WIFUST trade ideas

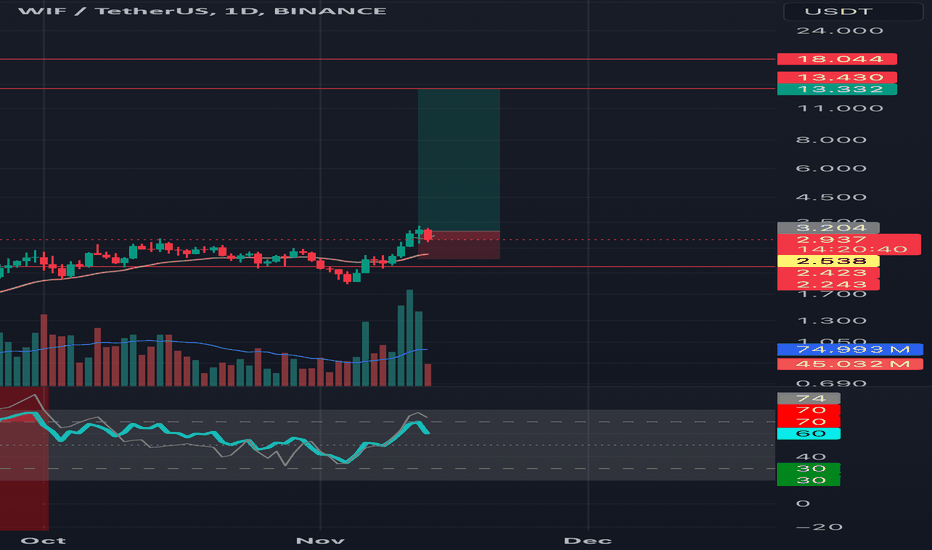

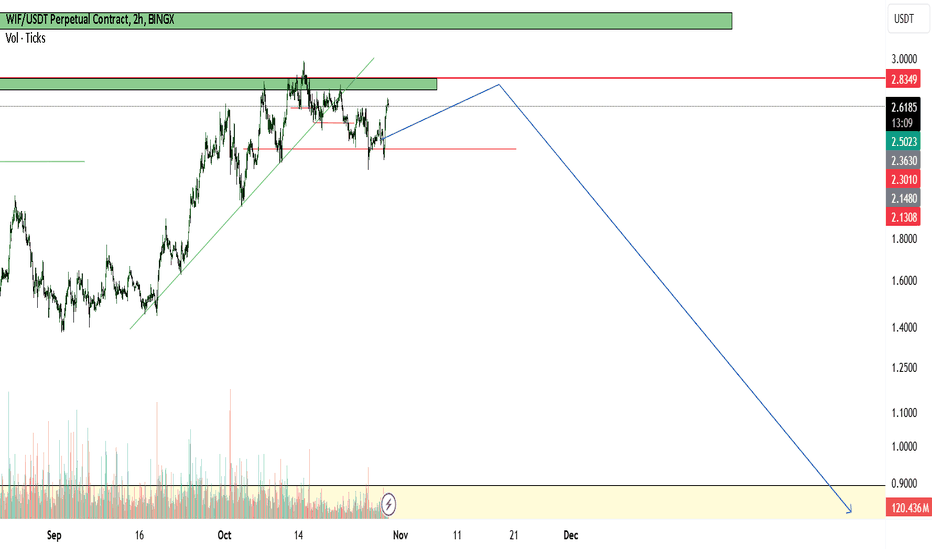

DOGWIFHATKeeping it simple and I believe this is a high probability short here.

Entry as close to $3 as possible. I am in at $2.93

Its a worthless dog in a hat meme. It does nothing. Its a picture of a dog in a hat.

Its hit the target of an Adam and Eve pattern breakout. We have daily RSI bearish divergence. Higher highs in the chart and lower highs in the RSI.

First TP is $2.65 My final target is between $2.11 and $1.99

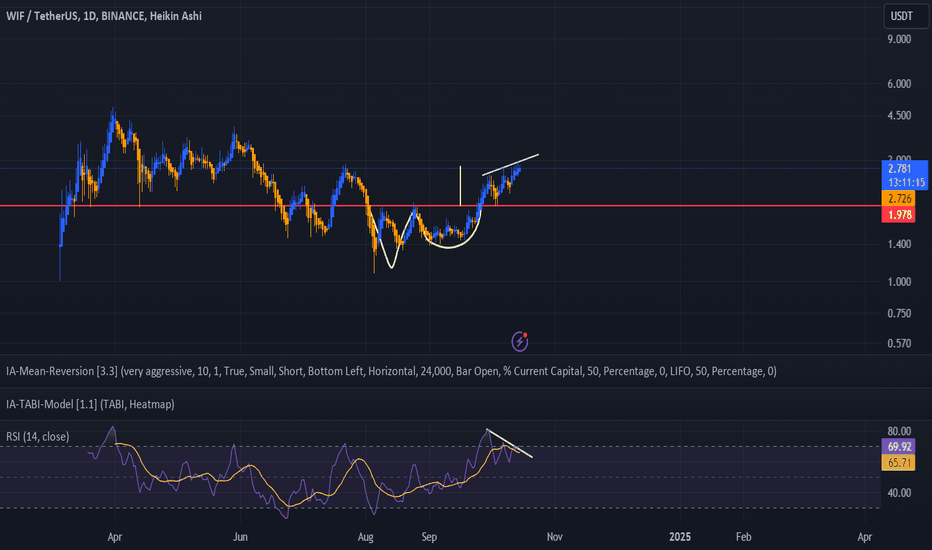

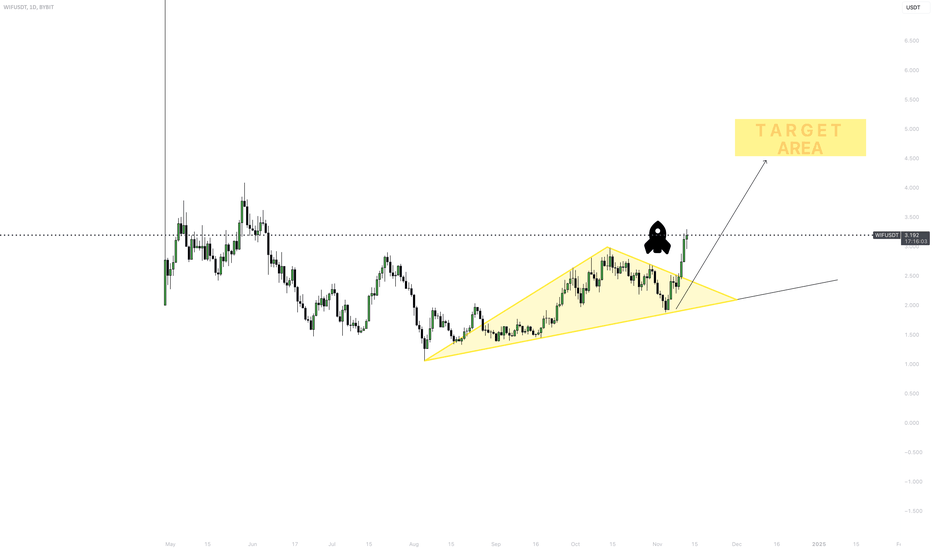

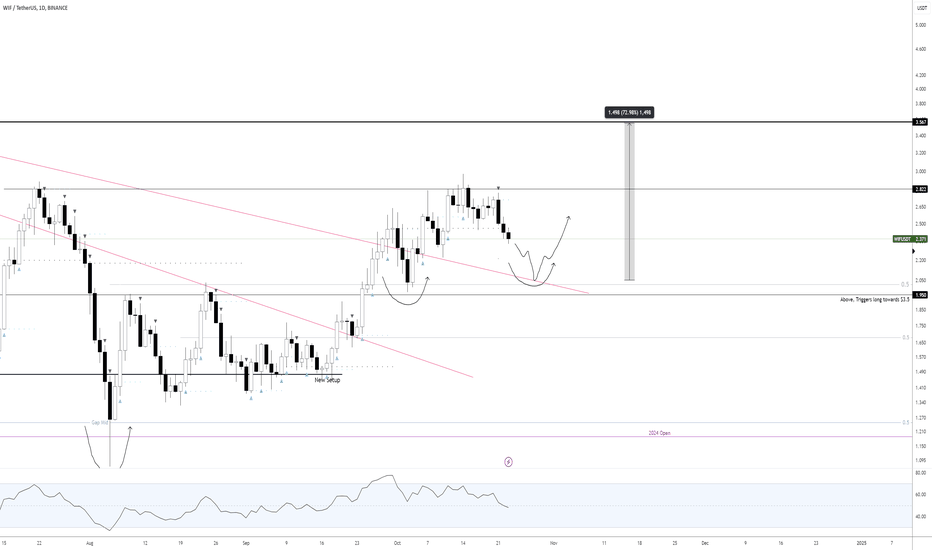

Attention WIFUSDT Fans! 🚀🚀 Attention, WIFUSDT fans! 🚀🚀

This chart might look like pure art, but it's actually the Picasso of all bullish setups. The only indicator I’m rocking here? That trusty rocket icon—'cause nothing says "ready for liftoff" like a little fuel emoji power!

Here's my 7-12 week breakdown: WIFUSDT is aiming for the stars, with a solid target of $4 to $6. This isn't just a casual hike; this is a serious moon mission. Think of it as WIFU booking a one-way ticket to the stratosphere.

So, if you're ready for what might just be the most (self) educated guess in crypto history, buckle up!

