XAUUSD trade ideas

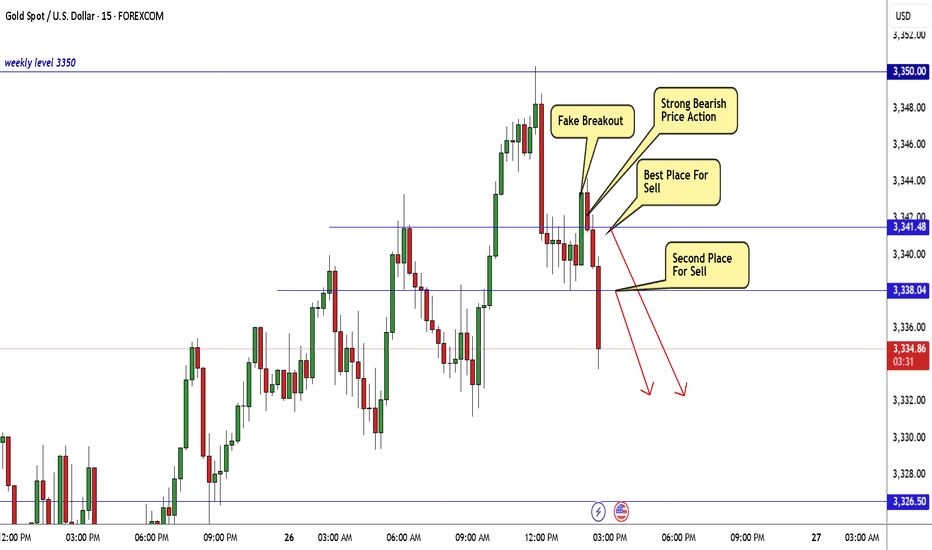

Gold Breakout Done New Short Entry Valid To Get 200 Pips !Here is my opinion on gold at he moment , in 15 mins T.F wr have a fake breakout but 3343.00 forced the price to go down which is a great res for this pair and we have avery good bearish price action and good closure below my res level 3341.00 so it`s my num 1 place to enter a sell trade if the price go back to retest it , and if not , 3383.00 will be my best place to sell it .

Weekly Analysis of the Dollar Index, BTC, SPX500, NAS100 & GOLDIn this week's video I break down key technical patterns and indicators to discuss the behavior and direction of the Dollar index, Bitcoin, SPX500 and NAS100 Indices and finally GOLD for the coming week. I highlight price trends, support and resistance levels, candlestick formations, and moving averages to identify potential targets. My goal is to interpret market sentiment and forecast possible price movements based on historical data and technical signals. I hope you find value in my analysis to make informed trade and investment decisions. Cheers

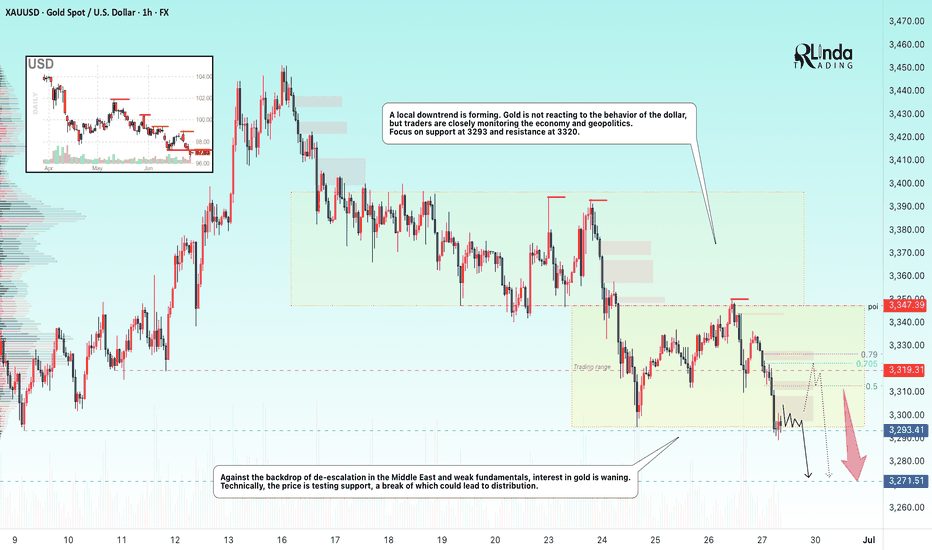

GOLD → Local bearish trend. Retest of support.FX:XAUUSD is technically looking a little weak. Support is being retested amid de-escalation of geopolitical conflicts in the Middle East. Interest in the metal is waning.

On Friday, gold remains under pressure ahead of data on the core PCE index, a key inflation indicator for the Fed. If inflation turns out to be higher than expected, this could strengthen expectations of a rate cut as early as July, supporting gold. The probability of a July cut is currently estimated at 21%, and 75% for September. Amid dollar volatility caused by rumors of a possible Fed chair replacement and trade negotiations with the EU and China, traders remain cautious, awaiting clarity on inflation and monetary policy

Technically, before falling, gold may form a correction to 3320 (liquidity capture).

Resistance levels: 3320, 3336, 3347

Support levels: 3293, 3271

If the fundamental background remains unchanged and gold continues to decline towards support at 3293 and break through this level, the breakout could lead to a fall to 3271. However, I do not rule out the possibility that after a sharp decline, a correction to 3320 could form before the fall.

Best regards, R. Linda!

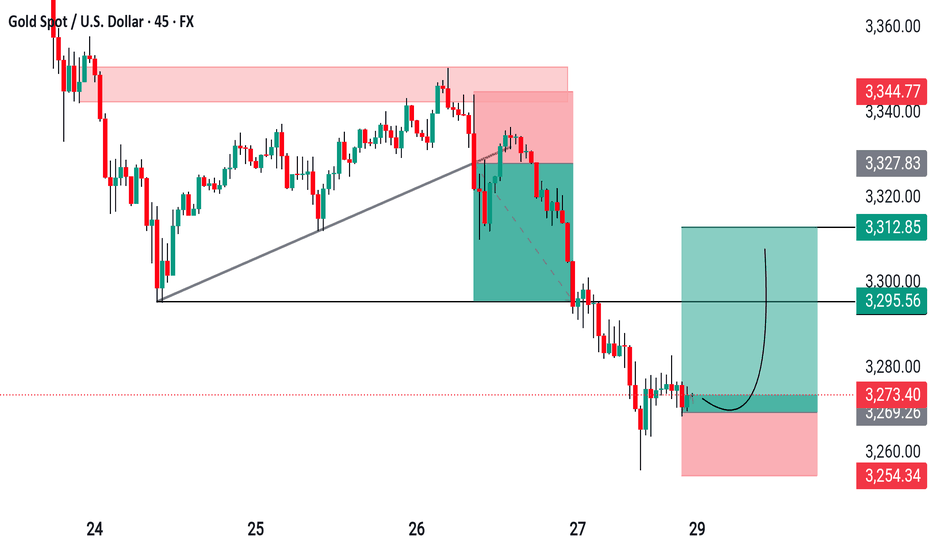

Go long on dips and short on rallies📰 News information:

1. Gold market liquidity at the end of the month

2. Impact of geopolitical situation

📈 Technical Analysis:

Last week we predicted that gold would rebound. Today, after gold rebounded as expected, we gave a short trading strategy. Gold fell precisely at the point we gave, 3295, and successfully hit our TP3280-3270. The result confirmed the correctness of our trading strategy. Next, we will focus on the long trading opportunities below 3270-3260.

🎯 Trading Points:

BUY 3270-3260

TP 3290-3300

SELL 3295-3300-3310

TP 3280-3270

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD OANDA:XAUUSD

Gold Fails to Hold the Fear – Ceasefire Triggers 500+ Pip DropIn yesterday’s analysis, I pointed out that despite the weekend escalation in the middle-east, which triggered a gap up in Gold, the price action didn’t confirm the fear narrative. Gold failed to hold its gains – a clear sign of weakness.

📌 What happened next?

Throughout the day, Gold attempted multiple pushes toward 3400 – but each effort was met with strong selling pressure.

Then came the ceasefire announcement… and Gold dropped hard, now trading around 3320, locking in over 500 pips of profit from my short setup.

________________________________________

❓ More importantly, what’s next for Gold?

More important than the short-term noise is what the charts are now telling us:

📉 Weekly chart? Bearish.

🕯️ Daily chart? Also turned bearish after last week’s indecisive price action.

________________________________________

📌 Strategy remains the same:

I continue to sell rallies, and I’m now watching the 3280 support zone for a possible test in the coming hours.

