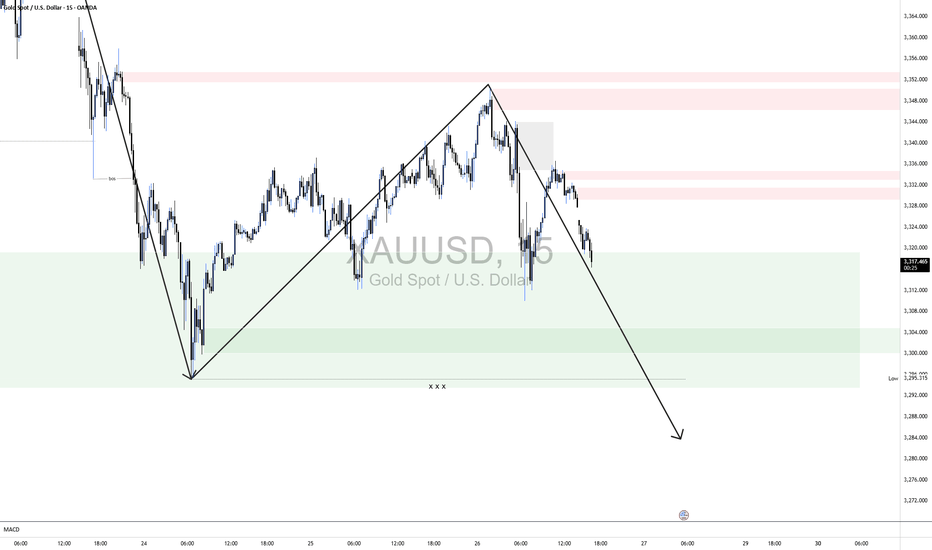

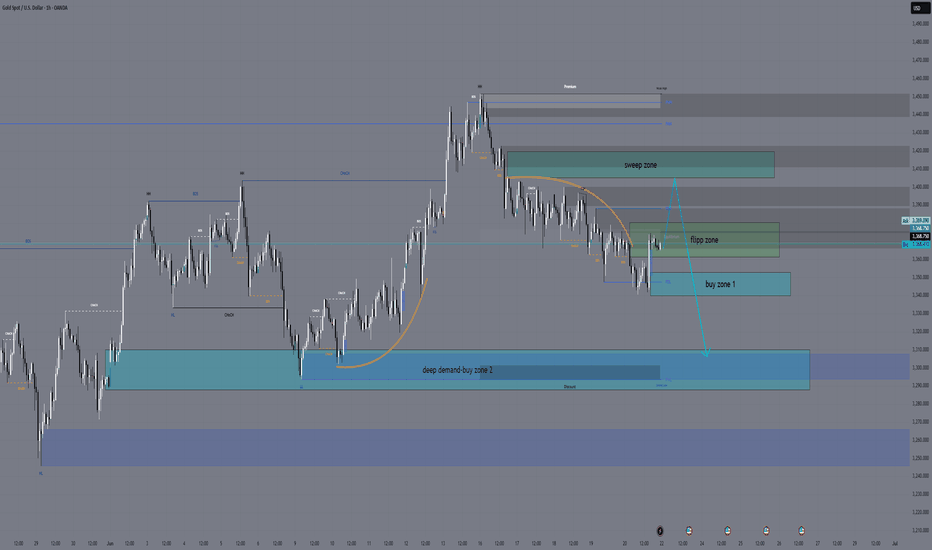

XAUUSD 📉 XAUUSD Technical Overview (15-min TF)

Recommendation: Bearish.

The pair is showing clear downside momentum, with price having broken below recent intraday highs and forming a series of lower highs and lower lows on the 15‑minute chart.

Target:

We are targeting the prior intraday low around 3295, which represents a logical short-term support area and likely liquidity target before price could consolidate or correct.

XAUUSDK trade ideas

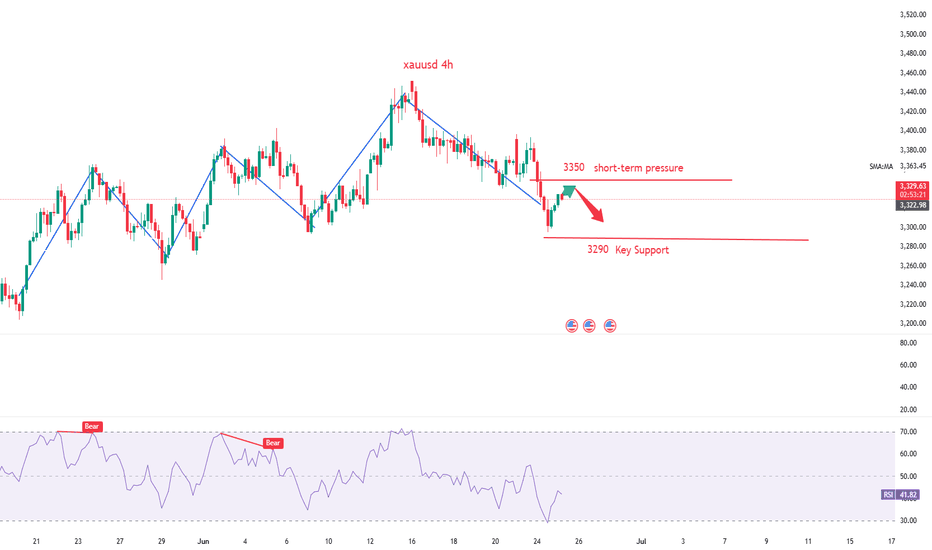

Will gold prices continue to decline?On Tuesday, spot gold once fell below the $3,310 level and finally closed down 1.67% at $3,322.82 per ounce, as the Israel-Iran ceasefire dented safe-haven sentiment and Fed Chair Powell stated that more time is needed before considering interest rate cuts. Spot silver closed down 0.46% at $35.90 per ounce. The benchmark 10-year U.S. Treasury yield closed at 4.2960%, and the 2-year yield at 3.8310%. Powell indicated that current policy is in a favorable position to wait and see before considering rate adjustments, adding that "colleagues privately say I'm doing the right thing". The vast majority of officials believe rate cuts later this year would be appropriate, while noting it's "too early to declare the U.S. dollar is falling".

