VIRTUALUSDT trade ideas

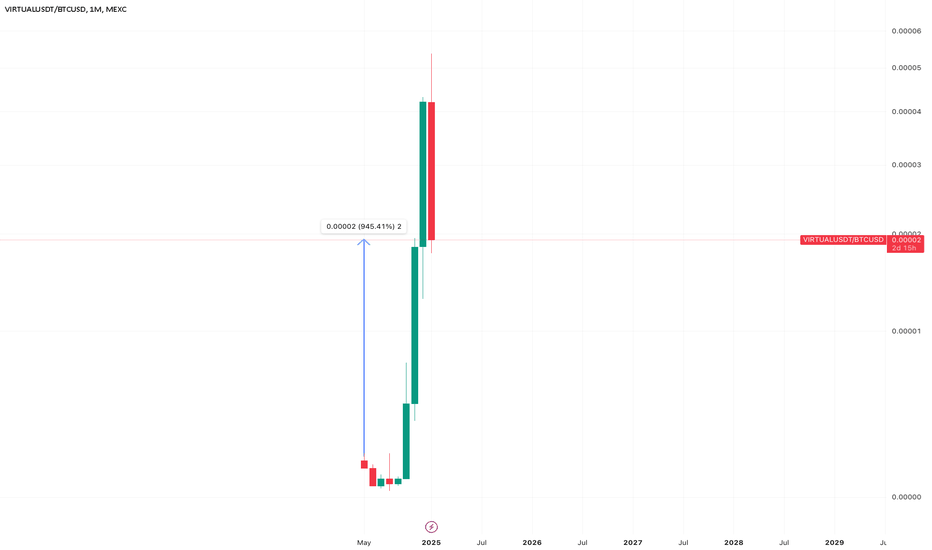

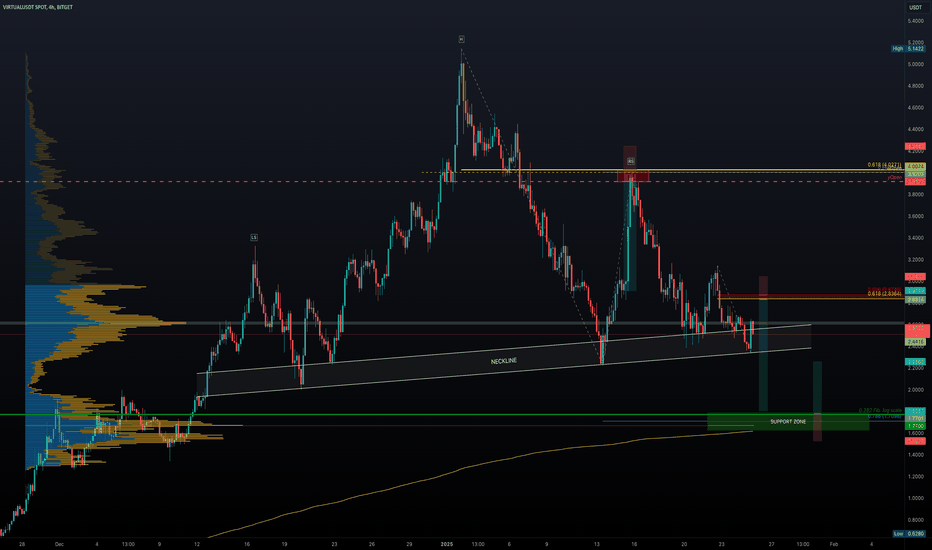

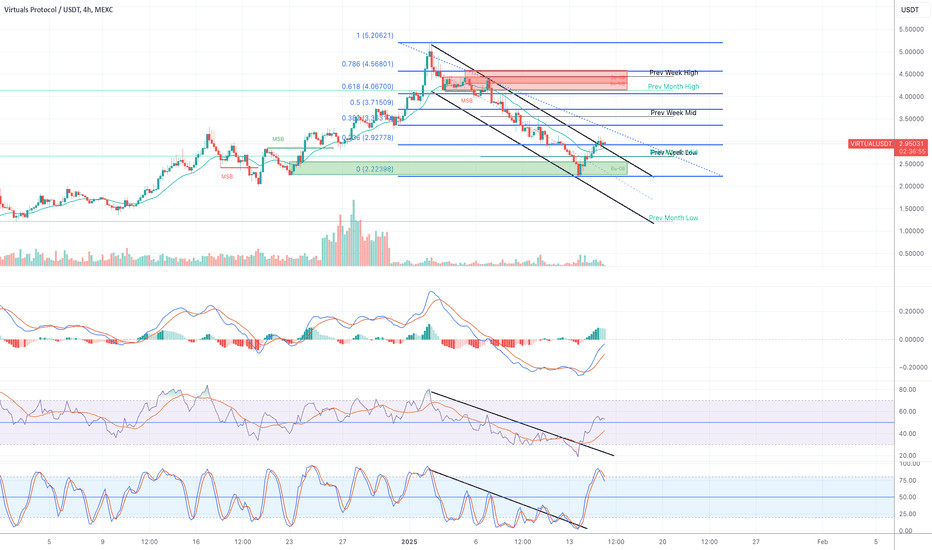

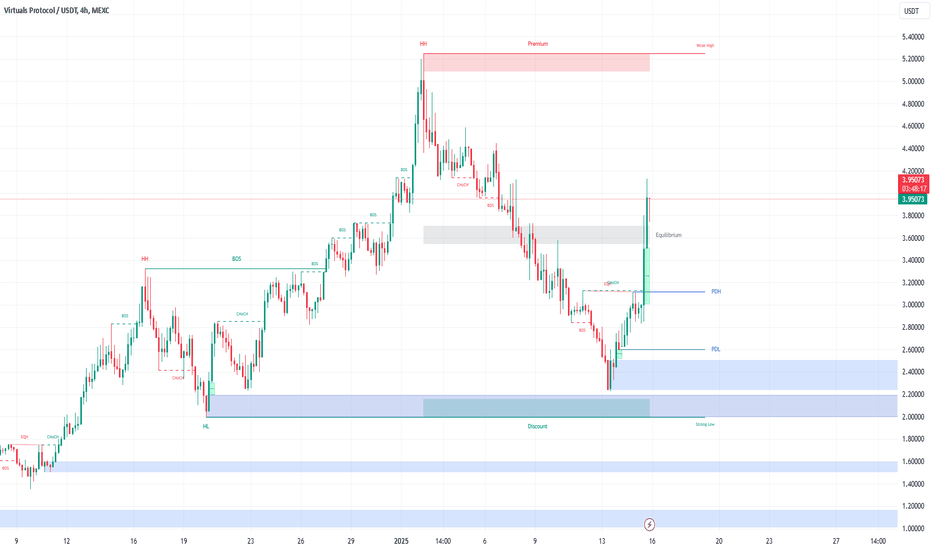

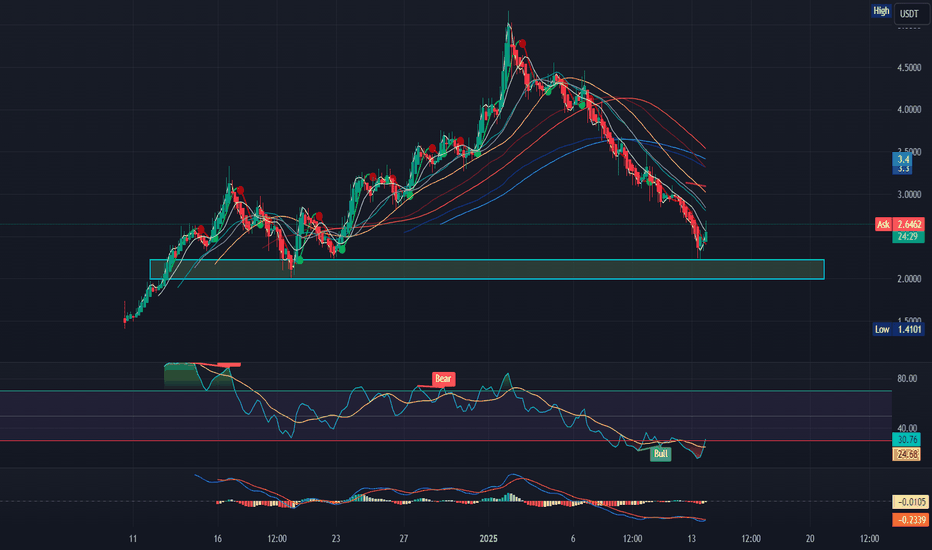

VIRTUAL - A Long Opportunity or More Pain Ahead?VIRTUAL has dropped over 50% from its all-time high of $5.14, now trading around $2.50. A head and shoulders pattern has formed, with price currently testing the neckline, a bearish sign that could signal further downside. Let’s break down potential targets and trade setups.

Key Levels and Support Zone:

1.) POC from December 2024 Range:

Located at $1.67, a significant level from previous trading activity

2.) Anchored VWAP:

Taken from the lows, currently around $1.62, reinforcing the $1.66 zone as strong support

3.) Fibonacci Retracement (Log Scale):

The 0.382 Fib from the recent wave sits at $1.77, providing additional confluence for the support area

4.) Trend-Based Fibonacci Extension:

The 0.786 Fib aligns at $1.71, further strengthening the $1.70–$1.80 range as a reliable support zone

Trade Setups:

Short Setup:

Entry: $2.836 (Fib retracement 0.618 from the current downtrend)

Target: around $1.80

Stop Loss: Above $3

Risk-to-Reward: 5:1

Potential Drop: 30–40% from the entry level

Long Setup:

Entry: $1.70–$1.80 range

Target: Depends on confirmation and take profit areas. A realistic initial target could be around $2-$2.30

