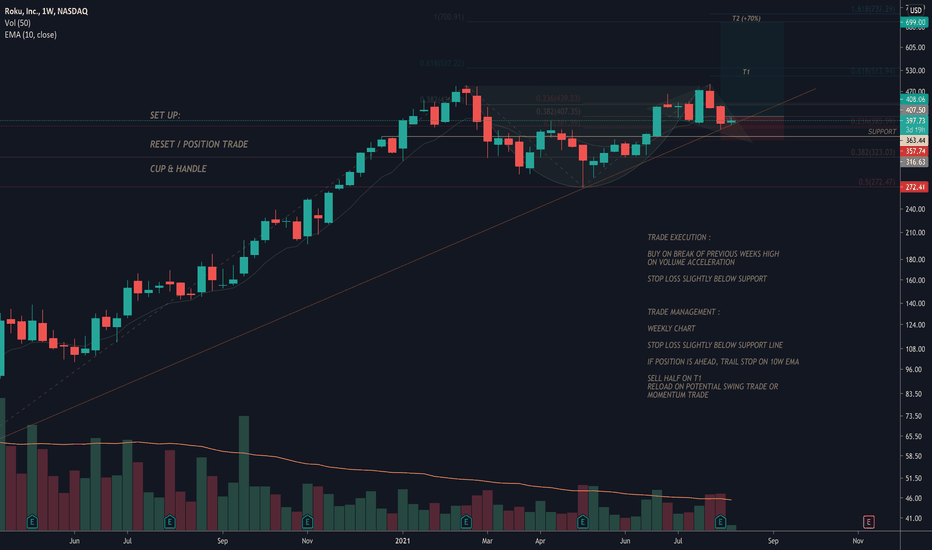

ROKU : RESET / POSITION TRADEThe Cable Box Is a Relic of the Past

Linear TV has offered viewers thousands of channels for a seemingly low price, but users today want more modern options and a better deal. While ~86 million households in the US still pay for linear TV, its days seem to be numbered.

Disruptive innovation typically follows a pattern: it evolves slowly at first and then all at once. Since peaking in 2011, the number of US linear TV households has declined 2.1% at an annual rate. That said, according to our research, by 2025, the number of US linear TV households will be cut nearly in half, from ~86 million at the start of 2020 to ~44 million, a level last seen more than 30 years ago.

As was the case with print media, we believe ad dollars are likely to shift from linear TV to more efficient platforms like streaming, a trend that traditional media companies have recognized. For example, during the past year alone, Comcast, Fox, and Viacom have acquired three players in the ad-supported streaming space: Xumo, Tubi, and Pluto TV, respectively.

That said, connected TV platforms are becoming a threat to traditional media companies. TV operating systems like Roku, Fire TV, and Android TV motivate many, if not most, television purchases. During the next five to 10 years, if the ad market for streaming soars, as we believe it will, TV operating systems like Roku will benefit from the share shift in revenues, taking 30% of the $70 billion ad load on each of their channels.

