Gold continues to be weak, but be careful about operations📣Gold prices fell 2% last Friday, hitting a near one-month low. Optimistic trade-related agreements boosted risk appetite and weakened the attractiveness of gold as a safe-haven asset. This week, the market will usher in a group meeting of major central bank governors around the world (Fed Chairman Powell, European Central Bank President Lagarde, Bank of England Governor Bailey, Bank of Japan Governor Kazuo Ueda, and Bank of Korea Governor Lee Chang-yong). The market will also usher in non-agricultural data. In addition, Powell's remarks on whether to resign may ignite the market this week. Gold prices may fluctuate more around the lower track of the Bollinger Band at $3,270/ounce this week.

Technical analysis:

Last Friday, the K-line had a lower shadow, and the Bollinger Band did not diverge. It is not easy to go short directly in operation, but wait for the rebound to confirm 3295 and the key resistance of ma5 to be short.

💰 Operation strategy: Rebound to 3280-3283 to go short, target 3270-3265, stop loss 3288-3290

If you are a beginner, I suggest you first understand what trading is.

XAUUSD.F trade ideas

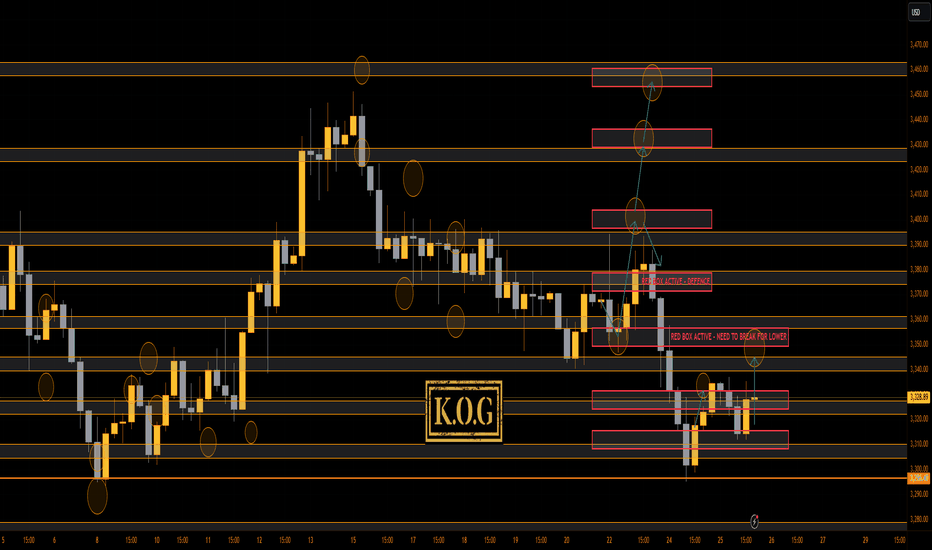

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

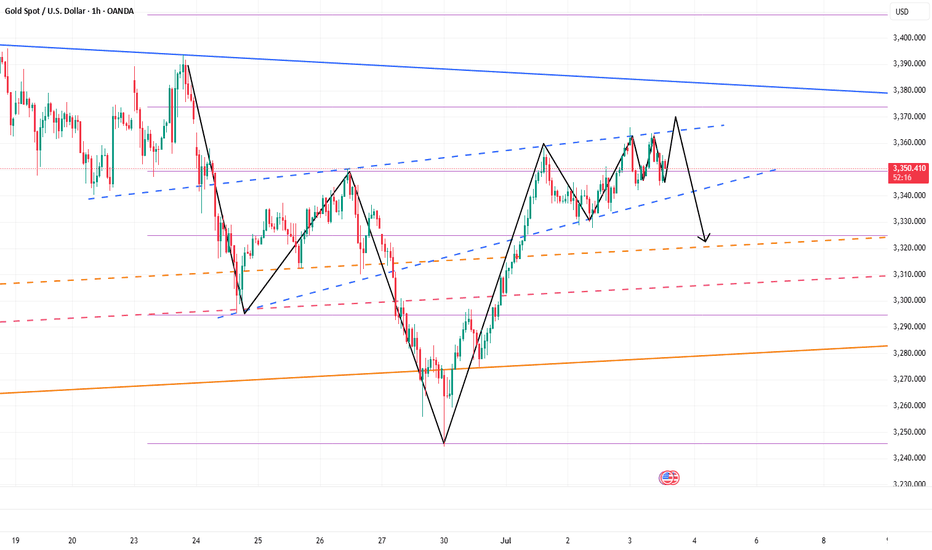

A ranging day and honestly, very frustrating for traders due to the up and down which hasn't allowed us to really hold without ridiculous stop losses. We hit the target yesterday, we're still not retesting that low so those entries are still active, but we really need to see this break above the 3335 level to go higher.

For that reason, we will say if red box active continues to support the price we can look for this to go a little higher but that 3340-45 level is the one to watch. The daily has flipped for lower pricing so tomorrow a high may be put in before further declines.

As always, trade safe.

KOG

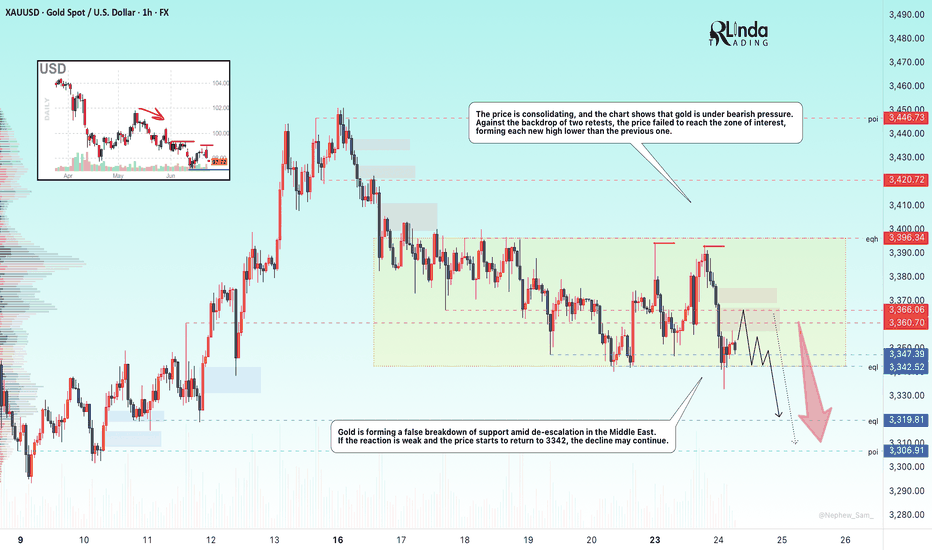

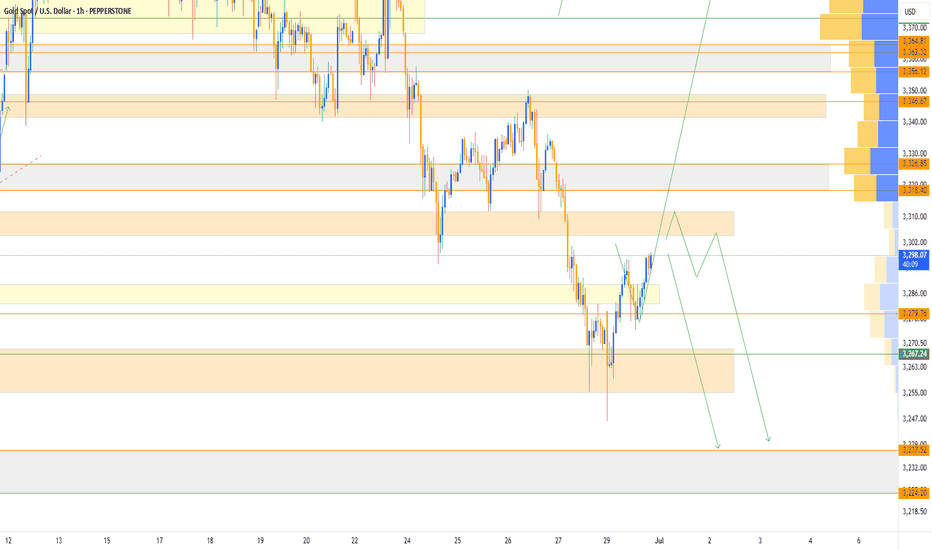

GOLD → Declining interest. Retest of supportFX:XAUUSD experienced significant volatility toward the end of the US trading session. This was due to developments in the Middle East. The de-escalation of the situation is leading to a decline in interest in the metal.

The announced ceasefire between Iran and Israel has reduced demand for gold as a safe-haven asset, while falling oil prices have reduced its appeal as a hedge against inflation. Gold is supported by expectations of a Fed rate cut in July. The focus is on Fed Chair Powell's testimony before Congress and further developments in the Middle East.

Technically, the price confirms the local bearish structure. A continued assault on the 3340 support level could trigger a further decline.

Support levels: 3343-3340, 3320

Resistance levels: 3360, 3366

Focus on the trading range (consolidation) 3340 - 3400. De-escalation of the conflict in the Middle East may lead to a decline in interest in gold as a hedge asset, which may cause the price to break down of consolidation. If the retest of 3340 continues, the price will begin to contract before the level, in which case the chances of a breakdown and decline will only increase. The target will be the liquidity zone of 3320 - 3306

Best regards, R. Linda!

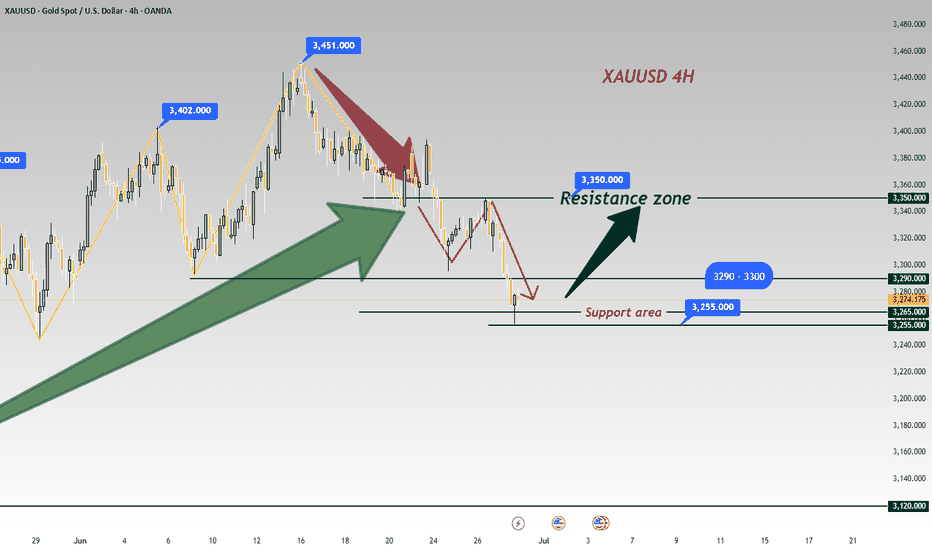

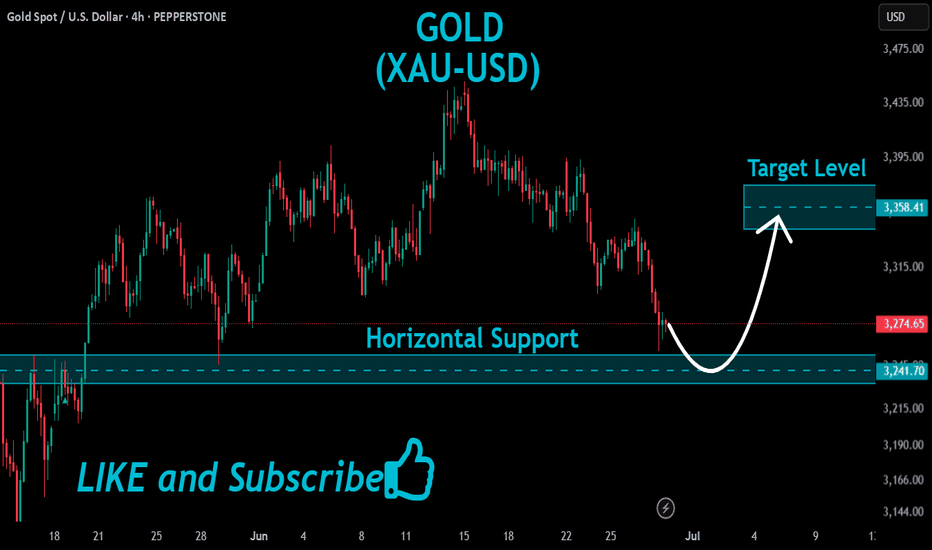

Next Week Aims for 3300 Break💎 Last week, gold opened gap-up on Monday 🔼 but then trended lower 🔽. However, the 3290-3300 support zone remained robust from Mon-Thu ⚡. It plunged to ~3255 on Fri before rebounding 🌱. Next week's open may surge to 3290-3300 🔥!

🚀 Sell@3260 - 3270

🚀 TP 3280 - 3290 -3300

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

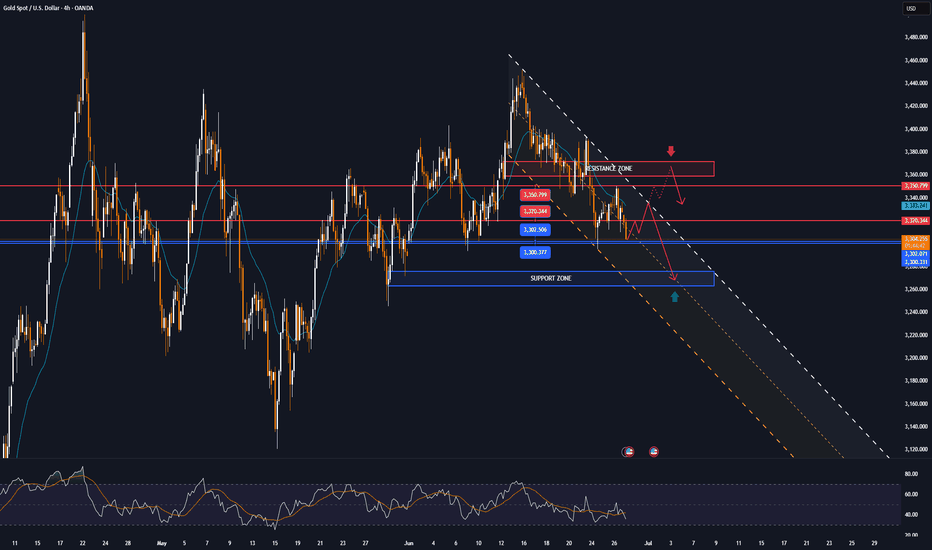

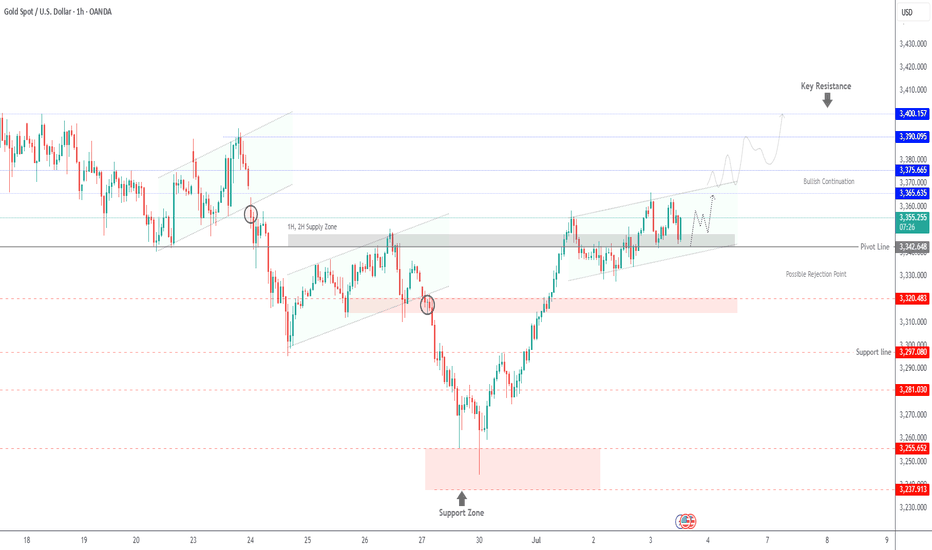

GOLD recovers, capped by $3,350, trend viewOANDA:XAUUSD recovered then weakened as it failed to break above $3,350, supported by a weaker dollar and market uncertainty sparked by reports that U.S. President Donald Trump could replace Federal Reserve Chairman Jerome Powell in September or October. The reports raised concerns about the future independence of the Federal Reserve, boosting demand for safe-haven gold.

On Wednesday, Trump called Powell “terrible” and said he was considering three or four candidates to replace him. Meanwhile, the Wall Street Journal reported that Trump was even considering announcing a potential successor as early as September or October.

The current market narrative is that once Trump nominates a new Fed chair, market expectations will tend to favor a more “dovish” Fed. This could lead to a weaker US dollar, higher long-term US Treasury yields and higher stock prices.

Forexlive points out that this story may be more an emotional reaction than a result of objective and rational thinking. The policy of the FOMC (Federal Open Market Committee) is decided not only by the Fed Chairman but also by a majority vote of the 12 voting members (including 7 directors and 5 regional Fed presidents). The Fed Chairman does have a lot of influence, but he does not have absolute control over monetary policy. The Fed was originally designed to be independent of political pressure.

Moreover, even if Trump nominates the next chairman, there is no guarantee that this will automatically lead to a rate cut. In fact, Powell was also nominated by Trump, but his monetary policy decisions are still based on professional judgment rather than serving Trump's wishes.

So, in the worst case, the market could face policy uncertainty as differences between FOMC members increase and more disagreements emerge. Currently, there are fewer moderate members on the committee, while neutral or hawkish members dominate.

Markets are now focused on personal consumption expenditure (PCE) data due later today (Friday) for further clues on whether the Federal Reserve will cut interest rates.

On the geopolitical front, a ceasefire between Israel and Iran appeared to be in place on Wednesday after Trump hailed a swift end to the 12-day conflict at the NATO summit and said he would seek a commitment from Iran to abandon its nuclear ambitions in talks next week.

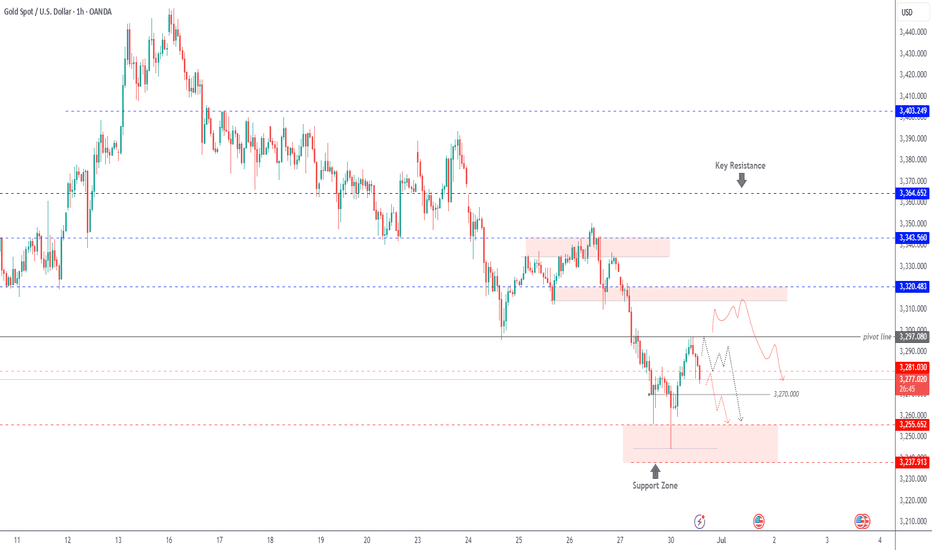

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, after gold recovered and reached the initial target at 3,350 USD, the nearest resistance is also the price point of the EMA21 noted for readers in the previous publication.

However, the recovery momentum is currently weakening, specifically at the time of writing, the gold price is falling below 3,320 USD. Gold falling below 3,320 USD provides conditions for a possible decline with the next target around 3,302 - 3,300 USD, which is the area of the 0.382% Fibonacci retracement confluence with the lower edge of the price channel.

In terms of momentum, the RSI is heading down and breaking below 50, which should be considered an initial bearish signal.

Overall, gold does not have a clear long-term trend as the uptrend is still the main trend, while the momentum is showing signs of decline.

But personally, I am still leaning towards the uptrend, and continue to look for positions to buy.

Finally, the notable positions will be listed as follows.

Support: 3,302 – 3,300 USD

Resistance: 3,320 – 3,350 – 3,371 USD

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

→Take Profit 1 3359

↨

→Take Profit 2 3353

BUY XAUUSD PRICE 3272 - 3274⚡️

↠↠ Stop Loss 3268

→Take Profit 1 3280

↨

→Take Profit 2 3286

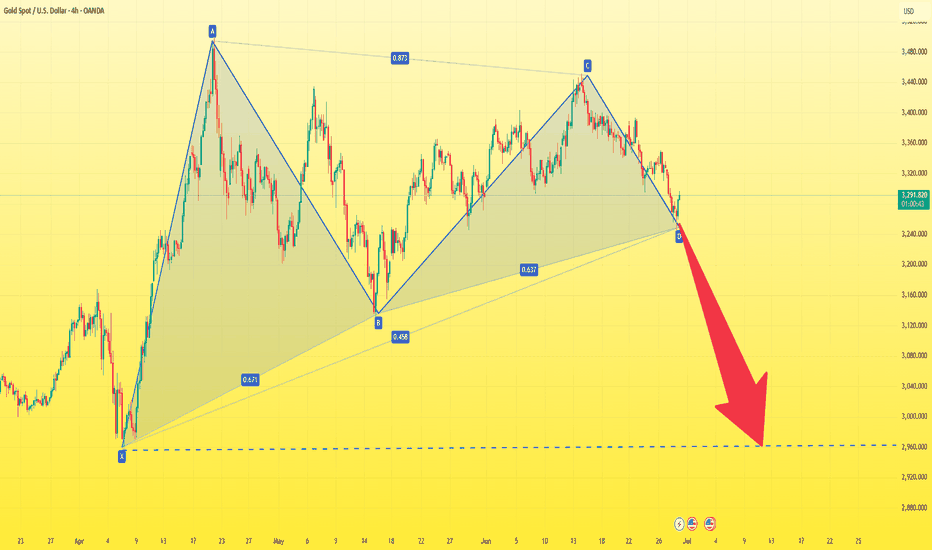

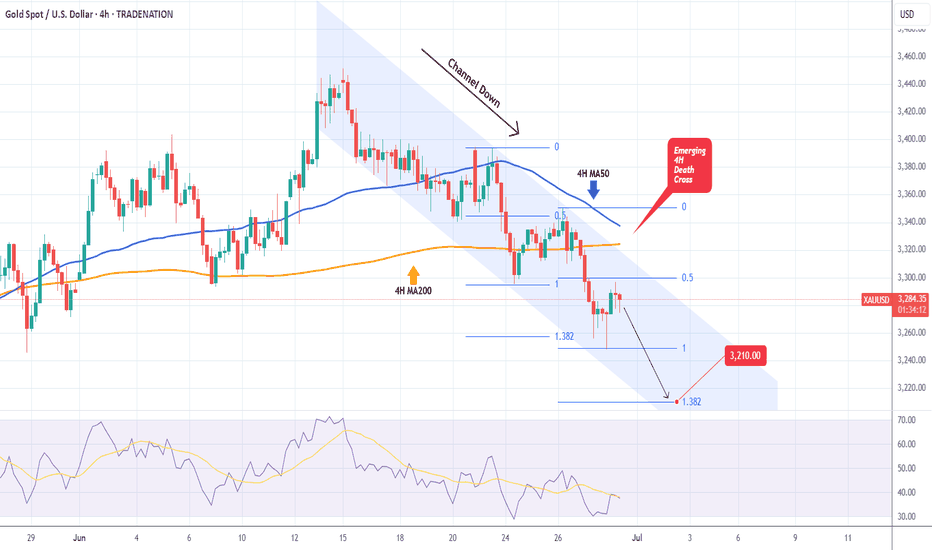

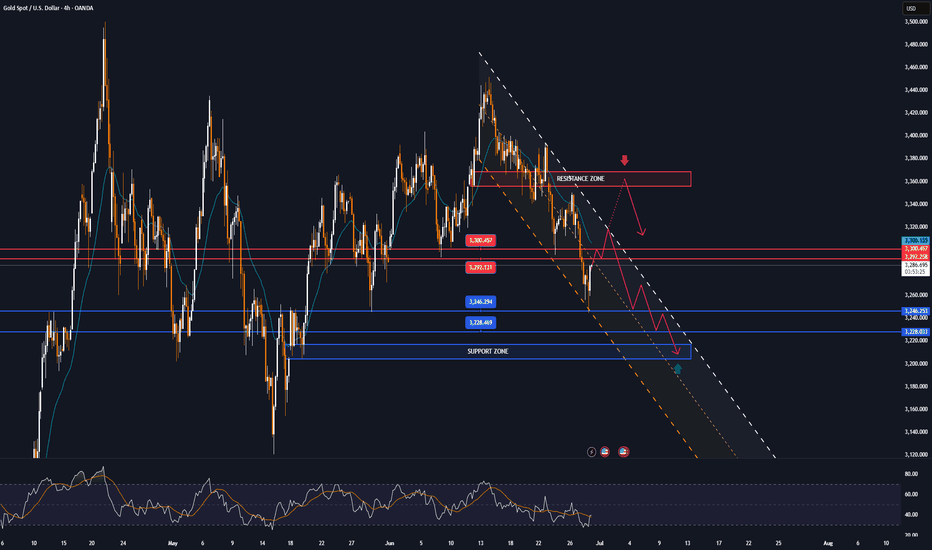

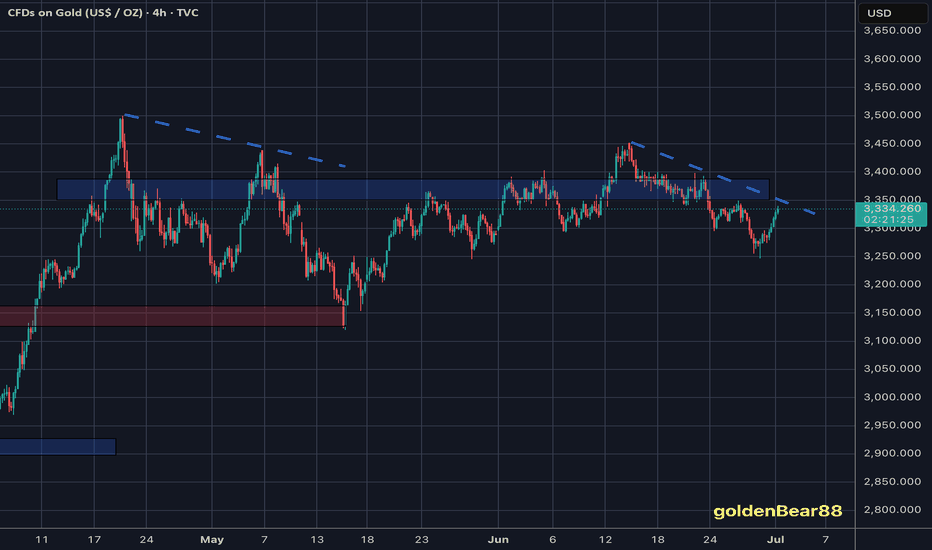

XAUUSD Channel Down starting new Bearish Leg.Gold (XAUUSD) has been trading within a 2-week Channel Down, recently rejected on its 4H MA50 (blue trend-line). The last Lower High was priced on the 0.5 Fibonacci retracement level, so currently we are on the ideal level for a new short.

With a 4H Death Cross emerging, we are targeting the 1.382 Fibonacci extension (as the previous Bearish Leg did) at 3210 for the Channel's new Lower Low.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

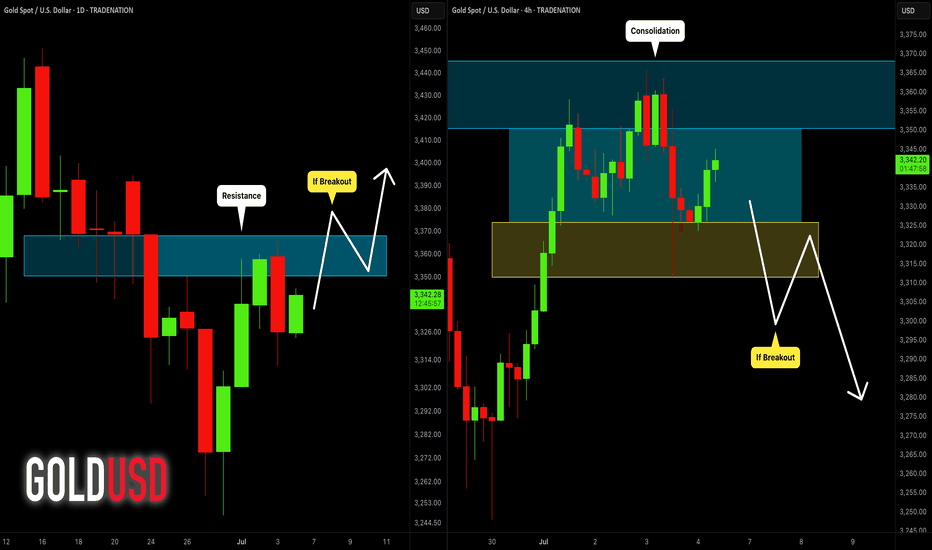

GOLD (XAUUSD): Potential Scenarios Explained

Here is my updated technical outlook for Gold with potential scenarios.

Bullish Scenario

The price is currently testing a significant daily resistance cluster.

Its bullish breakout and a daily candle close above 3368 will

provide a strong confirmation.

More growth will be expected then.

Bearish Scenario

For now, the market is consolidating on the underlined resistance.

The price is stuck within a horizontal range on a 4H time frame now.

Your bearish signal will be a breakout of its support and a 4H candle

close below 3310.

It will provide a strong bearish confirmation.

The market might be weak and remain within a 4H range today.

But, everything can happen, so watch carefully.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

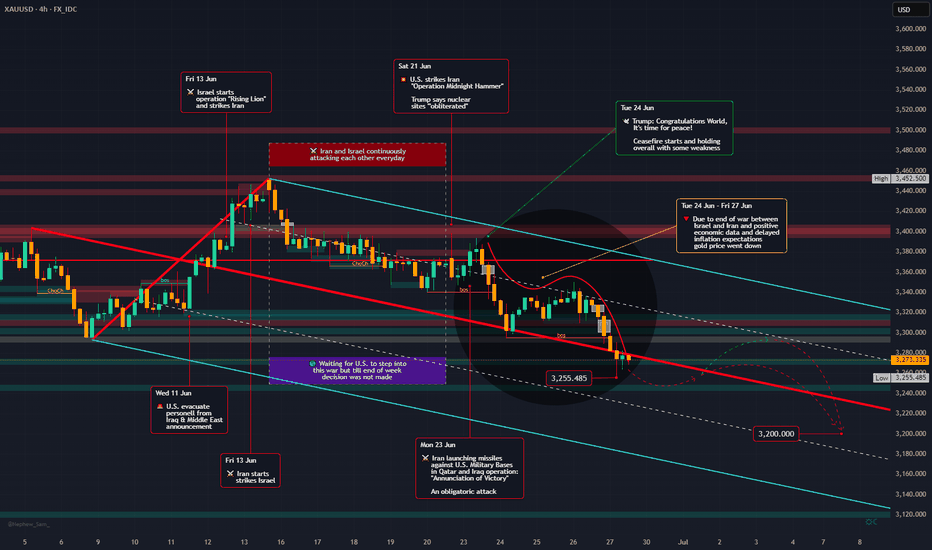

Down the road - Gold Outlook June 30 - July 24, 2025FX_IDC:XAUUSD

📰 The past weeks has been a wild ride for gold prices, caught between the fiery conflict in the Middle East and a deluge of crucial economic data from the U.S. 📈 Adding to this, a detailed technical analysis provides a deeper look into gold's immediate future.

**Geopolitical Drama Unfolds & Peace Prevails!** 🕊️ ceasefire negotiations.

Initially, gold was shrouded in uncertainty 🌫️ due to the Iran-Israel war, with markets bracing for potential U.S. involvement and a full-blown escalation. Daily tit-for-tat attacks between Iran and Israel kept everyone on edge, and the question of U.S. intervention remained a nail-biter 😬, though President Trump did announce a 14-day "timeout".

Then came the dramatic twist on June 21st: "Operation Midnighthammer" saw the U.S. unleash bunker-buster bombs on Iranian uranium enrichment facilities. 💥 Short time later, the U.S. declared mission accomplished, stating their goal of destroying these sites was achieved, and no further attacks would follow.

Iran's response, "Operation Annunciation of Victory," on the following Monday, involved missile strikes on U.S. military bases in Qatar and Iraq. 🚀 Interestingly, these attacks were pre-announced, allowing for safe evacuations and thankfully, no casualties. 🙏

The biggest surprise came from President Trump as he declared, "Congratulations world, it's time for peace!" 🎉 He then brokered a ceasefire between Israel and Iran, which, despite being fragile, largely held, leading to the war's end.🤝 Both nations, as expected, officially claimed victory – a common move to satisfy their citizens. 🏅

Personally, I was genuinely surprised that the U.S.President mediated ceasefire, actually brought the conflict to a close – but it's a welcome outcome! 🙏

**Economic Data & Fed's Steady Hand** 💹🏛️

The cessation of hostilities triggered a steady downward slide in gold prices from June 24th to 27th. ⬇️ This dip initially met some market resistance but it ultimately prevailed, especially with the release of mixed U.S. economic data, which, despite being varied, was generally interpreted positively by the market.

The spotlight also shone on the Federal Reserve, with several representatives speaking and Fed Chair Jerome Powell undergoing a two-day Senate hearing. 🎤👨⚖️ Powell meticulously explained the Fed's rationale for holding interest rates steady, despite market pressures. 🤷 However, recent whispers suggest the Federal Reserve might actually cut rates in September! 😮

## Geopolitical News Landscape 🌍📰

India / Pakistan

Pakistan rejected claims that it supported militant groups active in Indian Kashmir. India issued a formal protest but reported no fresh border clashes during the week.

Outlook 🔮: De-escalation is possible in the short term. However, unresolved disputes over water rights (Indus Treaty) could reignite tensions.

Gaza Conflict

Heavy Israeli airstrikes killed dozens in Gaza, including civilians near aid centers. The UN warned that U.S.-backed aid systems are failing. Humanitarian corridors remain blocked.

Outlook 🔮: Ceasefire talks may resume in July, but success depends on international pressure and safe humanitarian access.

Russia / Ukraine

Russia advanced 36 sq mi in eastern Ukraine, deploying outdated T-62 tanks. Ukraine reinforced defensive lines, aided by Western military packages.

Outlook 🔮: The front remains volatile. Sustained Western support will be key to halting further Russian gains.

U.S. – China Trade War

A breakthrough deal was signed for China to fast-track rare-earth exports to the U.S. Talks on tech transfer and tariffs continue behind closed doors.

Outlook 🔮: A phased de-escalation is possible, but deep trust issues linger, especially over semiconductors and AI.

🌐 Global Trade War

Several countries, including Brazil and Thailand, imposed fresh restrictions on Chinese imports, echoing the U.S. stance. Global supply chains remain fragmented.

Outlook 🔮: Trade blocs like the EU and Mercosur may take on greater importance as countries hedge against rising protectionism.

Trump vs. Powell

Fed Chair Powell resisted political pressure, stating rate cuts are unlikely before September. Trump called him “stubborn” and demanded immediate easing.

Outlook 🔮: The Fed’s independence is under strain. If Trump wins re-election, major policy shifts could follow.

📈 U.S. Inflation

Despite tariffs, core inflation remains elevated. Powell warned of persistent price pressures. Trump insists the Fed should cut rates to boost growth.

Outlook 🔮: A rate cut later in 2025 is possible—if labor market data weakens. Until then, inflation will remain politically explosive.

## Technical View 📐📈

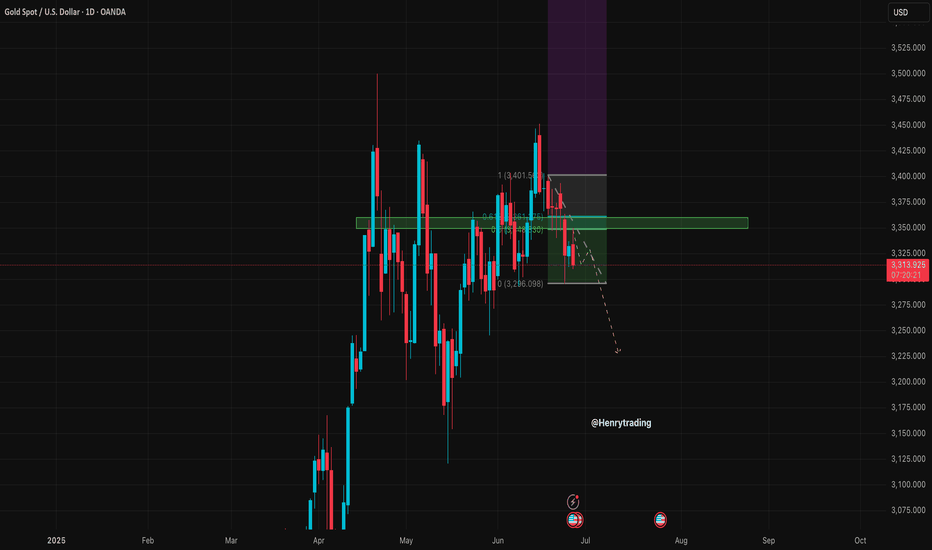

**Current Market Context:** Gold plummeted to $3,273.67 USD/t.oz on June 27, 2025, marking a 1.65% drop from the previous day, which confirms the strong bearish momentum. The price action shows a significant retreat from recent highs around $3,400.

**ICT (Inner Circle Trader) Methodology Analysis:**

* **Market Structure:**

The trend is clearly bearish, with a definitive break of structure (BOS) to the downside.

* **Order Blocks:**

Several bearish order blocks have been identified at prior resistance levels, specifically in the $3,380-$3,400 range.

* **Fair Value Gaps (FVG):**

The aggressive sell-off has created multiple imbalances, particularly in the $3,350-$3,320 range.

* **Liquidity Pools:**

Buy-side liquidity above $3,400 has been swept. Sell-side liquidity is now accumulating below the $3,270 lows, which is the current target zone.

* **Session Analysis:**

The London session showed aggressive selling, followed by a continuation of bearish momentum in the New York session. The Asia session could see consolidation or further declines.

* **Smart Money Concepts:**

Heavy selling pressure suggests "smart money" distribution. There's been strong bearish displacement from $3,380 down to $3,270, indicating the market is currently in a "sell program" phase.

**Gann Analysis:**

* **Gann Angles & Time Cycles:**

The primary 1x1 Gann angle has been broken, pointing to continued weakness. Key price squares indicate resistance at $3,375 (25²) and support at $3,249 (57²). Daily cycles suggest a potential turning point around June 30-July 1, while weekly cycles indicate continued pressure through early July.

* **Gann Levels:**

* Resistance: $3,375, $3,400, $3,481 (59²)

* Support: $3,249, $3,136, $3,025

**Fibonacci Analysis:**

* **Key Retracement Levels (from recent swing high to low):**

* 78.6%: $3,378 (Strong resistance)

* 61.8%: $3,348 (Key resistance zone)

* 50.0%: $3,325 (Psychological level)

* 38.2%: $3,302 (Minor resistance)

* 23.6%: $3,285 (Current area of interest)

* **Fibonacci Extensions (Downside Targets):**

* 127.2%: $3,245

* 161.8%: $3,195

* 261.8%: $3,095

* **Time-Based Fibonacci:**

The next significant time cluster is July 2-3, 2025, with a major cycle completion expected around July 15-17, 2025.

**Institutional Levels & Volume Analysis:**

* **Key Institutional Levels:**

* Major Resistance: $3,400 (psychological + institutional)

* Secondary Resistance: $3,350-$3,375 (order block cluster)

* Primary Support: $3,250-$3,270 (institutional accumulation zone)

* Major Support: $3,200 (monthly pivot area)

* **Volume Profile Analysis:**

* High Volume Node (HVN): $3,320-$3,340 (fair value area)

* Low Volume Node (LVN): $3,280-$3,300 (potential acceleration zone)

* Point of Control (POC): Currently around $3,330

**Central Bank & Hedge Fund Levels:**

Based on recent COT data and institutional positioning, heavy resistance is seen at $3,400-$3,430, where institutions likely distributed. An accumulation zone for "smart money" re-entry is anticipated at $3,200-$3,250.

**Cycle Timing Analysis:**

* **Short-Term Cycles (Intraday):**

Bearish momentum is expected to continue for another 12-18 hours. A daily cycle low is likely between June 29-30, with a potential reversal zone on July 1-2 for the 3-day cycle.

* **Medium-Term Cycles:**

The current weekly cycle is in week 3 of a 4-week decline. The monthly cycle indicates a mid-cycle correction within a larger uptrend. For the quarterly cycle, Q3 2025 could see a major low formation.

* **Seasonal Patterns:**

July-August is typically a weaker period for gold ("Summer Doldrums"). September has historically been strong for precious metals ("September Effect"), setting up for a potential major move higher in Q4 2025 ("Year-End Rally").

**Trading Strategy & Levels:**

* **Bearish Scenario (Primary):**

* Entry: Sell rallies into the $3,320-$3,350 resistance zone.

* Targets: $3,250, $3,200, $3,150.

* Stop Loss: Above $3,380.

* **Bullish Scenario (Secondary):**

* Entry: Buy support at $3,250-$3,270 with confirmation.

* Targets: $3,320, $3,375, $3,400.

* Stop Loss: Below $3,230.

**Key Events to Watch:**

* **US PCE Data:**

Fresh downside risks could emerge ahead of the US Personal Consumption Expenditures (PCE) Price Index data release.

* **Fed Communications:**

Any hawkish rhetoric from the Federal Reserve could further pressure gold.

* **Geopolitical Developments:**

Ongoing global events could trigger safe-haven demand.

**Conclusion:**

The technical picture for gold suggests continued short-term weakness, with the metal testing its 2025 trend line at $3,290 following last week's rejection at the $3,430 resistance. However, the longer-term outlook remains constructive, given gold's robust performance year-to-date. Key support at $3,250-$3,270 will be crucial in determining the next significant price movement.

**Upcoming Week's Economic Calendar (June 29 - July 4, 2025):** 🗓️🌍

🗓️ Get ready for these important economic events (EDT)

* ** Sunday , June 29, 2025**

* 21:30 CNY: Manufacturing PMI (Jun) - Forecast: 49.6, Previous: 49.5

* ** Monday , June 30, 2025**

* 09:45 USD: Chicago PMI (Jun) - Forecast: 42.7, Previous: 40.5

* ** Tuesday , July 1, 2025**

* 05:00 EUR: CPI (YoY) (Jun) - Forecast: 2.0%, Previous: 1.9%

* 09:30 USD: Fed Chair Powell Speaks

* 09:45 USD: S&P Global Manufacturing PMI (Jun) - Forecast: 52.0, Previous: 52.0

* 10:00 USD: ISM Manufacturing PMI (Jun) - Forecast: 48.8, Previous: 48.5

* 10:00 USD: ISM Manufacturing Prices (Jun) - Forecast: 70.2, Previous: 69.4

* 10:00 USD: JOLTS Job Openings (May) - Forecast: 7.450M, Previous: 7.391M

* ** Wednesday , July 2, 2025**

* 08:15 USD: ADP Nonfarm Employment Change (Jun) - Forecast: 80K, Previous: 37K

* 10:30 USD: Crude Oil Inventories - Forecast: -5.836M

* ** Thursday , July 3, 2025**

* Holiday: United States - Independence Day (Early close at 13:00) 🇺🇸⏰

* 08:30 USD: Average Hourly Earnings (MoM) (Jun) - Forecast: 0.3%, Previous: 0.4%

* 08:30 USD: Initial Jobless Claims - Forecast: 239K, Previous: 236K

* 08:30 USD: Nonfarm Payrolls (Jun) - Forecast: 129K, Previous: 139K

* 08:30 USD: Unemployment Rate (Jun) - Forecast: 4.2%, Previous: 4.2%

* 09:45 USD: S&P Global Services PMI (Jun) - Forecast: 53.1, Previous: 53.1

* 10:00 USD: ISM Non-Manufacturing PMI (Jun) - Forecast: 50.3, Previous: 49.9

* 10:00 USD: ISM Non-Manufacturing Prices (Jun) - Forecast: 68.7

* ** Friday , July 4, 2025**

* All Day: Holiday - United States - Independence Day 🎆

**Gold Price Forecast for the Coming Week** 🔮💰

Given last week's market movements, there's a strong likelihood that the downward trend in gold prices will continue.🔽 However, fresh news can always flip the script! 🔄 As of now, I expect gold to dip further to $3255 by mid-next week. Yet, a brief rebound towards $3300 isn't out of the question before a potential drop to $3200 by week's end or early the following week. 🤞

Please take the time to let me know what you think about this. 💬

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

GOLD MARKET ANALYSIS AND COMMENTARY - [Jun 30 - Jul 04]Last week, OANDA:XAUUSD fell sharply from an opening price of $3,392/oz to a low of $3,255/oz and closed at $3,274/oz. The reason was that Israel and Iran had officially ceased fire, although negotiations with the US remained difficult. In addition, FED Chairman Jerome Powell reaffirmed that there was no rush to cut interest rates due to high inflation risks. In addition, summer is a period of weak demand for physical gold, continuing to put pressure on gold prices.

In addition, summer is typically the low season for physical gold demand, which could continue to weigh on gold prices.

In addition to the seasonal lull in trading that has affected the gold market, improving economic sentiment as the Trump administration has said there is progress in trade agreements, especially the framework agreement on trade with China, will also continue to negatively impact gold prices next week.

Thus, gold prices next week may continue to be under downward pressure, but the decline may not be too large as gold prices next week are still supported by some fundamental factors.

This week, the US will release the non-farm payrolls (NFP) report and the unemployment rate for June. According to forecasts, NFP may reach 120,000 jobs. If NFP increases higher than expected, the FED will continue to delay cutting interest rates, negatively affecting gold prices next week. On the contrary, if NFP drops sharply below 100,000 jobs, it will increase the possibility of the FED cutting interest rates, helping gold prices rise again next week, but not too strongly.

📌Technically, the gold price closed below $3,300/oz this week, which could pave the way for a drop to $3,200/oz next week, or below that to $3,120/oz. If the gold price rebounds above $3,300/oz next week, it could trigger a recovery to $3,330-$3,360/oz.

Notable technical levels are listed below.

Support: 3,246 – 3,228USD

Resistance: 3,292 – 3,300USD

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

BUY XAUUSD PRICE 3178 - 3180⚡️

↠↠ Stop Loss 3174

GOLD | Pressure Below Pivot – Eyes on 3255 and 3238GOLD | Market Outlook

The overall momentum remains bearish as long as the price trades below the pivot line at 3297.

Currently, the price is attempting to stabilize below 3281, suggesting a potential continuation of the downtrend toward 3270 and 3255.

A confirmed 1H close below 3255 would further strengthen the bearish scenario, opening the way toward 3238.

Sell Setup:

Valid if 1H candle closes below 3281→ Targets: 3270 and 3255

Buy Setup:

Valid if 1H candle closes above 3297→ Targets: 3314

Key Levels:

• Pivot: 3281

• Support: 3255 / 3238

• Resistance: 3297 / 3314

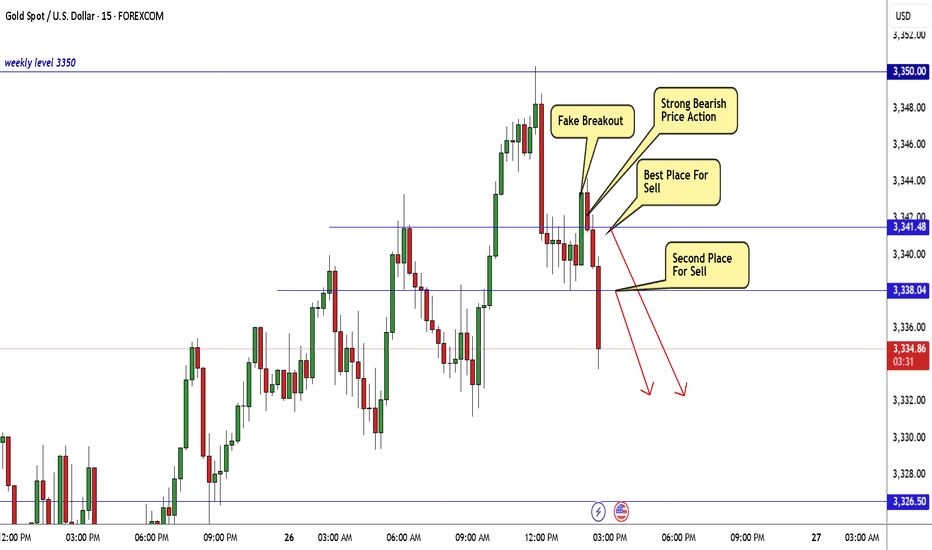

Gold Breakout Done New Short Entry Valid To Get 200 Pips !Here is my opinion on gold at he moment , in 15 mins T.F wr have a fake breakout but 3343.00 forced the price to go down which is a great res for this pair and we have avery good bearish price action and good closure below my res level 3341.00 so it`s my num 1 place to enter a sell trade if the price go back to retest it , and if not , 3383.00 will be my best place to sell it .

Excellent start of E.U. sessionAs discussed throughout my yesterday's session commentary: "My position: I am Highly satisfied with my Profit and will take early weekend break, not catching a Falling knife."

I have monitored the Price-action from sidelines throughout Friday's session as explained above however mid E.U. session I have engaged two #100 Lot Buying orders on #3,278.80 few moments ago and closed both of my Scalps on #3,285.80 with excellent Profit.

Quick update: No Swing orders today, only aggressive Scalps similar to Scalp orders I mentioned above from my key re-Buy points. If #3,300.80 is recovered, newly formed Bullish structure will push for #3,313.80 and #3,327.80 test. If #3,300.80 benchmark is preserved, I will still keep Buying (Scalp only however). I will have Gold's major move revealed after today's session.

Excellent opportunities on GoldAs discussed throughout my yesterday's session commentary: "My position: I have engaged #4 Scalp orders throughout yesterday's session (all in Profit) and will continue to do so however on the other side (Buying) from my key entry points. Keep in mind that overall trend remains Bullish and Trade accordingly."

As I expected upside extension as per above, I have waited for #3,352.80 - #3,357.80 my local Top's for the sequence and started aggressively Selling Gold from #3,348.80 first, then #3,352.80 #4 aggressive Selling Scalps and #3,357.80 final two Scalps which I held all the way towards #3,345.80 Support for the fractal (cca #130k Profits Intra-day).

My position: Since #3,337.80 was neckline for upside Bull structure, I was aware if it gets invalidated to the downside, it will open doors for #3,327.80 extension (which held twice throughout late U.S. and Asian session). I don't expect much Selling action today however Bulls need another Fundamental push to invalidate wall of Resistances at #3,340's and #3,350's. I will continue Scalping as opportunity arise / no Swing orders.

Gold on relief rallyAs discussed throughout my yesterday's session commentary: Quick update: No Swing orders today, only aggressive Scalps similar to Scalp orders I mentioned above from my key re-Buy points. If #3,300.80 is recovered, newly formed Bullish structure will push for #3,313.80 and #3,327.80 test. If #3,300.80 benchmark is preserved, I will still keep Buying (Scalp only however). I will have Gold's major move revealed after today's session."

Technical analysis: I have been aware that another failed attempt to invalidate #3,272.80 - #3,278.80 local Support zone will most likely result into firm rejection and yet another push towards #3,302.80 psychological benchmark and ultimately the #3,327.80 level which represents Short-term Resistance line which is now invalidated to the upside (as discussed above already). Keep in mind that the current Bullish Short-term set-up can offer a great opportunity for those who missed the last rally to enter at almost (# +1.00%) of the Price so many Sellers which were liquidated will now engage multiple Buying orders so Buying pressure will be significantly Higher. Gold is extending the Trade nicely inside the healthy Hourly 4 chart's Ascending Channel and after failed Support zone reversal. Price-action has even more probabilities now to test #3,352.80 psychological benchmark. Gold is Fundamentally Bullish as well due Tariffs announcement.

My position: I have engaged #4 Scalp orders throughout yesterday's session (all in Profit) and will continue to do so however on the other side (Buying) from my key entry points. Keep in mind that overall trend remains Bullish and Trade accordingly.

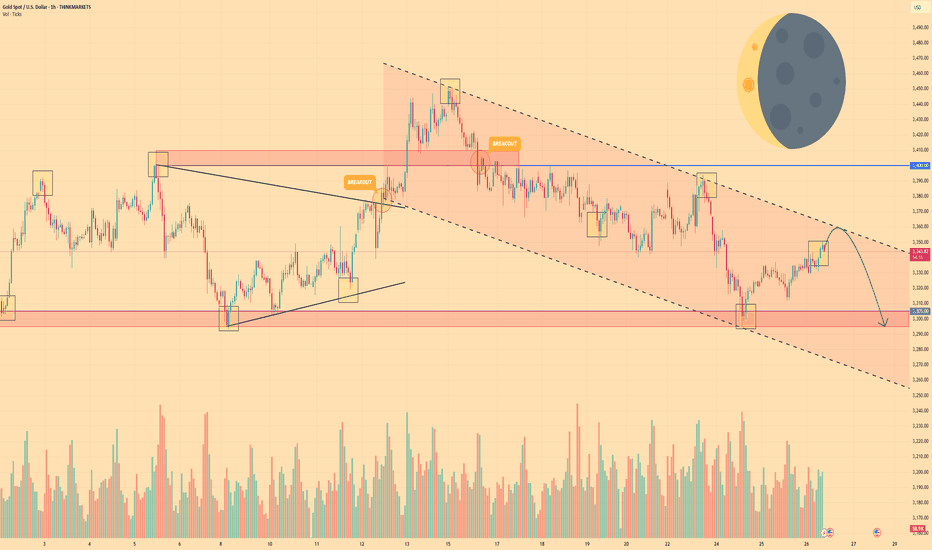

GOLD - Price can continue to move down in falling channelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some days ago price bounced from support level and started to grow to $3400 level, making a small correction before.

When it reached this level, price entered to wedge, where it made a correction and then started to grow.

In a short time, price exited from wedge and soon broke $3400 level, but then it started to decline in a falling channel.

In falling channel, Gold broke $3400 level one more time and in a short time declined to $3305 support level.

After this movement, Gold turned around and started to move up to resistance line of channel.

I expect that Gold can reach resistance line of channel and then start to decline to $3295 support area.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

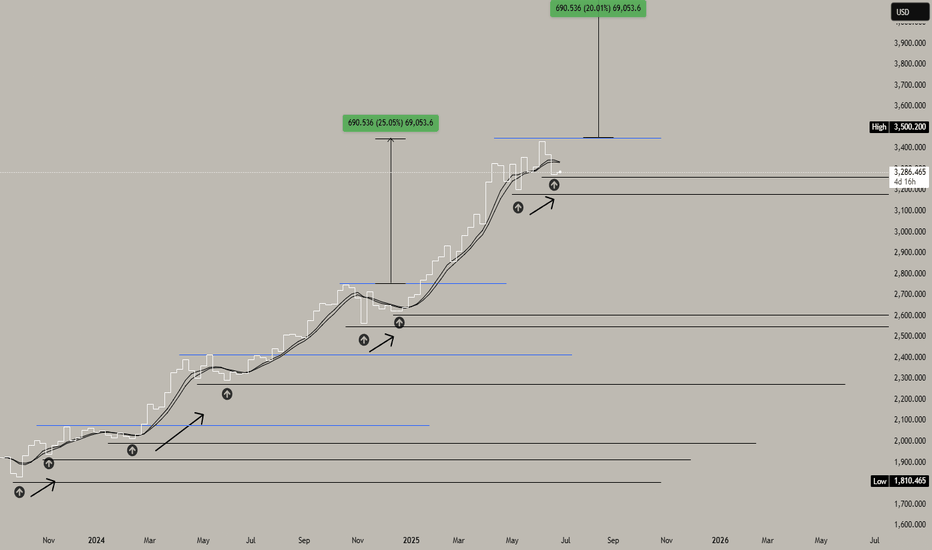

GOLD, back at higher base. BUY at 3250 enroute to ath 3500 / 4k.GOLD had a wonderful run this past few seasons grinding up a series of ATH taps every higher baselines since 1500.

After goin to a new parabolic highs of 3500 ATH, GOLD did hibernate a bit and got trimmed back to 3240 levels -- a precise 61.8 FIB tap. This is where most buyers converge, and position themselves on the next run up.

The next ascend series will be far more generous eyeing new higher numbers never before seen. Ideal seeding zone is at the current price range of 3250.

Current higher lows on momentum metrics has been spotted conveying intense upside pressure as it moves forward.

Spotted at 3250

Interim target at 3500 ATH

Long term: 4000

TAYOR.

Trade safely. Market will be market.

Not financial advice.

Luxury, War, and Clarity – This Is the Golden Reset.🟨 The Real Gold Era: Clarity While the World Burns 🟨

"While some bleed in the streets, others sip cocktails in the Bahamas. This is not a coincidence. This is the new world."

Right now, we live in a time like no other.

People are dying in wars they never chose.

Currencies collapse. Nations threaten each other.

And yet — capital flows, gold climbs, and the rich get richer.

🕰️ A war started long ago — and most never saw it:

2020–2022: They printed trillions. COVID shut down the world. Fiat was silently devalued.

2022–2023: Russia was cut off from SWIFT. BRICS started buying gold. The dollar was no longer untouchable.

2023–2024: Gold broke $2100… then $2400… now $3400+. Even high interest rates can't stop it.

2025: U.S. and Israel strike Iran. BRICS discuss a gold-backed currency. Trust in fiat? Gone.

The Gold Era is no longer just metaphor. It’s the new battlefield.

💣 "War is loud. Wealth is silent."

While bombs fall in the East,

✨ capital quietly moves to safe havens.

While families flee,

✨ smart money finds gold, data, and sovereign positioning.

While headlines scream chaos,

✨ traders make decisions in silence.

🌍 But here's the paradox:

We also live in a world of unmatched abundance:

You can build a brand from a phone.

You can trade gold from a beach.

You can learn SMC, AI, geopolitics — and use it to build freedom.

You can escape the system, if you understand the structure.

In this gold era, the true asset isn't just metal.

It's mental clarity. Information. Sovereignty.

The gold is you.

📉 This isn’t just about trading.

It’s about knowing where we are in the timeline of collapse and rebirth.

The markets don’t lie — they expose what’s really coming.

And those who read them… can rise while others fall.

🧠 Final note:

Not everyone survives a reset.

But those who think in structure, who lead with clarity — they don’t just survive.

They reposition.

They build.

They lead.

🟡 Welcome to the Real Gold Era.

Where charts speak louder than news.

Where truth is a position.

Where you don’t wait for safety — you create it.

—

✍️ GoldFxMinds – where structure meets truth.

📢 Disclosure: This analysis was created using TradingView charts through my Trade Nation broker integration. As part of Trade Nation’s partner program, I may receive compensation for educational content shared using their tools.

Revealed: Beware of a strong counterattack from gold bears!Perhaps due to the impact of the NFP market later, gold fluctuated relatively cautiously today, and neither the long nor the short side showed signs of breakthrough, and the overall trend remained volatile. However, as gold rebounded, the market bullish sentiment gradually tended to be optimistic. In the short term, the lower support area was relatively obvious, that is, the second pull-up point 3335-3325 area, followed by 3315-3305 area;

However, as gold rebounded twice and fell after touching 3365, the suppression above was also obvious. In the short term, it faced the suppression of 3375-3385 resistance. If gold cannot effectively break through this area, gold bears may make a stronger counterattack, so I don’t think gold bears have no chance at all.

Therefore, I think there is still a good profit opportunity to try to touch the top and short gold. You can consider trying to short gold in the 3365-3375-3385 area and look at the target: 3340-3330-3320.

XAUUSD has been in a strong free fall following the sell strategXAUUSD has dropped sharply in a free fall, perfectly following the sell strategy from 3348–3350.

We have won.

Trading Strategy for XAUUSD OANDA:XAUUSD

Based on the current price structure and short-term bias, here are two tactical trade setups:

Sell Setup – If Price Rejects Resistance

Entry: 3,348 – 3,350 USD

Stop-loss: 3,357 USD

Take-Profit 1: 3,340 USD

Take-Profit 2: 3,335 USD

Take-Profit 3: 3,330 USD

Buy Setup – If Price Holds Support

Entry: 3,328 – 3,330 USD

Stop-loss: 3,320 USD

Take-Profit 1: 3,338 USD

Take-Profit 2: 3,340 USD

Take-Profit 3: 3,348 USD

Important: Always set a stop-loss in every trade to manage risk effectively.

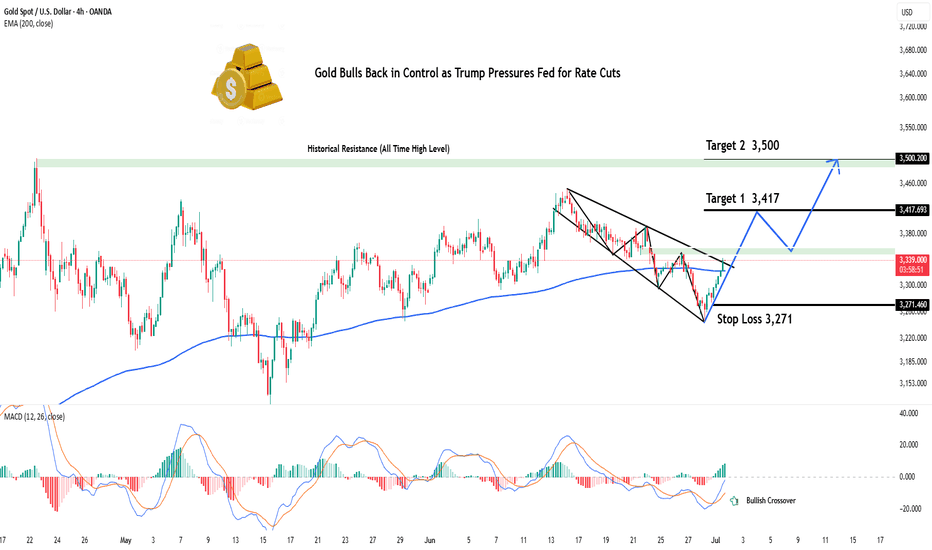

Gold Bulls Back in Control as Trump Pressures Fed for Rate CutsHey Realistic Traders!

President Trump is ramping up pressure on the Fed to cut interest rates , saying the U.S. is falling behind countries with looser policies. As several Fed officials begin to shift their stance, expectations for rate cuts are growing. That’s putting pressure on the dollar and giving gold a fresh boost.

We’ll take a closer look at what this means for OANDA:XAUUSD (Gold) through technical analysis and explore its upside potential.

Technical Analysis

On the 4-hour chart, Gold has moved above the EMA-200, signaling a shift in momentum to the upside. Price has also broken out of a Descending Broadening Wedge (DBW) pattern, which often indicates the start of a bullish trend.

The breakout was confirmed by a Bullish Marubozu candle, reflecting strong buying pressure. To add further confirmation, the MACD has formed a bullish crossover, reinforcing the upward momentum.

Looking ahead, the first target is seen at 3417. If reached, a minor pullback toward the historical resistance zone (green area) may occur, with a potential continuation toward the second target at 3500.

This bullish outlook remains valid as long as the price stays above the stop-loss level at 3271 . A break below this level would invalidate the setup and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on XAUUSD.

Gold Holds Above 3342 Ahead of Key U.S Data –Bullish Bias IntactGold Rises as Market Awaits Key U.S. Economic Data

Gold prices are pushing higher as investors position ahead of today’s major U.S. economic releases, including NFP and unemployment figures. Expectations of weaker data are supporting bullish sentiment.

Technical Outlook (XAU/USD):

Gold maintains a bullish structure as long as it trades above 3,342.

→ A push toward 3,365 is likely

→ A 1H close above 3,365 would open the path toward 3,375

However, if price closes below 3,342 on the 1H chart, bearish momentum may build, targeting 3,331 and 3,320

Key Levels:

• Resistance: 3,365 / 3,375 / 3,390

• Support: 3,341 / 3,331 / 3,320