Stop Loss: Below $1.52

Risk-to-Reward: 2:1 or better depending on take profit strategy

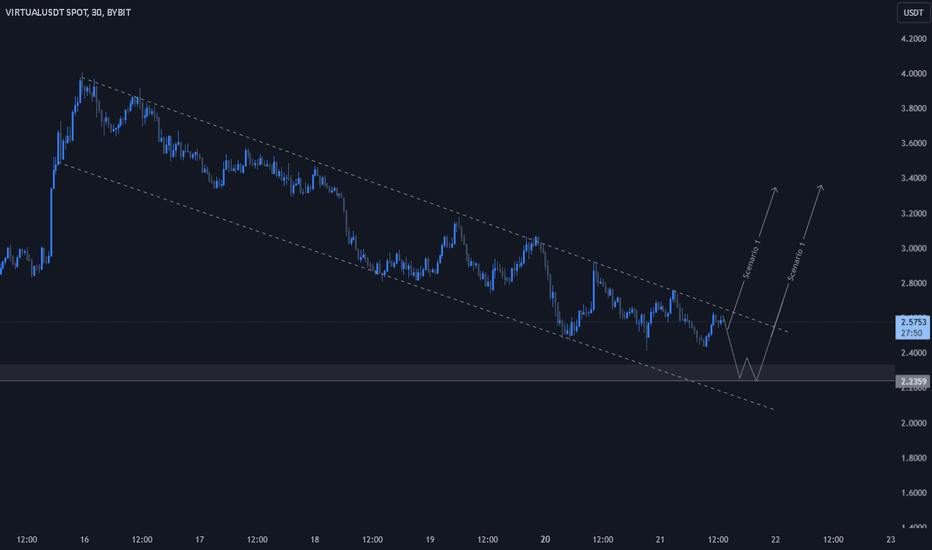

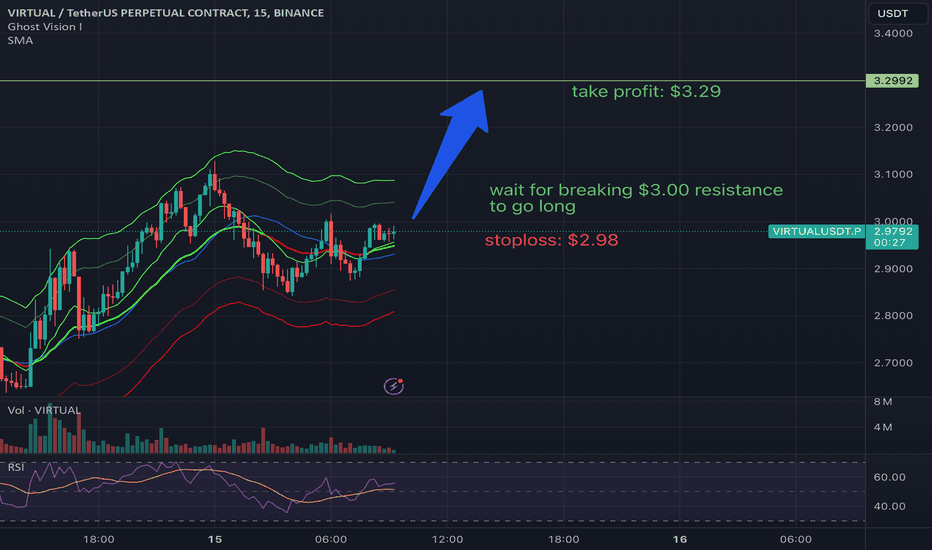

VIRTUALUSDT - Breakout WatchVirtuals looking ready for another breakout

Confluence of MACD crossover and a price move piercing the downwards resistance towards 3.1 could see a swift move higher.

Great R/R at this point with the whole Altcoin market cap rumbling higher before Trump takes office tomorrow with what's likely going to be a record number of day 1 executive orders.

