LYFT trade ideas

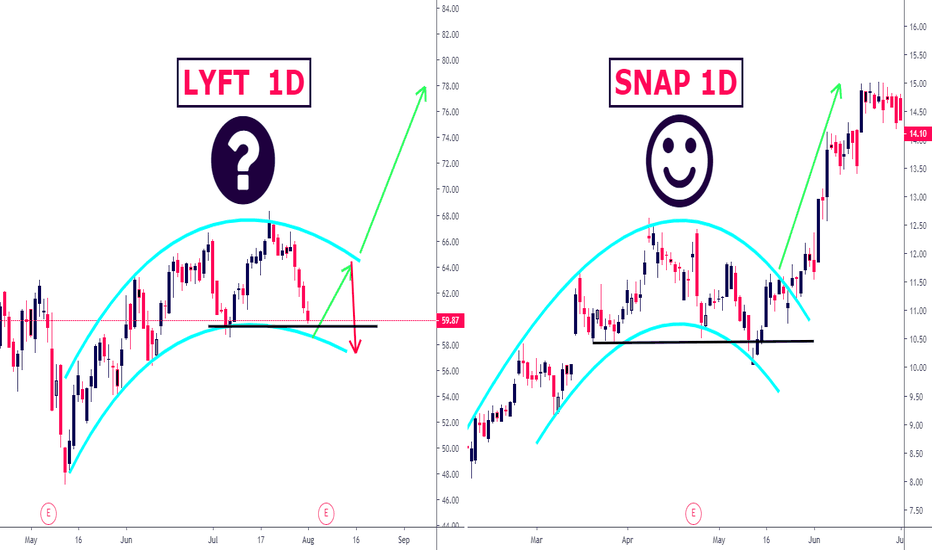

Will Lyft Repeat What Snap Did Already?Hello dear stock traders & friends, hope you're doing well guys! ;)

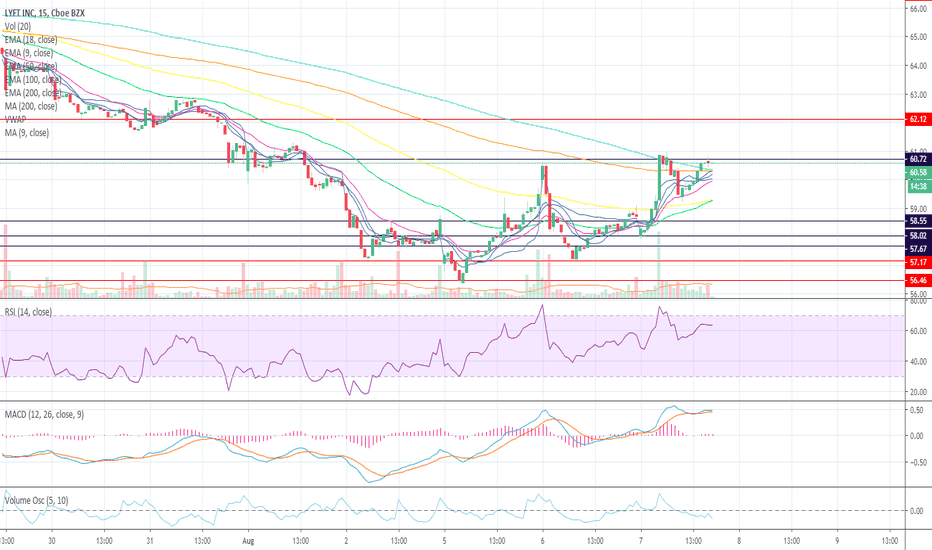

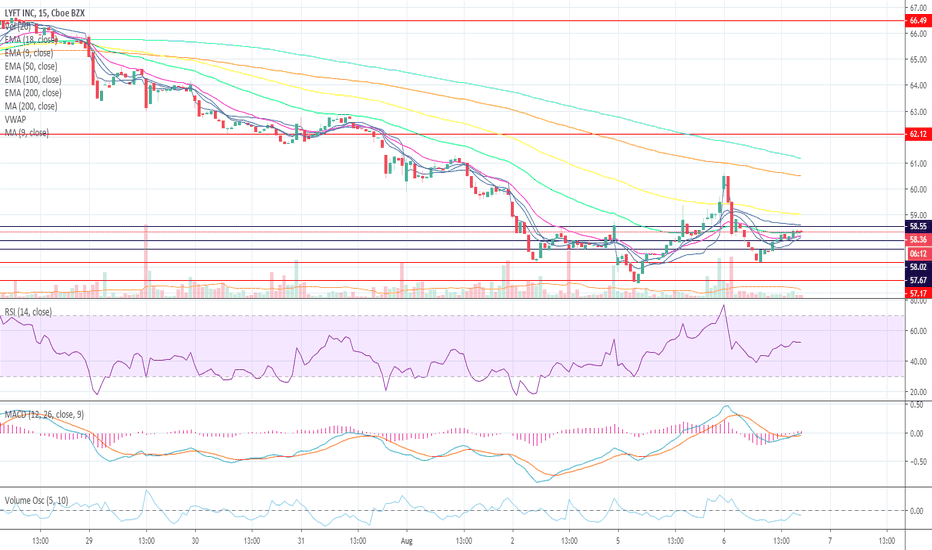

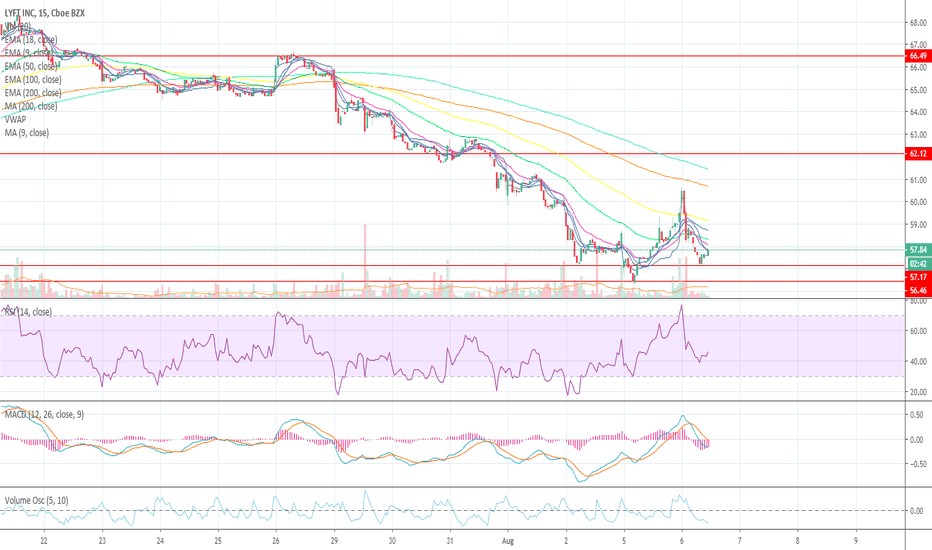

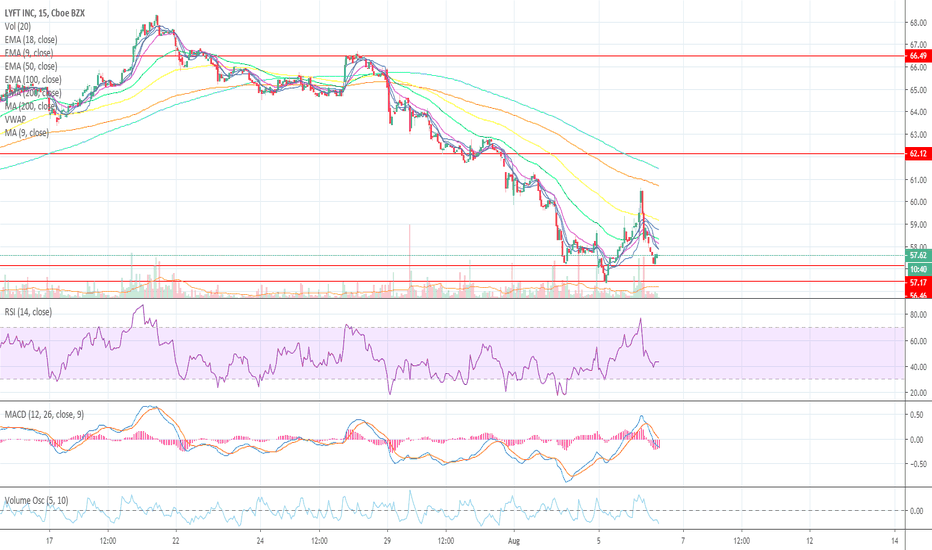

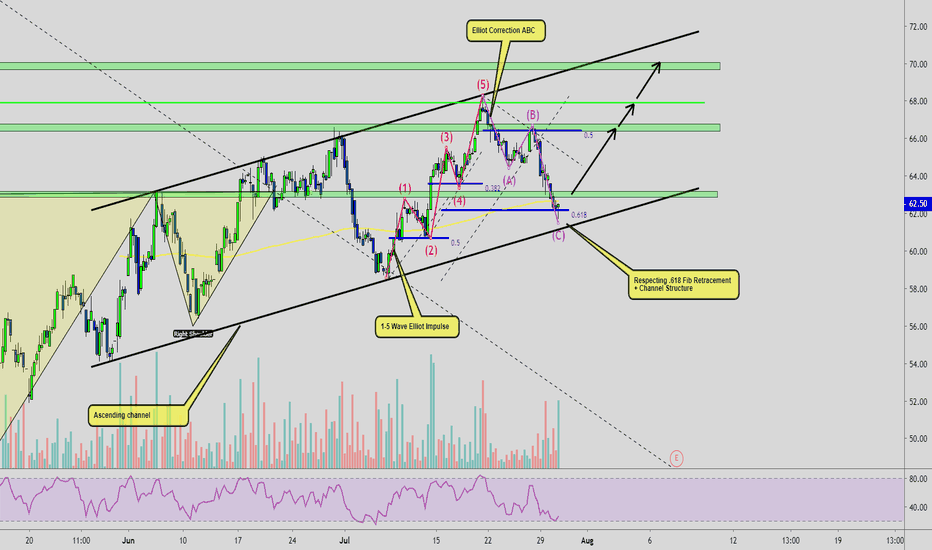

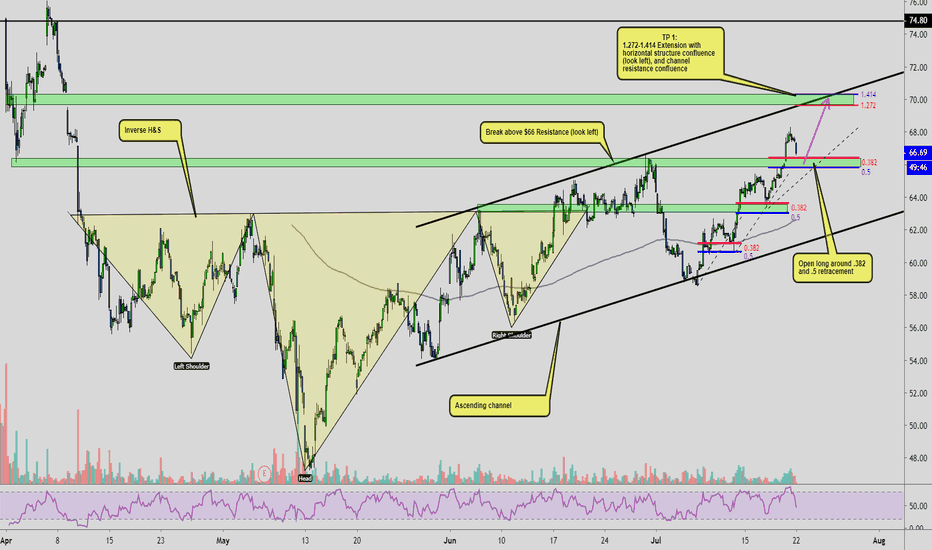

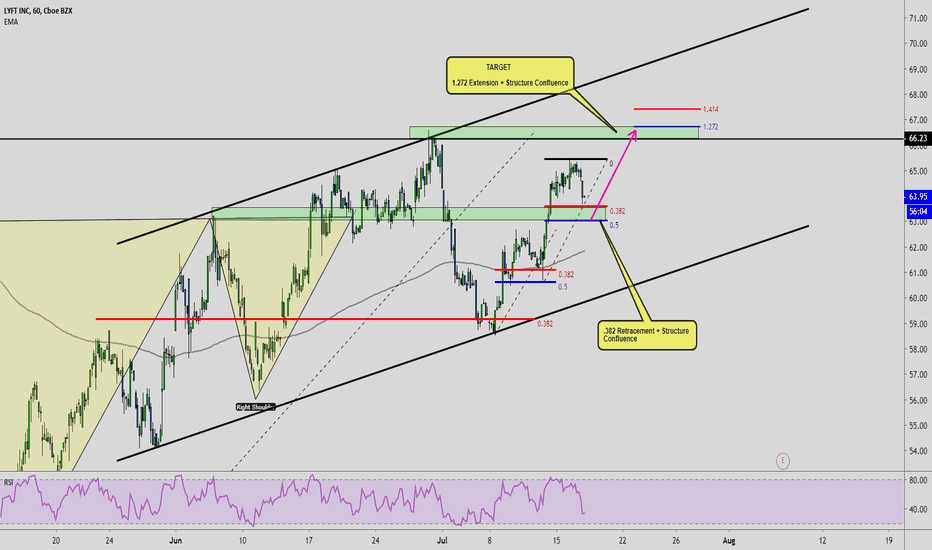

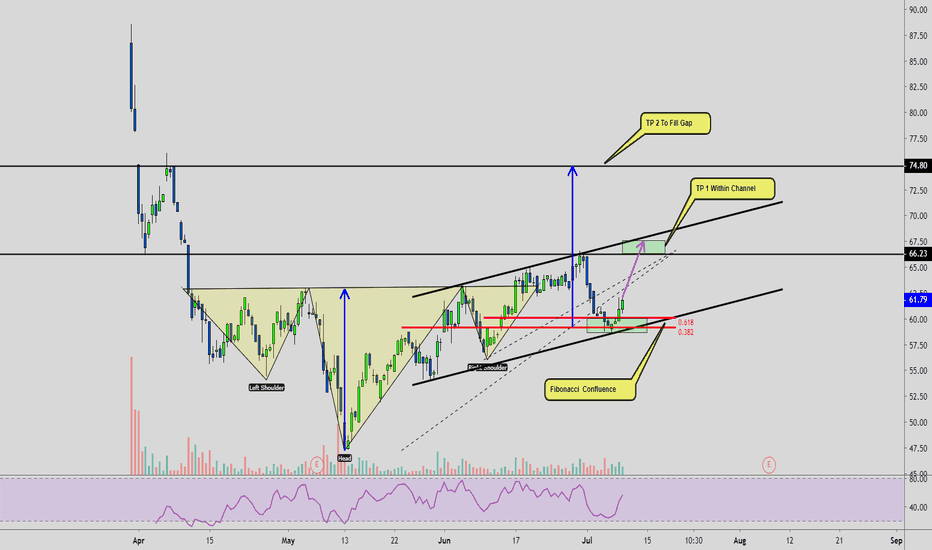

In this comparison, I wanna show you the similarities between Lyft & Snap: In trading we often have 'non-linear' trendlines & corrections , which I'm personally counting in my analyses when looking at stocks or commodities or crypto.

In this case case we have nice rounded bullish upmove, which always gets into a descending ending move, before we see a break out of this shape.

=> Snap went from $11.50 to almost $18,50 breaking from this pattern.

Of course it will strongly depend on company performance over the coming months, but Lyft could similarly see a bounce going on from the current $60-59 zone, and even another dip to $57, before we see a breakout coming. We could go towards $78-80 psychological in this case.

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Edgy is providing online education only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

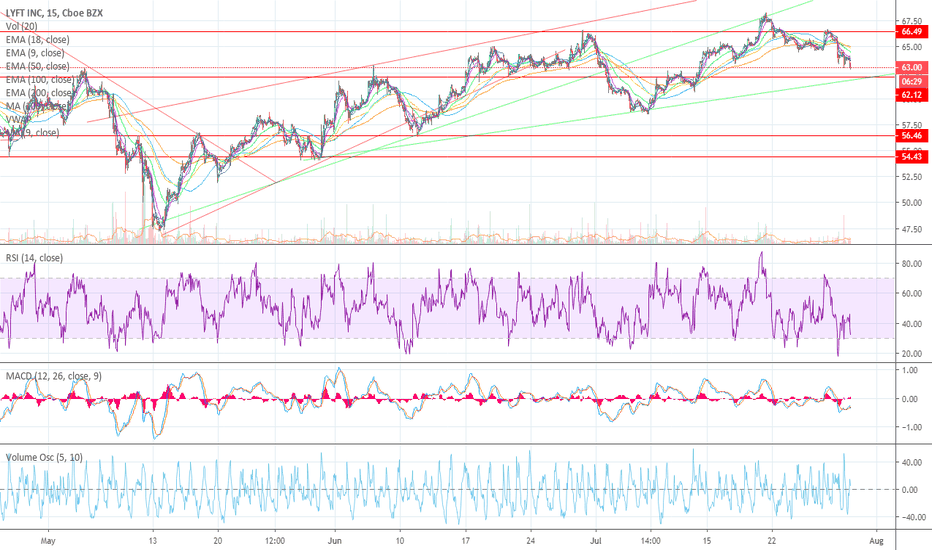

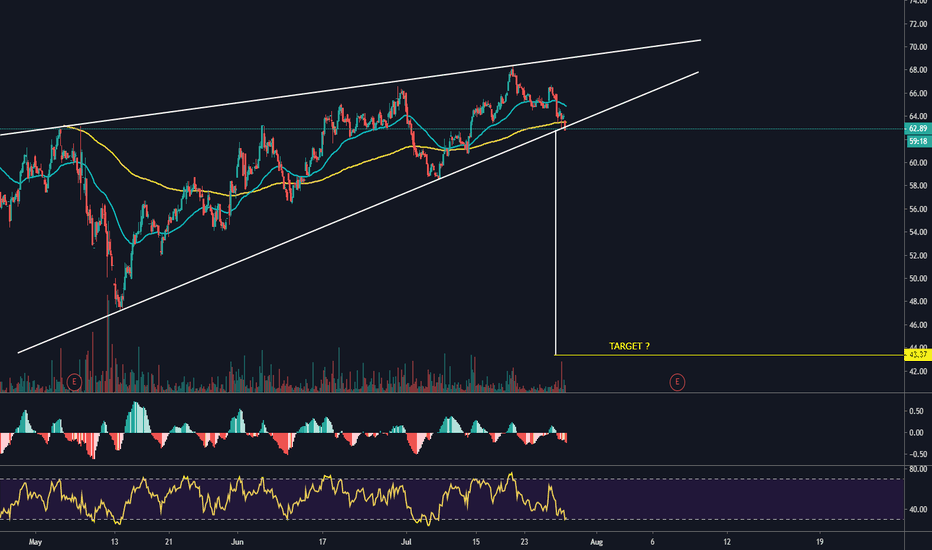

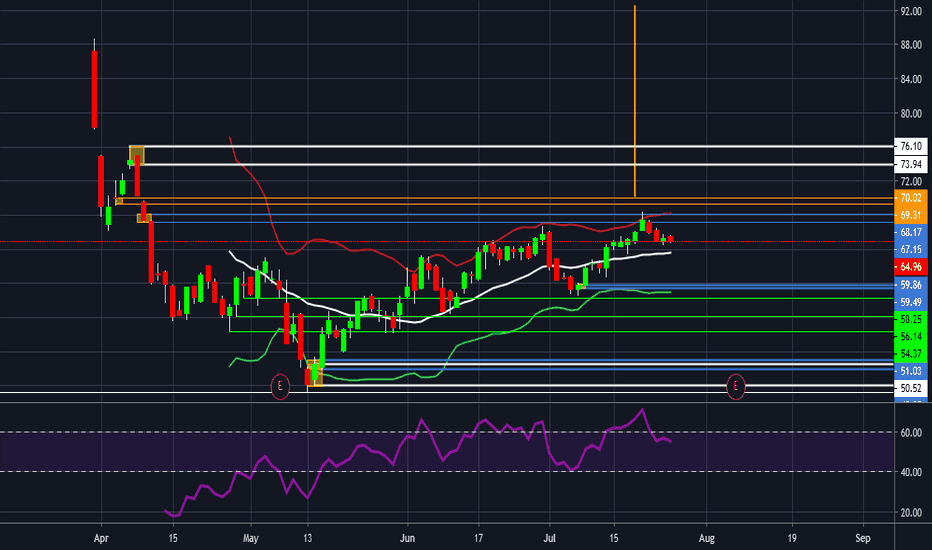

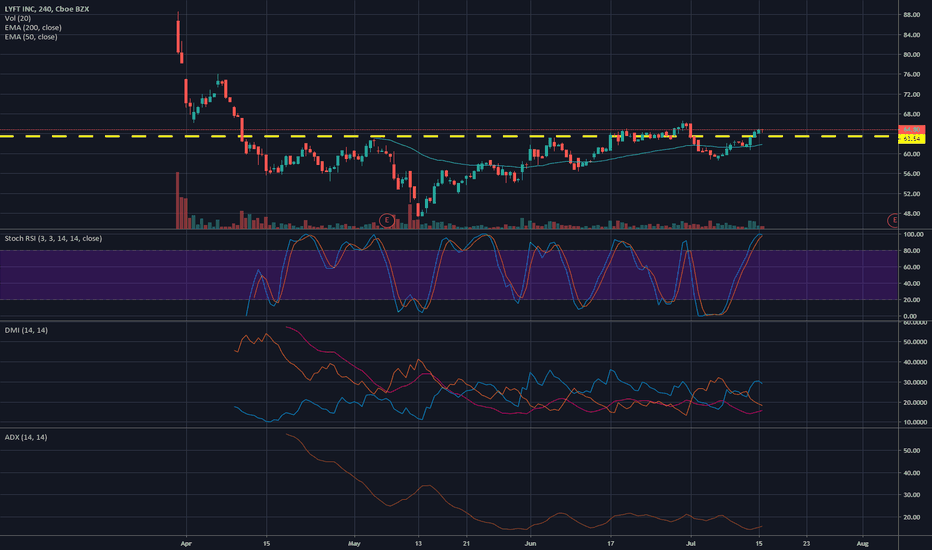

Lfyt Mark UpI do not trade Lyft, yet. I would like to share what I would do IF I were to trade this stock. I believe the overall is bullish even though we might see price head to the downside before we get some real bullish momentum into the market. That vertical represents the length of the move I'm projecting. I would long it from the $76.10 to $92 only if there's a break followed by a retest of the $76.10 price point.

*DISCLAIMER* THESE ARE JUST MY HUMBLE OPINIONS, NOT TRADING ADVICE.

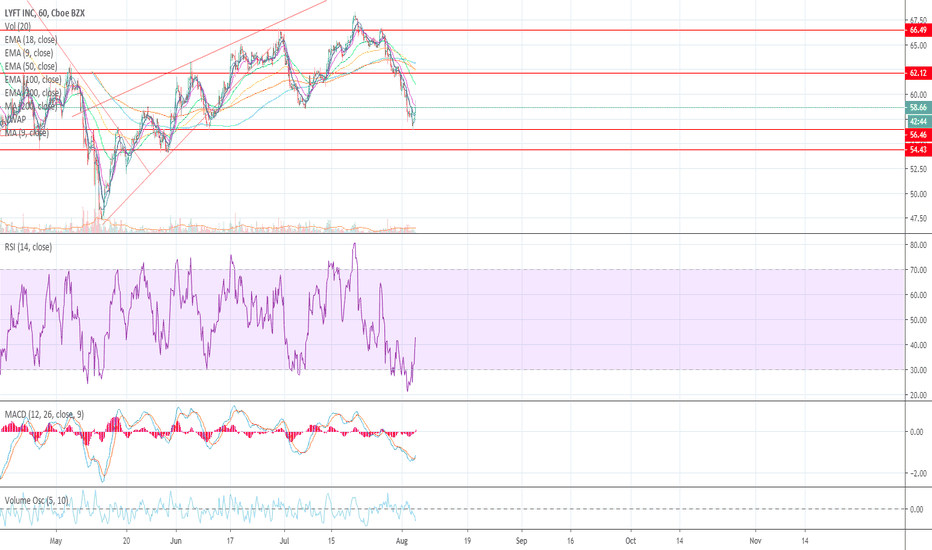

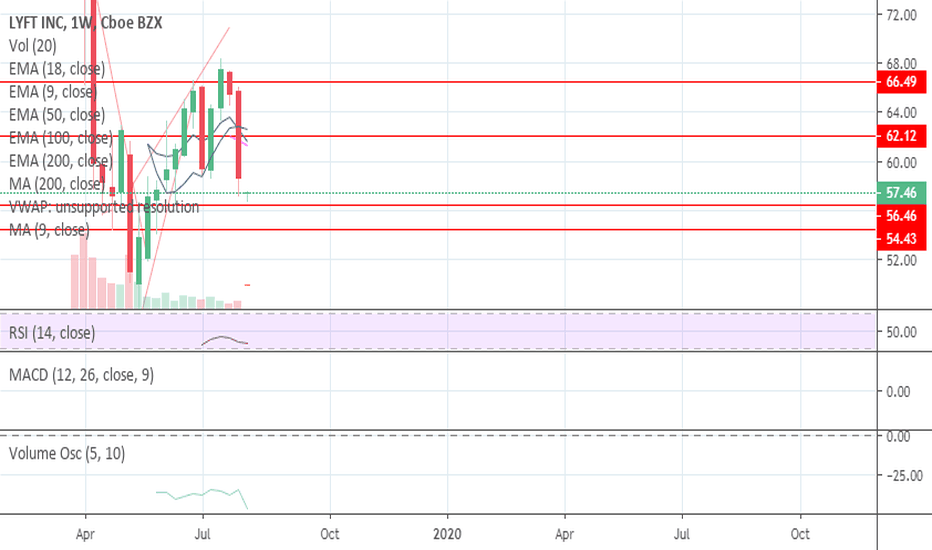

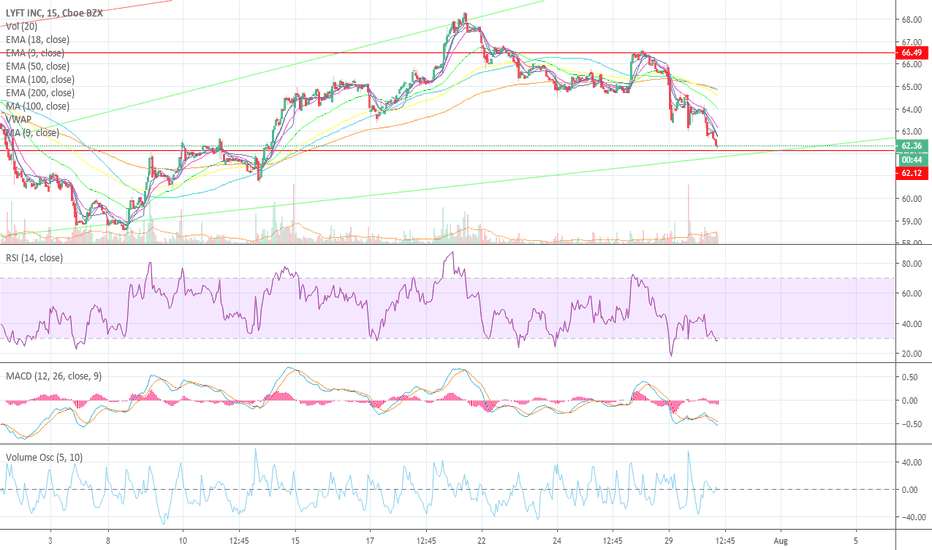

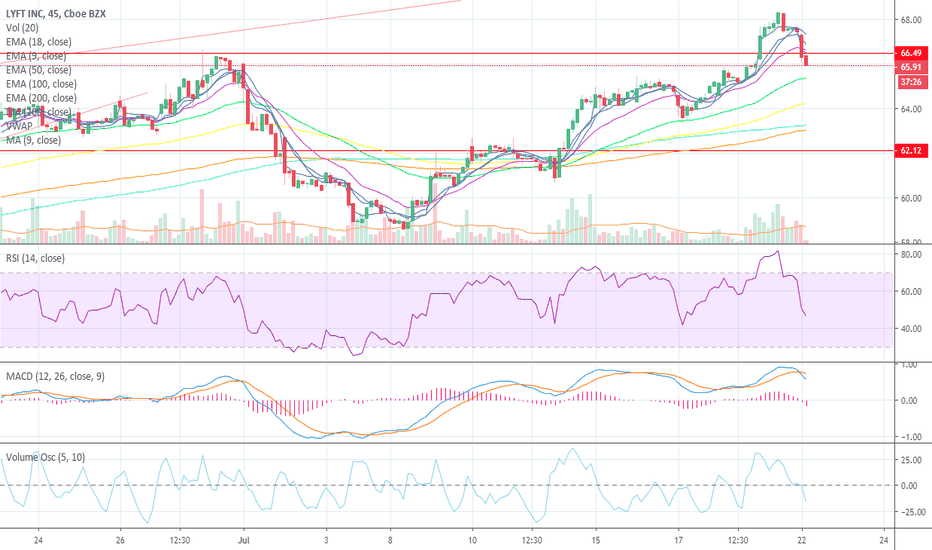

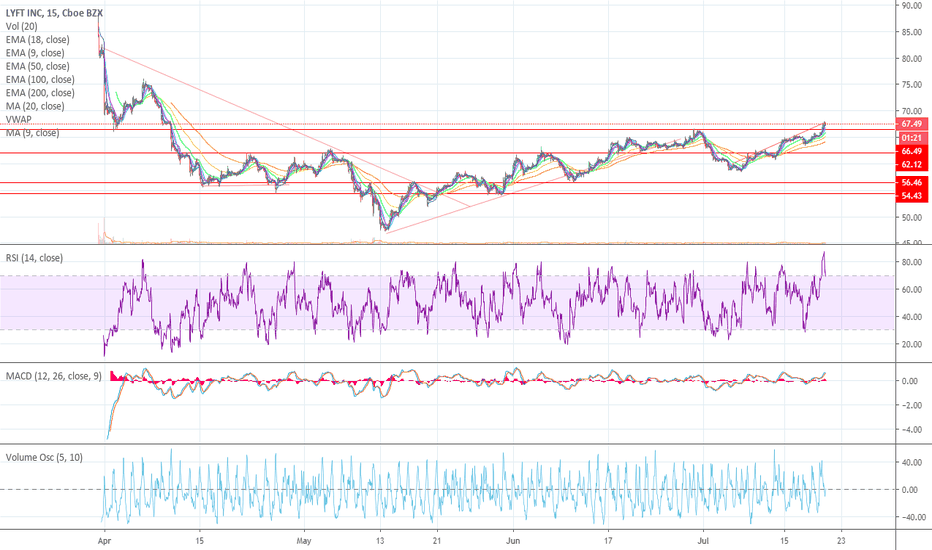

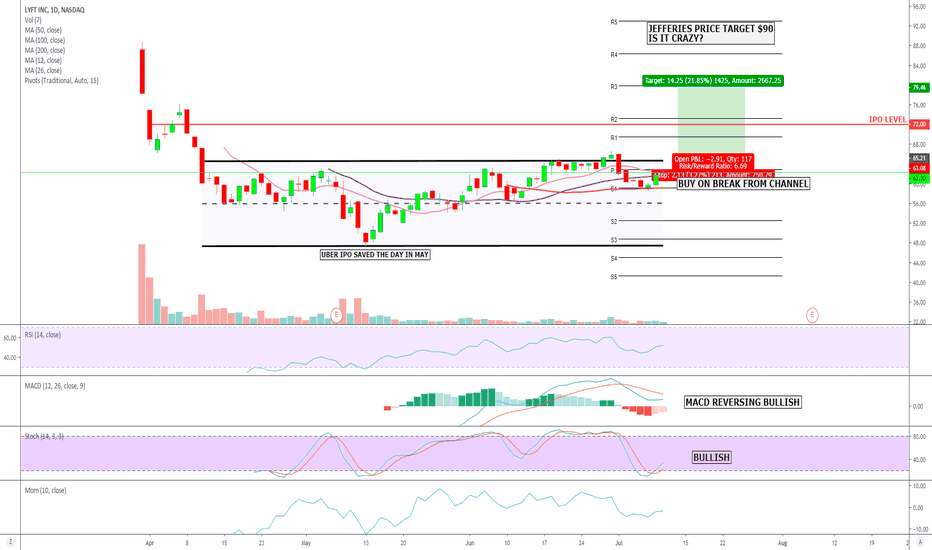

Uber saved the day for LYFT. While examining LYFT you have to consider where the stock would be if UBER had not come on the scene in may, Its IPO changed the sentiment of the investor and analysts community whom had the Knives out for LYFT from the minute the first share was traded. Rightly so to , the IPO was somewhat of a disaster and the anticlimax of the year so far, after all the company is burning money with no attention of changing that while in hyper growth mode.

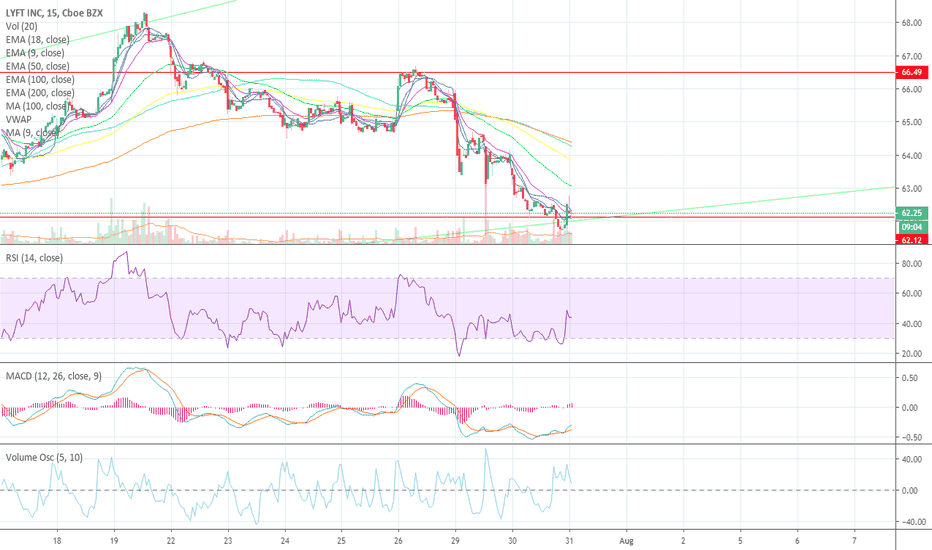

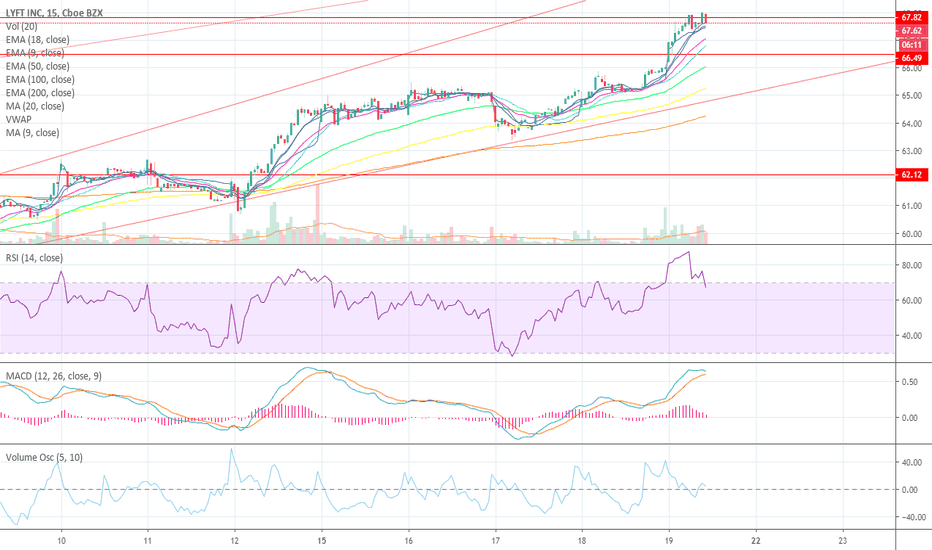

Technically the chart is starting to become bullish as the stock has seemingly built a base since early May.

Currently looks poised to breakout from a channel with above $65 as a possible long, if volume improves and the market remains bullish.

AVERAGE ANALYSTS PRICE TARGET $53

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

COMPANY PROFILE

Uber Technologies, Inc. operates as a technology platform for people and things mobility. The firm offers multi-modal people transportation, restaurant food delivery, and connecting freight carriers and shippers. The company was founded by Oscar Salazar Gaitan, Travis Kalanick, and Garrett Camp in 2009 and is headquartered in San Francisco, CA.