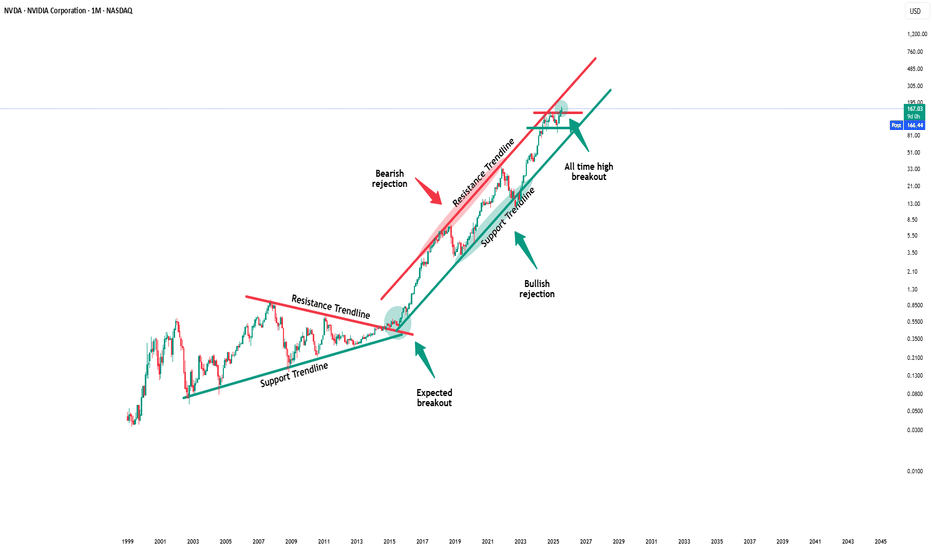

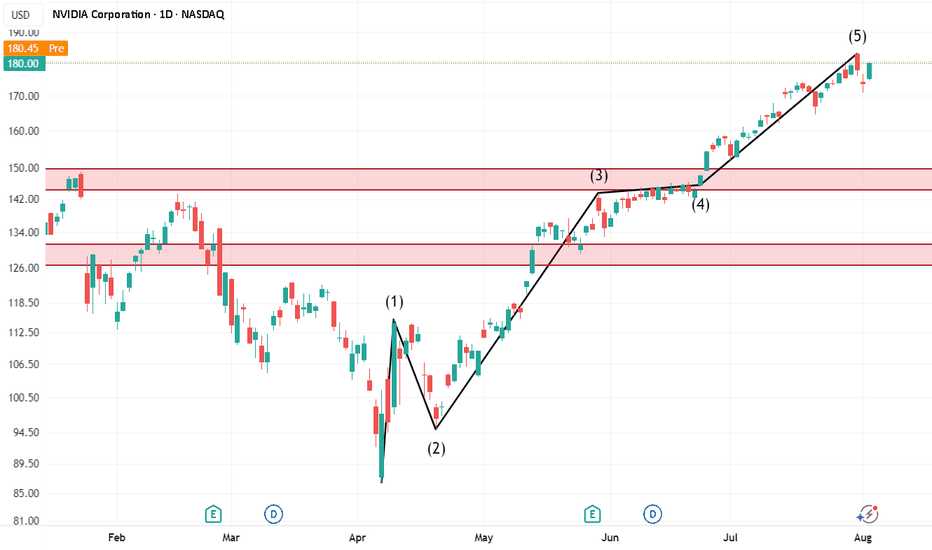

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

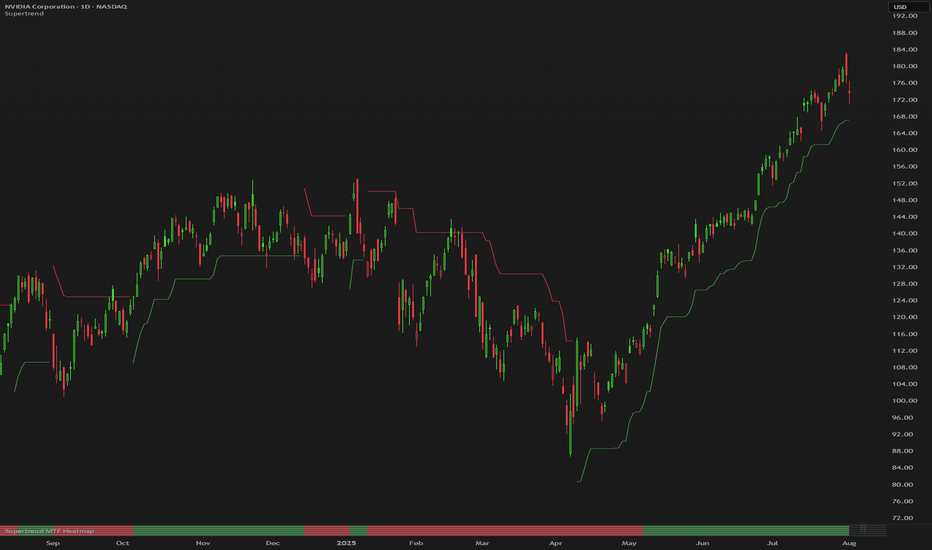

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to happen, Nvidia has to confirm the all time high breakout now.

📝Levels to watch:

$150

🙏🏻#LONGTERMVISION

SwingTraderPhil

NVDA trade ideas

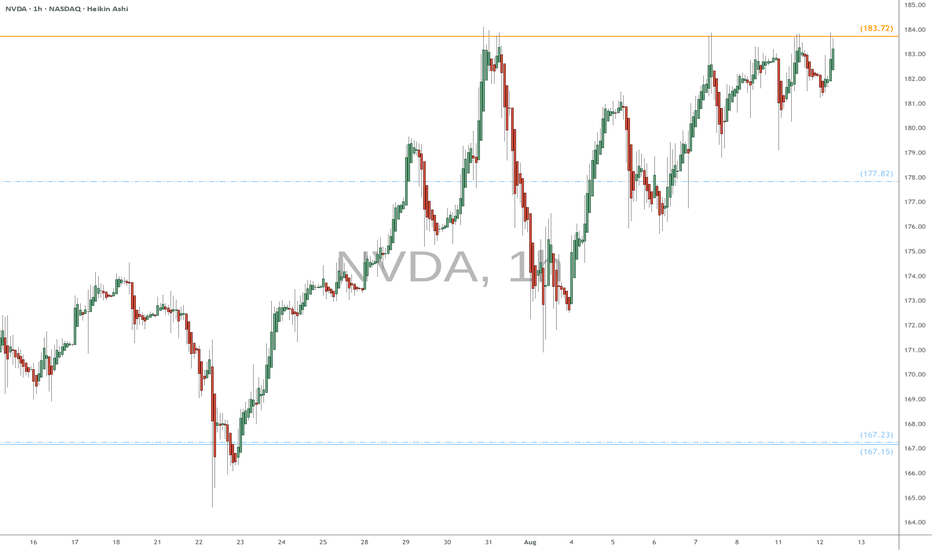

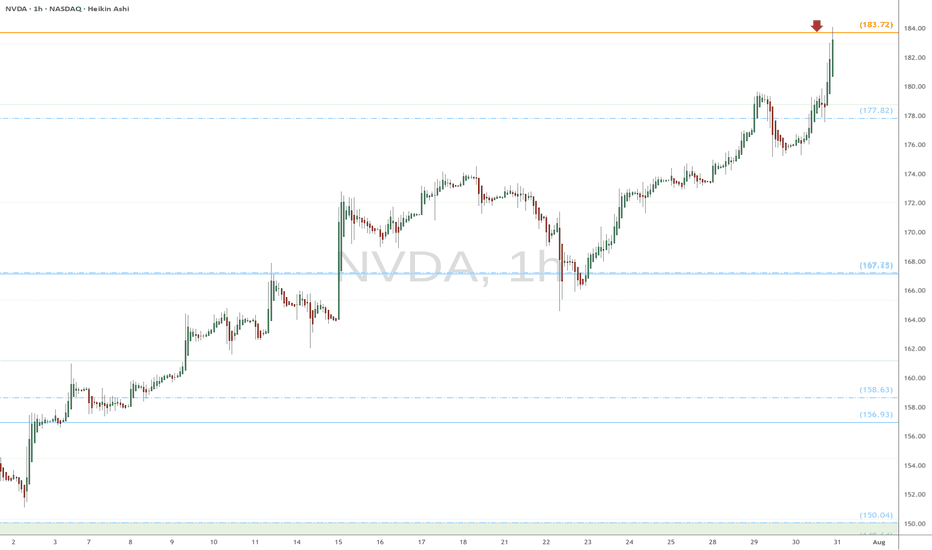

NVDA eyes on $183.72 again: Golden Genesis Fib about to Break? NVDA looks ready for a break out to new highs.

Beating against the Golden Genesis at $183.72

Looking for a Break-n-Run, maybe no retest even.

$195.01 is first target and should be quick.

$201.51 is next target maybe after a dip.

$177.82 is high support for bulls to hold.

.

Previous analysis that gave EXACT Shorts from this Fib:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

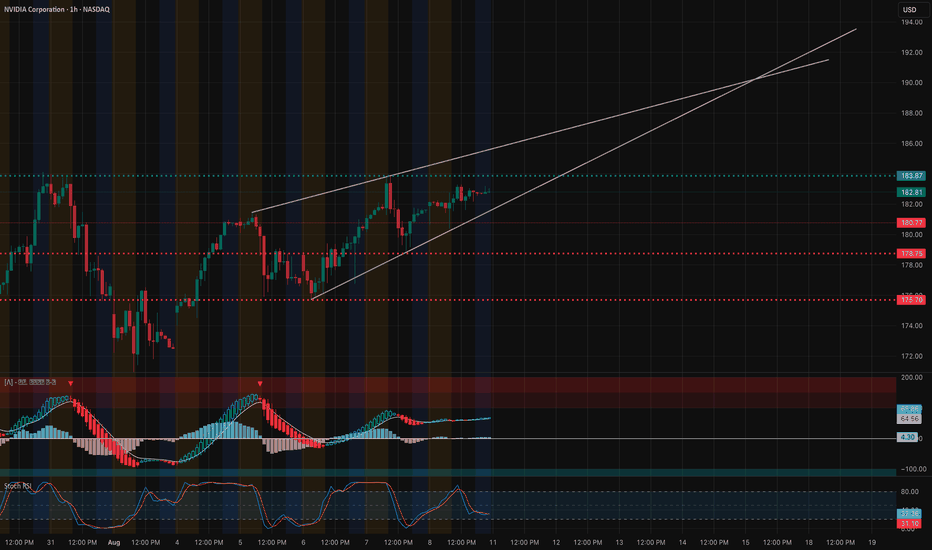

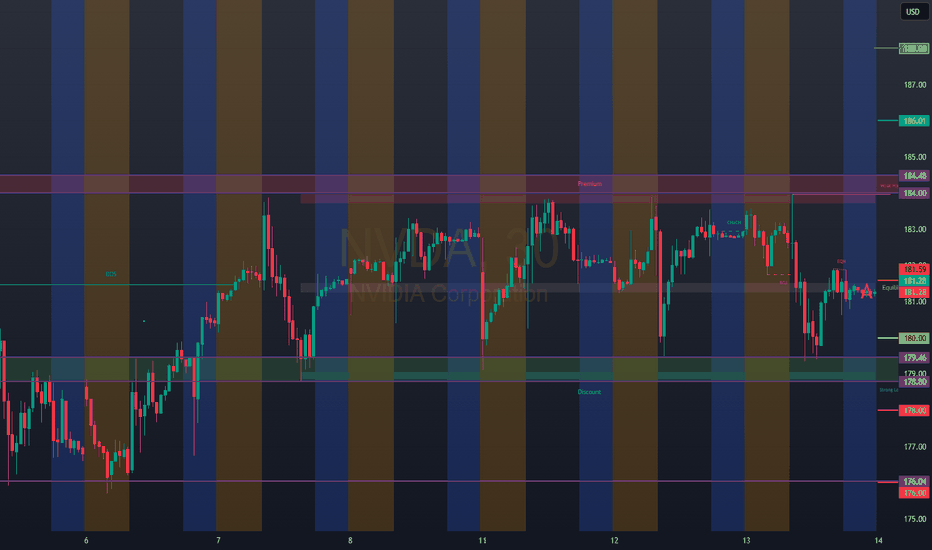

NVDA Technical Analysis & GEX Outlook. Aug. 11Technical Analysis (1H Chart)

NVDA is currently trading at 182.81, forming a rising wedge pattern — typically a bearish reversal setup, especially when nearing resistance. Immediate resistance is at 183.37, the upper bound from recent swing highs. Support is layered at 180.70, 178.75, and 175.70. MACD shows momentum flattening after a bullish run, while Stoch RSI is in mid-range, suggesting room for either a continuation push or a rejection. A break below the wedge’s lower trendline could trigger a retracement toward 178.75 first.

Bullish Case: Break and hold above 183.37 could retest 185–187 in short order, with momentum needing confirmation from volume.

Bearish Case: Failure to push past 183.37 and a wedge breakdown could accelerate selling toward 180.70, then 178.75.

GEX & Options Sentiment (1H View)

* Key Gamma Resistance: 185.0 — largest positive NET GEX and call wall.

* Above 185: Next strong resistance is 187.5 (33.3% / GEX7), then 190 (2nd call wall).

* Support Levels: 172.5 (2nd put wall, -2.16%), 167.5 (put support, -2.86%).

* Options Metrics: IVR 17.1 (low), IVX avg 42.6 (slightly declining -3.65%), Calls 2.1%, GEX +47m (positive skew).

Implication: Positive GEX above 182.5 suggests dealer hedging could dampen upside momentum, but a breakout over 185 could trigger a gamma squeeze toward 187–190. If price drops below 180, downside could accelerate toward 175–172 zone due to put wall positioning.

Thoughts & Strategy

* For Calls: Safer above 185 on volume confirmation for a push toward 187–190.

* For Puts: Watch for wedge breakdown below 180.70 to target 178.75–175.70.

* Avoid mid-zone trades between 181–183 without strong momentum confirmation.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and do your own research before trading.