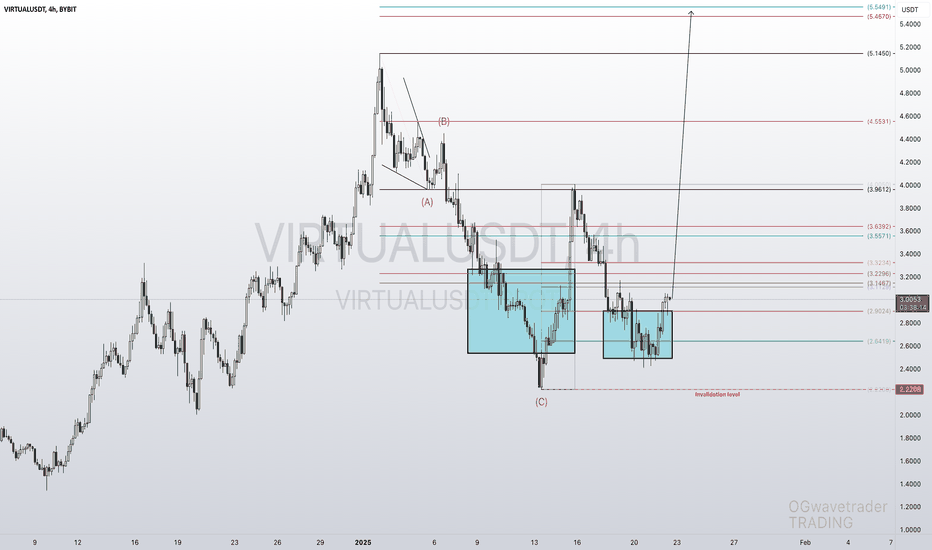

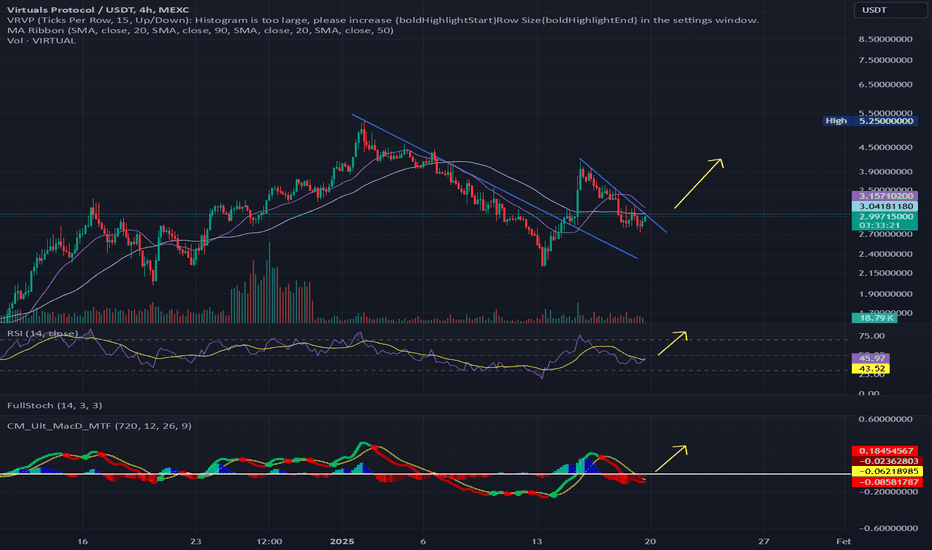

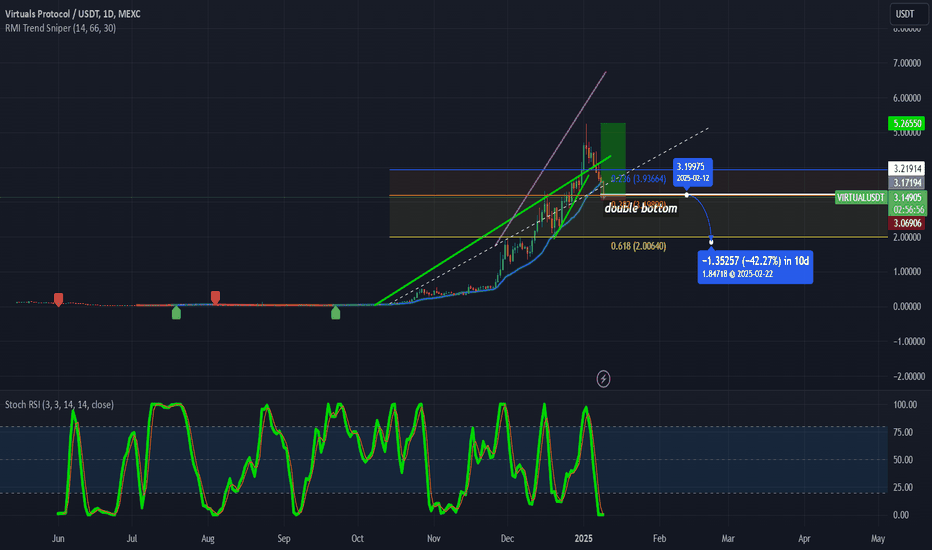

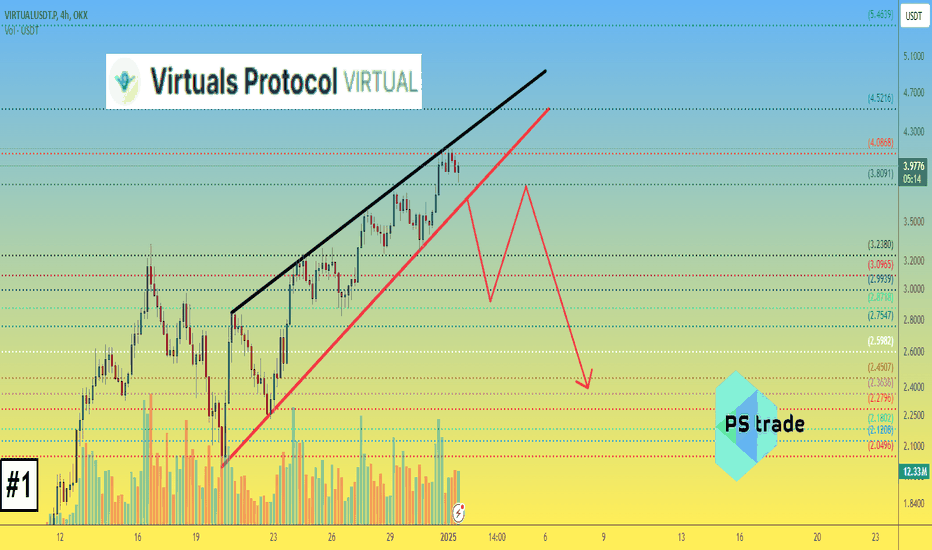

Almost time to buy, not yet! ! Yesterday, I published my analysis on Virtual protocol and wrote that I would buy when a certain conditions are met.

These conditions are:

1) Daily stochastics (9,3,3) reset and start to move upwards

2) Daily MACD remains above 0 level (bull zone)

3) 4H MACD lines cross and enter the bull zone.

4) 4H stochastics are not overbought territory (it is okay if the conditions above are met but it might experience a few more pull backs if stochastics are overbought)

5) 4H candle breaks and closes above the top descending parallel channel and stays and also it is above Fib 0.236.

In the last few days, the bull is starting to show some signs of strength. Daily stochastic has reset and now is moving back up. Daily MACD remains in the bull territory. Therefore, the environment to open a long position is now present. The price has moved and closed above the descending parallel channel as well as Fib 0.236 in the 4H chart.

HOWEVER, the 4H stochastics has already reached the overbought territory and rolling down before 4H MACD made it to the bull territory. That means, the first attempt for the bull run has failed. The price might move sideways between key fib levels for a while until the stochastic is reset.

