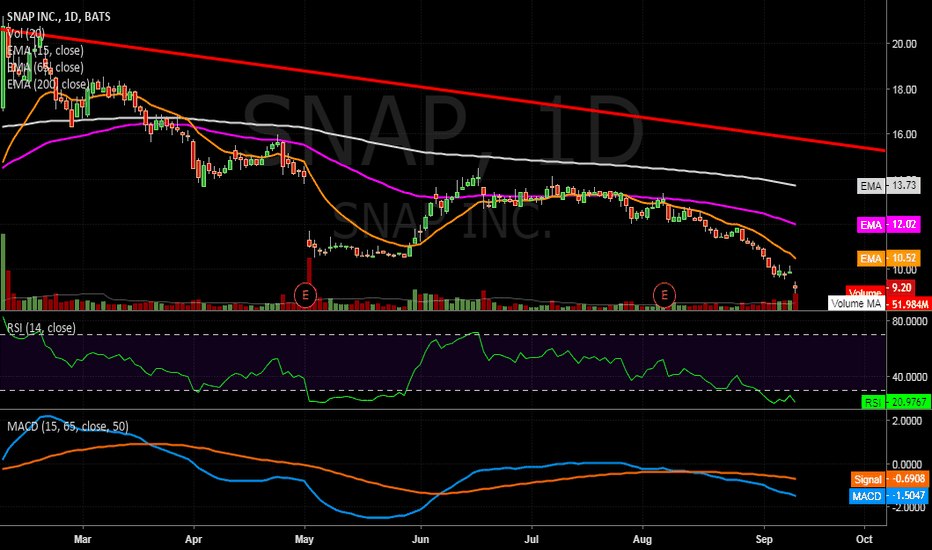

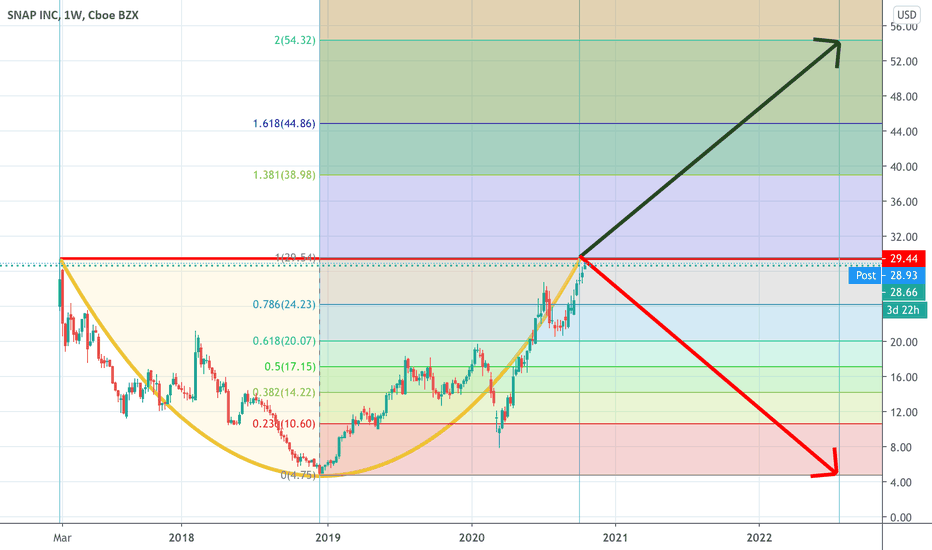

BUY !!! We are facing another Wall-St manipulation on Snapchat.

BTIG analyst Rich Greenfield downgraded Snap - price target $5 so the big boys can load up and steal million cheap shares .

Remember when BTIG was downgraded FB in the past , and later they came out said : ''not having a buy on Facebook has clearly been a mistake in 2017 and we are simply not going to allow that mistake continue''

I am very confident on Snap. Snap has unique futures than any other social media app in the market .

Dont sell your shares if you are long on Snap.

''Opinions are my own , trade at your own risk''

1SI trade ideas

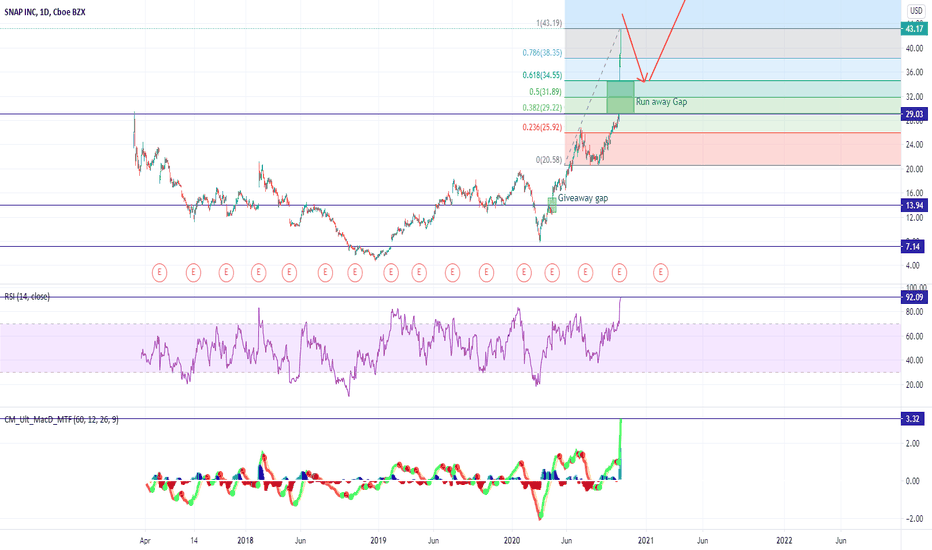

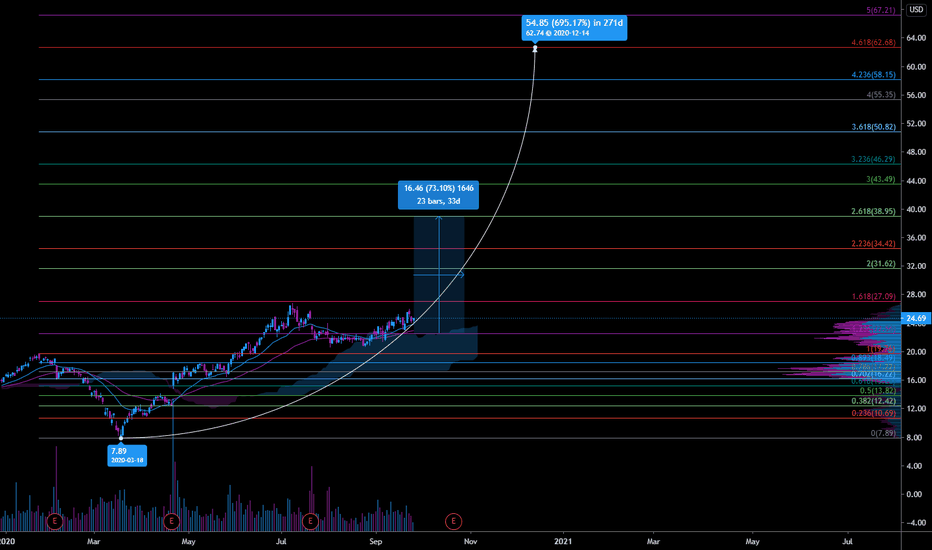

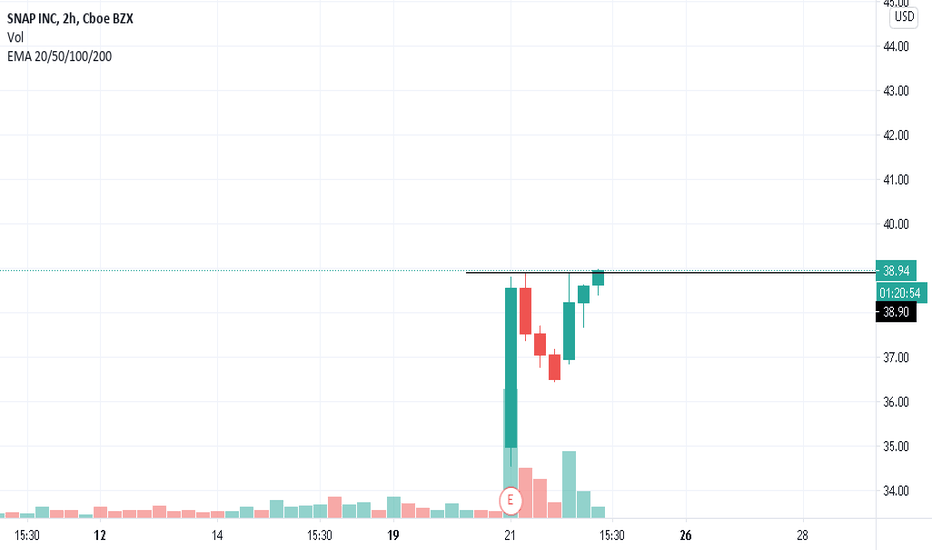

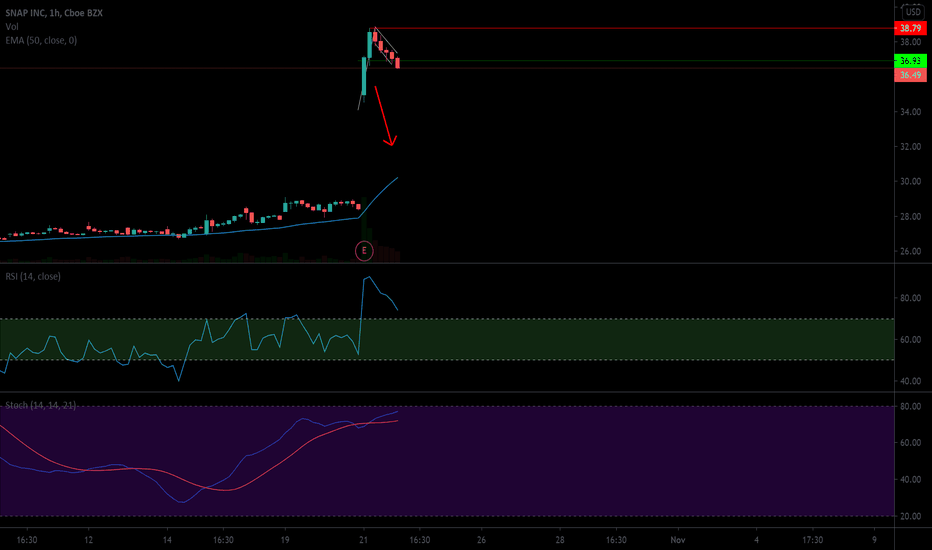

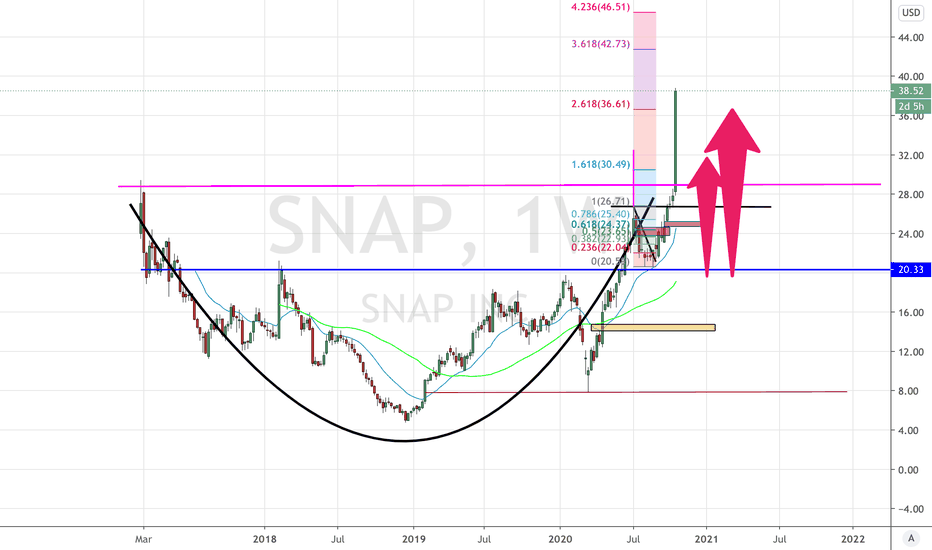

OverboughtBeat estimated revenue (0,01 EPS) on 10/20/20 gave momentum to stock and bounced ATH ( more than 51% in 3 days) All indicators started to show overbought. On monday can make another gap to up (45) (exhaustion gap) and my opinion will be pulled back fib retracement (0,618) $35-36 in short term.

This is not financial advice.

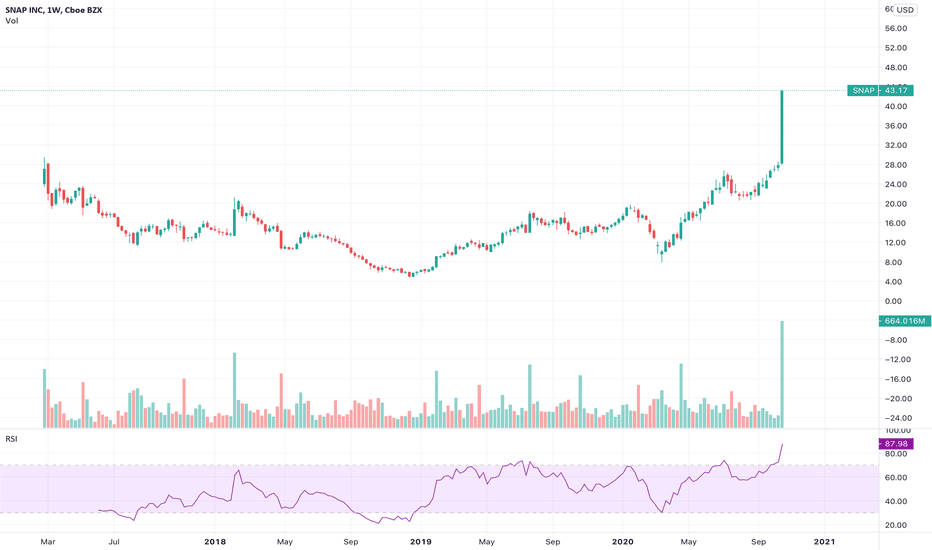

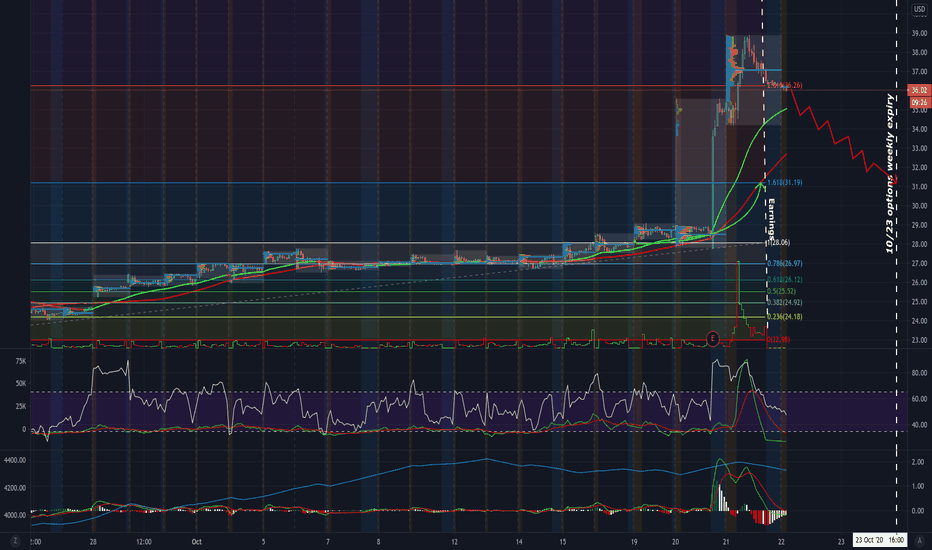

Oh Snap. Snap went up about 50% this week with its RSI hitting 92 on the daily chart; making it one of the most over bought stock on the NYSE.