SOURCE : Nicholas Grous, Analyst, March 09, 2021, ARK INVEST

ark-invest.com

ROKU trade ideas

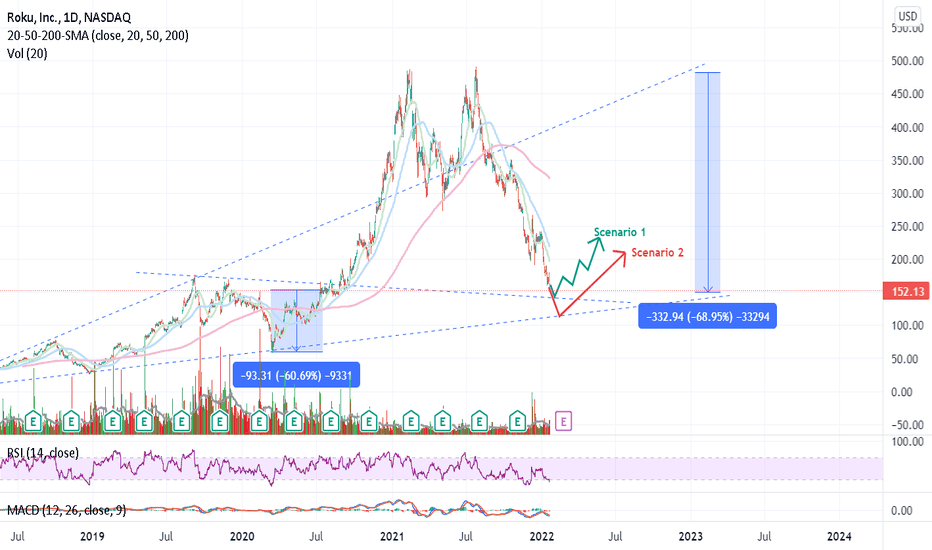

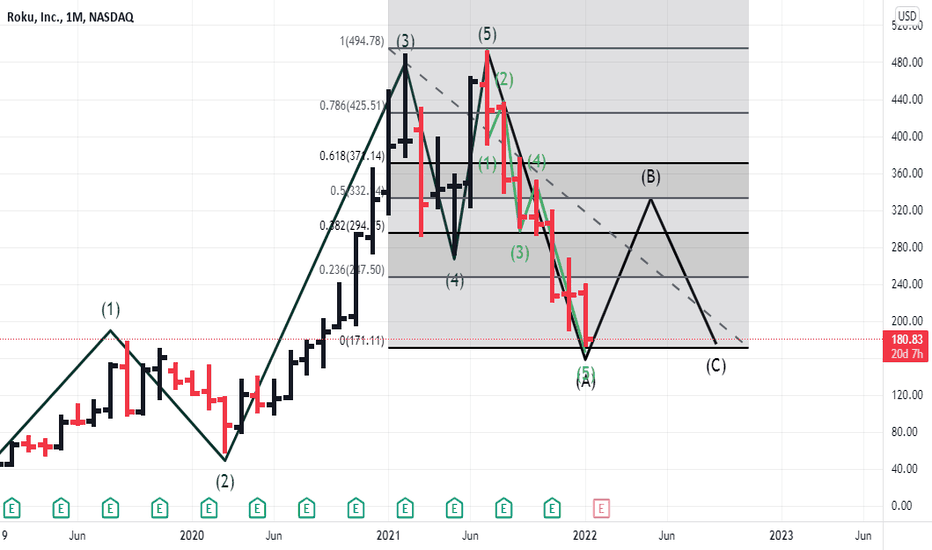

ROKU: Go short or go brokeI've seen a lot of users on here recommending their followers go long on ROKU and unfortunately anyone who followed their ideas lost a lot of money. You can't seem to reason with these permabulls either. Anyone who longed anything over the last 13 years would have surely made money and now have blind confidence in themselves. Not many of these users on this platform have traded during a bear market and it's going to eat a lot "influencers" or "professional analysts" alive.

Here's a few reasons to be short ROKU:

1.) We are going into a high interest rate environment and any stock with a high P/E is going to suffer the greatest. ROKU has a P/E of 77 as I write this.

2.) ROKU earnings estimates are $896 million and ROKU has never surpassed $700 million in revenue

3.) We are going into a bear market and if you look back 5 years you will find where this stock price is headed. I would not be surprised if this stock dips below $70 this year or early next year.

I hope this helps and don't fall on the bull sword that some of these analysts are going to have you fall on if you follow them.

