XAGUSDG trade ideas

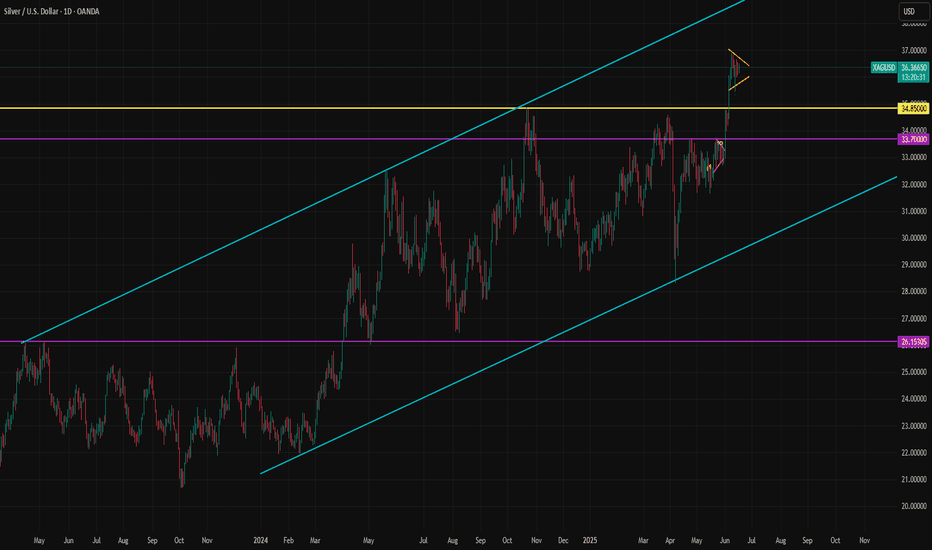

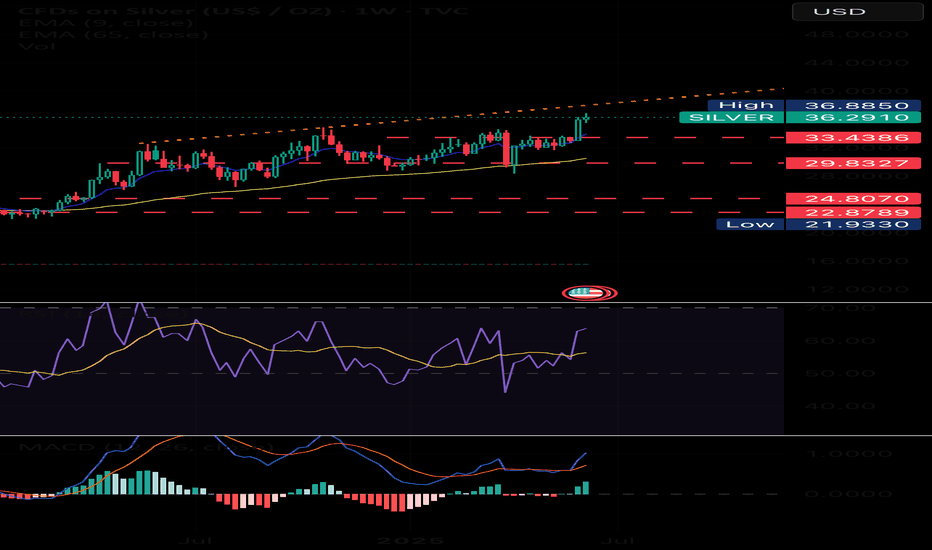

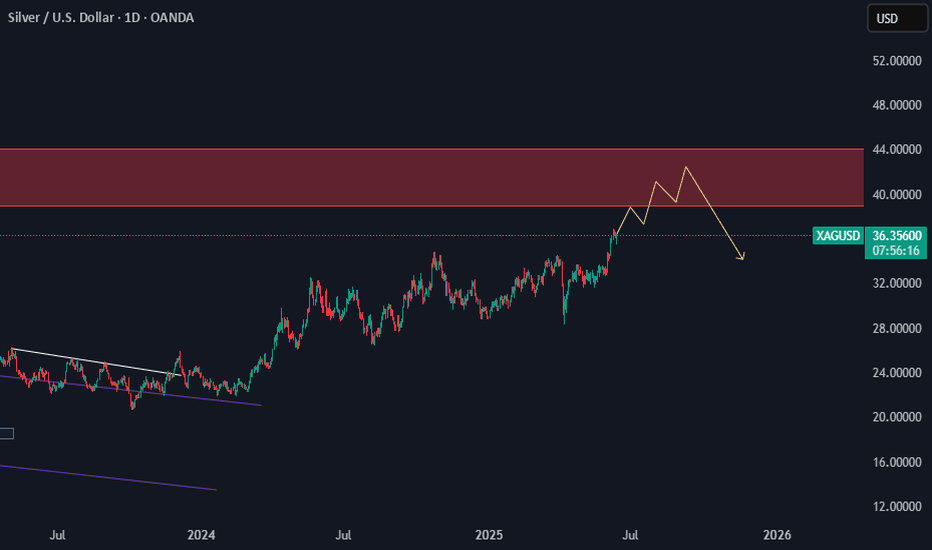

Why Silver Could Outperform Gold in the Coming Months? Silver recently broke out above the key 34.85 resistance level, and this could be a game changer for the medium-term outlook. With rising concerns over government debt, trade uncertainty, and escalating geopolitical risks, gold rallied strongly from 2000 to 3500. Gold and silver typically have a high correlation, and silver tends to follow gold. However, during the latest tariff-driven rally, gold pushed toward 3500 while silver failed to keep up. So, why did gold outperform silver this time?

The answer lies in the demand dynamics. Gold demand primarily comes from the investment side, while silver demand has traditionally been balanced around 50% investment and 50% industrial use. That balance has now shifted significantly. According to the Silver Institute, only 17.8% of 2025 silver demand is expected to come from investments. If we group jewelry and silverware with investment as a “store of value” category, the mix becomes 61% industrial and 39% investment.

This shift has been driven by a surge in silver demand from the electrical and electronics sector. The growth of clean energy and AI technologies has accelerated silver usage. In fact, the electrical and electronics sector is projected to account for 40.5% of total silver demand in 2025. This explains why slowing global trade and economic activity have had a more negative effect on silver compared to gold, pushing the gold/silver ratio to historically high levels.

That said, this same dynamic could fuel silver’s rise in the coming years, supported by long-term trends in clean energy and advanced technology.

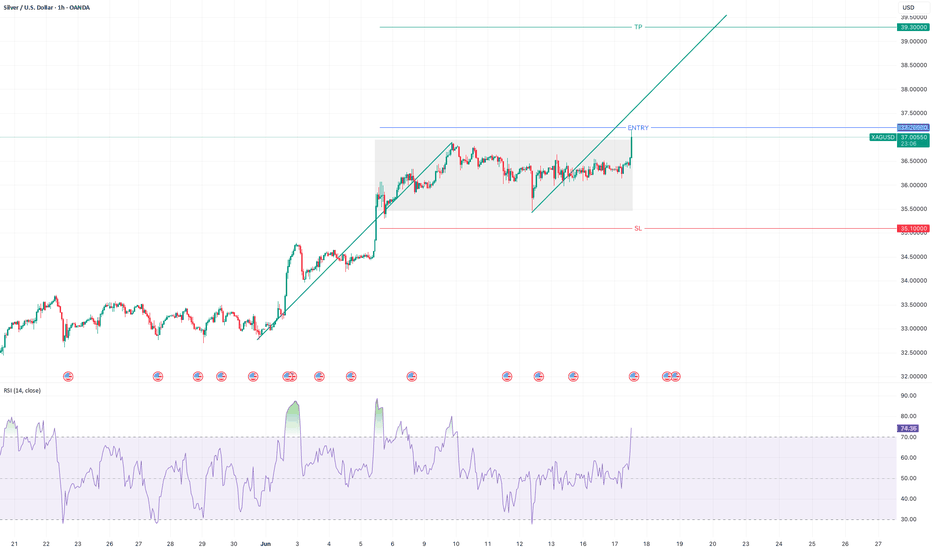

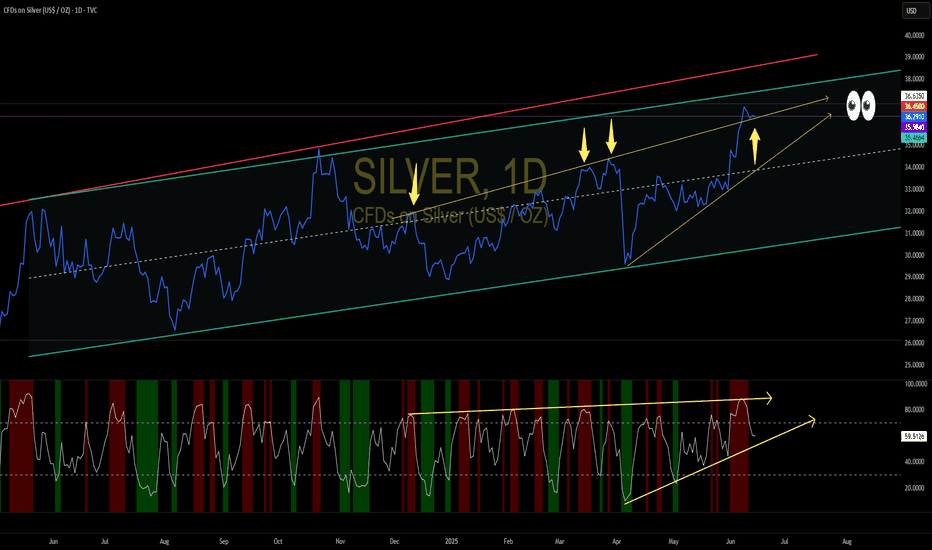

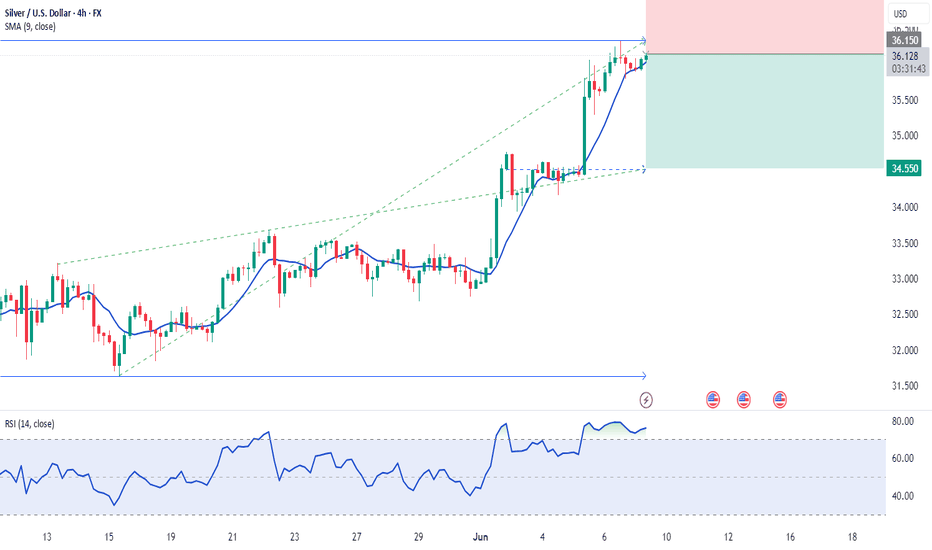

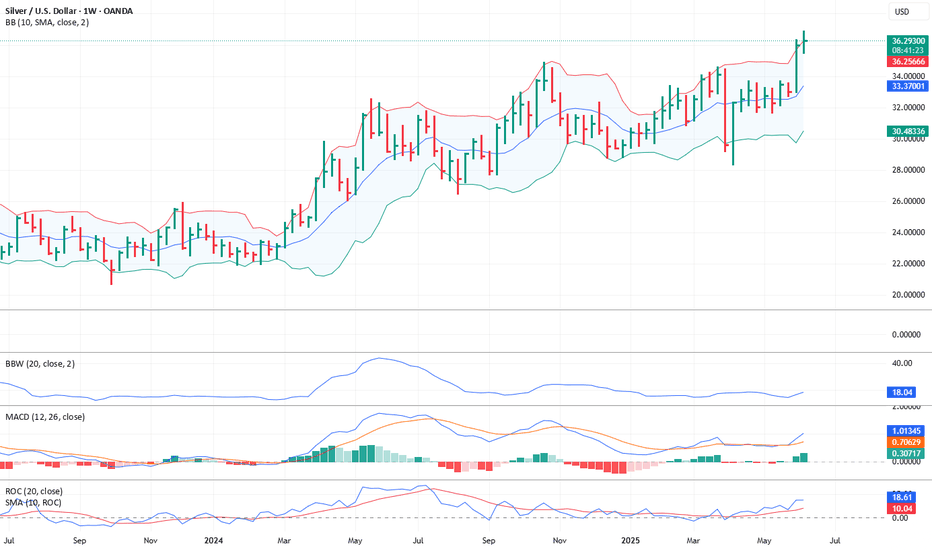

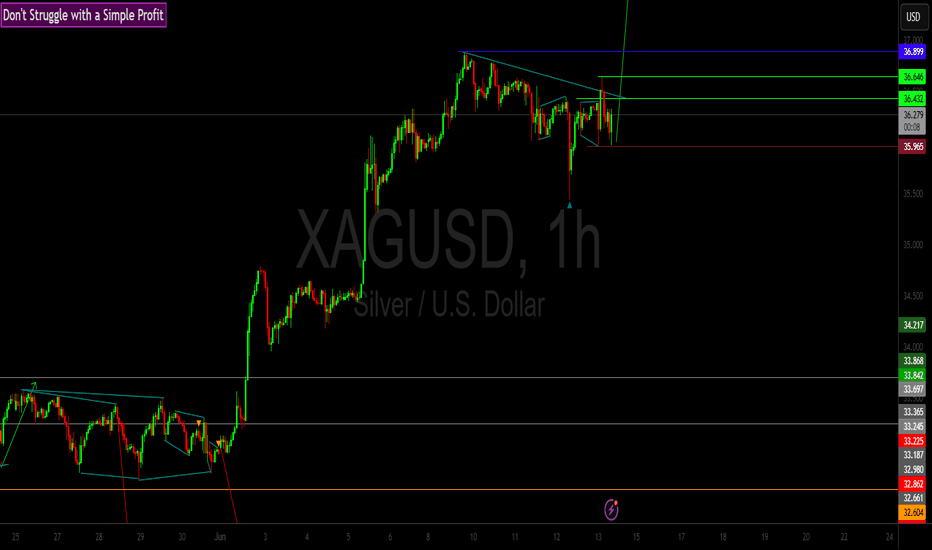

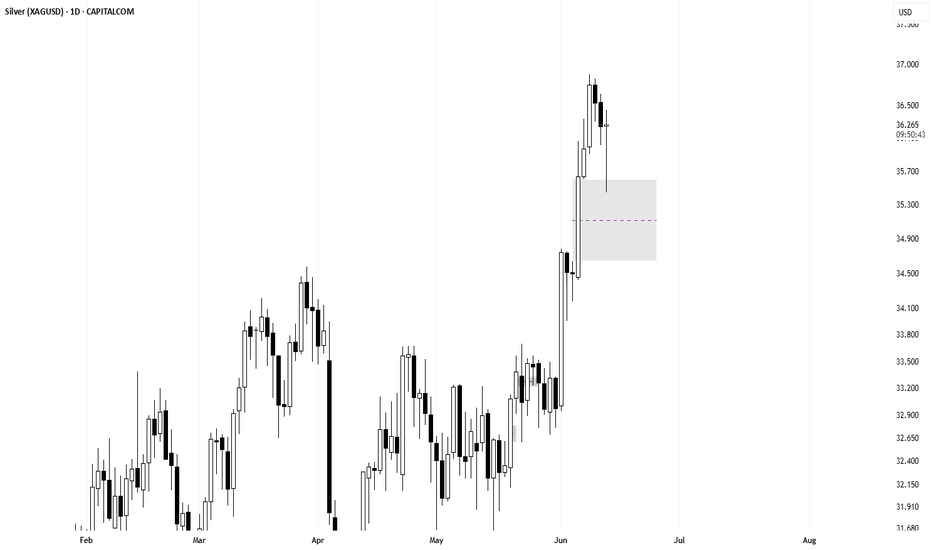

The breakout of 34.85 is a significant technical development . Silver has been in an active uptrend channel since 2024, but the 34.85 level repeatedly capped upward moves since October. With this breakout, silver now has room to rise gradually toward the upper boundary of the channel, potentially reaching near 40. Key support levels to watch are 34.85 and 34.45. As long as they hold, the primary direction remains upward. The moves may be gradual but could include sharp surges and continuation patterns like flags.

