KO trade ideas

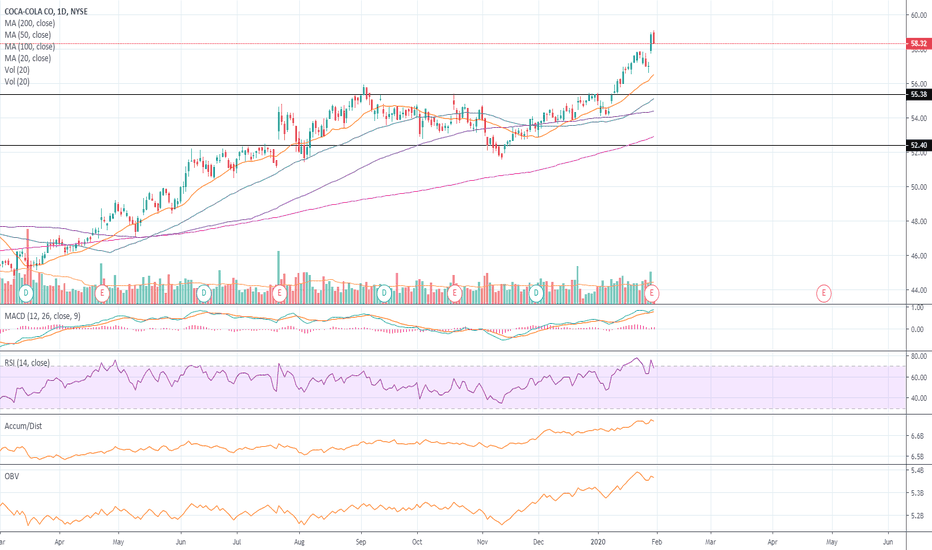

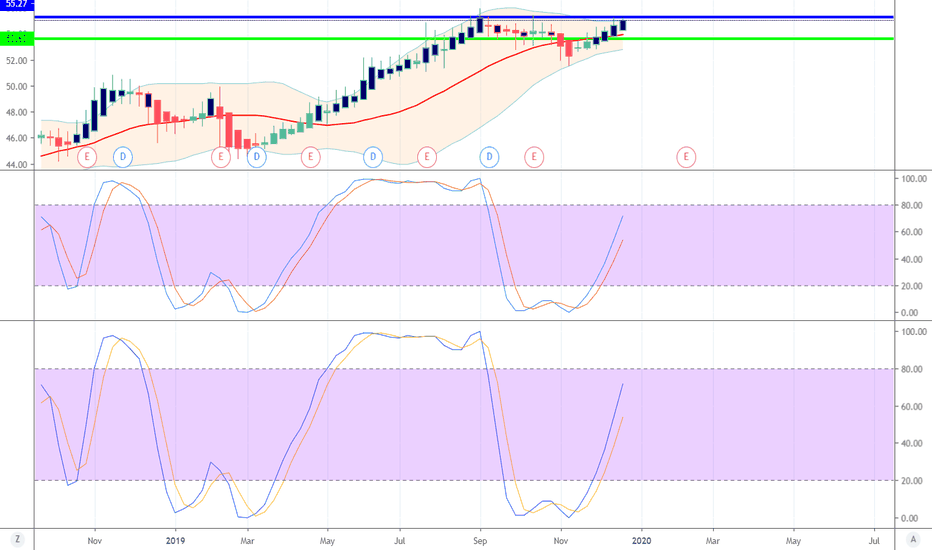

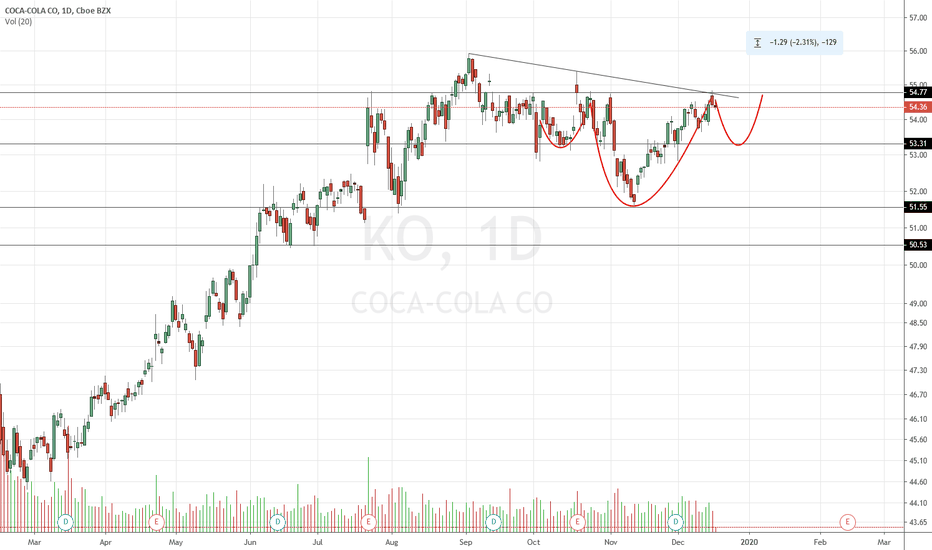

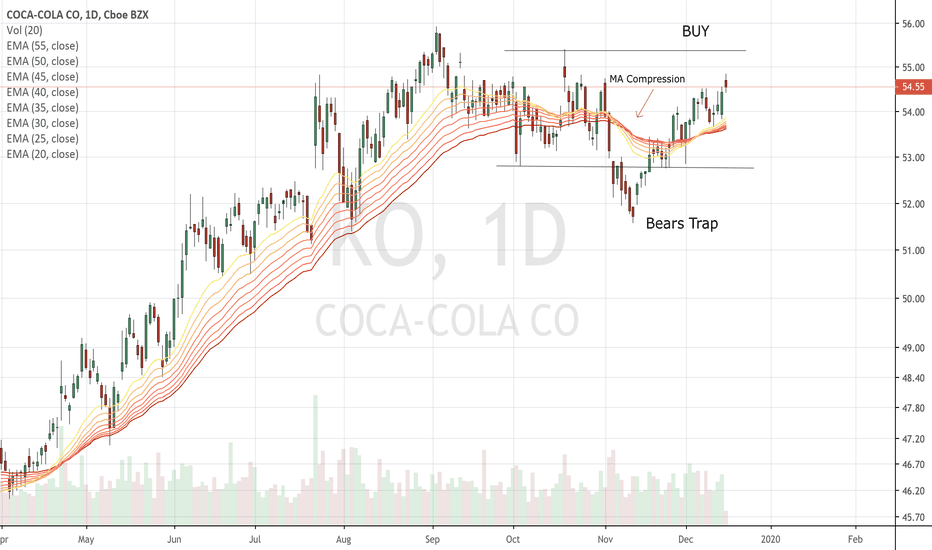

