Solana Hits Target with 9x ROI, More Upside Ahead?Solana just smashed our target, delivering up to 9x returns for those who held on. In this video, we break down the current setup, where the next 40% move could come from, and what to watch in funding rates and BTC dominance. Altcoins are waking up. Are you ready?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

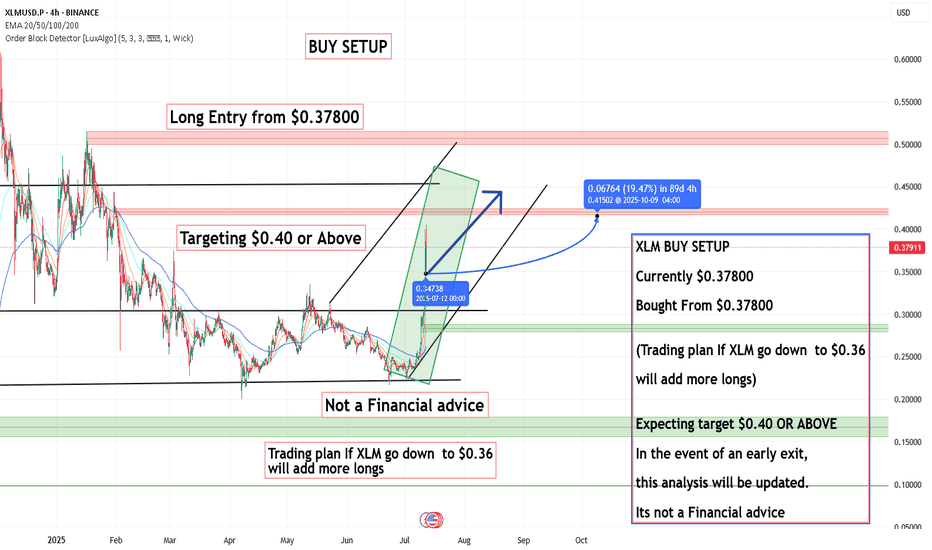

XLMUSD trade ideas

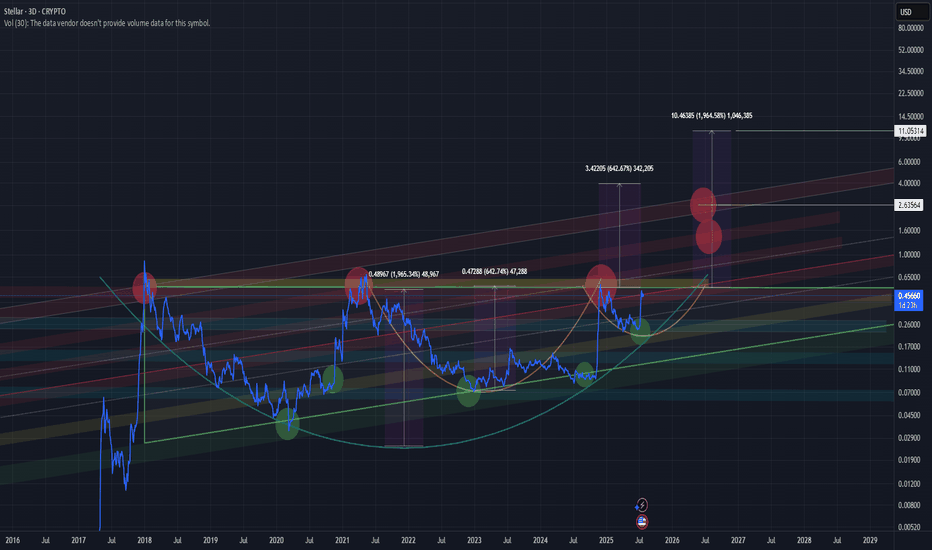

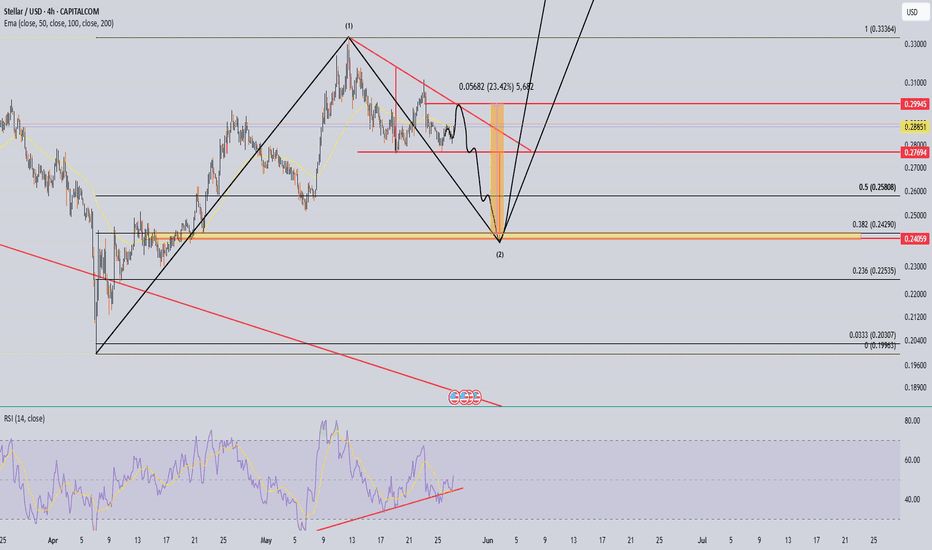

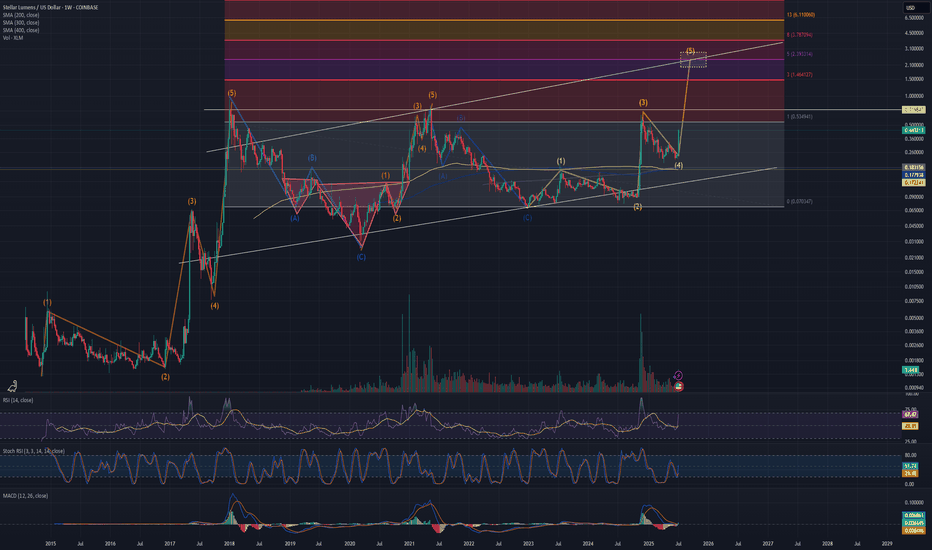

XLM/USD XLM is showing one of the strongest bullish setups right now.