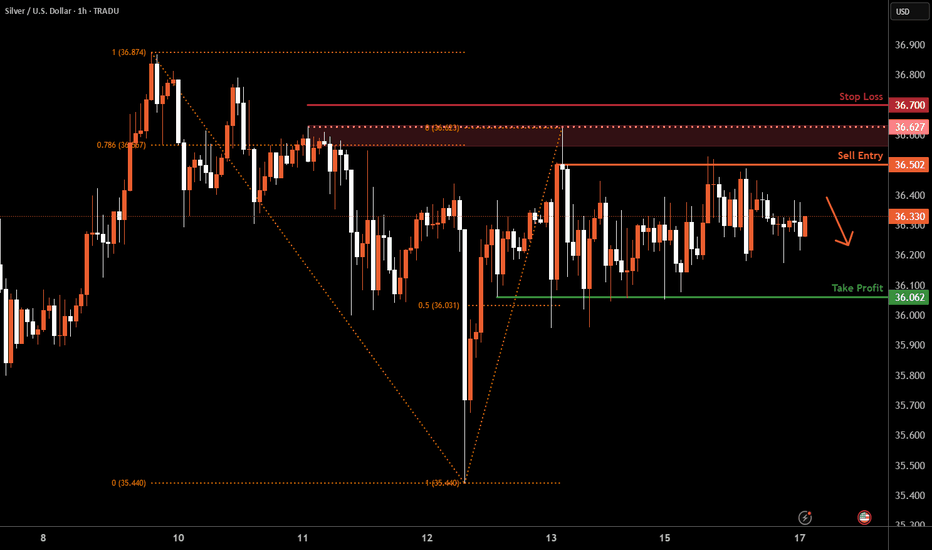

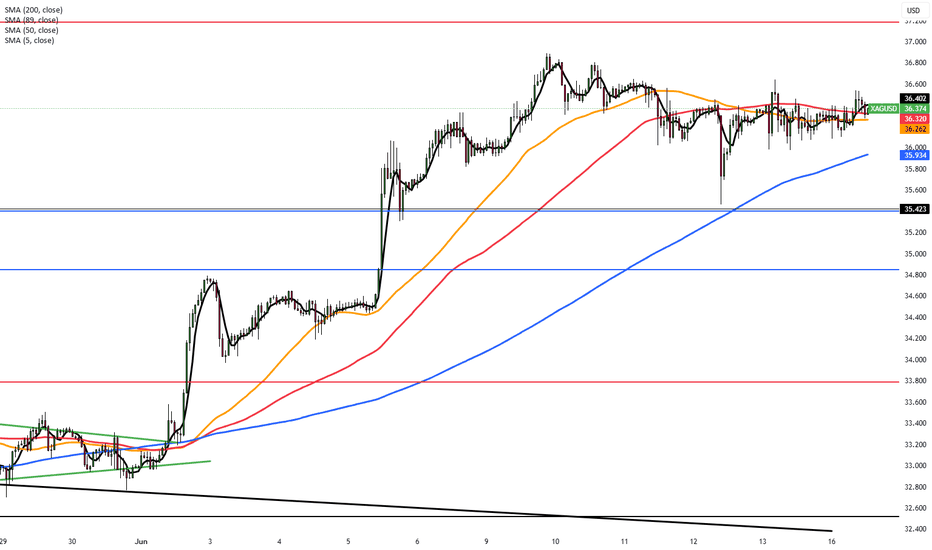

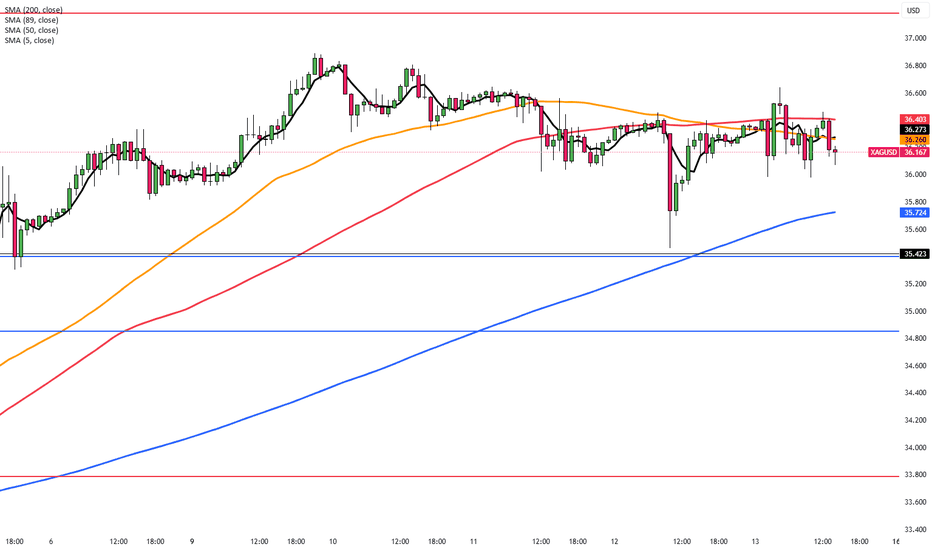

Silver H1 | Rising into a swing-high resistanceSilver (XAG/USD) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 36.50 which is a swing-high resistance.

Stop loss is at 36.70 which is a level that sits above the 78.6% Fibonacci retracement and a swing-high resistance.

Take profit is at 36.06 which is a multi-swing-low support that aligns closely with the 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

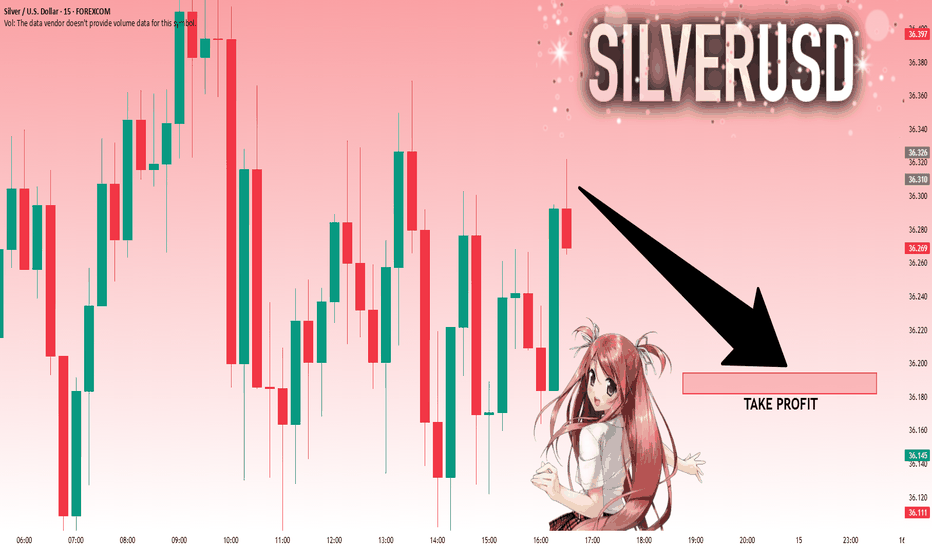

SILVER: Will Go Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 36.344 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

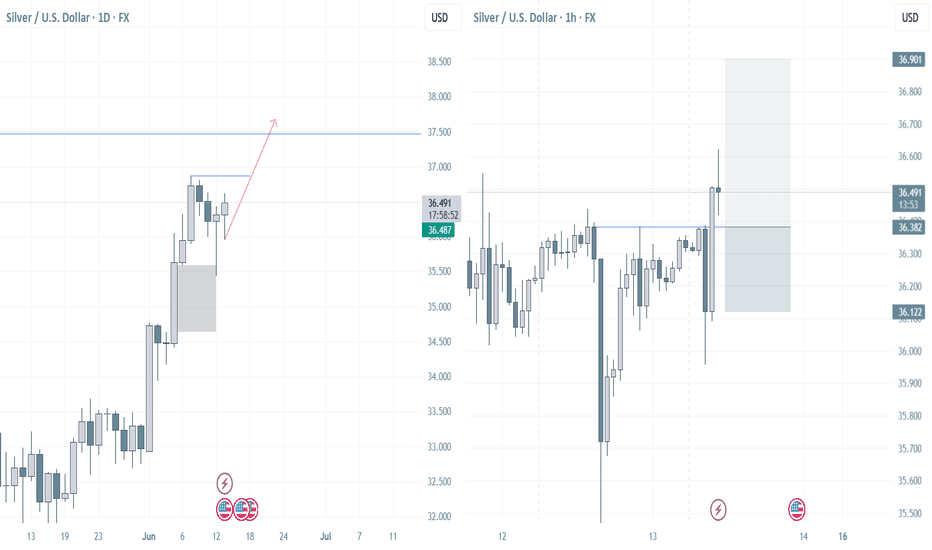

Silver Gains on Tensions, Eyes on FedFriday’s strong U.S. data may support the dollar, as the University of Michigan’s Consumer Sentiment Index rose to 60.5 in June from 52.2, beating forecasts of 53.5 and marking the first gain in six months.

Geopolitical tensions continue to drive safe-haven demand, especially for silver. Israel struck Iranian nuclear and missile sites Friday, killing military officials. On Sunday, Iran began its fourth phase of response, warning of firm retaliation to further Israeli actions.

Markets now turn to Wednesday’s Fed meeting. While rates are expected to stay unchanged, futures still price in two cuts this year, possibly starting in September, supported by last week’s soft inflation data.

Resistance is set at 36.90, while support stands at 35.40.

Silver As global tensions and war intensify, silver becomes more than just a safe-haven asset it’s a strategic resource.

💥 Silver plays a key role in military tech, from drones to advanced weapons systems.

📈 Holding silver isn’t just smart… it’s a hedge against geopolitical instability.