Look at locations volume has increased. I don’t think the volume justifies the move up it made. The company only saw a 4% increase in usage from last month but that doesn’t justify its price. It could go higher but I am slowly adding puts because when it comes back down to 35 it will come down strong.

SNAP pullback from gigantic 1 day gain, possible 1.618 FibonacciI won't be surprised if SNAP has a pullback the next 2 days after it's gigantic $8.05 (28.3%) 1 day gain on massive volume 254M shares vs average 44M shares or 500% volume pop. A reasonable scenario would be for SNAP to get to the 1.618 Fibonacci retracement on the monthly chart. Also, because tomorrow is weekly options expiry, I suspect peeps taking huge profit gains today to lock it in before tomorrow's uncertain price action.

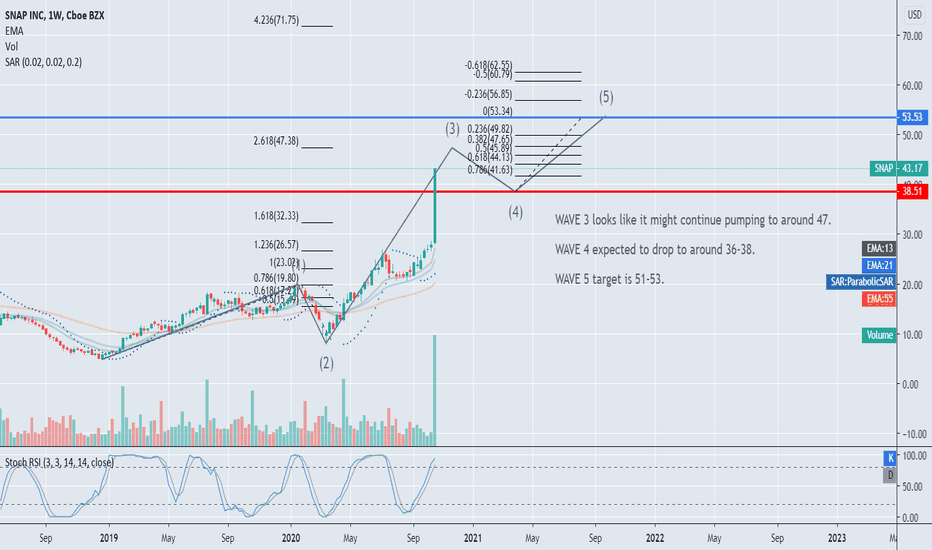

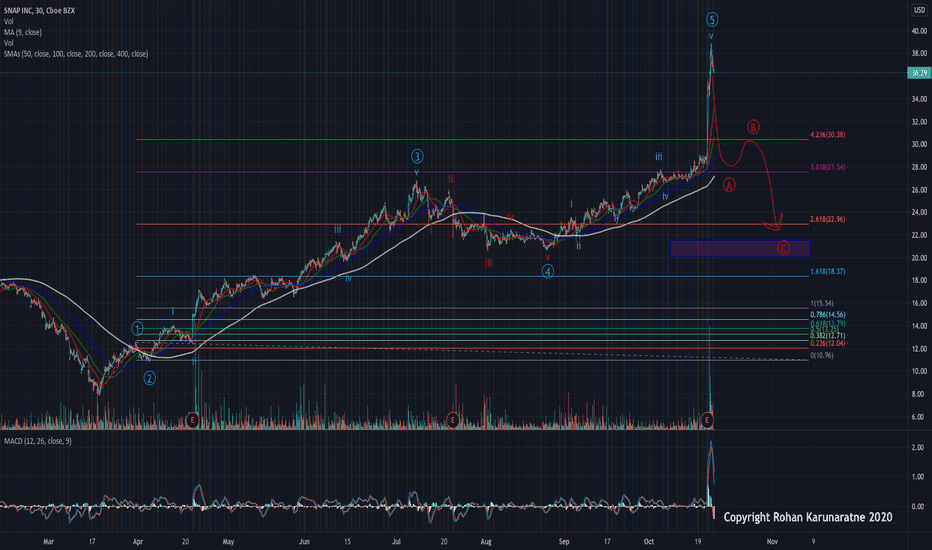

SNAP very overextended, looking for ABC retracement to 21Very very overvalued on SNAP, definitely needs to correct massively on a macro scale, looking for an ABC retracement to target region around 21. An alternate count could also be placed with a 12345 macro count being developed with a bullish target around 45, but I do think that the technicals need to correct. Copyright Rohan Karunaratne 2020

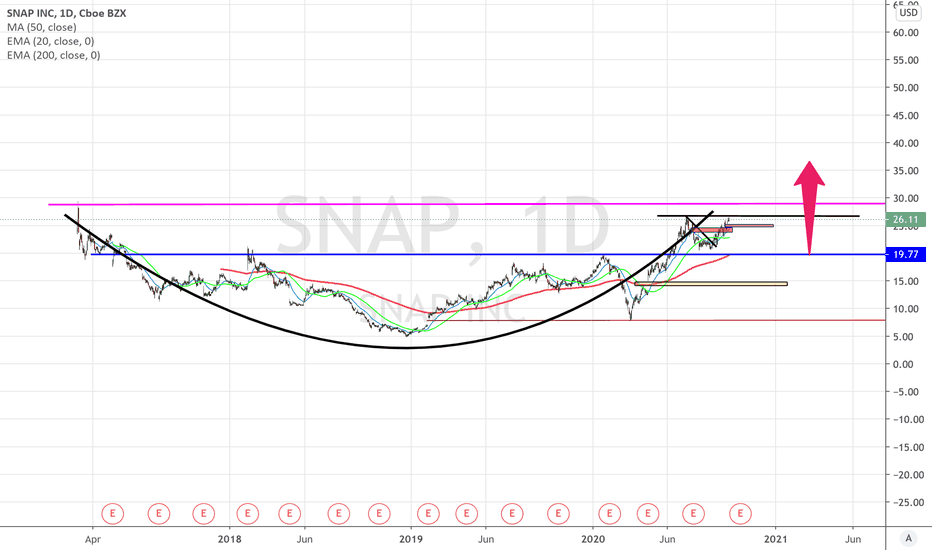

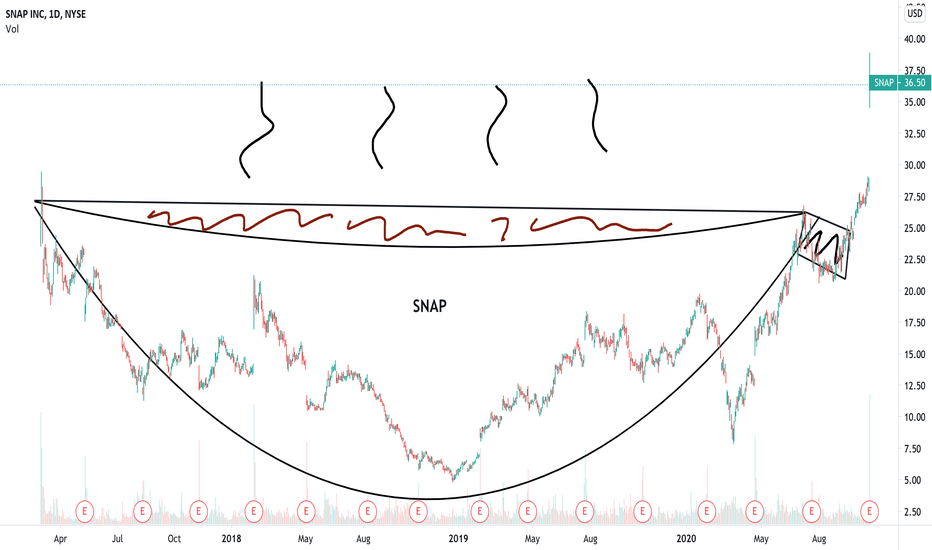

Snapchat soars! That's one giant cup and handleIt was interesting to watch Snapchat today after its earnings beat. It soared 30%. I personally think Snapchat is great, but have never really understood the long-term growth plan. Snap Kit seems really promising. But I noticed their user growth is not growing as fast as Instagram or Facebook or TikTok. So it's interesting to see that it's worth $50+ billion.

At the same time, I do notice that Snapchat is focusing more on global growth. So perhaps that is the exciting number. Global numbers and global users as opposed to just North American users.

I am watching closely to see how the pop holds up and this chart is a massive cup-and-handle chart I wanted to draw. Yes, it's not perfect and little ridiculous, but it had to be done. Snapchat since its IPO has been a mess! Congrats to any and all who bought at the bottom and held.

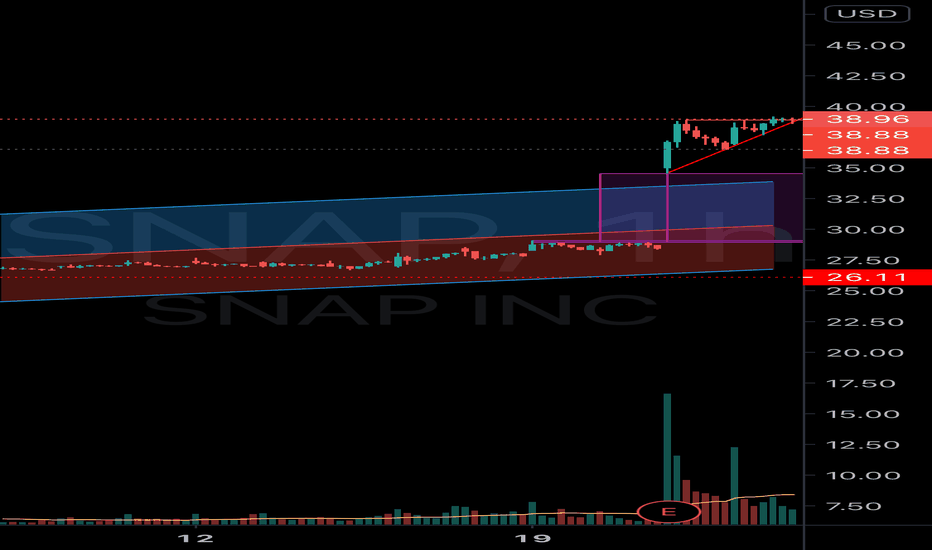

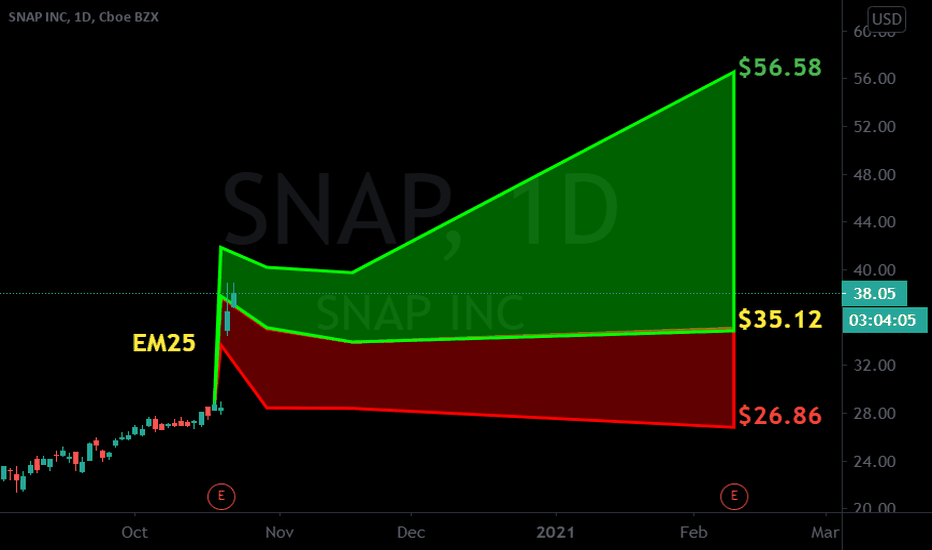

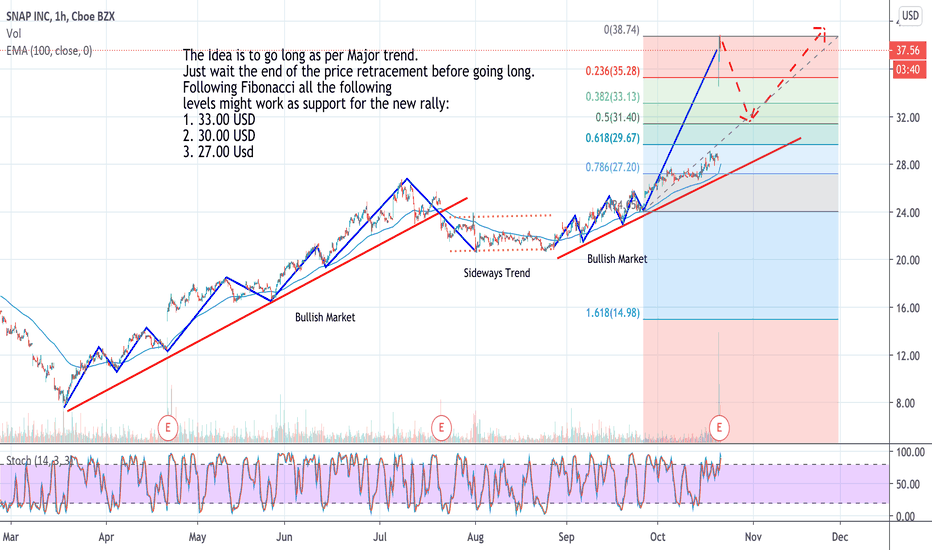

SNAPCHAT Stock Analysis - Snap Technical AnalysisThe Idea is to go long as per Major trend.

Just wait the end of the price retracement before going long.

Following Fibonacci all the following levels might work as support for the new rally:

1. 33.00 USD

2. 30.00 USD

3. 27.00 Usd

Fundamental Analysis

Snap shares jump more than 30% after earnings show strong gains in Snapchat online-advertising sales, which leads to gains for other social-media ad companies

