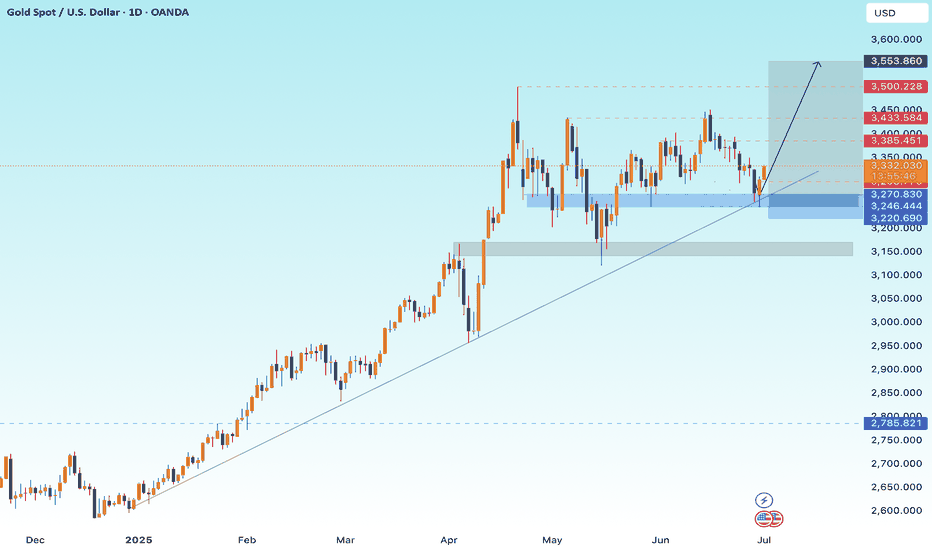

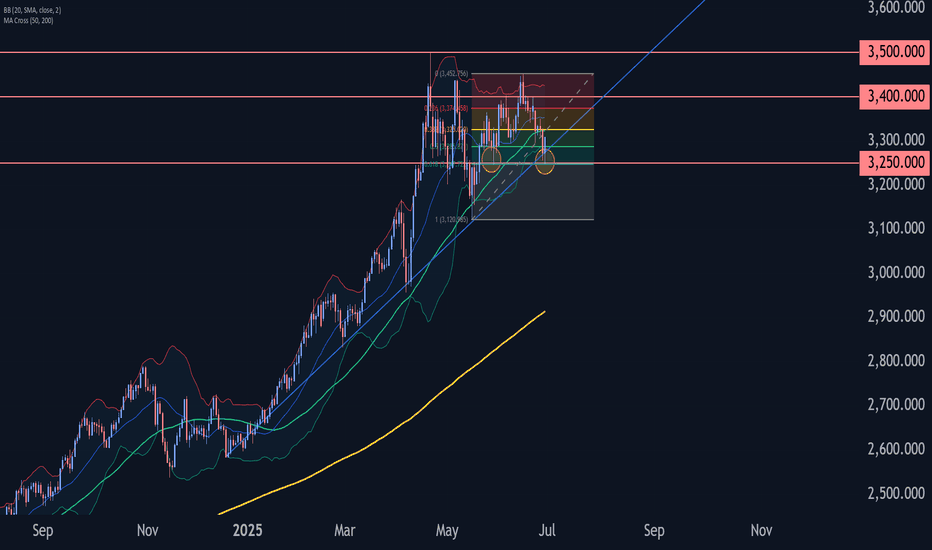

GOLD Bulls Winning ! 560 Pips and Still Aiming for +2500 Pips ! 📊 GOLD XAU/USD — Trendline Play in Action!

My plan from yesterday played out perfectly: price bounced from $3274 to $3334 — that’s +560 Pips banked so far! 💙

But this is only the start of the bigger move — I’m still targeting a 2500 Pips upside on this bullish leg.

✅ Technical Bias:

Price is respecting the main ascending trendline perfectly.

Demand zone at 3220 – 3270 held as expected.

Next resistances: 3385, 3433, 3500, then 3553 as extended target.

✅ Fundamental Bias:

The market is still pricing in more Fed rate cuts, which keeps the upside for gold alive.

📢 If you like clear setups that deliver:

Like 👍 | Comment 💬 | Share 📤 | Follow 🔔 me for real-time technical & fundamental updates!

