LULU trade ideas

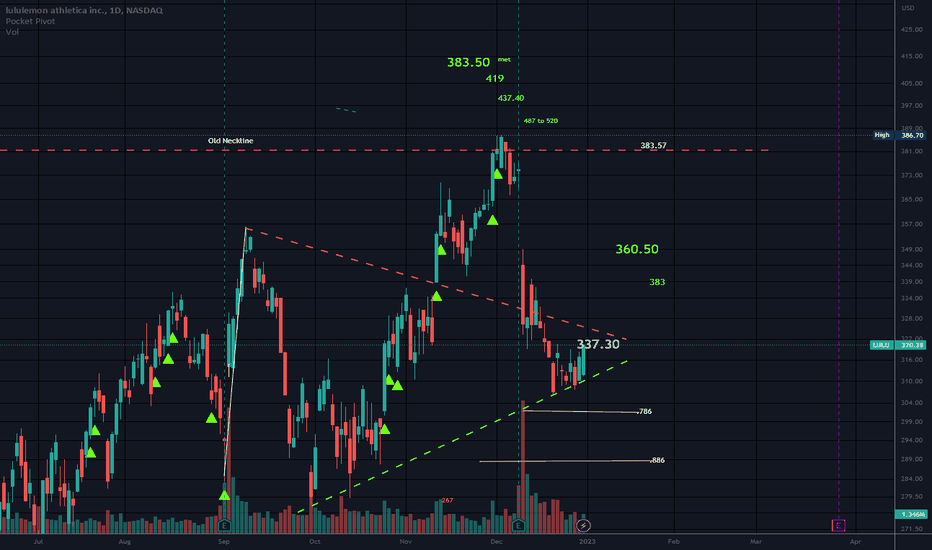

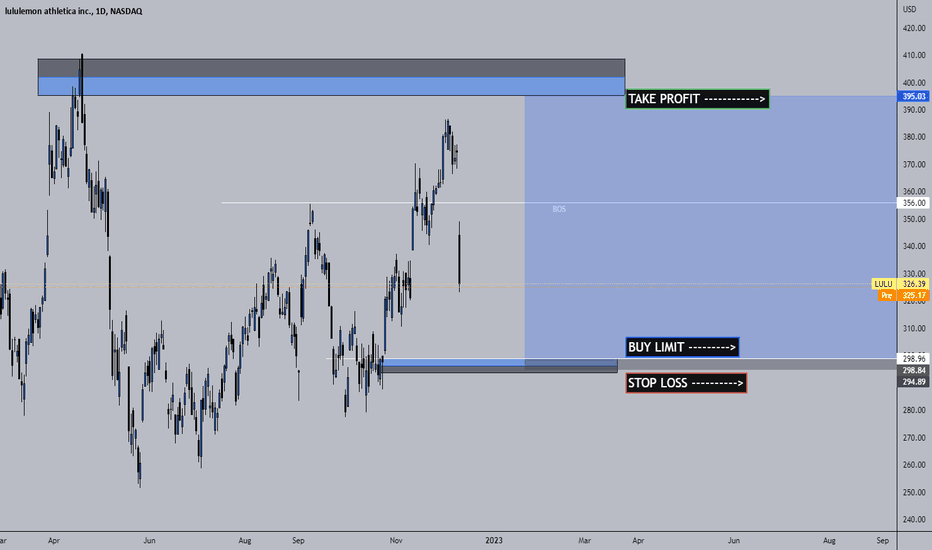

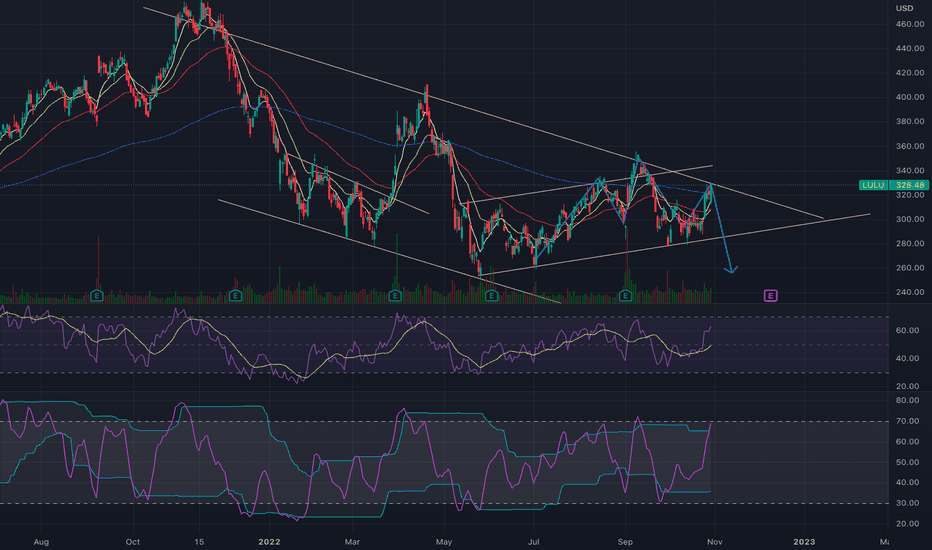

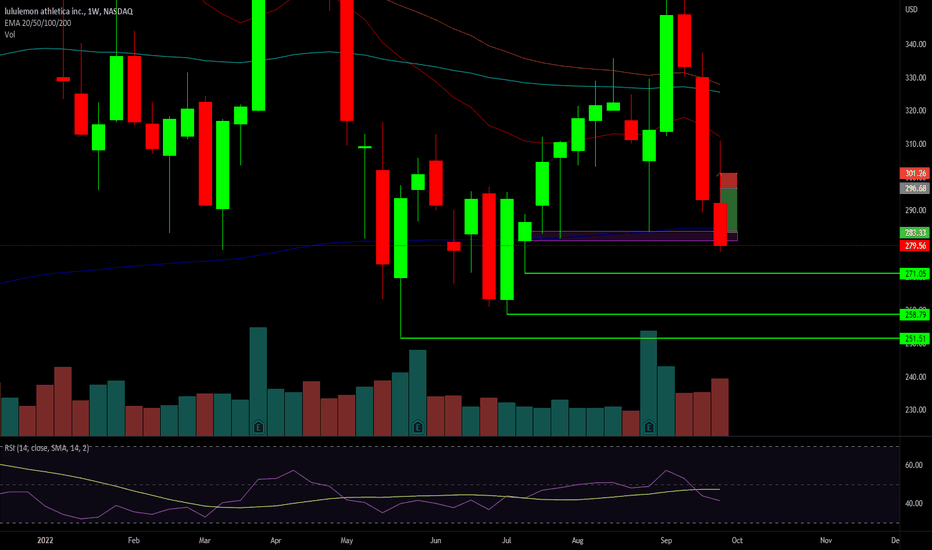

LULU re-test and dip below $300 likely on the way very soon...USING HEIKIN-ASHI CANDLES on the DAILY CHART

- Heavy selloff after earnings on December 8, 2022 - changing short-term technical sentiment from bullish to bearish, and long-term technical sentiment from bullish to neutral.

- Broke below key trendline on December 14, 2022 with bearish signal courtesy of Lux Algo.

- Dipped and closed below Trend Regularity Adaptive Moving Average Line - a.k.a. the yellow line in the chart screenshot - with force on December 19, 2022 - changing short-term technical sentiment from bearish to very bearish, and long-term technical sentiment from neutral to bearish.

- Relative Strength Index close to convergence at 40% , which could act as additional resistance.

- Double Top rejection below the Trend Regularity Adaptive Moving Average Line , which provided a strong confirmation for short trade entry and stop loss (above TRAMA line at $321) .

Exit target for profit-taking:

- $300 (whole number general buyer reaction anticipated)

- $277.5 (current swing low)

