#W waiting for good signal for good entryWaiting for good signal for good entry

SO SOOOON

#W

#WUSDT

#WUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #XAI #W ****

#bitcoin

#BTC

#BTCUSDT

BINANCE:WUSDT

WUSDT trade ideas

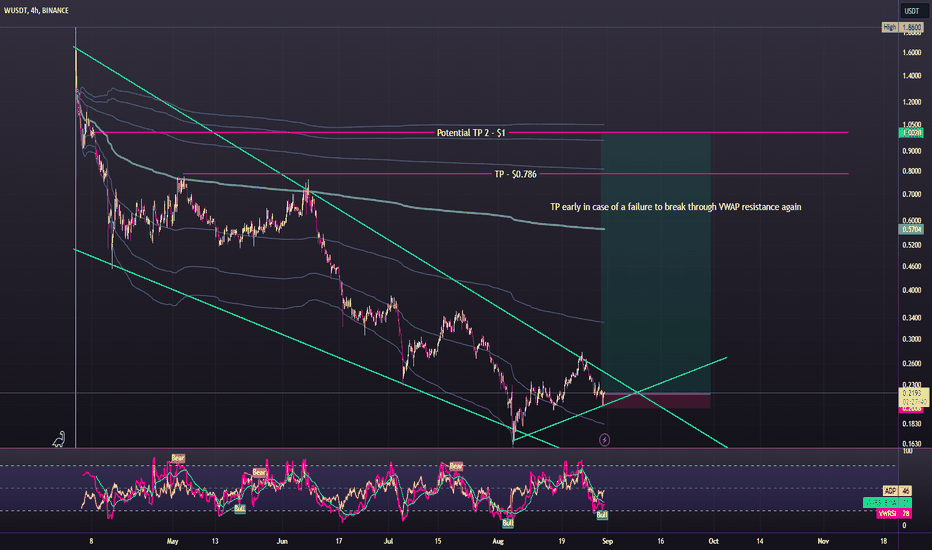

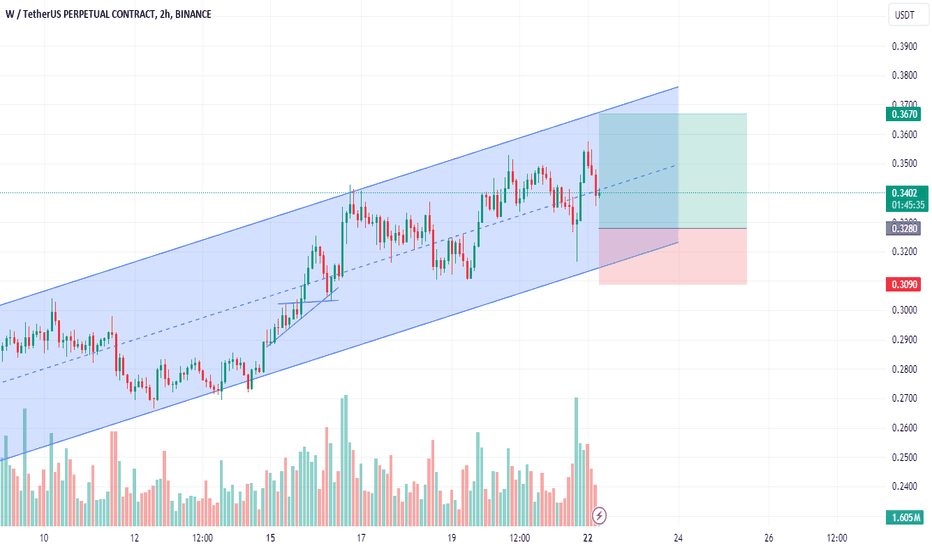

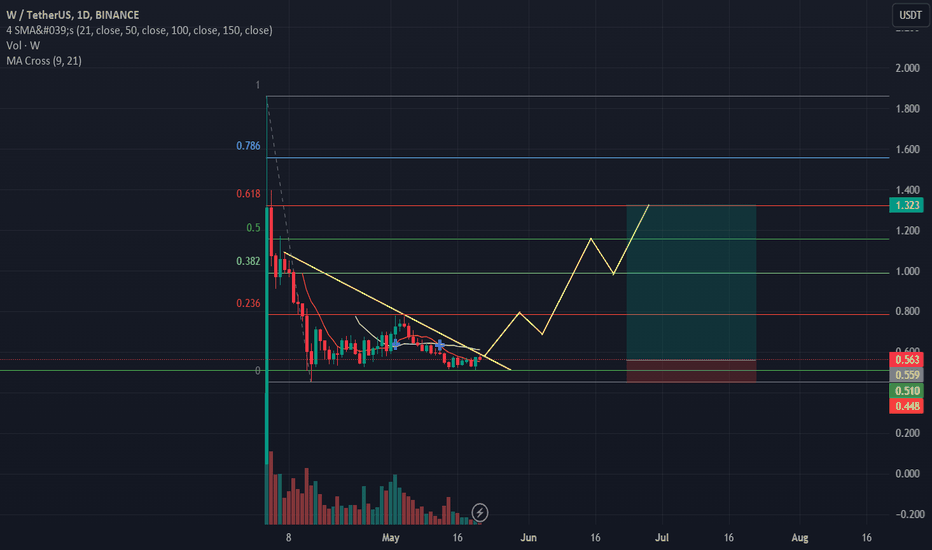

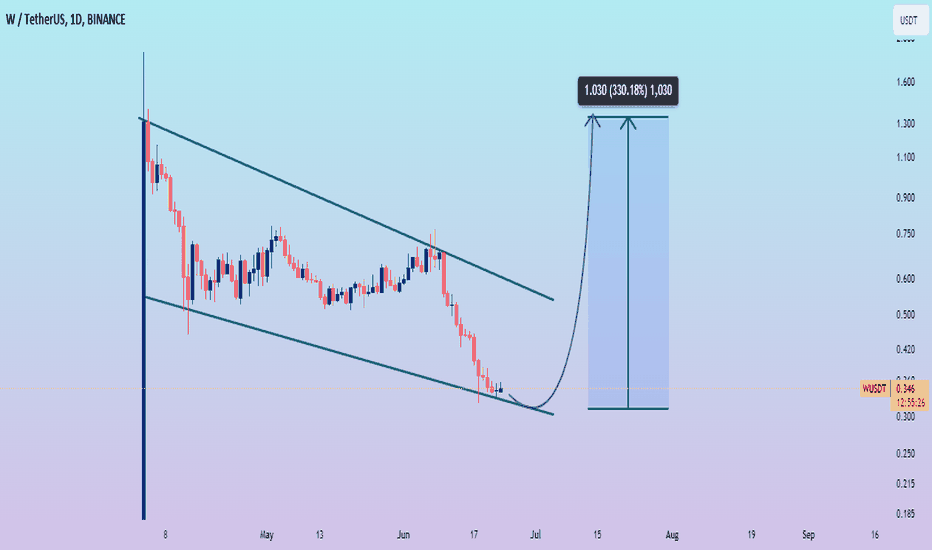

Wormhole - Falling Wedge Close To Breakout - Potential 360% MoveA lot of new token launches (Airdrop/Pre-Sale at least) this year seems to suffer the same fate: Price might pump a bit at launch with decent volume, but soon after the interest dies and the price dumps. I've seen several coins now with huge falling wedges like we can see here, and the breakouts are usually insane. W looks like it's getting very close to finally getting out of this wedge.

This looks like a great place to enter a long. Main target is $0.786, and the plan would be to hold maybe ~20% if it looks like it can push $1. The VWAP has acted as a resistance in the past, if the price fails to go past this VWAP again I'd just sell, as it's likely to reverse again.

The St. Dev. Bands line up quite well with my targets, and could end up becoming more precise TPs.

The targets probably seem unrealistic, and maybe they are for the shorter term at least, but these markets move in strange ways, I've been seeing some crazy price action lately (like CLOUD for example)

Tight SL here, would probably look to enter somewhere lower if it gets hit.