XAUUSDK trade ideas

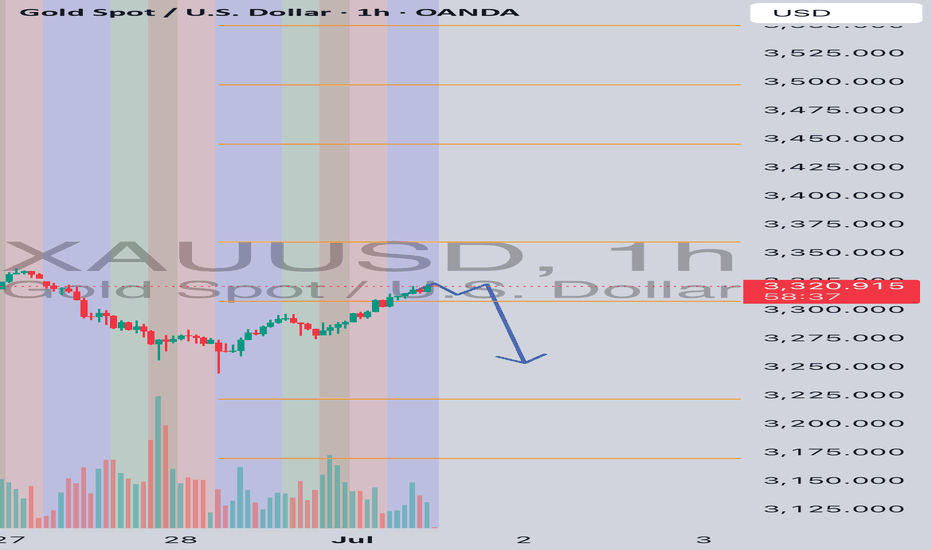

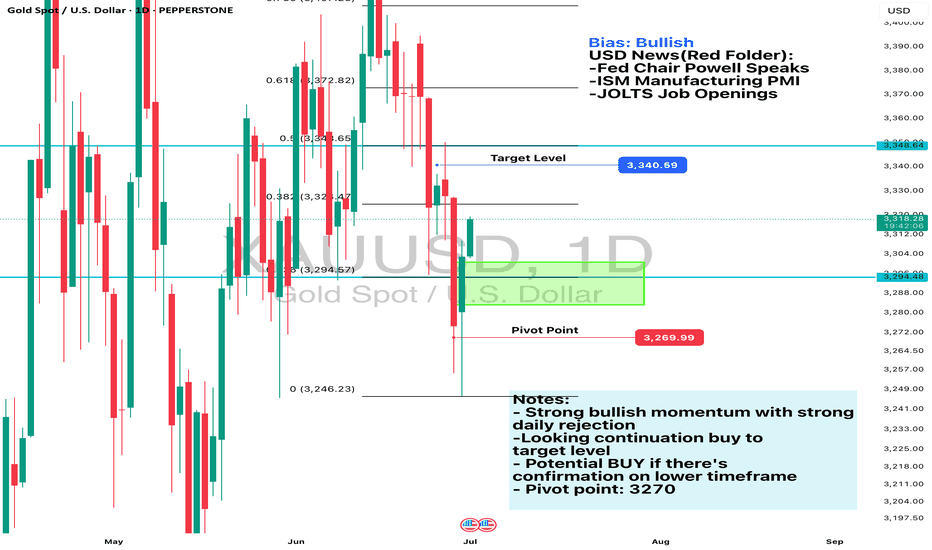

Daily Analysis- XAUUSD (Tuesday, 1st July 2024)Bias: Bullish

USD News(Red Folder):

-Fed Chair Powell Speaks

-ISM Manufacturing PMI

-JOLTS Job Openings

Notes:

- Strong bullish momentum with strong

daily rejection

-Looking continuation buy to

target level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3270

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

XAU / USD 4 Hour ChartHello traders. I just wanted to follow up on this chart. I have changed nothing since the last post. I just wanted to show the trade set up was on point. Big G gets a shout out. Be well and trade the trend. I find the first few days of the week gold carves out its potential paths both up and down. Wednesday, many times the weekly will be right in the middle of the moves from the previous few days. Not sure if that makes sense, but I just ripped a bongload of Gorilla Glue and I am not proof reading this or checking for typos.. my bad. Be well and trade the trend. Let's see how the overnight sessions play out. Thanks for checking out my chart.

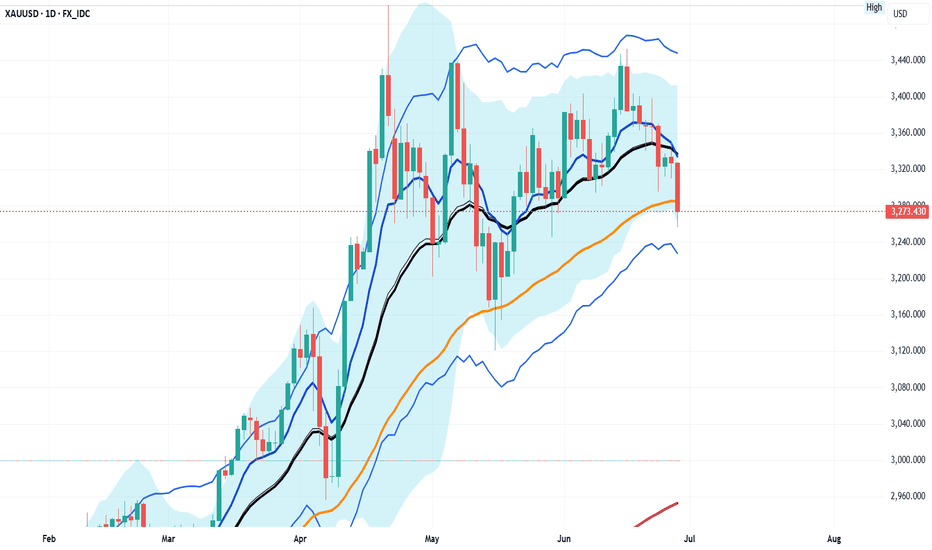

Gold Wave Analysis – 30 June 2025

- Gold reversed from support level 3250.00

- Likely to rise to resistance level 3400.00

Gold recently reversed up from the support level 3250.00 (which stopped wave (b) at the end of May, as can be seen from the daily Gold chart below) intersecting with the lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from May.

The support level 3250.00 was further strengthened by the upward-sloping support trendline from February.

Given the clear daily uptrend, Gold can be expected to rise to the next resistance level 3400.00, which stopped the previous short-term correction ii.

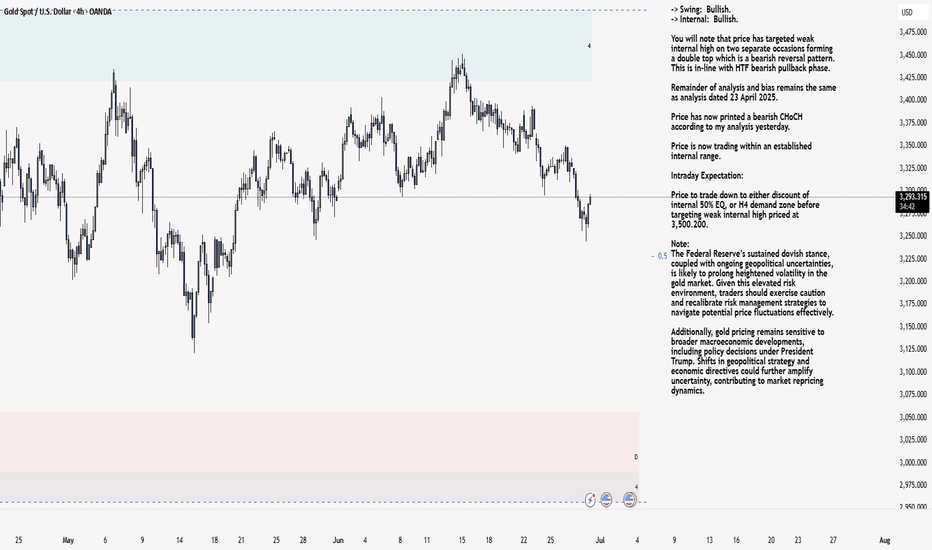

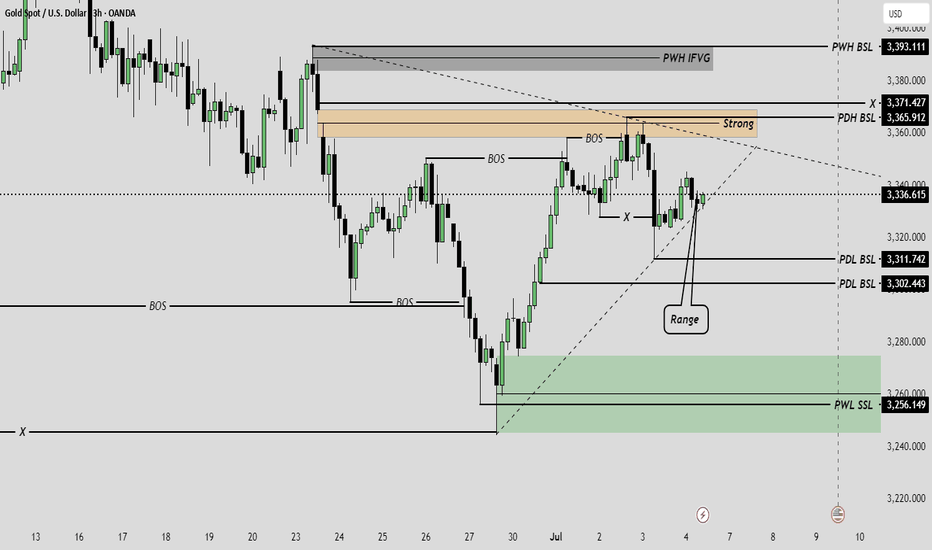

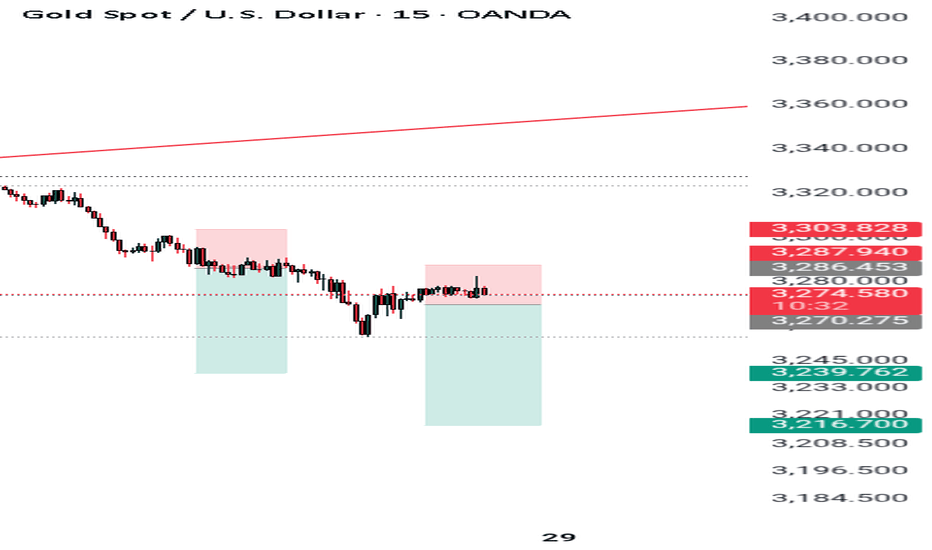

XAU/USD 30 June 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

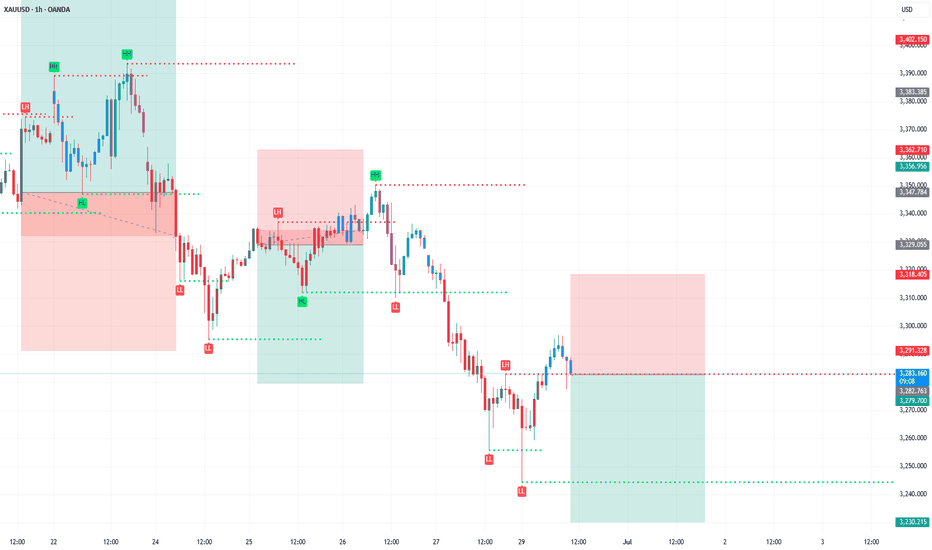

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

On H4 TF price has been failing to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

