XAUUSDG trade ideas

The gold bull-bear game intensifiesThe gold bull-bear game intensifies: a breakthrough opportunity is hidden in the short-term shock

The gold market experienced violent fluctuations this week, and the core contradiction came from contradictory employment signals:

ADP cooling: The number of private sector jobs in the United States unexpectedly decreased in June, which once strengthened the expectation of a rate cut in September and pushed the gold price up

Non-farm counterattack: The subsequent non-farm employment announced exceeded expectations (206,000), which quickly extinguished the enthusiasm for rate cuts and gold prices gave up gains

Central bank support: Global central banks continue to buy gold (China increased its gold reserves in June), building a safety cushion for long-term prices

The essence of the "data fight" reflects that the resilience of the US economy remains, but cracks have appeared. The Federal Reserve dares neither cut interest rates too early (inflation risk) nor over-tighten (loosening of the employment market). This swing state will prolong the volatility cycle of gold, but every sharp drop is an opportunity for central banks and long-term investors to enter the market.

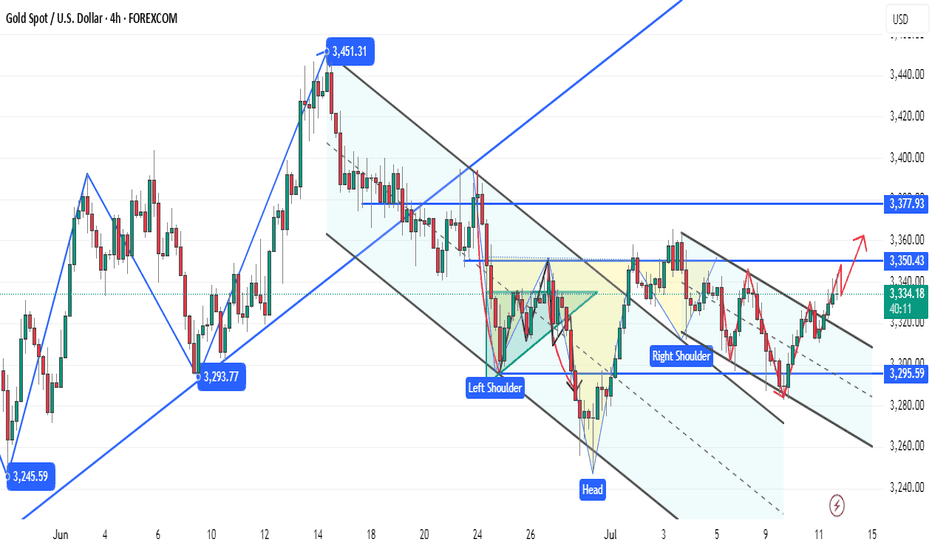

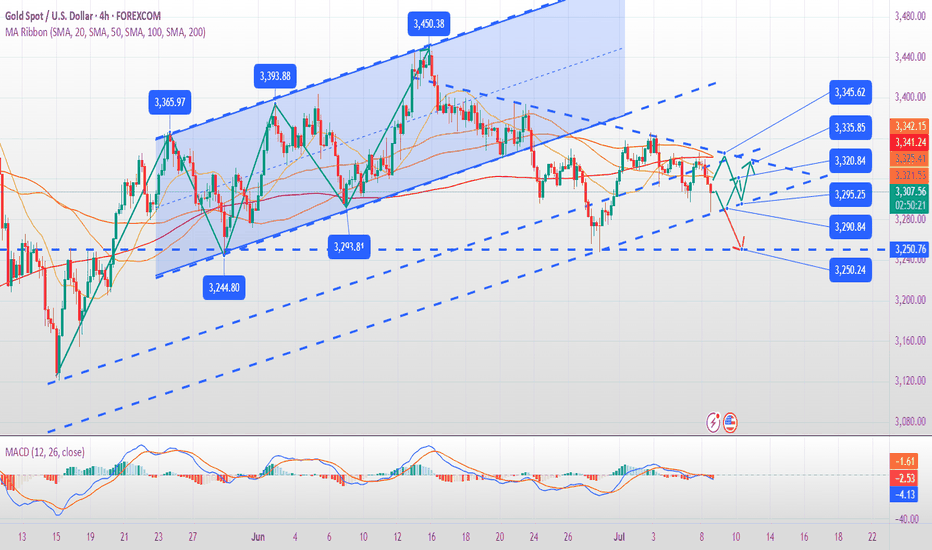

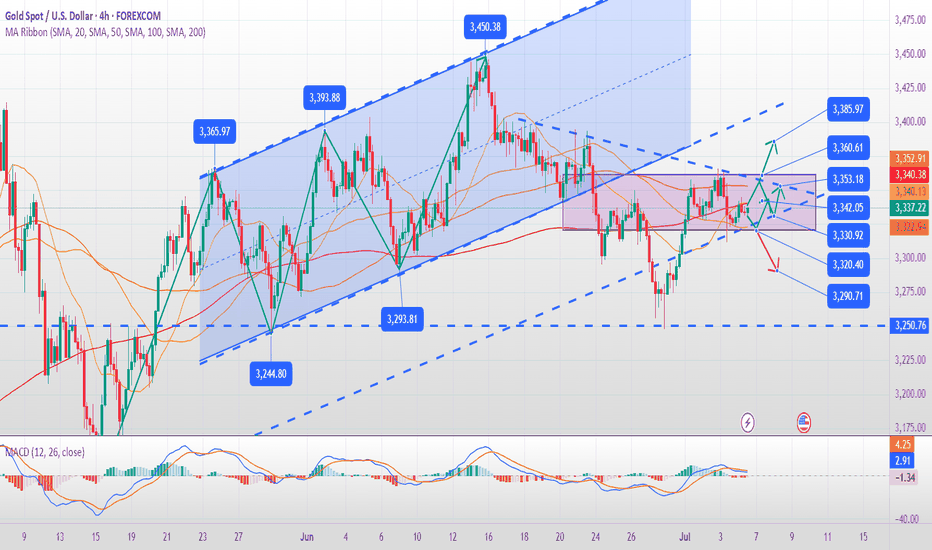

Technical aspect: Breakthrough signal of the four-hour chart

Current market characteristics:

Key position: 3344-3346 area has become the watershed between long and short positions. After three unsuccessful tests, the probability of this breakthrough has increased

Morphological structure: Breakthrough of the downward trend line of the four-hour chart + MACD golden cross, long arrangement of hourly moving average

Volume coordination: After yesterday's retracement to 3330 support, the volume rebounded, showing strong low-level support

Operation strategy:

Bull defense line: 3330-3325 (if broken, it will turn into shock)

Upward target:

▶ The first target is 3360 (previous high psychological position)

▶ The second target is 3380 (Fibonacci extension position)

▶ Ultimate target 3400 (option barrier)

Specific plan:

Conservatives:

Light long position at 3333-3335 (stop loss 3323)

After breaking through 3347, add more positions (stop loss 3335)

Radicals:

Batch layout above the current price of 3340, with 3325 as the ultimate defense

Risk warning:

⚠️ Beware of the volatility caused by Powell's speech on Friday night

⚠️ If 3320 is lost, beware of a deep correction to the 3300 mark

Currently, gold is in the "accumulation breakthrough" stage, with a bullish technical side but requiring fundamentals to cooperate. It is recommended to use the "small stop loss breakthrough" strategy, and it is better to miss it than to go against the trend. If it can stand firm at 3350 this week, it will no longer be a fantasy to look at 3400 in the third quarter.

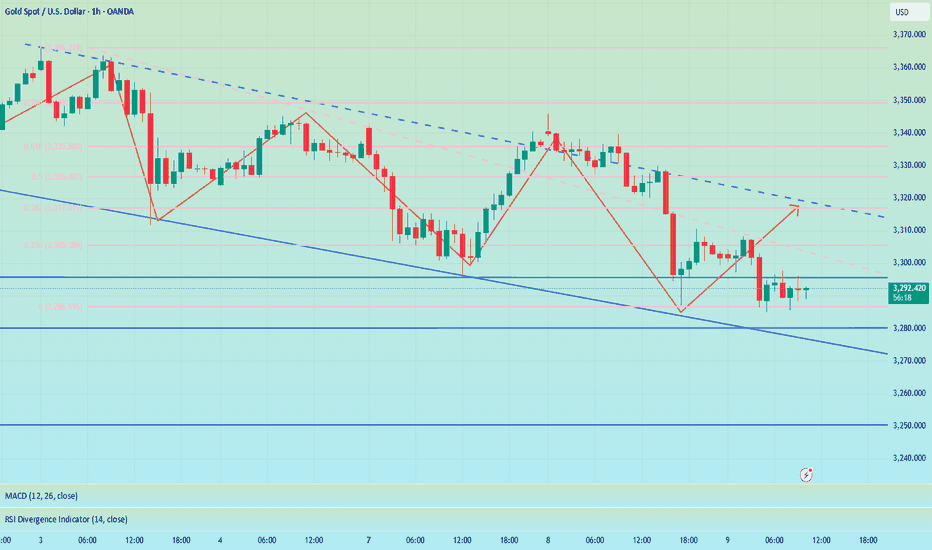

Gold Market Rebounds to 3330 – Eyes on Unemployment ClaimsGold market respawns to the 3330's in reaction to the 3285 mitigation, signaling a potential market correction ahead. With unemployment claims on the radar, traders anticipate more volatility and key sentiment shifts as the data unfolds. follow for more insights , comment and boost idea

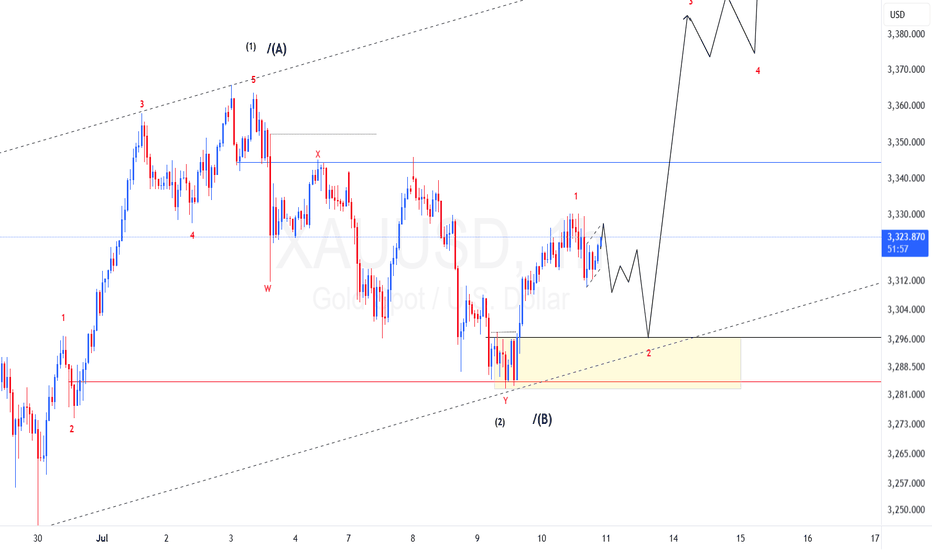

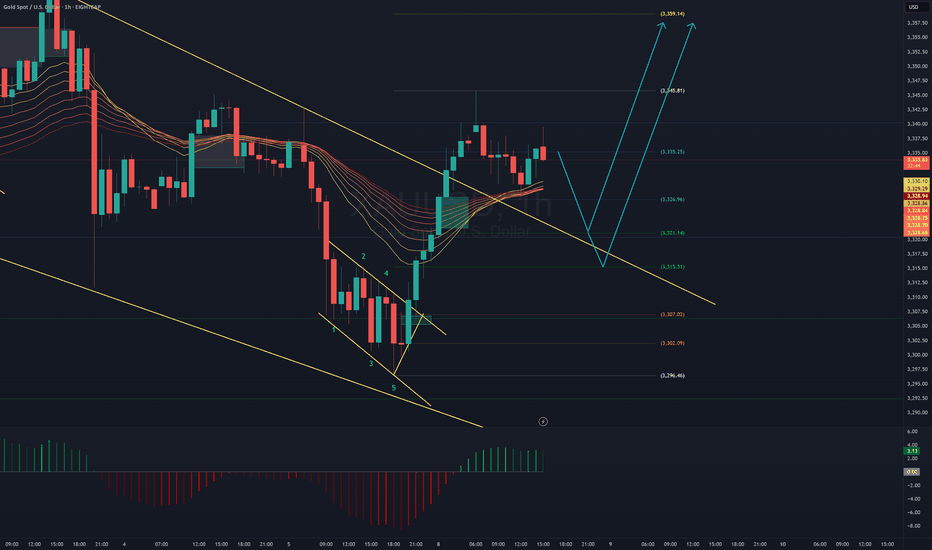

XAUUSD Elliot waves update: What to expect?Bullish bias is still on. Price made impulsive wave 1 of lower degree and now we should expect price to continue up to test the upper trend line. There is also a possibility that the 4th wave is still in play and a possible triangle is about to be finished, however, this does not change our current bias to the upside. I am expecting price to drop to test the extreme order flow before continuing. To take advantage of the bullish move one need to find the entry around this extreme order flow marked with a rectangle. "Trade responsibly, this is not financial advice"

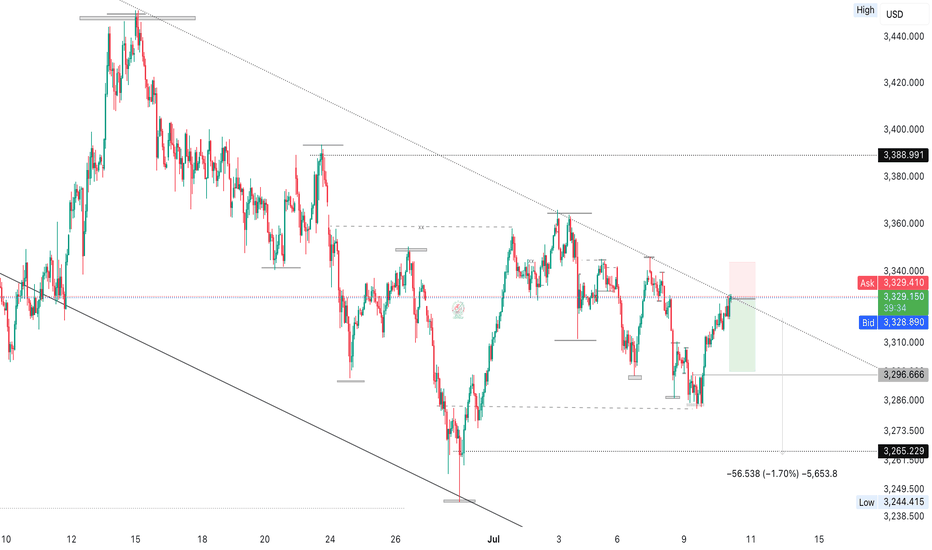

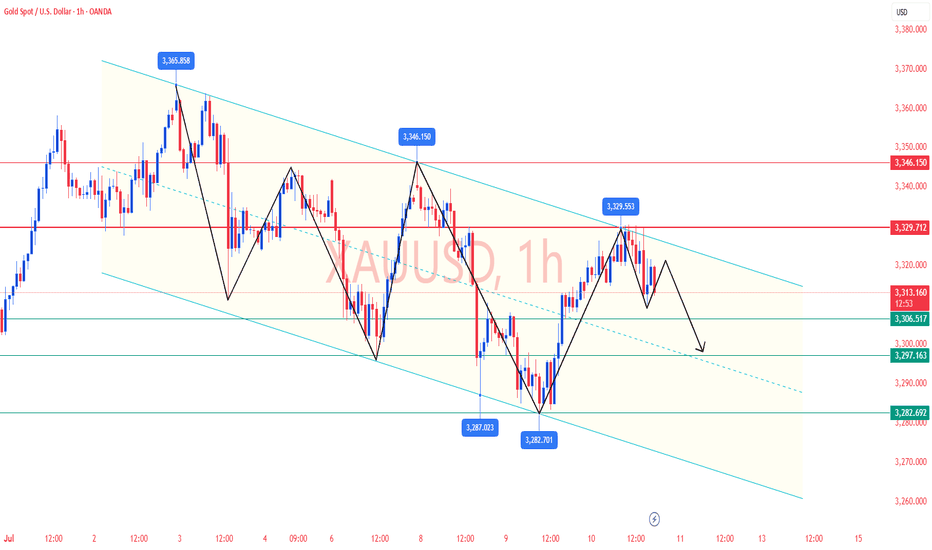

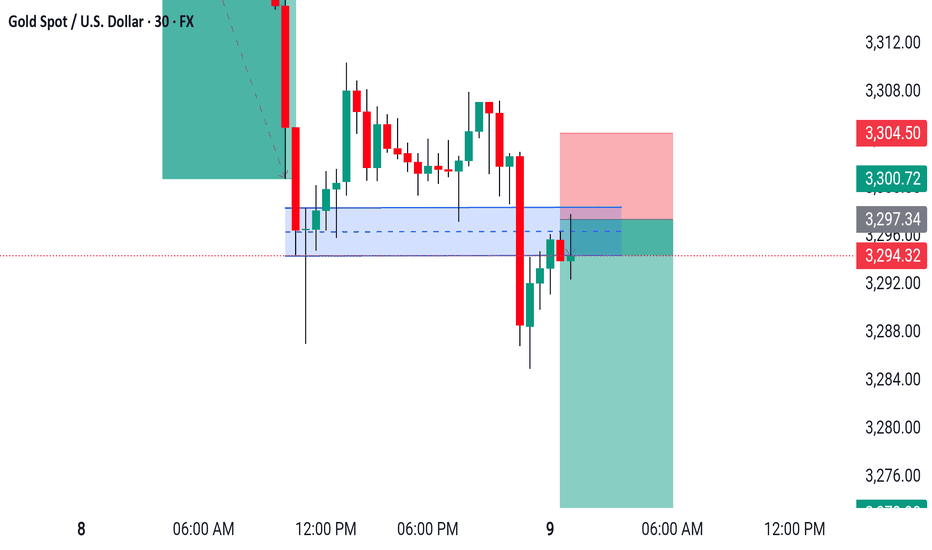

Gold Trading Strategy | July 10-11✅ Technical Analysis:

🔸 Confirmed Resistance at High Levels:

Gold was rejected around the 3328–3330 area, which aligns with our previous assessment of the upper boundary of the descending trend channel. This zone has acted as a key resistance area during multiple past rebounds and is once again proving to be a valid pressure point.

🔸 Consolidation Between 3310 and 3320 After Pullback:

Although gold has pulled back, it has not broken below 3310 decisively, indicating that while bears hold the advantage, there is still buying interest below. Structurally, the overall movement is still a "pullback–rebound–correction" pattern within a broader downtrend.

🔸 Bearish Alignment in the 1-Hour Moving Averages:

Short-term moving averages (MA10/20/60) are still aligned in a bearish formation, with lower highs in each rebound and no clear reversal signal from the candlesticks. The short-term trend remains tilted to the downside, with a higher probability of further pullback if the price fails to break resistance.

🔴 Key Resistance Levels: 3330 / 3345 / 3365

🟢 Key Support Levels: 3307 / 3300 / 3282

✅ Trading Strategy Reference:

🔰 If gold fails to break above the 3328–3330 resistance area, the strategy remains to sell on rallies.

🔰 First support to watch is 3307 / 3300. If 3300 is broken, downside could extend toward the 3282–3275 zone.

🔰 If gold later breaks and closes firmly above 3330 (with a strong bullish candlestick), then a short-term trend reversal is possible, and the next upside targets would be 3345–3365.

🔥 Reminder: Trading strategies are time-sensitive and should be adjusted in real time based on market conditions, especially after key support or resistance levels are broken. If you need more accurate and timely trading signals, feel free to reach out to me directly!

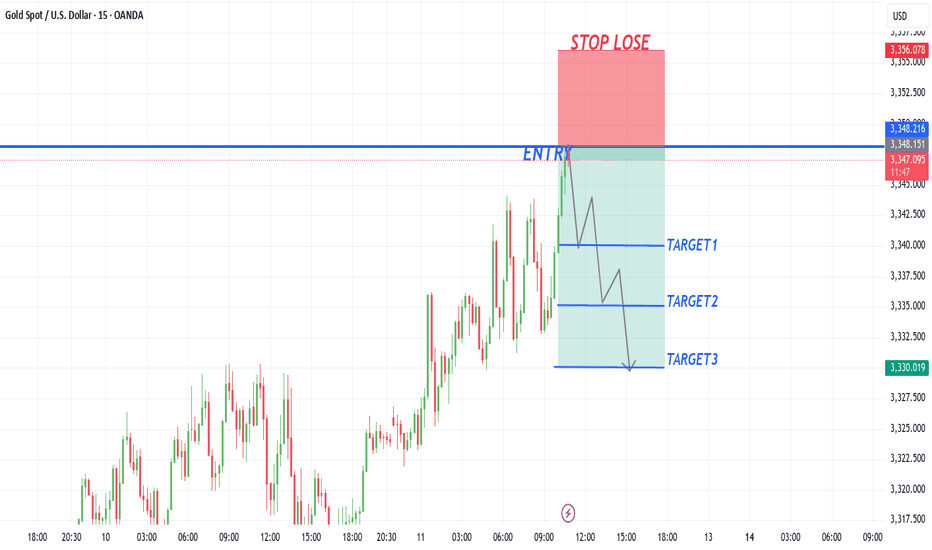

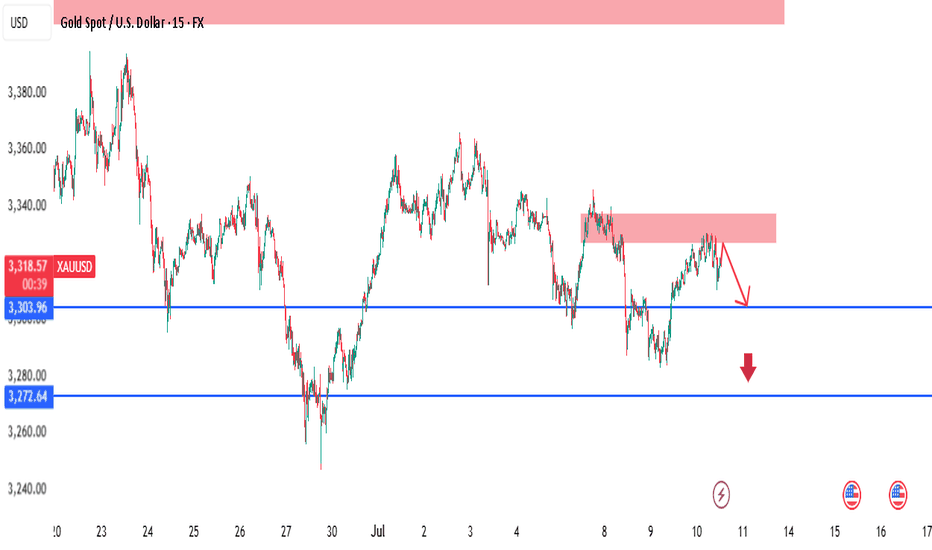

XAUUSD - Intraday SMC Bearish Setup | 15m ChartGold is currently reacting to a visible 15m supply zone after a bullish retracement. Price failed to break above the short-term supply (highlighted in red), showing signs of potential short-term reversal.

🔍 Key SMC Insights:

Supply Zone at 3318.47 – 3320 area is holding firm, with price showing clear rejection and lower highs forming.

Internal CHoCH already confirmed — suggesting short-term bearish order flow is active.

Liquidity Grab and rejection around the supply confirms smart money may be offloading positions.

Imbalance Below near 3303.96, with further inefficiency down to 3272.64.

📍Trade Idea:

Sell Entry: After a retest or failure to break above the 3318.47 zone.

Target 1: 3303.96 (near-term support and minor liquidity)

Target 2: 3272.64 (major liquidity zone + possible demand area)

Invalidation: Bullish break and close above 3320 would shift intraday bias.

⚠️ Monitor lower timeframes (1m–5m) for confirmation before executing trades. This setup aligns with the 4H bearish structure, enhancing confluence.

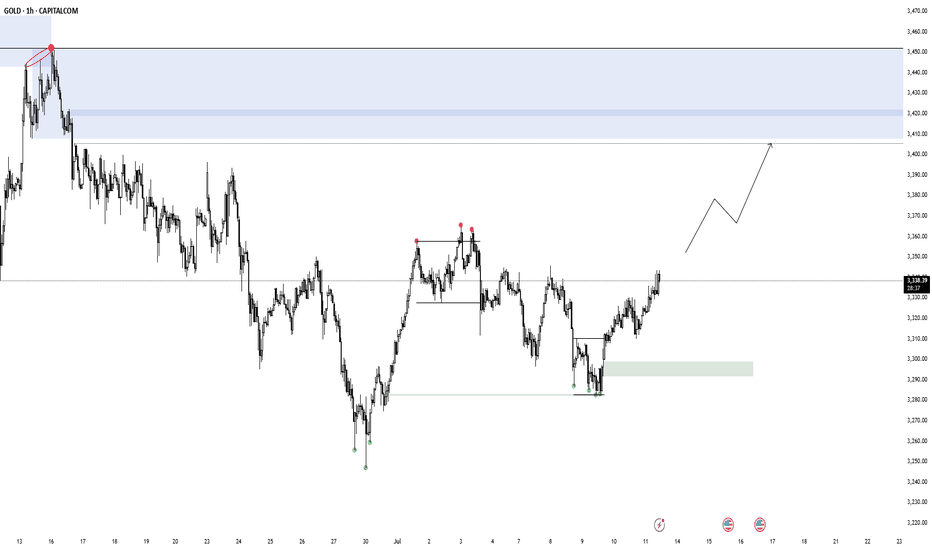

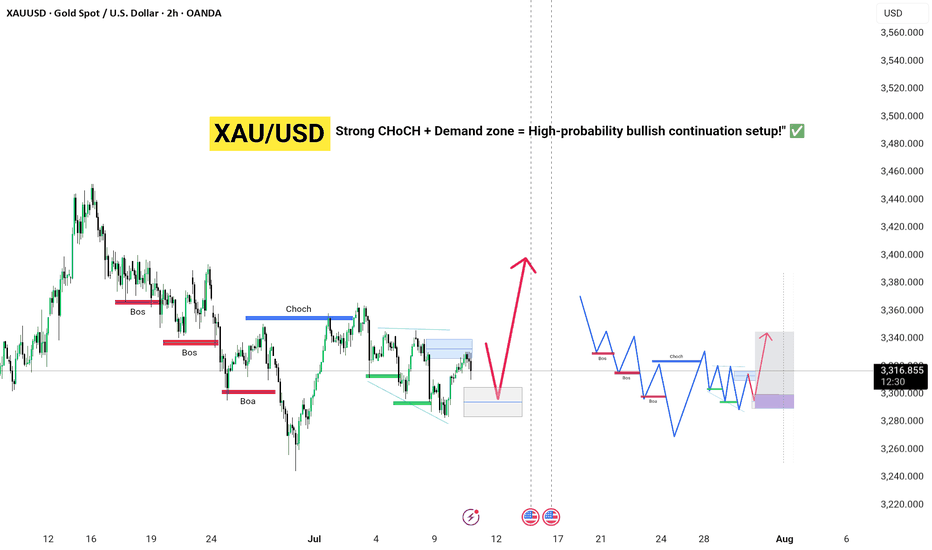

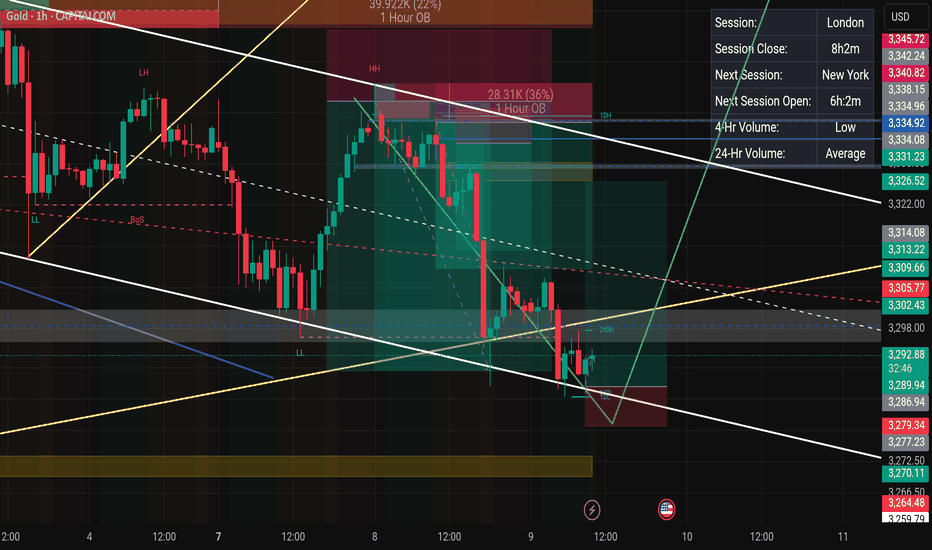

Bullish move , gold money Strong CHoCH + Demand zone = High-probability bullish continuation setup!" ✅

Key Highlights:

🔴 Multiple BOS confirm bearish trend continuation up to late June.

🔵 CHoCH on early July marks a potential bullish reversal zone.

📉 Price currently retracing into a demand zone (highlighted blue box) for potential long entries.

🔮 Expected bullish leg targeting the 3,350–3,400 zone before another possible correction.

🧠 Projected schematic aligns with Wyckoff accumulation + SMC concepts—anticipating further BOS and CHoCH as price unfolds.

📅 Watch for upcoming U.S. economic events that may influence volatility (shown with news icons).

📌 Bias: Bullish above demand zone | Invalidation: Clean break below demand and failure to hold above recent BOS.

The decline in gold prices has not stopped. Do you know what to

Gold did not provide a better position to go long during the day, but continued to fluctuate, and was under pressure at 3330 many times. The short-term suppression was obvious, and the increase was limited. It is expected to usher in a decline today. Consider short-term short operations, pay attention to shorts near 3326, stop loss at 3334, and take profit at 3300. Pay attention to risks.

Short-term trading of gold in the evening of July 10: shorts near 3326, stop loss at 3334, take profit at 3306

Gold Bounces Strongly from the Bottom XAUUSD: Gold Bounces Strongly from the Bottom – Is This the Start of a Breakout?

🌍 Macro Overview – Gold’s Movement and Market Sentiment

Gold recently experienced a strong bounce from the 3.282 USD/oz low, reaching 3.317 USD/oz. This movement has sparked some optimism, but let’s take a look at the key macroeconomic factors that might be influencing gold:

📉 US bond yields have decreased, signaling that market risk aversion is returning

💵 The USD remains strong, but buying interest in gold in Asia is increasing as confidence in fiat currencies begins to wane

🇪🇺 The EU is accelerating negotiations with the US on tariffs ahead of the August 1st deadline. If these talks fail, gold could benefit

🏦 The Fed continues to maintain interest rates, but the market is betting on a potential rate cut in September if inflation remains controlled

📊 US unemployment data and the Fed's speech tonight will be key, as the market is anxiously waiting for clues on the Fed’s next move

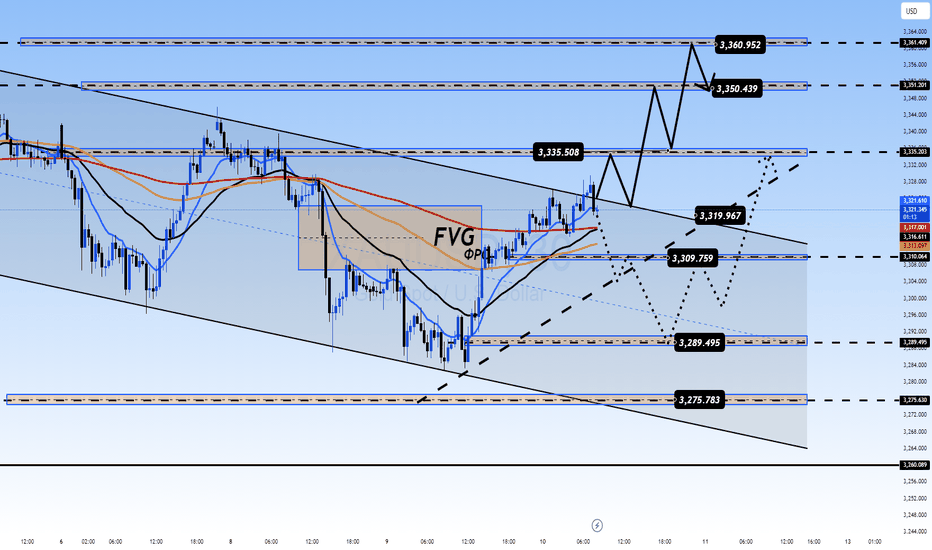

📊 Technical Analysis – Gold Approaching Key Resistance Levels

Gold is trading within a descending channel, but there are clear signs of a potential breakout after testing the lows.

Key resistance levels are found around 3330 – 3340, which will be crucial for determining if gold can continue its upward movement.

The Fair Value Gap (FVG) has appeared between 3310 – 3320, suggesting that if buying pressure continues, a breakout above these levels is likely.

🎯 Trading Strategy for Today – Focused on Clear Entry Points

🟢 BUY SCALP:

Entry: 3310 – 3308

SL: 3304

TP: 3314 → 3318 → 3322 → 3326 → 3330

🔵 BUY ZONE (safer entry points):

Entry: 3290 – 3288

SL: 3284

TP: 3294 → 3298 → 3302 → 3306 → 3310 → 3320 → 3330

🔴 SELL SCALP (if price hits resistance levels):

Entry: 3335 – 3337

SL: 3342

TP: 3330 → 3325 → 3320 → 3315 → 3310 → 3300

⚫ SELL ZONE (strong resistance at 3360-3362):

Entry: 3360 – 3362

SL: 3366

TP: 3356 → 3352 → 3348 → 3344 → 3340 → 3336 → 3330

📌 Note:

Always set SL and TP appropriately to protect your account, especially in a market that might experience significant volatility today.

Watch volume during London and New York sessions to gain clearer insights into market direction. If gold breaks above resistance, a strong breakout could follow.

💬 Gold has bounced back strongly, but is this the start of a larger rally, or just a temporary correction? What’s your take on today’s trend? Share your thoughts in the comments below!

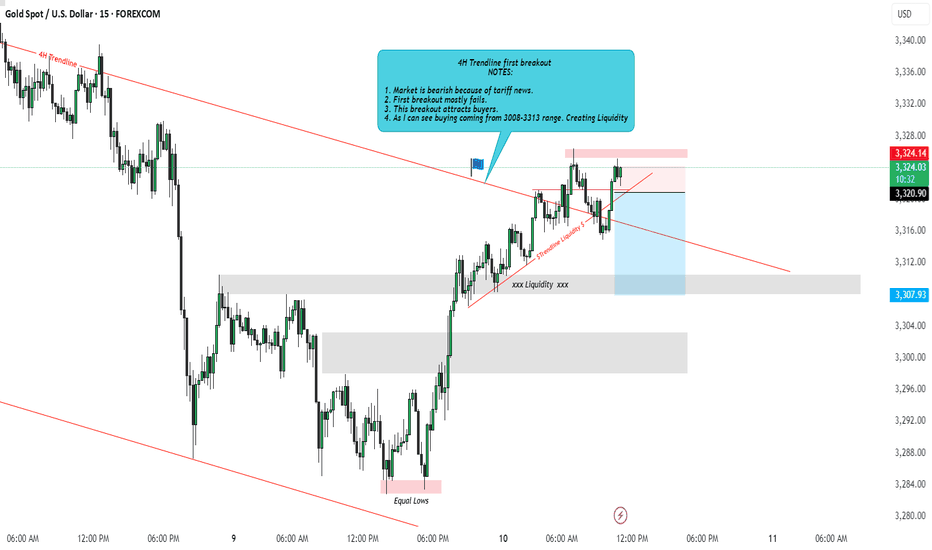

XAUUSD Idea: 4H Trendline First Breakout - Liquidity PlayFOREXCOM:XAUUSD

🔍 Analysis Overview:

Price has just broken above a 4H descending trendline for the first time. However, I remain cautious due to the following key observations:

📌 NOTES:

The broader market sentiment is still bearish due to recent tariff-related news, which often fuels risk-off behavior.

Historically, the first breakout of a strong trendline often fails, trapping early buyers.

This breakout is likely attracting buy-side liquidity, giving institutions an opportunity to hunt stops.

My observation shows buying interest started around the 3308–3313 range, suggesting smart money accumulation and a possible trap.

📉 I'm watching for a fake breakout and potential reversal targeting the liquidity zones marked below around 3307 and possibly lower.

The liquidity sweep below equal lows could offer a better risk-reward setup.

💡 Conclusion:

If price fails to hold above this breakout and shows signs of rejection, I will be anticipating a return towards the previous demand zone for a liquidity grab.

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #LiquidityGrab #ForexTrading #TrendlineBreak #MarketPsychology #TradingSetup #SMC #PriceAction

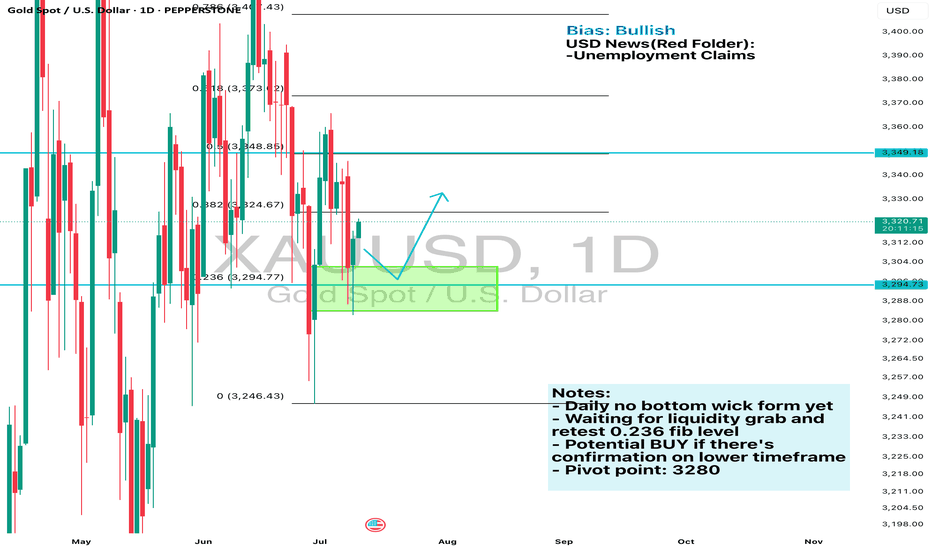

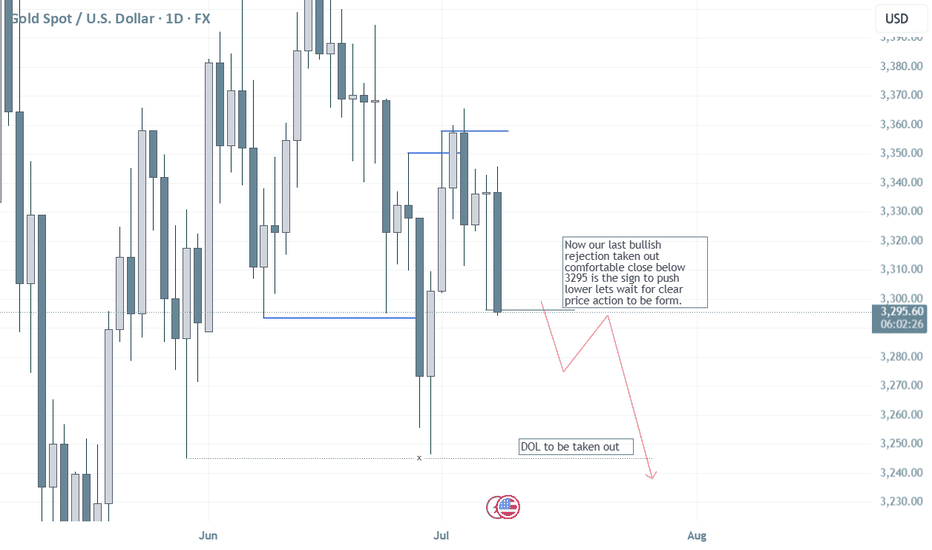

Daily Analysis- XAUUSD (Wednesday, 9th July 2024)Bias: Bullish

USD News(Red Folder):

-Unemployment Claims

Notes:

- Daily no bottom wick form yet

- Waiting for liquidity grab and

retest 0.236 fib level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3280

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

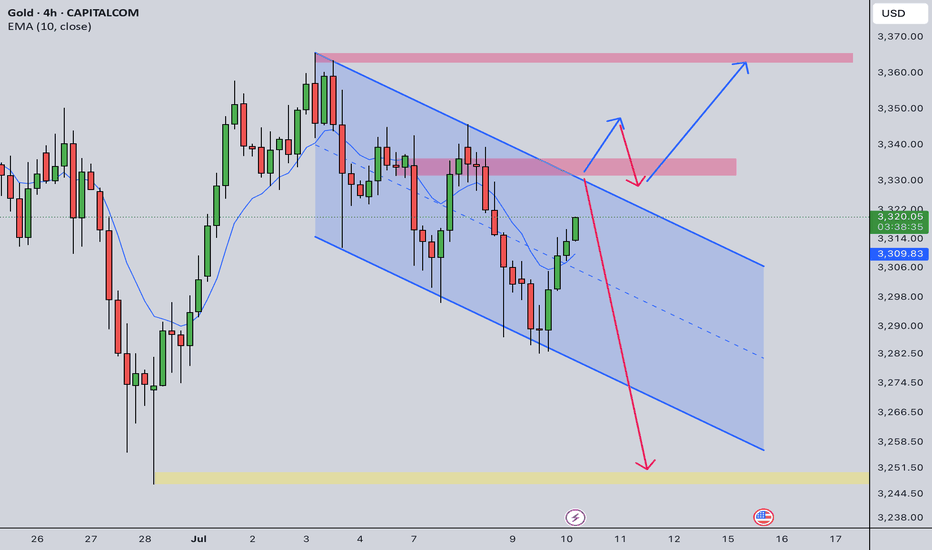

Gold Intraday Trading Plan 7/10/2025Gold has been very choppy recently. It seems not having any clear direction. Although in weekly post I am bearish in short term, there is lack of momentum for it to go down. Currently it is traded within a channel indicated in the chart. I am going to trade on the channel top.

If the channel holds, I will sell around 3330, towards 3250. If the channel top is broken, I will buy upon retest, towards 3365.

Analysis and strategy of gold trend on July 9:

Core logic sorting

Bull-bear game intensifies:

Positive factors:

Risk aversion: Trump's tariffs on Japan and South Korea (effective on August 1) caused market anxiety, and the decline of US stocks supported gold.

Central bank gold purchases: The People's Bank of China has increased its gold holdings for 8 consecutive months, and long-term demand is stable.

Negative factors:

Stronger US dollar: The US dollar index rose to 97.67 (a one-week high), suppressing gold pricing.

Technical pressure: $3345 has become a strong resistance, and multiple highs and falls show that bulls are weak.

Market focus:

In the short term, pay attention to the persistence of risk aversion and the trend of the US dollar index. If the US dollar pulls back or geopolitical risks escalate, gold may break through the range.

In the long run, the weak US dollar (down 10% this year) and global loose policies still support gold.

Key technical signals

1. Daily level

Range oscillation: 3295-3345 US dollars are in a narrow range, and the moving average is glued together, and it is necessary to wait for a directional breakthrough.

Long-short watershed:

Break above 3345 → open upside space, target 3380-3400.

Break below 3295 → may test 3270-3260 support.

2. 4-hour level

Signs of pressure: double tops formed near 3345, MACD golden cross momentum weakened, if the dead cross is confirmed, the callback will be strengthened.

Key support: 3300 (psychological barrier), if it falls below, look to 3270.

3. 1-hour level

Short-term bearish: moving average diverges downward, K-line is under pressure from short-term moving average, and the rebound momentum is insufficient.

Today's operation strategy

1. Main strategy: short on rebound

Entry point: short with a light position in the 3330-3335 range, stop loss above 3345.

Target: 3280-3270 (if it falls below 3270, hold and look at 3260).

Logic: 3345 resistance is effective + strong US dollar + technical side is bearish.

2. Auxiliary strategy: short-term long on pullback

Entry conditions: 3270-3260 stabilizes (such as K-line closes long lower shadow or MACD bottom divergence).

Stop loss: below 3250, target 3295-3300.

Logic: lower edge support of range + risk aversion may be repeated.

3. Breakthrough strategy

Break above 3345: chase long, target 3360-3380, stop loss 3330.

Break below 3260: wait and see whether the decline accelerates, avoid counter-trend operations.

Risk warning

Sudden events: If the US stock market plummets or the trade conflict escalates, gold may quickly break through 3345.

US dollar fluctuations: pay attention to whether the US dollar index can stand firm at 97.5. If it falls back, it will ease the pressure on gold.

Data impact: US economic data (such as PPI, Fed speech) may disturb the market.

Summary

Short-term: Prioritize shorting below 3345, and strictly stop loss.

Mid-term: If it breaks through 3345, turn to long thinking, and if it breaks below 3260, wait and see.

Gold Trading Strategy | July 9-10✅Yesterday, gold prices briefly surged due to heightened safe-haven demand, but we remained skeptical about the sustainability of the rebound and continued to uphold our strategy of shorting at higher levels. As expected, gold eventually moved lower, breaking below the previous day's low and establishing a bearish continuation pattern. Our bearish outlook was confirmed by market action.

✅In terms of price structure, although gold saw a moderate rebound during the latter part of the U.S. session, the momentum was weak, indicating that strong resistance remains overhead. The market continues to exhibit a bearish tone, so today’s strategy remains unchanged—waiting for a rebound to resume short positioning.

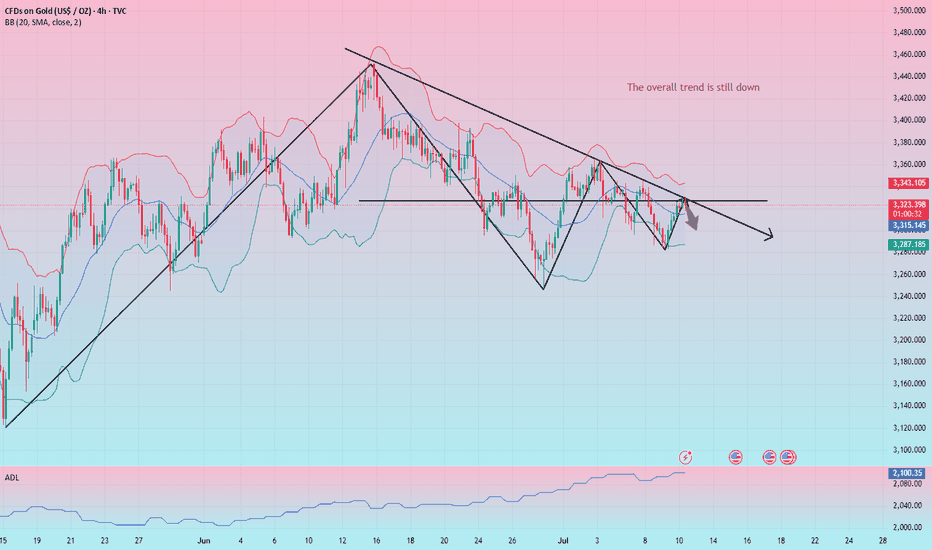

✅Technical Analysis:

🔸Daily Chart: Gold remains in a state of high-level consolidation with signs of momentum exhaustion. Yesterday’s price action saw resistance near the 3345 level once again, followed by a pullback. Although it temporarily broke below 3300, the price later recovered, reflecting a tug-of-war between bulls and bears. The candlestick pattern shows alternating bullish and bearish candles, lacking sustained direction, and no clear single-sided trend has emerged yet.

🔸4H Chart: Gold continues to trend lower in a step-like, descending pattern. The recent high at 3345 marks a lower high, and current resistance is forming near the downtrend line and the midline of the Bollinger Bands—around 3333 and 3320. Price action suggests high probability of rejection in this zone. We recommend continuing to short near resistance, with the next target at the 3255 level. The overall structure remains a slow, choppy downtrend.

🔸1H Chart: The bearish trend persists with new local lows being formed. Moving averages are aligned in a clear downtrend formation with strong bearish momentum. After breaking below 3313 yesterday, a minor rebound failed to hold, confirming 3313 as a key resistance level. Now, early trading is facing pressure near 3315, suggesting a good area to look for short entries.

🔴Key Resistance Zone: 3315–3320

🟢Key Support Zone: 3287–3275

✅Trading Strategy Reference:

🔻Short Strategy:

🔰Enter short positions in the 3313–3315 area in multiple entries.

🔰Stop loss: 8–10 USD

🔰Target: 3300–3285, with potential extension toward 3275 if support is broken.

🔺Long Strategy:

🔰Consider long positions in the 3275–3278 range with staggered entries.

🔰Stop loss: 8–10 USD

🔰Target: 3290–3300, with further upside potential toward 3305 if resistance breaks.

🔥Note: Trading strategies are time-sensitive. For more accurate and real-time Trading Signals, feel free to contact me directly.

7.9 Latest gold trend analysis and operation layout📰 News information:

1. Federal Reserve meeting minutes

📈 Technical Analysis:

Our decision to close our positions at 3305 yesterday was undoubtedly a very strategic one. After reaching a high of around 3310 last night, it began to fall. At the same time, I also gave VIP members the news that it might fall back to around 3300. Since the opening, the lowest point has reached around 3285. The overall trend is still under our control.

At present, gold will still usher in technical corrections in the short term. The current price of 3293-3290 support can be considered for long positions. If the European session continues to fall below the low, you can try to go short during the NY session. If the European session continues to maintain sideways consolidation, you can consider retreating and going long during the NY session. As long as the key support of 3250 below is held, gold will maintain its consolidation trend in short-term trading. On the contrary, once it falls below 3250, gold may directly touch the 3200 mark. Focus on the minutes of the Federal Reserve meeting, which may further influence the trend of gold.

🎯 Trading Points:

BUY 3293-3290-3285

TP 3305-3310-3320

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

Analysis of the latest gold trend next week:

Analysis of gold news: Friday (July 4) coincided with the US Independence Day holiday, and gold prices were in a narrow range of fluctuations. Strong employment data not only pushed up the US dollar and US bond yields, but also significantly weakened the market's expectations of the Federal Reserve's early rate cuts, which greatly reduced the attractiveness of gold. At the same time, the US Congress passed the Trump administration's massive tax cut and spending bill, further injecting complex variables into the economy. There will be no key data to watch today. Due to the US Independence Day, all markets will close early, which will limit the fluctuation range of gold prices.

Key technical signals:

Daily level:

Range fluctuations: Gold prices repeatedly tested in the 3320-3360 range, the Bollinger band narrowed, and the MACD kinetic energy column shrank, indicating that the market was in a wait-and-see mood.

Key support/resistance:

Support: 3320 (5-day moving average), 3300 (psychological barrier + Bollinger lower track).

Resistance: 3350-3360 (non-agricultural starting point + daily middle track).

4-hour level:

Short-term bottoming signs: After the non-agricultural data, the gold price fell to 3322 and then rebounded, forming a double bottom prototype, but it needs to break through 3350 to confirm the reversal.

RSI is neutral (around 50) and may maintain a narrow range of fluctuations in the short term.

2. Next week's market deduction

1. Baseline scenario (oscillation and consolidation, 60% probability)

Trend: The gold price fluctuates in the 3320-3360 range, waiting for CPI data to guide the direction.

Operation strategy:

Short-term high-sell and low-buy:

Long order: Long at around 3320-3325, stop loss 3305, target 3350.

Short order: Short at 3350-3360 under pressure, stop loss 3370, target 3320.

2. Bullish breakthrough scenario (30% probability, CPI data required)

Trigger conditions: CPI is lower than expected (such as below 3.2%), the market re-bets on interest rate cuts, and the US dollar weakens.

Trend: After breaking through 3360, it may test 3380 (200-day moving average) or even 3400.

Operation strategy:

Break through and chase long: Follow up after stabilizing 3360, target 3380-3400.

3. Bearish breakout scenario (10% probability, need continued strength of the US dollar)

Trigger conditions: CPI is stronger than expected (such as more than 3.5%), and the Fed's hawkish remarks suppress expectations of rate cuts.

Trend: After breaking below 3300, it may test 3260 (June low).

Operation strategy:

Break through and follow short: After breaking below 3300, chase short, target 3260.

III. Trading strategy and risk management

Short-term trading (suitable for intraday positions)

Shock strategy: Buy high and sell low in the range of 3320-3360, with strict stop loss (10$-15$).

Breakout strategy: Wait for CPI data and follow the trend. If it breaks through 3360, chase longs or if it falls below 3300, follow shorts.

Mid-term layout (pay attention to the trend after CPI)

If CPI is positive: set up long orders at 3330-3340, with a target of 3400.

If CPI is negative: set up short orders at 3350-3360, with a target of 3260.

Risk warning

Liquidity risk: Speech by Fed officials (such as Powell) may trigger short-term sharp fluctuations.

Geopolitical risk: Sudden conflicts or banking crises may trigger safe-haven buying, breaking the technical logic.

4. Summary and key points

Core range: 3320-3360 (maintain the idea of oscillation before breaking through).

Long-short watershed:

Breaking through 3360 → opening up space to 3400.

Breaking through 3300 → opening a downward trend to 3260.

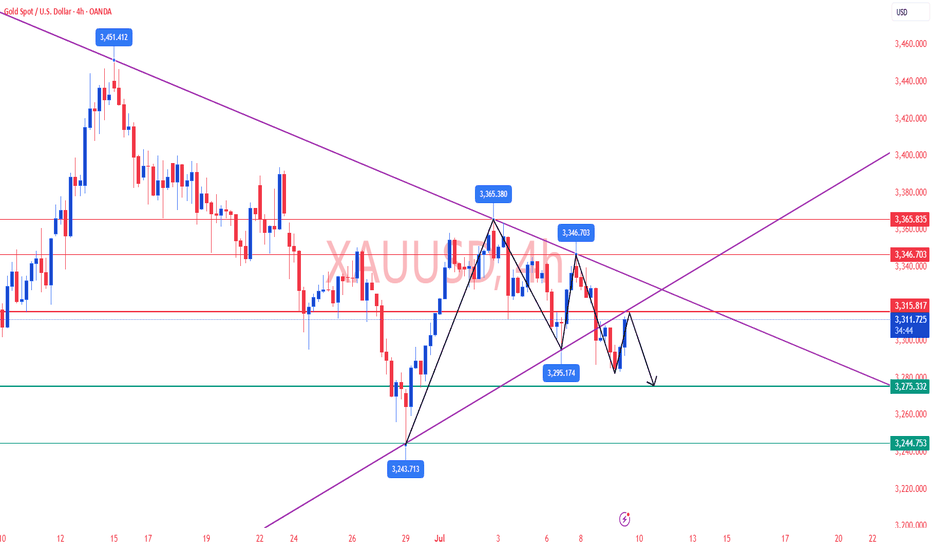

BullsSince hitting 3360+ Gold has formed a channel(flag) on which it has been declining on. Main goal is the 71 -79 retracement region before we get back to buys towards new all time highs.

Currently we at the lower end of the channel giving a buy opportunity towards the 1hr FVG @3325-3330 where we will also look for more sells and target 3280 -3274 (the 71 -79 retracement region).

NB don't force the market and watchout for major news

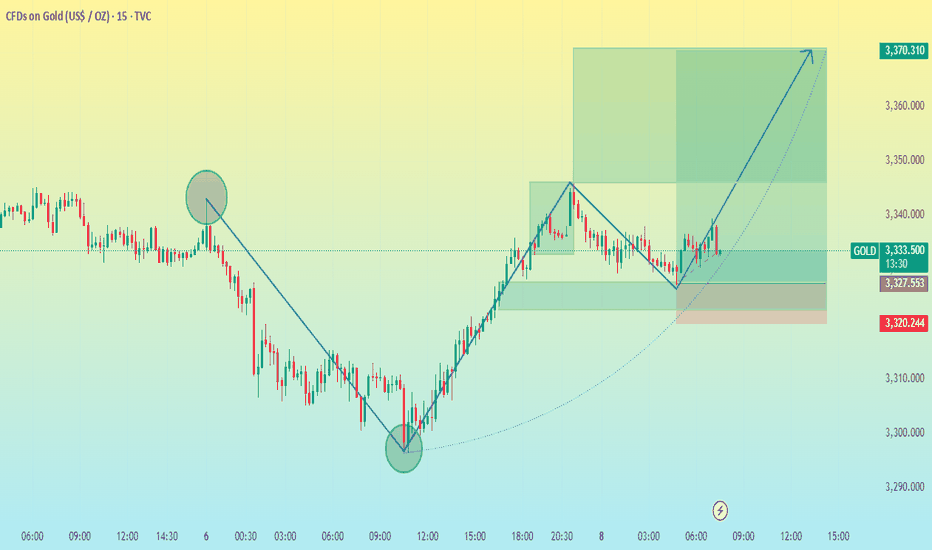

XAU/USD 15M CHART PATTERNHere's a structured summary of your XAUUSD (Gold/USD) trade setup:

---

📈 Trade Setup: BUY XAUUSD

Entry: 3333

Stop Loss: 3320 (13 pips below entry)

---

🎯 Take Profit Levels:

1. TP1: 3340 (7 pips gain)

2. TP2: 3350 (17 pips gain)

3. TP3: 3370 (37 pips gain)

---

⚖ Risk/Reward Ratios (Approx):

TP1: ~0.54 : 1

TP2: ~1.31 : 1

TP3: ~2.85 : 1

---

✅ Comments:

You’re targeting scaling out profits as the price climbs, which is a sound risk management approach.

Stop loss is tight, so you may get stopped out easily on volatility unless you're trading with confirmation (e.g., bounce from support or bullish candlestick setup).

Consider monitoring macroeconomic events or news that could affect gold prices (like CPI, NFP, Fed speeches).

Would you like help with setting this up in a trading platform or calculating position size based on your risk?

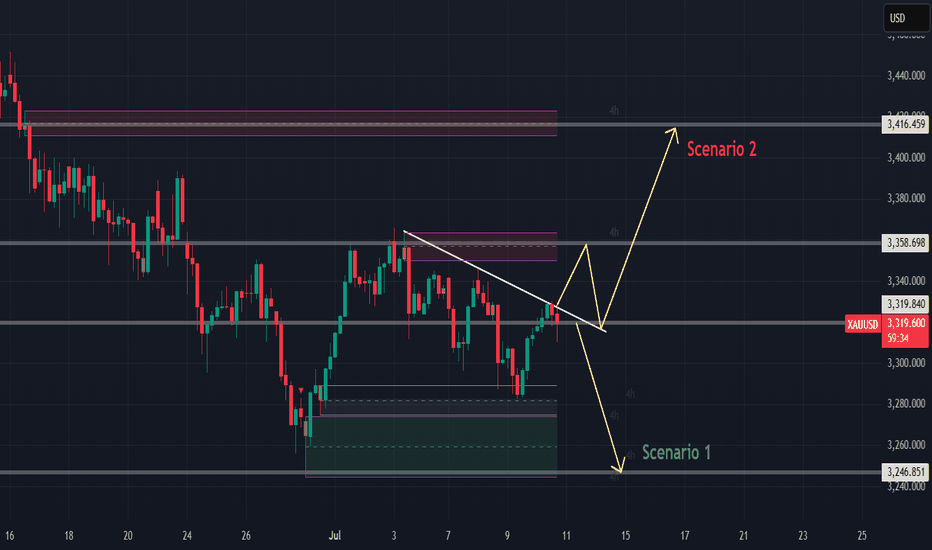

GOLD SETUP UPDATE - CLEAN BREAKOUT & RETEST PLANGold just broke out of a falling wedge pattern with a clean 5-wave completion.

Now it's pulling back — we prepare for two potential scenarios:

🔹 Scenario A:

If price retests the lower trendline (around 3,315–3,320) and gives a strong rejection, we look to buy targeting:

→ 3,345

→ 3,359

🔹 Scenario B:

If it skips the retest and continues to rally — we follow the breakout momentum.

✅ EMA ribbons are still holding bullish.

✅ MACD histogram flipped green — showing buyer pressure coming in.

🚫 Invalid if price breaks below 3,307 or 3,296.

Time to cut and reassess if that happens.

💡 Reminder: Wait for confirmation. Don’t FOMO.

Plan your trade — ride the structure, not the hype.

#GoldAnalysis #TechnicalSetup #ForexTrading #PriceAction #FaizIsmail