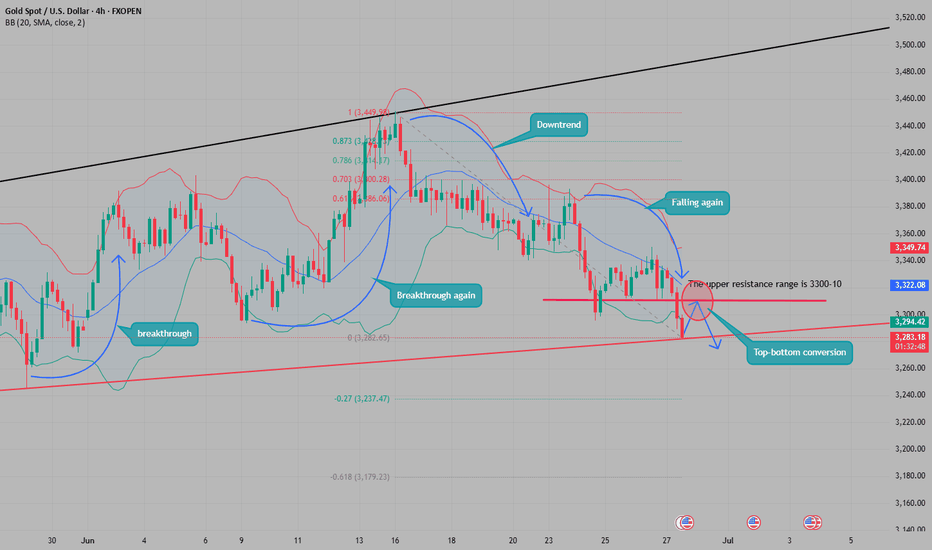

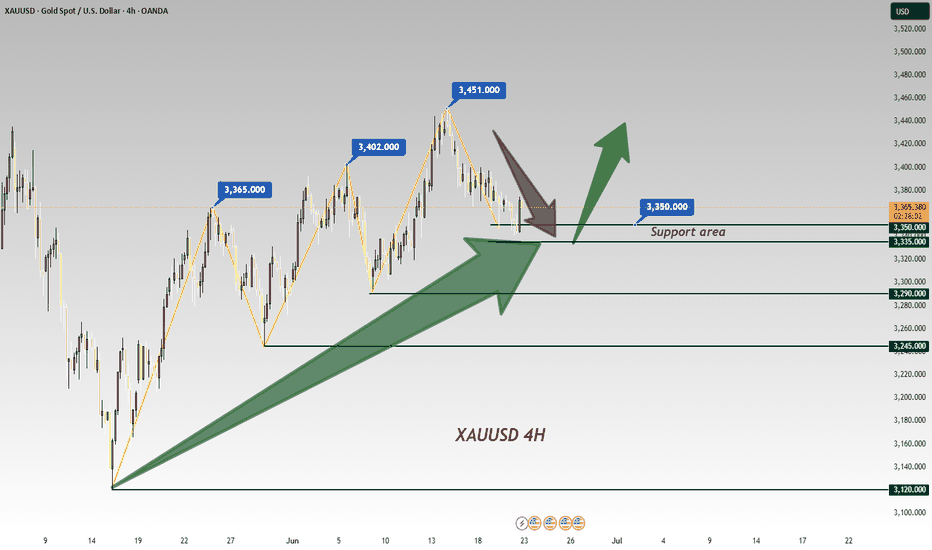

Is today Black Friday?On Thursday, gold prices rose to 3350 with support from 3333-30. When the key support of 3320 was broken, it indicated that the short-term rise turned into a fall. This morning, the rebound to 3320 confirmed the pressure of the top and bottom conversion, and then slowly fell all the way to break the integer mark of 3300 US dollars.

In 4 hours, it has fallen below the previous low of 3295, and will continue to fall. There are two support positions below, namely 3277 and 3263. Don’t expect a big rebound before going short in the negative market. If the rebound is large, it will not fall. This kind of negative decline is generally judged by the 15- and 30-minute patterns. When resistance appears in the big cycle, the market has actually fallen a lot.

Today, I think the pressure is mainly in the 3300 and 3310 areas. 3310 can be considered as the pressure of the top and bottom conversion. Pay attention to 3377 and 3363 below. If you consider more, you may be at a relatively extreme position of 3363. For the time being, the general direction is mainly short.

XAUUSD.F trade ideas

Gold Buy- Go for buy if setup given

- just a small trade

- Refine entry with smaller SL for better RR, if your strategy allow

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."

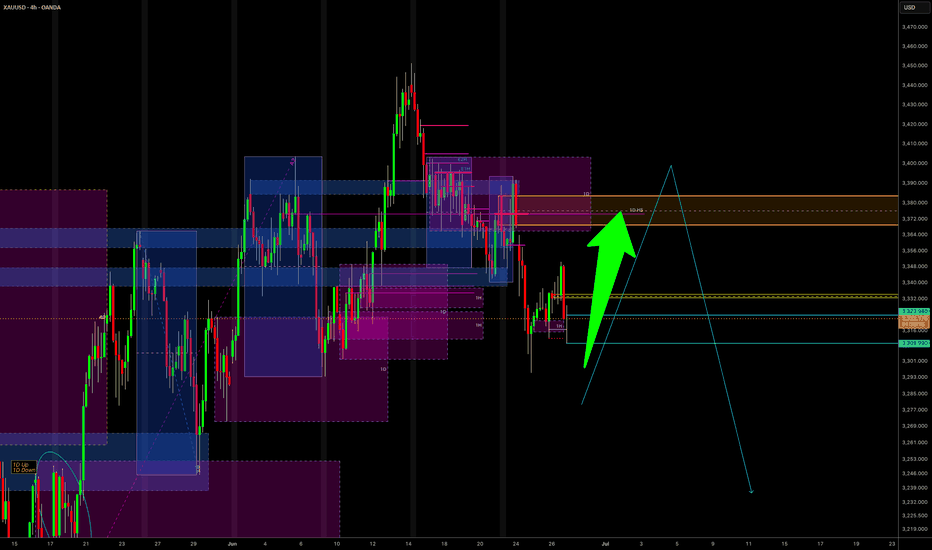

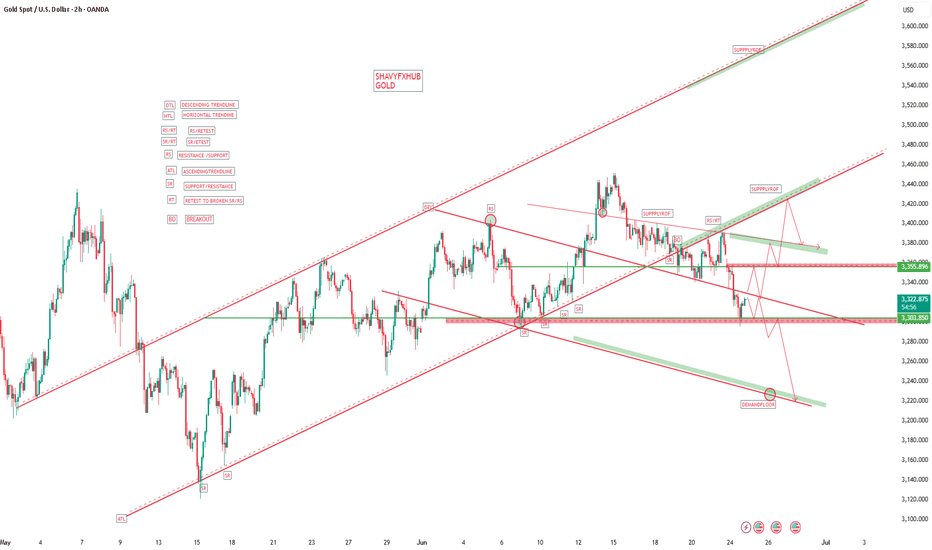

Gold Trading Strategy June 26✏️ D1 candle shows a recovery but not significantly. Gold is currently reacting at the key resistance zone of 3342.

The immediate support zone that the price is heading toward is 3326. This forms a breakout range between 3326 and 3342.

A bullish channel may form if there is a strong price reaction at 3326. Conversely, if 3326 is broken, it could confirm a continuation of the downtrend targeting 3302 during the European and US sessions today. The bearish target could even extend to 3278.

📈 Key Levels

Breakout Range: 3326 - 3342

Support: 3326 - 3314 - 3302 - 3278

Resistance: 3342 - 3363 - 3388

📊 Recommended Trade Setups

BUY: 3302–3300 | SL: 3297

SELL: 3363–3365 | SL: 3369

Hanzo Drex | 15-Min Bullish Reversal Setup – 300 Pips in Sight🔥 Gold – 15 Min Scalping Analysis

⚡️ Objective: Precision Reversal Execution

Time Frame: 15 -Minute Warfare

Entry Mode: Only after verified Reversals

👌Bullish Reversal : 3397

Price must break liquidity with high volume to confirm the move.

☄️ Hanzo Protocol: Dual-Direction Entry Intel

➕ Zone Activated: Strategic liquidity layer detected — mapped through refined supply/demand mechanics. Volatility now rising. This isn’t noise — this is bait for the untrained. We're not them.

🦸♂️ Tactical Note:

The kill shot only comes after the trap is exposed and volume betrays their position.

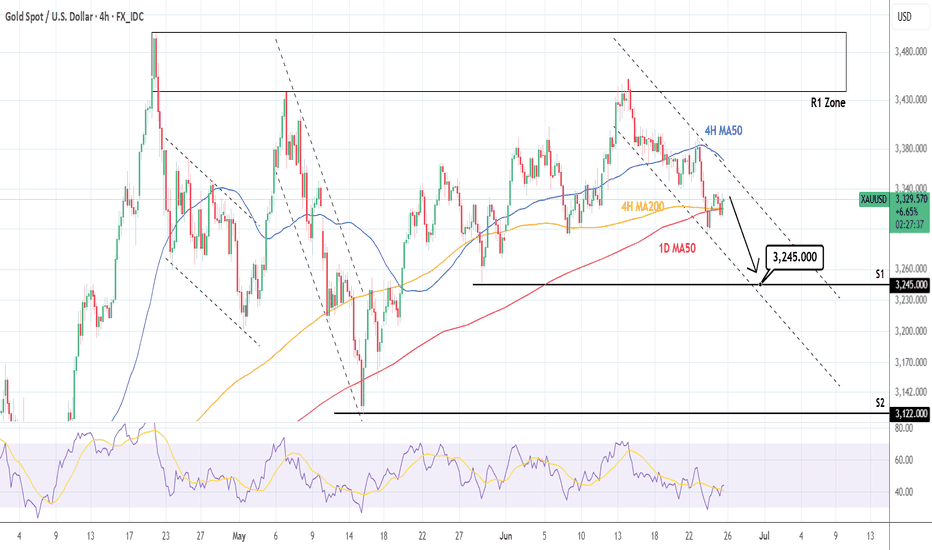

XAUUSD: Trend changed to bearish. Significant downside potentialGold turned neutral again on its 1D technical outlook (RSI = 49.253, MACD = 18.142, ADX = 16.679) as it crossed below both the 4H MA200 and 1D MA50. The two form a Bearish Cross. Technically a Channel Down has emerged, no different than those that emerged after rejections on the R1 Zone (like now). As long as the 4H MA50 acts as a Resistance and holds, we will be bearish, aiming at the S1 level (TP = 3,245).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

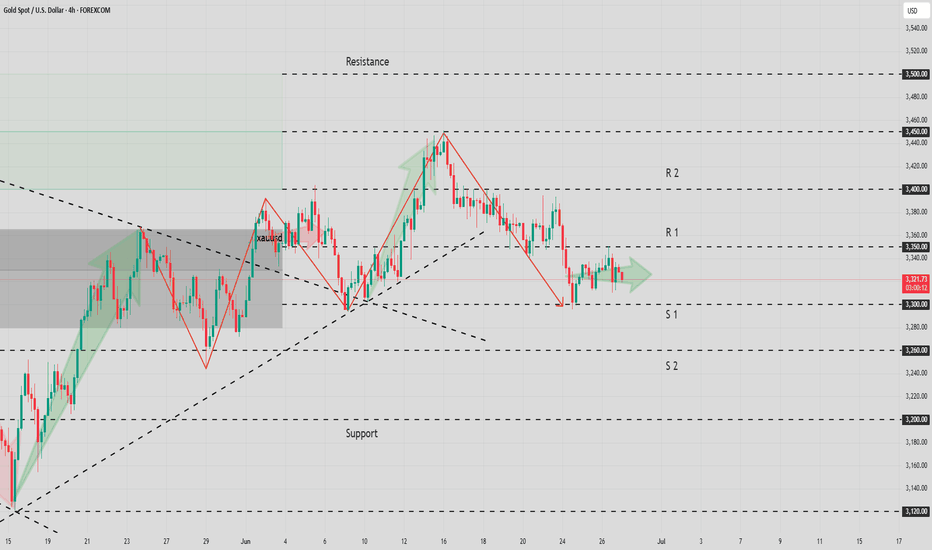

XAU/USD: Range Trading Awaiting BreakoutCore Logic:

1.Macro Drivers: Powell's dovish remarks continue to reverberate, with U.S. Treasury yields declining, the U.S. Dollar Index breaking below 97, and the debt ceiling extended to July 24—safe-haven demand props up gold prices.

2.Technical Outlook:

Currently trading in a $3,300–$3,350 range, with shrinking volume reflecting market caution.

Trend Projection:

- Likely to remain range-bound between $3,300–$3,350; a breakout will depend on progress in previously mentioned catalysts.

- If data misses expectations or geopolitical risks (e.g., Iran tensions) escalate, gold may rally to $3,360; otherwise, it could test $3,300 support.

Trading Strategies:

- Long positions: Enter lightly at $3,300–$3,310, stop-loss at $3,290, target $3,340.

- Short positions: Sell on rejection above $3,345, stop-loss at $3,360, target $3,320.

