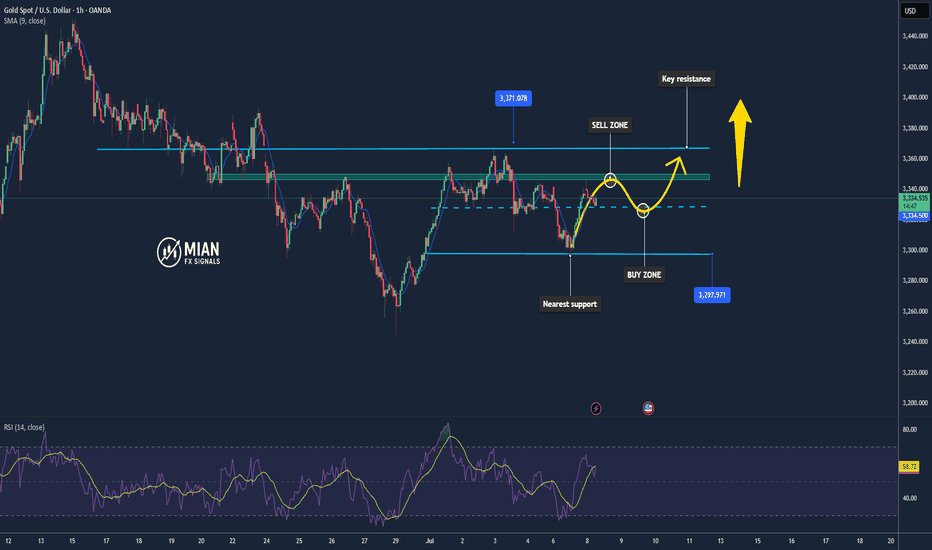

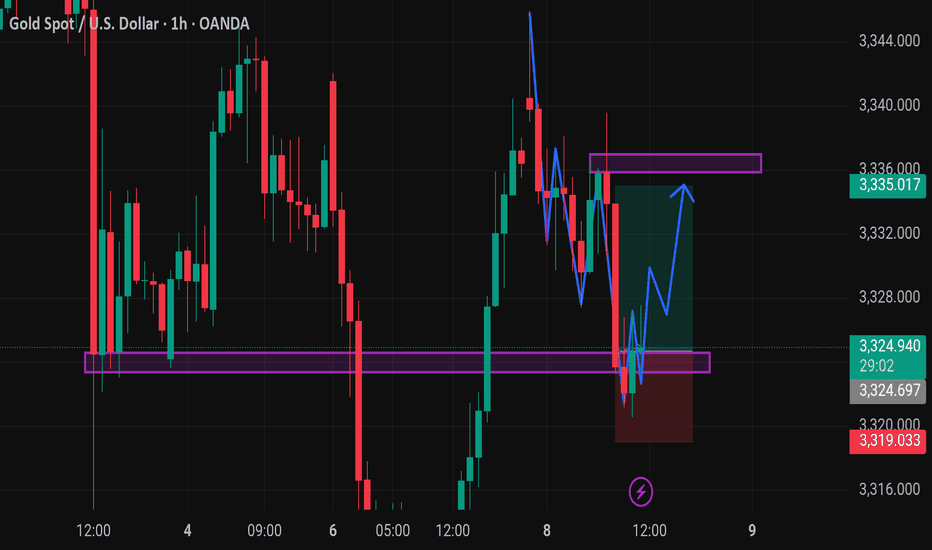

Gold Ranges at $3,330–$3,335 – Ready for the Next Move📊 Market Overview:

Gold is currently trading around $3,330–$3,335/oz, supported by a softer US Dollar and cautious sentiment ahead of key US labor data. According to TradingView, gold is consolidating in a tight range, reflecting market indecision while awaiting a clear breakout signal.

📉 Technical Analysis:

• Key resistance: $3,345–3,350 – a strong supply zone that recently rejected price.

• Nearest support: $3,320–3,330 – multiple bounce points observed here.

• EMA09: Price is hovering around the 09 EMA on both 1h–4h timeframes → neutral/slightly ranging.

• Candlestick / Volume / Momentum:

o A “bearish flag” pattern appears to be forming, suggesting potential for a downside breakout.

o Weak buying volume during upward moves signals limited bullish strength.

📌 Outlook:

• Gold may continue to consolidate between $3,330–$3,345.

• A break above $3,345 with strong volume could open the path to $3,360–$3,380.

• A break below $3,330 could lead to further correction toward $3,300–$3,320.

💡 Suggested Trading Strategy:

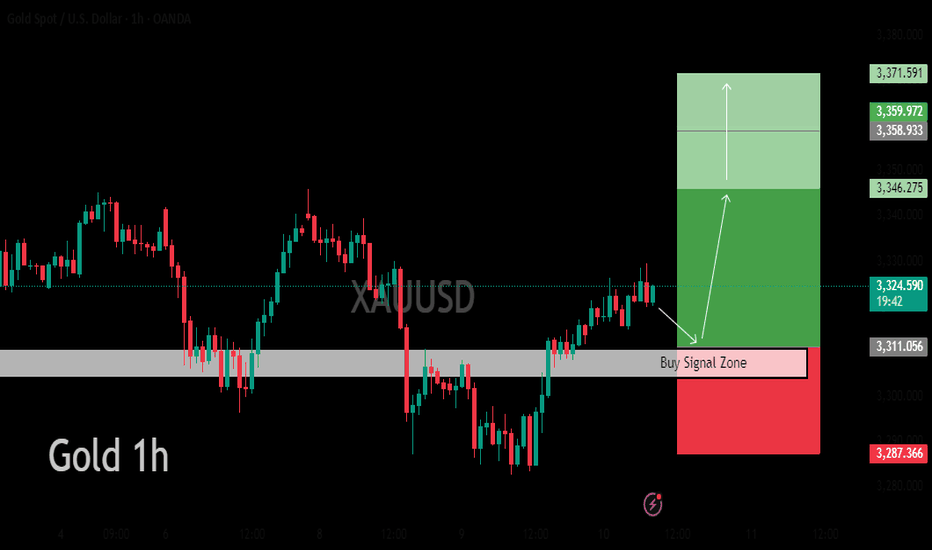

SELL XAU/USD at: 3,343 – 3,345

🎯 TP: 40/80/200 pips

❌ SL: 3,355

BUY XAU/USD at: 3,330 – 3,327

🎯 TP: 40/80/200 pips

❌ SL: 3,320

XAUUSDG trade ideas

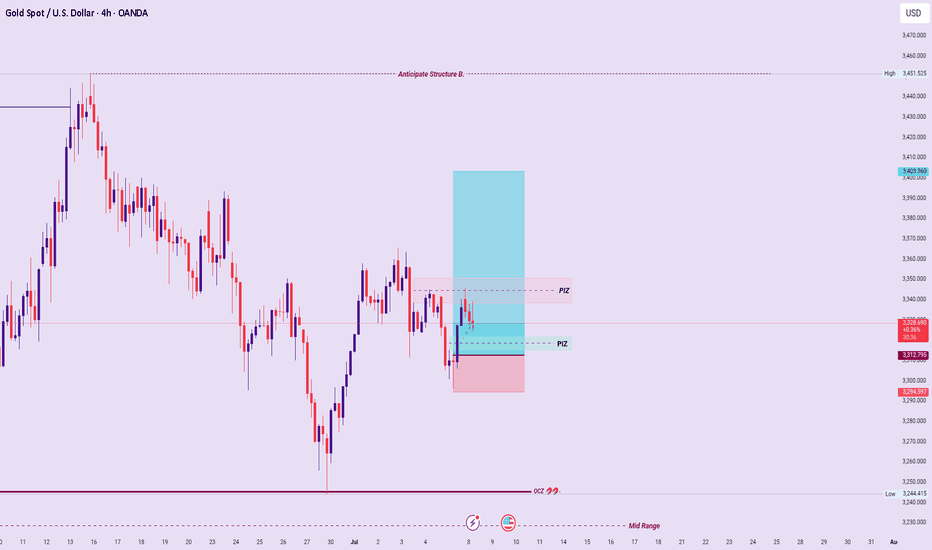

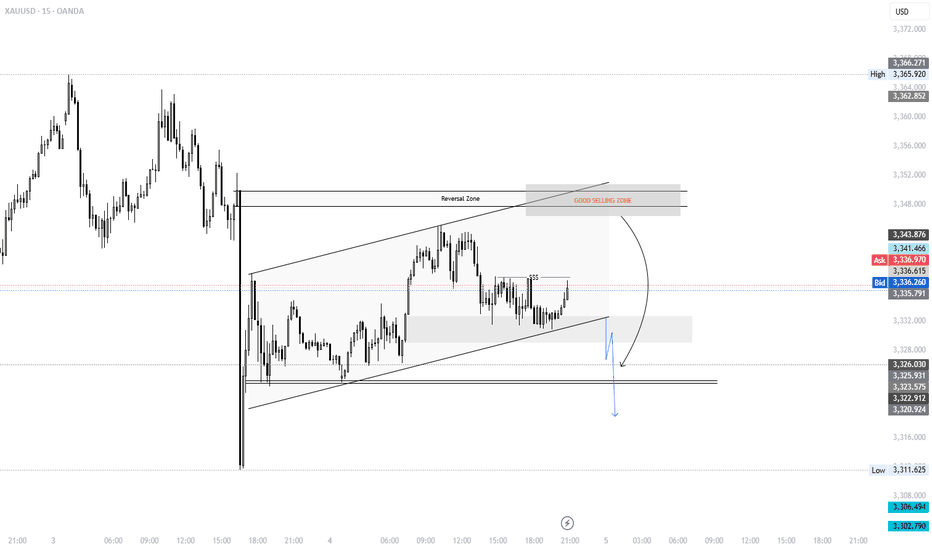

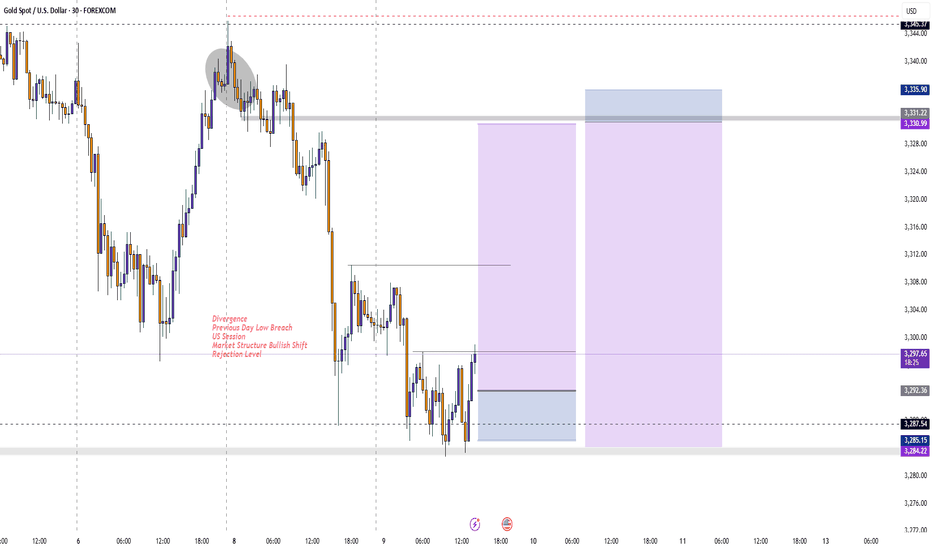

XAUUSD – Trade Projection (Post-London Open)

Current Market Context:

Price is currently oscillating between two Higher Timeframe Price Inefficiency Zones (PIZ), resulting in a neutral bias for initiating new positions.

Anticipated Scenarios & Bias Filters:

If both upper and lower PIZ zones reject price, confirming compression and exhaustion, bias will shift toward a Sell-Side Bias Environment (SBE).

If the lower PIZ acts as support and price trades decisively above the upper PIZ, it strengthens alignment with the HTF Ascend Sequence and confirms a renewed Buy-Side Bias Environment (BBE).

Execution Plan:

Preferred entry confirmation: Momentum Breach Entry (MBE) post-structural resolution from the PIZ boundaries, in line with breakout momentum.

Summary :

Neutral bias in the interim; awaiting directional clarity from PIZ reactions. Prepared to align with the first strong rejection-confirmation sequence and respond with momentum-based entry.

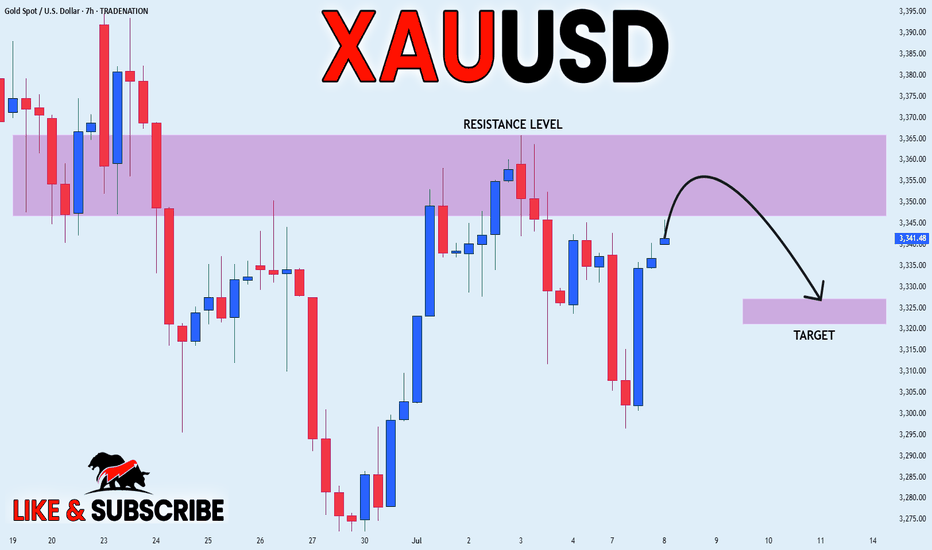

GOLD RESISTANCE AHEAD|SHORT|

✅GOLD is going up now

But a strong resistance level is ahead at 3360$

Thus I am expecting a pullback

And a move down towards the target of 3325$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

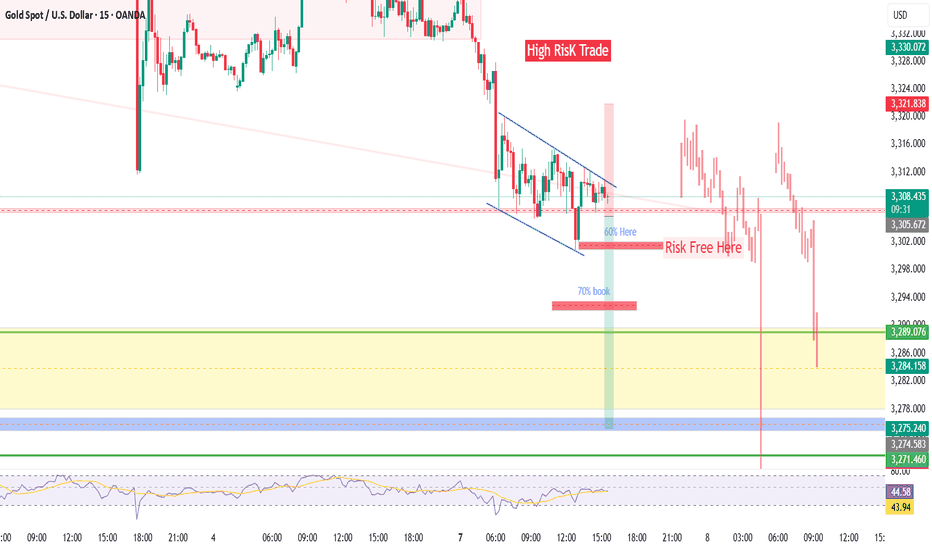

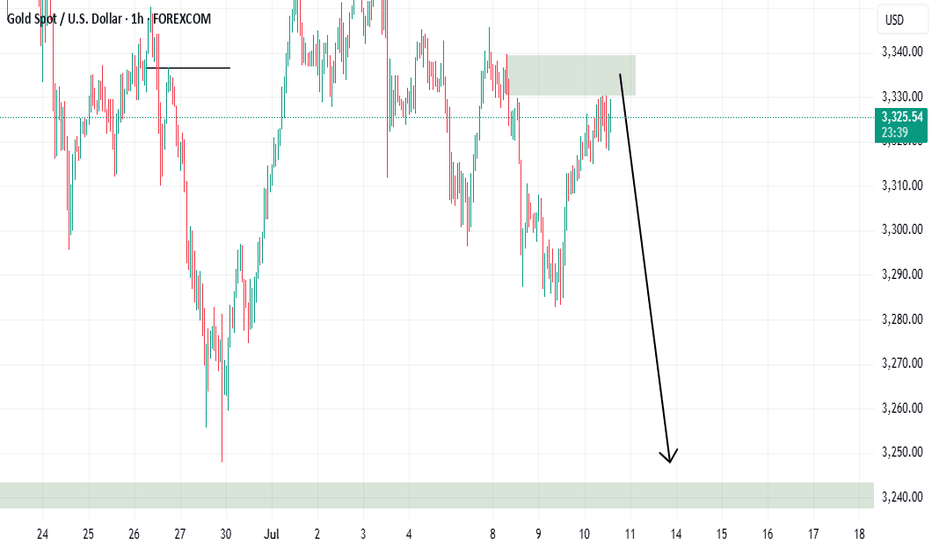

Don’t chase shorts when gold is at a low level, wait for a rebou

From the 4-hour analysis, today's upper short-term resistance focuses on the hourly top and bottom conversion position near 3318-24. The intraday rebound relies on this position to go short once and look down. The lower short-term support focuses on the vicinity of 3280. The overall support relies on the 3280-3325 area to maintain the main tone of high-altitude low-multiple cycles. In the middle position, watch more and move less, and follow orders cautiously, and wait patiently for key points to enter the market.

Gold operation strategy:

Gold 3285-3287 line long, stop loss 3277, target 3315-23 line, break and continue to hold

Gold Trapping both Buyers and Seller

Gold Trapping Both buyer and sellers . As i mentioned yesterday this is the sign of early consolidation on daily Time frame. Not perfectly rejecting & respecting both Bullish and Bearish Arrays. Stay out of gold till either side of clear price action. Above bearish Rejection or Below Bullish Rejection is the perfect area to ride on trade.

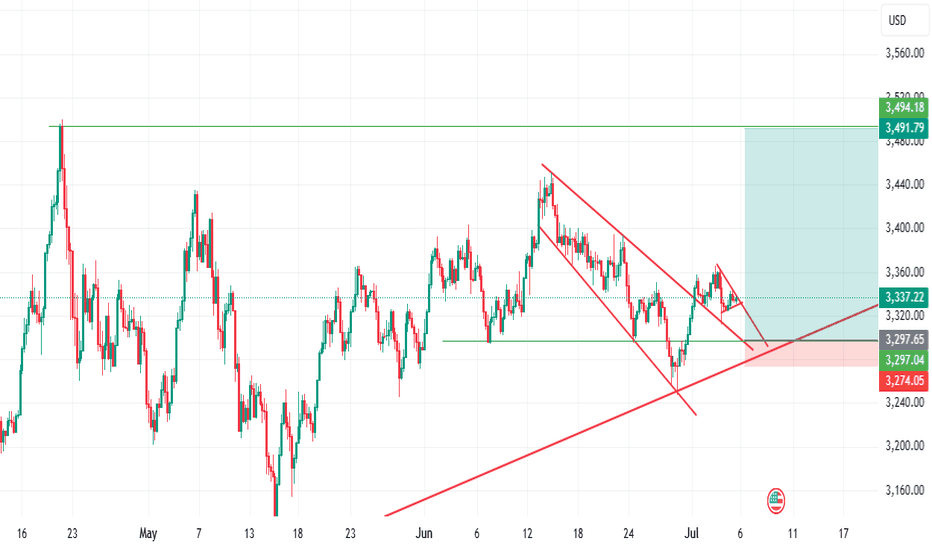

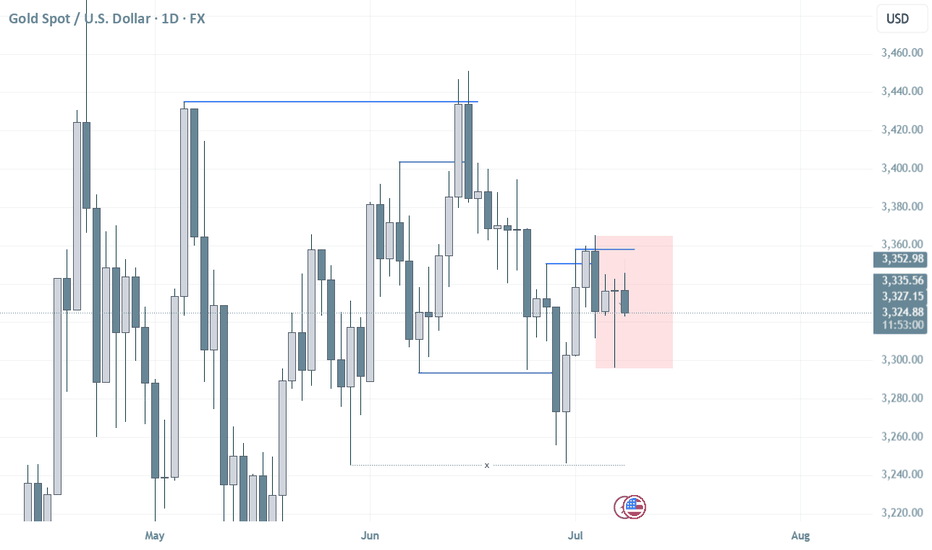

Gold Trading Strategy | July 7-8✅ Key Resistance Zone: $3340–$3345

🔴 Daily Resistance: $3345 is the neckline of a typical “M-top” pattern. On July 7, gold prices surged to $3342 before quickly retreating, indicating strong selling pressure at this level. A valid breakout has not yet occurred.

🔴 4H Chart Resistance Band: The $3338–$3340 zone overlaps with both the 20-day and 60-day moving averages, forming a confluence with the daily resistance. This creates a key short-term ceiling, and unless it's broken, further upside will likely be capped.

✅ Key Support Zone: $3300–$3310

🟢 Weekly Pivot Zone: $3311 is a medium-term pivot level. A daily or weekly close below this level could confirm the start of a broader downward trend.

🟢 Psychological Support: $3300 is a major round-number support and also represents the average cost basis for many short-term long positions. On July 7, the price rebounded after touching a low of $3306, showing that buyers are still active around this level.

🟢 Major Support Band: The $3290–$3295 zone includes the 60-day moving average and previous horizontal support. A breakdown here could trigger technical selling, opening the path toward $3280–$3260.

✅ Trading Strategy

🔰 Break above $3345: Go long, target $3365–$3370, stop loss at $3330.

🔰 Break below $3295: Go short, target $3280–$3260, stop loss at $3310.

🔰 If price stays in $3300–$3340 range: Focus on selling at highs and buying at lows. Favor short-side setups unless resistance is broken. Stop loss at $3350.

✅ Gold remains within a $3300–$3340 trading range, with a short-term technical consolidation pattern. A breakout could be triggered by upcoming policy headlines or geopolitical events (e.g., trade negotiations).

✅ Suggested approach: Use a “light position + key-level stop-loss” strategy. Watch for a breakout above $3345 or a breakdown below $3295 to shift from range trading to trend-following.

✅ Bias remains bearish unless the $3345 resistance is convincingly broken. Until then, rebounds are likely to be short-lived technical corrections—prefer to sell into strength.

GOLD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse GOLD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3,317.31 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3,309.44.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Gold’s Last Push🧠 MACRO OUTLOOK FOR GOLD

1. 📉 Central Bank Rate Sentiment (Macro Risk Bias: Neutral to Bullish Gold)

Central Bank Meeting Probable Move Cut Probability Hold Probability

Fed Jul 30 Hold 4.7% 95.3% ✅

RBA Jul 8 Cut 94% ❗

BoE Aug 7 Cut 80.8% ❗

ECB Jul 24 Hold 9.3% 90.7% ✅

BoC Jul 30 Hold 26.5% 73.5% ✅

RBNZ Jul 9 Hold 16.9% 83.1% ✅

✅ Most majors (Fed, ECB, BoC, RBNZ) are expected to hold — gold-friendly

❗RBA and BoE rate cuts ahead — mildly bullish for gold

2. 💸 FED CUT PROJECTION (Through End of 2025)

Jul: 93.3% chance to HOLD

Sep: 73.1% chance of CUT

Oct: 55.9% chance of CUT

Dec: 69.9% chance of CUT

🟡 Progressive rate cuts expected by year-end, favoring a longer-term bullish trend on gold

⚙️ VOLATILITY & IMPLIED RANGE (XAUUSD)

Implied Volatility: 14.09%

Range Estimate Value

1SD High 3355.38

2SD High 3385.78

3SD High 3414.87 🔺

1SD Low 3267.56

2SD Low 3237.73

3SD Low 3209.36

✳️ Key Resistance: 3385–3415

🛑 Key Support: 3237–3209

Current price at 3336.6 sits mid-range, slightly bullish

📰 FUNDAMENTAL NEWS REACTION (NFP & GOLD)

Date NFP Actual vs Forecast Gold Reaction

Jul 3 144k vs 126k forecast (Hot) 🔥 -200 ticks

Jun 6 139k vs 126k (Hot) 🔥 +36, -104 ticks

May 2 177k vs 138k (Hot) 🔥 -105 ticks

🔴 Gold reacted bearishly to strong NFP — Jobs > Forecast = USD strength → Gold weakness

🔍 MARKET FLOWS (MOC)

Index Buy Sell Net

NASDAQ 345M -86M +258M ✅

MAG7 113M -41M +72M ✅

S&P 500 1055M -1041M +13M

DOW 30 106M -168M -62M ❌

🟢 Risk-on sentiment visible from large NASDAQ & MAG7 inflows

🟡 Caution on S&P

🔴 DOW weak

This supports a mild bearish pressure on gold short-term due to risk appetite.

✅ CONCLUSION (For Gold Traders)

🔻Short-Term Outlook (This Week):

Bearish bias due to recent strong NFPs + net equity inflows

Rate cuts are delayed (Fed holding in July)

Expect gold to retest 1SD/2SD lows around 3267–3237 if USD strength persists

🔺Mid-Term Outlook (Q3-Q4 2025):

Dovish tilt from major banks (RBA, BoE, Fed by Sep-Dec) supports long-term gold upside

Key upside potential into 3385–3415 area if dollar weakens and yields drop

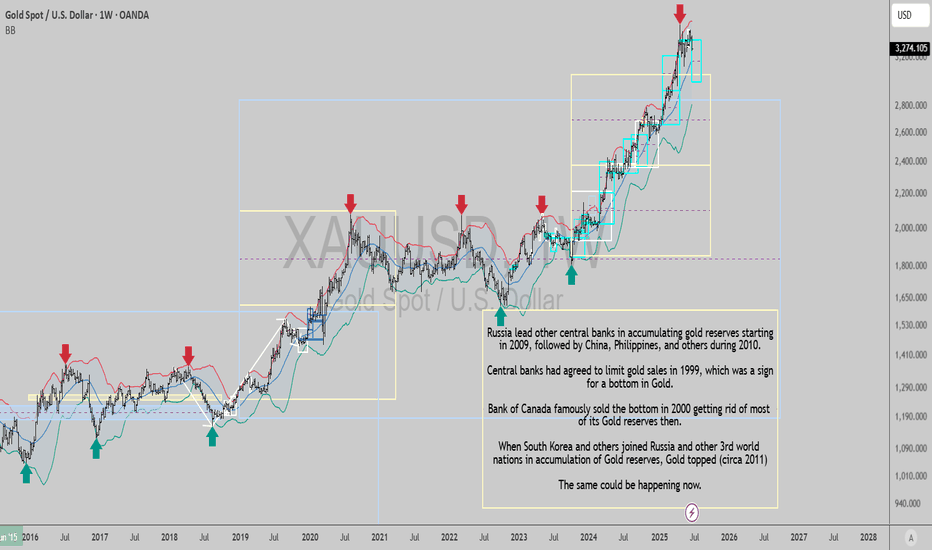

Gold topped...GM gents, it seems OANDA:XAUUSD will reverse the advance here, a weekly timeframe down trend has fired just now. It's either the start of a correction or a reversal of the huge trend it had since Oct 2023.

The arrows on chart show the spots where the weekly timeframe trend reversed, so you get an idea of what to expect.

Best of luck!

Cheers,

Ivan Labrie.

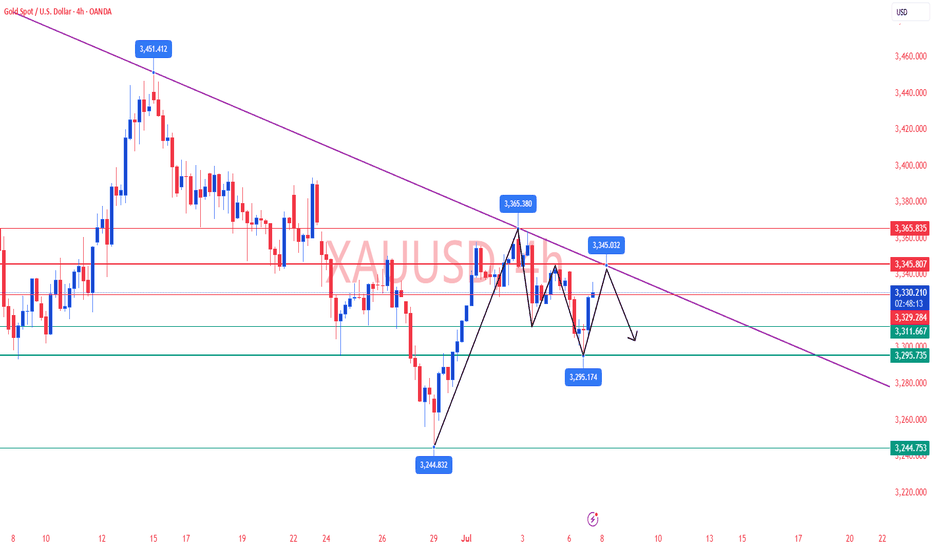

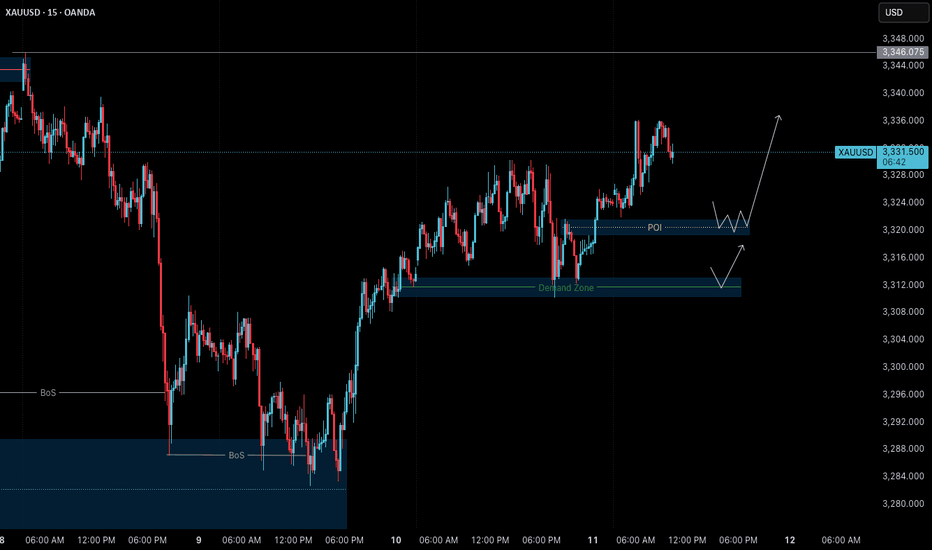

Gold – July 11 | H4 & M15 Aligned, Higher Highs in Sight🟡 Gold – Higher Highs in Sight | July 11 Analysis

As outlined in our July 10 analysis

( Gold – H4 OB Held, BoS Confirmed ),

price retested the 3313–3310.5 POI and continued upward in alignment with the broader bullish structure.

Gold is now trading around 3330–3335 , and both H4 and M15 remain in clear uptrends — forming a consistent sequence of higher highs and higher lows .

This post is intended purely for educational and structural observation —

not as trading advice or encouragement to enter trades.

Please use your own strategy, confirmation methods, and risk assessment before taking any action.

🔄 Structure Alignment

✅ H4: Bullish continuation

✅ M15: Trend aligned, forming HH–HL structure

🟢 Bias: Long-only setups (based on structure)

🔍 Key Supply & POI Zones

📌 3345–3346:

→ Strong supply zone

→ If price breaks above, we expect a new higher high

📍 If retracement occurs before breaking 3346:

→ Watch 3319.5–3321.5 (M15 POI)

→ Valid only if respected with M1 confirmation (ChoCh + BoS)

🎯 Trade Plan (Educational Observation)

🛑 No shorts — structure does not support counter-trading

🕒 Monitor: For price to revisit the 3319.5–3321.5 zone

✅ If respected + M1 confirms → structure favors long

🎯 Target: Move above 3346 , continuing the bullish sequence

🧠 Final Thoughts

Price structure remains in strong alignment — but the key is confirmation, not prediction.

Wait, observe, and only act within your own defined process.

📖 Trade the structure, not the emotion.

When the trend aligns, hesitation costs more than waiting.

📘 Shared by @ChartIsMirror

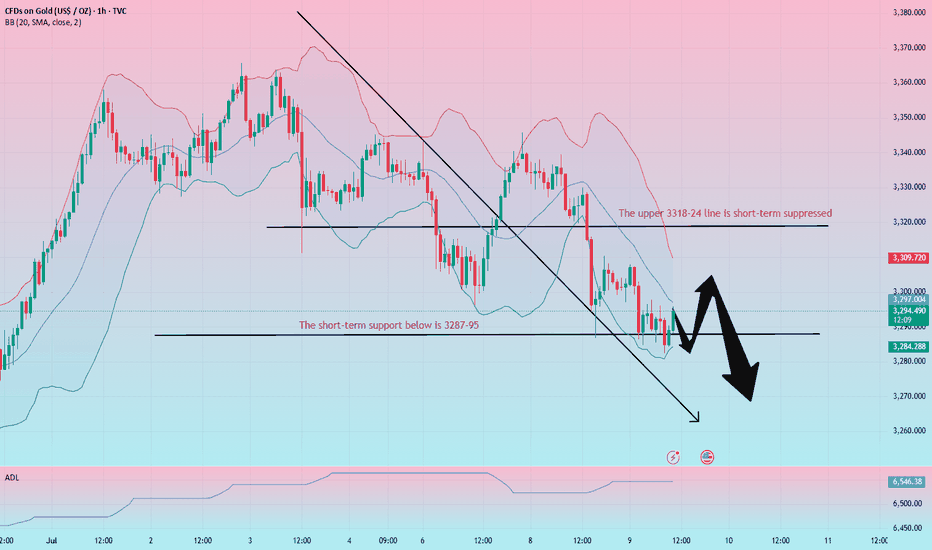

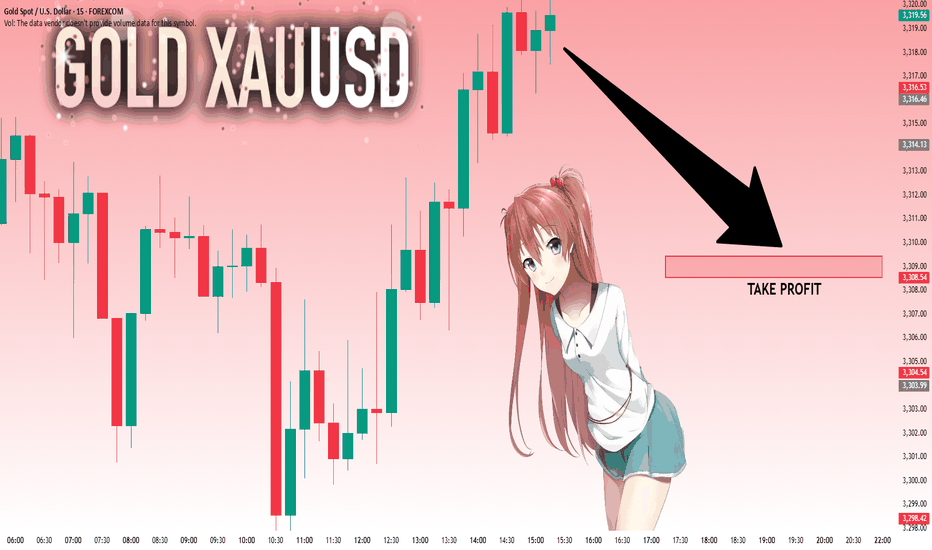

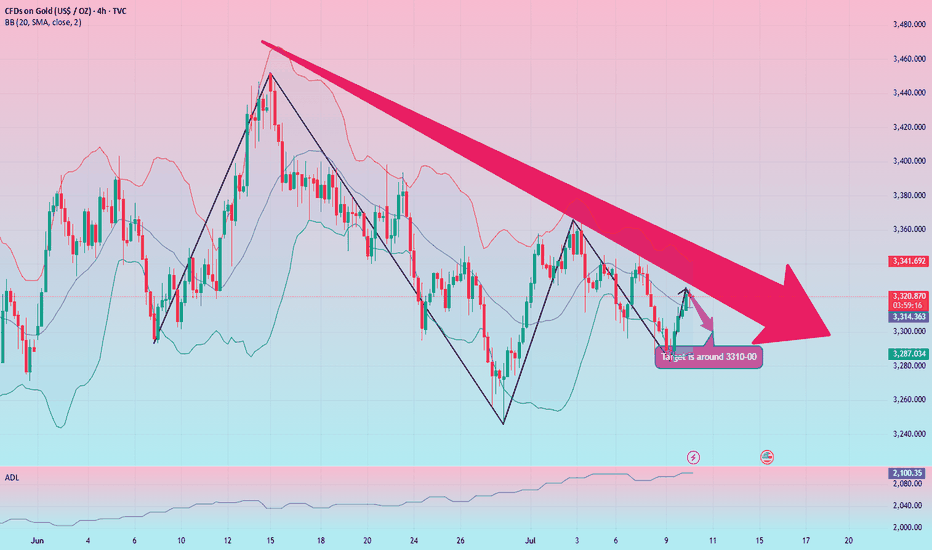

Gold continues to short

Life is like a thread. As long as today continues and as long as there is hope for tomorrow, we will always be at the starting point and on the road to running. Don't be afraid of the long road, don't complain about the lack of scenery on the roadside, don't despair at any time, just keep running, the bumps under your feet are the cornerstones of our life, and perhaps the turning point is just around the next corner!

Gold, on the eve of the US market yesterday, the shorts repeatedly touched the lower support of 3282, but ultimately lacked the momentum to make a final push, which led to a reverse reversal in the US market and a continuous rebound effect. As of the morning of the day, the highest reached near 3326, and the daily line also closed at the bald small positive line of the lower lead. The current upper pressure is maintained at the previous 3330 line. This position will also be related to the continuity of the long and short positions in the later period, and the highest in the morning will also be maintained near this position. For the European market, this position is even more important. Once it continues to break through, the US market will likely continue to rise, and it can also be used as the position of the long and short watershed in the short term, and the recent trend continuity is extremely high. , most of them are maintained in the range of shock operation, and the support below will be maintained at 3310, which is also the key defensive point of the European session. Although the daily line is currently closed at a small positive line, it is still obviously insufficient in power, and the multi-hour line is also maintained in the downward channel without a breakthrough. In the short term, it is still in a bearish situation overall. If there is no breakthrough for a long time, it may continue to fall in the later period. If gold rebounds near the morning high, it can continue to short. If the European session breaks through strongly, it needs to adjust its direction before the US session. If gold rebounds near 3325-26, it can be shorted. The target is around 3310-00, and the loss is 3335!

Gold rebounds near 3325-26 during the day, and the target is around 3310-00, and the loss is 3335.

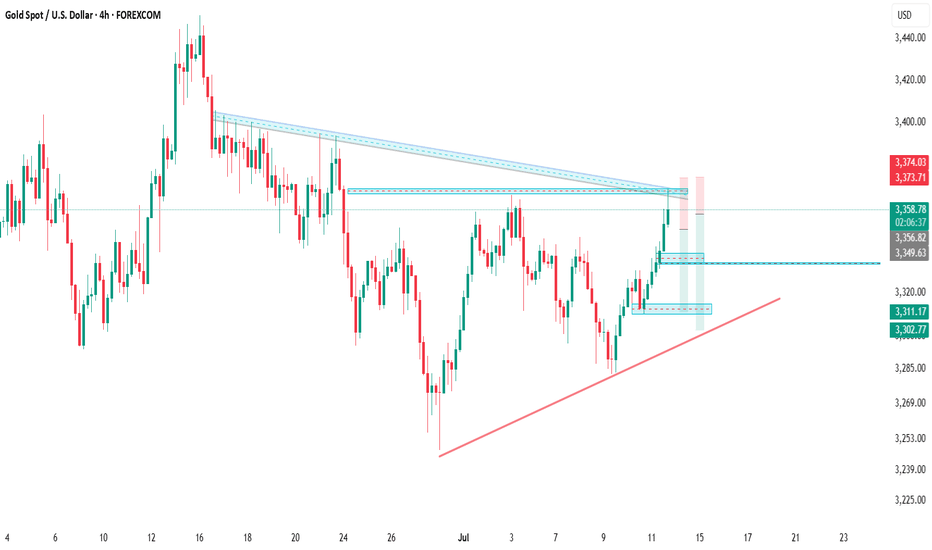

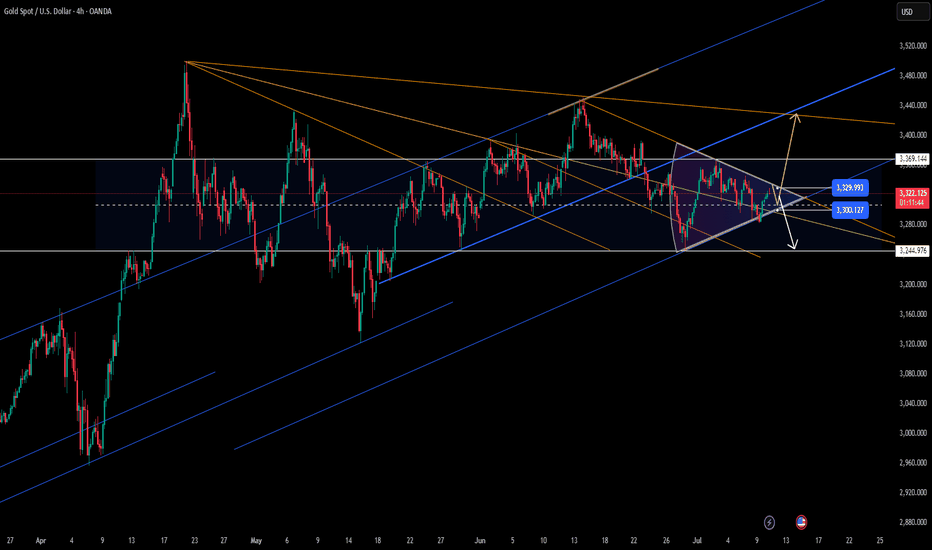

Gold prices converge, 3300-3330 range breaks?Gold prices converge, 3300-3330 range breaks?

The following current events may become catalysts for gold price changes:

Trump announced on social media that August 1 is the deadline for "reciprocal tariffs" and mentioned that he plans to impose a 200% tariff on medicines and a 50% additional tax on copper.

The market quickly digested the expectation of escalating trade conflicts.

The market expects that Trump may threaten to increase tariffs to force other countries to make concessions, but may eventually extend the deadline.

If the breakdown of negotiations triggers risk aversion, gold prices may hit $3,400; if a small agreement is reached, gold prices may fall back to $3,300.

Focus:

July 11 US CPI data: will verify inflation stickiness and affect the direction of real interest rates.

If CPI is lower than 2.8%, it may strengthen expectations of interest rate cuts and boost gold prices; if it is higher than 3.0%, it may suppress gold performance.

Fed policy signal: The minutes of the June FOMC meeting released on July 11 may provide more details about the internal differences in the interest rate decision.

In addition, Powell's recent statement shows that he is cautious about interest rate cuts. If this position continues, gold prices may temporarily fall into a volatile pattern.

Optimistic scenario (probability 30%): The United States and Japan reach a small agreement, and the price of gold falls back to $3,300;

Pessimistic scenario (probability 50%): The breakdown of negotiations triggers risk aversion, and the price of gold hits $3,400;

Extreme scenario (probability 20%): Trump restarts tariffs on China, triggering the price of gold to hit the previous high of $3,450.

Technical analysis:

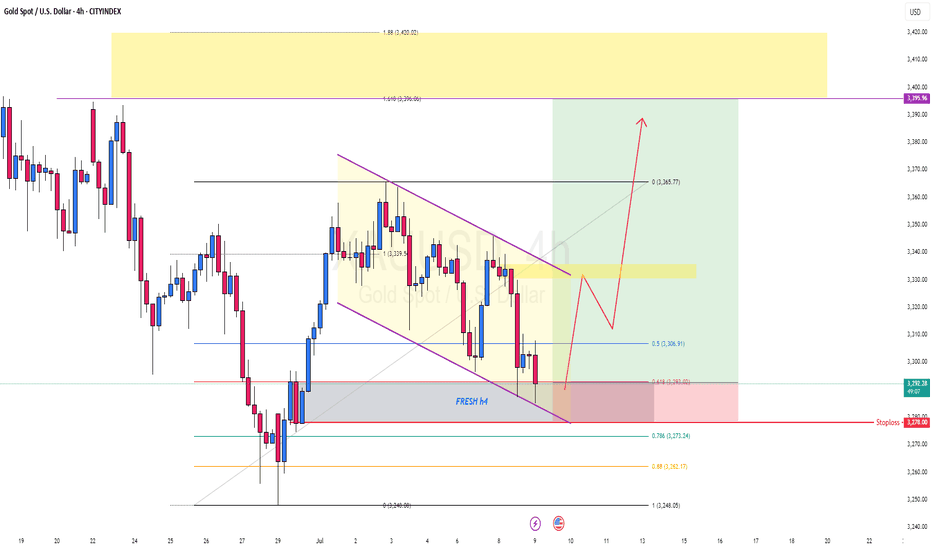

As shown in the figure: 4-hour cycle

Gold prices converge, range oscillation: 3,300-3,330

This range will determine the direction of the next trend of gold prices.

As the oscillation space becomes narrower and narrower, it is expected that a new round of market will break out today or at the latest this Friday.

The author believes that if the bullish tone of the macro trend remains unchanged, the price of gold may still break upward.

There is a high probability that the high of $3,400 will be hit again this week.

Of course, we must respect all possible scenarios.

Intraday trading strategy:

Long strategy:

Buy: 3310-3315

Stop loss: 3295

Target: 3330-3350-3400

Short strategy:

Sell: 3325-3330

Stop loss: 3335

Target: 3315-3310-3300-3285-3250

The market is currently volatile, but the focus of gold price trading is on trends rather than prices. When emotions strike, the direction of making money is the key.

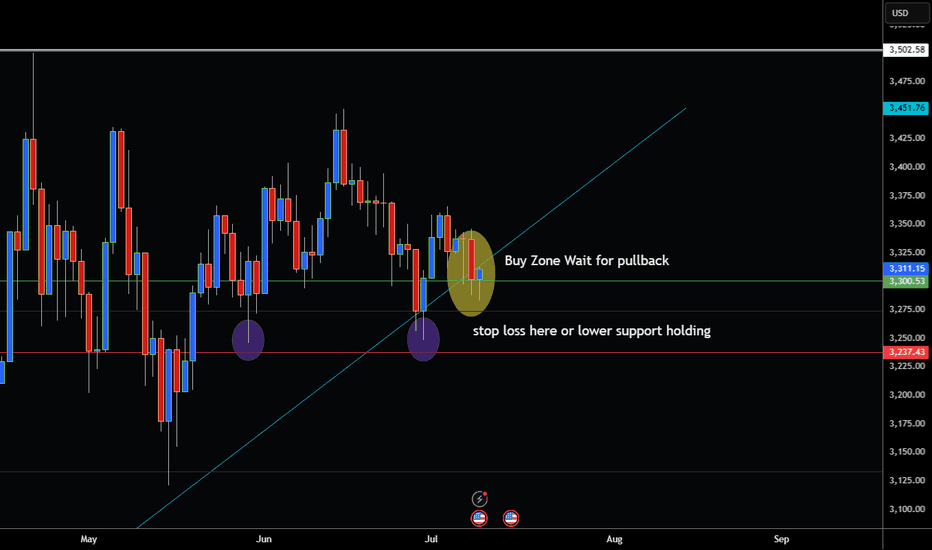

GOLD PULLS BACK TO TREND LINE AND RE-ENTERS BUY ZONE!Hey Traders so looking at Gold right now seems like we are consolidating at 3310 looking for direction. However I think the trend is still up because if you look close at support levels 3240 it has rejected that level twice.

Of course markets can flip on a dime when something unpredictable happens in this tariff driven environment so we still need to be cautious.

Seasonally Gold Rises in the Summer from a historical standpoint. But watch out to see what happens at todays FED meeting.

So if your Bullish this is the place to buy cautiously consider small position on an aggressive entry and put stop below 3230 which looks like it could be good level.

Or if conservative wait until after FED meeting to see how market reacts off this level and they buy again on a pullback if market reacts positive.

However if Bearish I would wait for a daily close and break below 3215 or 3200 before considering selling.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford