XAUUSD - Prop firm or your own account? - Trading Psychology"$100K Funded? Or $1K account you own?? Welcome to the Inside Battle of Every Trader"

You want capital, freedom and win big.

But the question is: do you do it with your own money, or someone else’s?

You’ve got the $100K funded dream on one side. Big leverage, strict rules, payout drama.

And on the other side? Your own $1K account. Zero limits, zero support, and a whole lot of emotional damage.

This is a breakdown of what really happens behind both paths — the adrenaline, the self-sabotage, the mind games, and the payouts that sometimes never come.

The Prop Firm Path: Pass, Survive, Then Pray

Phase 1: You trade with hunger.

You’ve got the goal in sight, and every move is calculated. You’re alert, focused, mechanical. The structure helps. The rules feel like a challenge. Everything feels possible.

Phase 2: You trade with fear.

Now you’re tiptoeing. The target’s smaller, but the pressure is suffocating. Hesitation.Overthink. You play defense — and that’s when you lose. You stop executing your edge and start trading to avoid failure.

Funded: The real test begins.

You go live, you trade well, you hit payout… and suddenly the firm has a problem. A new rule is “suddenly” enforced. A clause is reinterpreted. A delay happens. You’re told to wait. Or worse — your account is shut with no warning.

That’s the part no one prepares you for: the waiting, the silence, the mental snap.

Passing isn’t the end. It’s barely the middle.

✅ So, Should You Go Prop? Here's What You Need to Know

Yes — if you’re ready to treat this like a hostile contract.

If you’re trading a prop account, you are trading their rules, their terms, their timing. You are not a partner — you are a performer. And they are very comfortable pulling the plug.

If you do it:

• Be colder than the system.

• Read every rule twice.

• Trade Phase 2 like a surgeon — no ego, no rush.

• And never treat a payout like it's guaranteed — treat it like a fight you have to win more than once.

You don’t just pass. You survive.

And if you’re not ready to survive, stay out.

🚨 Do not forget — It’s Simulated Capital. And That’s the Game.

Let’s not pretend it’s hidden:

You’re NOT TRADING REAL MONEY. You’re executing on a simulated account that mirrors real conditions — nothing more.

When you get paid, it’s not because you “grew” capital. It’s because you performed better than the masses who failed their challenges and fed the payout pool.

This isn’t shady. It’s the model — and it works because most traders lose.

So don’t delude yourself into thinking you’re managing funds.

You’re monetizing discipline inside a challenge-based system.

And if you know how to work that system? You get paid.

If you don’t? You become someone else’s payout.

🔓 Trading Your Own Money: Real Freedom or Emotional Damage?

With your own capital, there’s no one watching — and no one helping.

You set the rules. You decide how aggressive, how cautious, how chaotic.

But the second you click “Buy,” your psychology comes for you like a debt collector.

Because real trading isn’t what’s on the screen — it’s what’s happening between your ears.

You lose your money, you lose your confidence.

You win big, and suddenly you think you’ve figured out the market — until the market slaps you for it.

There’s no one to blame, and that makes it ten times harder.

But here’s the part no one can take away from you: every lesson is yours.

Every win is clean. Every loss hits deep. And if you make it — you really made it.

💡 How to Make Self-Funded Work for You

✅ Start with small capital — but also invest in your trading education.

Join a group that teaches you how to trade, not signal groups that just give you orders when to buy or sell, without explaining why.

✅ Join a real trading community.

Surround yourself with people who post actual breakdowns — who teach, not flex.

Avoid ego chats. Avoid circus chats. Find people who show the why, not just the entry.

(If you’re reading this, you already found the right space.)

✅ Focus on fixing mistakes — not faking wins.

Nobody cares how many pips you caught if you blew 5 trades getting there. Get real about your risk management and lot size.

✅ Learn to stop after a win.

Don’t feed your dopamine. Protect your equity. Walk away while you’re still in control.

✅ Respect your losses. Don’t chase them.

Red days don’t destroy traders. Revenge trading does. Stop. Reset. Come back sharper.

✅ If you’re not paying yourself yet, don’t panic.

Some seasons are for building, not cashing out. Don’t force results just to feel good — let the system earn before it pays.

🔄 The Hybrid Advantage: Rent the rules. Own the skill.

Some traders don’t pick a side.

They use prop firms like a hired weapon — fast, effective, disposable and

Personal accounts like a vault — protected, scalable, sacred.

They switch between them based on market conditions, mental load, and long-term goals.

You don’t need to be loyal to a style just be loyal to your results.

🧠 Final Word:

Trading becomes real, sustainable, and successful only when your mind is at peace with the path you chose.

If you wake up anxious about your account — if you feel pressure before you even open the chart — that’s not discipline, that’s misalignment.

This doesn’t mean trading should feel easy. But it should feel right.

You should wake up curious to read price, not terrified to take a trade.

Whether you trade $100K or $1K, the real account is always in your head.

You should feel like this work belongs to you — not like you’re trying to survive someone else’s idea of success.

Whether you trade with a prop firm or your own account, or both, the goal is the same:

Mental clarity. Emotional control. Strategic confidence. You’ll know you’re on the right path the moment the stress fades — and the obsession becomes patience, structure and joy with success.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

