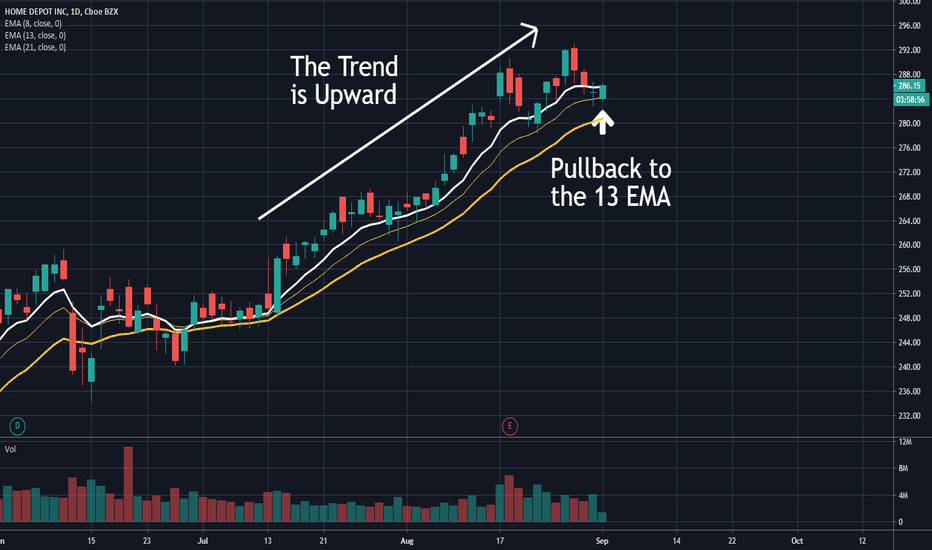

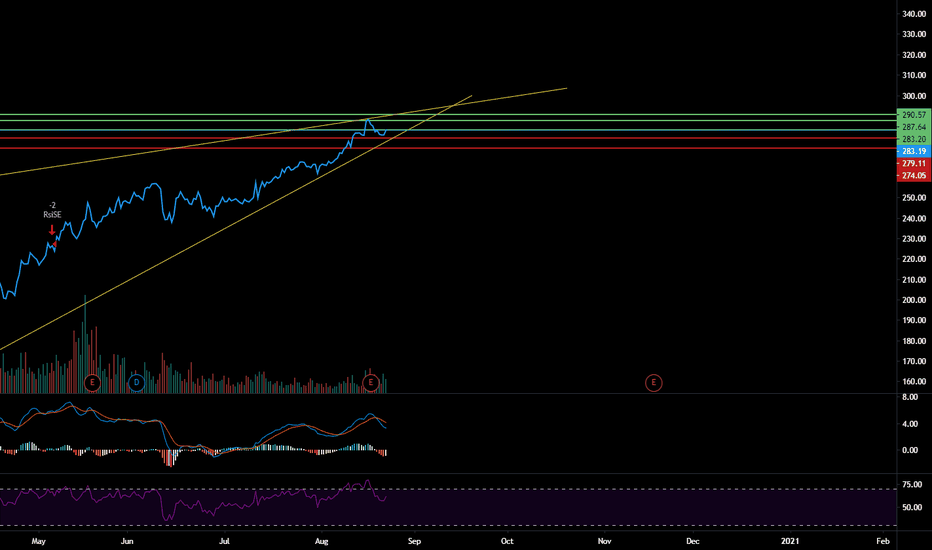

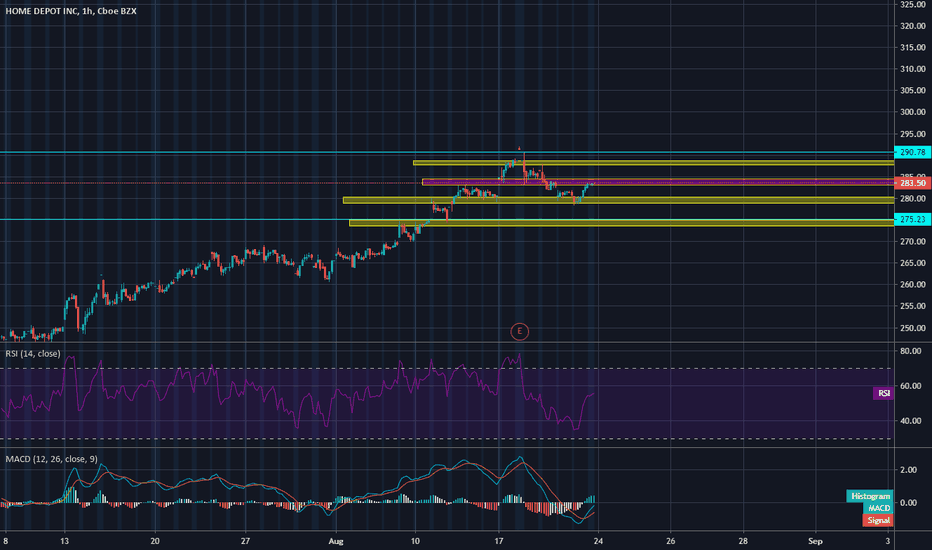

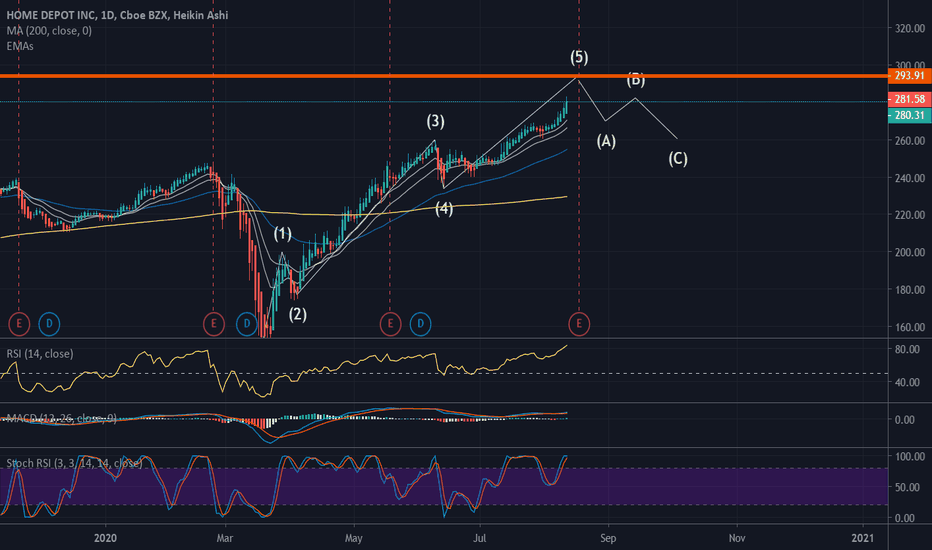

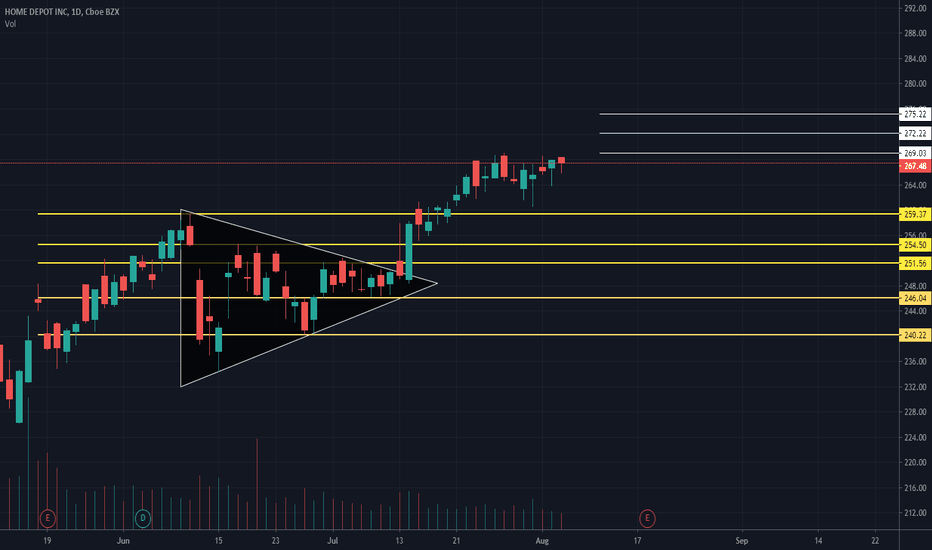

Home Depot pulls back to the 13 EMAHome Depot ( NYSE:HD ) is pulling back along with the Dow today and is finding support at the 13 Day EMA as shown on the chart above. Could this be a pullback trade? I would like to think so, but as the SPY soars to new highs, we continue to be in an overextended market. I think Home Depot has the potential to continue higher provided that the SPY or DOW doesn't sell off. Even though SPY is made up of many other companies that have nothing to do with Home Depot, there is still market risk (also known as beta risk, systematic risk, undiversifiable risk) which is the risk that the stock will move along with the broader market.

I will continue to monitor Home Depot to see if today's idea was a bullish pullback trade.