Technically, gold's daily chart formed a large bearish candle with a lower shadow, breaking below previous support levels amid consolidation. This suggests the bearish trend may persist.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@3330-3335

TP:3300-3295

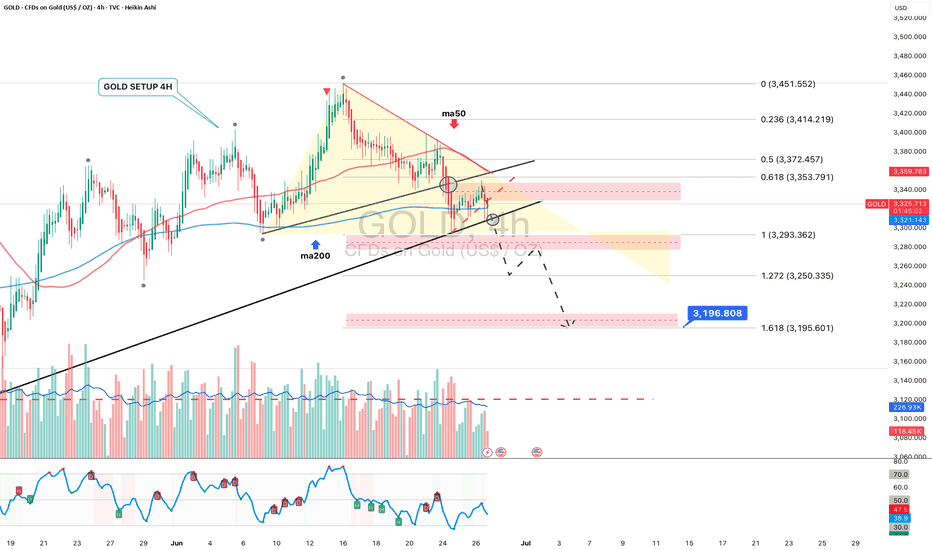

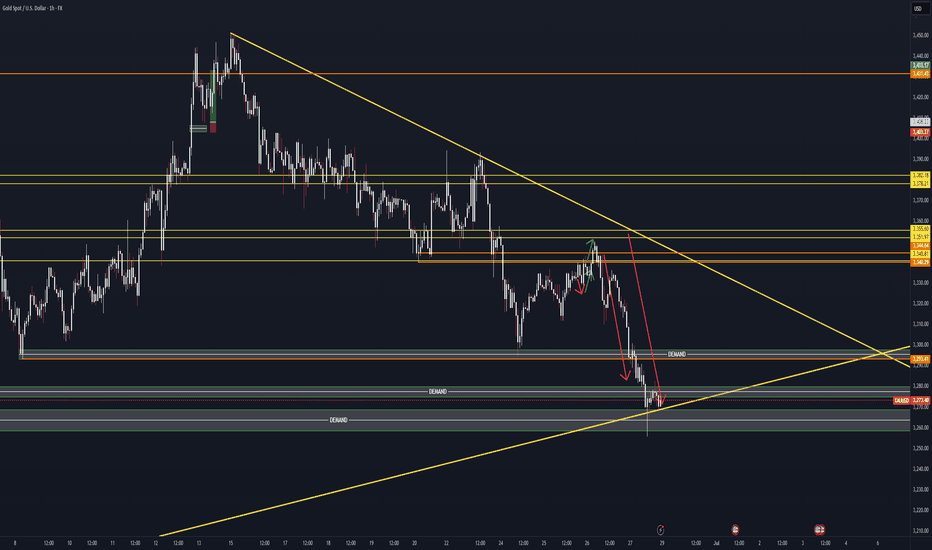

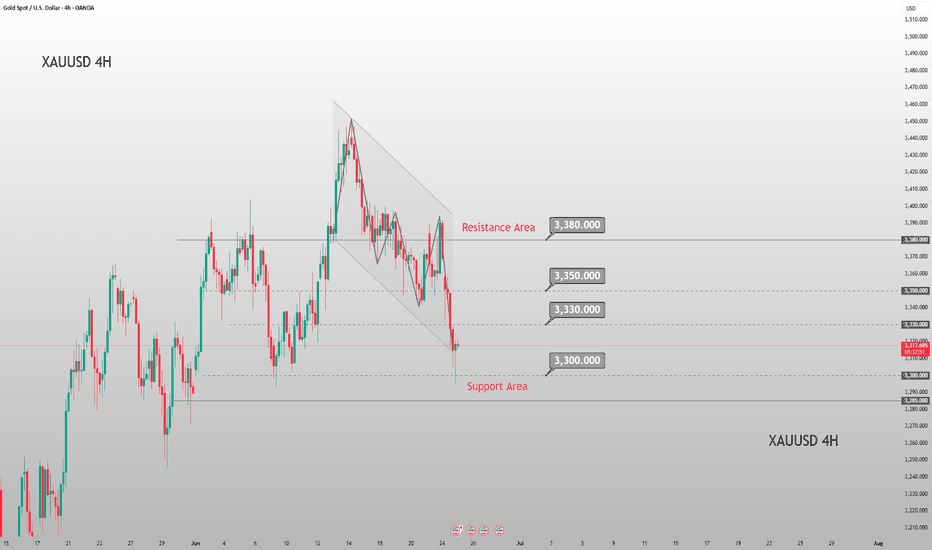

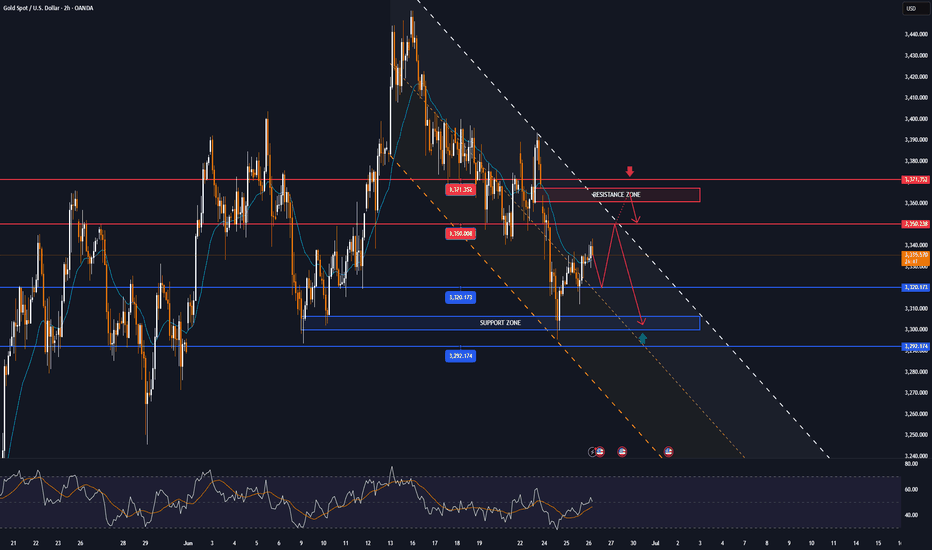

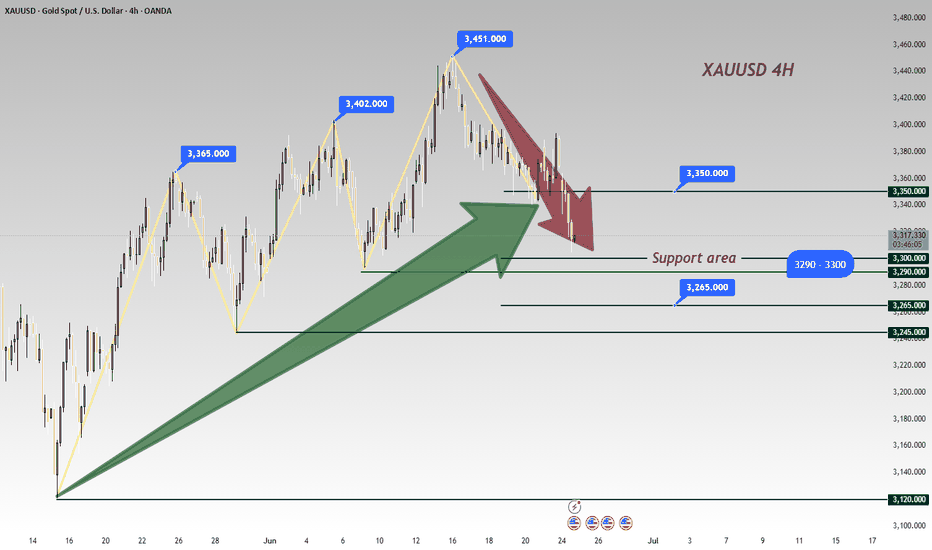

GOLD 4H: not all that glitters is bullish...The 4H chart shows a clean descending triangle breakdown. Price failed to reclaim the trendline and was rejected under both MA50 and MA200. The bounce into 3325–3340 was absorbed — classic liquidity sweep and fade. Volume confirms bearish control.

Technically, the breakdown below 3320 opens the way toward $3293 (1.0 Fibo), $3250 (1.272 extension), and final target at $3195 (1.618), where buyers might step in. RSI supports the continuation without signs of reversal. Structure broke — and the market is telling us where it's heading.

Tactical plan:

— Entry at market or on a retest of $3325–3335

— Targets: $3293 → $3250 → $3195

— Stop: above $3340 (above MA50 and broken trendline)

When gold looks shiny, smart traders look deeper. This breakout isn’t golden — it’s a trap for late bulls.

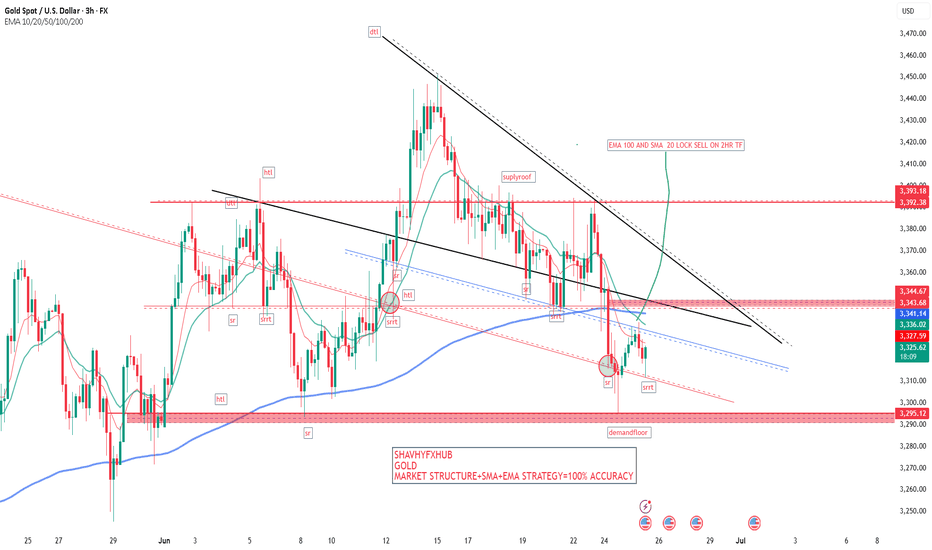

XAUUSD Daily Sniper Plan – Monday, June 23, 2025Current Price: 3368.76

Trend: Bearish on H4 | Corrective on H1 | Weak Bullish Attempt on M15

Market Context: Gold is consolidating under EMA pressure after FOMC. Price is pinned inside a key flip zone, awaiting Monday’s fundamental triggers.

🔸 HTF Overview (D1, H4, H1)

📰 Macro + Economic Context – Week of June 23–28:

This is a high-impact week for USD with Fed speeches, inflation, and growth data. Monday opens with caution:

Monday, June 23

🟠 FOMC Member Waller Speaks

🔴 Flash Manufacturing & Services PMI

🟠 Existing Home Sales

Tuesday, June 24

🔴 Fed Chair Powell Testifies

🟠 CB Consumer Confidence

🟠 Richmond Manufacturing Index

Wednesday, June 25

🔴 Powell Testimony (Day 2)

🟠 New Home Sales

Thursday, June 26

🔴 Final GDP q/q

🔴 Unemployment Claims

🟠 Durable Goods Orders

🟠 Pending Home Sales

Friday, June 27

🔴 Core PCE Price Index

🟠 Revised UoM Consumer Sentiment

📌 Monday is lighter in impact, but PMI data and Waller’s speech may spark the week’s directional bias. Avoid trading blindly into PMI spikes.

H4 Structure & Bias:

Bearish trend intact: Lower High = 3418, Lower Low = 3311

EMAs (21/50/100) aligned downward — price capped below 3380

RSI still under 60 = no bullish momentum

Rejection zone remains valid at 3406–3420 (H4 OB)

Strong demand expected at 3340–3352 and extreme at 3310–3288

🔸 LTF Precision (M30, M15)

Price compressing around 3365–3372

RSI around 56 → indecision

No bullish HH above 3380 = still within bearish control

EMA flattening → prepare for trap setups around NY open

🧭 Trade Scenarios

🔻 Sell Zone – 3406–3420

H4 OB, FVG top, liquidity above 3405

Entry: 3412

SL: 3426

TP1: 3312

TP2: 3288

TP3: 3265

🧠 Wait for sweep or strong bearish reaction — no early entries.

⚠️ Flip Zone – 3360–3380

No-trade zone: EMA cluster + mid-FVG

Only use for confirmations, not entries

🟢 Buy Zone – 3340–3352

OB + demand + Fib retracement

Entry: 3348

SL: 3334

TP1: 3448

TP2: 3472

TP3: 3490

🟢 Buy Zone – 3310–3288

Below LL sweep (3311)

Deep liquidity + OB demand

Entry: 3298

SL: 3280

TP1: 3365

TP2: 3405

TP3: 3440

📍 Key Structural Levels – June 23

Level Type Role

3460 Bull Trap Limit Irrational spike area

3445 FOMC Unfilled wick – trap zone

3426 Sell Zone Risk protection above OB

3418 H4 LH Confirmed bearish structure

3410 OB Midpoint Micro-rejection inside OB

3395 Previous HH Inducement target

3384 FVG Top Minor LTF rejection

3360–3380 ⚠️ Flip Zone MA/FVG compression – avoid entries

3352 OB entry edge Buy Zone 1 upper limit

3340 OB base Buy Zone 1 key level

3311 H4 LL Confirms bear structure

3300 Round Level Psychological + liquidity

3288 OB base Final demand structure zone

3265 Final TP Bearish extension only

✅ Final Action Plan

📉 Stay bearish below 3380 unless a clean HH + OB support forms

⚠️ Avoid trading inside 3360–3380 flip zone during NY PMI data

🛒 Longs valid only from 3340 or 3310 with confirmation (RSI, PA, OB)

🧠 Focus on structure integrity and clean OB rejections only

💬 Will you fade the 3412 OB or wait for the sniper bounce at 3348?

🔔 Follow and 🚀@GoldFxMinds for premium breakdowns, macro updates, and real-time sniper execution guidance.

🔹 Disclosure: As part of Trade Nation’s Influencer Program, we receive monthly compensation for using their charts.

GoldFxMinds

XAUUSD - Breakdown: - RISK OFF - Gold Bears Part IV - Complete TVC:GOLD buyers got flushed all week 💥

Big Boy sells only.

Sometimes you’ve got to put your balls on the line and call it ahead — no hesitation.

New Ideas next week, Thank you and keep supporting!!

We did just that.

#Trump #DXY #Gold #XAUUSD #Dollar #Metals #CommodityTrading #KeepGoing #SmartMoneyMoves

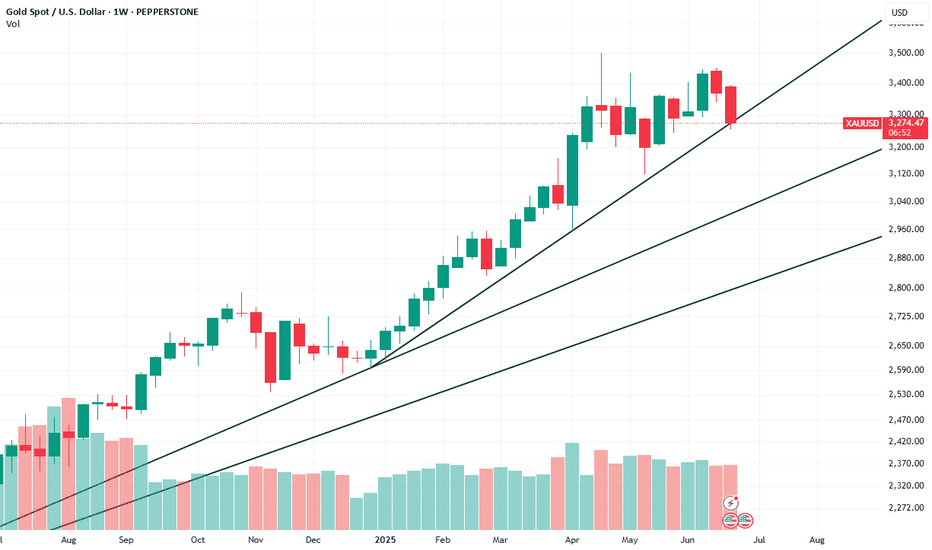

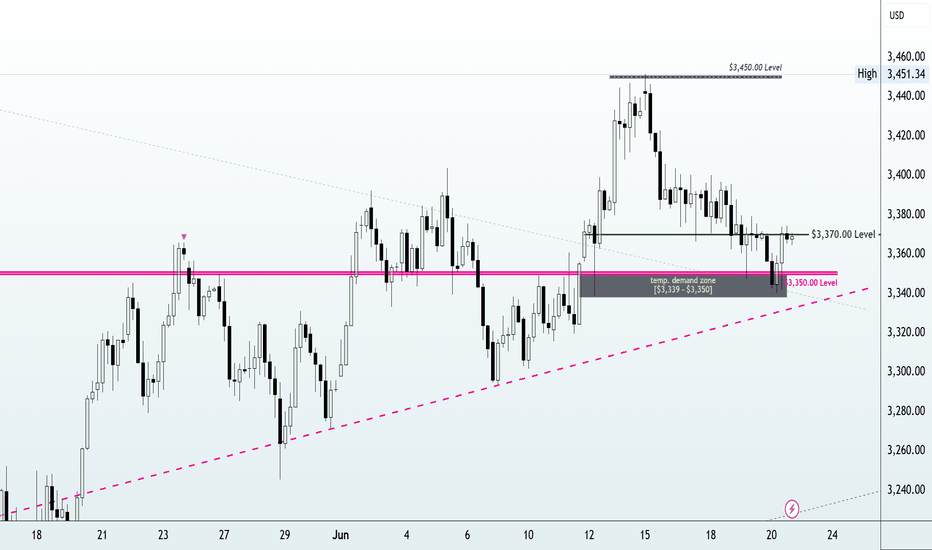

Is this the end of the bears of XAUUSD?2 weeks in a row, the sellers were in control. The downward force this week is strong. The possibility of a further drop in the future is highly probable. However, there's also a potential recovery next week. Overall, it's still an uptrend; however, I won't ignore the new LH that formed this week as well.

Gold Trading Analysis and Strategies for Sideways Decline MarketAfter Trump announced a comprehensive ceasefire agreement between Israel and Iran, market risk aversion significantly cooled, and gold prices plunged by more than $30 in early trading. Although the stability of the ceasefire agreement remains doubtful, the rebound in risk appetite has dominated market trends, with stock markets rebounding, oil prices falling, and demand for safe-haven assets declining.

From a technical perspective, the moving average system on the daily chart of gold shows an intertwined state, indicating a relative balance between bulls and bears. The current key resistance above is near 3350, which is an important psychological threshold. If effectively broken, it may open up upward space; the lower support is focused on the 3285-3290 range, which is the lower edge of the May consolidation platform. A break below this level may intensify correction pressure. The loss of the midline in the 4-hour chart further confirms the short-term weak structure, providing technical support for the downward trend.

XAUUSD

sell@3330-3340

tp:3320-3310

buy@3285-3290

tp:3310-3320

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

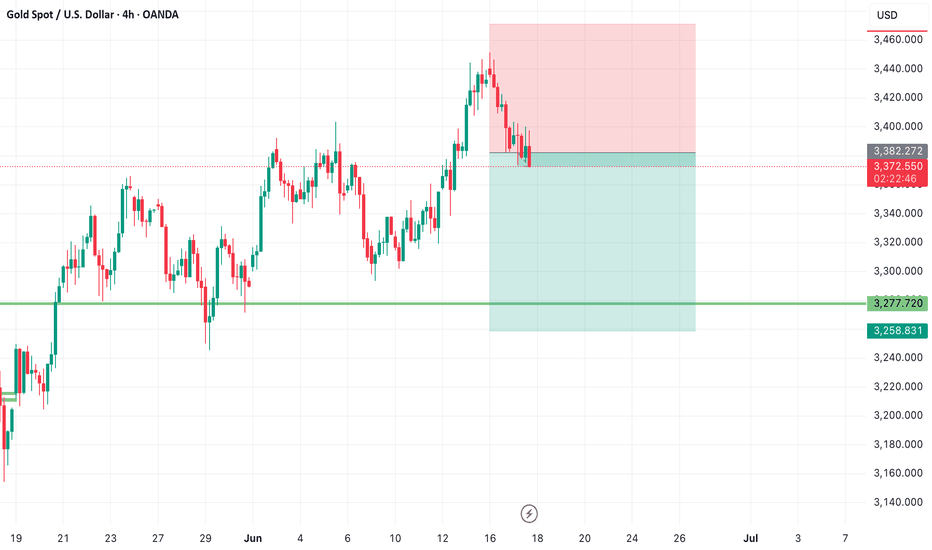

XAUUSD Short Opportunity🔻 XAUUSD Short Opportunity – Targeting 3258.840

Gold is showing signs of weakness after testing key resistance zones.

I'm currently watching a short-term sell setup with a downside target at 3258.840.

If bearish pressure continues, this level could be hit soon.

📉 Keep an eye on confirmation candles and momentum shifts.

👉 Follow me for more real-time setups and precision entries in Gold & Forex!

GOLD recovers from around $3,300 area, short-term targetsOANDA:XAUUSD has recovered slightly and is currently trading around $3,332/oz, supported by a decline in the US dollar and US bond yields. The market is closely watching the fragile ceasefire between Israel and Iran.

The US Dollar Index TVC:DXY is near a one-week low, making dollar-priced gold more attractive to holders of other currencies. The benchmark 10-year US Treasury yield is holding near its lowest in more than a month.

As the conflict between Israel and Iran ends, geopolitical risk levels have disappeared, safe-haven funds have flowed back and thus gold is under pressure.

From a more macro perspective, gold remains in an uptrend and real yields are expected to fall further amid continued Fed easing. In the short term, if the market reprices rate cut expectations to become hawkish, this could trigger a technical correction in gold.

Economic data in the coming months will be particularly important for the gold market. If inflation data remains weak or the labor market deteriorates further, Fed officials could cut rates sooner or more significantly than expected.

A ceasefire between Iran and Israel brokered by U.S. President Donald Trump appeared to have taken effect on Wednesday, a day after both countries signaled a temporary end to their conflicting air strikes.

WASHINGTON (Reuters) - U.S. consumer confidence unexpectedly fell in June, reflecting growing concerns among households about job prospects and another sign of a weakening labor market amid uncertainty over Trump’s tariffs.

Federal Reserve Chairman Jerome Powell told Congress on Tuesday that higher tariffs could start to push up inflation this summer, a key period when the Fed considers whether to cut interest rates.

Traders of federal funds futures are currently pricing in a cumulative 60 basis points of rate cuts through 2025, with the first cut likely to come in September.

Technical Outlook Analysis OANDA:XAUUSD

Gold has recovered slightly after testing the important support area noted by readers in yesterday's edition, around the raw price point of $3,300. However, the temporary recovery is being limited by the EMA21 moving average, followed by the 0.236% Fibonacci retracement level, which can also be considered as upside targets for the time being.

In terms of overall structure, gold is still in an uptrend with the price channel as the main trend. On the other hand, RSI is also hovering around 50, indicating that the market sentiment is still hesitant and does not have enough momentum for a complete trend.

Intraday, gold still has a bullish technical outlook, but a sell-off that takes gold below the 0.382% Fibonacci retracement level would be a bearish signal in the near term. Therefore, long positions should be opened near the $3,300 area, with protective levels behind the 0.382% Fibonacci retracement.

Notable positions will also be listed as follows.

Support: $3,320 – $3,300 – $3,292

Resistance: $3,350 – $3,371

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

→Take Profit 1 3359

↨

→Take Profit 2 3353

BUY XAUUSD PRICE 3301 - 3303⚡️

↠↠ Stop Loss 3297

→Take Profit 1 3309

↨

→Take Profit 2 3315

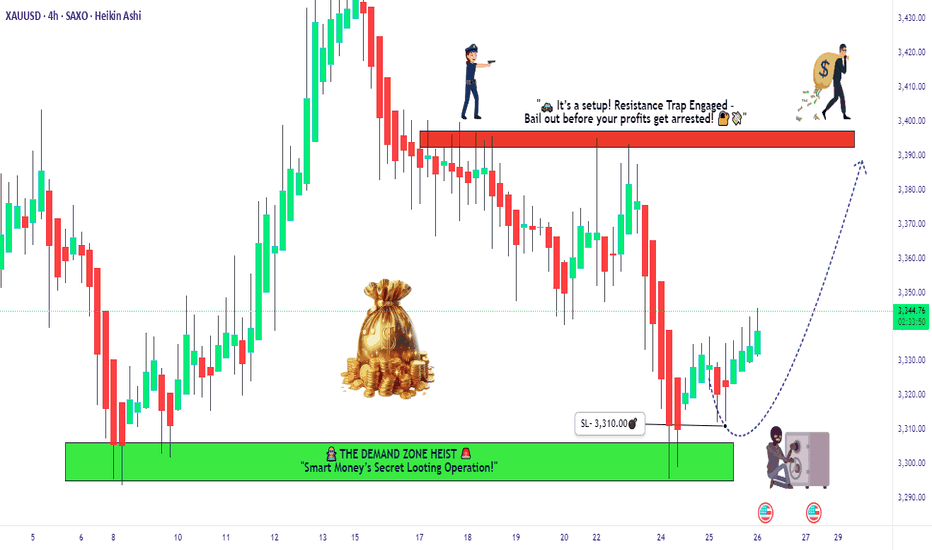

"Gold Vault Breach! XAU/USD Heist Plan in Motion"🏴☠️💰 XAU/USD Gold Heist Blueprint 💰🏴☠️

“The Vault’s Open… Time to Load Up!”

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers 🤑💰💸✈️

Get ready to execute the Golden Robbery with style and precision! Based on our 🔥Thief Trading Style🔥 using both technical & fundamental weapons, we’ve decoded the latest gold vault password: XAU/USD (Gold vs USD) is showing bullish bias!

🎯 Heist Instructions:

📈 Entry Point –

“The vault is wide open!”

Enter long anytime — but for the sharp shooters, place buy limits on the most recent 15/30min swing lows or pullback zones for a stealthier entry. Let the retracement pull the guards away 😏🔐

🛑 Stop Loss –

🔒 Set your Thief SL just below recent swing lows on the 4H timeframe (around 3310.0).

🔧 Adjust based on risk tolerance, lot size, and number of open trades — every heist has its escape plan!

🏁 Target Zone –

🎯 Aim for 3395.0 — or vanish before the cops show up!

Trail the stop as you go and don’t get greedy — wealth is preserved when exits are clean! 🏃♂️💨

🧲 Scalper's Advisory:

Only steal on the Long Side! Bulls are funding this operation.

💼 Big pockets? Dive in.

💳 Small stack? Swing with the pros & follow the plan.

🎯 Use Trailing SL to keep the loot safe.

📊 Market Insight – Why We Rob Gold Now?

XAU/USD shows bullish momentum 🐂 backed by:

Macro & Fundamental Data 🧠

Geopolitical & Intermarket Trends 🌍

COT Reports & Sentimental Outlook 💼

Dollar Weakness + Safe Haven Flow 💸

📚 Always cross-check the news wires & reports to validate the path! Fundamentals are the lockpick tools behind every breakout! 🔓📈

⚠️ Stealth Warnings:

📆 News Events = Increased Surveillance!

🚫 No new entries during high-volatility news drops.

🛡 Use Trailing SL on live trades to secure the bag.

💖 Wanna Support Our Heist Style?

Smash that 🚀 BOOST BUTTON 🚀

It fuels our Thief Army and helps you & your crew loot the market with confidence and flair!

Every day’s a new caper — follow the plan, manage your risk, and stay outta jail! 🏆💪🤝🎉

🔐 See you in the next Robbery Blueprint — Stay Locked & Loaded!

🐱👤💼📈💣💸

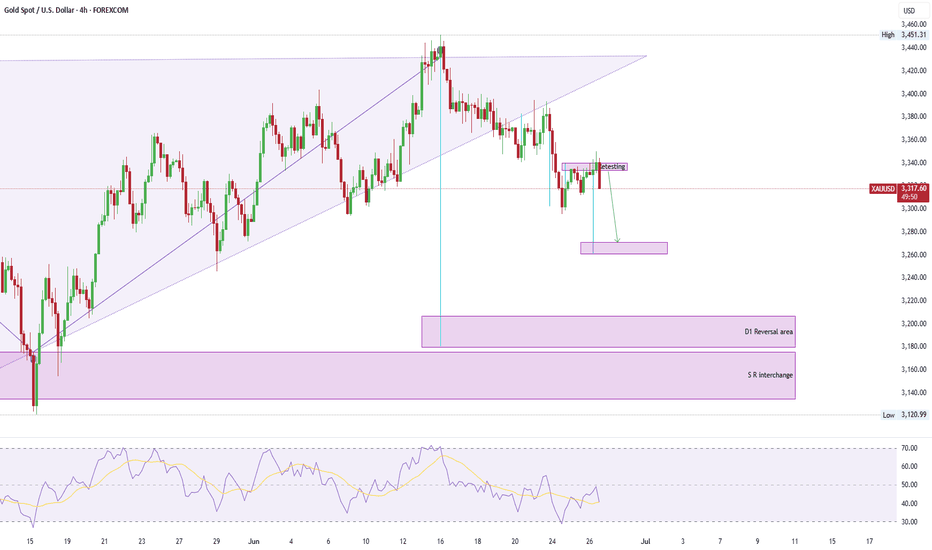

Trading Strategy (XAUUSD) – June 25, 2025 After a sharp decline in the previous session, XAUUSD has shown a mild recovery and is currently trading around 3,332 USD. However, price action suggests this could merely be a pullback within a broader downtrend, as gold has yet to break above the key resistance zone.

Technical Analysis

Price Action

Gold has bounced from the support zone between 3,291 – 3,317 USD, which has historically acted as a strong demand area. This zone also aligns with the Fibonacci 0.382 retracement from the previous bullish leg.

However, XAUUSD remains below the key resistance zone at 3,373 – 3,392 USD, which is a confluence of:

- The Fibonacci 0.618 retracement from the most recent downtrend

- A historical supply zone that has been rejected multiple times

- The upper boundary of the sideways range formed since May

- If price fails to break through this zone in the coming sessions, the risk of continued downside remains high.

RSI Indicator

- The RSI (14) is currently hovering around the neutral zone (49–54), indicating that the rebound lacks the strength needed to confirm a trend reversal.

- The RSI has not crossed above the 55 threshold, suggesting the dominant trend is still bearish.

Key Technical Levels to Watch

Resistance:

- 3,373 – 3,392 USD: Confluent resistance zone (Fibonacci 0.618 + prior supply zone)

- 3,435 – 3,452 USD: Major swing high, a key medium-term reference level

Support:

- 3,291 – 3,317 USD: Immediate support zone, still holding strong

- 3,250 – 3,224 USD: Potential downside target if the bearish momentum resumes

Suggested Trade Setups

Scenario 1 – Buy if price holds above 3,291 and shows confirmation signals

Entry: 3,295 – 3,300 USD

Stop-loss: Below 3,289 USD

Take-profit: 3,340 – 3,355 – 3,370 USD

Conditions: Must show clear bullish reversal patterns (Pin Bar, Bullish Engulfing) on H1 or H4 timeframe

Scenario 2 – Sell if price rejects from resistance zone with confirmation candle

Entry: 3,370 – 3,375 USD

Stop-loss: Above 3,392 USD

Take-profit: 3,330 – 3,310 – 3,290 USD

Conditions: Clear bearish rejection candle + declining volume

Note: XAUUSD is currently in a technical rebound phase after a strong drop but lacks solid reversal confirmation. Traders should closely monitor the price reaction near the 3,373 – 3,392 USD resistance zone over the next sessions. This area will determine whether the downtrend will resume or a reversal begins.

Stay tuned for more daily trading strategies, and make sure to save this analysis if you find it helpful for your trading plan.

Strategy analysis by @Henrybillion

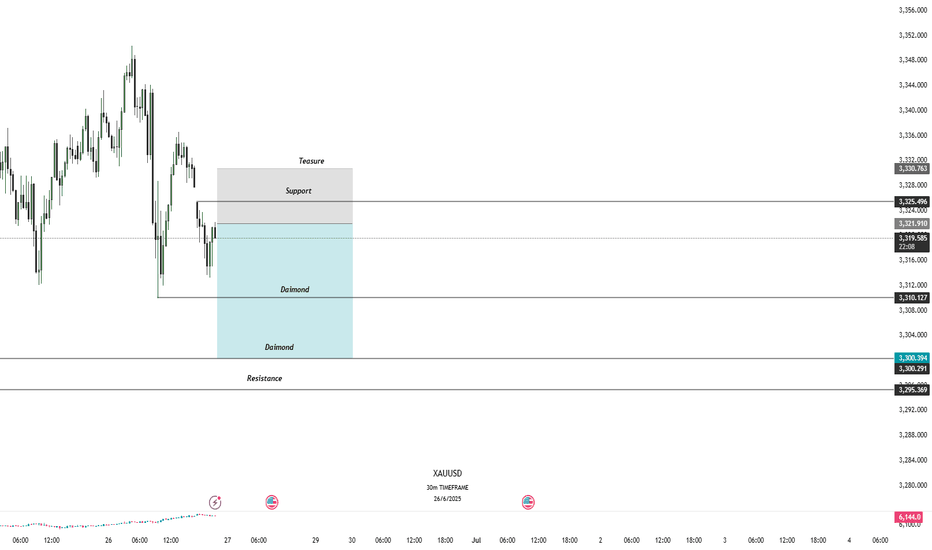

Gold Rejection Zone – Sell Setup in PlayGold (XAUUSD) is currently reacting to a key resistance zone (Teasure + Support Flip).

Price is testing the previous support, which may now act as resistance. A rejection from this level could trigger a strong sell-off.

