HD trade ideas

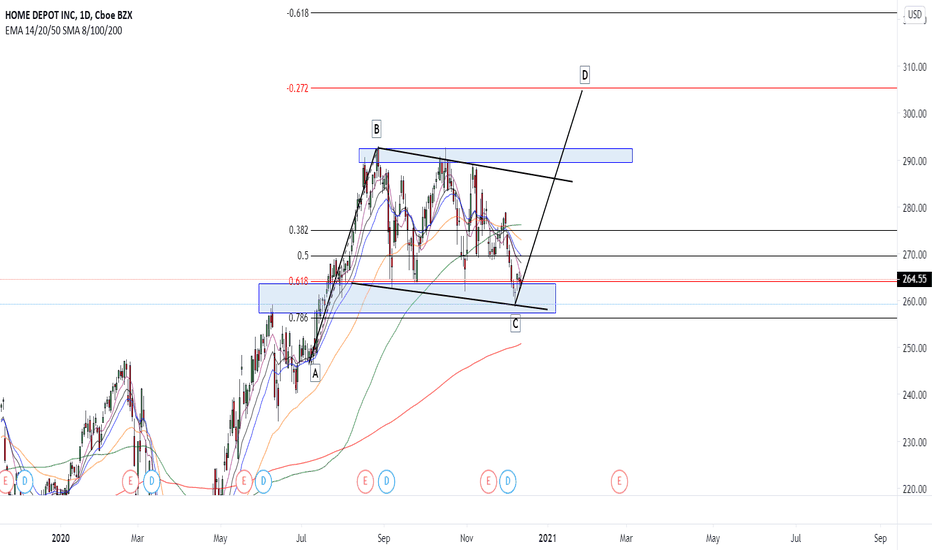

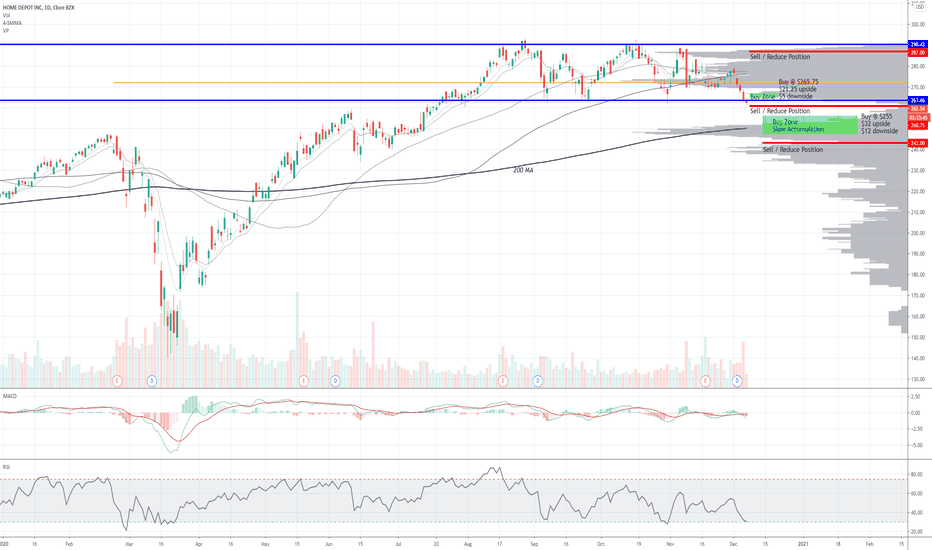

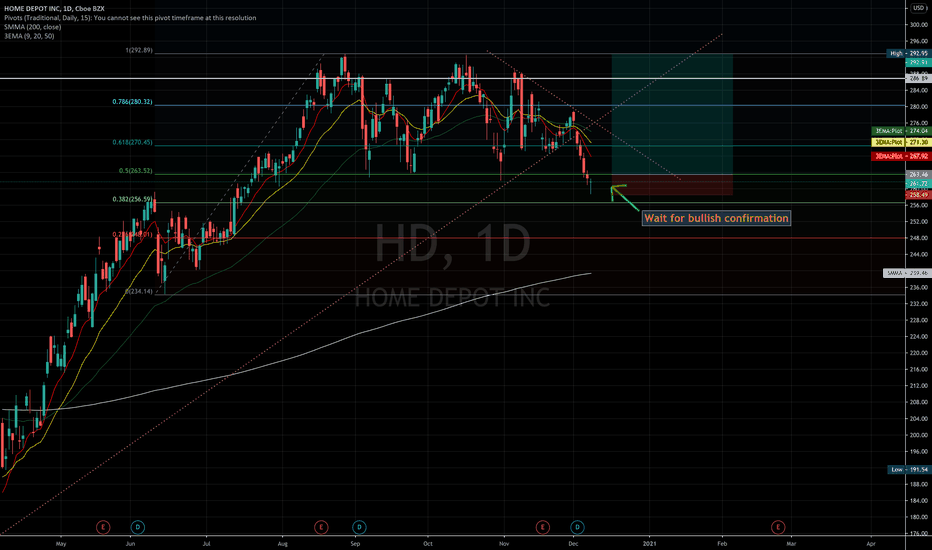

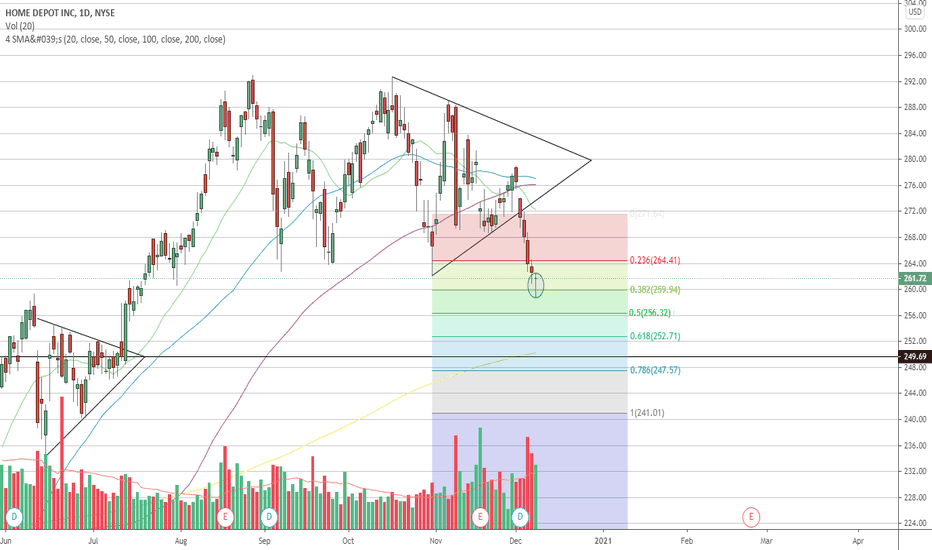

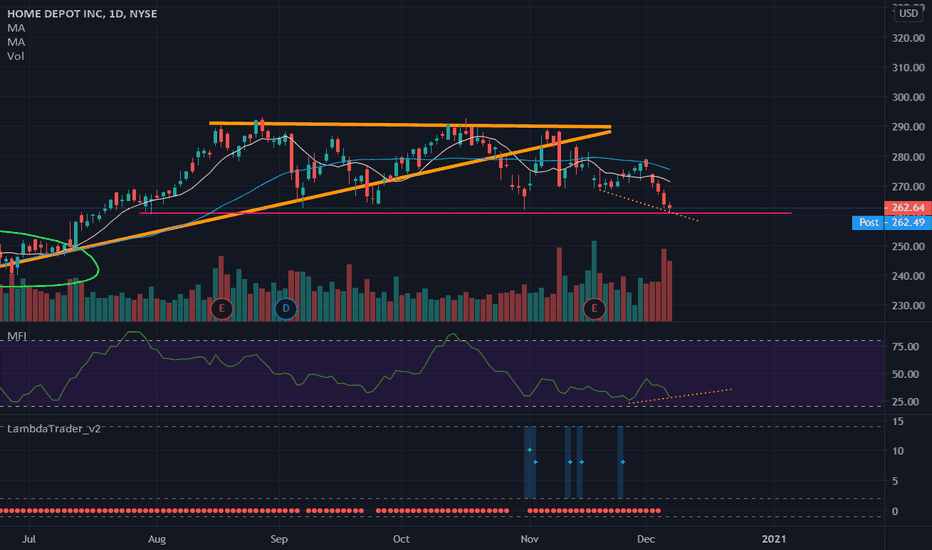

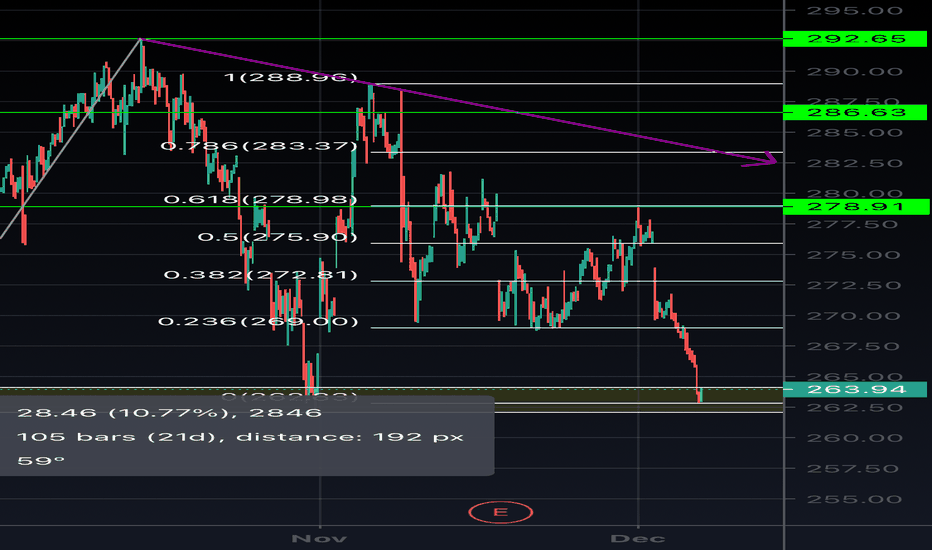

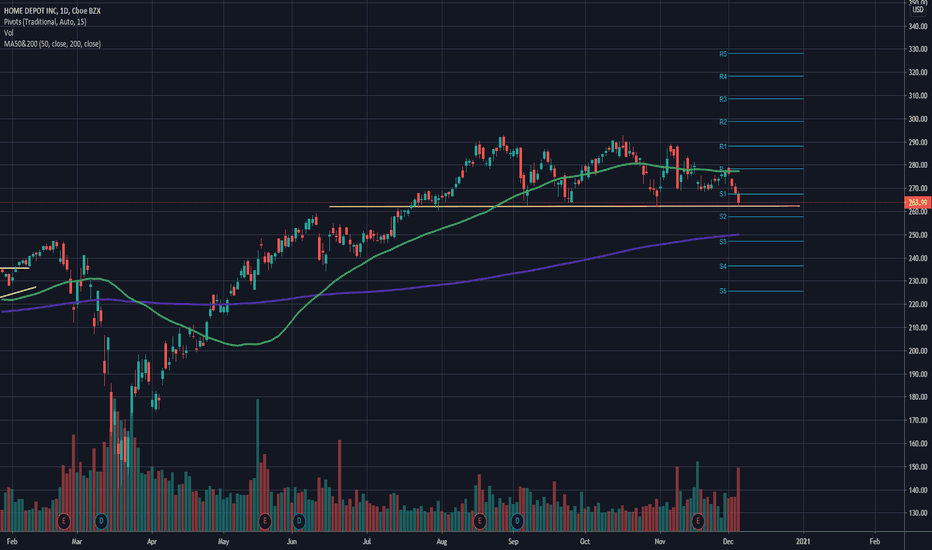

HD Long Short Term EntryLooking for a bounce back to the upside on HD this week or a drop to the 200 MA. In my thinking, there are two entry points here depending on price action. Reversal today or this week and buy around $265 with reducing or selling position at $287. Stop-loss around $260.75. If the drop continues then looking at a slower accumulation of a short-term position between $255 and $248 to be more cautious on entry point and average in, this would be in the 200 MA range and to me seems like a bit of a long shot. Both entries would reduce around $287 on the upside.

I also think either of these buy points would be a good place for adding to a long term position.

A long entry for me would be adding to an existing long-term long position with the intention of reducing back to similar levels of holdings.

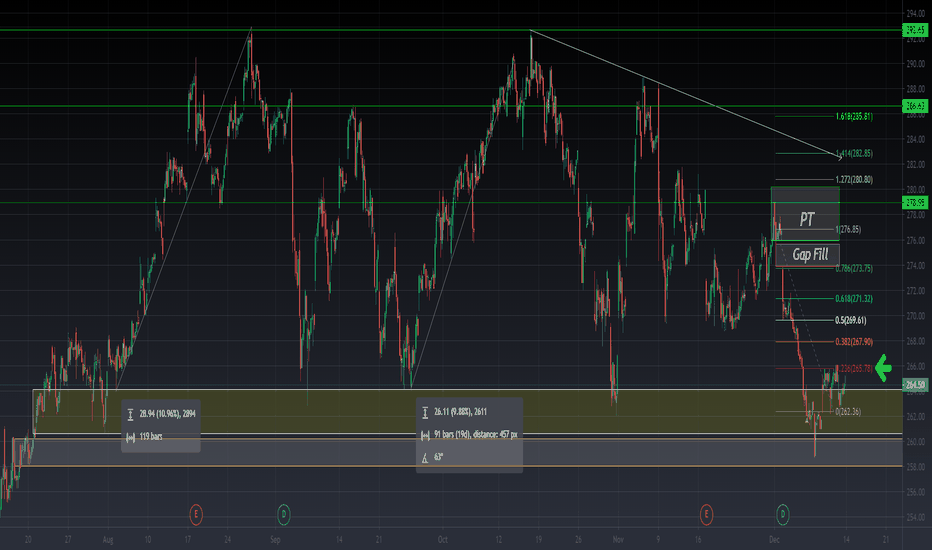

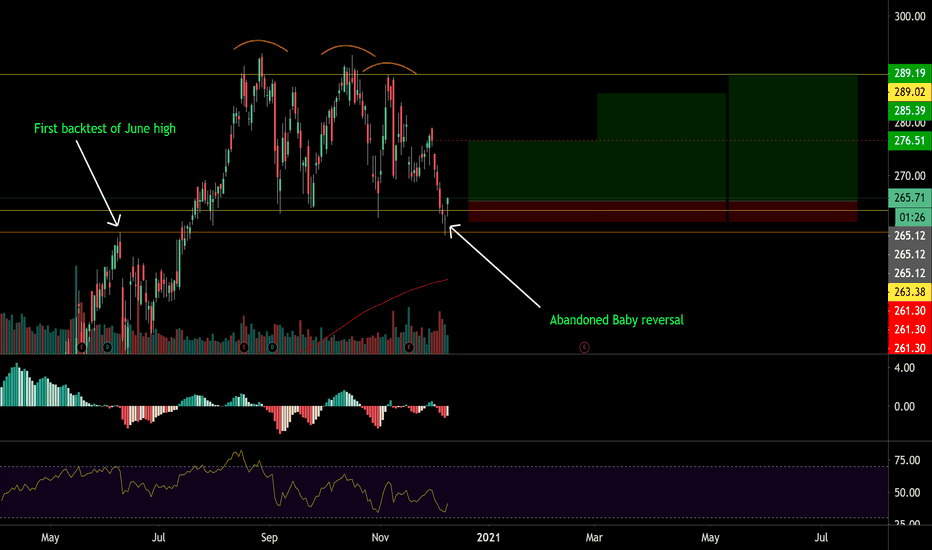

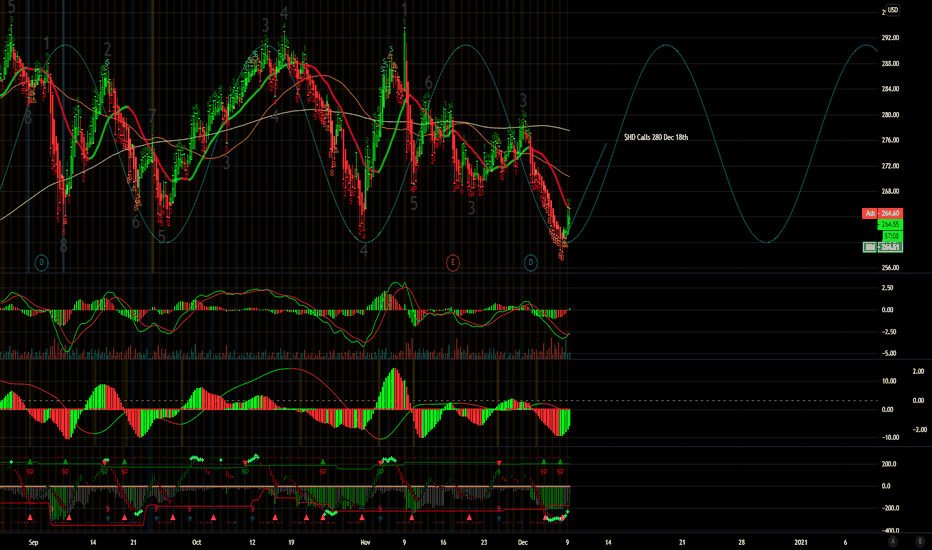

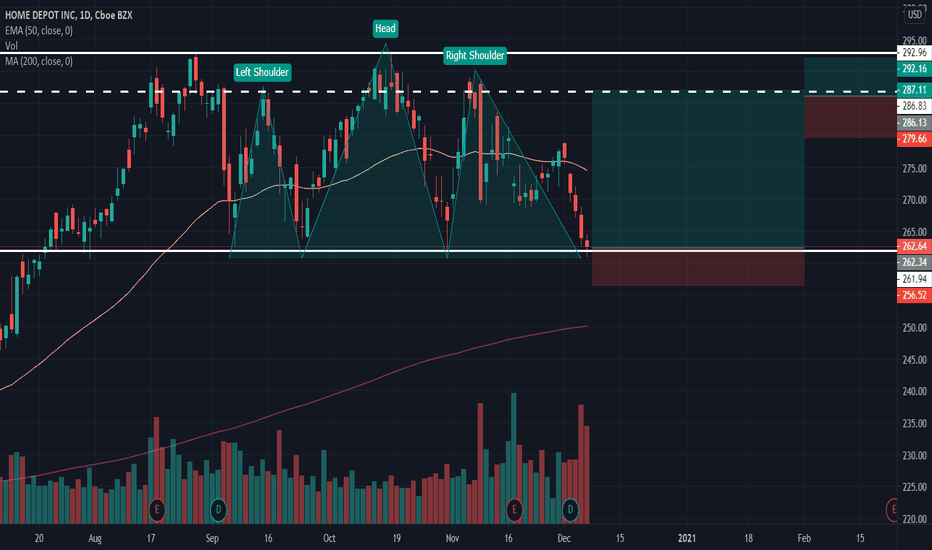

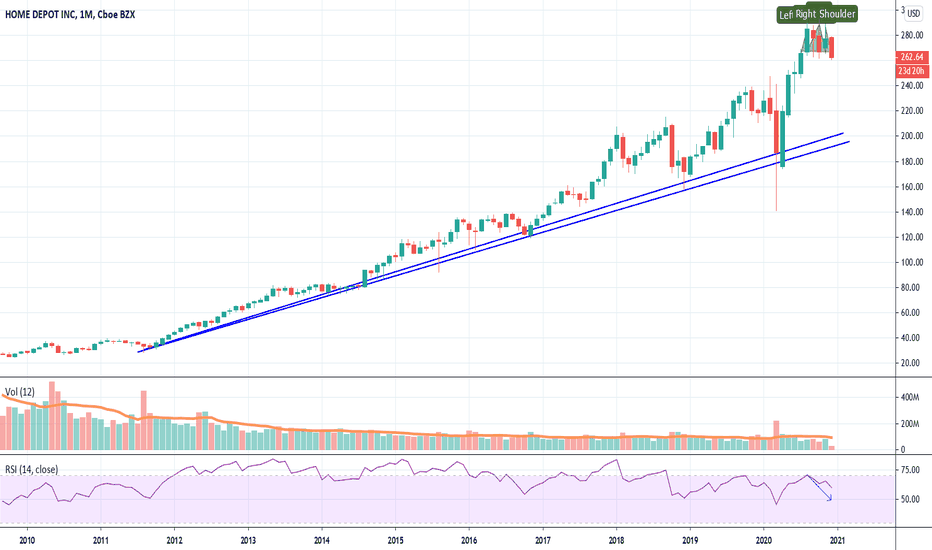

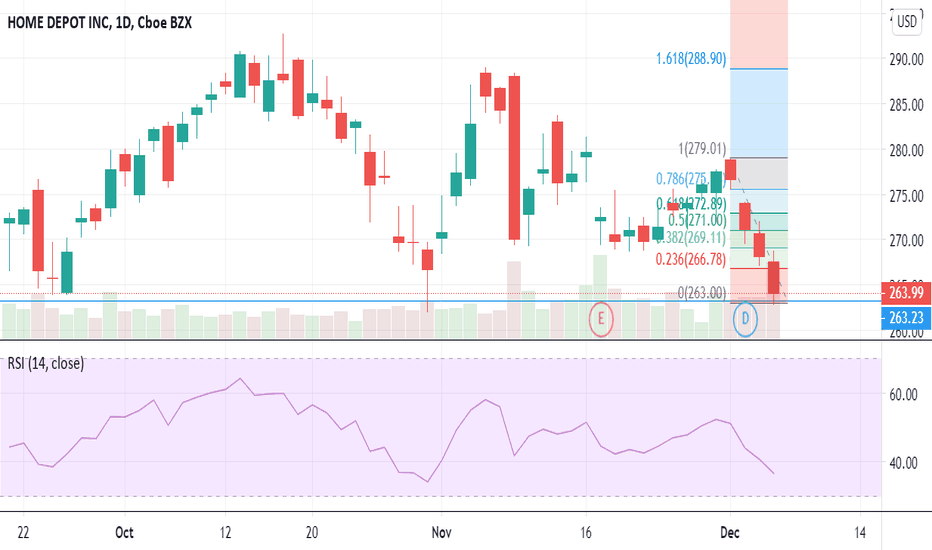

3 month H&S completed in home depot; expect a sharp move in decYou can watch this in conjunction with my Lowe's trade posted below. Essentially they're a play on the same industry and overall market crash in dec; (they're price is strongly correlated to the general market). Choose whichever one works better for your risk management.

Like always, thanks for the constructive feedback

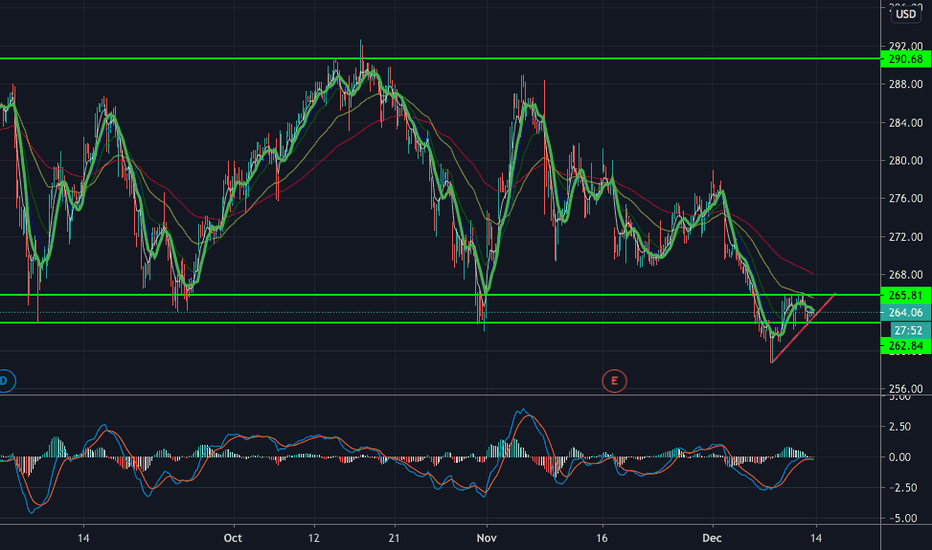

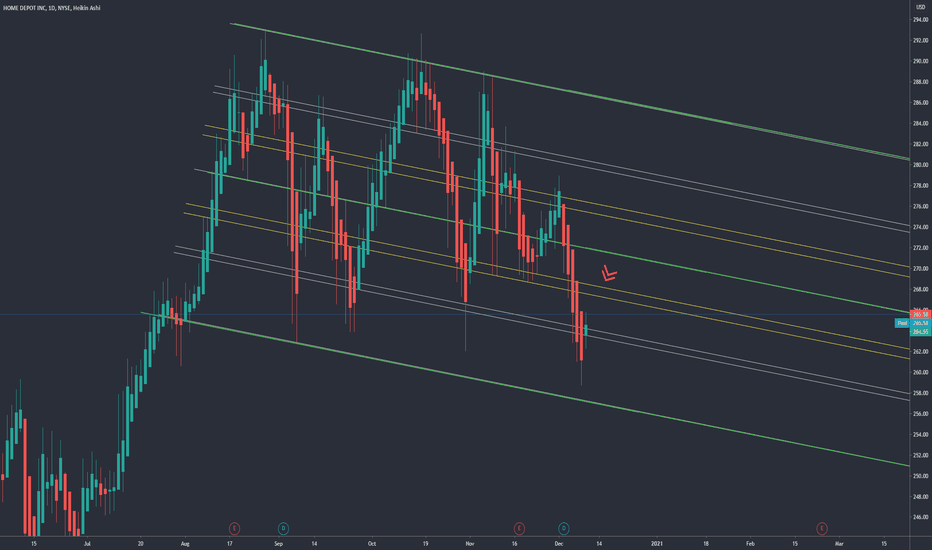

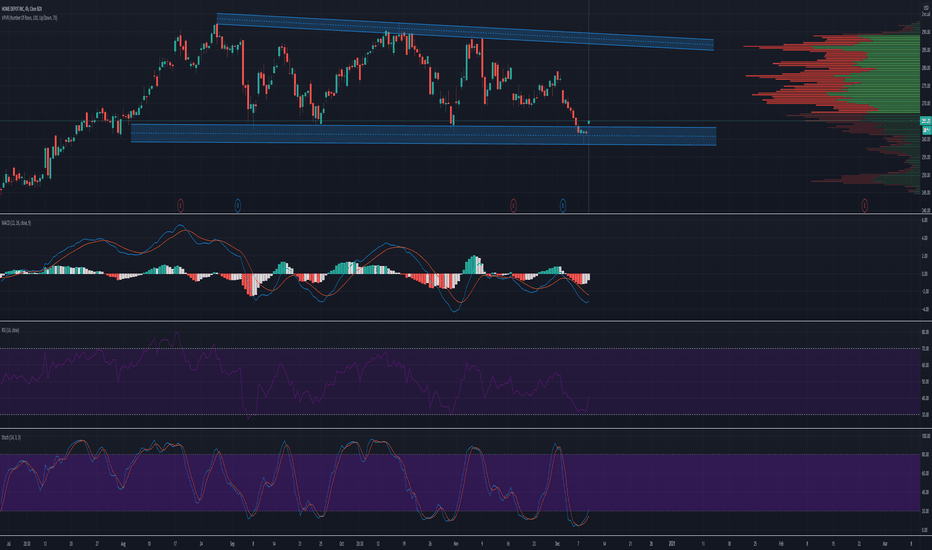

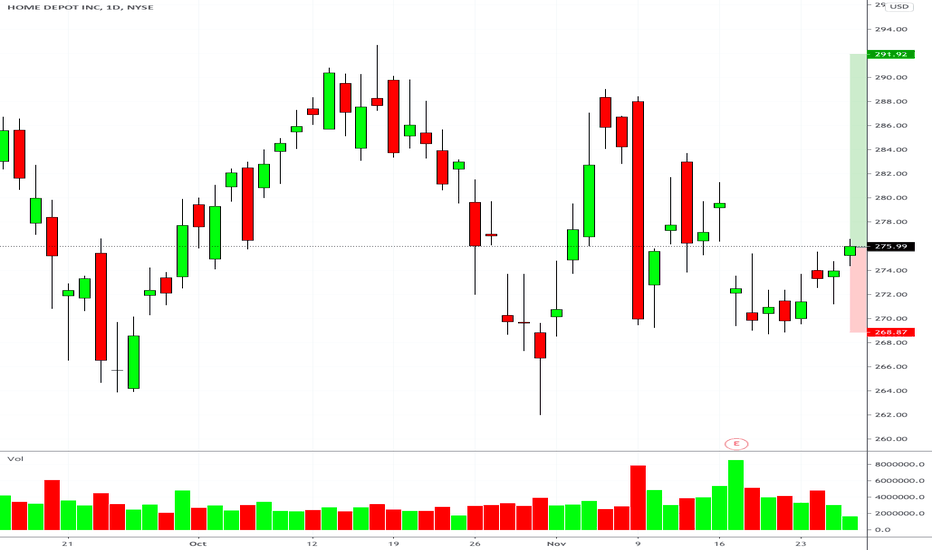

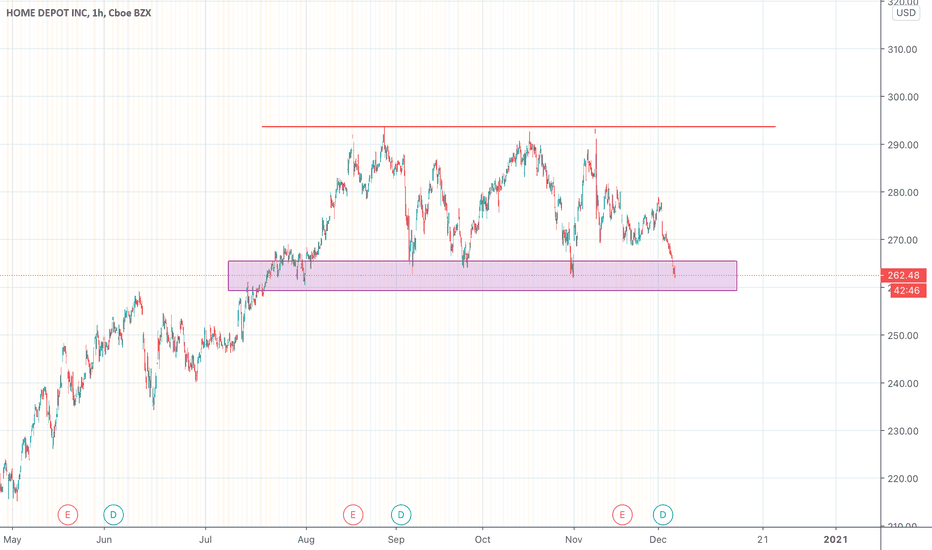

HD bounce correctionHD now in a correctional level. Since Sept it has bounced off these same levels. Earnings good, Price target raised yesterday from $300 to $320 by Morgan Stanley. Everyone received their dividends, last time it did this, it had a massive drop to correction as well and recovered fast. Way past FIB retracement buying area also.

Long calls scooping up here.