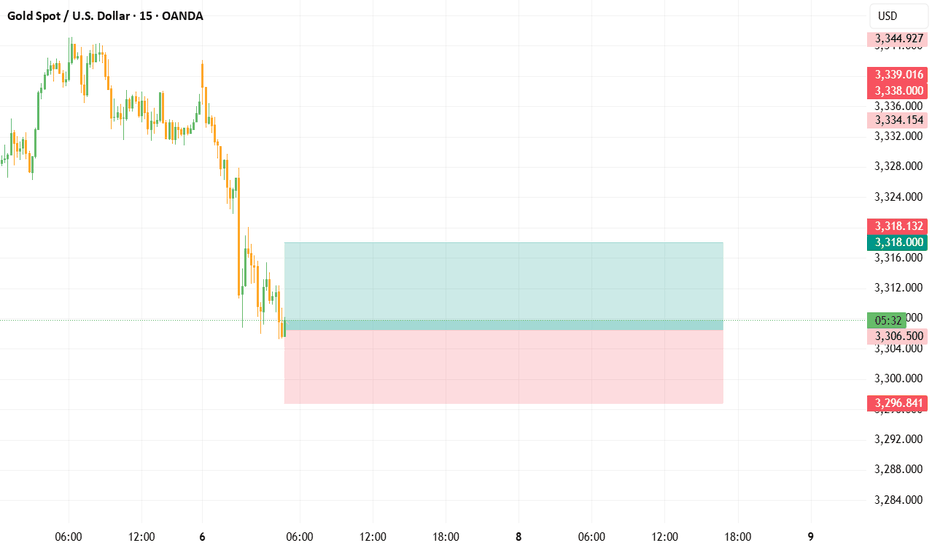

The intraday low has already appeared, so go long on gold boldlyGold unexpectedly fell sharply to around 3287. To be honest, the short position is relatively strong. However, since gold fell below 3000, we can clearly see that gold has shown strong resistance to falling during the decline, and the volatility tends to converge around 3287, proving that the buying support below is strong; and as gold continues to retreat, the off-market wait-and-see funds will be more willing to go long on gold; and some short positions will be more willing to go long on gold after profit taking;

In addition, although the short position is strong, it is difficult to continue in the short term. The intraday decline is basically in place. It is estimated that 3287 is the intraday low, so at this stage, it is inconvenient for us to continue to chase short gold. On the contrary, we can boldly go long on gold in the 3305-3295 area and look at the target area: 3320-3330.

XAUUSDG trade ideas

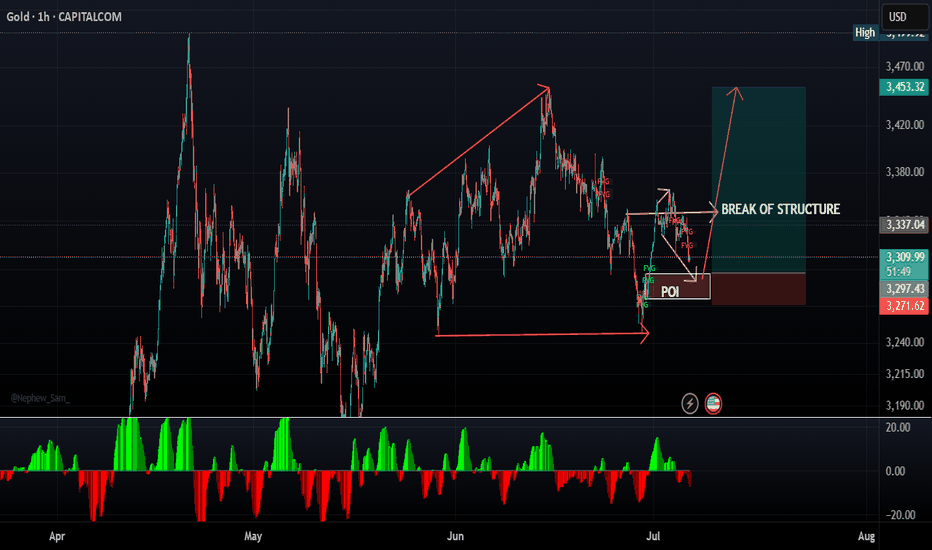

XAUUSD LONG/BUY 1:6RReason for buy

1. Break of structure

2. Corrective structure in play (Running flat)

3. Order block at 3299 levels (POI)

4. Impulsive wave up expected to complete the structure (Expanding flat)

Entry: 3299 (POI)

STOPLOSS: 3272

TAKE PROFIT:

1. 3372

2. 3408

3. 3460

4. 3500

Always use a STOPLOSS

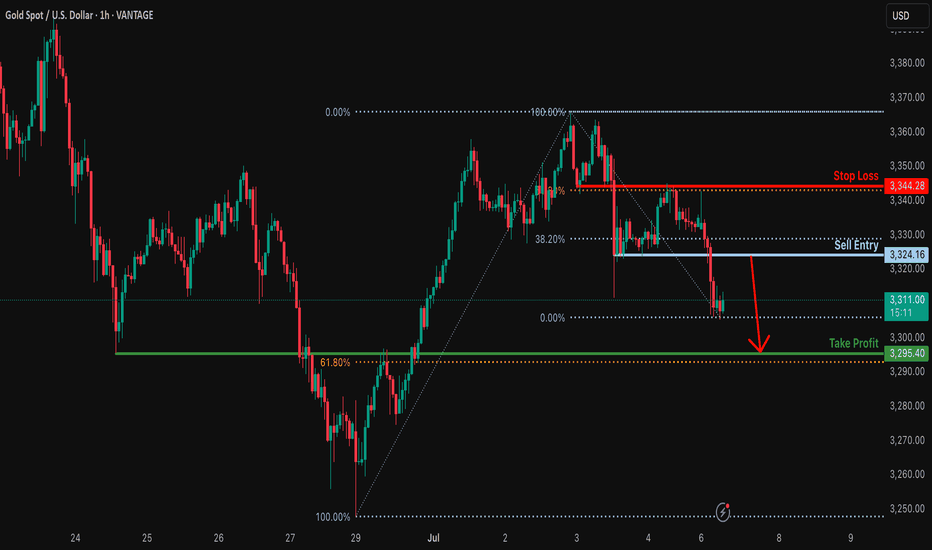

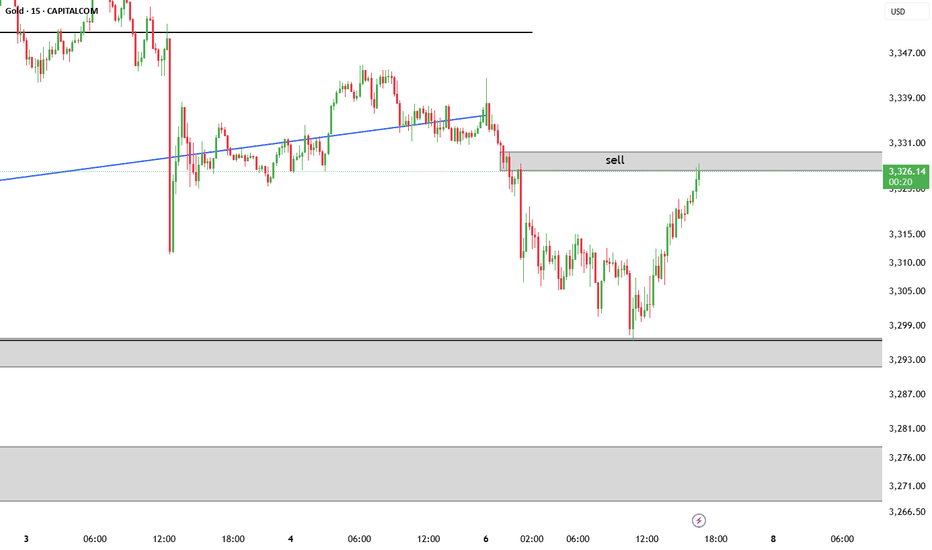

Bearish reversal off pullback resistance?XAU/USD is rising towards the resistance level which is a pullback resistance that is slightly below the 38.2% Fibonacci retracement and could drop from this level too ur take profit.

Entry: 3,324.16

Why we like it:

There is a pullback resistance level that is slightly below the38.2% Fibonacci retracement.

Stop loss: 3,344.28

Why we like it:

There is an overlap resistance level that aligns with the 61.8% Fibonacci retracement.

Takeprofit: 3,295.40

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

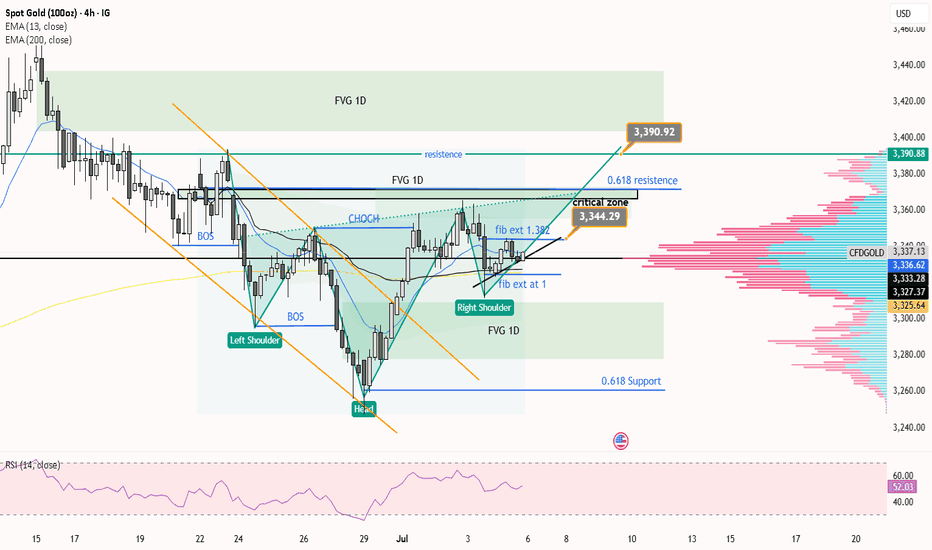

Gold Gaining Strong Bullish MomentumHello Traders,

Let's talk about Gold. Here is what I see for its next moves.

I use these tools to help me:

EMA (Exponential Moving Average)

Fib Ret. & Ext. (Fibonacci Retracement and Extension)

VWAP (Volume Weighted Average Price)

Volume Profile

RSI (Relative Strength Index)

Looking at the big picture, it looks bullish for Gold. I see an inverse head and shoulders pattern forming. Also, the EMA and VWAP are below the price, which is a bullish sign. Gold also broke out of falling wedges and then moved back a little (a retracement), which is another bullish signal.

There is an important area I call the critical zone. This zone is between $3344 and $3364. It's important because it has a Fibonacci extension (between 2 and 1.618), a small FVG (Fair Value Gap) from the 1-day chart, and a resistance level from the 4-hour chart (at 0.618). This critical zone is important on both the 1-hour and 4-hour charts.

My idea is this: If the price of Gold goes above $3344, we can expect it to move higher into that critical zone, maybe up to $3364.

But, if you look very closely, there is also an ascending triangle pattern. This means we need to wait. It's best to wait until the price clearly breaks out (moves up strongly) or breaks down (moves down strongly) from this triangle before you open any trade.

Fundamental analysis:

FOMC Meeting Minutes (July 9):

Impact on Gold: Stronger (less rate cut chance) = Negative/Neutral for Gold. Weaker (more rate cut chance) = Positive for Gold. Volatility expected.

Trump's Tariff Deadline & Announcement (July 9 onwards):

Impact on Gold: New/higher tariffs = Strongly Positive for Gold (safe haven demand). This is the biggest risk/opportunity.

US Dollar ($) Trend:

Impact on Gold: US Dollar is downtrending = Positive for Gold.

US Bond Yields:

Impact on Gold: If yields fall = Positive for Gold. If yields stay high/rise = Neutral/Negative for Gold, but other factors (tariffs, central bank buying) might reduce this negative impact.

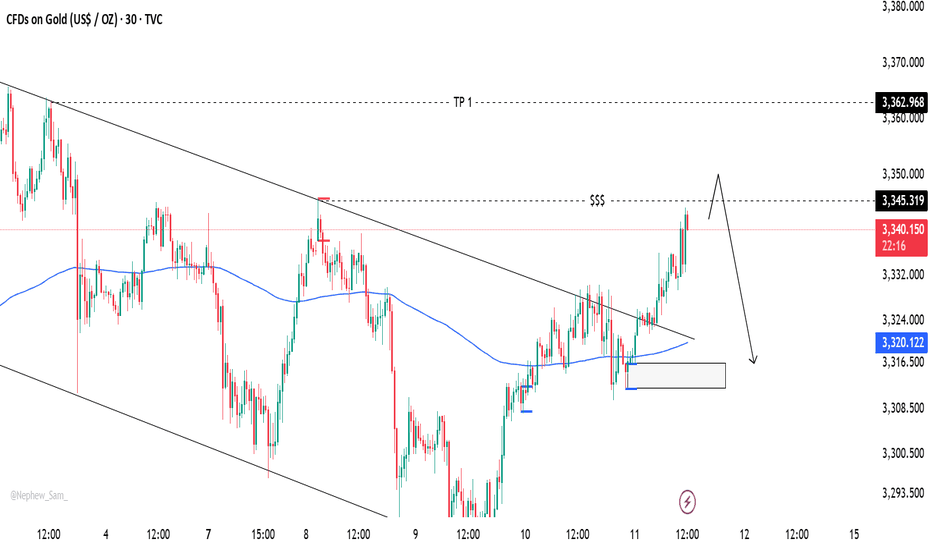

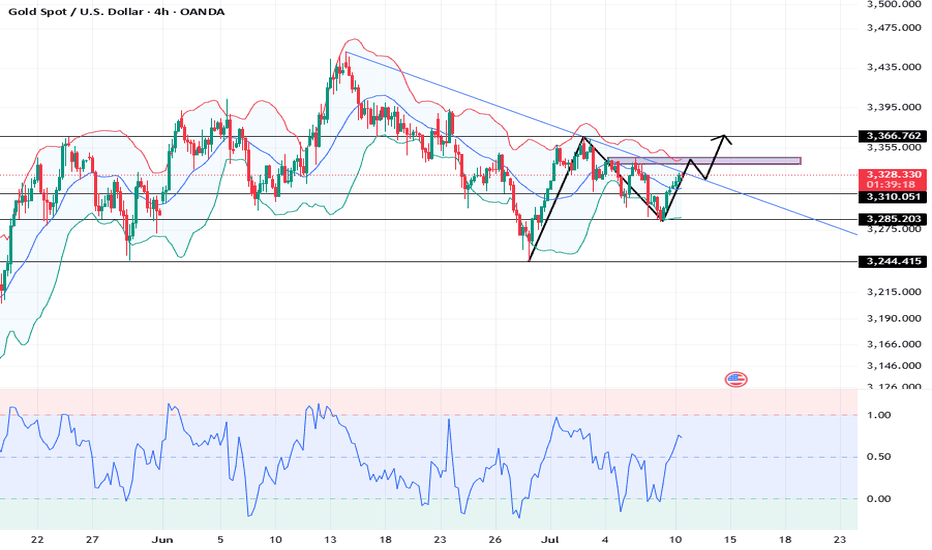

Gold’s Chart Update Next Move: Bullish or Bearish?Gold has shown strong bullish momentum 💪 as it breaks through the descending trendline 📉, positioning itself to target the upper liquidity zone 💰. Right now, we have two key scenarios to watch:

1️⃣ Bullish Scenario: If Gold breaks above the 3345 level and closes a solid candle above it 🔝, we could see a move towards 3360 🚀, signaling further upward potential.

2️⃣ Bearish Scenario: However, if Gold sweeps the 3345 zone and fails to maintain the bullish momentum 🔻, we may see a pullback that could push prices lower 📉.

Stay vigilant 👀 and keep an eye on price action for the next big move! 🔍📊

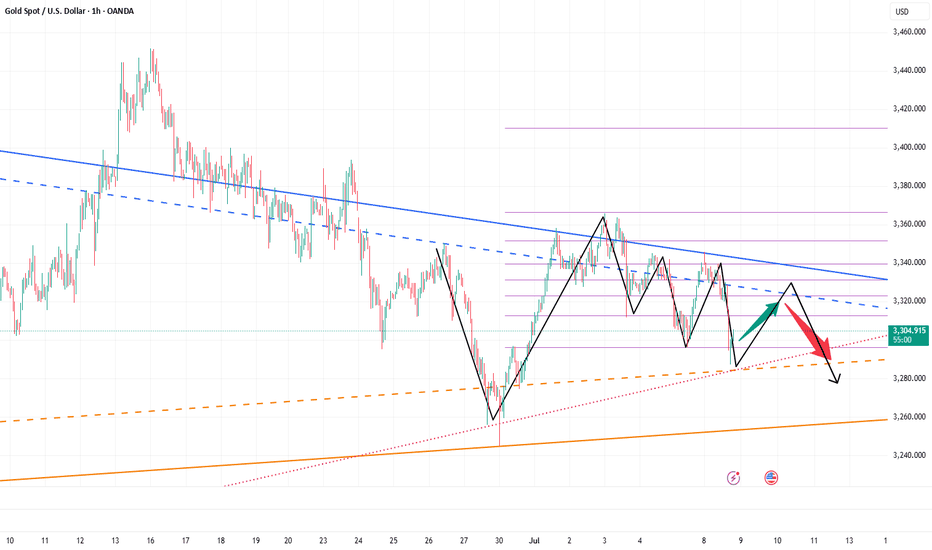

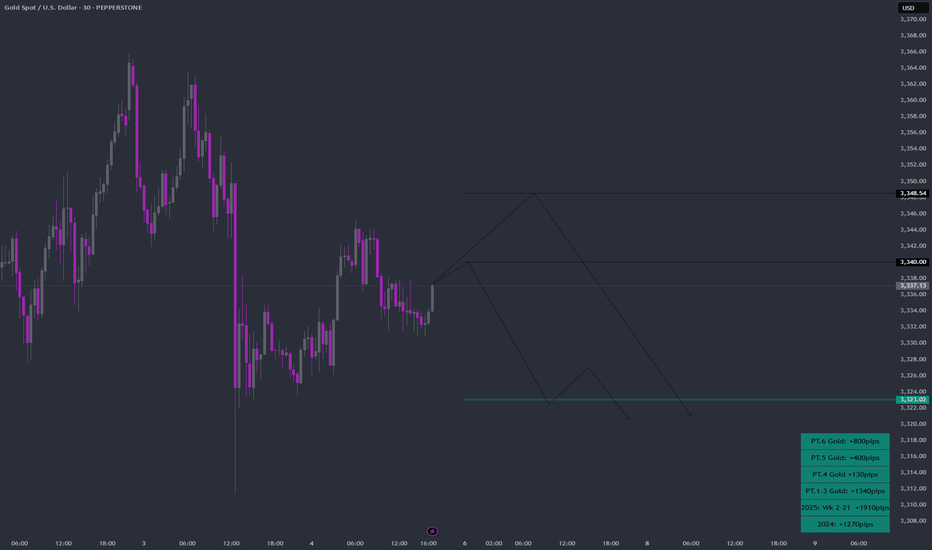

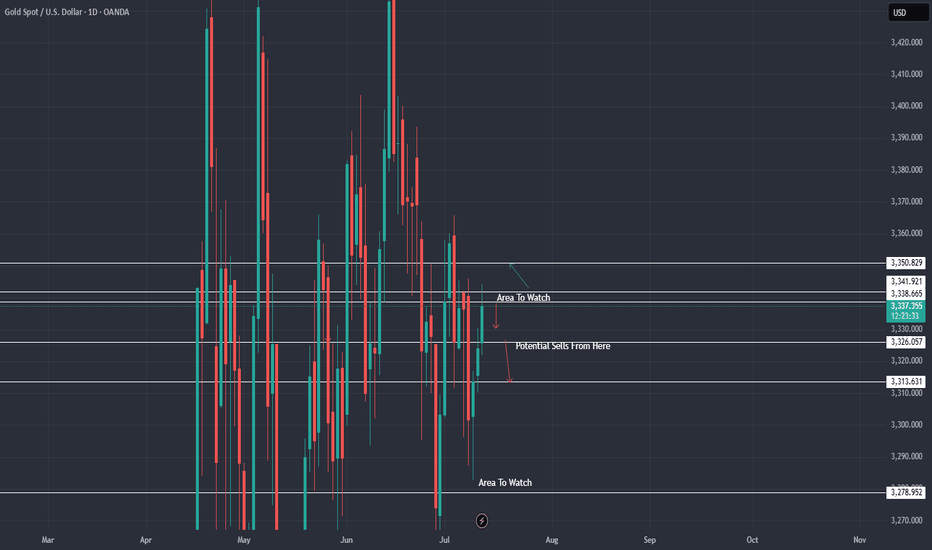

Everybody loves Gold Part 7Great trading last week. Gold really pushing deep into blues.

This week takes a downturn with possibilities highlighted on the chart; all pointing towards LOS (Level of significance). This level is calculated based on previous week high-low values.

Trade parameters:

1. SL: 50-100pips

2. TP: 3-4x SL

3. double tops/bottom (around LOS) are direction changers.

As always price action determines trades

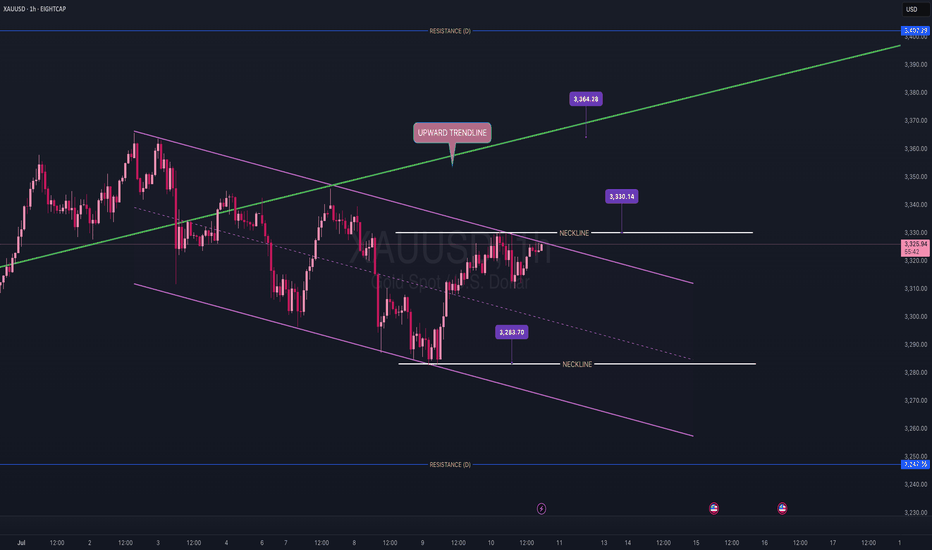

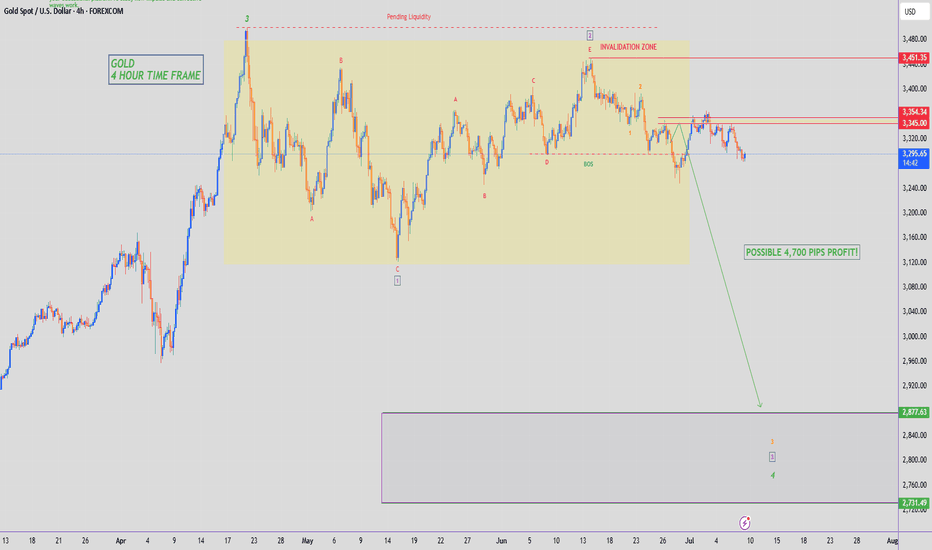

Gold Analysis – Multi-Timeframe OutlookOn the Monthly timeframe, we’ve now seen a clear triple wick rejection, signaling potential downside momentum. After multiple failed attempts to break above the $3,400 level, price action has begun to retrace.

Looking at the 1H timeframe, we’ve broken below the upward trendline, and price continues to push lower. This reinforces the bearish sentiment for now.

That said, if we see a break and close above $3,330, I’ll be watching for a potential retest of the previous trendline near the $3,364 level. Conversely, a break below $3,283 could open the door for further downside toward the $3,247 level.

Heading into Friday, with no significant USD news on the calendar, I’m expecting low volatility and potential sideways movement.

Trade Ideas:

• Sell zone: $3,325 – $3,330

• Buy zone: $3,308 – $3,313

As always, risk management is key — only risk 1–2% of your capital per trade.

Good luck and stay disciplined!

Gold Extends Gains Amid Uncertainty FOREXCOM:XAUUSD

XAUUSD is currently moving within the $3,270 – $3,360 range 📈, holding steady under buying pressure over the last few hours ⏳.

🌏 During today’s Asian and early European sessions, gold climbed to around $3,330 🥇, extending gains as investors monitored trade tensions and absorbed the latest FOMC Minutes 🗂️. A weaker U.S. dollar 💵⬇️ continues to support gold, attracting safe-haven flows 🛡️ amid ongoing market uncertainty.

📊 Meanwhile, the Fed’s June meeting minutes 🪙 revealed disagreements among officials 🤔 on the timing and scale of potential rate cuts 🔻. While most anticipate some easing later this year, views range from cuts as early as July to no cuts until year-end. The Fed maintains a cautious, data-driven approach 🧭, citing tariff-related inflation risks, slowing consumer spending, and a strong labour market as key factors for their policy outlook.

👀 We will continue to monitor gold closely for potential breakout or reversal signals within this range. Stay tuned for updates!

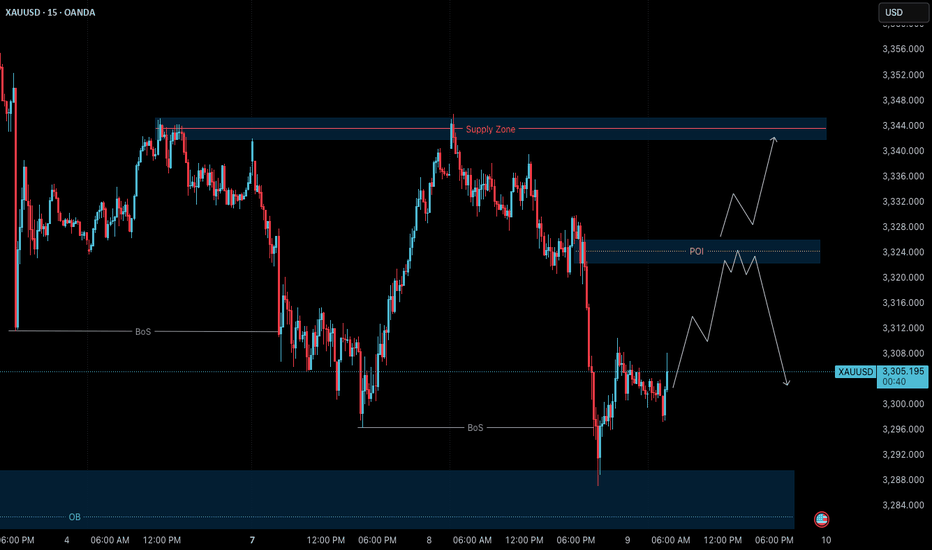

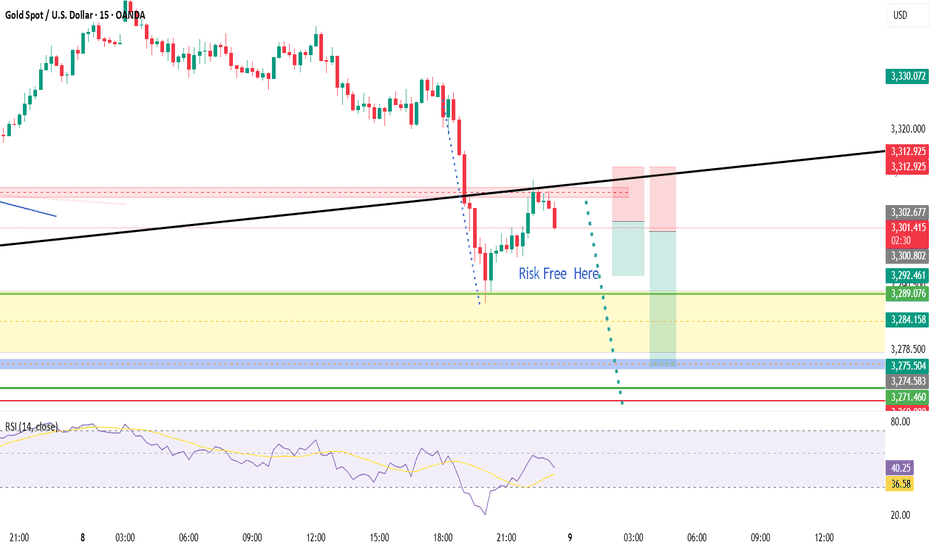

Gold (XAUUSD) – July 9 | M15 Bearish Pullback After H4 OB Tap🟡 Gold (XAUUSD) – July 9 Analysis | H4 OB Tapped, M15 Still Bearish

The market has just tapped into the H4 order block near 3280 (3288–3275) — a level we’ve been tracking closely.

However, price action shows that the H4 pullback is still active and not yet complete.

Yesterday, Gold respected the H4 supply zone (3342–3345) exactly as anticipated.

Since then, price broke below the M15 low at 3296 , confirming that bearish momentum remains valid on the lower timeframe.

🔍 Structure Breakdown

• H4: Pullback ongoing

• H4 OB: 3288–3275 (just tapped)

• M15: Broke below 3296 → Bearish trend continuation confirmed

• Current M15 State: In pullback phase

⚠️ Key Consideration:

While we are looking at bearish opportunities, keep in mind that the H4 OB (3288–3275) is a significant demand zone.

If the market begins to reclaim structure and breaks the Lower High(H4 supply zone), this could signal resumption of the H4 uptrend .

Until that happens, we remain cautiously short — but prepared to adapt.

📌 What We’re Watching

Despite the H4 OB tap, M15 remains bearish until proven otherwise.

So the focus stays on short opportunities — no longs unless structure shifts.

📍 Key M15 POI for Rejection:

→ 3322–3326 (Order Block)

→ If price pulls into this zone and gives M1 confirmation (ChoCh + micro BoS)

→ We’ll plan short setups aligned with current trend

If this zone fails, or structure flips bullish, we’ll wait patiently for a potential revisit of the H4 supply zone (3342–3345) — which remains a valid short area for high-probability setups.

🧠 Summary:

✅ H4 OB (3288–3275) tapped

❌ No bullish reversal yet — M15 still bearish

🔍 Watching 3322–3326 for possible short

📉 Bias: Bearish until structure shifts

But be flexible — if LH breaks, the game changes.

📖 Respect the structure.

The chart doesn’t reverse because you want it to —

It reverses when the market is done moving the other way.

📘 Shared by @ChartIsMirror

XAUUSD – Gold Surges on Safe-Haven Flows and Strategic BuyingXAUUSD is rebounding from the bottom of a descending channel, showing signs of breaking through the short-term resistance around $3,332.700. If price holds above this level, the bullish momentum could extend toward $3,350 and beyond.

On the news front, President Trump's announcement of new import tariffs on multiple countries has triggered safe-haven inflows into gold. Meanwhile, consistent buying from central banks and the ongoing trend of global de-dollarization continue to provide solid support. Unless a major negative shock occurs, gold is likely to maintain its upward momentum in the short term.

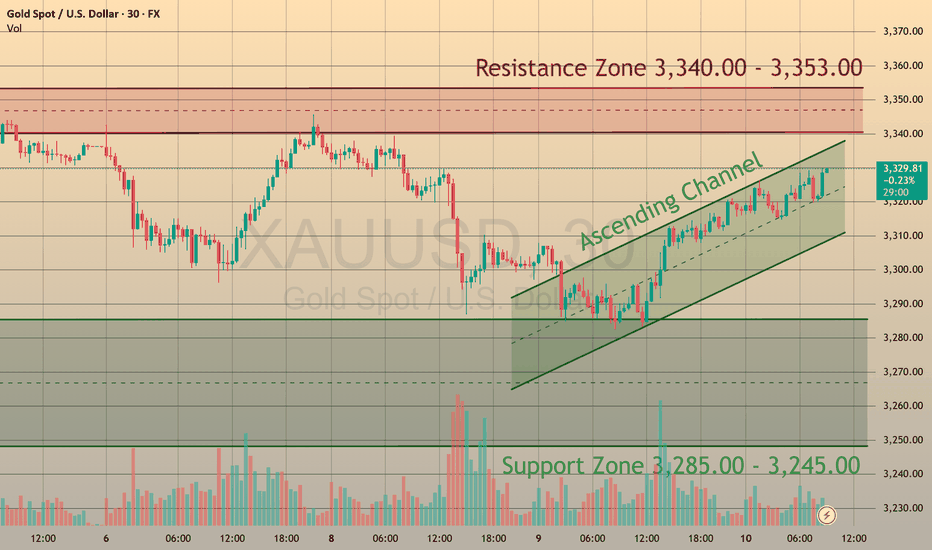

Gold: Market analysis and strategy for July 10.Gold technical analysis

Daily chart resistance level 3345, support level 3245

Four-hour chart resistance level 3340, support level 3285

One-hour chart resistance level 3330, support level 3310.

Yesterday, gold bottomed out and rebounded, standing above 3310, breaking the previous downward rhythm. The breakthrough of the previous opening means that gold is likely to continue to rise. The current market is bullish above 3310. You can buy around 3310. The upper resistance is 3340/45 area. The gold price runs in this area. If the top signal appears at a small level, you can sell.

In terms of intraday operations, it is recommended to sell in the 3340-45 range after rising, and buy when it falls back to 3310. It runs in a narrow range and can be scalped.

SELL: 3343 near

BUY: 3310near

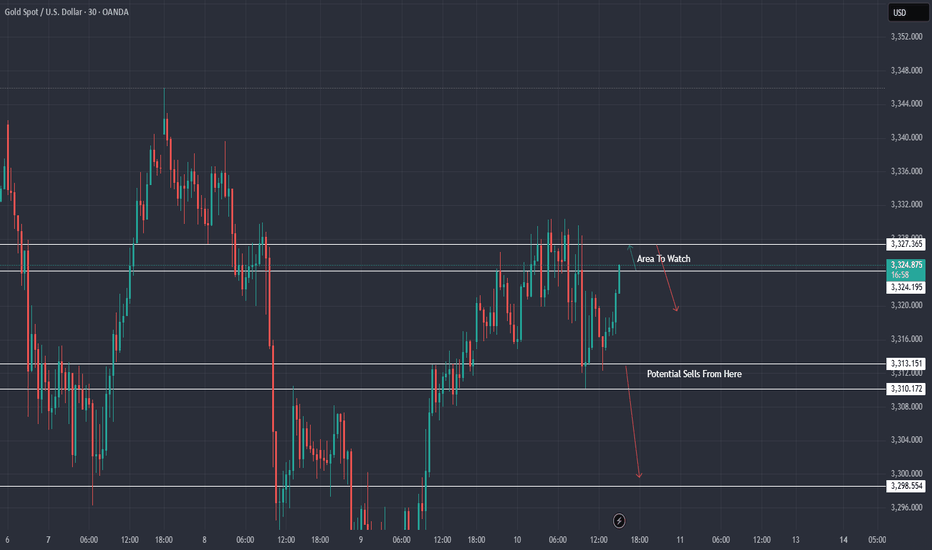

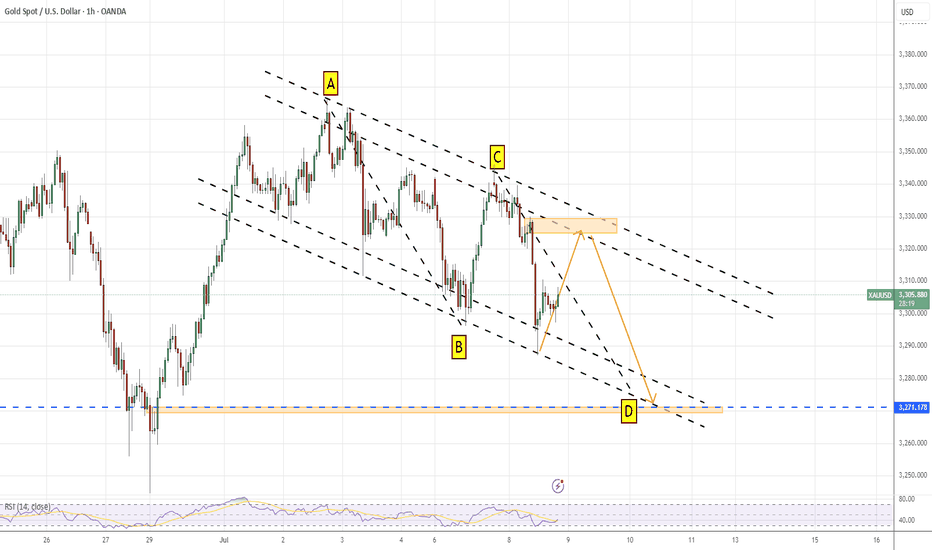

XAUUSD hour chart observationGold's hourly chart is clearly moving within a channel

There is a high probability of a rebound in the short term.

The key position is at the upper edge of the channel.

This happens to be the supply area【3324...3329】 of the hourly chart.

If there is a good reversal signal in the supply zone, you can try shorting.

Things to pay special attention to , If there is no reversal signal,Not suitable for short orders

short term Target:Approximately at the position where AB=CD is completed

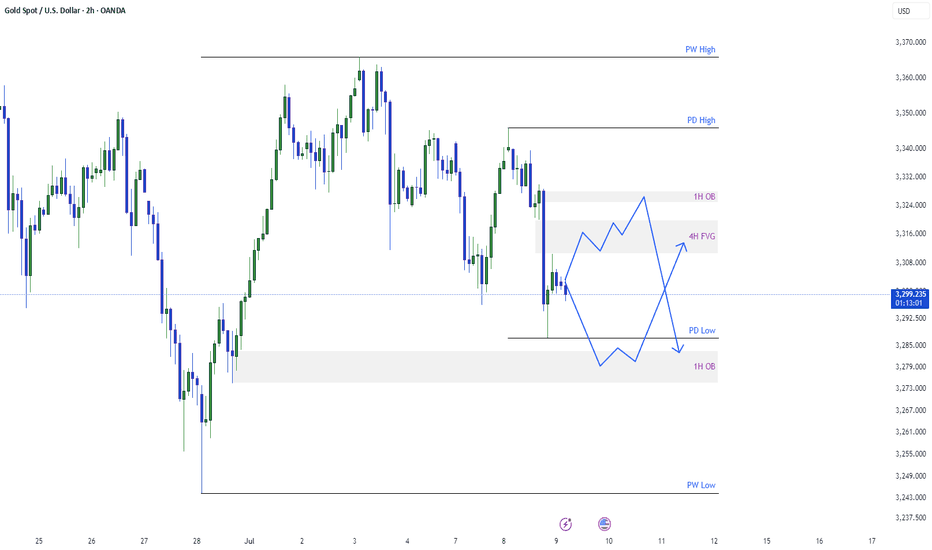

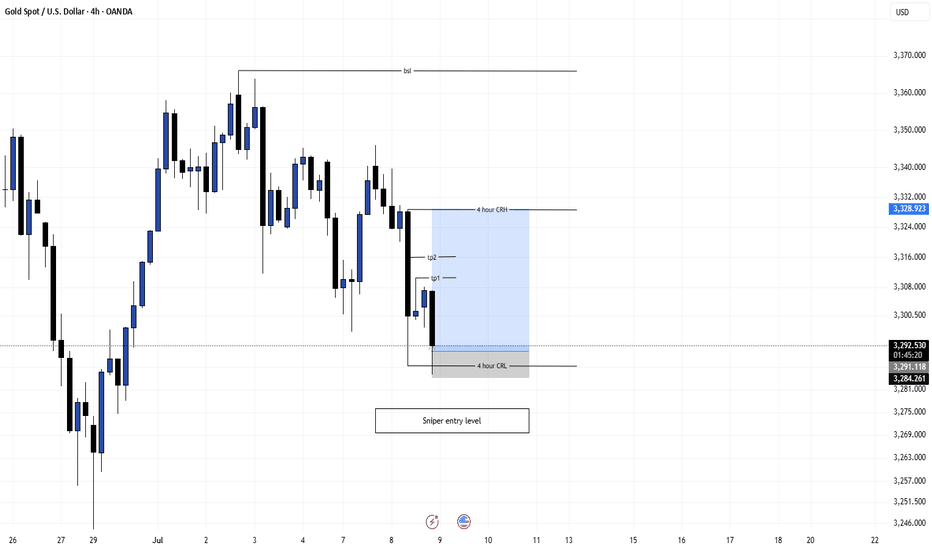

Gold Wants to Go lowerSee my previous analysis for gold I described I will take the low and has taken already. now the daily candle shown good sell. today there are two possibilities. Either gold will have pullback or will go further in sell. I have given both possibilities in my analysis.

For Pull Back: It may take the previous day low and then retraces back to 4 hour FVG or to the order block residing at 3324.

For Further sell : It may pull back to 4 hour FVG and then goes back to take previous day low.

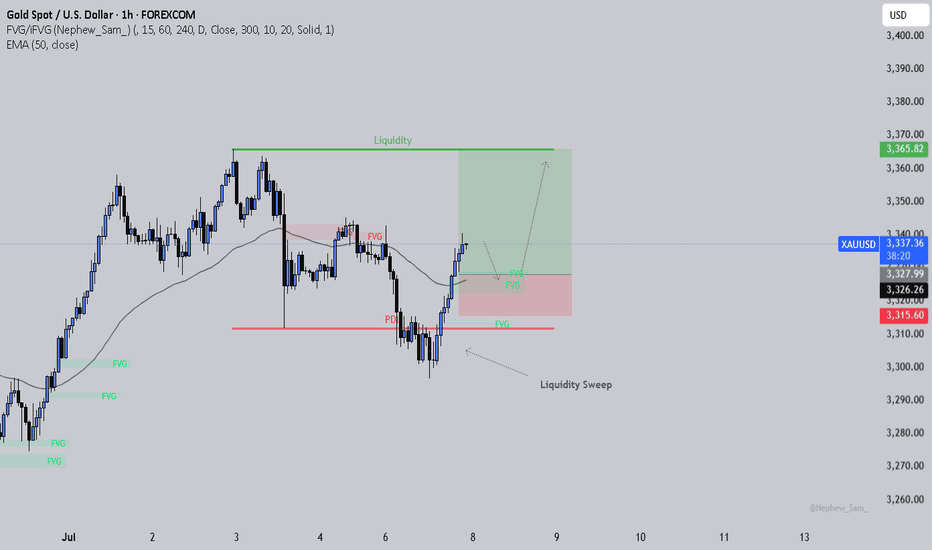

Following Price Flow to the Next TargetPrice swept liquidity below the previous day’s low and then powered back up, breaking structure to the upside. Now it’s sitting above the 50 EMA, moving through fair value gaps left by the rally. I’m watching for a possible pullback into the FVG zone near the EMA. If that level holds, price could look to reach for the liquidity above around 3,365.

But here’s what matters most. Even if this ends up being a losing trade, I’d rather take that loss knowing I stuck to my plan than catch a random win by breaking my rules. Because long-term, winning trades that come from impulse actually set you up for future damage. They teach bad habits.

Losses that happen inside your system? Those are simply the cost of doing business. They protect your discipline and keep your edge intact. Over time, that’s exactly what allows you to stay in the game and grow your account.

XAU / USD Daily ChartHello traders. Here is a daily chart showing the areas I will be watching to see how gold reacts. Wishing everyone a Happy Friday, we are almost halfway through the month, and we are more than half way through the year. Time is moving fast. Hope some of you are holding crypto as the monetary system is flawed, fake and failing. Big G gets a shout out. Let's see how the current 4 hour candle closes, as well as the 1 hour. I will post a lower time frame chart in a few hours when Pre NY volume starts to come in here in the US, which is just under 3 hours from now. Be well and trade the trend. It's Friday, so trade safely.

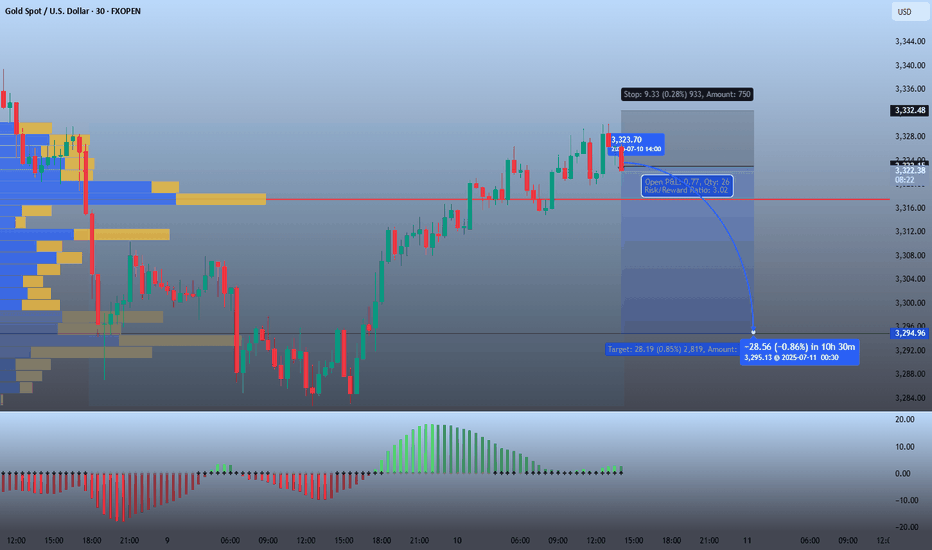

XAU/USD 30-Min Bearish Setup📉 XAU/USD 30-Min Bearish Setup – July 10, 2025

Gold is currently showing signs of short-term exhaustion after a steady climb from sub-$3,300 levels. Price action is stalling just below $3,326, aligning with a low-volume node on the volume profile, suggesting weak continuation momentum.

🔻 Short Setup Parameters:

Entry: $3,323.70

Stop Loss: $3,332.48 (0.28%)

Take Profit: $3,295.13

Risk/Reward Ratio: 1:3.02

Target Move: -28.56 pts (-0.86%)

Expected Duration: ~10 hours

📊 Technical Factors:

Volume Profile: Price is stalling near a previous high-volume resistance band

Bearish Divergence: Histogram shows momentum fading (MACD histogram flattening)

Market Structure: Lower highs and potential intraday double-top forming around $3,326

📌 A break below $3,320 could confirm this bearish bias and accelerate the move toward $3,295 zone. Setup remains valid while price stays under $3,326.50.

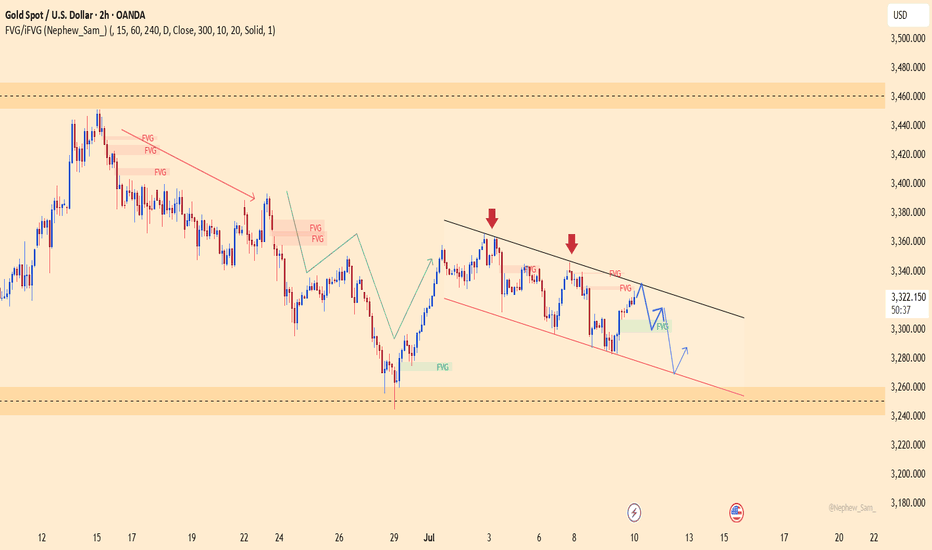

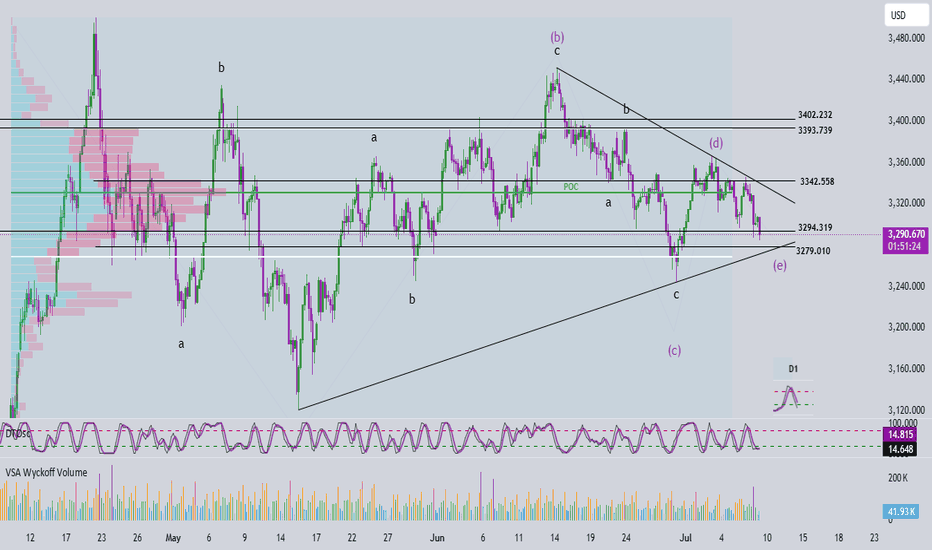

Elliott Wave Analysis – XAUUSD July 9, 2025

🔻 Momentum Analysis

D1 timeframe: Momentum is approaching the oversold zone and may reverse upwards today or tomorrow.

H4 timeframe: Momentum is already in the oversold zone. The two momentum lines are converging, signaling weakening downward pressure and a potential reversal.

🌀 Elliott Wave Structure

The price level around 3318 (previous buy zone) failed to hold, despite a ~100-pip bounce before continuing to decline.

Currently, price is nearing the lower boundary of a contracting triangle – a typical abcde corrective pattern.

Based on the current wave structure:

- Wave d (purple) appears to be complete.

- Price is now likely forming wave e, expected to end near 3279, which coincides with the triangle’s bottom support.

If the pattern holds, a strong breakout above the upper triangle boundary is expected once wave e completes.

However, note: the formation of a triangle during a corrective wave often signals that the uptrend is nearing its end in the longer term.

📌 Trading Plan

Given the complex 3-wave structure typical of triangles, risk is elevated, so:

Trade with reduced position size, or

Preferably wait for a confirmed breakout above the triangle before entering.

Suggested Trade Setup:

✅ Buy Zone: 3280 – 3277

❌ Stop Loss: 3270

🎯 Take Profits:

TP1: 3309

TP2: 3342

TP3: 3390