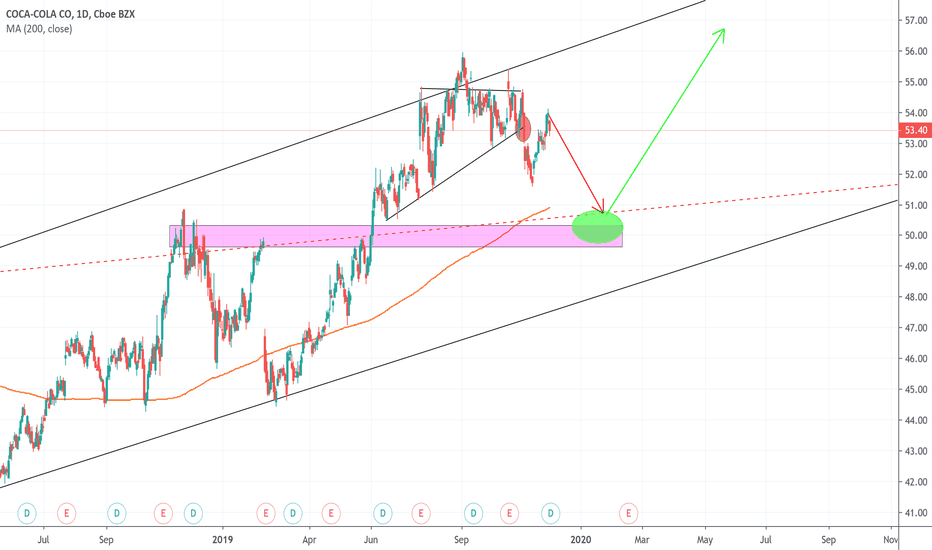

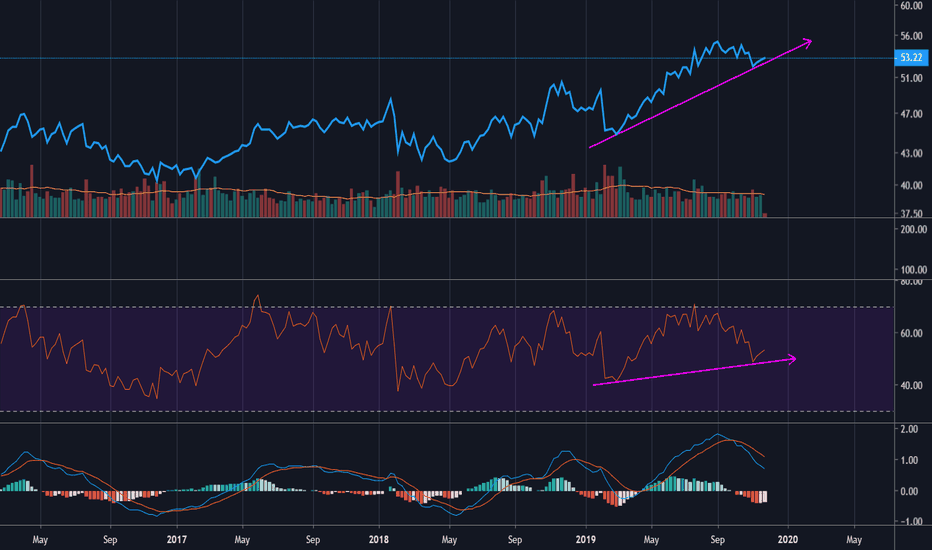

Buy long term with KOMy strategy is to combine several techniques at once:

+ Price channel and trend line: help me identify the direction of the price,

+ Supply - demand: help me identify the reversal position,

+ Elliott wave: help me determine the cycle of price,

+ Candlestick pattern and price action: Help me correct the position to the order

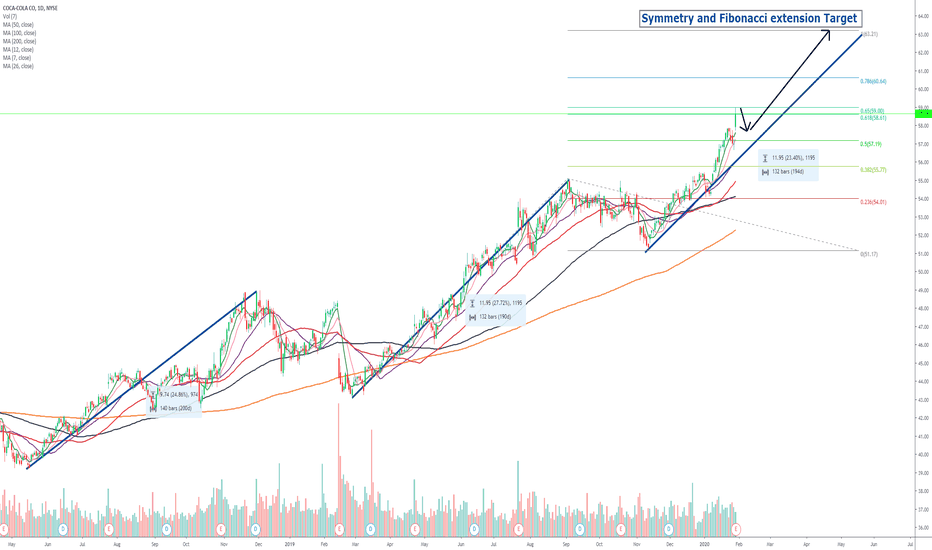

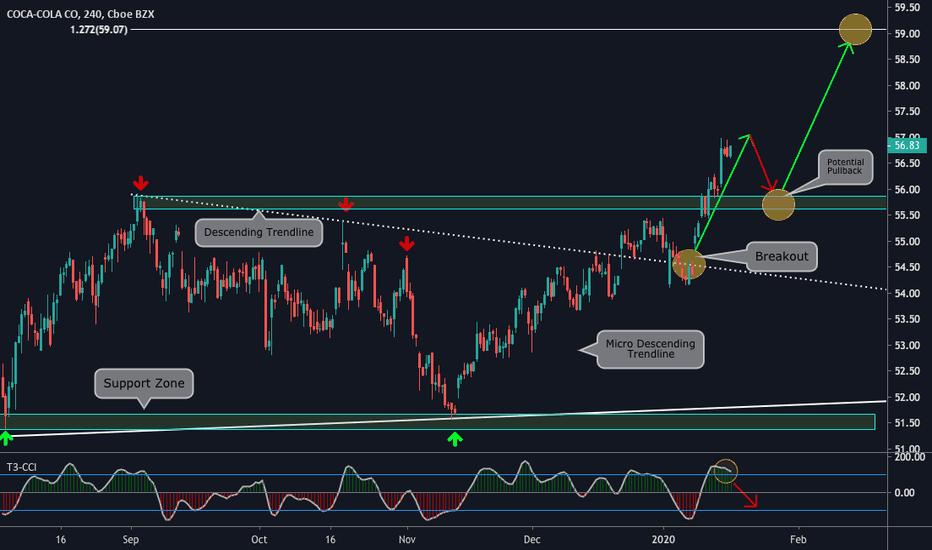

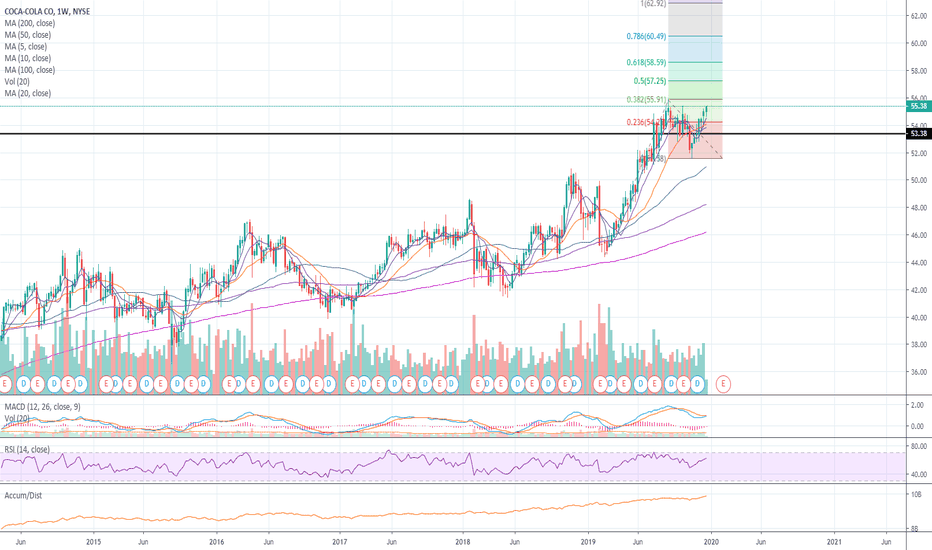

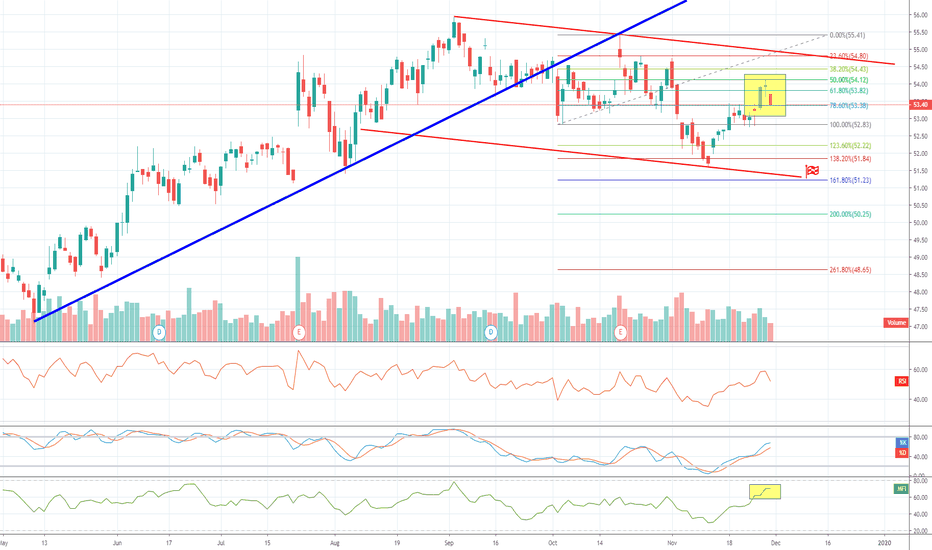

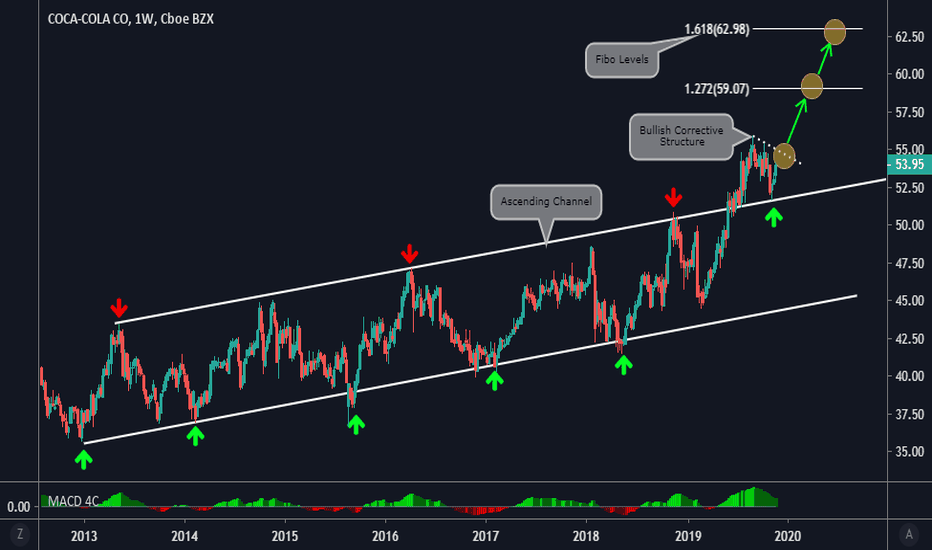

Coca Cola has plenty of upside

Another great earnings report from KO.

Stock has acted in a quiet symmetrical pattern in the past so a projection of those moves takes us to $63.

Which is also in confluence with Fibonacci 1-21 extension targets.

Possible a slight pullback before advancing higher as Fibonacci levels are now resistance which should be temporary

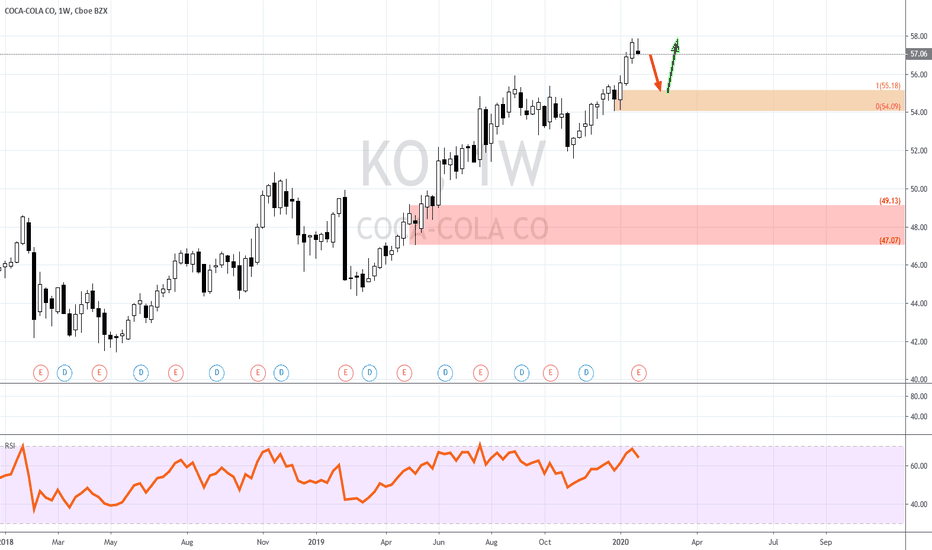

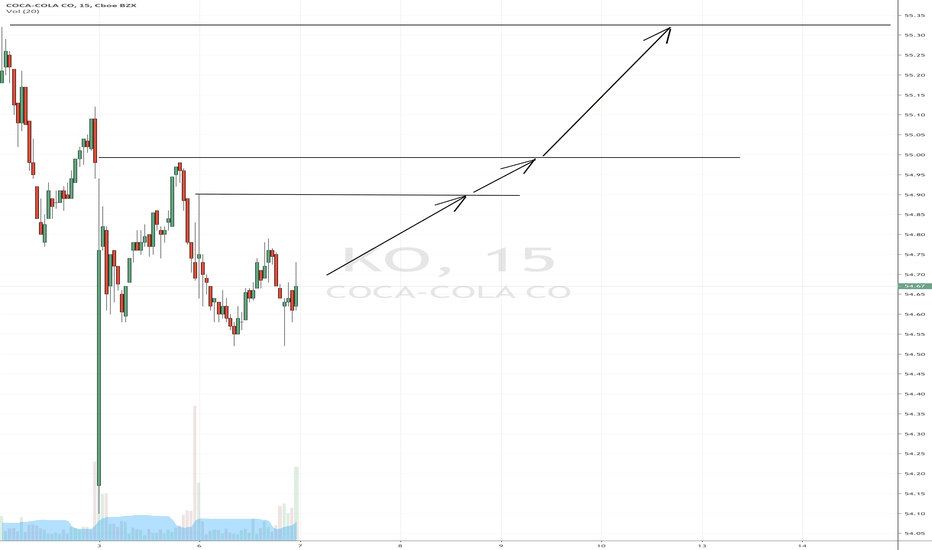

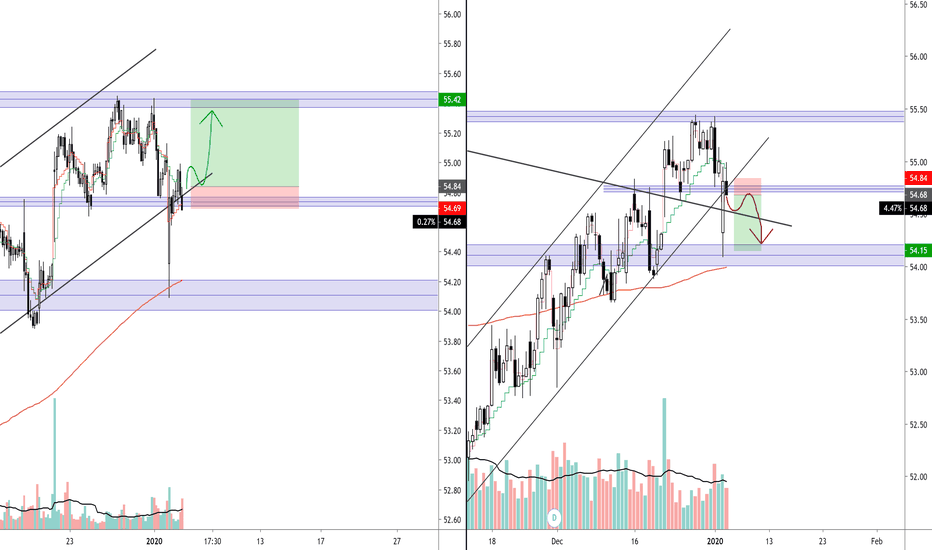

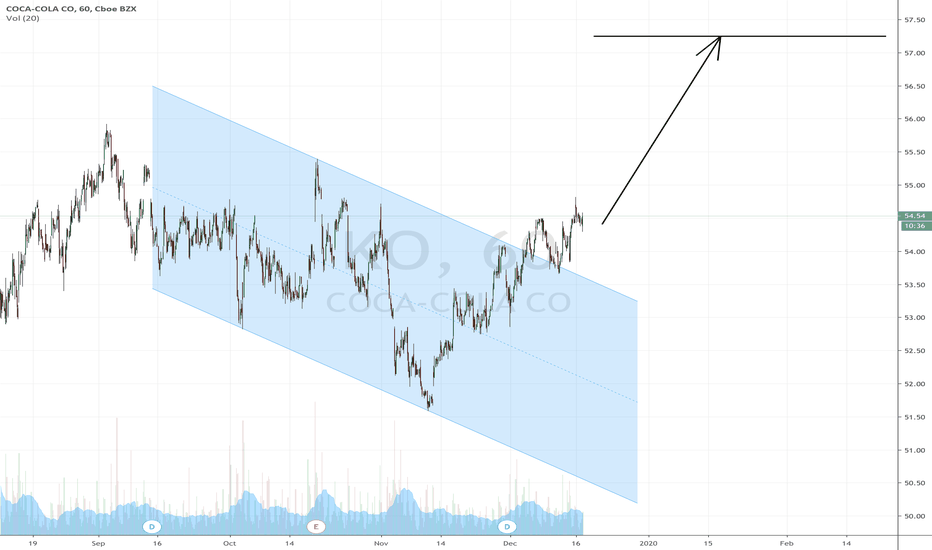

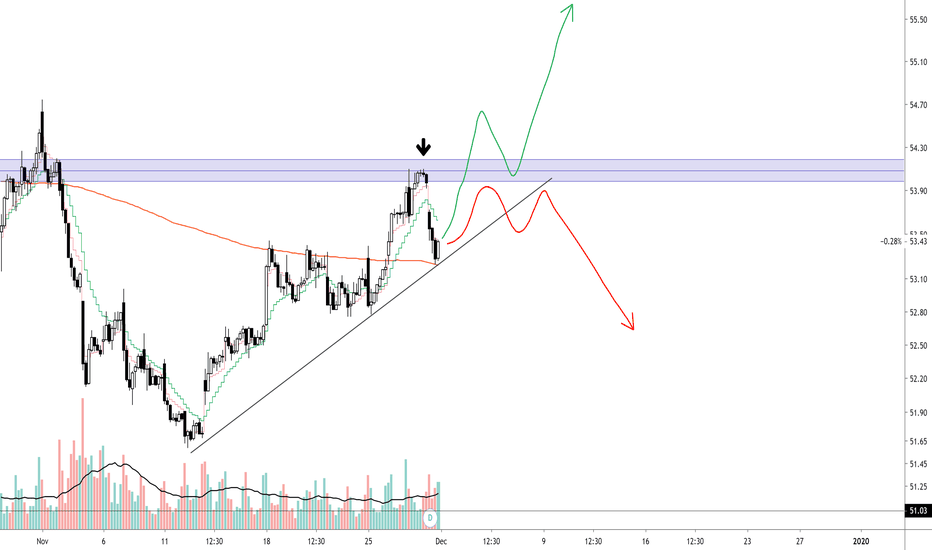

Short Term Bullish KOThe question here is not whether or not price action is moving higher in the short term, but rather its' how quickly KO moves to the upside. Very bullish here. Should see the 54.90 level tomorrow or the next day. Then 54.99 and our target level to focus on is 55.33 in the next day to several days...a week at the most.

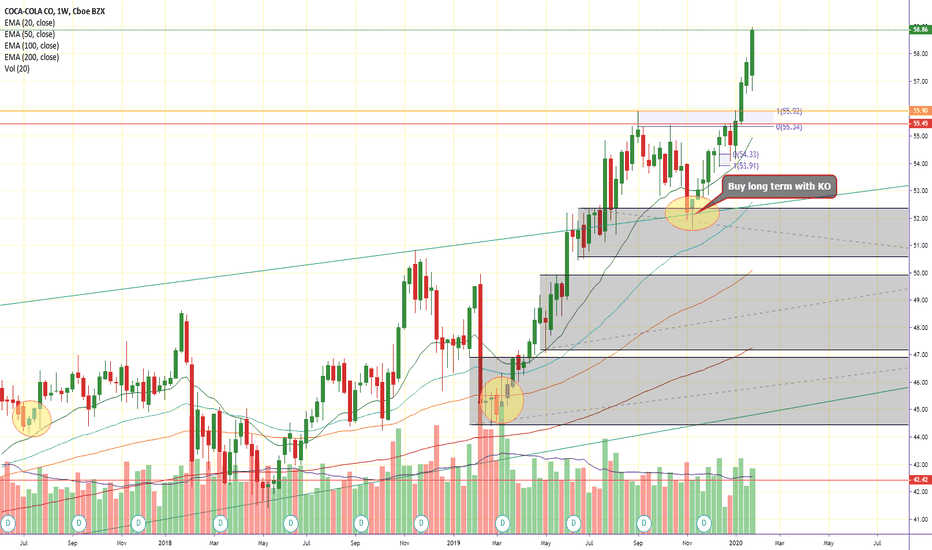

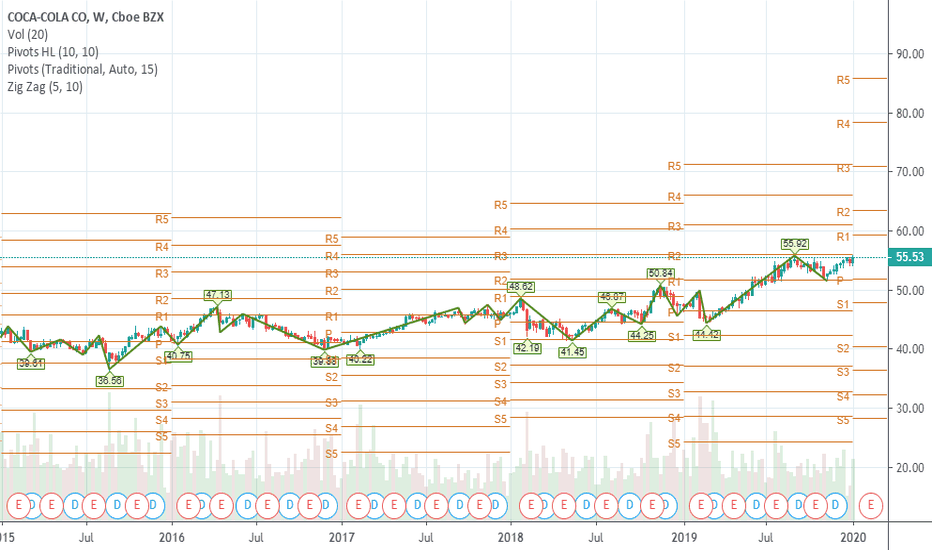

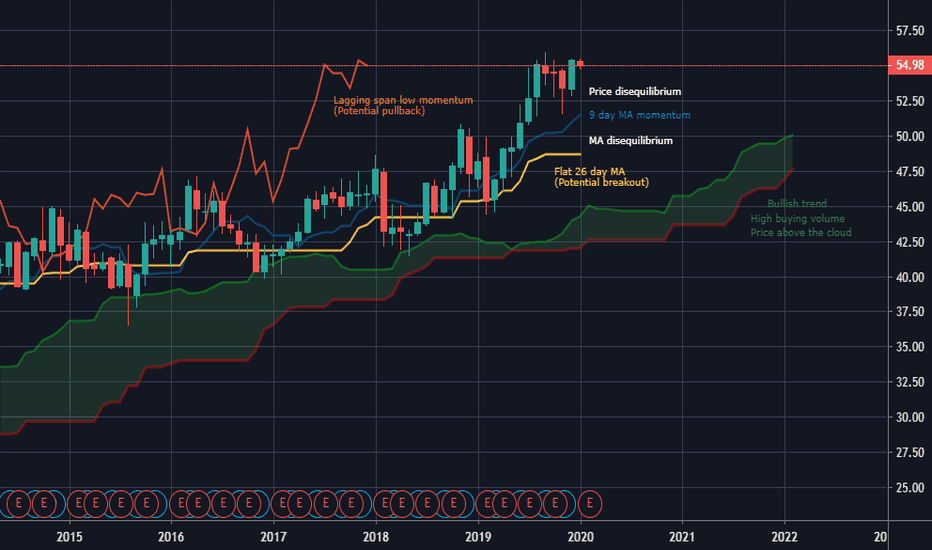

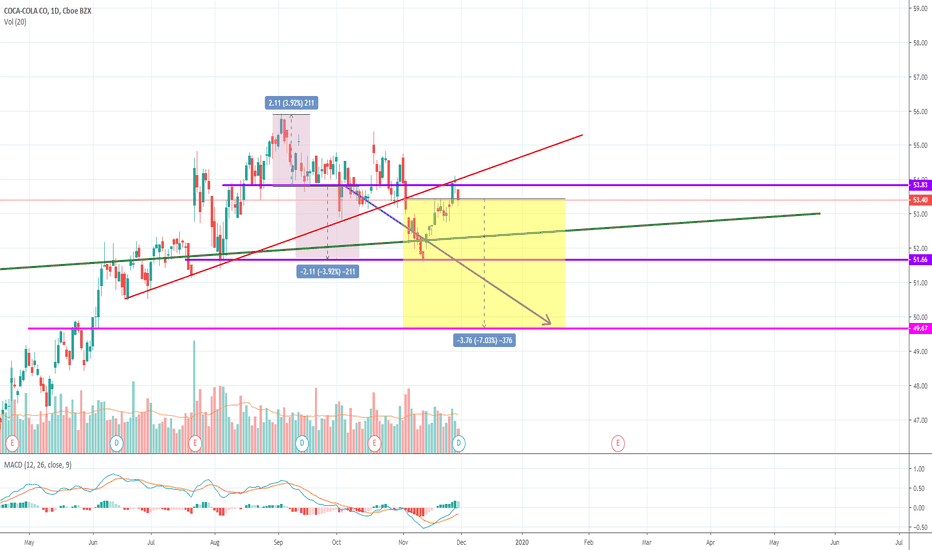

"Coca-Cola: Top and Bottom Analysis" by ThinkingAntsOkWeekly Chart Explanation:

- Price was on an Ascending Channel since 2013.

- Price broke it up.

- It is on a Bullish Corrective Structure.

- If it breaks it, it has potential to move up towards the Fibo Levels.

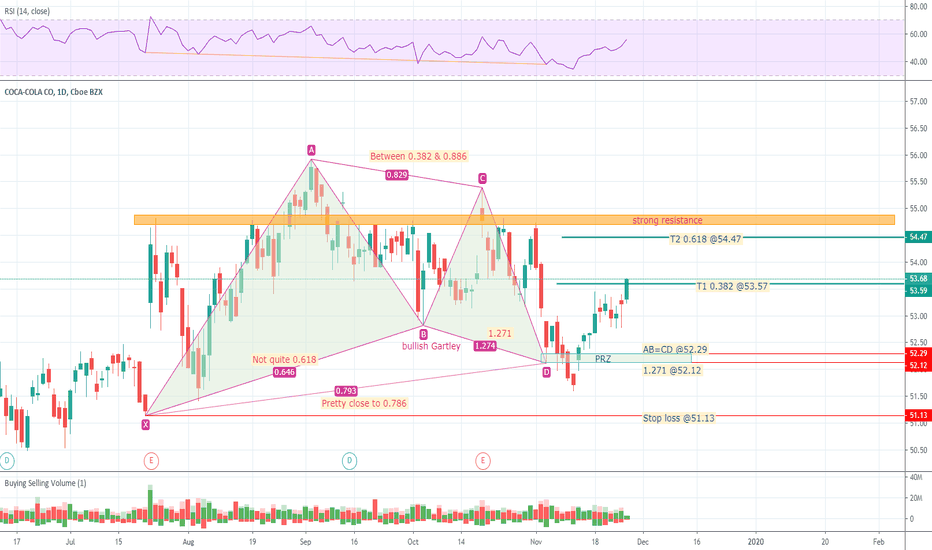