XAUUSD.F trade ideas

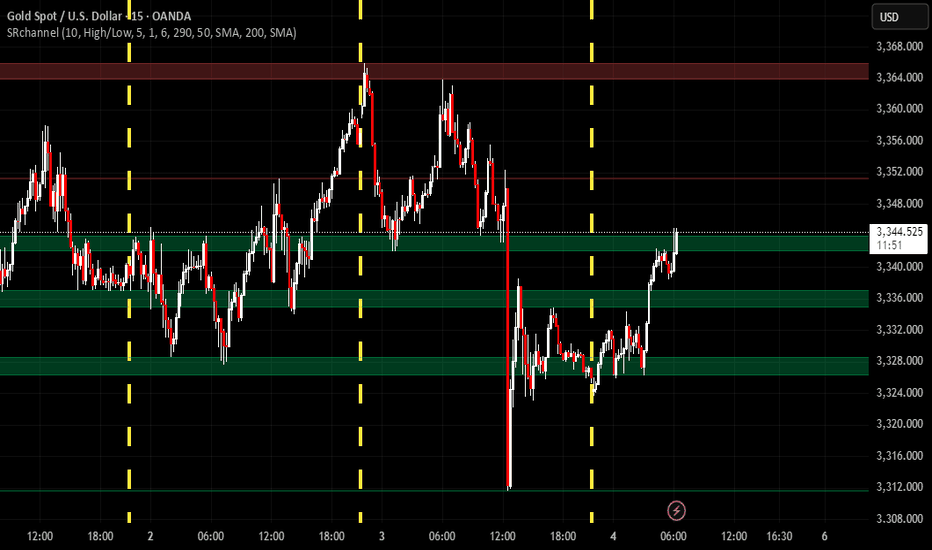

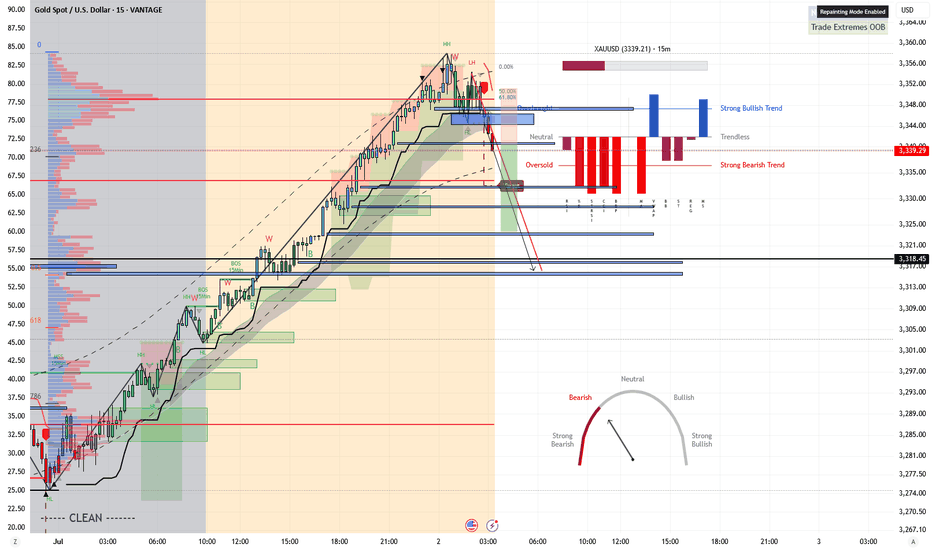

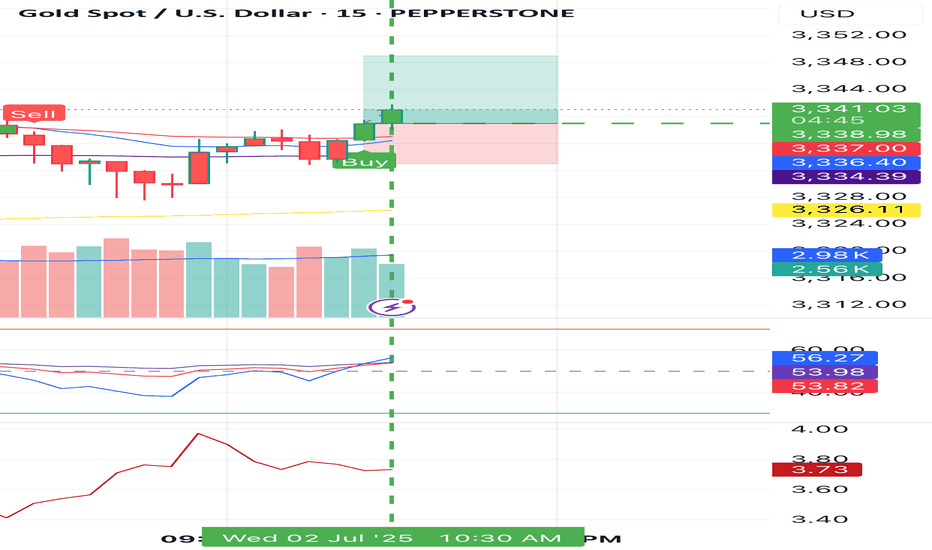

Gold Market Analysis Current Price: 3341.58

Market Behavior:

The price is ranging sideways, trading in a tight consolidation zone just below the resistance zone (around 3344).

Key Resistance Levels:

3344 → Immediate resistance

3348 – 3352 → Next minor supply zone

3357 – 3360 → Strong resistance ahead (if breakout occurs)

Key Support Levels:

3332 – 3330 → Short-term demand

3324 – 3320 → Stronger support zone

📌 Trader Insight:

"Gold is in a consolidation phase between 3330 and 3344. Wait for a confirmed breakout above 3344 for bullish momentum toward 3357+. If rejected again, expect a retest of support near 3332 or deeper."

✅ Trade Setup (Example):

Buy Scenario (Breakout):

Entry: Above 3345

Target: 3357

Stop Loss: Below 3338

Sell Scenario (Rejection):

Entry: Near 3344 resistance, if rejected

Target: 3332 / 3324

Stop Loss: Above 3348

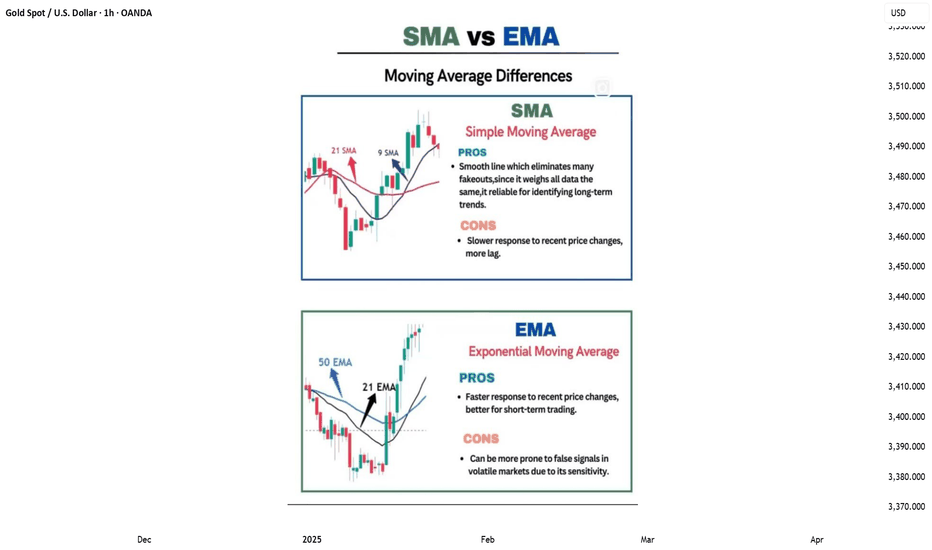

TRADING KNOWLEDGE – MOVING AVERAGE (MA)The Moving Average (MA) is a popular technical indicator that helps smooth out price data to better identify market trends. MA doesn't predict the future but helps traders clearly see the current direction of the market.

