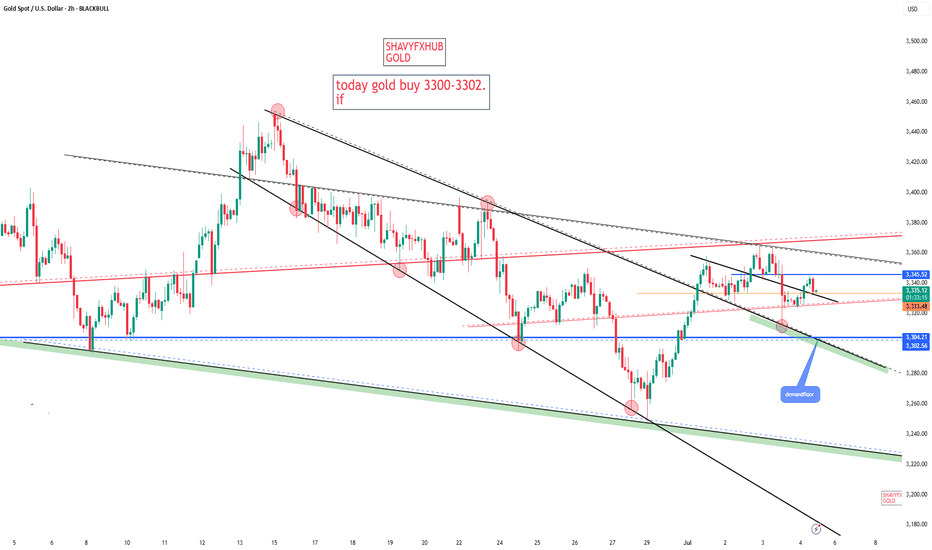

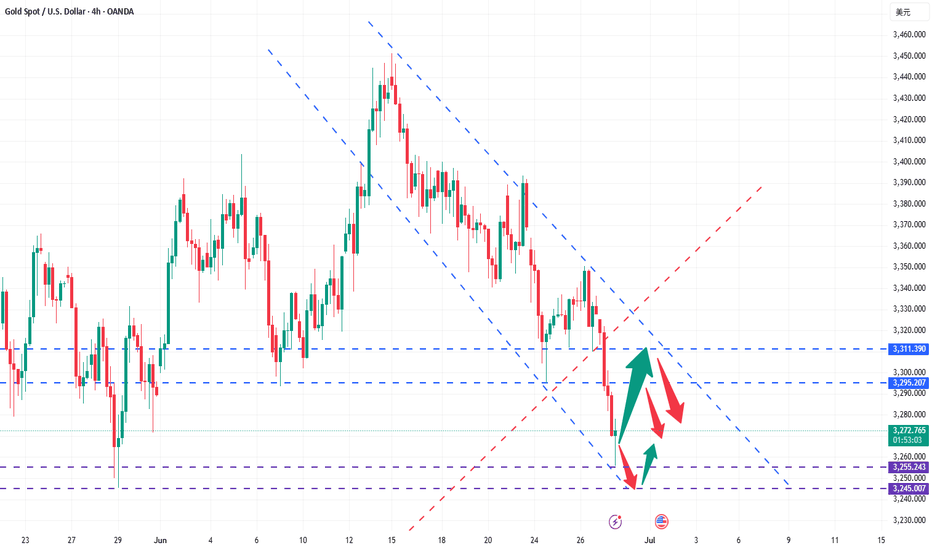

GOLD GOLD, we will watch every price action and respond accordingly ,from the lower zone am watching 3300-3302 descending trendline break out retest which will likely be in the 3300-3302 level and the fib is giving 0.63 fib.in addition to that i have a horizontal support to back my back my buy bias.

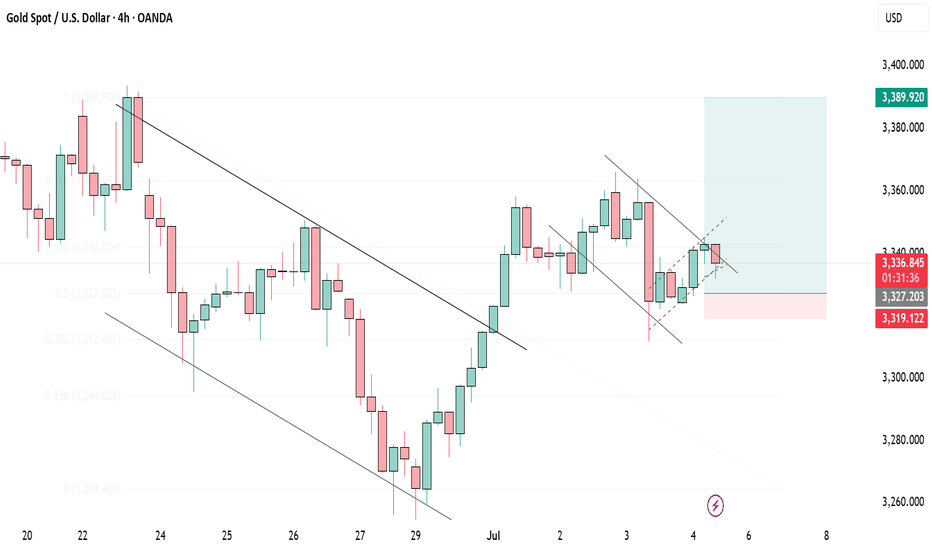

NOTE that H4 of gold is giving bearish after rejecting 3364 yesterday.

trading is 100% educated probability.

trade with caution and know that any key level can fail.

