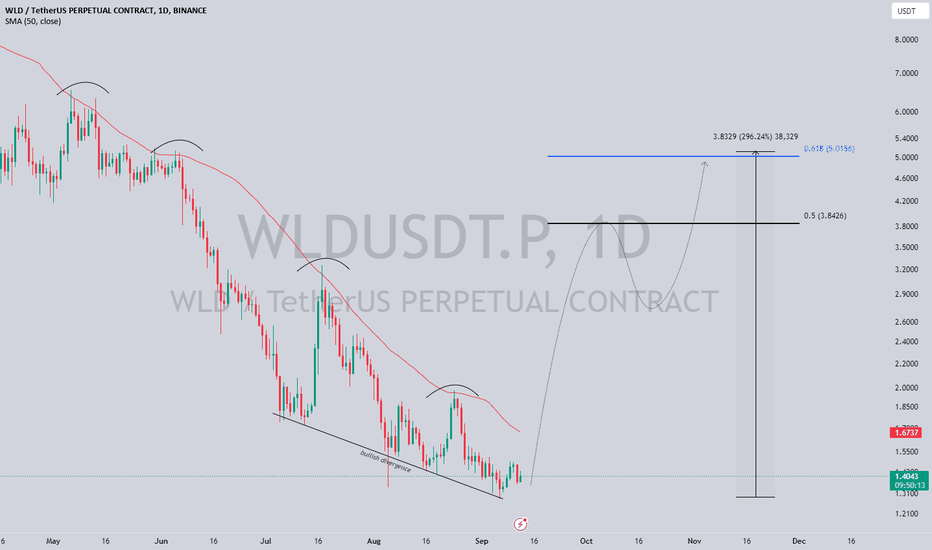

WORLDCOIN to $5?WLD has the worst tokenomics right now and is programmed to slow rug 📉🩸.

WLD currently has a daily unlock of 3.4 Million tokens ($4.75 million) and monthly unlock of 102 million tokens ($140 million).

Worldcoin investors receive 1.3 million WLD daily and worldcoin team receive 1.8 million tokens daily 💩. That's a high sell pressure of $140 million monthly considering that MIL:WLD circulating marketcap is only $600 million.

👉 I think short-term pump and dumps should be expected more often on WLD to attract buyers for exit liquidity but for long-term price forecast.