Not financial advice

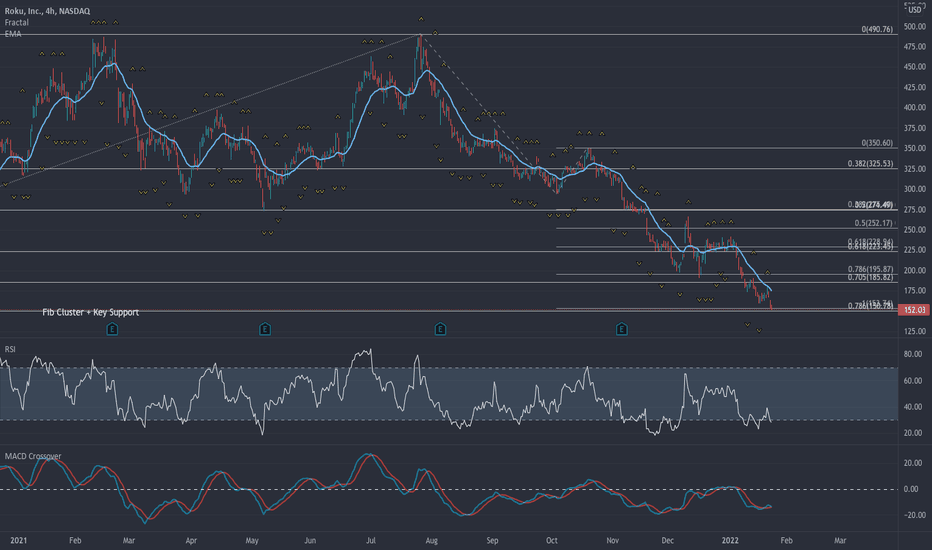

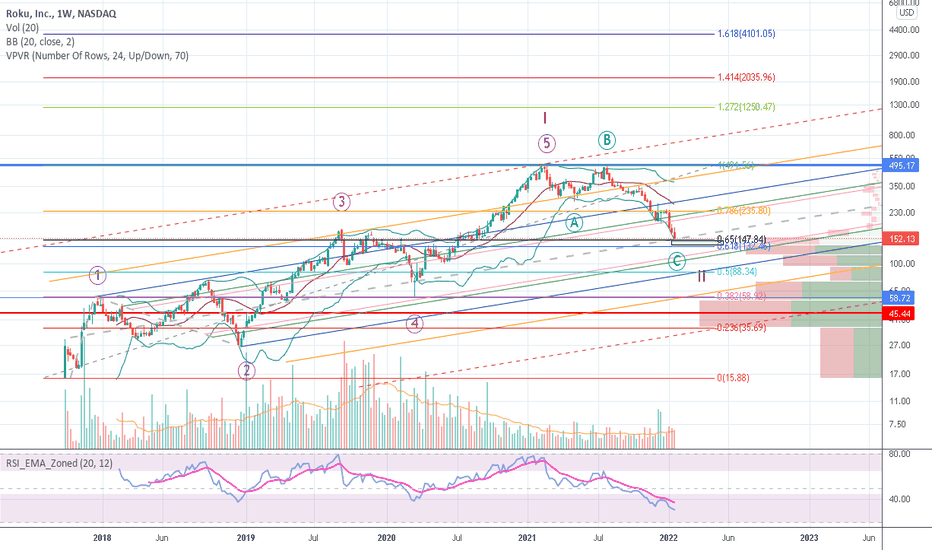

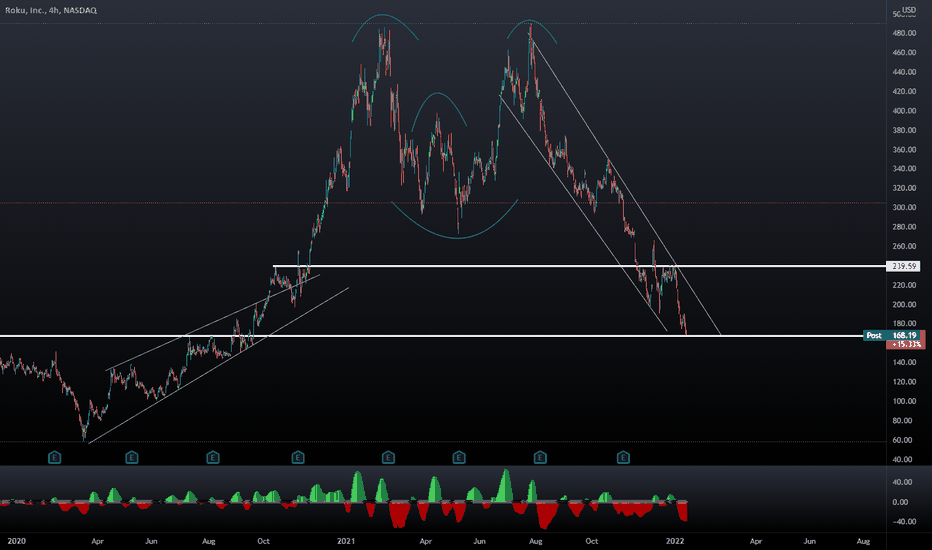

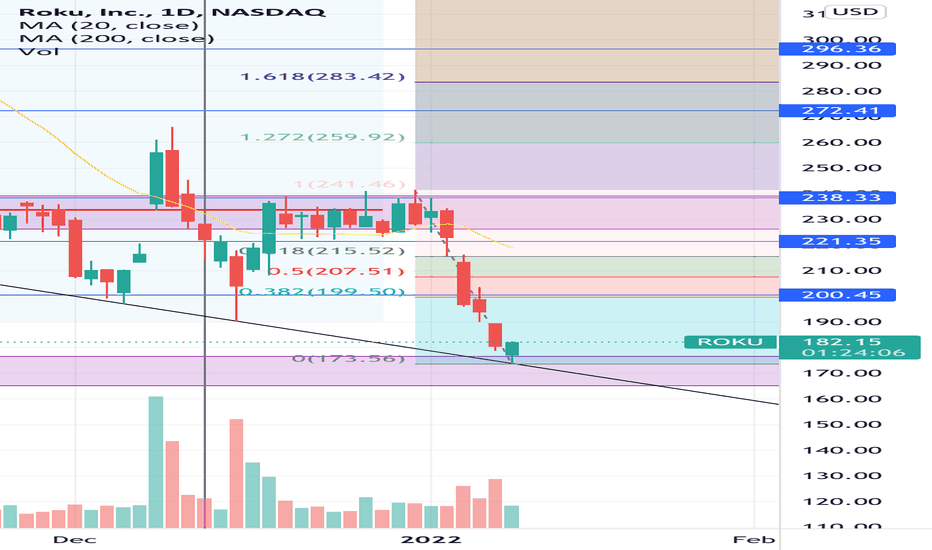

ROKU - Confluence zone (opportunity for bargain hunters)???Confluence includes:

Fib Extention and projection cluster zone

Diagonal and horizontal support confluence

Divergence building

Price fell 70% from High

While I feel there is a lot of competition in the field ROKU is playing in and longer-term they may have harder times, there is a potential that market bargain hunters jump in at these levels, the key will be to wait for a confirmation trigger confirmed by price action on a smaller time frame.

Market volatility is very high and the fact that this potential trade is against the trend dictates being very nimble.

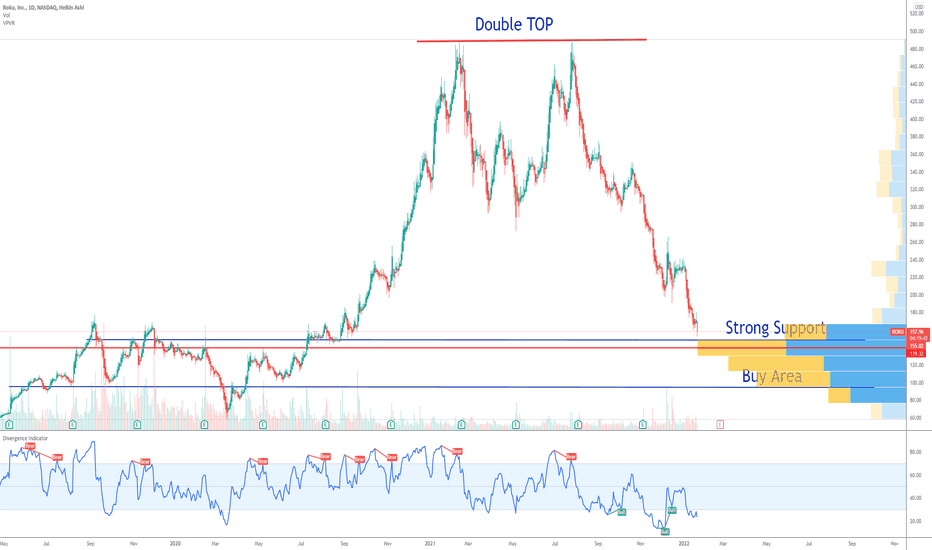

ROKU: Area of InterestRoku has dropped by a lot. The recent general weakness in the markets and the crash on streaming companies have accelerated the price decline. However, there are confluence building to peak my interest.

1. RSI is at all time low reading, even in weekly timeframe

2. Price is almost getting at .618 retrace from all time low to all time high

3. Approaching median line on the pitchfork at the same area of the important fib level

4. A large volume node on the weekly scale and even on daily timeframe at the same area

5. at each major low price is moving up a fib level on the pitchfork. The median line can provide a good turning point

Even though price can definitely fall lower, the boxed zone will be my first area of interest, at least for a nice bounce t0wards $200. I will get in with a tight stop loss just below the box and see what happens. Potentially a great risk to reward play.

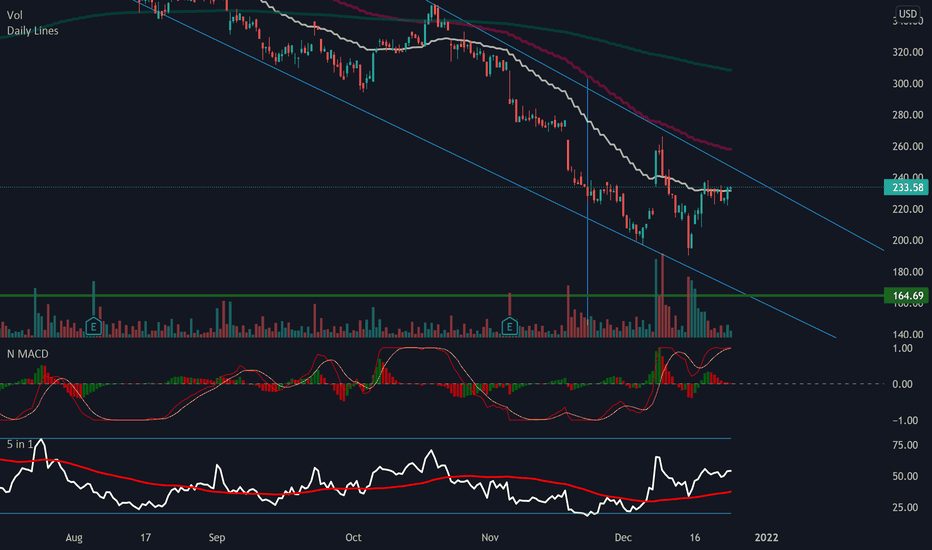

Short ROKU CMP $180.41Short ROKU CMP $180.41. Price continue to fall for $ROKU. After my recent short target $205 area achieved, I think stock has more room to go down and is heading towards $160 area where it started it's major run. MACD turned negative and it's trading below all the major moving averages. Short target of $160 area in coming days. Various support and resistance are marked in cyan color lines. Setup is invalid if it trades above 20 SMA price level.

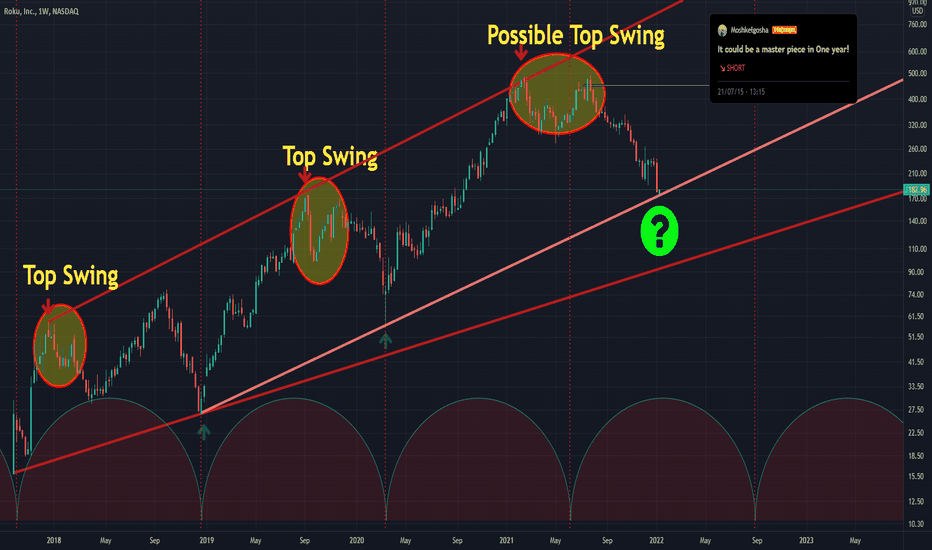

ROKU the next Netflix ? In terms of selloff i mean.

If you remember, Roku was a Netflix project in 2007.

Roku TV founder Anthony Wood created Roku and started the streaming boxes without Netflix taking a risk.

ROKU is embarking on its original content journey in a market with strong competitors.

Waiting for the stock to come to the high volume buy area.

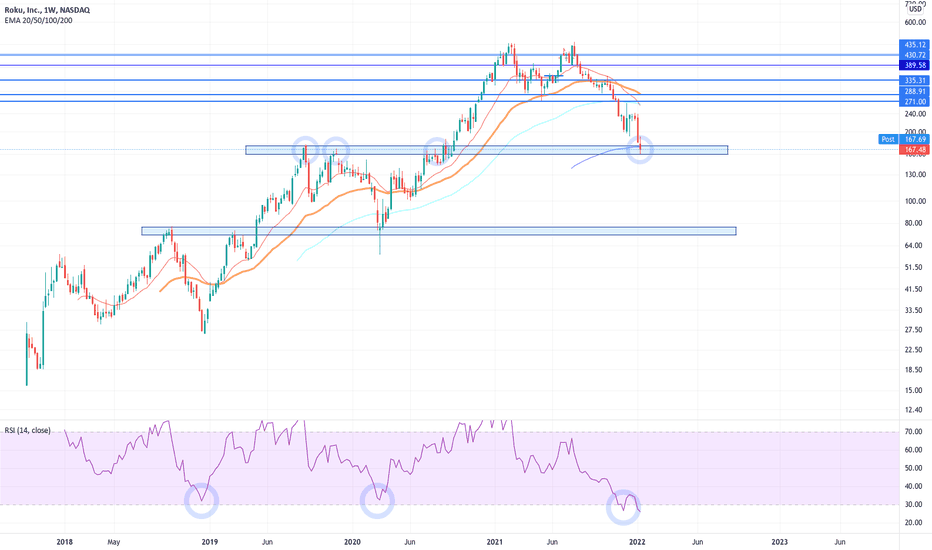

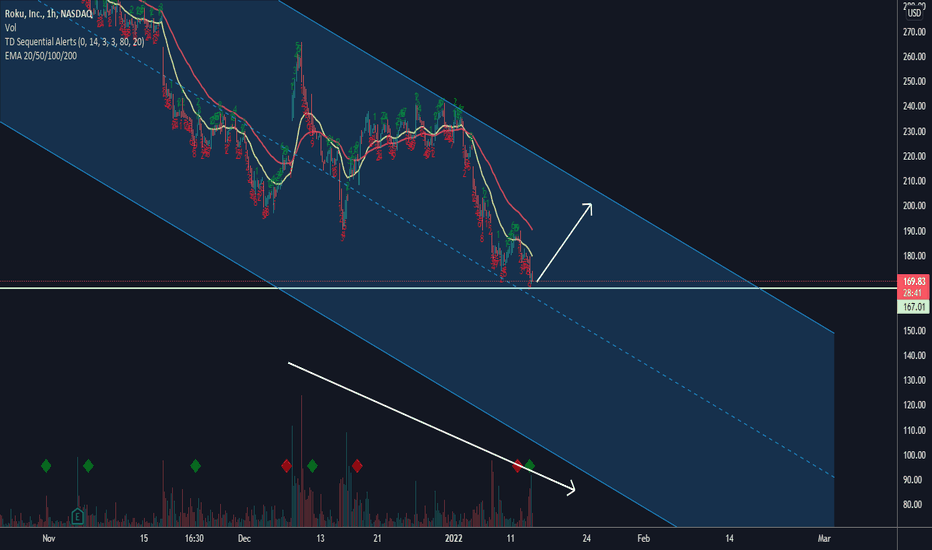

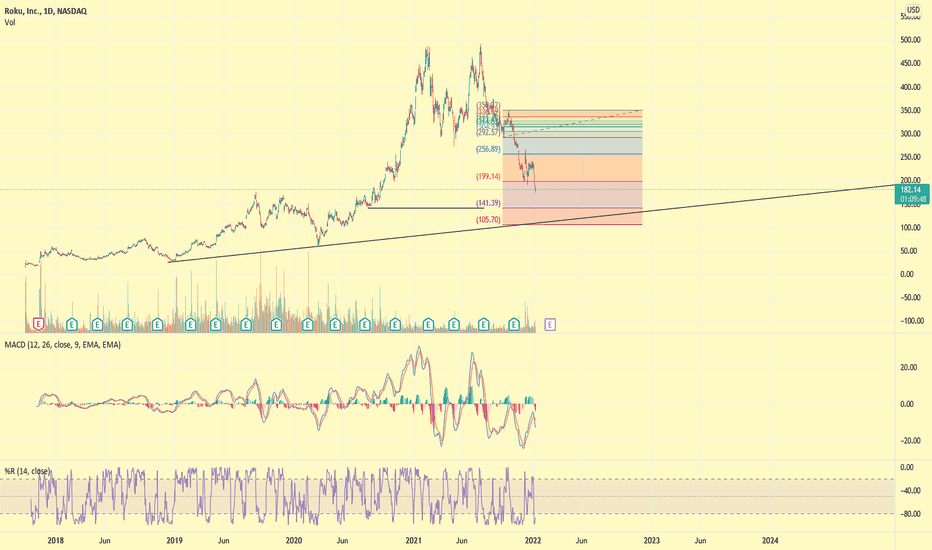

ROKU: IS THIS WHERE WE GO UP AGAIN?ROKU:

Weekly chart currently sitting on the 200ma .

At historical support -resistance zone.

Demark Sequential Buy 9 daily.

RSI a bit oversold on weekly. Bullish divergence on daily.

Are we bouncing here or do we keep going down?

Whatever is it, I like the good risk vs reward long entry here.

You might argue that we're going against the trend and you're right, however he odds favour the bulls.

Long term investment, swing or short term trade? Your choice.

Stop around 155.

Trade safe!

