TESLA - Slava NikoleTesla stock market open on Easter Monday morning for the next few weeks ago so I'm not too concerned that you can use your own business you can get a ride for you to get a new phone yet but it can get it can get it can get a new car can be done in about the election of it I can be a

TL0 trade ideas

CUP AND HANDLE $TSLA TO $515 MINIMUMThe cup and handle is a bullish chart pattern commonly used by traders to spot potential buying opportunities. It features a rounded "cup" formation followed by a slight downward drift forming the "handle." This pattern typically signals a continuation of an upward trend once the handle completes its consolidation phase.

ROBOTAXI BOOM

BUY NOW NASDAQ:TSLL NASDAQ:TSLA

Tesla vs. BYD: The Market’s Greatest IllusionIntroduction: The Tale of Two Companies

You don’t need to be an economist to see it. Just compare Tesla and BYD.

BYD: Founded in 1995, Chinese, over $107 billion in revenue.

Tesla: Founded in 2003, American, with less revenue—but a market cap six times bigger.

The reason? Because one sells cars, and the other sells dreams. And Wall Street loves a good dream.

The Illusion Economy: When Hype Outweighs Reality

Tesla’s valuation isn’t tied to assets, production, or profits. It’s a ritual of collective belief—a performance act where branding replaces substance, and expectation outweighs reality.

It’s the same logic behind a $1,000 jacket that costs $100 to make. Put a fancy logo on it, and suddenly, it’s not overpriced—it’s "premium." You're not just buying a product; you're investing in a lifestyle. Sure. Keep telling yourself that.

Tesla is the $1,000 jacket. BYD is the actual tailor shop.

Tesla vs. BYD: The Numbers Tell the Story

Tesla’s market cap is over $1 trillion, while BYD’s is under $200 billion. Yet, BYD outsells Tesla globally, especially in China, where it dominates the EV market. Tesla’s valuation is built on brand perception, future promises, and speculative optimism, while BYD’s is grounded in actual production and revenue.

Financial Storytelling Over Business Reality

Tesla isn’t just a car company—it’s a financial illusion. Markets rise not on performance, but on promise. Stock prices reflect not what a company is, but what a hedge fund feels it might become. It’s not a business model—it’s mood swings with decimal points.

BYD’s Competitive Edge

Production Power: BYD manufactures more EVs than Tesla annually.

Battery Innovation: BYD’s Blade Battery is safer, lasts longer, and is cheaper than Tesla’s.

Affordability: BYD’s EVs are significantly cheaper, making them more accessible to global consumers.

Market Reach: BYD dominates China, the world’s largest EV market, while Tesla struggles with pricing and competition.

The Consequences of Buying the Dream

Tesla’s valuation isn’t creating better cars. It’s just creating dumber investors.

Investors who think they’re visionaries because they bought into the hype.

Consumers who think they’re elite because they bought the label.

Boards who think they’re gods because someone inflated their stock ticker.

But every illusion has an expiration date. Every bubble has its needle. And when dreams are sold on credit, reality always comes to collect.

Reality Always Comes to Collect

This isn’t growth. It’s speculative theater funded by your retirement account.

Real value doesn’t need hype. It appears in supply chains, production lines, tangible goods, and on profit sheets that make sense even without a TED Talk.

So next time you see Tesla’s trillion-dollar valuation, ask yourself: Are you investing in a business? Or are you just buying the dream—before it bursts?