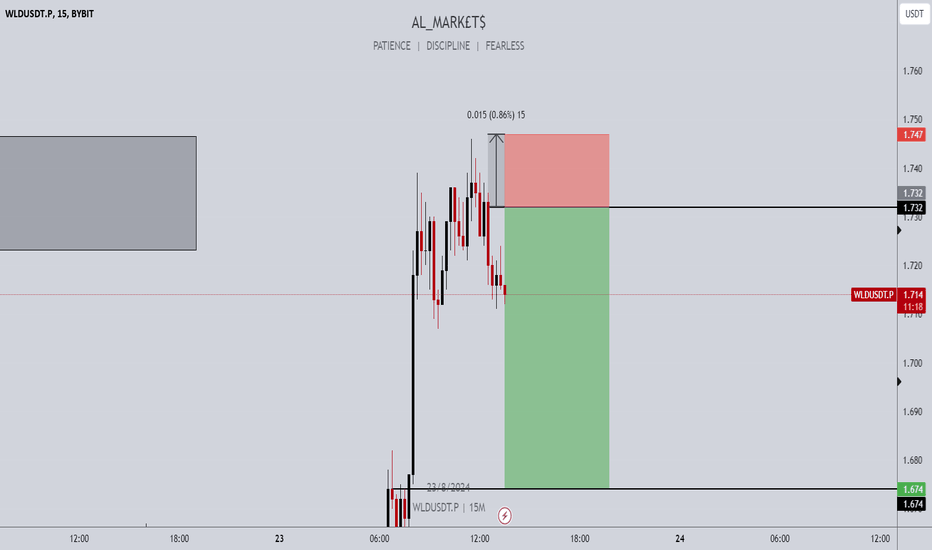

WLDUSDT.PS trade ideas

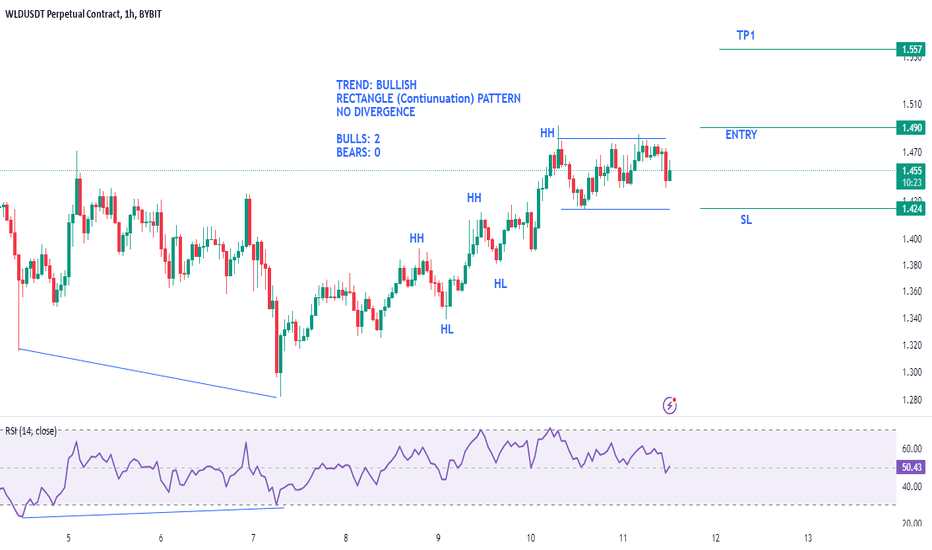

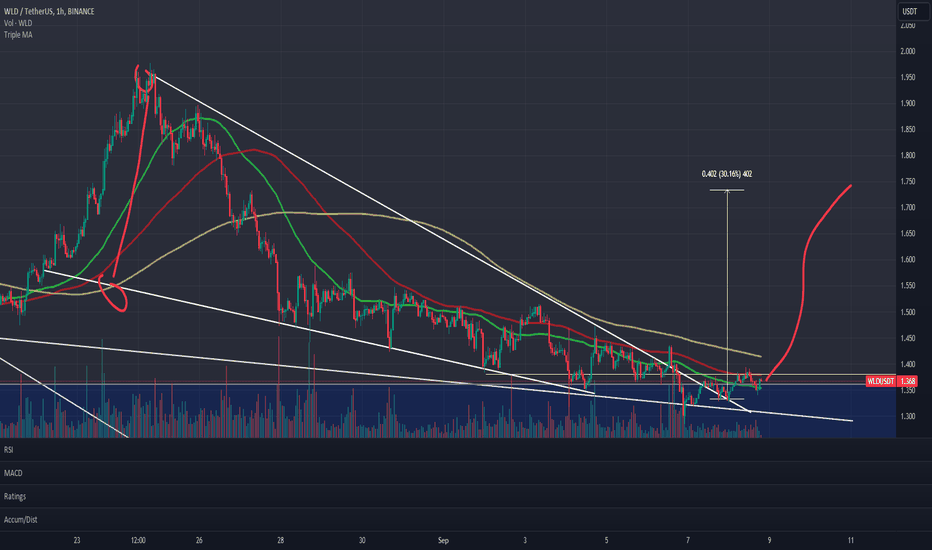

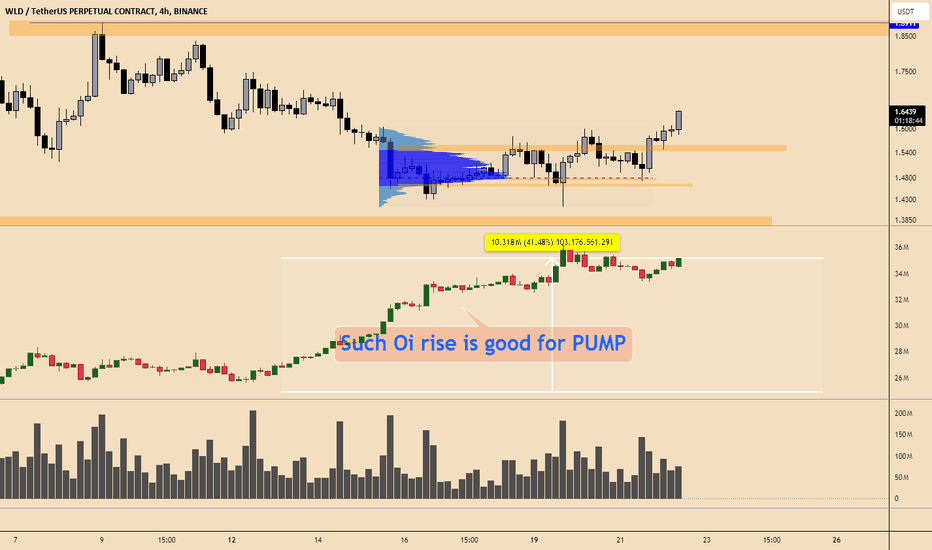

wld/usdtbullish flag pattern, indicating bullish reversal on 4hr chart. Because of bullish sentiment of expected rate cut it will soon pump within next couple of days. entry 1 and2 are suggested on the basis of support and tps are suggest on the basis of moving averages. reason for my focus on this coin is, it is not pumped in previous rally as it should be or as others, in spite of it being good AI coin. so I see more potential gains in it, as soon as it fulfills tp 2it will sky rocket and will not be found at this price. though it still take a lil time to breakout from daily 23 ema