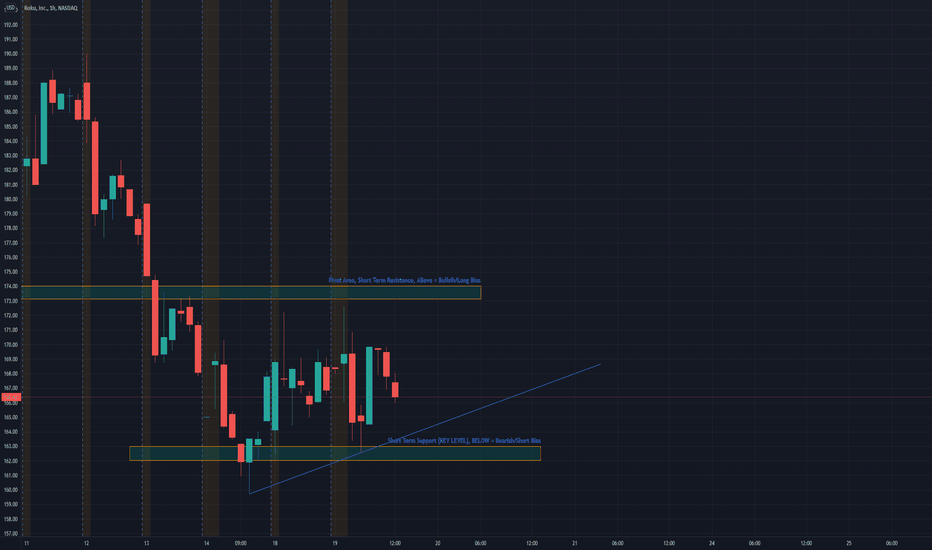

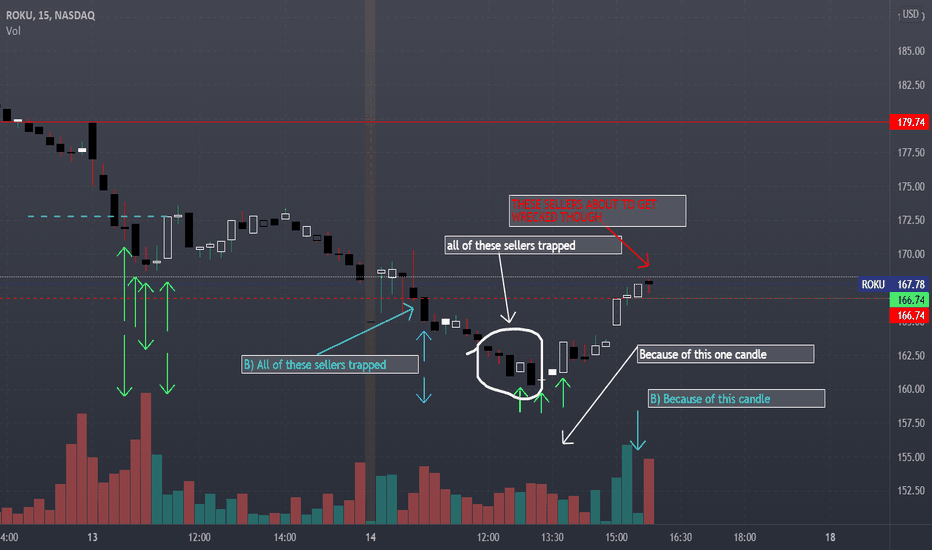

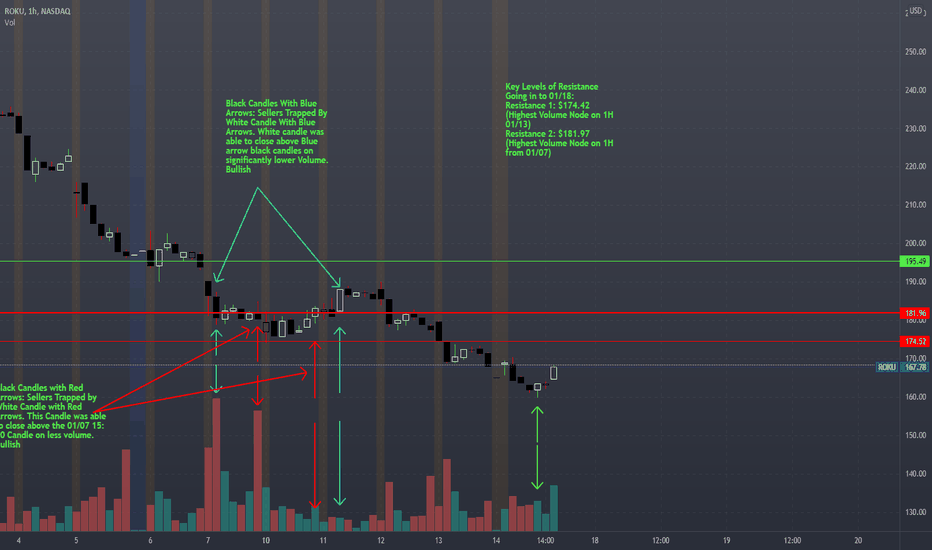

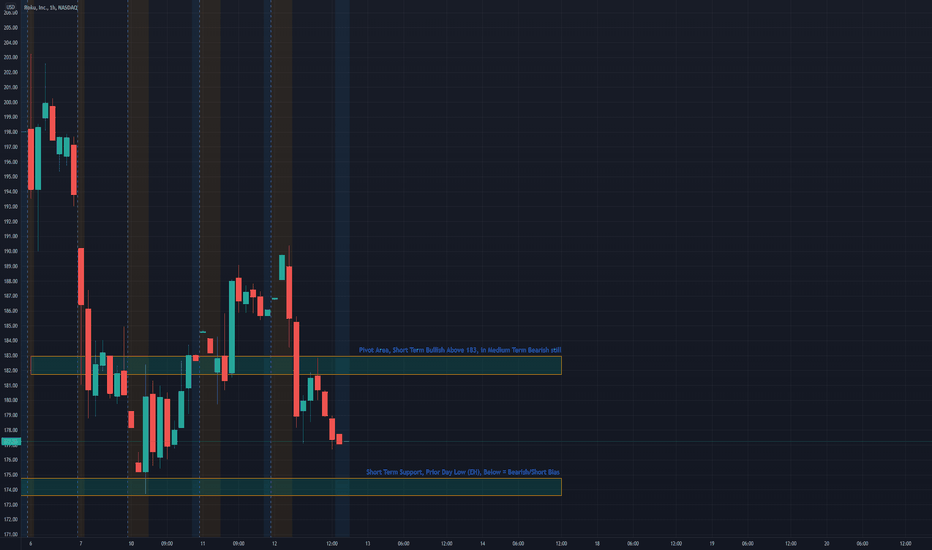

$ROKU, trading it 1/20For 1/20, intraday trading ideas for options; For red or green market day. #options #daytrading

Break over 174 (entry, long), it can see 180-184 (exit)

Break below 162 (entry, short), it can see 152-156 (exit)

Option Trading 101:

Risk what you can lose (0.5%-5%)

Watch buyers and sellers (their interactions & sentiment, ex. exhaustion of buying or selling, etc.) in strikes that you’re watching & the ticker too; this is how YOU manage YOUR trade.