Patience. Discipline. Let the market come to you. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

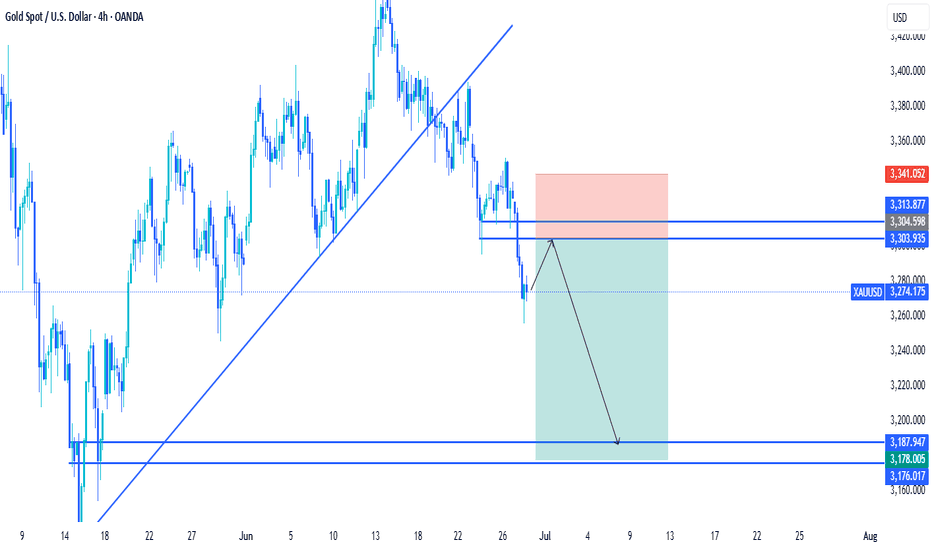

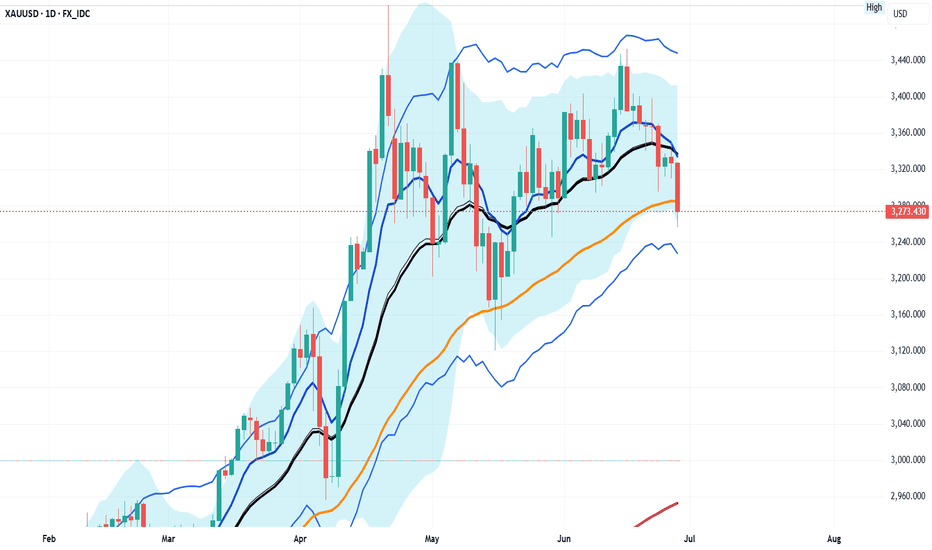

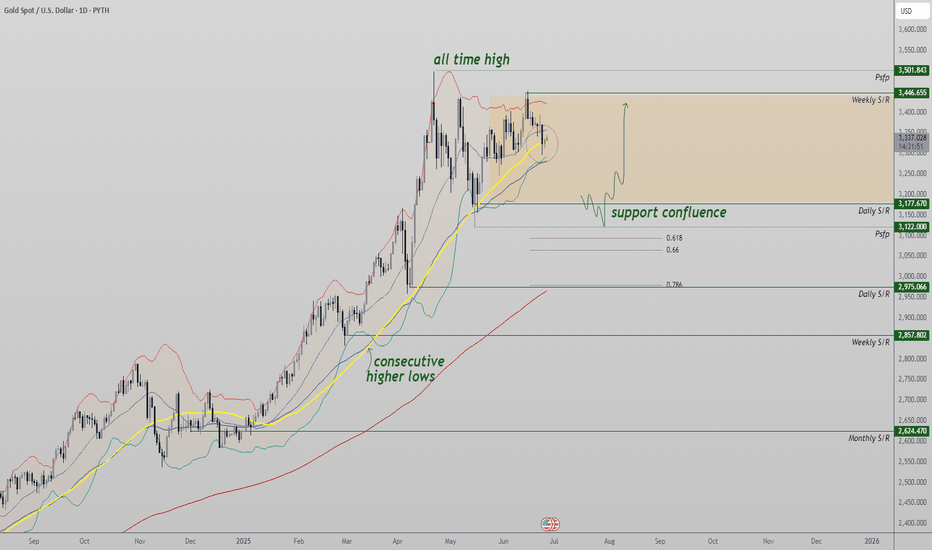

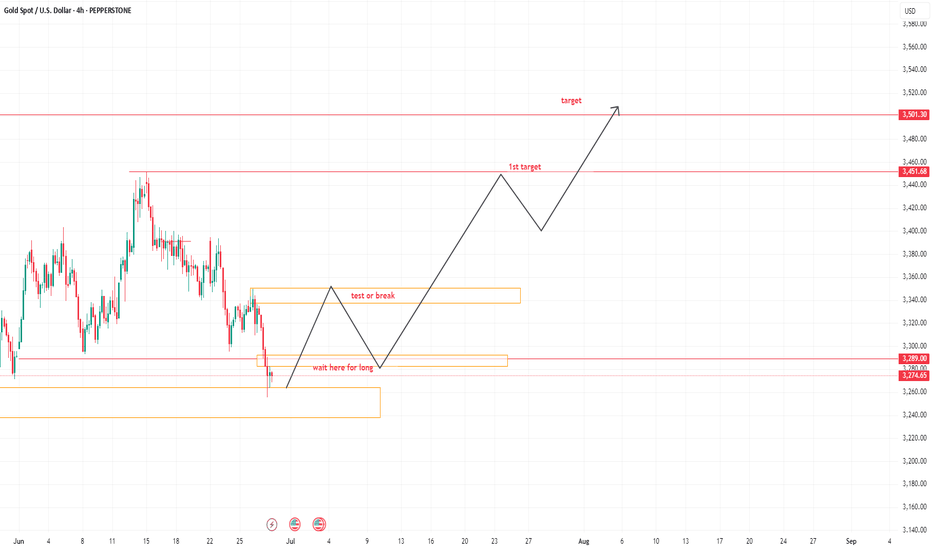

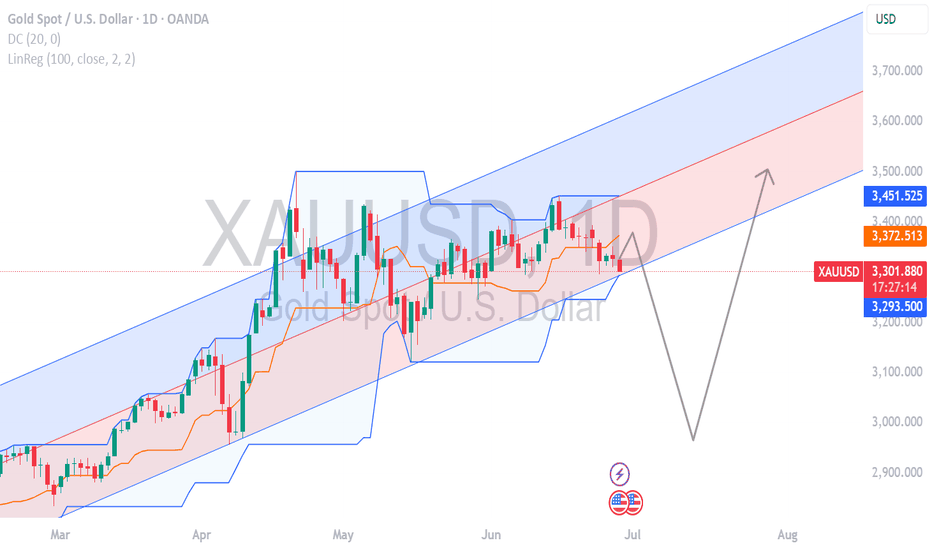

Gold Remains Bullish, But Market Needs Correction Before New ATHGold continues to trend upward with consecutive higher highs and higher lows, but a deeper correction may be necessary before the next major bullish leg can begin with conviction.

Price action on gold remains firmly in a bullish structure. The market has consistently produced strong impulses followed by shallow pullbacks, signaling aggressive buyer interest. However, from a technical trading perspective, current levels may not offer ideal long entries without a corrective move first. A deeper pullback toward support would reset momentum and offer higher probability setups for trend continuation.

Key Technical Points:

- Support Zone at $3,177: Daily support with swing low and 0.618 Fibonacci confluence

- 50 MA + 51 EMA Support: Dynamic moving averages guiding the higher low structure

- Potential Liquidity Sweep: A dip below daily support could trap bears before continuation

Gold’s current uptrend is well-defined, with a clear structure of higher highs and higher lows. Each dip has been aggressively bought, and the market has continued climbing with little resistance. However, this type of trend often leads to overextension, and traders are beginning to look for a corrective pullback to create a more sustainable setup.

The $3,177 support level is the key zone to watch. Not only does this level represent a daily horizontal support, but just below it sits a key swing low and the 0.618 Fibonacci retracement of the most recent leg higher. This area could serve as a prime candidate for a liquidity sweep—where price briefly dips to trap breakout sellers before reversing back upward.

Adding to this, the 50-day moving average and the 51-day exponential moving average are both supporting the trend and aligning with the higher low formation. These moving averages have been providing dynamic support throughout this rally, acting as a technical guide for buyers.

While there is always the possibility that gold continues higher from current levels, a pullback toward the $3,177 area would provide a healthier setup. It would allow the market to reset, rebalance, and potentially attract sidelined buyers who missed the initial move. Such a correction would preserve the higher low structure while maintaining bullish integrity.

What to Expect in the Coming Price Action:

If gold holds above the $3,177 support zone, the bullish trend may resume without deeper retracement. However, a brief dip below that level to sweep liquidity could offer the best long opportunity. Until a corrective move confirms, traders should remain cautious of chasing highs without a valid structure reset. Long bias remains intact as long as the higher low structure holds.

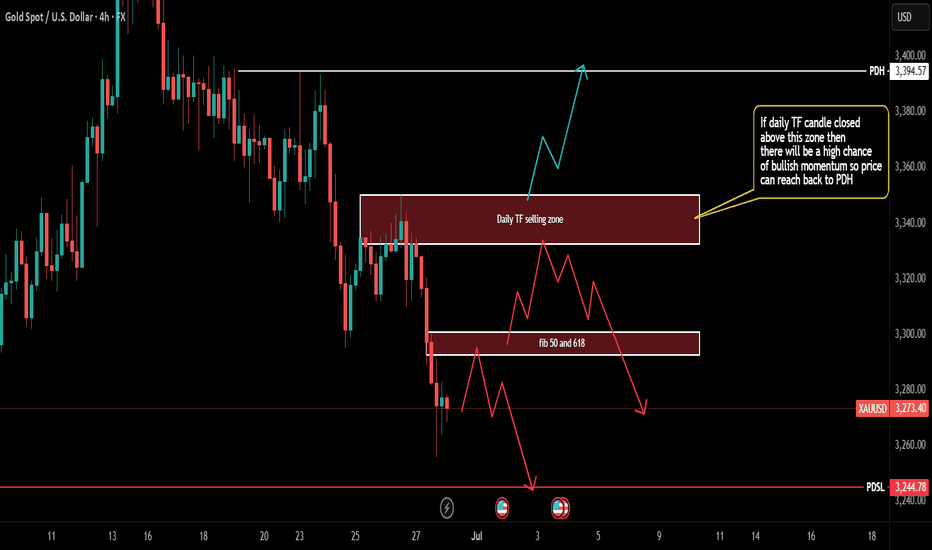

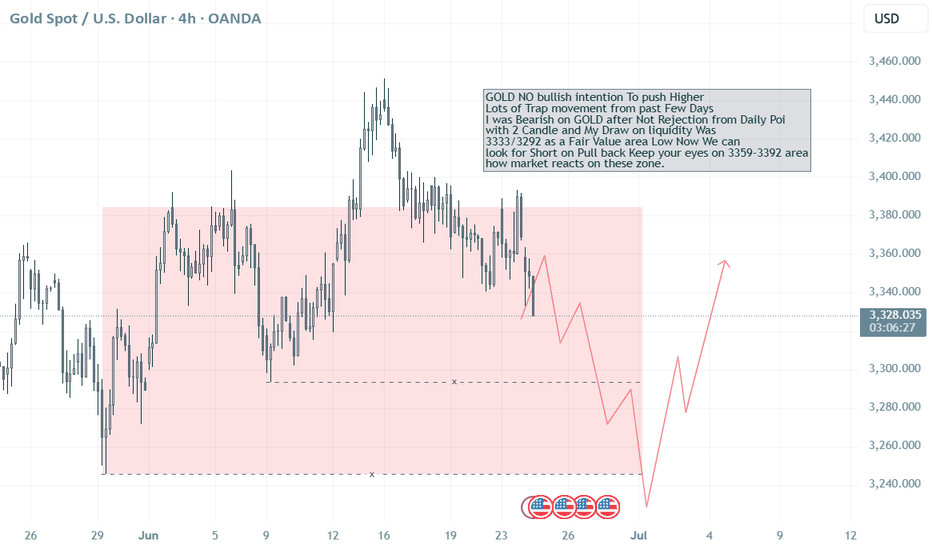

No Bullish intention on GOLD, Seller on Control? Target 3292?

GOLD NO bullish intention To push Higher

Lots of Trap movement from past Few Days

I was Bearish on GOLD after Not Rejection from Daily Poi

with 2 Candle and My Draw on liquidity Was

3333/3292 as a Fair Value area Low Now We can

look for Short on Pull back Keep your eyes on 3359-3392 area

how market reacts on these zone.

Report - 27 june1.

Bond Market Exodus: Why Investors Are Ditching US Long-Term Debt

In Q2 2025, net outflows from US long-dated bond funds hit $11 billion, marking the fastest pace since early 2020. This comes despite more than $39 billion pouring into short-dated funds, which are still yielding attractive real returns due to the Fed's high policy rate.

This flight from the long end is not just about yield differentials — it’s a clear repricing of sovereign risk and fiscal sustainability. The market is beginning to fear that the US is no longer a guaranteed safe haven at the long-duration end of the curve. President Trump’s renewed tax policies — projected to add trillions to the national debt — are weighing on confidence, while incoming tariffs and the risk of structurally higher inflation amplify concerns.

“There is a lot of concern domestically and from the foreign investor community about owning the long end of the Treasury curve.” – Bill Campbell, DoubleLine

Market Implication: The term premium is re-emerging — longer bonds must offer significantly higher yields to attract buyers. In real terms, longer-dated Treasuries are down ~1% this quarter, clawing back losses after tariff-induced volatility in April.

Strategic Allocation:

Stay overweight short-duration debt (SHY, BIL, floating-rate notes) for yield preservation and minimal duration risk.

Avoid duration extension. TLT, ZROZ, and long-dated corporates may face additional downside as issuance ramps and demand fades.

Consider non-dollar fixed income exposure (e.g., EU sovereigns, South Africa, Brazil), particularly where inflation targeting credibility is rising.

Macro Impact:

This shift jeopardizes debt affordability. With $33 trillion in debt and rising interest expense, the US could face debt spiral risks unless inflation softens or fiscal discipline returns. An elevated term premium can ripple into mortgages, corporate borrowing, and municipal finance, potentially crowding out private investment.

2.

Geopolitical Tensions: Iran's Nuclear Program and the Market's Response

Despite US claims of obliterating Iran’s nuclear capabilities in recent strikes, preliminary European intelligence indicates Iran’s 408kg stockpile of highly enriched uranium remains largely intact. It was reportedly dispersed before the attacks — undercutting the narrative of complete neutralization.

President Trump’s remarks, suggesting “nothing was taken out” of the main Fordow facility due to logistical constraints, reflect a public relations overstatement rather than a decisive strategic victory. While US defense officials stand by the attack’s symbolic impact, reports suggest the nuclear program was set back by months, not years.

“Trump exaggerated because he needed to... Anyone who heard his remarks could tell there was a different reality.” — Ayatollah Ali Khamenei

Market Implication:

The gold price remains elevated, closing at $3,328.22, up 0.15% on the day, and +26.81% YTD — a clear hedge against geopolitical instability.

Oil markets initially spiked but reversed as the Israel-Iran ceasefire held. Brent Crude ended at $67.14, down -6.1% over the week.

Defense stocks, particularly in US and Israeli names, are seeing flows as investors anticipate further defense budget expansions.

Strategic Allocation:

Hold or overweight gold (GLD, XAUUSD) in strategic portfolios as a volatility hedge.

Avoid chasing oil at interim highs unless further strikes materialize — use energy exposure as a short-term trade, not a structural bet.

Monitor Iranian retaliation risk and its effect on shipping lanes, which would impact insurance costs and transport-linked equities.

Macro Impact:

With Iran's capacity largely intact, nuclear diplomacy is effectively frozen. The uncertainty adds to regional instability, and markets may underprice the risk of a re-escalation. Meanwhile, continued weapons development forces global powers to shift attention (and potentially resources) away from economic diplomacy.

3.

US Export Collapse: Trade Policy Bites the Domestic Economy

In May, US goods exports fell by $9.7 billion (–5.2%), marking the largest monthly decline since the pandemic crash in 2020, according to the Census Bureau. Exports totaled $179.2 billion, sharply down from April’s figures.

This contraction followed President Trump’s "Liberation Day" tariff blitz, which spooked global trading partners. Despite some tariff suspensions, others — such as a blanket 10% duty and sector-specific metals tariffs — remain active.

“Amid the de-escalation phase of the tariff story, we are now seeing an unwind in both imports and exports.” — James Knightley, ING

Key Export Drivers:

Industrial supplies (crude oil, metals): Down 13.6% in May after a 16% surge in April.

Vehicle exports: Rebounded +3.5% after a 20% drop in April.

Trade deficit: Widened to $96.6 billion, above expectations.

Practical Market Implications:

Logistics & industrial names (FedEx, Caterpillar) face short-term margin pressure.

Commodities sensitive to trade flows — particularly metals — could see softening demand (watch steel and copper ETFs like SLX and COPX).

Dollar exposure may become more volatile as lower exports pressure the current account, contributing to a weaker dollar narrative.

Broader Economic Impact:

With inventories full and international demand softening, US manufacturing will decelerate.

Capex and employment in export-sensitive sectors are at risk if the trade environment doesn’t stabilize.

Investor Strategy:

Short-term caution on transportation (e.g., FedEx reported a sharp drop in China-US freight).

Reallocate toward domestic-facing sectors (utilities, consumer staples) that are more insulated from trade.

Currency traders may view this as a signal to fade the USD if combined with Fed dovishness.

4.

US Debt Avalanche: The Bond Exodus and What It Means for Markets

Investors are rapidly fleeing long-term US bonds, with net outflows reaching $11 billion in Q2, the sharpest retreat since early 2020, according to EPFR data. This comes amid growing concern over the US’s ballooning debt load, worsened by Trump’s proposed tax cuts and trade tariffs.

“It’s a symptom of a much bigger problem... concern about owning the long end of the Treasury curve.” — Bill Campbell, DoubleLine

Why It Matters:

Trump's tax plan is forecast to add trillions to federal debt, compelling the Treasury to issue a flood of bonds.

Simultaneously, tariffs are feared to fuel inflation, which erodes bond values — especially those with long durations.

Market Movement:

Long-term US debt fell ~1% in Q2 (Bloomberg index).

In contrast, short-term US bond funds gained $39 billion in inflows, driven by high yields at the front end of the curve.

“With inflation still above target and heavy government supply, this is driving skittishness about the long end.” — Robert Tipp, PGIM

Practical Investment Outlook:

Expect higher yields at the long end of the curve if debt issuance remains elevated and inflation expectations rise.

Flattening yield curve risk if short-end rates remain high while long-end selling continues.

Duration-sensitive portfolios (e.g. pensions) may suffer performance drag unless repositioned.

Global Spillovers:

A weaker long bond market raises benchmark rates globally, making it costlier for emerging markets to borrow.

Foreign investors (e.g., Japan and China) may diversify out of Treasuries, potentially moving capital into higher-yield EM debt or European assets.

The sell-off contributes to dollar weakness, especially when coupled with trade disruptions and Trump’s criticism of the Fed.

Investor Strategy:

Reduce duration exposure; consider floating-rate notes or shorter-dated fixed income instruments.

Explore international bonds, especially EM local currency debt, which is currently outperforming.

Use steepening yield curve trades (e.g., 2s/10s steepeners) as a way to hedge fiscal risks.

5.

Iran’s Nuclear Resilience: What Intel and Markets Tell Us

Despite claims from President Trump that Iran’s nuclear capabilities were “obliterated” in recent airstrikes, early intelligence assessments suggest otherwise. According to European and US officials, Iran’s 408kg stockpile of near-weapons-grade uranium remains largely intact, having been dispersed to other locations before the strikes.

“It did not achieve anything... Trump exaggerated.” — Ayatollah Ali Khamenei

Strategic Interpretation:

US and Israeli strikes targeted Fordow, Natanz, and Isfahan — key nuclear infrastructure.

While significant damage occurred, no total structural collapse was confirmed.

This reinforces that Tehran maintains breakout capacity, and could resume enrichment rapidly if it chose to.

“The nuclear programme suffered enormous damage... but not complete destruction.” — Rafael Grossi, IAEA

Market Impact and Geopolitical Outlook:

The revelation that Iran’s uranium reserves survived the assault reduces confidence in the effectiveness of US deterrence.

Oil markets remain unfazed. Traders priced in the symbolic nature of Iran’s missile response and read the US-Israel actions as limited in strategic disruption.

Brent crude fell sharply by 6.1% to $67/bbl post-ceasefire — evidence markets anticipate no extended supply shock.

What to Expect:

Volatility premium on oil is falling. No major disruption to Strait of Hormuz = no major repricing.

Increased likelihood of backchannel diplomacy, especially as Tehran seeks to assert survival and avoid regime destabilization.

However, shadow escalation (e.g., cyber, proxy strikes) remains plausible.

Practical Asset Implications:

Oil traders are in sell-the-spike mode: Risk-on reactions are now short-lived.

Defensive commodity plays (e.g., gold) saw a pullback as perceived geopolitical risk faded.

Military-industrial equities may experience cooling momentum unless new threats emerge.

Risk of sanctions rollbacks or renegotiations could reprice energy and emerging market assets tied to Iran’s trade (e.g., India, China).

6.

Export Shock: Tariffs Bite into US Trade Performance

US goods exports plummeted by 5.2% in May, marking the sharpest drop since 2020, as President Trump’s aggressive “Liberation Day” tariff strategy triggered a major disruption in global demand for American goods. Total exports fell to $179.2bn, down $9.7bn from the prior month.

Breakdown:

Industrial supplies (including oil and metals): –13.6%

Vehicles: +3.5% (recovering from a –20% collapse in April)

Trade deficit widened to $96.6bn, beating Wall Street expectations.

“This is the tariff shock starting to filter into real data.” — ING’s James Knightley

Economic Implications:

Tariff retaliation and inventory overhang are key drivers of the export decline.

Partners reduced US imports anticipating further tariffs or supply chain reshuffles.

The loss of export revenue compounds fiscal stress, especially with simultaneous tax cuts and increased military spending.

Sectoral Risks:

Energy exporters (e.g., Texas oil firms) are hit hard — crude exports falling.

Industrial metals and machinery producers face slower foreign orders.

Shipping and logistics (e.g., FedEx) flagged the US–China lane as the weakest and most unpredictable trade route.

Market Outlook:

Dollar weakness persists, with the Dollar Index near a 3-year low, reflecting investor fear over twin deficits (fiscal + trade).

Equities may remain resilient, especially domestically focused or tariff-insulated names.

However, multinationals with global exposure could underperform due to shrinking foreign sales.

What to Expect:

Volatility in trade data until clarity returns on tariff regimes.

Renewed calls for bilateral trade talks or exemptions from key US partners (e.g., EU, Mexico).

Watch for nearshoring trends to accelerate as companies avoid tariff risk.

7.

EM Rally: Emerging Markets Outshine Developed Peers Amid US Fiscal Anxiety

In a stunning reversal of past trends, emerging market (EM) assets are rallying across asset classes in 2025 — defying both the global macro gloom and the shadow of US tariff policy.

By the Numbers:

JPMorgan EM Local Bond Index: +10% YTD

MSCI EM Equity Index: +10%

MSCI World (Developed Markets): +4.8%

EM bonds in global AUM: Rising from a low 5% share

This rotation reflects a clear diversification trend away from dollar assets, fueled by erratic US policymaking, record federal debt, and a weakening dollar. The Treasury-specific risk premium is rising — and EMs are absorbing the flow.

Drivers of the Rally:

Dollar weakness: Eases FX pressure, gives central banks room to cut.

Inflation-adjusted yields in EMs at 20-year highs, making debt highly attractive.

Declining fiscal risks in EMs contrast with ballooning G7 debt burdens.

China and South Korea lead equity optimism with innovation themes and policy clarity.

“Even small inflows are having disproportionately large effects.” — Goldman Sachs’ Kevin Daly

Risks and Rotation:

Geopolitical conflict in the Middle East did not dent EM flows — a clear sign of confidence in regional resilience.

Oil prices falling reduced tail risks for EM energy importers like India and South Korea.

Still, EM equity outflows in Q1 were sizable (–$22bn), only partially reversed in May–June (+$11bn net).

Practical Strategy for Investors:

Local currency bonds in Brazil, South Africa, Indonesia — rich yields, FX tailwinds.

Tech-heavy equity plays in China and Taiwan — exposure to global AI boom.

EM corporates still lag — cautious positioning advised due to higher default risk.

What to Watch:

Further EM policy easing, especially in Asia, will support equities.

US yield volatility may occasionally disrupt flows, but the narrative has shifted.

Multi-asset portfolios should consider overweighting EM exposure tactically in H2 2025.

8.

Shell, Sovereign Risk, and the Oil Sector Outlook: BP Takeover Denied, Sector Under Pressure

Shell’s explicit denial of takeover talks with BP, despite media speculation, offers clarity but also raises key strategic questions for the European energy sector. The sector continues to grapple with sluggish price action, mounting decarbonization pressures, and a renewed focus on capital discipline.

Key Takeaways:

Shell stated it had “no intention” of acquiring BP and had not been in talks, invoking a six-month standstill period under UK takeover law.

BP shares rose 1.3%, Shell +0.5%, largely a relief rally and not based on synergies.

This quells short-term merger speculation, but it underscores the pressure on oil majors from activist investors (e.g., Elliott’s 5% stake in BP) demanding deeper cuts, higher returns, and optionality in energy transition strategy.

“Shell has preferred buybacks to acquisitions.” — Wael Sawan, CEO

Sector-Wide Implications:

BP’s aggressive renewables push has backfired, denting valuation and making it a takeover target.

Oil majors are capital-rich but investment-conservative, amid uncertain demand outlook and energy policy volatility.

High integration costs and risk of job losses are politically toxic, limiting mega-deal feasibility.

Practical Market Interpretation:

With Brent crude hovering around $68–$70, oil equities remain valuation-sensitive and vulnerable to dividend cuts or FX shocks.

Investors should favor capital-efficient names with strong free cash flow and disciplined buyback programs.

Avoid speculative merger plays; instead, track cost reduction execution and decarbonization pace.

What to Watch:

Further activist pressure on BP and Total to streamline operations.

Potential US M&A activity in smaller shale players instead of global giants.

Any signs of OPEC+ discord or US SPR use amid volatile demand expectations.

9.

New World Development: Hong Kong’s Property Giant Faces Systemic Risk

New World Development (NWD), one of Hong Kong’s largest property conglomerates, is undergoing a delicate refinancing operation amid ballooning debt, weak property sales, and a declining tourism-reliant retail economy. The implications ripple across the Asian credit markets, Chinese property sector, and Hong Kong's financial stability.

Key Financials:

Net debt: HK$124.6bn

Refinancing talks: HK$87.5bn in bank loans

Interest costs > operating profits in 2H FY2024

Annual loss: HK$20bn, the first in two decades

Shares down 22% YTD, market cap ~HK$14bn

The developer’s leverage and stalled mainland China expansion expose it to credit market deterioration, at a time when trust in property-linked balance sheets is thin.

“It won’t be a question of how much you’re willing to pay — the cover won’t be available.” — Everest CEO Jim Williamson, referring to US casualty insurance but resonant here too.

Systemic Concerns:

Barclays estimates NWD accounts for 7% of all HK commercial property loans — nearly double Evergrande’s systemic exposure in mainland China.

Property defaults or asset fire-sales could cause bank provisioning hikes, spread to retail REITs, and exacerbate deflationary pressures.

Mitigating Actions:

NWD pledged flagship assets (e.g., Victoria Dockside) as collateral.

Actively selling projects at discounts.

Chow Tai Fook Enterprises selectively buying assets, indirectly supporting liquidity.

However, refusal to engage with bondholders, deferred perpetual interest payments, and a leadership reshuffle have eroded market confidence.

Strategic Implications for Investors:

Avoid unsecured Chinese real estate debt—bondholder transparency is poor.

Favor secured exposure or government-backed REITs tied to stable rental income.

Look for HKMA guidance: policymakers are signaling banks to avoid panic provisioning, implying the government will step in to prevent contagion.

Broader Macro Read:

Reflects fragility of China’s "recovery-lite" property model, where urban development exceeds real demand.

HK real estate’s softening is also a proxy for declining mainland tourism, rising capital costs, and shifting investor preferences.

10.

Meta’s Copyright Win: Legal Green Light for AI Model Training

Meta's recent legal victory over authors suing for unauthorized use of books in AI training marks a critical turning point in the legal framework surrounding AI development. The U.S. District Court ruled that the tech giant’s use of millions of texts to train its LLaMA models constituted “fair use”, delivering a massive tailwind to AI innovation — and to equity investors betting on the sector.

Case Summary:

Plaintiffs included notable authors like Ta-Nehisi Coates.

Meta trained its AI on LibGen-sourced books without permission.

Judge Chhabria: Ruled for Meta due to “poor argumentation” by plaintiffs — not because the court inherently favored AI use.

“This ruling does not stand for the proposition that Meta’s use of copyrighted materials to train its language models is lawful. It stands only for the proposition that these plaintiffs made the wrong arguments.” — Judge Vince Chhabria

Precedent and Practical Impact:

Reinforces the fair use doctrine for transformative technologies.

Encourages aggressive data utilization strategies by other firms.

Raises the bar for future copyright suits, requiring stronger arguments like market harm (e.g., reduced author royalties).

Implications for Tech and Equity Markets:

AI development costs may fall sharply as legal uncertainty fades.

Generative AI leaders (Meta, Anthropic, OpenAI) now face fewer near-term litigation barriers.

Paves the way for AI ETF inflows, bolsters AI-leveraged tech indices (e.g., SOXX, QQQ).

Equity long positions in semis (NVDA, AMD), cloud (MSFT, GOOGL), and enterprise AI (CRM, ORCL) become even more strategic.

Regulatory Outlook:

A longer-term battle is likely over “market dilution” claims.

Courts may soon have to decide whether AI-generated outputs undermine economic incentives for human creators.

Policy frameworks from the EU or US Congress are likely within 12–18 months.

Strategic Takeaways for Investors:

Increase exposure to AI infrastructure (e.g., Nvidia, Micron, Arista).

Maintain vigilance on evolving IP litigation trends — regulatory tone may shift depending on 2025 political outcomes.

Avoid over-concentration in companies still facing unresolved copyright or data privacy battles (e.g., Open-source LLMs with gray training data).

11.

ETF Innovation: ‘Autocallables’ Go Retail – A Structural Shift in Yield Exposure

The launch of the first US-listed ETF tracking autocallable structured products by Calamos Investments, with JPMorgan support, signals a transformative shift in how retail investors access complex income strategies. Once limited to ultra-high-net-worth clients, these derivatives — with yields near 14.7% — are now democratized through a simple ticker trade.

What Are Autocallables?

Autocallables offer periodic coupons unless a linked index (e.g., S&P 500) falls below a pre-set barrier. If the barrier is breached consistently, investors risk losing principal. They are akin to structured credit instruments but are tied to equity indices, not borrowers.

Triggered by market declines.

Maturity: typically 3 years, quarterly checks.

Final protection barrier: ~60% of starting level — breach = principal loss.

ETF will hold 52+ autocallables diversified by issuance date.

Investment Mechanics:

Calamos Autocallable Income ETF (CAIY) charges 0.74% annual fee — above the average for US derivative-income ETFs (0.51%).

It’s part of a wider trend: structured outcome ETFs have exploded from $3.5bn in 2019 → $179bn today (Morningstar).

Mimics yield exposure of high-yield bonds, but linked to equity volatility.

Analyst Commentary:

Ben Johnson, Morningstar: “ETFs are taking share from all financial products — not just mutual funds, but also from bespoke structured notes.”

Elisabeth Kashner, FactSet: warned of misunderstanding risks: “Advisers will struggle to explain these. If markets fall, protection and yield disappear.”

Practical Implications:

Retail investors gain access to high-yielding structured credit proxies.

If adopted at scale, this could divert flows from traditional high-yield bonds and annuities.

Volatility derivatives embedded in autocallables will impact options markets and hedging strategies.

Risk Outlook:

In a sharp downturn, coupon stops and capital protection collapses — potentially leading to double-digit losses.

These ETFs may suffer sudden illiquidity if linked indices breach multiple trigger levels at once.

Systemic Considerations:

Broad adoption of these ETFs could amplify equity downside during sharp corrections — as dealers hedge risk via S&P futures.

Scenario: A systemic correction triggers autocallable barrier breaches, prompting delta-hedging cascades → market destabilization.

Investor Strategy:

Use as non-core, tactical exposure for income in low-volatility environments.

Monitor S&P drawdowns and ETF option volumes for stress signals.

Avoid relying on these instruments for downside protection in portfolios targeting retirement stability.

12.

Wall Street Outlook: Dollar Slide, Powell Speculation, and Inflation Signaling

Markets steadied this week as geopolitical tensions cooled with the Iran-Israel ceasefire, but underlying stress in key asset classes persists — particularly in foreign exchange and rate-sensitive sectors. Traders are recalibrating for what could be a pivot in US monetary policy, as political noise intensifies over Fed leadership and dollar weakness accelerates.

Dollar Pressure Deepens:

The US Dollar Index slid to a three-year low, falling 0.5% after the Wall Street Journal reported that President Trump may replace Fed Chair Jay Powell earlier than expected.

The euro surged to $1.1710, its strongest level since September 2021.

“We suspect that some of this narrative is seeping into perceptions,” said Macquarie’s Thierry Wizman, pointing to speculation over Fed independence.

This decline is especially concerning given the rebound in Treasury yields, which would traditionally support the greenback. Instead, we are witnessing a breakdown in classic correlations, as political interference becomes a dominant narrative.

Powell’s Job and Policy Path:

The idea of a “shadow chair” to pressure the Fed into rate cuts has unnerved institutional allocators. The White House denied imminent changes but confirmed the president’s “right to change his mind.”

This raises risk premiums around Fed credibility, especially with inflation still a threat and growth signals weakening.

Any leadership uncertainty at the Fed historically results in higher long-end yields due to perceived policy drift or political bias.

Safe Havens and Gold Dynamics:

Gold fell 0.2% to $3,324/oz, losing some haven allure post-ceasefire.

Continued outflows are expected unless inflation data surprises to the upside or Fed intervention appears politically constrained.

Equity Markets:

S&P 500 closed just under its all-time high, up 0.6%.

Risk-on sentiment is heavily liquidity-driven, with AI optimism (led by Nvidia) adding a secondary tailwind.

Oil and Inflation:

Brent crude rebounded to $68.49/bbl, up 1.2%, despite subdued supply risk.

Inflation-linked assets remain moderately priced, but any disruption to the Strait of Hormuz or further US-China escalation could reignite tail-risk pricing.

Practical Implications:

Dollar weakness can spur a rotation into EM equities, gold, and real assets.

Investors should brace for increased FX volatility and repricing of global rate differentials.

Portfolios with high USD exposure may benefit from increased geographical diversification.

TIPS and short-duration Treasuries become more attractive as stagflation hedges in case Powell is replaced with a dovish successor.

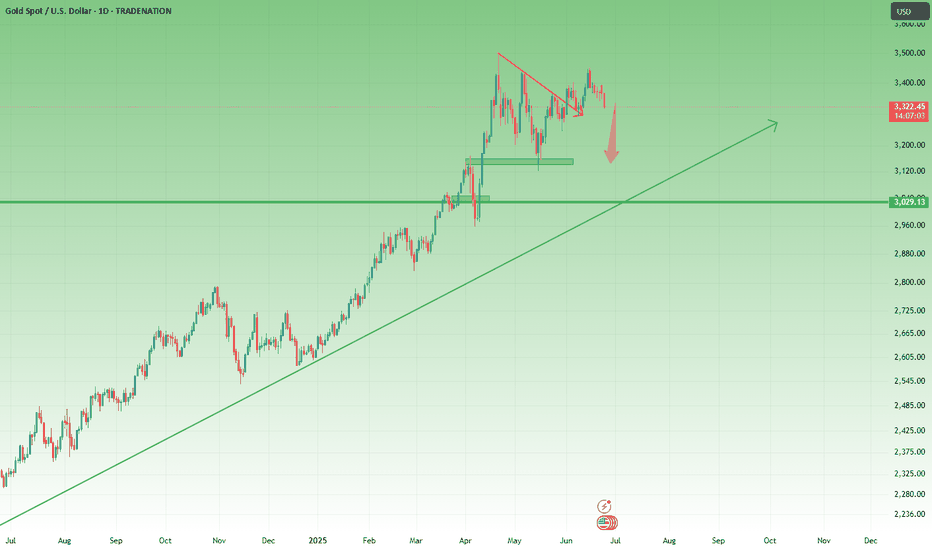

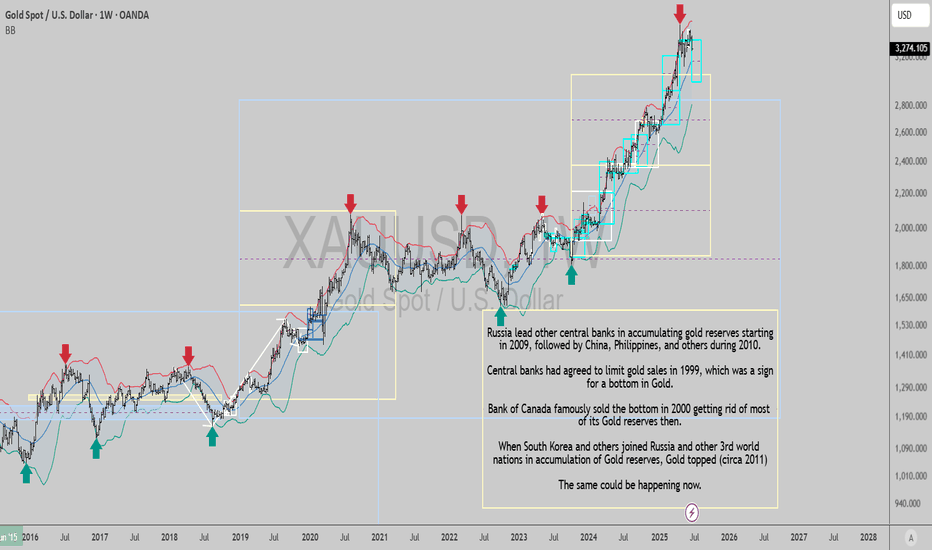

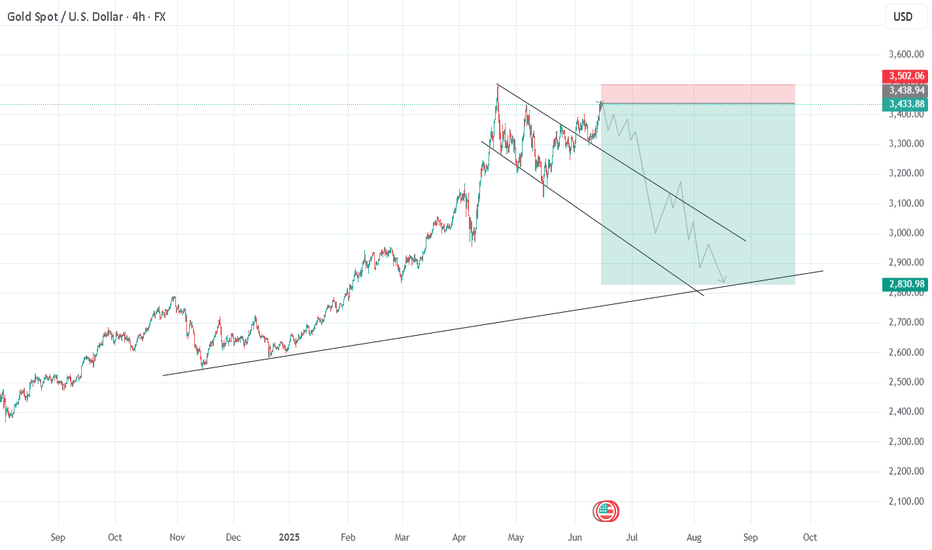

Gold topped...GM gents, it seems OANDA:XAUUSD will reverse the advance here, a weekly timeframe down trend has fired just now. It's either the start of a correction or a reversal of the huge trend it had since Oct 2023.

The arrows on chart show the spots where the weekly timeframe trend reversed, so you get an idea of what to expect.

Best of luck!

Cheers,

Ivan Labrie.

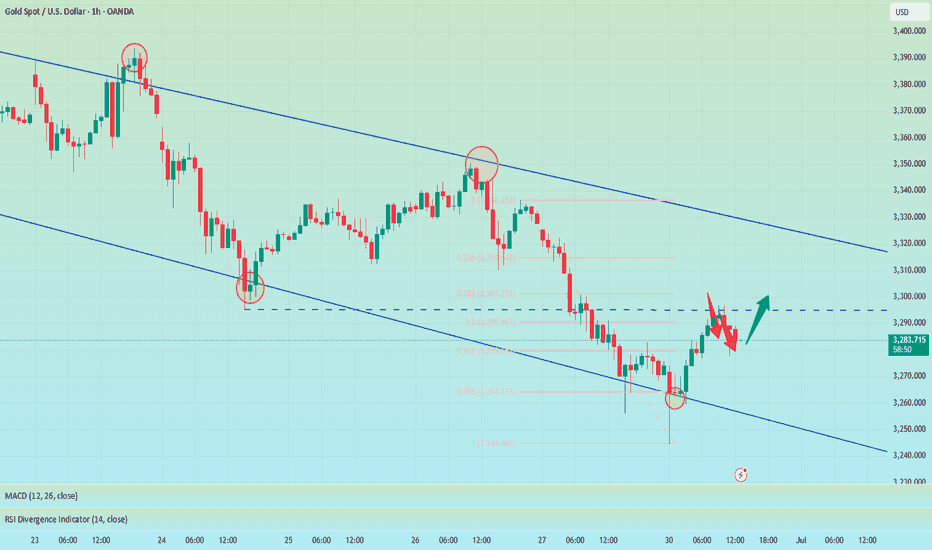

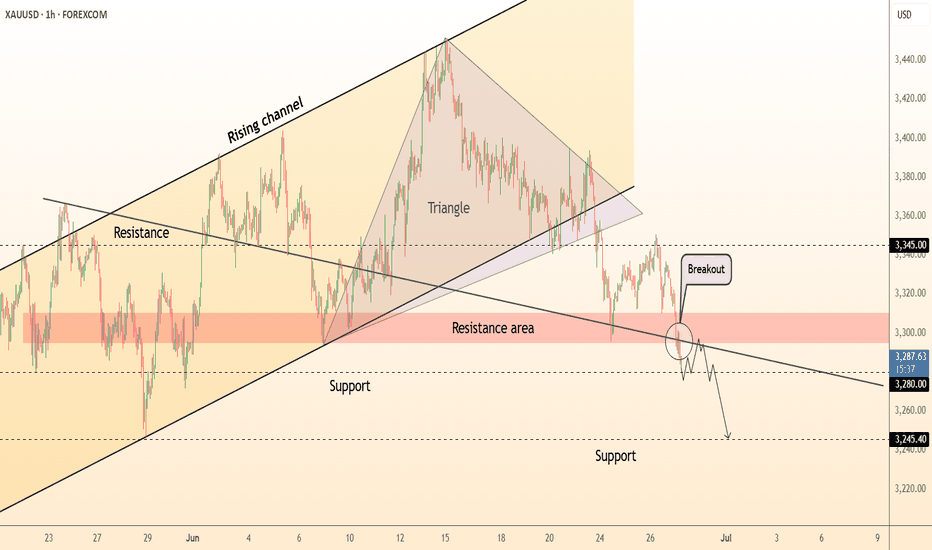

DeGRAM | GOLD broke the demand zone📊 Technical Analysis

● Price sliced beneath the long-term rising‐channel base and the triangle apex, turning 3 300-3 310 into fresh supply; the current pull-back is a textbook bearish retest of the break zone.

● Hourly structure now tracks a new descending trend-line; failure to reclaim 3 300 keeps momentum pointed to the next fib / horizontal shelf at 3 280, with the channel width projecting 3 245 support.

💡 Fundamental Analysis

● Rebound in US 2-yr yields after hawkish Fed speakers and a stronger-than-expected durable-goods print lifted the DXY, reducing short-term bullion appeal.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

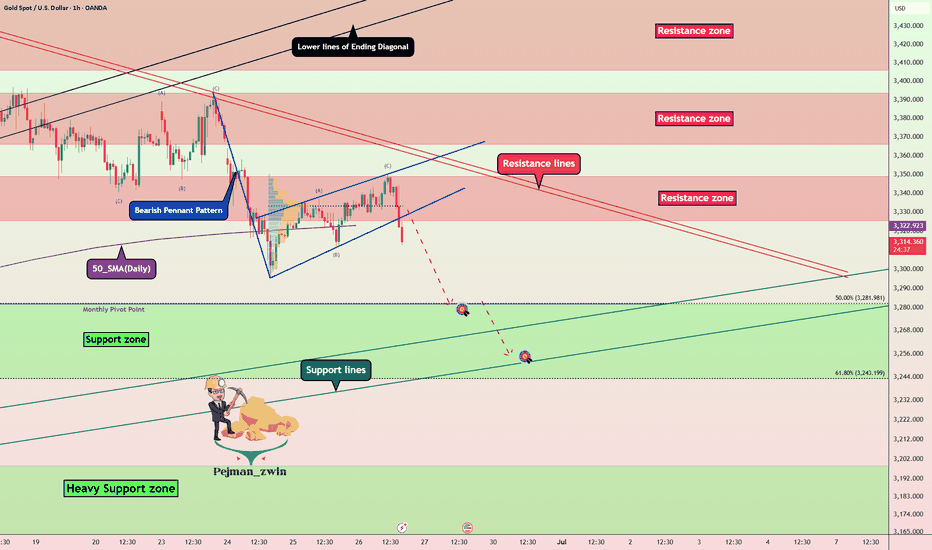

Gold Breakdown Confirmed — Bearish Pennant Targets UnfoldingGold ( OANDA:XAUUSD ) started to decline as I expected in my previous idea after the lower lines of the Ending Diagonal broke .

Gold is moving near the Resistance zone ($3,349-$3,325) . And Gold seems to be crossing the 50_SMA(Daily) .

From a Classical Technical Analysis perspective , the Bearish Pennant Pattern seems to indicate a continuation of the downtrend in Gold .

From an Elliott wave theory perspective , it seems that Gold has completed the Zigzag Correction(ABC) , and we can expect the next 5 downwaves .

I expect Gold to continue to decline at least to the Support zone($3,281-$3,243) and Monthly Pivot Point .

Note: Stop Loss (SL) = $3,360

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD DISTRIBUTION TYPEHello folks. its been a while I am posting. Been dealing with this idea last week.

wait for a rally to 3344, if it breaks above 3351 then we still waiting below our main Entry 3280-3289 zone. less stoploss below the friday low.

Trade it swing if we see monday rally. then wait our entry.

Goodluck and have fun trading,

If trading is a lifestyle this is it.

this is your lifestyle.

waiting here is boring.

thats why we need to be more patience.

xiaaaaooo.

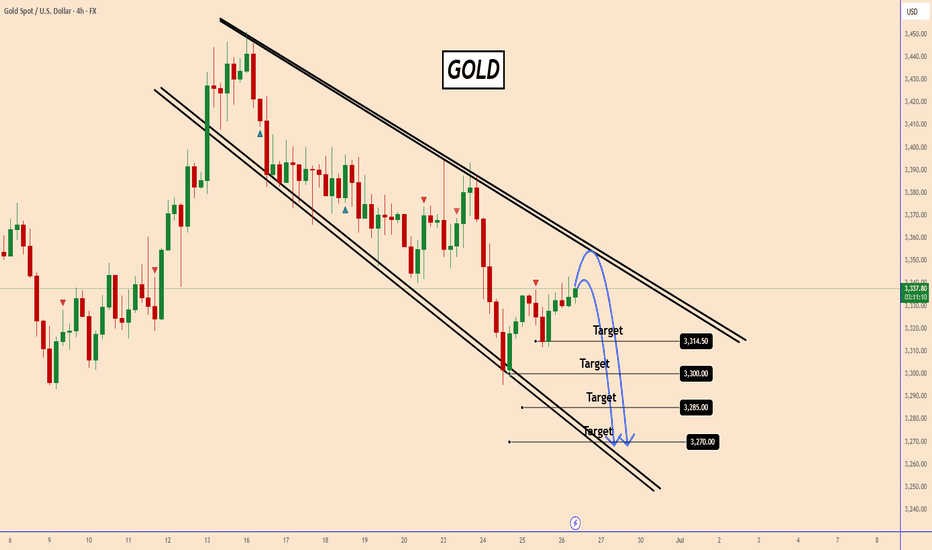

Gold: A Bearish Outlook - Another Point of ViewGold: A Bearish Outlook - Another Point of View

Since yesterday, gold has not moved much despite the situation in the Middle East looking calm and stable for the moment.

In a normal market, gold should have started another downward wave, given that a ceasefire was reached between the influential countries and a war that could have lasted for years given their military arsenal.

Yesterday, Federal Reserve Chairman Powell testified for the second day and his comments were aggressive, despite being provoked by many of Trump's supporters with very aggressive tones. This was probably one reason why the US dollar did not show strength.

However, gold is a safe-haven asset and if it is to respect its status, chances are it will fall further, at least as a profitable moment, because all the important events have ended so far. It could create a possible reversal from the current area as shown in the chart.

Key downside targets: 3314.50, 3300, 3285, and 3270.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

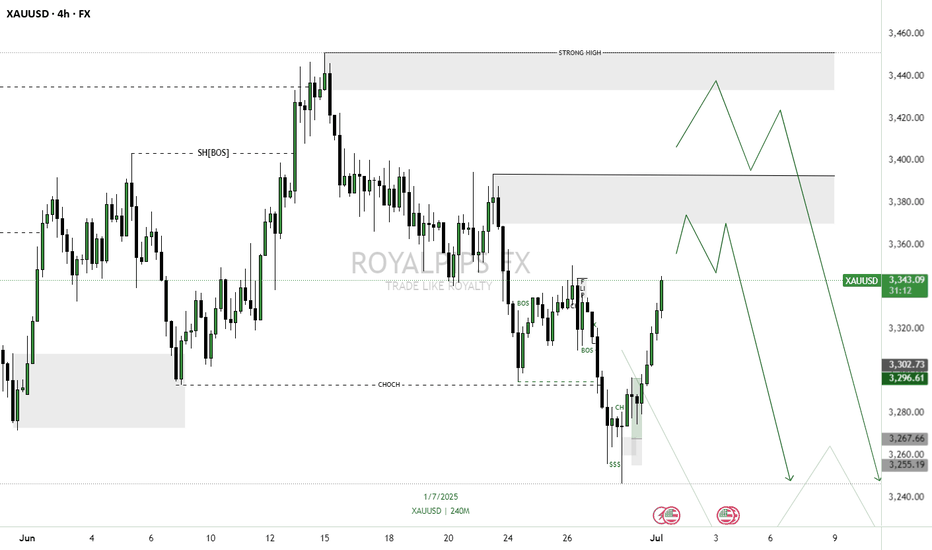

XAUUSD GOING SHORTGOLD has recently broken its last low, shifting market structure (CHOCH) and indicating sellers are currently in control. This break opened up 2 clear Supply Zone above — a small base or last bullish candle before the drop — which is a key area where unfulfilled sell orders may be resting.

Price is likely to retrace back into these Supply Zone to fill those orders. Once it reaches this area, we expect selling pressure to resume and push price downward, honoring the imbalance left by the drop.

Entry:

I’m looking to sell from this Supply Zone on a pullback,

This lets me enter at a premium price while trading in direction of the newly established downward momentum.

Target:

The first Target Profit (TP) is set at the next Demand Zone below, where buying pressure might emerge. This Demand Zone is a key area to watch for a reversal or a temporary halt in downward momentum.

Stop Loss:

To control risk, the Stop Loss (SL) is placed just above the Supply Zone.

If price climbs above this area, it would invalidate the Supply’s ability to hold, signalling a potential reversal.

✅ Summary:

• Market has shifted to bearish after breaking last low.

• Supply Zone above is a key area to watch for selling opportunities.

• Sell upon retracement into Supply, with Stop Loss above and Target at Demand below.

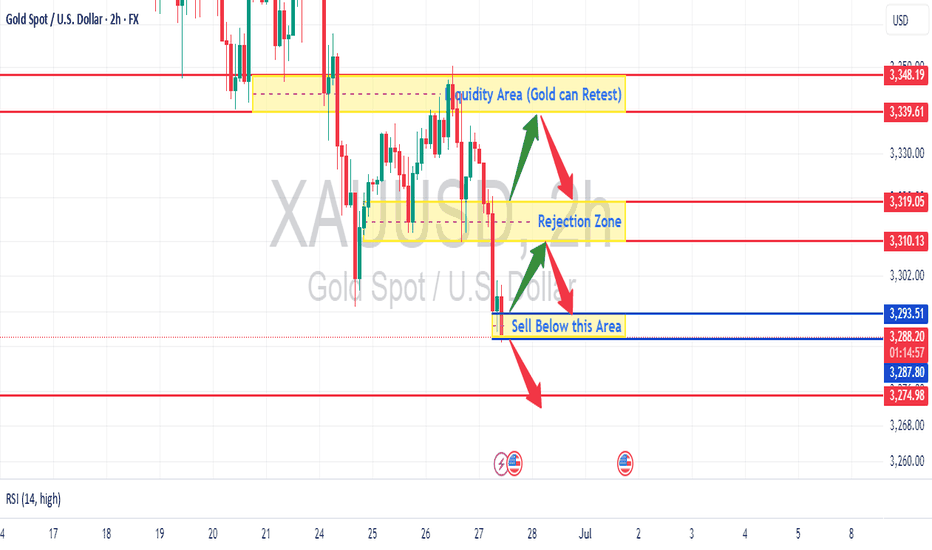

XAUUSD - Local Bearish Trend and Retest of Support-ResistanceOverall Trend:

The chart shows that Gold (XAUUSD) has been in a downtrend over the depicted period, particularly after a significant drop around June 24th/25th from the higher price levels (around 3348-3350). While there have been attempts at recovery, the price has generally been making lower highs and lower lows, indicating bearish momentum.

Key Observations and Potential Entry Points:

Liquidity Area (Resistance/Potential Retest Zone): -The yellow shaded area marked "Liquidity Area (Gold can Retest)" between approximately 3330 and 3348 acted as a strong resistance zone after the initial drop.

Potential Entry (Short): If the price were to rally back into this "Liquidity Area" and show clear signs of rejection (e.g., bearish candlestick patterns like pin bars, engulfing patterns, or failure to break above it), it would be a strong point to consider a short (sell) entry. The red arrow indicates this possibility.

Rejection Zone (Current Resistance): - The yellow shaded area marked "Rejection Zone" around 3310-3319 is currently acting as a significant resistance. The price has attempted to break above it multiple times and has been rejected.

Potential Entry (Short): This area also presents a potential short (sell) entry if the price retests it and shows clear signs of rejection. The current candle is below this zone, indicating the rejection has already occurred.

"Sell Below this Area" (Breakdown Point): - The blue shaded area around 3293.51 - 3287.80 is highlighted as a critical support level.

Strong Point to Enter Trade (Short): - The chart explicitly labels this as "Sell Below this Area." If the price breaks convincingly below this support level (with strong bearish candle close below and follow-through), it would be a high-conviction short (sell) entry point. This indicates a potential continuation of the downtrend to lower targets. The red arrow signifies this downward move.

RSI (Relative Strength Index): - The RSI (14) is currently at 28.33. This indicates that Gold is approaching or is in oversold territory. While oversold conditions can sometimes precede a bounce, in a strong downtrend, prices can remain oversold for extended periods. It's crucial to combine RSI with price action. If the price breaks below the "Sell Below this Area" with an already oversold RSI, it might suggest a strong bearish momentum overwhelming any immediate bounce.

Trade Entry Strategy Summary:

Aggressive Short Entry: Consider a short if the price retests the "Rejection Zone" (3310-3319) or the higher "Liquidity Area" (3330-3348) and shows clear bearish rejection.

Confirmation Short Entry (Strongest Signal): The most robust short entry highlighted is a confirmed break and close below the "Sell Below this Area" (3293.51 - 3287.80). This would signal a continuation of the bearish momentum.

Important Considerations:

Risk Management: Always define your stop-loss order (e.g., above the rejection zone or above the breakdown level) to limit potential losses.

Target Levels: While not explicitly marked with targets, after a breakdown, look for previous swing lows or significant psychological levels as potential profit targets. The red line at 3274.98 could be an initial target if the "Sell Below this Area" is breached.

Confirmation: Always wait for candlestick confirmation (e.g., a strong bearish close) before entering a trade.

Timeframe: This is a 2-hour chart. The analysis is valid for this timeframe, but always consider higher timeframes for broader trend confirmation.

News/Fundamentals: While this is a technical analysis, be aware of any upcoming economic news or events that could impact Gold prices.

In conclusion, the chart strongly suggests a bearish bias for Gold, with key resistance zones above and a critical support level below that, if broken, could lead to further significant downside.

Disclaimer Warning - Do your own research before trading in Gold, we are not responsible for your loss...

XAUUSD GOLD buy holdXAUUSD GOLD BUY NOW – LONG TRADE SETUP ACTIVE 🟡📈

Gold has pulled back to a key support area and is now showing signs of strength at the current price of $3301.

This zone is acting as a strong base for buyers, signaling a potential bullish continuation in the coming sessions.

We are entering a LONG position with a favorable risk-to-reward ratio, supported by market structure and technical confirmation.

🔹 Current Price: $3301

🎯 Target Levels: First target at $3350, extended target at $3400+

🛑 Stop Loss: Recommended below $3275 to protect capital

As long as price holds above the support zone, bulls remain in control.

Patience, discipline, and proper risk management are key — let the trend do the work.

Gold is poised for upside — time to ride the wave!

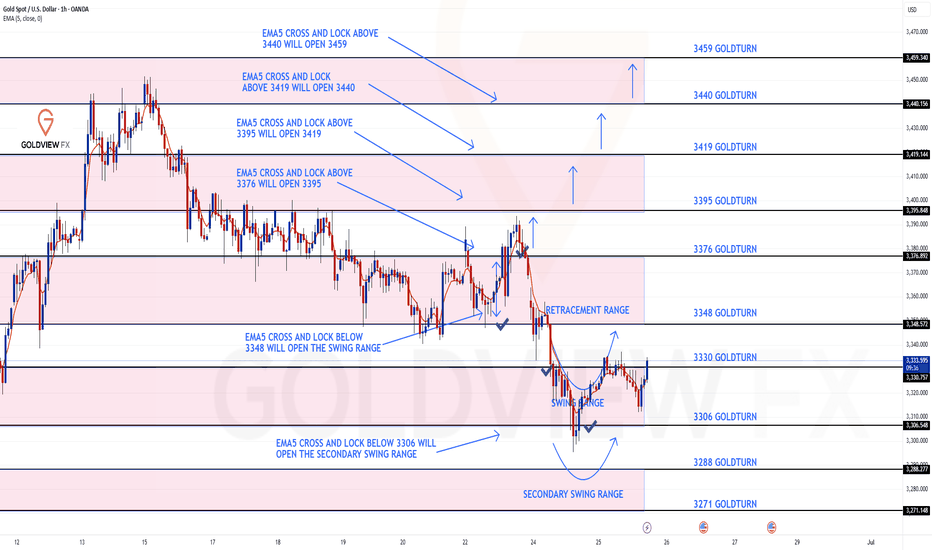

GOLD ROUTE MAP UPDATEHey Everyone,

Another smashing day on the charts with our levels being respected perfectly inline with our plans to buy dips.

After completing our bearish 3348 and bullish 3376 target we had the cross and lock above 3376 leaving a gap to 3395, which fell short just by few pips.

We then had the cross and lock below 3348 opening the swing range, which was also hit perfectly. We got the perfect bounce, just like we analysed allowing us to buy dips and now seeing the swing range carry out the move. We will see if this is completed for the full swing range 3348.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3376 - DONE

EMA5 CROSS AND LOCK ABOVE 3376 WILL OPEN THE FOLLOWING BULLISH TARGETS

3395

EMA5 CROSS AND LOCK ABOVE 3395 WILL OPEN THE FOLLOWING BULLISH TARGET

3419

EMA5 CROSS AND LOCK ABOVE 3419 WILL OPEN THE FOLLOWING BULLISH TARGET

3440

BEARISH TARGETS

3348 - DONE

EMA5 CROSS AND LOCK BELOW 3348 WILL OPEN THE SWING RANGE

3330 - DONE

3306 - DONE

EMA5 CROSS AND LOCK BELOW 3306 WILL OPEN THE SECONDARY SWING RANGE

3288

3271

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

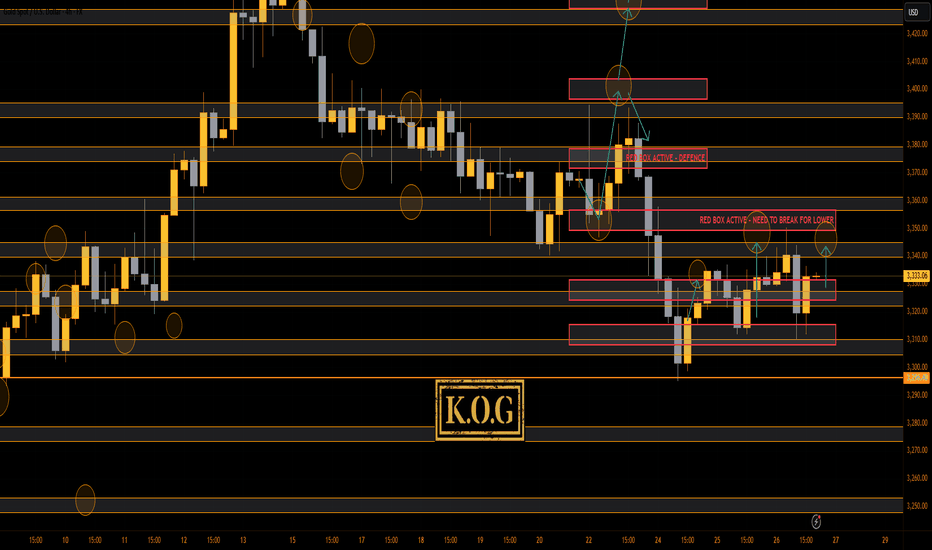

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Again, just like yesterday, we completed the long trade into the red box, RIPPED then played red box hockey before swooping the low and coming back up. What madness on the markets with continuous whipsawing which is not allowing traders to hold positions without huge stop losses.

For now, we have support at the 3325-8 level which if held should give us a move upside towards the red box. What we want to see here is do we get a lower high or not?

MA's still drawn together and more choppy price action expected in the sessions to come.

As always, trade safe.

KOG

H1 pullback in bullish H4 marketThe market is at a point where we must sell, it's at a maximum of Elliott Waves, wave 5 is already extremely extended, so prepare for a mega drop of several weeks while everyone continues to buy at the lows, it will continue to go down. In summary, we have a bullish market on H4, now there will be a correction on H1, that is, a bearish trend on H1 for several weeks; it is not an ABC, but 5 bearish waves.

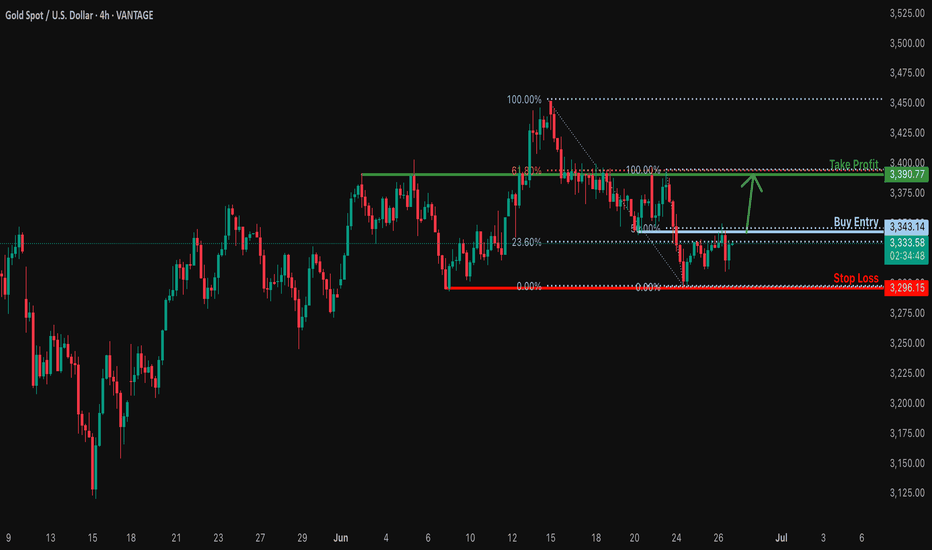

Bullish breakout for the Gold?The price is reacting off the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and a breakout of this level could lead the price from this level to our take profit.

Entry: 3,343.14

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 3,296.15

Why we like it:

There is a pullback support level.

Take profit: 3,390.77

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.