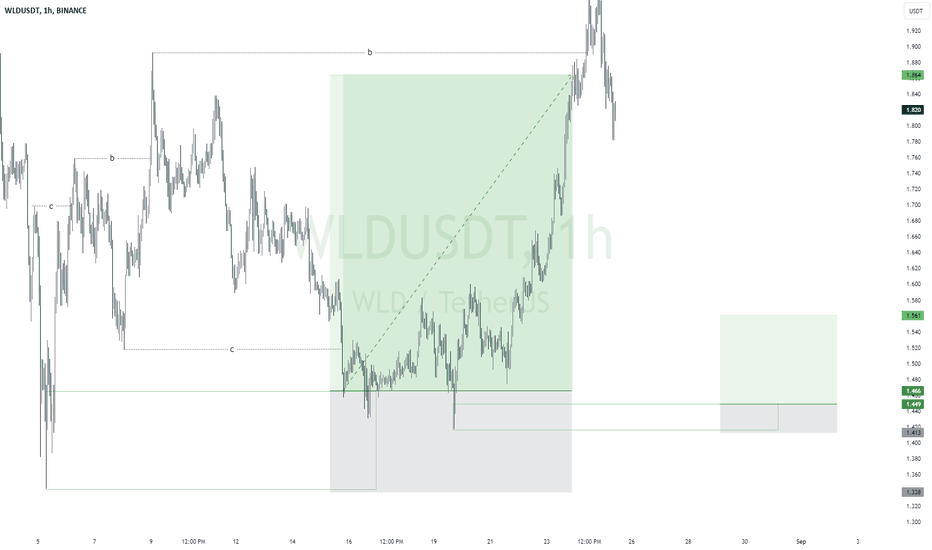

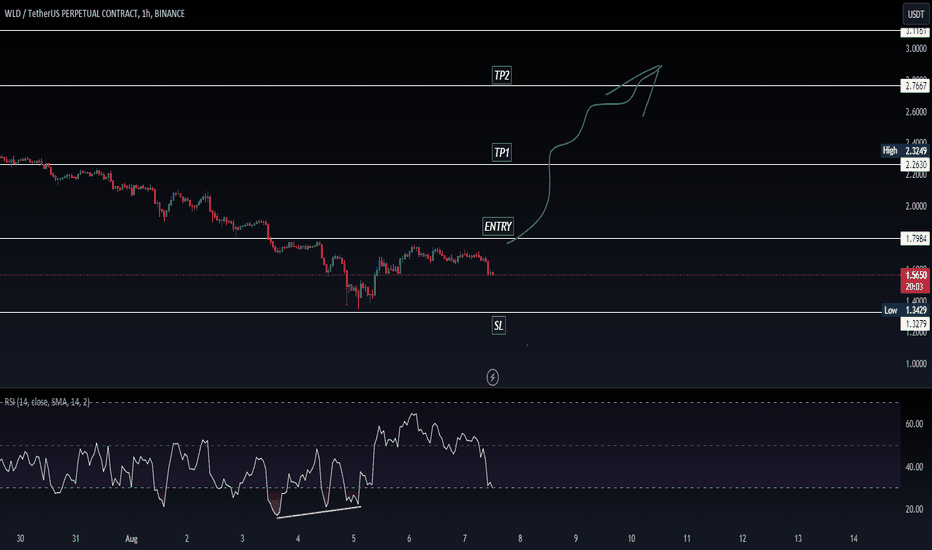

WLDUSDTPrice is making a series of Higher Highs and Higher Lows after the Bullish Divergence on 1 Hr time frame and Now the trend is bullish. We can see a rectangular pattern on chart which is usually a continuation pattern. So our trade plan would be to go long on the upside break out while keeping our stop loss on the last Lower Hight and at least one to one profit target.