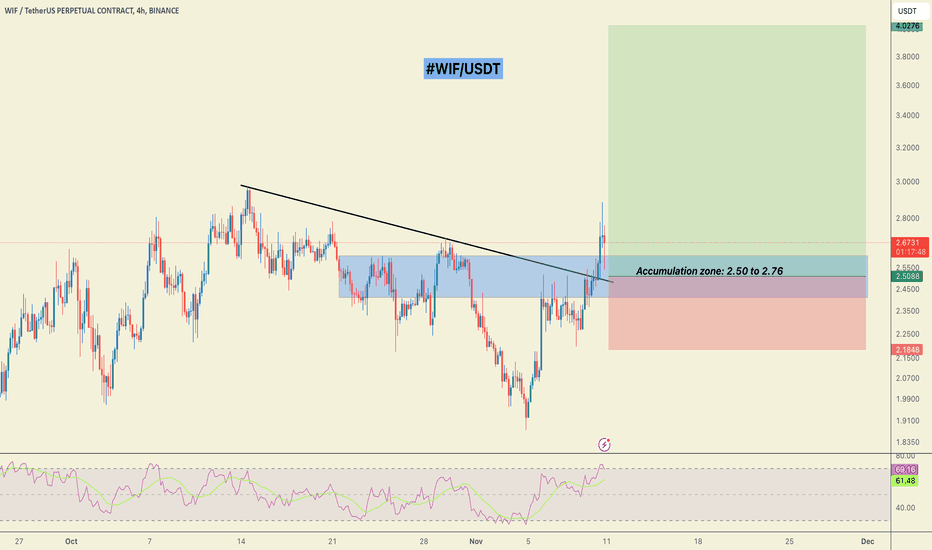

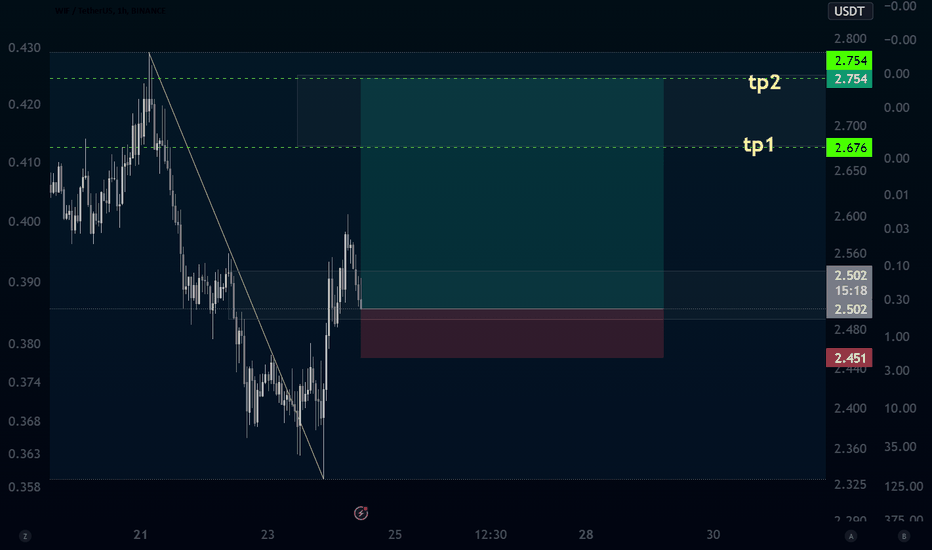

#WIFUSDT Lucrative Futures Trade Setup!WIFUSDT Lucrative Trade Setup!

- Entry: $2.50 to $2.73

- Stop Loss: $2.18

- Targets:

- $2.95

- $3.15

- $3.44

- $3.78

- $3.92

- $4.03

- Leverage: Adjust based on your risk appetite; 3x leverage is recommended.

DYOR, NFA

If you want me to post more setups, follow me and please hit that like button.

Thank you

#PEACE

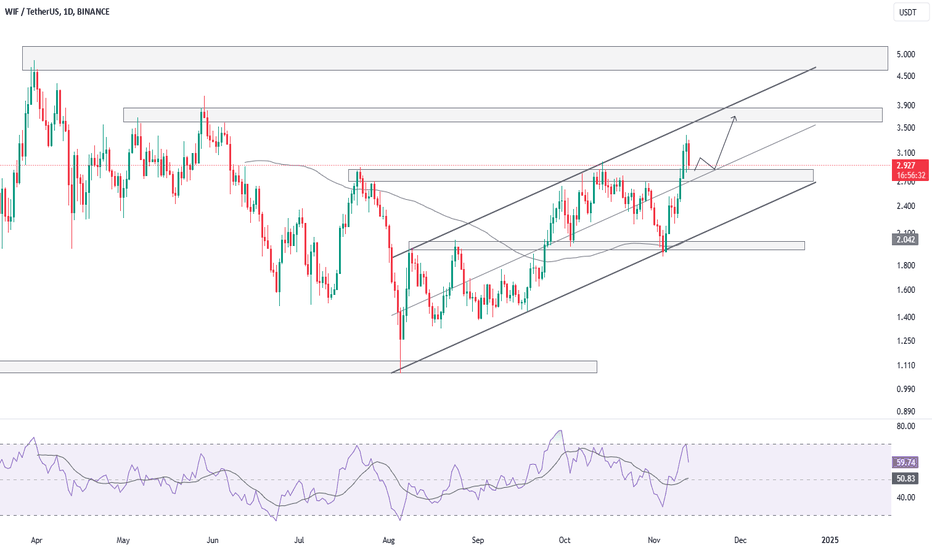

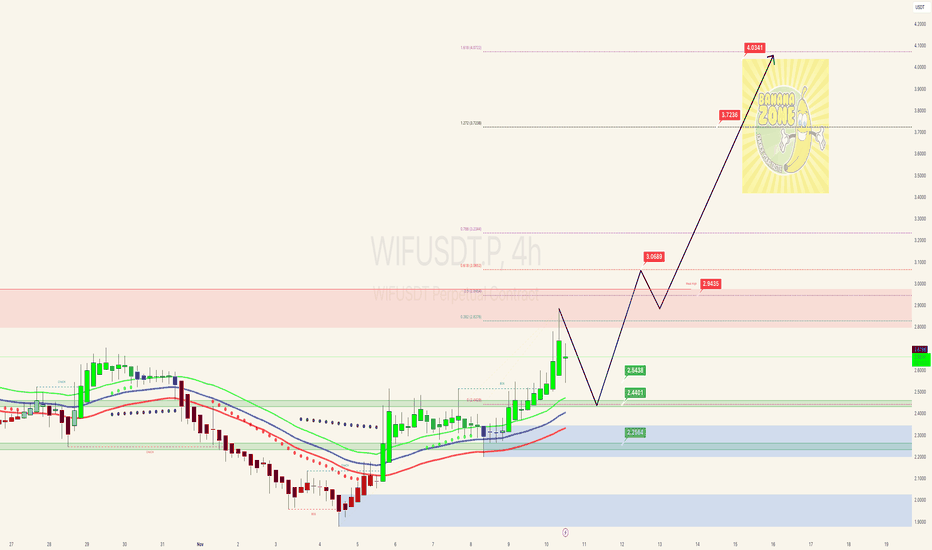

The Banana Zone Series - WIF Buy the Dip Levels (7 of 10)Alt-season is here. BTC breakout has been confirmed. If you missed positioning for the next level of exponential moves, what are some of the buy the dip zones while still have time for the bigger moves into the banana zone.

