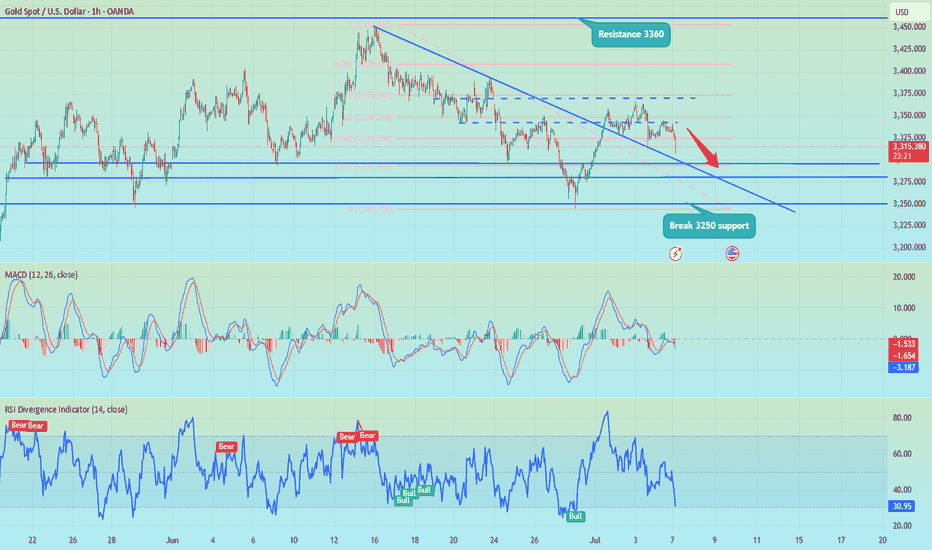

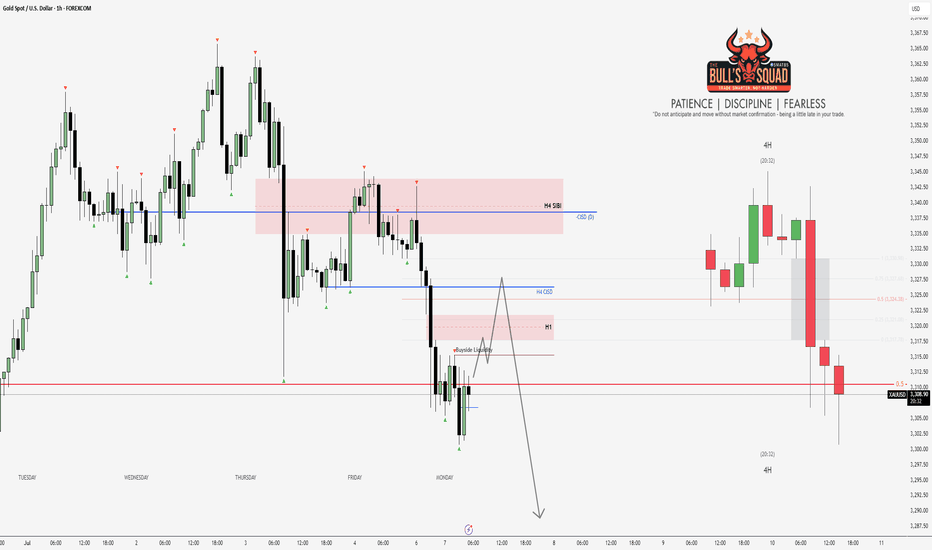

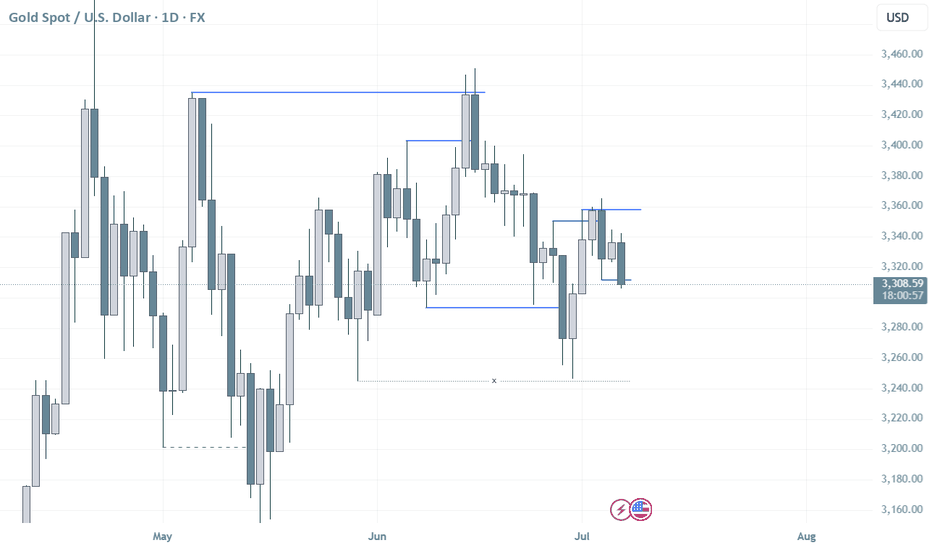

Gold Analysis and Trading Strategy | July 7✅Gold opened weakly during the Asian session today, with prices dropping nearly $40 in early trading—likely due to technical selling pressure from above. The rebound once again failed to break the key 3345 resistance level, which serves as the neckline of the previous “M-top” pattern formed at the 3365 high. This level has become a clear resistance zone. If gold continues to struggle below this line, the short-term trend remains biased toward consolidation with a bearish tone.

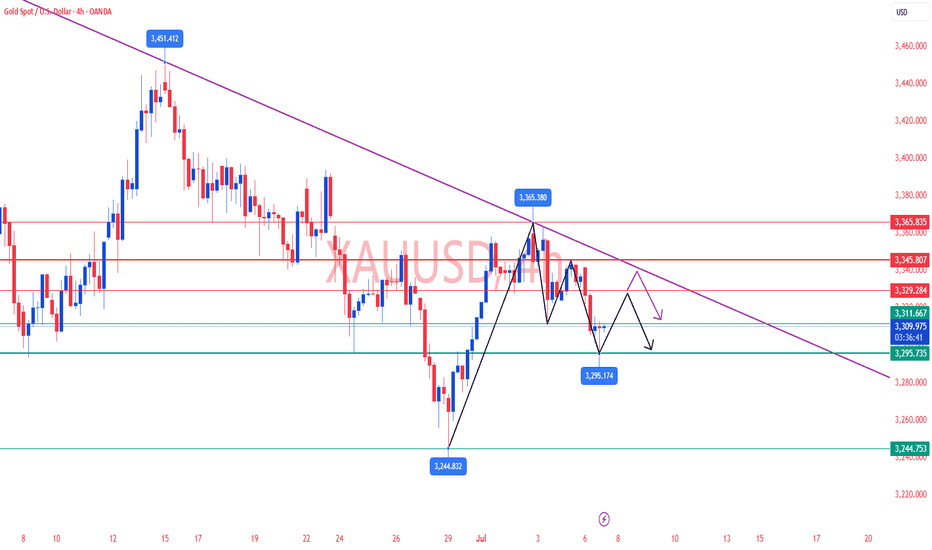

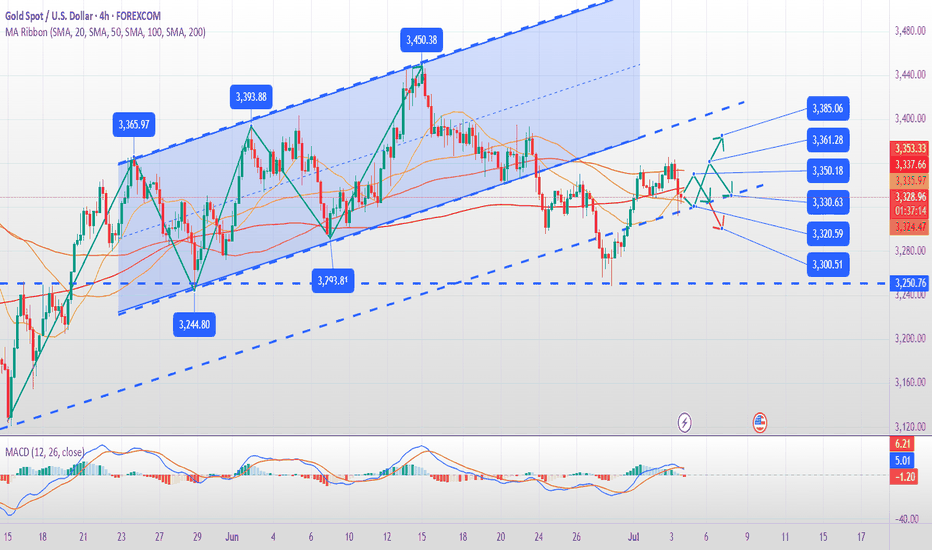

✅ 4-Hour Chart Structure:

Since retreating from the 3365 high, multiple rebound attempts have been capped around the 3345 area. Last Friday, a second rally failed at the mid-Bollinger Band and closed lower, forming a local double-top pattern. This morning’s rebound to 3342 was again rejected, confirming continued downward pressure in this area.