🔍 2 Main Types of MA:

🔔 SMA (Simple Moving Average): The average of closing prices over a set period (e.g., SMA 20 = average of the last 20 candles).

🔔 EMA (Exponential Moving Average): Similar to SMA but gives more weight to recent prices, making it more responsive to market changes.

📈 What is MA used for?

📍Trend Identification:

💡Upward sloping MA → Uptrend

💡Downward sloping MA → Downtrend

📍Trading Signals:

💡Price crossing above MA → Buy signal

💡Price crossing below MA → Sell signal

📍Combining Two MAs (Short & Long Term):

💡Short MA crosses above long MA → Buy signal (Golden Cross)

💡Short MA crosses below long MA → Sell signal (Death Cross)

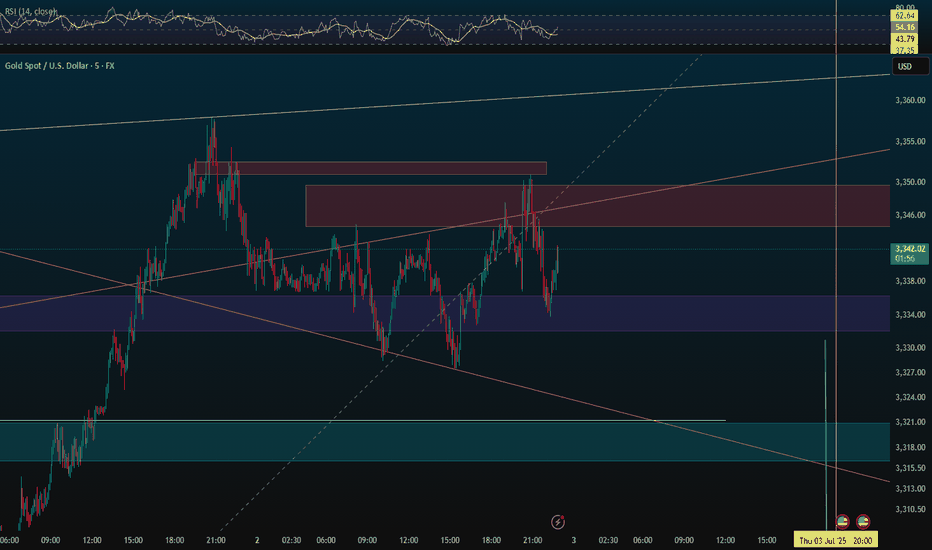

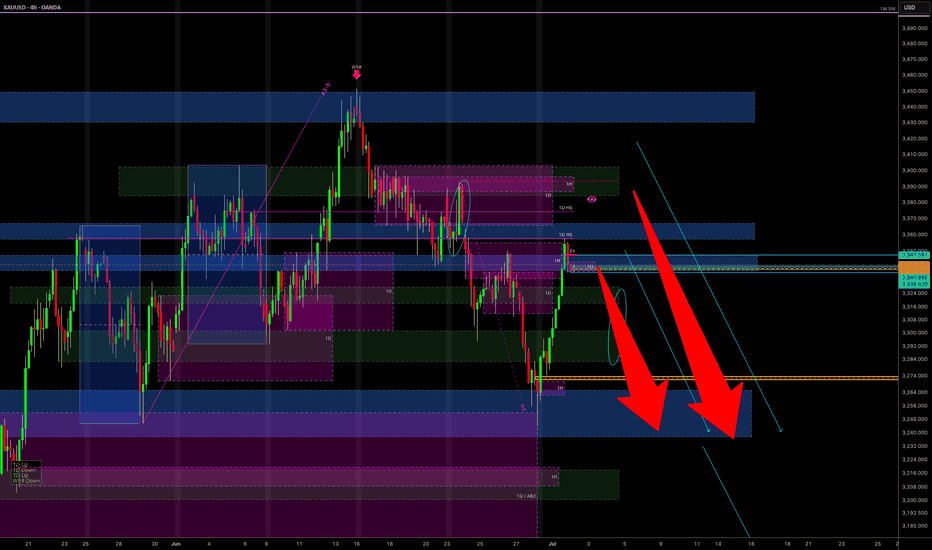

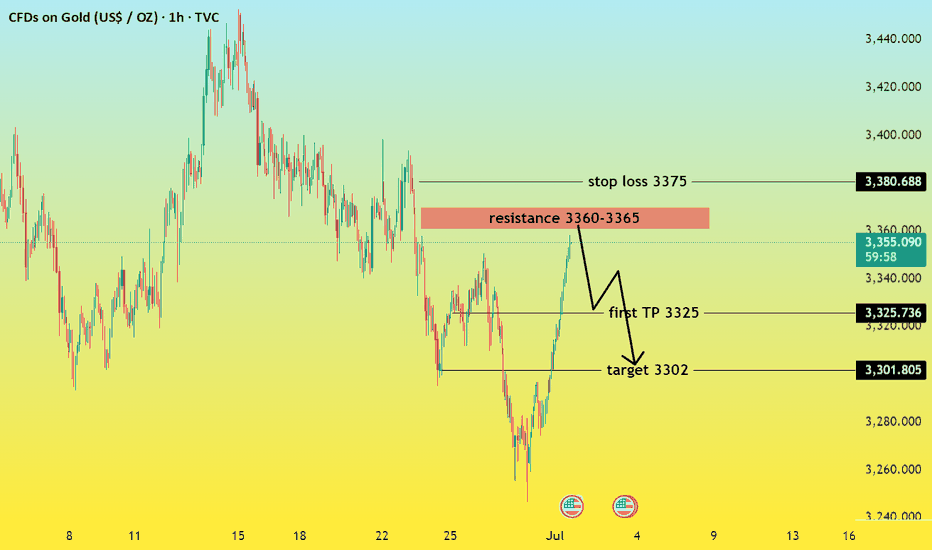

Gold Sell- look for sell

- Refine entry with smaller SL for better RR, if you know how

- keep looking for sell even if price goes one more up

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."