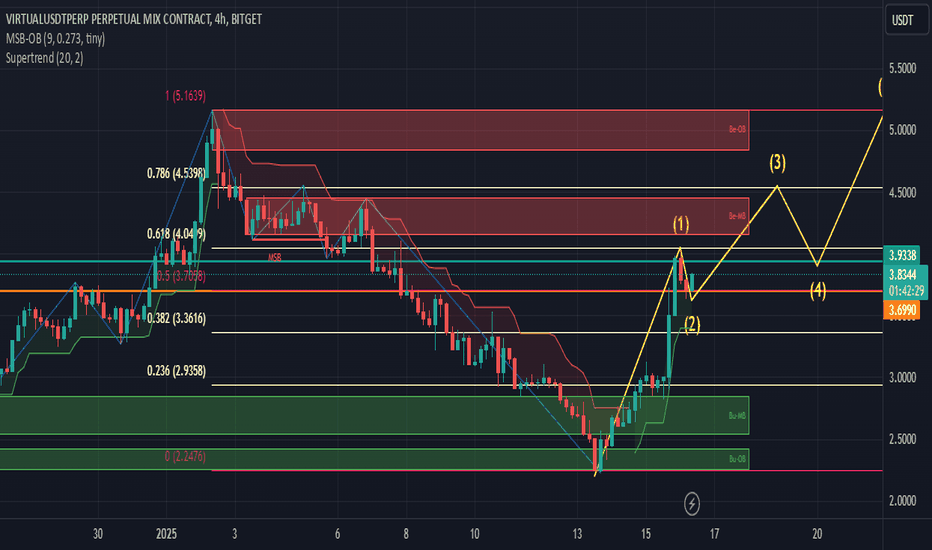

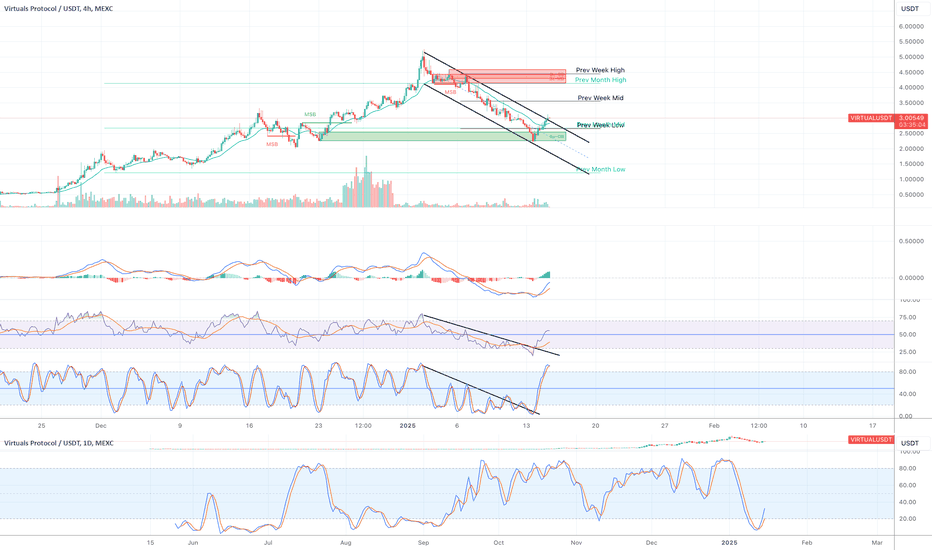

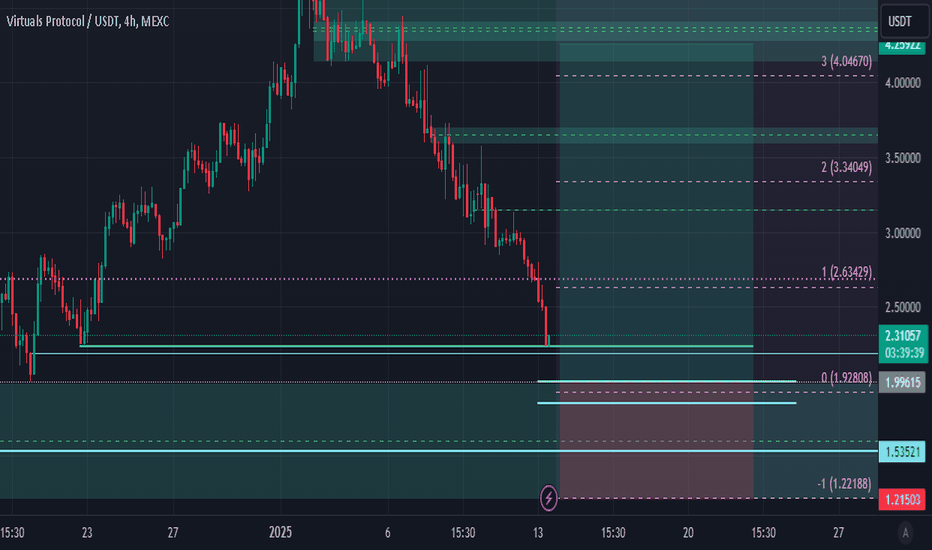

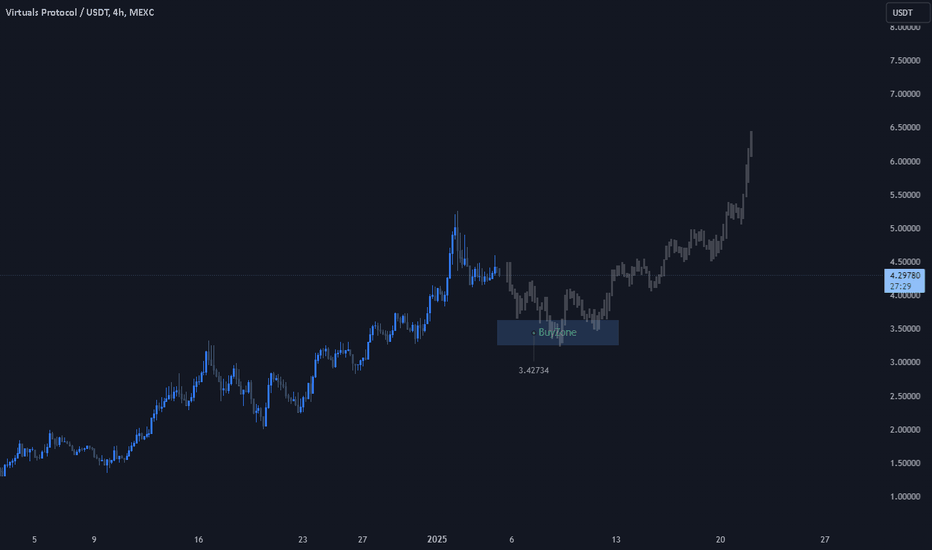

$VIRTUAL Rockets Past $3.20: Bulls Eye $5.00 Target!$VIRTUAL/USDT 4H Chart Analysis

Breakout confirmed: SPARKS:VIRTUAL has broken above the $3.20 resistance with strong volume, indicating bullish momentum and a potential trend continuation.

