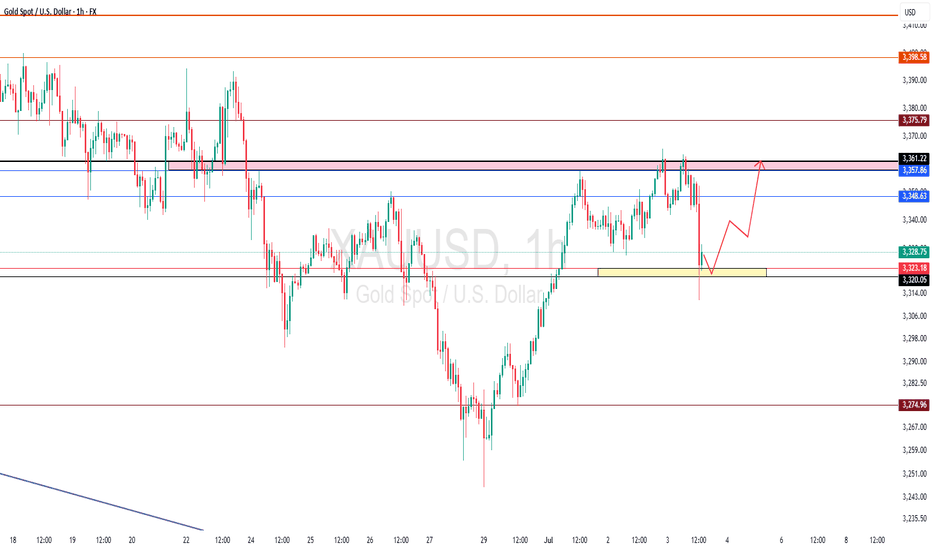

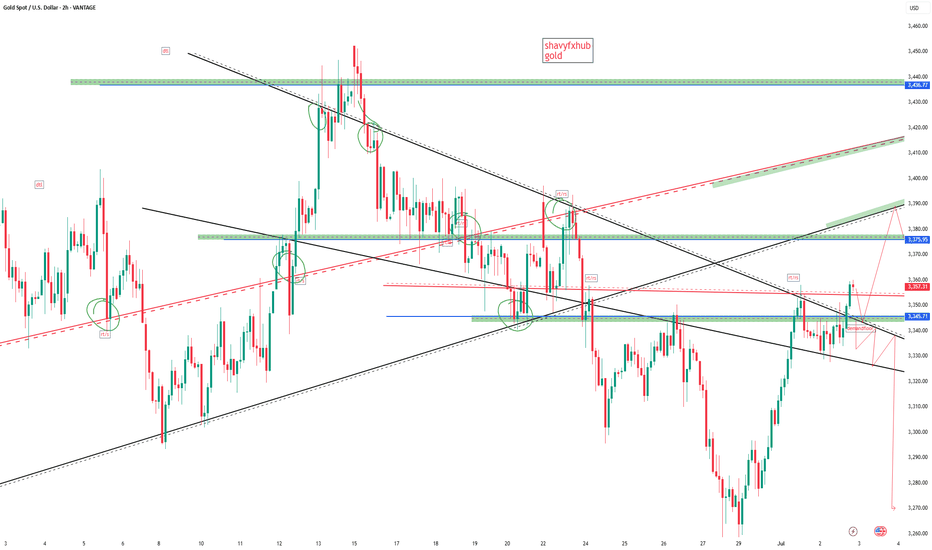

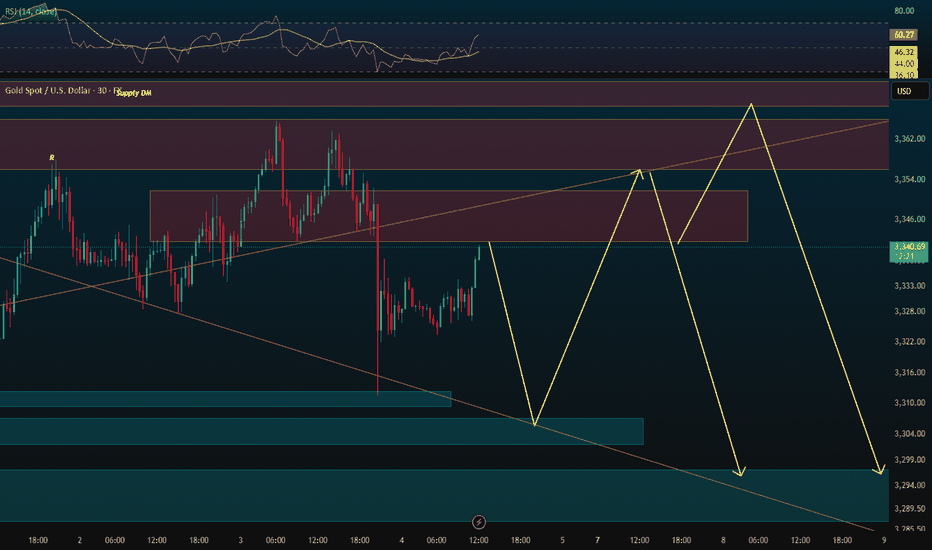

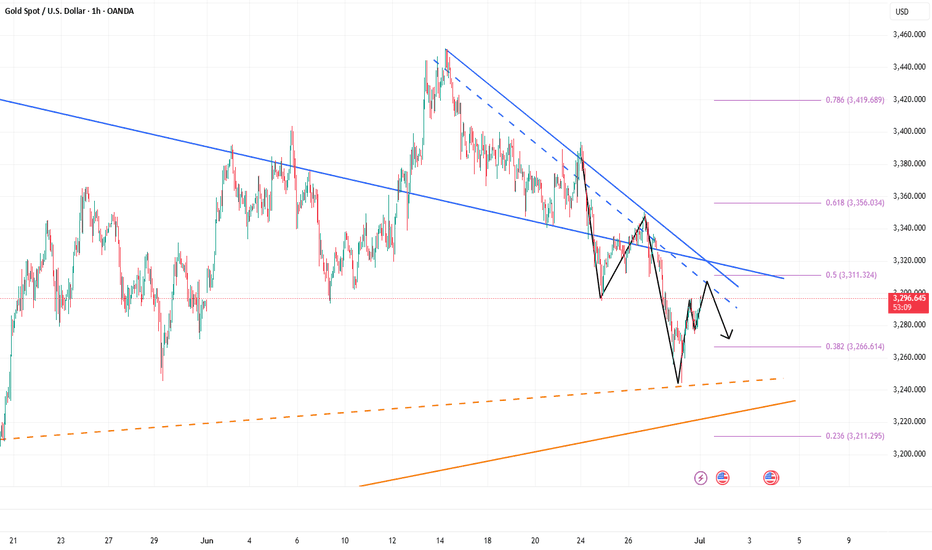

GOLD - at CUT n REVERSE Area? holds or not??#GOLD.. market palced around 3317 18 as day low so far but hour closed above 3323 that was our area.

so keep close our region that is around 3320 to 3323

that is our ultimate region for now and if market hold it in that case we can expect bounce again

NOTE: below 3320 we will go for cut n reverse on confirmation.