A macro “Cup”, with a smaller “Cup with Handle” forming inside it — a powerful setup often leading to parabolic breakouts.

Before a true breakout, price may fake out to the downside, trapping longs.

This is classic market maker behavior — shakeouts followed by strong reversal and breakout. Stay focused on the reaction around yellow zone.

Currently in the final stages of the “handle” formation.

A breakout may confirm a move toward $4

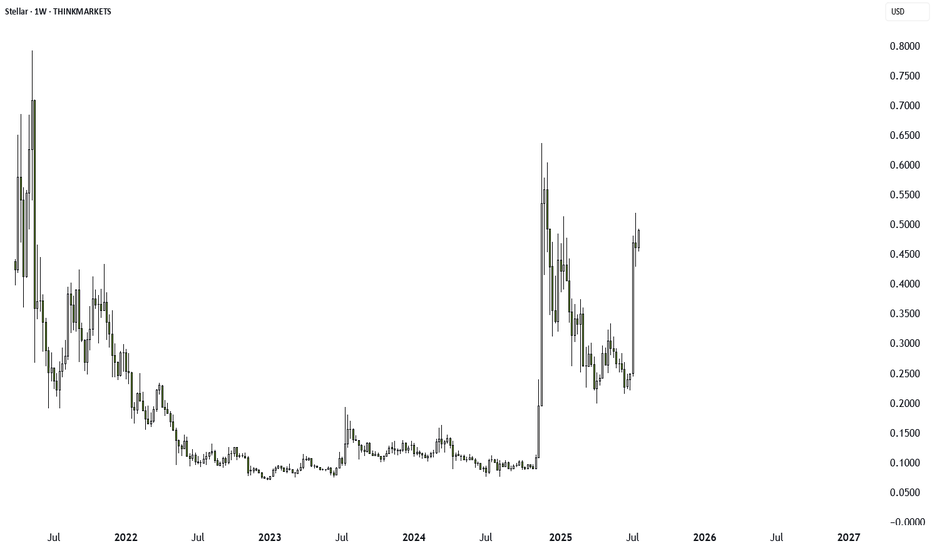

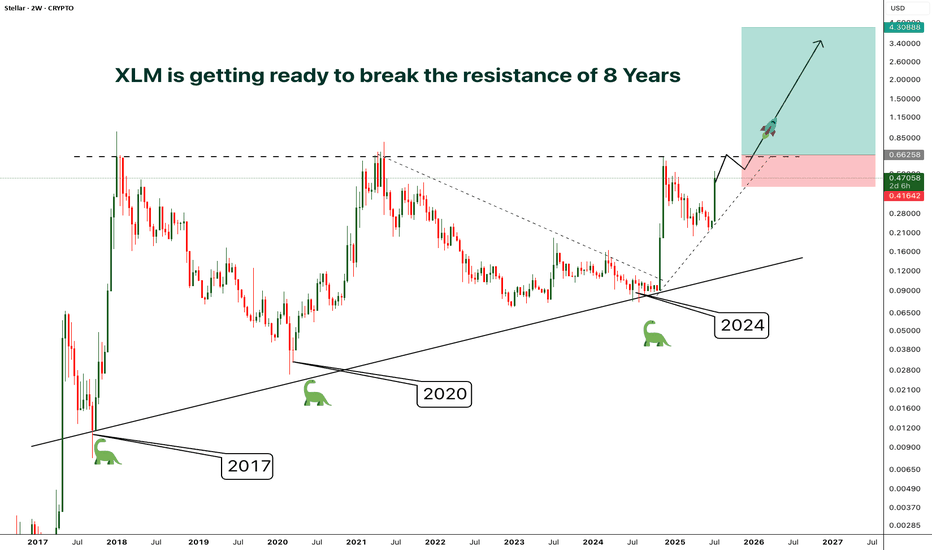

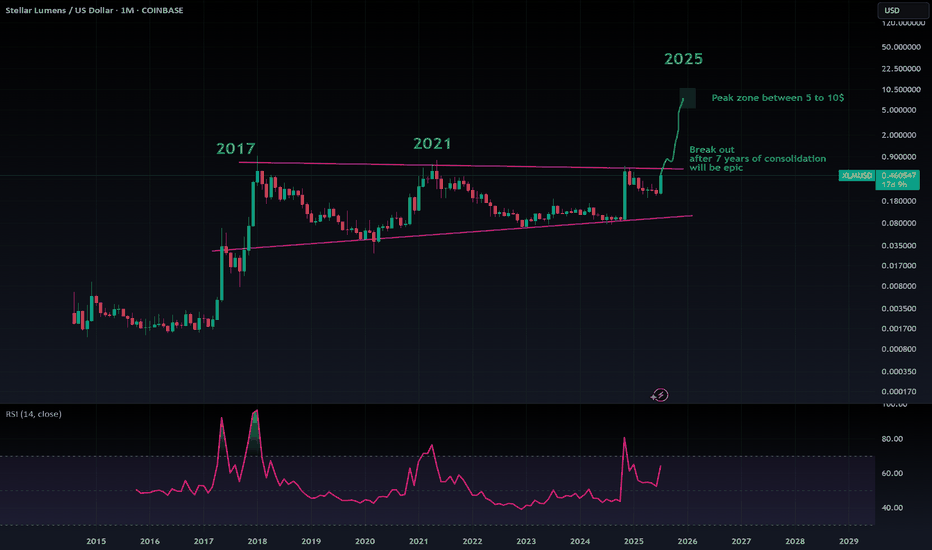

XLM - Resistance/Consolidation of 8 Years- Finally after 8 years of consolidation and getting rejected by the resistance at the same level around 0.65, XLM is preparing to break out from the almost decade old resistance

- A clear breakout from this resistance will phenomenal

- The price surge after the breakout will be unlike anything you've ever seen.