XAUUSD - SELL After a reasonable big run up like this they will take profits

Looks like it's roiling over watching Super Trend and break of

Buffer Zone with Bearish Continuation Candle can easily Shoot back up if Wicks but should be plenty of room to make money on this one.

Hardest part is being patient

Selling seems to capitulate everyone wants to capture as much profit as possible or should I say Algo's

NY also current session so they have plenty of push and Greedy as can be !

USD has turned Strong for now also

Don't forget to protect profits when you deem fit should it run into profit trading Forex - Gold is very unpredictable their game is to take yr money deliberately - do the opposite just to snag yr hard earned cash.

Lets See : )

Embracing Uncertainty

In trading, the illusion of certainty is often our biggest enemy.

Even the cleanest setups—like a MTR (Major Trend Reversal)—can fail.

Mark Douglas said it best:

“Anything can happen.”

This simple truth is what keeps professional traders humble and disciplined.

Respect the market, manage your risk, and never assume you know what comes next.

Stay sharp.

#MJTrading

#GoldTrading #XAUUSD #TradingPsychology #AnythingCanHappen #MarkDouglas #ForexMindset #TradingQuotes #PriceAction #RiskManagement #MindOverMarkets #ChartOfTheDay #MJTrading

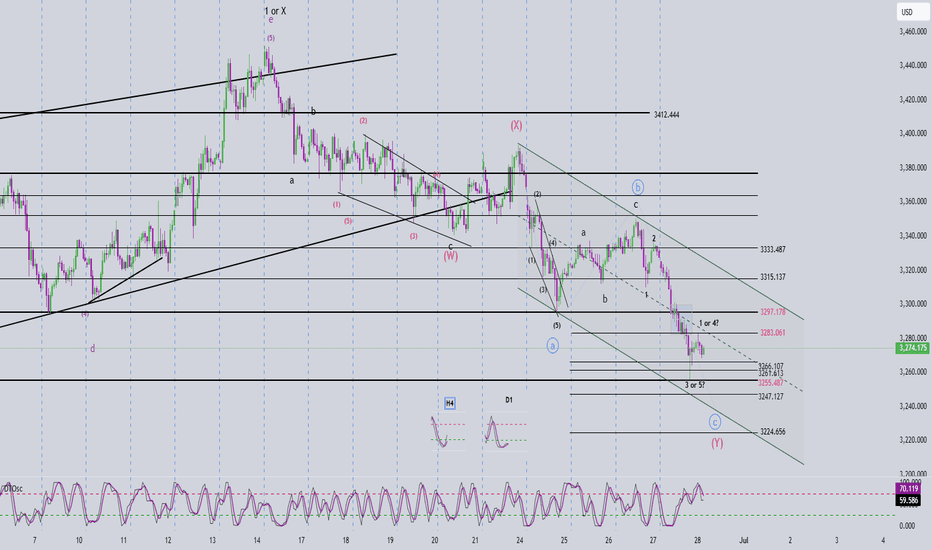

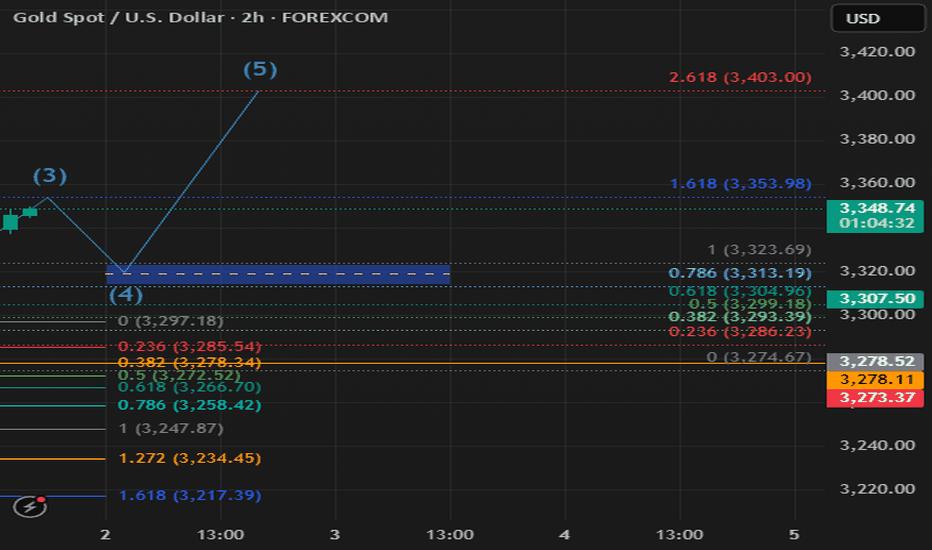

Elliott Wave Analysis – XAUUSD Trading Plan for June 30, 2025

🌀 Elliott Wave Structure

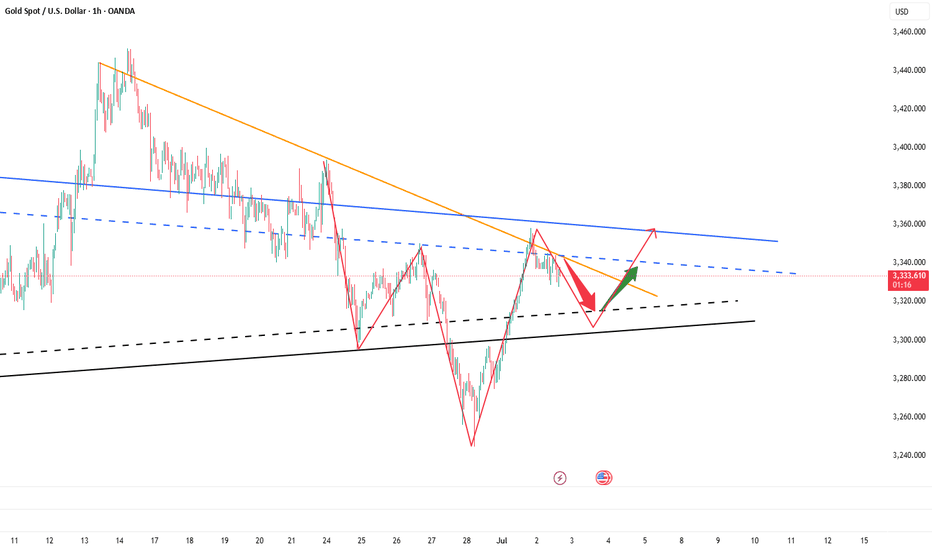

On the H1 chart, we observe a double zigzag correction WXY (in red). Currently, Wave Y appears to be developing as a green abc structure.

In this abc structure:

+ Wave a started with a leading diagonal (5-wave triangle).

+ Wave b followed as a typical abc correction (in black).

+ Wave c is currently unfolding as a clear 5-wave impulsive move, characterized by sharp and rapid price action.

The key issue now is to determine whether:

+ The price has completed wave 5 (black), or

+ It has only completed wave 3 (black) within the green wave c.

If the current movement is wave 3 (black), we should expect a wave 4 correction, followed by one more leg down to complete wave 5. In this scenario, wave 5 will be confirmed if the price breaks below 3255. There are two potential target zones for wave 5:

+ Zone 1: 3247

+ Zone 2: 3224

If wave 5 has already completed, the upward move to 3283 could be wave 1 of a new bullish trend. The next pullback would be wave 2, with an expected target between 3266 – 3261.

⚡️ Momentum Analysis

D1 timeframe: Momentum is in the oversold region, suggesting a high probability of a bullish trend in the upcoming week. This supports the view that wave c (green) of wave Y (red) is nearing completion.

H4 timeframe: Momentum is turning bullish, indicating the current upward movement may continue. This adds to the uncertainty about whether wave 3 or wave 5 has ended.

🧭 Trading Plan

📍 BUY ZONE 1

Entry: 3264 – 3261

SL: 3254

TP1: 3283 | TP2: 3297 | TP3: 3315

📍 BUY ZONE 2

Entry: 3247 – 3244

SL: 3237

TP1: 3283 | TP2: 3297 | TP3: 3315

⚠️ Important Note

This trading plan assumes either wave 3 or wave 5 has completed. Therefore, if in the early Asian session, the price does not touch the 3264 – 3261 zone but instead rises above 3283 without closing above 3297, and then drops back below 3283, we should avoid buying at 3264 – 3261.

Instead, we should wait for a potential entry at the 3247 – 3244 zone.

