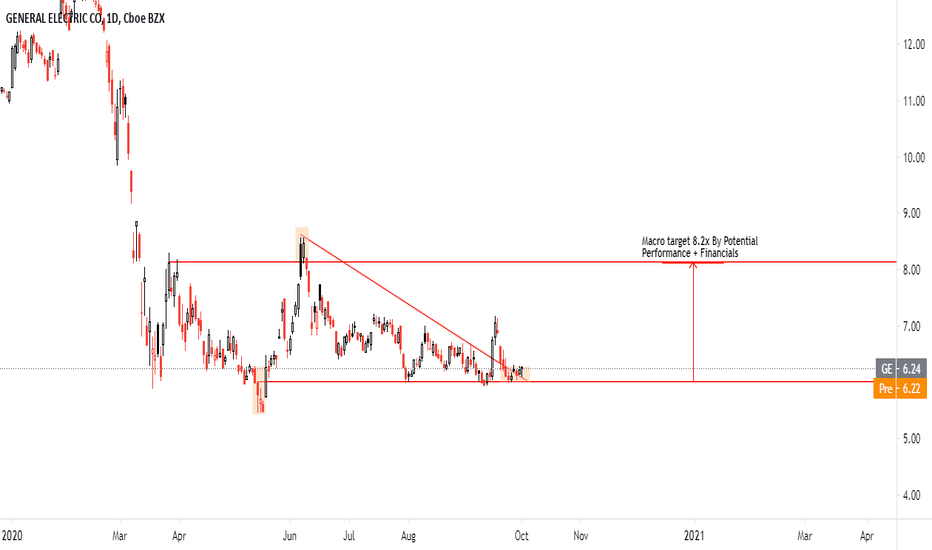

General Electric Stock Analysis + Ready for recovery !📌 General Electric Stock Analysis. For Financials Analysis Sheet kindly message us through Trading View.