#Silver #Geopolitics #DefenseStocks #SafeHavenAssets #MilitaryTech #Commodities

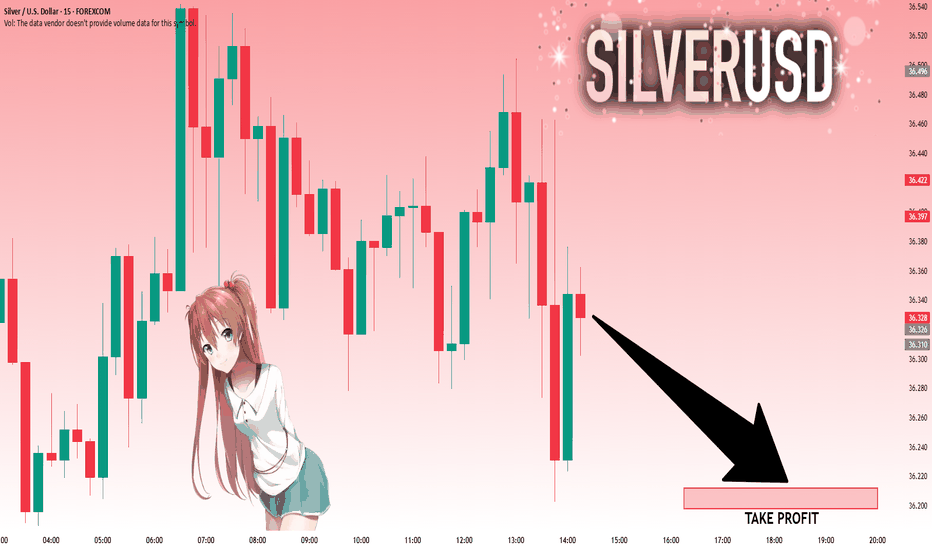

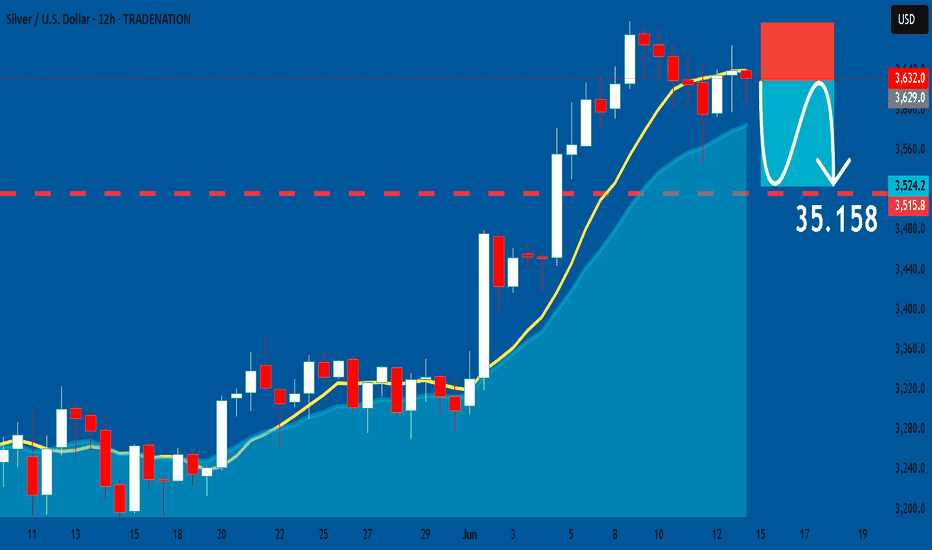

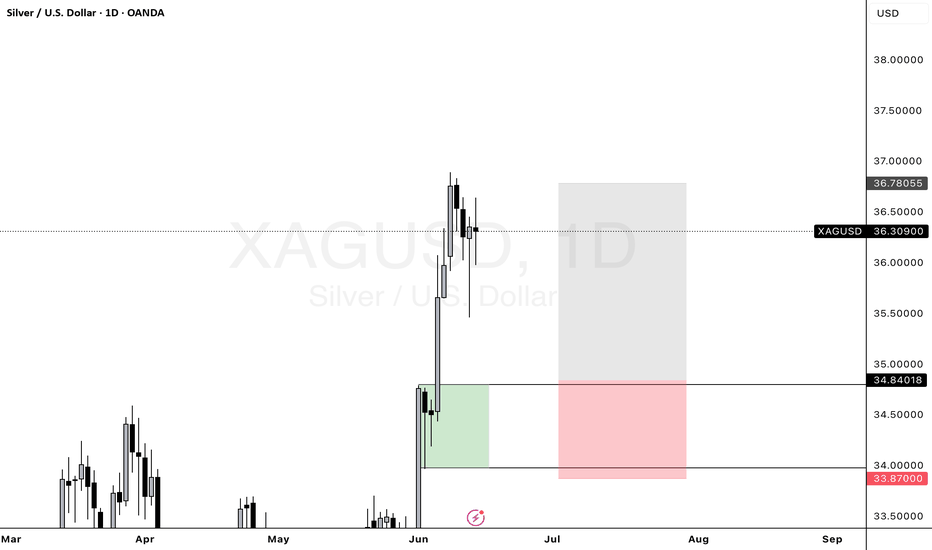

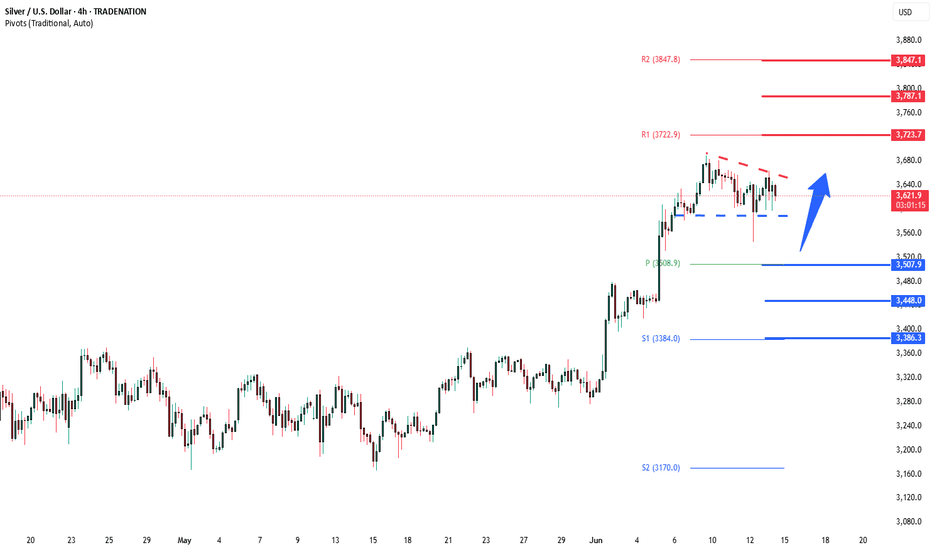

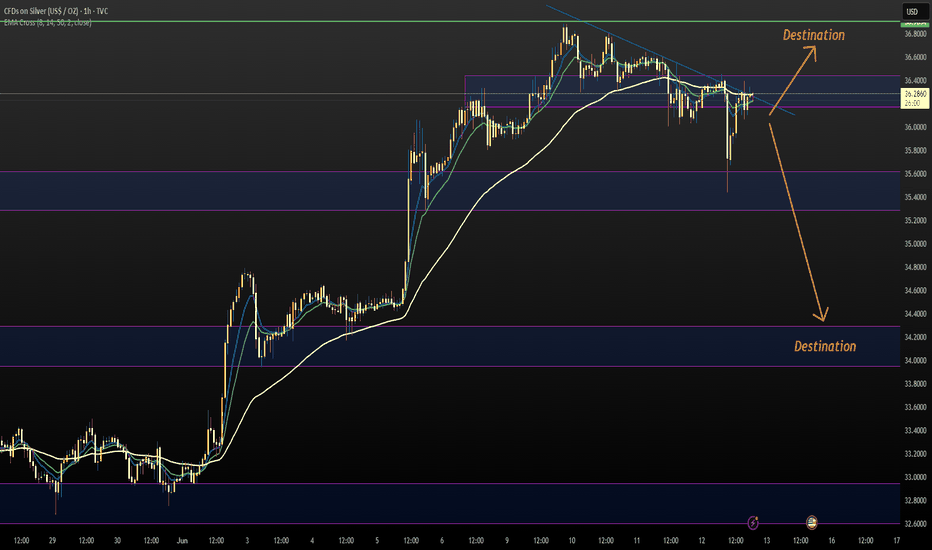

SILVER: Short Trade Explained

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 36.320

Stop Loss - 36.874

Take Profit - 35.158

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

silver daily cp 📓 Updated Journal Entry – XAGUSD

Direction: Buy

Entry Zone: Daily CP demand

Trend: Monthly, Weekly, and Daily all bullish

Target: 2R reward from entry

Status: Pending

Chart: View Chart

Notes:

Watching for price to enter the daily CP demand and form a bullish entry signal

Will exit at 2x the distance of the stop loss once in

Setup aligns with trend-following strategy and continuation logic

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 36.303 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

