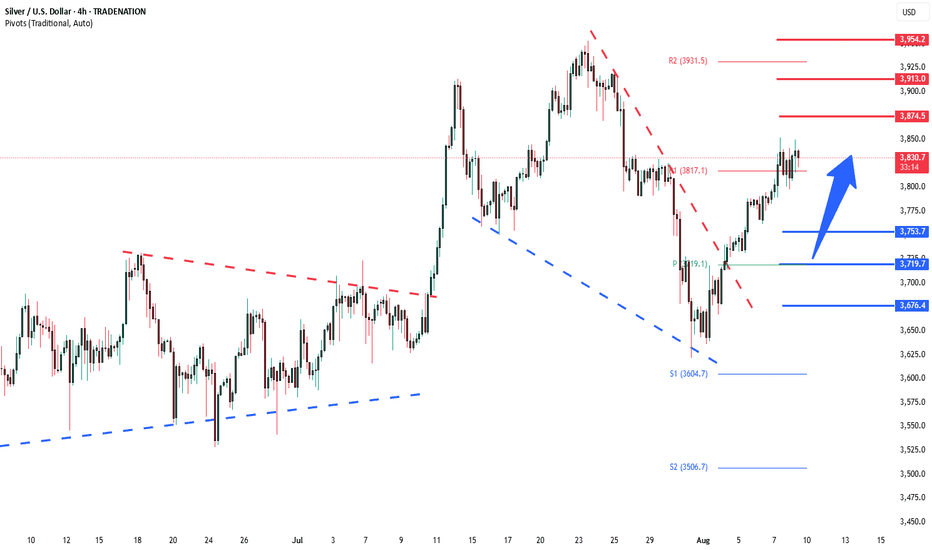

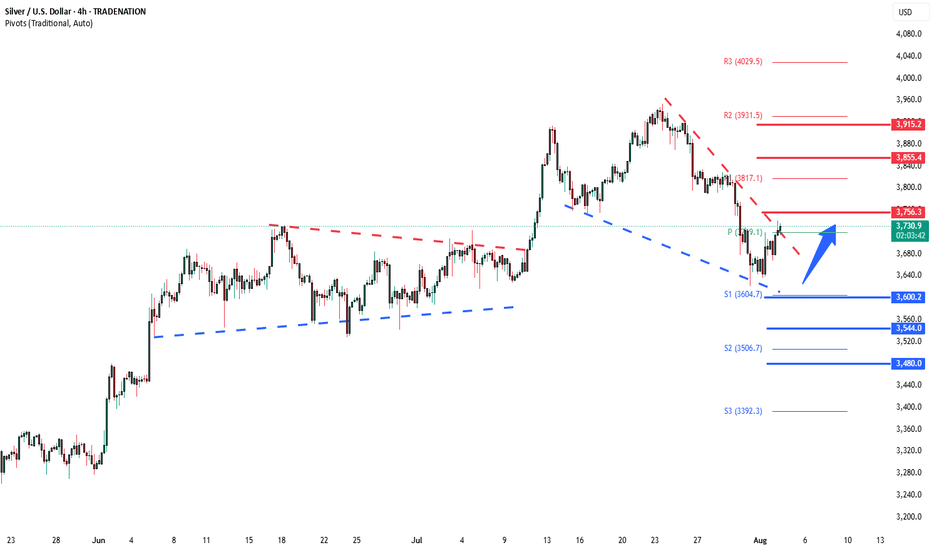

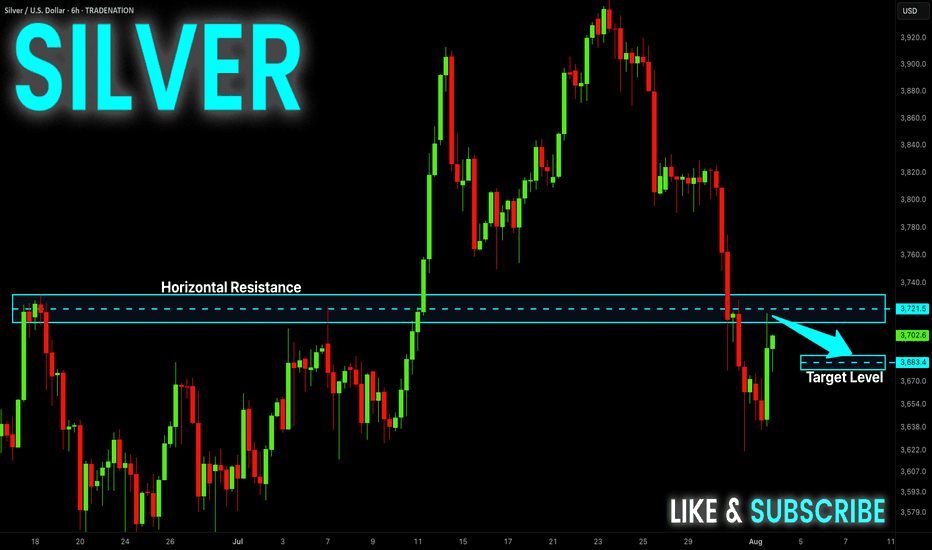

Silver important support at 3753The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3753 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3753 would confirm ongoing upside momentum, with potential targets at:

3875 – initial resistance

3913 – psychological and structural level

3954 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3753 would weaken the bullish outlook and suggest deeper downside risk toward:

3720 – minor support

3676 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the silver holds above 3753. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