XAUUSDK trade ideas

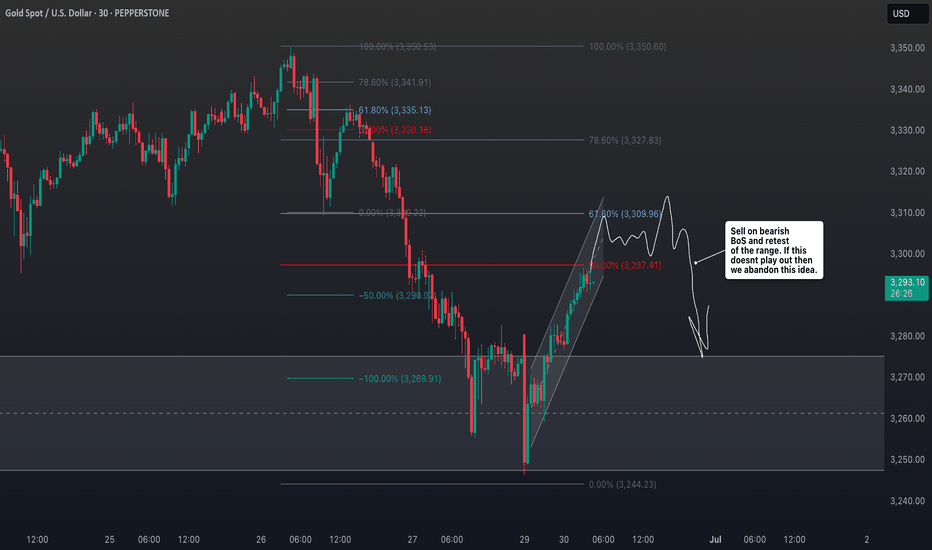

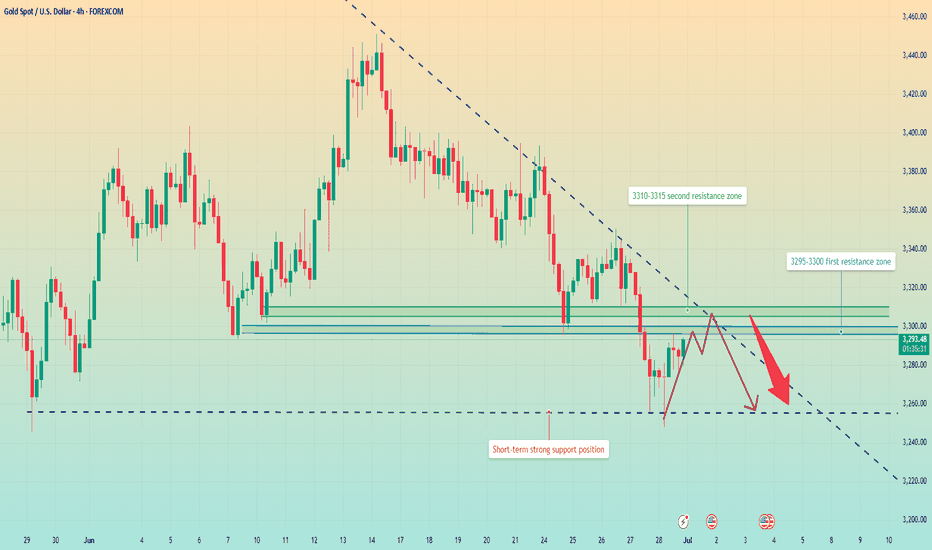

XAUUSD Under Pressure: What the Market Is Telling UsGold (XAUUSD) is currently trading with a clear bearish bias, showing sustained downside momentum on the 4H timeframe 🕒. Price has been gradually stepping lower, and the structure continues to favor the sellers.

As expected for early in the week, there’s been a bit of choppy movement ⚖️, but the overall sentiment remains weak. Unless we see a strong shift or catalyst, I’ll be maintaining a bearish outlook.

🧭 I’m watching for price to revisit key resistance levels, and if we get a clean break and retest 🔄, I’ll be looking for potential short setups from areas of previous demand that flip into resistance.

🌐 Keep an eye on broader risk sentiment — if NASDAQ starts pulling back or DXY strengthens, it could fuel further downside in gold.

As always, this is not financial advice, but the detailed breakdown is available in the latest video 🎥.

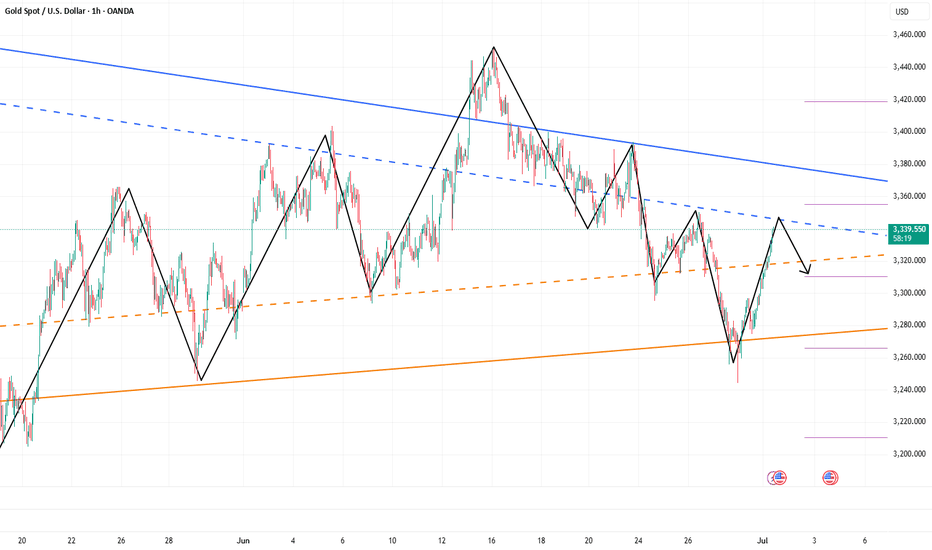

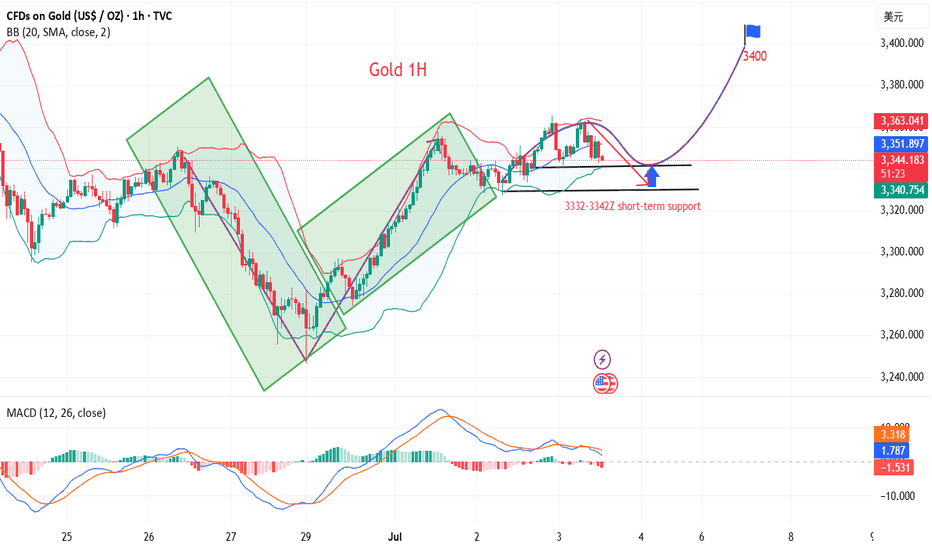

Short gold, it may retreat again after reaching 3340-3350Although the rebound in gold has exceeded my expectations to a certain extent, it is obviously not a good time to chase the rise in gold. The gold rebound mainly benefits from Trump's repeated requests for the Federal Reserve to cut interest rates, which has led to the continued weakness of the US dollar. In fact, we can clearly see that the gold rebound is not supported by trading volume, and the rebound without volume may face the risk of collapse again at any time. So I don't advocate chasing long gold at present.

Currently, gold has rebounded to around 3339, almost recovering most of the losses in the previous downward wave (the starting point of the previous wave was 3350), but gold is still under pressure in the 3340-3350-3355 area. In the absence of volume support, gold may fall again after touching this resistance area.

Therefore, shorting gold is still the first choice for short-term trading at present; at least make sure not to chase high!