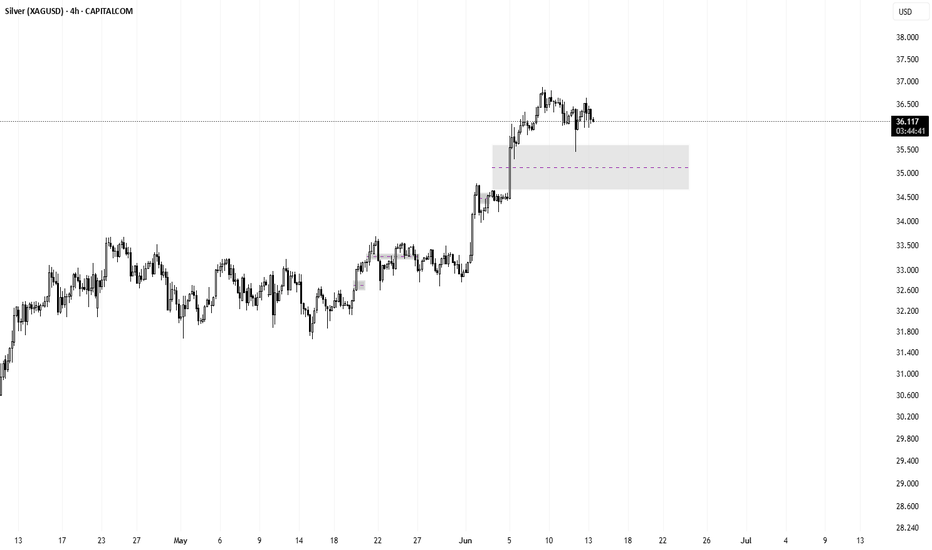

Silver to Continue UpWhen a price goes to oversold/overbought levels as indicated by the Bollinger Band, one must them look at the Band Width. When this indicator is rising, it shows that price is stronger than the average. My rule of thumb is to stay positioned in the direction of the trend until this number reverses.

Rate Cut Bets Keep Silver in FocusSilver slipped toward $36 per ounce as investors locked in gains after hitting a 13-year high. The metal remains supported by strong industrial demand, supply deficits, and safe-haven interest during global uncertainty. Industrial uses, especially in solar and electronics, account for over half of the demand. A fifth consecutive annual supply deficit is expected, though the Silver Institute sees the gap narrowing by 21% in 2025. Softer U.S. inflation data for May also increased expectations of Fed rate cuts beginning in September, helping sustain interest in precious metals.

Resistance is set at 36.90, while support stands at 35.40.