📍 Stock info

Market Cap 54.62B

Revenue (ttm) 77.37B

Net Income (ttm) -4.48B

Shares Out 8.75B

EPS (ttm) -0.58

PE Ratio n/a

Forward PE 16.00

Dividend $0.04

Dividend Yield 0.64%

📍 Stock Quote

Trading Day Oct 2, 2020

Last Price $6.24

Previous Close $6.23

Change ($) 0.01

Change (%) 0.16%

Day's Open 6.28

Day's Range 6.11 - 6.29

Day's Volume 96,781,556

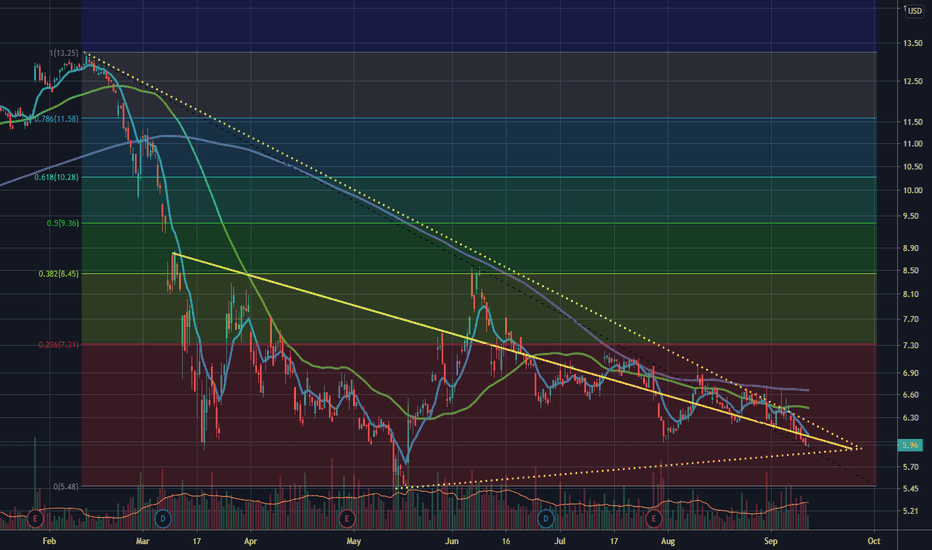

52-Week Range 5.48 - 13.26

📍 Market Cap 54.62B

Enterprise Value 95.07B

Earnings Date (est) Oct 28, 2020

Ex-Dividend Date Sep 25, 2020

Shares Outstanding 8.75B

Float 8.70B

EPS (basic) -0.58

EPS (diluted) -0.58

FCF / Share 0.69

📍 Dividend $0.04

Dividend Yield 0.64%

Earnings Yield n/a

FCF Yield 10.97%

Payout Ratio n/a

Shares Short 103.57M

Short Ratio 1.28

Short % of Float 1.19%

Beta 0.92

📍 PE Ratio n/a

Forward PE 16.00

P/FCF Ratio 9.11

PS Ratio 0.71

PB Ratio 1.58

Revenue 77.37B

Operating Income 819.00M

Net Income -4.48B

Free Cash Flow 5.99B

📍 Description

General Electric Company operates as a high-tech industrial company in the United States, Europe, Asia, the Americas, the Middle East, and Africa. It operates through Power, Renewable Energy, Aviation, Healthcare, and Capital segments. The Power segment offers technologies, solutions, and services related to energy production, including gas and steam turbines, generators, and power generation services. The Renewable Energy segment provides wind turbine platforms, and hardware and software; offshore wind turbines; solutions, products, and services to hydropower industry; blades for onshore and offshore wind turbines; and high voltage equipment. The Aviation segment provides jet engines and turboprops for commercial and military airframes; maintenance, component repair, and overhaul services, as well as replacement parts; integrated digital components; and additive machines and materials, and engineering services. The Healthcare segment provides healthcare technologies in medical imaging, digital solutions, patient monitoring, and diagnostics; drug discovery; biopharmaceutical manufacturing technologies; and performance enhancement solutions to hospitals, medical facilities, pharmaceutical and biotechnology companies, and life science research markets. The Capital segment leases and finances aircraft, aircraft engines, and helicopters; provides financial and underwriting solutions; and manages its run-off insurance operations which provides life and health insurance and reinsurance products. The company was founded in 1892 and is headquartered in Boston, Massachusetts.