- Risk management: Cap single-trade exposure ≤3% to mitigate data-driven volatility.

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

XAUUSD Trading Signals: Buy Dips at 3335-3345 Amid Bear Trap💡 Trading Framework In-Depth Analysis:

The Fed's policy statement failed to stir volatility (markets had fully priced in dovish expectations 💨);

Weekly market pattern: Asian sessions consistently saw rallies 📈, followed by profit-taking pullbacks in subsequent sessions 📉;

Tactical entry logic: Use intraday highs in Asian trading as resistance references for long positions 🎯.

📊 Technical Validation & Risk Anchors

⚠️ Key Warning: Geopolitical bullish signals ignored → classic "bear trap" characteristics (bear trap 🚫);

⏳ Timing Strategy: Asian session highs form ideal resistance levels—recommend entering on pullbacks to the 38.2% Fibonacci support level 🎯.

⚡️⚡️⚡️ XAUUSD Precision Trading Signals ⚡️⚡️⚡️

🚀 Long Entry Range: 3335-3345 (stop loss can be set below 3325)

🚀 Take-Profit Target Range: 3360-3370 (partial profit-taking at first target 3360 recommended)

📢 Service Value-Added Notes

✅ Core trading signals updated daily in the morning (validated across 4-hour/daily double-timeframes);

✅ Refer to signal logic at any time during trading for sudden situations 🧭 (with historical win-rate statistics attached);

🌟 Wishing you smooth trading Next week — seize pullback opportunities to position 👇

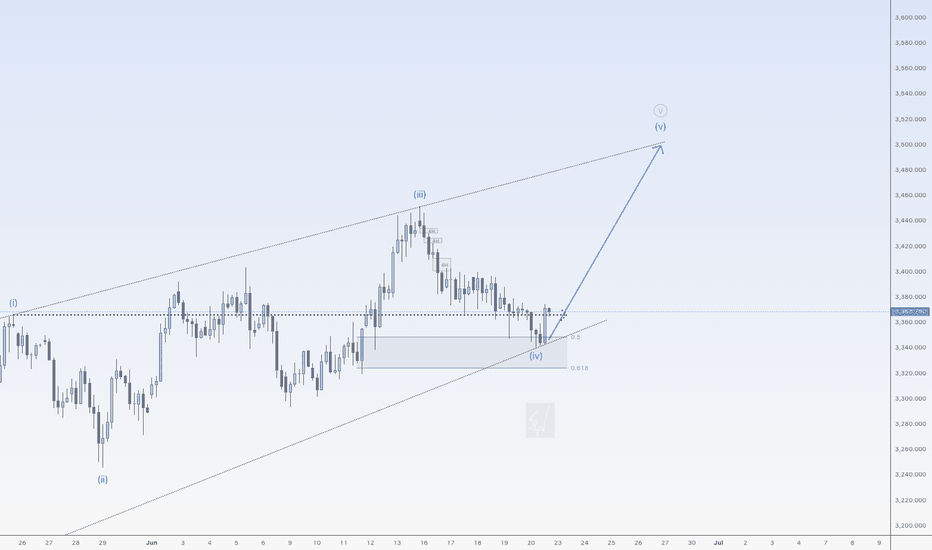

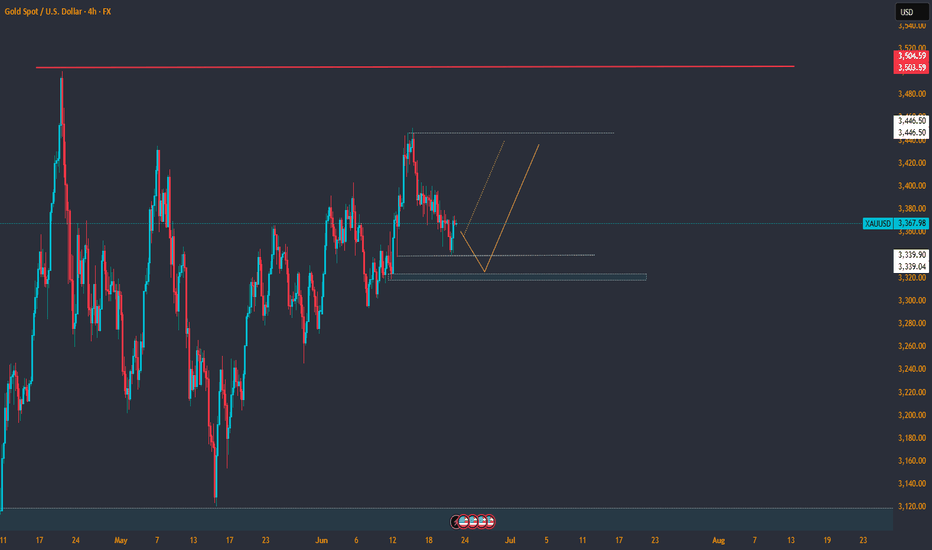

Another move up for goldHi traders,

Last week gold made a bigger (overlapping) correction down (wavecount updated). Price could be making an ending diagonal (wave 5)

If this is correct, then next week we could see a small correction down and more upside.

Let's see what price does and react.

Trade idea: Wait for a small correction down on a lower timeframe to finish and trade longs again.

If you want to learn more about trading FVG's & liquidity sweeps with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

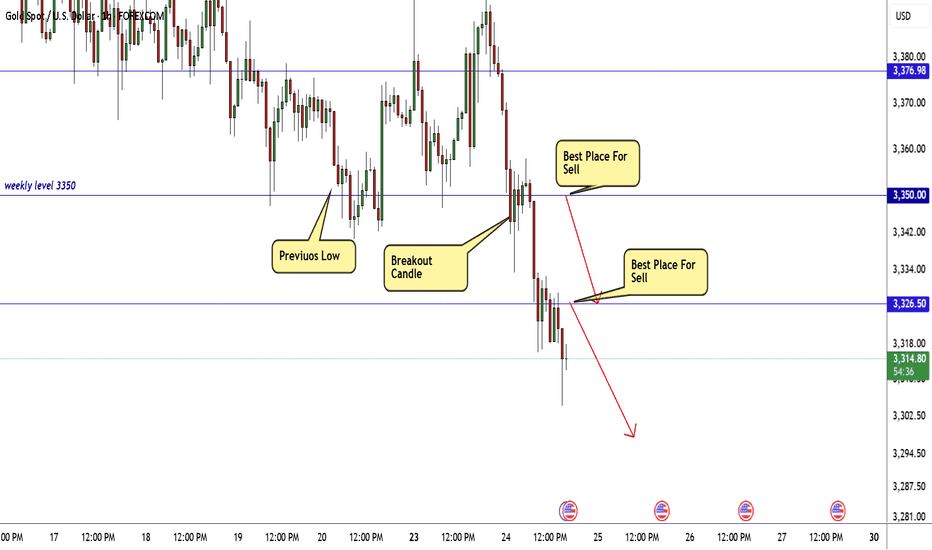

GOLD 2 Best Places For Sell Very Clear , Don`t Miss 300 Pips !Here is my opinion on Gold at the moment after the price moved very hard to downside as i mentioned in the last update , now we have a very good 2 places to sell it again , the first one @ 3326.00 , it`s a very good place to sell it cuz it was a very good support and the price break it and now it will play as a good res so we can sell from it , and if the price go higher we can sell from area between 3350 : 3345.00 , it will be a great place to sell it also , and if the highest place who force the price to downside we can add another sell entry from 3326.00 if we have a daily closure below it .

GOLD The US 10-year Treasury yield is approximately 4.29%-4.37%

The US Dollar Index (DXY) is trading near 97.877, showing relative stability with minor fluctuations

Impact on Markets Today

The slight decline in the 10-year yield suggests modest easing of bond market pressure, possibly reflecting cautious investor sentiment amid ongoing fiscal concerns and expectations of Fed rate cuts later this year.

The DXY near 97.9 indicates a moderately strong dollar, though recent trends show some weakening due to fiscal worries and softer economic data.

Together, a stable-to-slightly weaker dollar and a modestly lower 10-year yield can support safe-haven assets like gold, though elevated yields still pose a headwind. But despite the dips of both the 10 year us government bond yield and the dollar index ,GOLD lost over 500pips from Asian session to Newyork session trading on cease fire deal between Israel and Iran by united states of America.

In brief: The US 10-year yield’s slight dip combined with a steady DXY reflects a market balancing inflation, fiscal concerns, and Fed policy outlook. This environment supports cautious risk-taking with safe-haven demand still relevant.

follow zone of buy and sell for educational purpose only.

#gold #dollar

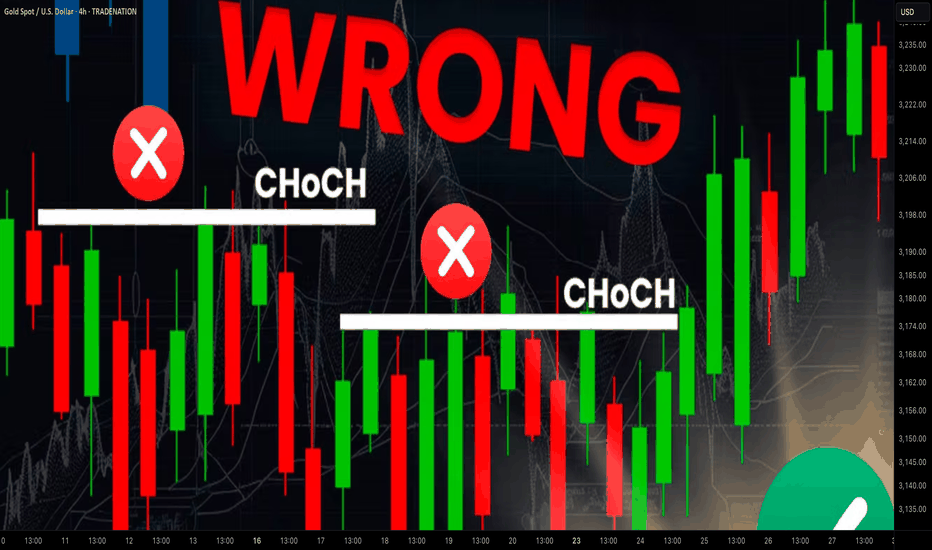

Learn Best Change of Character CHoCH Model in Trading with SMC

Most of the SMC traders get Change of Character CHoCH WRONG!

In this article, I will share with you Change of Character models that have a low accuracy and better to be avoided.

I will teach you the best CHoCH model for Forex Gold trading and show you how to identify it easily.

Let's start with the basic theory first and discuss what Change of Character signifies.

Change of Character in Bearish Trend

In a downtrend, Change of Character CHoCH is an important event that signifies a violation of a bearish trend.

CHoCH is confirmed when the price breaks and closes above the level of the last lower high.

Above, is a text book Change of Character model in a bearish trend.

For the newbie traders, such a price action provides a strong signal to buy while it fact it is NOT .

One crucial thing is missing in this model to confirm a bullish reversal.

According to basic trend analysis rules, we say that the market trend is bullish if the price forms a bullish impulse, retraces and sets a Higher Low HH , forms a new bullish impulse with a new Higher High HH.

Only then, we can say that the market is trading in up trend.

CHoCH model above confirms a bearish trend violation BUT it does not confirm a trend change.

Such a model may easily signify a deeper correction.

Look what happened with GBPNZD.

Though the price formed a confirmed bearish CHoCH, it was a false signal and just an extended correction.

That's a perfect bullish reversal model.

It combines CHoCH and conditions for a bullish trend.

Such a union is extremely accurate in predicting up movements.

Examine a price action on USDJPY.

Not only the price formed a confirmed CHoCH but also we see a start of a new bullish trend.

Change of Character in Bullish Trend

In an uptrend, Change of Character CHoCH is a significant event that signifies a violation of a bullish trend.

CHoCH is confirmed when the price breaks and closes below the level of the last higher low.

Above is a typical model of a bearish CHoCH.

For many traders, that is the signal to open short.

However, it is not that accurate and one important component is missing there.

According to basic price action rules, the market trend is bearish

if the price forms at least 2 bearish impulses with Lower Lows LL and a pullback between them with a Lower High LH.

Only when these 3 conditions are met, a bearish trend is confirmed .

Perfect bearish Change of Character model should include both CHoCH and a bearish trend price action. That will confirm a violation of a bullish trend and start of a new bearish trend.

EURCAD has a very strong potential to continue falling:

not only we see a valid bearish Change of Character but also

a start of a new bearish trend based on a price action.

Next time when you identify CHoCH on forex market, make sure that you check the preceding price action. It will help you to more accurate assess reversal probabilities and make a wiser trading decision.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