Silver energy buildup, Bullish continuation pattern developing Key Support and Resistance Levels

Resistance Level 1: 3723

Resistance Level 2: 3787

Resistance Level 3: 3847

Support Level 1: 3507

Support Level 2: 3448

Support Level 3: 3386

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

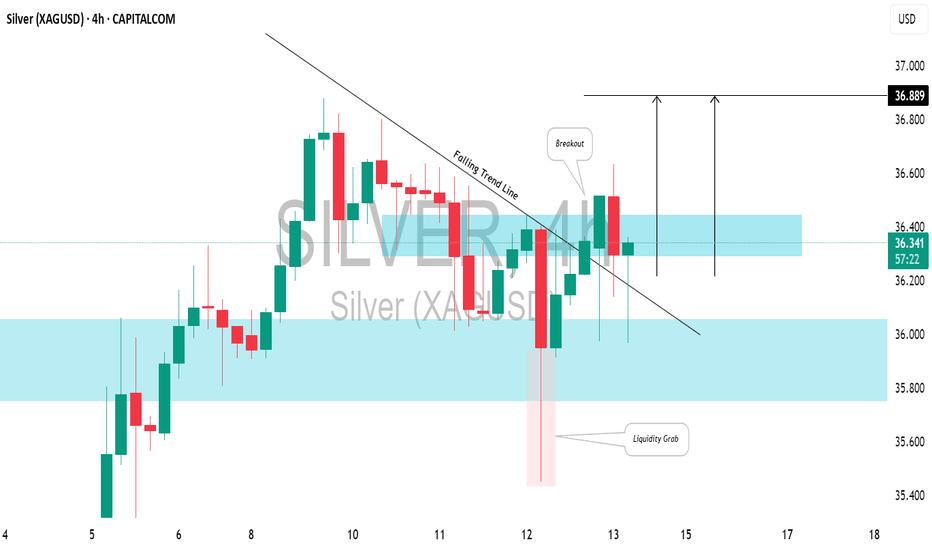

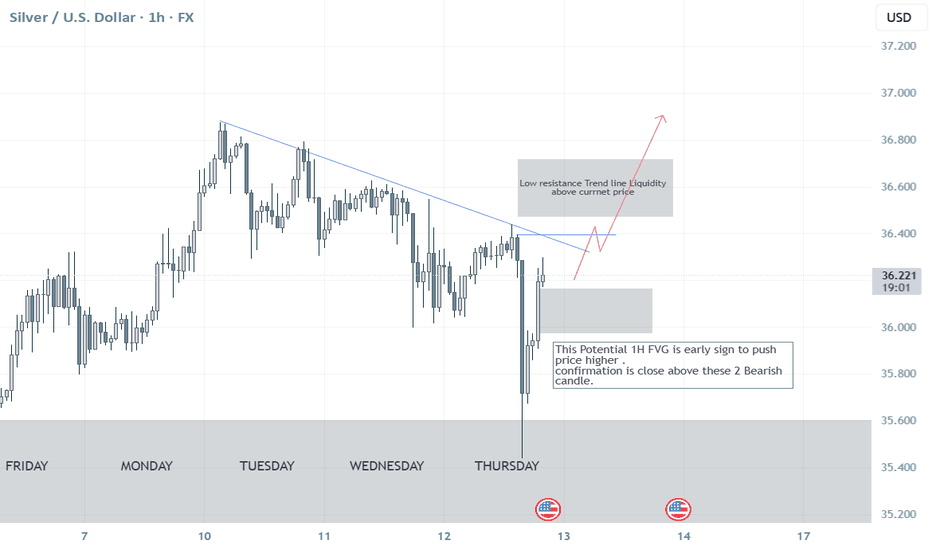

SILVER (#XAGUSD): Strong Bullish Move Ahead?!It appears we've seen a legitimate liquidity grab following a test of a crucial daily/intraday structure on 📈SILVER.

After a false breakout of the highlighted area, the price rebounded and broke through a significant downward trend line and a minor horizontal resistance on the 4H chart.

I believe the market could stay bullish and potentially reach at least the 36.88 level again.

Silver the sad metalIt's Friday and today's post is of less serious nature. Sometimes it's good to have a little fun and get back to very serious posts next week.

Gold and Silver often are part of the same conversation. It makes sense Silver and Gold price data have a correlation coefficient of approximately 0.80 over the past 20 years. I mean they are like to inseparable friends that have been doing everything together since before you or I were born.

So someone might ask hey silver why are you still sleeping. No new high since 2011 now for some of us that feels like just yesterday. Let's break it down though a child born in 2011 is now in Grade 9. Hope that silver was not to pay for their college fees.

A typical basket of groceries went up by over 42.94% according to CPI change. (Which is probably low since the basket changes and manipulates inflation numbers.) That puts current silver purchasing power at about ~$25 value of its 2011 price. Congrats 14 years later Silver half what it bought in 2011. That store of value is more like frosty the snow man in the summer time. Silver made the same price high in 1980 I'd tell you about it but I am not old enough. Let's ignore that for now.

Come on now it's not all gloom out there. Jokes aside. Silver price has moved up significantly since 2020 low around $11. What do we know about assets that break out after a long time stuck under a price point. Typically as some would say they go to the moon. Don't expect that here. Why it's been 45 years. If silver meets up with his old friend Gold he will remind his old friend that he is the more volatile of the two. Forget the moon it would be a space race to mars. My most conservative target would be $100. The 1.618 FIB retracement level. By that metric Gold is already at its 2 FIB retracement level. For silver that's 165.

Disclaimer:

The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.

Silver expectation 1HWell, this could be tricky, as i would like to see silver consolidate for a short time, then break through that top trend line. Or, it could come down for a second touch of support, then bounce off it and bull its way to the top. Me personally, i think it might do a bullish move, buts lets wait and see. #BuyTheBull

Dollar - WE HIT OUR FIRST TARGET TODAY!!!Amazing work on the dollar for about a month of analysis and finally hitting our target. Its taken its sweet time to drift lower but we have the bigger move today which clipped our target.

Follow for more updates on dollar and what im looking to trade.

Please like and sub and get notified when videos come out if you like my content.

Go back and look at tall the 2 min clips for the last month. We have been in sync all this time