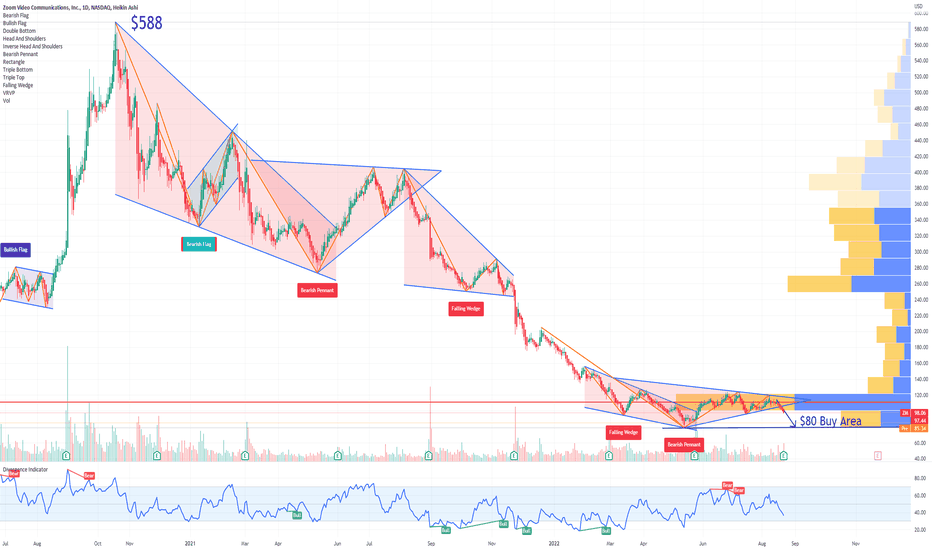

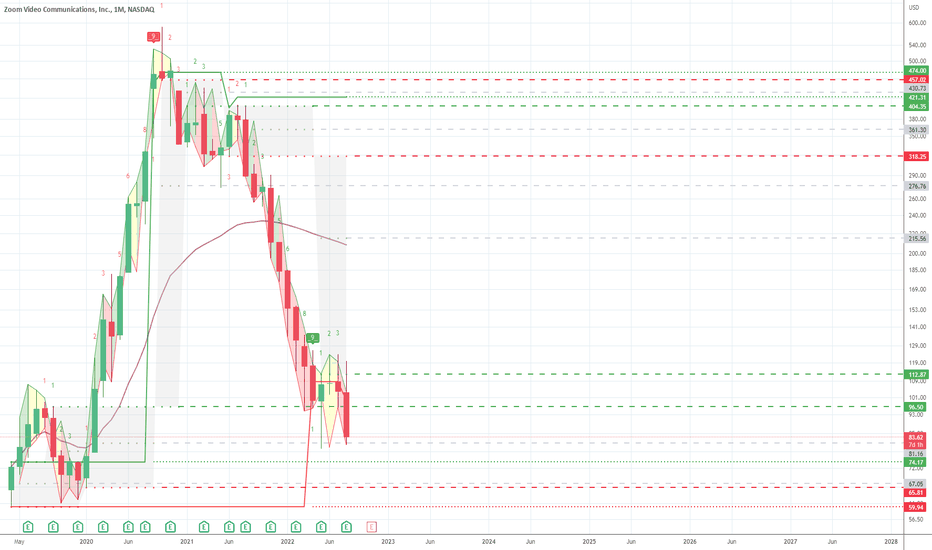

Zoom #zm #zoom $zoom $zm update Let's take a look at Zoom since its IPO in 2019.

I think that Zoom could be another one of these stocks that is moving so much more like Risk and crypto that there is a good chance it finds its own base and bottom before much of the rest of the overall stock market etc.

I think that these current levels are becoming quite attractive even for swing trades over the next few weeks/months. but even more so for anyone looking to park some $ for the next 12-36 months, or more.

I feel that Zoom was not just a Temp. useful play during lockdowns and covid19. I think that Zoom will continue to grow and gain adoption. I think that Zoom still has a bright future and has opportunities to even evolve and become something more then it currently is.

If you would like More zoom updates, please feel free to let me know in the comments and what your timeline is like, and I'll do my best to try and help deliver added insight.

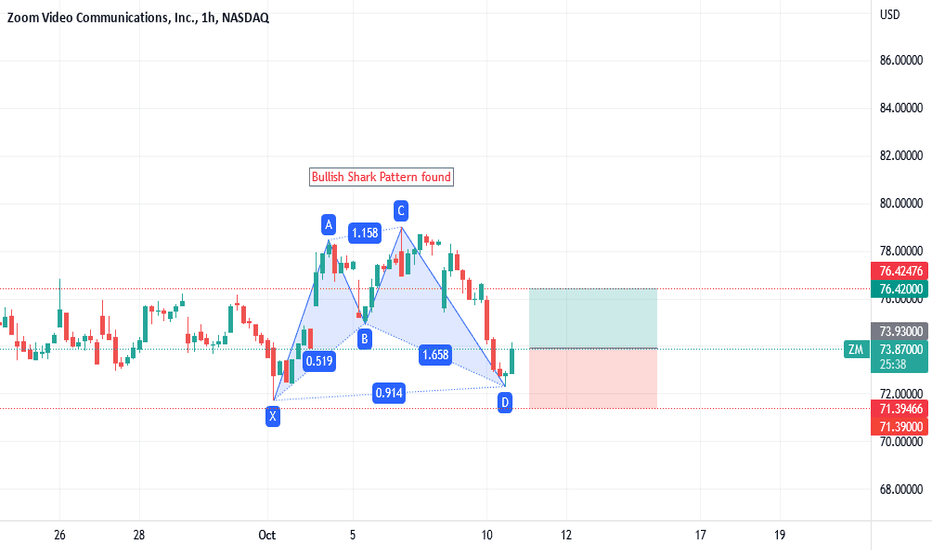

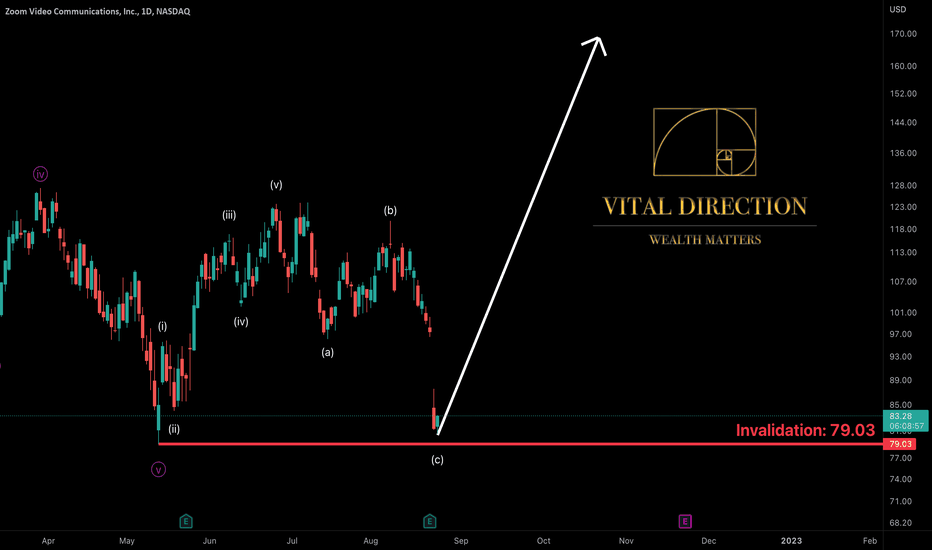

ZOOM trade ideas

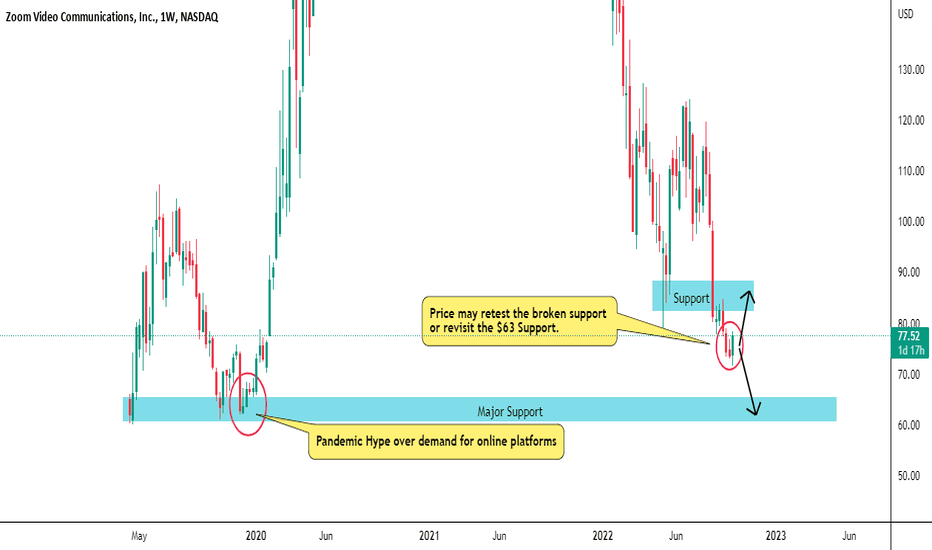

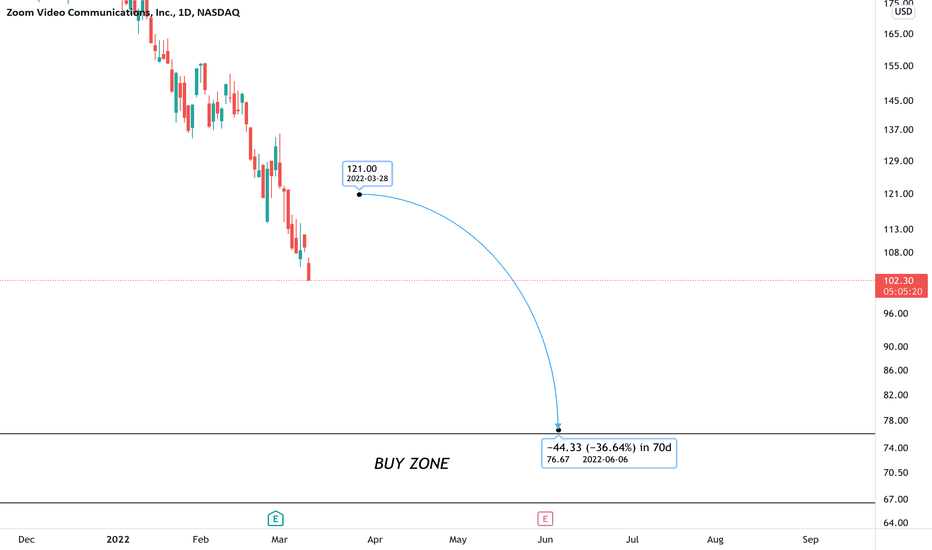

ZOOM WIPED 95% OF GAINS HAPPENED SINCE PANDEMIC. MORE DOWNSIDE!!Check out the trade plan for ZM today based on the technical analysis. Hope this analysis is useful, make sure to hit the thumbs and also follow my tradingview profile for future updates. Thank you!