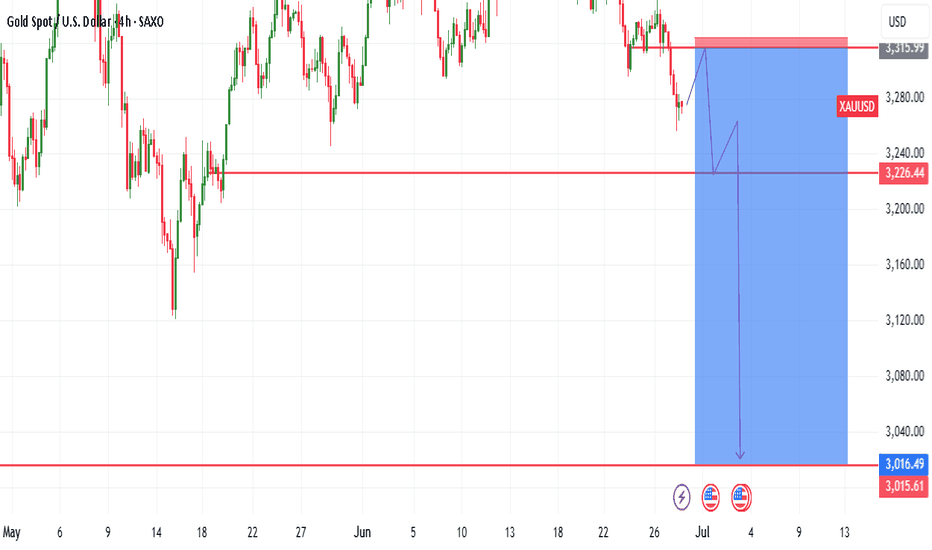

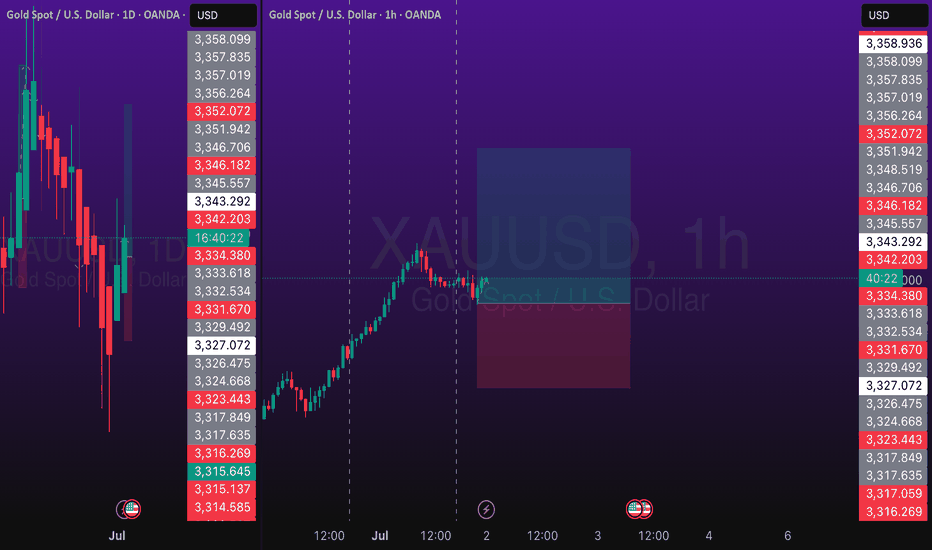

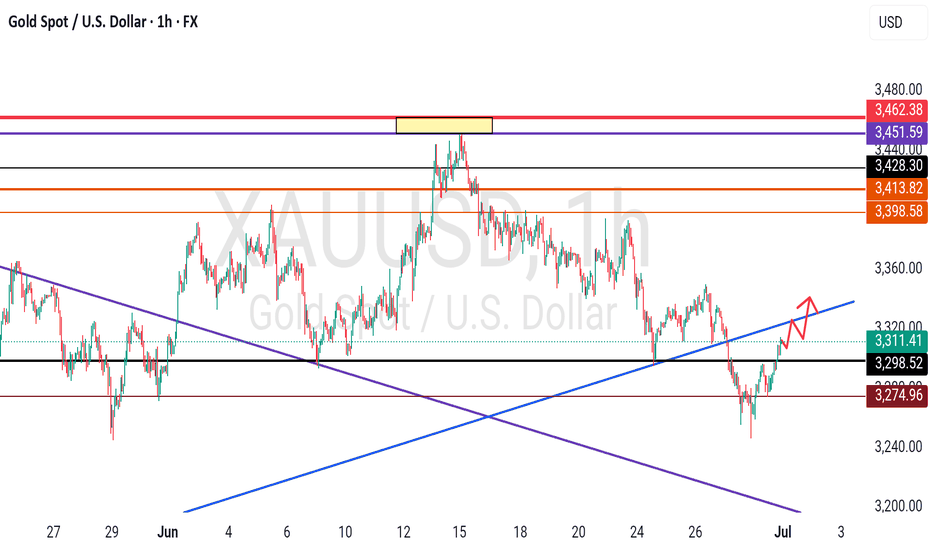

GOLD TOP DOWN ANALYSIS FOR MON. 30TH JUNE - FRI 4TH JULY, 2025Gold looks bearish heading into the new week. We had the formation of a weekly engulfing candle last week. I expect a pullback buy at market open from the current level to a take-profit level of 3316.

After that, I expect a sell-off from the 3318 level down to the 3000 level for the rest of the week.

I will be posting daily updates here, cheers!

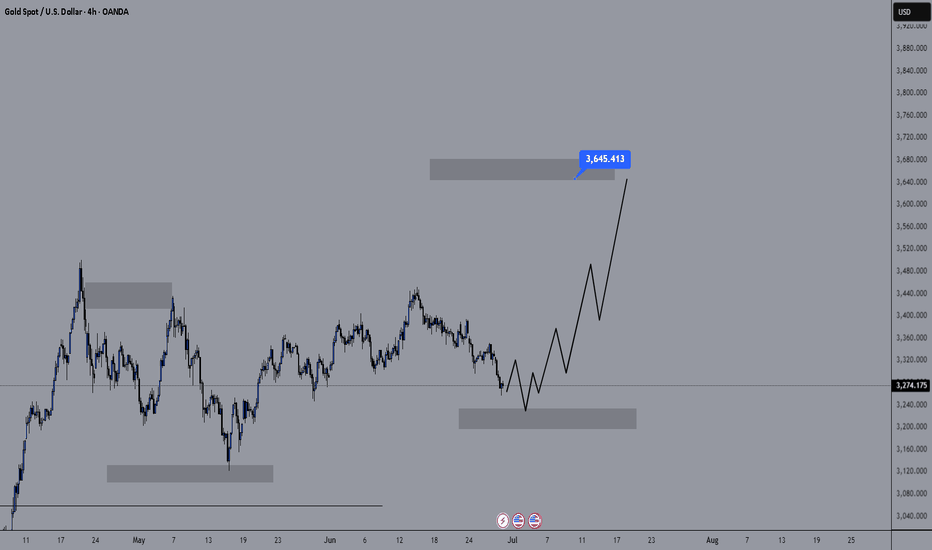

Will this growth spurt be newsless?Hello friends..

