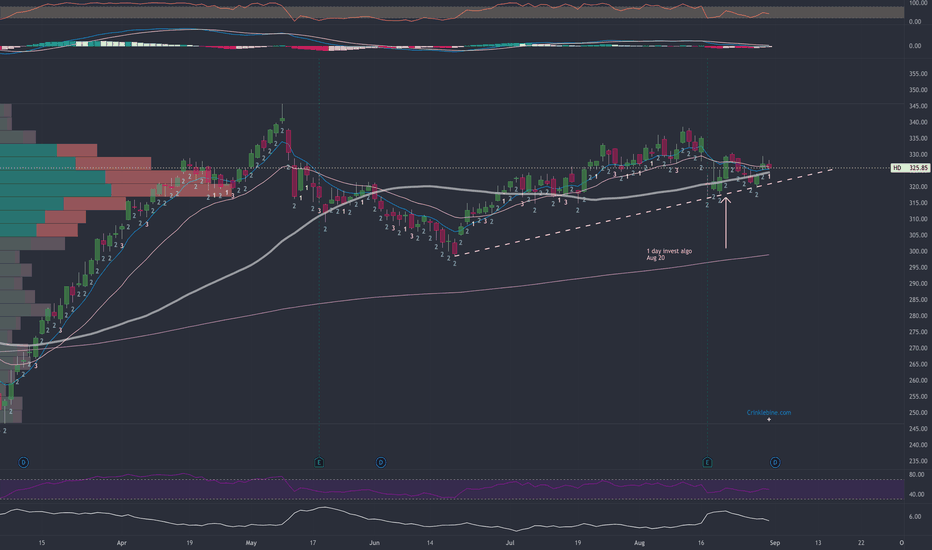

HD trade ideas

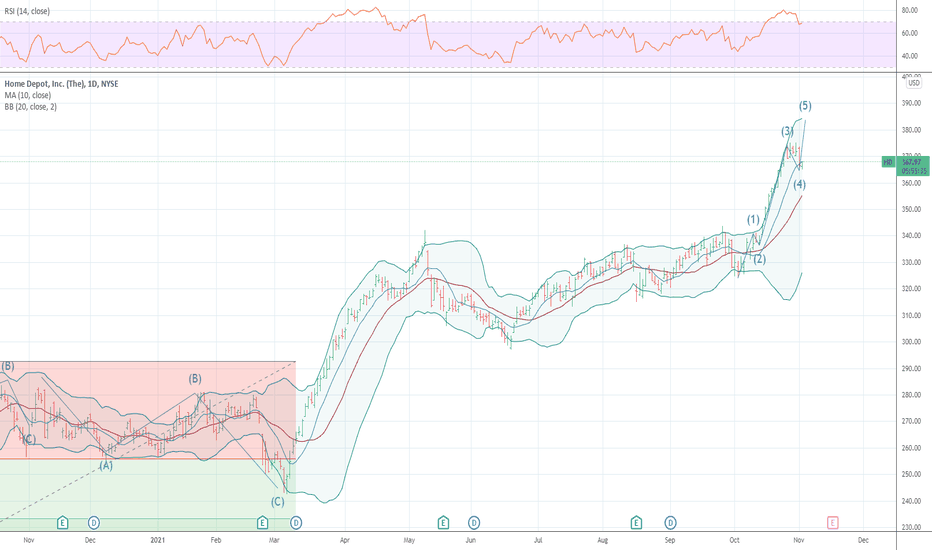

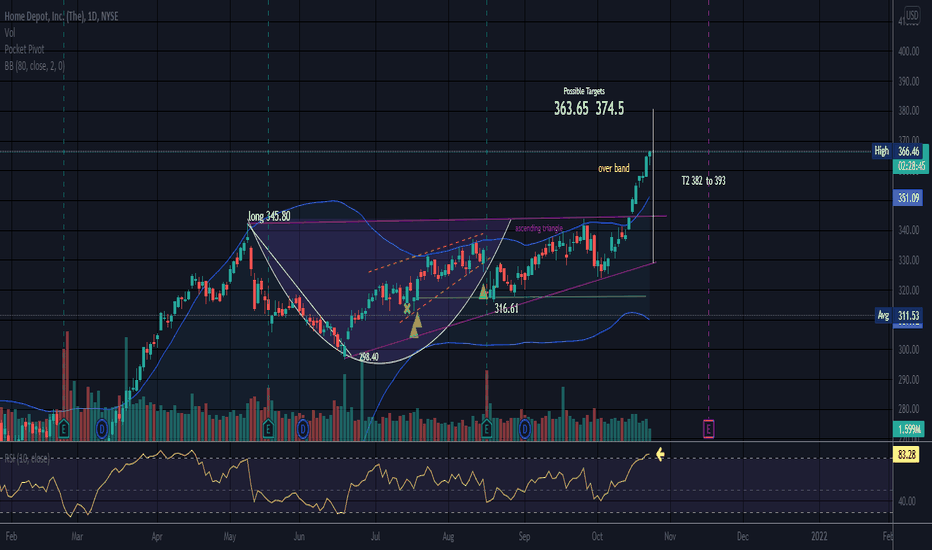

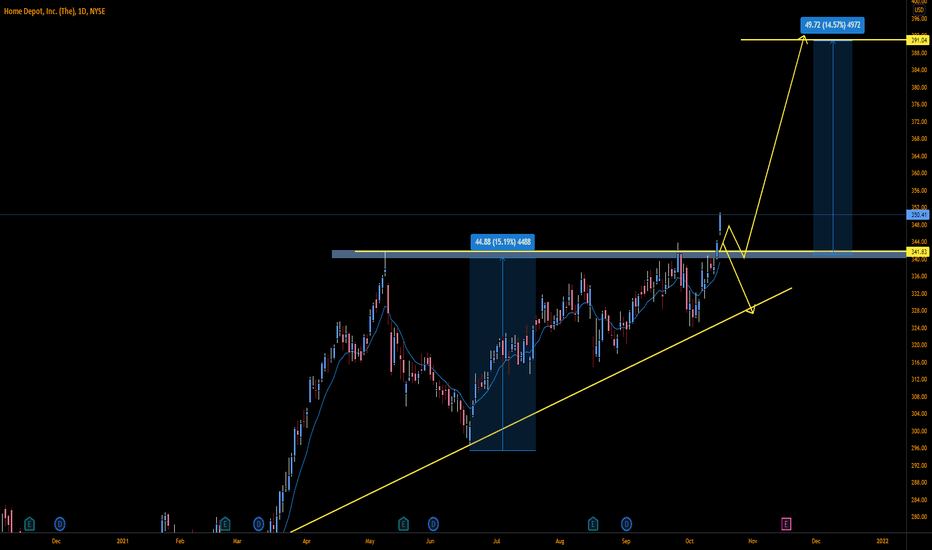

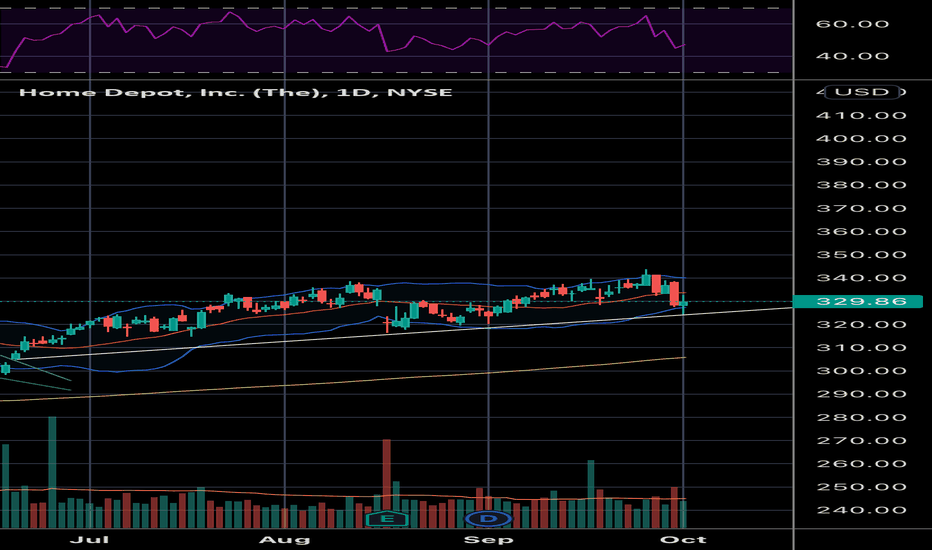

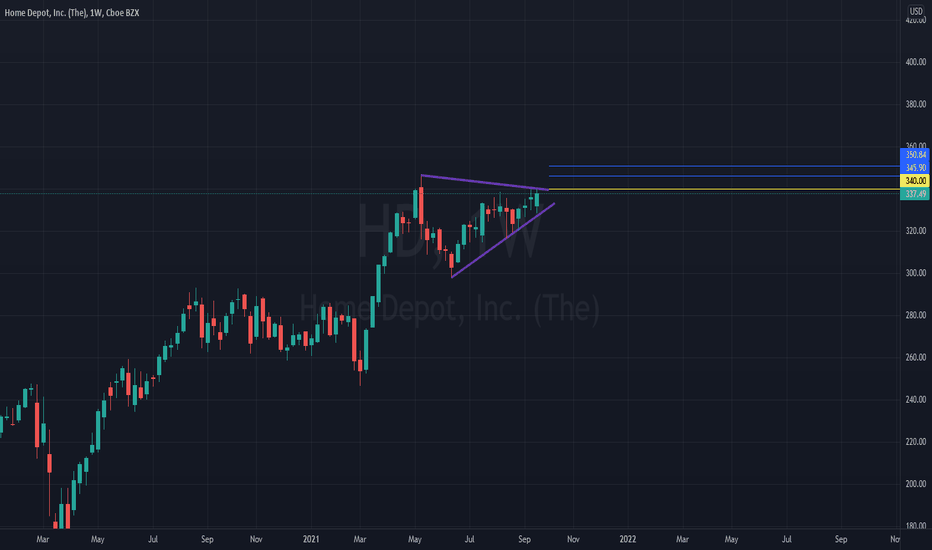

Cup and Handle Ascending TrianglePrice is above the bands set on 80 SMA. Very bullish and shows a ton of momentum. Closing in on Targets 1.

I get a bit nervous when price is over the top band set on 80 as price usually returns the bands. When price is over the top band, it is almost always overbought. Price can remain outside the top band and in overbought condition for a while in some cases with extreme momentum or a security may just ride the top band while slightly over the top band.

Targets 2 are long term and may or may not be met. My focus is on targets 1 as I do own this.

No recommendation.

Trying to reach for the stars here, but keeping my feet on the ground.

You can measure the wide end of a triangle at the side end and project it from the bottom trendline of a triangle to get a guesstimate of where price may go. Any triangle can break up or down. This one broke to the upside.

RSI is set on 80 verses 70.

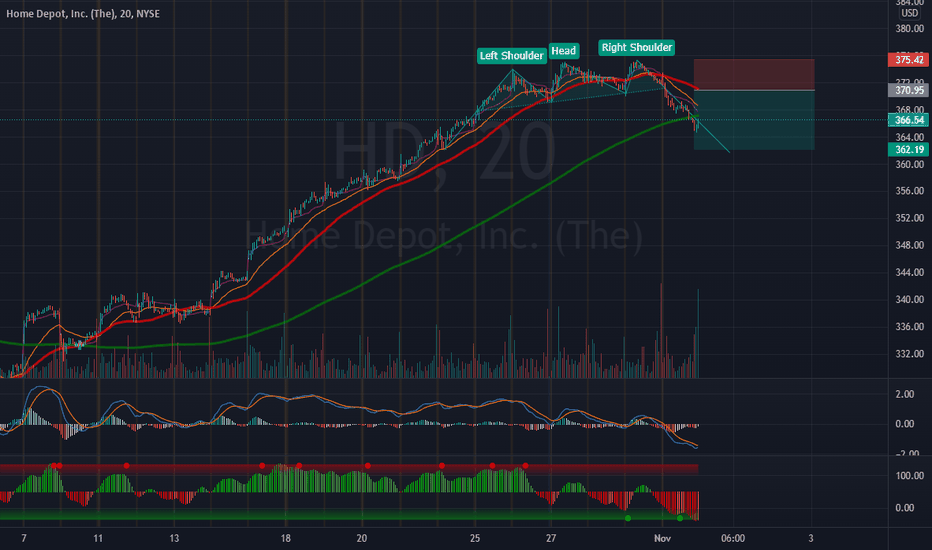

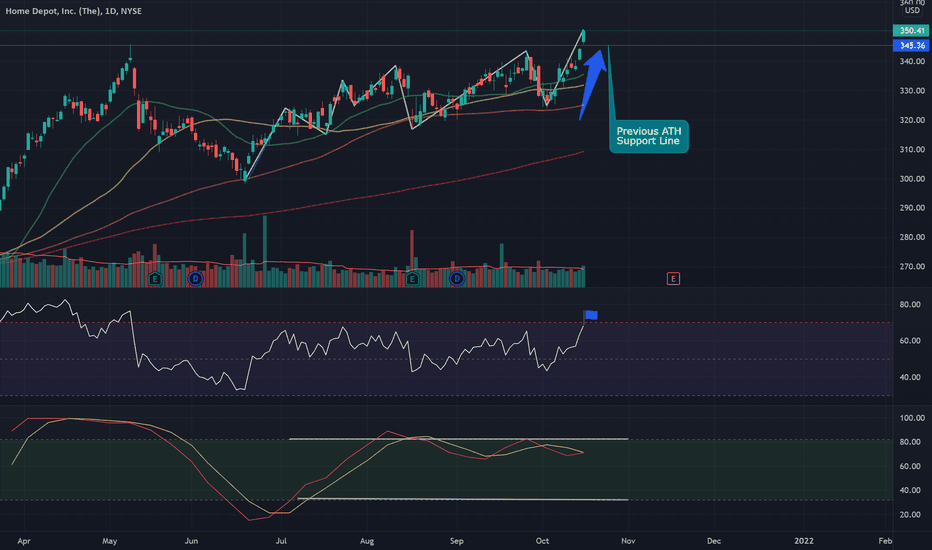

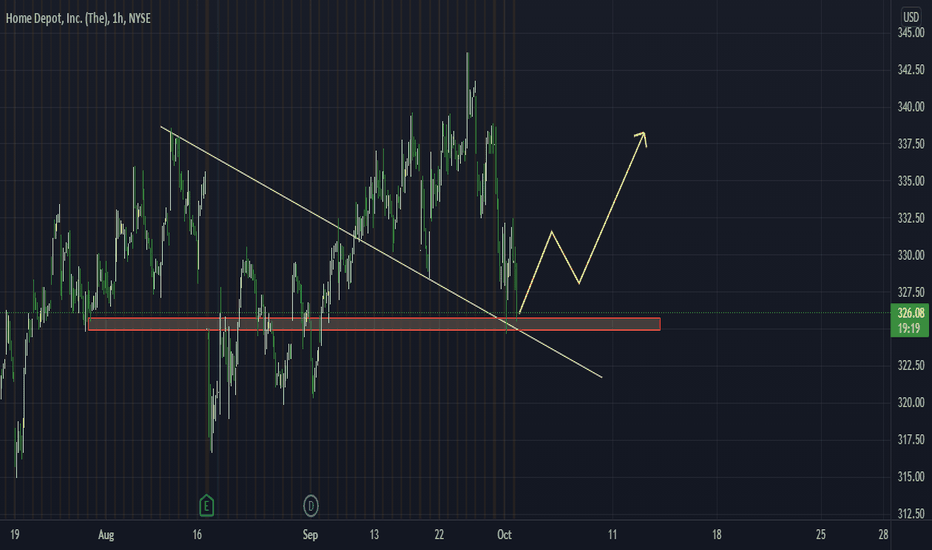

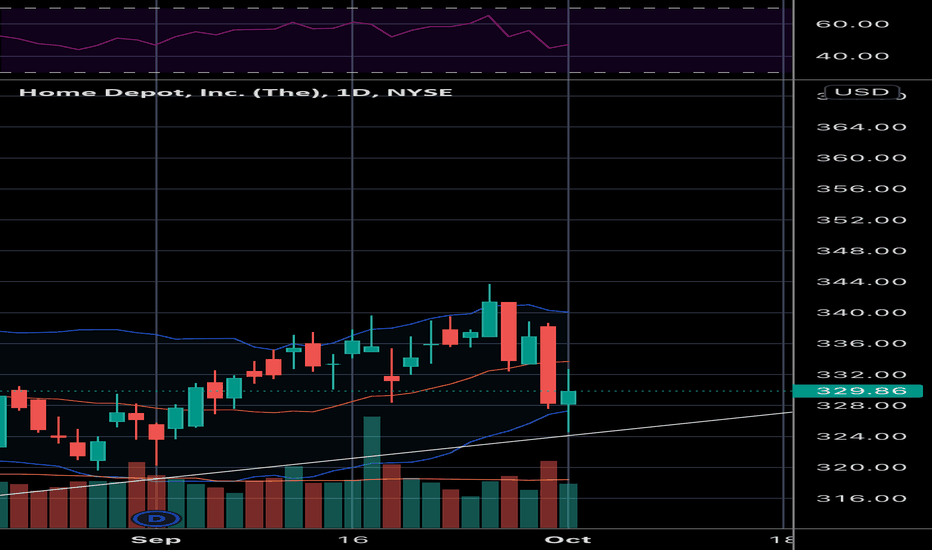

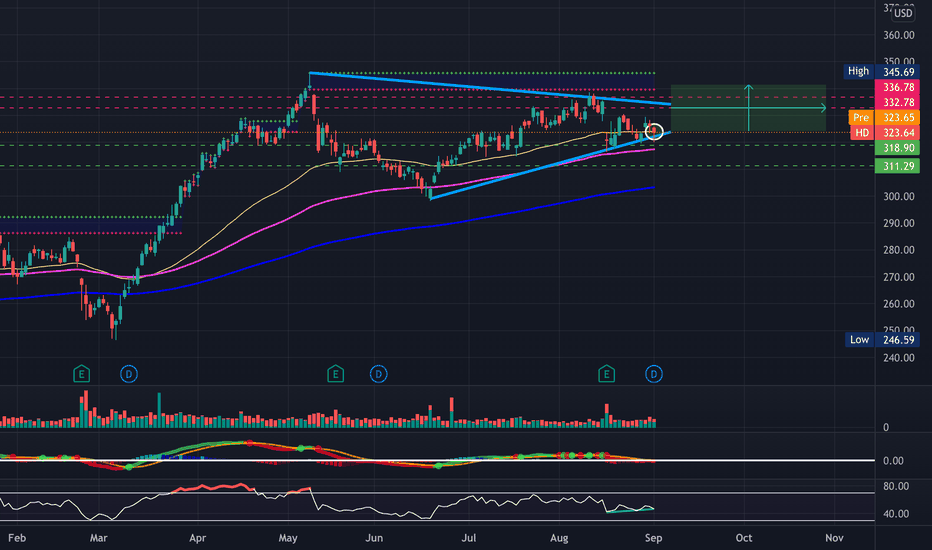

HD breaking out!* Exceptional earnings year-over-year

* Very strong up trend

* Breaking out of a 5 month consolidation with slightly more volume than average

* Pays out dividends with a Payout Ratio of 44.10% which means the company has more room for growth and potentially increase dividends as well.

Trade Idea:

* You can enter now as indicated if you don't mind a little volatility

* Given that it only broke out with slightly higher than average volume, this may visit the 339 area before heading higher.

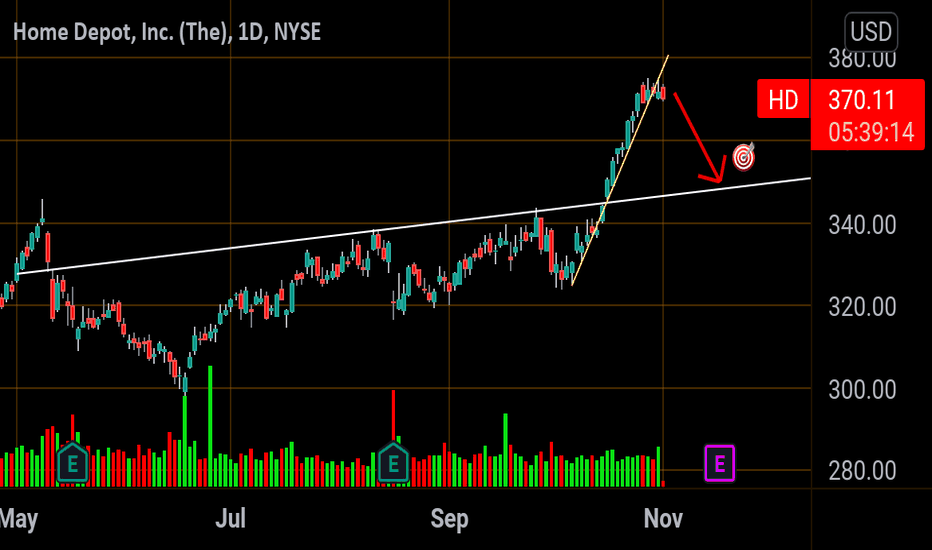

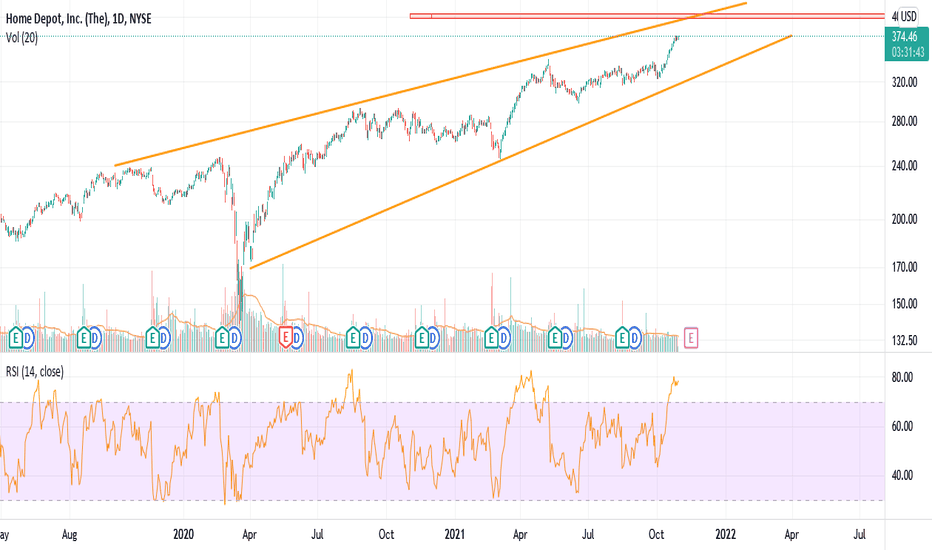

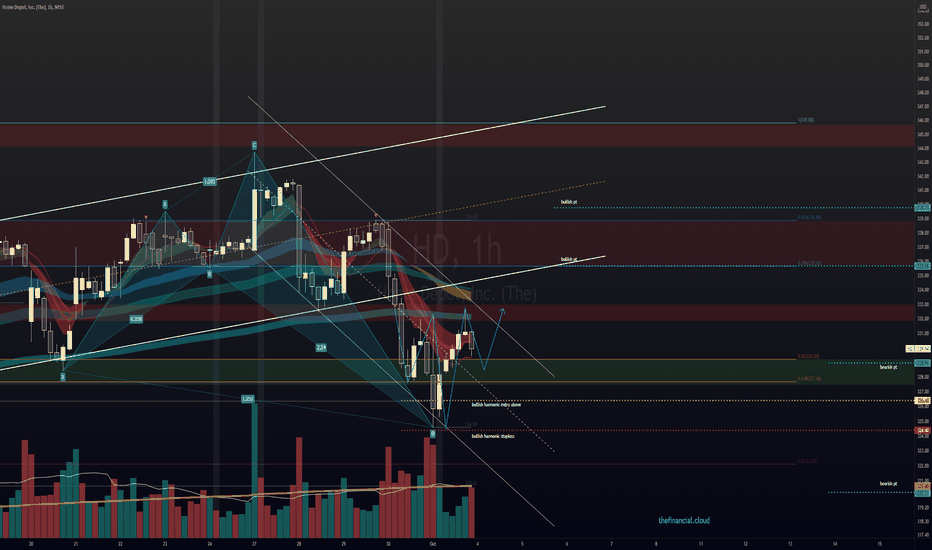

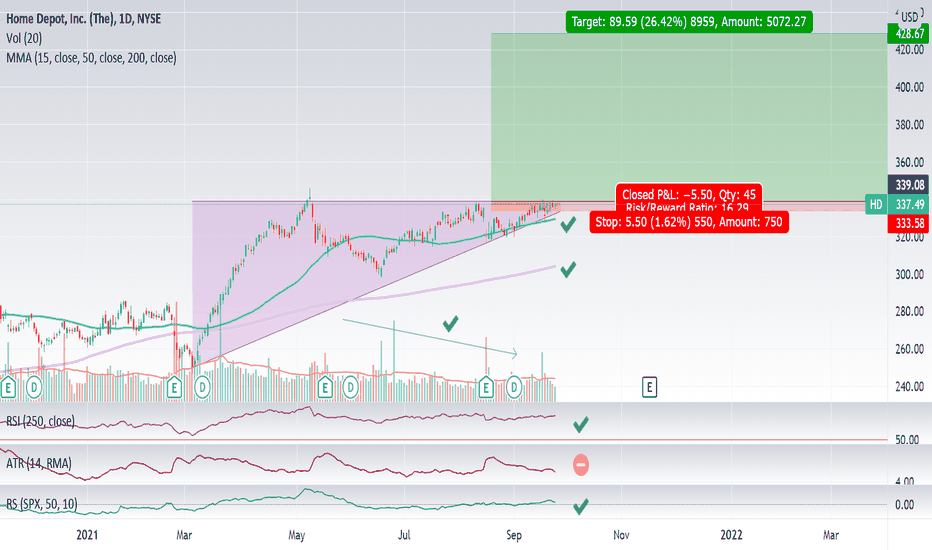

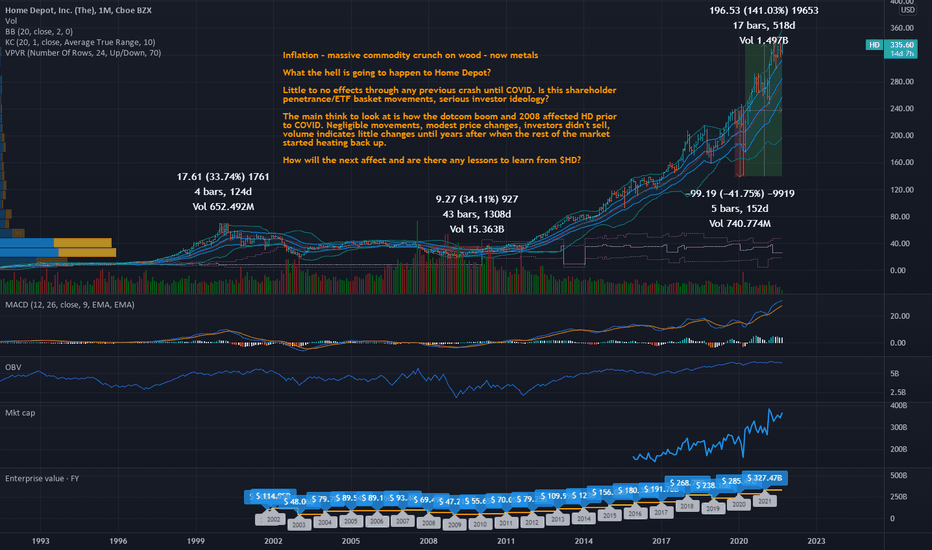

Home Depot; Previous crash haven worth an analytical eyeDisclaimer

This analyst has been curious on NYSE:HD for quite some time, especially considering the massive amount of growth over the last few years. This analyst keeps their investments in Home Depot limited to buying at Home Depot (except plumbing stuff which Lowes has better of), but the curiosity remains all the same. Looking at recent ownership changes among institutions here , we see the classic major shareholders, but among the top and most recent actions, are sells. Short interest is sitting around ~10 million shares in a massive float, yet the dividend ratio is still ~2%. This 2% is a magic number for companies as it is supposed to match a defined inflation rate and common gains rate.