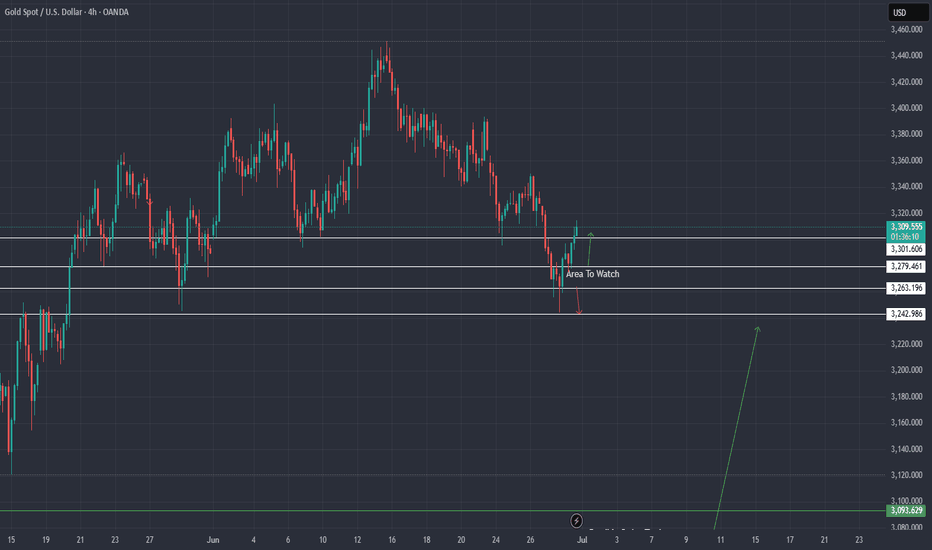

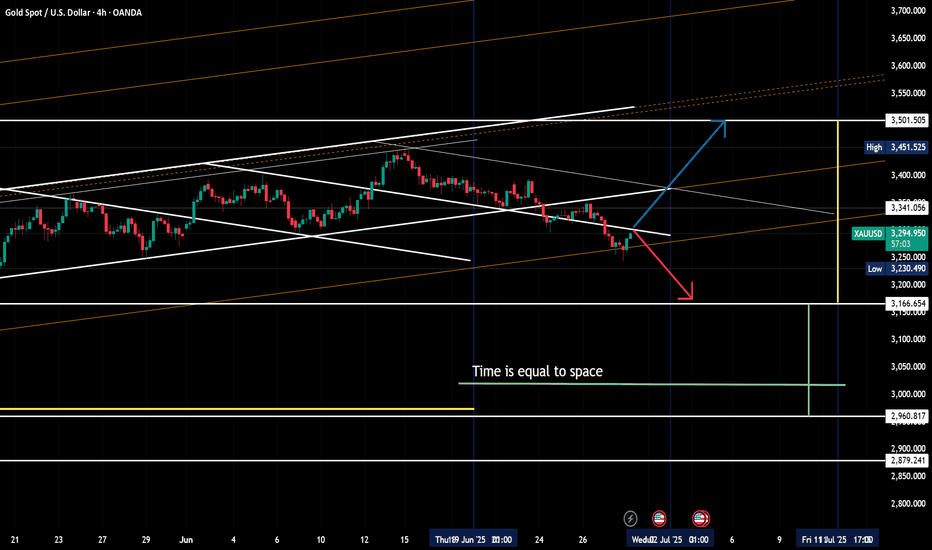

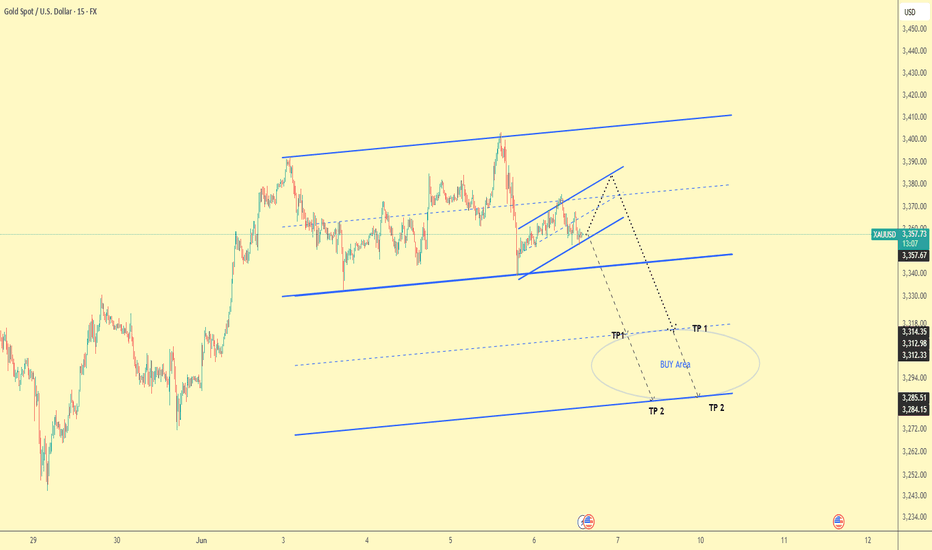

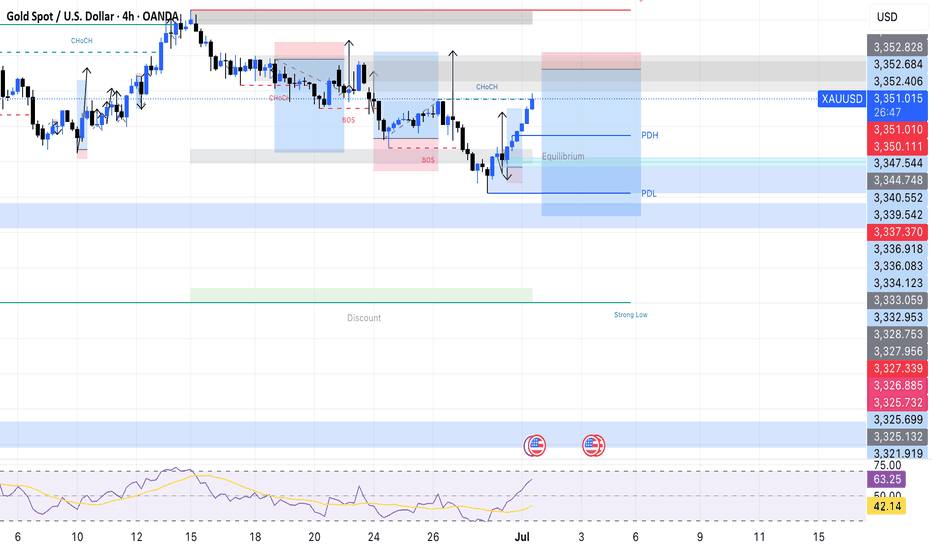

Gold price bull-bear life and death line--3300Gold price bull-bear life and death line--3300

Gold rose in the Asian session today

Buy on dips and technical rebound:

Last Friday (June 28), gold fell 2%, hitting a low of $3247/ounce. Some investors believed that it was oversold in the short term and bought on dips during the Asian session.