good luck

trade wisely

XAUUSD.F trade ideas

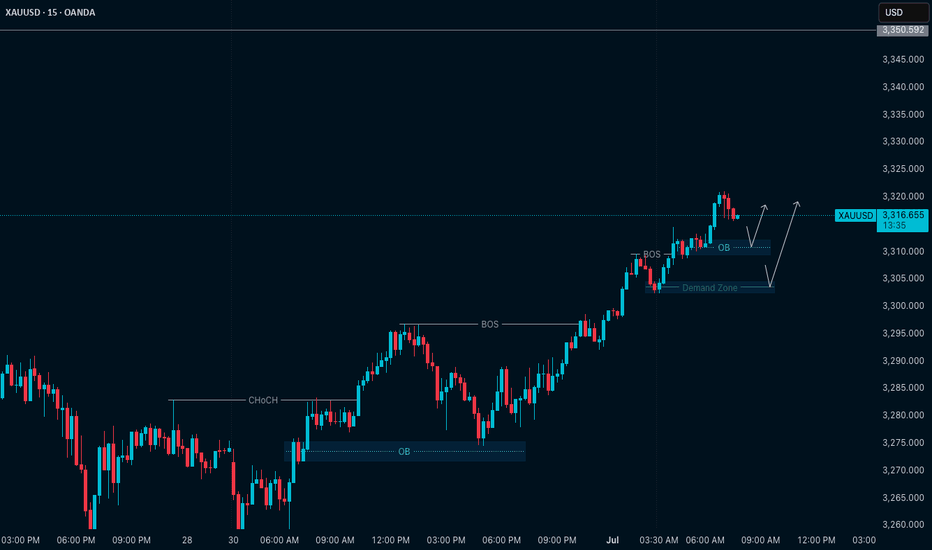

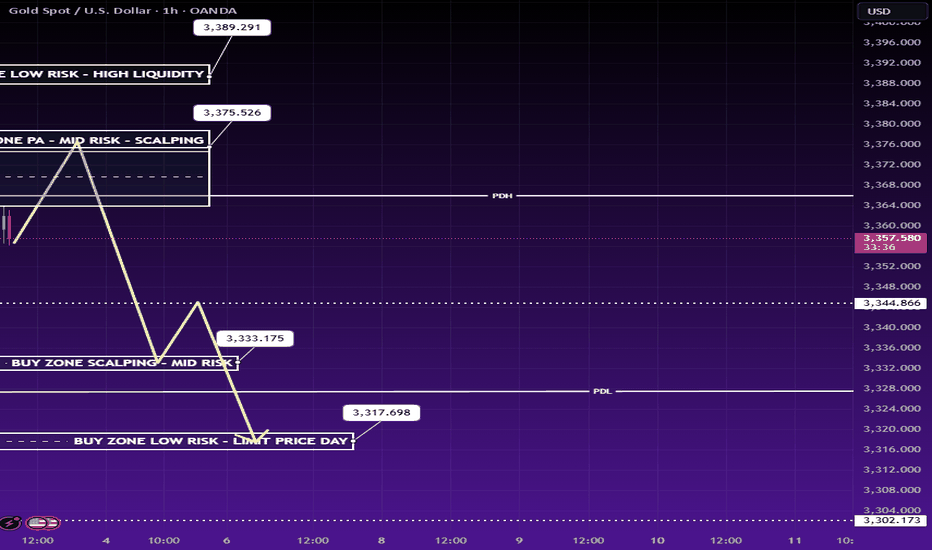

Gold (XAUUSD) – July 1 Analysis📍 H4 Key LH Zone: 3348.500 – 3350.500

This is a major decision zone.

Current market structure:

🔸 M15 is in an uptrend with confirmed ChoCh + BoS

What to watch:

We’re approaching the H4 LH supply zone — now we observe how price behaves here.

🔹 If price breaks above this H4 LH zone:

→ HTF and LTF trends align to the upside

→ Potential continuation of the bullish move

🔹 If price respects and stays below this LH zone:

→ Then this recent up-move could be a pullback

→ We may see a new low forming — so be cautious

📍 M15 Zones for Long Setup (if confirmed):

• 3309.500 – 3312.500 (Order Block Zone)

• 3302.500 – 3304.600 (Demand Zone)

We will watch these levels closely.

If price respects these zones and gives M1 confirmation (ChoCh + BoS) — we’ll plan for long entries accordingly.

📖 Let structure guide your decisions. Let price speak first.

📘 Shared by @ChartIsMirror

Author of The Chart Is The Mirror — a structure-first, mindset-grounded book for traders

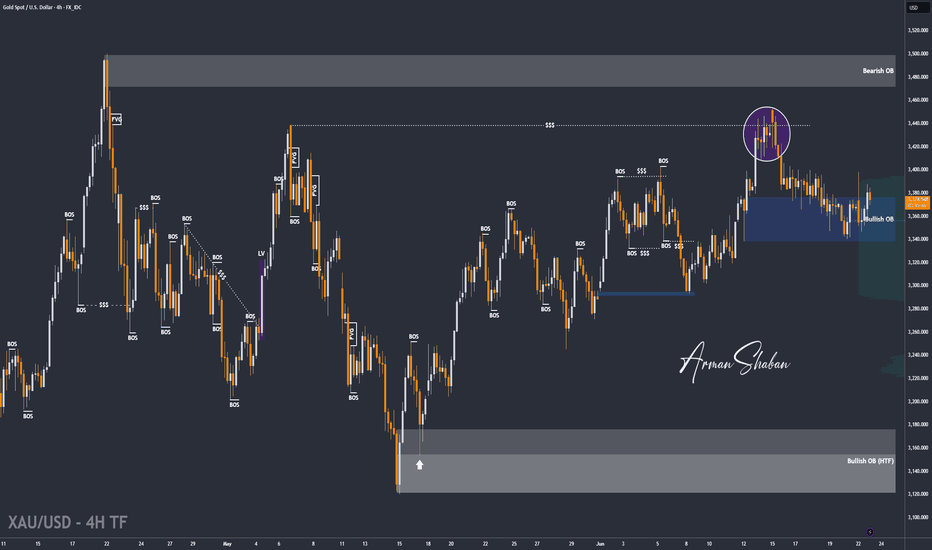

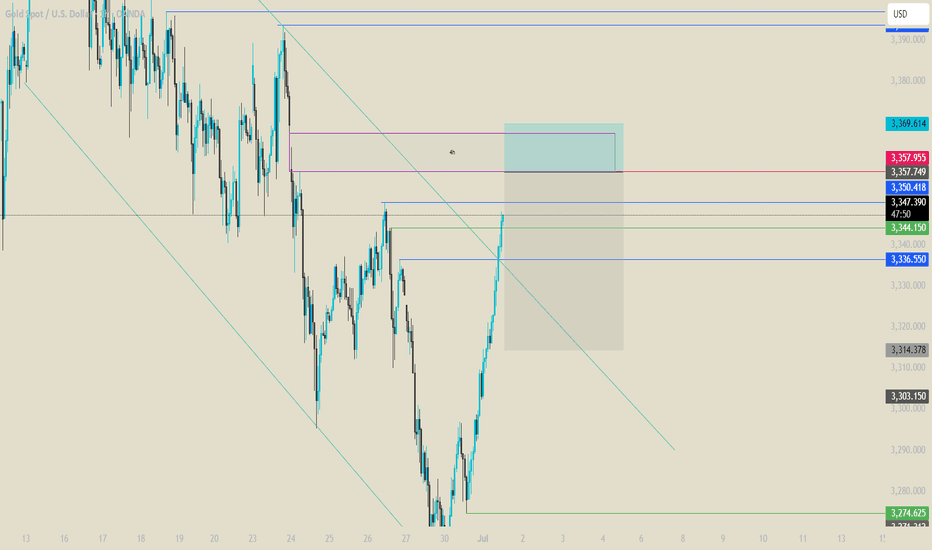

Gold Holding Strong – Eyes on $3400 and Beyond! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that after our last analysis, the price corrected down to $3341, then rallied back up to $3399. Currently, gold is trading around $3373, and if it manages to hold above $3355, we can expect further upside movement.

