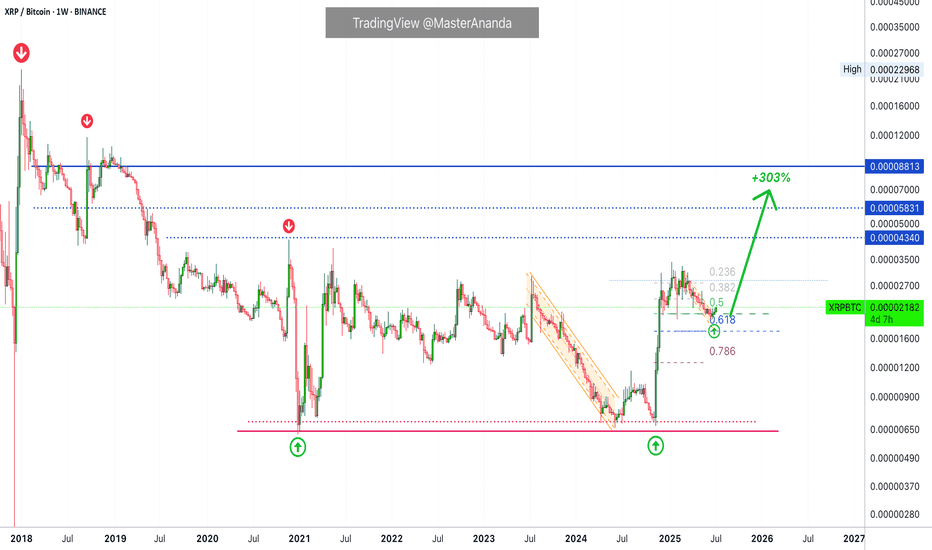

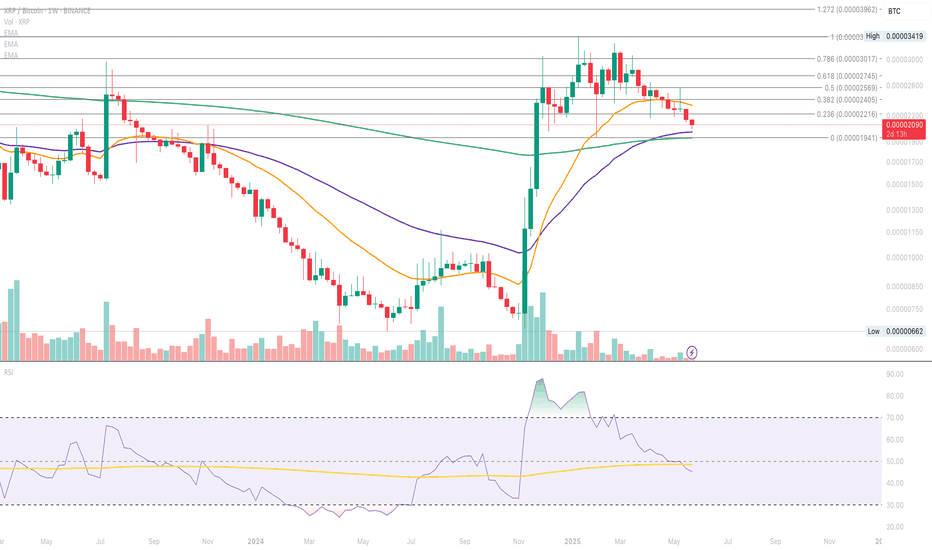

XRPBTC 303% Bullish Wave in the Making (Or Higher)One of the most unique charts in the entire Cryptocurrency market, XRPBTC produced very little retrace after its major late 2024 bullish breakout and recovery. This small retrace is a signal of strength. When prices produce a strong advance but fail to move deep once the advance is over—consolidatio

Related coins

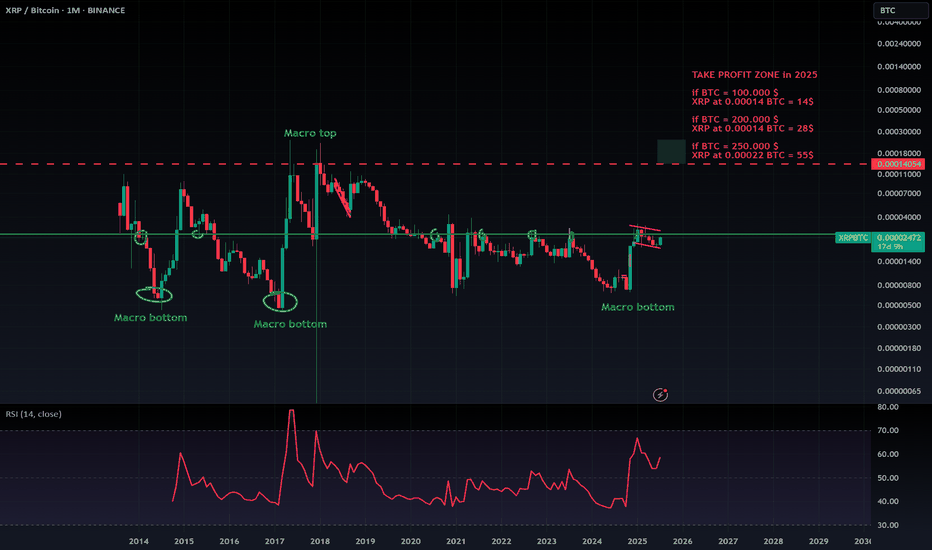

XRP ready for blast off, 2017 style !Already in position for soooo long, I can wait a few more weeks !

But, the target will be reached soon !

Any price action around the red dash line will be sold agressively.

Then it purely depend if we have only one leg of bullish move, or two legs with a strong pullback like in 2017. Let's see !

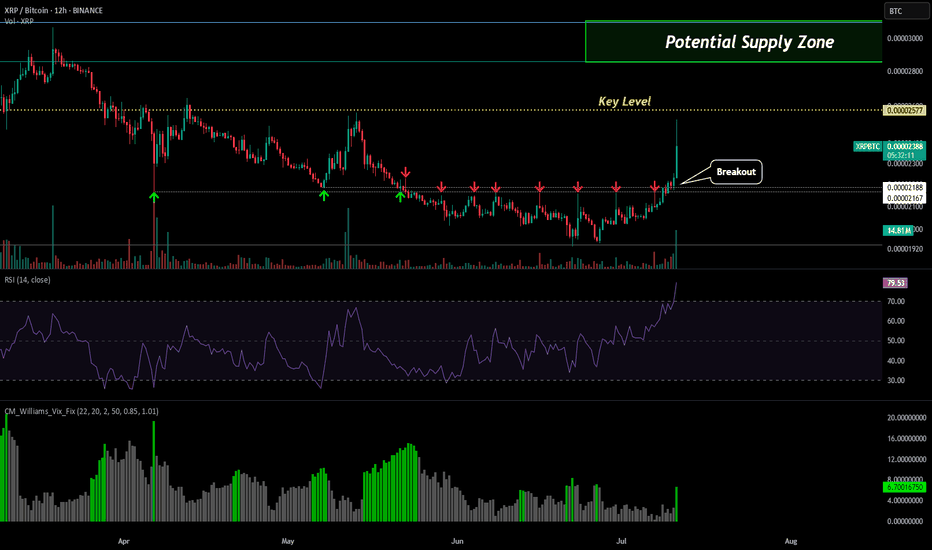

XRPBTC - Massive BreakoutPlease refer to our previous post:

As mentioned in our last post we believed the XRP/BTC chart to be the most important chart in preparation of an XRP breakout.

Now we have seen the level of 0.00002150 break. Upon breakout and retest the XRP/BTC pair has started to skyrocket helping to fuel the

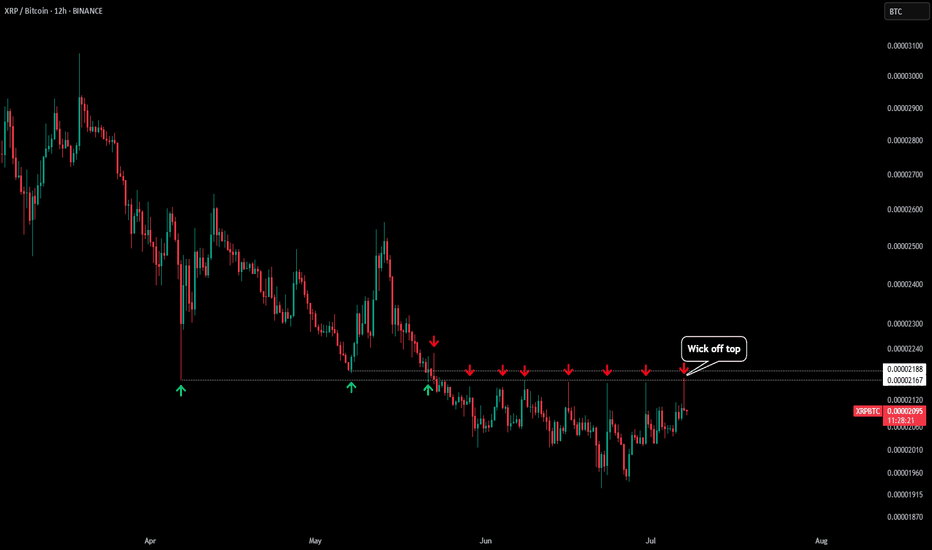

XRP/BTC - Most Important ChartIf you are wanting an XRP breakout then this is the chart you want to be paying attention to. XRP Priced in BTC.

The wick bottom in April 2025 market a significant level for the short term price action of XRP/BTC. This level was established at 0.00002165.

Once that level was broken to the downsi

XRP Alert: $3 Bets Dominate as Massive "Wedge" Pattern SignalThe Anatomy of a Sleeper Awakened: Analyzing the $3 XRP Bet and the Decisive XRP/BTC Technical Pattern

In the relentless and often forgetful cycle of the cryptocurrency market, assets can fall into long periods of dormancy. They become laggards, overshadowed by newer, faster-growing projects, their

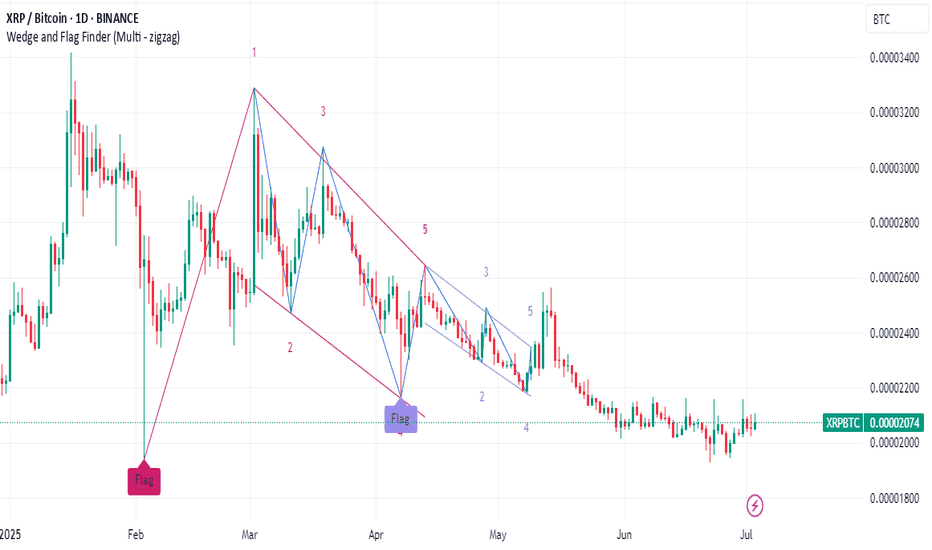

Chart history XRPThis analysis will take a lot of time because it is medium-term and the failure point is close and only when it is broken does the analysis fail. Other than that, it is in a downward trend and all the data is explained on the chart.

*In principle, I am not a supporter of any direction, but I am only

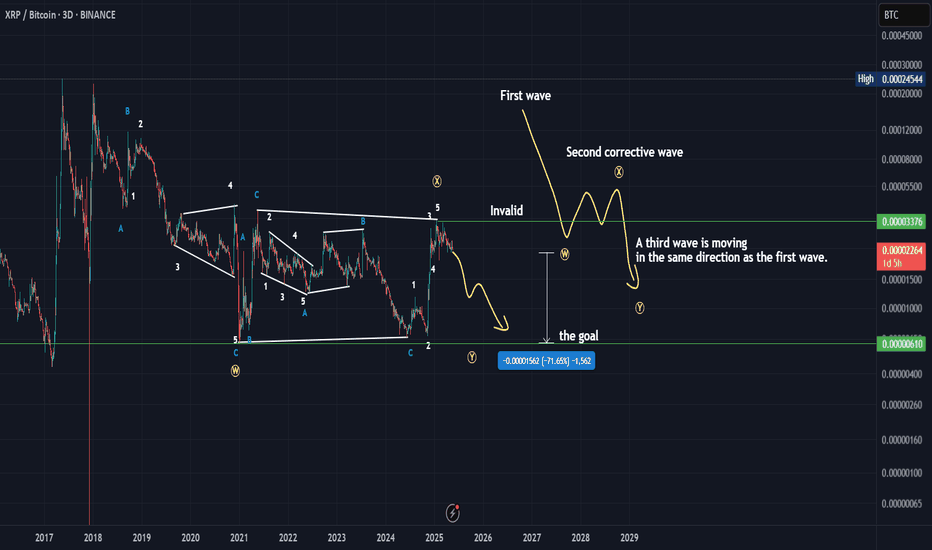

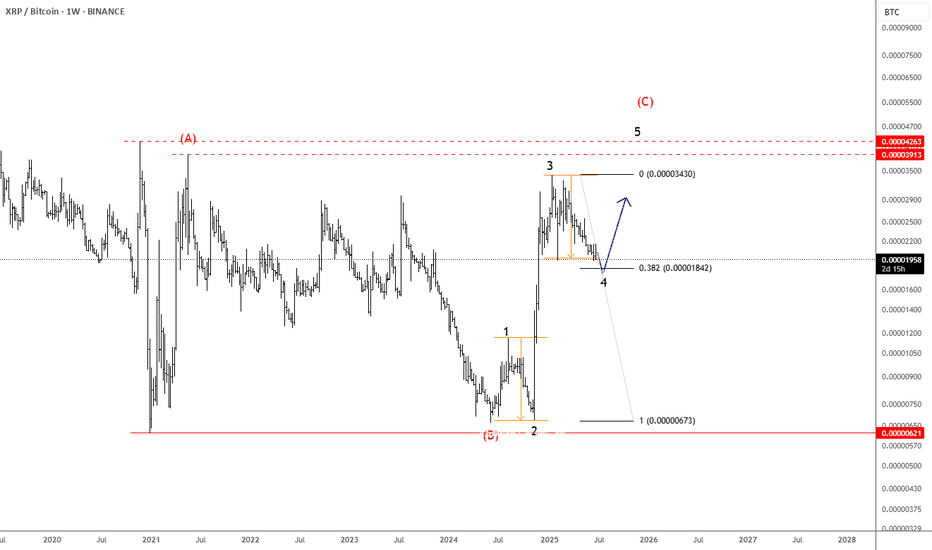

XRPBTC May Face Another Rally This YearXRPBTC pair can be trading in a larger weekly (A)(B)(C) flat correction, where wave (C) can be now in progress as a five-wave bullish impulse back to 2021 highs.

XRPBTC is currently slowing down due to BTC dominance, but notice that it's now testing February 2025 lows, so wave 4 correction can be c

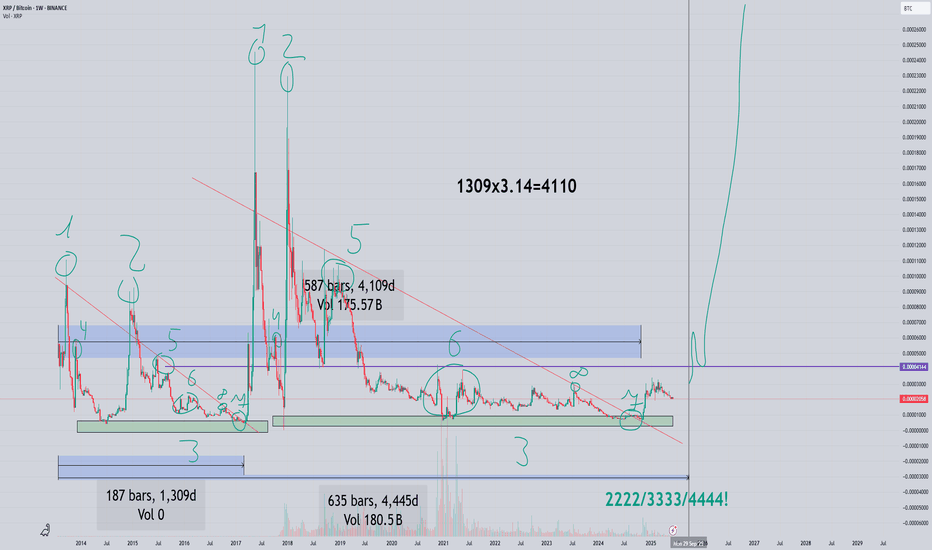

XRP 4444 day mega pump/cycleI used geometric progression by cycles to gain a deeper understanding of what is happening on the graph, apart from what can be seen from the fractals. The fact that the graph repeats itself means that it is cyclical. Cyclicality in infinite time is infinite, which means it has no angles. The circle

XRP will start to outperform BTC in coming weeks.XRP will start to outperform BTC in coming weeks.

We have a golden cross on weekly timeframe and is reaching big support around 2000 sats also we had a nice reset on rsi levels between January and now.

On the montly timeframe we had nearly 6 months of consolidation. The next move will be a super ex

Skeptic | XRP Analysis: Can It Hit $6 After Bitcoin’s $111k?Hey everyone, Skeptic here! Bitcoin just smashed through the $107K resistance, shaking up the whole crypto scene! Is XRP ready to rocket to $6 ? Curious about spot and futures triggers? Stick with me to the end of this analysis for the full breakdown. 😊 Let’s dive in with the Daily Timeframe

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.