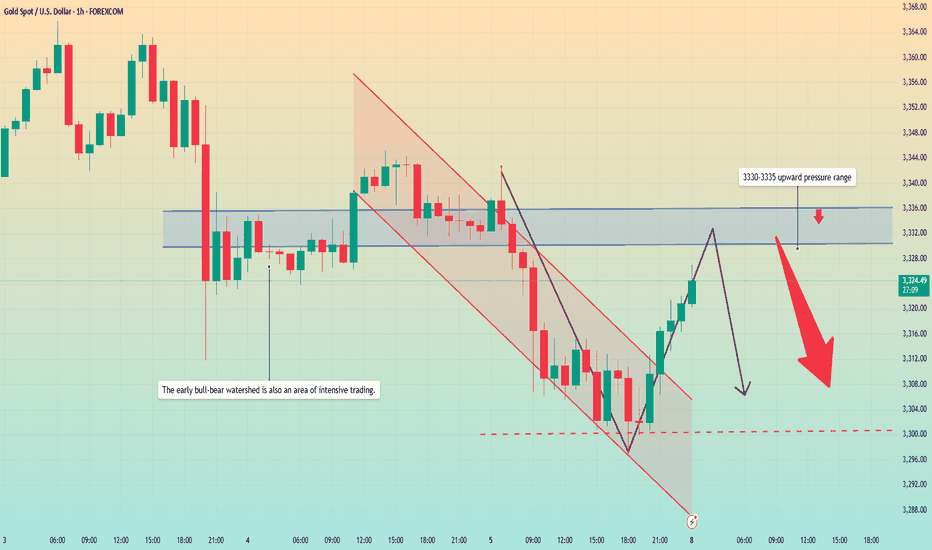

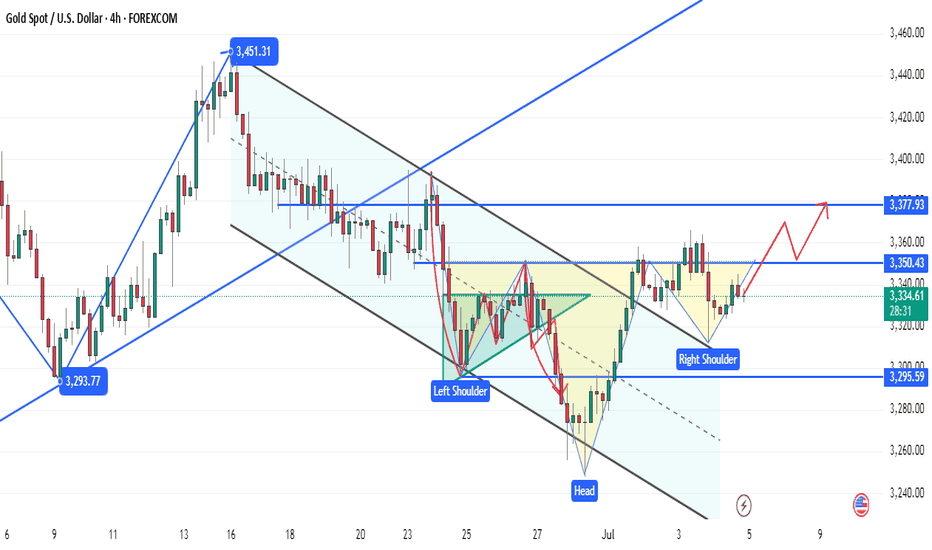

✅ 1-Hour Chart Structure:

After the release of last week's non-farm payrolls data, gold formed a short-term double top. After breaking the neckline, the rebound lacked momentum, reaffirming that sellers dominate near resistance. In the short term, bearish pressure remains in control.

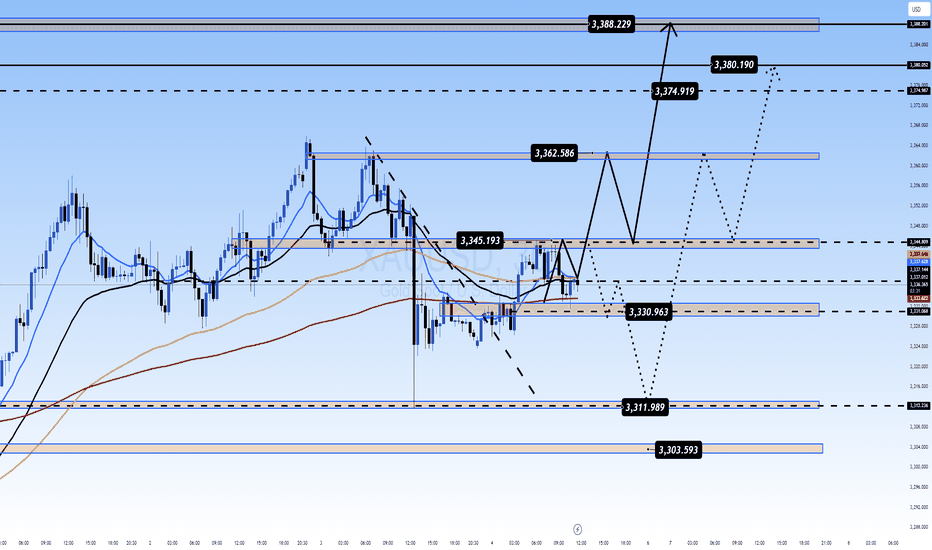

✅ Key Technical Levels:

🔴Short-term Resistance: 3325–3330

🔴Major Resistance Zone: 3345 (M-top neckline)

🔴Strong Resistance: 3365 (M-top peak)

🟢Short-term Support: 3305

🟢Critical Support: 3295

🟢A break below 3295 could open further downside toward 3275 or even 3246

✅Intraday Trading Strategy:

🔻 Short Position Strategy:

Consider layering into short positions around the 3325–3330 area. Stop-loss: 8–10 $

Targets: 3310–3300; if 3300 breaks, watch for a move toward 3295

🔺 Long Position Strategy:

If price pulls back and stabilizes around 3295–3298, consider layering into long positions. Stop-loss: 8–10 $

Targets: 3305–3315; if 3315 breaks, look for a move toward 3325

✅Strategy Summary & Outlook:

Gold remains in a broad high-level consolidation phase, with frequent short-term shifts between bullish and bearish sentiment. We recommend a range-trading approach—selling on rallies and buying on dips—while closely monitoring whether the 3345–3350 resistance zone is breached. This key area will likely determine the directional breakout this week.

✅Maintain disciplined risk management, avoid chasing moves, and stay alert to intraday momentum shifts.