You can consider shorting gold with the 3340-3350-3355 area as resistance, and look at the target: 3320-3310-3300

XAUUSD NEXT POSSIBLE MOVEIn this video, I break down my bullish outlook on XAUUSD (Gold) from a 4H and broader market perspective.

With gold currently consolidating near the 3,260 zone, I believe there’s strong potential for a move toward 3,400 in the coming sessions.

One of the key drivers I’m watching is the escalating geopolitical tension between Israel and Iran. If conflict resurfaces or intensifies, we could see a renewed rush into safe-haven assets like gold — historically a reliable response during uncertainty and risk-off sentiment.

Watch the full analysis for detailed levels, market structure, and what I’m looking for in terms of confirmation.

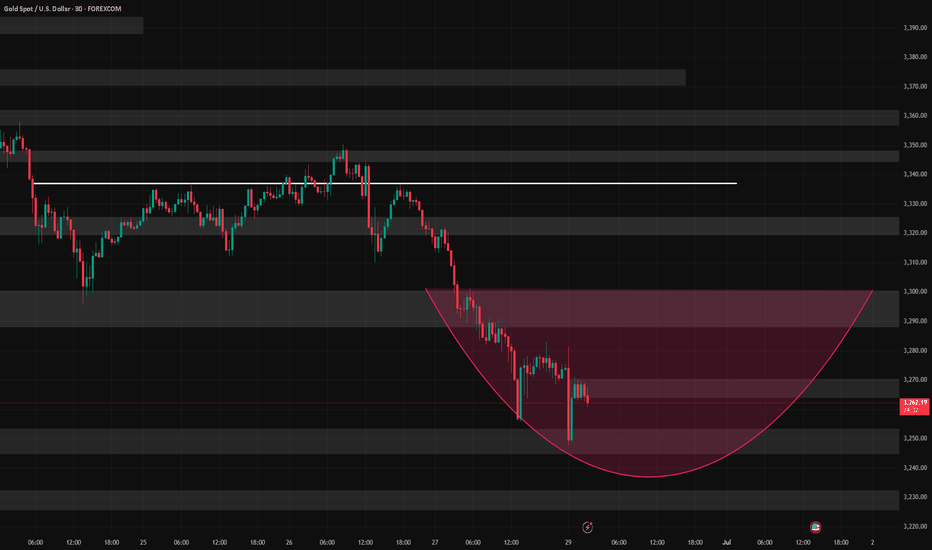

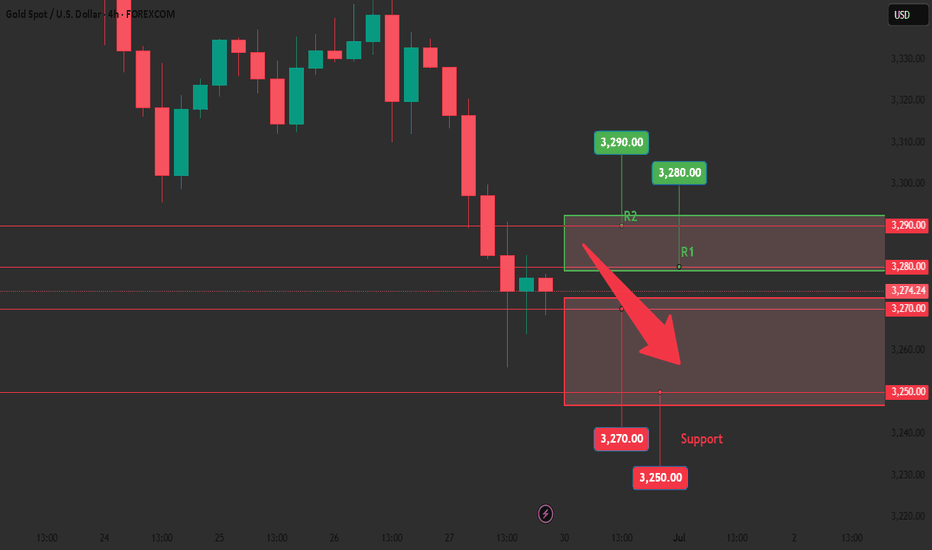

Gold fluctuates upward. Is the decline over?On Monday, gold opened at around 3282, and then fell back quickly to around 3247 under pressure; the downward low was blocked, and then rebounded strongly to around 3297; the market currently maintains a small upward trend.

At present, we need to focus on the resistance range of the upward trend.

From the 4-hour chart, the upper short-term resistance is around 3295-3300, followed by the suppression range of 3310-3315. The main direction of short-term operations maintains the rebound short-selling strategy. The support below is around 3255; the overall short-term operation relies on 3260-3300 to maintain the main tone of high-altitude participation unchanged.

Operation strategy:

Short near 3305, stop loss 3320, profit range 3270-3260.

A new week has just begun. I wish you all gain something from the market fluctuations.

Go short before breaking 3350, go long before falling to 3320📰 News information:

1. Geopolitical situation

2. Tariff implementation and interest rate cut bill

📈 Technical Analysis:

As I said, the US stock market closed early today, and the market will lack some momentum. It is difficult to have a large fluctuation. It is expected to fluctuate and consolidate. I also explained in the previous post that the upper pressure in the short term is at 3340-3350. If it is touched, we can try to short and defend 3360. If it falls back to 3323, we can try to go long for the first time. If it continues to fall, it is expected to reach 3315-3305. Therefore, if it first touches 3323, go long, SL 3316, and consider going long if it touches 15-05 below.

🎯 Trading Points:

SELL 3340-33350

TP 3330-3320-3310-3300

BUY 3323

TP 3333-3340-3350

BUY 3315-3305

TP 3325-3333-3340

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD

Gold non-agricultural layout strategy

💡Message Strategy

Small non-farm data "big surprise"

The ADP employment report released on Wednesday showed that the number of private employment in the United States decreased by 33,000 in June, the first decline since March 2023. Economists surveyed previously expected the number to increase by 100,000 on average.

The ADP employment report showed that the number of private employment in the United States fell for the first time in more than two years in June, indicating that the Federal Reserve may cut interest rates as early as September.

Spot gold closed up $18.20 on Wednesday at $3,356.90 per ounce.

Bednarik pointed out that gold has gained upward momentum recently, with a gold price target of $3,373.50 per ounce. The "big surprise" of the ADP data suggests a weak non-farm payrolls report in June.

📊Technical aspects

1. The daily line was the support line for the rise in the previous month. It fell back very hard last week and turned into suppression. It was tested repeatedly and finally a big Yin hit the lower track of the pattern. However, it started at a low point this week and rose steadily. Now it has returned to the top of the lifeline again. At this point, the space will consider switching again.

2. The four-hour pattern opens slightly upward, with the lifeline 3330 as the dividing line between strength and weakness. Hold here and climb upward step by step.