- I'm planning to enter after a confirmed breakout, entry before the breakout will be risky in case if the price gets rejected again.

Entry Price: Candle closeAbove 0.65

Stop Loss: Below 0.41

TP1: 0.88574

TP2: 1.21012

TP3: 1.92545

TP4: 2.68849

TP5: 4.27772

Don't forget to keep stoploss

Cheers

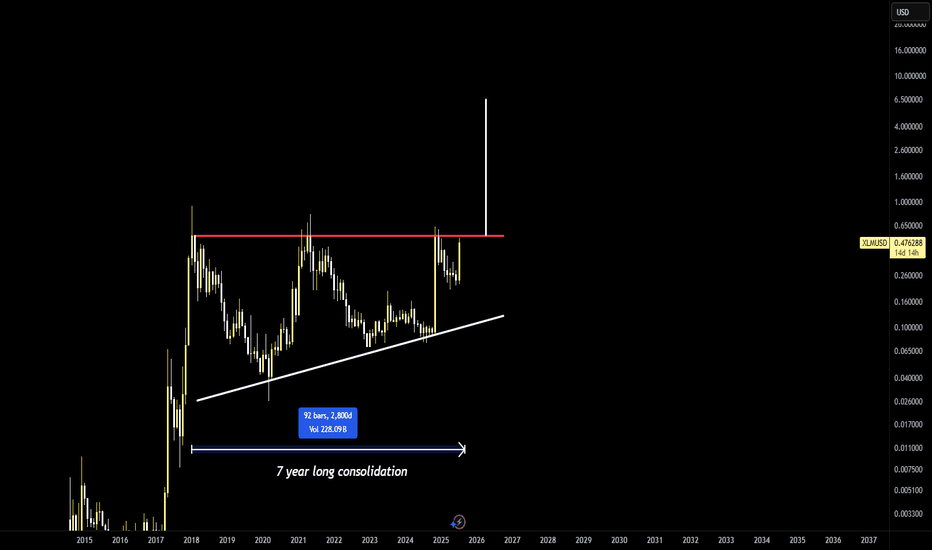

GreenCrypto

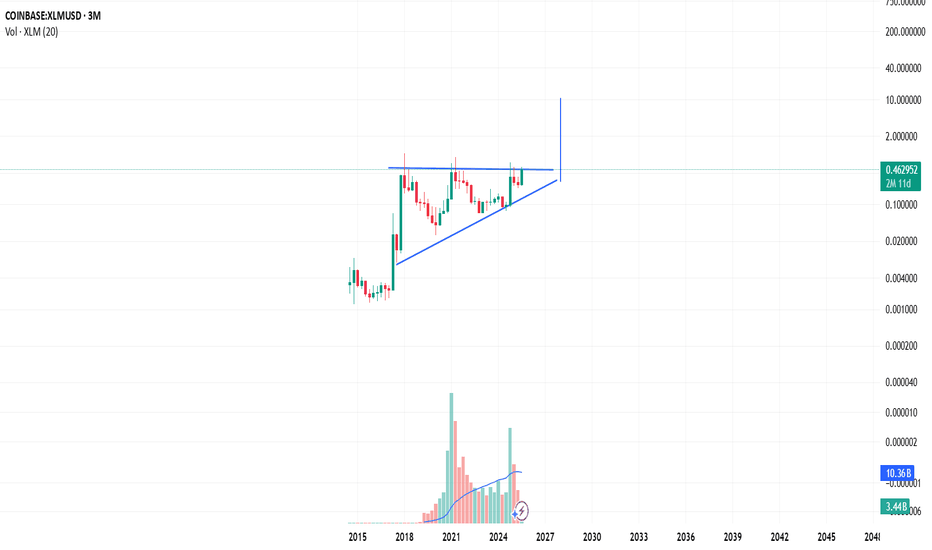

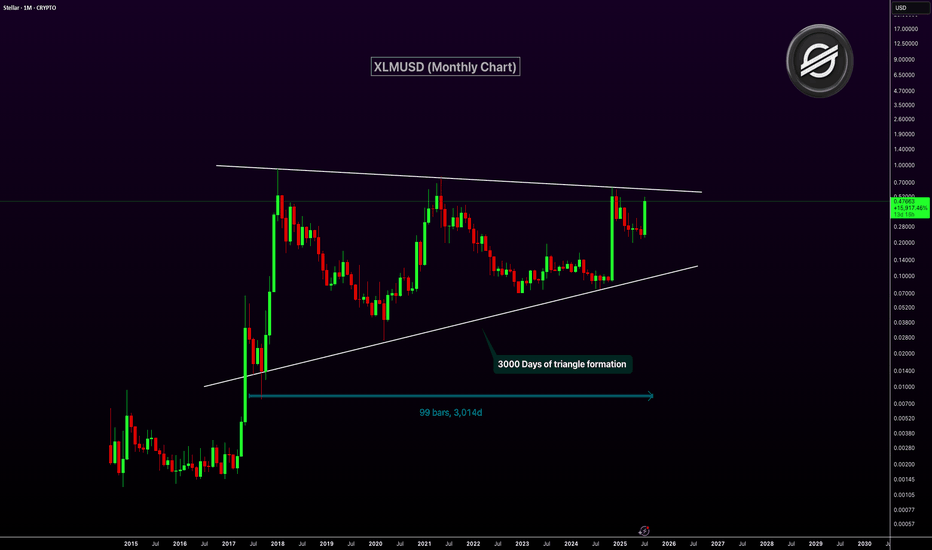

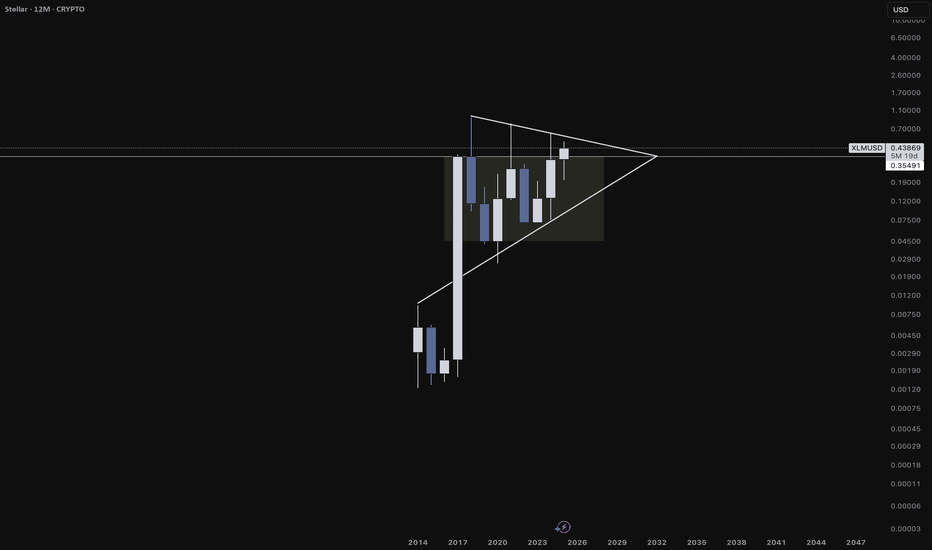

XLMUSD Nearing Breakout After 3,000-Day Triangle FormationXLM has been consolidating inside a massive symmetrical triangle for over 3,000 days. This long-term pattern on the monthly chart dates back to 2017. The price is now approaching the