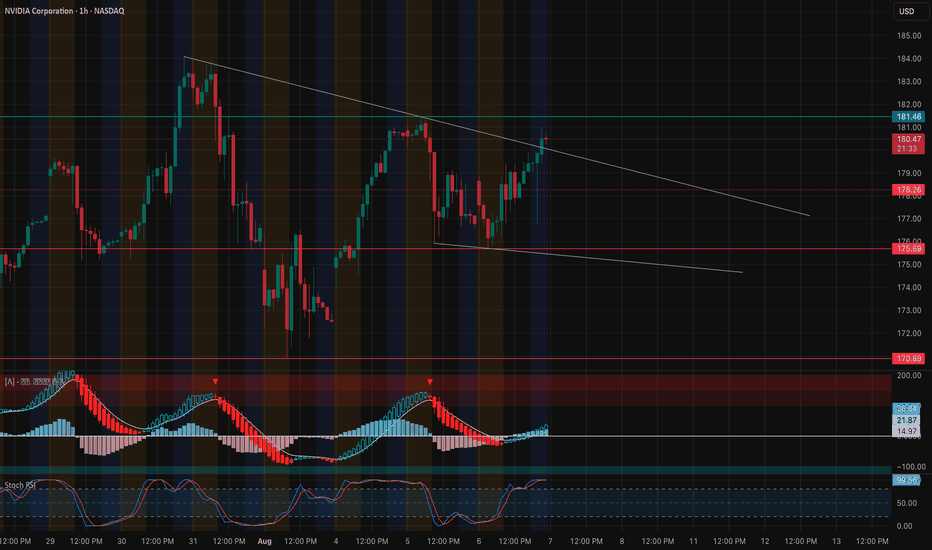

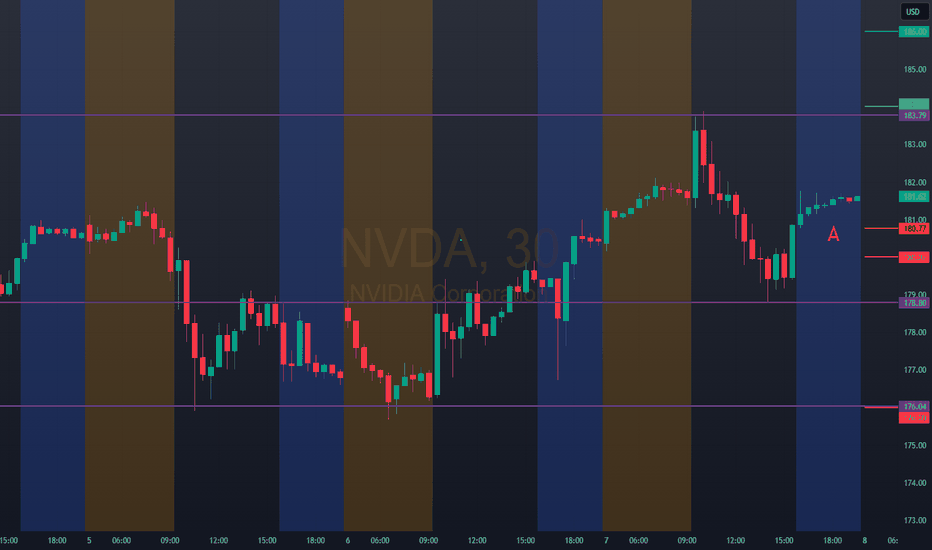

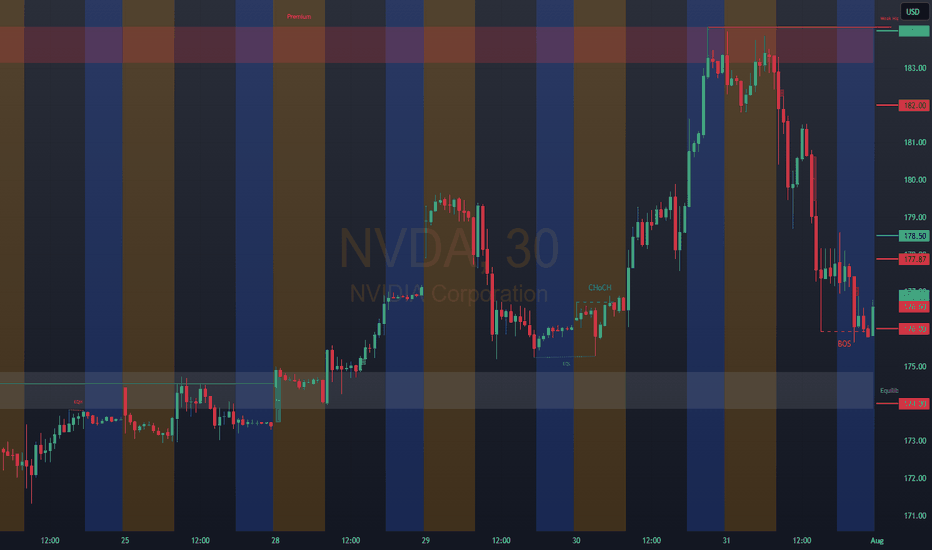

NVIDIA at the Crossroads: Will This Breakout Hold or Fake? Aug 7🧠 Technical Analysis – 1H + 15M Chart

NVDA is testing the upper bound of a symmetrical triangle on the 1-hour chart — a critical spot that could either break for continuation or reject back into the wedge.

* Trendline resistance from previous highs is pressing NVDA around 180.80–181.50.

* Stochastic RSI is overheated (>99), suggesting a potential pullback or fakeout before true breakout strength.

* MACD is crossing bullish with increasing histogram momentum — short-term buyers are stepping in.

On the 15-minute chart, we see:

* Tight coil forming near 181.00.

* Minor resistance at 181.46 from previous rejection.

* A bullish breakout above 182.00 on volume would confirm a short-term rally.

⚠️ Keep an eye for a potential fakeout above trendline and reversal back below 179.70 — a CHoCH could trap late bulls.

💥 GEX + Options Sentiment (Based on 1H Chart)

* GEX Map shows massive resistance forming around 182.5–185, with:

* 57.12% Call Wall at 182.5

* 51.68% Call Wall at 185

* Gamma is heavily concentrated just above current price — strong dealer hedging could cap upside moves if flow doesn't increase.

* Support Zones:

* 175 → Put support and HVL level

* 172.5 → Cluster of downside GEX risk (-7.23%)

* IVR is at 19.3 (low), with Call flow only at 3.4% — suggesting institutions are not aggressively chasing upside here.

🎯 Trade Scenarios

Bullish Breakout Setup

* ✅ Entry: Above 182.00 breakout

* 🎯 Target: 184.20 → 185.50

* 🛑 Stop: Below 179.50 or re-entry inside triangle

Bearish Rejection Setup

* 🔻 Entry: Rejection from 181.50–182.00 zone

* 🎯 Target: 178.20 → 175

* 🛑 Stop: Above 182.30

My Thoughts:

NVDA is at a decision point — either break out and squeeze through GEX walls or get trapped and fade to lower support zones. Volume and reaction at 182 will be key. This is a high-risk area for chasers — ideal zone for scalpers and short-term breakout traders with tight stops.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

NVDA heads up at $183.72: Golden Genesis fib to mark a TOP?Chips have been flying high since the April lows.

NVDA has just hit a Golden Genesis fib at $183.72

This is a "very high gravity" fib so expect a reaction.

It is PROBABLE that we "orbit" this fib a few times.

It is POSSIBLE that we reject to form a major top.

It is PLAUSIBLE that we Break-n -Retest to continue.\

.

See "Related Publications" for previous EXACT plots ------>>>>>>>>

Such as this post at the last Golden Genesis:

Hit the BOOST and FOLLOW for more such PRECISE and TIMELY charts

============================================================

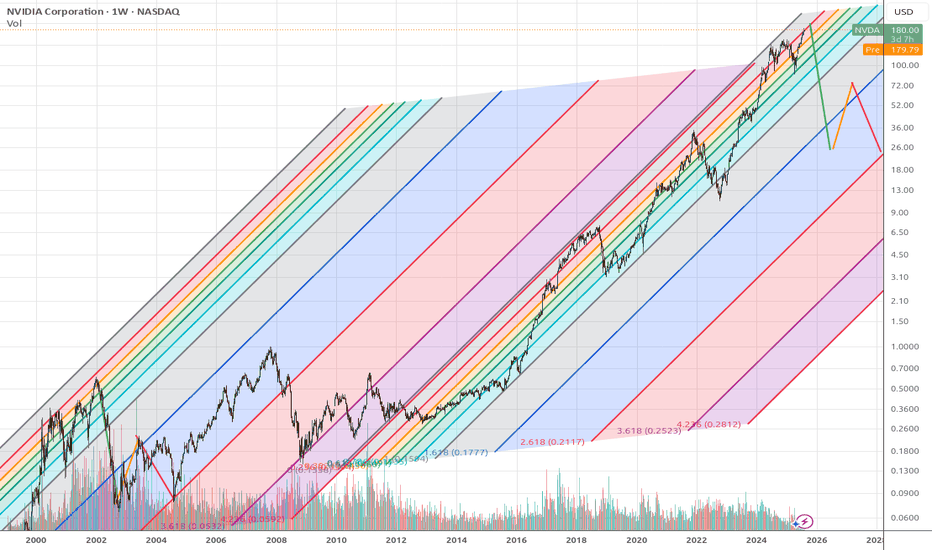

.

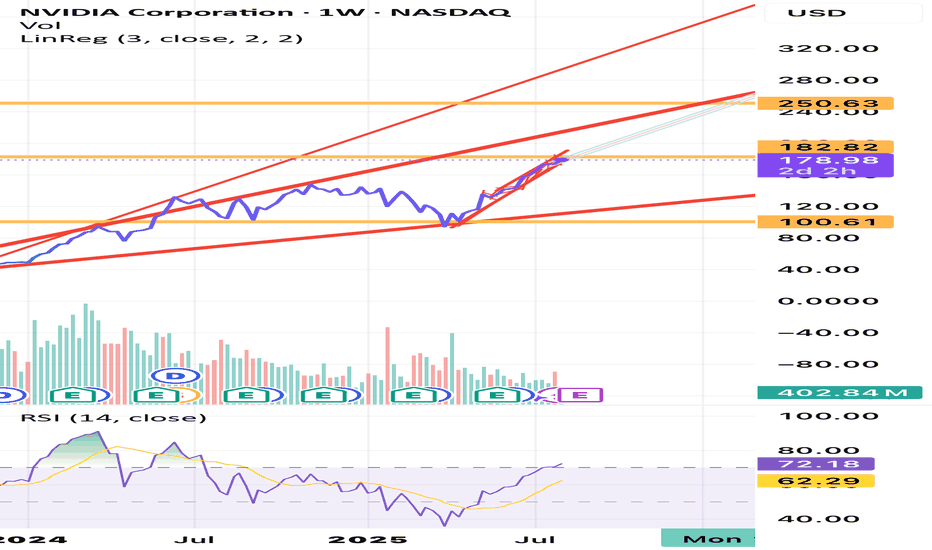

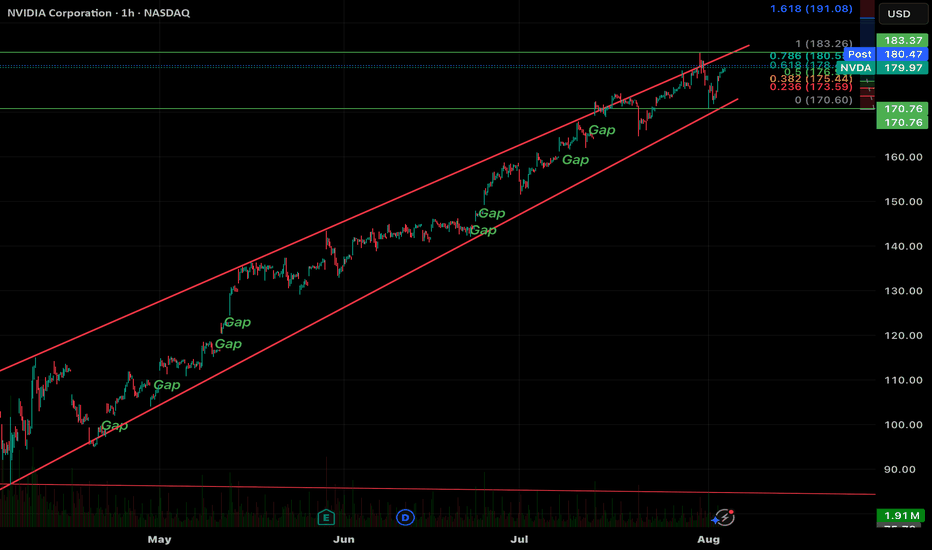

NVDA: Bullish Channels and Momentum CheckWe're seeing a compelling case for continued upward momentum in NVDA, but it's crucial to understand the different layers of the trend and key resistance levels.

Macro Trend: The Expanding Bullish Channel

On the weekly timeframe, a larger expanding bullish channel has been forming. The price is currently near the top of this larger channel, which could act as a significant resistance level. This gives us a long-term context for the stock's current price action.

Micro Trend: The 'Small' Bullish Channel

Zooming in, NVDA is currently moving within a smaller, short-term bullish channel. The linear regression tool that I've created confirms this upward momentum. This smaller channel shows the real-time path buyers are following. It's a great way to see the current trend in detail and identify short-term support and resistance.

Momentum Check: The Weekly RSI

While the price action looks strong, a look at the weekly RSI (Relative Strength Index) suggests a note of caution. The RSI has been in a strong upward trend, but when comparing the current state to previous weekly RSI oversold positions, it appears the momentum could be "tapped a little harder." This might imply that the stock could experience a short-term pullback to cool off before a potential breakout, especially since we're currently close to the top of the large channel. Though I’m not necessarily seeing any pullback indicated yet, being we are currently sitting safe above the bottom of the current smaller bullish channel.

Conclusion: Key Levels to Watch

My analysis suggests that NVDA has strong upward momentum within two distinct bullish channels. I've marked various price targets that align with my charting and are designated by professionals as key levels to watch.

Emotional Reactivity: The Silent Killer of Trading PerformanceEven with the best strategy, traders often fall short — not because the system fails, but because they do. One of the most common culprits? Emotional reactivity.

Fear and greed are the twin saboteurs.

Fear leads to hesitation, premature exits, or failure to take action.

Greed tempts us to oversize, chase trades, or hold too long.

These emotional spikes don’t just “feel bad” — they disrupt the brain’s decision-making systems. Under pressure, the amygdala takes over, bypassing the prefrontal cortex (where rational thinking happens)—this results in reactive behaviour: impulse entries, revenge trades, panic exits.

🔧 How to Defeat Emotional Reactivity

Here are proven strategies that work — not just in theory, but in the trenches of real-world trading.

✅ 1. Use Pre-Defined Rules & Checklists

The more rules you build into your system, the less room there is for emotion to interfere.

Think: “If X and Y are true, then I enter — no debate.”

🎯 2. Risk in Terms of ‘R’

Instead of thinking “I’m risking $5,000,” say “I’m risking 1R.”

This reframing normalises risk, reduces attachment, and keeps you focused on process over outcome.

📓 3. Track Emotional States in Your Journal

Don’t just log trades. Record your mental state before and after.

Over time, patterns emerge: when you’re most reactive, most hesitant, most aggressive.

🧘 4. Control Your Environment & Physiology

Fatigue, caffeine overload, or noise can heighten emotional spikes.

A calm workspace and healthy habits reduce the likelihood of hijacked decision-making.

🌬️ 5. Use Breathing to Regulate State

Even 60 seconds of box breathing can short-circuit fear.

Try this: inhale 4 sec → hold 4 sec → exhale 4 sec → hold 4 sec.

🕵️♂️ 6. Trade Fewer, Higher-Conviction Setups

Most overtrading is emotional.

By filtering out B-grade trades, you reduce stress and decision fatigue.

Final Word

You can’t eliminate emotion — but you can contain it.

The goal is to become emotionally aware and systematically anchored.

Master this, and you stop trading your feelings — and start trading your edge.

👍 If this resonated, drop a like or comment below.

🔁 Repost to help other traders cut through the noise.

📌 Follow for more mindset and execution tips grounded in real-world trading.

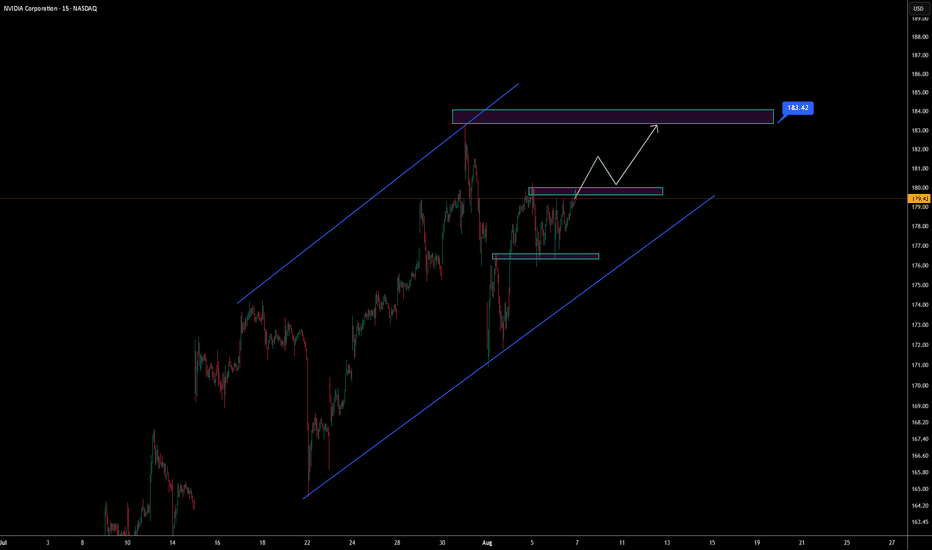

NVIDIA Approaching Breakout – Targeting 183.42 Within AscendingNVIDIA is moving within a well-defined ascending channel.

The price is currently consolidating near a local resistance area, showing signs of bullish continuation.

A breakout above this zone could confirm momentum toward the upper boundary of the channel, with a projected target around 183.42.

Watching for bullish structure and volume confirmation.