Potential bullish targets are $3400, $3417, $3450, and $3468.

Market Recap & Forecast – Egyptian EditionMarket Recap & Forecast – Egyptian Edition

Yalla ya shabab—before you run off to Sahel or your cousin’s mashwi, let’s break down the market moves. Bring your tea—we’re about to see how they played us like a baladi tabla.

🗓️ 3-Day Recap (June 30 – July 2)

✅ Monday (June 30)

Market woke up strong—“Ana mesh hayemny!” like Adel Emam in El Irhab Wel Kabab.

Closed above 3302—bulls were flexing harder than Mekky in El Kabeer Awy saying “Eh da? Eh da? Enta betgannen ya basha?”

Momentum nearly maxed out—like your cousin after 3 Red Bulls.

RSI ~54, climbing.

Volume big and bold.

Translation: Bulls controlled everything—“El gameya di beta3ty ana!”

✅ Tuesday (July 1)

Tried to smash 3360–3394—market replied with Adel Emam’s classic:

“E7na benedhak 3alek!”

Closed near 3330, confused like a tourist in Sayeda Zeinab.

Volume dropped—enthusiasm disappeared faster than konafa on the table.

Market Maker Move:

“Ta3ala ta3ala, khod fake breakout we yalla salaam!”

✅ Wednesday (July 2)

Price stuck in a boring tight range—like someone waiting for their turn at the Mogamaa.

RSI still climbing but exhausted—“Khalas ya basha, malhash ta3ma,” as Mekky would say.

EMAs clustering—“Mafeesh haga hte7sal.”

Volume low—everyone thinking about the holiday.

Conclusion: The market was basically on vacation already.

📊 What’s Coming July 3rd (Cairo Time)

Set your alarms if you’re not too busy watching El Kabeer Awy reruns:

2:15 PM Cairo: ADP Jobs—could send the market spinning.

4:00 PM Cairo: ISM Services PMI—maybe some drama.

4:30 PM Cairo: Oil Inventories—“keda ya basha, haga sadeema.”

Early close because Americans have fireworks and kebab to grill.

🔍 Levels to Keep an Eye On

Fib Retracements:

38%: 3355

50%: ~3320

61%: 3302–3310

Zones:

🟥 Sell Zone (Habibi, Calm Down): 3394–3433

🟨 Chop Zone (El Malaal): 3330–3360

🟩 Buy Zone (Inshallah Bounce): 3246–3302

Above 3394? “Eh da? Enta betla3 3aleena?”

🕵️ Market Maker Tactics

Step 1: “Yalla, ne3mel rally zay el aflam el mosalsalat.”

Step 2: Sell into your excitement.

Step 3: “Yalla salaam,” as Adel Emam would say.

Step 4: Leave you staring at your screen, thinking:

“Ana mesh fahim haga!”

⚡ Forecast for July 3rd

Liquidity? “Ra7et fein?”—basically gone.

Early spike to 3394? Maybe—but “ma tesdaa2sh!”

By the afternoon, expect the market to drift back to 3300 for a nap.

🎲 Chances:

70% sideways boredom.

30% quick stop hunt to ruin your mood before mashwi.

📈 Hypothetical Trade Setup (Just for Education—Khalas ya basha)

Sure—here’s a clean, actionable rewrite that keeps the exact meaning, instructions, and flow but is tighter, clearer, and direct:

🟡 ENTRY PLAN

Scenario 1 – Sell the Trap

Setup: Price spikes into 3394–3430

Entry: Sell Limit at 3390

Confirmation:

✅ 1-minute Delta turns negative

✅ RSI fails to hold above 62

✅ Footprint shows absorption

Stop Loss: 3435

Target 1: 3330

Target 2: 3310

Execution: Place limit order. No chasing.

Scenario 2 – Buy the Clean Break

Setup: Sustained buying above 3430

Entry: Buy Stop at 3432

Confirmation:

✅ 5-minute close over 3430

✅ Volume >250% of 5-minute average

✅ Delta +1000 or higher

Stop Loss: 3395

Target 1: 3465

Target 2: 3480

Execution: Stop order to catch breakout momentum.

Scenario 3 – Fade into Reversion

Setup: Price fails to hold above 3368 intraday Fib

Entry: Market Sell below 3365

Stop Loss: 3390

Target: 3331 (POC)

🛡 Risk Controls

Max risk per trade: 1–2% of total equity

If price stays between 3360–3390 on low volume, do nothing.

Why?

Resistance stubborn—like Adel Emam yelling “Ana la!”

Market makers cashing out before the holiday.

Pre-holiday rallies disappear faster than mekka7a in Ramadan.

❓ Q1: What should you do while waiting for 3390?

Answer:

Absolutely nothing.

You do not:

❌ Short below 3390 without confirmation

❌ Flip bias every 15 points

❌ Chase 1-minute candles just to feel busy

Why?

Because 3360–3390 is the trap zone. Market Makers churn liquidity here, run stops, and create noise to bait impatient traders.

✅ Instead, you watch:

Does price consolidate under 3390?

Is volume drying up?

Is delta divergence building?

Your role is simple:

Sit on your hands until price enters your control zone.

Trading is 90% waiting. The other 10% is precise execution.

❓ Q2: What if price never hits 3390?

Answer:

If the setup doesn’t trigger, you do nothing.

Example:

Price never reaches 3390

No volume spike

No delta confirmation

Result:

✅ No trade

✅ No regret

✅ No FOMO

You are not throwing darts in the dark. You are running a clear plan:

If your criteria are met, you act.

If they’re not, you stay flat.

Example No-Trade Scenario:

Price stalls between 3350–3380 all day

Volume stays low

No stop sweep or breakout

You wait and protect your capital.

🔥 Pro Tip

If you feel you must do something:

Tighten your watchlist

Set conditional orders

Check correlated markets (Silver, DXY, yields)

Watch VWAP and ATR for shifts

Update your bias at each session open (London, NY)

But never force a trade out of boredom.

Here’s the reality:

Most of your profit will come from 2–3 clear, high-quality trades a week—not from taking 50 random entries.

✅ Quick Cheat Sheet

Trend: Bullish but exhausted.

RSI: ~56 and losing steam.

Levels: 3355, 3368, 3394

Zones:

🟥 Sell: 3394–3433

🟩 Buy: 3246–3302

Liquidity: “Mafeesh!”

Market Makers: Already on holiday.

⚠️ Reminder:

This is for learning, not for throwing your salary in the market. As Adel Emam said:

“Elly yetgawwez emra2a te7tag el falas.”

(He who marries a woman needs money—same with trading. Don’t blow your budget.)

