JDGROWTH: (info from barchart)

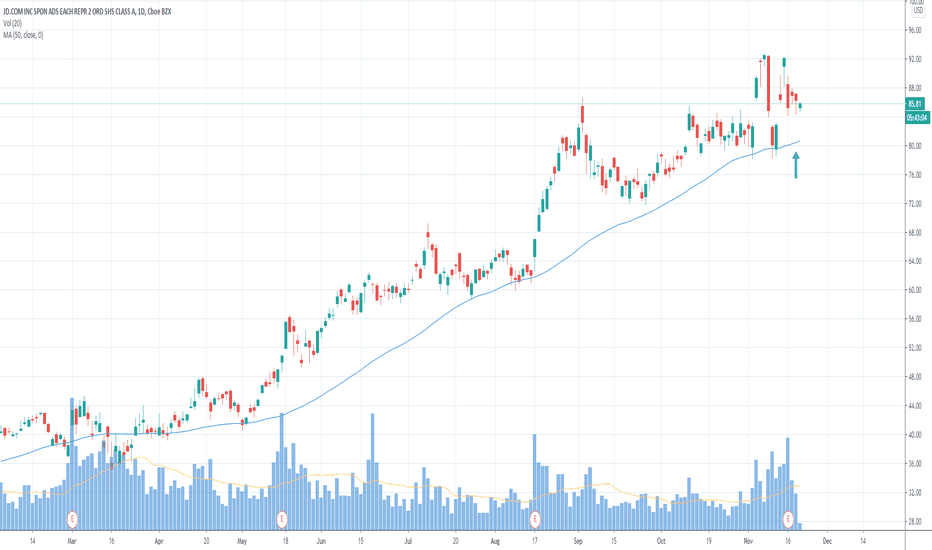

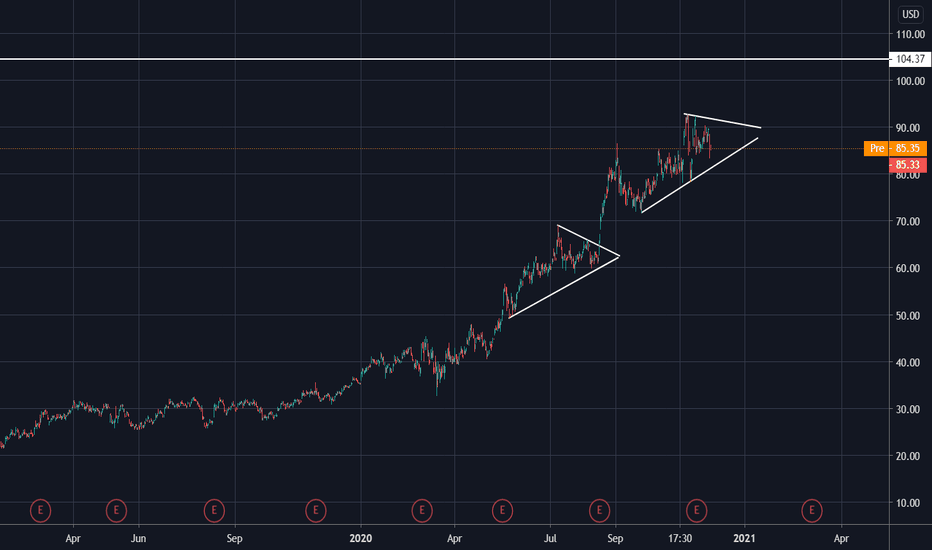

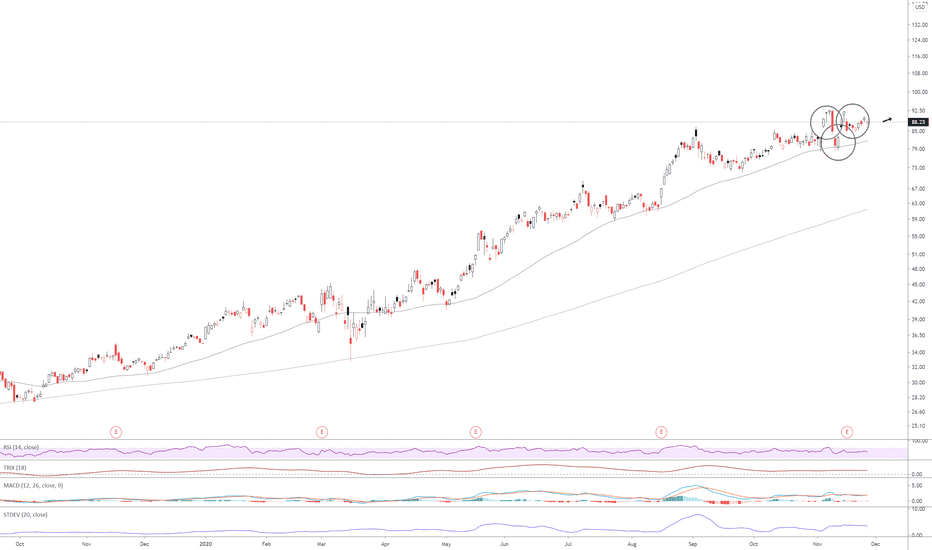

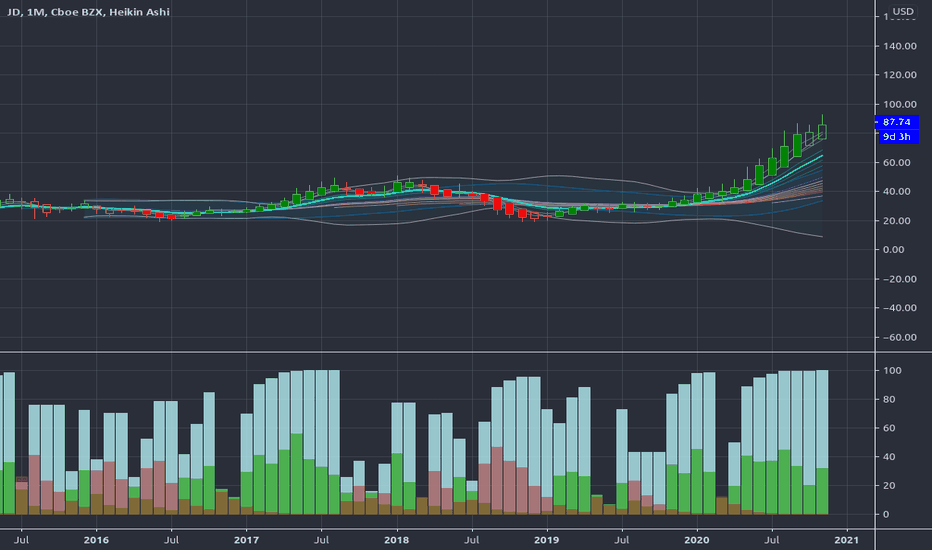

1-Year Return 175.94%

3-Year Return 128.77%

5-Year Return 207.04%

5-Year Revenue Growth 347.07%

5-Year Earnings Growth 143.31%

5-Year Dividend Growth 0.00%

Next Earnings Date 11/16/20

JD.com is an online direct sales company in China. The Companyoffers a selection of authentic products. It offers computers; mobile handsets and other digital products, home appliances; automobile accessories; clothing and shoes; luxury goods including handbags, watches and jewelry, furniture and household products; cosmetics and other personal care items; food and nutritional supplements; books, e-books, music, movies and other media products; mother and childcare products; toys, sports and fitness equipment; and virtual goods. JD.com, Inc. is based in Beijing, China.