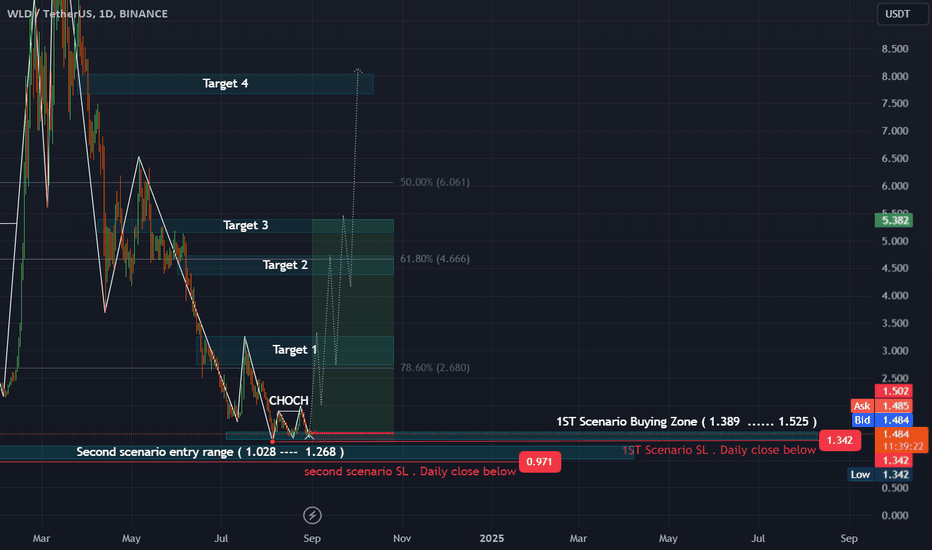

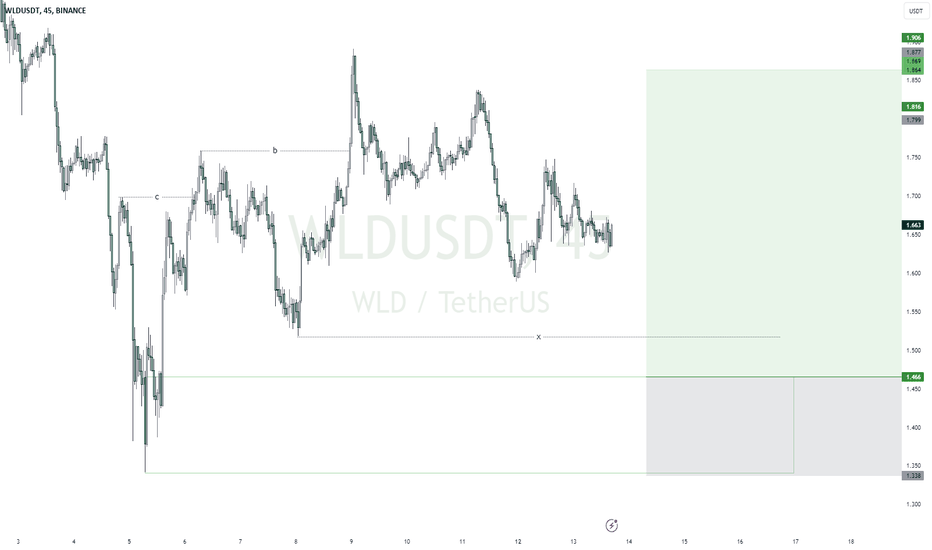

#WLD 2ND scenarioMIL:WLD in case of failing the 1ST scenario so the

2nd scenario will be like that

re-entry range ( 1.028 ---- 1.268 )

Stop loss ... daily close below ( 0.971)