We continue the series with WIF.

As you can see in my analysis, pull backs to $2.45 and below is my new accumulation zone. I will initiate some leveraged longs for new trades in preparation for the moves to the banana zone in the alt season.

For more aggressive traders, $2.55 and below can be the trigger longs with tight stops.

Not a financial advice so DYOR.

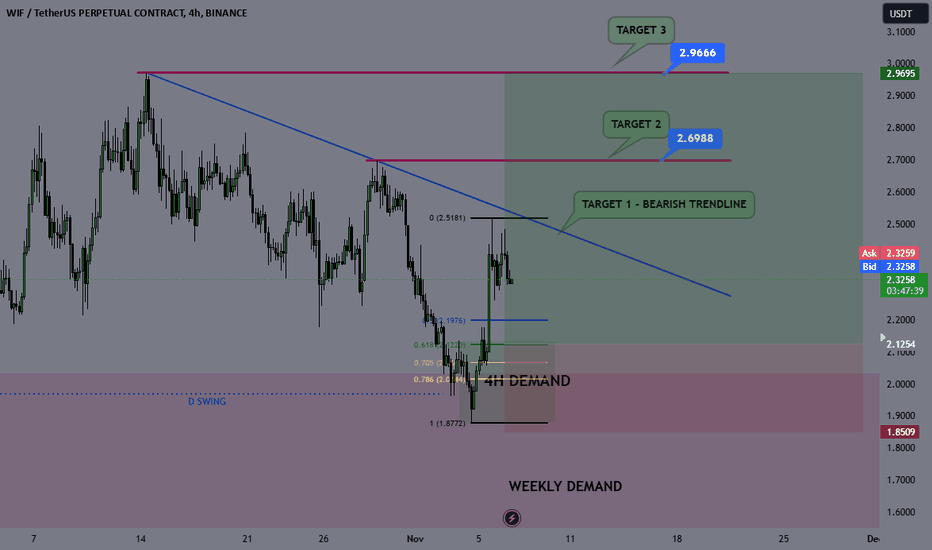

WIF COIN LONG OPPORTUNITY - Solana Memecoin WIF is one of the top memecoins on the Solana blockchain. It often shows strong momentum, especially when Solana is moving upwards. Watching WIF can be useful for tracking both Solana’s trend and the memecoin market.

Technical Analysis: The price recently ran the daily swing liquidity and tapped into the weekly demand zone, where it faced strong rejection and began an upward move.

We also saw rejection near the bearish trendline that has influenced the downward trend over the last few weeks.

I’ll be looking for lower time frame confirmations around $2.12, which aligns with the 4-hour demand zone and Fibonacci retracement discount level.

Stop Loss: $1.85

Target 1: Bearish trendline

Target 2: $2.69

Target 3: $2.96

Technical Analysis and Future Forecast for Dogwifhat (WIF) MemeOverview: Dogwifhat (WIF) has garnered significant attention in the memecoin sector, especially following the successful launch of the DOGS token. This momentum suggests a prevailing trend favoring dog-themed cryptocurrencies during the current Bitcoin bull run.

Price Targets:

Target 1 (T1) : $5.67

Target 2 (T2) : $8.77

Target 3 (T3) : $12.00

Technical Indicators:

W.ARITAs™ Indicator: Our proprietary W.ARITAs™ algorithm , which employs advanced quantum theory techniques to detect irregularities in large datasets, forecasts a strong bullish trend for WIF.

On the 2-day timeframe, the indicator remains in the 'Lime Green' zone, indicating sustained bullish momentum.

Momentum Assessment: Since its launch, WIF has exhibited robust upward momentum, aligning with the broader market's positive sentiment towards memecoins.

Market Correlation: Historically, memecoins have shown a positive correlation with Bitcoin's performance. As Bitcoin approaches the $95,000 mark, we anticipate a corresponding surge in WIF's price, potentially reaching our projected targets.

Conclusion: Based on our comprehensive analysis, supported by the W.ARITAs™ indicator and current market dynamics, we project that WIF is poised for significant growth. Investors should monitor the outlined price targets and consider the prevailing bullish indicators when making investment decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consider their risk tolerance before making investment decisions.