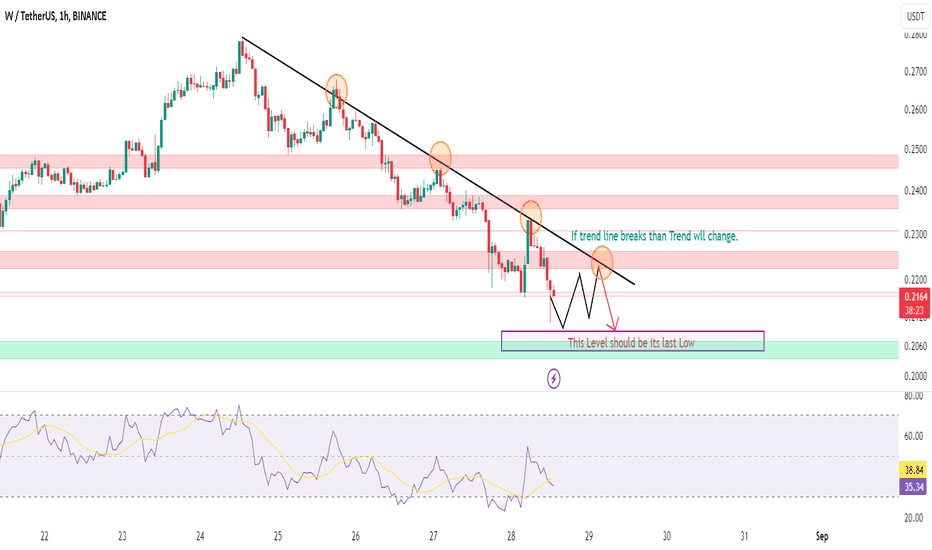

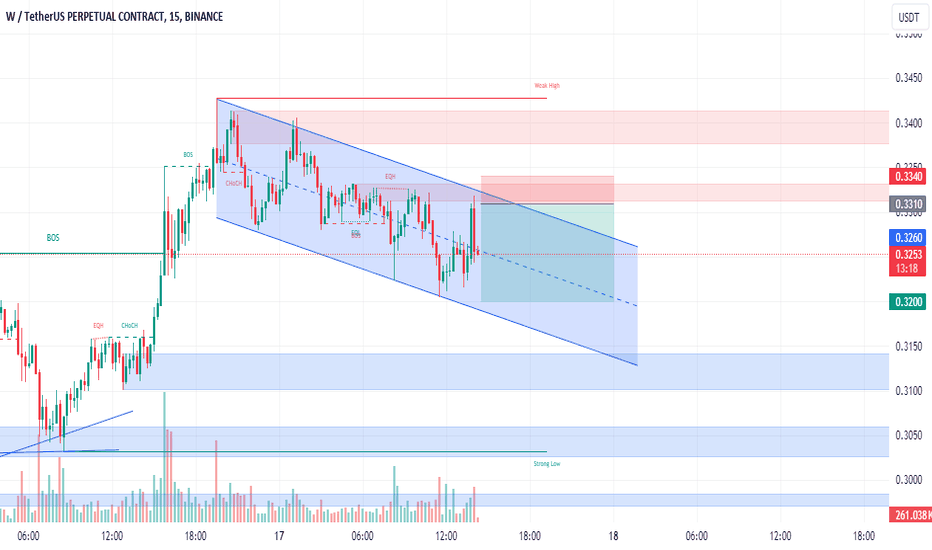

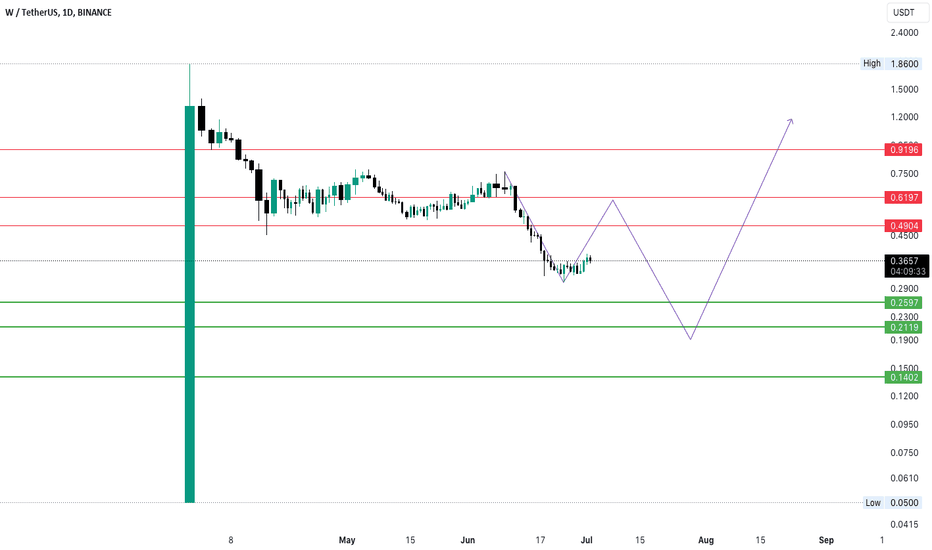

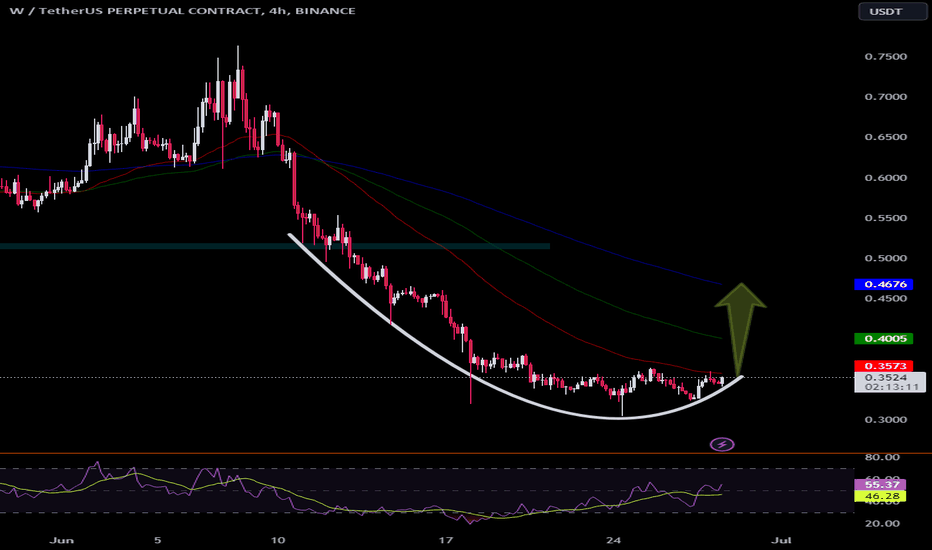

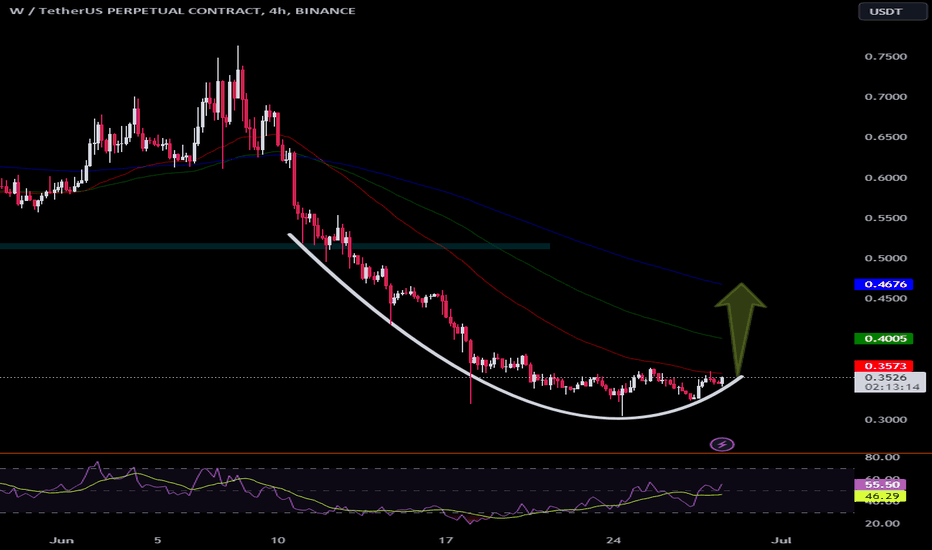

Wormhole $W, Grear R/R SetupBINANCE:WUSDT has been beaten so hard since its listing few weeks ago. I believe Its building a base for a reversal. Newly launched tokens tend to go up fast when they reverse as there is not that much over-hanging supply. My invalidation is a break of its last low, which could happen and I am fine with it!

