XRPUSD.P trade ideas

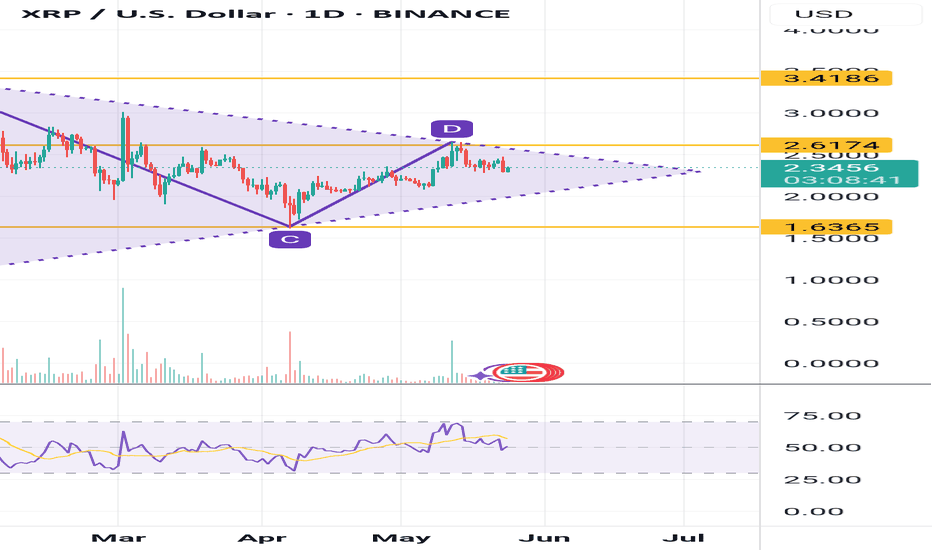

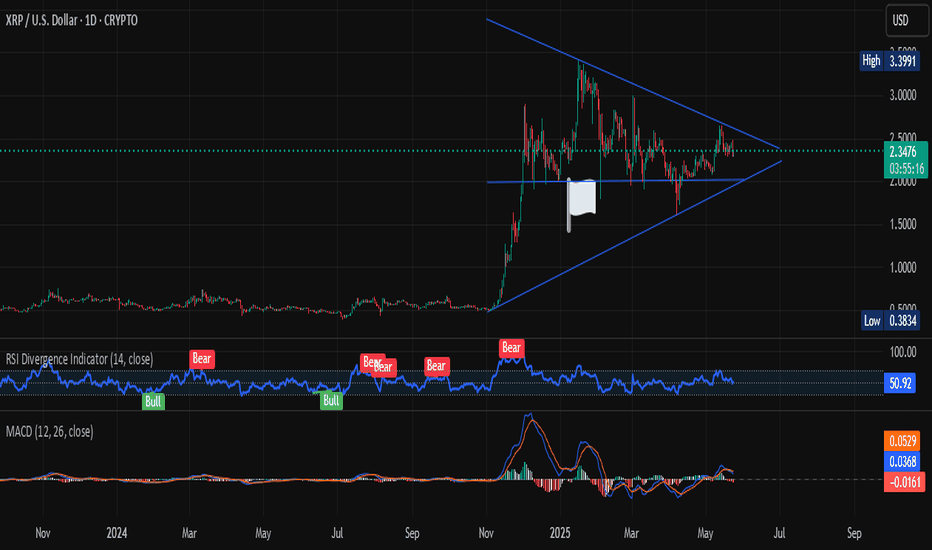

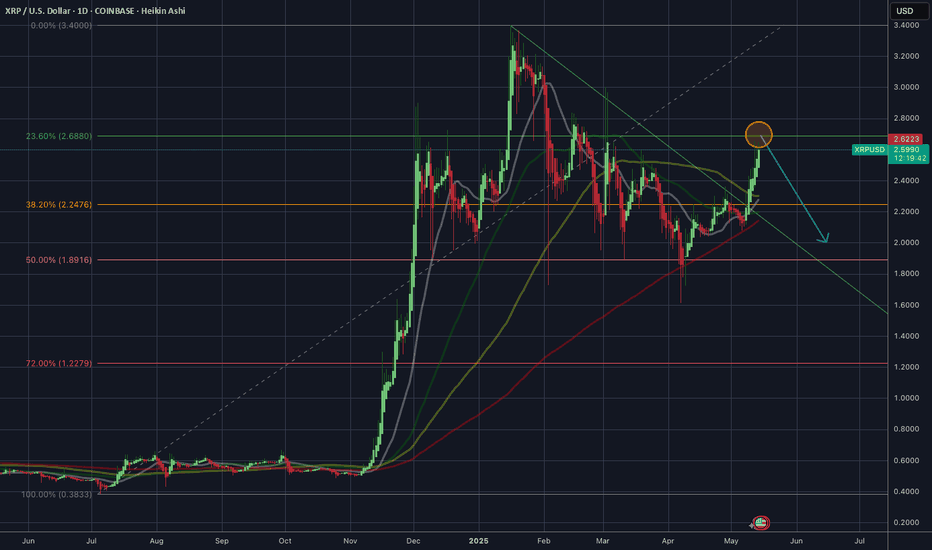

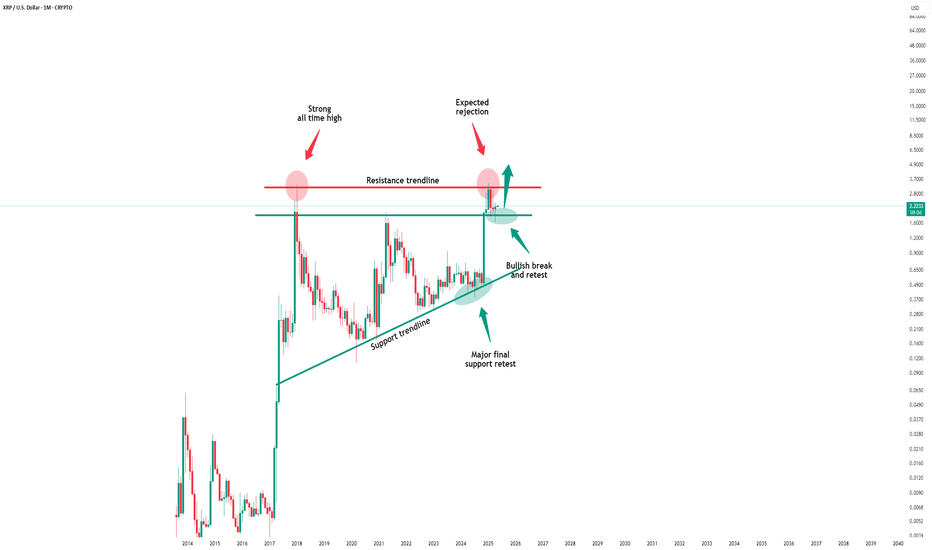

XRP Coiled for Breakout. Eyes on $5 if Trendline Holds.XRP/USD is trading above a long-term rising trendline, consolidating tightly in a bullish compression pattern.

This setup resembles a classic “coiled spring,” with price tightening just above key support. We’ve had consistent higher lows since late 2024, and the current structure favors a breakout over $2.70, which would open the door for a run to $3.50 and $5.00+

1. Trendline Support: Clean bounce from ~$2.00, higher lows holding since November 2024

2. Resistance: Horizontal resistance at $2.70 is the breakout level

3. RSI: Neutral (~50.88), resetting for a fresh move

4. MACD: Bullish crossover, momentum building slowly

5. Volume: Declining — typical before breakout patterns

A. Buy Zone: $2.00–$2.20 (support touch)

B. Breakout Add-on: Over $2.70 with strong volume

*Risk management is key. The longer this consolidates above trendline support, the stronger the breakout move will be. Of course, all is probability, but this is what I'm seeing.

**Clearly this isn't investment advice, only educational. ALWAYS seek a professional when investing.

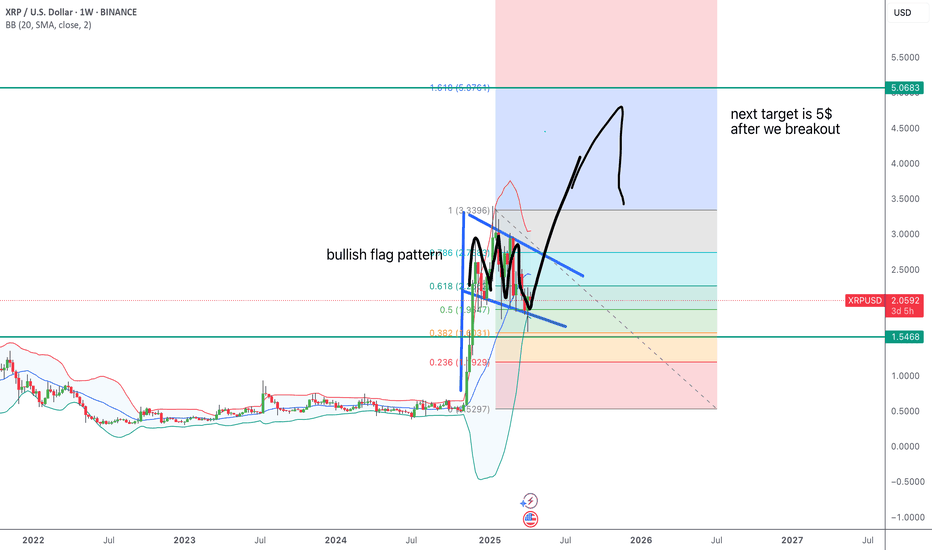

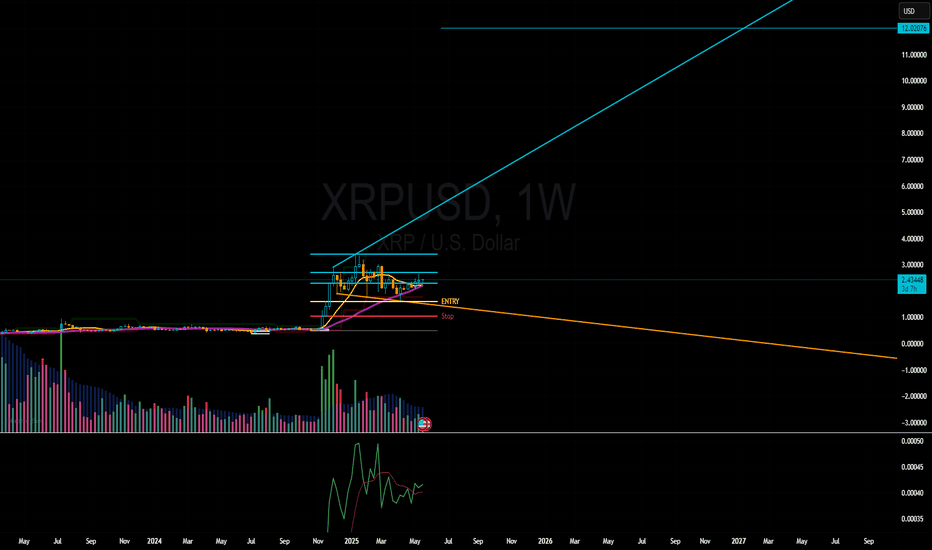

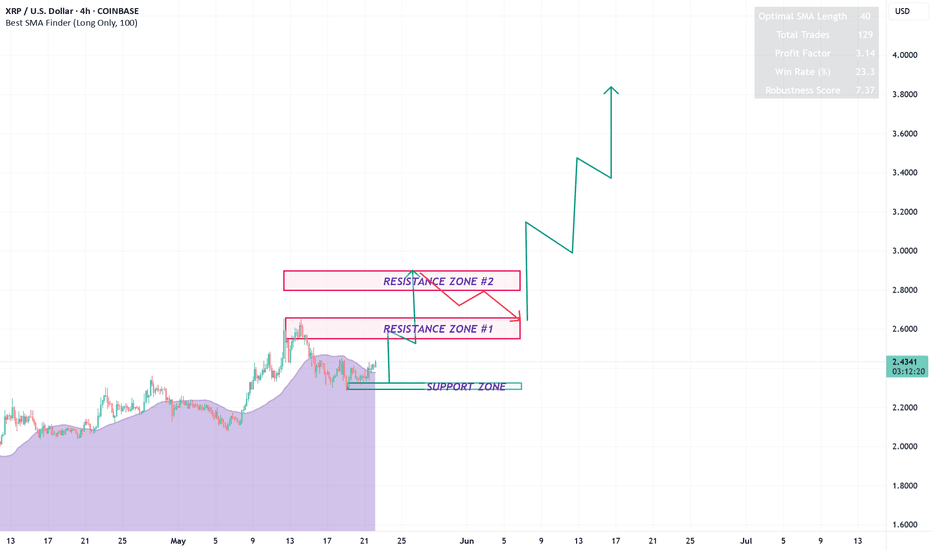

XRP BULL RUN LOADING - MID MAY BREAKOUT??My analysis is that we will see a bull run middle to end of may that breaks us out of the bullish flag that we see on our weekly chart. It may take longer than that but eventually we will breakout of that pattern and our next ATH should be something like 5$. Thoughts?

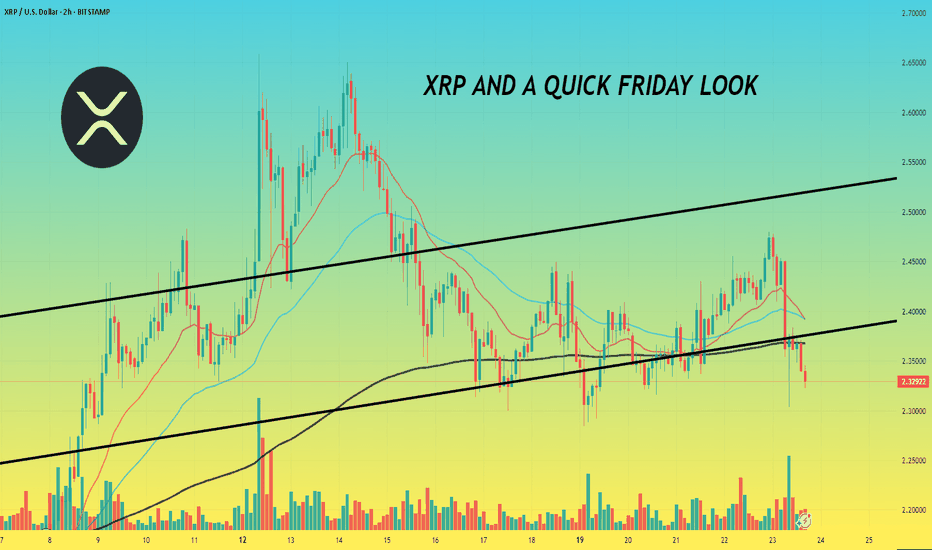

XRP AND A QUICK FRIDAY LOOK🔥 Hey hey, happy friday, it's definitely a busy one but hope everyone's doing well. As usual, we'll get going with our thoughts and try and keep things short.

🔥 Gonna focus on technical for the most part today as we look at things and follow up from our previous idea which is also linked below for reference.

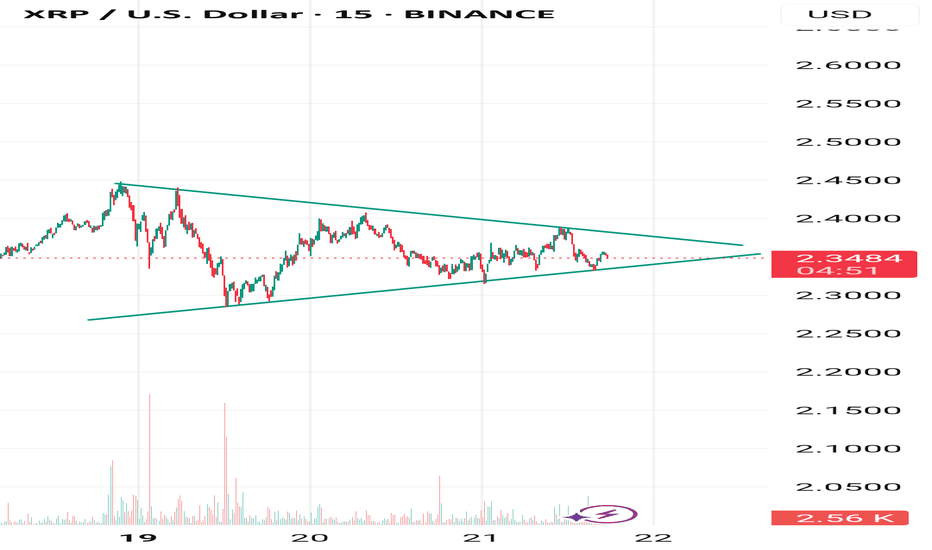

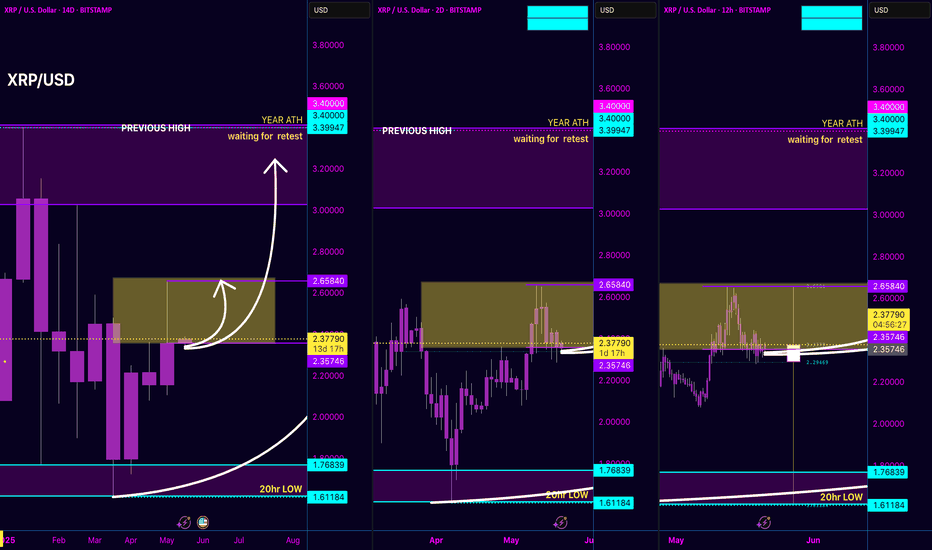

🔥 Looking at our 2 hourly we can see that we're still we continued with the trend and we're able to keep within that ascending channel but we did end up hitting a pretty tough resistance at $2.5 at which we got a pretty quick reversal, sell off. More than likely a coordinated move to sell off enough to have us lose that 200 EMA which was successful.

🔥 We ended up losing that 200 EMA and as of currently we've exited our ascending channel so to get reference on things we've got our Fibonacci chart below to find some good horizontal levels, especially as we approach an important support level being $2.99-3

🔥Next few day's I'll be keeping watch of that Fibonacci Retracement Chart for those levels. It's not perfect but gives some pretty good insight on things and these sort of horizontal channels we've got. Take $2.45-$2.42 for instance. Whenever we got out the channel we broke out or at least tried to and whenever we fell below that $2.35 support we'd get vice versa and fall, retrace.

🔥 So main things so watch right now are whether or not we can keep within that channel or if we'll fall into the one below and if we can regain that 200 EMA or if we fail by which then we could be seeing a retest of $2.99 and should that fail look to $2.20 and $2.10.

🔥 Regardless, XRP still stands in a great position for the long term as we last noted on our previous Big picture idea and whatever happens within the next few days and weeks will simply be market makers playing their game and technical running things till we get some more news or developments. On that note I've got to run but happy we could get something quick out today.

🔥 And as always, thanks so much for the support! Really appreciate it and let's keep at it till, same as ever. Always have more to gain and get done, work towards. Till next, keep posted and have a positive day.

