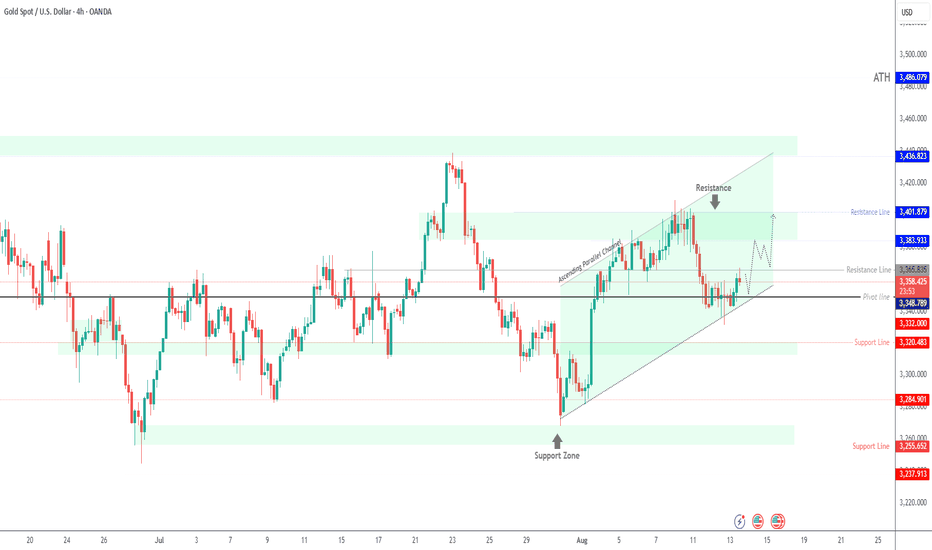

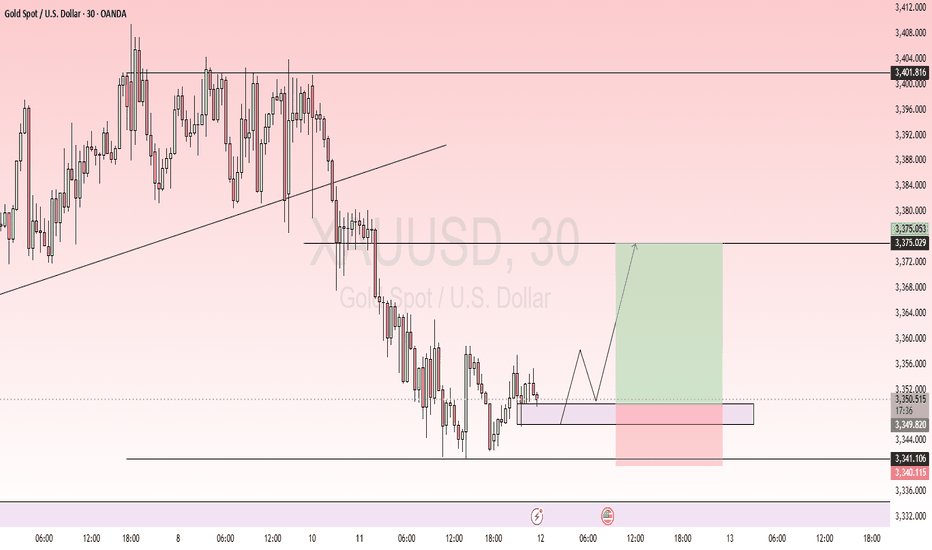

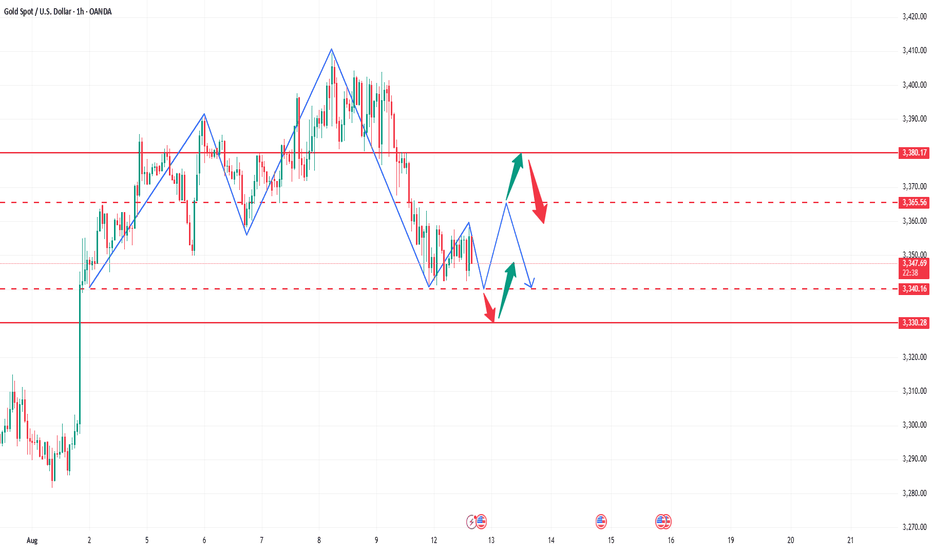

Gold | Range-Bound Ahead of Key Breakout – Pivot at 3355Gold Futures Rise on U.S. Interest Rate Cut Optimism

Optimism for a September rate cut is growing following softer consumer price index data and a weak nonfarm payroll report.

Trade tensions have eased after the extension of the U.S.–China tariff truce, and geopolitical risks have cooled ahead of the upcoming Trump–Putin summit.

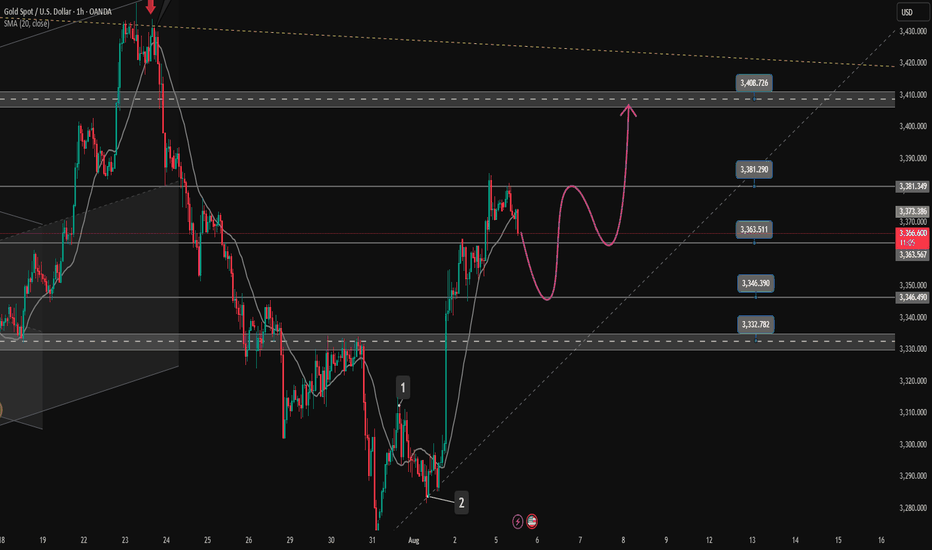

Technical Outlook:

Gold remains in consolidation between 3348 and 3365 until a breakout occurs.