Current price: $3.95.

Key levels:

Support: $3.20 (recently established support following the breakout).

Resistance:

Target 1: $4.40 (next immediate resistance).

Target 2: $5.00 (extended resistance if bullish momentum continues).

Pattern: A textbook bottom formation has been completed, signaling a strong reversal.

Trade setup:

Entry: Current level ($3.95) or on a pullback near $3.60.

Target:

T1: $4.40.

T2: $5.00 (if momentum sustains).

Stop loss: Below $3.60 to minimize downside risk.

Risk-to-reward: Favorable R:R, particularly if the price sustains above $3.60 and trends toward T2.

Confidence level: 8/10, given the clean break of $3.20 resistance and volume confirmation

.

Considerations:

Volume confirmation: Ensure buy volume remains strong, especially near $4.40.

Momentum check: Watch RSI for signs of overbought conditions as price approaches $4.40-$5.00.

Resistance reaction: Be prepared for potential consolidation or rejection near $4.40 before targeting $5.00.

This setup suggests a strong bullish continuation if $3.60 holds, with clear upside targets in sight.

Long opportunity imminent? I am going to buy when the following conditions are met:

1) Daily stochastics (9,3,3) reset and start to move upwards

2) Daily MACD remains above 0 level (bull zone)

3) 4H MACD lines cross and enter the bull zone.

4) 4H stochastics are not overbought territory (it is okay if the conditions above are met but it might experience a few more pull backs if stochastics are overbought)

5) 4H candle breaks and closes above the top descending parallel channel and stays and also it is above Fib 0.236.

There are a lot of conditions to meet and it might take a while, but from my past experiences, when these conditions are met, the price start to move smoothly in the direction of my bias. I don't need to go through unnecessary emotional roller coaster.

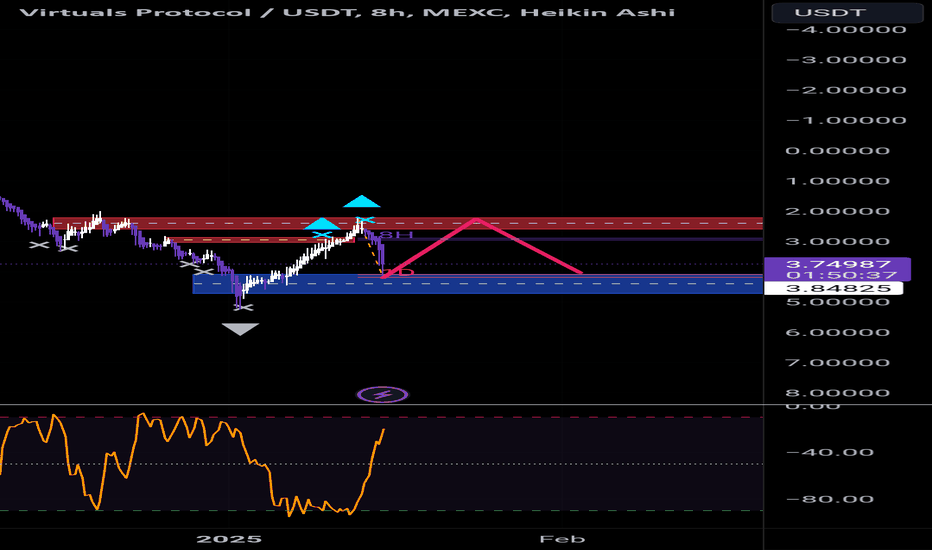

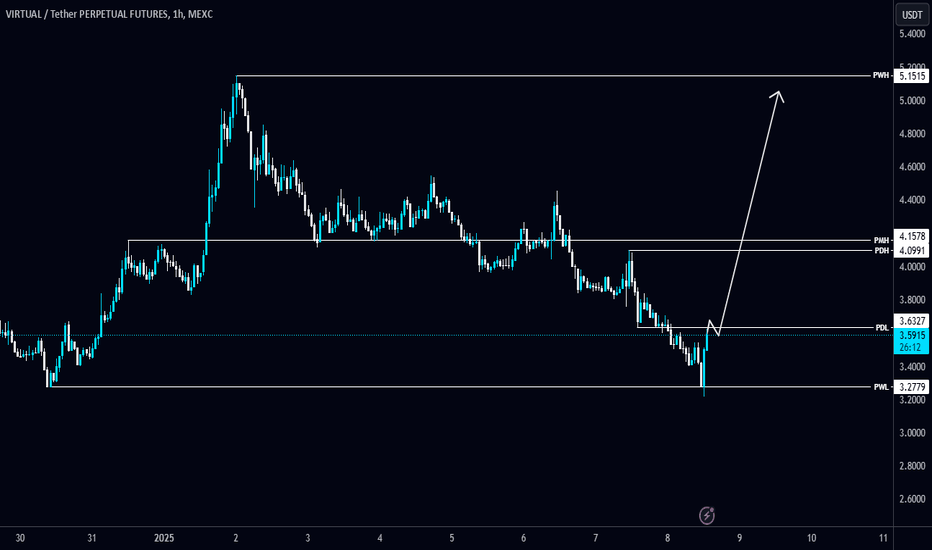

VIRTUALhuge correction of Virtual, it seems that the investors take lots of profit during this correction, but rn it seems that the door is open for the new investors and if you see, in 4h ft price it is oversold, RSI and MACD are showing strength and accumulation, i will wait couple of hours to see how market will act and probably i will open a small amount of money a long position.

lets wait and see, patience pays.

dyor + nfa.

always remember, never trust anybody, we are not market makers, we just try to fish what market gives to us.

Public trade #3 - #Virtual price analysis ( Virtual Protocols )🎄 While the whole world is moving away from New Year's celebrations, and most cryptocurrencies are lazily hanging out in consolidations

🥳 MM coins #VIRTUAL does not sleep, and the price of OKX:VIRTUALUSDT.P is going higher and higher in the sky)

🔽 But as soon as the price drops below the red trend line, longs may be hurt, and the festive mood will disappear.

#VirtualsProtocol

You can try to make your first purchases around $2.90.

But it is safer in the range of $2.40-2.40

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

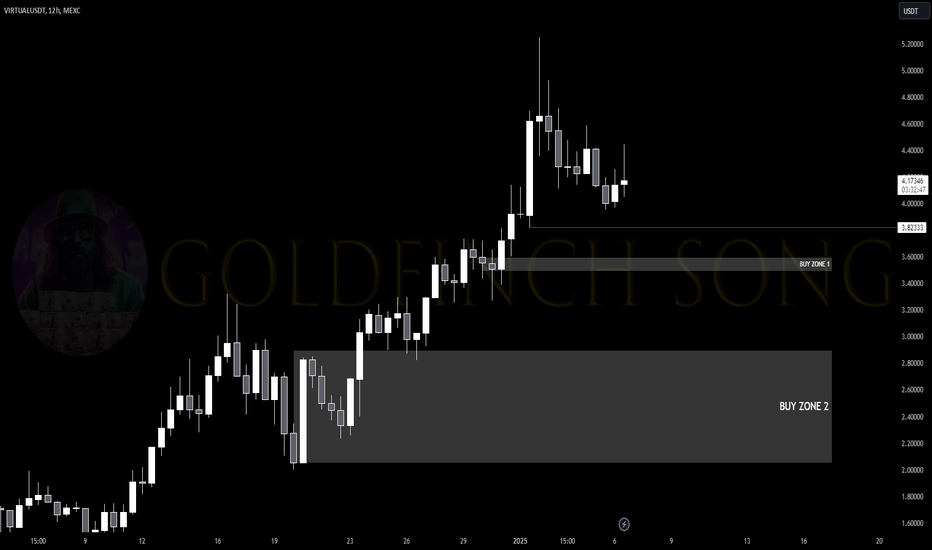

VIRTUAL Cooling Off After a Strong RallySPARKS:VIRTUAL has shown impressive growth recently, but momentum is fading. Daily RSI peaks are trending lower—not a bearish divergence, but a sign of cooling off and a likely correction.

Price is nearing an untested 12H demand zone (Order Block), a strong potential area for long positions.

Narrative and Market Outlook:

The AI narrative remains strong, yet a short-term "Dead Cat Bounce" followed by accumulation is expected before the next impulse move.

Deeper corrections could test significant support levels, potentially delaying recovery into March.

Strategy Moving Forward:

Focus on high-probability zones like the 12H demand area for entries.

Be patient—accumulation during corrections can set the stage for future upside.

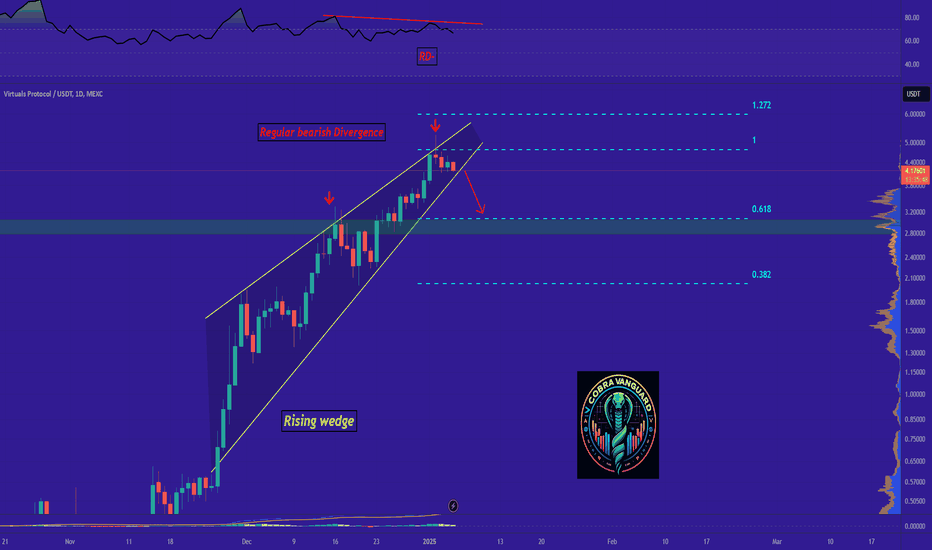

VIRTUAL IS BEARISH !!!!The price is in a wedge, and if it breaks the wedge, it can drop to the 0.618 Fibonacci line. Also, the bearish divergence in the RSI strengthens this signal.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

VIRTUALUSDT - My swing trade with lots of upside!BYBIT:VIRTUALUSDT

I've been trading this coin successfully in 1m - 15m charts from around 13-Dec-24. I've realised there is potentially a lot more upside and more gains to be had by switching to a swing trade and let it run.

I have started a swing position (see inside chart screenshot) on 31-Dec-24 and is currently up, using the liquidation level as my SL to allow the trade plenty of room to move.

Will adjust SL accordingly in the next few days depending on price action and trend.

Ai & OnChain Opportunities | Crypto insights for 2025How Base, Ai & Pump Fun Will Shape the Crypto Market in 2025

2024: A Milestone Year for On-Chain Growth

The year 2024 may prove pivotal for onchain development, potentially rivaling the "DeFi Summer." Narrative driven investment opportunities are expected to proliferate, fueled by the widespread adoption of the “everything can be a Meme” concept and the rapid asset issuance popularized by Pump Fun. Meme projects can now launch without requiring top tier centralized exchange (CEX) listings, with market caps in the onchain space reaching approximately $1 billion. This presents significant profit opportunities for ordinary users, with toptier CEXs serving as the final stage for cashing out on-chain investments.

Challenges for Established Assets

Rising tensions between VCCoin and its community have led to underperformance for new assets listed on major CEXs, while older projects struggle to stay relevant. Many such projects lack motivation or fail to adapt to market changes, often adopting a passive strategy while awaiting unlock periods.

Key Predictions for 2025

1. DEX/CEX Monthly Volume Ratio to Exceed 20%

In December 2024, decentralized exchange (DEX) trading volumes hit a record $320 billion, marking over 200% year-over-year growth. The DEX/CEX ratio rose from 9.6% in December 2023 to 11.7%, peaking at 13.9% during the year. Continued improvements in Web3 wallets and on-chain tools, spearheaded by CEXs, along with the growing appeal of the Meme sector, are expected to accelerate user migration from CEXs to DEXs.

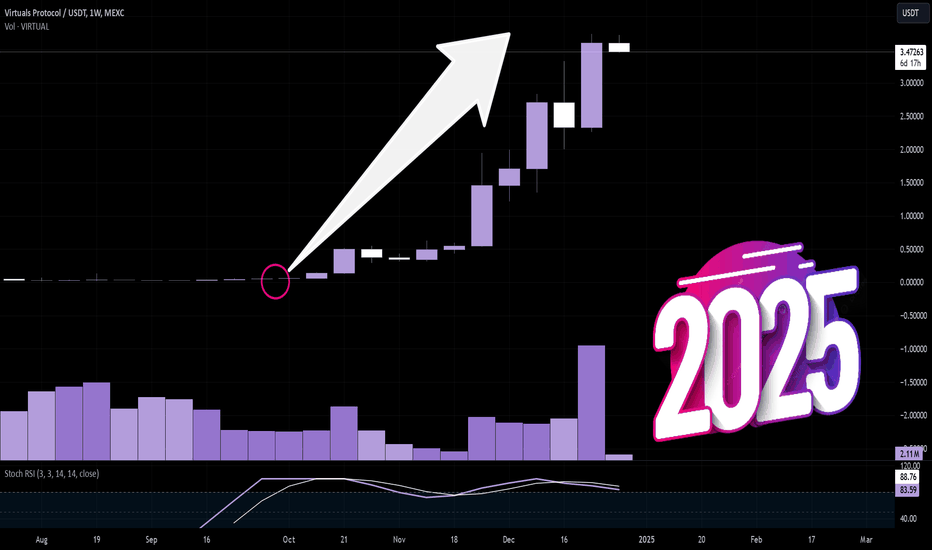

2. AI Agents/AI Meme Market Cap to Eclipse NFTs

AI Agents integrated with tokenization have emerged as the fastest-growing narrative, with the total market cap for related tokens reaching $12 billion. Frameworks like ai16z’s Eliza and Virtuals Protocol’s Game Framework have gained dominance, enabling rapid deployment of AI Agent tokens. Virtuals Protocol’s VIRTUAL token leads the sector with a $3.5 billion market cap, bolstered by a robust ecosystem of subtokens.

3. Emergence of Vertical Launch Platforms

The success of Pump Fun on Solana, a low-cost launchpad for issuing Memecoins, has inspired similar platforms across other networks. Specialized vertical platforms like vvaifu (AI Agents) and Pump Science (DeSci) are gaining traction. The expansion of the “everything can be a Meme” narrative is expected to drive demand for more niche launchpads.

4. Base Ecosystem Tokens to Debut on Binance

The Base network, an Ethereum Layer 2 developed under Coinbase, is predicted to have at least five native tokens listed on Binance’s spot market. With a concentrated ecosystem led by Virtuals and Farcaster, Base is positioned as a key contender for listings. Integration with Coinbase Wallet and the potential for favorable U.S. policies could enhance its competitive edge.

5. Hyperliquid’s Spot Market to Drive Wealth Effects

Hyperliquid, leveraging its HYPE token airdrops and novel asset standards (HIP1 and HIP2), is positioned to create exclusive wealth-generation opportunities. Projects like Solv Protocol and Azuki Anime have utilized its spot listing auctions, attracting significant interest. HYPE’s value, while substantial, will benefit from increased trading volume and partnerships with exclusive projects.

These projections reflect growing innovation in onchain development, with decentralized finance, AI tokenization, and specialized launchpads driving the next phase of market evolution.