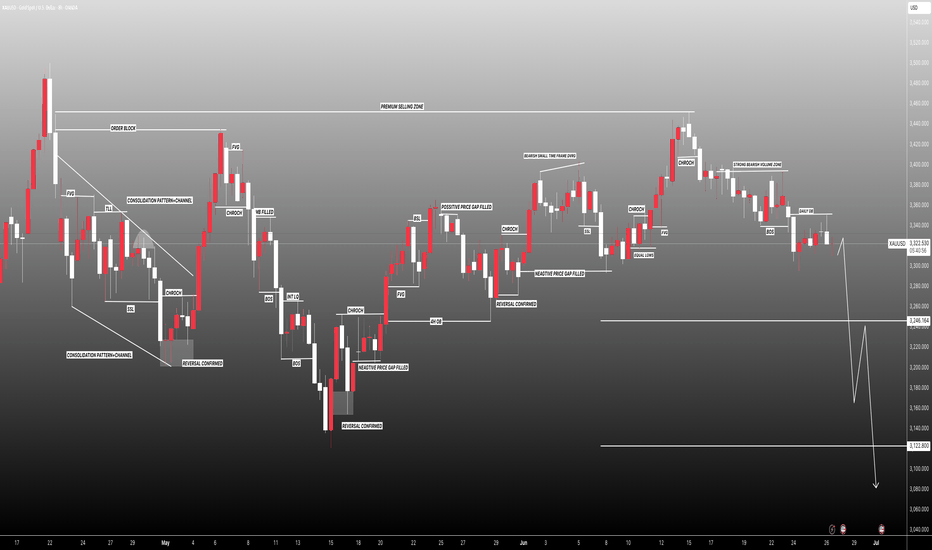

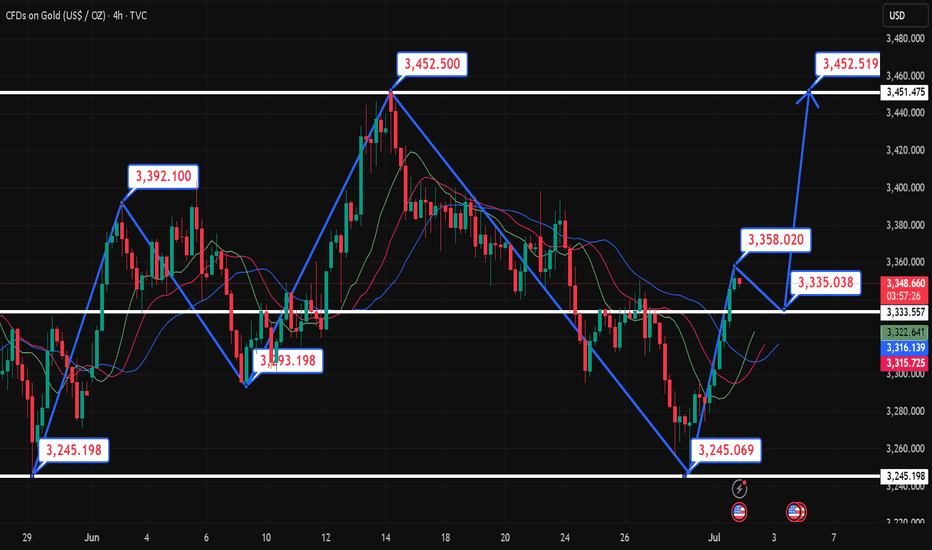

XAUUSD: We must adapt to the market conditions! Bears in ChargeGold prices dropped as Trump announced a ceasefire between Iran and Israel, causing a significant decline. We anticipate this trend to persist, as recent price data, including volume and price momentum, indicates a strong seller’s control in the current market conditions. We have two targets for you to set your own based on your analysis, along with a stop-loss based on your strategy.

We appreciate your unwavering support throughout the years. Please like and comment.