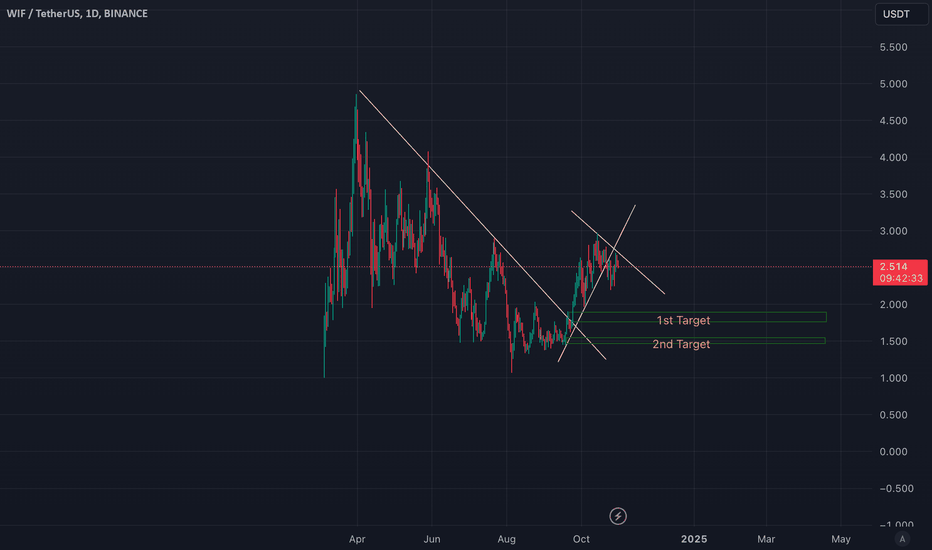

WIF at $2: A Bargain OpportunityI had to create a new post on this one. There are good chances this week and the next will see sell-offs leading up to the election date.

I'm interested in buying below $2, even if it seems unlikely to reach that level. It’s a price point I’d feel comfortable bidding at, rather than entering in the middle of nowhere.

If it goes below $2, it will clearly invalidate this setup, so I want to position myself closer to my ideal entry levels.

Let’s set alerts and wait patiently.

CRYPTOCAP:WIF

WIF Weekly#WIF Weekly

CRYPTOCAP:WIF is currently accumulating below the mid-resistance👀

Overall it's a massive bullish flag🔥

Short-Term I am looking for ranging between mid-resistance & demand zone, then get ready for breakout🚀

🎯mid-term target - 3$

🎯mid-term target - 3.5$

🎯long-term target - 4.5$

🎯long-term target - 6$

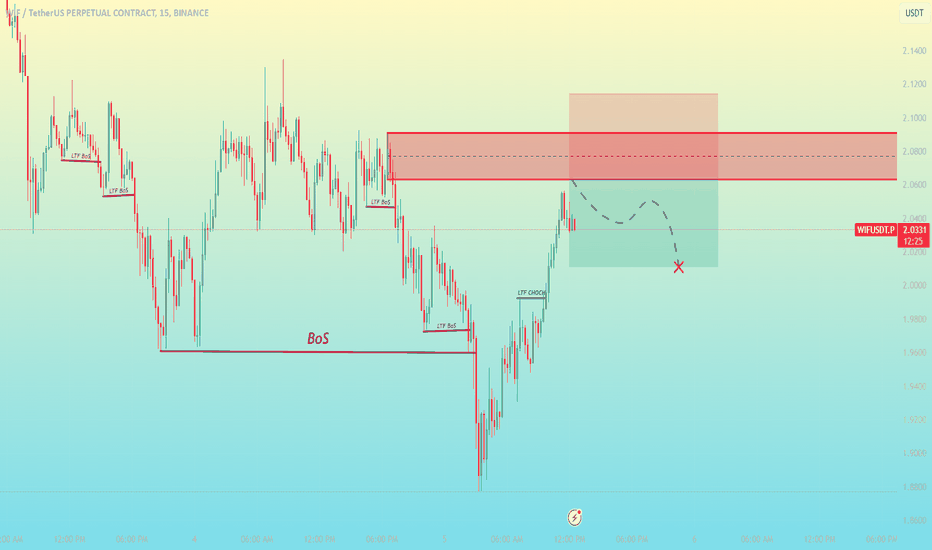

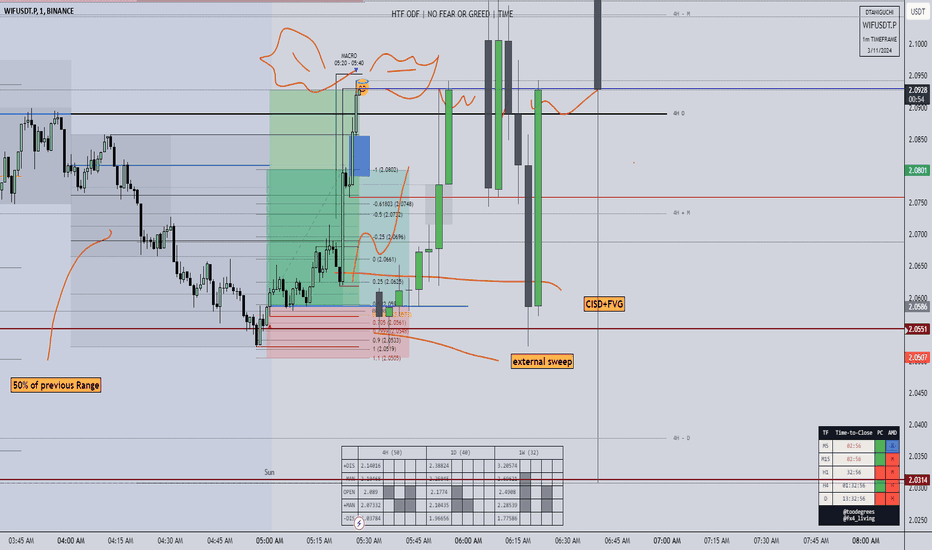

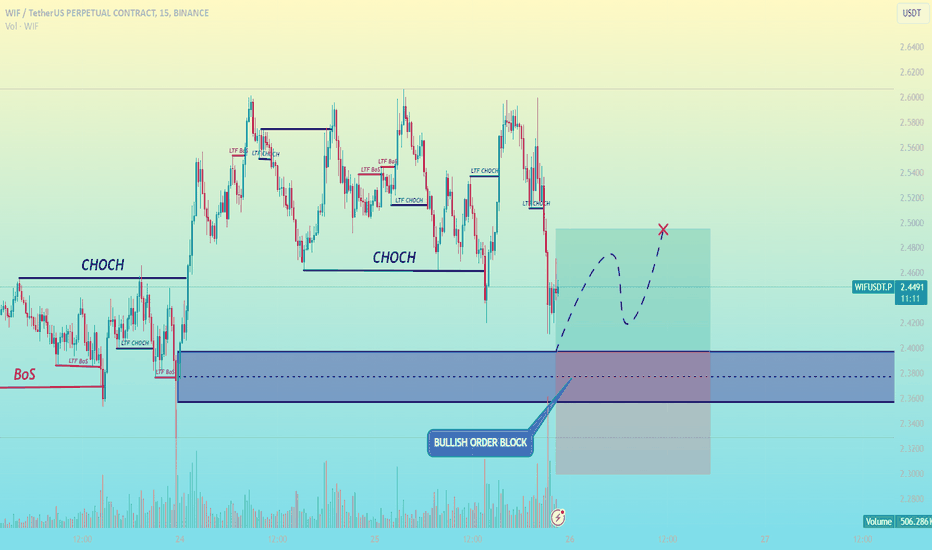

WIFUSDT.P / LONG / M15WIFUSDT may fall from the Bearish Order Block

Bearish Order Block: 2.0909 and 2.0632

WIFUSDT is likely to fall from the bearish order block, with a high probability that this trade will end in profit. Let’s monitor how the price responds in this zone.

WIFUSDT.P / LONG / M15

LEVERAGE :- 75X

Entry Price :- 2.0628

Stop Loss :- 2.1143

Take Profit :- 2.0113

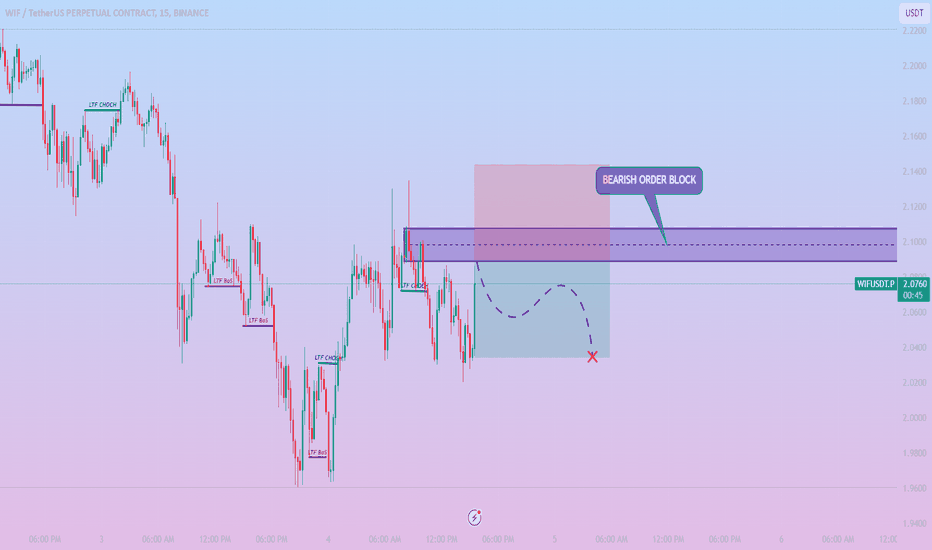

WIFUSDT.P /SHORT / M15WIFUSDT may fall from the Bearish Order Block

Bearish Order Block: 2.1078 and 2.089

WIFUSDT may decline from this bearish order block, with a high probability that the price will move in our anticipated direction. I’ve used Smart Money Concepts (SMC) for chart analysis. Let’s see how the price reacts in this area!