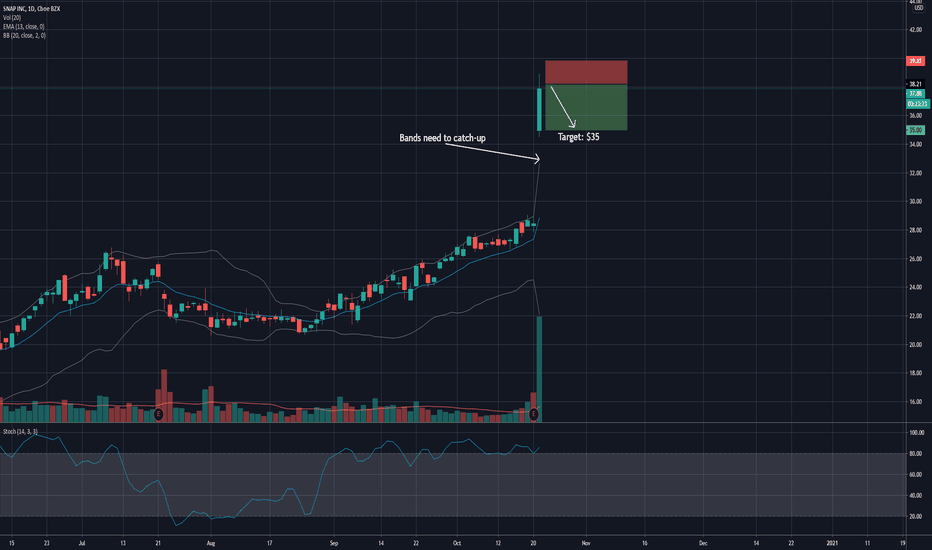

SNAP SnapbackSNAP just reported earnings and skyrocketed to new highs. It has now reached parabolic levels and has super exceeded its upper bollinger band, to where its not even in the ballpark. This tells me that this is going to sell off and is only going on momentum at the moment from day traders. Typically in SNAP's history it sells off in the other direction if its overextended after earnings. I suspect it will come back to the $35 this week.

SnapChat (SNAP)Snap chat absolutely smashed its earnings report to new highs, BUT... what goes up must come down, I'm going to let it settle for a few days and see where it wants to be. I believe that the price per share for snap chat is extremely low and should be taken advantage of, it's potential for growth and popularity with young people is through the roof. Its a potentially very good investment.... we will see.