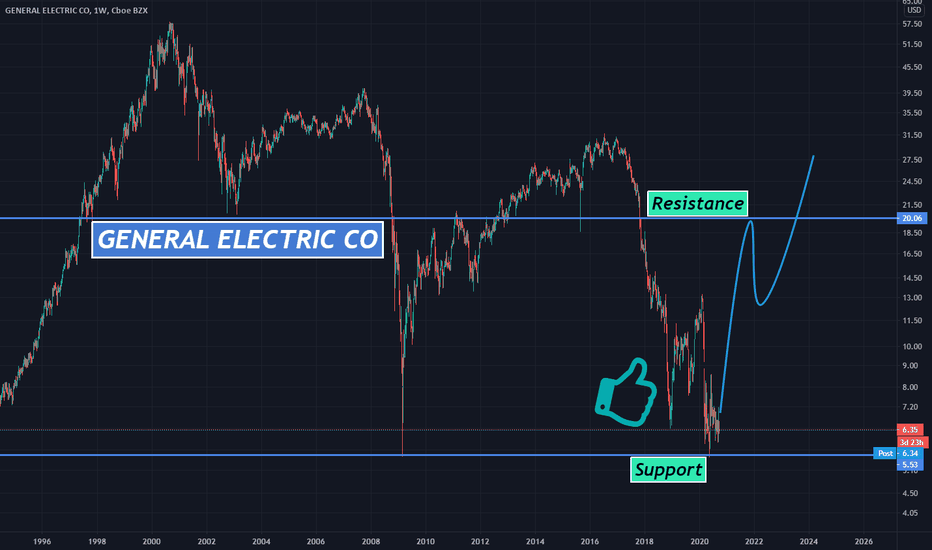

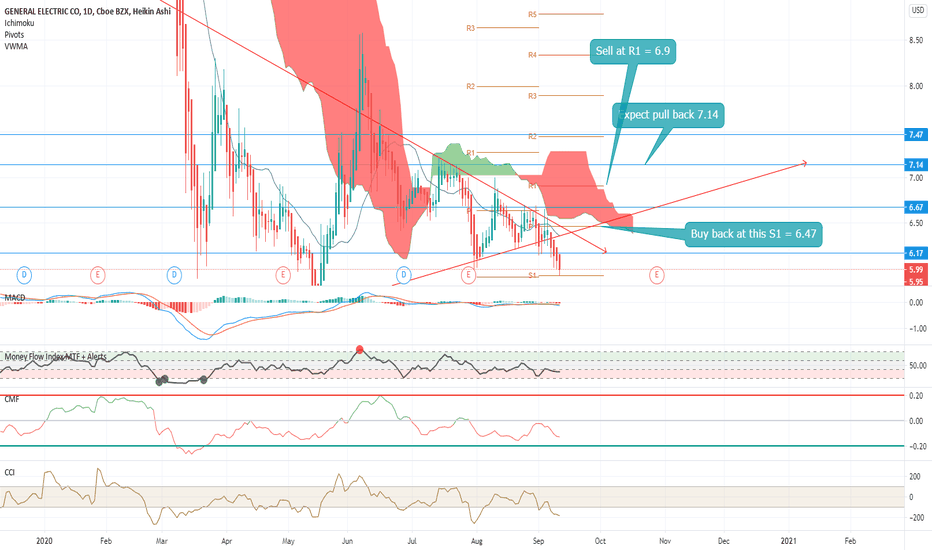

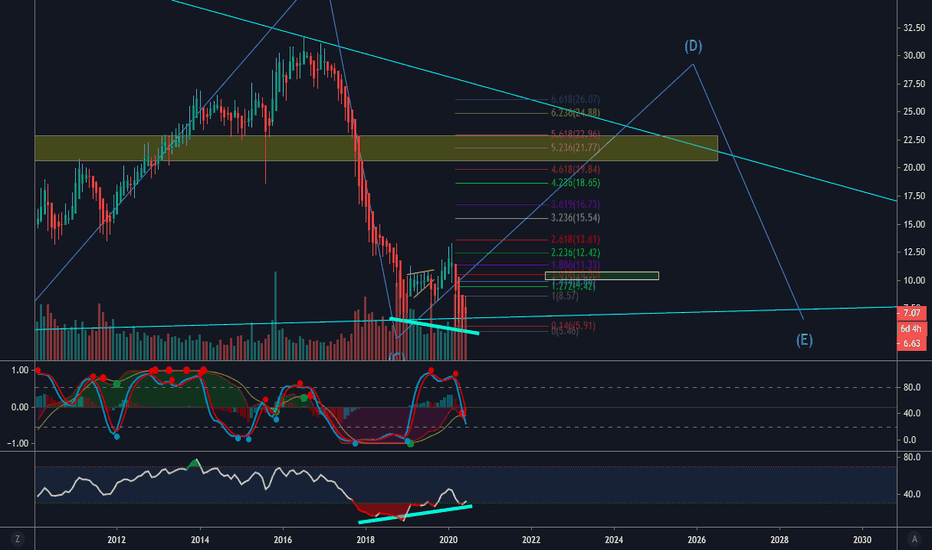

💡 Is GE a good idea after all?

With its focus on renewable energy and its decision to stop catering to the shrinking coal industry -- in addition to its stronger financial position -- it's understandable why investors have grown so interested in GE's stock lately. For investors with a higher tolerance for risk and a willingness to weather near-term volatility, GE seems worth considering to Hold for better returns an portfolio Building.

Thank You.

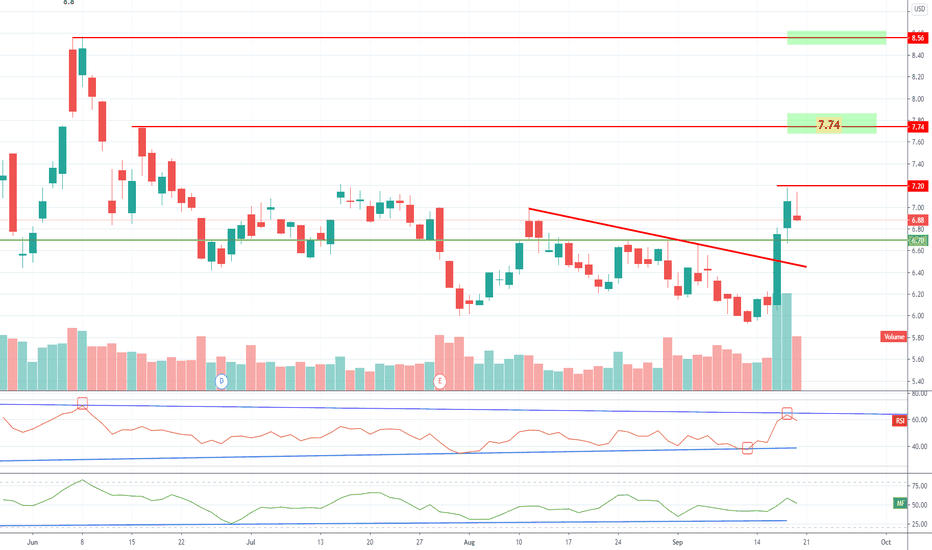

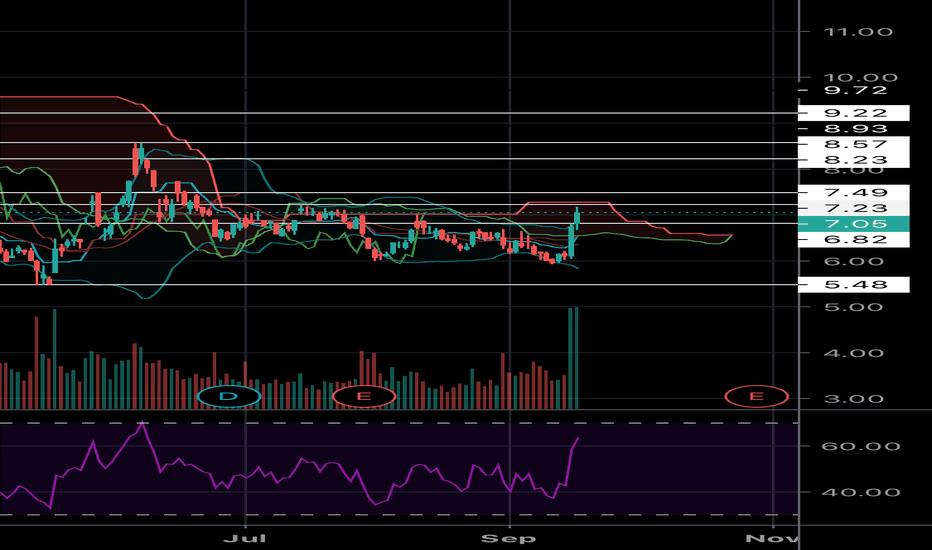

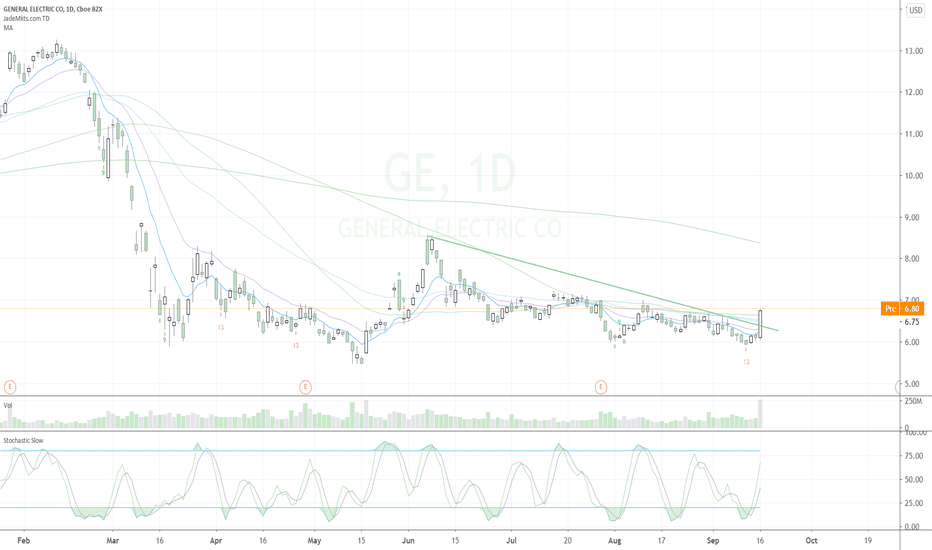

GE trade ideas

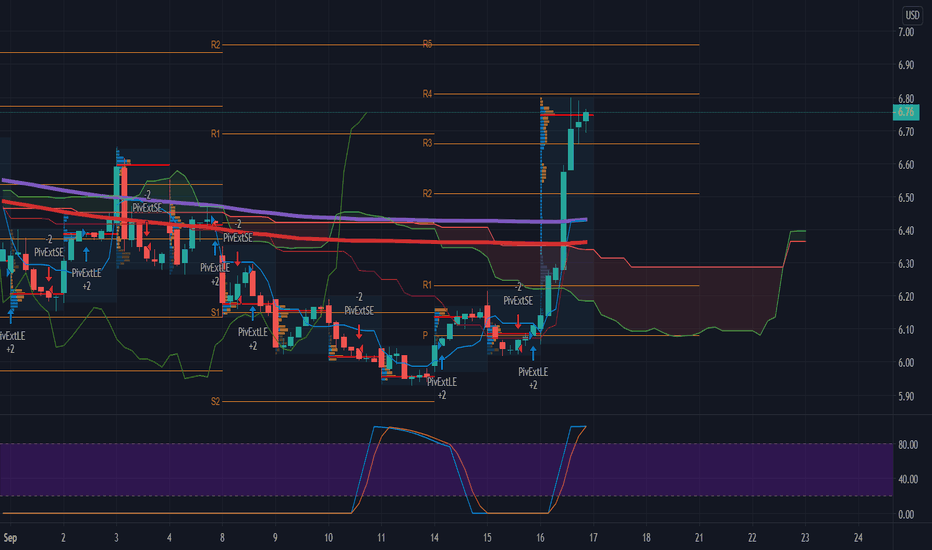

$GE Bullish pattern targeting 7.74 then 8.5 SL 6.5 closed 6.88Almost large double bottoms at 6 and followed by bullish power candle. Still indicators showing more room for upside move targeting 7.74 then 8.5 which around 10-20% of current level. looking bullish for long term too. could go back test the broken trend then moves up again .

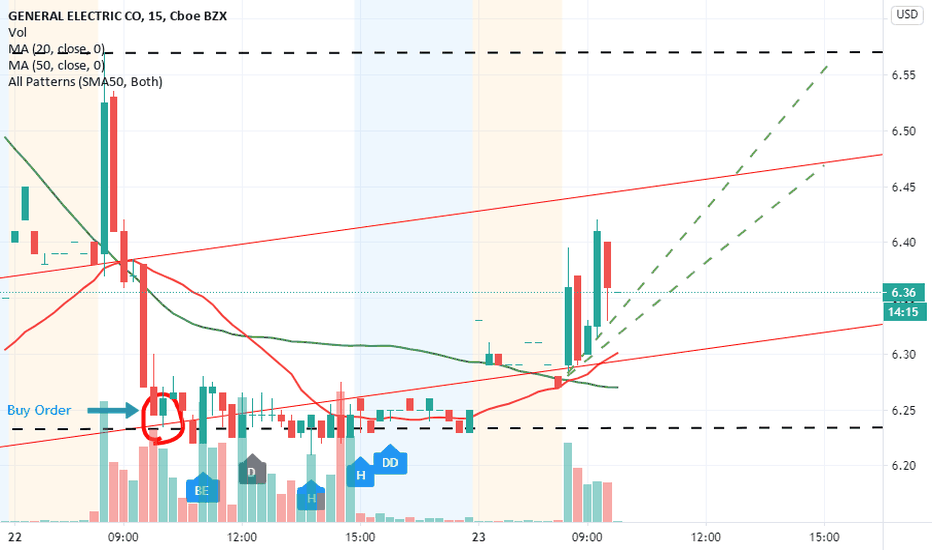

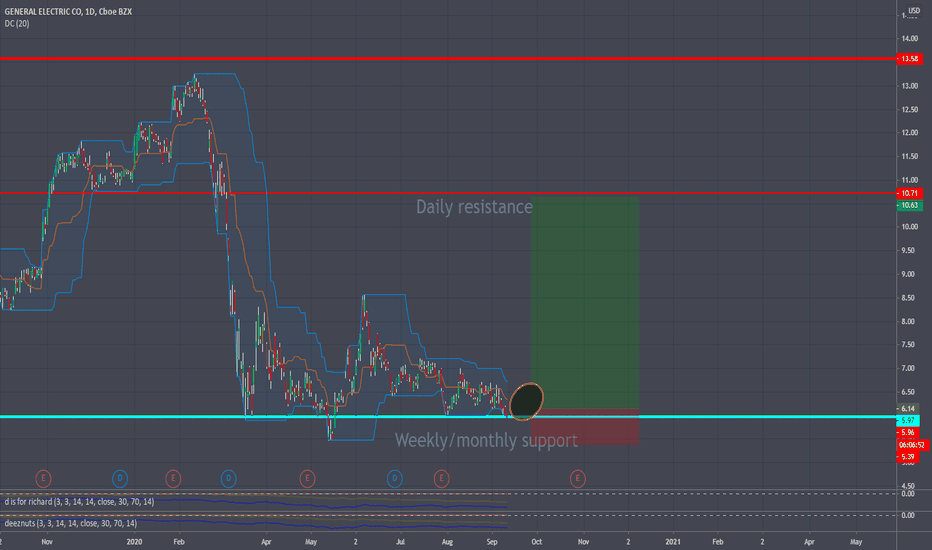

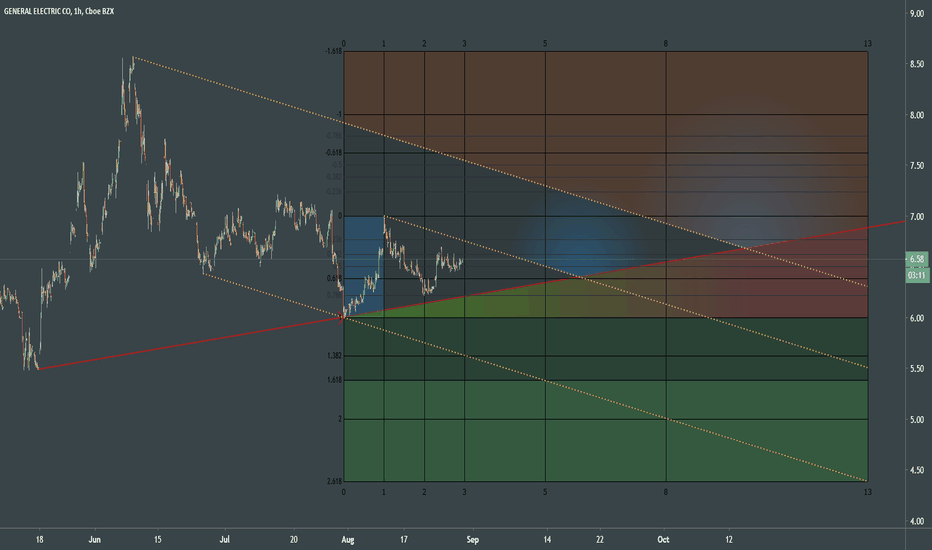

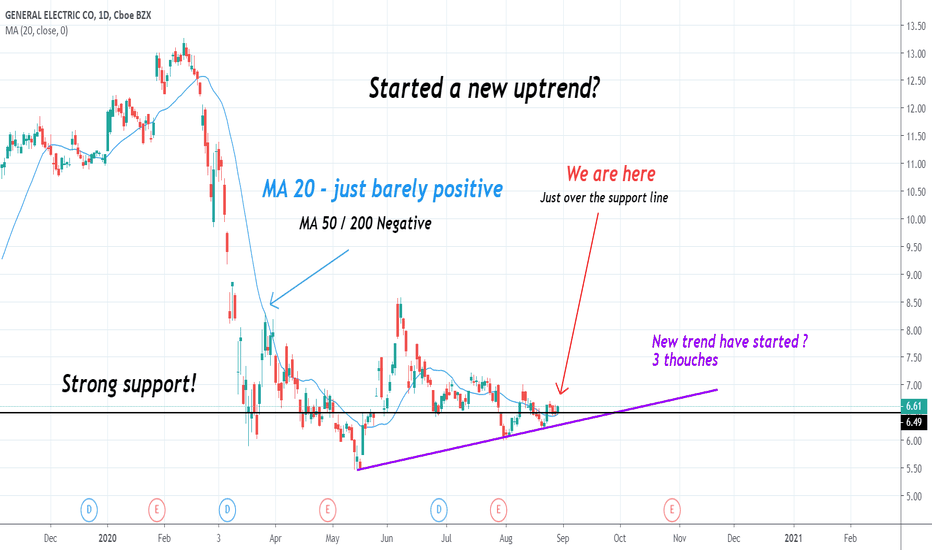

Long GEHey All,

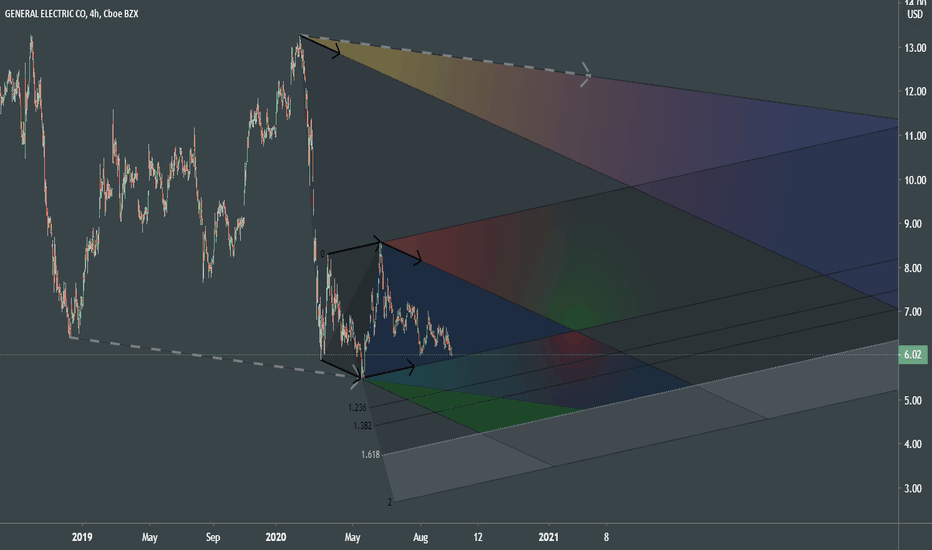

This one is also purely based on price action.

Bounced of Weekly/Monthly Resistance, but no clear entry signal yet.

Im waiting for a clear signal to enter, because this could break up.

Follow me for more like this !

If it is helping you, please leave a like and a comment.⠀

_____________________________________________________________________________⠀

This information is not a Recommendation. It is purely for Educational Purposes.⠀

⚠ Keep in mind this is just a prediction, i might go in on this trade but stick to your own strategy and method.

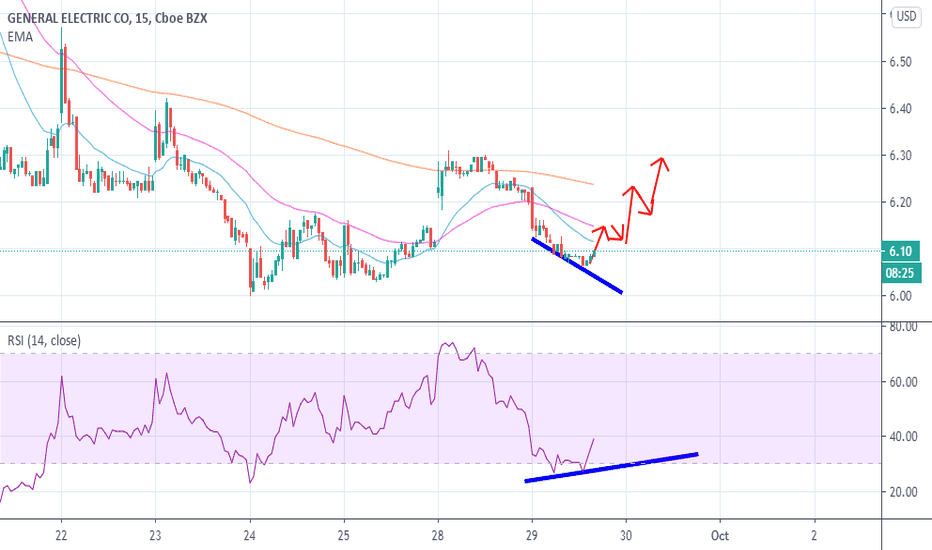

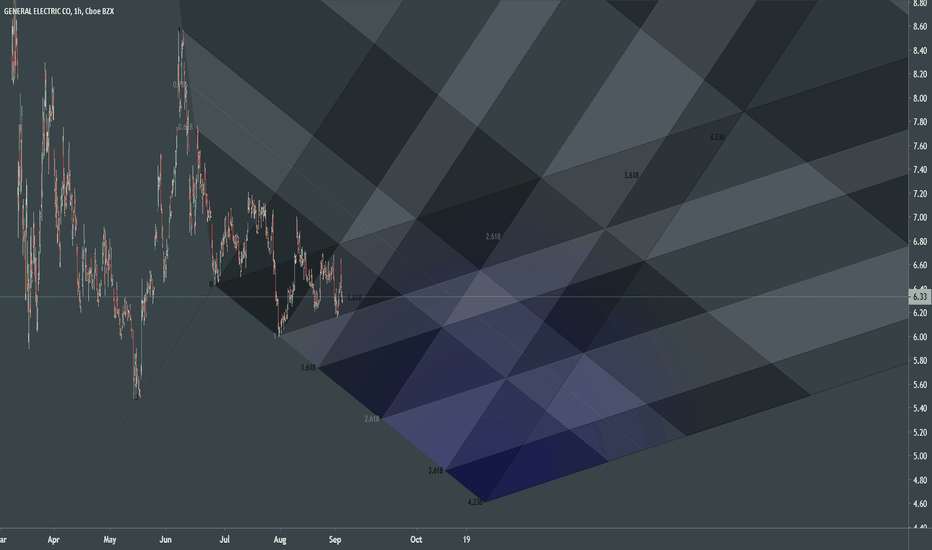

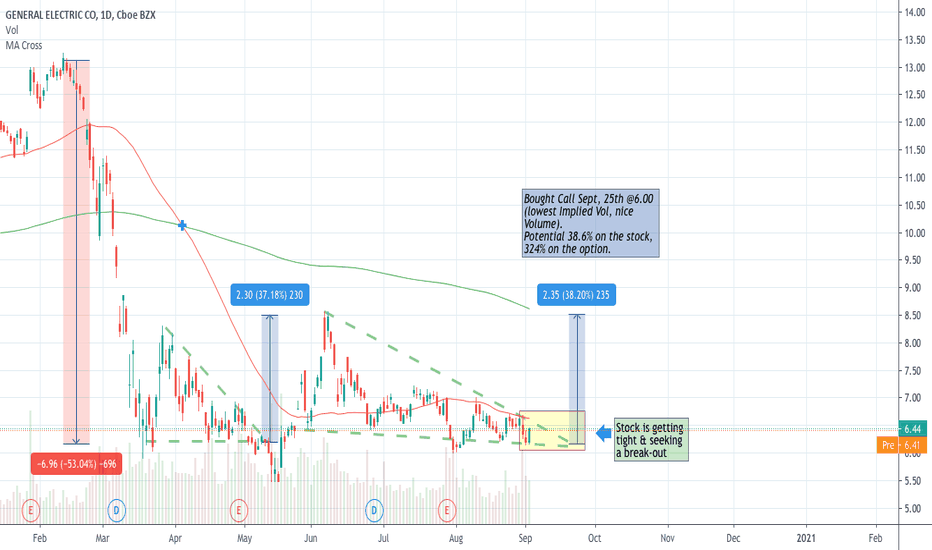

Potential Buy signal in General ElectricsPrice movement is getting tight within a beautiful Triangle. Books tell us this might be a Descending Triangle. What I see? The stock made the same exact figure earlier this year and boomed 37% upwards after a 11.37% downside movement.

Not the optimal set up but your risk is defined.

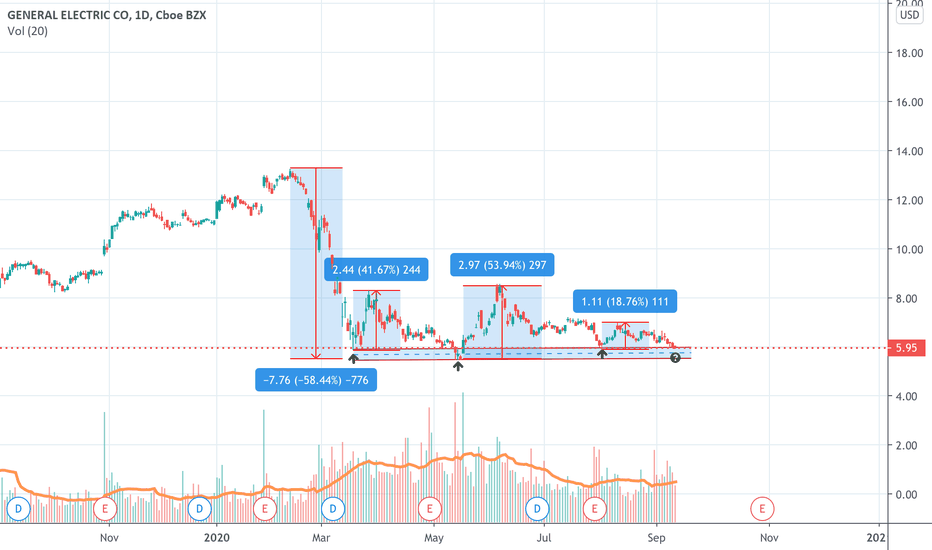

GE 1/9/2020 (Ready for take off?) This stock has been manipulated by big fund management constantly beating the stock down and up.

We have seen last year how analyst degraded the stock just so the big boys can upload their funds , and later rocketed .

set stop loss of $2, enough buffer for speculations. Hold it tight and ignore all noises.

How far lower can a conglomerate go?