In previous crashes, Home Depot maintained stable price, likely to do a small investor base that was relatively happy staying stable. As capitalism hungers, Home Depot starts taking off post 2008 when the US went on a massive weaponization of debt leading to a historic period of hyperinflation of equities.

I cannot recommend any investment on Home Depot, the fundamentals and mechanics unclear, investors philosophies unknown, no major patterns suggest themselves save for the steady impulse up, and where it ends is anyone's guess.

Sometimes the best thing to do in a crash, is nothing. There are always stocks full of investors that are willing to carry the investment through term on the hopes of tomorrow. May we all find shelter in these equities soon.

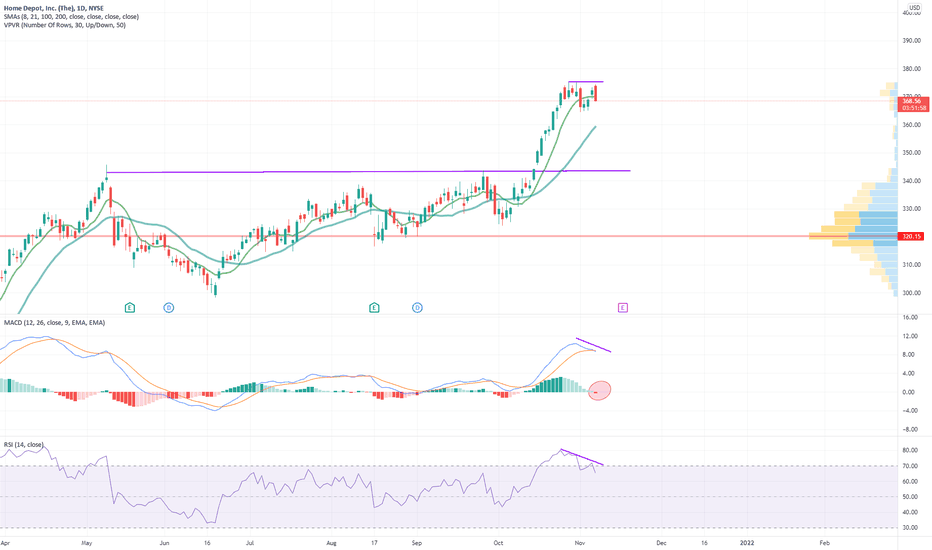

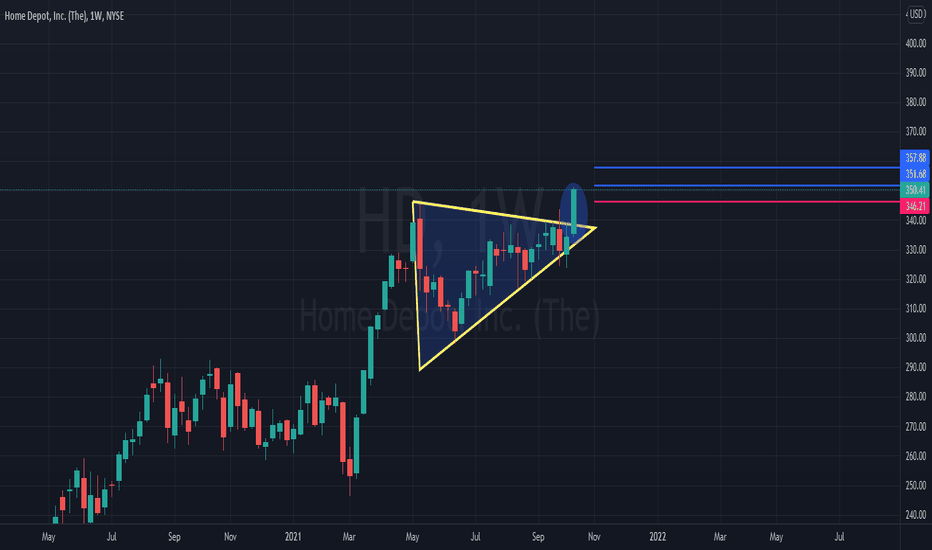

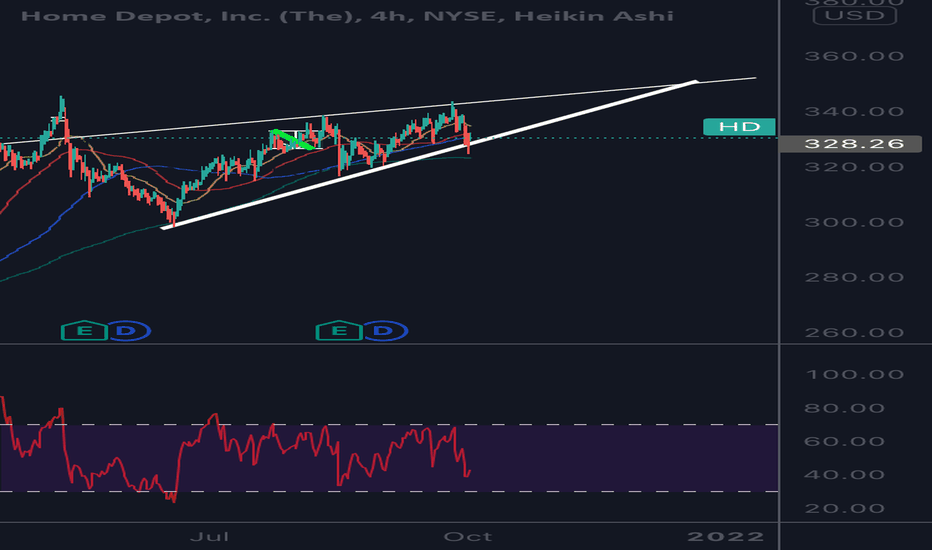

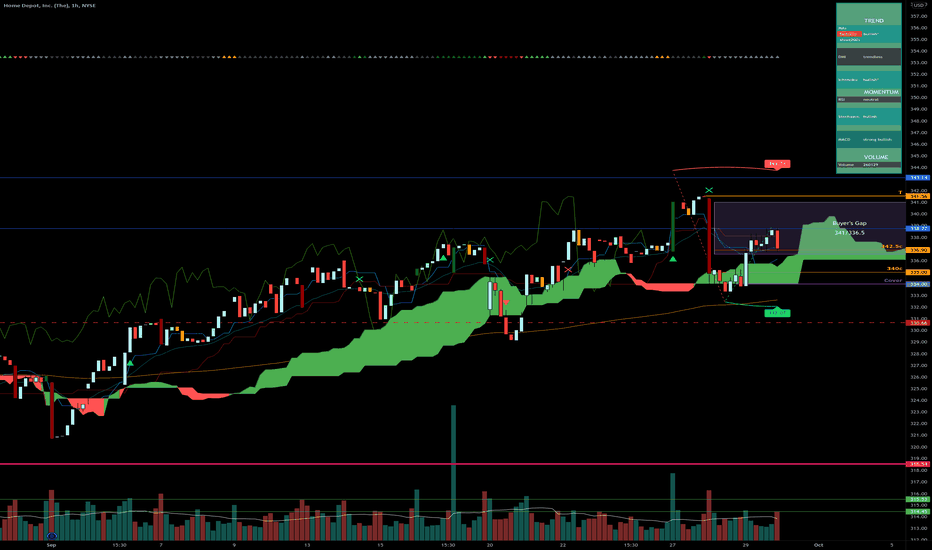

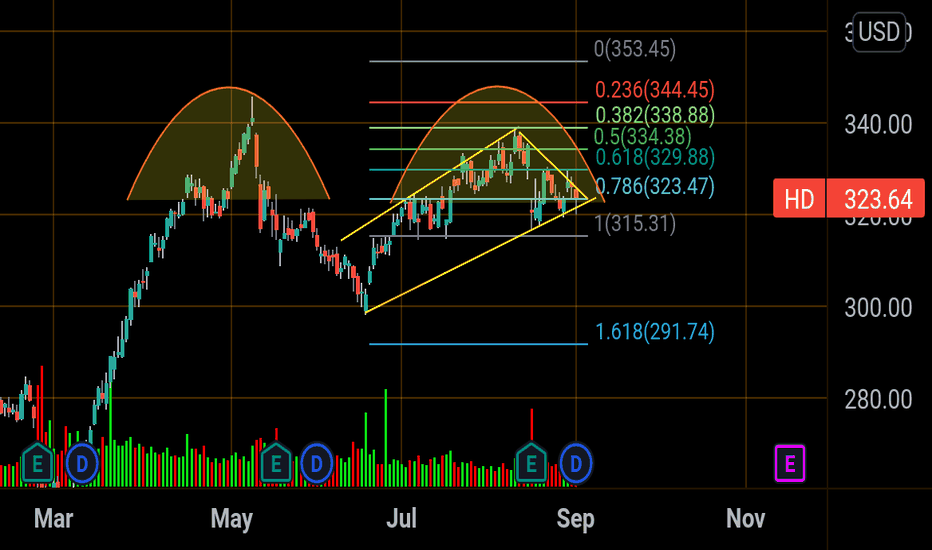

Bullish Pennant- BreakoutWatching HD closely here and looking for a breakout (Broader Market Conditions Permitting) -

- MACD is seemingly about to cross

- Bullish hammer right on the 50-day EMA

- Slight bullish divergence on the RSI

- just some support and resistance levels to keep an eye on along with some RSI based supply and demand zones

PT1- $325.78

PT2- $328.73

PT3- $329.49+