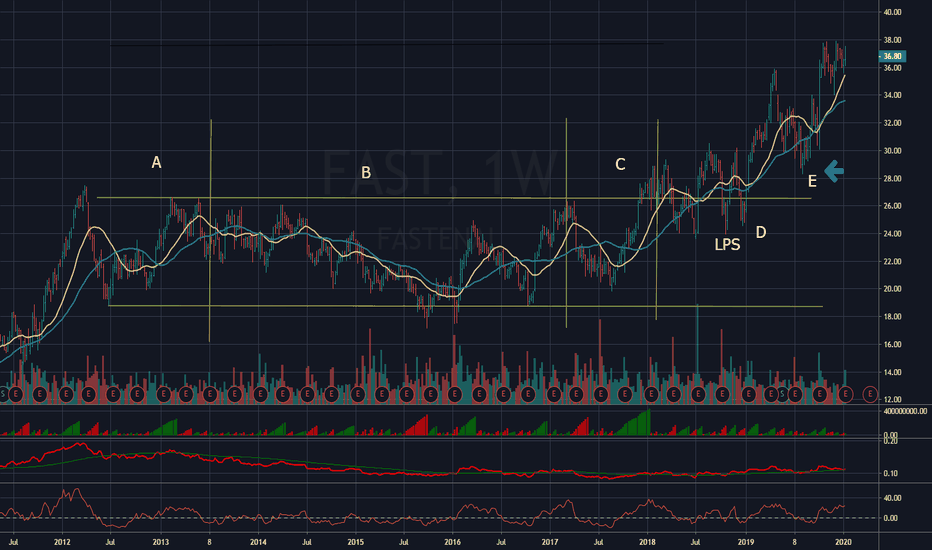

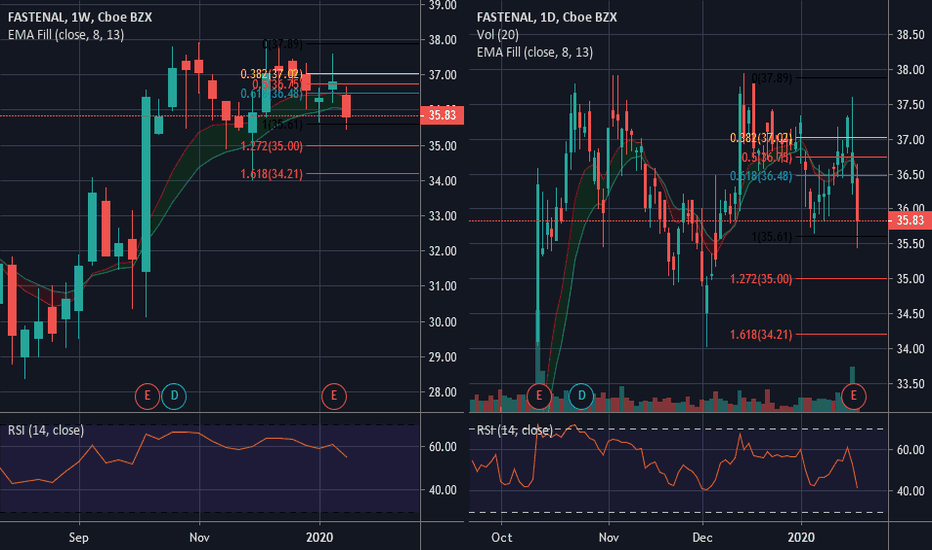

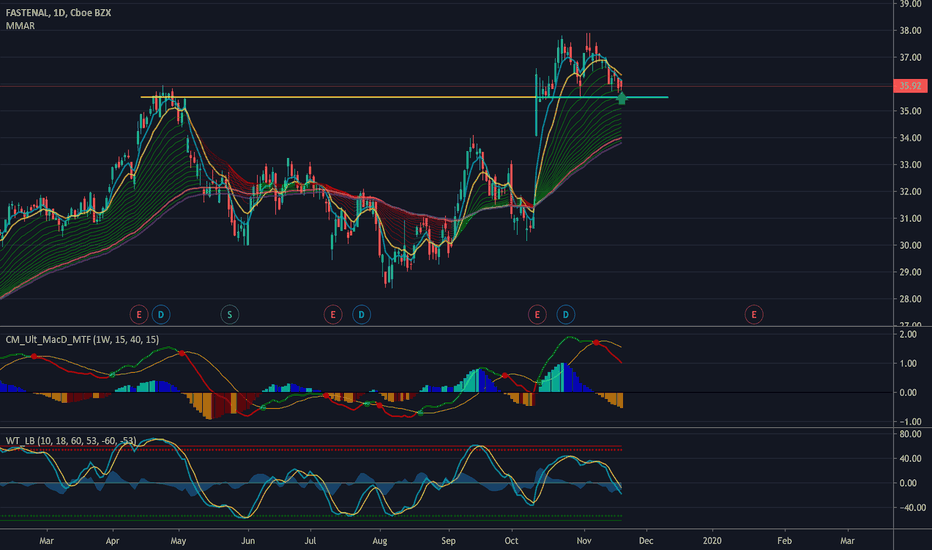

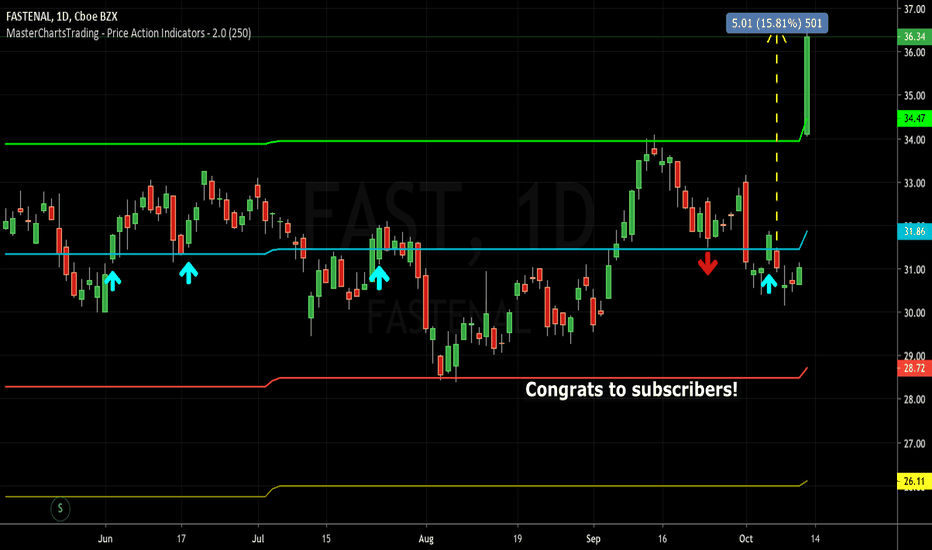

Congrats to Subscribers! Fastenal up over 15%It is very easy to read price action if you have a reference point. These support/resistance lines are there to help you read where the buyers and sellers are likely to make a stand.

MasterChartsTrading Price Action Indicators show good price levels to enter or exit a trade.

The Blue indicator line serves as a Bullish Trend setter.

If your instrument closes above the Blue line, we think about going Long (buying).

For commodities and Forex, when your trading instrument closes below the Red line, we think about Shorting (selling).

For Stocks, I prefer to use the Yellow line as my Bearish Trend setter (on Daily charts ).

Be sure to hit that Follow button! Please find me on social networks via the link on my profile page for more ideas from MasterCharts!

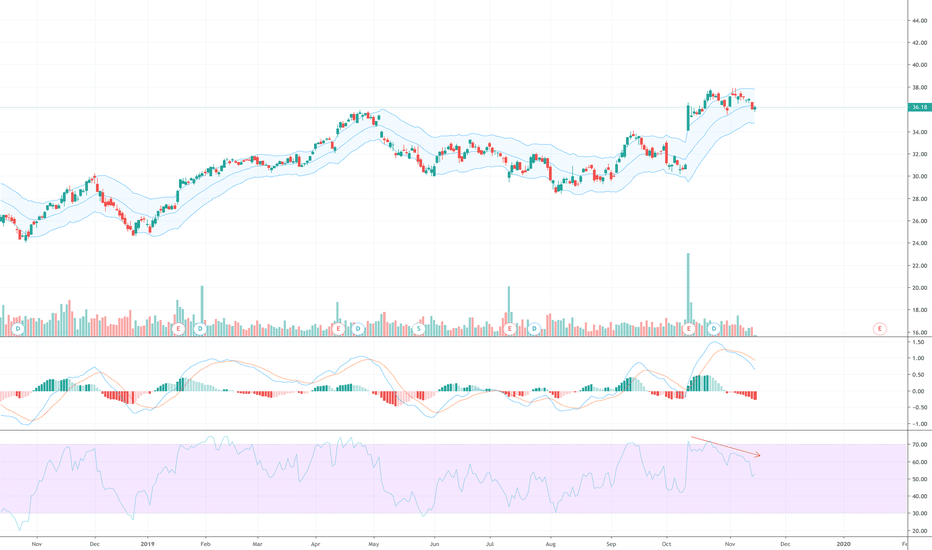

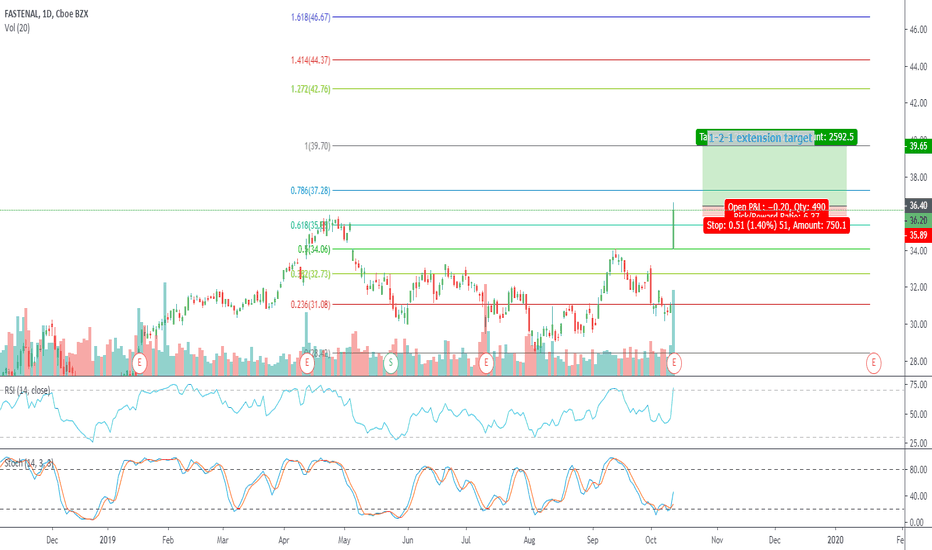

$FAST Fastenal Jumps on Sales Beat Simply a buy and is on the way to all time high.

Yield 2.84%

P/E ratio 23.24

Short interest 6.94%

Company profile

Fastenal Co. engages in the provision of fasteners, tools, and supplies which can help in the manufacture of products, build structures, protect personnel, and maintain facilities and equipment. It products include cutting tools & metalworking, fasteners, material handling, storage & packaging power, transmission & motors, tools & equipment, electricals, abrasives, hydraulics & pneumatics, plumbing, lifting & rigging, raw materials, fleet & automotive, welding, office products & furniture, janitorial and lighting. The company was founded by Robert A. Kierlin, Michael M. Gostomski, Henry K. McCannon, John D. Remick, and Stephen M. Slaggie in November 1967 and is headquartered in Winona, MN.