Consider following and checking out bio and prior posts and recaps (on twitter ), have a great one. NOT FINANCIAL ADVICE.

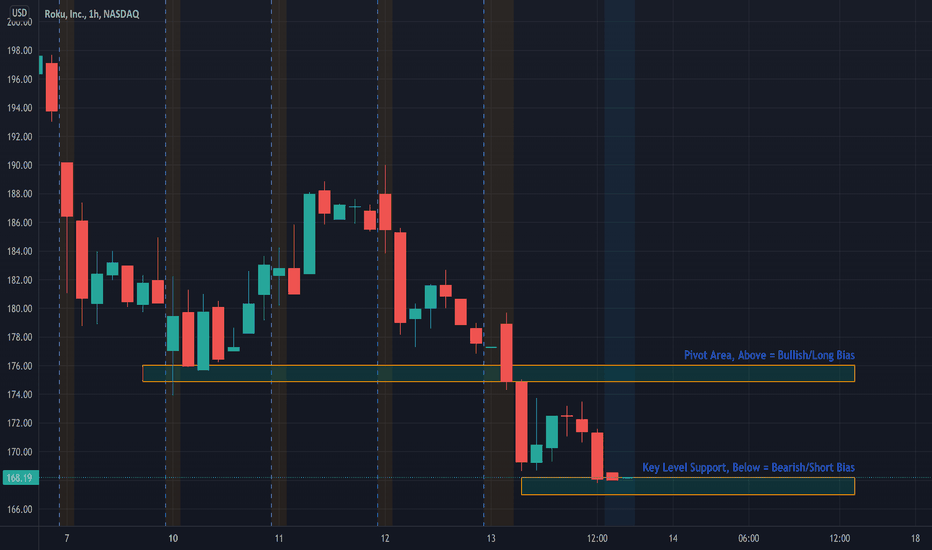

$ROKU, trading it 1/19For 1/19, intraday trading ideas for options; For red or green market day. #options #daytrading

Break over 174 (entry, long), it can see 180-184 (exit)

Break below 162 (entry, short), it can see 152-156 (exit)

Option Trading 101:

Risk what you can lose (0.5%-5%)

Watch buyers and sellers (their interactions & sentiment, ex. exhaustion of buying or selling, etc.) in strikes that you’re watching & the ticker too; this is how YOU manage YOUR trade.

Consider following and checking out bio and prior posts and recaps (on twitter ), have a great one. NOT FINANCIAL ADVICE.

$ROKU, trading it 1/18For 1/18, intraday trading ideas for options; For red or green market day. #options #daytrading

Break over 171 (entry, long), it can see 177-181 (exit)

Break below 159 (entry, short), it can see 149-153 (exit)

Option Trading 101:

Risk what you can lose (0.5%-5%)

Watch buyers and sellers (their interactions & sentiment, ex. exhaustion of buying or selling, etc.) in strikes that you’re watching & the ticker too; this is how YOU manage YOUR trade.

Consider following and checking out bio and prior posts and recaps (on twitter ), have a great one. NOT FINANCIAL ADVICE.

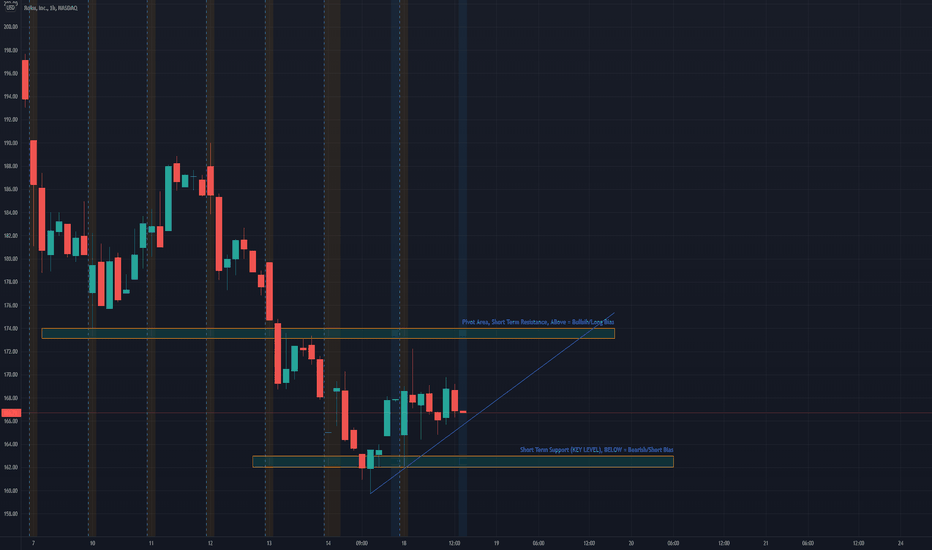

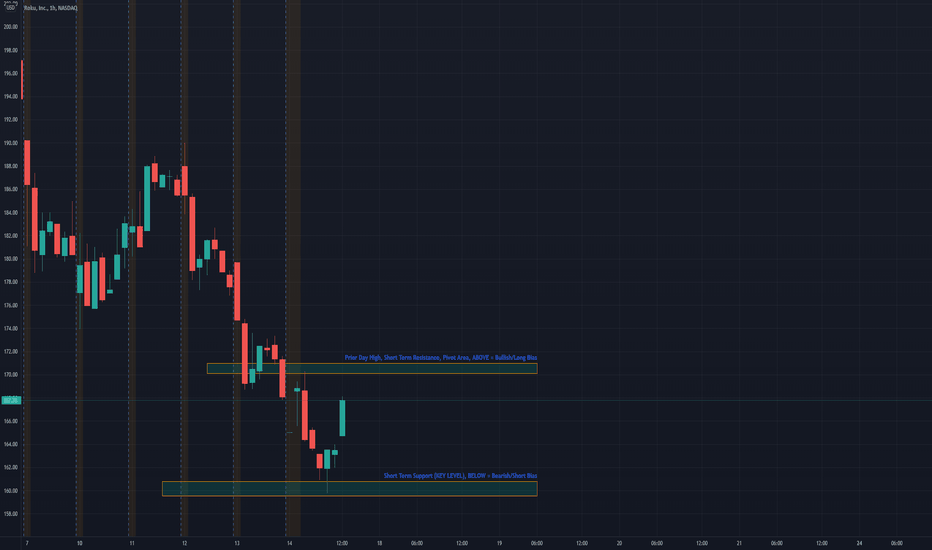

$ROKU, trading it 1/14For 1/14, intraday trading ideas for options; For red or green market day. #options #daytrading

Break over 176 (entry, long), it can see 182-186 (exit)

Break below 167 (entry, short), it can see 157-161 (exit)

Option Trading 101:

Risk what you can lose (0.5%-5%)

Watch buyers and sellers (their interactions & sentiment, ex. exhaustion of buying or selling, etc.) in strikes that you’re watching & the ticker too; this is how YOU manage YOUR trade.

Consider following and checking out bio and prior posts and recaps (on twitter ), have a great one. NOT FINANCIAL ADVICE.

$ROKU, trading it 1/13 For 1/13, intraday trading ideas for options; For red or green market day. #options #daytrading

Break over 183 (entry, long), it can see 190-194 (exit)

Break below 173 (entry, short), it can see 162-166 (exit)

Option Trading 101:

Risk what you can lose (0.5%-5%)

Watch buyers and sellers (their interactions & sentiment, ex. exhaustion of buying or selling, etc.) in strikes that you’re watching & the ticker too; this is how YOU manage YOUR trade.

Consider following and checking out bio and prior posts and recaps (on twitter ), have a great one. NOT FINANCIAL ADVICE.

A chart is better than a thousand tales..!On July 15th,2021 when was 404 I published my short analysis for ROKU! in less than 6 months, it went down almost 60% to 173.65..!

Now I think it could experience a nice 20-30% rebound..!

Best,

Moshkelgosha

DISCLAIMER

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.

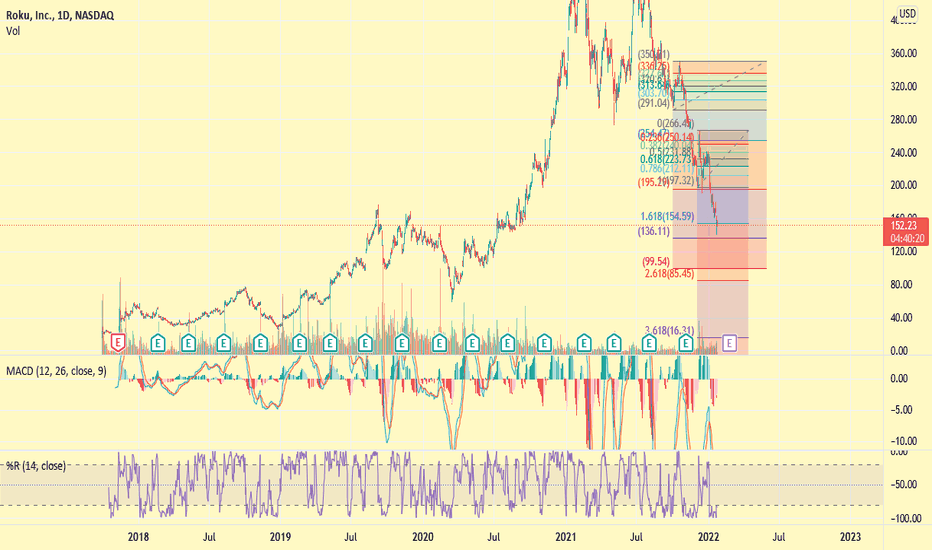

ROKU: still more sellingROKU may try to retest the 2.618 fib retracement, but overall I am short this stock. As this company has one of the highest P/E ratios in the tech sector, that is a main reason to be short especially during a rising interest rate environment. I am short to $141 which would bring this stock to the 3.618 fib retracement level.

Not financial advice

ROKU bullish setup ROKU hitting a big buy level for me here. Major TL support and major price zone tagged here. Targeting a run towards 199-200 which coincides w prior pivot level and Fibonacci retracement level. I am taking next weeks 195/205 call debit spreads for 2.25 debit, looking for 4.00 on half and then looking to add a 205/215 call credit spread to turn it into a lower risk to risk free butterfly. Trade at your own risk