WIFUSDT.P /SHORT / M15

LEVERAGE :- 50X

Entry Price :- 2.0890

Take Profit :- 2.0345

Stop Loss :- 2.1435

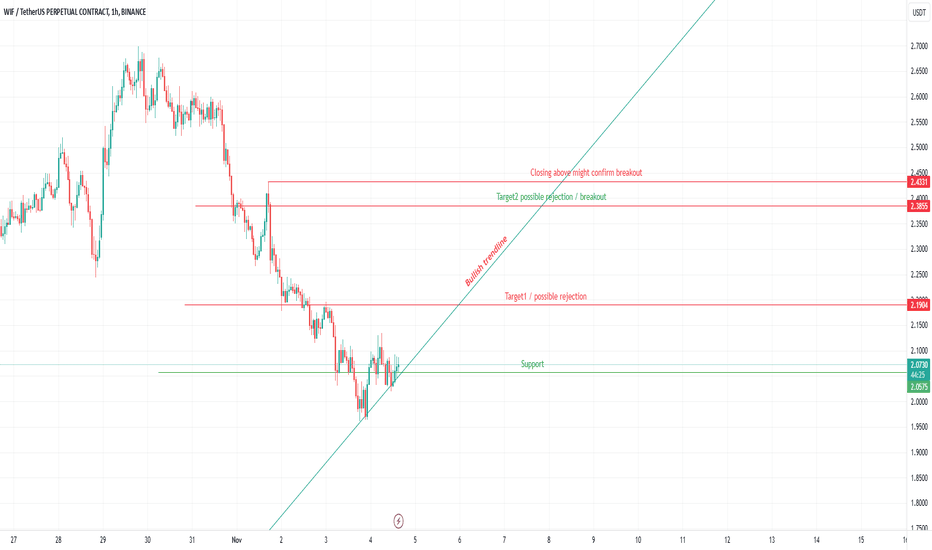

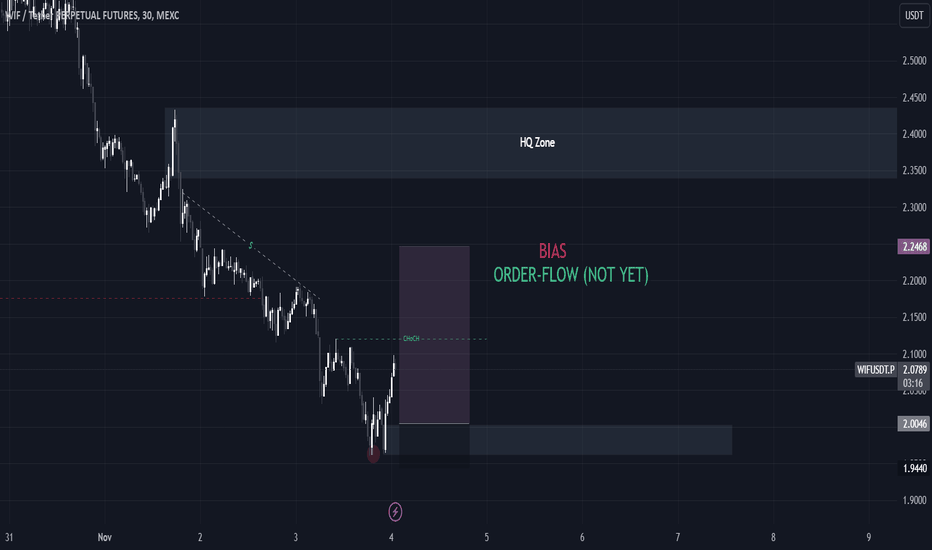

WIFhello to everybody and hope you are all doing well.

in tonight's analysis, we are looking at WIF.

the price recently shifted bearish after a fake change of character to the upside and is currently going for a pullback towards the upside and in the long term potentially take us lower.

We can use this pullback in our use and actually take a long trade towards the upside.

we are currently waiting for the price to have an M15 change of character and look to buy toward all of the liquidity below the zone that the price could potentially sell-off.

all those liquidity pools in the chart as shown are our potential zones to target so as soon as the price shifts bullish in micro time frames I will set an order at the zone shown on the chart and take a 1:4RR.

Remember to use the proper risk management system and stay profitable.

thank you and have a good night

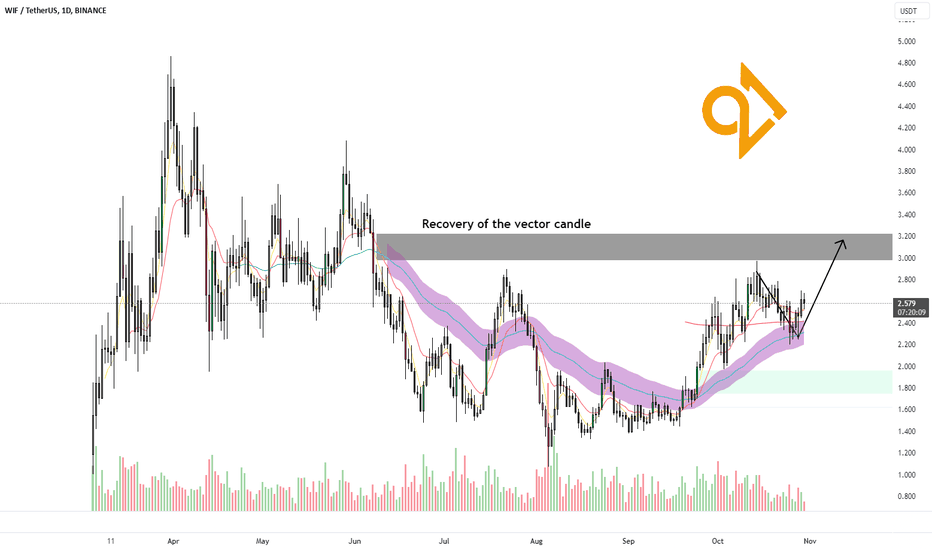

25% Possible Gain on WIFWe have made a reversal down to the EMA50 in the last few days and it looks good so far if we hold it. An interesting point is the $3.2 zone, where a lot of liquidity is expected. This could lead to a price increase of up to 25%. Mark the zone on your charts. You will see how the price will soon interact with it.

WIFUSDT / M15 / LONGWIFUSDT Potential Upside from Bullish Order Block

Bullish Order Block: 2.3972 to 2.3573

WIFUSDT is nearing a bullish order block, indicating a potential upward move from this level. Let’s wait for the price to reach the order block before considering a position. Once it touches, we’ll look for confirmation of an upward trend. Let’s see how the price reacts at this zone.