upper resistance trendline of the triangle. A breakout from this structure could ignite a major bullish rally.

The current monthly candle shows strong momentum with over 100% gains. A confirmed breakout above resistance could mark the start of a macro uptrend. This triangle is one of the most significant technical setups in XLM’s history.

Target 1: $1.00

Target 2: $2.50

Target 3: $5.00

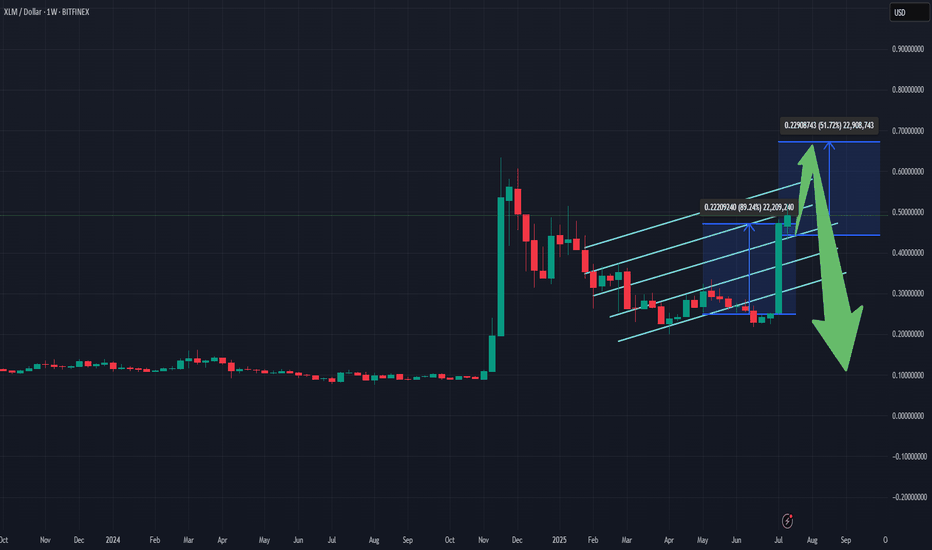

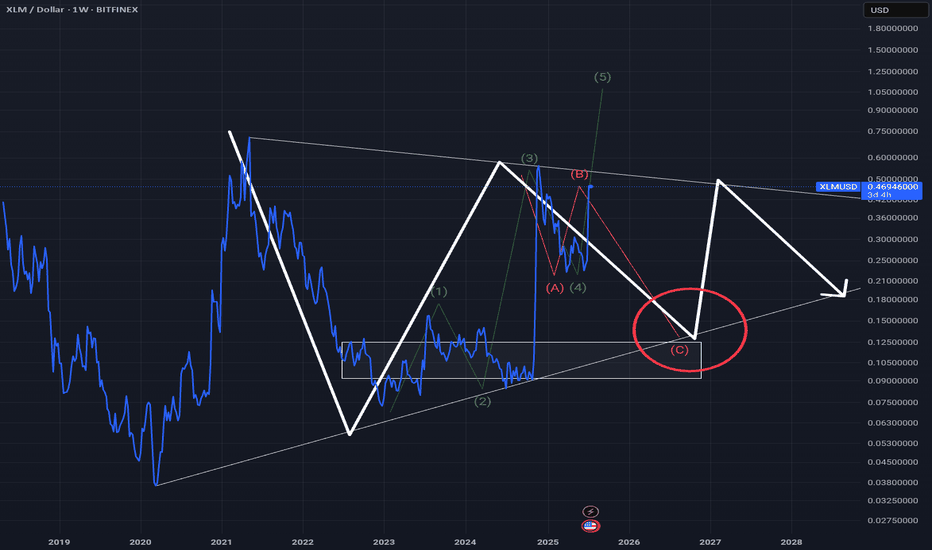

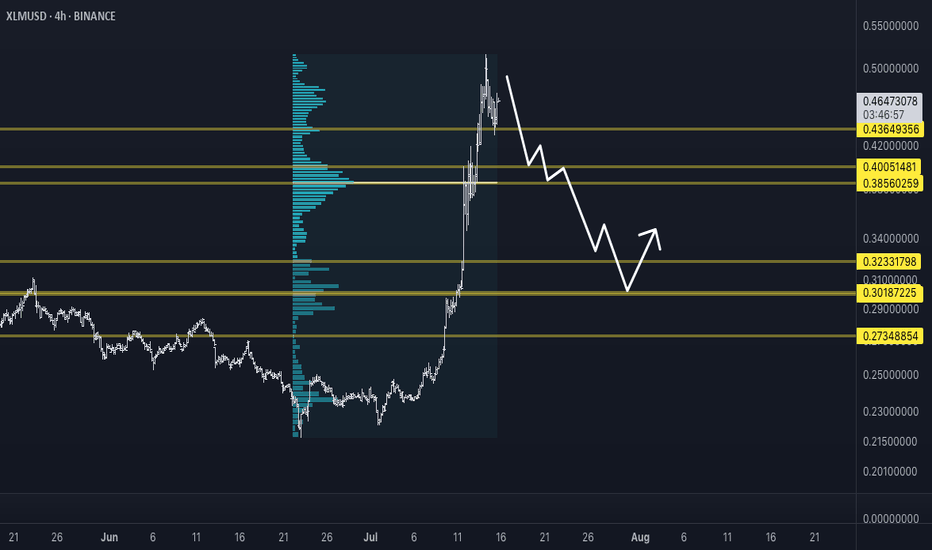

WATCH OUT!!! RED ALERTStay vigilant. So many dummies out

there right now making all kinds of

ridiculous predictions. I've heard

several prophetic warnings about a

flash crash in the markets in August.

Maybe...maybe not. I will keep some

reserve USDC on the side and set my

limit orders accordingly. This is NOT

financial advice. Stay on alert here

just in case market makers try to

get everyone RRRRReKT. This would

be the 2nd candle on the weekly time

frame. Most bull cycles will produce

5 green candles on the weekly however,

I urge strong caution in the 67 cent area.

Oh...one more thang...

******* HAPPY XLM HUNTING ********

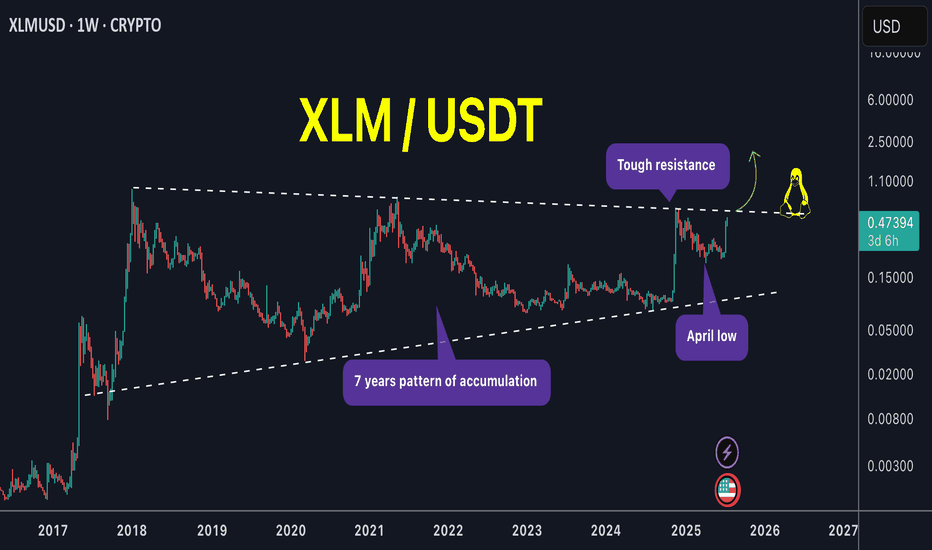

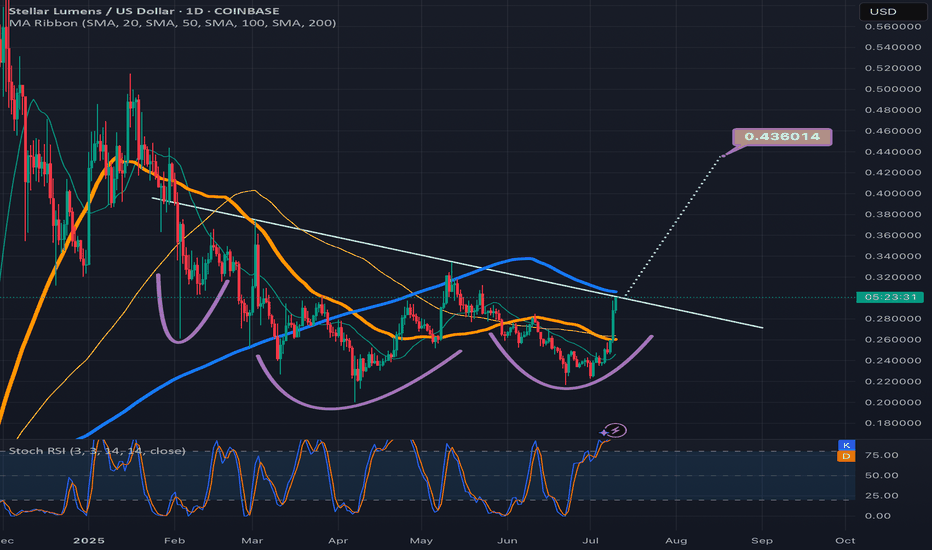

XLM is the pump over or just getting started !XLM / USDT

What a huge weekly candle! We catched its strong move very early around 0.29$ a week ago (75% profits locked in spot)

With a zoom out chart we can see price is setting up nicely with several tests of pattern boundary. Next test of the upper boundary can lead to huge breakout of this mega pattern !

NOTE: Price must not close below april low and should close above upper boundary unless that its just a range

Keep an eye on it closely !

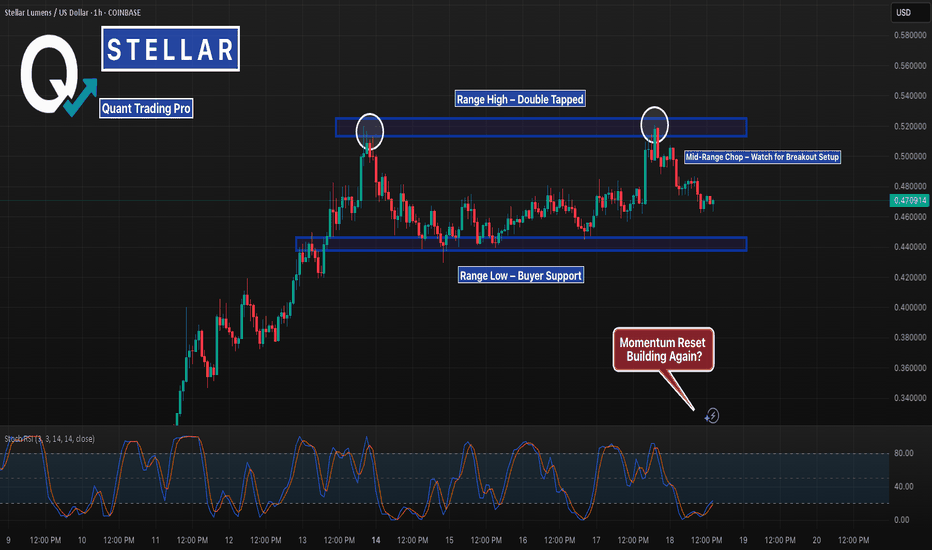

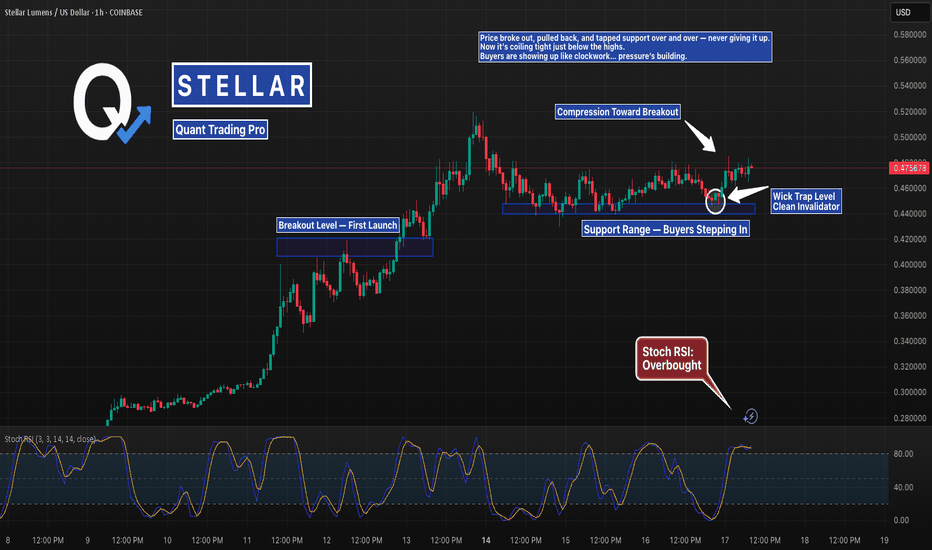

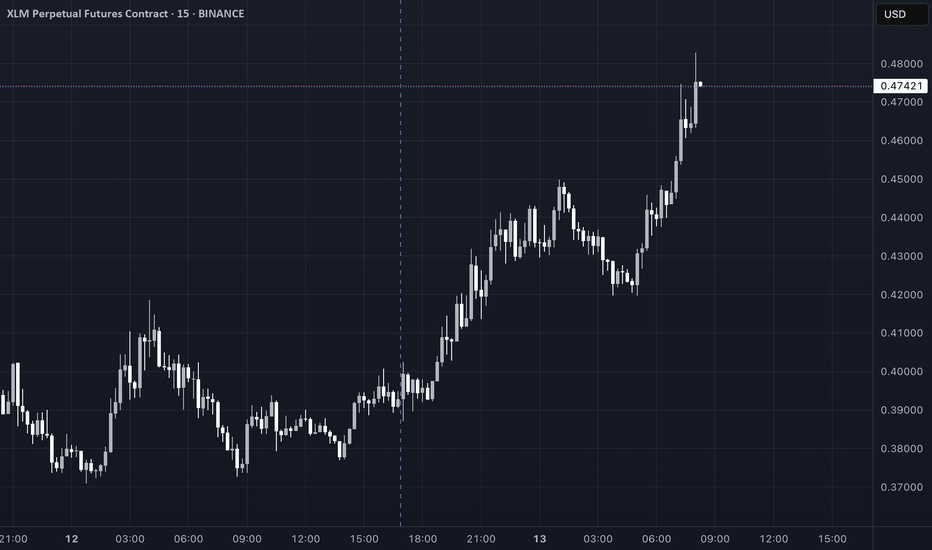

XLM Coiling at the Highs After Holding Support PerfectlyStellar broke out, then printed the cleanest support range you’ll find.

Wicks into demand, fast rejections, and now it’s compressing just under resistance.

If it breaks from here, there’s room to stretch.

But don’t forget — the longer it coils, the harder it snaps.

#XLM #StellarLumens #XLMUSD #SupportAndResistance #BreakoutSetup #CryptoCharts #TradingView #QuantTradingPro #BacktestEverything

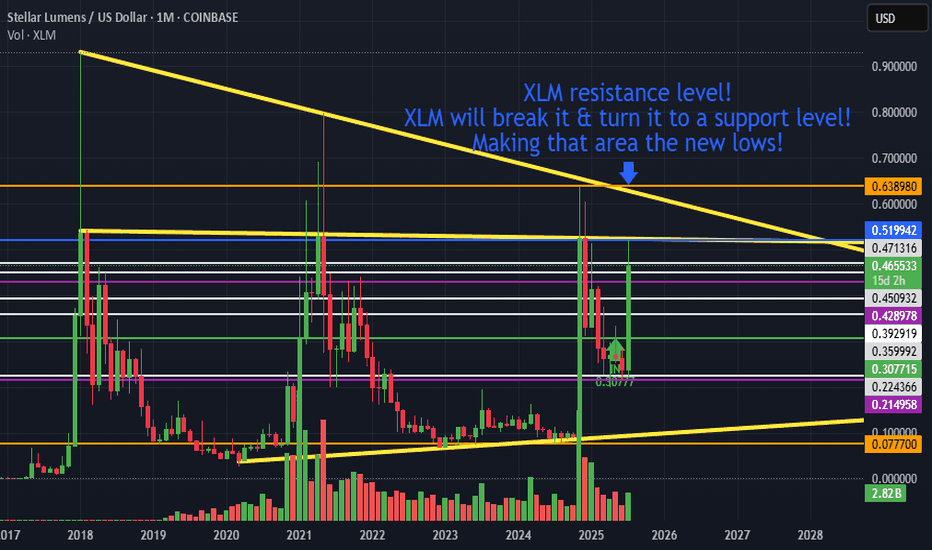

The one chart to rule them all - Stellar- the best looking setup in the crypto market

- the trade of the cycle

- as soon as monthly closes above resistance (red) XLM is likely to skyrocket higher, much higher

- with XLM recently acting as XRP beta, it is likely this move occurs once Ripple is comfortable above its 2017 high and heads to the triangle target of 10-12$

XLM Crypto Analysis Summary (2025-07-13)XLM Crypto Analysis Summary (2025-07-13)