3. The double lines on the hourly chart formed a dead cross after breaking through and turning into pressure last week, which helped to further increase the volume and fall by more than 100 US dollars. After breaking through and standing on it this time, it turned into support. The double line range is 3332-3342. This area is used as the boundary to switch between the upper and lower spaces. The support line for the bulls to dominate is the upper rail position of 3332, and the support line for the bulls to sweep is the lower rail position of 3316

💰Strategy Package

Long Position:3332-3340,SL:3316,Target: 3400

Gold Is Set to Bottom Out and Rebound This WeekGood morning, everyone!

At today’s open, gold once again dipped into the 3258–3248 buy zone, then rebounded toward 3270. From a structural perspective, gold has clearly entered a downward trend, but this decline is unlikely to be one-directional—short-term rebounds and consolidations are expected along the way.

Based on my experience, below 3250 remains a favorable area for initiating long positions. Whether the price rebounds directly or continues lower before building a stronger base to challenge 3300 again, the broader outlook remains bullish as long as the 3200 support holds. A bottoming reversal this week is still the more probable scenario.

As such, the focus early this week should be on buying near the lows, with short opportunities on rebounds as a secondary strategy. Monitor key support levels for signs of strength.

This week is also packed with important data—including PMI, Non-Farm Payrolls (NFP), and the unemployment rate, in addition to regular economic releases. Given the current macroeconomic backdrop, significant market volatility is expected—bringing both risk and opportunity. Manage your exposure carefully and stay adaptable.

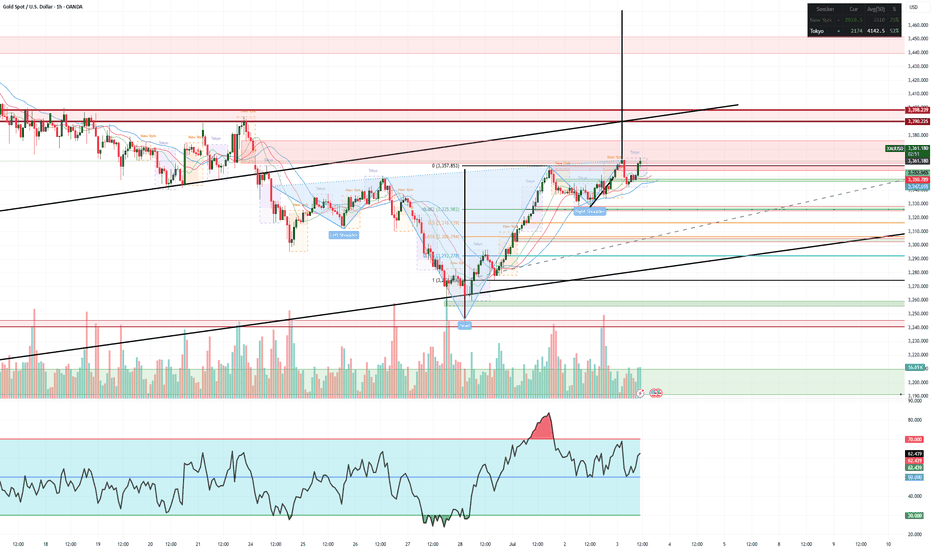

Gold bullish SetupAs per my analysis gold is making inverted Head n Shoulder. we all know the break of this pattern is Bullish scenario. Fundamentally gold is bullish due to instability in world and dollar is going weak. Technically gold sweep the liquidity and makin HH n HL. Seasonality also tell us gold is bullish in month of July.

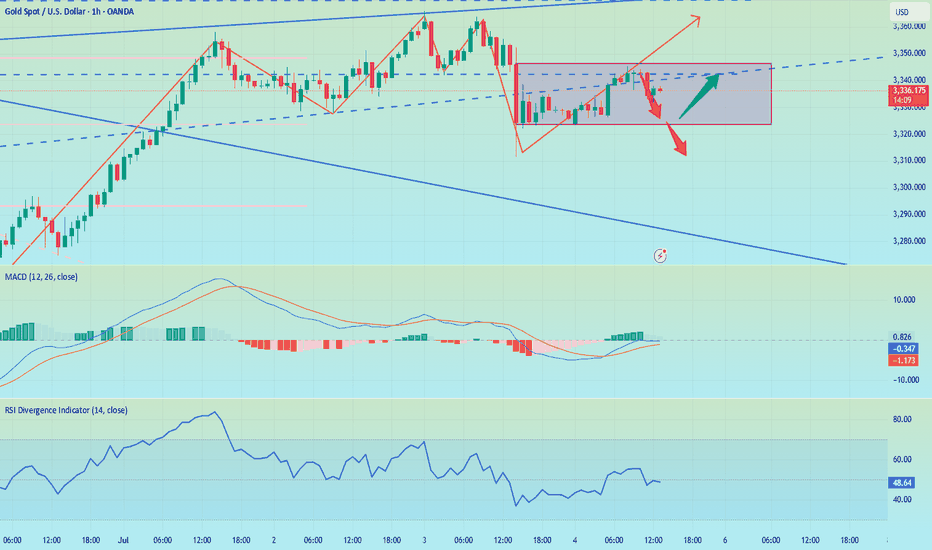

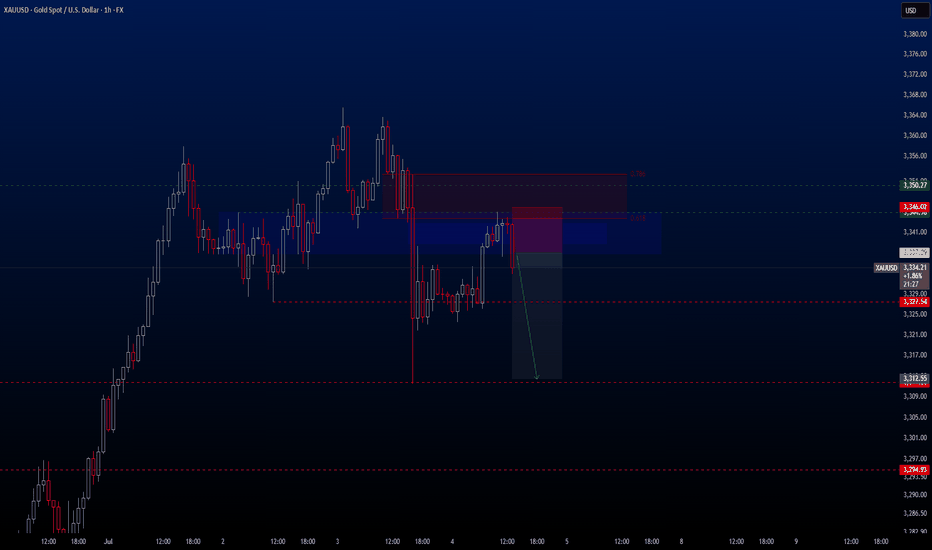

XAUUSDHello traders. After a short break, we’ve identified a promising sell opportunity on the XAUUSD pair.

Despite the U.S. Independence Day holiday, I believe we may still see solid movement in gold during today's session.