Zoom has broken important support formed at $85. More importantly, we have seen 95% of gains happen since the pandemic has got wiped off completely by now. Still, the bearish trend remains strong and possibly we may see the major support formed close to $63 once again. At the moment we have seen some bullish activity where the price is about to revisit the broken supported area.

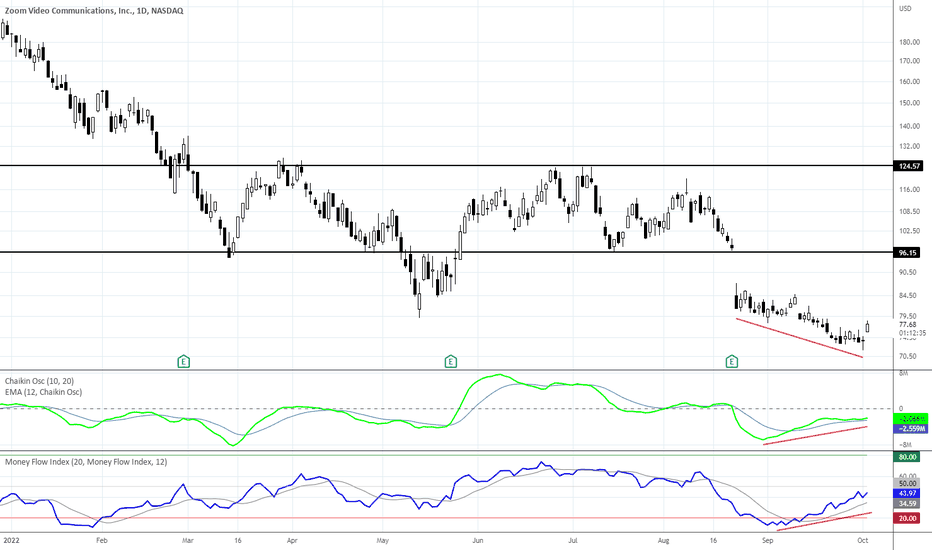

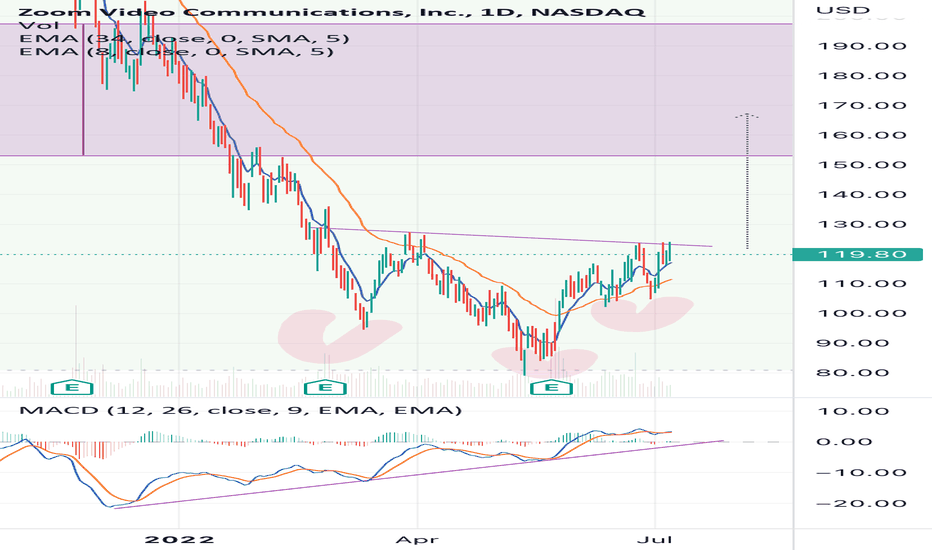

Positive Divergences: NVDA, SYNH, ZMPositive Divergences are developing in many stocks as they reach strong support levels.

NVDA, SYNH and ZM are examples that showed signs of the run down ending as volume indicators diverged upward against the decline. This is an early buy to cover signal for short positions.

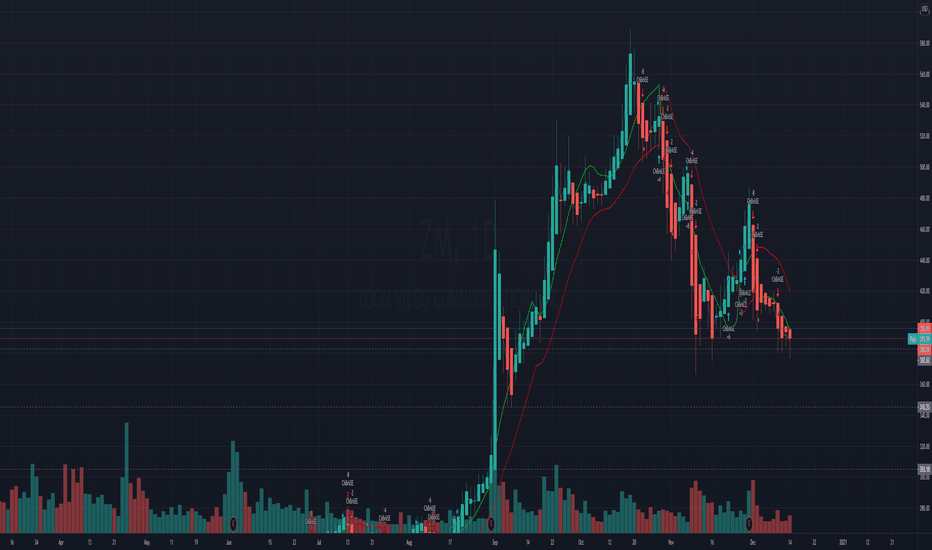

ZM | ShortNASDAQ:ZM

Possible Scenario: SHORT

Evidence: Bearish Price Action, Bearish Channel Breakout, Bearish Divergence, Moderna Vaccine, Official Election results

TP1: ~381 TP2:~348

This is my idea and could be wrong 100%.

*I'm a day-trader, so this idea is valid for few days, long term I'm bullish on this stock.

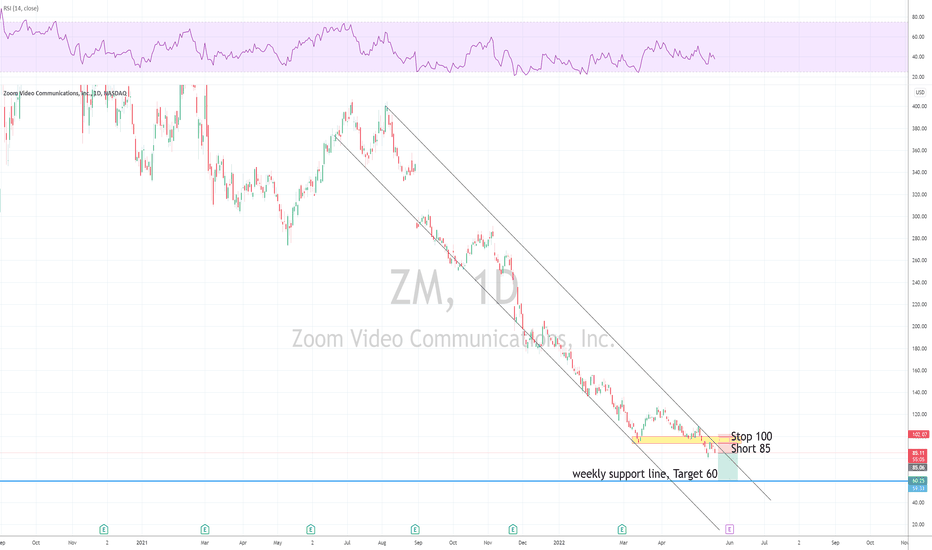

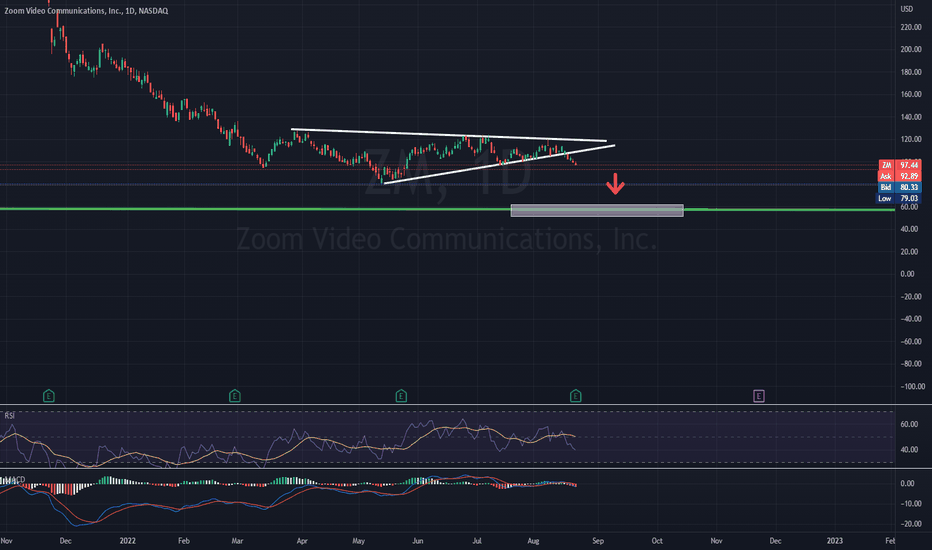

ZM ShortDowntrend

Next Earning 7/1/2022 Estimate 0.88 (Feb Earning 1.29)

Short 85

Stop 100

Target 60 (weekly support line)

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

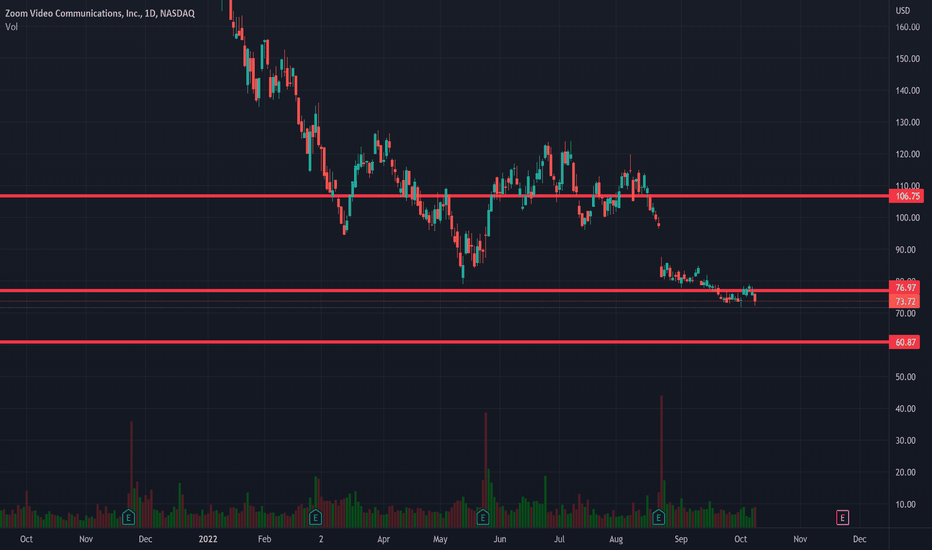

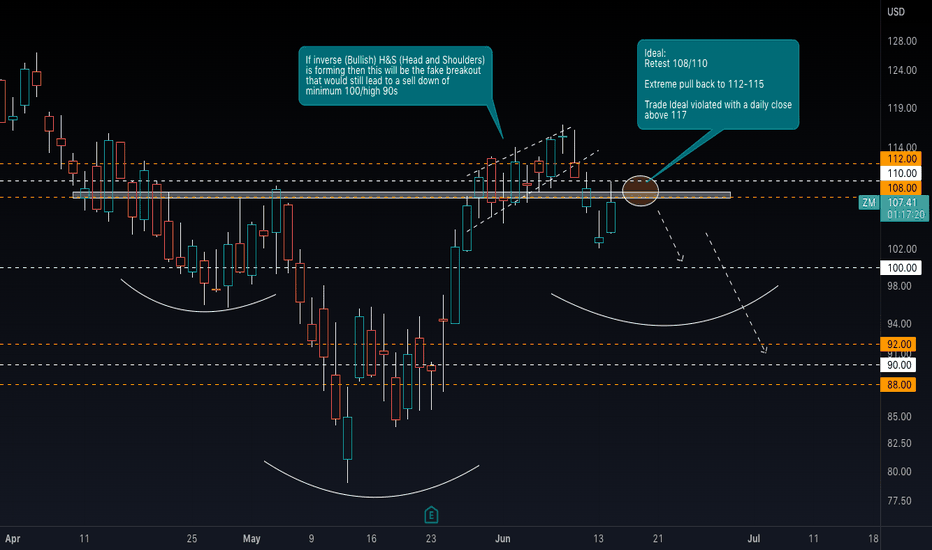

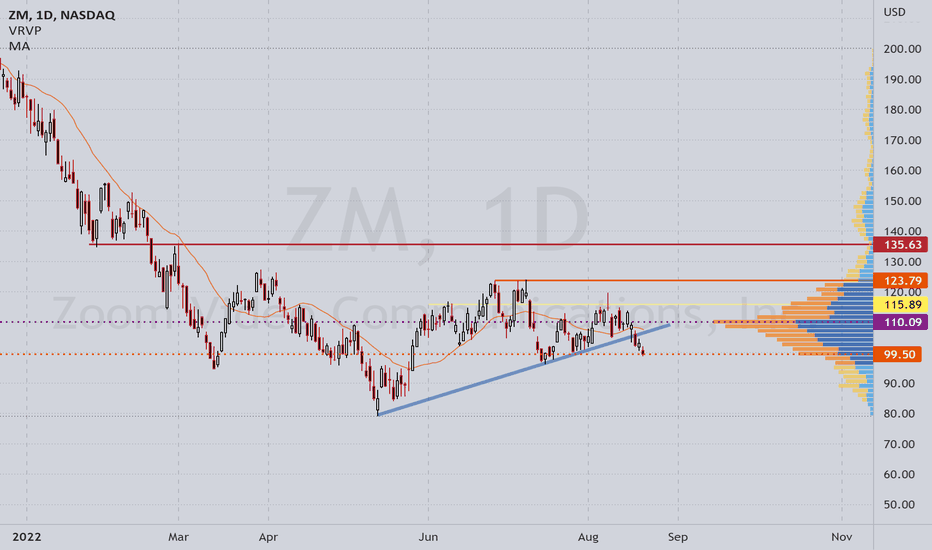

ZM still under Massive Selling PressureToday we have ZM (ZOOM) on the daily chart

With the huge sell offs in the market we still see much more downside on the table especially for growth and tech stocks like ZM.

We offered a bullish outlook that would have an inverse Head & Shoulders forming

However to complete the right shoulder we would still need to sell down into the low High 90s

We do have some news coming out tomorrow so ideal would be to see a pump in the market back into the 108s-110 area before the selling continues.

We are prepared go see even higher prices to make a true daily retest or Double top back at 112-115 area

Not unless we break above and close above 117 will our bearish bias be removed.

With that being said.. we DO NOT think we are forming a bullish Inverse Head and Shoulders and will likely close this week towards the lows of 90

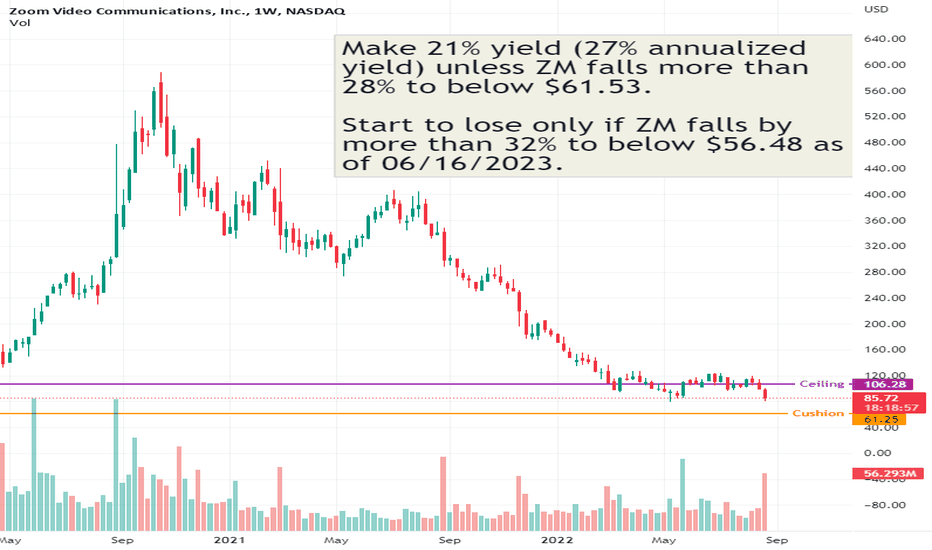

An Option for ZMZM has been on a steep downward trend since stay at home began to lift last year. Now its nearing the IPO stock price with 10x the revenue. We all know it can go lower but perhaps at these prices your considering a position based on its new lines of business and cash stock pile that is ripe for acquisitions. So let's look at a play that can provide a buffer down to pre the IPO price with a fixed 24% yield ( 30% annualized yield ) unless ZM falls more than 24% to below $65.27 . Where we can only start to lose if ZM falls by more than 29% to below $60.94 as of 06/16/2023.

Required Capital: $8470.94

Order

Buy 4 $55 puts

Sell 5 $65 puts

Exp 6/16/23

Limit price: $16.65

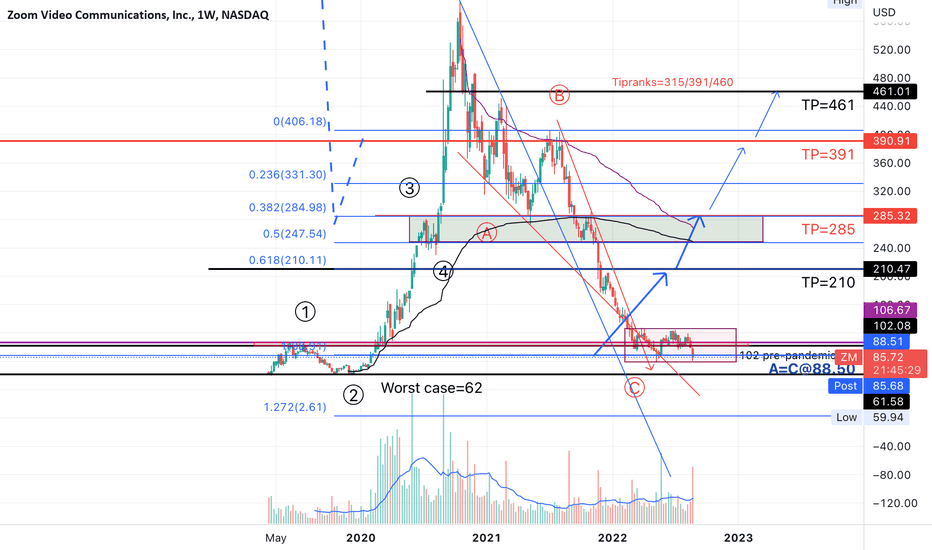

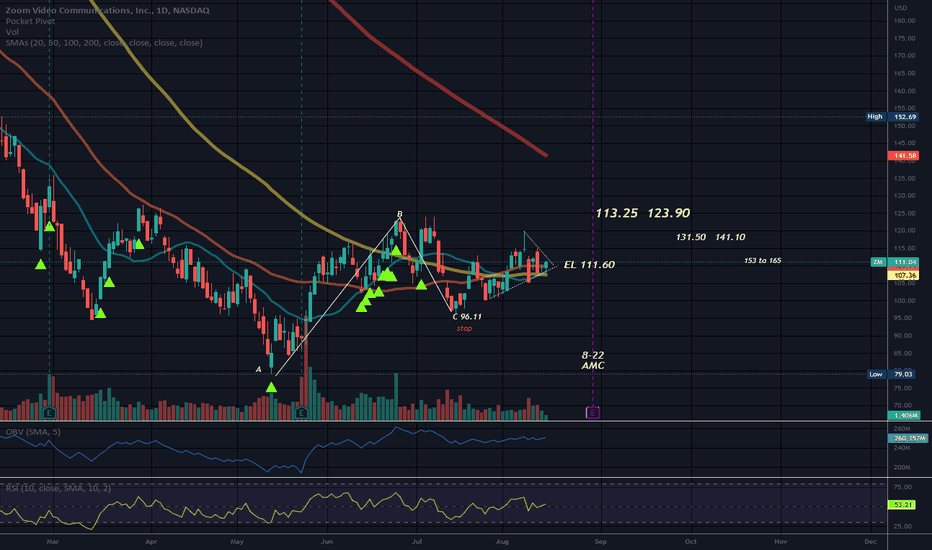

ZM accumulating @pandemic zone since Russian invasion; next TPsZM will continue to increase user base in the next few years even if work-from-home subdues. It has made a perfect ABC correction with A=C & is has been consolidating in the pre-pandemic 102 zone since Russian invasion started in Feb 2022.

The risk of worst-case scenario is very low compared to the great upsides if a new EW cycle begins after ZM breaks above the pandemic zone & go above Ichimuko cloud in the 4Q2022.

Not trading advice

NASDAQ:ZM:Cathie Wood's $ARKK bought 839,301 shares todayAmong other trades, ARK sold 293,661 shares of NVIDIA (NASDAQ:NVDA) and 954,387 shares of Signify Health Inc. (NYSE:SGFY), as the stock spiked recently on reports of a bidding war between Amazon (NASDAQ:AMZN), UnitedHealth (NYSE:UNH), and CVS (NYSE:CVS)

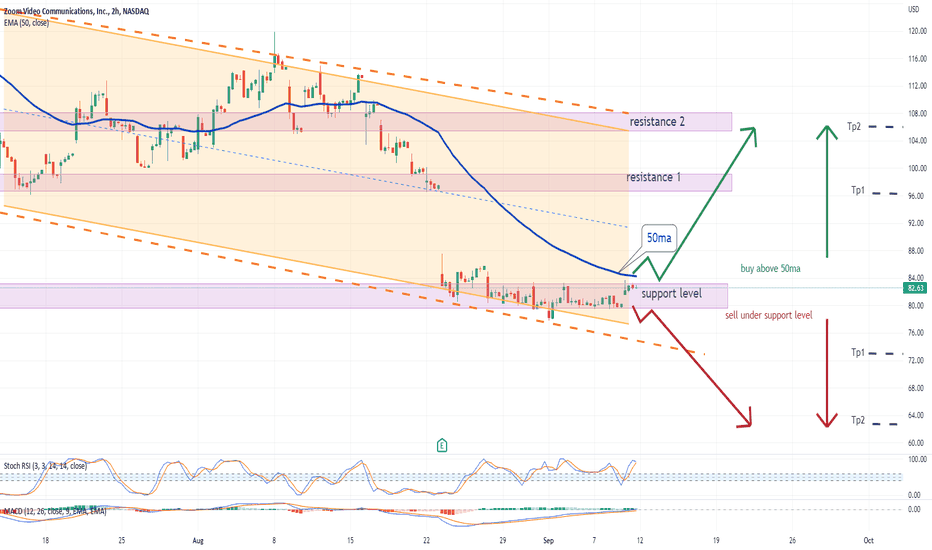

ZM - PUT Option PlayComing out of positive earnings (drop in revenue still) and still seeing this downward pressure, I expect there to be more downward move. Although RSI is oversold right now, I do expect a rejection at the $83 zone that I marked which is where I plan to scoop up a PUT option. (Not Financial Advice)

ZOOM - BEARISH SCENARIOBad news for ZOOM and its investors. Although the company reported better than expected EPS on Monday the shares dropped on expectations for weak results in the next earnings season.

