MICRON TECHNOLOGY INC stock forum

JPMorgan Supercharges Micron Technology Price Target, Raising It to $185 from $165 — Firm Holds Strong Overweight Rating!

08/12/25 5:57 AM

JPMorgan just turbocharged their outlook on Micron Technology, hiking the price target to an impressive $185! This bold move underscores their unwavering confidence in Micron’s growth potential. Keeping an Overweight rating firmly in place, JPMorgan signals this is one stock to watch closely as it powers ahead!

08/12/25 5:57 AM

JPMorgan just turbocharged their outlook on Micron Technology, hiking the price target to an impressive $185! This bold move underscores their unwavering confidence in Micron’s growth potential. Keeping an Overweight rating firmly in place, JPMorgan signals this is one stock to watch closely as it powers ahead!

Wall Street keeps sleeping on Micron, and it’s almost comical. Everyone’s dazzled by flashy AI chipmakers, but here’s the hard truth: without Micron’s cutting-edge memory technology, AI doesn’t just slow down — it flat-out stops. AI models are massive, data-hungry beasts that rely entirely on lightning-fast, high-capacity memory to function. That’s where Micron’s DRAM and NAND come in — they’re the backbone, the fuel, the lifeblood of AI. Without memory, AI is just an expensive paperweight. And no amount of inflation or tariffs can change that fundamental truth — AI is the future, and Micron holds the key.

Meanwhile, AMD trades at over 100x earnings on $1.73 EPS, while Micron, posting nearly $10.00 earnings with a similar share count, languishes at just a 10x to 15x multiple. To put this in perspective, Micron just boosted its earnings per share guidance for next quarter to a number that exceeds what AMD and Palantir make combined in an entire year. Inflation and tariffs might rattle other sectors, but AI’s insatiable hunger for memory makes Micron virtually immune. Demand for faster, denser, more efficient memory only grows as AI evolves. Micron isn’t just riding the AI wave — it’s the wave maker. When the market finally catches on, Micron will no longer be a bargain; it’ll be priced as the essential powerhouse driving the future.

I also think Micron could be a takeover target at current levels. It's just to cheap!

Meanwhile, AMD trades at over 100x earnings on $1.73 EPS, while Micron, posting nearly $10.00 earnings with a similar share count, languishes at just a 10x to 15x multiple. To put this in perspective, Micron just boosted its earnings per share guidance for next quarter to a number that exceeds what AMD and Palantir make combined in an entire year. Inflation and tariffs might rattle other sectors, but AI’s insatiable hunger for memory makes Micron virtually immune. Demand for faster, denser, more efficient memory only grows as AI evolves. Micron isn’t just riding the AI wave — it’s the wave maker. When the market finally catches on, Micron will no longer be a bargain; it’ll be priced as the essential powerhouse driving the future.

I also think Micron could be a takeover target at current levels. It's just to cheap!

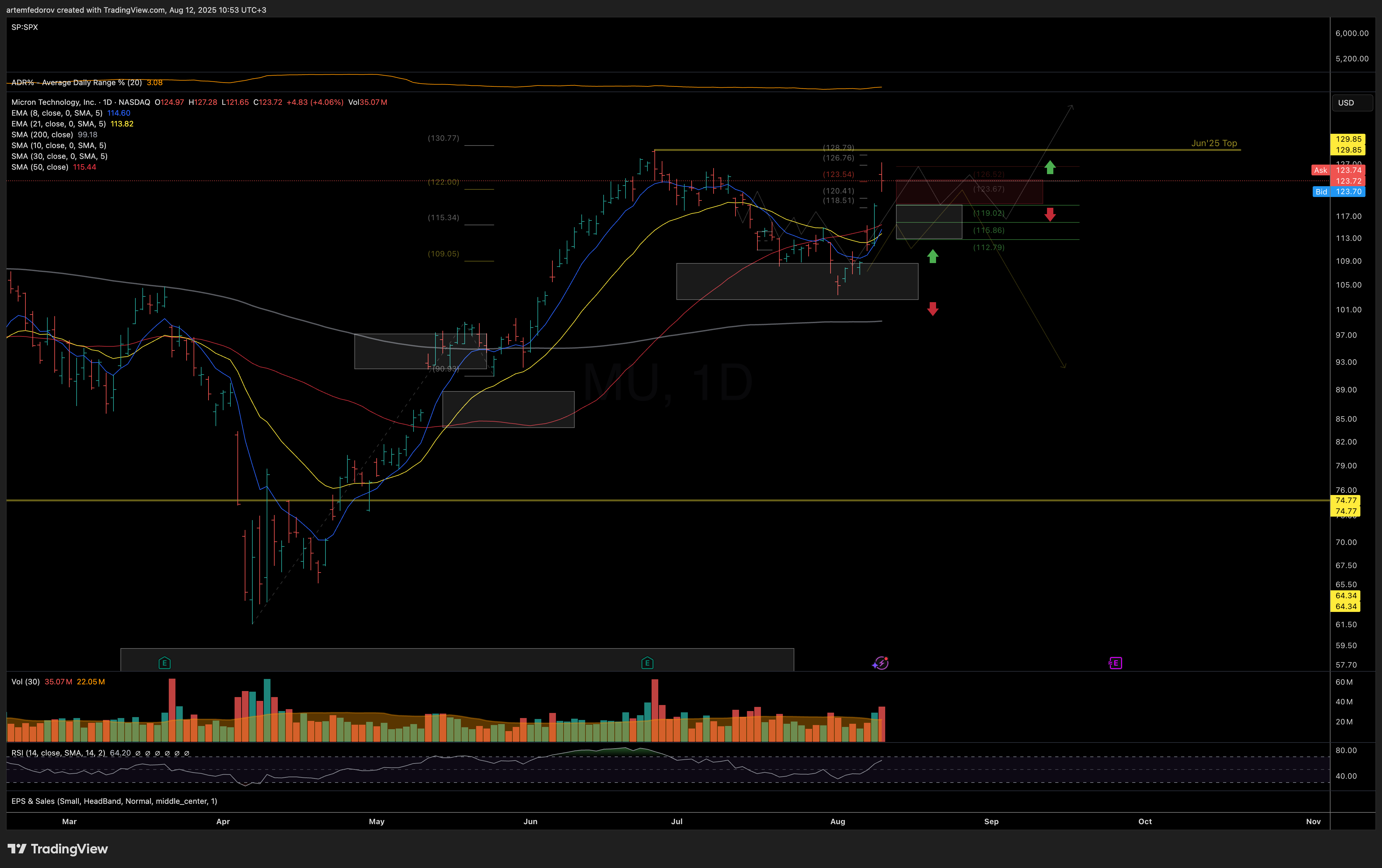

Chart: tradingview.com/x/aa92kbQK/

Previously:

On resistance (Aug 7): tradingview.com/symbols/NASDAQ-MU/minds/?mind=-6_XhCGoSS2RbJaVC4QlIQ

On support zone (Jul 22): tradingview.com/symbols/NASDAQ-MU/minds/?mind=lC00CdAOSKKV0PgeSD4wvw

On downside potential (Jul 15): tradingview.com/symbols/NASDAQ-MU/minds/?mind=XceWvkkVTs-scPU_cfqeLA

Micron Technology ( MU) – Strong Buy

MU) – Strong Buy

Needham’s latest valuation call on Micron misses the mark by a wide margin. The same analyst assigning Palantir ( PLTR) a market value at over 600x earnings now suggests Micron is worth only $150—a disconnect that defies fundamental logic.

PLTR) a market value at over 600x earnings now suggests Micron is worth only $150—a disconnect that defies fundamental logic.

Based on current industry trends and AI-driven demand, Micron has the potential to generate $10–$12 EPS in FY2025, with further upside likely in 2026 as capacity, pricing, and margins expand. Applying even a conservative market multiple implies a fair value well north of $200 per share today.

In our view, this is a classic case of market mispricing. Micron remains strategically critical to AI infrastructure, underappreciated by the broader market, and trading at an attractive entry point. We maintain a Strong Buy rating.

MSFT

MSFT  AMD

AMD  NVDA

NVDA

Needham’s latest valuation call on Micron misses the mark by a wide margin. The same analyst assigning Palantir (

Based on current industry trends and AI-driven demand, Micron has the potential to generate $10–$12 EPS in FY2025, with further upside likely in 2026 as capacity, pricing, and margins expand. Applying even a conservative market multiple implies a fair value well north of $200 per share today.

In our view, this is a classic case of market mispricing. Micron remains strategically critical to AI infrastructure, underappreciated by the broader market, and trading at an attractive entry point. We maintain a Strong Buy rating.