🔍 Trade Details

✔️ Timeframe: 1-Hour (H1)

✔️ Risk-to-Reward Ratio: 1:2.70

✔️ Trade Direction: Sell

✔️ Entry Price: 3337.09

✔️ Take Profit: 3312.16

✔️ Stop Loss: 3345.63

🕒 If momentum fades or the price consolidates in a tight range, I will keep this trade open only until 23:00 (UTC+4). After that, I’ll close it manually—whether in profit or loss—depending on how price action evolves.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

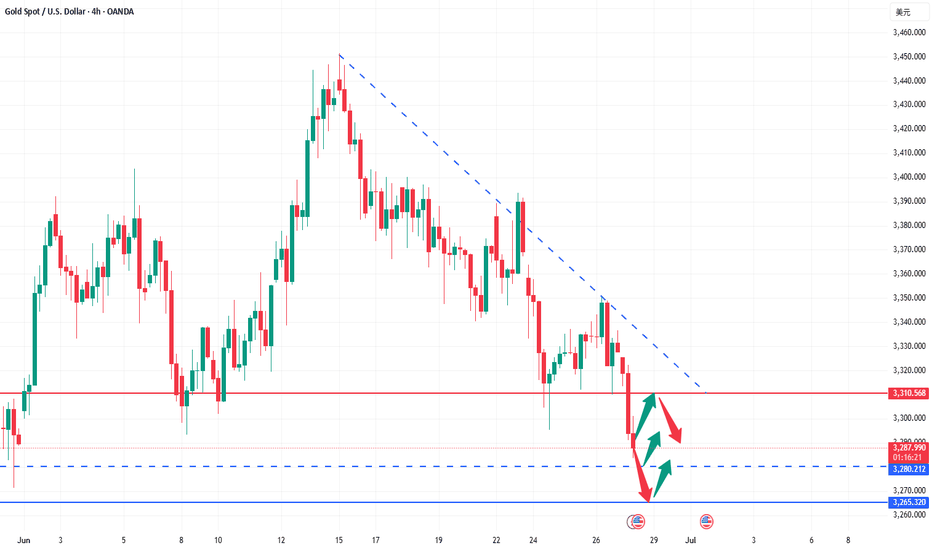

Where will gold go?In 4 hours, it has fallen below the previous low of 3295, and will continue to fall. There are two supports below, namely 3280 and 3265. Don't expect a big rebound before going short in a negative market. If the rebound is large, it will not fall. This kind of negative decline is generally judged by the 15- and 30-minute patterns. When resistance appears in the big cycle, the market has actually fallen a lot.

Today, I think the pressure is mainly in the 3300 and 3310 areas. 3310 can be considered as the pressure of the top and bottom conversion. Pay attention to 3280 and 3265 below. If you consider going long, these two positions are the main positions. For the time being, the general direction is mainly short.

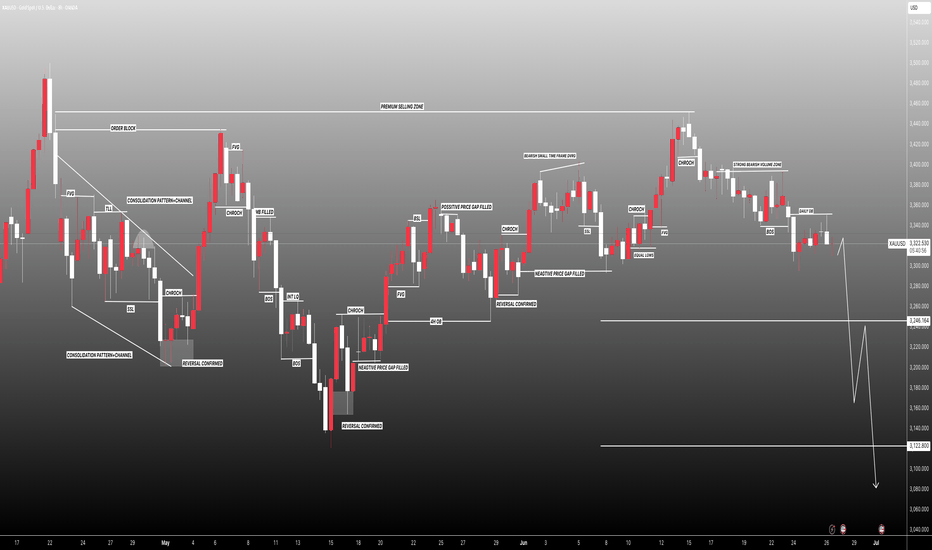

Gold strategy analysis for next week, hope it helps youThe current gold price stands at $3,273, showing a significant decline from previous levels. Looking back at Friday's trading, the gold market was in a state of "unrelenting decline": during the early Asian session, gold attempted a rebound, edging up to around $3,328, but was quickly met with resistance and pulled back. The downward trend continued into the European session, and with the release of the U.S. May Personal Consumption Expenditures (PCE) price index data during the U.S. session, gold prices fell further, hitting a low of around $3,355. Although there was a small rebound in recovery afterward, it eventually closed near $3,274, forming a large阴线 with a long lower shadow on the daily chart.

**Factors Influencing the Trend**

Market sentiment has reacted strongly to the optimistic agreements reached on trade-related matters, which has significantly boosted risk appetite. Simply put, when people feel the market environment is safe and there are plenty of profit opportunities, they are less willing to park their money in safe-haven assets like gold, thus greatly reducing gold’s appeal as a safe haven.

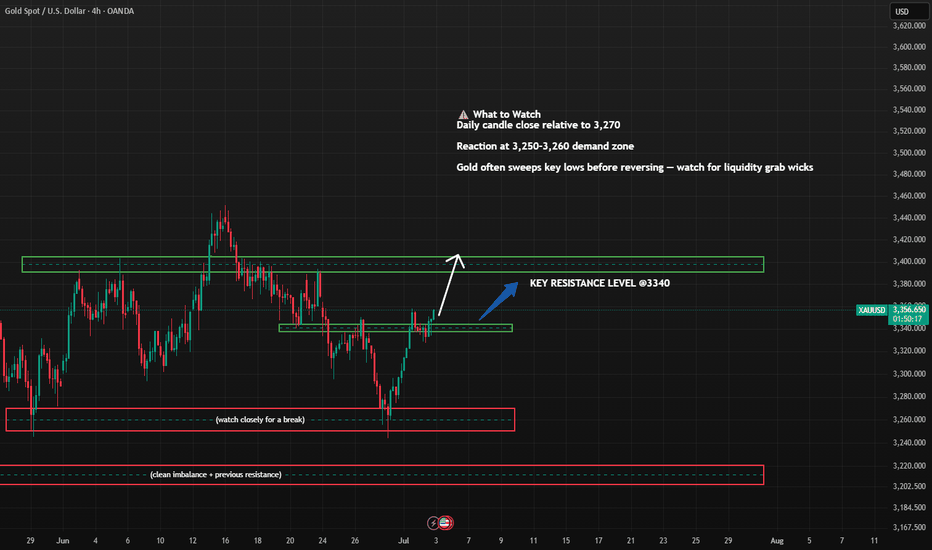

**Technical Analysis**

- **Daily Chart**: Gold has broken below the 5-day moving average, and short-term moving averages have formed a "bearish alignment"—it’s like a group of friends who were originally running in the same direction suddenly all turned around and started running downward.