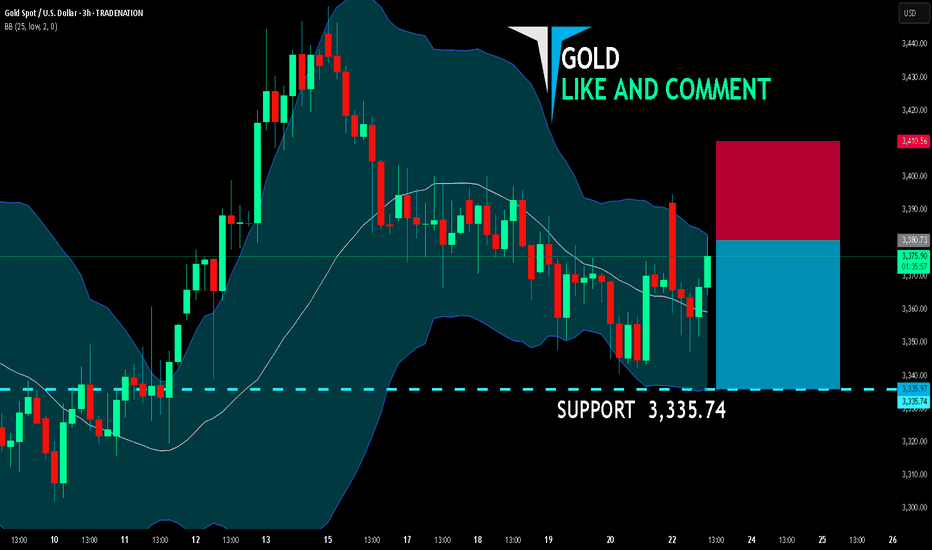

GOLD SHORT FROM RESISTANCE

GOLD SIGNAL

Trade Direction: long

Entry Level: 3,380.73

Target Level: 3,335.74

Stop Loss: 3,410.56

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

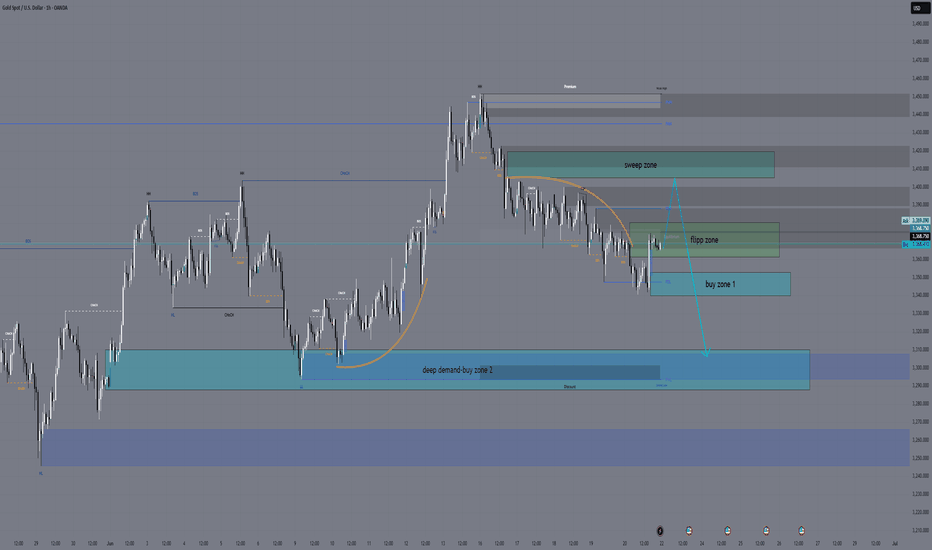

XAUUSD Daily Sniper Plan – Monday, June 23, 2025Current Price: 3368.76

Trend: Bearish on H4 | Corrective on H1 | Weak Bullish Attempt on M15

Market Context: Gold is consolidating under EMA pressure after FOMC. Price is pinned inside a key flip zone, awaiting Monday’s fundamental triggers.

🔸 HTF Overview (D1, H4, H1)

📰 Macro + Economic Context – Week of June 23–28:

This is a high-impact week for USD with Fed speeches, inflation, and growth data. Monday opens with caution:

Monday, June 23

🟠 FOMC Member Waller Speaks

🔴 Flash Manufacturing & Services PMI

🟠 Existing Home Sales

Tuesday, June 24

🔴 Fed Chair Powell Testifies

🟠 CB Consumer Confidence

🟠 Richmond Manufacturing Index

Wednesday, June 25

🔴 Powell Testimony (Day 2)

🟠 New Home Sales

Thursday, June 26

🔴 Final GDP q/q

🔴 Unemployment Claims

🟠 Durable Goods Orders

🟠 Pending Home Sales

Friday, June 27

🔴 Core PCE Price Index

🟠 Revised UoM Consumer Sentiment

📌 Monday is lighter in impact, but PMI data and Waller’s speech may spark the week’s directional bias. Avoid trading blindly into PMI spikes.

H4 Structure & Bias:

Bearish trend intact: Lower High = 3418, Lower Low = 3311

EMAs (21/50/100) aligned downward — price capped below 3380

RSI still under 60 = no bullish momentum

Rejection zone remains valid at 3406–3420 (H4 OB)

Strong demand expected at 3340–3352 and extreme at 3310–3288

🔸 LTF Precision (M30, M15)

Price compressing around 3365–3372

RSI around 56 → indecision

No bullish HH above 3380 = still within bearish control

EMA flattening → prepare for trap setups around NY open

🧭 Trade Scenarios

🔻 Sell Zone – 3406–3420

H4 OB, FVG top, liquidity above 3405

Entry: 3412

SL: 3426

TP1: 3312

TP2: 3288

TP3: 3265

🧠 Wait for sweep or strong bearish reaction — no early entries.

⚠️ Flip Zone – 3360–3380

No-trade zone: EMA cluster + mid-FVG

Only use for confirmations, not entries

🟢 Buy Zone – 3340–3352

OB + demand + Fib retracement

Entry: 3348

SL: 3334

TP1: 3448

TP2: 3472

TP3: 3490

🟢 Buy Zone – 3310–3288

Below LL sweep (3311)

Deep liquidity + OB demand

Entry: 3298

SL: 3280

TP1: 3365

TP2: 3405

TP3: 3440

📍 Key Structural Levels – June 23

Level Type Role

3460 Bull Trap Limit Irrational spike area

3445 FOMC Unfilled wick – trap zone

3426 Sell Zone Risk protection above OB

3418 H4 LH Confirmed bearish structure

3410 OB Midpoint Micro-rejection inside OB

3395 Previous HH Inducement target

3384 FVG Top Minor LTF rejection

3360–3380 ⚠️ Flip Zone MA/FVG compression – avoid entries

3352 OB entry edge Buy Zone 1 upper limit

3340 OB base Buy Zone 1 key level

3311 H4 LL Confirms bear structure

3300 Round Level Psychological + liquidity

3288 OB base Final demand structure zone

3265 Final TP Bearish extension only

✅ Final Action Plan

📉 Stay bearish below 3380 unless a clean HH + OB support forms

⚠️ Avoid trading inside 3360–3380 flip zone during NY PMI data

🛒 Longs valid only from 3340 or 3310 with confirmation (RSI, PA, OB)

🧠 Focus on structure integrity and clean OB rejections only

💬 Will you fade the 3412 OB or wait for the sniper bounce at 3348?

🔔 Follow and 🚀@GoldFxMinds for premium breakdowns, macro updates, and real-time sniper execution guidance.

🔹 Disclosure: As part of Trade Nation’s Influencer Program, we receive monthly compensation for using their charts.