targets and taking profits are same

#WLD

MIL:WLD

#WLDUSDT

#WLDUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD ****

#bitcoin

#BTC

#BTCUSDT

BINANCE:WLDUSDT

#WLD in a good buying range for a huge profit and small stoploss#WLD

MIL:WLD

#WLDUSDT

#WLDUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD ****

#bitcoin

#BTC

#BTCUSDT

BINANCE:WLDUSDT

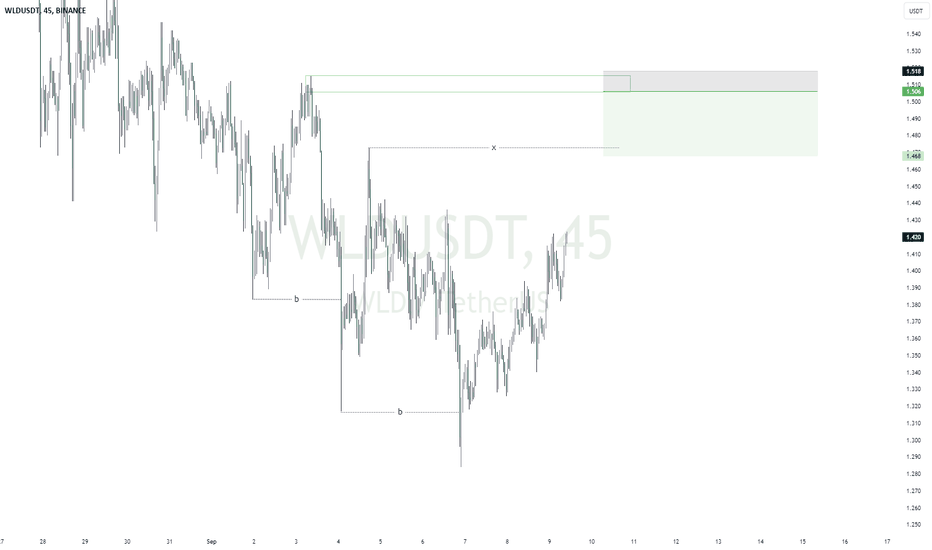

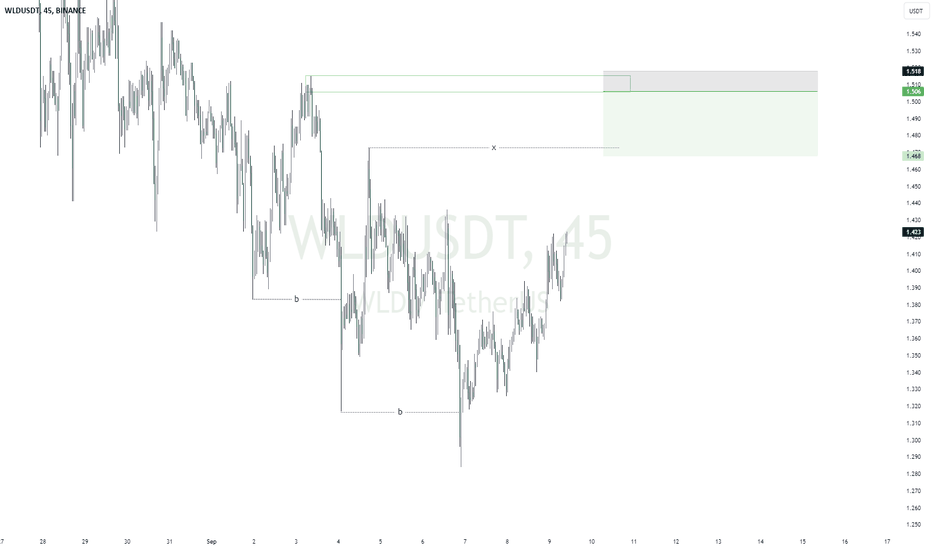

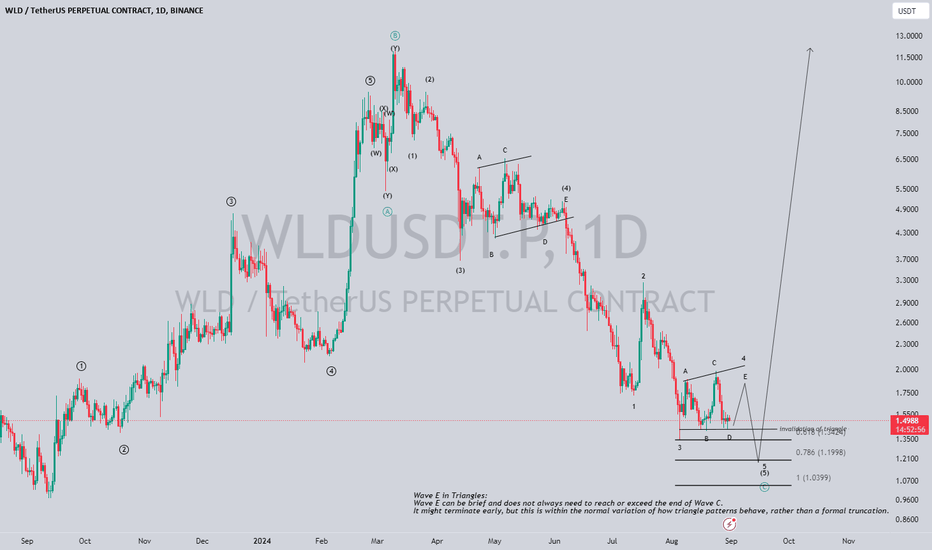

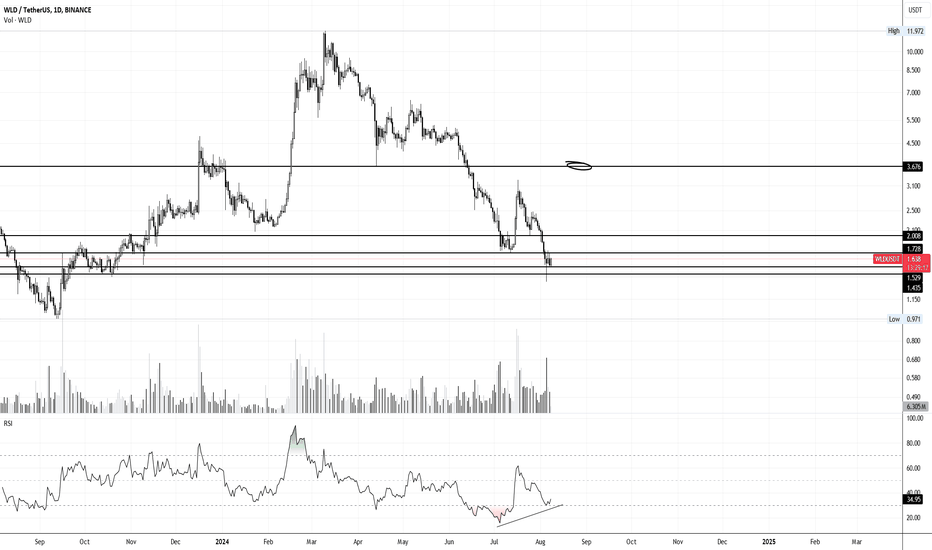

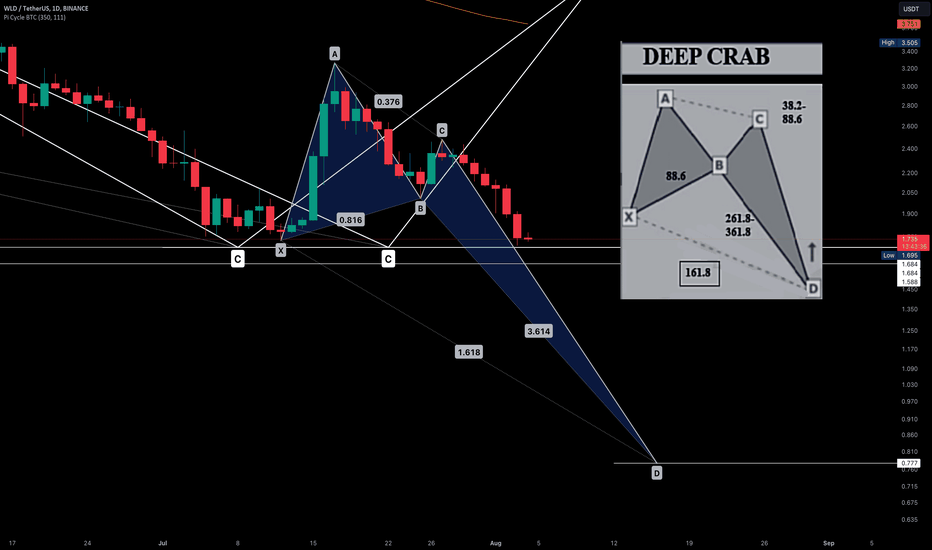

WORLDCOIN will breakout soon?WLD 1-day timeframe analysis (re-count)

WLD is now -88% from its all time high and is very concerning, its C wave indeed overlap with Wave 2 of the previous impulsive wave, this overlap does not violate any Elliott Wave rules, as long as the wave counts and degrees are correctly applied.

𝐓𝐫𝐮𝐧𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐓𝐫𝐢𝐚𝐧𝐠𝐥𝐞 𝐏𝐚𝐭𝐭𝐞𝐫𝐧𝐬:

(We are now forming a triangle again in the final impulsive wave of the correction)

In the case of a triangle (ABCDE):

𝐖𝐚𝐯𝐞 𝐄 can be shorter, and this is sometimes loosely referred to as "truncated," though it's not a formal term within Elliott Wave

theory.

𝐖𝐚𝐯𝐞 𝐄 does not necessarily have to reach the trendline drawn from the ends of Waves A and C. It can fall short, creating what might be perceived as a "truncated" appearance.

The invalidation level is indicated in the chart below. If it materializes, the potential reversal zone could range from $1.34 to $1.19. Please note, this is for educational purposes only and should not be considered financial advice.

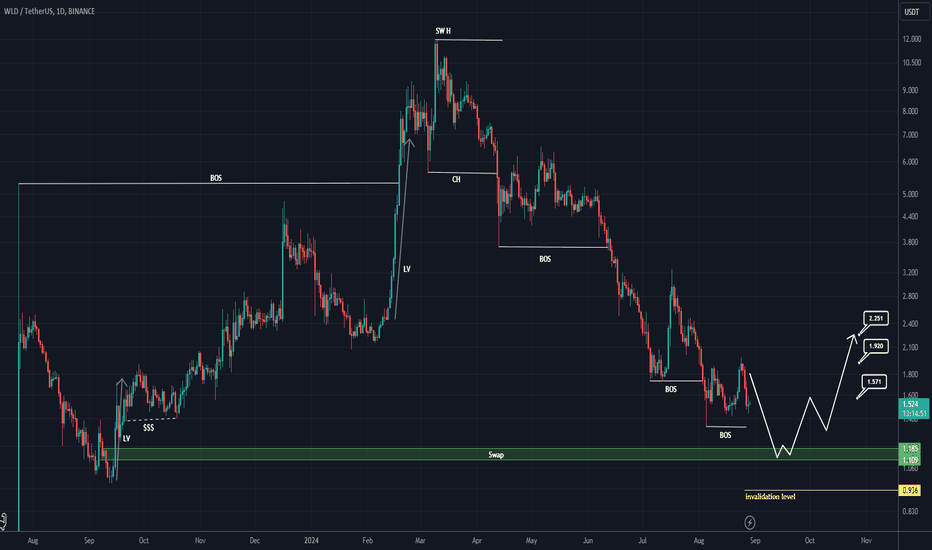

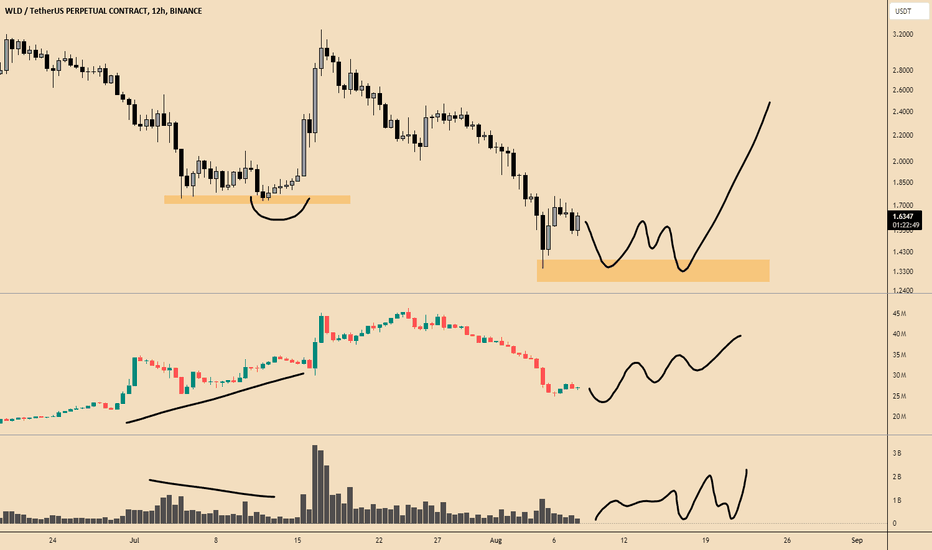

WLD buy/long setupAfter many drops, WLD is approaching the origin of the movement and a swap zone.

We are looking for discount ranges for buy/long positions.

We are looking for buy/long positions in the swap range. The swap range is actually within the discount range.

Closing a daily candle below the invlidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

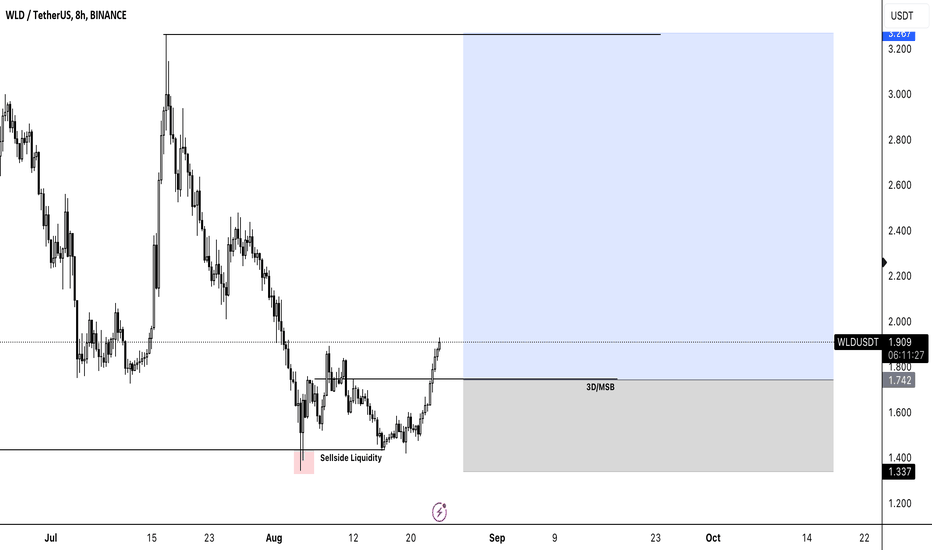

WLD Long

The market recently captured sellside liquidity around 1.337 USDT, indicating that weak hands might have been cleared out, suggesting a potential bullish move. The price also broke through the 3D/MSB level at 1.742 USDT, further supporting the bullish bias.

The market structure suggests that the price could continue to move towards the next liquidity zone in the 3.200 to 3.207 USDT range.

An entry could be considered around the current price of 1.902 USDT, ideally on a retest of the 3D/MSB level at 1.742 USDT to achieve a better risk-to-reward ratio. The stop loss should be placed below the recent liquidity sweep at 1.337 USDT, while the take profit target is set at the liquidity zone near 3.207 USDT.

Position management should be aligned with your risk tolerance, ensuring that the stop loss does not exceed a predetermined percentage of your account balance.

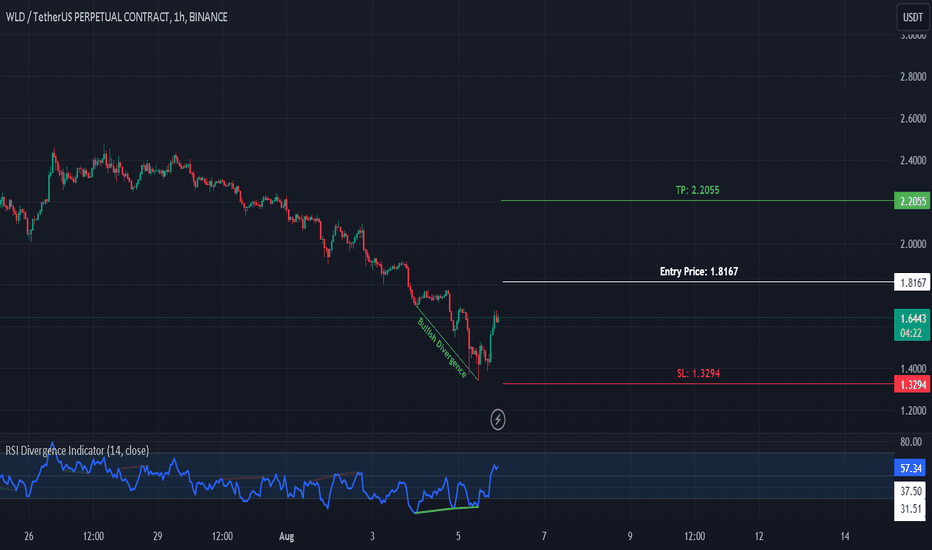

Daily bullish divergence for WLDThis is pretty much one of the best setups one could ask for: A bullish divergence on the daily chart. It's pretty straight forward as price should not drop below the lower low being made on a higher RSI print. We have seen this many time with coins like TRB, where I predicted the violent short squeeze few weeks ago using this method.

There is a lot of upside potential for WLD given it's down almost 90%, so worth a shot IMO. It could run into the yearly open over the next few weeks, maybe higher, but I don't know at this point.

Still early to get in, first step would be a break of 1.80$ and hold from there, tight setup would be a stop just below 1.5$. If you want to play it safe place your stop below 1.4$ and adjust your risk management accordingly.

Stay safe!

WLD: Investment Analysis and StrategyWorldcoin (WLD) is trading at $2.318. Here’s a detailed analysis based on the provided charts and data.

Technical Analysis

Price Trends and Resistance Levels:

The trading volume is 511.987K WLD, indicating active trading but lower liquidity compared to larger cryptos like SOL.

Slightly bearish, with a histogram value of -0.003, MACD line at 0.040, and signal line at 0.043, suggesting caution.

%K at 48.52 and %D at 51.25, indicating a neutral stance.

The RSI stands at 56.93, suggesting that WLD is neither overbought nor oversold.

Fundamental Analysis

Market Position and Adoption:

Worldcoin is gaining attention for its unique approach to identity verification and decentralized finance. Its adoption and utility within its ecosystem are key drivers for long-term growth.

Technological Advancements:

Worldcoin’s innovative use of biometrics for identity verification and its integration into various DeFi applications provide it with a unique market position.

Ecosystem Growth:

The growth of Worldcoin’s ecosystem, including partnerships and new use cases, will be crucial for its long-term success.

Market Sentiment

Market sentiment for WLD is cautiously optimistic, with neutral technical indicators and a slight bearish signal from the MACD. Investors are watching for signs of a breakout from the descending trendline or a stronger confirmation of support.

Potential Market Scenarios

Bullish Scenario:

A decisive break above the $2.468 resistance could lead to further upward movement, potentially targeting higher resistance levels.

Bearish Scenario:

If WLD fails to break above the descending trendline and local resistance, it could retest the support levels at $2.287 and $2.106. A break below $2.106 could signal further declines.

When to Buy Worldcoin (WLD) for Long-Term Investment

Current Situation:

Given WLD's current price and the technical indicators, a cautious approach is advised.

Optimal Buying Strategy:

Wait for a Breakout or Dip: Watch for a breakout above $2.468 for bullish confirmation or wait for a dip towards the solid support level at $2.106.

Consider DCA Strategy: To mitigate the risk of market timing, consider a dollar-cost averaging (DCA) strategy by buying small amounts at regular intervals.

Conclusion and Market Outlook

Worldcoin (WLD) is currently navigating a critical range with significant support and resistance levels to monitor. While technical indicators suggest a neutral to slightly bearish short-term outlook, the long-term potential remains dependent on ecosystem growth and broader market conditions.

Impact of Bitcoin:

It's essential to note that Bitcoin (BTC) is currently at a crucial level. If BTC fails to surpass its all-time high and experiences a significant drop, it could negatively impact the broader cryptocurrency market, including WLD. Monitoring BTC's price action is vital for understanding potential risks to WLD's price movements.