- **4-Hour Chart**: The Bollinger Bands have widened, and gold prices are like being pushed by a force, moving steadily downward along the lower band. The previous top-bottom conversion level at around $3,310 is crucial. If gold fails to reclaim this level next week, it will be like losing an important position in a battle, which will intensify short-term selling pressure and make it highly likely that the downward trend continues.

**Outlook for Next Week**

The market will be bustling next week:

- Major central bank governors worldwide will hold a panel discussion, like a gathering of "financial giants" to discuss important matters. Their remarks and consensus may have a significant impact on the market.

- The non-farm payroll data, long known as a "heavyweight bomb" in financial markets, will also be released. It reflects the state of the U.S. job market, which is closely linked to the economy and monetary policy, so its release often triggers sharp market fluctuations.

- Additionally, talks about whether Powell will resign may continue to ferment next week, stirring up the market.

Affected by these major events, gold prices are expected to fluctuate more violently around the lower Bollinger Band at $3,270 per ounce next week, and there is a need to be cautious of a second dip.

**Comprehensive Judgment**

The gold market faces high uncertainty next week, but the probability of an overall bearish trend is relatively high:

- **Upper Resistance**: Pay attention to the $3,310–$3,300 range in the short term, a key boundary between bulls and bears. A breakthrough here could bring a turnaround for gold.

- **Lower Support**: Focus on the $3,250 level in the short term. A break below this level may open up further downside space.

From the indicator signals:

- The MACD double line is running below the zero axis, forming a death cross, and the green energy column is continuing to expand—like a car stepping on the gas, accelerating downward.

- The RSI is operating in the oversold region around 39. Although there is a possibility of a short-term bottom, it also faces a pullback correction. However, the bearish momentum currently holds the upper hand.

Gold strategy analysis for next week, hope it helps you

XAUUSD sell@3290~3280

SL:3310

TP:3370~3350

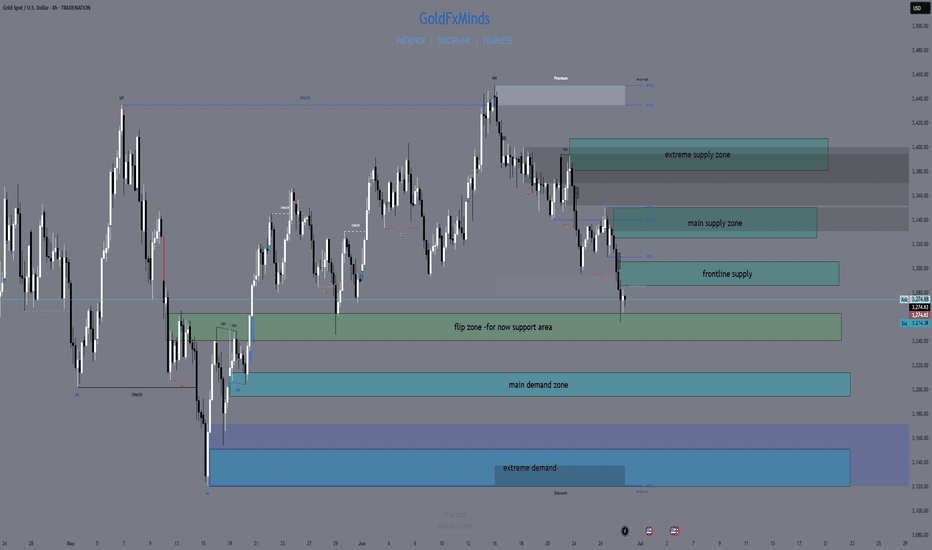

H4 Outlook | XAUUSD Monday • June 30 • 2025Hey fam,

Fresh week on gold — clean structure, clean levels, clean execution ahead. Forget the noise. We trade price, we trust precision.

🔍 Market Flow & Bias

Gold remains bearish on the H4 timeframe.

Lower highs, lower lows, clean rejection from supply, and all EMAs (21/50/200) aligned down. RSI hovers near 30, showing heavy momentum — not exhaustion yet.

Price is coiled, not crushed. If structure holds, we follow the short flow into deeper zones.

📌 Bias: Bearish below 3325. Pullbacks into supply = opportunity.

—

🧱 Zones of Interest (Clean & Confluent)

🔺 Zone 1 – 3380–3405 | Extreme Supply

Top OB zone with resting liquidity above. If price sweeps this level and fails, expect a sharp reversal. Only valid with reaction (CHoCH or bearish engulfing).

🔺 Zone 2 – 3325–3350 | Main Supply

Strong H4 breaker block. Origin of the last major selloff. Already defended once — if it holds again, look for sniper shorts from within.

🔺 Zone 3 – 3285–3305 | Frontline Supply

First inducement zone. Clean micro-OB that could give early fade trades. If bulls break through, Zone 2 becomes magnet.

⚖️ Zone 4 – 3260–3240 | Flip Shelf

Range base. If price holds, bulls might step in short-term. But a clean break below shifts momentum fully toward lower demand.

🟢 Zone 5 – 3215–3195 | Main Demand

Unmitigated OB with imbalance. If gold drops here with momentum and forms rejection wicks or CHoCH on LTF → long opportunity for bounce.

🟢 Zone 6 – 3150–3120 | Extreme Demand

Macro swing demand. Deepest discount level on the chart. Valid only if market flushes — this is the “last stand” for buyers.

—

🎯 Key Levels Zone Cheat-Sheet

Above

• 3380–3405 → Extreme Supply (trap zone)

• 3325–3350 → Main Supply block

• 3285–3305 → Micro OB inducement

Below

• 3260–3240 → Flip shelf (structural pivot)

• 3215–3195 → Main buy zone

• 3150–3120 → Deep macro demand

—

⚔️ Execution Plan

We sell from reaction zones, not assumptions.

We buy from confluence, not hope.

Every zone above comes with condition: no confirmation, no entry.

—

📣 Found this useful?

Drop a ⚔️ in the comments, tag your bias, 🚀and follow GoldFxMinds for sniper-level execution.

This isn’t guessing. This is structure. This is clarity.

GOLD (XAUUSD): Bearish Move From Resistance

Gold went overbought after a test of a key daily resistance cluster.

A formation of multiple bearish imbalance candles on an hourly time frame

signifies a local dominance of the sellers.

The price will continue retracing at least to 3323 support.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold may collapse again, don't get buried in it!In the past two trading days, gold began to rebound from a low of around 3245, and has now rebounded to around 3358, with a rebound of up to $113. Moreover, there has been no significant retracement during this rebound, indicating that gold has little intention to fall, and may even continue to rise.

But for me, gold rebounded from 3245. Even if a double bottom structure with 3275 as the secondary low was constructed on the technical level, it should not be enough for gold to rebound more than $113 in just two days as it fell below many supports in the early stage and bullish confidence suffered a serious blow. Moreover, it happened before the uncertain news of the NFP market.