GoldFxMinds

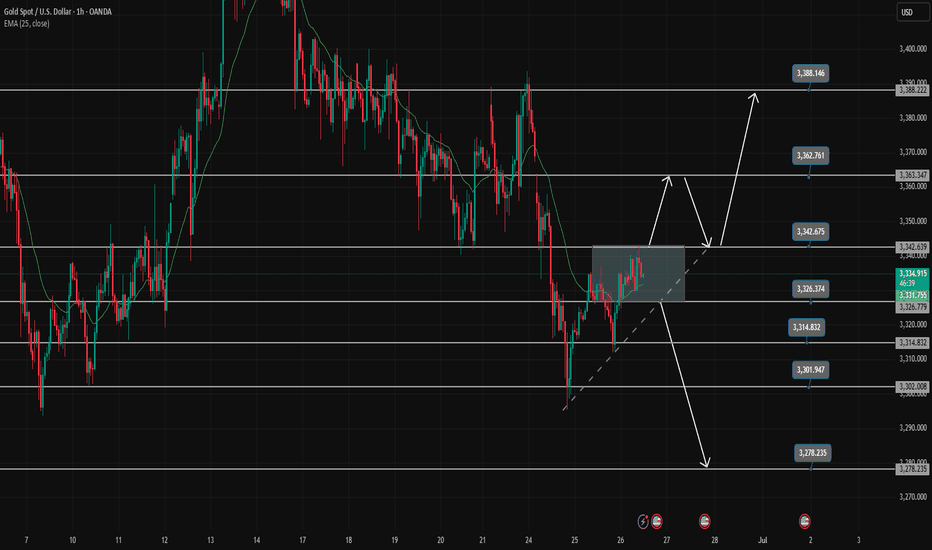

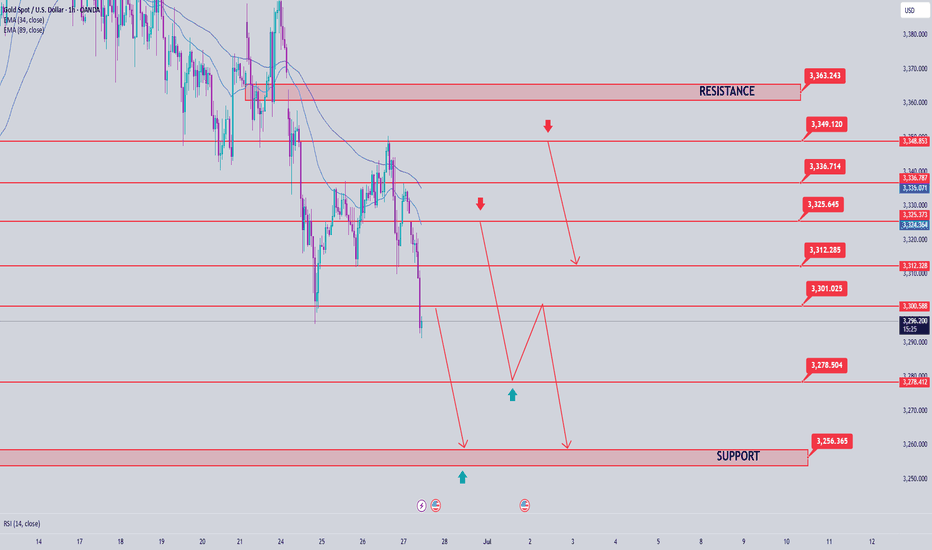

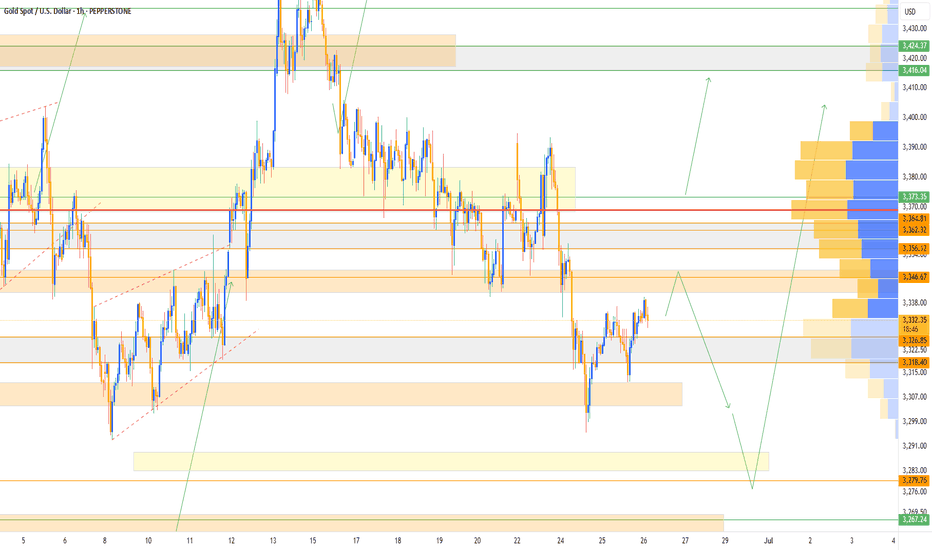

Gold Price Analysis June 27Daily Trend Analysis:

The price has reacted strongly at the 3348 level, forming a clear and sustainable bearish structure. The 3296 zone is now a critical level — a confirmed breakout below this area could lead to a deeper decline, especially with limited potential for recovery on Friday.

Today, the bearish trend is likely to face less resistance compared to the bullish side. As such, a move toward the support zones at 3278 and 3255 is highly probable.

Any bullish retracement during the European session should be viewed as a good opportunity to look for SELL setups, targeting 3278 and 3255.

As previously analyzed, SELL zones are clustered around key resistance levels. Traders should closely watch price reactions in these areas for potential entry signals.

🔹 Breakout key level: 3296

🔹 Support zones: 3278 – 3255

🔹 Resistance zones: 3300 – 3312 – 3325 – 3336 – 3348 – 3363

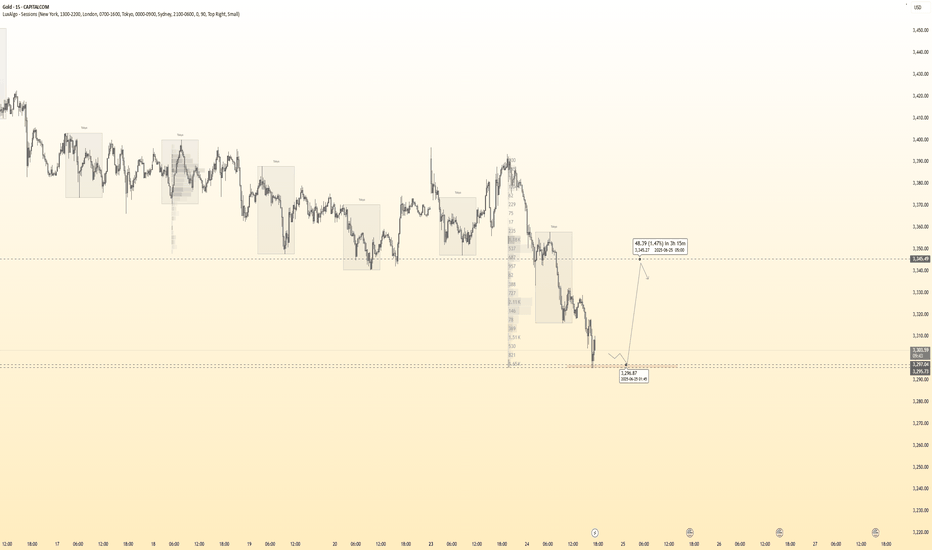

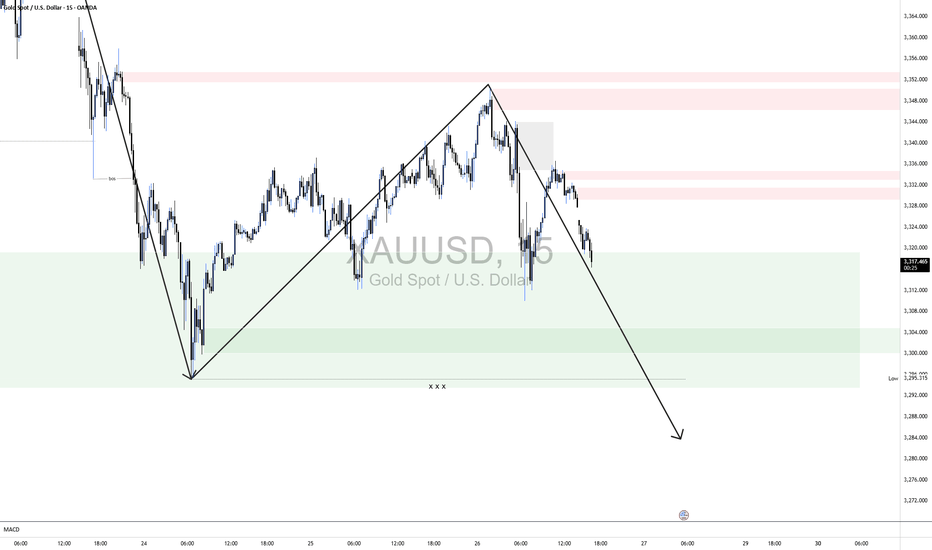

XAUUSD 📉 XAUUSD Technical Overview (15-min TF)

Recommendation: Bearish.

The pair is showing clear downside momentum, with price having broken below recent intraday highs and forming a series of lower highs and lower lows on the 15‑minute chart.

Target:

We are targeting the prior intraday low around 3295, which represents a logical short-term support area and likely liquidity target before price could consolidate or correct.

XAUUSD Update 21th June 2025After 1 week pull back, the price still find it support.

On the last Friday, it seems like bounce at 3339 support.

We need more further movement, and we'll see if 3339 hold as support, next target is 3440 level.

But if gold need more further correction, than 3320 is next support to retest.

Have a Good Luck !

#xauusd #Goldanalysist

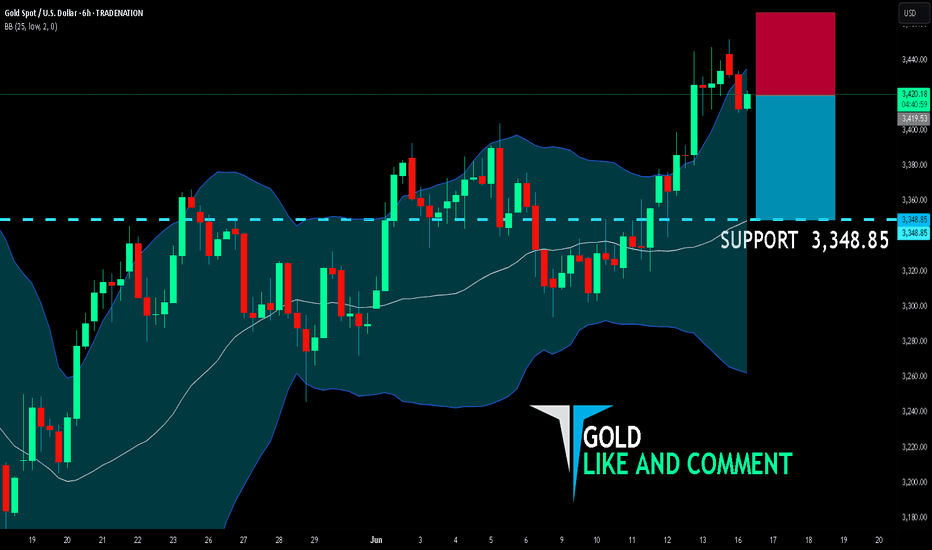

GOLD BEARS WILL DOMINATE THE MARKET|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,419.53

Target Level: 3,348.85

Stop Loss: 3,466.65

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD/GOLD/SellThe pressure from the bears is too great. In the end, the pressure from above was not broken. Instead, it broke out and fell after being under pressure. The stop loss was hit.

The current price is 3285. After gradually boosting the US dollar index. The trend of gold prices has continued to fall. More importantly, the tariff issue has been eased. At the same time, geopolitical factors are also orderly and stable. This is the news that caused the bears to attack.

History has not become the savior because of repeating itself. Of course, this is also an emergency. In some transactions, the extremely low probability of causing losses is a common problem in transactions. However, our analysis team has stabilized a high trading win rate.

Then the next trading plan is still to focus on the pressure from above. If the London market rebounds above 3300. It is still mainly selling. 3314 is an important level for short-term rebound, and we need to pay attention. Although there is no obvious sign of rebound yet, the release of short-selling pressure has been alleviated because the decline is slow. Today's main trading idea is still to sell at high levels.

The target is to focus on the position of 3264-3248. Remember the risk of buying at low levels. Do not trade independently.

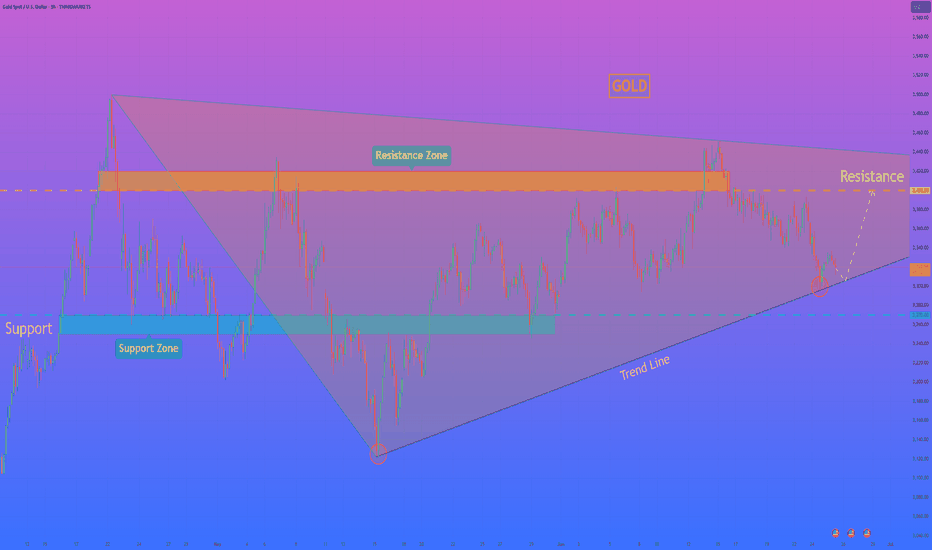

HelenP. I Gold will rebound up from trend line to $3400 levelHi folks today I'm prepared for you Gold analytics. After looking at this chart, we can see how the price after a prolonged consolidation inside a large wedge pattern, XAUUSD, approached the ascending trend line again - this line has acted as a key support several times in the past. This time is no exception: the price reacted to it with a bullish bounce. We can see a confluence here — trend line support coincides with the lower boundary of the wedge and the local support zone at 3270 - 3250 points. Now the price is trading above this line, showing early signs of recovery. Given the symmetry of this structure and past behavior, I expect gold to continue rising from current levels. The nearest major obstacle lies in the resistance zone around 3400 - 3420, which acted as a turning point before. That’s why my current goal is set at the 3400 level. If bulls hold the trend line, we may see a steady move toward this key resistance. Given the trend line reaction, wedge structure, and current momentum, I remain bullish and expect further growth. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