Comprehensive Summary of Each Model's Key Points

Grok/xAI Report

Technical Analysis: Current price at $0.47, significantly above all moving averages, indicating a short-term uptrend but overbought conditions as indicated by an RSI of 89.93. Price is outside Bollinger Bands, signaling a likely correction. Market Sentiment: Positive sentiment due to altcoin rallies, but technical overextension suggests potential for profit-taking. Conclusion: Modestly bearish outlook with a strong probability (>70%) of a pullback. Recommend entering a short position at $0.47 with a stop-loss at $0.50 and take profit at $0.40. Claude/Anthropic Report

Technical Analysis: Similar findings with price at $0.47, overbought RSI (89.93), and significant distance from the upper Bollinger Band at $0.40 highlighting significant risk of pullback. Market Sentiment: Euphoric sentiment but warns of imminent reversals due to overextension. Conclusion: Aimed for a short position as well but with a different target and stop-loss placement. Proposes entry at $0.47, stop-loss at $0.52, and take-profit at $0.38. Gemini/Google Report

Technical Analysis: Affirms the bullish trend due to price above all MAs but highlights overbought RSI and Bollinger Bands indicating a need for caution. Market Sentiment: Positive altcoin movement correlating with Bitcoin, suggesting potential for continued growth but also warns of speculative dynamics. Conclusion: Encourages waiting for a pullback to $0.40 for a long entry. Proposed stop-loss at $0.38 and take-profit at $0.50, though leaning towards caution. DeepSeek Report

Technical Analysis: Price maintains a position significantly above moving averages, and the high RSI and Bollinger Band readings indicate potential price reversion. Market Sentiment: Euphoric market sentiment, though devoid of fundamental backing. Warns of the "dumb money" effect. Conclusion: Strongly bearish for shorting at $0.47, with a risk/reward ratio emphasizing potential gains from a mean reversion. Llama/Meta Report

Technical Analysis: Confirms high prices and overbought conditions similar to others, but suggests a cautiously optimistic bullish outlook. Market Sentiment: Positive sentiment detected, yet overbought conditions imply revisiting support before new longs are advisable. Conclusion: Proposes a long trade if a pullback to $0.40 occurs, but acknowledges an overall risk assessment opposing current long entries.

Areas of Agreement and Disagreement

Agreement:

All reports recognize the overbought conditions based on an RSI above 89 and significant price movements above key moving averages. Each model finishes with a recommendation for a bearish or cautious position acknowledging the likely impending correction. Disagreement:

The nature of the recommended trade (short vs. long) varies; Grok, Claude, and DeepSeek recommend shorting, whereas Gemini advocates waiting for a long position upon a pullback, and Llama suggests a similar cautious long entry. The specifics of stop-loss and take-profit levels also vary across reports, reflecting differences in perceived market volatility and risk management style.

Conclusion

Overall Market Direction Consensus: The market is broadly seen as moderately bearish due to extreme overbought conditions, despite the bullish price trends observed.

Recommended Trade:

Trade Direction: Short Entry Price: $0.47 Stop Loss Level: $0.50 Take Profit Level: $0.40 Position Size Recommendation: 1 lot (approximately 2,128 XLM contracts at 50x leverage, given a $10,000 account). Adjust based on personal risk tolerance. Confidence Level in Recommendation: 70% Key Risks and Considerations: Potential continued upward momentum due to market sentiment, volatility causing sharp movements, and correlation with major cryptocurrencies like Bitcoin. Strong monitoring during trade execution due to high slippage risk. Trade Entry Timing: Enter at market open.

TRADE_DETAILS (JSON Format) { "instrument": "XLM", "direction": "short", "entry_price": 0.47, "stop_loss": 0.50, "take_profit": 0.40, "size": 1, "confidence": 0.70, "entry_timing": "market_open" }

📊 TRADE DETAILS 📊 🎯 Instrument: XLM 📉 Direction: SHORT 💰 Entry Price: 0.47 🛑 Stop Loss: 0.5 🎯 Take Profit: 0.4 📊 Size: 1 💪 Confidence: 70% ⏰ Entry Timing: market_open

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Here's Why XLM is on the Verge of a Massive breakoutThe next 10 years of success for the Stellar Network (XLM) are being shaped by decisions, developments, and trends happening right now (2024–2025). Here’s a breakdown of the long-term shaping factors currently in motion that will influence Stellar's trajectory through 2035:

------------

🌍 1. Real-World Use Cases Being Built Now

Stellar is not waiting for hypothetical adoption — it’s already deploying use cases that are foundational to its future success.

Examples:

MoneyGram Access gives real people the ability to cash in/out of crypto in over 180 countries.

USDC on Stellar enables stablecoin remittances with instant settlement and low fees.

Stellar Aid Assist provides governments and NGOs a working model for humanitarian digital cash aid.

Long-Term Impact: Building trust and infrastructure in the real world now means exponential network effects later — especially in emerging markets where crypto utility > speculation.

-------------------------------------------------------------------------------------------

🛠️ 2. Soroban (Smart Contracts) Rollout

Stellar is rolling out Soroban, a Rust-based smart contract platform that will transform the network into a programmable blockchain.

Why Soroban is Important:

Enables DeFi, lending, NFTs, on-chain identity, and DAOs.

Designed for predictable gas fees, making it ideal for finance and compliance.

Makes Stellar more competitive with Ethereum, Solana, Avalanche, etc.

Long-Term Impact: Soroban turns Stellar into a platform where real, decentralized applications can live — critical for long-term value capture and developer retention.

-------------------------------------------------------------------------------------------

🌐 3. Laying Global Payment Infrastructure

Stellar is quietly building global payment rails through partnerships with:

Fintechs (MoneyGram, Leaf, Settle, Cowrie)

Stablecoin issuers (Circle for USDC, Novatti for AUDC)

Payment aggregators in Africa, Latin America, Southeast Asia

Long-Term Impact: By 2030, these partnerships could evolve into a globally interconnected network of on/off ramps, anchors, and stablecoins. This gives Stellar real utility far beyond speculation.

-------------------------------------------------------------------------------------------

🏛️ 4. Regulatory Alignment & Compliance Tooling

The Stellar Development Foundation (SDF) is heavily involved in regulatory dialogue, including:

Working with the BIS Innovation Hub and IMF working groups

Building on-chain compliance tools (e.g. KYC/AML anchor guidelines)

Developing the Stellar Disbursement Platform, which complies with aid distribution requirements

Long-Term Impact: As crypto becomes more regulated, networks that built with compliance in mind will thrive. Stellar is positioning itself as a compliant blockchain for finance, especially for governments and NGOs.