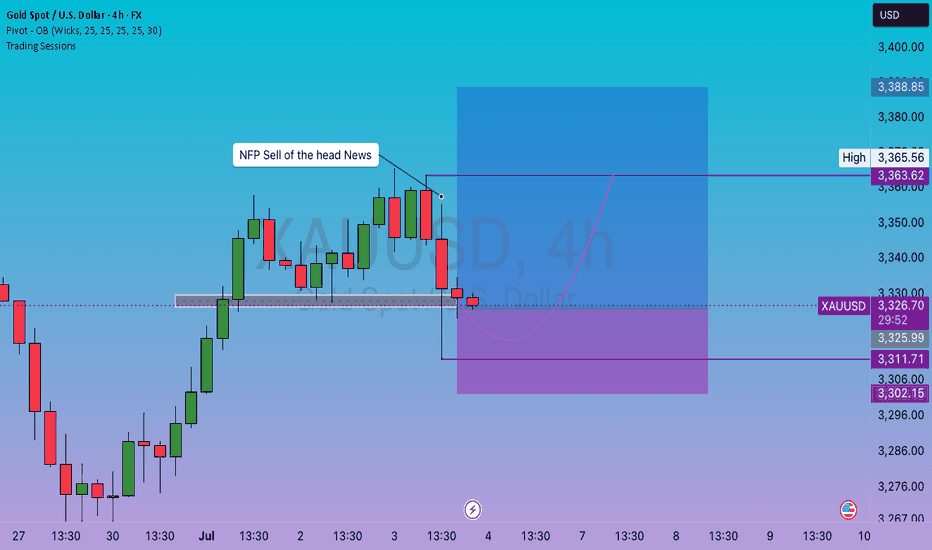

GOLD XAUUSD The ADP Non-Farm Employment Change report for today showed a surprising decline of 33,000 jobs, well below the forecast of a 99,000 forecast and down from the previous month’s modest gain of 29,000 jobs.

Key Details:

This negative figure indicates that private businesses in the US shed 33,000 jobs in June, marking a contraction in private-sector employment—the weakest report since March 2023.

The report is produced by the ADP Research Institute, which uses anonymized payroll data from about 26 million workers to estimate private-sector employment changes ahead of the official government Non-Farm Payrolls (NFP) report.

The decline reflects ongoing uncertainty among employers amid policy and economic challenges, including tariff impacts and consumer caution.

Market Implications:

The unexpected job losses may raise concerns about the health of the US labor market and the broader economy.

This data could increase expectations for Federal Reserve rate cuts or a more dovish stance, potentially weighing on the US dollar and boosting safe-haven assets like gold and silver.

However, the ADP report often diverges from the official NFP, so markets will closely watch the upcoming government jobs data for confirmation.

In summary:

June’s ADP report revealed a contraction of 33,000 private-sector jobs, far below expectations, signaling caution in US labor market hiring and adding uncertainty to the economic outlook ahead of the official payrolls release.

#gold #xauusd

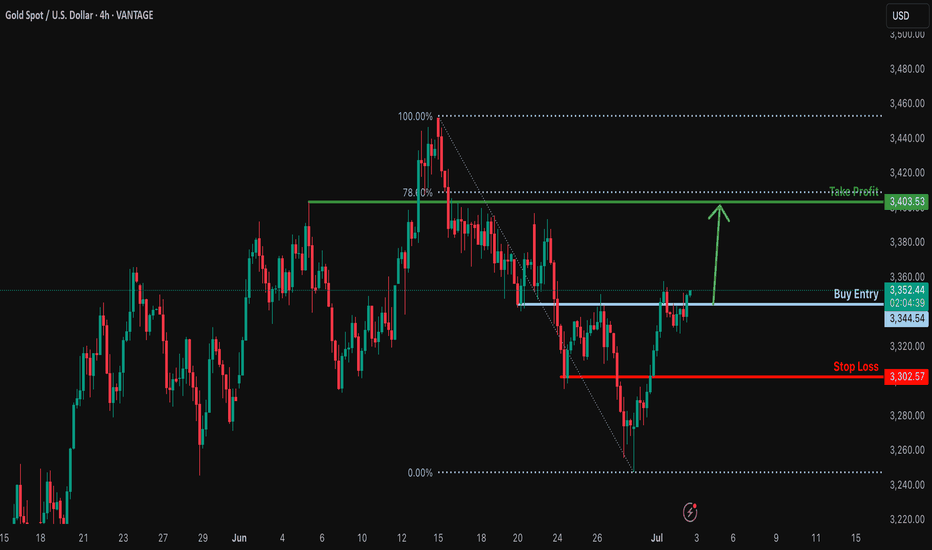

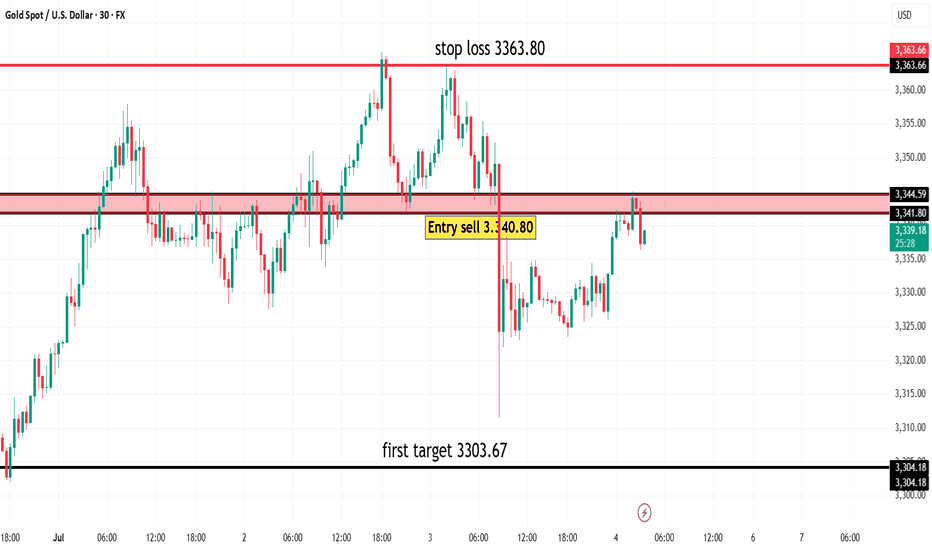

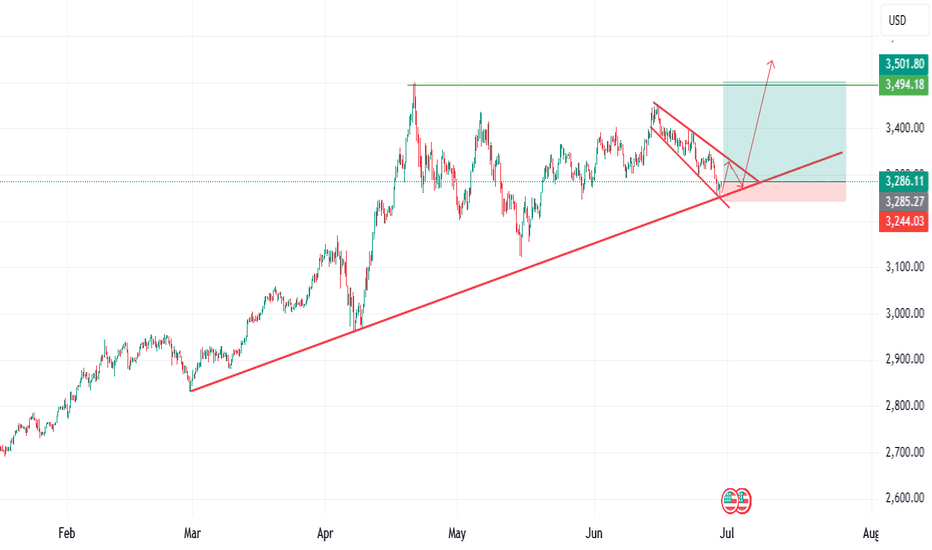

Bullish rise for the Gold?The price is reacting off the resistance level which is a pullback resistance and could potentially rise from this level to our take profit.

Entry: 3,344.54

Why we like it:

There is a pullback resistance level.

Stop loss: 3,302.57

Why we like it:

There is a pullback support level.

Take profit: 3,403.53

Why we like it:

There is a pullback resistance level that lines up with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

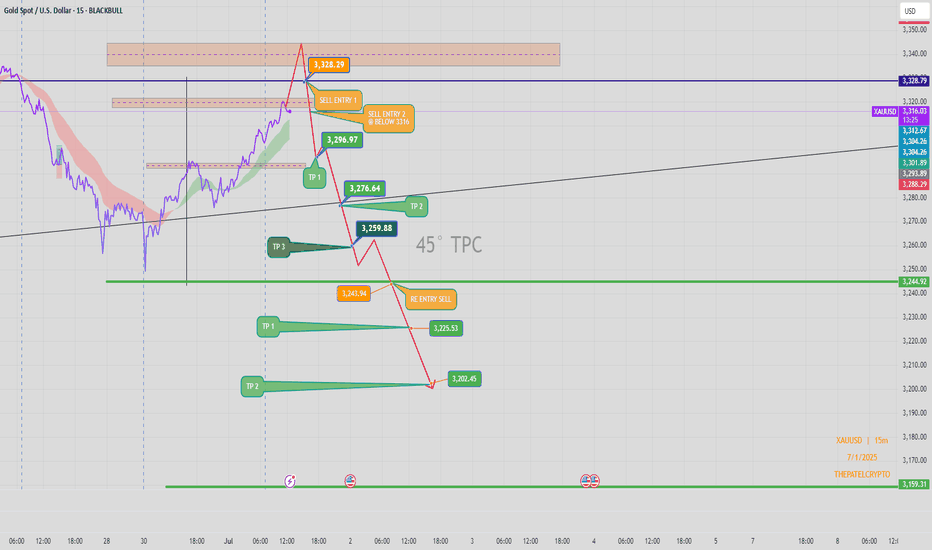

XAUUSD 15min – Bearish Setup | Short Trade Plan Below 3328Price action on Gold (XAUUSD) is showing signs of exhaustion near the 3,328 resistance zone, where we anticipate potential bearish rejection. A short opportunity may unfold once confirmation occurs below the key structural level of 3316.

Sell Trade Setup:

🔹 Primary Entry (Sell Entry 1):

📍 Zone: Around 3,328.29

📌 Reaction expected near major supply & resistance zone.

🔹 Confirmation Entry (Sell Entry 2):

📍 Below 3,316

📌 Break below structure may trigger bearish momentum.

Targets:

🎯 TP 1: 3,296.97 (Initial reaction zone)

🎯 TP 2: 3,276.64 (Mid support/EMA cross zone)

🎯 TP 3: 3,259.88 (Key structural support)

🎯 Extended TP:

3,243.94 (Re-entry confirmation level)

3,225.53 (Prior base structure)

3,202.45 (Final target if strong momentum follows)

3,159.31 (Ultimate low if sellers dominate trend)

Re-Entry Plan:

🔄 If price retraces after TP 3, watch for rejection at 3,243.94 to re-enter short toward the next levels.

Confluence Factors:

✔ 45° TPC angle supports bearish path

✔ Structure break expected below 3316

✔ EMA resistance and trendline rejection from upper zone

✔ Volatility cluster observed near 3,328 – ideal for trap setup

Bias:

Bearish below 3,316 – Expecting a downward continuation if structure confirms breakdown.

Author:

📅 1 July 2025

📊 Chart: XAUUSD – 15min

🧠 Shared by: @THEPATELCRYPTO

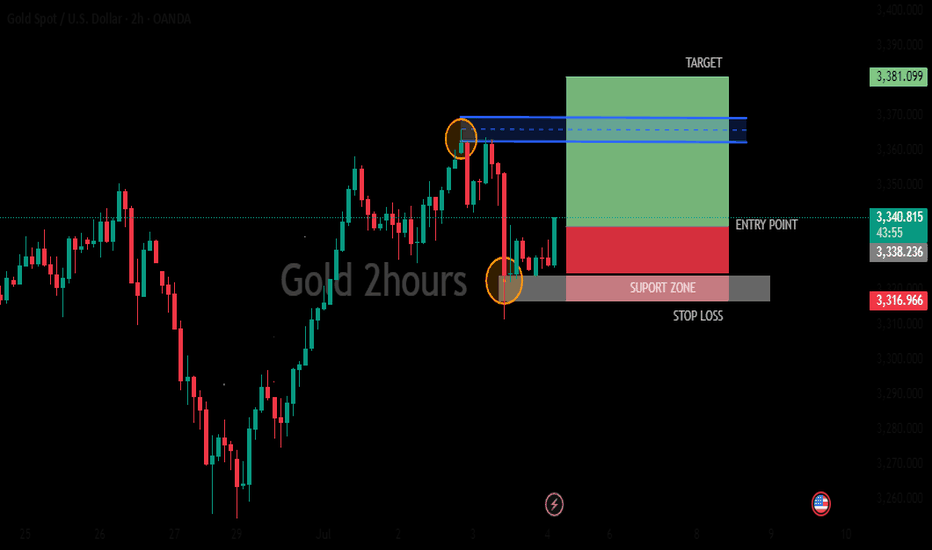

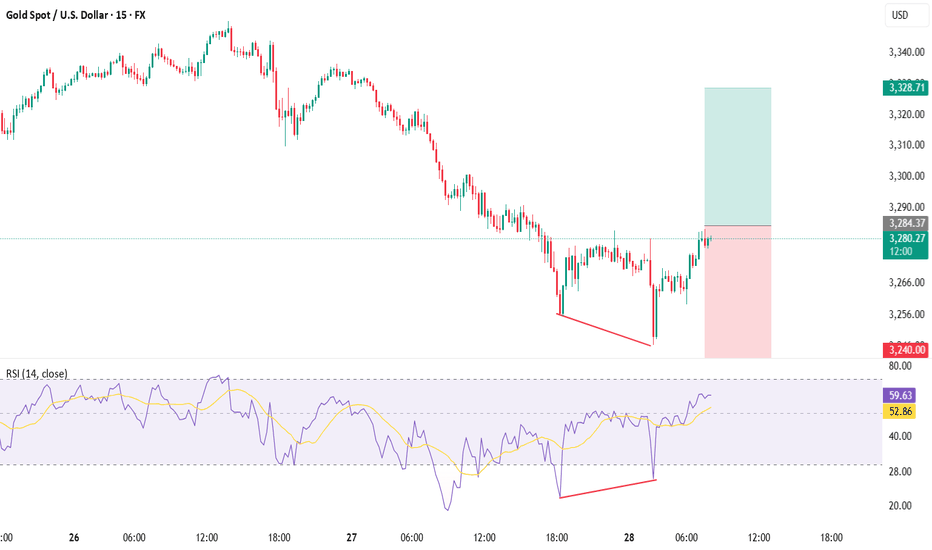

XAUUSD📉 The Setup: Bullish Divergence on XAUUSD (15m/30m)

Buy only on Breakout

🔍 Observation:

On the 30-minute timeframe, price made a lower low while the RSI indicator printed a higher low — classic sign of bullish divergence 🔄.

💡 Translation: Bears are losing steam! Bulls may be preparing to charge in! 🐂⚡

📊 Trade Plan – Long Entry

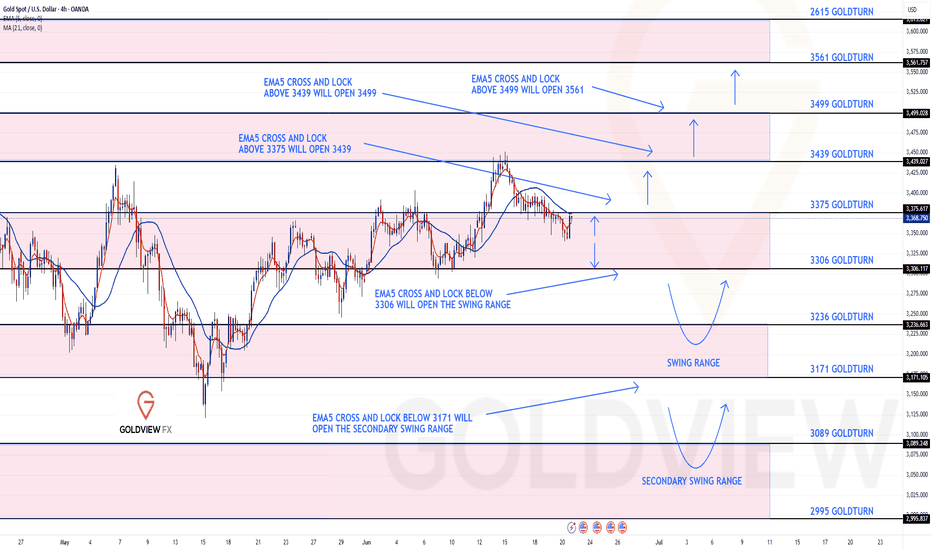

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3375 and a gap below at 3306. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3375

EMA5 CROSS AND LOCK ABOVE 3375 WILL OPEN THE FOLLOWING BULLISH TARGETS

3439

EMA5 CROSS AND LOCK ABOVE 3439 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3306

EMA5 CROSS AND LOCK BELOW 3306 WILL OPEN THE SWING RANGE

3236

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

2995

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

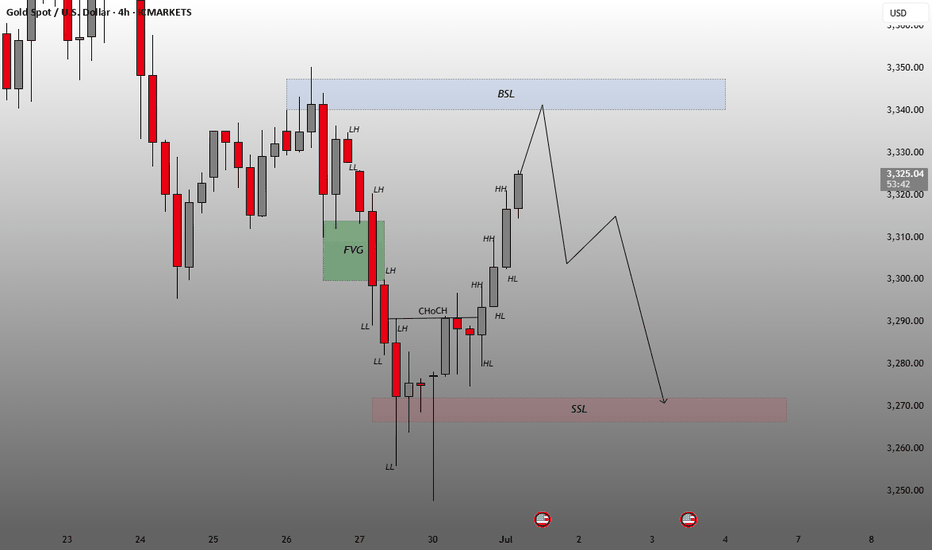

Smart Money Concepts or Inner Circle Trade methodologies.Key Zones and Annotations

FVG (Fair Value Gap) – Marked in green:

Represents an imbalance in price (gap between candles).

Price often returns here to “fill” or mitigate that inefficiency.

BSL (Buy-Side Liquidity) – Marked in blue near the $3,340 area:

Indicates an area above recent highs where stop-losses (liquidity) might be resting.

This area is often targeted before reversals.

SSL (Sell-Side Liquidity) – Marked in red near the $3,270 area:

Represents liquidity below recent lows.

This is a potential bearish target.

Structure Labels

LL (Lower Low), LH (Lower High), HH (Higher High), HL (Higher Low):

Used to track market structure direction (bearish/bullish trend).

ChoCH (Change of Character):

Indicates a shift in market structure, typically a sign of a trend reversal.

Price Projection

The projected path shows a short-term move upward toward the BSL region (~$3,340), suggesting liquidity grab or premium pricing area.

Then, a bearish reversal is projected targeting the SSL zone (~$3,270), suggesting a potential drop after the BSL is taken.

Conclusion

The chart suggests a short-term bullish move to clear buy-side liquidity followed by a bearish continuation targeting lower liquidity zones. This type of analysis is commonly used in Smart Money Concepts (SMC) or ICT (Inner Circle Trader) methodologies.

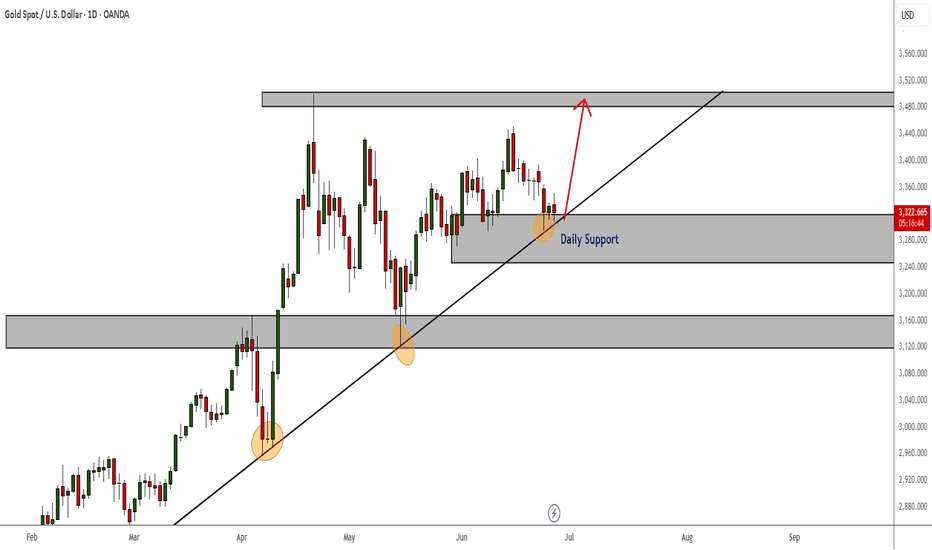

Gold in Support and 3rd touch of trendlineLooking at the daily timeframe, I am still seeing strong signs of a bullish confirmations. Firstly that daily support zone has been rejecting the bears' efforts since the beginning of this month and now we have a 3rd touch of the support trendline.

As long as that daily support zone continues to hold, I remain bullish overall. Even if there still consolidation happening on much lower timeframes in the meantime. I will be ready to catch the bull run upon the right confirmations.

GOLD The ADP Non-Farm Employment Change for July 2,have a forecast of 99,000 jobs, compared to the previous month’s very weak result of 37,000—the lowest since March 2023. The ADP National Employment Report is a monthly indicator that tracks changes in non-farm private sector employment in the US, based on anonymized payroll data from ADP’s clients, covering about one-fifth of all US private employment.

Who is responsible?

The report is produced by the ADP Research Institute, part of Automatic Data Processing (ADP), in partnership with the Stanford Digital Economy Lab.

Why it matters:

The ADP report is viewed as a leading indicator for the official Non-Farm Payrolls (NFP) report from the Bureau of Labor Statistics (BLS), released two days later.

It provides early insight into US private sector job growth and labor market health, and significant deviations from forecasts can move financial markets.

Note that the ADP report covers only private sector jobs, not government employment, so its numbers can differ from the official NFP.

Summary Table:

Report Date Forecast Previous Responsible Department

July 2, 2025 99,000 37,000 ADP Research Institute (ADP)

In summary:

The ADP Non-Farm Employment Change report, produced by the ADP Research Institute, forecasted a rebound to 99,000 jobs in June after a very weak 37,000 in May, providing an early signal on the health of US private sector employment.

(2)US10Y drops to historical low to 4.193% and currently broken 1hr descending trendline at 4.281% ,4.3% resistance will be watched for breakout buy bond buyers.

(3) DXY Key Points:

The DXY measures the US dollar’s strength against a basket of six major currencies: the euro (57.6% weight), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%).

After peaking near 110.075$ in January 2025, the index has softened , trading near 96.600-101.966.on weekly TF 101.966 was a retest to broken weekly demand floor .

The dollar’s decline reflects market expectations of Federal Reserve rate cuts later in 2025, easing inflation pressures, and some geopolitical easing.

the DXY to rebound will henge and depend on Fed policy and global economic conditions.

GOLD buyers are watching for the direction of trade ,

Chinese Demand and Policy:

China is one of the largest gold consumers and holders. Domestic demand, central bank gold purchases, and monetary policy in China heavily influence XAU/RMB. If China’s economy slows or trade tensions with the US worsen, demand for gold as a safe haven may increase, supporting XAU/RMB even if the dollar is strong.

China's recent opening of the Shanghai Gold Exchange's (SGE) first offshore gold vault in Hong Kong on June 26, 2025, represents a significant development with potential, albeit indirect, implications for XAU/USD (gold priced in US dollars) .

Key Aspects of the Hong Kong Gold Vault:

Location and Operation: The vault is located in Hong Kong and operated by Bank of China's Hong Kong unit .

Yuan-Denominated Trading: All transactions and settlements in the vault are denominated exclusively in yuan, either via cash or physical bullion delivery . Two new yuan-denominated gold trading contracts were launched alongside the vault .

Strategic Objectives:

Increased Influence on Gold Pricing: China, as the world's leading gold producer and consumer, aims to gain greater control and influence over global gold pricing mechanisms .

Yuan Internationalization: The initiative seeks to accelerate the international usage of the yuan, supporting China's broader de-dollarization efforts . This allows China to import gold in yuan, reducing reliance on the US dollar for commodity trading .

Enhanced Global Reach: The vault expands the SGE's physical infrastructure beyond mainland China, creating a new gateway for international gold trading and solidifying Hong Kong's role as a key financial hub .

Physical Settlement: It facilitates the physical settlement of gold contracts outside mainland China .

Implications for XAU/USD:

While the new vault directly promotes yuan-denominated gold trading, its implications for XAU/USD are primarily indirect and long-term:

De-dollarization Efforts: By promoting yuan-denominated gold trading, China is actively working to reduce global reliance on the US dollar in commodity markets . If successful, a more diversified global gold trading landscape could gradually diminish the dollar's sole influence over gold prices, potentially leading to less direct inverse correlation between the dollar and gold .

Increased Demand and Liquidity: The vault aims to attract more international participants to yuan-denominated gold markets, potentially increasing overall gold demand and liquidity in the Asia-Pacific region . While this demand is primarily yuan-driven, a generally stronger global gold market could indirectly support XAU/USD .

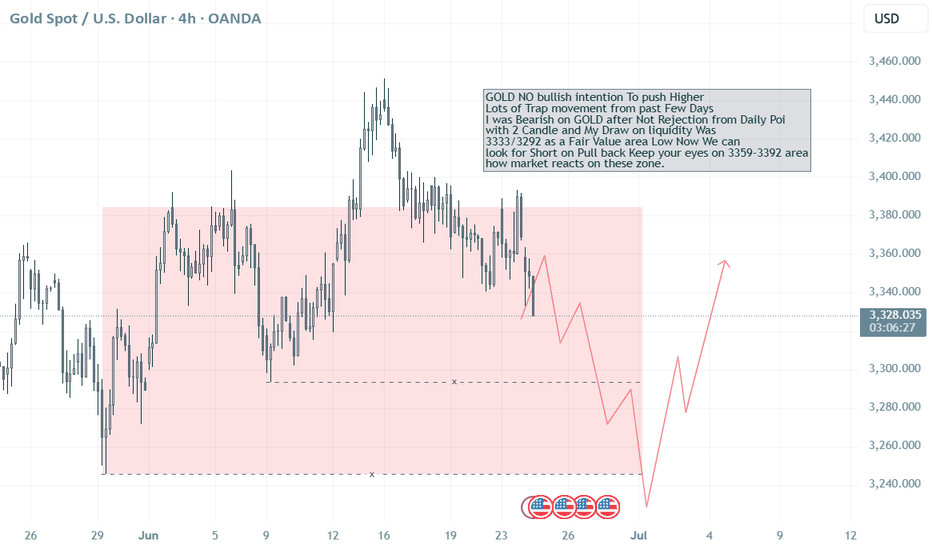

No Bullish intention on GOLD, Seller on Control? Target 3292?

GOLD NO bullish intention To push Higher

Lots of Trap movement from past Few Days

I was Bearish on GOLD after Not Rejection from Daily Poi

with 2 Candle and My Draw on liquidity Was

3333/3292 as a Fair Value area Low Now We can

look for Short on Pull back Keep your eyes on 3359-3392 area

how market reacts on these zone.

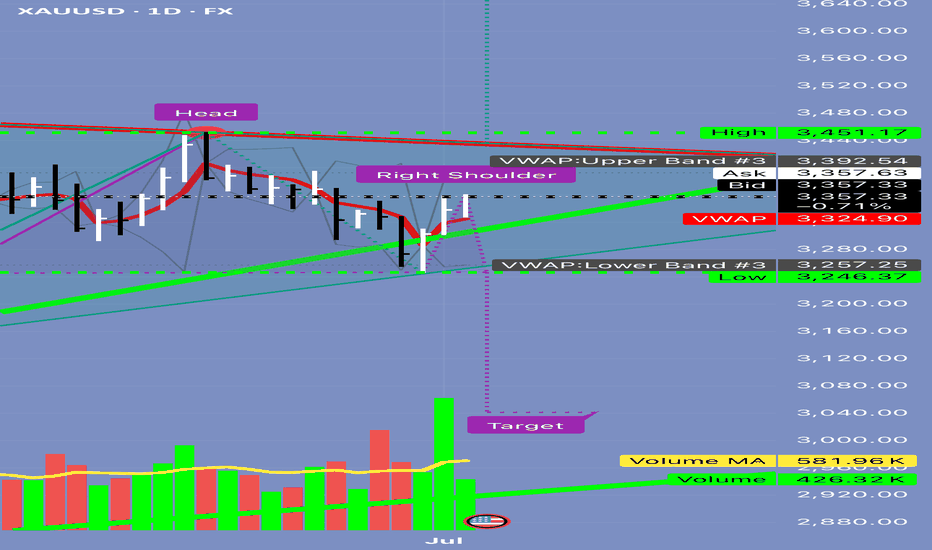

Gold at Key Level Before NFP – Big Move Loading ?📉 Fundamental Analysis

Gold remains in a strong bullish structure, supported by multiple macroeconomic and political drivers:

ADP Employment Report Missed Expectations: With a shocking -33K reading, market sentiment shifted firmly against the US Dollar, pushing gold higher.

Fed’s Easing Outlook: Markets are now pricing in a 90% probability of a rate cut in Q3, weakening real yields and supporting demand for gold.

Trump’s “Super Bill” Momentum: Political cohesion among Republicans has re-ignited fiscal stimulus expectations, fuelling concerns over long-term US debt sustainability—another tailwind for gold as a safe haven.

🧠 Smart Money Technical Framework (H1)

Price has moved into a Premium FVG Zone, showing signs of potential exhaustion after forming a clear CHoCH and bullish BOS. The current zone (3,375 – 3,376) aligns with a mid-risk sell region, where price may experience short-term rejection before revisiting demand zones.

Market structure suggests liquidity sweep potential towards the downside before any continuation of the larger bullish trend.

📊 Trading Strategy – Smart Money Zones & Key Levels

🔵 BUY SCALP: 3,334 – 3,333

🔴 SL: 3,329

✅ TP: 3,340 → 3,344 → 3,350 → 3,360

🔵 BUY ZONE LOW RISK: 3,317 – 3,316

🔴 SL: 3,311

✅ TP: 3,320 → 3,325 → 3,330 → 3,336 → 3,345 → 3,350 → 3,360

🔴 SELL SCALP ZONE: 3,375 – 3,376

🔴 SL: 3,380

✔️ TP: 3,370 → 3,366 → 3,360 → 3,355 → 3,350

🔴 SELL ZONE HIGH PROBABILITY: 3,388 – 3,390

🔴 SL: 3,394

✔️ TP: 3,384 → 3,380 → 3,376 → 3,370 → 3,366 → 3,360

📌 Notes:

Be cautious ahead of NFP data and the upcoming US bank holiday—expect liquidity traps and sudden volatility.

This setup is ideal for intraweek scalping and liquidity-based reversals.

All trades follow Smart Money Concepts logic: premium vs. discount zones, CHoCH + BOS confirmations, and institutional order flow anticipation.

Short gold, it will fall again when encountering resistanceIn the short term, gold retreated to around 3274 and then rebounded again, and it is only one step away from 3300. Will gold regain its bullish trend again?

I think it is difficult for gold to break through in the short term. Although gold retreated to around 3274 and successfully built a double bottom structure with the second low point and the low point of 3245, it only increased the rebound space; it is not enough for gold to regain its bullish trend. Since gold fell and broke through, the confidence of bulls has been hit hard. The previous support at the technical level has formed a strong resistance area after the top and bottom conversion, and to a certain extent helped the short force. In the short term, gold faces resistance in the 3310-3320 area. Before gold breaks through this area, the short energy still has the upper hand.

Therefore, shorting gold is still the first choice for short-term trading.

It is appropriate to consider shorting gold in batches in the 3300-3320 area, and look at the target: 3385-3375-3365

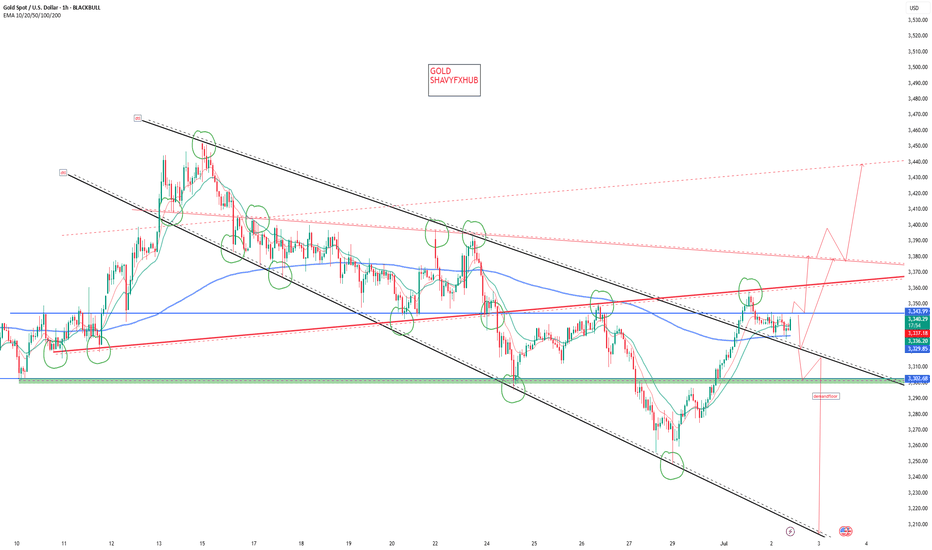

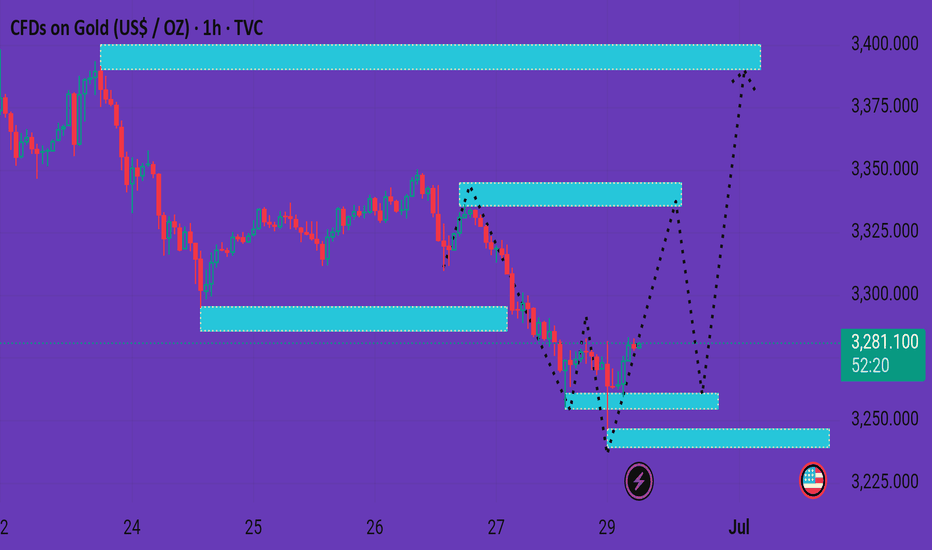

Xauusd market The chart you've shared is a 1-hour timeframe for Gold (CFDs on Gold, US$ / OZ) and seems to illustrate a potential bullish reversal scenario. Here's a detailed breakdown:

---

🔍 Chart Overview

Current Price: 3,280.920

Recent Movement: Price has been in a downtrend but recently formed a potential bottom with some sideways consolidation.

---

🟦 Highlighted Zones

1. Support Zone (Bottom - ~3,240)

Marked with a U.S. flag emoji (likely news-related support).

Price previously bounced from this zone — a key area of demand.

2. Mid-Level Supply/Resistance Zone (~3,300–3,320)

Price may test this zone if bullish momentum continues.

A key intraday resistance to watch.

3. Upper Supply Zone (~3,360–3,400)

If price breaks the mid-level zone, this is the next potential target.

Final bullish target area.

---

📈 Projected Paths (Dashed Lines)

Primary Scenario:

Bounce from current level → retest mid-resistance (~3,320) → possible breakout → target upper zone (~3,400).

Alternative Scenario:

Slight retracement back to the lower support (~3,260–3,245) before rallying to higher zones.

---

🔄 Interpretation

Bullish Bias: The chart is structured for a bullish reversal.

Confirmation Needed: A break and hold above the mid-resistance (~3,320) would validate the bullish path.

Risk Zone: If price falls below the bottom support (~3,240), the bullish setup may be invalidated.

---

Would you like a trading plan or entry/exit suggestion based on this setup?