As we said in the previous analysis, we are still waiting for another upward leg. (Because the trend is bullish in the long term)

Now we are looking for buying deals in gold next week after the market opens. (Technically, it is in a good range for buying deals)

The lower area that has been identified can be a good range for buying.

You can keep the target for this deal at $3645 (which is good in terms of risk to reward).

.

I hope you have used this analysis well.

You can follow our page to see more analyses.

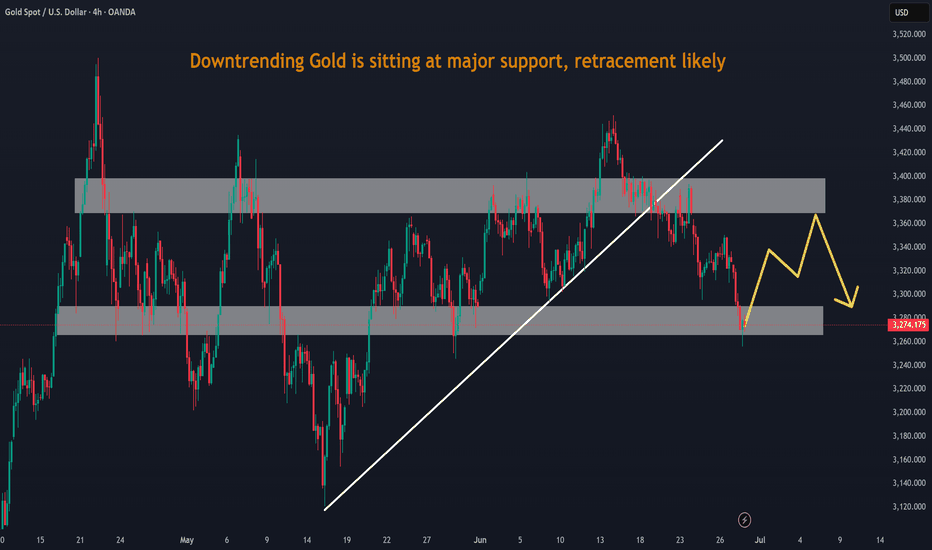

XAUUSD Bearish Setup | Support Levels in SightGold has broken down from the ascending channel, indicating a potential shift in market structure toward bearish momentum.

🔎 Technical Highlights:

Clear breakdown from the ascending channel

Price currently facing resistance near $3,323

Two key support zones:

🟩 First Support: $3,295 – potential bounce area

🟩 Second Support: $3,258 – deeper downside target

📊 Short-Term Outlook: Expecting a minor pullback before continuation lower toward the $3,295 support. If that level fails to hold, the next target becomes $3,258.

💡 Trade Idea: Watch for rejection below $3,323 for a possible short opportunity targeting $3,295 and $3,258. Keep an eye on momentum and volume.

🔔 Note: Always use proper risk management. This setup is based on current price action and may change with market dynamics.

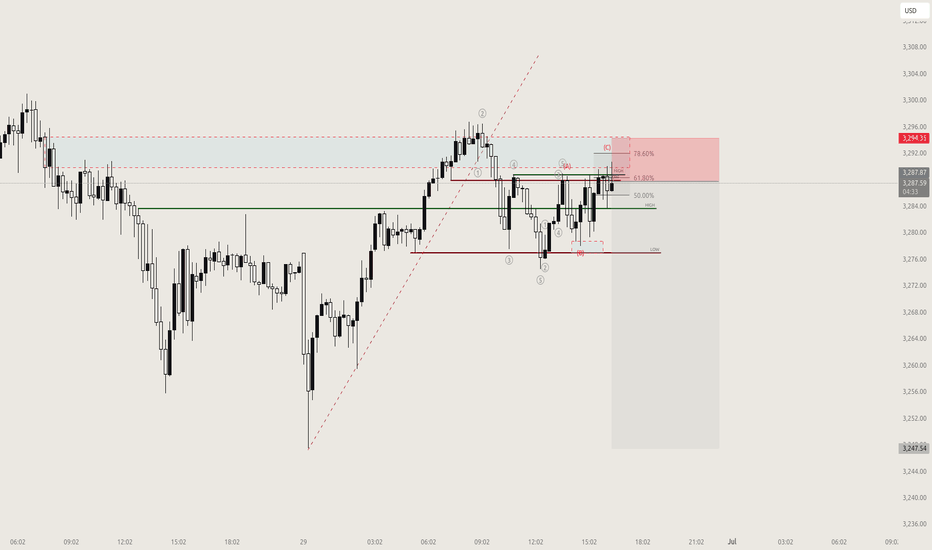

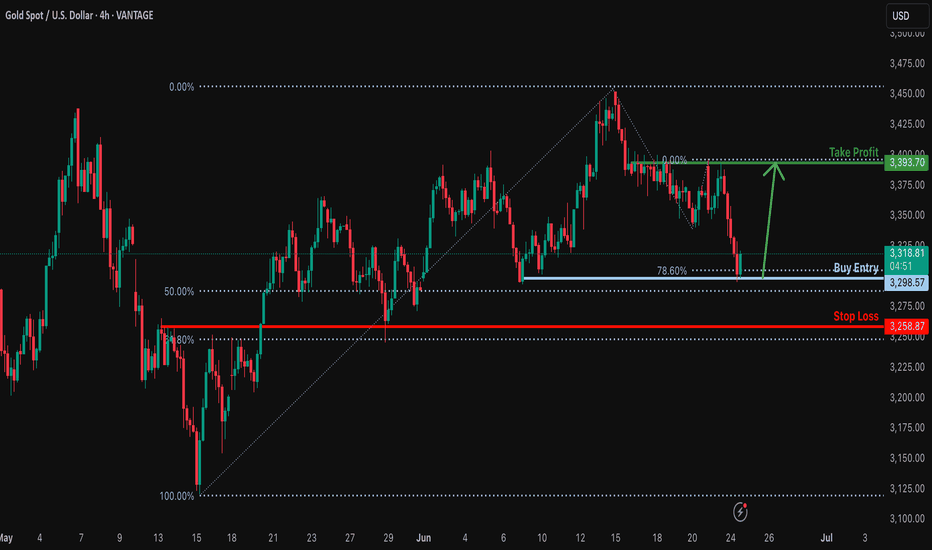

Bullish bounce off pullback support?XAU/USD is reacting off the support level which aligns with the 78.6% Fibonacci projection and the 50% Fibonacci retracement and could rise from this level to our take profit.

Entry: 3,298.57

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci projection and the 50% Fibonacci retracement.

Stop loss: 3,258.87

Why we like it:

There is an overlap support level that lines up with the 61.8% Fibonacci retracement.

Take profit: 3,393.70

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

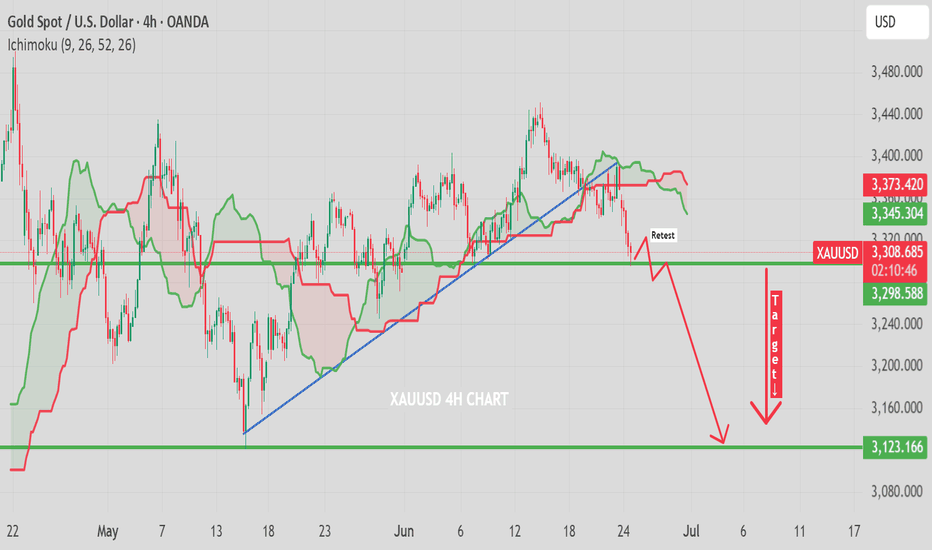

XAUUSD 4H Chart – Trendline Break and Retest in Play"Gold (XAUUSD) on the 4H timeframe has broken below the ascending trendline and is currently in the process of retesting the previous support, now turned resistance. If the retest holds, further downside is expected towards the 3123 level, as marked on the chart. Ichimoku Cloud also shows a bearish outlook, supporting the potential drop. Traders should watch price action closely around the retest zone for confirmation."