Entry Price :- 2.3974

Take Profit :- 2.4950

Stop Loss :- 2.2998

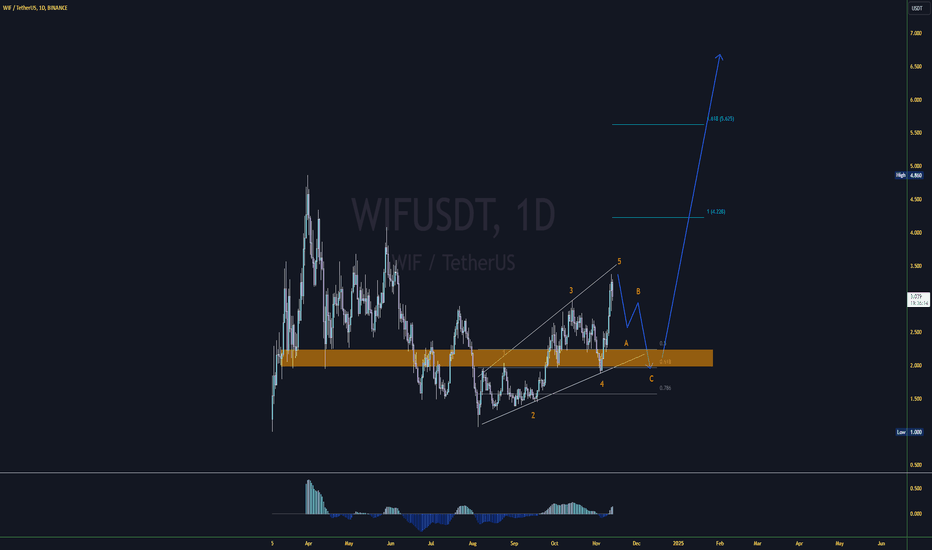

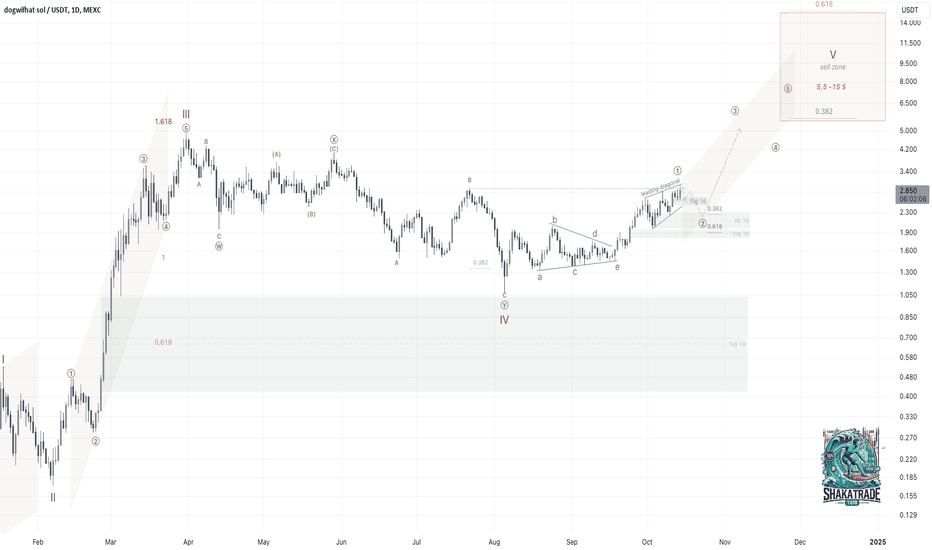

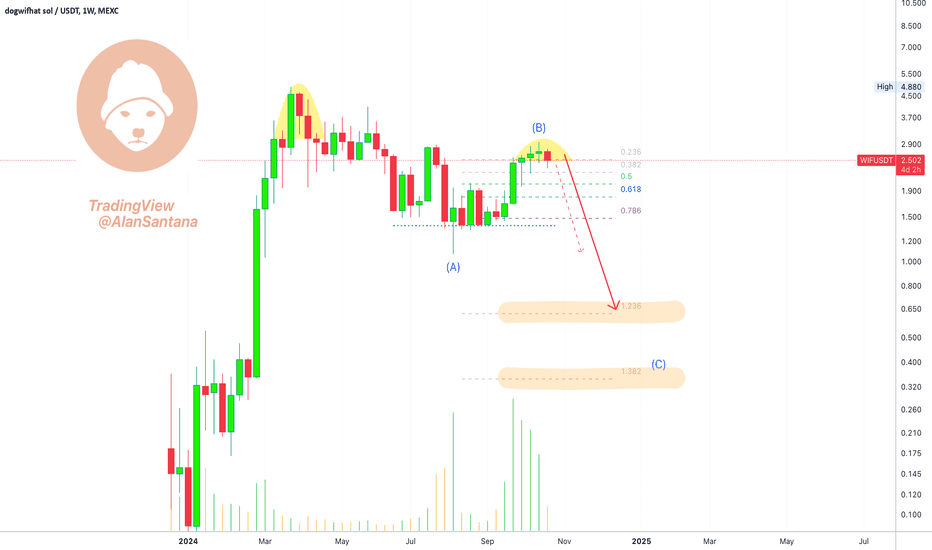

dogwifhat Correction Alert! (You've Been Warned!)I see five green weeks leading to a lower high (Doji) with decreasing volume each week and then the action turning red. This is happening after dogwifhat (WIFUSDT) peaked in late March 2024. So the five green weeks after a rounded bottom counts as an inverted correction which is over, and once a correction is over we get an impulse.

The initial and main move is the decline that started in March, so, we are about to experience the continuation of the bearish impulse, the resumption of the downtrend; dogwifhat is about to crash.

Thank you for reading.

Namaste.