-------------------------------------------------------------------------------------------

💸 5. Tokenization of Real-World Assets (RWAs)

The future of blockchain is heading toward tokenizing everything — and Stellar is already positioning itself at the front of that movement.

Franklin Templeton tokenized a U.S. mutual fund on Stellar.

Stablecoins like USDC and native fiat tokens are in active use.

Discussions are ongoing around CBDC pilots and tokenized bonds.

Long-Term Impact: The network that supports the most trusted tokenized assets — from CBDCs to real estate to securities — will gain enormous value from volume and liquidity. Stellar is in that conversation now.

-------------------------------------------------------------------------------------------

🧠 6. Mission-Aligned Ecosystem Funding

The Stellar Development Foundation holds billions of dollars in XLM and is using it to:

Fund early-stage startups building on Stellar

Run accelerator programs and hackathons

Expand into new regional markets (Africa, Asia, LATAM)

Long-Term Impact: Unlike many ecosystems that fizzle due to lack of funding or misaligned VC interests, Stellar has long-term strategic capital to guide the network toward its mission of financial access.

-------------------------------------------------------------------------------------------

🔐 7. Security, Speed, and Simplicity

From day one, Stellar has prioritized:

Fast block finality (~5 seconds)

Very low fees (< $0.001)

Energy-efficient consensus (SCP – Stellar Consensus Protocol)

These strengths are especially important for high-volume, low-margin applications like:

Micropayments

Remittances

Real-time settlements

Tokenized wages and aid

Long-Term Impact: As the blockchain infrastructure layer for finance matures, efficient networks will dominate. Stellar’s technical foundation makes it a sustainable long-term option.

-------------------------------------------------------------------------------------------

🧭 8. Stellar’s Focused, Long-Term Vision

SDF’s mission isn’t to be “just another smart contract chain” — it’s to improve access to equitable financial services, especially in underbanked regions.

That vision is:

Clear

Consistent

Attractive to partners, governments, and NGOs

Long-Term Impact: Clarity of mission = better talent, partners, funding, and resilience during market cycles.

-------------------------------------------------------------------------------------------

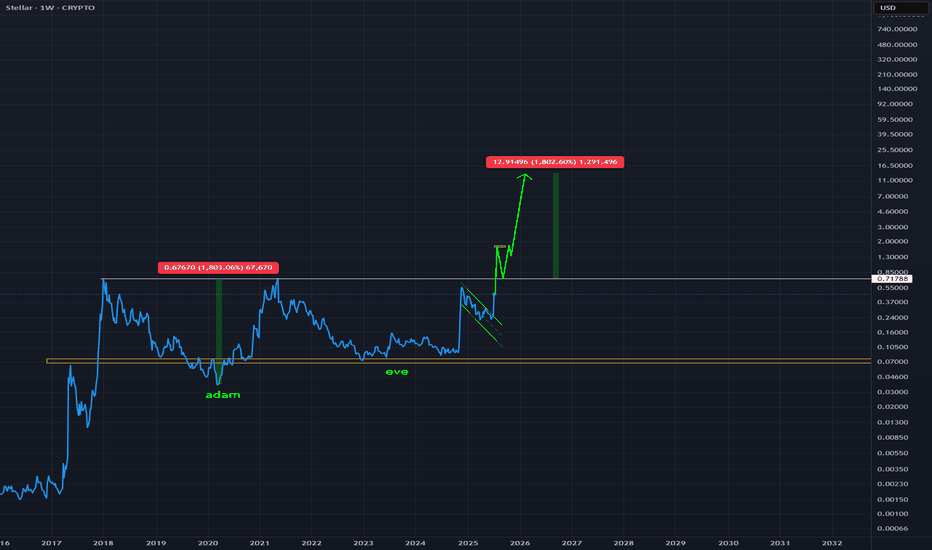

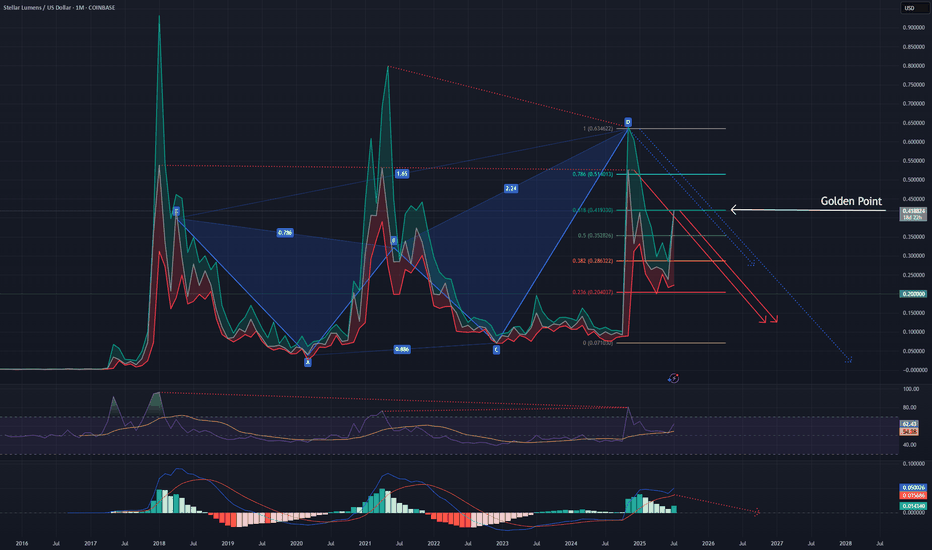

#XLM/USD - SHORTI won't specify the timing and goals here, but I think it's enough to take precautions and avoid becoming food.

At this stage, there is a hidden bearish divergence and a global extended bearish divergence, and neither of them has even started to develop.

At this stage, the decline is caused by approximately 7 factors, one of which is the Gartley butterfly pattern.

I'm sure no one on the Internet has noticed that the asset has no bullish factors for growth, but there are many bearish factors.

The ratio is:

11 bears vs 0 bulls.

(I have provided 2 out of 11)

If anyone has any bullish factors that they have heard of or know about, please let me know in the comments, but please avoid using hamster triangles or anything similar, as it does not make sense in this game.

(Not an investment recommendation).