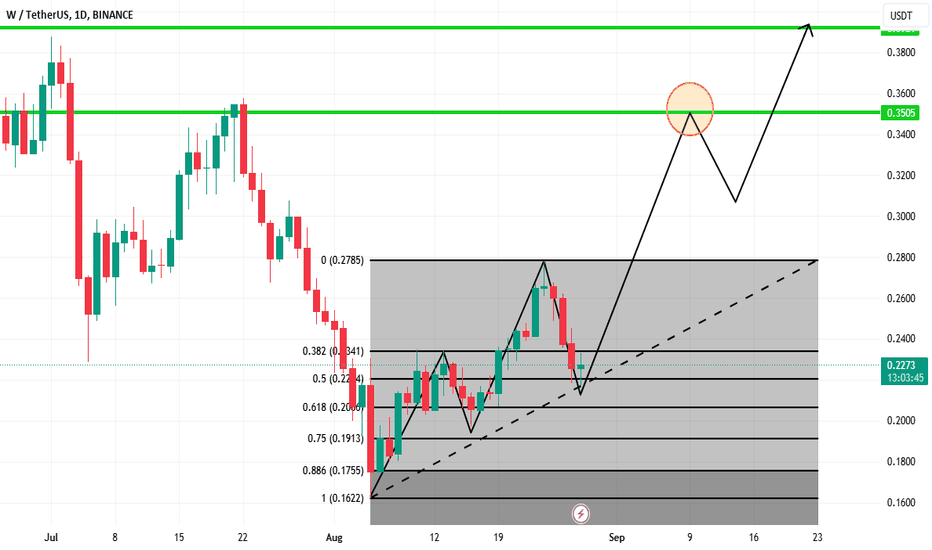

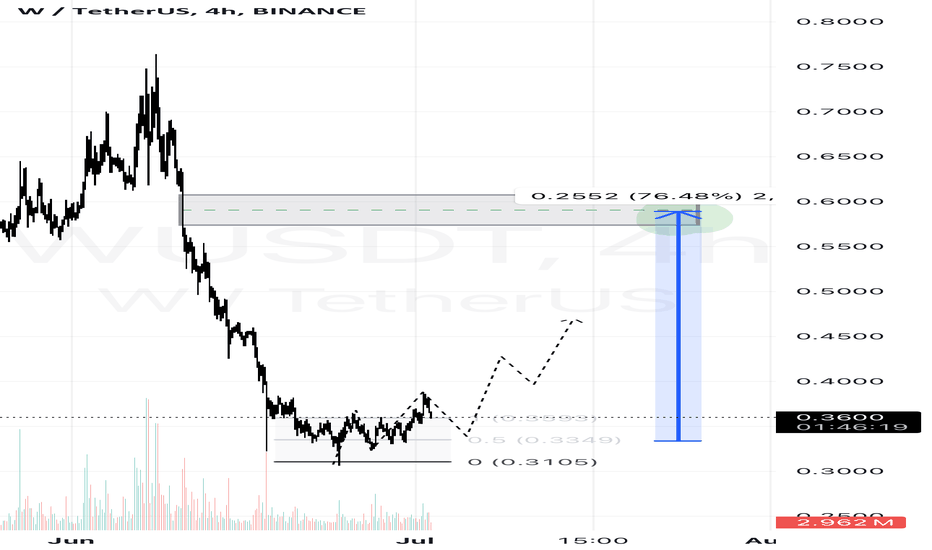

Large amounts of tokens unlocked----WIn the crypto market, there is an event-driven strategy based on token unlocking, which we mentioned in a previous analysis on WLD. This week Wormhole (W) will unlock tokens on August 3, releasing 600m W, worth approximately 180m US dollars. Equivalent to 33.33% of Cir.supply. The ingredients are Foundation Treasure, Ecosystem, and Community, and they may sell the tokens. W may fall as a result.

Wormhole belongs to the Cross-Chain Communication track. Unlike cross-chain bridges that meet the needs of ordinary users, the purpose of Wormhole is to build a cross-chain layer to meet the protocols’ demand and improve interoperability. Layer0, Omni network and Axelar all belong to this track. It is the future development demand of the crypto market, but it is difficult to have a pump like the AI track in the short term. So there are trading opportunities combined with unlocking events.

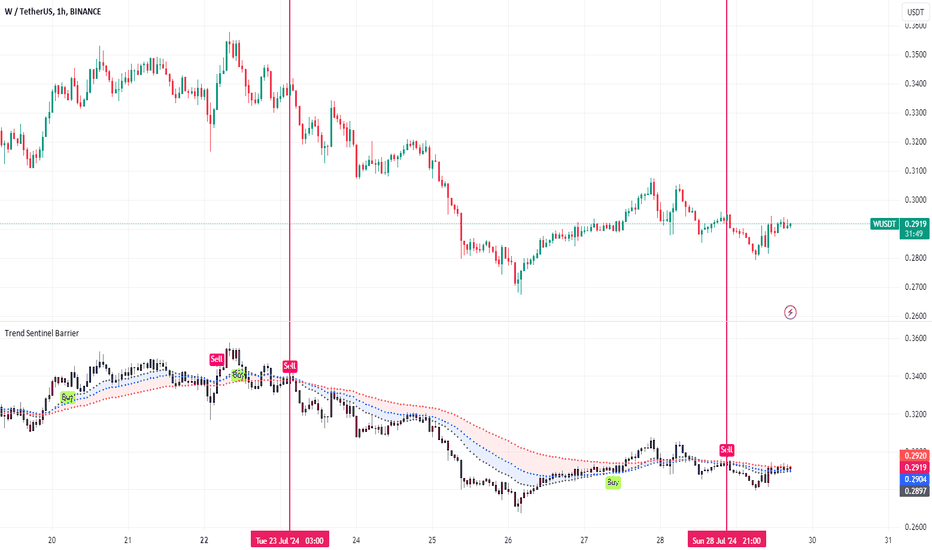

Since it will be unlocked this week, both 1h and 4h are good trading levels. If you are not good at trading, then you can use the TSB indicator. TSB has successfully predicted multiple entry of short positions and prompted the SELL signal again on July 28. This indicates that we are currently in a bearish trend. The price is currently rebounding to the wavy area, which, as we have been saying, will provide short strength and is a good position to add positions.