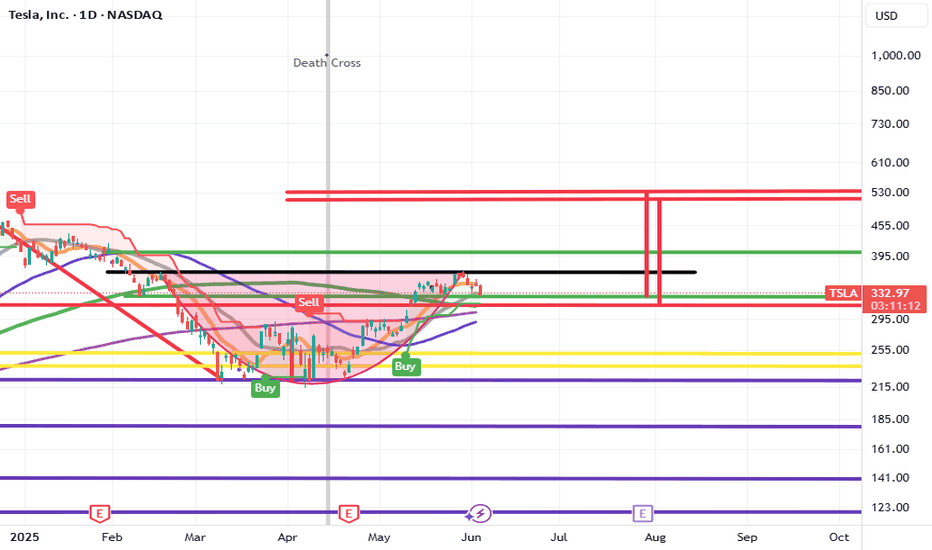

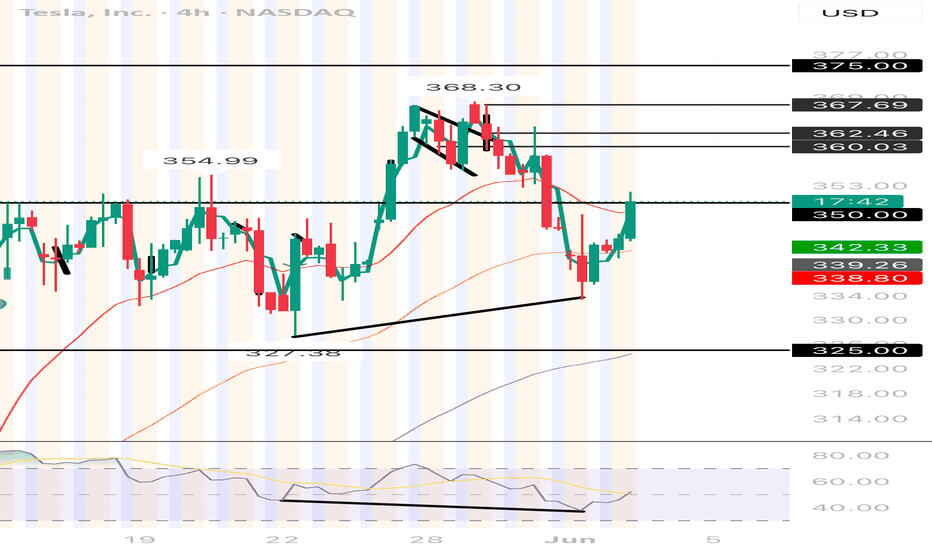

INTRADAY TSLA. SHORT @ 352. LONG @ 333. Overview -

TSLA is showing declining sales and low vehicle registration in the many countries. Although, that hasn't deterred the stock holder into panic selling, we aren't bullish on TSLA but we aren't necessarily bearish either. The market trend is going to determine the immediate direction today. We will go with a slightly bearish approach on TSLA, mainly because it was rejected from the 365 area despite trying to hold it.

The important levels in the premarket are 343 and 348.

INTRADAY TRADE PLAN -

1. If the stock opens at 345 and plummets to 343, where it confirms strength. We LONG till 348. Take a partial out at 343 and put a trailing stop.

2. If the stock opens at 345 and rallies to 348, where it confirms weakness. We SHORT till 343. Take a partial out at 343 and put a trailing stop.

3. If the stock goes till 343 and consolidates. We observe the volume footprint and side with the sellers if they are dominant. If the buyers show strength instead, then we do nothing and wait for the price to drop lower.

4. If the stock goes till 348 and consolidates. We observe the volume footprint and side with the sellers if they are dominant. We stay back if buyers are showing strength. We wait for the price to drop a little and verify if the buyer strength hold even stronger at the lower levels. Once we confirm it, we go LONG at 345 or 343.

5. If the stock goes straight to 352-355 area. We wait for even the slightest sellers aggression and we go SHORT until 345 area (or any other area where we see buying presence).

6. If the stock goes straight to 333-336 area. We wait for the buyers to step up with a little aggression and we go LONG until 348 area (or any other area where we see selling presence).

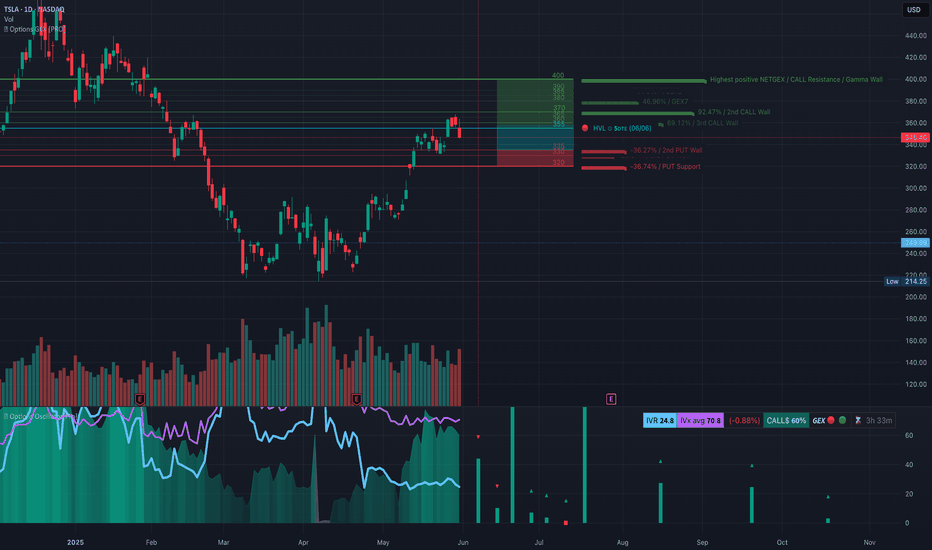

TSLA Weekly Options Outlook — June 3, 2025📉 TSLA Weekly Options Outlook — June 3, 2025

🚨 AI Model Consensus: Moderately Bearish into June 6 Expiry

🧠 Model Breakdown

🔹 Grok (xAI)

Bias: Bullish (Contrarian)

Setup: 5-min RSI oversold (~23.5); daily momentum weakening.

Trade: Buy $372.50C @ $0.88 → Bounce play

Confidence: 65%

🔹 Claude (Anthropic)

Bias: Bearish

Setup: Daily/M5 MACD bearish; RSI oversold; max pain magnet at $340

Trade: Buy $340P @ ~$5.55

Confidence: 75%

🔹 Llama (Meta)

Bias: Bearish

Setup: Below EMAs; RSI oversold; mixed longer-term read

Trade: Buy $342.50P @ $6.65

Confidence: 70%

🔹 Gemini (Google)

Bias: Bearish

Setup: Daily MACD bearish crossover; oversold short-term

Trade: Buy $320P @ $1.06

Confidence: 65%

🔹 DeepSeek

Bias: Bearish

Setup: MACD and EMAs confirm bearish setup; near max pain

Trade: Buy $340P @ $5.60

Confidence: 75%

✅ Consensus Summary

📉 4 of 5 models favor puts on TSLA

🧲 Max Pain at $340 is the dominant magnet

📉 Bearish MACD across timeframes; under EMAs

🔄 Short-term RSI is oversold — bounce risk acknowledged

📰 Mixed Tesla headlines & falling VIX offer minor support

🎯 Recommended Trade

💡 Strategy: Bearish Naked Weekly Put

🔘 Ticker: TSLA

📉 Direction: PUT

🎯 Strike: $340

💵 Entry: $5.60

🎯 Profit Target: $8.40 (+50%)

🛑 Stop Loss: $4.48 (−20%)

📏 Size: 1 contract

📅 Expiry: 2025-06-06

⏰ Entry Timing: Market Open

📈 Confidence: 73%

⚠️ Key Risks to Watch

🔄 Bounce Risk: RSI oversold — snapback could occur

📰 Tesla news (Powerwall, China) could surprise to upside

🧲 Max pain at $340 may anchor price near entry

⌛ Weekly theta decay means early move is essential

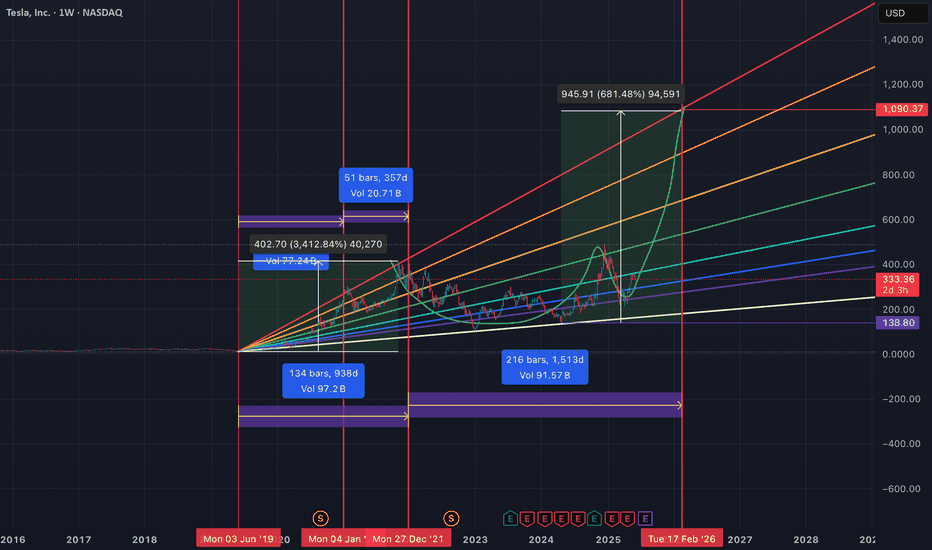

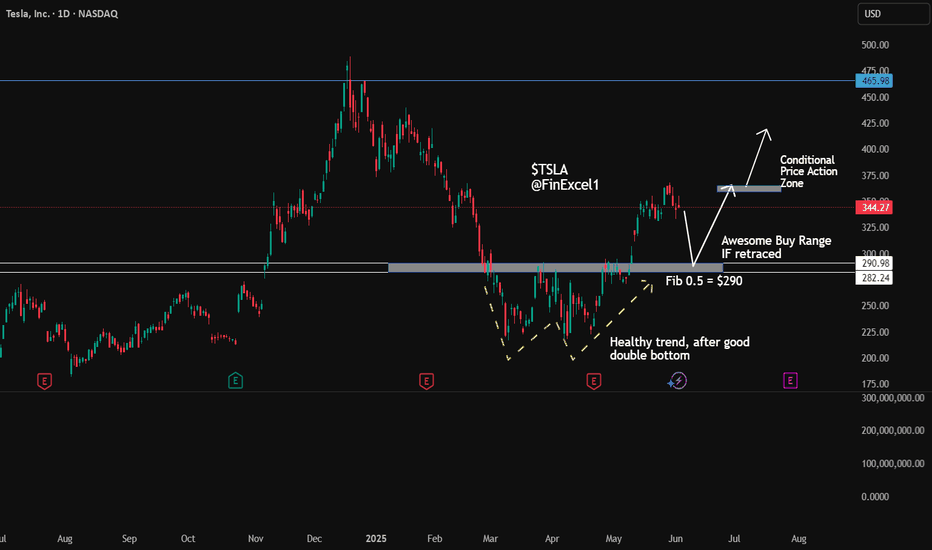

TSLA long term game!See I think TSLA is a long term stock. With the innovation it is doing in energy, automobile, robotaxi(FSD), robotics... I believe it is in the front of technology for human kind.

TSLA will inevitably impact each and every aspect of our day to day life.

There is recent pullback potential to the Fib 0.5 of price $290, and that price is the resistance turned support. I believe it will retrace and people who were thinking to buy TSLA, might be a nice chance, just my simple opinion.

A few bullish candle stick pattern in $282-$290 will support the long movement, I believe.

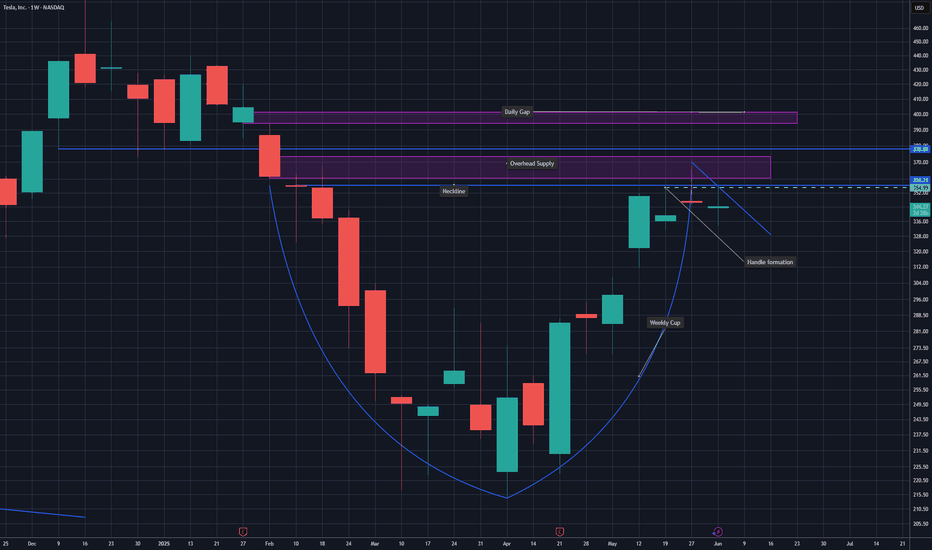

TSLA weekly cup and handleNASDAQ:TSLA

Last week, the daily chart on TSLA showed a cup and handle formation. Price attempted to break up but rejected overhead supply in the 360s. Price action is starting to show the formation of a handle on the weekly chart that may present a stronger move in the coming weeks to break through the 360 resistance level and overhead supply. June tends to be a strong month for TSLA historically, so the move could happen by the end of the month. Strong break of 360 and a close over to confirm a projected movement to $400 as a first price target, with $420.69 as a secondary PT.

TSLA LONG 🚨 NASDAQ:TSLA Play – June Catalyst Incoming 🚨

Seeing bullish divergence on the RSI – momentum’s shifting even as price consolidates. Classic setup for a breakout.

Pair that with the RoboTaxi event dropping June 12, and this becomes more than just a technical bounce – we’ve got a real catalyst on deck that could reshape the narrative.

Loaded up here. Risk/reward looks 🔥 ahead of the event.

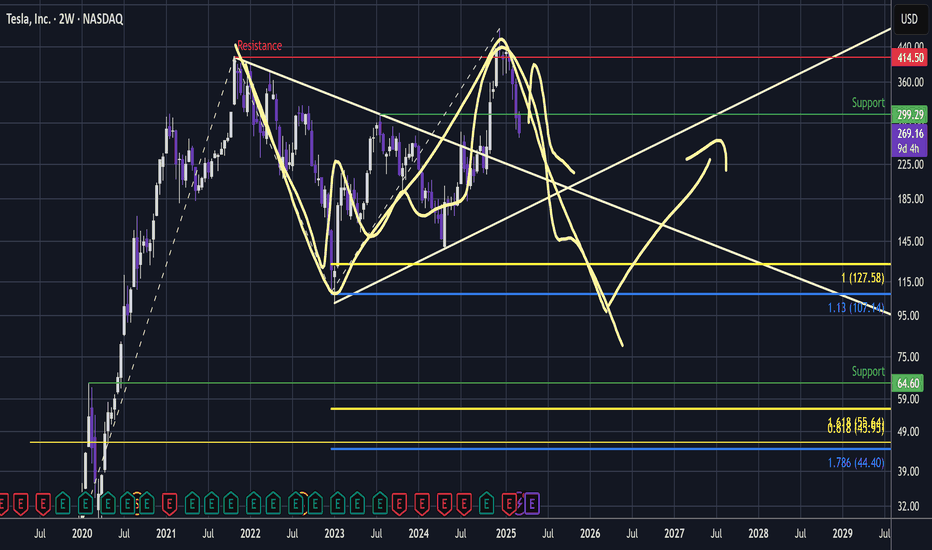

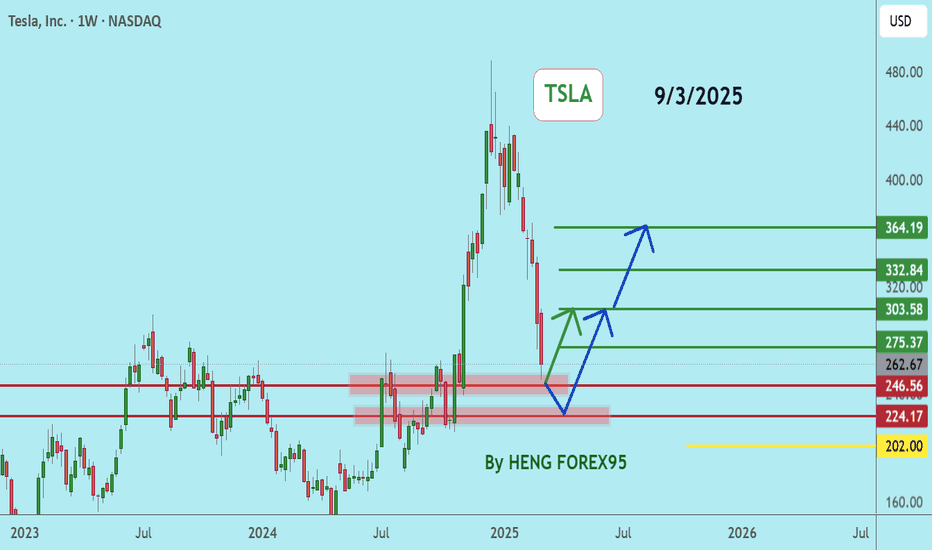

TSLATesla is in a correction phase, the price has a chance to test the support zone 246-218. If the price can stay above 218, it is expected that the price will have a chance to rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

TSLA – Something Big Is Brewing🚀Tesla just keeps pushing. Now trading around $346, it's not just riding market momentum — it's building it. And with the robotaxi launch in Austin coming June 12, the narrative might be shifting from “just EVs” to mobility revolution.📍 Levels I’m Watching

Possible entries:

• $335–$325 – Looks like it’s consolidating here

• $315–$290 – Clean retest zone if we dip

• $265 – Would love a deeper pullback but not counting on it

Targets?

• $370 – Short-term test

• $395 – Momentum breakout zone

• $420+ – If the hype around robotaxis takes hold

⚠️ Disclaimer: This isn’t financial advice. Just sharing how I see things. Do your own research and trade safe.

💬 If this helped, drop a like and follow. I post trades that actually make sense not just moonshots.