XAGUSD trade ideas

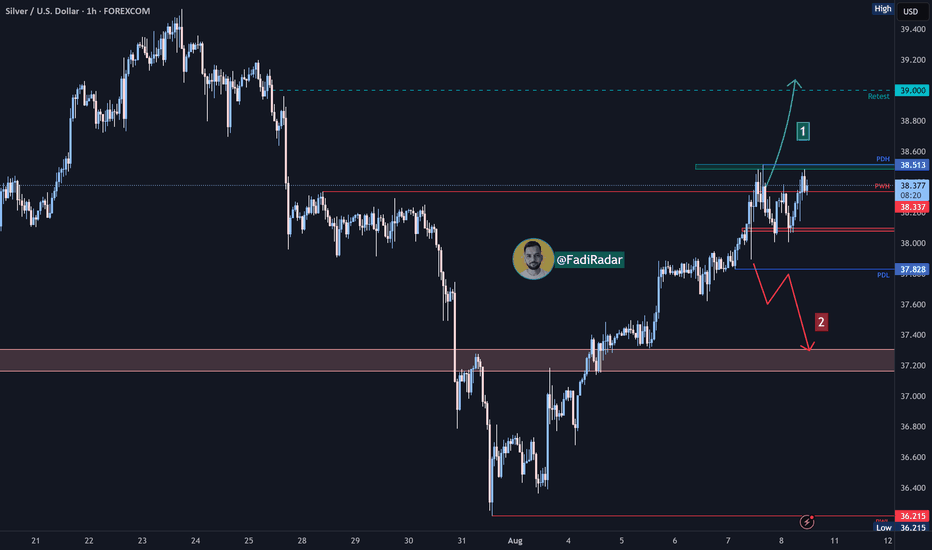

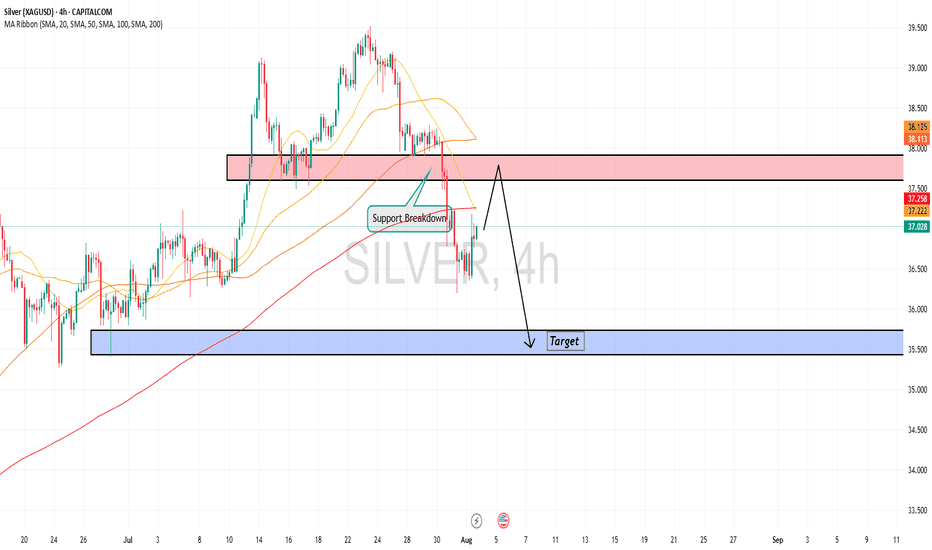

Silver (XAG/USD) Analysis:Silver is showing a short-term bullish trend and is currently testing the $38.50 resistance area.

🔻 Bearish Scenario:

If the price rejects $38.50 and closes below $38.00, this could support a decline toward $37.80, followed by a test of the $37.40 support zone.

🔺 Bullish Scenario:

A confirmed breakout and close above $38.50 may open the door for a move toward the $39.00 level.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets closely and analyze the data before making any investment decisions.

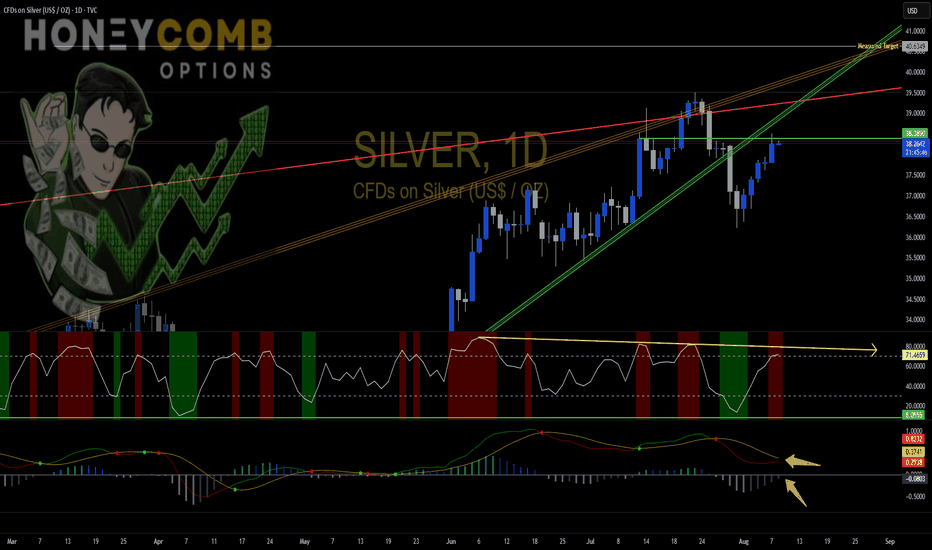

"I remember this chart pattern in 2020.. Just before the big.."This one is going to be epic..this coming economic collapse is

going to make people rich and sadly the middle class poor

Believe it or not.I remember this chart pattern in 2020..

Just before the big market crash.

They say the poor can not get poorer

but its the middle class that gets poor

This means the average young people are

going to lose their jobs or decide to get a second job,

Capitalism is a factor of production

and having buying power

is the best feeling in the world

because i have been unemployed for a long time.

Capitalism is the only place i call home.

Even in the difficult times.

Capital markets have been my food and drink.

My hopes and dreams.

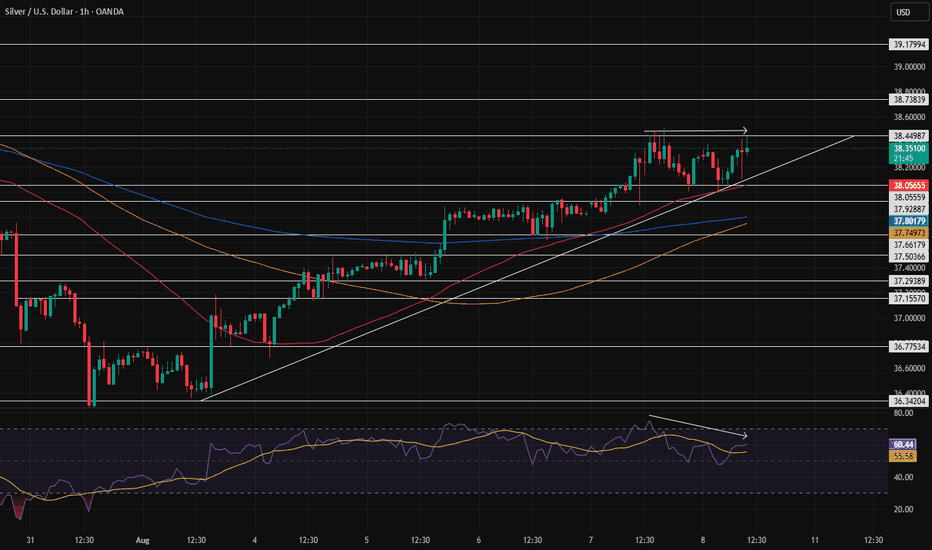

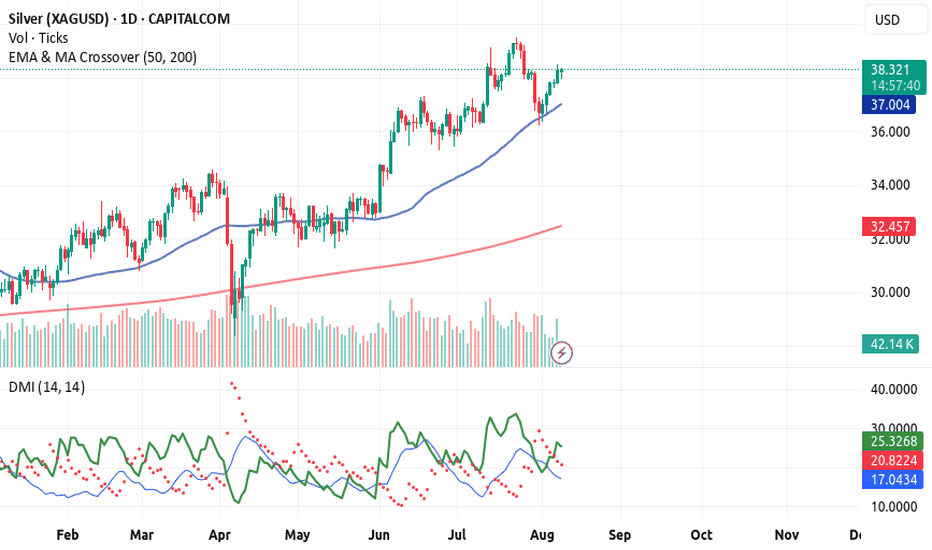

The silver TVC:SILVER price is going up because

it is following the rocket booster strategy

So what is the rocket booster strategy?

This strategy has 3 steps:

1-The price has to be above the 50 EMA

2-The price has to be above the 200 EMA

3-The price should gap up

That last step is very important

because you can see the gap from the

ADX indicator below

That trend line [ green line ]

shows that buyers are gaining strength

and running the market

But that line [ Blue line below the red line and green line]

also shows that a BIG move is coming

this big move is going to be Massive..

You will hear about it in the news by the time

it hits its peak this is going to be like 2020...

Just watch out anyway buy silver now.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please

learn risk management and profit taking strategies.Feel free to use a simulation trading account before you trade with real money.

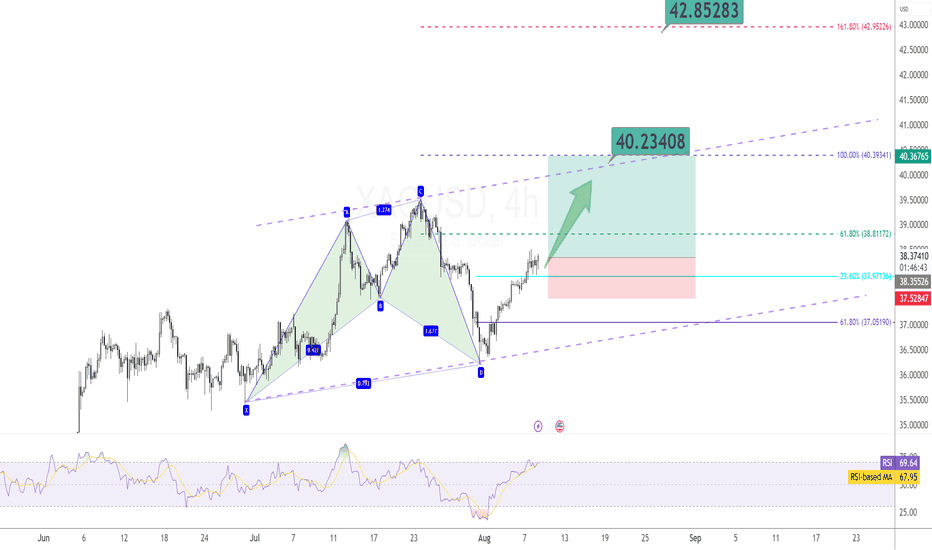

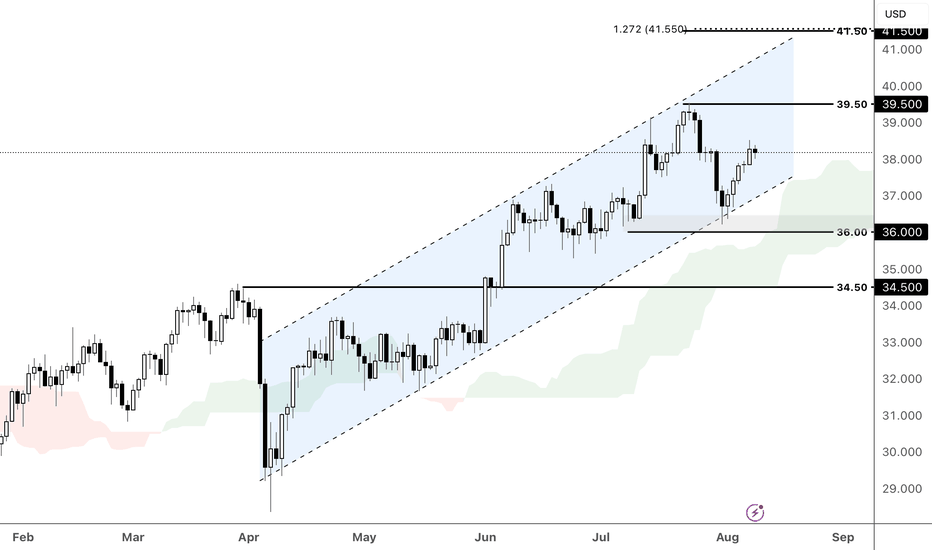

Will trade tensions drive silver prices higher?Silver prices extended their rally this week, buoyed by growing expectations of Fed rate cuts as recent US labor market data pointed to a slowdown. Weaker job numbers have added to the case for a dovish shift in monetary policy, pressuring the US dollar and making non-yielding assets like silver more attractive.

Geopolitical tensions also boosted safe-haven demand. US President Trump's move to double tariffs on Indian goods, in response to India's continued imports of Russian oil, has heightened uncertainty in global trade. Reports that Trump may meet Russia's President Putin next week to discuss ending the Russia-Ukraine conflict have only added to the geopolitical premium in silver prices.

Meanwhile, political speculation around Fed leadership is beginning to influence sentiment. Trump is expected to nominate a replacement for outgoing Fed Governor Adriana Kugler and is reportedly shortlisting candidates to succeed Jerome Powell when his term is over. The prospect of a more dovish Fed under new leadership has weakened the dollar and offered further support to silver.

From a technical perspective, XAGUSD rebounded above the lower bound of its ascending channel, suggesting the bullish momentum is intact. If the price continues to climb, a break above the 39.50 resistance could open the door to an extended move toward 41.50, which aligns with the channel's upper bound and the 127.2% Fibonacci extension. However, if prices break below key support at 36.00, this would suggest fading momentum and could trigger a deeper retracement toward 34.50.

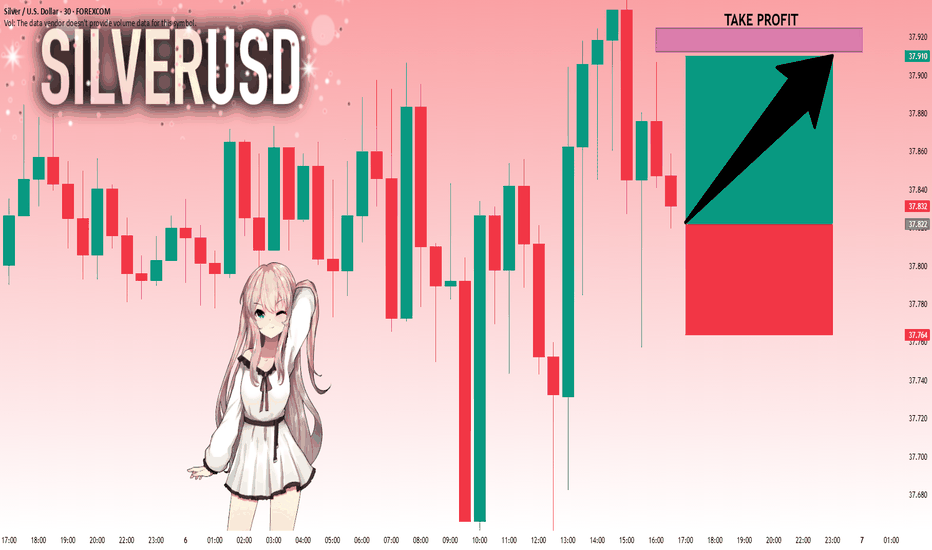

SILVER: Target Is Up! Long!

My dear friends,

Today we will analyse SILVER together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 37.822 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 37.912.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

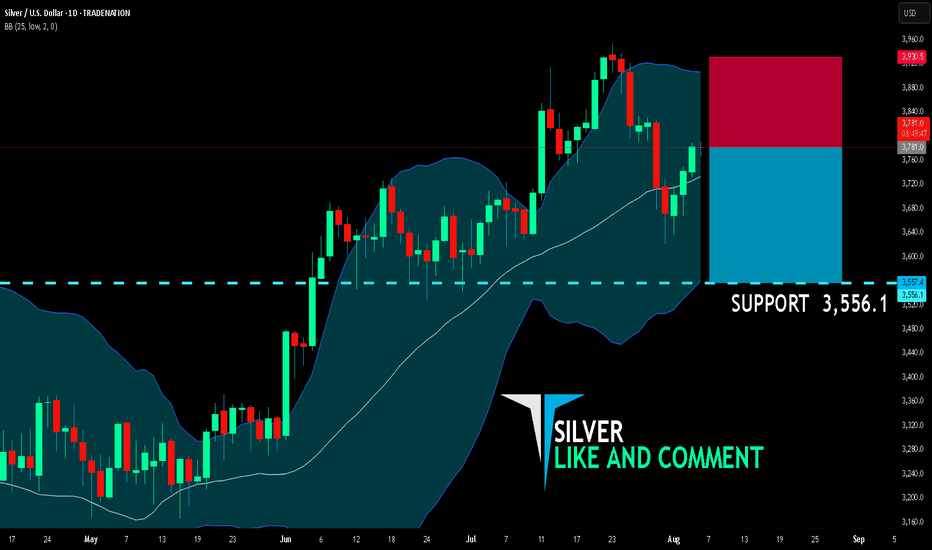

SILVER BEARS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,781.0

Target Level: 3,556.1

Stop Loss: 3,930.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

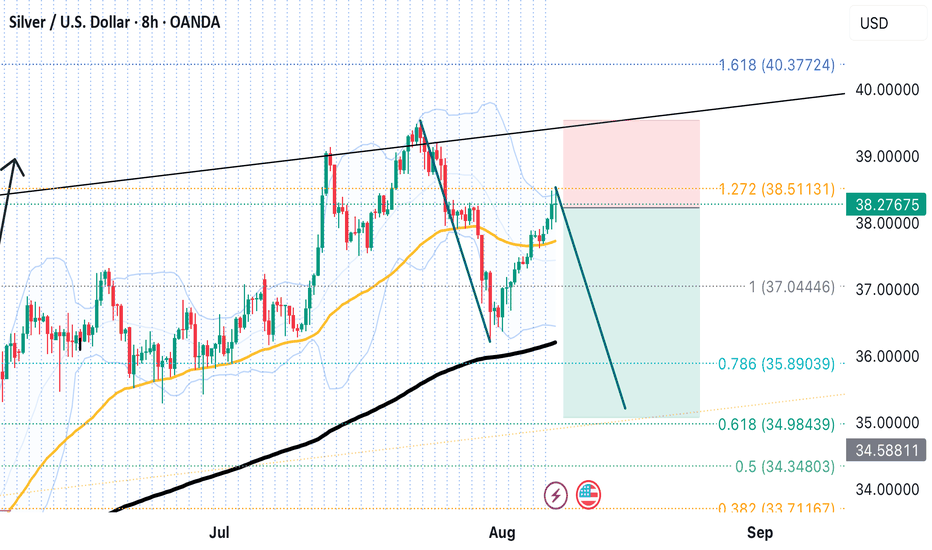

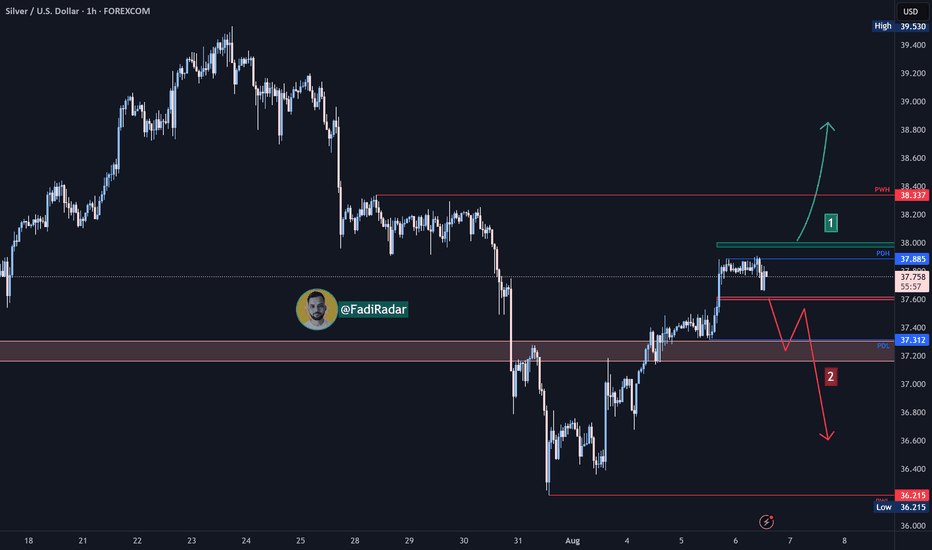

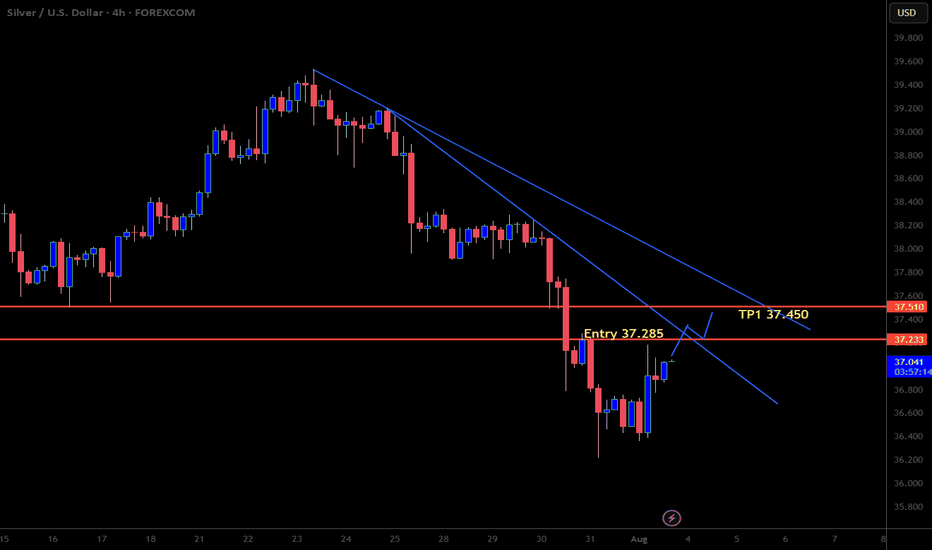

Silver (XAG/USD) Technical Analysis:Silver maintains a short-term bullish trend and is currently testing the $38.00 resistance zone.

🔹 Bearish Scenario:

If price rejects this level and closes below $37.60, we may see a decline toward $37.30, and possibly $37.00.

🔹 Bullish Scenario:

If price breaks above $38.00 and holds, upside momentum could extend toward $38.30 and $38.80.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

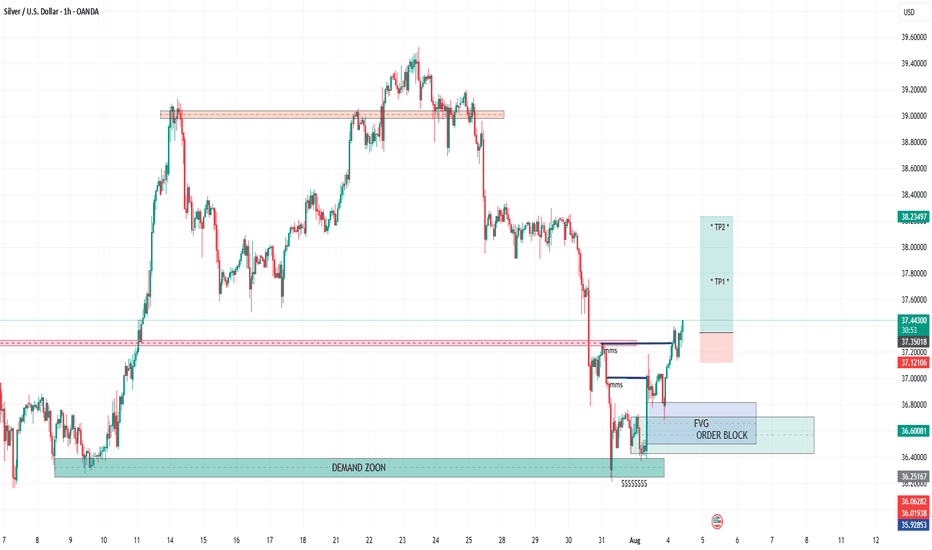

XAG/USD Long Setup | H1 TimeframeA classic setup based on #SmartMoneyConcepts:

✅ Change of Character (CHOCH) after a liquidity sweep.

✅ Price returned to the Order Block & filled the FVG.

✅ Entry at the Point of Interest (POI) with a high R/R.

Waiting for it to reach the buy-side liquidity targets. Do you agree?

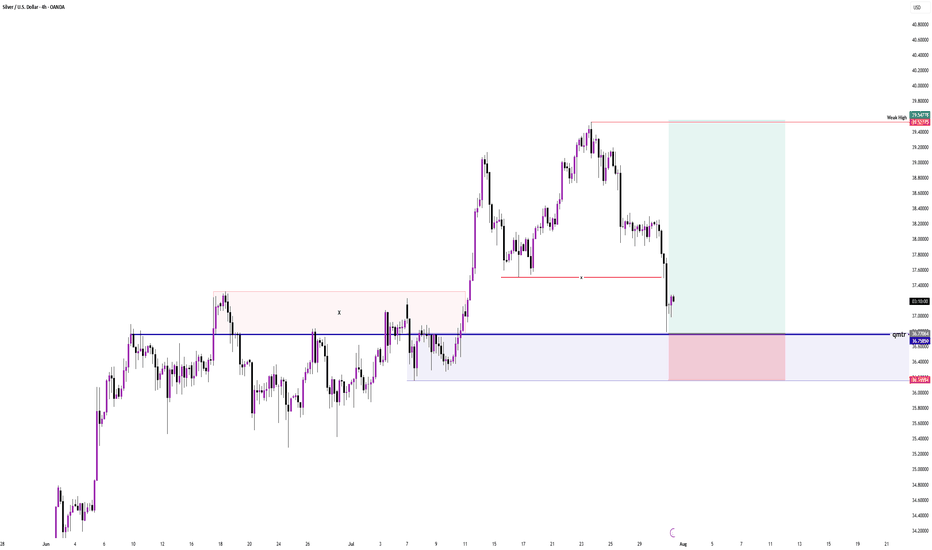

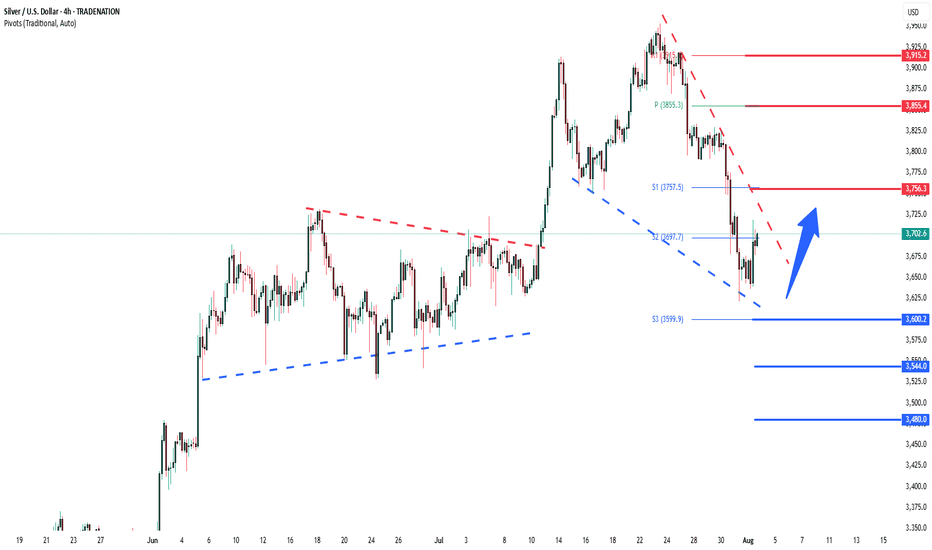

Silver bullish breakout supported at 3600The Silver remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 3600 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3600 would confirm ongoing upside momentum, with potential targets at:

3756 – initial resistance

3855 – psychological and structural level

3915 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3600 would weaken the bullish outlook and suggest deeper downside risk toward:

3544 – minor support

3480 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the silver holds above 3600. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver is in the Bearish trend after testing ResistanceHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

SILVER Move Down Ahead! Sell!

Hello,Traders!

SILVER is about to retest

A horizontal resistance level

Of 37.21$ and its a strong

Key level so after the retest

We will be expecting a

Local pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

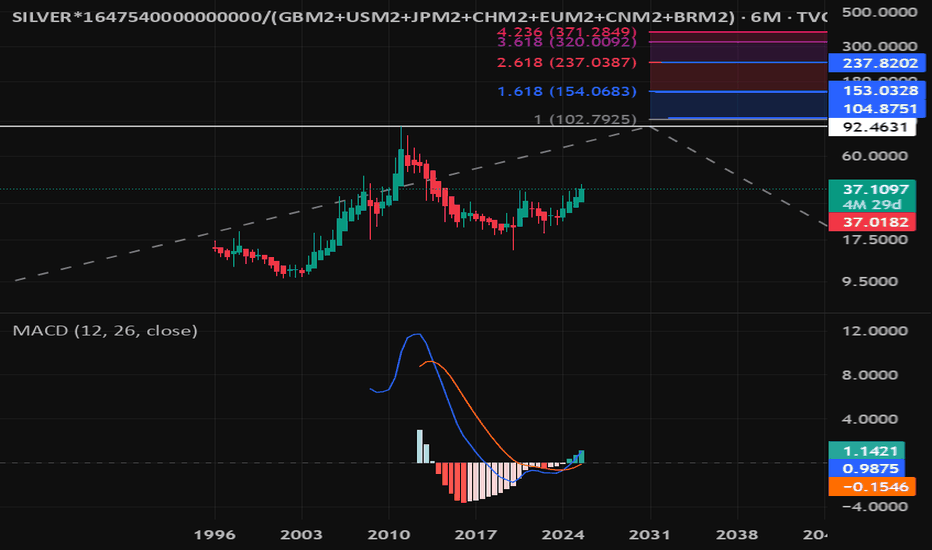

Silver against many world M2 supplies.Here we see silver divided by many global m2 supplies...

We can see silver is JUST STARTING ITS MOVE to catch up to gold.

We corrected for the 1.4 quadrillion in M2, and see silver's targets all over $100!

This confirms silver is ready to move again, after gold's run, and perhaps make an explosive move higher!

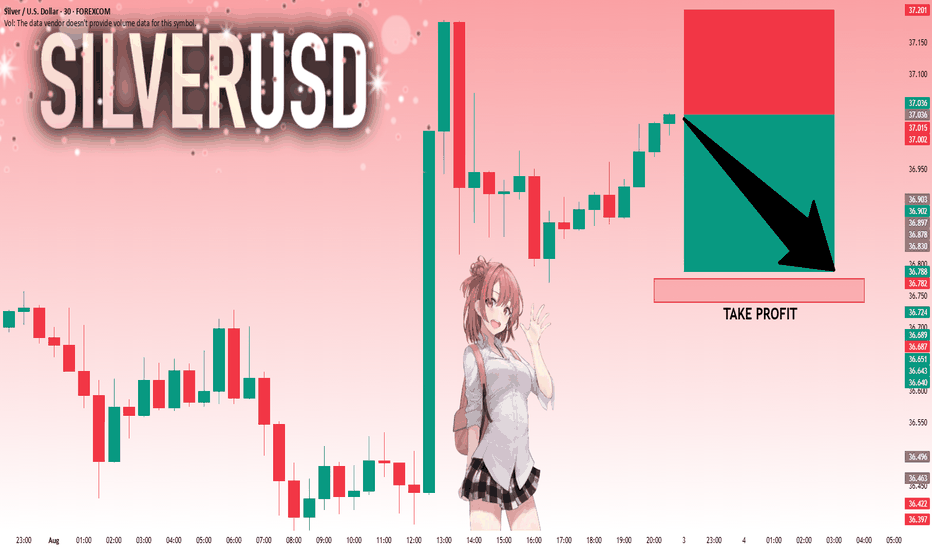

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 37.036 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 36.788..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Silver The Week AheadKey Support and Resistance Levels

Resistance Level 1: 3756

Resistance Level 2: 3855

Resistance Level 3: 3915

Support Level 1: 3600

Support Level 2: 3544

Support Level 3: 3480

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

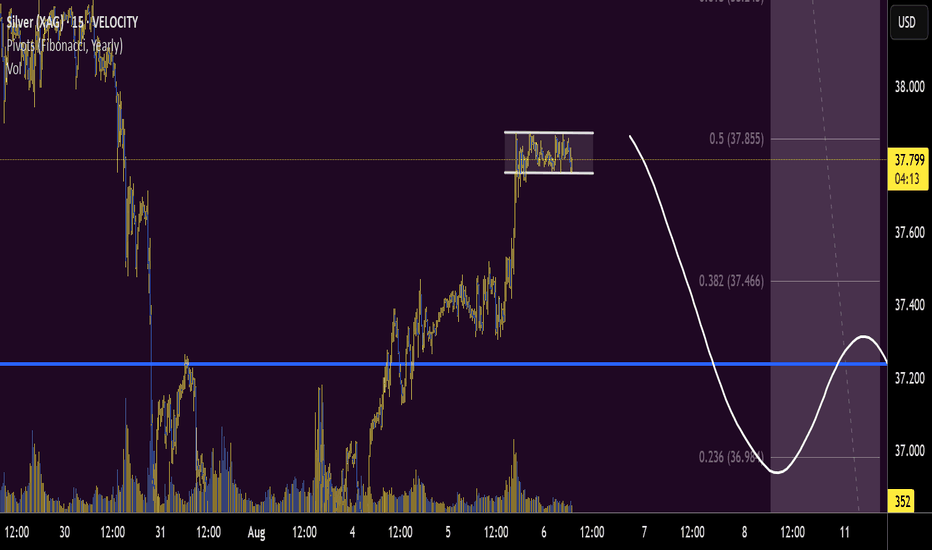

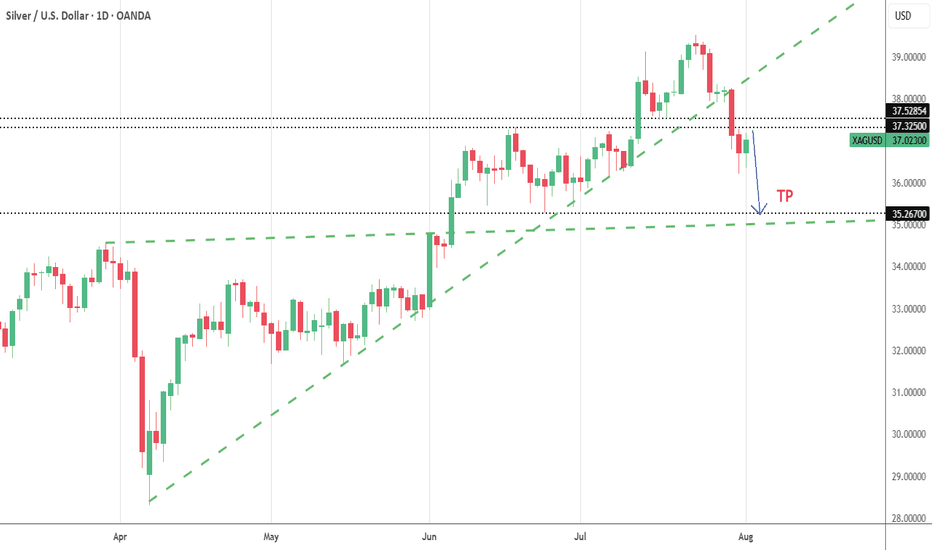

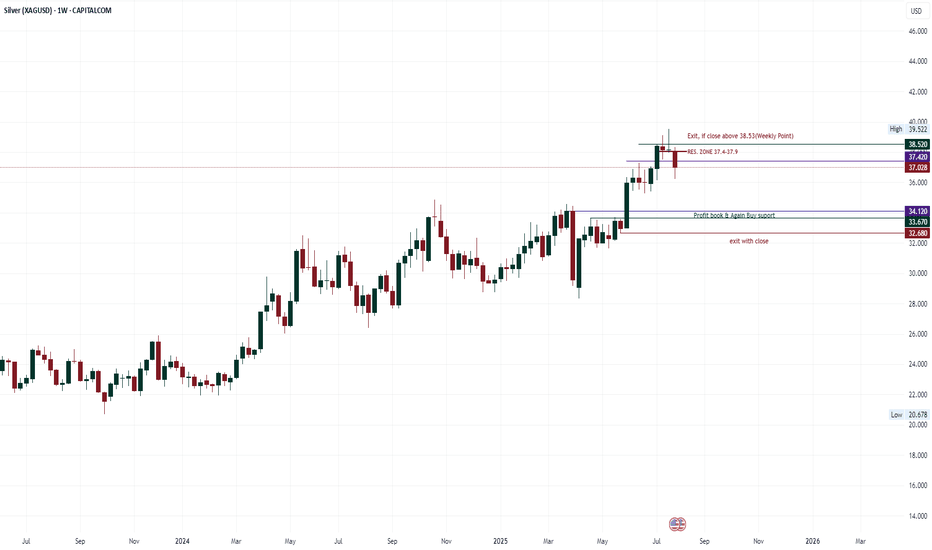

silver correction patternThere has been no close above 38.52 in the last 4 weeks, i.e. every weekend has closed below 38.52. The weekend candle of 7 July is an important candle, apart from this this week's candle has also closed below the low of 14 July, which also indicates a down sign, over all a resistance zone is shown from 37.42 to 37.95. This pattern can go down to 34.1 or 33.67. But use a strict weekend Stop loss of 38.52.