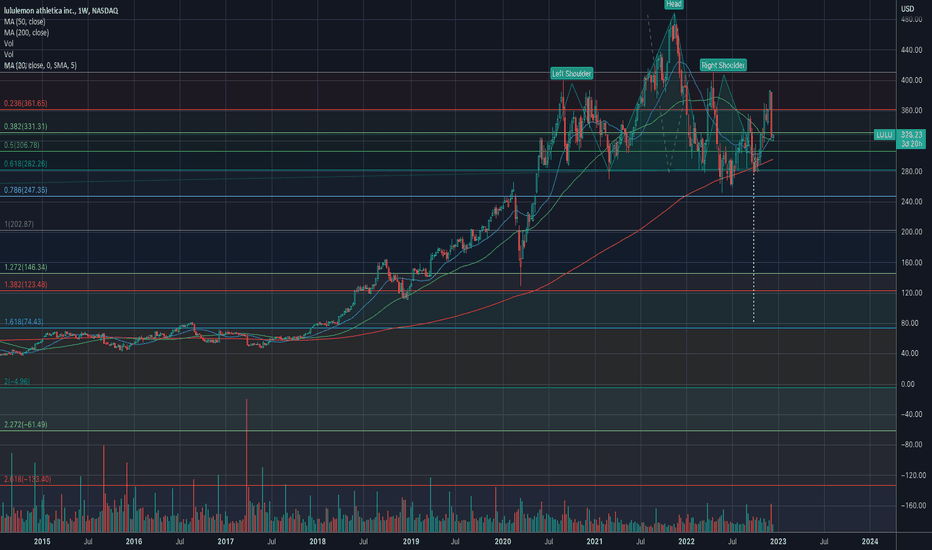

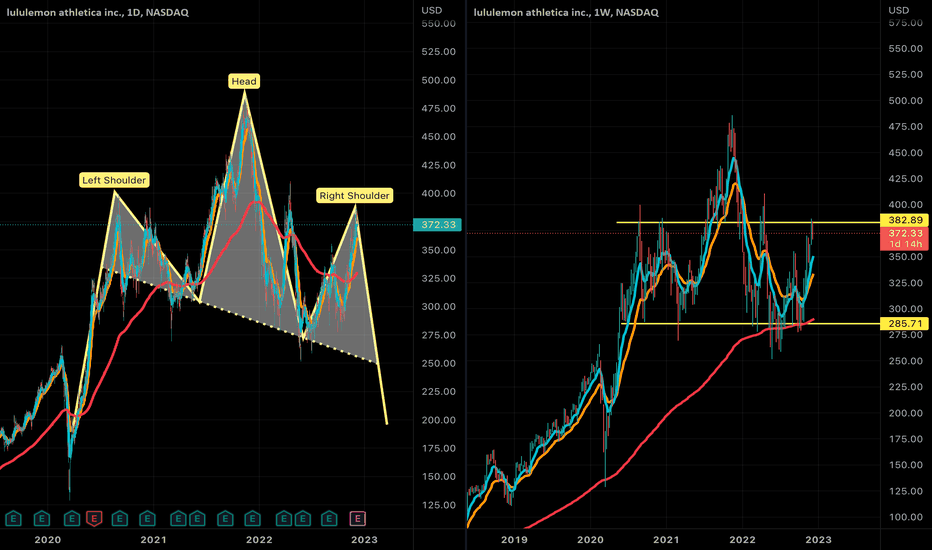

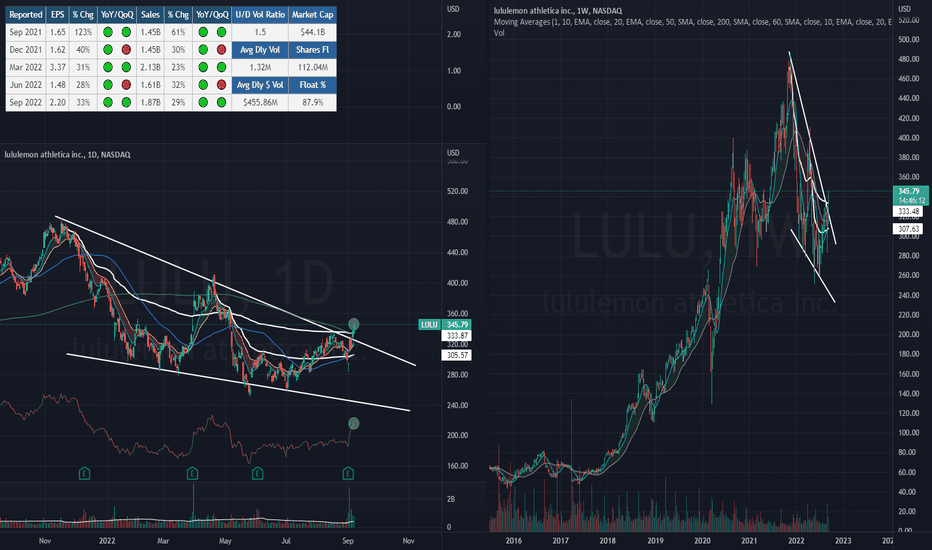

LULU - Short OpportunityTechnical Analysis:

A bearish head and shoulder pattern has emerged and a short signal appeared. A break below 273.6 would be a clear confirmation of long term downtrend.

Fundamental Catalyst:

LULU inventories increased 85% in Q3 2022 compared to Q3 2021. With over 60% of their revenue coming from retail, LULU will continue to face immense competition from e-commerce sellers of athleisure wear that offer equally good quality apparels but at more affordable prices. The recession will likely hit the company hard. LULU has been underperforming in the retail sector index.

Will observe the price action for the next few days / weeks and update when there is an entry opportunity.

NASDAQ:LULU

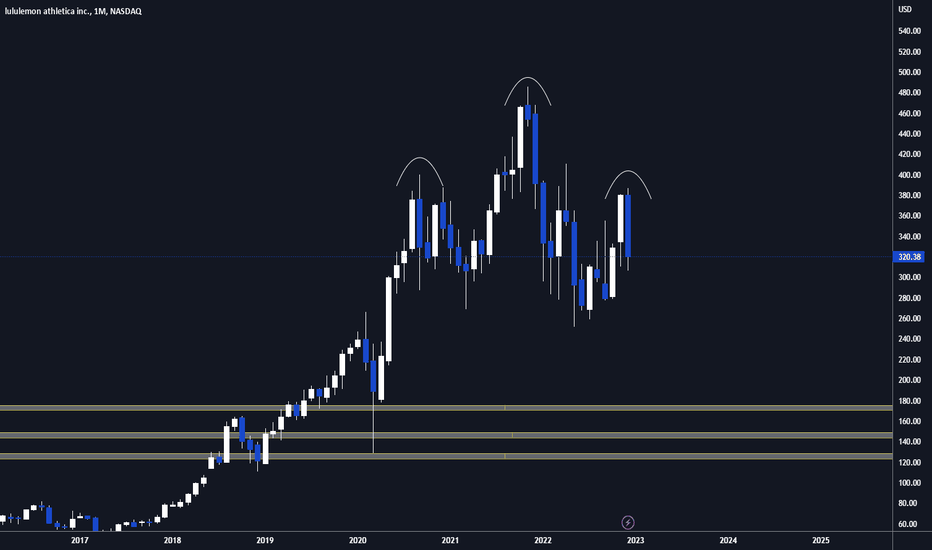

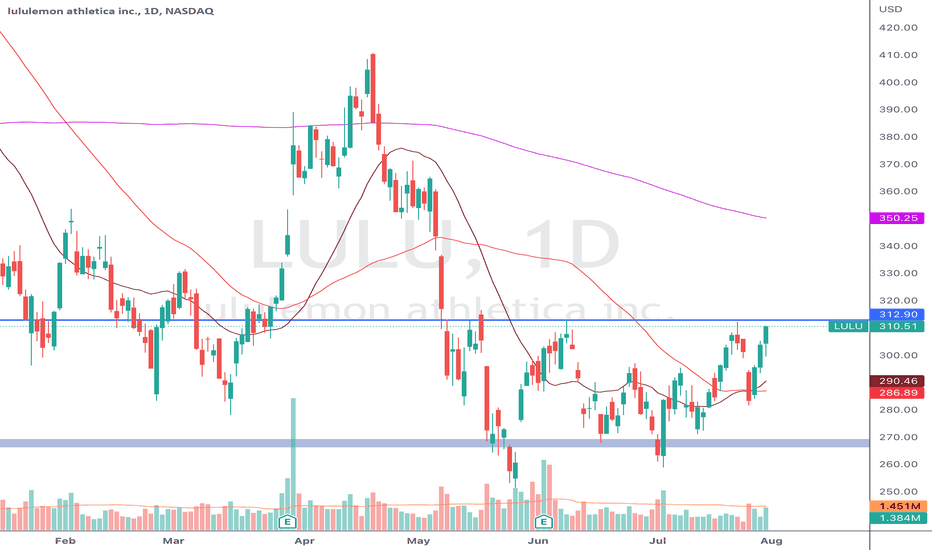

$LULU - breaking down below $182 would be badLulu looks like it's still playing out H&S with the neck line at $282.

Breaking down below $282 neck line will be bad and could send the stock to $247 again.

The full measured move for the break down is $75 and it is quite hard to imagine the stock going down to that level.

I am neutral. 👀ing for opportunity to load.

——

Trade is done when it hit one of the target or stop loss is hit.

Disclaimer: Trading note. Not an investment advice.

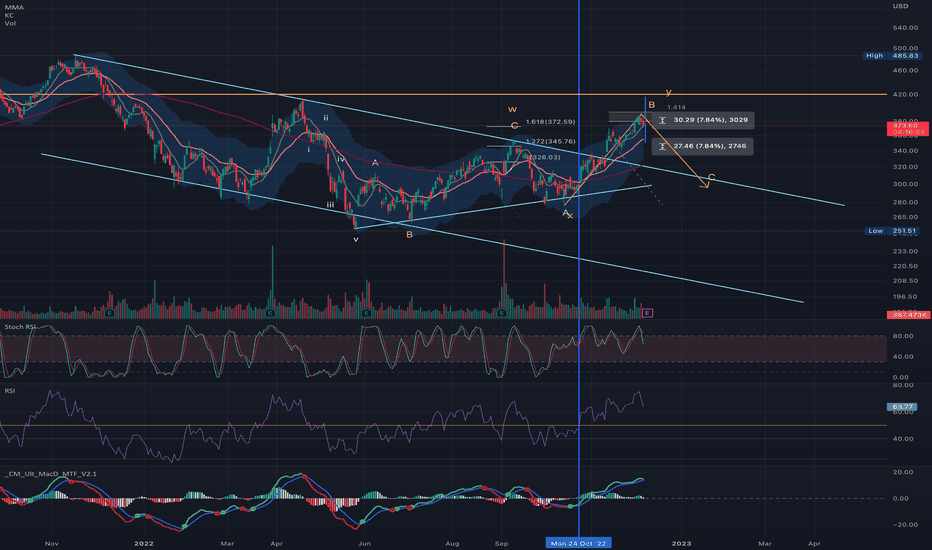

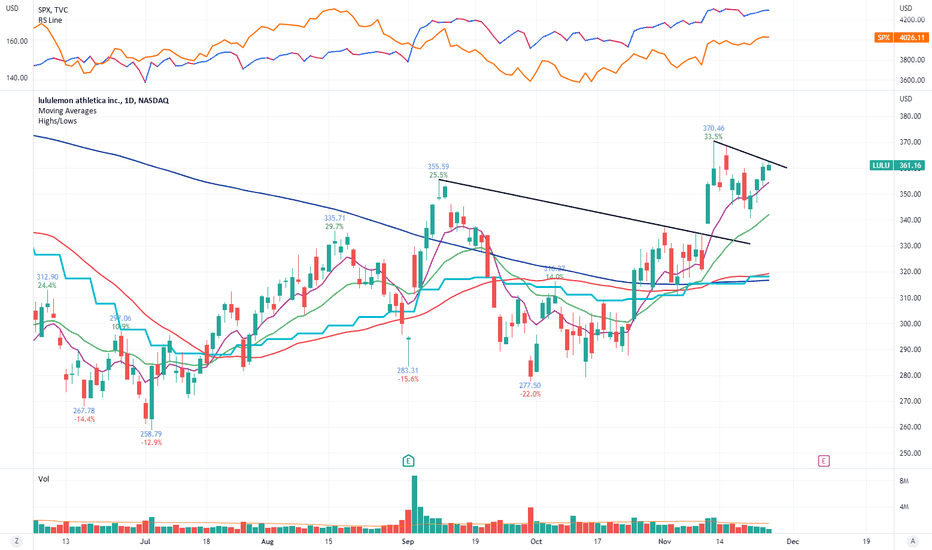

Holding the Breakout Since breaking out of its cup with handle base LULU has held above the breakout level and the left side high of the base. That is something that we haven’t seen much of this year. LULU has formed a nice flag with a multitouch trendline. If LULU can push above the trendline it is actionable

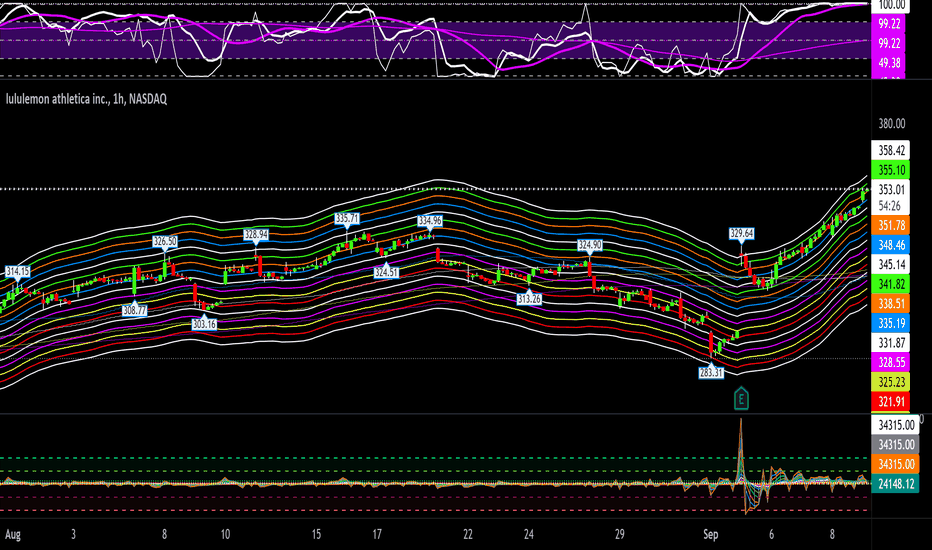

LULU shortLULU pi RSI is at 100 on the 1hr chart. A short entry trade is on my radar. Especially going into next week's macroeconomic Calendar events.

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com

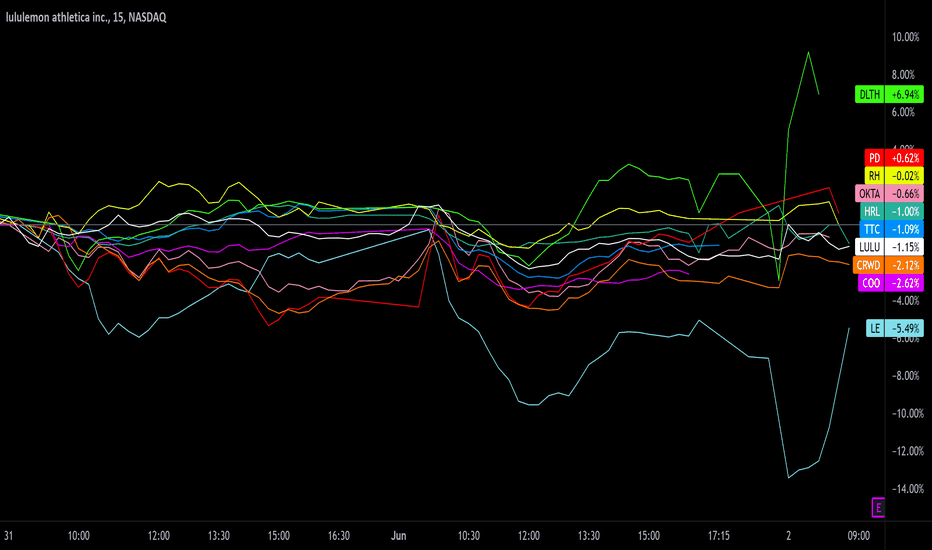

Earnings watch 6/2Earnings watch 6/2:

DLTH

PD

RH

OKTA

HRL

TTC

LULU

CRWD

COO

LE

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com

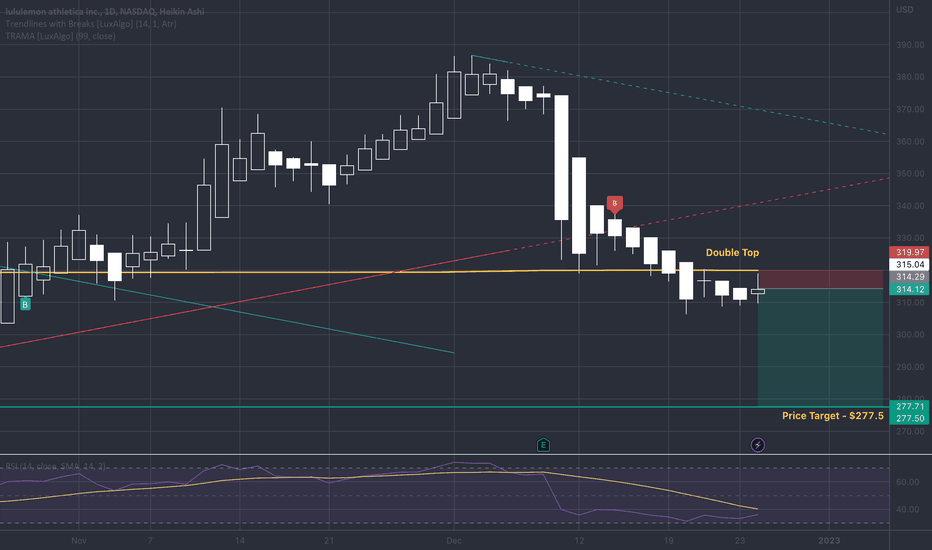

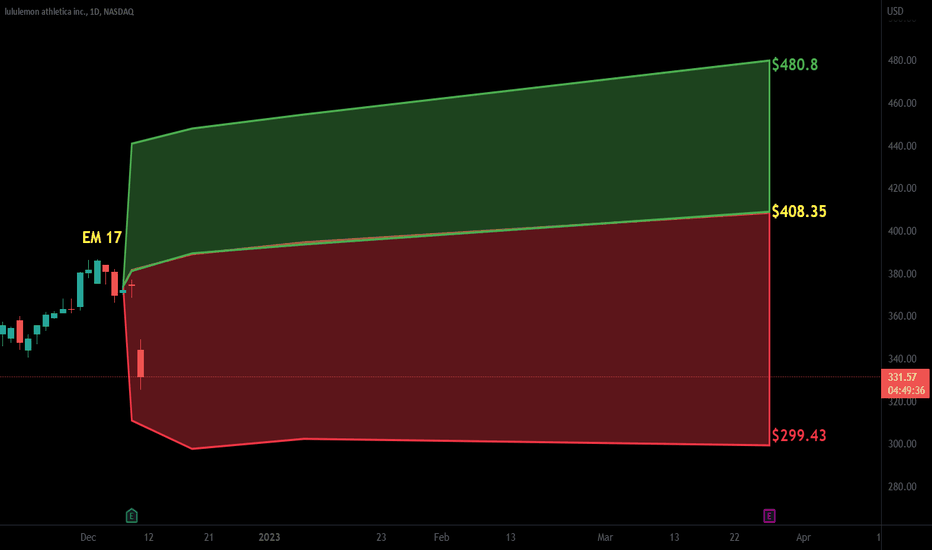

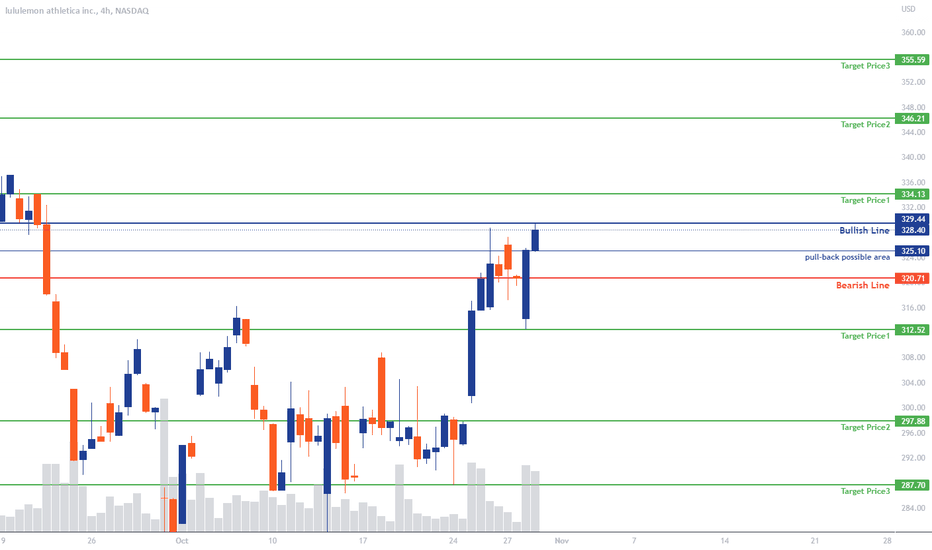

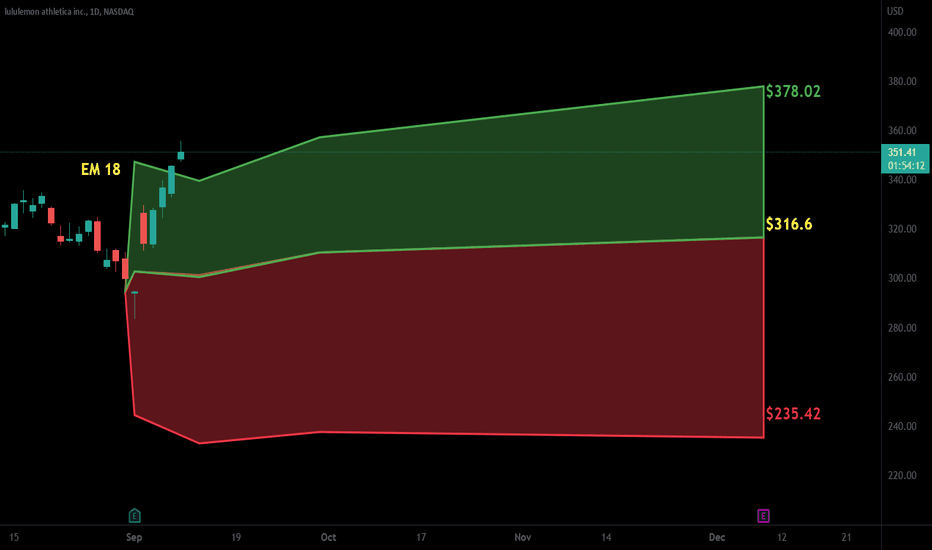

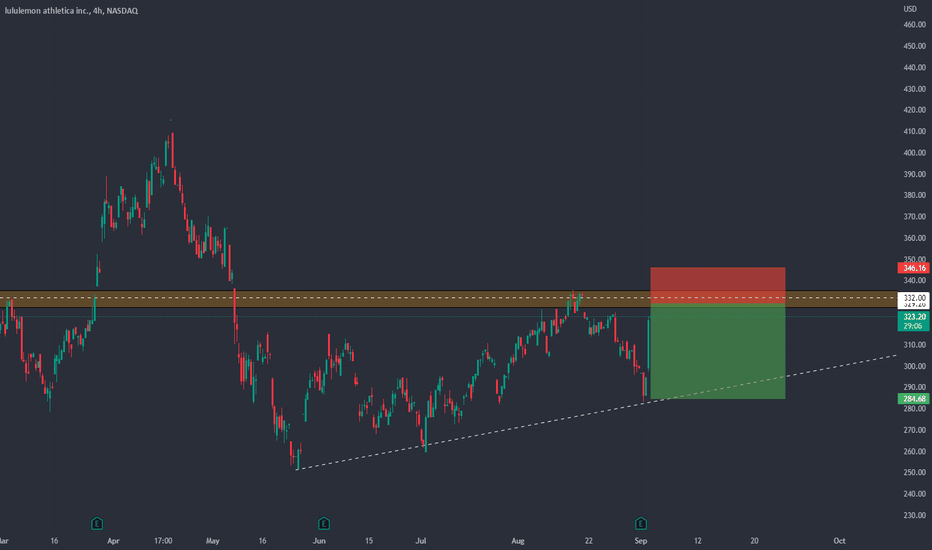

LULU: Fade the rally!Lulumelon Athletica

Short Term - We look to Sell at 329.26 (stop at 346.16)

They reported better than expected earnings and the stock jumped up premarket. The medium term bias remains bearish. We are assessed to be in a corrective mode higher. Bespoke resistance is located at 332.00. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 284.68 and 272.00

Resistance: 332.00 / 410.00 / 478.00

Support: 283.00 / 246.00 / 129.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

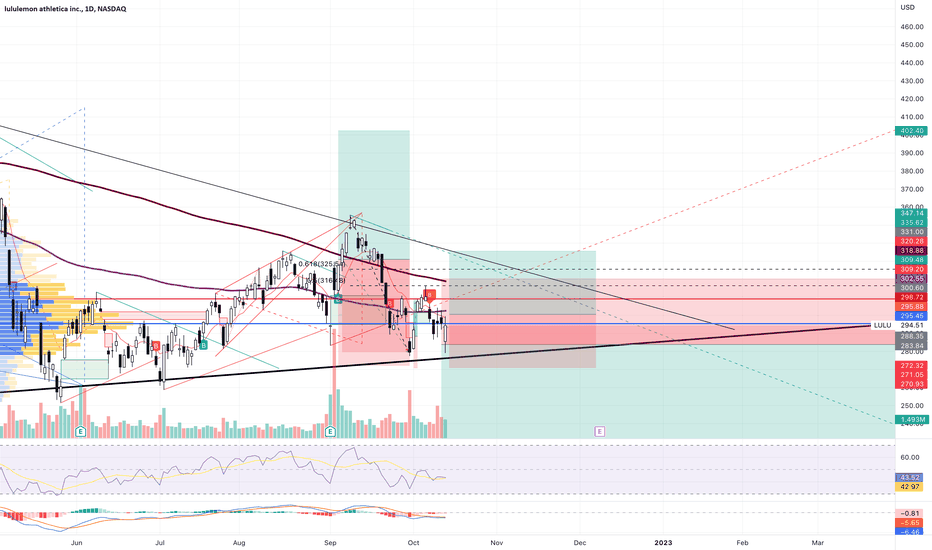

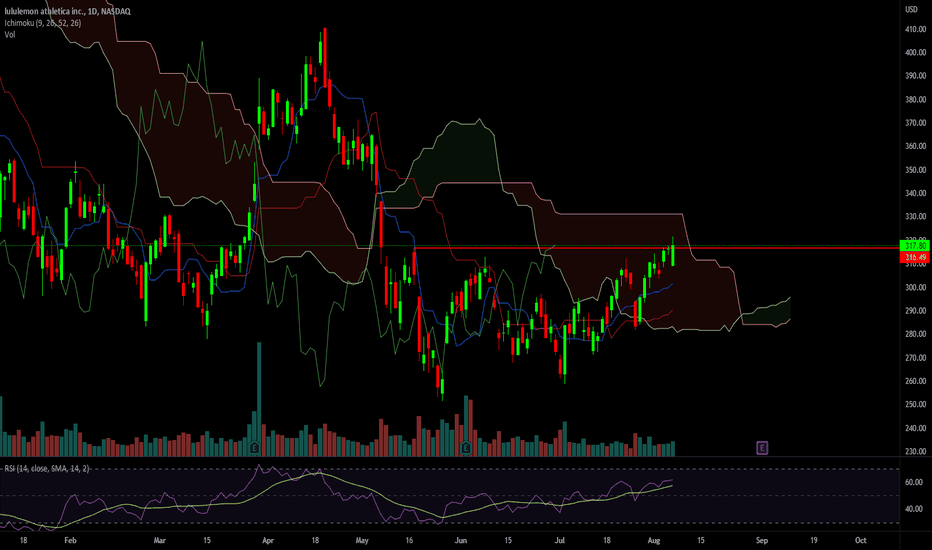

9/1 - Lulu Pre-Earnings Analysis Higher probability of downside move with Lulu earnings scheduled evening of 09/01:

1. Multi-month head and shoulders was cleanly pierced and then retested with downward pressure from its base.

2. Multi-week down trend off of 200 SMA.

3. Multi-day weakness leading to today, with overall rounding of price to the downside.

4. Multi-year support would occur around 245.

5. General market weakness and downward revisions from retailers.

Conclusion: Earnings volatility on 09/02 could see test of $245.