So I have to consider that the market did it deliberately, and its primary purpose was to kill a large number of short chips in the market and lure more attracted long chips; secondly, the sharp rise before the NFP market may be to reserve room for the NFP market to fall in advance; in addition, I have to consider that the US dollar has fallen to a three-year low. If it continues to fall, there may be a global crisis of confidence in the US dollar, and the oversold rebound demand for the US dollar will also suppress gold.

Therefore, I still will not advocate chasing the rise of gold for the time being; on the contrary, I will actively seek opportunities to short gold in the 3350-3370 area; and once gold turns to a downward trend again, it may at least test the 3325-3315-3305 area downward in the short term.

GOLD: Next Move Is Up! Long!

My dear friends,

Today we will analyse GOLD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3,346.90 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3,365.74.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

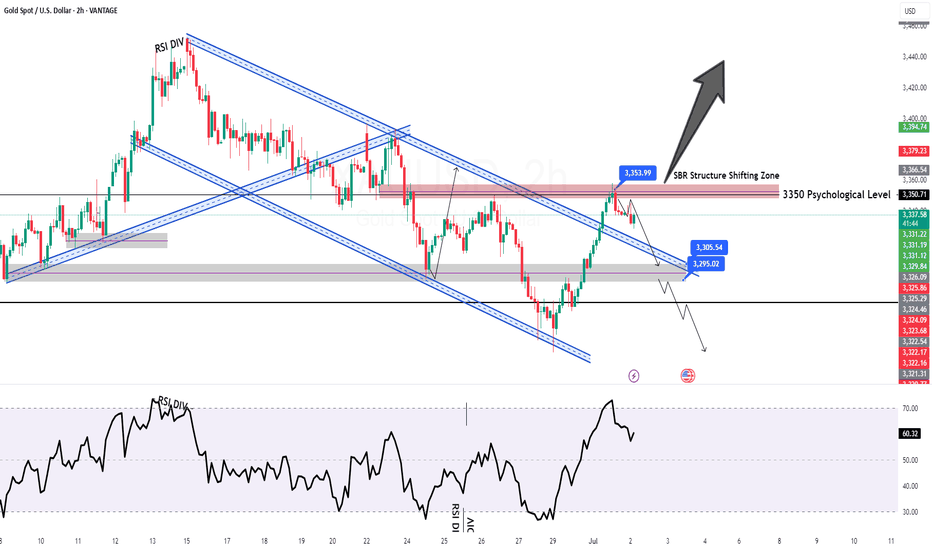

GOLD H2 Intraday Chart Update For 2 July 2025Hello Traders,

Today all eyes on breakout of 3360-70 zone in order to GOLD go for further advance below this zone all eyes are remains on 3318 level if market successfully maintain 3330 level then will go down further towards 3300 Psychological Level after passing 3318

NFP main event of the day which is held by tomorrow

Disclaimer: Forex is Risky

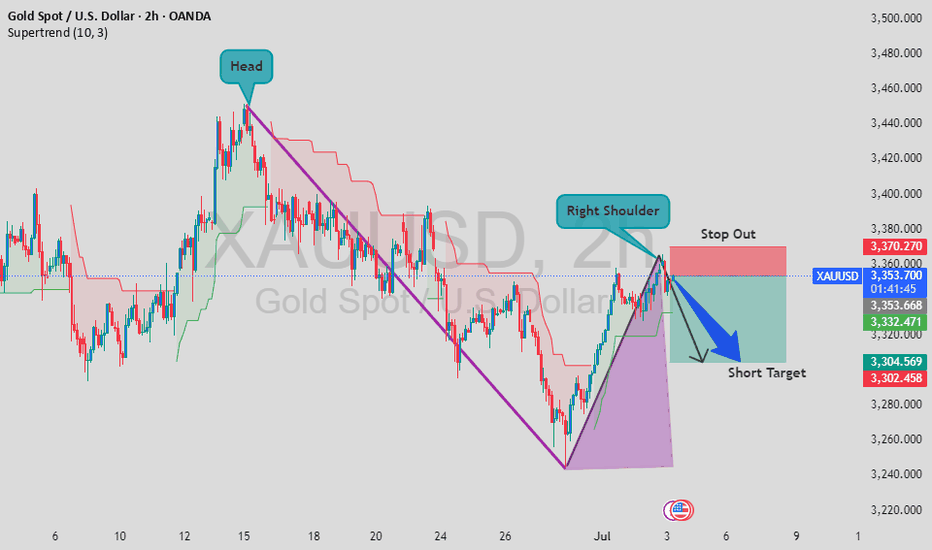

XAU/USD Potential Head & Shoulders Pattern FormingXAU/USD - Potential Head & Shoulders Pattern Forming 🔍

A possible Head and Shoulders pattern is taking shape on the 2H chart. With the right shoulder now forming and price nearing resistance, this setup could indicate a short opportunity.

🎯 Short Target: 3,304

🛑 Stop Out: 3,370

This setup offers a clean risk-to-reward ratio. Let’s see how price reacts in the coming hours!

💬 Drop your thoughts in the comments – do you agree with this setup? Let's support each other with ideas!

👍 Don’t forget to like and share if you find this helpful – your support means a lot!