XAUUSD trade ideas

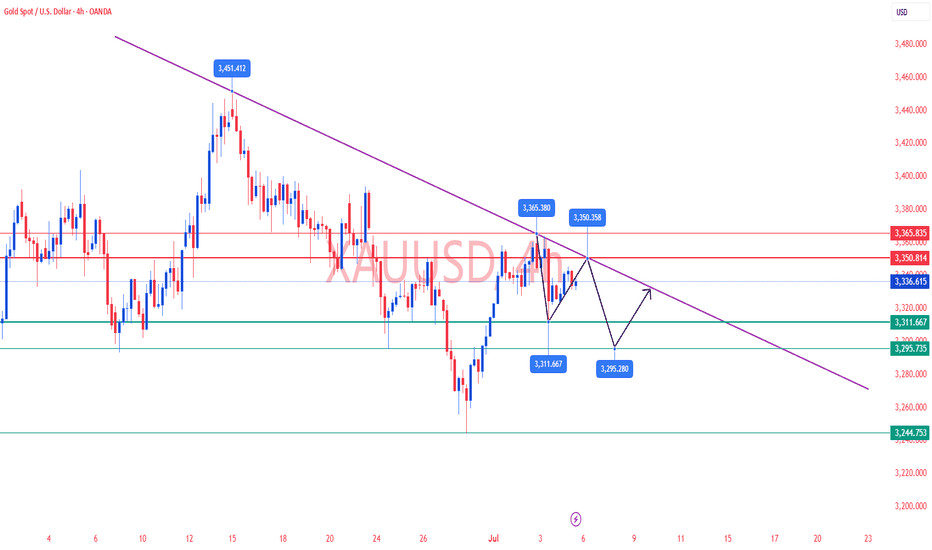

Gold rebounded from the bottom. Is the decline over?Gold prices faced selling pressure in today's Asian market. The price fell from 3343 to around 3320 in the early Asian session. The European price continued to fall, reaching a low of around 3296, and then rebounded upward. The current price is fluctuating around 3320.

Most investors will focus on the minutes of the Federal Open Market Committee (FOMC) meeting to be released on Wednesday to get guidance on the trend.

From the hourly chart, the upper pressure position is constantly being corrected. The current average pressure value is around 3330-3335. At the same time, this position is also the watershed between long and short positions in the previous dense area. The price may rebound to this position again. The lower support level is in the range of 3300-3290.

Quaid believes that the current market is still showing a downward trend, and the price may fall back below 3300 again.

Operation strategy:

Short around 3330, stop loss 3340, profit range 3310-3300, sustainable ownership after breakthrough.

Gold short-term shock operation ideas

💡Message Strategy

Current Price and Context

Gold is trading around $3,310 and continues to retreat as traders remain cautious amid heightened macroeconomic uncertainty. While some safe-haven demand remains, a stronger dollar and weakening confidence among safe-haven buyers put gold under selling pressure. Concerns about global trade policy and tightening monetary policy continue to weigh on gold's short-term outlook.

Key Drivers

Geopolitical Risks: Trade tensions and global uncertainty have again sparked cautious sentiment, which has provided limited support for gold, but the absence of major conflicts has left it lacking direction.

U.S. Economic Data: Strong labor market data and upcoming inflation data supported the dollar, curbing gold's upward momentum.

FOMC Outcomes: The Fed remains cautious and does not signal an immediate rate cut; high yields reduce the appeal of non-interest-bearing assets such as gold.

Trade Policy: While tariffs have been a concern, flows between risk and safe-haven assets have been mixed as there has been no new escalation.

Monetary policy: Rising global bond yields and the Federal Reserve's wait-and-see attitude limit gold's gains in the short term.

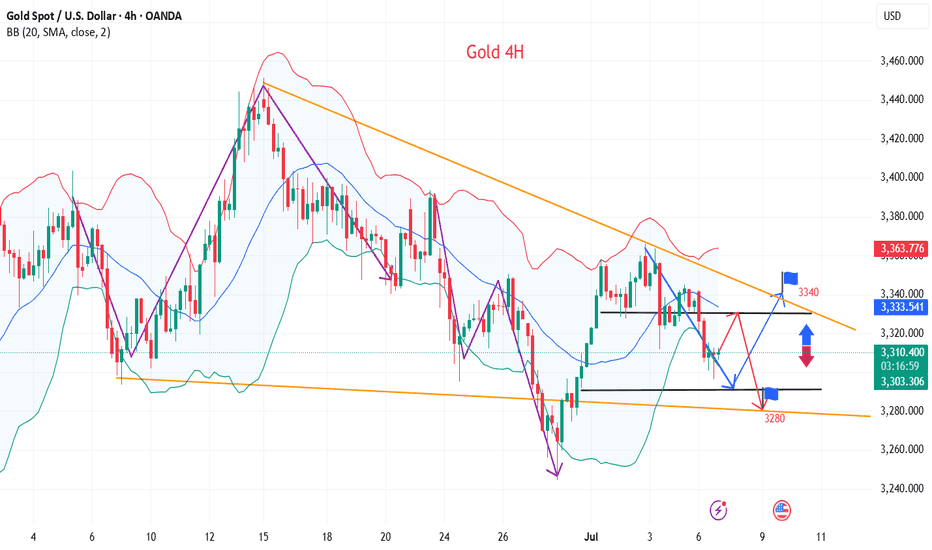

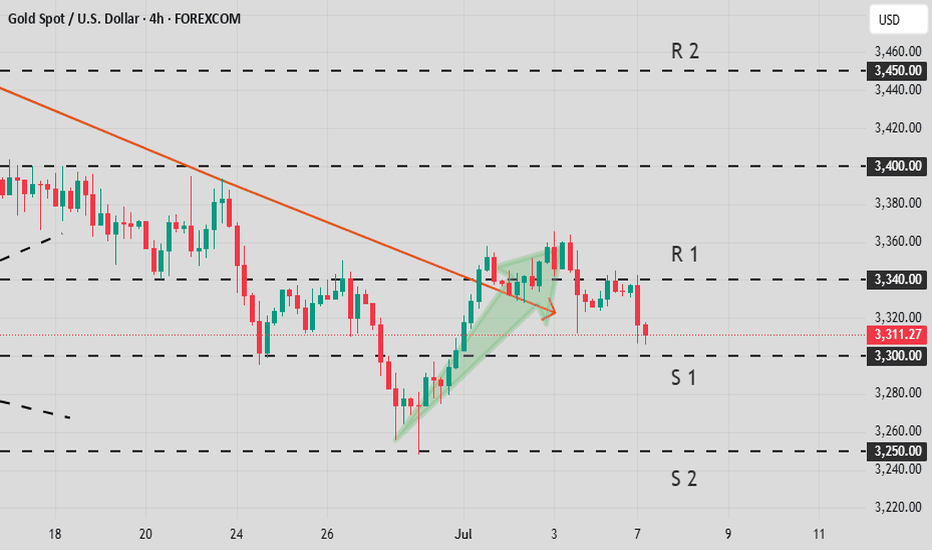

📊Technical aspects

From the 4-hour analysis, the support line of 3290-3300 is concerned below, the short-term resistance above is concerned about 3315, and the suppression line of 3345-50 is focused on. The overall main tone of high-altitude low-multiple cycle participation remains unchanged. In the middle position, watch more and do less, and follow orders cautiously, and maintain the main tone of participation in the trend. Wait patiently for key points to participate. Pay attention to the specific operation strategy in time.

💰Strategy Package

Long Position:3290-3300,SL:3275,Target: 3330-3340

Short Position:3320-3330,SL:3305,Target: 3280-3290

New tariffs are coming. How should gold respond?📰 News information:

1. 90-day tariffs are about to expire

2. New unilateral tariffs

3. Geopolitical situation

📈 Technical Analysis:

On July 4th local time, there were constant turmoil in American politics and trade. Trump declared that the US government would send letters to trading partners that day to set new unilateral tariff rates, which would most likely take effect on August 1. He also revealed that the new tariff rates could soar to 70%. At the same time, Japan-US trade negotiations encountered obstacles, India planned to impose retaliatory tariffs on the United States, and the China-EU tariff war had also begun. At present, the news seems to be more favorable to the bulls.

From a technical point of view, gold closed higher last week, showing that there is still upward momentum this week. In the short term, we need to pay attention to the pressure in the 3365 and 3375 - 3380 areas, and the 3400 mark is a key position where bulls and bears are fighting fiercely. Before breaking through this position, we must be alert to the risk of falling back after a high rise. Pay attention to the support of 3310-3305 and 3295-3285 below. If effective support is obtained, we can consider going long. If it breaks, it may go to 3270-3260. Gold jumped to 3342 at the opening of the Asian session and then fell back. 3345 is the key in the short term. The news may affect its subsequent trend. In the short term, pay attention to the suppression of 3345 on the upper side, and further to the strong resistance area of 3365-3380. If there is resistance and pressure, you can short at a high level. The impact of recent news is erratic, so enter the market with caution and be sure to set TP and SL strictly.