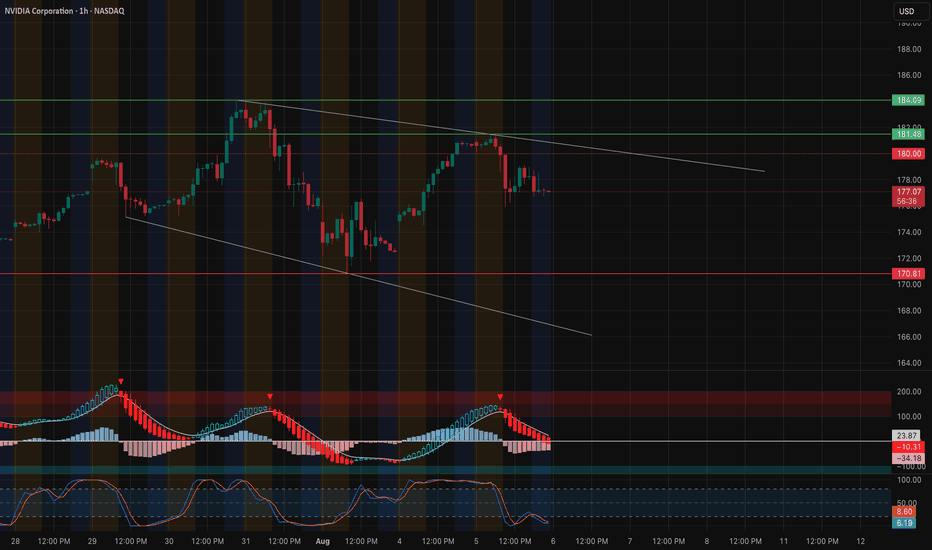

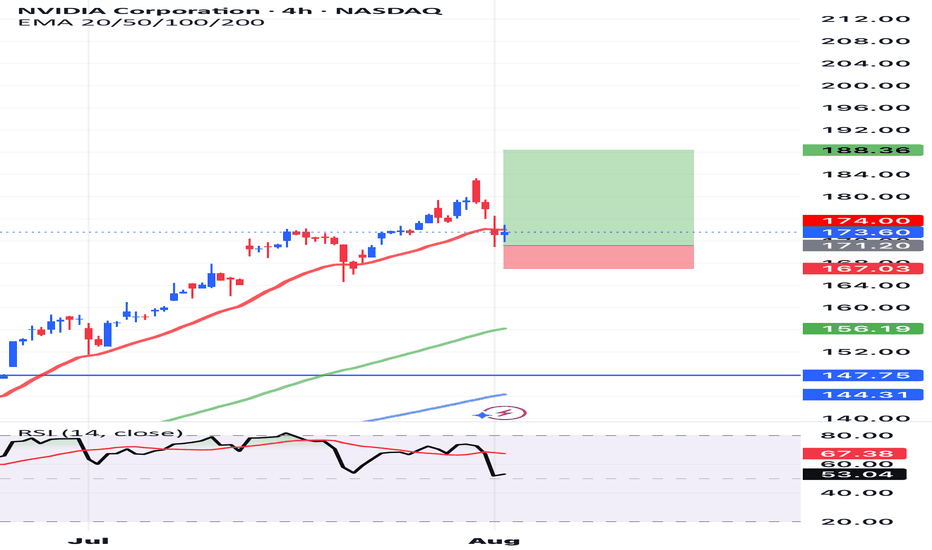

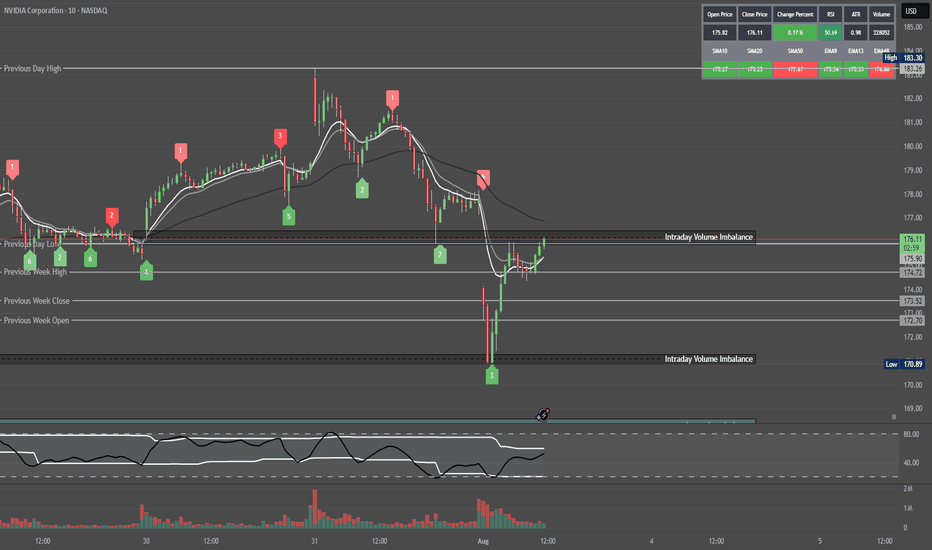

NVDA at a Make-or-Break Level. TA for Aug. 6🚀 NVDA at a Make-or-Break Level — Key GEX & Price Action Signals

Technical Overview (1H Chart)

NVDA is currently trading around 177.15, sitting just under the 180 psychological and technical resistance. Price action remains inside a descending channel, with sellers defending the 180 level while buyers have been active near 175.

The recent bounce from 170.80 aligns with the bottom channel support, but the lack of strong follow-through shows hesitation ahead of heavy resistance.

Gamma Exposure (GEX) Insights

* Major Call Walls:

* 180 → Highest positive GEX & Gamma Wall resistance.

* 184.09–185 → 2nd Call Wall cluster, significant dealer hedging pressure if broken.

* Put Support Zones:

* 175 → Strong GEX-based put support; losing this could accelerate downside.

* 170.80 → Major pivot & prior low, last strong GEX defense.

* Dealers are positioned in a way that staying below 180 keeps upside contained, while a clear breakout above 180 could trigger dealer covering and a squeeze toward 184–185.

Momentum & Oscillators

* MACD → Bearish momentum cooling off but still in the red, suggesting consolidation.

* Stoch RSI → Oversold zone, signaling potential short-term bounce attempt.

Trade Scenarios

* Bullish Case: Break & hold above 180 opens the door for 184–185 retest. Option traders could target near-term calls above 180 with tight stops.

* Bearish Case: Rejection at 180 and drop back under 175 could lead to 170.80 retest. Ideal for puts targeting 175 → 171 zone.

Options Trading Thoughts (Based on GEX)

* Preferred Bullish Setup: Wait for confirmed breakout over 180 → Calls targeting 184 strike, short expiry for momentum.

* Preferred Bearish Setup: Puts if rejection at 180 holds & price slips below 175, targeting 172–171 zone.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage your risk.

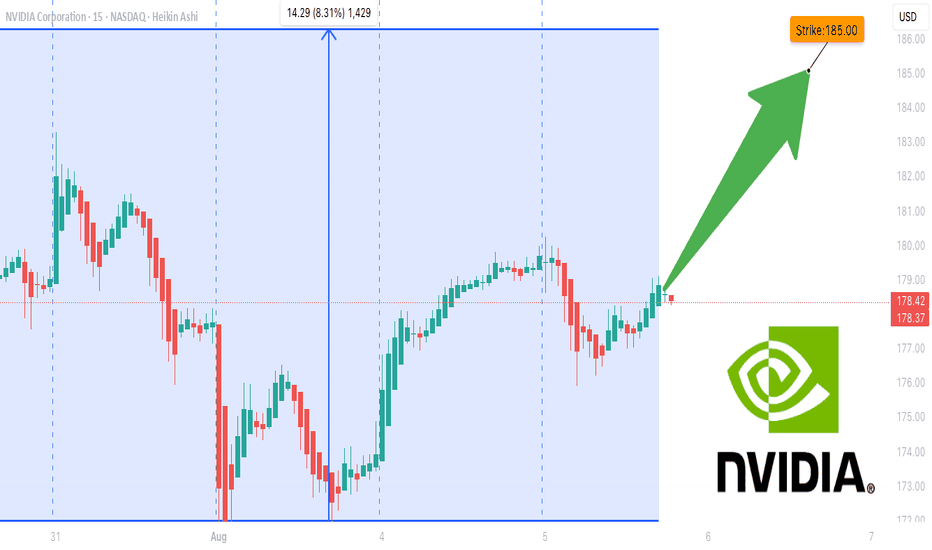

NVDA Don't Miss Out !!!!

**NVDA \$185C Weekly Momentum Surge ⚡ All Models Aligned – 75% Confidence Setup 🔥**

---

### 📊 **Post Body (Optimized for TradingView):**

**NVDA Weekly Call Play — Aug 8 Expiry (3 DTE) 🔥**

📈 **Momentum Snapshot:**

* **Weekly RSI:** 🔼 Above 50 and climbing

* **Daily RSI:** 🔻 Falling — short-term caution

* **Volume:** 1.2x previous week (🟢 Institutional flow)

* **Volatility (VIX):** <22 — favorable setup

* **Gamma Risk:** 🟠 Moderate

---

🧠 **Model Scorecard Summary:**

* **Grok / xAI:** 4/5 Bullish 🟢

* **Gemini (Google):** 3/5 Bullish with 80% confidence 🟢

* **Claude (Anthropic):** 5/5 Bullish 💯

* **LLaMA (Meta):** 4/5 Bullish 💪

* **DeepSeek:** 5/5 Bullish 🚀

✅ **Consensus:** Strong Bullish 🔥

---

### 💡 **Trade Setup:**

* 🎯 **Strategy:** Long CALL

* 🟢 **Strike:** \$185

* 📅 **Expiry:** Aug 8, 2025

* 💵 **Entry Price:** \$0.96

* 📈 **Target Exit:** \$1.90 (100% gain)

* 🛑 **Stop Loss:** \$0.48 (50% risk cap)

* 📏 **Size:** 1 contract

* ⏰ **Timing:** Market Open

* 📊 **Confidence Level:** 75%

---

⚠️ **Key Risks to Watch:**

* Time decay – Only 3 DTE ⏳

* Daily RSI divergence 😬

* Gamma risk & market volatility (track \ TVC:VIX )

---

### 🧾 **Auto-Logger JSON (for tracking):**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 185.00,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.90,

"stop_loss": 0.48,

"size": 1,

"entry_price": 0.96,

"entry_timing": "open",

"signal_publish_time": "2025-08-05 09:43:22 UTC-04:00"

}

```

---

### 🏷️ **Suggested Hashtags (TradingView Style):**

`#NVDA #OptionsTrading #WeeklyOptions #CallOptions #MomentumStocks #AIStocks #TechLeaders #TradingSetup #RSISignal #GammaSqueeze #NVIDIA #OptionAlert #HighConviction #TradeIdeas #TechBreakout`

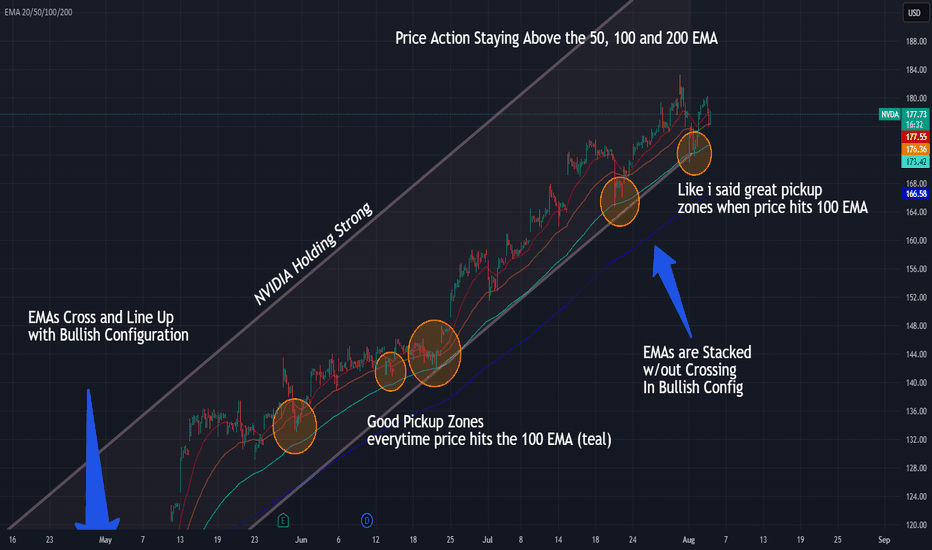

(updated) NVDA Bounces Off the 100 EMA AgainPrice keeps respecting the 100 EMA as a pickup zone — just like every other pullback in this trend.

📌 EMAs still stacked in bullish configuration

📌 NVDA holding inside rising channel

📌 Each tag of the teal line = another entry opportunity

⏱️ Timeframe: 1H

#nvda #stocks #technicalanalysis #ema #trendtrading #chartupdate #tradingview

NVDA Weekly Trade Setup (2025-08-02)

### 🟢 NVDA Weekly Trade Setup (2025-08-02)

🚀 **BULLISH CONSENSUS** across 5 top-tier models

📉 Daily RSI: Weak — but weekly trend is STRONG

💼 Institutional Volume: Confirmed accumulation

📊 Options Flow: Call/Put leaning bullish

---

### 🎯 TRADE SETUP

**💥 Direction:** CALL (LONG)

**📍 Strike:** \$182.50

**📅 Expiry:** 2025-08-08

**💵 Entry:** \$0.73

**🎯 Target:** \$1.46 (100% gain)

**🛑 Stop:** \$0.36 (50% risk cap)

**✅ Confidence:** 75%

**🕒 Entry Timing:** At market open

---

### 🧠 Model Breakdown:

✅ **Grok/xAI:** Weekly bullish, 4/5 signals green

✅ **DeepSeek:** Volume confirms; cautious on daily RSI

✅ **Google/Gemini:** Bullish weekly > bearish daily

✅ **Claude:** Weekly momentum + rising options flow

✅ **Meta/Llama:** All signals aligned for \$182.50 call

---

### ⚠️ Risk Watch:

* Falling Daily RSI = short-term drag risk

* Key Support: Watch for \$178 breakdown

* Earnings/events could spike volatility

---

### 📦 TRADE JSON (for tracking):

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.46,

"stop_loss": 0.36,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-08-03 00:54:05 UTC-04:00"

}

```

---

🔥 *“Smart money is circling. Ride the wave, not the noise.”*

💬 Drop your thoughts below. Will NVDA break \$185 next week?

NVIDIANVIDIA Corporation is a leading American technology company known for designing and manufacturing graphics processing units (GPUs), system-on-a-chip units (SoCs), and AI computing platforms. Founded in 1993, the company originally focused on gaming graphics but has since evolved into a global powerhouse in artificial intelligence, data centers, autonomous vehicles, and high-performance computing. NVIDIA’s GPUs are widely used not only in gaming and visual computing but also in scientific research, AI model training, machine learning, and cloud infrastructure.

In recent years, NVIDIA has been at the forefront of the global AI boom. Its data center business, powered by its high-end GPU architecture (like the H100 and newer generations), has become a critical backbone for tech companies, cloud providers, and governments seeking to build large-scale AI systems. The company also made major strategic moves through acquisitions and software integration, further solidifying its dominance in the AI hardware space. NVIDIA’s strong financial performance and technological leadership led to rapid growth in its market capitalization, briefly making it one of the most valuable companies in the world.

As of August 2025, NVIDIA’s stock is trading at $173.60 per share, following a stock split that adjusted its price while increasing liquidity. Despite broader market volatility, NVIDIA remains a key player driving the AI revolution and is closely watched by investors and analysts. Its valuation continues to be shaped by demand for AI chips, innovation in GPU architecture, and its ability to maintain technological leadership amid growing global competition. NVIDIA stands at the intersection of multiple megatrends, making it a critical stock in both the technology and semiconductor sectors.

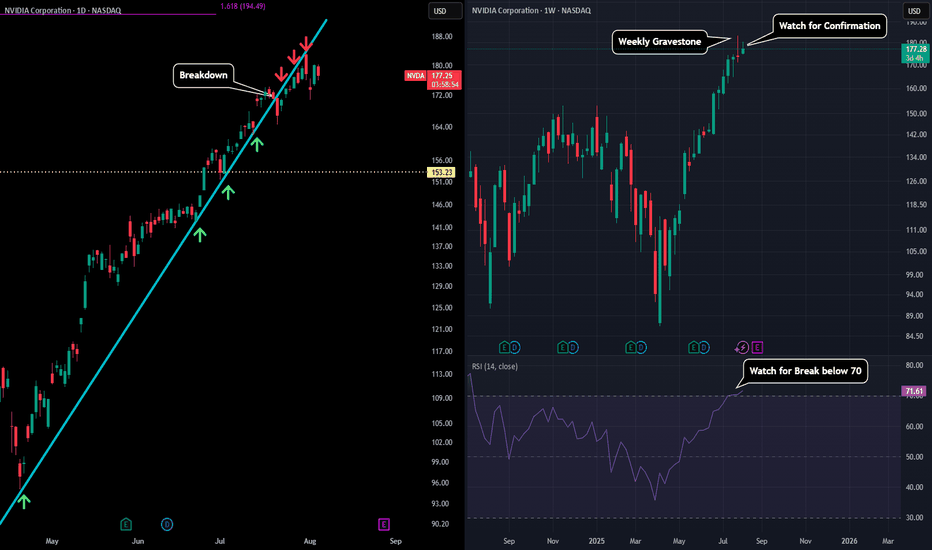

NVDA - Few Warning Signs Please refer to our previous post:

Here we were pointing out the structural break of our blue trendline on the daily. It acted as support the whole way up (green arrows) and now has been flipped into resistance so far (red arrows).

Also if you look at the chart on the right we had a MAJOR bearish signal flash. A weekly gravestone doji formed which could end up marking the top. We haven't had the confirmation yet, but depending on how price action play out this week we could have a very good idea of what next.

If we see bearish momentum and this weekly candle flip red that could be the first sign of this gravestone marking the top as it is a reversal candle. That would also send our strength on the RSI below the 70 which could look as a rejection from overbought conditions.

However, if we are able to maintain this weekly candle green (better yet break the gravestone doji high) that would show strength bouncing from overbought and send us towards that $200 target.

Quantum's TSLA & NVDA Trades 8/1/25Simply breaking down what I look at going into the trading day. Premarket watchlist was short but nailed TSLA short for 150% and could have made double that on TSLA and NVDA longs. Due to hitting my daily goals I had to walk away to avoid overtrading but what an amazing day.

NVDA: 177.87Bullish Entries: 174.00/178.50 Stop 177.00 Target 182.00–184.00

Bearish Entries: 178.50/176.00 Stop 177.00 Target 172.00................Note if you find it somewhat confusing, here is the clarification 178.50 possible bullish reach zone wait for confirmation. 174.00 possible rebound zone or rejection of the bearish entry wait for confirmation for the bearish entry.

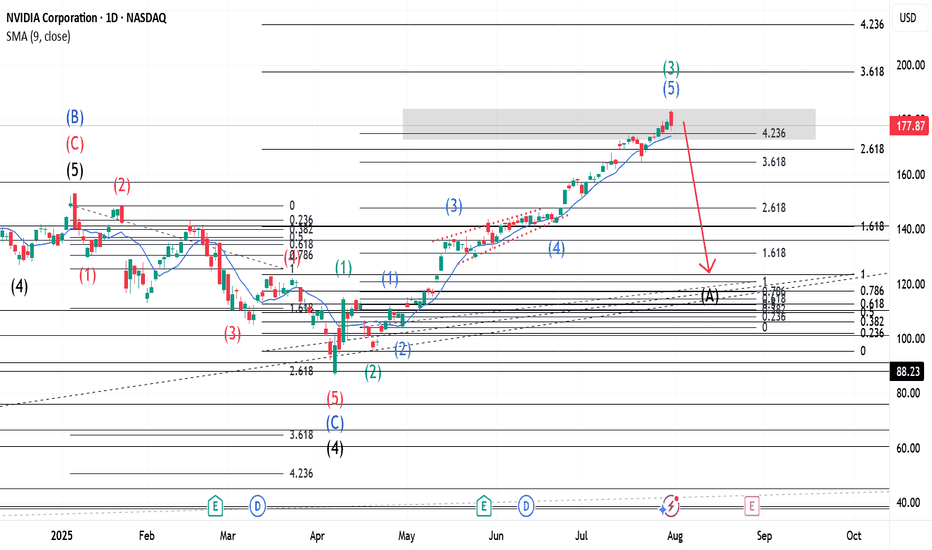

$NVDA ~ An Elliott Wave Breakdown.Earlier in the main wave, our Wave 2(Black) was a Zigzag hence a Flat was expected for Wave 4(Black). Wave B(Blue) closed beyond Wave 3(Black) and our Wave 4 made a 5 wave move(Shown in Red) that retested at the 261.8% Fib. level. With Wave C(Blue) complete, it was coined Wave 4(Black). Wave 5(Black) was launched and has a 5 wave move shown in Green. With a Zigzag for Wave 2(Green), a Flat should be expected for Wave 4(Green). Wave 3(Green) has 5 waves with a triangle for Wave 4(Blue). A confirmation at its current location(423.6% Fib. level) would mean that Wave 3(Green) is complete and a Wave A(Black) of the previously mentioned Flat should be anticipated. Please check my detailed breakdown for a broader perspective into the same.

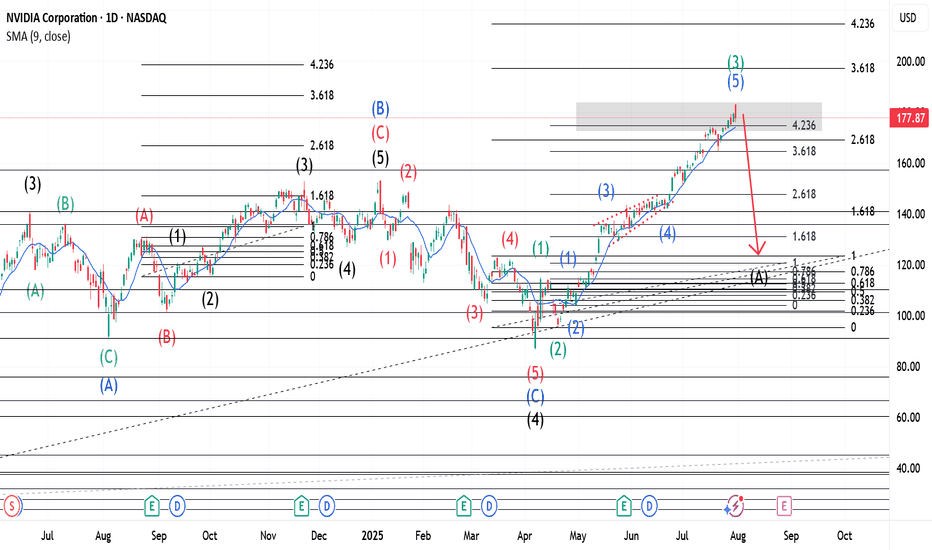

NB: The placement of Wave A(Black) of the Flat mentioned above is purely for demonstrative purposes.

$NVDA ~ An Elliott Wave Breakdown.(Detailed Spectrum)Our Wave 2(Black) of the main wave was a Zigzag hence a Flat for Wave 4(Black). When Wave 3(Black) completed a three wave move, shown in Green, was made, hence A(Blue). Wave B(Blue) went beyond the end of 3(Black) and had 3 waves, shown in Red, also(as expected for Flats). The last of this 3 wave move(Wave c-Red) had 5 waves shown in Black. Upon completion, our Wave B(Blue) was over and we expected a Wave 4(Black). Our Wave 4 made a 5 wave move(Shown in Red) that retested at the 261.8% Fib. level. With Wave C(Blue) complete, it was coined Wave 4(Black). Wave 5(Black) was launched and has a 5 wave move shown in Green. With a Zigzag for Wave 2(Green), a Flat should be expected for Wave 4(Green). Wave 3(Green) has 5 waves with a triangle for Wave 4(Blue). A confirmation at its current location(423.6% Fib. level) would mean that Wave 3(Green) is complete and a Wave A(Black) of the previously mentioned Flat should be anticipated.

NB: The placement of Wave A(Black) of the Flat mentioned above is purely for demonstrative purposes.