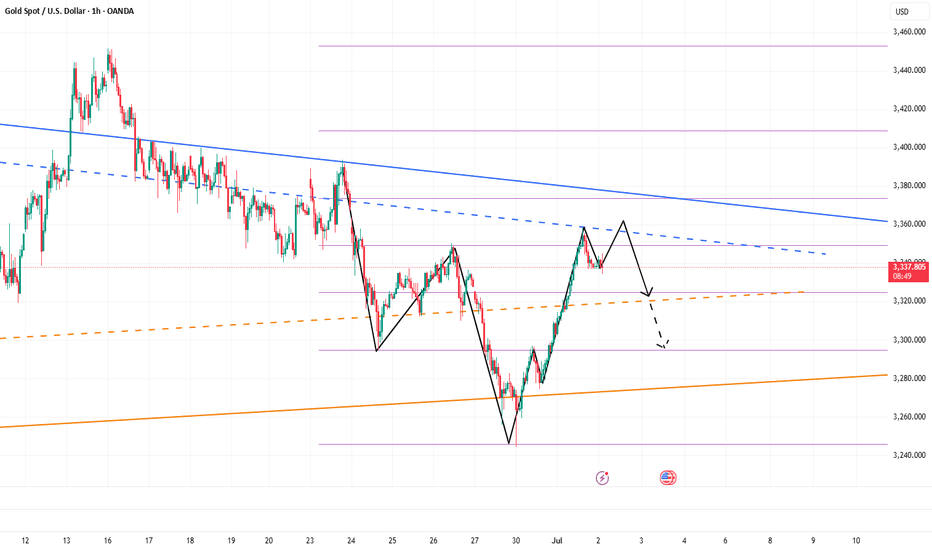

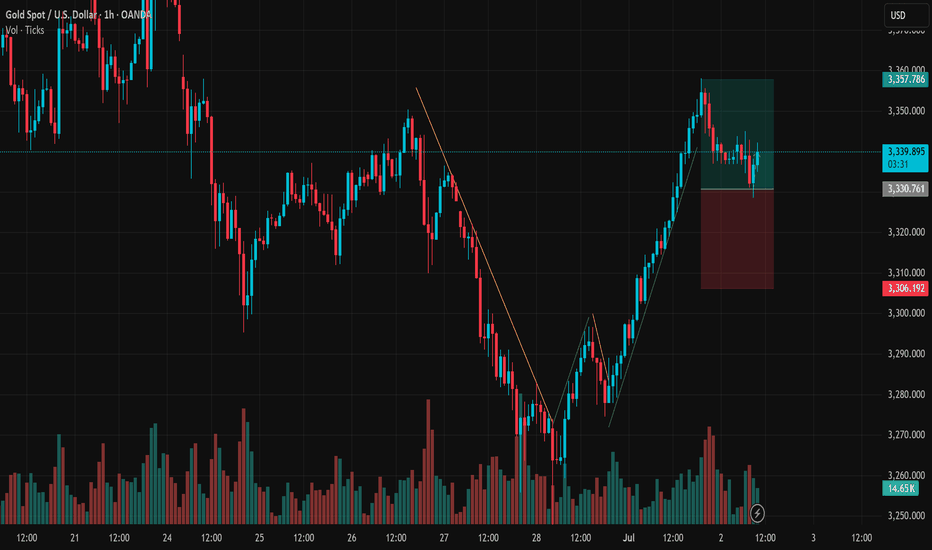

XAUUSD Consolidates Near Resistance After Strong RallyGold (XAUUSD) on the 1H timeframe has staged a solid bullish reversal from the 3,263 USD support zone, reaching a recent high of 3,357 USD. Now, the market is entering a consolidation phase just below this resistance. This price action may be setting the stage for the next directional move.

After breaking a clear descending trendline, XAUUSD formed a two-leg bullish structure with higher highs and higher lows – a classic signal of trend reversal. The rally paused around 3,357 USD, a previous swing high acting as short-term resistance. The price is currently ranging between 3,330–3,340 USD with decreasing volume, indicating a potential accumulation zone rather than distribution.

Resistance: 3,357 USD – breakout target

Support zone: 3,330–3,335 USD – short-term demand zone

Invalidation level: 3,306 USD – below this, bullish structure breaks

As long as price holds above 3,330 USD, a bullish continuation remains the primary scenario. Traders can look for pullbacks or bullish patterns within this zone for potential long entries. A break and close above 3,357 USD would confirm strength, opening the path toward 3,370 or even 3,390 USD.

Stop-loss should be placed below 3,306 USD to manage risk if the breakout fails. If price loses the 3,306 support decisively, the setup turns neutral to bearish short-term.

The breakout leg was supported by rising volume, validating real demand. Current low-volume sideways movement suggests the market is “cooling off” after the rally, often a precursor to the next breakout move. Watching for bullish engulfing candles or volume spikes near support can offer trade confirmation.

Conclusion:

Gold remains in a bullish technical structure on the 1H chart. The current range between 3,330–3,357 USD is key. If price breaks above resistance, we could see strong continuation toward higher levels. Traders should stay patient, manage risk carefully, and let price action confirm the next move.

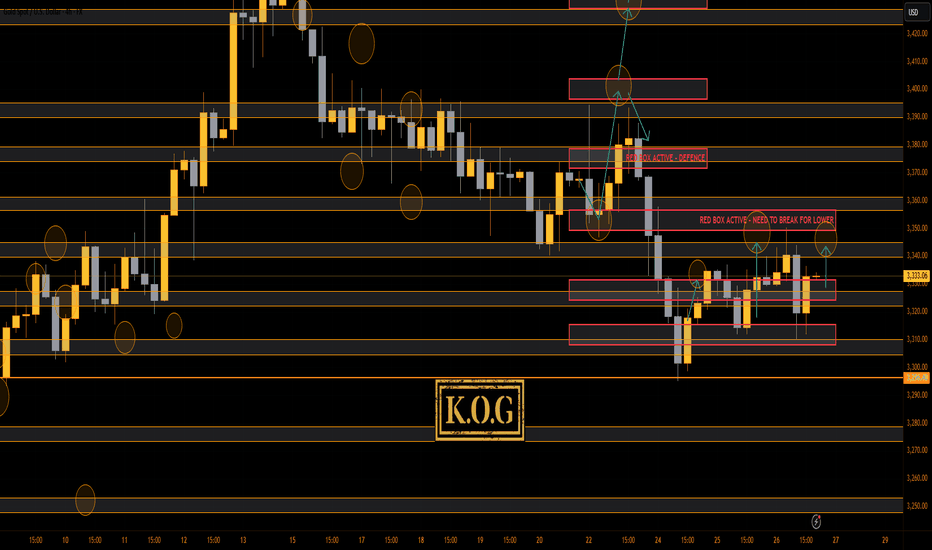

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Again, just like yesterday, we completed the long trade into the red box, RIPPED then played red box hockey before swooping the low and coming back up. What madness on the markets with continuous whipsawing which is not allowing traders to hold positions without huge stop losses.

For now, we have support at the 3325-8 level which if held should give us a move upside towards the red box. What we want to see here is do we get a lower high or not?

MA's still drawn together and more choppy price action expected in the sessions to come.

As always, trade safe.

KOG

It’s the right time to make a golden layout!Gold opened at 3328 today and started the downward mode. After the European session, it continued to fall and broke the new low. The negative opening data of the US session also continued the downward mode. So far, it has reached the lowest point of 3255 and rebounded, but the strength is not very strong. After all, the upper pressure is still very strong. In the short term, we pay attention to the previous low point of 3295-3300, and focus on the upper 3305-3311. Today, the short-term operation of gold is mainly short-selling on rebounds, and long-selling on callbacks is supplemented.

From the 4-hour analysis, the upper short-term resistance is around 3295-3300, with focus on the important suppression at 3305-3311. The rebound will continue to be mainly short and look to fall back. The lower short-term support is around 3255-3245. Relying on this range as a whole, the main tone of high-altitude and low-multiple participation remains unchanged.

Gold operation strategy:

1. Short-selling in batches near the rebound of gold near 3295-3310, with a target of 3380-3370.

2. When gold falls back to around 3345-3455, go long in batches, with the target at 3370-3380.

XAUUSD: We must adapt to the market conditions! Bears in ChargeGold prices dropped as Trump announced a ceasefire between Iran and Israel, causing a significant decline. We anticipate this trend to persist, as recent price data, including volume and price momentum, indicates a strong seller’s control in the current market conditions. We have two targets for you to set your own based on your analysis, along with a stop-loss based on your strategy.

We appreciate your unwavering support throughout the years. Please like and comment.

Team Setupsfx_

❤️🚀