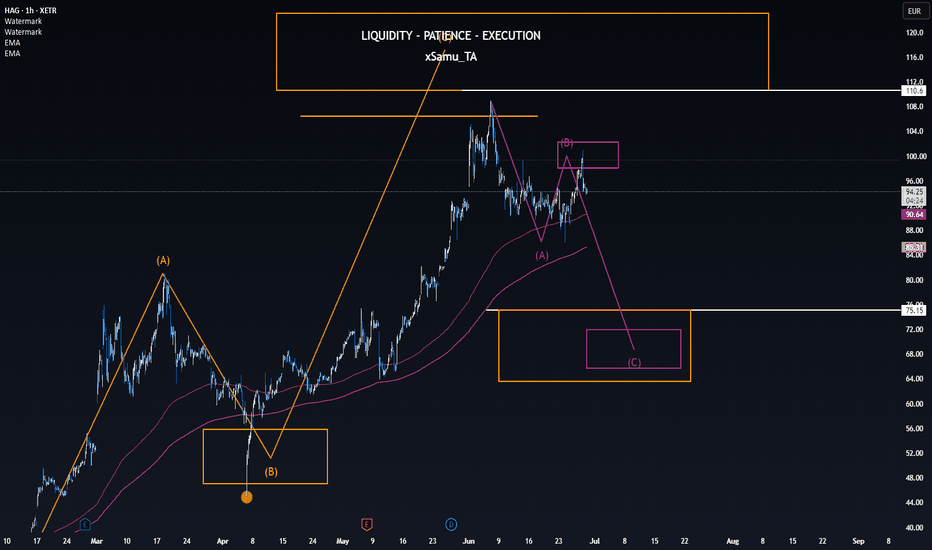

HAG investors should prepare for downsideHensoldt AG topped out a bit early—unfortunate, but no real drama.

The broader idea of higher highs remains fully intact.

To fuel the next leg up, I could very well see the violet structure playing out, guiding us directly into the bullish rebound zone. But for that to unfold, we first need a clean break below point A.

Should that happen, investors should prepare for roughly 25% downside before the real opportunity begins.

Stay focused. Don’t fear the dip - embrace the setup.

HAG trade ideas

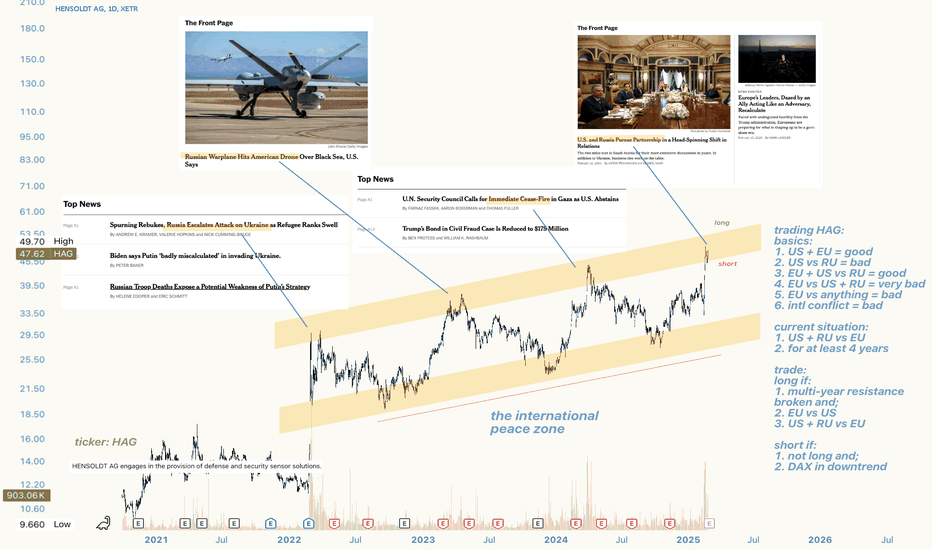

HAG Long: A trade based on the current geopolitical climateHENSOLDT AG ( HAG ) continues to respect its long-term ascending channel, with price action now testing multi-year resistance. Heightened geopolitical tensions, particularly between the US, EU, and Russia, coincide with recent upward momentum. Historically, international conflicts have bolstered defence equities, and the current macro backdrop remains consistent with that theme.

A sustained breakout above resistance could signal a shift in market expectations, while the underlying trend reflects the broader geopolitical landscape. Ironically, the chart represents the doomsday clock better than the clock itself. The irony doesn't end there, for global peace lies below the support for this stock. As soon as supporters of this stock take their hands off the wheel, peace inches closer. Bears on defence stocks bring peace. 🏝️

For now, it's time to be a bull. Probably.

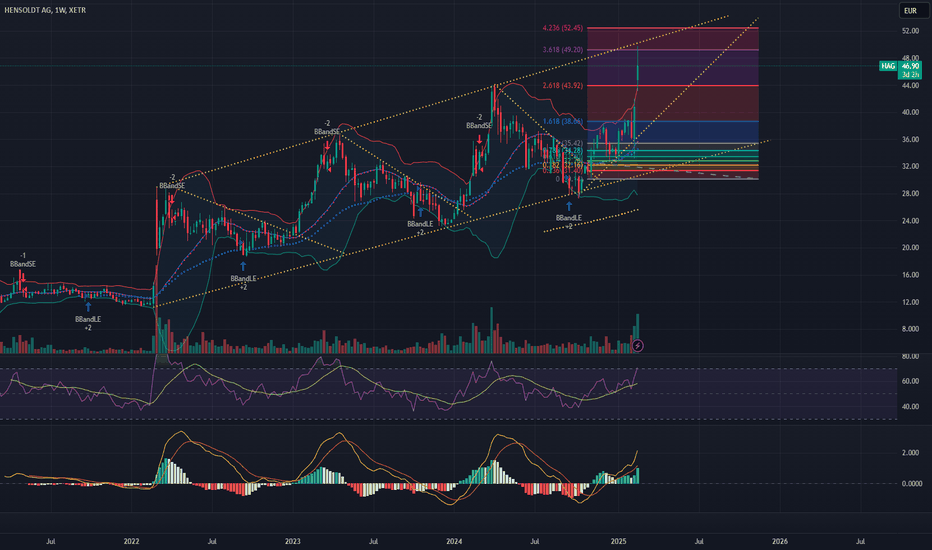

Trading Idea - #HensoldtMy trading idea for Hensoldt - Buy/LONG

Target: 26.00 EUR (+10 %)

Stop: 22.50 EUR

Defense electronics specialist HENSOLDT could benefit the most from higher European defense spending. Although the share price has already almost doubled, the valuation remains attractive, so the stock has further space to move upwards.

The majority of analysts see the price above EUR 30.00.

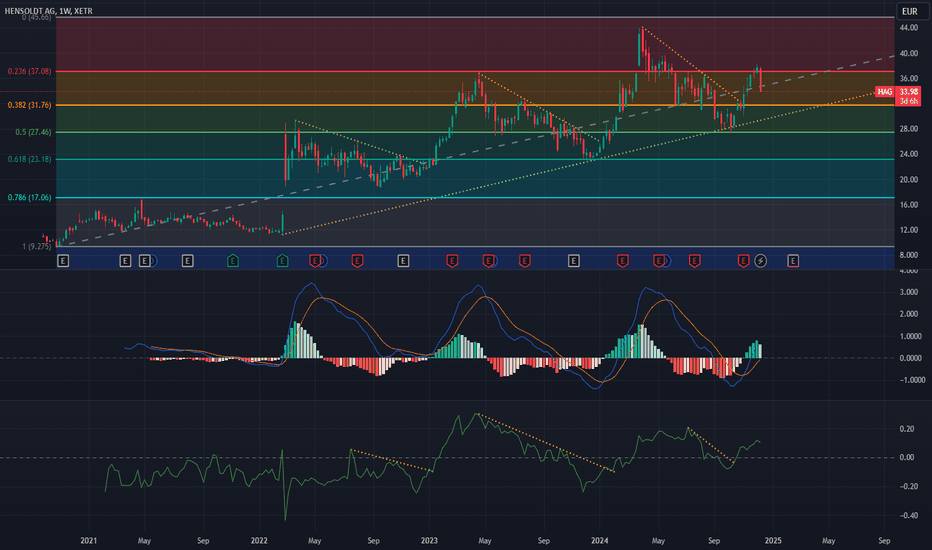

Trading Idea - #HENSOLDT (Make Love, Not War!)BUY

ENTRY: 14.32 EUR

TARGET: 16.46 EUR (15% profit)

STOP: 13.32 EUR

Hensoldt is a German manufacturer of search, detection, navigation, guidance, aeronautical and nautical systems and instruments.

1.) Hensoldt could get some impetus on the upward trend line.

2.) Hensoldt receives order for the German Armed Forces reconnaissance system Pegasus

3.) The board of directors with a positive assessment of the defense company.

4.) Thanks to the strong order situation, further business development is possible.

5.) Electronics are gaining in importance in the defense industry. HENSOLDT is well positioned to successfully serve the market.