Team Setupsfx_

❤️🚀

XAUUSDG trade ideas

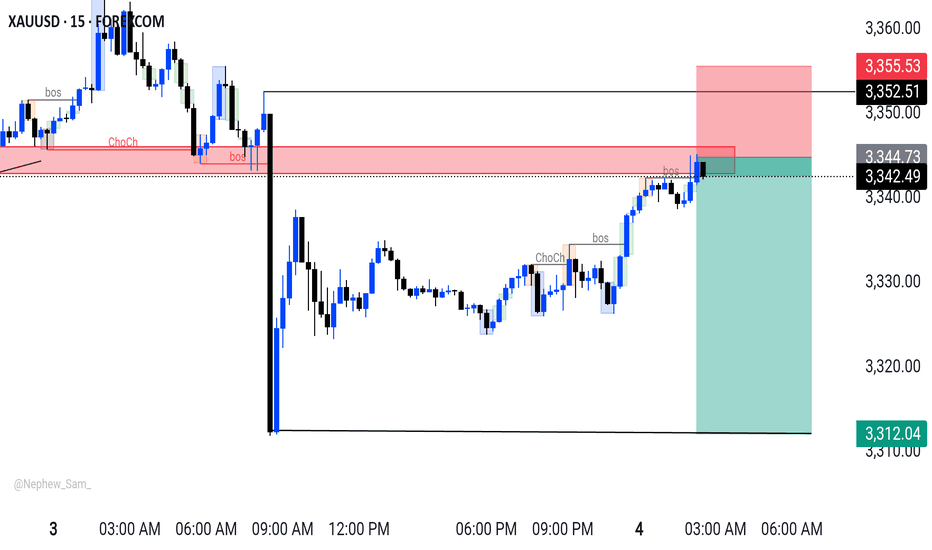

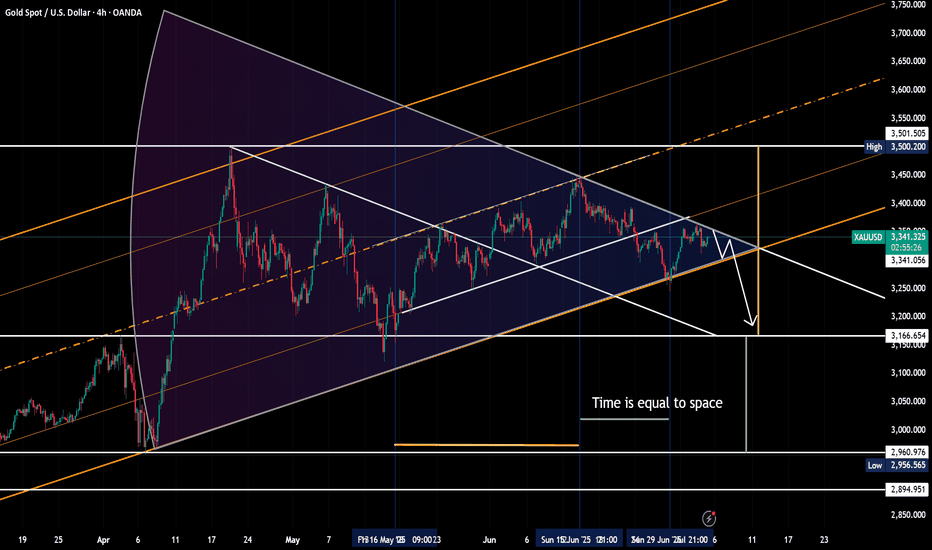

XAUUSD Analysis – July 2–3, 2025: Resistance Holds Gold is currently trading around 3,337 USD, having tested the 3,350 USD resistance zone without a successful breakout. The price remains under pressure from key macroeconomic factors:

- The Dollar Index (DXY) is stable above 106 – a sign of continued demand for the greenback, which weakens gold.

- U.S. 10-year Treasury yields hold around 4.35%, reinforcing the view that the Fed will keep interest rates high.

- The Core PCE report for June remains above the Fed’s 2% inflation target, decreasing expectations of a rate cut in Q3.

- Safe-haven demand is weak, as geopolitical tension in the Middle East and Eastern Europe remains subdued.

➡ Overall, these factors confirm that XAUUSD remains under bearish pressure in both the short and medium term, especially while key resistance remains intact.

1. Technical Analysis – XAUUSD on D1 Chart

- Price recently tested the 3,340 – 3,350 USD resistance zone, a confluence of:

Previous supply zone

- Fibonacci retracement 0.5–0.618 from 3,399 USD

- Key Change of Character (CHoCH) level

- RSI is forming a mild bearish divergence, signaling weakening bullish momentum.

- EMA20 and EMA50 are both sloping downward – confirming the prevailing bearish trend.

This setup is typical of a Sell on Rally pattern, with each retracement being rejected at strong resistance.

2. Key Technical Zones to Watch

Technical Role

- 3,350 – 3,340 Major resistance (Fibo 0.5–0.618 + supply + CHoCH)

- 3,294 – 3,285 Nearest support – previously a resistance-turned-support

- 3,255 – 3,235 Short-term target zone – June low

- 3,223 – 3,205 Strong medium-term support – April low + extended Fibo

3. Suggested Trade Setup

Preferred Scenario: SELL below 3,350

Entry: 3,345 – 3,347

Stop Loss: 3,351

Take Profit 1: 3,335

Take Profit 2: 3,330

Take Profit 3: 3,320

Ps : XAUUSD is retesting a major resistance zone without macro or technical catalysts for a sustained breakout. The best approach remains to sell at resistance and take profit near support, in alignment with the ongoing bearish trend.

The strategy will be updated regularly – don’t forget to save and follow to stay ahead of market opportunities.

The analysis was provided by @Henrybillion

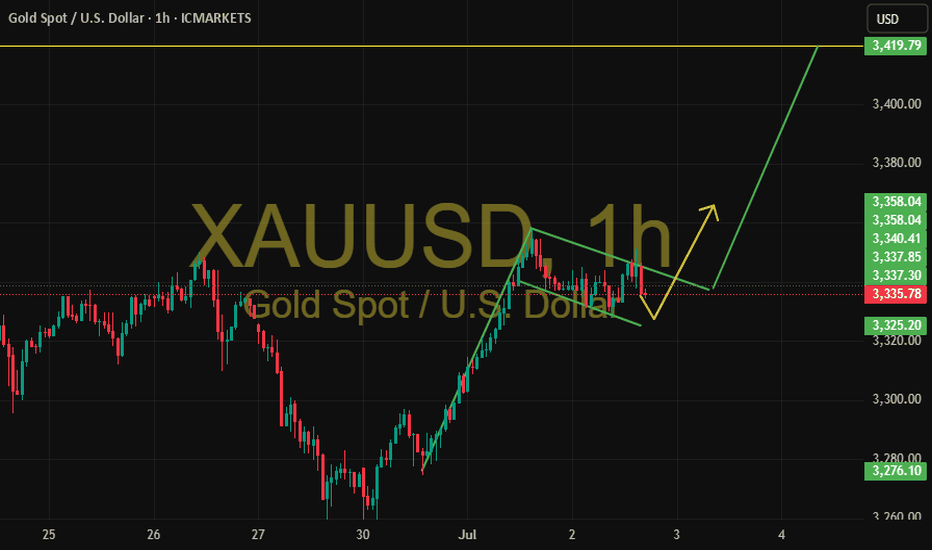

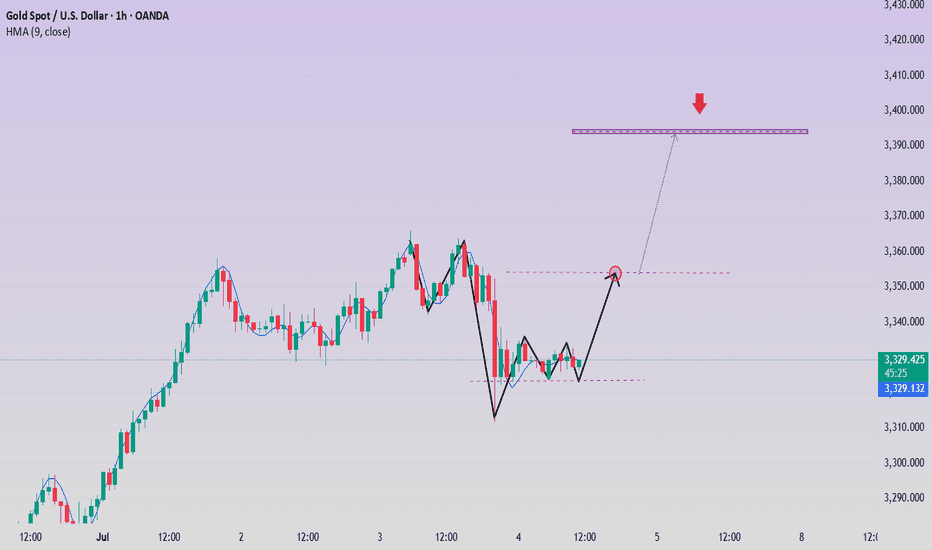

XAUUSD – Bullish Flag Pattern on the Hourly Chart📌 XAUUSD – Bullish Flag Pattern on the Hourly Chart

Gold completed a strong upward move last week and then entered a corrective phase forming a classic bullish flag pattern with a descending channel.

🟡 Currently, price is consolidating within the pattern boundaries. As long as it holds the support area around 3,325, the favored scenario is a continuation of the bullish trend upon an upward breakout.

🎯 Technical target after breakout: 3,419, based on the flagpole height.

📉 In case of a downside break, the scenario will be reassessed.

🔍 This analysis is for educational purposes only and not a trading recommendation.

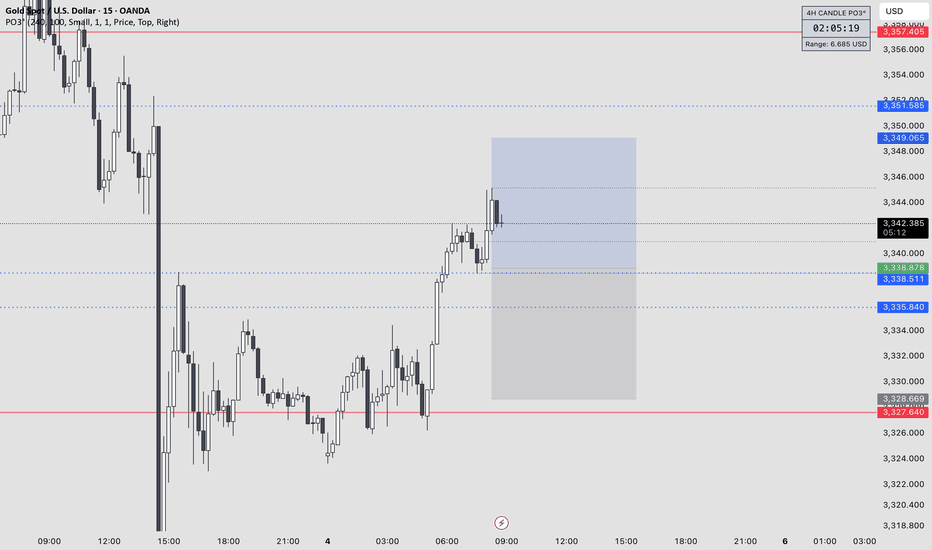

Gold price range: 3310-3360Gold price range: 3310-3360

Spot gold fell to $3311.65 during the session, but it is still fluctuating above the key support level of $3310, and the current price is around 3340.

As shown in the figure:

The latest triangle convergence range oscillation pattern has been shown to everyone

Key pressure area: 3355-3360

Key support area: 3310-3320

It is expected to enter a range oscillation pattern on Friday.

Due to the US Independence Day holiday, today's gold price trend is more affected by the performance of the Asian session.

According to analysis and observation, the gold price showed a pull-up or oscillating upward trend in the Asian session this week.

Most of the factors that led to the rise in gold prices this week can be attributed to the pull-up rhythm in the Asian session.

According to Chinese news reports: China has suspended holdings of gold, but Turkey and India are still buying.

In other words, the main factors for this week's rise are Turkey and India.

At present, the range of gold price fluctuations will become narrower and narrower, and it is unlikely that a new general direction will appear this week.

Then the corresponding strategy is:

In the oscillation range of 3310-3360, use oscillation thinking to trade

Short at high level, stop loss at 3365

Long at low price, stop loss at 3300

The author prefers the idea of short at high price

7.4 Non-farm payrolls exploded, and expectations for the Fed’s rOn Thursday, as the strong US employment data dispelled the market's expectations of the Fed's recent rate cut, the US dollar index rose sharply before the US market, returned to above the 97 mark, and once rose to an intraday high of 97.42.

Spot gold fell sharply, once falling to $3311 during the session, a drop of more than $50 from the intraday high, and then recovered some of its losses and remained near 3330 for consolidation.

The current upper suppression position of the daily line is almost here at 3350, and the lower support is located at 3320-25.

So if it is maintained in the range of consolidation, it is likely to be rectified at 3320-50.

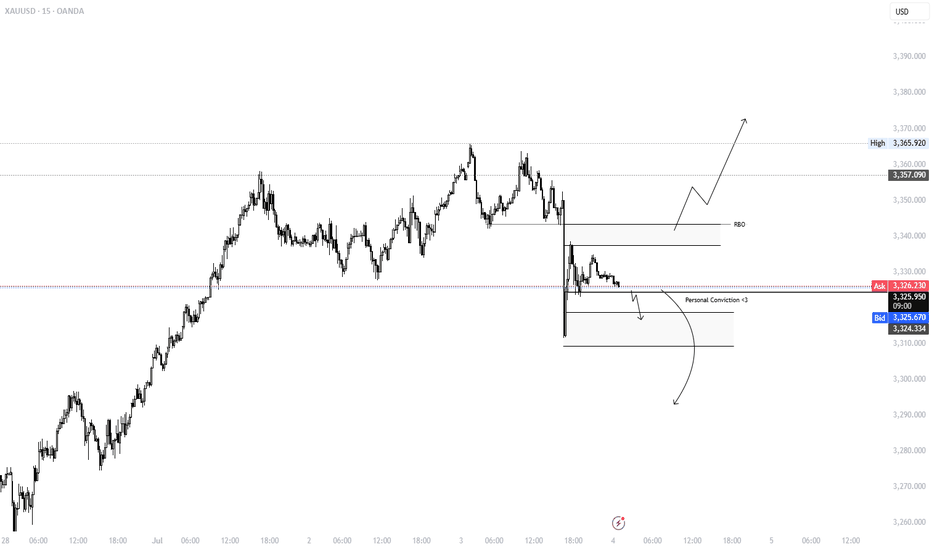

Secondly, from the hourly chart:

It can be seen from the trend of 3247 to 3365.

The Fibonacci 618 position is exactly here at 3320.

Although the lowest point last night was pierced to around 3311, it can be seen that the entity still closed above 3320.

As long as 3320 cannot be broken, the best case scenario is to maintain it at 3320-50 for consolidation. If not, once 3350 is broken, the high point of 3365 will definitely not be able to be maintained.

Therefore, for today's operation, try to maintain the high-selling and low-buying range of 3320-50.

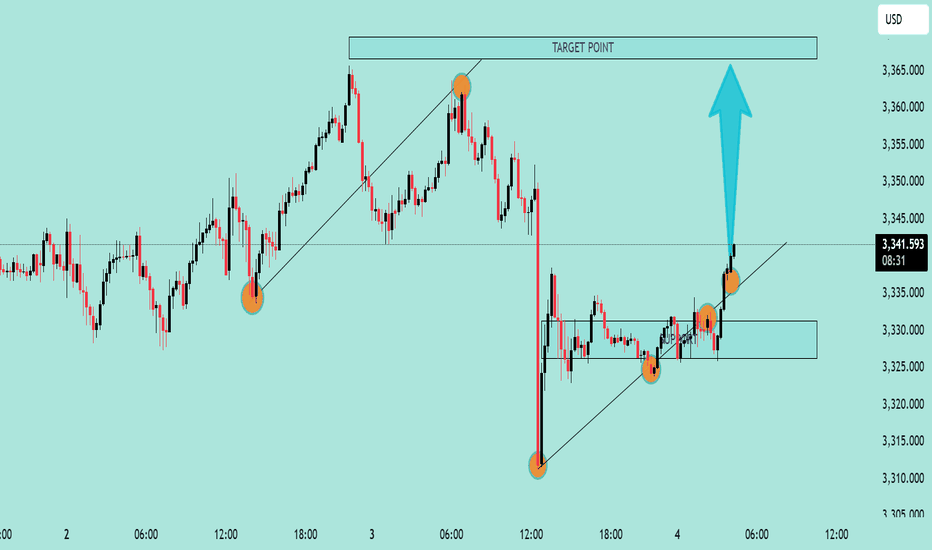

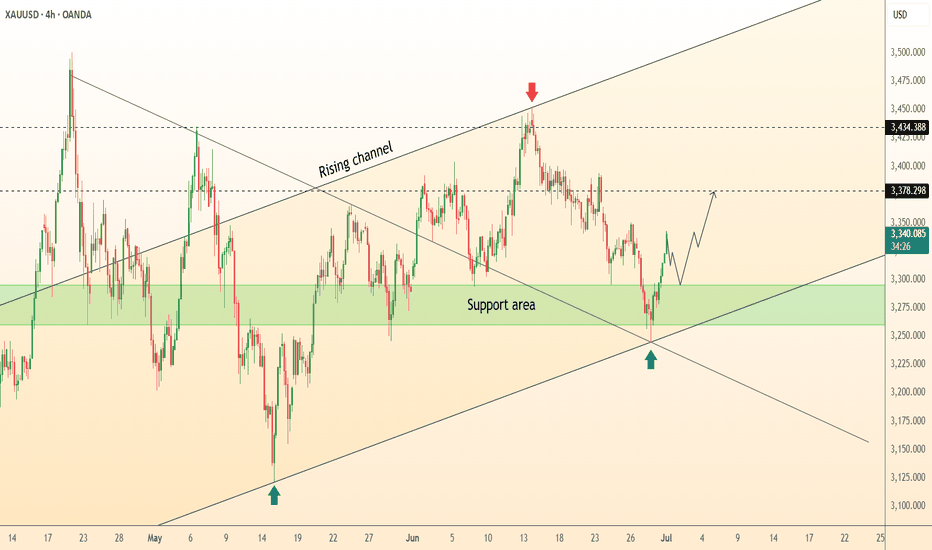

Gold/USD Bullish Breakout Toward Target Zone Gold/USD Bullish Breakout Analysis 🚀🟢

The chart illustrates a strong bullish breakout from a consolidation zone, signaling upward momentum:

🔍 Key Technical Observations:

Support Zone: The price respected the support area around 3,325 – 3,330 USD, forming a solid base for reversal.

Bullish Structure: Series of higher lows and higher highs indicate a bullish trend formation.

Breakout Confirmation: Price broke above short-term resistance with a strong bullish candle, indicating buying pressure.

Trendline Support: The ascending trendline has held well, confirming trend continuation.

Target Point 🎯: Projected target is near 3,365 USD, which aligns with a previous resistance and Fibonacci confluence zone.

✅ Conclusion:

The breakout above resistance, supported by a bullish structure and momentum, suggests further upside potential toward the 3,365 USD target zone. As long as price holds above the breakout level, bullish bias remains valid.

🛑 Watch for invalidation if price falls back

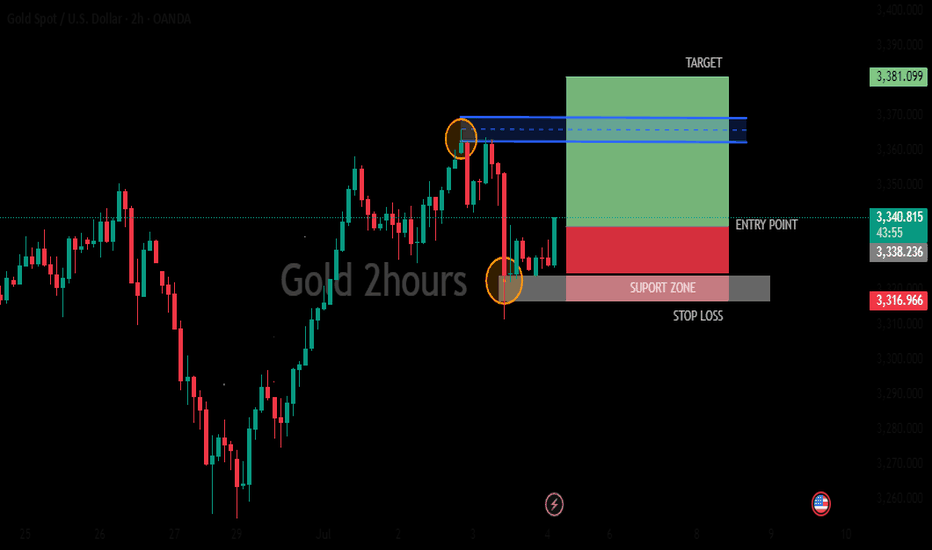

Gold fluctuates during the day, short-term profits will be left

📌Main driving events of gold

The big non-agricultural data in the United States caused the gold price to fall by almost 40 US dollars in one breath, but after a short emotional storm, the market returned to calm. Today's market began to bottom out and rise. As of now, the non-agricultural market has been backed by 50%, and the energy of the shorts has been basically digested. Next, the bulls will start to exert their strength! Today's direction is still the same and continue to be bullish!

📊Comment analysis

In the US market, the gold price rebounded after the decline and the bottom of the second retracement appeared. The support level is 3322. After a night of fluctuations, gold has begun to rise, and the low point has begun to rise. The key point of the day is still 3323. In the morning, we wait for the gold price to fall back to around 3323 and we will buy the bottom and go long. We don’t expect to surpass yesterday’s high point during the day, but at least it will go to 3350!

💰Strategy Package

Long position:

Gold long at 3322-3327, stop loss 3315, target 3350-3360

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

Gold price recovers above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) trades at $3,292 after rebounding from an intraday low of $3,246 and looks set to close out June with a modest gain of over 0.18%. However, its upward momentum has been restrained by easing geopolitical tensions in the Middle East and growing optimism over forthcoming trade agreements. Meanwhile, analysts at Citi expect Gold to consolidate within the $3,100 to $3,500 range throughout the third quarter.

In Washington, US Treasury Secretary Scott Bessent expressed confidence that the “One Big Beautiful Bill” will make progress in the coming hours. The sweeping tax reform legislation, which narrowly passed the Senate over the weekend, includes major tax deductions funded by reductions in Medicaid spending and green energy incentives.

⭐️Personal comments NOVA:

Gold price recovers above 3300 , ahead of NF reports this week . Accumulates above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3272-$3270 SL $3265

TP1: $3283

TP2: $3295

TP3: $3310

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD The ADP Non-Farm Employment Change for July 2,have a forecast of 99,000 jobs, compared to the previous month’s very weak result of 37,000—the lowest since March 2023. The ADP National Employment Report is a monthly indicator that tracks changes in non-farm private sector employment in the US, based on anonymized payroll data from ADP’s clients, covering about one-fifth of all US private employment.

Who is responsible?

The report is produced by the ADP Research Institute, part of Automatic Data Processing (ADP), in partnership with the Stanford Digital Economy Lab.

Why it matters:

The ADP report is viewed as a leading indicator for the official Non-Farm Payrolls (NFP) report from the Bureau of Labor Statistics (BLS), released two days later.

It provides early insight into US private sector job growth and labor market health, and significant deviations from forecasts can move financial markets.

Note that the ADP report covers only private sector jobs, not government employment, so its numbers can differ from the official NFP.

Summary Table:

Report Date Forecast Previous Responsible Department

July 2, 2025 99,000 37,000 ADP Research Institute (ADP)

In summary:

The ADP Non-Farm Employment Change report, produced by the ADP Research Institute, forecasted a rebound to 99,000 jobs in June after a very weak 37,000 in May, providing an early signal on the health of US private sector employment.

(2)US10Y drops to historical low to 4.193% and currently broken 1hr descending trendline at 4.281% ,4.3% resistance will be watched for breakout buy bond buyers.

(3) DXY Key Points:

The DXY measures the US dollar’s strength against a basket of six major currencies: the euro (57.6% weight), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%).

After peaking near 110.075$ in January 2025, the index has softened , trading near 96.600-101.966.on weekly TF 101.966 was a retest to broken weekly demand floor .

The dollar’s decline reflects market expectations of Federal Reserve rate cuts later in 2025, easing inflation pressures, and some geopolitical easing.

the DXY to rebound will henge and depend on Fed policy and global economic conditions.

GOLD buyers are watching for the direction of trade ,

Chinese Demand and Policy:

China is one of the largest gold consumers and holders. Domestic demand, central bank gold purchases, and monetary policy in China heavily influence XAU/RMB. If China’s economy slows or trade tensions with the US worsen, demand for gold as a safe haven may increase, supporting XAU/RMB even if the dollar is strong.

China's recent opening of the Shanghai Gold Exchange's (SGE) first offshore gold vault in Hong Kong on June 26, 2025, represents a significant development with potential, albeit indirect, implications for XAU/USD (gold priced in US dollars) .

Key Aspects of the Hong Kong Gold Vault:

Location and Operation: The vault is located in Hong Kong and operated by Bank of China's Hong Kong unit .

Yuan-Denominated Trading: All transactions and settlements in the vault are denominated exclusively in yuan, either via cash or physical bullion delivery . Two new yuan-denominated gold trading contracts were launched alongside the vault .

Strategic Objectives:

Increased Influence on Gold Pricing: China, as the world's leading gold producer and consumer, aims to gain greater control and influence over global gold pricing mechanisms .

Yuan Internationalization: The initiative seeks to accelerate the international usage of the yuan, supporting China's broader de-dollarization efforts . This allows China to import gold in yuan, reducing reliance on the US dollar for commodity trading .

Enhanced Global Reach: The vault expands the SGE's physical infrastructure beyond mainland China, creating a new gateway for international gold trading and solidifying Hong Kong's role as a key financial hub .

Physical Settlement: It facilitates the physical settlement of gold contracts outside mainland China .

Implications for XAU/USD:

While the new vault directly promotes yuan-denominated gold trading, its implications for XAU/USD are primarily indirect and long-term:

De-dollarization Efforts: By promoting yuan-denominated gold trading, China is actively working to reduce global reliance on the US dollar in commodity markets . If successful, a more diversified global gold trading landscape could gradually diminish the dollar's sole influence over gold prices, potentially leading to less direct inverse correlation between the dollar and gold .

Increased Demand and Liquidity: The vault aims to attract more international participants to yuan-denominated gold markets, potentially increasing overall gold demand and liquidity in the Asia-Pacific region . While this demand is primarily yuan-driven, a generally stronger global gold market could indirectly support XAU/USD .

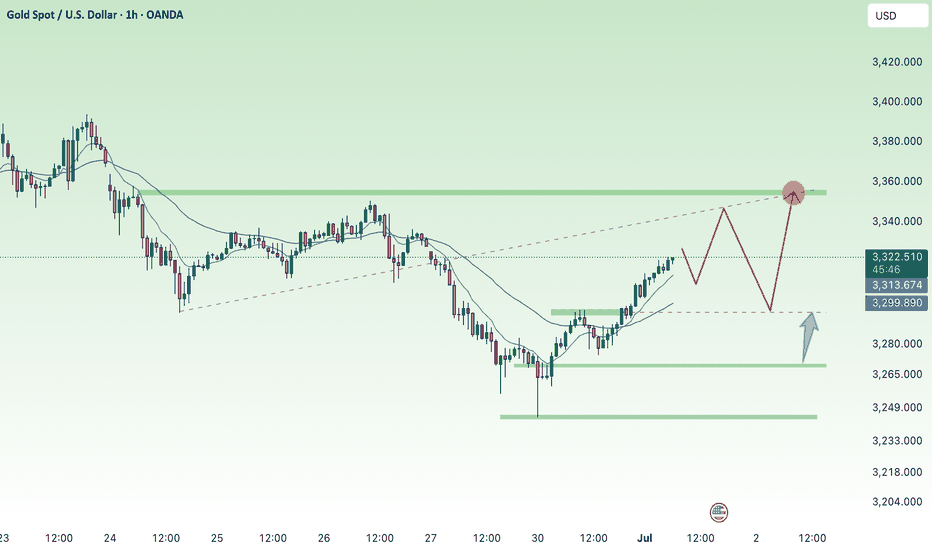

DeGRAM | GOLD held the support area📊 Technical Analysis

● Bullish rebound from the green 3 250-3 300 demand, where the rising-channel base and May’s inner trend-line intersect, prints a higher low and invalidates the prior break.

● Price is reclaiming the channel median; a push through 3 378 unlocks the June swing cap at 3 434, while risk is contained by the fresh pivot turned support at 3 300.

💡 Fundamental Analysis

● Softer US ISM-Mfg prices and a dip in 2-yr yields eased dollar pressure, while IMF data show another uptick in official gold purchases—both restoring near-term bid.

✨ Summary

Long 3 300-3 320; hold above aims 3 378 → 3 434. Invalidate below 3 250.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

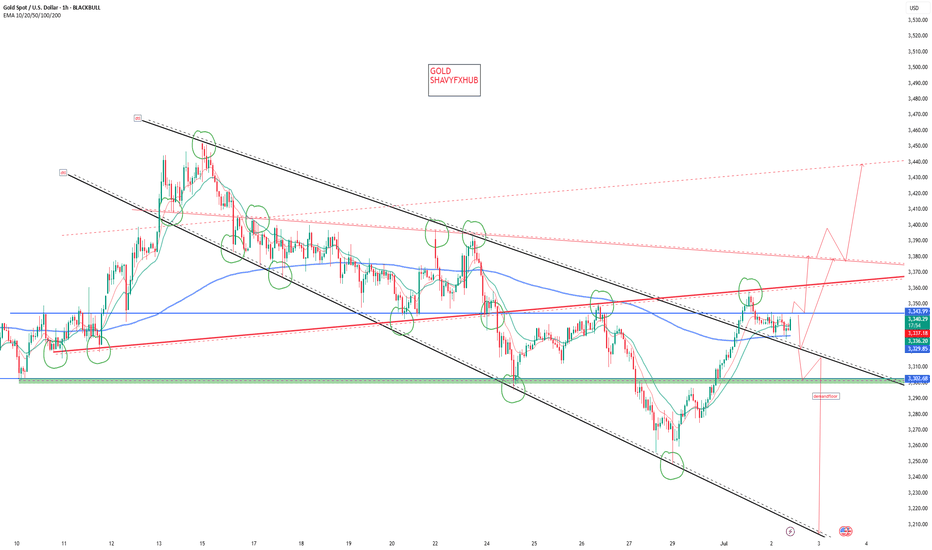

7.1 Technical guidance for short-term gold analysis!!!Gold hourly level: From the opening to now, it has been rising slowly with a small negative in the middle. It is all positive. This kind of pull-up pattern must not be tested for shorting. During the European session, it also broke through the upper rail resistance of the 3335 downward channel. There is a second pull-up in the US session; but it has not been able to step back, and even the 10-day moving average does not give a chance. If you want to step back and follow the long position, there is no chance for the time being, and going long directly seems more radical; conservative can wait patiently, be bullish, and don't go short; if it can be confirmed tonight that it is above 3335, you can try to follow the bullish trend, and the upper resistance target is 3374;

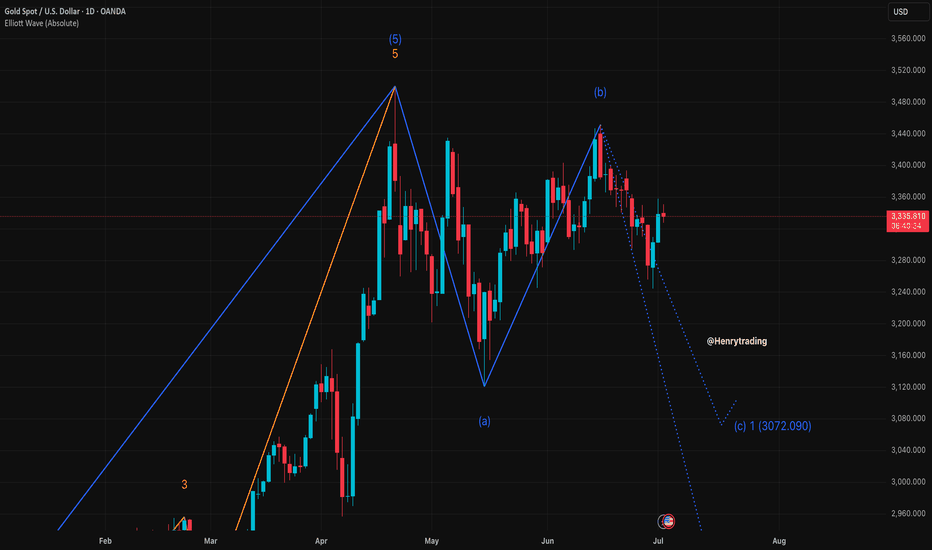

XAUUSD – Bearish Month?🧭 Fundamental Bias: Bearish (-7/10)

– 🔥 NFP beat: 147K vs 110K → Fed cuts unlikely soon

– 💵 Dollar & Bond Yields UP

– 📈 Risk-on (Stocks ATH)

– 🛢️ Oil dropped = easing inflation

– 🏛️ No fresh Fed dovish hints

– 🕊️ Geopolitics stable for now (Iran/Trump)

📍 Technical View:

Price consolidating under supply zone (~3330).

From Congestion to Collapse: Understanding Distribution and H&S A Simple Lesson: How to Identify Congestion Zones in the Market — Schabacker’s Approach and the Head and Shoulders Pattern

⸻

👤 Who Was Schabacker?

🔹 Richard Schabacker was one of the pioneers who authored seminal works on technical analysis.

🔹 He lived over 90 years ago and served as Editor-in-Chief of Financial World magazine.

🔹 His most notable book is:

Technical Analysis and Stock Market Profits

🔹 Published around 1932 in the United States.

🔹 Schabacker is often considered the “grandfather” of technical analysis, and much of the methodology traders use today can be traced back to his insights.

⸻

🟢 What Did He Teach?

🔹 Schabacker introduced a critical concept:

✅ The Congestion Zone

🌟 What Does It Mean?

When the market makes a strong move—either a sharp rally or a steep decline—price often becomes trapped in a range:

• Buyers at higher levels wait for further gains.

• Sellers at lower levels expect more downside.

But in reality, retail traders aren’t moving the market. Large institutions and funds—the so-called smart money—are in control.

👈 When these big players want to exit positions, they avoid selling everything at once to prevent a sudden collapse in price and to avoid revealing their hand.

✅ Their Playbook:

• Keep price contained within a narrow band between support and resistance.

• Gradually increase volume over time.

• Attract new buyers who believe the trend is still intact.

• Quietly distribute their holdings without alarming the market.

🌟 Why Do They Do This?

If they were to dump all at once:

• Price would drop rapidly.

• Everyone would realize a large seller was active.

• Institutions would get stuck, unable to exit at favorable prices.

🔻 So They Create Congestion and Distribution:

1️⃣ Sell discreetly over time.

2️⃣ Maintain the illusion that the trend is healthy.

3️⃣ Trap latecomers who buy into the range.

⸻

🟢 How Do You Recognize This on a Chart?

🎯 A Simple Example:

• Price climbs steadily from 3,000 to 3,300.

• Suddenly, it surges to 3,450.

✅ Most traders think the rally will continue.

🌟 What happens next:

• Price stalls between 3,380 and 3,450.

• Numerous candles form in this area.

• Volume remains elevated.

🔥 Inside this range:

1️⃣ Institutions sell into every upward move.

2️⃣ Early buyers remain committed, hoping for new highs.

3️⃣ New participants enter, unaware of the distribution.

🔻 What Do You See?

• Repeated candles oscillating within the same band.

• Failed breakouts above resistance.

• Sustained high volume.

✅ This is the classic Congestion Zone.

⸻

💡 How Can You Tell If It’s Distribution, Not Accumulation?

• Persistent high volume indicates steady selling.

• Price struggles to make fresh highs.

• Long upper wicks signal selling pressure.

• A Head and Shoulders pattern may start forming.

⸻

🎯 What Happens After Congestion?

• Institutions complete their distribution.

✅ Price breaks sharply below the range.

✅ The market drops quickly.

✅ Late buyers are forced to sell at losses.

⸻

🟢 Practical Illustration:

Visualize the range like this:

| |

| The Range |

| |

3380 ————> Resistance

| Multiple Candles |

| Multiple Candles |

| Multiple Candles |

3300 ————> Support and Neckline

✅ If price breaks below 3,300 on heavy volume:

• The distribution is complete.

• Price declines rapidly.

⸻

📌 Key Takeaway:

After any strong move, expect congestion as large players exit. Once they’re done, the trend often reverses.

⸻

🎯 Quick Tips:

✅ Never rush to buy inside congestion after a big rally.

✅ Watch volume—if it’s high, it’s likely distribution.

✅ Wait for a clear breakdown before shorting.

✅ Your target should at least match the size of the preceding move.

⸻

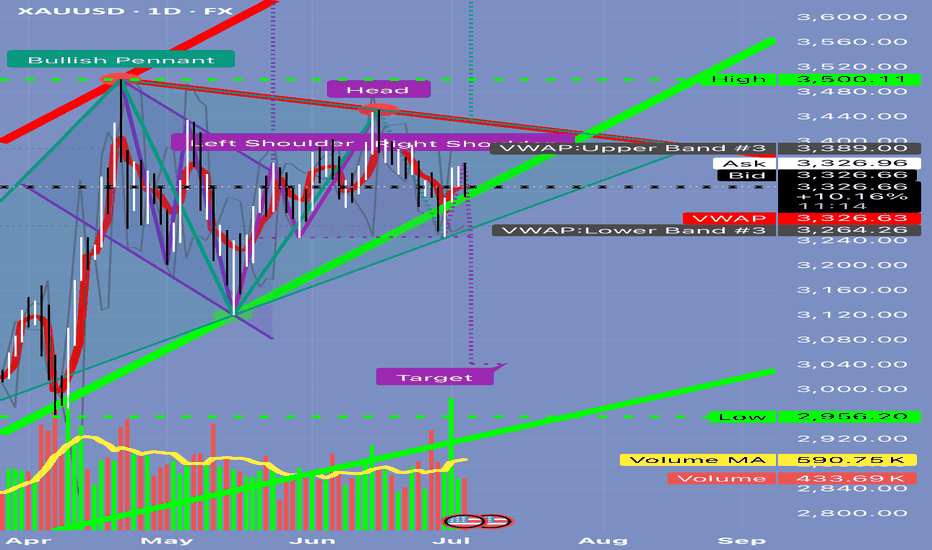

🔥 Let’s Cover the Head and Shoulders Pattern:

✅ What Is It?

A reversal pattern appearing after a strong uptrend, signaling the end of bullish momentum.

⸻

✅ Pattern Components:

1️⃣ Left Shoulder:

• Price makes a high.

• Pulls back.

2️⃣ Head:

• Rallies to a higher high.

• Declines again.

3️⃣ Right Shoulder:

• Attempts to rise but fails to exceed the head’s high.

4️⃣ Neckline:

• Connects the lows between the shoulders and the head.

🔻 When the Neckline Breaks Down:

It’s a strong sell signal. The market often drops decisively.

⸻

💡 Example in Numbers:

• Price moves from 3,200:

1️⃣ Up to 3,350 (Left Shoulder)

2️⃣ Down to 3,300

3️⃣ Up to 3,400 (Head)

4️⃣ Down to 3,300

5️⃣ Up to 3,350 (Right Shoulder)

6️⃣ Down to 3,300

✅ If price closes below 3,300 on strong volume, the pattern is confirmed.

🎯 Target Calculation:

• Head = 3,400

• Neckline = 3,300

• Distance = 100 points

• Target = 3,200

⸻

🟢 How To Trade It:

1️⃣ Don’t preemptively sell during the right shoulder.

2️⃣ Wait for a confirmed breakdown.

3️⃣ Enter a short position targeting 3,200.

4️⃣ Set your stop loss above the right shoulder.

⸻

🟢 Final Advice:

✅ The Head and Shoulders is powerful if confirmed by volume.

✅ Always wait for the neckline break—otherwise, it could be a false signal.

✅ Keep monitoring volume for confirmation.

⸻

🔥 Be disciplined in your analysis and decisive in your execution.

🔥 As Warren Buffett said:

“The stock market is a device for transferring money from the impatient to the patient.”

⸻

If you found this valuable, let me know—I’d be glad to prepare more lessons. 🌟