HD trade ideas

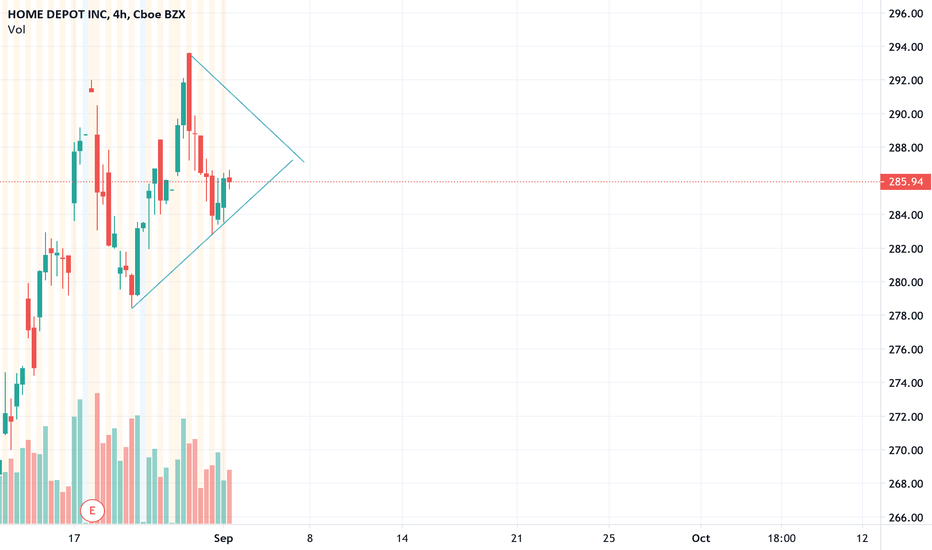

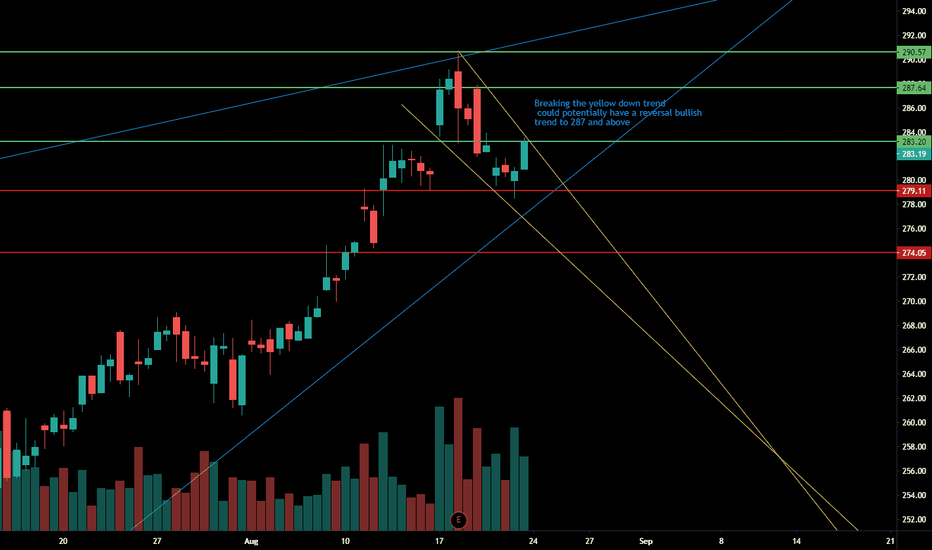

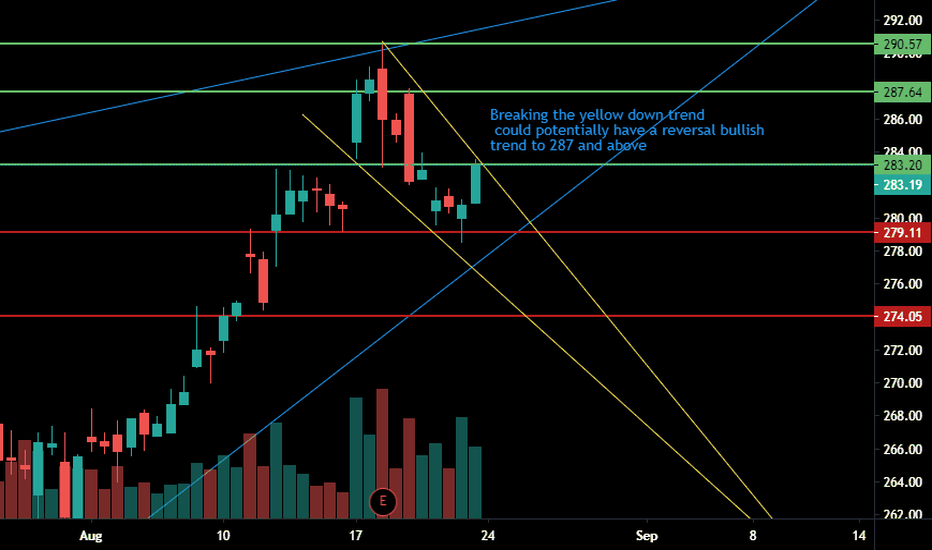

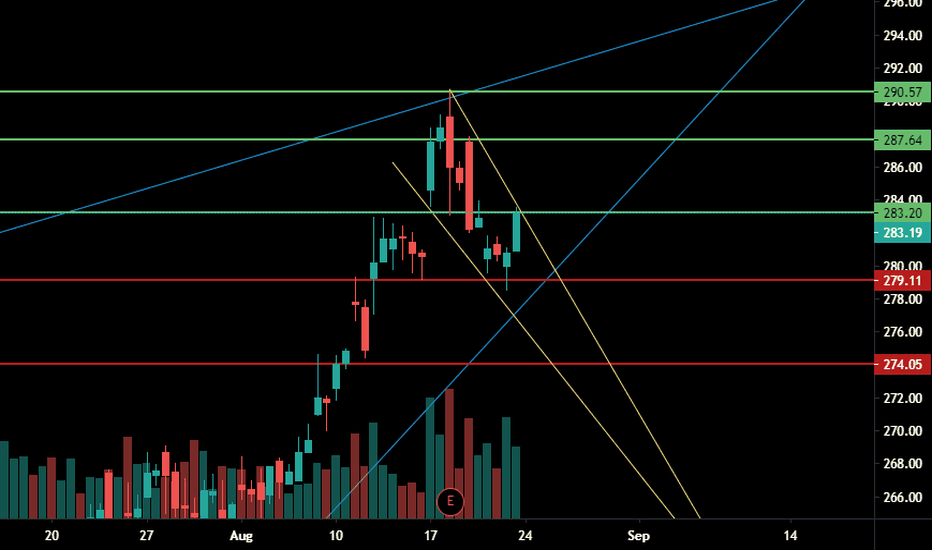

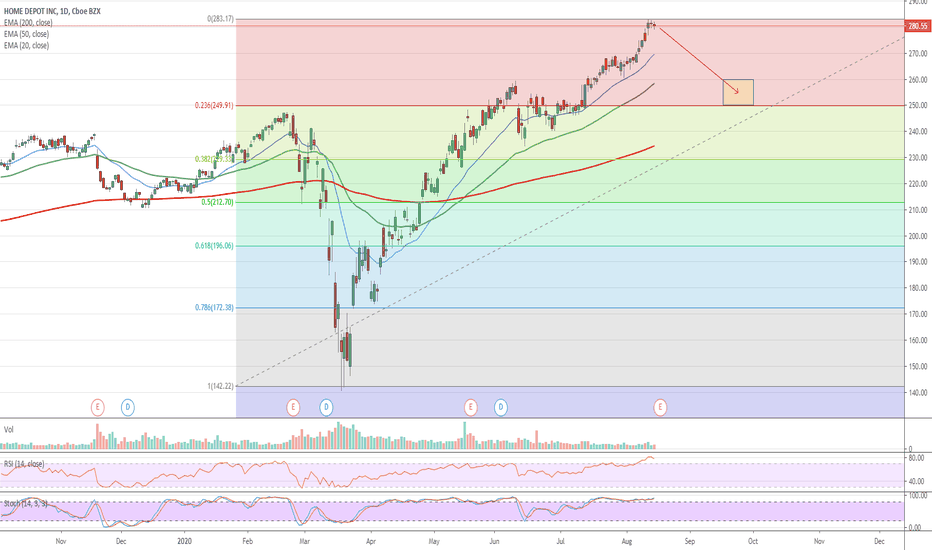

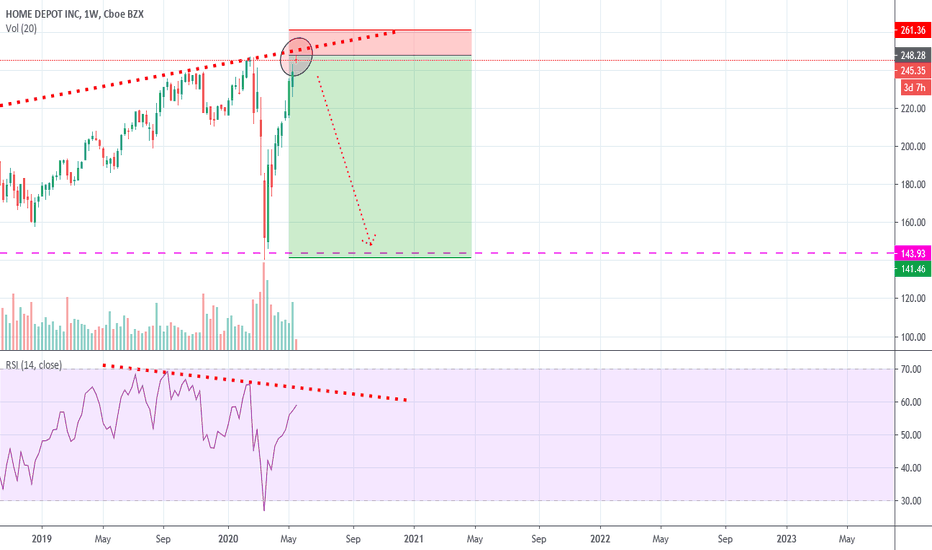

HD - could a real pullback begin? swing putsI have been watching this stock for a while, and this is possibly a double top showing bearish divergence. Directional volume has seen buyers "ruling" for a while now and it may be time for supply to pick up (more selling). You can also add trend lines to the chart and use 30m chart for entry.

On the weekly chart today's candle was 2 pennies away from being a true reversal candle (this week's open is below last week's green candle open). Stock price is unusually high above 10sma.

I am holding 9/4 280 puts at a loss because I bought too early, but they are much better today. I am holding overnight.

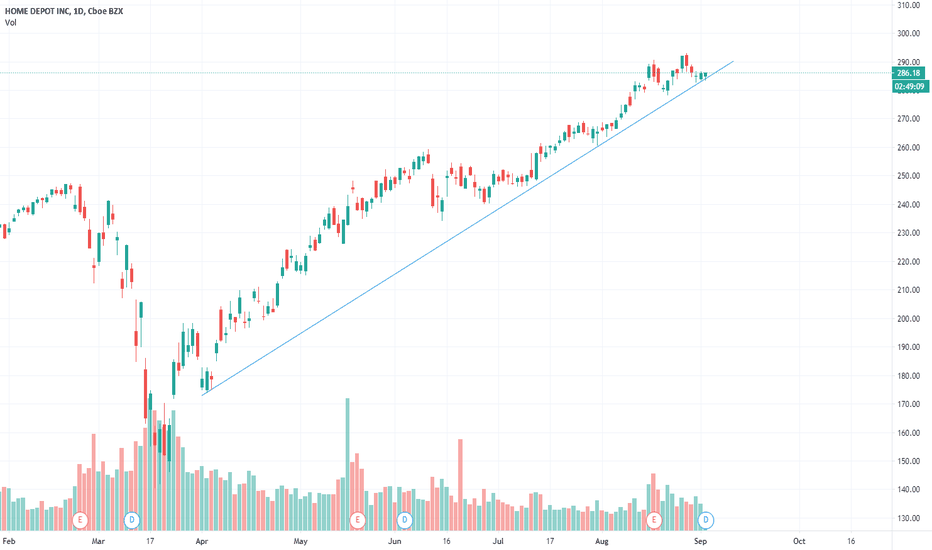

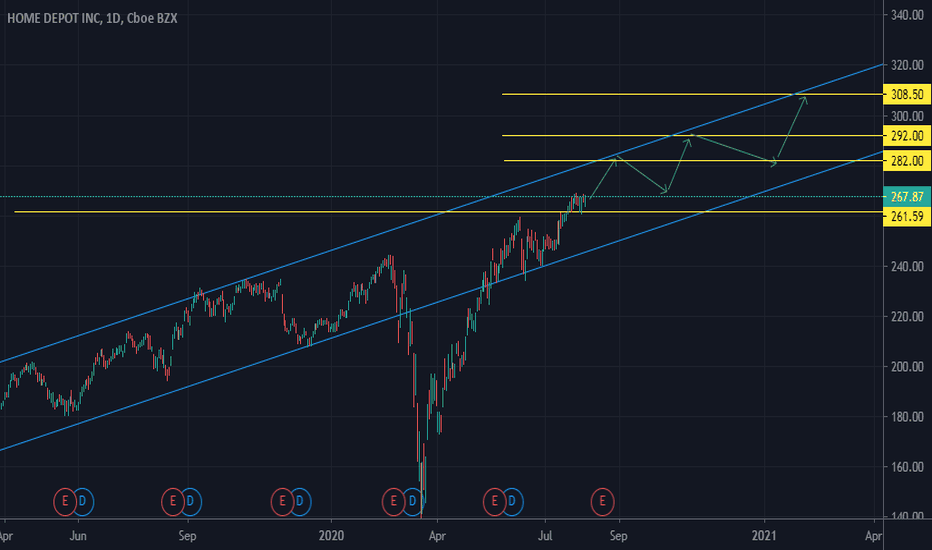

$HD:NYSE - HOME DEPOT INC - Breaking out over old highsHome Depot is running well at the moment registering as a strong buy on the Trading View TA signals. Another one breaking out over old highs. Worth a watch.

The Home Depot, Inc. (The Home Depot) is a home improvement retailer. The Company sells an assortment of building materials, home improvement products, and lawn and garden products, and provides various services. The Home Depot stores serves three primary customer groups: do-it-yourself (DIY) customers, do-it-for-me (DIFM) customers and professional customers. Its DIY customers are home owners purchasing products and completing their own projects and installations. The Company assists these customers with specific product and installation questions both in its stores and through online resources and other media designed to provide product and project knowledge. Its DIFM customers are home owners purchasing materials themselves and hiring third parties to complete the project or installation. Professional Customers are primarily professional renovators/remodelers, general contractors, repairmen, installers, small business owners and tradesmen.

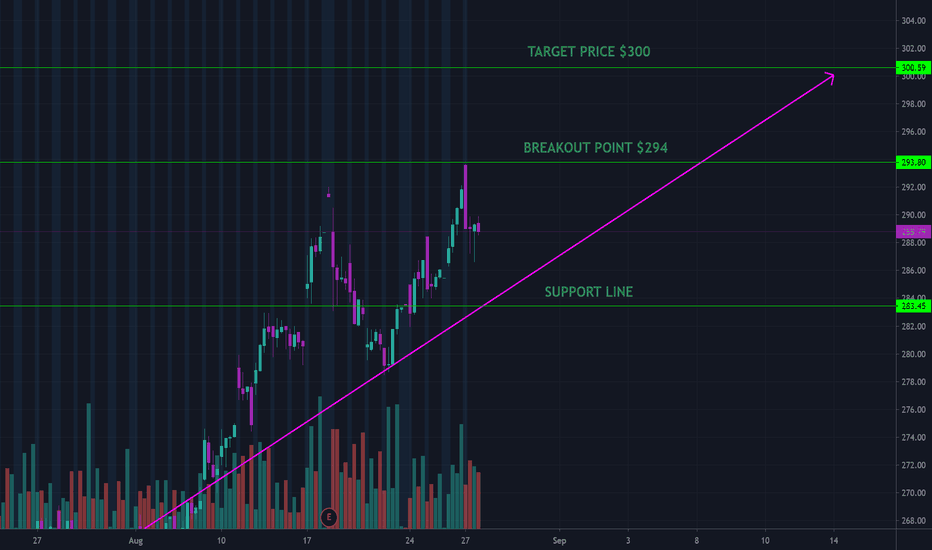

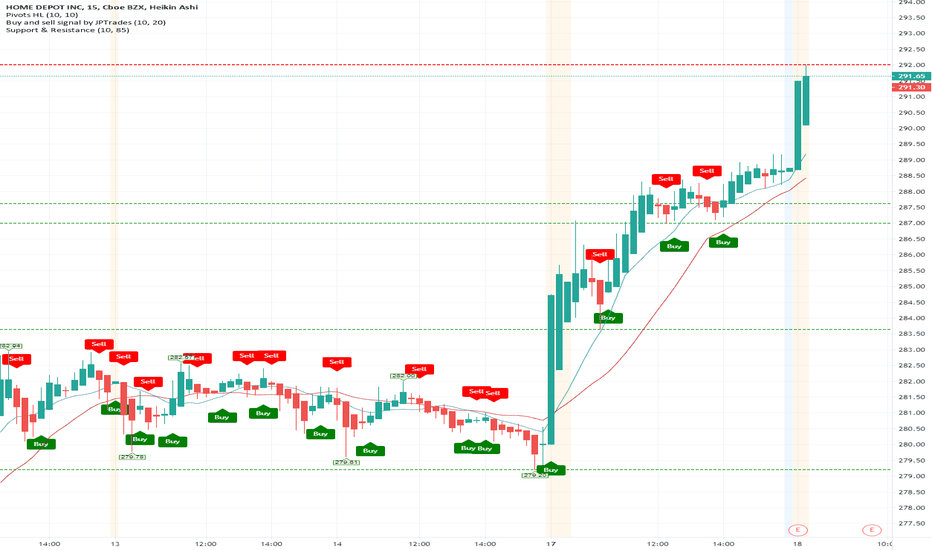

HOME DEPOT INC Good Entry Buy I am a consultant for anyone who needs a consultant, I see that HOME DEPOT INC will GO UP in the next few HOURS

NB:

1, When you decide to use my ideas in your trading, please contact me to inform you of some things and monitor the position together without specifying a take profit or stop loss, we will decide when to open and close the position

2 (When I set the take profit and stop loss in a number that does not mean that the price will reach it, I gave a buy or sell signal only according to the analyzes I made in the chart and delete it later, in the order to share it with you so that you have a clear picture and read it clearly, thank you!)

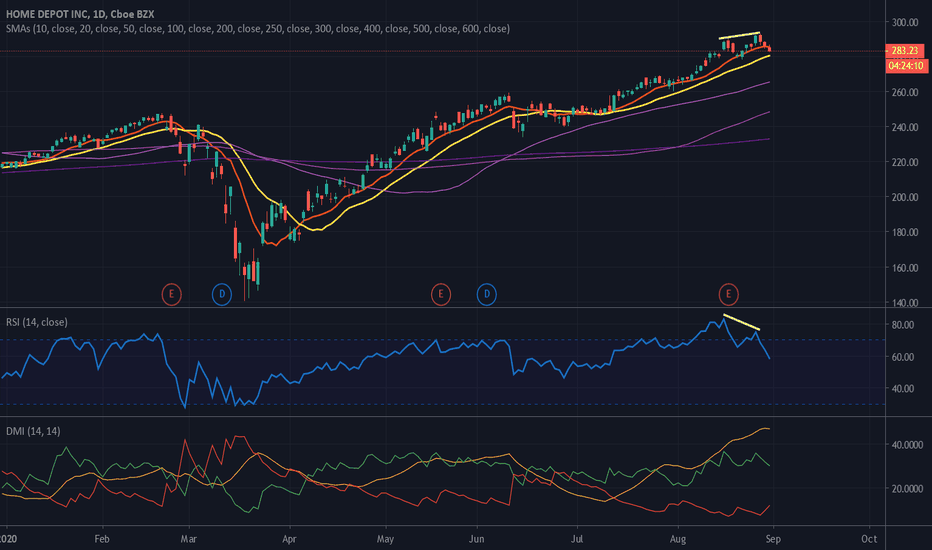

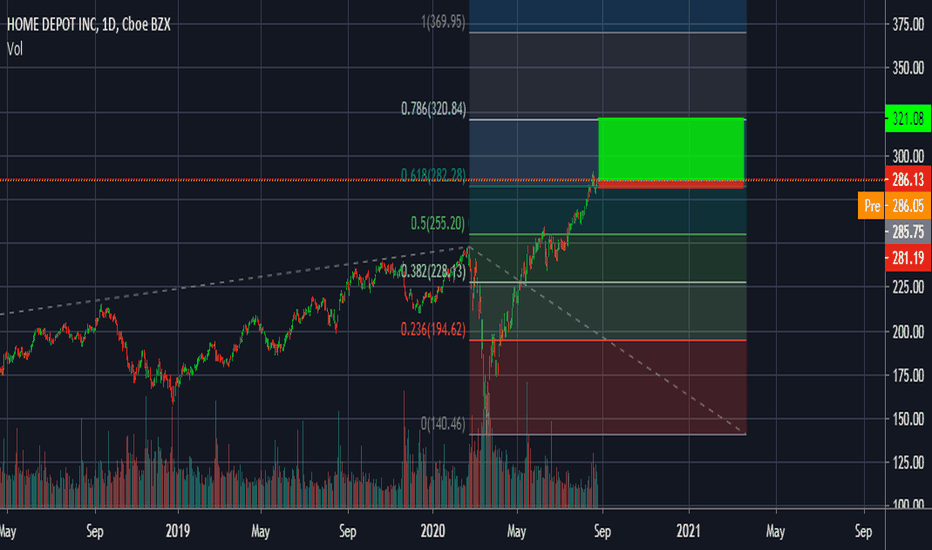

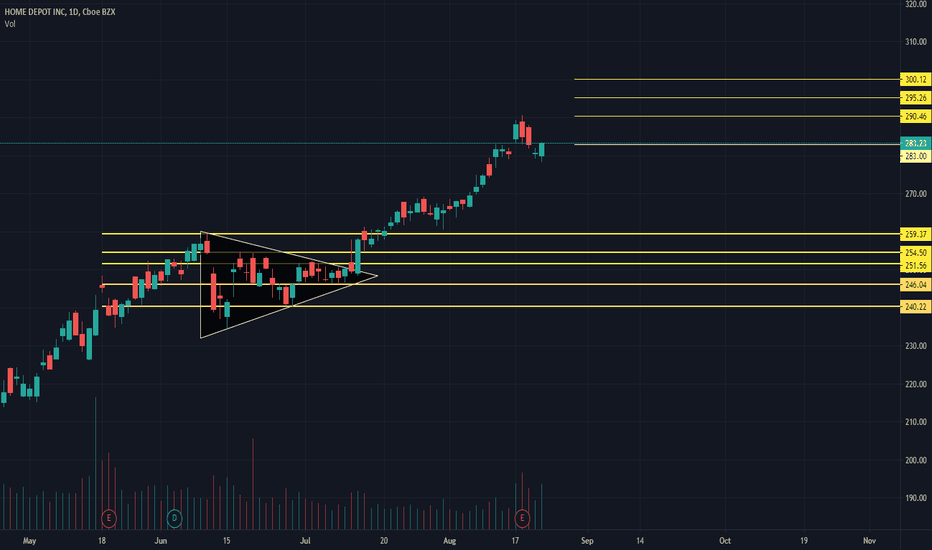

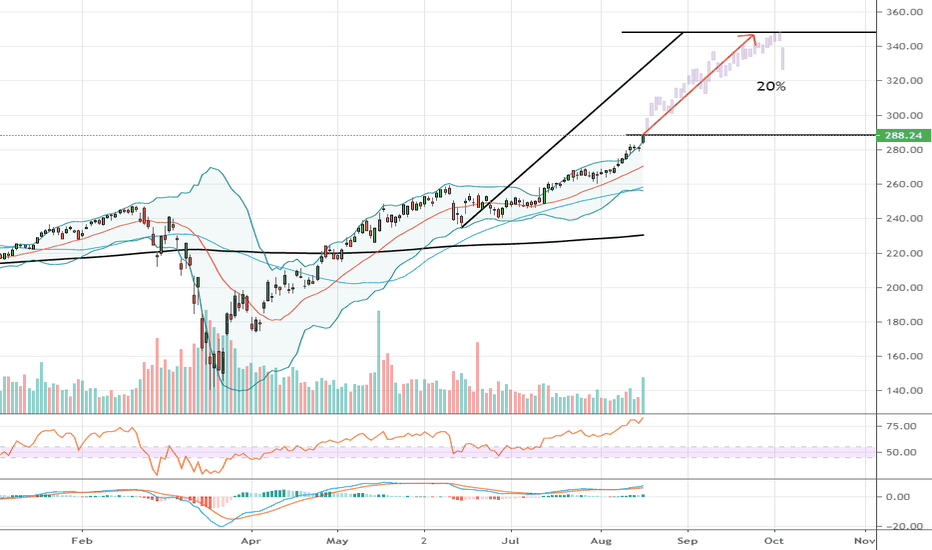

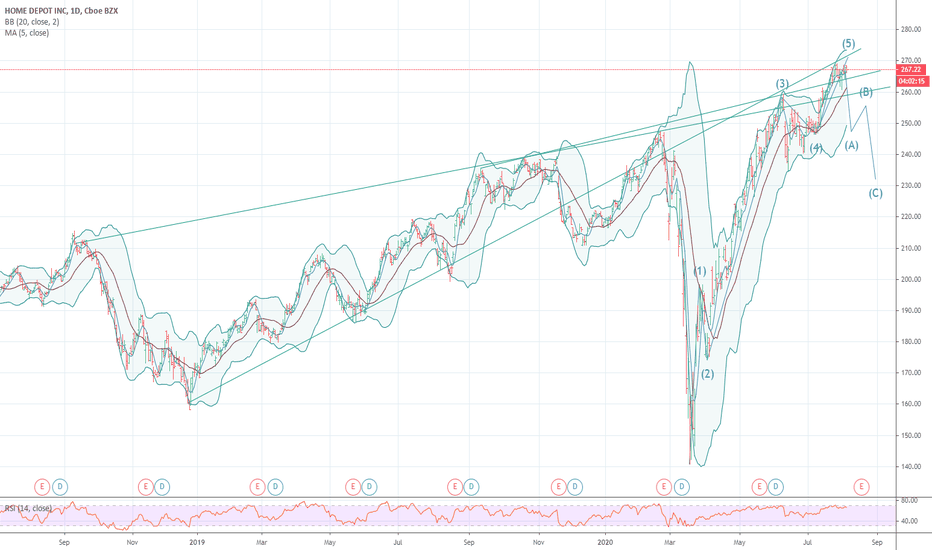

$HD Home Depot - Over Extended Heading Into Earnings$HD Home Depot - Over Extended Heading Into Earnings

Earnings this week before the open on Tuesday. Stock looks to be running out of gas after essentially doubling off the March lows. This has the potential for a "sell the news" post-earnings sell off.

P/E ratio currently sitting at around 28x - its highest level ever. The only other time it was ever over 25x was in January 2018 when it was about 27x. This was followed by about a -15% correction over the next couple months.

Medium term target: $250-$260 range by Oct

Note: Not investment advice.