Key support level of $3,270:

From a technical perspective, there is a concentrated area of institutional buying near $3,270, which will trigger a short-term rebound.

Near $3,300 is still a strong resistance range.

Although Powell maintains a hawkish stance, the market is still betting on a rate cut in September (with a probability of more than 90%), and the decline in the US dollar index supports gold.

As shown in Figure 4h:

The current fluctuation range of gold price: 3240-3300, with a fluctuation range of nearly 60 US dollars

Short selling strategy:

Sell: 3295-3300 range

Stop loss: 3305

Target: 3280-3270-3250

Buy 1: 3250 (conservative)

Buy 2: 3270 (stable)

Buy 3: 3280 (aggressive)

Stop loss: 3240

Target: 3300-3320+

It is recommended to pay attention to the long-short strength dividing line near 3300

Standing at 3300, the market will continue to rise this week

As long as the gold price is below 3300, take a high-altitude mentality

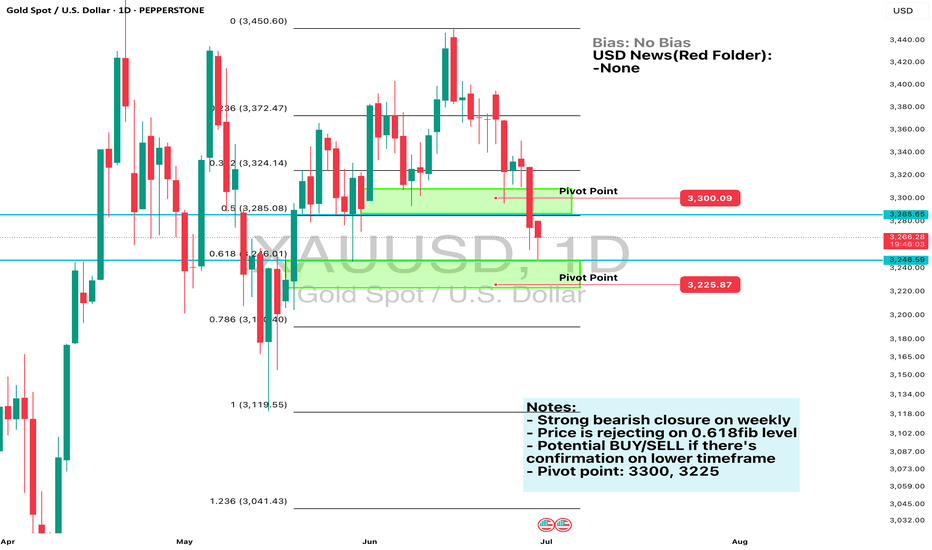

Daily Analysis- XAUUSD (Monday, 30th June 2024)Bias: No Bias

USD News(Red Folder):

-None

Notes:

- Strong bearish closure on weekly

- Price is rejecting on 0.618fib level

- Potential BUY/SELL if there's

confirmation on lower timeframe

- Pivot point: 3300, 3225

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

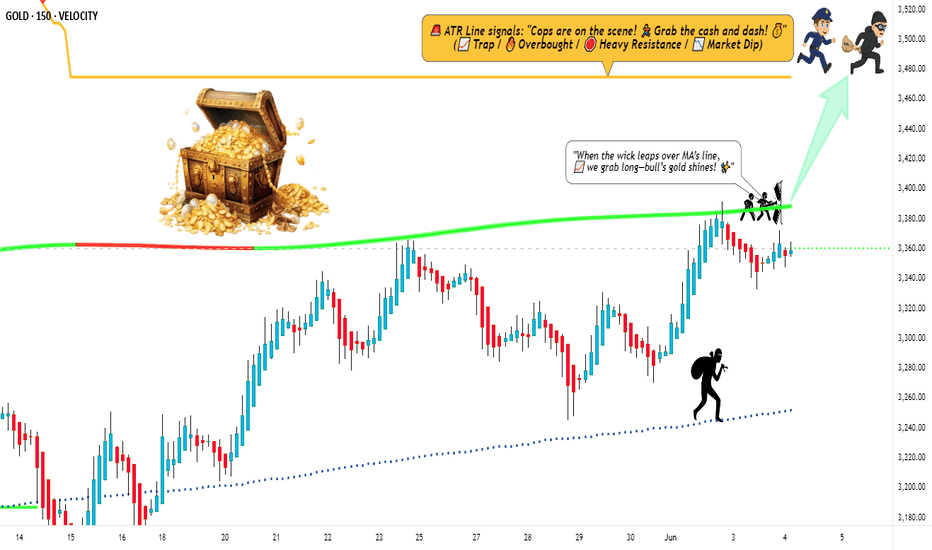

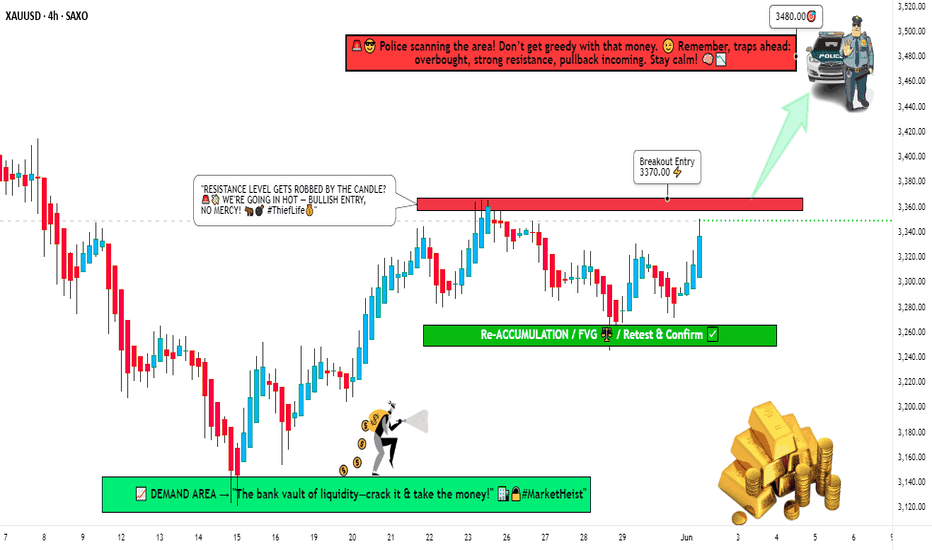

"Stealing Gold Profits: XAU/USD Long Setup (Risk-Reward Heist)"🔥 GOLD HEIST ALERT: XAU/USD Breakout Robbery Plan (Long Setup) 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention, Money Makers & Market Robbers! 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting a heist on XAU/USD (GOLD). Follow this master plan for a bullish escape near the high-risk ATR zone. Beware—overbought signals, consolidation traps, and bearish robbers lurk! Take profits fast and treat yourself—you’ve earned it! 🏆💸

📈 ENTRY: THE HEIST BEGINS!

Wait for Resistance Breakout (3400.00) → Then strike!

Buy Stop Orders: Place above Moving Average.

Buy Limit Orders: Use 15M/30M pullbacks (swing lows/highs).

Pro Tip: Set a chart ALERT to catch the breakout live!

🛑 STOP LOSS: DON’T GET CAUGHT!

For Buy Stop Orders: Never set SL before breakout!

Thief’s SL Spot: Recent swing low (4H timeframe).

Adjust SL based on your risk, lot size, and order count.

Rebel Traders: Place SL wherever—but you’ve been warned! 🔥

🏴☠️ TARGET: 3480.00

Scalpers: Long-only! Use trailing SL to lock profits.

Swing Traders: Join the robbery crew for bigger gains.

📊 MARKET CONTEXT:

XAU/USD is neutral but primed for bullish moves 🐂. Watch:

Fundamentals (COT Reports, GeoPolitics, News).

Intermarket Trends & Sentiment.

Positioning & Future Targets (Check our bio0 for analysis linkss!).

⚠️ TRADING ALERTS:

News Releases = High Volatility!

Avoid new trades during major news.

Use Trailing SL to protect open positions.

💥 SUPPORT THE HEIST!

Hit the Boost Button 💖→ Strengthen our robbery team!

Profit daily with the Thief Trading Style. 🏆💪🚀

Stay tuned for the next heist—more loot awaits! 🤑🐱👤🎉

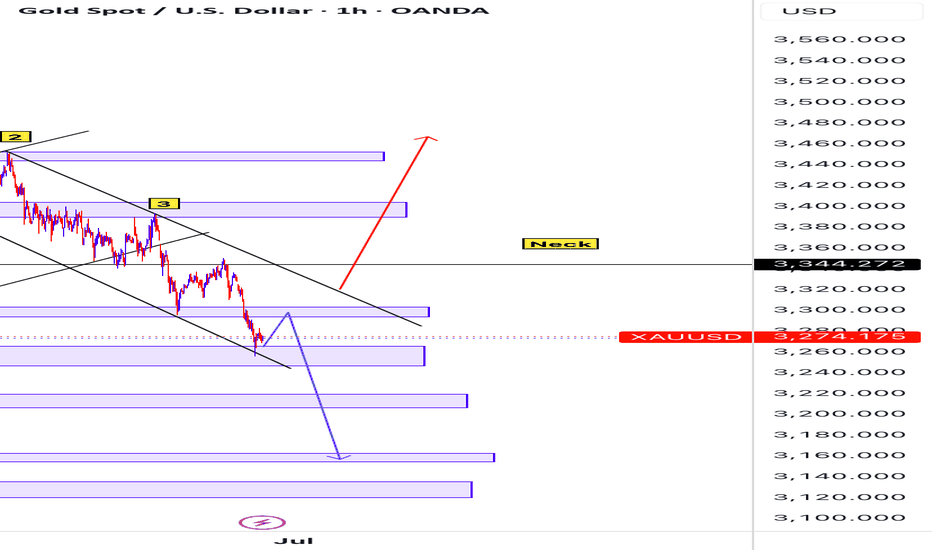

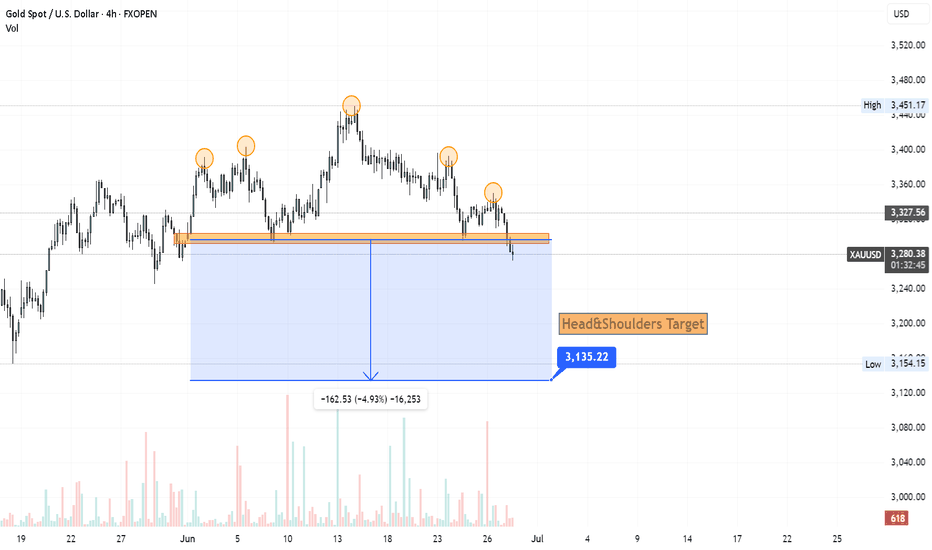

This is my trend line manipulation strategy+Support & ResistanceGOLD ANALYSIS: On this chart the numbering shows a head and shoulder partten which has broke the neckline showing a selling pressure. So automatically price is in down trend but a break of the new trend above will marked with the red arrow will leads to the upside prevail.

Gold Trade Plan 06/06/2025Dear Traders,

Today, the first ascending channel will likely be broken, and price may enter the lower channel. I've marked the potential buy zone on the chart. Once the upper channel breaks decisively, I expect the price to reach the midline of the lower channel, with possible reactions from both the midline and the bottom of the channel."

Regards,

Alireza!

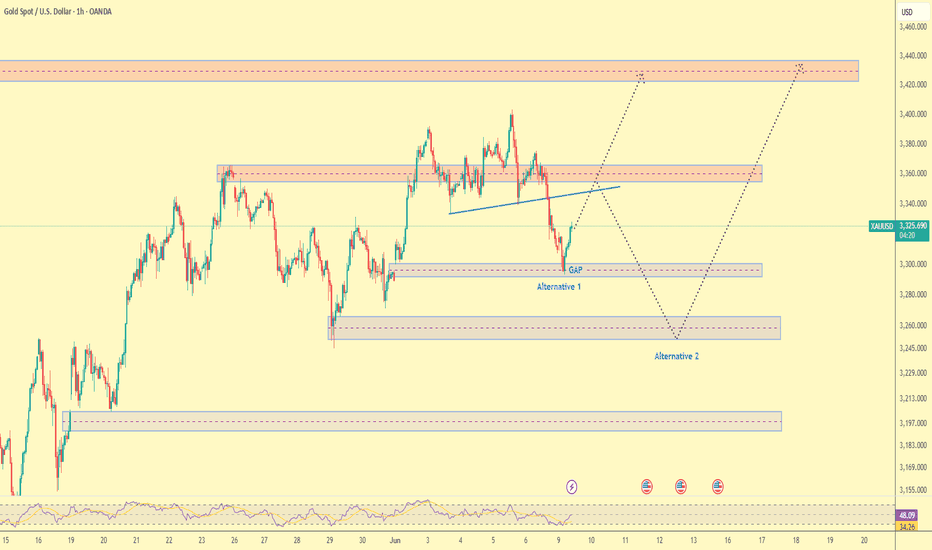

Gold Trade Plan 09/06/2025Dear Traders.

📊 XAUUSD Technical Analysis | 1H Timeframe | June 9, 2025

Price has recently broken below the ascending trendline and filled a nearby gap, now retracing back toward the broken structure zone. Two key scenarios are in play:

🔹 Alternative 1: A rejection from the broken resistance area could trigger a bearish continuation toward the demand zone around $3,260–$3,240.

🔹 Alternative 2: If sellers fail to defend this level, price may push higher to test the $3,420–$3,440 supply zone.

✅ Key Levels to Watch:

Resistance: $3,360 and $3,420–$3,440

Support: $3,260 and $3,190

📉 The RSI is hovering in the neutral-to-oversold range, signaling indecision in momentum.

📌 Summary:

Traders should monitor how price reacts to the current resistance zone. A clear rejection could validate the downside scenario, while a breakout may open the door for a bullish continuation.

Weekly Analysis of the Dollar Index, BTC, SPX500, NAS100 & GOLDIn this week's video I break down key technical patterns and indicators to discuss the behavior and direction of the Dollar index, Bitcoin, SPX500 and NAS100 Indices and finally GOLD for the coming week. I highlight price trends, support and resistance levels, candlestick formations, and moving averages to identify potential targets. My goal is to interpret market sentiment and forecast possible price movements based on historical data and technical signals. I hope you find value in my analysis to make informed trade and investment decisions. Cheers

Gold’s Big Heist—Will You Join the Loot or Get Robbed?🔥 GOLD HEIST ALERT: XAU/USD Breakout Robbery Plan (Swing & Scalp Strategy) 🔥

🌟 Greetings, Money Makers & Market Robbers! 🌟

Ready to loot the gold market? 🏆💰 Based on Thief Trading Style analysis (technical + fundamental), here’s how we execute the heist on XAU/USD—escape with profits before the bears trap us!

📈 ENTRY: The Heist Begins!

"Break the Wall!" Wait for RESISTANCE (3370.00) to crack, then strike!

2 Ways to Rob:

✅ Buy Stop above Moving Average (breakout confirmation)

✅ Buy Limit near pullback zones (15m/30m recent swing lows)

Pro Tip: Set a chart alert 🚨—don’t miss the breakout!

🛑 STOP LOSS: Protect Your Loot!

"Yo, listen! If you’re buying after breakout, DO NOT set SL until price confirms!

Thief’s SL Rule: Place at recent swing low (4H timeframe)—adjust based on your risk & lot size.

Rebels, beware! 🔥 Your risk, your rules… but don’t cry if the market robs you back!

🎯 TARGET: Escape Like a Pro

Main Take Profit: 3480.00 (or exit early if the market turns shady!)

Scalpers: Only LONG plays! Use trailing SL to lock profits.

Swing Traders: Ride the trend & split the loot wisely! 💰

⚠️ WARNING: News = Market Chaos!

Avoid new trades during high-impact news.

Trailing stops = your best friend to protect profits.

💎 WHY THIS HEIST?

XAU/USD Trend: Neutral (but bullish potential! 🐂)

Key Drivers: Geopolitics, COT data, macro trends—do your homework! 🌍📰

🚀 BOOST THE HEIST!

Like this plan? Smash the Boost Button! 🔥 Helps us steal more profits & share next robbery targets! Stay tuned—more heists coming soon! 🎯🤝

🎉 Happy Trading, Thieves! May the market favor your loot! �💸

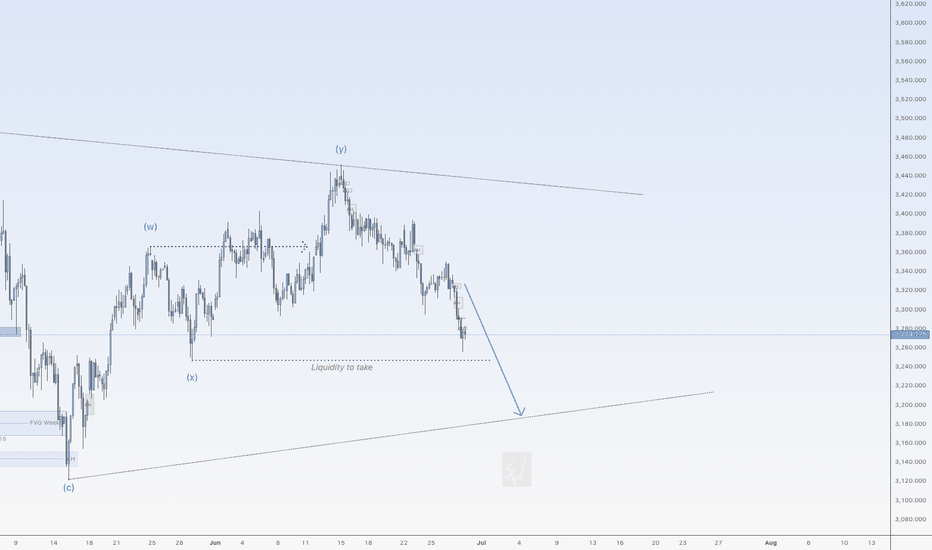

Down for goldHi traders,

Last week gold went lower then expected (wavecount updated).

The last wave down could be wave 2 or it's part of a big Triangle/ Flat.

Next week we could see this pair to go lower to sweep the liquidity below the lows and fill the 4H bullish FVG.

After that it could go up again.

Let's see what price does and react.

Trade idea: Wait for a small correction up on a lower timeframe to finish and trade (short term) shorts.

If you want to learn more about trading FVG's & liquidity sweeps with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Bearish drop?The Gold (XAU/USD) is rising towards the pivot, which has been identified as an overlap resistance, and could drop to the 1st support, acting as a pullback support.

Pivot: 3,339.40

1st Support: 3,297.74

1st Resistance: 3,389.16

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold Confirms Breakdown — Eyes on $3100 TargetGold has broken below the neckline of multiple Head & Shoulders formations, signaling potential downside continuation. This technical development opens the path toward the projected target around $3100, Let’s monitor whether the pattern fulfills its full potential.

#Gold #XAUUSD #HeadAndShoulders #TechnicalAnalysis #ChartPattern #GoldForecast #TradingView #Commodities #PriceAction

XAUUSD Bearish Setup | Support Levels in SightGold has broken down from the ascending channel, indicating a potential shift in market structure toward bearish momentum.

🔎 Technical Highlights:

Clear breakdown from the ascending channel

Price currently facing resistance near $3,323

Two key support zones:

🟩 First Support: $3,295 – potential bounce area

🟩 Second Support: $3,258 – deeper downside target

📊 Short-Term Outlook: Expecting a minor pullback before continuation lower toward the $3,295 support. If that level fails to hold, the next target becomes $3,258.

💡 Trade Idea: Watch for rejection below $3,323 for a possible short opportunity targeting $3,295 and $3,258. Keep an eye on momentum and volume.

🔔 Note: Always use proper risk management. This setup is based on current price action and may change with market dynamics.

XAUUSD Daily Sniper Plan – June 25, 2025👋👋 Hello traders!

Gold is still moving down strongly. Today’s plan is made for traders who want clear and precise levels. Let’s look at the structure, important zones, and where to watch for trades.

1. Higher Timeframe Overview (Daily, H4, H1)

Daily: Price is falling near the 200 EMA around 3323. RSI shows less buying strength. We wait for a clear move.

H4: The trend is down with lower highs at 3418 and lower lows at 3311. RSI is low, showing weak buying. Price is near the 200 EMA.

H1: Small bounce up to 3328–3332 resistance. RSI is weak, so price must break this zone to move higher.

2. Lower Timeframe Details (M30, M15)

M30: EMA5 crossed above EMA21 but price is near resistance at 3328–3332. RSI is neutral.

M15: Price broke a small wedge up but is limited by EMA21 and EMA50. RSI near 58 shows price could be overbought.

3. Key Zones and How to Trade Them

🔻 Sell Zone: 3345 – 3352

Look for signs that price rejects this zone (wicks, bearish candles) before selling.

🟡 Flip / Decision Zone: 3360 – 3380

Do not trade here. This zone will show if trend changes. Wait for clear confirmation.

🟢 Buy Zone: 3300 – 3285

Look for price rejection and strong buying signs before buying here.

🟢 Deep Buy Zone: 3265 – 3272

Only buy here if price goes below 3280 and shows strength.

4. What to Do

Current price is about 3323.

If price goes above 3332, watch the sell zone 3345–3352 for a short trade.

If price drops below 3332, expect a move down to the buy zone 3300–3285.

Do not buy above 3360 without a clear trend change.

Be patient and wait for good signals.

5. Important Levels

Zone Price Range Notes

Sell Zone 3345 – 3352 Best short zone

Flip Zone 3360 – 3380 Wait and watch, no trades

Buy Zone 3300 – 3285 Good buy zone

Deep Buy Zone 3265 – 3272 Last buy chance

📣 If you like clear and simple plans, please like, comment, and follow

I’m part of Trade Nation’s Influencer Program and get paid to use their charts.