The end of the COVID restrictions pushed people to return to work and rely less on video conference calls.

The next price target is located at the major support level of $60

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

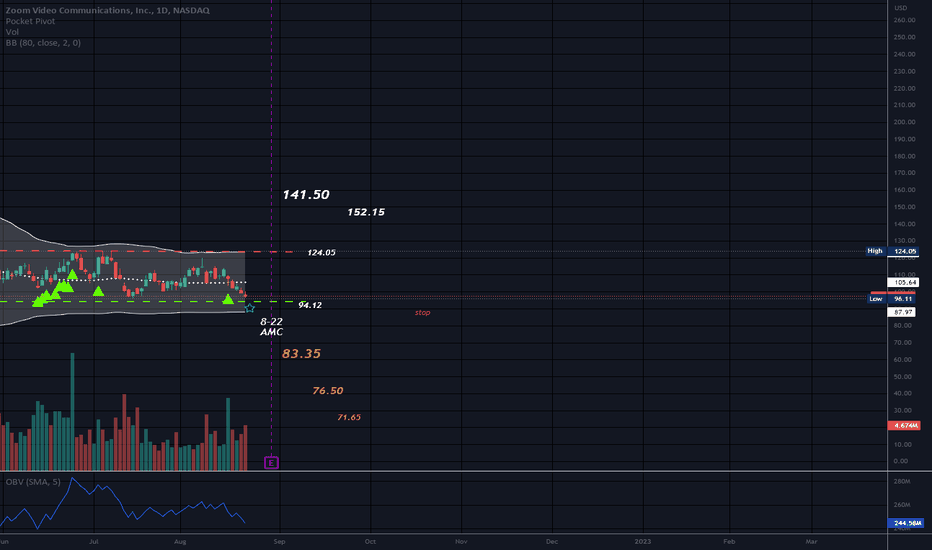

Earnings 8-22Rectangle

Earnings after market close.

No recommendation.

ZM is close to the bottom trendline. The top trendline is resistance.

Also, using some imagination, you could stretch this into an inverse H&S and top trendline would be the neckline.

Market is raining bullets so it is hard to think positive today.

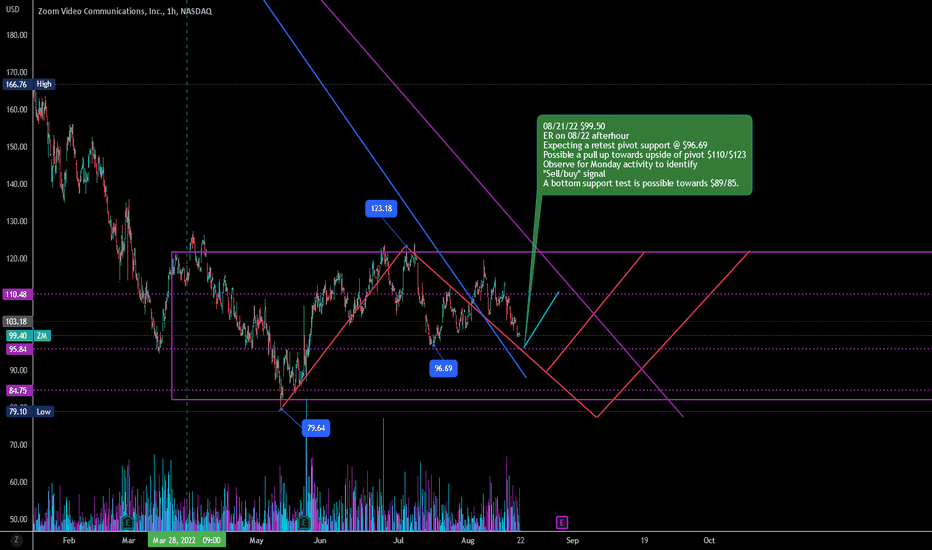

ZM Long short term and neutral in mid or long term Expecting a retest current pivot low $98s, then a pull up towards $110 with good ER report?

Observe for buy/sell signal by the afternoon.

On a mid-long term, more consolidation between $123-85 to be expected before decide new trend.

** Possible break through previous low $79.

$ZM -71% DISCOUNT (52-WK) -80% (ATH)!Zoom is a decent stock if you are thinking about adding a communication service stock to your watchlist/portfolio. It is currently showing a possible head and shoulders, but I think it has a way to go down after! The original Heavy buying positions is the $116 area!