A 1H close above 3365 would signal a bullish move toward 3383 and 3401.

A close below 3348 would open the way to 3332 and 3320.

The outlook for gold remains highly sensitive — positive trade negotiations could pressure prices lower, while rate-cut optimism supports the bullish case.

Resistance: 3365, 3381, 3401

Support: 3348, 3320, 3285

XAUUSD trade ideas

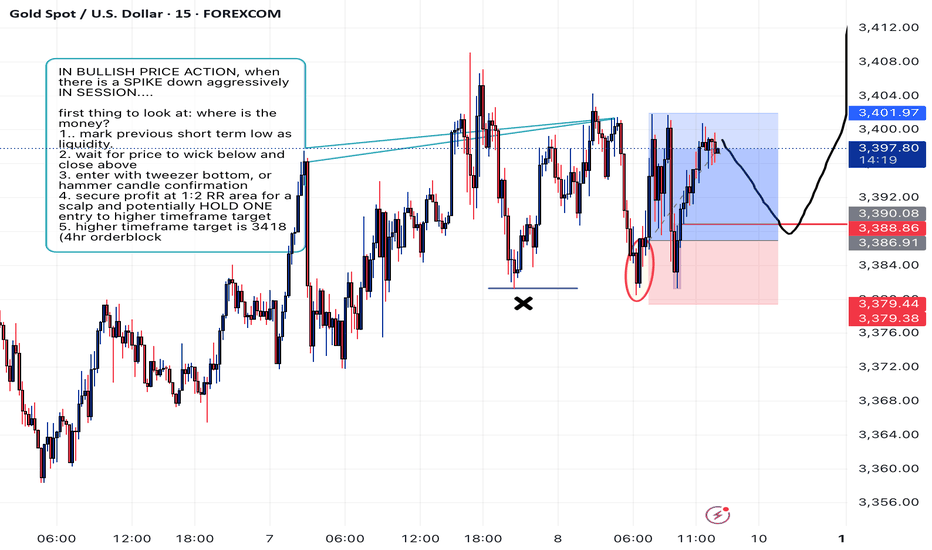

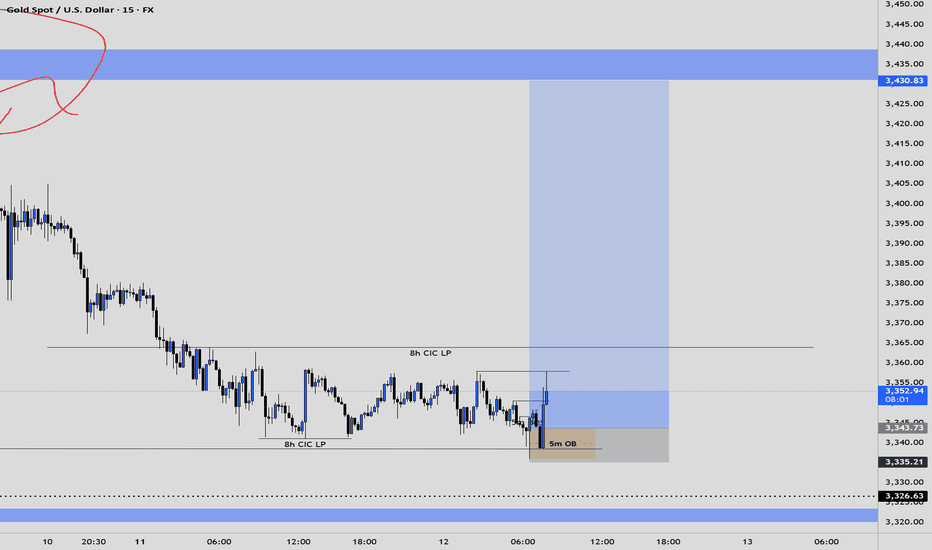

How to Trade Daily Orderflow Continuation Patterns on Lower TFStep 1. Zoom Out and Become Aware of Weekly, Daily, 4HR Orderflow. (a recent orderblock that got smacked)

2. Zoom Into Lower timeframe and Mark previous lows as liquidity.

3. During Major Session (New York or London) wait for price to move aggressively OPPOSITE of your bias. when this occurs set an alert below the Low or watch it.

4. when price wicks below the low and closes above, wait for CANDLE CONFIRMATION. study Japanese candlestick patterns: hammer, bullish engulfing, doji.

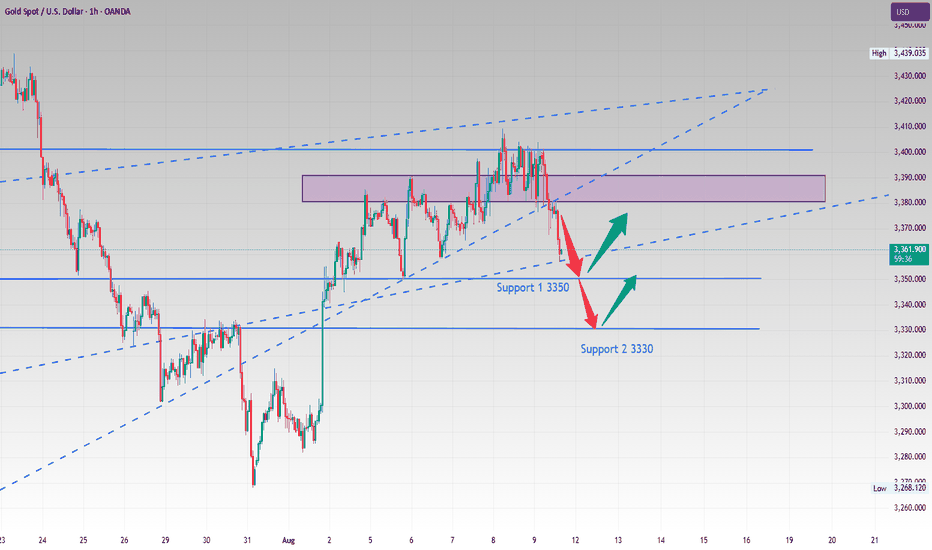

Wait patiently, 3350 is the key, if it falls below, look at 3330Gold experienced frequent fluctuations last Friday night. After opening today at around 3,400, it quickly fell back. Gold has already fallen below last Friday's low. 🐻

It is expected to retrace to test the support level of 3357-3350 today📈. If the support level is not broken, the bulls may rebound at any time.🐂

If it unexpectedly falls below, it may accelerate its decline to around 3330📉, where there is also support, and you can go long in the short term when it approaches📊.

On the whole, the main strategy during the day is to go long based on support and callback. If it touches 3357-3350 for the first time, you can consider going long with a light position.✅

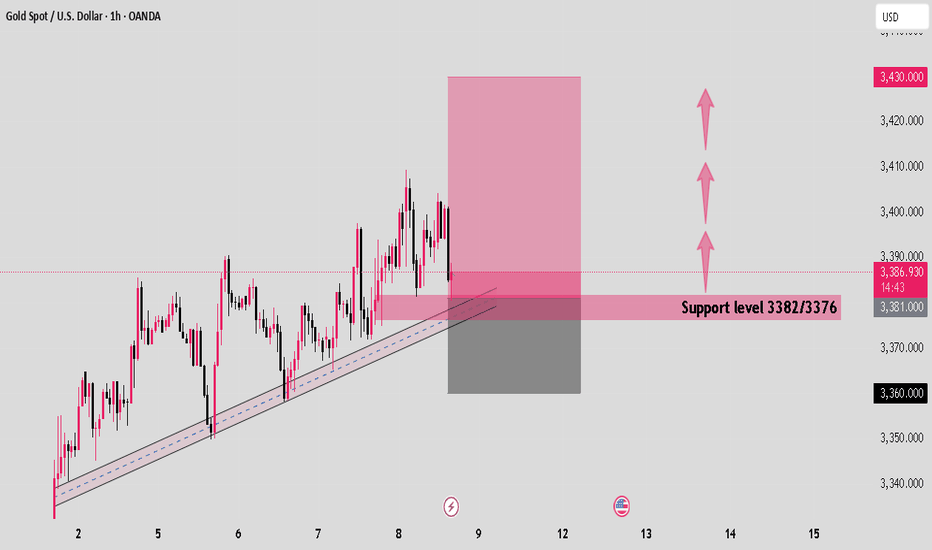

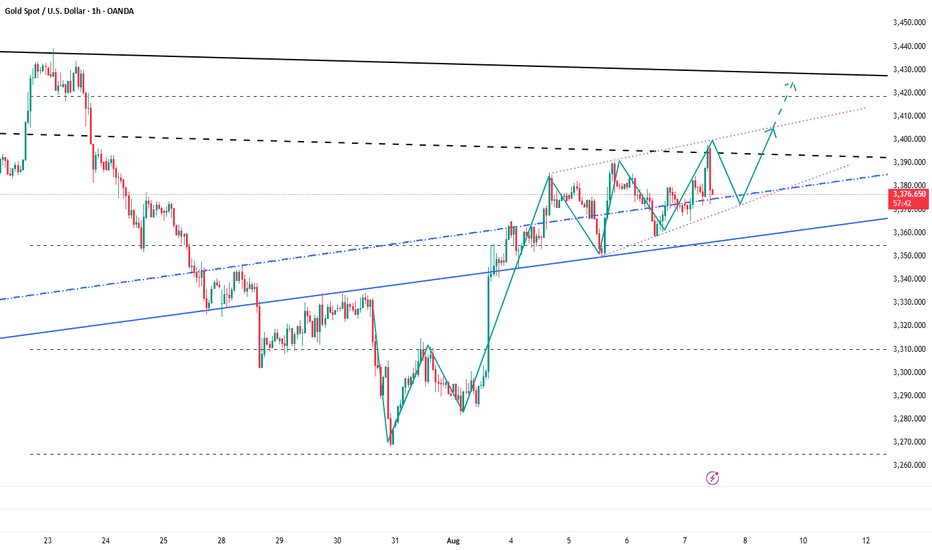

Gold targets 3430 - Bulls in controlHello IGT FOLLOWERS

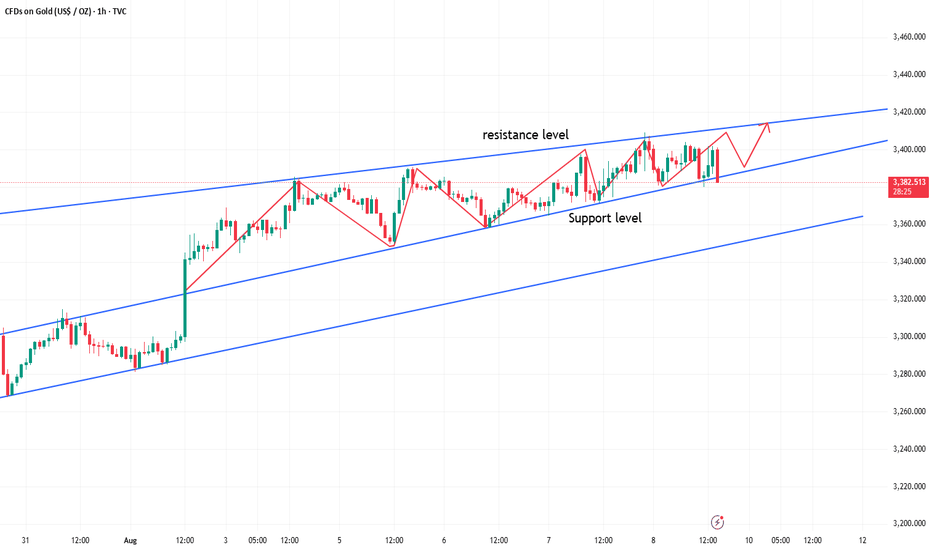

Here is my Gold overview, From last couple of days gold is respecting the trend line very well in the upwards, Gold is now working on a trend line's support area around 3382/3376. Indicating strong bullish momentum. A break of 3410 could confirm further upside till 3430..

Key points :

Entry point : 3381

Support Area : 3382/3376

Follow me for more latest updates and signals

Gold Gains Amid USD Weakness📊 Market Overview:

Gold rose modestly as the U.S. dollar weakened following softer-than-expected July CPI data, increasing the likelihood of a Federal Reserve rate cut in September. Geopolitical tensions surrounding the Trump–Putin meeting and ongoing trade war developments further supported demand for safe-haven assets like gold.

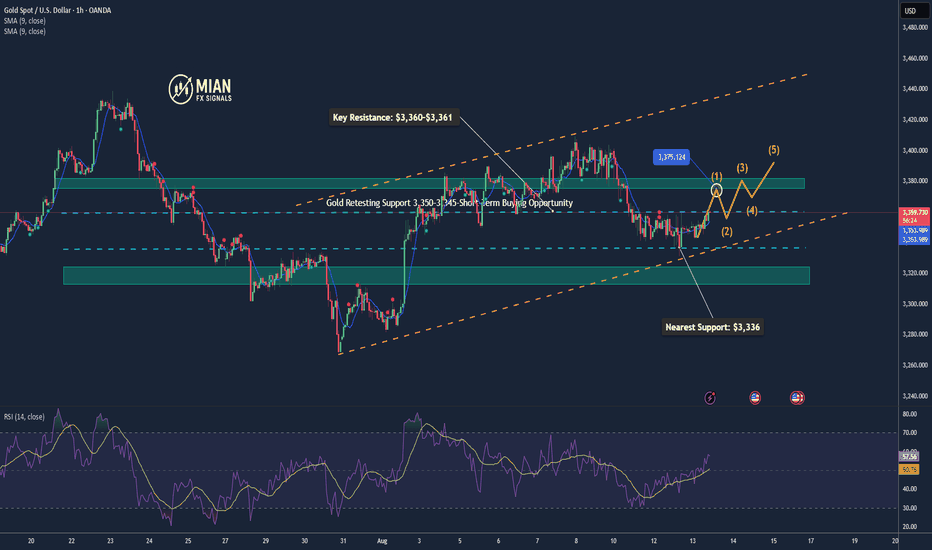

📉 Technical Analysis:

• Key Resistance: $3,360–$3,361 (near EMA50 area), $3,375–$3,380 (major resistance zone, 0.618 Fibonacci & option barrier)

• Nearest Support: $3,350–$3,351 (break below may lead to downside at $3,325), additional supports at $3,336, $3,324, $3,313

• EMA: Short-term trend neutral, slight bearish bias near resistance

• Candlestick / Volume / Momentum: RSI on H1 around 45–50 (neutral), volume declining, possible upcoming breakout

📌 Outlook:

Gold may continue to edge higher in the near term if it breaks resistance at $3,361 with strong volume and the USD remains weak. Otherwise, failure to surpass $3,375–$3,380 could lead to pullback toward support at $3,350 or further down to $3,330–$3,325.

________________________________________

💡 Suggested Trading Strategy:

🔺 BUY XAU/USD

Entry: 3,320 – 3,323

🎯 TP: 40/80/200 pips

❌ SL: 3,317

🔻 SELL XAU/USD

Entry: 3,375–3,378

🎯 TP: 40/80/200 pips

❌ SL: 3,381

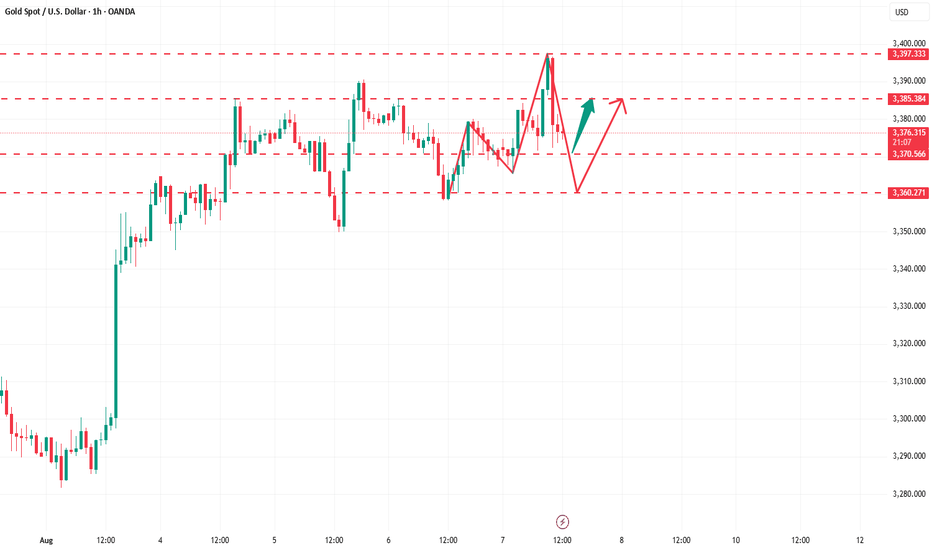

Only look for BUY signal points in the current trend of Gold✏️The D1 candle closed with strong bullish force at the end of the day. The gold trend is still increasing wave 3 and there is no sign of correction. The reaction around 3385 in the Asian session this morning is being awaited to see if it is a recovery of Gold or not. The BUY strategy at important support zones is still maintained and pay attention to the price reaction of the candle.

📉 Key Levels

Support 3363-3346-3332

Resistance 3385 - 3407

Buy trigger: Confirmation of buying candle at support zones 3363-3346-3333

Target: 3400.00

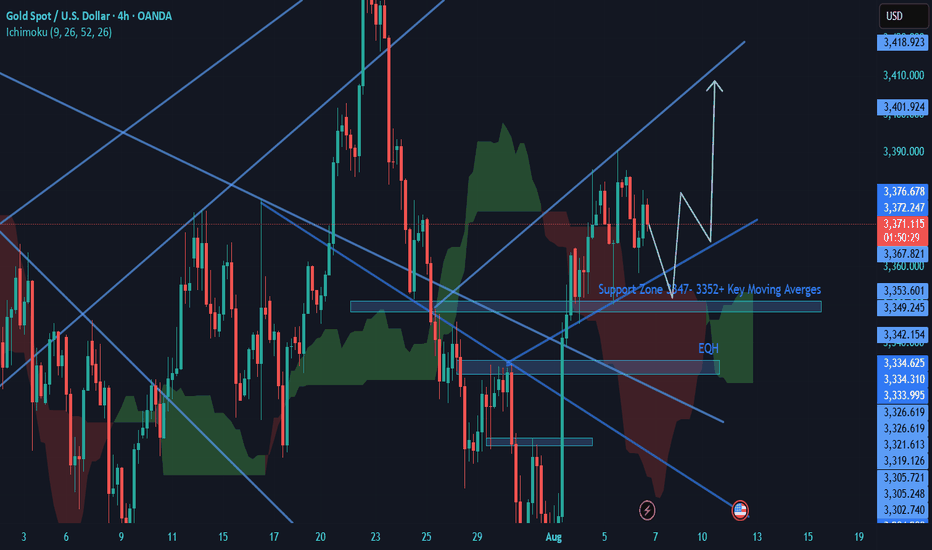

Gold Regained Bullish MomentumGold Technical Update:

Gold is currently exhibiting a bullish market structure, forming a bullish flag pattern on both the 4H and Daily timeframes, alongside an ascending triangle formation. Once this pattern completes, a breakout above the 3390 resistance is likely, potentially pushing the price toward the 3400–3430 zone.

Price remains above the Ichimoku Cloud, which indicates continued bullish momentum and provides a strong support zone around 3345–3352, reinforced by moving averages and structural support levels.

Today, the price has made a higher low at 3358, compared to the previous day’s low, suggesting strength in the current uptrend. A break above the psychological level of 3400 is anticipated, which could trigger bullish continuation toward 3430.

In light of the current technical setup, I maintain a bullish outlook, expecting the trend to continue. However, this view will be reassessed if price breaks below the daily lows of Tuesday and Wednesday, and closes below the 50-day moving average.

Good luck and trade safe!

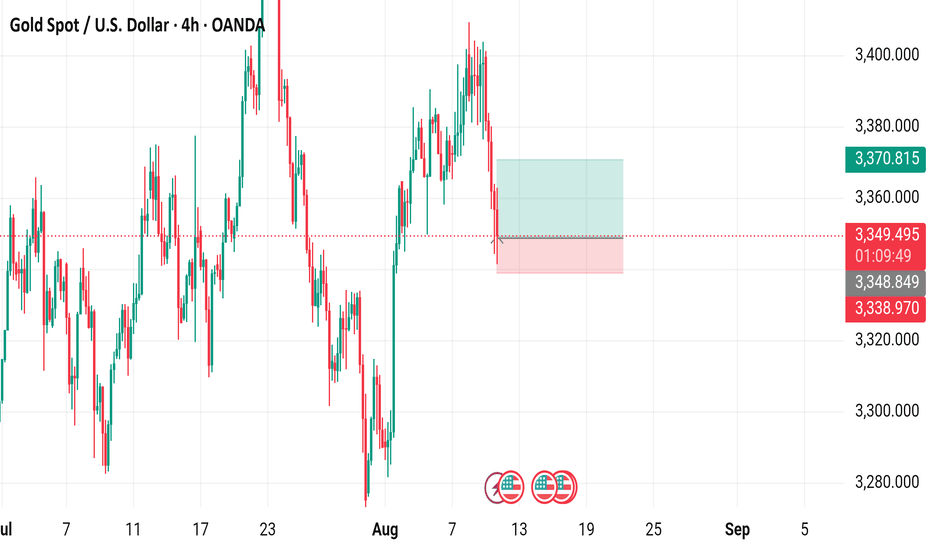

Gold Spot / U.S. Dollar (XAUUSD) 4-Hour Chart - OANDA4-hour price movement of Gold Spot (XAUUSD) against the U.S. Dollar, sourced from OANDA. The current price is $3,349.050, reflecting a decrease of $48.715 (-1.43%) as of 01:11:40. Key levels include a sell price of $3,348.830 and a buy price of $3,349.380, with a highlighted support zone around $3,348.849 and a resistance zone near $3,370.815. The chart covers the period from early August to mid-September 2025.

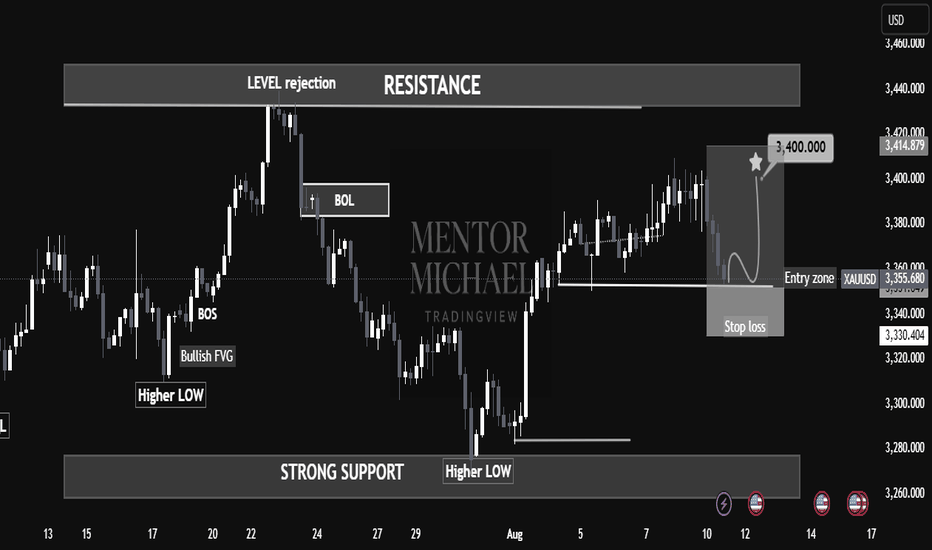

"Gold’s Next Big Move? The Hidden Entry Zone Smart Money "Gold’s Next Big Move? The Hidden Entry Zone Smart Money is Watching!"

Gold (XAUUSD) is currently consolidating after a series of higher lows, signaling sustained bullish momentum from the strong support region around $3,280–$3,300. Price has respected key structural points, forming a clean market structure with:

BOS (Break of Structure) confirming bullish intent after reclaiming prior resistance.

Bullish FVG (Fair Value Gap) acting as a liquidity zone for potential re-entries.

Multiple Higher Lows, highlighting strong buyer defense levels.

The chart indicates a possible short-term retracement into the $3,350–$3,357 entry zone, which aligns with demand structure. From this zone, buyers are expected to push toward the $3,400–$3,415 resistance target.

Key technical levels:

Entry Zone: $3,350–$3,357 (demand area)

Stop Loss: Below $3,340 to protect against deeper pullbacks

Take Profit: $3,400 psychological level and $3,414 structural resistance

Market Sentiment:

The combination of a strong support base, sustained higher lows, and bullish imbalance zones suggests a favorable risk–reward setup for long positions. A clean breakout above $3,415 could trigger a larger bullish leg toward the $3,440 resistance zone.

📈 Bias: Bullish above $3,350

💡 Watch for a reaction at the entry zone before committing to positions.

Gold trapped between 3,400.00 and 3,380 zoneAfter bouncing from 3,268.42 zone, Gold have been showing strong bullish momentum until it found itself between resistance zone 3,400.00 and support zone 3,380.00.

Zones to watch:

Support zones:3,800.00⬇️, 3,500.00⬇️

Resistance Zone:3,400.00⬆️, 3,430.00⬆️

🔎BIAS:

🔼Bullish: Break and hold above 3,400.00 could extend gains towards 3,430.00

🔽Bearish: Break below 3,380.00 may lead to 3,350.00 and even deeper pullback towards 3,330.00.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

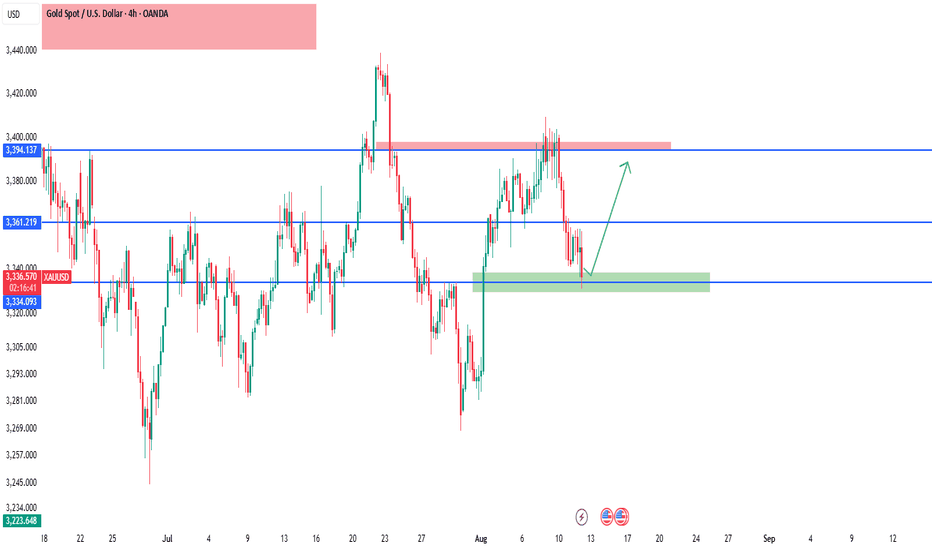

XAUUSD 4H Analysis – Bullish Reversal OpportunityGold is currently trading around $3,336, retesting a key demand zone near $3,334 – $3,340 (green box). This zone has acted as strong support in the past, aligning with a major horizontal level and previous breakout retests.

🔍 Key Levels:

Support Zone: $3,334 – $3,340 (green box)

Resistance 1: $3,361

Resistance 2: $3,394

Major Demand Zone Below: $3,223

📊 Technical Outlook:

Price has pulled back into a strong demand area after failing to break above the $3,394 resistance. If bulls defend this green zone, we could see a bounce toward $3,361 and potentially $3,394. A clean break above $3,394 could open the door for a retest of the $3,420+ zone.

However, if this demand zone breaks, sellers could push price lower toward $3,223.

💡 Trading Plan:

Buy Entry: Around $3,334 – $3,340 (on bullish confirmation)

Stop Loss: Below $3,323

Take Profit 1: $3,361

Take Profit 2: $3,394

⚠ Disclaimer: This is not financial advice. Always conduct your own analysis and manage risk properly before trading.

#XAUUSD #Gold #Forex #Trading #PriceAction #TechnicalAnalysis #SwingTrade #SmartMoneyConcepts #SupportAndResistance #CommodityTrading

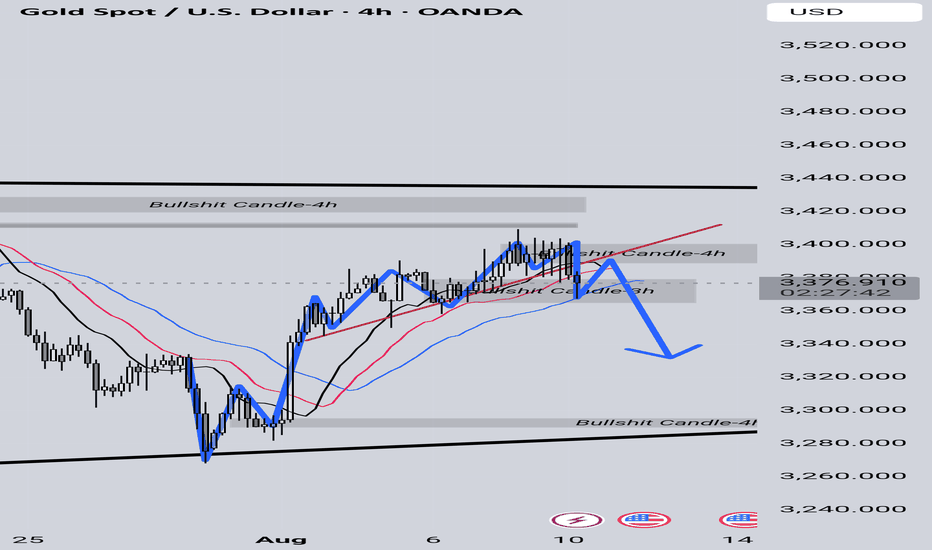

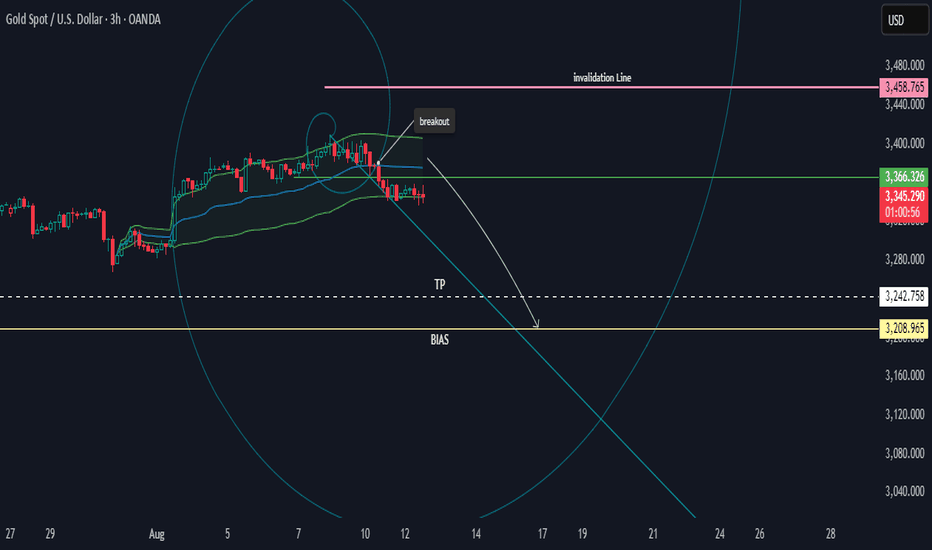

XAUUSD Bearish OutlookXAUUSD seems bearish at the H3 timeframe, hovering above the support line of the VWAP line below its blue centre-line. A drop below 3339.875 could lead to sellers reaching price targets of 3242.758 and 3208.965.

If bulls gain strength and break the 3458.765 level, then the setup will be invalid.

To pips and lots, happy trading,

K.

Not trading advice

Gold once again fell into range consolidation, how to operate inToday, Friday, gold finally closed above 3380 after Thursday's close. It initially surged to a high near 3408 on Friday's opening.

Gold is currently consolidating above 3380.

Over the past two days, gold has largely fluctuated between 3360 and 3360. After closing above 3380 yesterday, the current range has shifted to 3380-3400.

The hourly chart also shows the current range between 3380 and 3400.

Of course, 3380 is currently a significant support level.

If it falls below 3380 again, the range could fall back to 3380-60.

On the other hand, the current resistance above is around 3400 points.

If it stabilizes above 3400 (based on today's high, a new high would essentially indicate stability), the subsequent range would become 3400-3450.

This means that after stabilizing at 3400, there's a possibility of continued higher highs.

Of course, gold is currently trading between 3380 and 3400, depending on where it breaks in the US market.

Whichever way the breakout occurs, follow the trend.

Another possibility is that it could continue to consolidate between 3389 and 3400.

If this is the case, then you can simply buy low and sell high within the range.

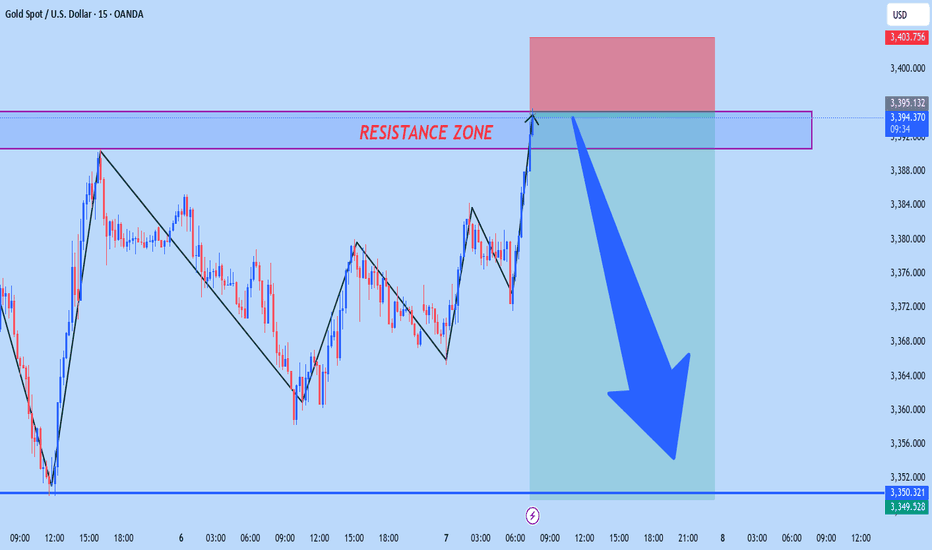

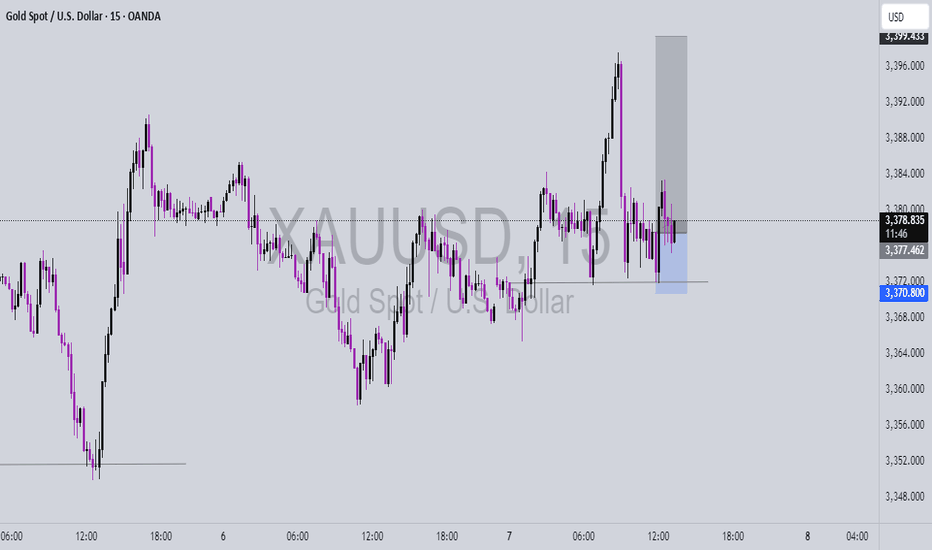

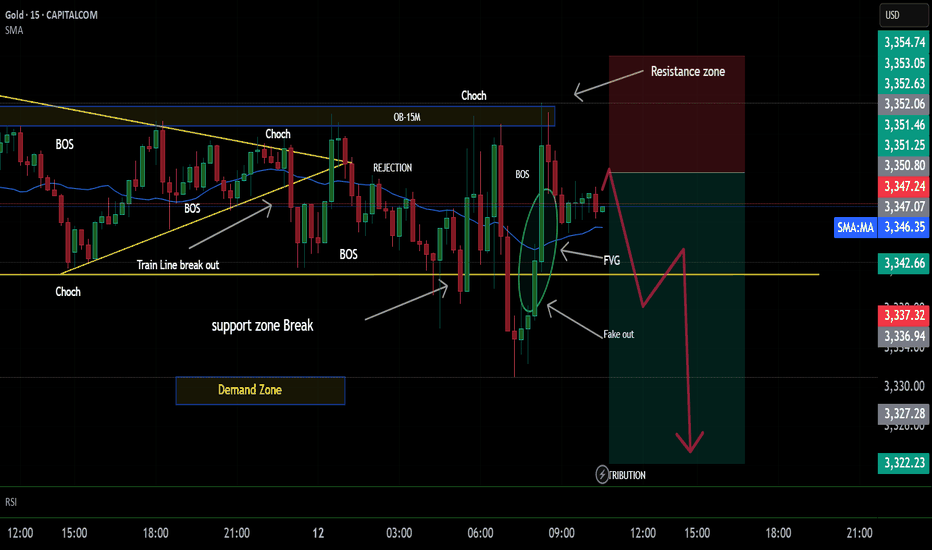

GOLD – Sellers Maintain Control After Resistance RejectionPrice action continues to respect the resistance zone (OB-15M), showing clear buyer weakness and reinforcing the bearish bias.

Key Points:

1. Resistance Rejection – Multiple attempts to break above the resistance zone have failed, confirming strong selling pressure.

2. Market Structure – Consecutive Break of Structure (BOS) and Change of Character (ChoCh) point to sustained bearish momentum.

3. Liquidity Grab – The recent fake out above support collected liquidity before resuming the downward move.

4. Bearish Target Zones:

• First: Mitigate the remaining Fair Value Gap (FVG) in higher timeframes.

• Second: Reach the distribution zone near 3,322 – 3,316.

Conclusion:

Unless price breaks and holds above the resistance zone with strong volume, the path of least resistance remains to the downside, with sellers aiming to fill inefficiencies and reach deeper liquidity levels.

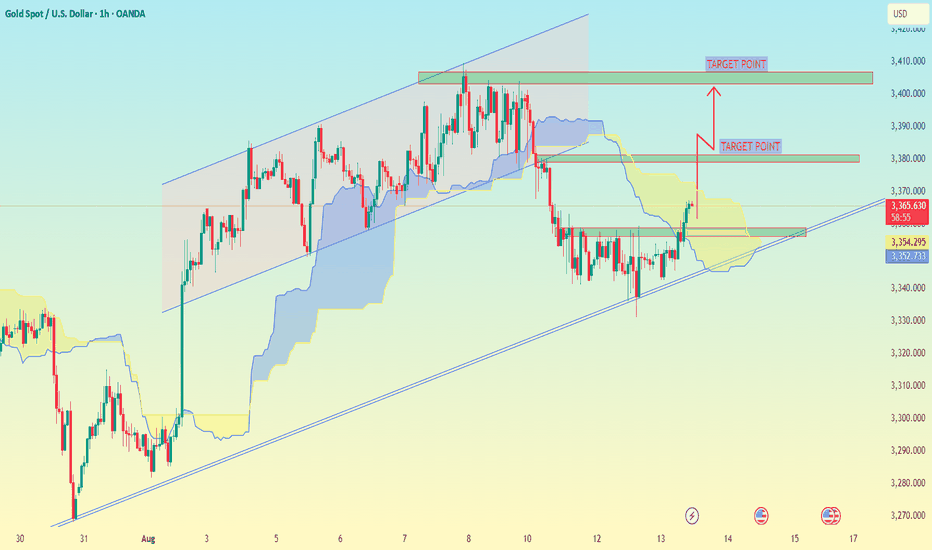

XAU/USD,1h Chart PatternBased on my chart, the two marked resistance zones (target points) for XAU/USD are:

First target: around 3,375 – 3,380 (short-term resistance inside the Ichimoku cloud area).

Second target: around 3,395 – 3,405 (previous swing high and top of the channel).

Since price is trending upward along the ascending trendline and just broke into the Ichimoku cloud, the first target is more conservative, while the second is for a stronger bullish push if momentum continues.

Gold trading rhythm is perfectly matchedIn the previous strategy, we recommended maintaining a high-selling and buying-low strategy for gold. We accurately predicted the high point near 3397 and arranged short positions near 3395. It then fell steadily to around 3371. Judging from the current gold trend, gold rose and then fell in the European session, touching around 3397, which is exactly the pressure level of the upward channel trend line. The Bollinger Bands in the 4H cycle closed, and the indicators temporarily showed signs of differentiation, but the overall market was resistant to declines at high levels. The current short-term support is around 3375-3370. If it does not break the short-term, it will still be volatile. If it falls below, the strong support of 3360 will be seen. The upper pressure levels are 3385, 3398-3400. In terms of operation, we still maintain a high-altitude, low-multiple short-term strategy. I will give the specific operation ideas at the bottom, remember to pay attention in time!

How to correctly grasp the gold trading opportunities?Yesterday, gold showed obvious weakness on the technical side. It fell rapidly after opening, broke through the 3380 mark and showed a narrow range of fluctuations. The decline continued in the European session, further testing the 3360 mark, and the weakening trend was obvious. In the U.S. session, it was under pressure and fell back to break the bottom, forming a medium-sized negative line. The overall gold price showed a unilateral short rhythm. Today, focus on the important support position of 3340-3330. If it falls back and does not break, you can consider short-term long positions, but the overall trend is still dominated by rebound shorting.

The upper resistance on the 4-hour chart is concentrated in the 3365-3380 area. The intraday rebound will continue to short in this range. The main tone remains unchanged. It is recommended to follow the trend and participate in the operation. I will prompt the specific operation strategy at the bottom, so stay tuned.

The gold operation strategy is as follows: short sell when it rebounds to 3365-3380 area, with the target at 3350-3345; if it falls back to 3340-3330 area and stabilizes without breaking, consider going long, with the target at 3355-3360.

Don’t Blink — Gold Charging Toward 3400!Overnight, we entered a long trade at 3365 and successfully closed the trade by hitting TP: 3395, locking in nearly 300pips of profit. This was a very successful and accurate trading strategy.

Just now, gold became very crazy after rising, and plunged directly from around 3397 to around 3372. It was a very scary and crazy diving action. In fact, I am not worried about it. On the contrary, I am very happy that it provides me with another opportunity to enter the market and go long on gold. I've already entered a long position in gold again, as planned, in the 3375-3365 area.

Regarding the recent plunge in gold, I think it was intended to scare off the long positions that were somewhat loose in their intentions. Although gold has fallen sharply, it is still in a recent volatile upward structure. The volatile upward structure has not been destroyed in the short term, so I believe that gold will not have much room for retracement for the time being under the support of the bullish structure. On the contrary, I believe that after gold touches around 3397, even if it is weak, it will try to hit the 3400 mark, and it is even expected to continue the bullish trend to the 3420-3430 area.

There may be many friends in the market waiting for the opportunity to enter the long market at 3350 or even 3340, but what I want to say is that under the support of the gold bull structure, the downward space has been greatly limited. In the short term, gold may not go to such a low position at all, so relatively speaking, I prefer to go long on gold in the 3375-3365 area, and I have indeed done so!