Introduction to indicators:

Trend Sentinel Barrier (TSB) is a trend indicator, using AI algorithm to calculate the cumulative trading volume of bulls and bears, identify trend direction and opportunities, and calculate short-term average cost in combination with changes of turnover ratio in multi-period trends, so as to grasp the profit from the trend more effectively without being cheated.

KDMM (KD Momentum Matrix) is not only a momentum indicator, but also a short-term indicator. It divides the movement of the candle into long and short term trends, as well as bullish and bearish momentum. It identifies the points where the bullish and bearish momentum increases and weakens, and effectively capture profits.

Disclaimer: Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies.

Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.

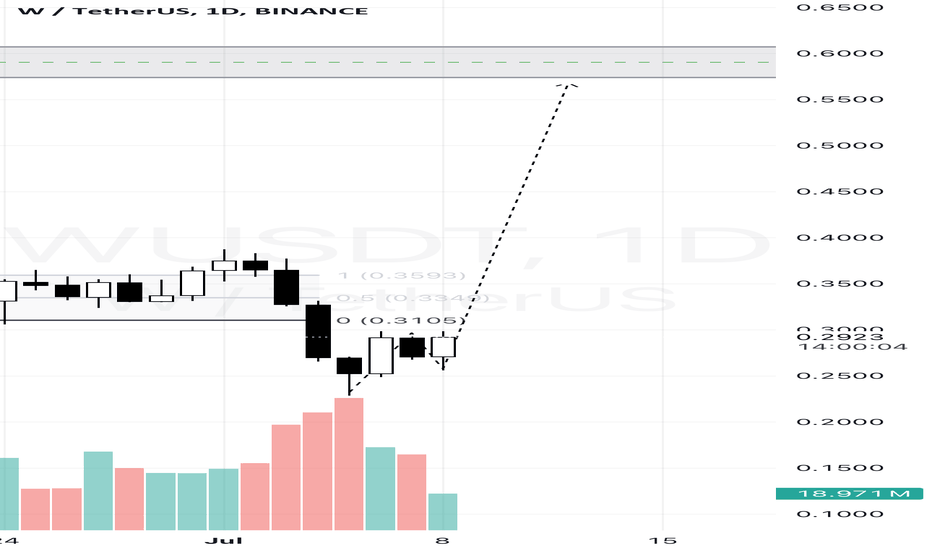

Wormhole: Potential Top 20 Contender for This Bull Run!Wormhole is a solid project with a good chance of being a top 20 project in this bull run. I own W and will accumulate more only if it drops below $0.30. The green-marked zones could be the bottom during this correction before reaching a new ATH. The red-marked zones might have a bigger impact, and we can talk about ATH only after it passes them.

WA very interesting asset, I've been watching its behavior for a long time, I think it's time to take a closer look at the turn, I see lateral movement, and attempts to build a structure, as well as the imbalance from above suggests that there is an opportunity to take this position in the medium term !

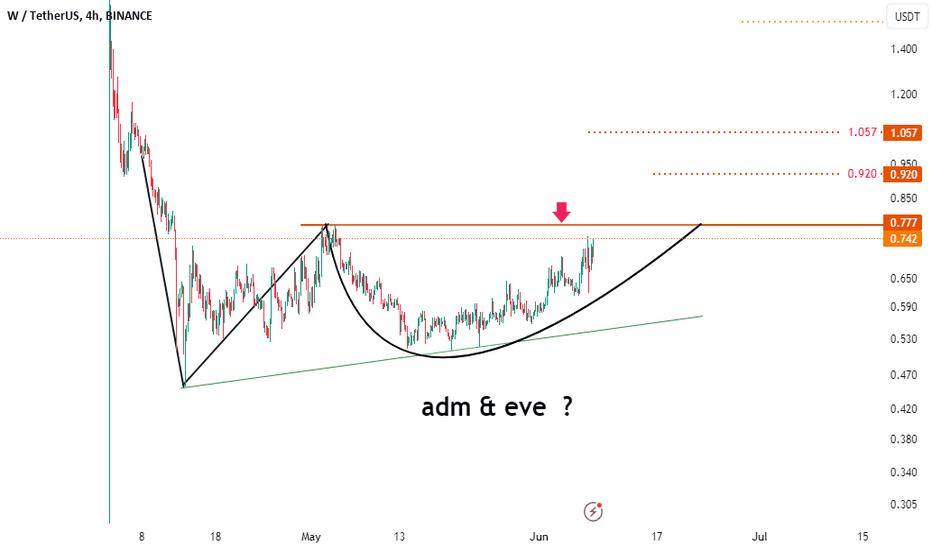

Wormhole Weekly AnalysisWormhole ( BINANCE:WUSDT ) has corrected around 34% over the past week, making it the top loser. Wormhole is a leading interoperability platform that supports multichain applications and bridges at scale.

As a newly listed coin, there isn't enough price action to analyze from the chart. The $0.778 level is a crucial resistance where Wormhole has faced rejections. The bearish market conditions have pushed Wormhole into a downward trajectory, reaching a low of $0.366. Currently, Wormhole is trying to establish resistance at this level, but if the bearish trend continues, further declines are likely.

On the daily time frame, oscillators show a neutral signal, while the moving average indicates a strong sell. In the weekly time frame, oscillators are very bullish, but the moving averages continue to suggest a strong sell.