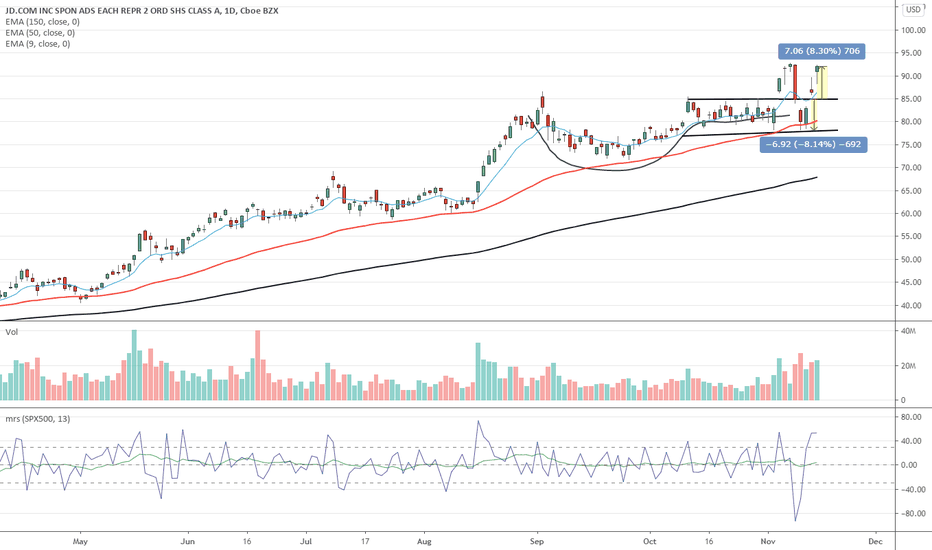

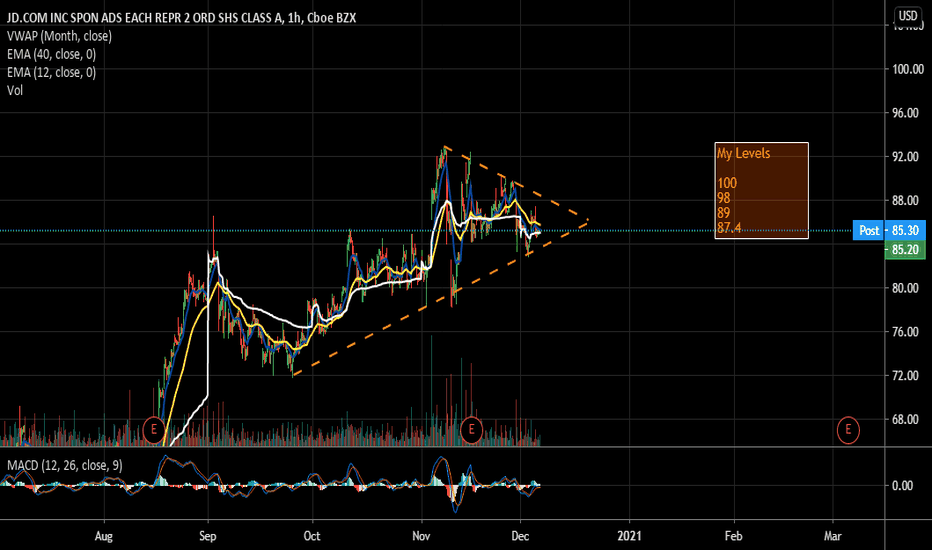

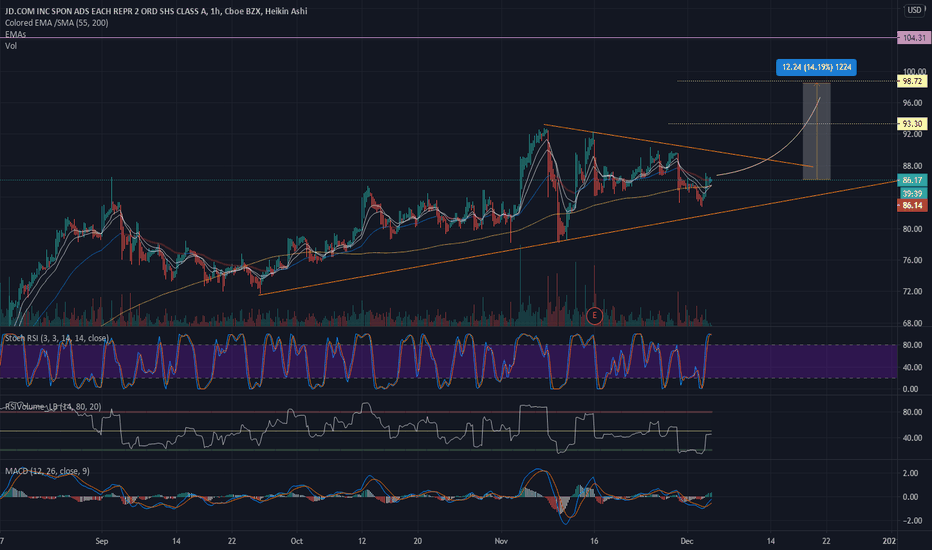

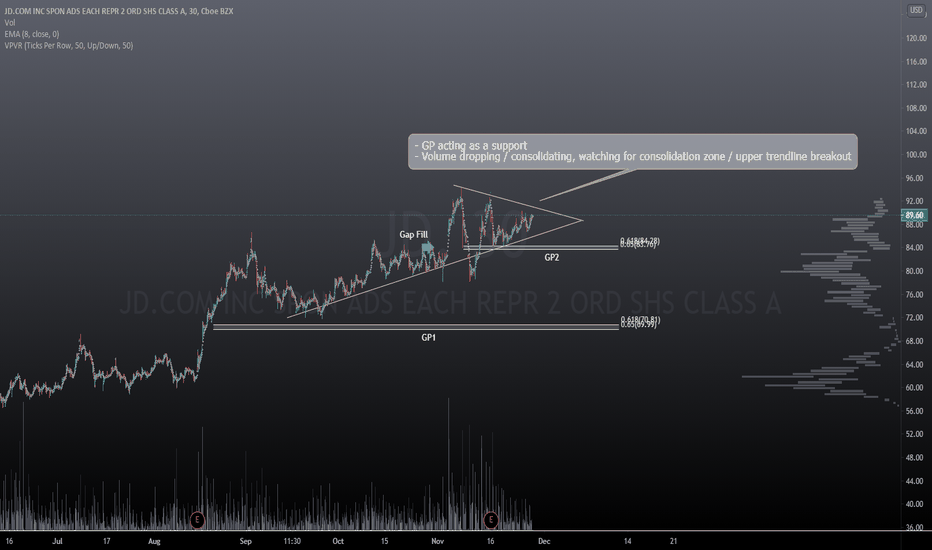

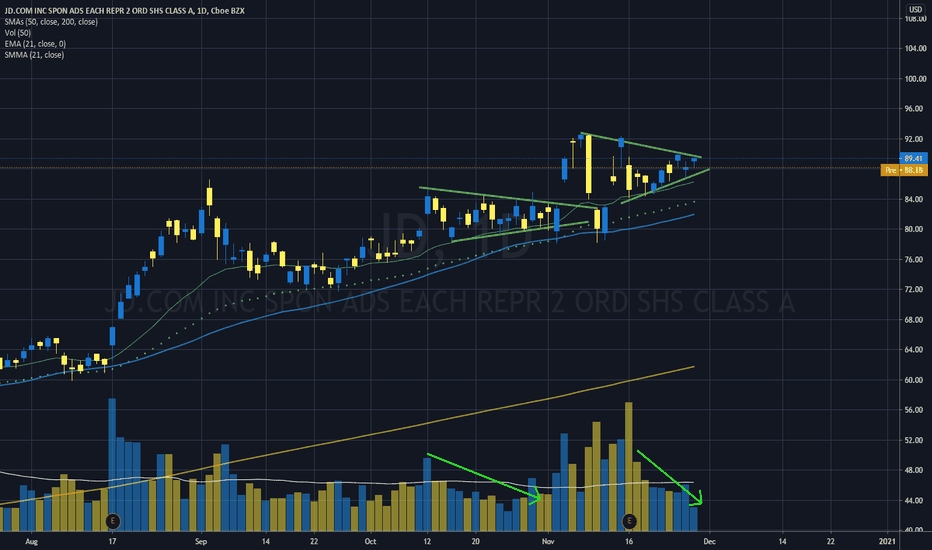

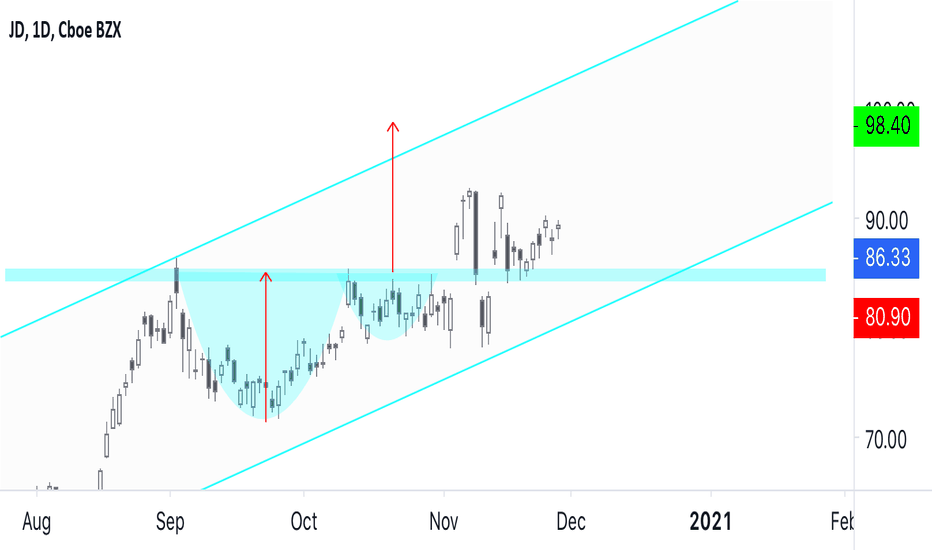

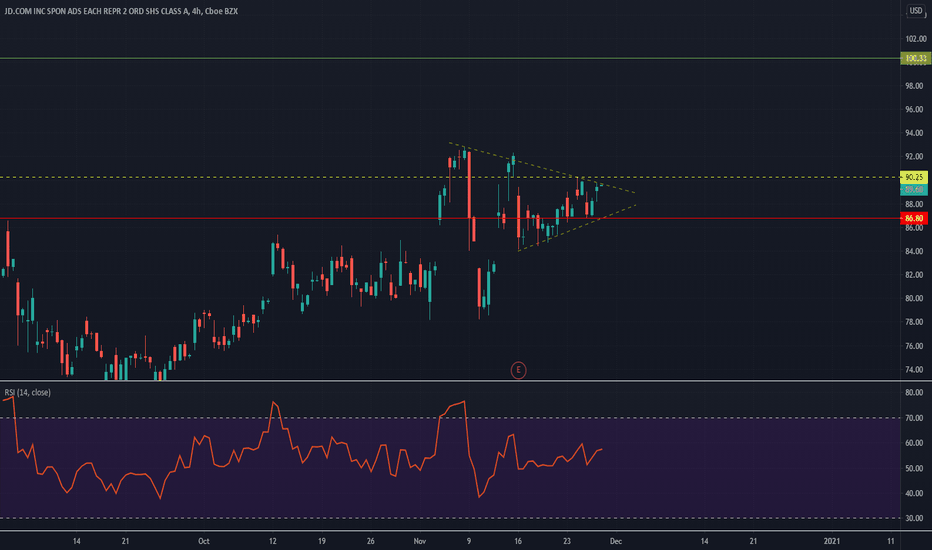

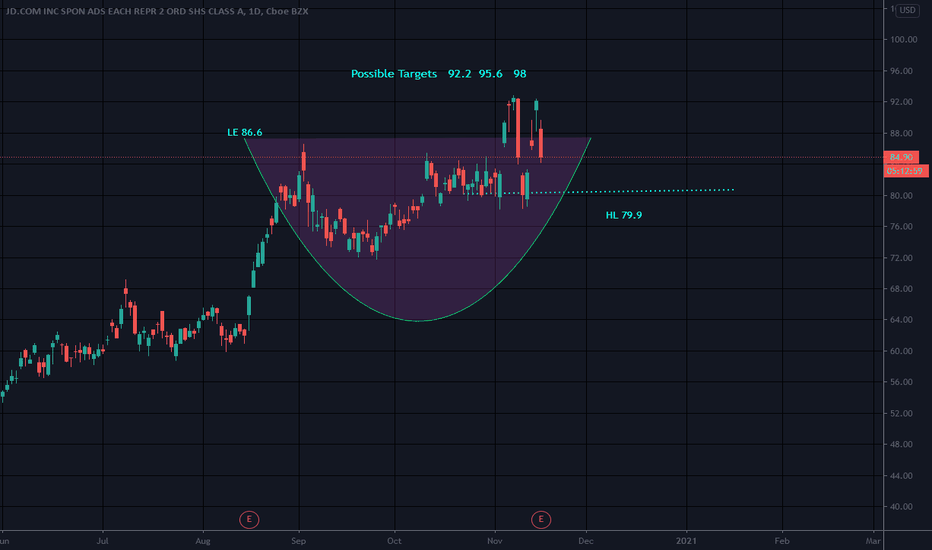

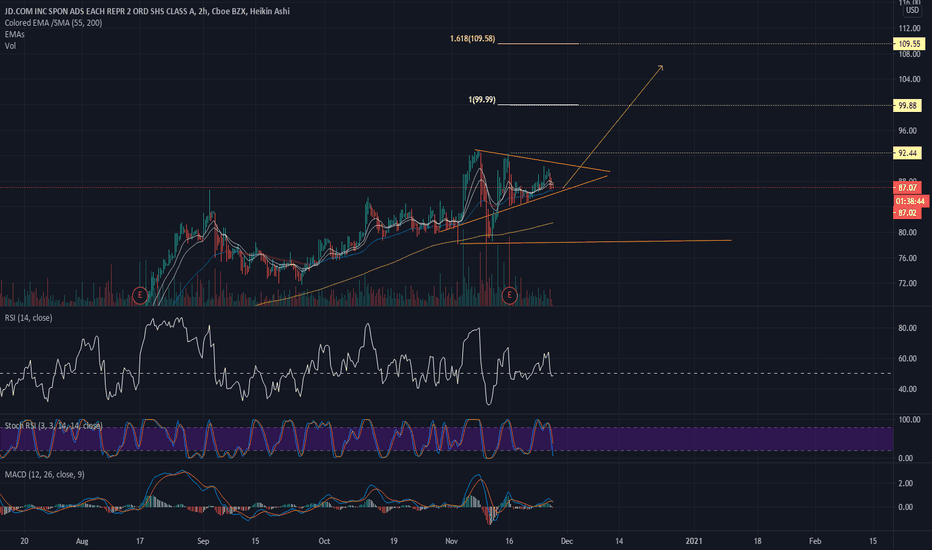

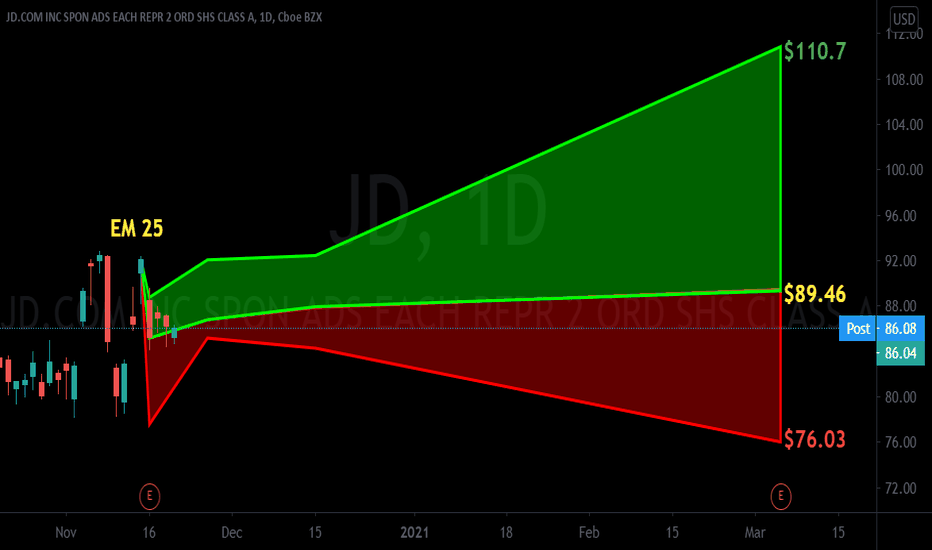

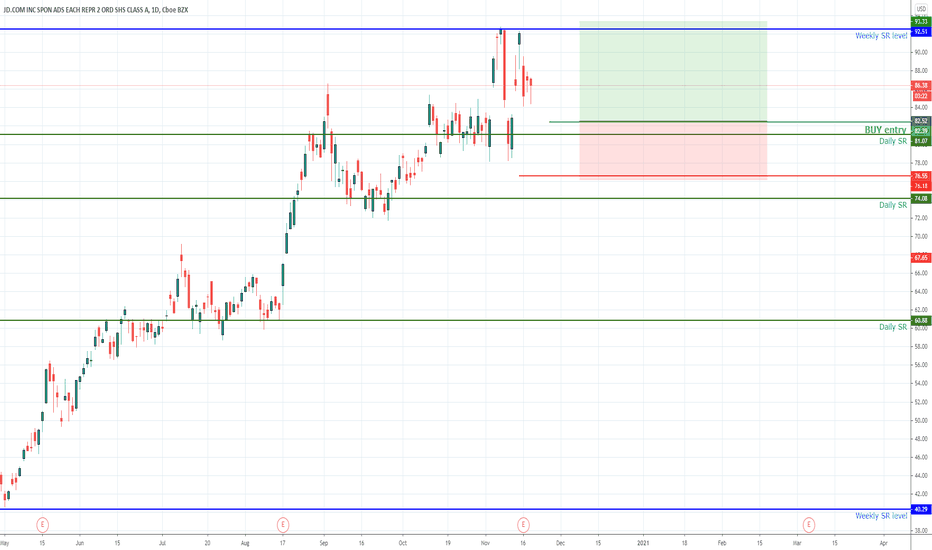

92.75 buy stop limit order.

85.33 stop (8%)

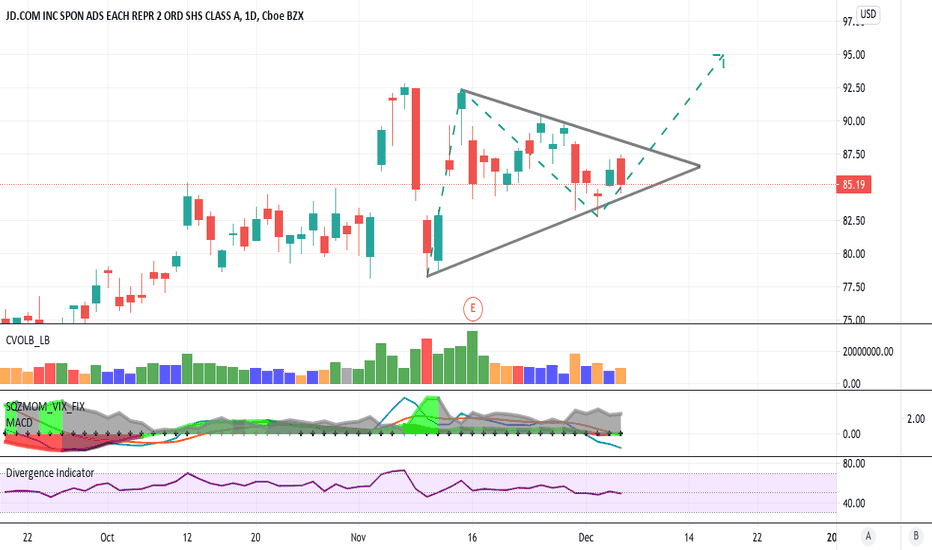

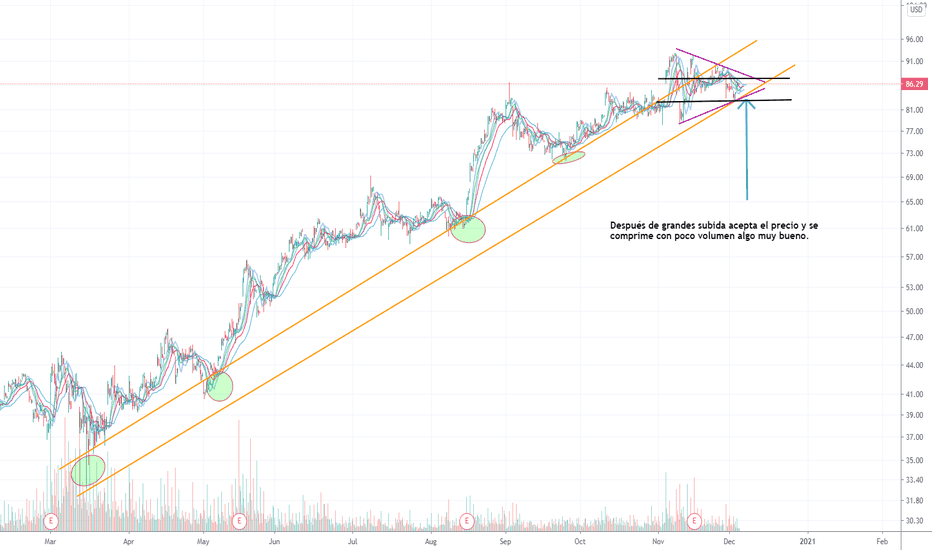

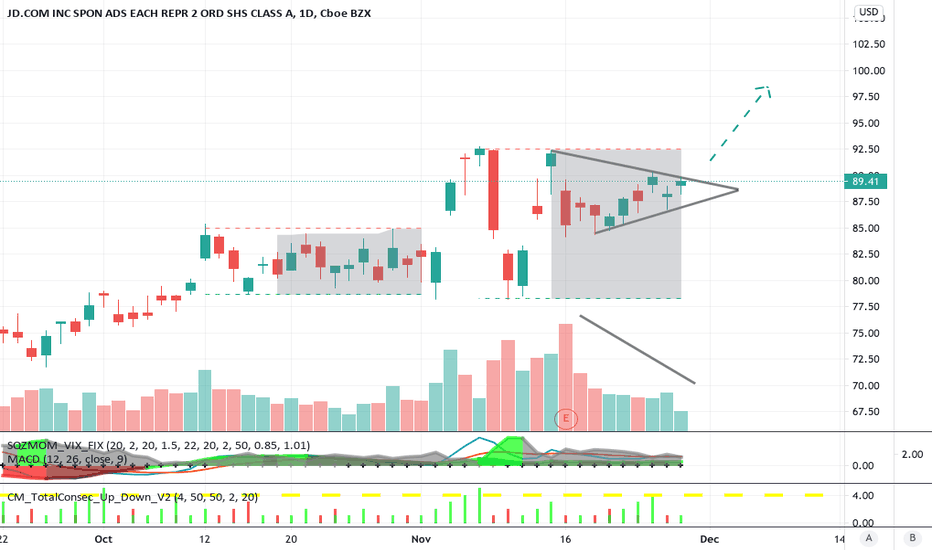

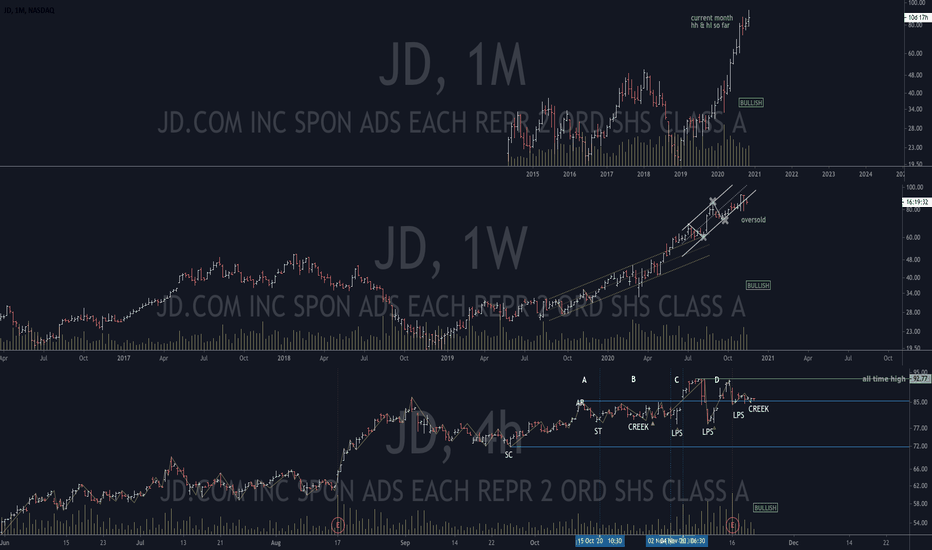

JD trade ideas

JD 11/20 target $95JD 11/20 target $95. Do your own due diligence, your risk is 100% your responsibility. Good luck and happy trading friends...

*3x lucky 7s of trading 101*

7pt Trading compass:

Price action

Volume average

Trend momentum

Current events

Revenue & Earnings

Debt / Cash

Book value

7 Common mistakes:

+5% portfolio trades

Bad risk management

Emotions & Opinions

FOMO

Lack of planning & discipline

Forgetting restraint

Repetitive errors

7 Important tools:

Trading View app

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books

Brokerage UI

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

tradingview.sweetlogin.com

$JD with a bearish outlook after earnings releaseAfter a negative under reaction following $JD earnings release, The PEAD projected a bearish outlook placing the stock in Drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.