This is not financial advice .

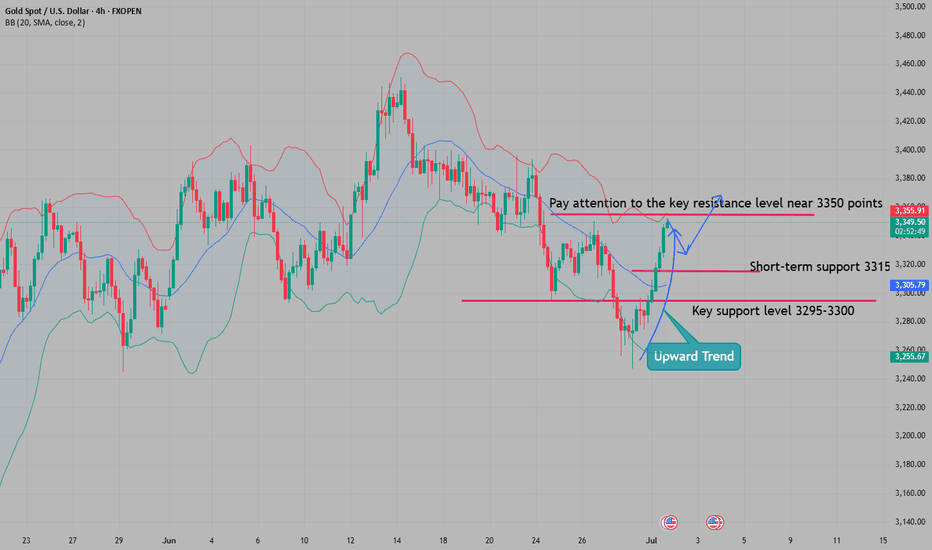

Exclusive trading strategy, short gold!From the current gold structure, we can see that gold still needs to continue to retest the 3320-3310, or even the 3305-3295 area; so in the short term, we can still seize the opportunity to consider shorting gold in batches in the 3340-3360 area.

Trading signal:

@3340-3360 Sell, TP:3325-3315-3305

A reliable trader must have an explanation for everything and respond to everything. I have always been committed to the market and insist on writing the most useful core strategies for traders. The transaction details can be seen in the channel!

X1: GOLD/XAUUSD Long Trades Risking 1% to make 1.8%X1:

#XAUUSD/#GOLD Long Trades

GOLD/XAUUSD Long for day trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Risking 1% to make 1.8%

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

XAU/USD Start July 20251. i start after XAU/USD break previous High and correction (fibbo 32.0) respected. based on elliot wave strategy we can targeting end of wave 3 at 3353 area and than correction wave 4 (target at fibbo 32.0 - 50.0). after target correction, continue wave 5 at target 3403 area.

2. fundamentally speaking, new months new quarter. there ins't new catalist and sentiment. Macro Economic this week focus on labour market at US and FED projection to cut rate.

3. War at Iran and Israel, Russia and Ukraine, India and Pakistan, Trade War case, etc,.

4. Will be update

Never hold a short position blindly!In the 4-hour timeframe, consecutive bullish surges have broken the previous weak consolidation pattern. Focus on the key resistance level around 3350 above; for short-term support below, pay attention to the 3315 level, with the critical support zone between 3295-3300 being the primary focus. Overall, maintain the main theme of participating in long positions at lower levels within this range. For prices in the middle of the range, it is advisable to adopt a "wait-and-see" approach, avoid chasing trades impulsively, and patiently wait for key levels to enter positions.

BUY TRAP OR TREND ?xauusd is supposed to frame bearish zone by faking bullish trend. the current candle sticks momentum indicate seller control. the dollar performance and high intererst rate along with geopolitical peace full events are likely to encourage a seller control.

the resistance is 3370 if market did not break it then it will fall on the last target i set up for you.

target 1 ( 3330)

target 2 (3302)

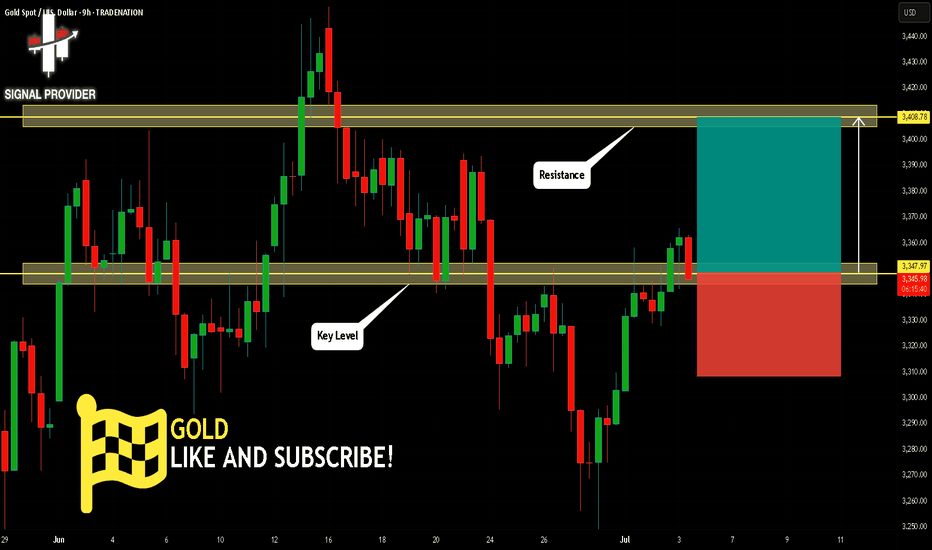

GOLD Will Move Higher! Long!

Here is our detailed technical review for GOLD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,347.97.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,408.78 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!