Daily Vision:

4H Vision:

Updates coming soon!

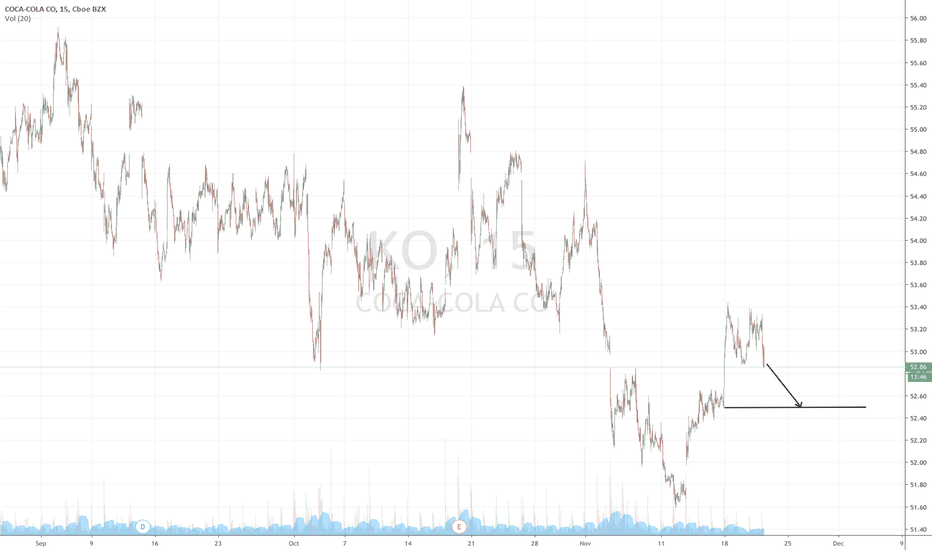

Short Term Bearish KOSo KO is showing weakness today, and it seems highly likely that we get a drop to 52.50 before bullish price action resumes. This is very short term, and we should see this play out in the next couple days or week or two at the most maybe. After this weakness in price action, we could possible see a strong move higher follow.