Sell Confirmation:

If price fails to break above 3325, we may see downside continuation.

🎯 Target Zones (Diamonds):

Diamond 1: 3310

Diamond 2: 3300

Final support near 3295

🛑 Invalidation above: 3330

Structure favors sellers — waiting for bearish confirmation before entry. Use proper risk management.

Let’s see how price plays out around this zone. 📉⚠️

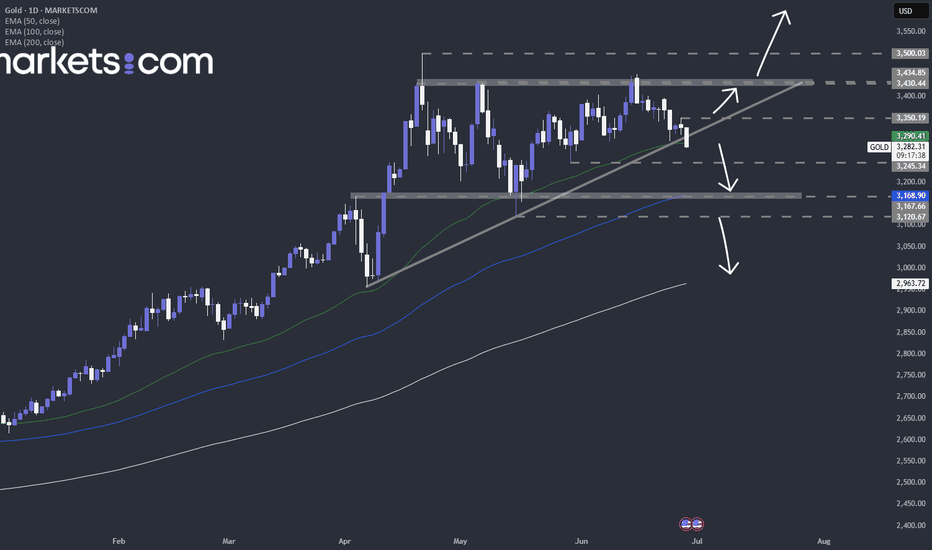

Is gold in an ascending triangle, or in a wider range?A quick technical piece on TVC:GOLD . What are your thoughts?

MARKETSCOM:GOLD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

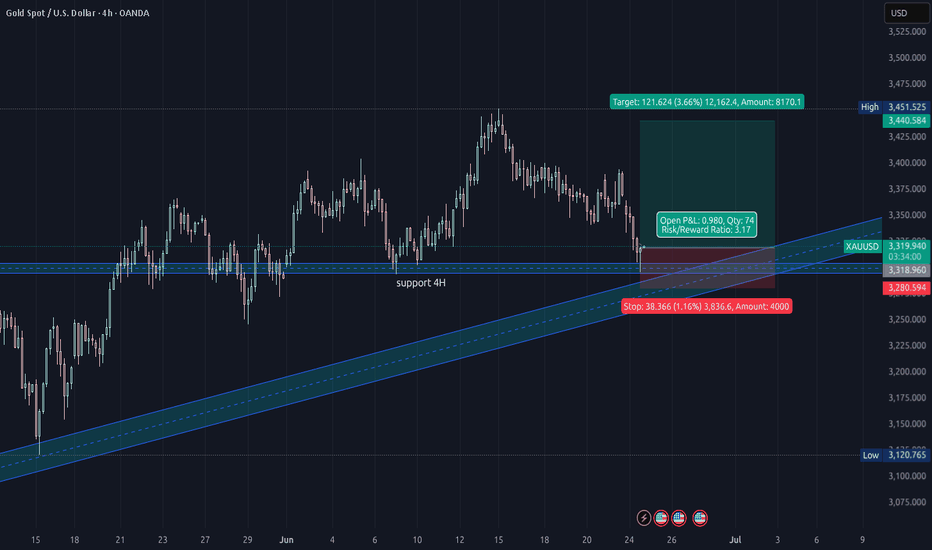

XAUUSD long on market priceHere is the technical analysis for XAUUSD (gold).

Top down analysis show upward momentum:

Also on daily is bounced close to daily support-

On chart in the beginning it's visible that on 4H price has bounce from 4H support.

Market price: 3320

SL: 3280

TP1: 3360

TP2: 3400

Tp3: 3440

GOLD Price Forecast: Is the Pullback Over? | Weekly OutlookWill XAUUSD resume its bullish trend, or is more downside ahead?

In this video, I break down last week’s gold price movement and the current market reaction to rising geopolitical tensions between Iran and Israel, now with the U.S. joining the conflict. We also assess the impact of the Fed’s recent rate hold, weak retail sales, and upcoming high-impact U.S. economic events like PMI, GDP, and Core PCE.

💡 Here’s what you’ll learn:

✅What caused gold’s pullback last week

✅Why institutional traders shake out retail buyers

✅Key fundamentals driving gold right now

✅How to position yourself smartly for the upcoming trading week

🔔 Don’t forget to like the video in support of this work.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#goldanalysis, #xauusd, #goldforecast, #goldpriceprediction, #forexanalysis, #fundamentalanalysis, #forextrading, #tradinggold, #goldnews, #federalreserve, #marketpsychology, #tradingstrategy, #geopoliticalrisk, #usdata, #iranisraeltensions, #goldbullish, #goldbearish, #forexmentor, #xauusdforecast, #tradingview

Gold Distribution I missed the perfect entry for this distribution model, but since the technical target hasn't been reached yet, I'll look for valid entries if they arise. The time displacement is good, it swept internal liquidity and left more to the downside. It looks more like a trend than a range deviation, so I'll be cautious with this trade if I take it.

GOLD Bearish Breakout! Sell!

Hello,Traders!

GOLD made a bearish

Breakout of the key

Horizontal level of 3,300$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

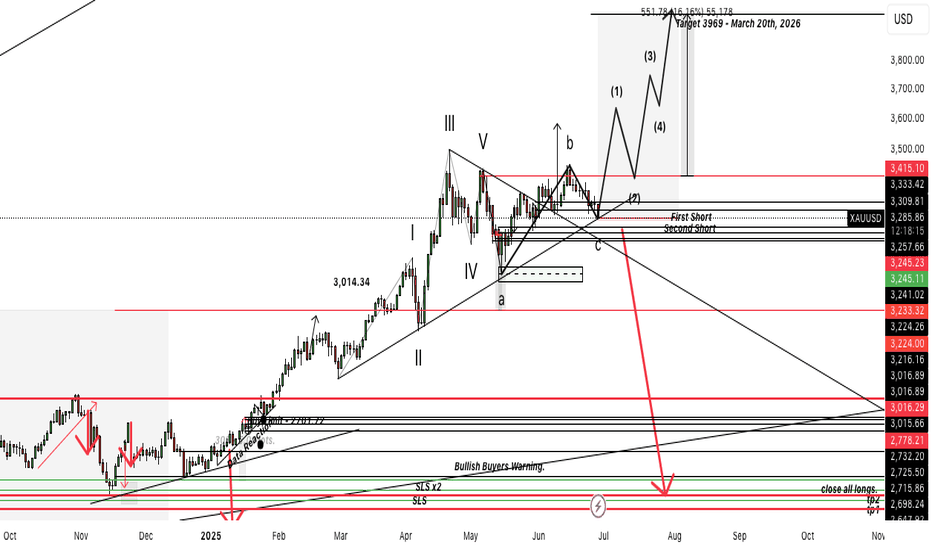

Gold Impulse / En Route 12345Long Gold. 3289-3280 Target 3673

SLS Just Below 78-70 Dpending on Leverage.

Gold failed our Beaish Zone Target Eliminating out bearish senitiment .

June 27th 2025 We Long Gold going into June 29th Weekend of Basel 3's Waiting Policy Until january 27th 2027. Gold will be extremely Bullish Afterthis corrective wave from 3415.

Today we enter Long Positions into the weekend Expecting a. Gap Up to Around 3338 Trapping All short sellers in the Month of June.

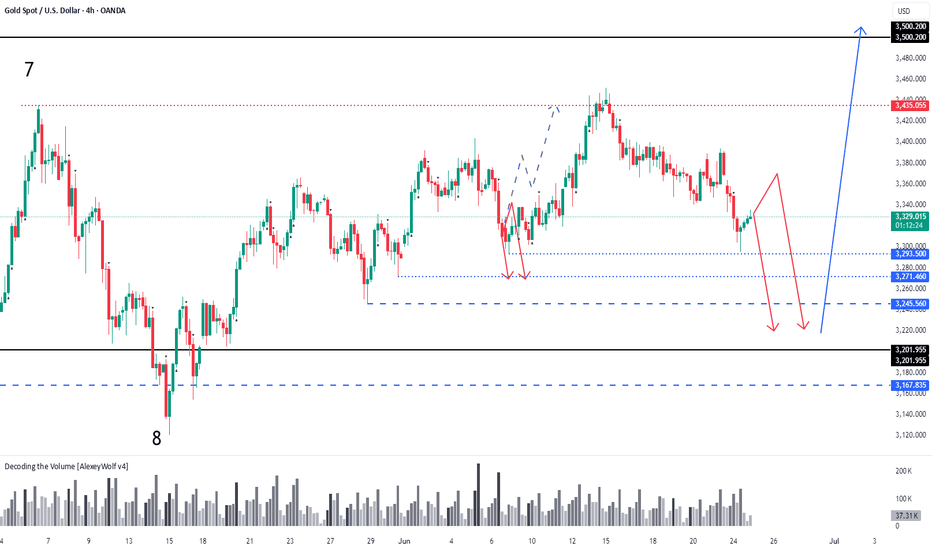

GOLD. Daily Timeframe overview with Initiative AnalysisHey traders and investors!

Daily Timeframe

Market phase : sideways. Seller's initiative.

Boundaries marked with black lines.

Gold followed an alternative scenario from the previous review toward 3435. The buyer played out the 8-9 vector of the range on the daily timeframe, and now the initiative has shifted to the seller. The seller's targets are 3245 and 3201 — areas to watch for potential buy patterns aiming for a new ATH. The price might get stuck in the 3293–3271 zone. If a strong buyer reaction occurs, a reversal may happen in this range.

The ideal area to look for buy patterns is around 3201.

Selling is risky.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

Will the 3300 support hold today?Due to the sudden ceasefire agreement between Iran and Israel today, the gold market quickly flipped from bullish to bearish — when gold tested the 3300 support level just now, it rebounded near 3315 📈.

It may challenge the 3290-3300 support range again later: if it effectively breaks below, the next target is the strong support at 3265, and it may eventually dip to 3200 before starting a rebound 🔄.

If the breakout fails, it may consolidate near 3330, waiting for further market guidance 📊

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@3330 - 3320

🚀 TP 3310 - 3305

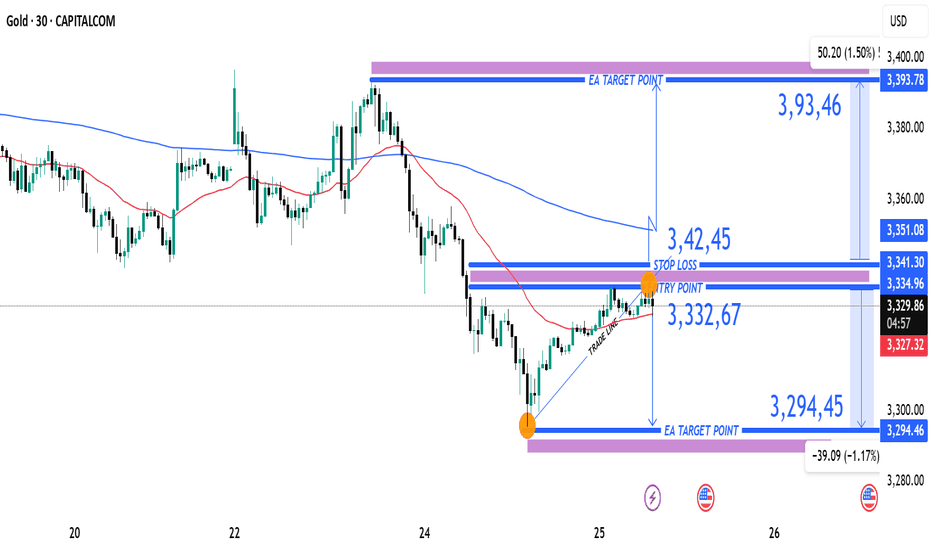

XAUUAD Reversal Setup Short Trade Opportunity Below Resistance Current Price: 3,327.56 USD

Entry Point: 3,332.67 USD

Stop Loss: 3,342.45 USD

Take Profit Levels:

Target 1 (Downside): 3,294.45 USD (-1.17%)

Target 2 (Upside): 3,393.78 USD (+1.50%)

🔧 Technical Indicators & Tools

Trade Line: Upward sloping trendline connecting higher lows, supporting recent bullish structure.

Moving Averages:

Red: Short-term (likely 50-period EMA)

Blue: Long-term (likely 200-period EMA)

Price is still trading below the long-term MA, suggesting broader bearish pressure.

Resistance Zone: 3,334.96–3,341.30 — a key supply area marked in purple.

Support Zone: 3,294.45 — identified as a previous demand level.

⚖️ Risk-Reward Analysis

Short Setup:

Entry: 3,332.67

Stop Loss: 3,342.45 (Risk ~10 USD)

Target: 3,294.45 (Reward ~38 USD)

R:R Ratio ≈ 1:3.8, which is favorable for a short trade.

📌 Summary

Bias: Bearish intraday

Setup Type: Short-sell at resistance zone

Confirmation: Price rejection or bearish candle near 3,334–3,342 zone

Invalidation: Break and close above 3,351.06 (upper resistance)