🎯 Trading Points:

SELL 3330-3345

TP 3320-3310-3295

BUY 3310-3305

TP 3320-3330-3345

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD

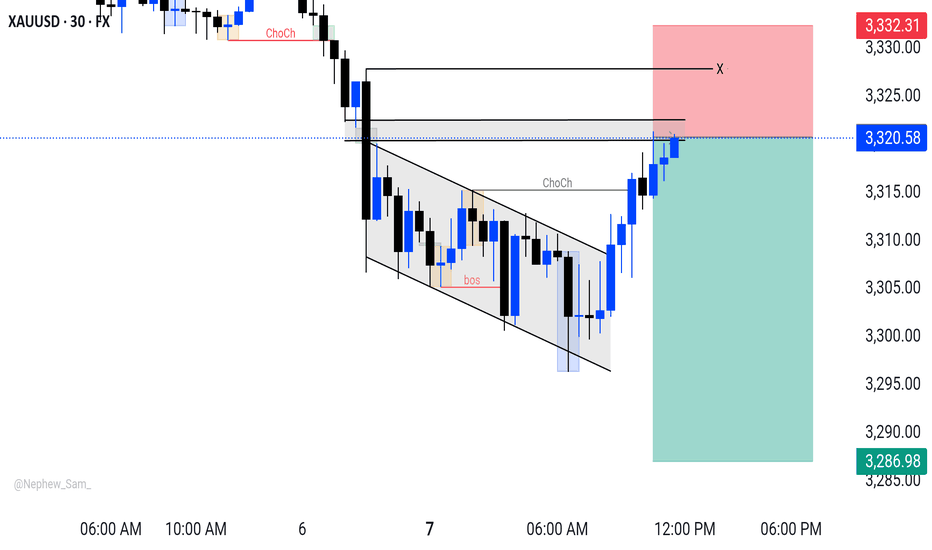

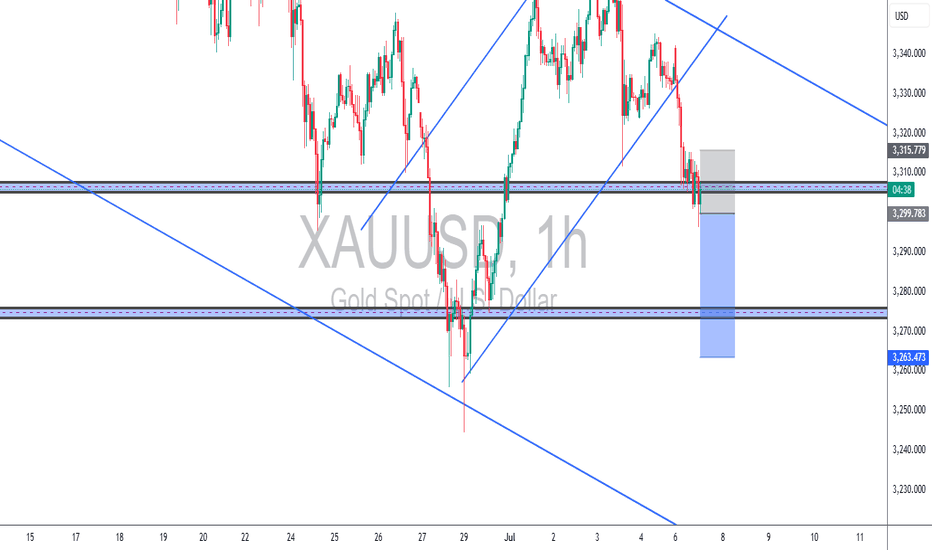

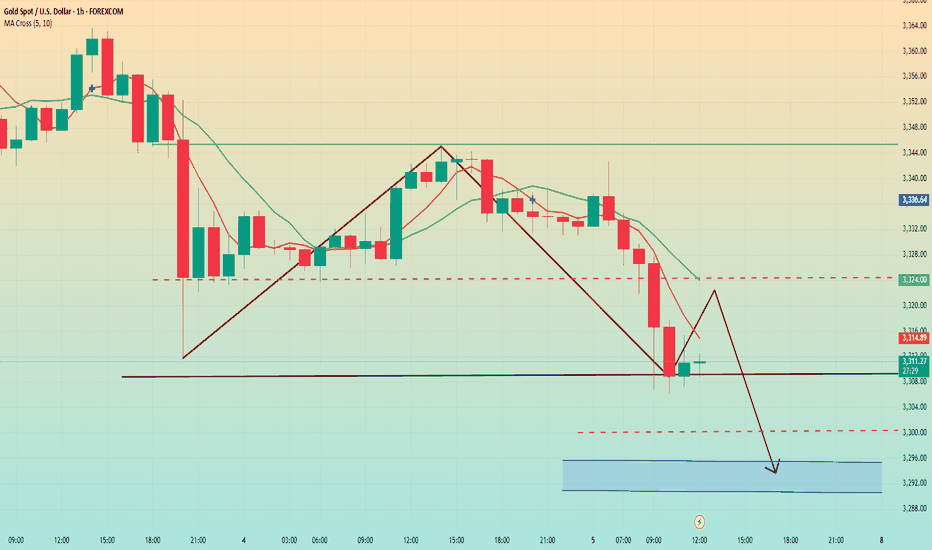

XAUUSD – Bearish Breakout Retest (TCB Strategy)🔍 Technical Overview:

Trend: Price has clearly broken below the rising channel.

Retest Zone: The grey box shows a bearish retest zone at 3,315–3,310, which price tapped before rejecting.

Current Support: Price is reacting at the 3,300 horizontal level (former demand zone).

Target Area: The blue box points to a possible TP zone around 3,263, aligned with previous structure support.

🔻 XAUUSD – Bearish Breakout Retest (TCB Strategy)

📅 Date: July 7, 2025

🕐 Timeframe: 1H

✅ Checklist Score: 95%

🔍 TCB Setup Breakdown:

Price broke below a rising channel and pulled back into a clean supply zone (3,310–3,315). NY session provided a strong rejection, aligning with structure shift and confirming short bias.

🎯 Entry: 3,310.00

🛑 Stop Loss: 3,316.50

🎯 Target: 3,263.47

📈 R-Multiple: Targeting ~+2.5R

🧠 Strategy: Trend → Countertrend → Breakout

📛 #TCBFlow #XAUUSD #GoldAnalysis #SmartMoneyConcepts #BreakoutRetest #TradingViewIdeas #GoldTrading #PriceAction #MarketStructure #NYSession #ForexStrategy #RiskReward #TrendlineBreak #SupplyDemand

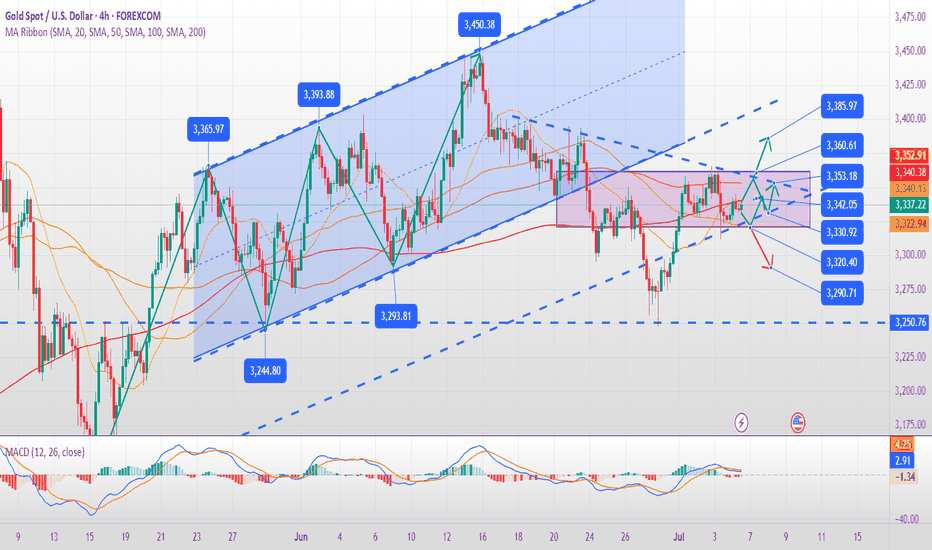

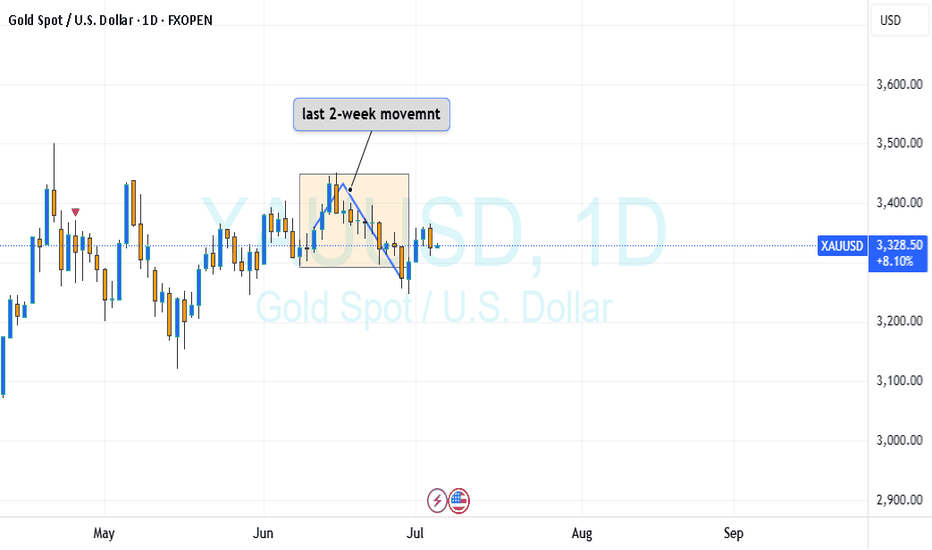

Analysis of the latest gold trend next week:

Analysis of gold news: Friday (July 4) coincided with the US Independence Day holiday, and gold prices were in a narrow range of fluctuations. Strong employment data not only pushed up the US dollar and US bond yields, but also significantly weakened the market's expectations of the Federal Reserve's early rate cuts, which greatly reduced the attractiveness of gold. At the same time, the US Congress passed the Trump administration's massive tax cut and spending bill, further injecting complex variables into the economy. There will be no key data to watch today. Due to the US Independence Day, all markets will close early, which will limit the fluctuation range of gold prices.

Key technical signals:

Daily level:

Range fluctuations: Gold prices repeatedly tested in the 3320-3360 range, the Bollinger band narrowed, and the MACD kinetic energy column shrank, indicating that the market was in a wait-and-see mood.

Key support/resistance:

Support: 3320 (5-day moving average), 3300 (psychological barrier + Bollinger lower track).

Resistance: 3350-3360 (non-agricultural starting point + daily middle track).

4-hour level:

Short-term bottoming signs: After the non-agricultural data, the gold price fell to 3322 and then rebounded, forming a double bottom prototype, but it needs to break through 3350 to confirm the reversal.

RSI is neutral (around 50) and may maintain a narrow range of fluctuations in the short term.

2. Next week's market deduction

1. Baseline scenario (oscillation and consolidation, 60% probability)

Trend: The gold price fluctuates in the 3320-3360 range, waiting for CPI data to guide the direction.

Operation strategy:

Short-term high-sell and low-buy:

Long order: Long at around 3320-3325, stop loss 3305, target 3350.

Short order: Short at 3350-3360 under pressure, stop loss 3370, target 3320.

2. Bullish breakthrough scenario (30% probability, CPI data required)

Trigger conditions: CPI is lower than expected (such as below 3.2%), the market re-bets on interest rate cuts, and the US dollar weakens.

Trend: After breaking through 3360, it may test 3380 (200-day moving average) or even 3400.

Operation strategy:

Break through and chase long: Follow up after stabilizing 3360, target 3380-3400.

3. Bearish breakout scenario (10% probability, need continued strength of the US dollar)

Trigger conditions: CPI is stronger than expected (such as more than 3.5%), and the Fed's hawkish remarks suppress expectations of rate cuts.

Trend: After breaking below 3300, it may test 3260 (June low).

Operation strategy:

Break through and follow short: After breaking below 3300, chase short, target 3260.

III. Trading strategy and risk management

Short-term trading (suitable for intraday positions)

Shock strategy: Buy high and sell low in the range of 3320-3360, with strict stop loss (10$-15$).

Breakout strategy: Wait for CPI data and follow the trend. If it breaks through 3360, chase longs or if it falls below 3300, follow shorts.

Mid-term layout (pay attention to the trend after CPI)

If CPI is positive: set up long orders at 3330-3340, with a target of 3400.

If CPI is negative: set up short orders at 3350-3360, with a target of 3260.

Risk warning

Liquidity risk: Speech by Fed officials (such as Powell) may trigger short-term sharp fluctuations.

Geopolitical risk: Sudden conflicts or banking crises may trigger safe-haven buying, breaking the technical logic.

4. Summary and key points

Core range: 3320-3360 (maintain the idea of oscillation before breaking through).

Long-short watershed:

Breaking through 3360 → opening up space to 3400.

Breaking through 3300 → opening a downward trend to 3260.

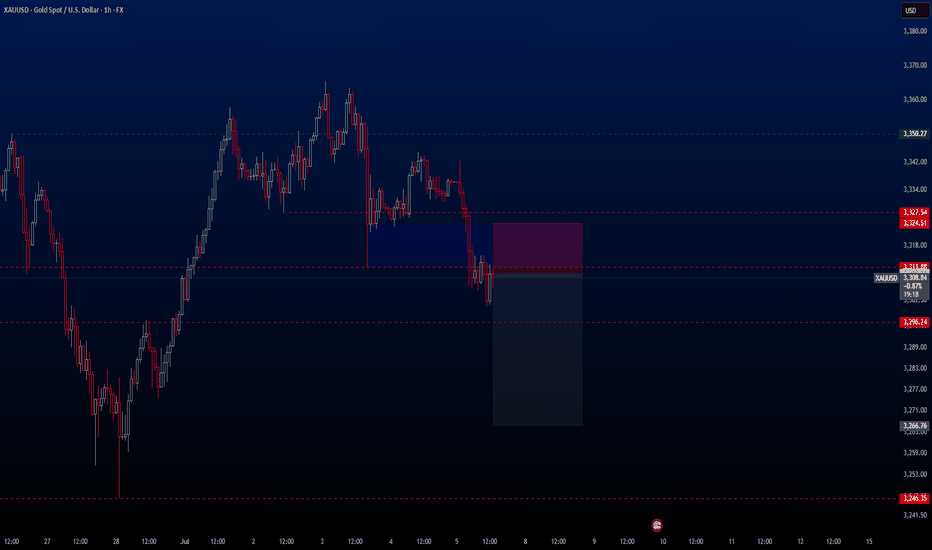

XAUUSDHello traders,

The Gold trade I shared last week has just hit TP. Based on current market conditions, I believe gold may continue its downward movement for a while. Therefore, I’m still holding a bearish bias and have just activated a new sell trade, which I’d like to share with you as well.

🔍 Trade Details

✔️ Timeframe: 1-Hour (H1)

✔️ Risk-to-Reward Ratio: 1:3

✔️ Trade Direction: Sell

✔️ Entry Price: 3310.11

✔️ Take Profit: 3266.76

✔️ Stop Loss: 3324.51

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Gold Trading Strategy for next Monday✅From the current short-term structure, gold is exhibiting a typical bearish continuation pattern, indicating that the primary trend remains downward. If gold fails to effectively break above the key resistance level at 3350 next week, it suggests that the prevailing downtrend is likely to continue. The probability of a short-term rebound being capped in this area is relatively high.

✅On the downside, attention should first be given to the 3310 level, which serves as a critical short-term support. A break below this level could open the door for a further decline toward the 3280–3250 zone, where traders should watch for potential bottoming signals or signs of strong support.

✅From the 1-hour chart perspective, short-term moving averages are beginning to turn lower, indicating weakening bullish momentum. Technically, a double top formation has developed, and the price has broken below the neckline, showing a lack of rebound strength. Despite a minor rebound to around 3345 yesterday, the price once again faced resistance and moved lower, reflecting a weak consolidation phase.

✅As such, the 3345–3350 area will be a critical short-term resistance next week. If the market opens higher due to bullish news over the weekend and breaks above this region, gold could regain upward momentum. Conversely, if the price remains suppressed under 3345–3350 and only shows weak rebounds, short-selling opportunities may arise near this zone.

✅Short-Term Trading Strategy:

Main strategy: Sell on rallies, buy on dips

🔴 Resistance level: 3345–3350

🟢Support level: 3310–3315

🔰If 3310 is broken, the next support area is 3280–3250.

✅Overall, unless gold breaks above key resistance, the outlook remains moderately bearish with a consolidation bias. Traders are advised to remain flexible and adjust their strategies in response to market news and developments.

✅If your recent trading results haven’t been ideal, feel free to reach out. I’d be happy to help you avoid common pitfalls and improve your performance. I will provide real-time strategy updates during market hours based on price action — stay tuned.

XAU/USD: Today's Strategy AnalysisVerification of Support Level Effectiveness

- $3306: As the 0.5 retracement level of the 3247-3365 band Fibonacci, it rebounded slightly after being first touched today. It is necessary to monitor whether a bullish candlestick stabilization signal forms at this level. If broken, the next target is $3290.

- $3290: Overlapping with the lower Bollinger Band support of the 4-hour chart, if a pullback signal with shrinking trading volume appears here, it can be regarded as a short-term long opportunity.

Suppression Effect of Resistance Level

- $3320-$3325: The suppression zone of the 5-day moving average at the 1-hour level, which is also near the early session rebound high. If the price is resisted and closes bearish when rebounding to this range, it confirms a short entry opportunity.

-

Operation Tips

Strictly set stop-loss orders to avoid capital drawdown caused by false breakouts of support/resistance levels.

XAUUSD

buy@3285-3295

tp:3310-3320

sell@3315-3325

tp:3305-3295

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

The bill was introduced; the price did not rise but fell.Due to the implementation of the US bill, most traders in the market are bullish on gold and believe that gold will soar on Monday. As a result, it jumped up and fell sharply this morning. This is the uncertainty of the market. Although the short position given near 3340 last Friday was late, it fell to the low point of 3306 at the opening of the Asian market today.

In addition, the key to this sharp drop is the high point before the rebound, that is, the starting point or the position of the top and bottom conversion. Once it is broken, you have to change your mindset. The volatile market is like this, just get used to it. The turmoil caused by Trump's bill will not appear for a while. It takes a process and cannot be unilaterally considered as bullish or bearish.

In the early Asian market, the price fell all the way from 3342 US dollars to 3306. How to judge the end of the decline? It is to stare at the high point of the rebound before the last decline of 3320 US dollars. The loss of 3300 US dollars in the early trading indicates that the gap-up opening is a lure for more.

Today, I think that 3325 above 3320 can be used as the dividing point between long and short positions. You can short with a light position near 3315, and pay attention to the 3295-3290 line below. After the upward breakthrough is confirmed, consider adjusting the position and making other arrangements. For the time being, we will look at the weak adjustment during the day.

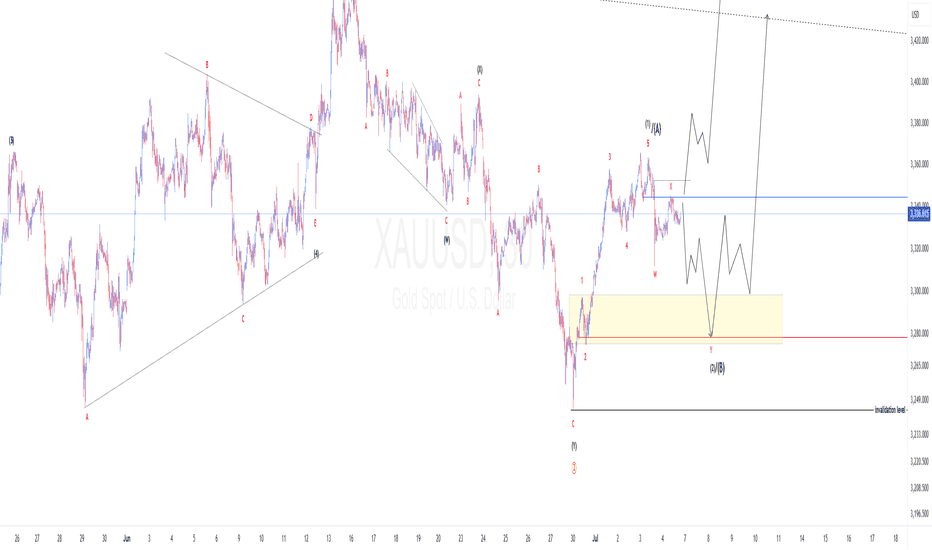

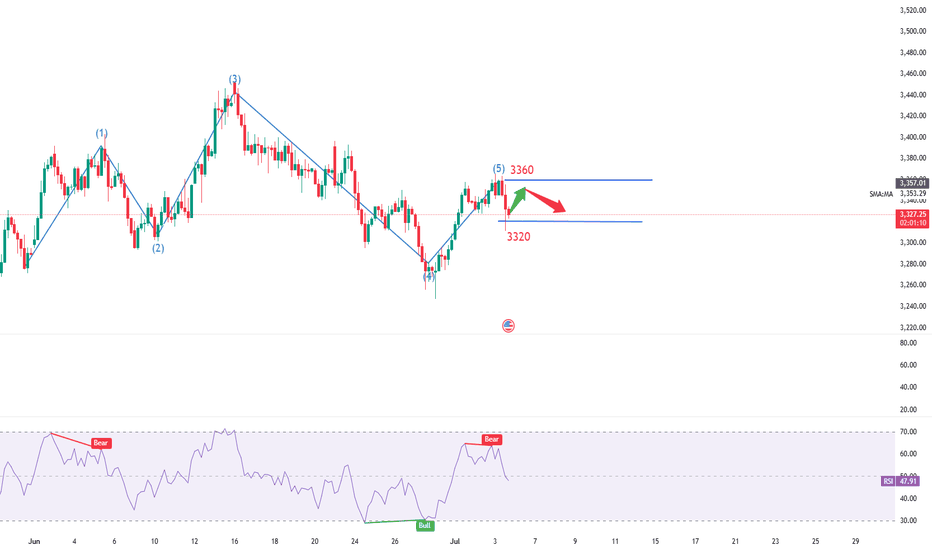

XAUUSD Elliotwaves update: Is wave 4 complete?The view we had in past three weeks was a possibility of complex 4th wave and our short term bias was bearish. But price reacted and closed above 61.8 Fibonacci retracement level and therefore changed our bias to bullish(Technically 4th wave is complete). Another confluence was a clear 5 waves after the reaction on the 61.8 fib. Now two possibilities, either wave 2 is complete and we should expect price to continue up from current price level or a possibility of double 3 to push price down to atleast 61.8 Fib before continuation to the upside. To take advantage of this anticipated move a trader should either wait for price to drop to the golden zone or wait for price to breach the immediate high and retest.

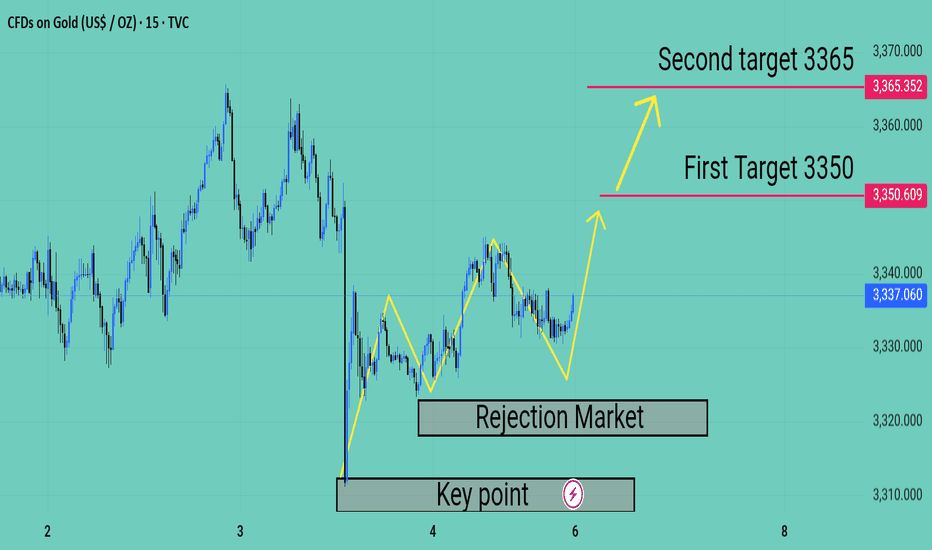

Xauusd Expecting bullish Movement Market I have identified a potential bullish setup based on key rejection zones and target levels

First Rejection Area 3325

Second Rejection Area 3310

First Target 3350

Second Target 3365

Price has shown strong support around the 3310–3325 zone, indicating possible buyer interest. If the market holds above this support range, we could see a move toward the 3350 and 3365 resistance levels

Analysis and strategy of the latest gold trend on July 4:

1. Non-farm data exceeded expectations, gold fell under pressure

The US non-farm payrolls data in June was strong, with 147,000 new jobs (expected 110,000) and the unemployment rate dropped to 4.1% (expected 4.3%), showing that the labor market is still resilient. This data reduced the market's expectations for the Fed to cut interest rates in the short term, leading to a strengthening of the US dollar index and US Treasury yields, and gold was under downward pressure.

Although the wage growth rate (annual rate of 3.7%) was slightly lower than expected, the overall employment data still supported the Fed's wait-and-see attitude, and gold may continue to be suppressed in the short term.

2. Technical analysis: shock adjustment, pay attention to key support and resistance

Daily level:

Gold previously stood on the middle track for three consecutive days, showing that the short-term bullish momentum was strong, but on Thursday, it closed negatively due to the negative impact of non-farm payrolls, forming a K-line with a long lower shadow, indicating that the market still has buying support.

If the 5-day moving average (near 3320) can be maintained today, it may rebound again; if it falls below the support of 3310-3300, it may further pullback.

4-hour level:

Gold is currently oscillating in the 3327-3360 range, 3345-3355 is short-term resistance, and 3310-3300 is key support.

MACD momentum weakened, RSI fell back to the neutral area, if it falls below 3310, it may test the support of 3275-3280.

3. Today's trading strategy

Short-term operation (intraday):

Long at low first, short at high later:

Long near the support level of 3320, target 3340-3350, stop loss below 3310.

Short at the resistance level of 3345-3355, target 3320-3310, stop loss above 3360.

If it falls below 3310, it may further drop to 3300-3280. You can consider shorting the trend.

Mid-term trend:

If the gold price stands above 3360, it may challenge the resistance of 3370-3400.

If it falls below 3300, it may enter a deeper adjustment, with a target of 3275-3250.

4. Market focus

Fed policy expectations: If subsequent economic data (such as CPI, retail sales) continue to be strong, gold may be further under pressure.

Geopolitical risks: The situation in the Middle East and US-EU trade frictions may still provide safe-haven support.

US dollar trend: If the US dollar index continues to strengthen, the upside space of gold will be limited.

Conclusion: Gold will remain volatile and bearish in the short term, and range trading is recommended in terms of operation.

Gold Daily Review

Dear traders, the sell-off last night directly brought the bulls back to their original form. The closing price of 3325 made most of the gains accumulated hard this week spit back. To me, this wave of market is a typical "data killing". The June non-agricultural data came out halfway, and the employment data was so strong that even the old foxes on Wall Street were surprised. Now the market's bet on the September rate cut has dropped directly from 70% to less than 50%. How can gold, which is "interest rate sensitive", withstand such a critical blow?

From a technical perspective, the negative line of the daily line is indeed ugly, but I think the bulls should not die. Look at the 4-hour chart. The Bollinger Bands have begun to "tighten their belts", and the 3310-3365 box is clearly drawn. Today is Independence Day. The US market closed early. Those Wall Street wolves probably ran to the Hamptons for a pool party. We are likely to play a "lying flat" market in the Asian and European markets. I calculated with my fingers that the 40 USD range of 3310-3350 is enough for us to toss around. Remember - short orders at the upper edge of 3345 should be as fast, accurate and ruthless as "whack-a-mole", and long orders at the lower edge of 3325 should be as patient as a fisherman!

The news is now "ice and fire". On the one hand, Trump's "big and beautiful" tax cut bill has just passed the test successfully. After this shot of booster, the US dollar and US bond yields are soaring like stimulants; on the other hand, drones in the Middle East are causing trouble again, and the small flame of geopolitical risk has not been extinguished. If you ask me, gold is like a "schizophrenic patient" now, jumping back and forth between inflation narratives and risk aversion sentiment.

Specific strategy:

① Directly "operate from a height" near the rebound of 3345, set the stop loss at 3352, and the target position is the 3330-3320 range. Remember that this position is the "previous high neckline position" and the probability of breaking is not high.

② You can "lighten your position and fish" when it falls back to 3325. The defensive position of 3315 must be strictly guarded, and the target position is the pressure zone of 3335-3345

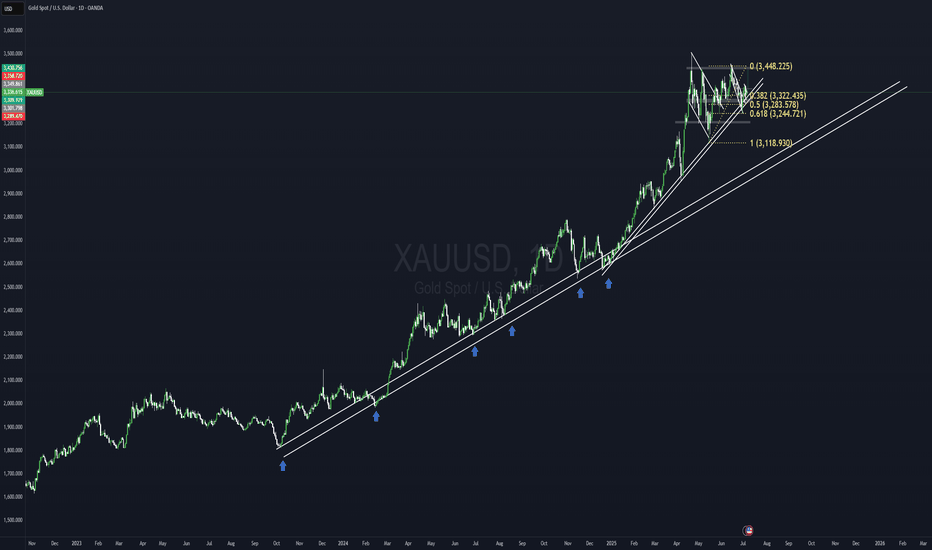

Gold Consolidating Ahead of Next Move Gold Consolidating Ahead of Next Move – Is 3390 the Bull Target or a False Breakout Trap?

🧭 Fundamental Outlook

Gold has entered a tight consolidation phase following a wave of high-impact macroeconomic events:

The US House of Representatives has passed Trump's “Super Bill”, raising expectations of increased fiscal spending and long-term inflationary pressures. In theory, this is supportive of gold prices.

However, strong NFP and Unemployment Rate figures released recently have reinforced dollar strength in the short term, suggesting the Fed may delay rate cuts → a temporary headwind for gold.

With Independence Day in the US, liquidity across global markets is expected to drop, increasing the risk of false moves or stop-hunt volatility.

🟡 The lack of immediate upside doesn’t mean bullish momentum has disappeared. Price may simply be building energy before its next leg.

📉 Technical Overview – XAU/USD

Gold has broken out of a minor descending trendline and is now testing a key supply zone around 3344–3345, which could determine the intraday trajectory.

🔍 Key Levels

Resistance Zones: 3345 – 3362 – 3374 – 3388 – 3390

Support Zones: 3330 – 3312 – 3304 – 3302 – 3298

🟢 Bullish Scenarios (Buy Setups)

📍 Intraday Buy Zone:

3313 – 3311

Stop Loss: 3307

Take Profit: 3316 – 3320 – 3325 – 3330 – 3335 – 3340 – 3345 – 3350

📍 Deep Pullback Buy Zone:

3304 – 3302

Stop Loss: 3298

Take Profit: 3308 – 3312 – 3316 – 3320 – 3330 – 3340

These zones are ideal for trend-continuation entries, especially if supported by bullish candles or price action on lower timeframes.

🔴 Bearish Scenarios (Short-Term Only)

📍 Intraday Sell Zone:

3362 – 3364

Stop Loss: 3368

Take Profit: 3358 – 3354 – 3350 – 3346 – 3340 – 3335 – 3330

📍 High-Risk Sell Zone:

3388 – 3390

Stop Loss: 3394

Take Profit: 3384 – 3380 – 3376 – 3370 – 3365 – 3360

Bearish positions should be reserved for signs of exhaustion or rejection patterns at resistance levels.

🧠 Trading Bias for Today

With limited liquidity due to the US holiday, price may remain trapped in a sideways range between 3320 and 3340. Traders should stay nimble and avoid overexposure.

✅ Primary bias: Buy dips near major support

⚠️ Alternative view: Only short if price confirms reversal at resistance

💬 What’s Your Take on Gold Today?

Will gold break through the 3390 barrier this week?

Or are we looking at one more dip before a true bullish continuation?

👇 Share your thoughts and trading ideas in the comments!

7.4 Non-farm payrolls exploded, and expectations for the Fed’s rOn Thursday, as the strong US employment data dispelled the market's expectations of the Fed's recent rate cut, the US dollar index rose sharply before the US market, returned to above the 97 mark, and once rose to an intraday high of 97.42.

Spot gold fell sharply, once falling to $3311 during the session, a drop of more than $50 from the intraday high, and then recovered some of its losses and remained near 3330 for consolidation.

The current upper suppression position of the daily line is almost here at 3350, and the lower support is located at 3320-25.

So if it is maintained in the range of consolidation, it is likely to be rectified at 3320-50.

Secondly, from the hourly chart:

It can be seen from the trend of 3247 to 3365.

The Fibonacci 618 position is exactly here at 3320.

Although the lowest point last night was pierced to around 3311, it can be seen that the entity still closed above 3320.

As long as 3320 cannot be broken, the best case scenario is to maintain it at 3320-50 for consolidation. If not, once 3350 is broken, the high point of 3365 will definitely not be able to be maintained.

Therefore, for today's operation, try to maintain the high-selling and low-buying range of 3320-50.

Gold?

Hi

Do you have a crystal ball? I do.. haha

You should rub/shine it frequently. Nahh.. just a joke.

I will call it : a prediction or bias.(That I hold , till proven wrong)

Look at weekly; formed 1 bar bullish , was taken/ broken low by 2 bearish bar.

So I'm bearish still.. although.. this week. it went into area of break price 3291.

The subtle point is.. where do i entry and how much price difference I will put in.

If 20$ gap.. price now $3330.00 +20$ = $3350

for 0.01 = 20$ risk

price 20$ seems reasonable if I'm at the right point/entry.

I'm too basic...

I'm too simple..

Not a guru

NB/ Yest NFP will be a strong bias too. What a sell off :)

Gold Latest Market Trend AnalysisThe data released by the U.S. Bureau of Labor Statistics showed that the U.S. seasonally adjusted non-farm payroll employment in June was 147,000, with the consensus forecast at 110,000. The previous value was revised up from 139,000 to 144,000. The annual rate of average hourly earnings in June stood at 3.7%, below the expected 3.90%, while the prior figure was revised down from 3.90% to 3.8%.

Following the release of the non-farm payroll report, interest rate futures traders abandoned their bets on a Federal Reserve rate cut in July. Currently, the market-implied probability of a Fed rate cut in September is approximately 80%, down from 98% prior to the report. On Thursday, gold exhibited a seesaw pattern, surging initially to hit resistance near $3,365 per ounce before retreating. During the U.S. session, it broke below support levels and further declined to hover around $3,311, where it staged a rebound. Gold remains in a high-range consolidation under selling pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@3350-3355

TP:3320-3325

Gold Ready to Explode Ahead of NFP and Trump’s “Super Bill”?Gold Ready to Explode Ahead of NFP and Trump’s “Super Bill”? | Global Macro Focus

🌍 MACRO UPDATE – What the World is Watching:

Gold continues its bullish trajectory as the USD weakens sharply following last night’s disappointing ADP jobs report (-33K vs expected +99K). This soft labour data has fueled further speculation that the Fed could begin rate cuts as early as September, with a 90% probability now being priced in.

In the political arena, Donald Trump’s recent statement that House Republicans are aligned to push forward a so-called “Super Bill” has triggered fresh uncertainty around US fiscal policy. This could elevate safe-haven demand for gold, especially if it leads to increased tensions over debt ceilings or government spending.

With the US Non-Farm Payrolls (NFP) due later today and the UK and US markets heading into a long weekend, traders should brace for heightened volatility and liquidity gaps.

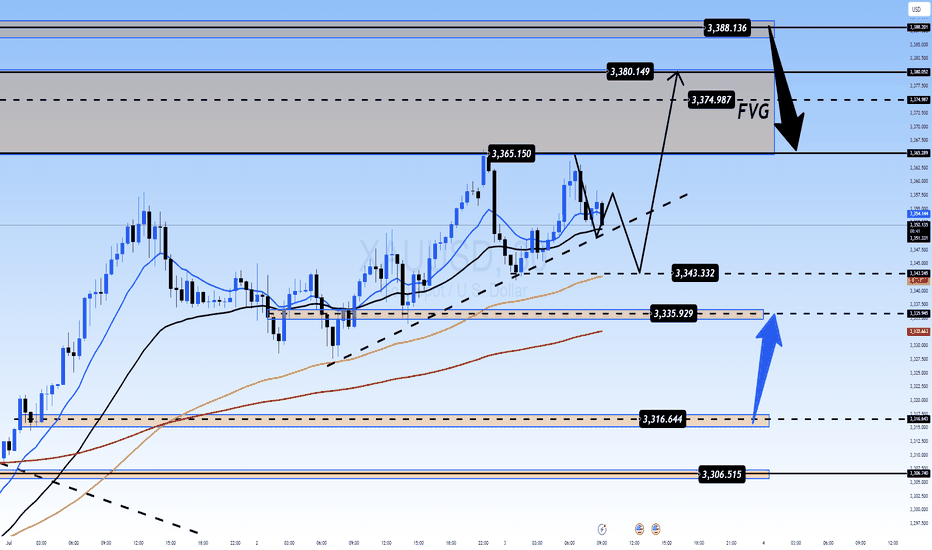

📈 TECHNICAL OUTLOOK – What the Charts Are Saying:

Overall Trend: Bullish structure remains intact as gold breaks and holds above 3365.

EMA Setup: Price trades above EMA 13/34/89/200 – signaling strong upside momentum.

Fair Value Gap (FVG): 3374 – 3388 area remains an unfilled FVG zone; possible magnet for short-term price action.

Key Resistance Levels: 3365, 3374, 3380, 3388, 3393

Key Support Levels: 3343, 3335, 3325, 3316, 3304

Trendline & Structure: The ascending trendline from 3316 remains unbroken, providing a potential bounce point if price corrects.

🎯 TRADE SETUPS – Strategic Zones to Watch:

🔵 Buy (Short-Term Scalp):

Entry: 3335 – 3333

SL: 3329

TP: 3340 → 3350 → 3360 → 3370

🟢 Buy Zone (Swing Perspective):

Entry: 3316 – 3314

SL: 3310

TP: 3320 → 3336 → 3350 → 3360

🔴 Sell Scalp (Reversal Zone)

Entry: 3374 – 3376

SL: 3380

TP: 3370 → 3360 → 3350

⚠️ Sell Zone (High-Risk Rejection):

Entry: 3388 – 3390

SL: 3394

TP: 3380 → 3370 → 3360

🔎 NOTE FOR GLOBAL TRADERS:

With UK markets partially closed and US session shortened ahead of the Independence Day holiday, liquidity may be thin and volatility could spike unexpectedly. Always place stop-loss and avoid emotional entries near key resistance.

💬 Do you believe gold can break and close above the FVG zone (3388) before the weekend volatility hits full throttle? Let’s discuss.