Let’s grow smart. 📈🧠

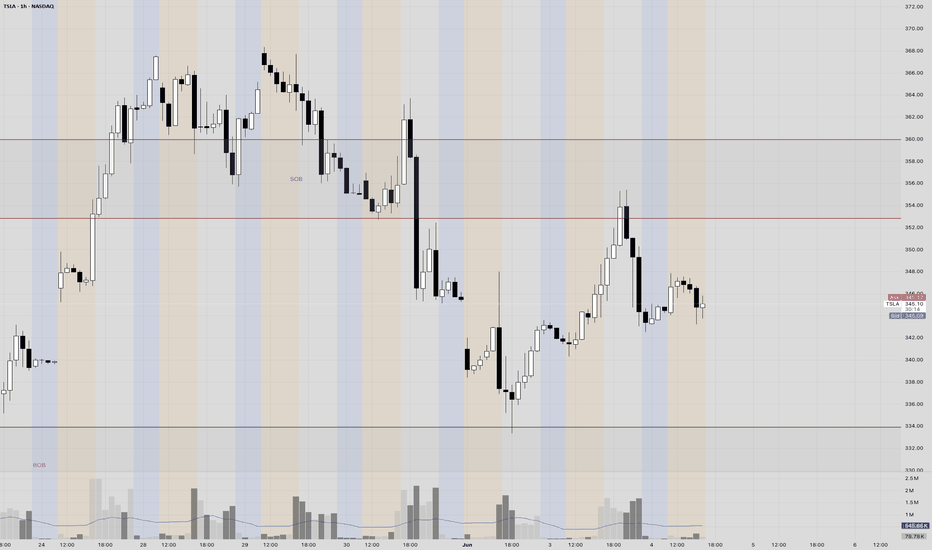

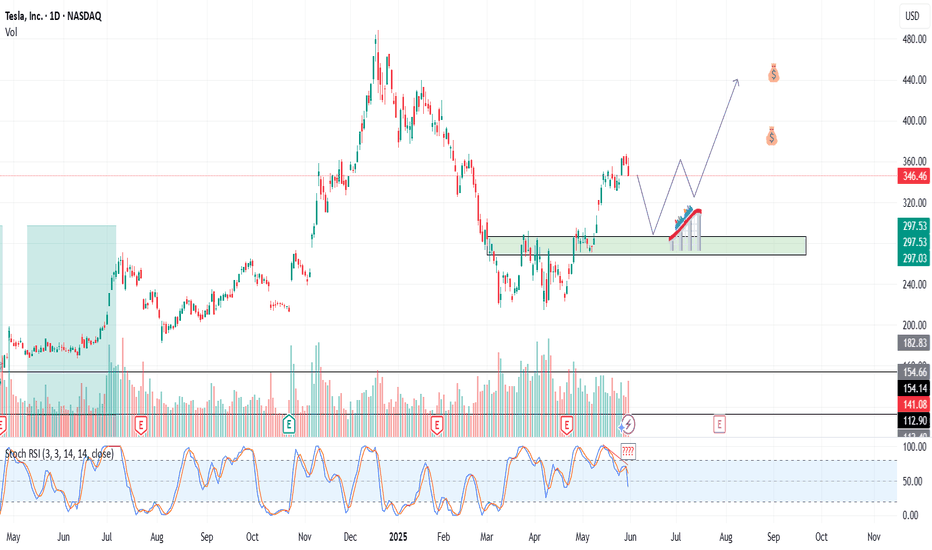

TSLA GEX Daily (Options Sentiment Outlook) June 2TSLA's GEX layout is looking real clean for directional play this week. We're hovering around 346.46, just below that major 355 HVL (High Volume Level) and 2nd CALL wall, which is where dealers are likely to defend or pin unless price makes a decisive move.

Here's the flow setup:

* 🟩 46.96% GEX and call wall cluster between 355–375, acting as short-term resistance unless we see a breakout.

* 🟥 Below sits strong put support near 320, and that's also near the bottom of the red zone (-36.74% GEX).

* ⚠️ IVR only at 24.8, so premiums are cheap — smart to consider directional plays before vol spikes.

🧠 Options Strategy Idea (Based on GEX):

* Bullish: Wait for clean break/close above 355, then go for Jul 19 370c or a debit spread like 355c/375c.

* Bearish Hedge: If TSLA fails 346 and drops under 335, consider Jul 19 330p/320p spread for risk-managed downside.

🎯 Call buyers should wait for confirmation over 355 — there's serious gamma resistance there.

Puts get spicy below 335 — dealers likely flip short and accelerate downside.

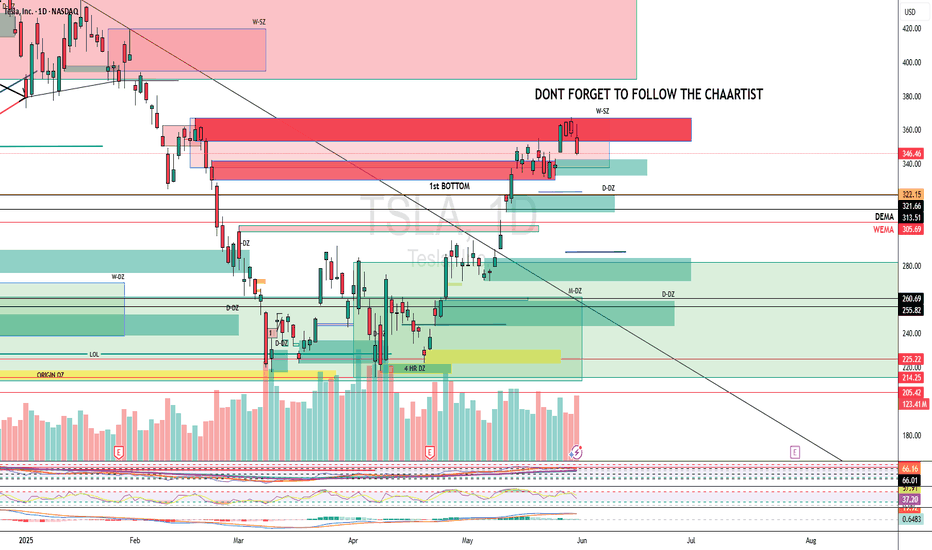

⏱️ TSLA 1H Chart (Swing & Intraday Action Plan)

Now zooming in to the 1-hour structure...

TSLA had a clean uptrend with some hesitation at 355, forming a local double top structure before Friday's selloff. We’ve bounced off 335 demand, and that’s shaping up as this week’s pivot zone.

Current structure notes:

* 📉 Strong rejection near 355.

* 📊 Price is consolidating under that level — likely gearing up for either a breakout or a deeper pullback.

* 🔄 EMA looks flat, volume tapering → signaling indecision.

📈 Swing Setup:

* Bullish: Long on reclaim + retest of 355, targeting 370–375. Stop below 348.

* Bearish: Short setup under 335 breakdown → target 320 zone. Stop above 340.

📉 Intraday Plan:

* Range: 335–355 is your battlefield.

* Play the edges:

* Short near 355 rejection → target 346 or 338.

* Long off 335 bounce → scalp back to 346–350.

💬 This zone is all about patience — don’t chase inside the chop. Let price either reclaim 355 or flush below 335 before going heavy.

🧠 Final Thoughts

TSLA’s setup is one of the more binary ones this week — it’s coiled under gamma resistance but holding key demand. GEX is telling us this: break 355 and the path is open to 370–400; lose 335 and things can slide to 320 fast.

Cheap IV? Great for debit spreads or directional plays. But stay reactive — TSLA rarely stays quiet for long.

⚠️ Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage risk and do your own research before trading.

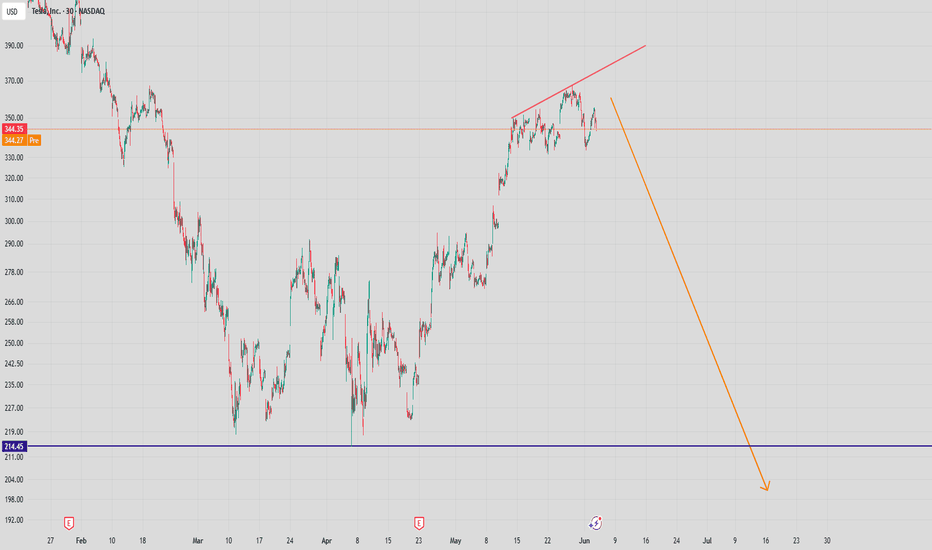

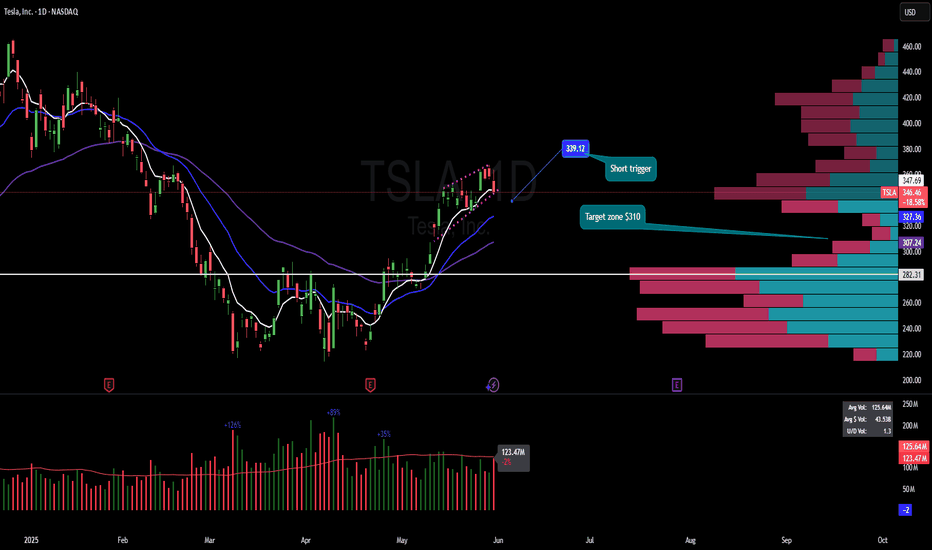

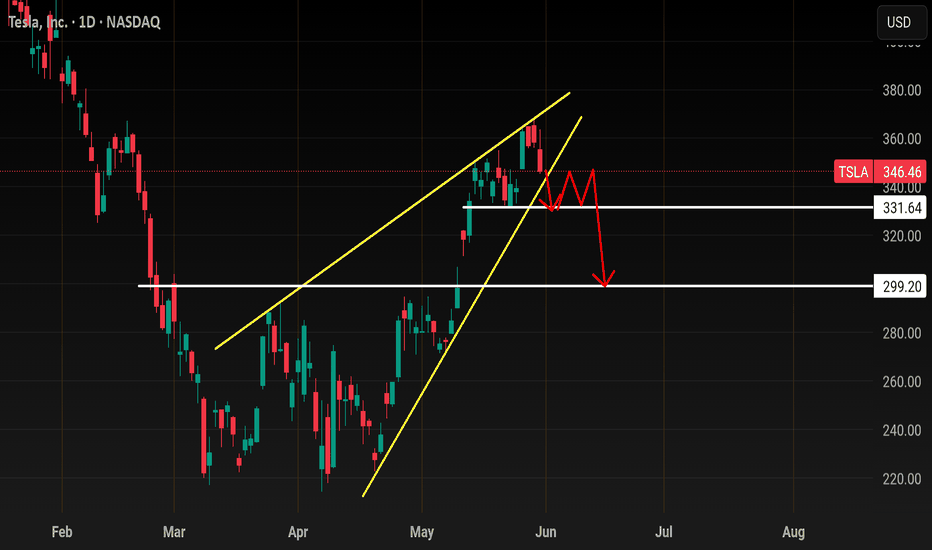

Trade of the week: $TSLA (Short)Trade of the week: NASDAQ:TSLA (Short)