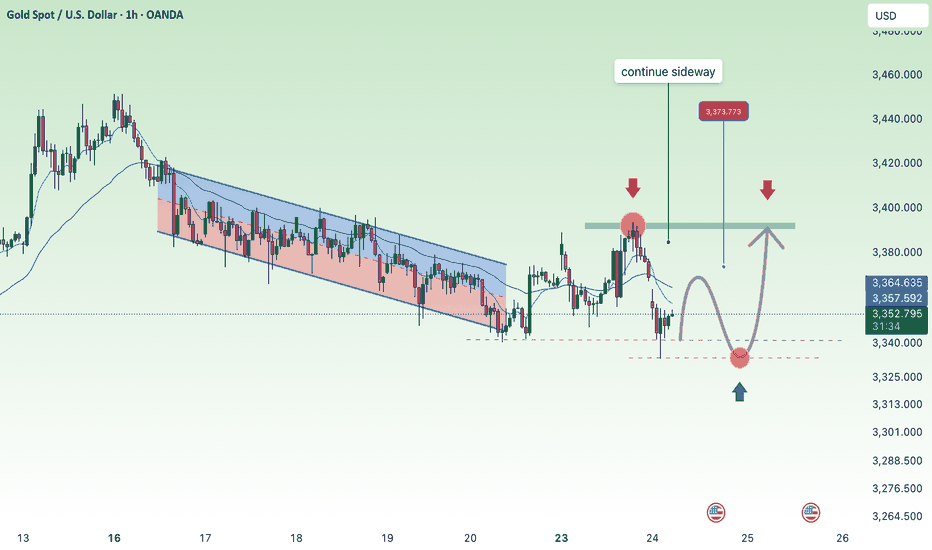

GOLD continue sideway , SELL 3393⭐️GOLDEN INFORMATION:

Gold prices remain well-supported during the North American session following breaking news that Iran has launched retaliatory strikes on US military bases in Qatar. The escalation comes in response to Washington’s weekend assault on Iranian nuclear facilities. As geopolitical tensions in the Middle East dominate headlines, investors have largely sidelined US economic data. At the time of writing, XAU/USD is trading at $3,385, up 0.39%.

Macroeconomic indicators have taken a backseat as heightened conflict drives market sentiment. Citing Israeli media, Al Arabiya reported that Iran targeted US bases in Qatar, Kuwait, and Iraq with missile strikes. In a further escalation, Tehran approved the closure of the strategic Strait of Hormuz and launched additional missiles at Israeli targets—amplifying safe-haven demand for gold.

⭐️Personal comments NOVA:

Gold prices reacted to a decrease in positive news about peace in the Middle East, continuing to accumulate.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3392- 3394 SL 3399

TP1: $3382

TP2: $3370

TP3: $3360

🔥BUY GOLD zone: $3319-$3317 SL $3312

TP1: $3327

TP2: $3338

TP3: $3349

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

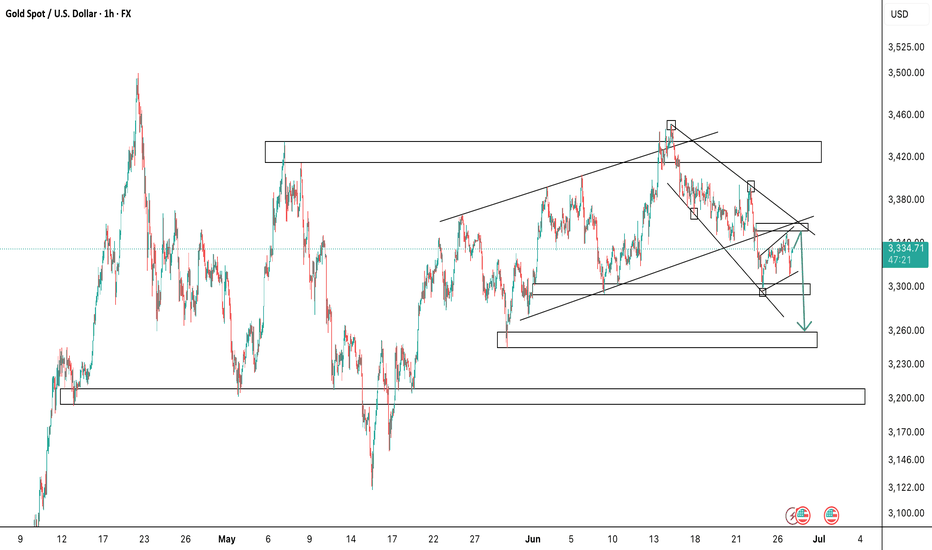

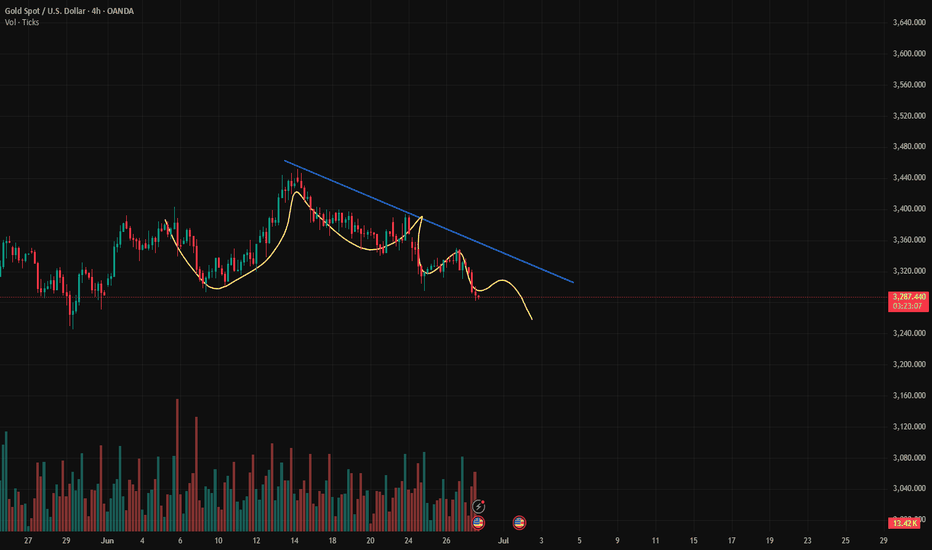

Gold Distribution I missed the perfect entry for this distribution model, but since the technical target hasn't been reached yet, I'll look for valid entries if they arise. The time displacement is good, it swept internal liquidity and left more to the downside. It looks more like a trend than a range deviation, so I'll be cautious with this trade if I take it.