Long term for First Solar Inc. - the time of 'solar action'Long-term First Solar Inc. - the time of 'solar action'

First Solar, Inc. is a provider of photovoltaic (PV) solar energy solutions. The Company designs, manufactures and sells PV solar modules with thin-film semiconductor technology, and also develops, designs, constructs and sells PV solar power solutions. The Company operates through two segments: components and systems. The Company's components segment designs, manufactures and sells solar modules, which convert sunlight into electricity. The Company's systems segment provides PV solar power systems or solar solutions for systems, which use the Company's solar modules. The Company provides operations and maintenance (O&M) services to plant owners that use solar modules manufactured by the Company or by other third-party manufacturers. The Company has approximately 30 manufacturing lines around the world and over 2.8 gigawatts (GW) of annual manufacturing capacity with lines having a production capability of approximately 2,500 modules per day.

www.google.com

FSLR trade ideas

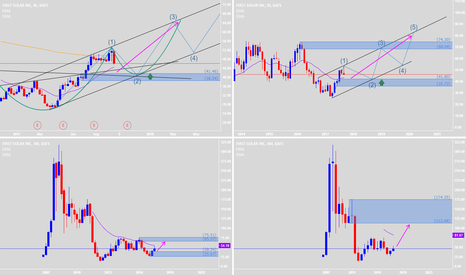

FSLR Breakout Pick of the weekLove this stock. 6 RR ratio! FSLR has formed an ugly rectangle bottom with a potential parabolic breakout (notice the curve at the end of the rectangle. Volume looks good for continue breakout. Also, scroll down the time frames. Notice the stair step pattern. These are classic signs there is a buy accumulating large stock lots at one time. The broader market has not caught on yet, but once they do this stock will go thru the roof.

15 minute

Daily

What if I am wrong? Well good news, you can define your risk by the either the top or the bottom of the rectangle. If you are a little more tolerant of throwbacks, define your risk by the bottom of the rectangle. If you are less tolerant (like me), define it by the top of the rectangle. I choose the second peak because I wanted to give myself room for a little intra day volatility.

I would suggest doing a nice options calendar spread. Ill probably do one for this coming week, next month and probably end of year. We will have to see how they are priced. Then I can roll up or out as needed.

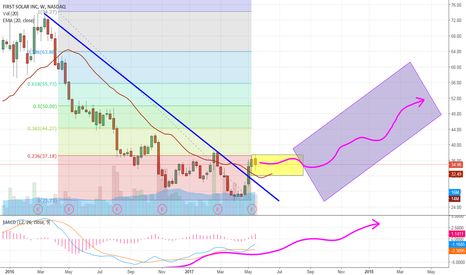

Long FSLRSet stop too close on previous FSLR Long. After stop being picked off FSLR surged. Bought back in on surge. As price continue to trend up continuing to increase postion size - stop set deeper at $58. Will move up stop each time price breaks out to new levels - will continue to set stop just below bottom of range from previous consolidation (before breakout).

Long FSLRFirst off it is in a clear long term up trend. Secondly, it has been consolidating for weeks now, and FSLR has shown a patter of consolidation and then a break out. Place a close stop at 58 if the consolidation breaks down. But projecting an eventual pop towards the 75 range. Great reward to risk ratio.