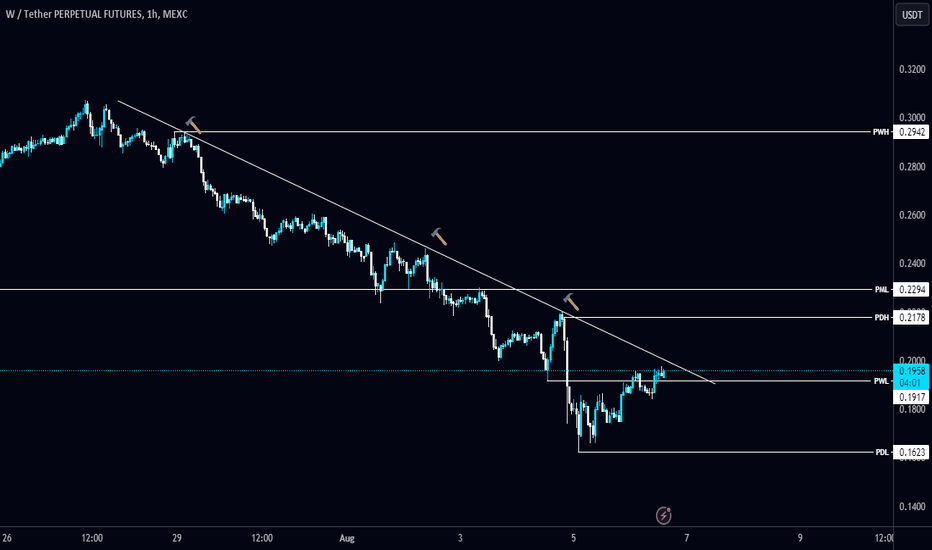

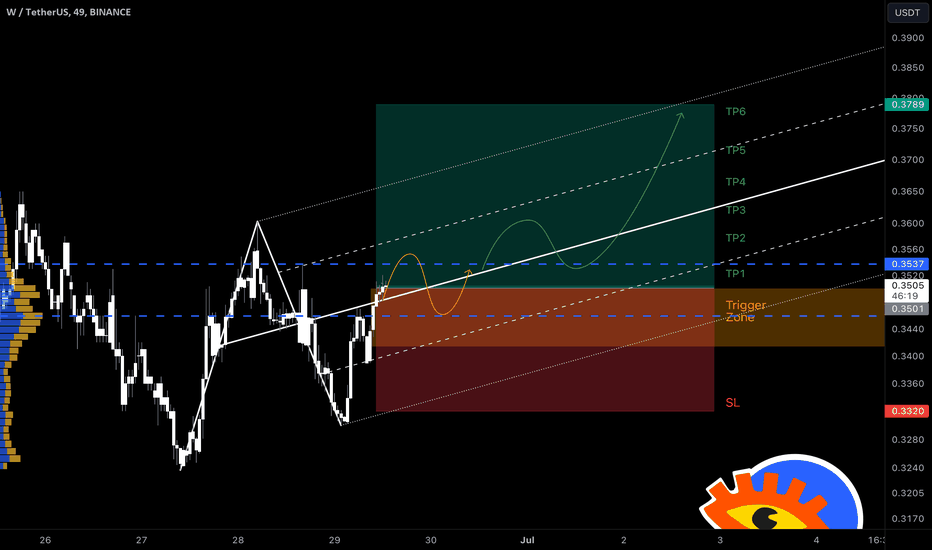

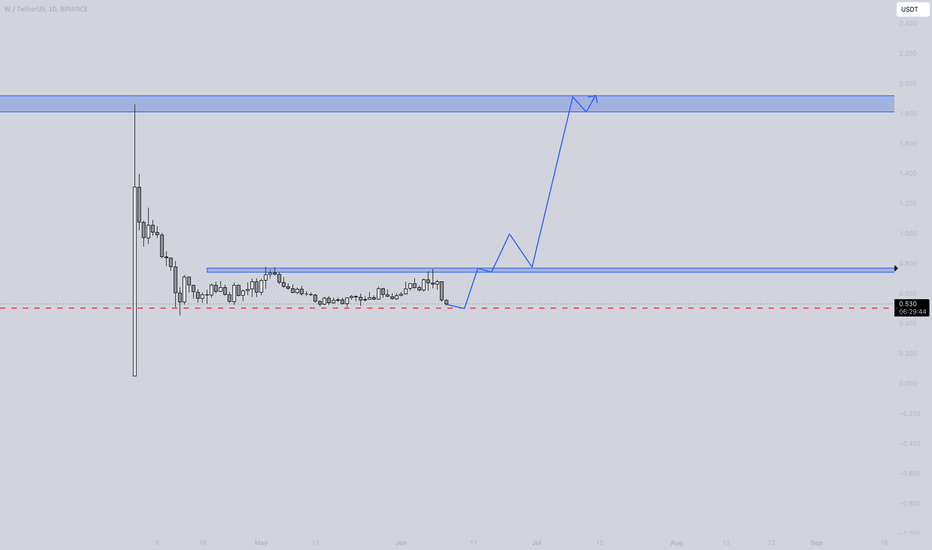

Wormhole potential swing long not sure if this'll get a run-up into the LayerZero launch but the bidded on the slowing sell pressure (see C-fork) with presumed resistances at or near the May Monthly high, and the Weekly equal highs (if it sustains).

if no unlocks/whales seling/etc., this should work out.

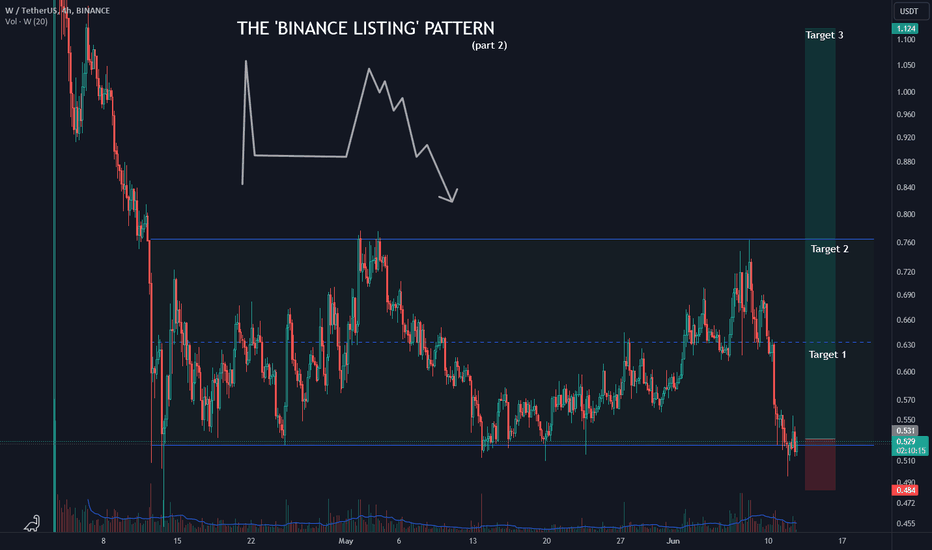

[LONG] Wormhole going for the binance listing pattern (part 2)After the first run Wormhole is giving another chance at a strong demand level.

buy: 0.50~0.55

target1: 0.634

mid channel. you can move your SL to entry at this point

target2: 0.748

upper band. take out half position here

target3: 1.11

first dead cat bounce top. here most spot buyers that got trapped will sell. don't risk your gains and close the position.

Let's see if this time it can reach the 3rd target!!

part 1: