MU trade ideas

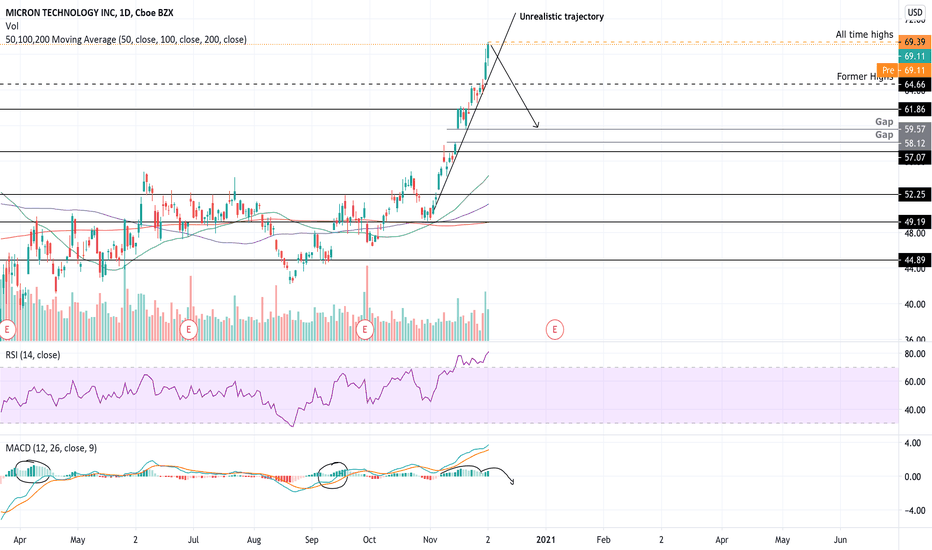

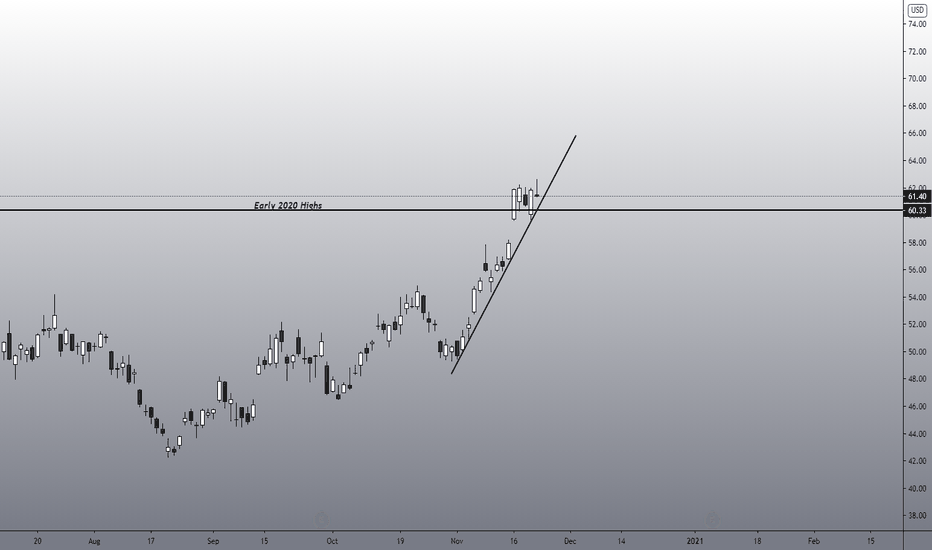

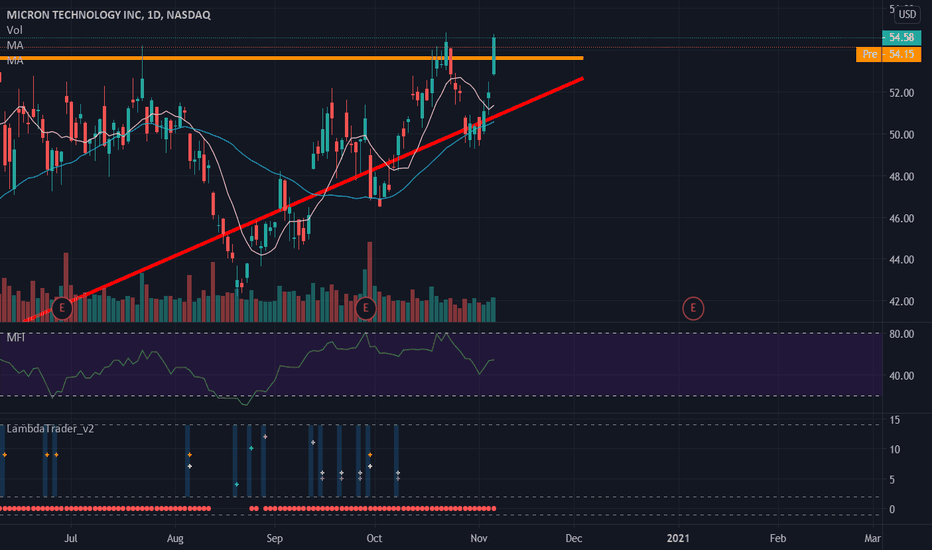

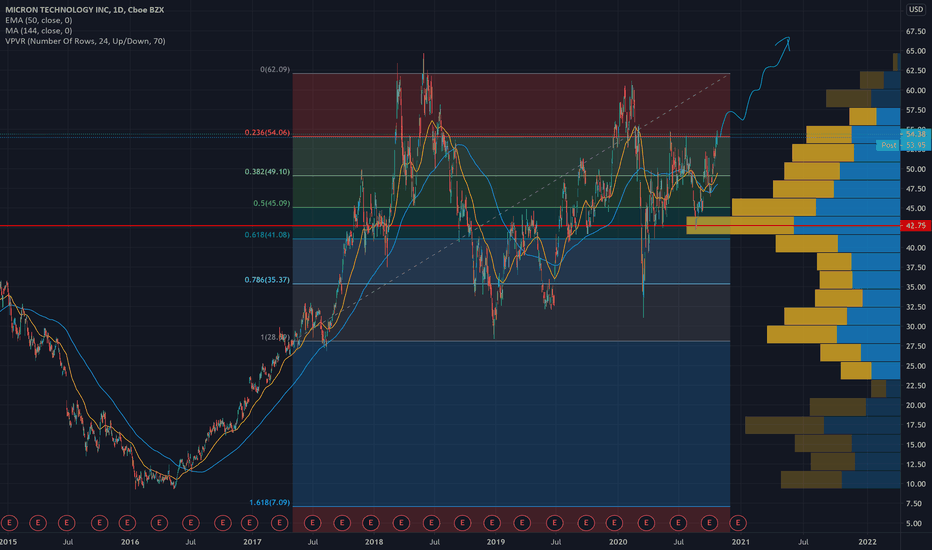

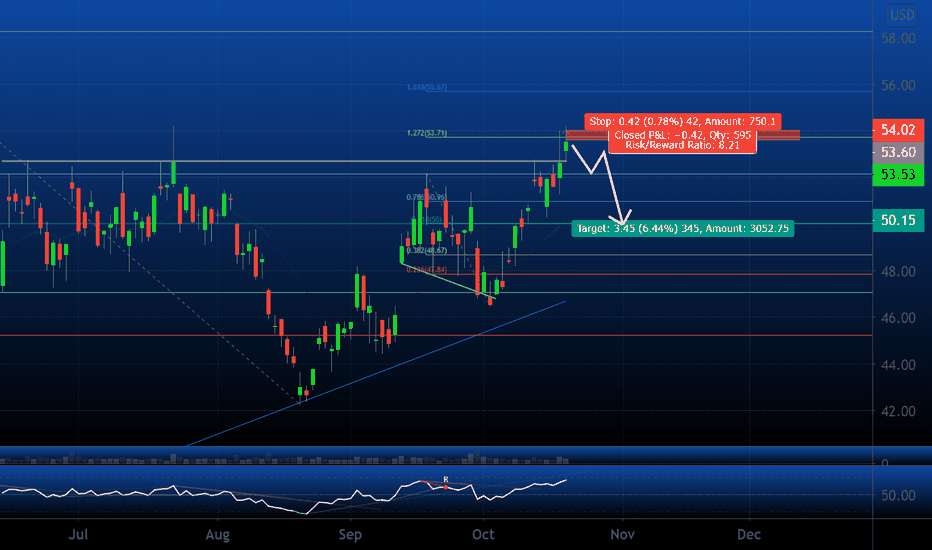

MU ShortAfter a golden cross with the 50 and 200 SMA NASDAQ:MU has pushed up into overbought conditions on the RSI leaving quite a mess as it stretches. Now at all time highs, I believe that it is a good time for a short. With lots of buying pressure in the last couple of days some consolidation is expected. Semi-conductors have been a strong play during 2020, however with a strong bid for Energy yesterday, I believe it is time for past due rotation for the continuation of the unprecedented bull market that has been carried heavily by tech centric stocks. The MAC-D is attempting to double extend to the upside for the first time since September and March lows, and with the overbought conditions it is safe to say that this move will likely be quickly rejected. My first target for MU is support at 61.68 and my second target is the gap up from 58.12 to 59.57. Note that the former highs are at 64.66 and this might serve as a testy area for MU.

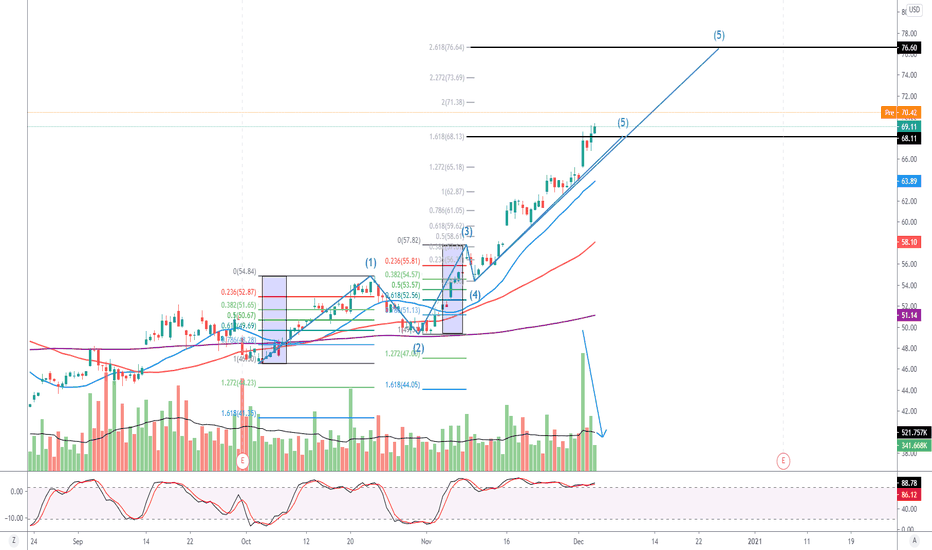

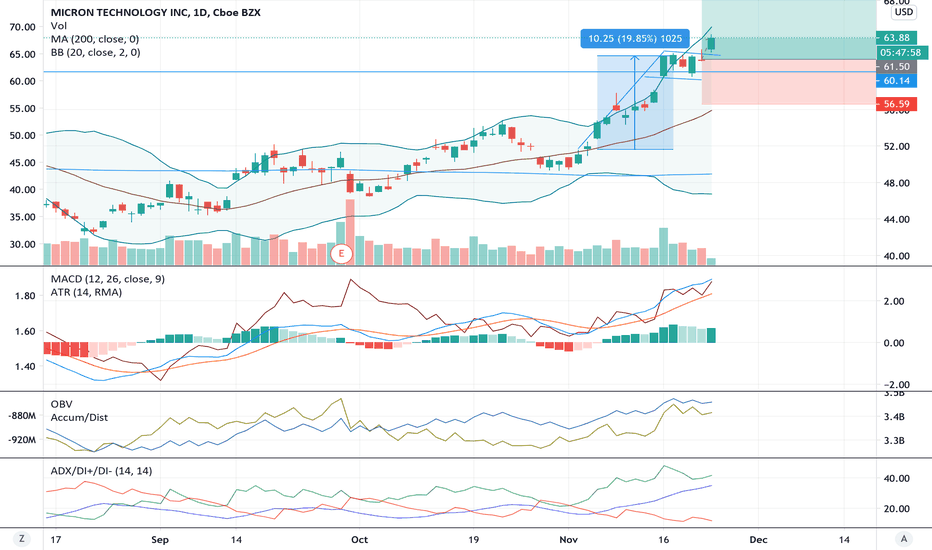

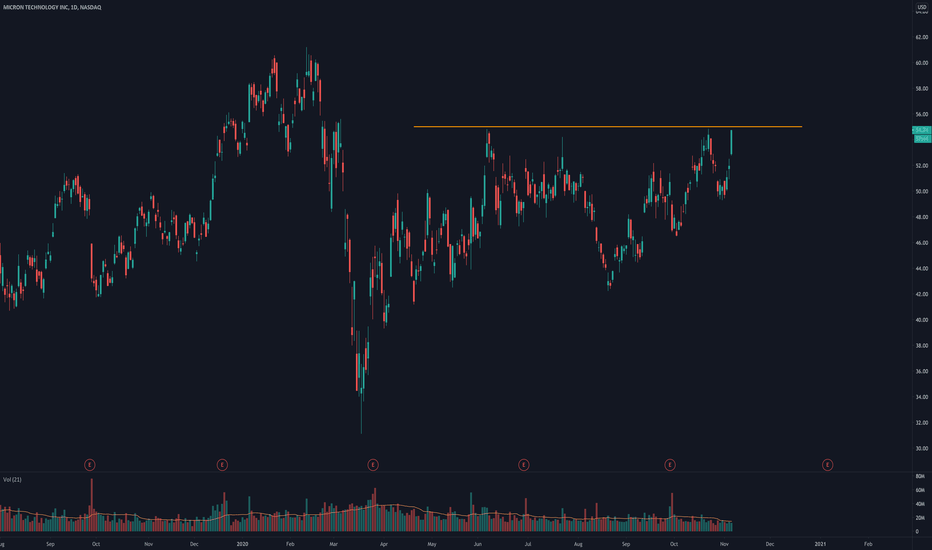

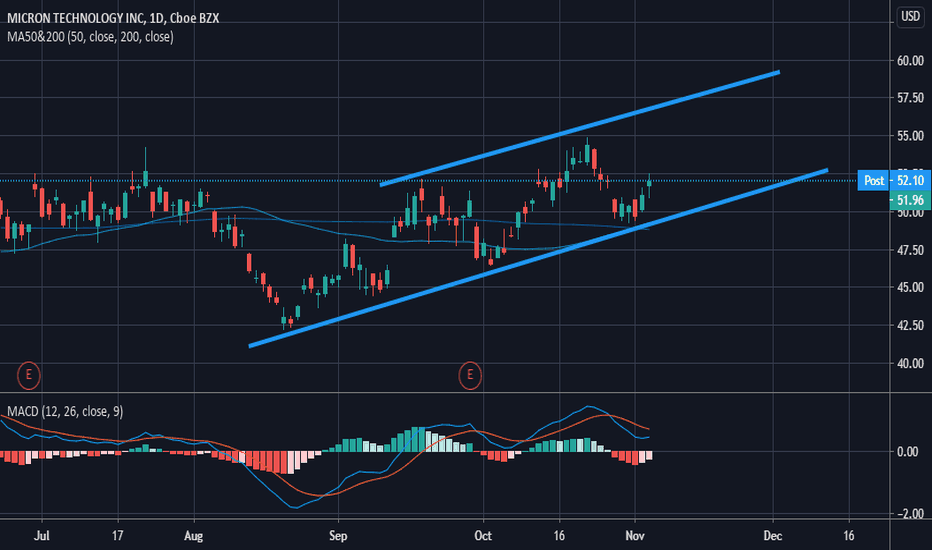

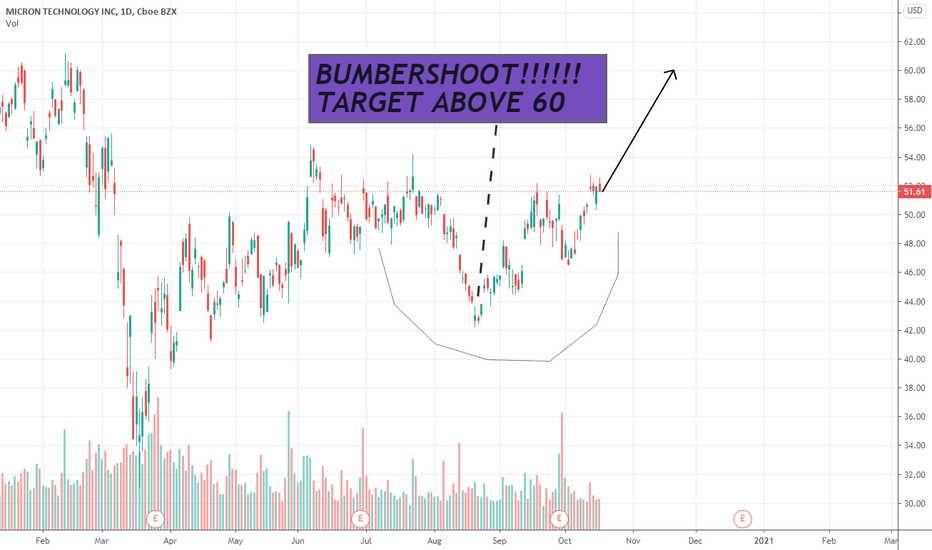

Bullish Flag on MU?It looks to me like there is a Bullish flag on NASDAQ:MU right now with the possibility of a $10 increase, also the ATR is looking very low which could mean a large shift in stock price soon.

Note: The $10 increase in value was derived from the last bullish flag pole

Last Edit: I'm new to this and I forgot to exclude the charts below the top one, please ignore them

WARNING: I am not a stock expert and am just learning technicals and chart patterns, if you like this idea and would like to replicate it please use fake money to test out this strategy.

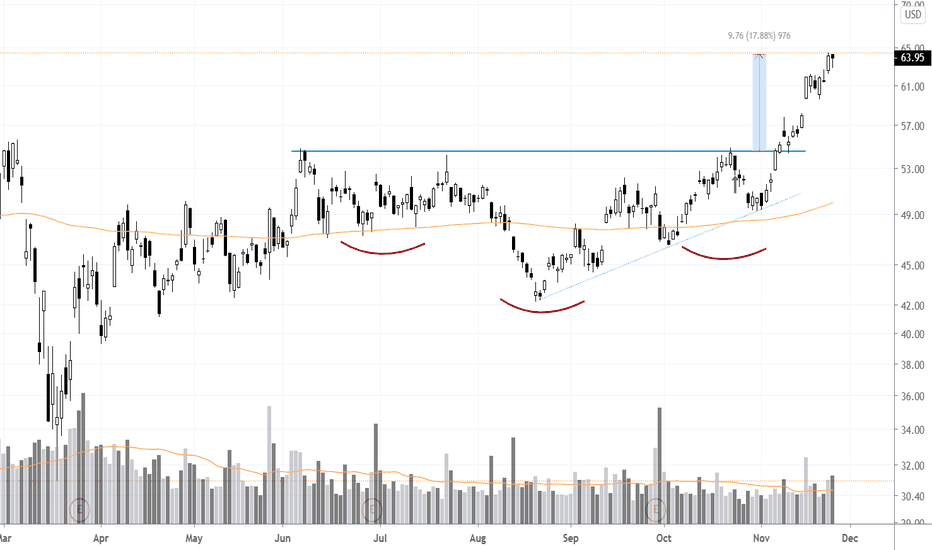

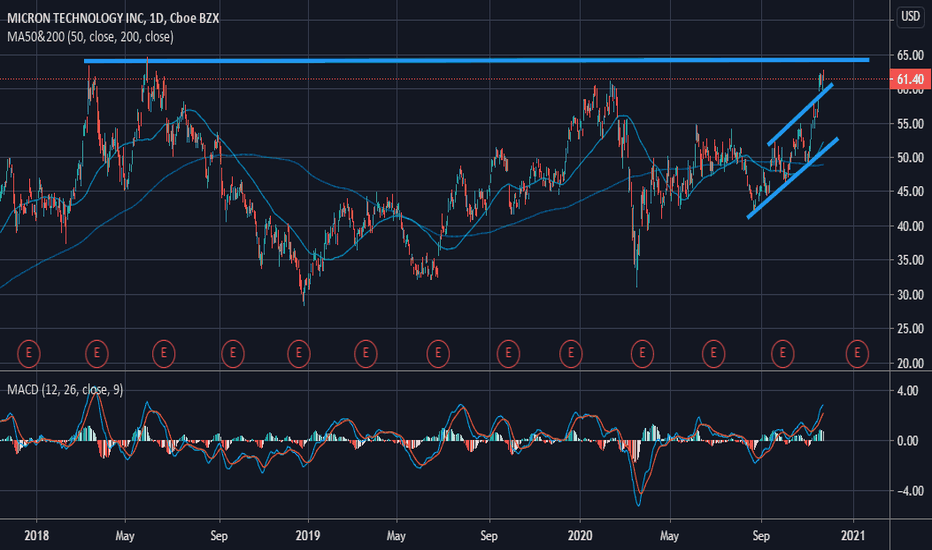

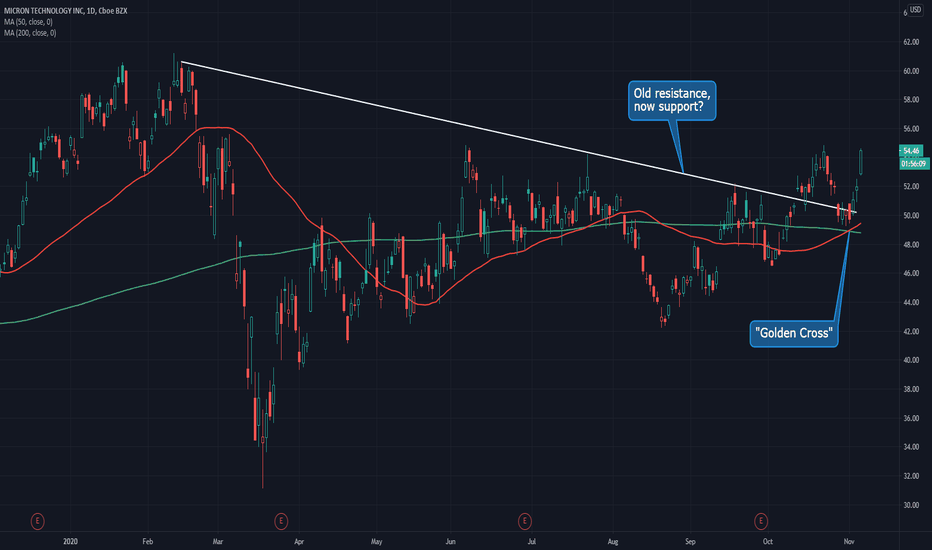

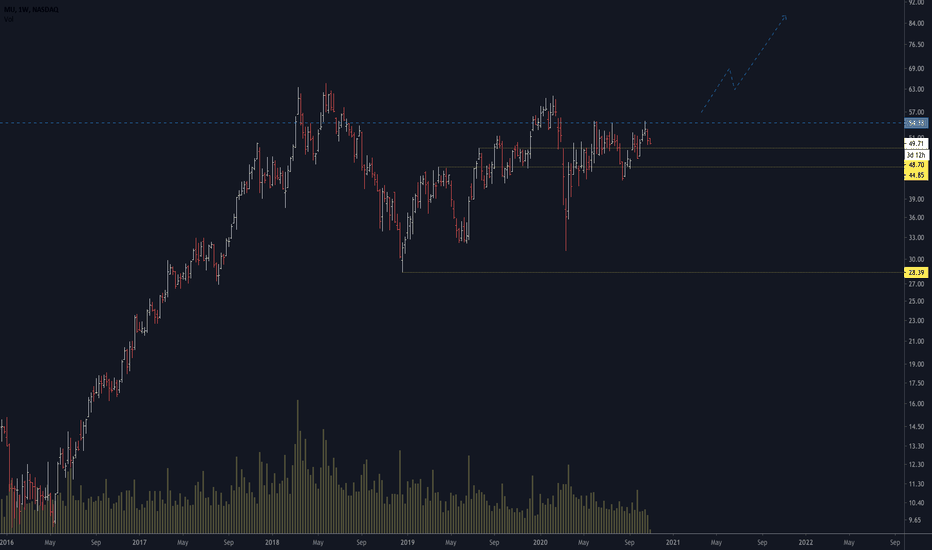

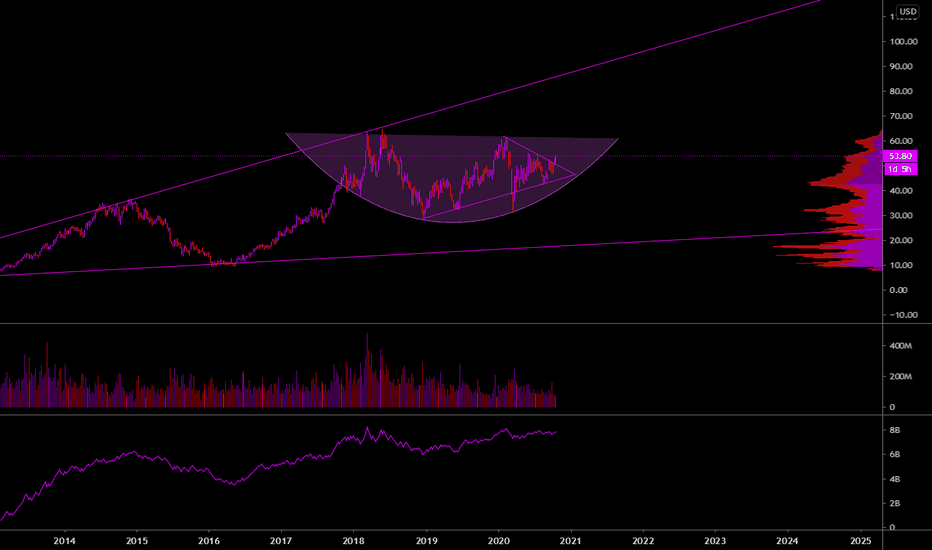

Is Micron Finally Ready to Move?On Tuesday, we cited the pullback in the Philadelphia Semiconductor Index. Today, we’re looking at a member stock that’s been dead in the water all year: Micron Technologies.

Worries about the Covid recession have dragged on the memory-chip maker, despite strong results. Analysts at Deutsche Bank and Citi also think pricing will improve over the winter.

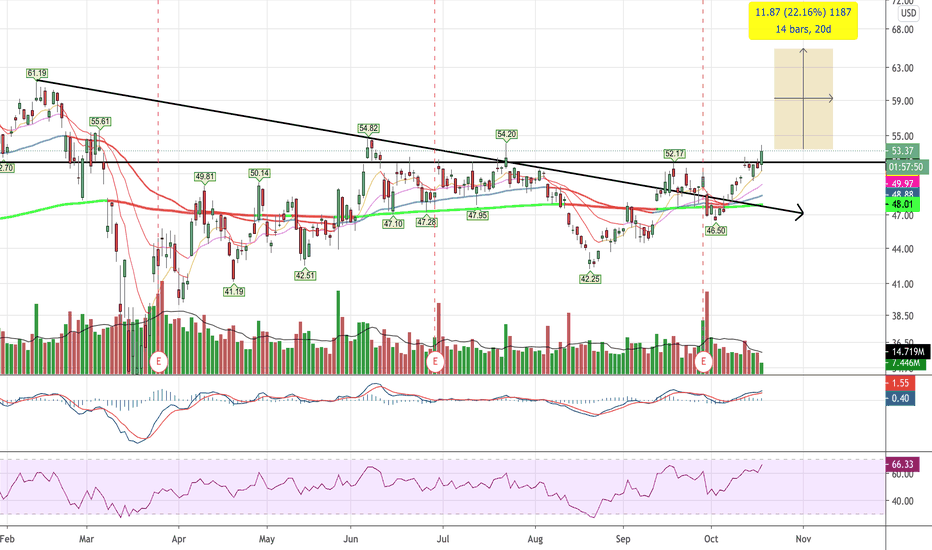

MU’s chart has some potential positives for the bulls. First is the falling trendline between the February and July highs. It broke that line three weeks ago and is now revisiting it as support. (Similar to the iShares Trust China Large-Cap ETF pattern on Monday.)

Second, MU’s 50-day simple moving average (SMA) just rose above its 200-day SMA: a “golden cross.”

There are also potential fundamental tailwinds given the strong industrial data this week from the U.S. and China, plus the upcoming iPhone 12 ramp. Traders may want to keep an eye on MU for a potential breakout.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

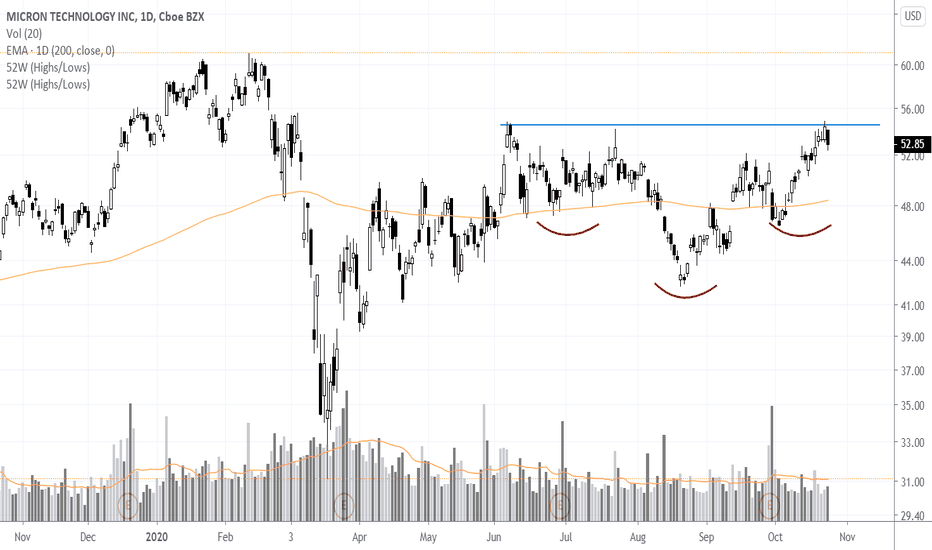

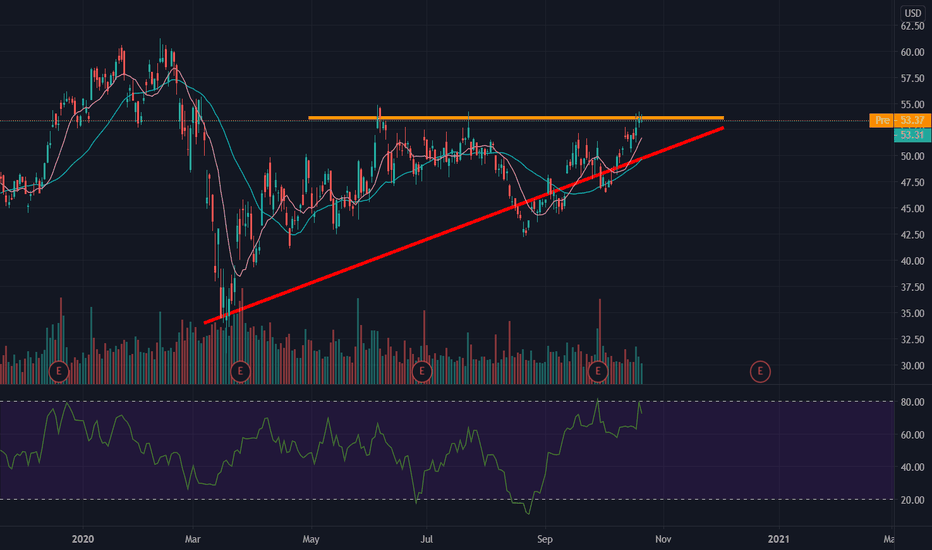

$MU 5 Month #HeadandShoulders Continuation #ChartPatternNASDAQ:MU is forming a 5 month head and shoulders continuation chart pattern with $54.50 price level acting as chart pattern neckline resistance. A daily close above that level will trigger a long breakout entry trade. Target for at least partial profits is around $60-$61 which is also the swing high from Feb pre-covid19 sell off.

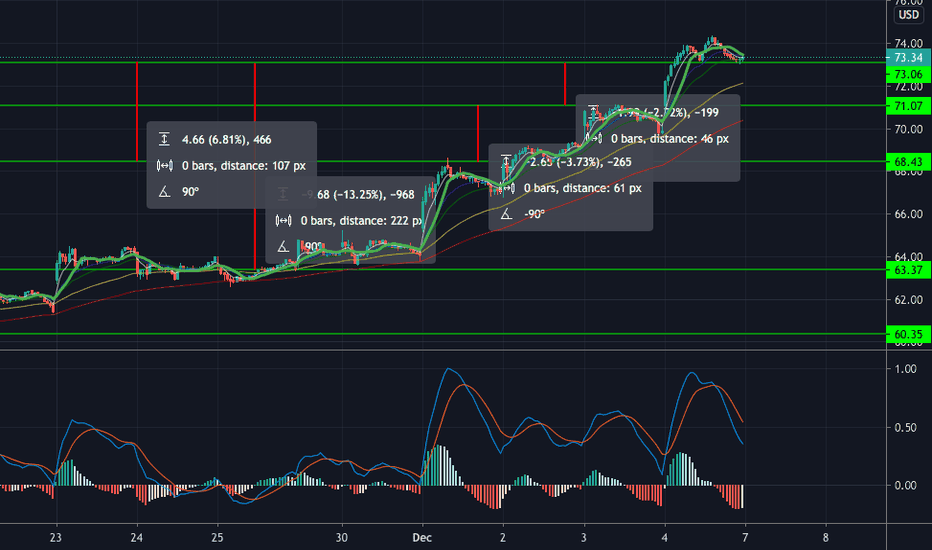

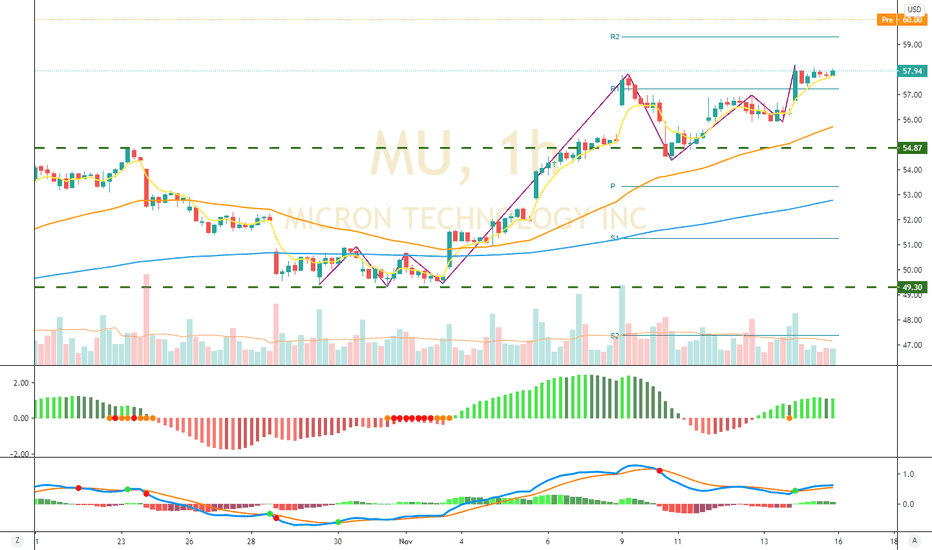

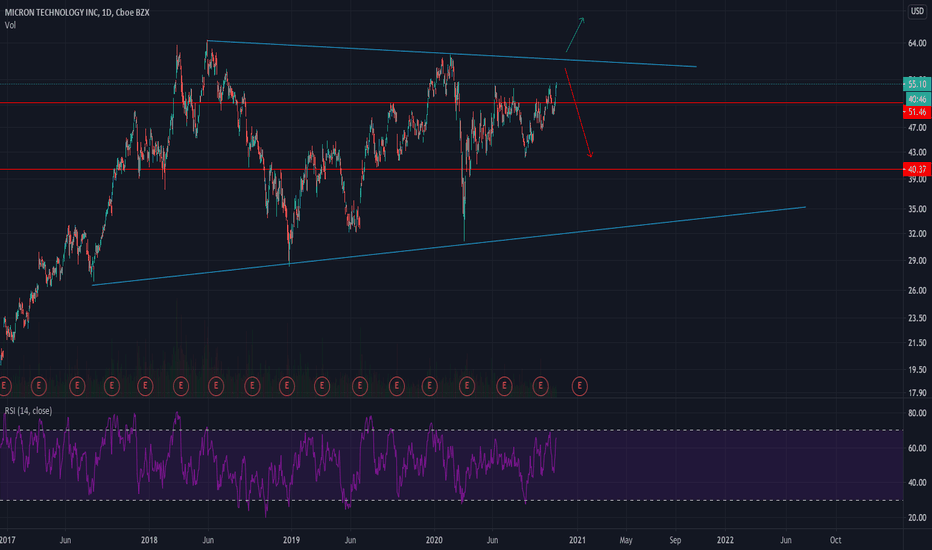

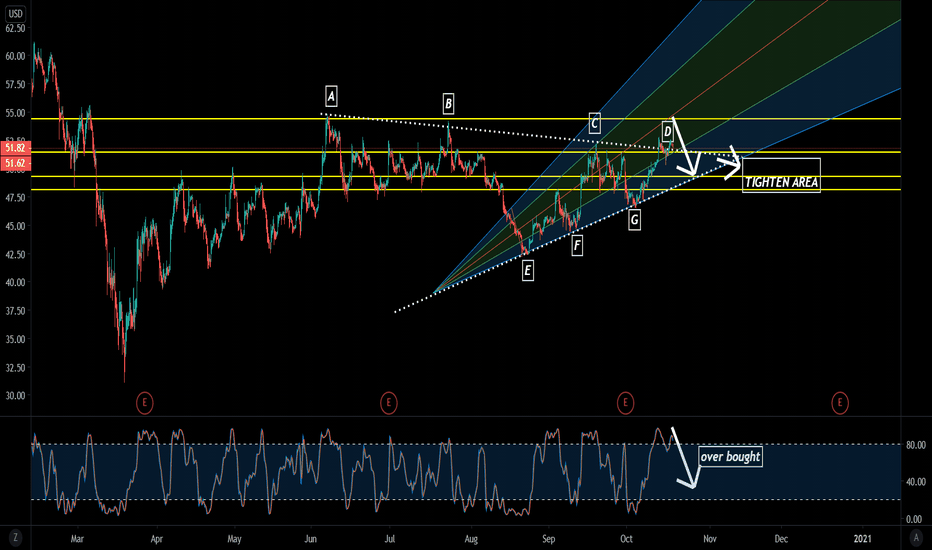

MICRON 1H OVER BOUGHT NOW...MU have Symmetrical Triangle but wait PRICE to enter the zone consolidate

tighten area.

then we will see clearly where the price will go. if breakout just follow the trend.

for this time short is the best. you guys see the points A, B, C my stocastic setting come from over baught.

this may also happen to point D

happy trading =)