Current price: $346

Entry Trigger:$339

Stoploss: $353

Call option: NASDAQ:TSLA $300 put expiry 06/20 at $4.45(*1 Contract only)

Thesis: NASDAQ:TSLA is in daily uprising channel aka building a wedge. NASDAQ:TSLA last week made a doji candle on weekly often that leads to reversal. You may take this trade at entry trigger point or You may find a cheaper entry or wait for trigger point (or me) to get into the trade. Contract price might vary depending on entry. Targeting sub $310 in upcoming weeks. Respect stoploss.

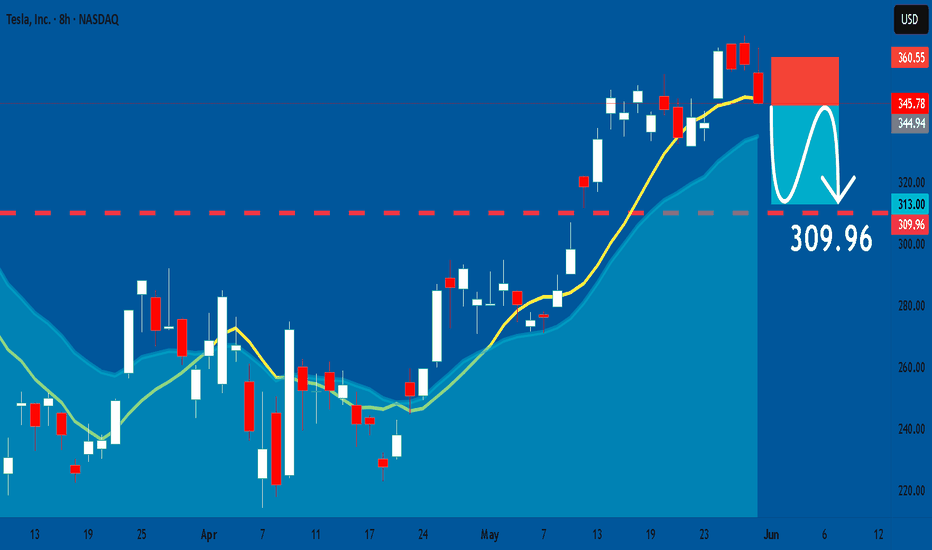

TESLA: Short Trade with Entry/SL/TP

TESLA

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short TESLA

Entry - 345.78

Sl - 360.55

Tp - 309.96

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

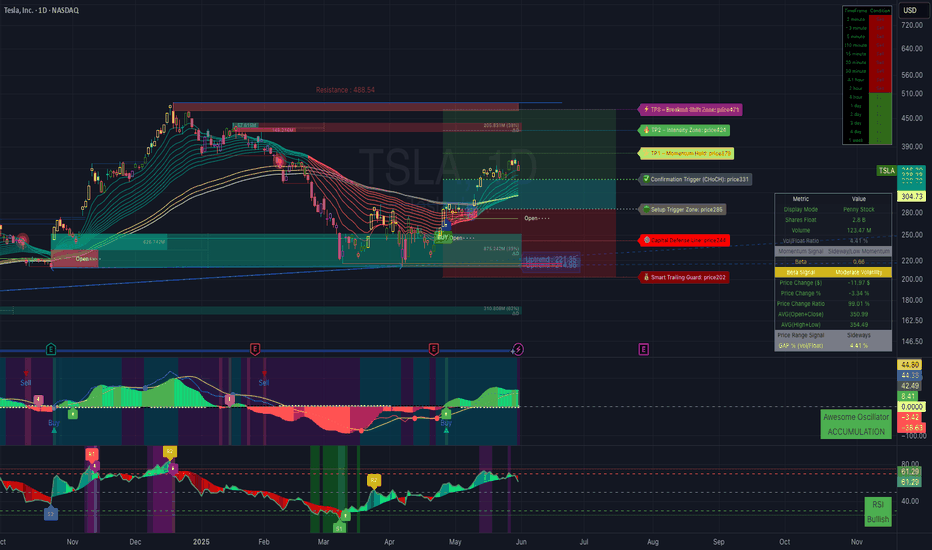

TSLA Trade Idea – New Structure Forming

📌 TSLA Trade Idea – New Structure Forming

🕒 12h Timeframe Analysis

TSLA’s previous structure is considered complete. A new structure is likely forming, with a strategic entry around $310 based on the 40-cycle pattern.

🔍 Key Observations:

Volume/Float ratio < 10%, showing low activity—most traders are waiting.

Dark pool data suggests heavy short interest, but I see this as high risk.

Market is still bullish, and current price action looks like a retest/consolidation, not a full bear trend.

📈 Macro View:

TSLA is likely forming a 385-day bullish structure with a potential upside target near $791. The current zone is a potential weekly entry point for swing or long-term plays.

🎯 Trade Plan:

Entry: $310

Stop Loss: $331

Target: $460 (short-term swing target)

Bias: Bullish

Strategy:

Long-term investors: Position entry, manage SL properly.

Option traders: Avoid buying—only consider option selling during chop.

⚠️ Disclaimer:

This trade plan is for informational purposes only and does not constitute financial advice. Trading involves significant risk. Always do your own research or consult a licensed advisor before making decisions.

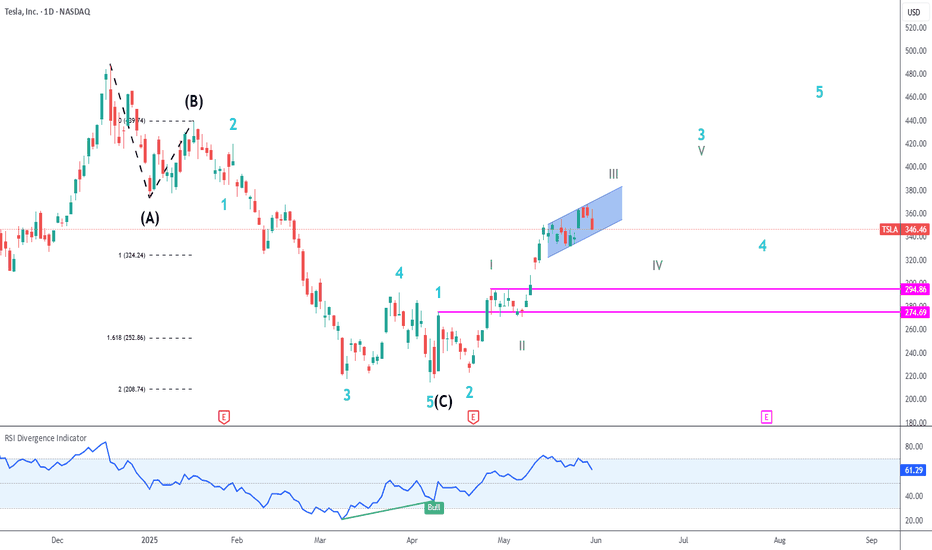

TSLA (Daily) Elliot Wave 3 UnderwayTSLA appears to still be printing a motif wave 3 after finding a bottom at the $208 high volume support node. Fib extension targets suggest we have much higher to go including a new all time high.

Upside resistance target sits just below $413 in the HVN.

Downside targets may test the previous swing high $284

Safe trading

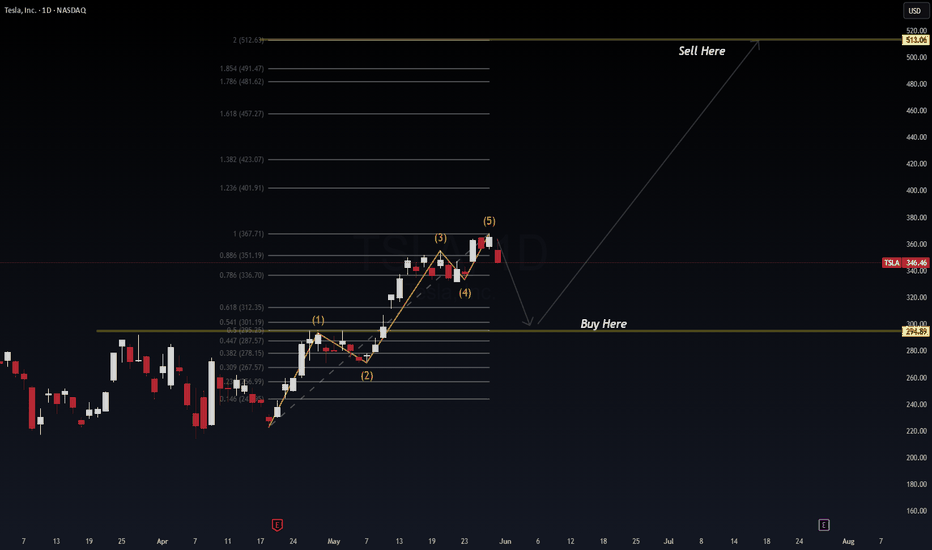

TSLA (Tesla) – Elliott Wave Impulse Ending + Fibonacci CorrectioTesla completed a textbook 5-wave Elliott impulse to the upside, topping out near the 1.0 Fibonacci extension ($367.71). We're now seeing signs of a corrective wave likely targeting the golden zone near $294.89 — aligning with SPY/NVDA retracements.

🔍 Elliott Wave Count:

Wave (1): Impulse from breakout

Wave (2): Shallow pullback

Wave (3): Extended rally

Wave (4): Minor correction

Wave (5): Final push – now failing

📉 Fibonacci Zones:

Current Price: $346.46

Wave 5 Completion: ~$367

Retracement Target: $294.89 (0.5–0.618 confluence)

Extension Target: $513.06 (2.0 extension from wave base)

📊 Probabilistic Outlook

🔻 Correction to $294.89 = 70% probability (based on wave structure + Fib retracement logic)

🔼 Rally to $513+ = 60% probability if support holds and market conditions remain risk-on

🌐 Macro Alignment (May 31, 2025)

🔄 Market rotation into value → temporary tech cooldown

📉 NVDA false breakout and SPY retracement suggest broader pullback

🧠 Tesla is a beta-multiplier to NASDAQ; expect correlation

🧭 Trade Plan:

Buy Zone: $294.89 (watch for confirmation + volume spike)

Sell Target: $513.06 (Fib 2.0 extension)

Stop: Below $278 (structure invalidation)

🧠 Pro Insight:

This is a Wave 2/4 retracement zone where institutions often reload. The broader macro pullback may present one of the last deep dips before a Q3 breakout.

#TSLA #ElliottWave #FibLevels #TechStocks #SmartMoney #SwingTrade #NASDAQ #WaverVanir #TradingView

TslaFirst off.. that weekly candle was horrendous

Rising wedge here.. you can see it on the rsi as well

The target of this rising wedge is 300 or daily 200sma..

Lets see how wed get there..

We would need to break below 330.00.

351-355 will be strong resistance if you see a test up in that area I would open a short for 330... cover at 330 and wait for the break below to short for 300

The sector tsla trades under is XLY..

I was saying for the last few days that tsla will have trouble unless XLY could clear 218.. now XLY has finished with a similar weekly reversal candle