Best regards,

~ Rock'

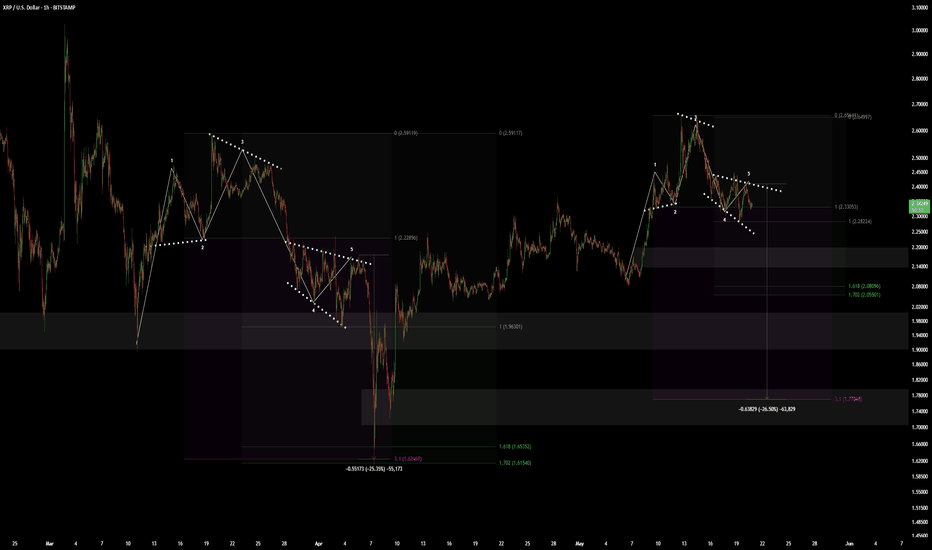

XRP - SHORT TERM PREDICTIONIM BULLISH LONG TERM, BUT THE PULLBACK FROM $2.60 IS VERY LIKELY DONT BUY WITH DONT BREAK THIS RESISTANCE LINE.

MAJOR PLAYERS CAN STILL TAKE PROFIT HERE AND THEN SELL-OFF TILL WE BETTER CLARITY FROM THE SEC REGARDING THE ETF APPROVALS.

In this Idea I focus on the XRP thats currently at major resistance around $2.60 to $2.70.

If this resistance levels break and holds support above $2.60. I believe we wont see the pullback.

If we dont close above this Resistance this week will have a pullback to $2.30 and even lower.

Next week will be a busy week for XRP as we might have more feedback from the SEC regarding the ETF approvals for XRP. If this fundamental aspect get clear guidance from the SEC this pair will surge to all time highs.

I would suggest not to buy now unless we have a good break above the $2.60 level.

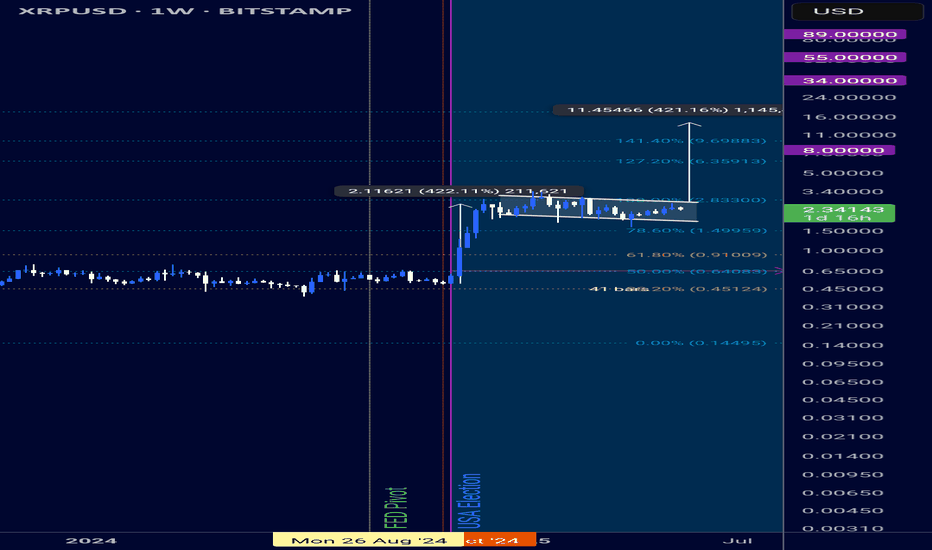

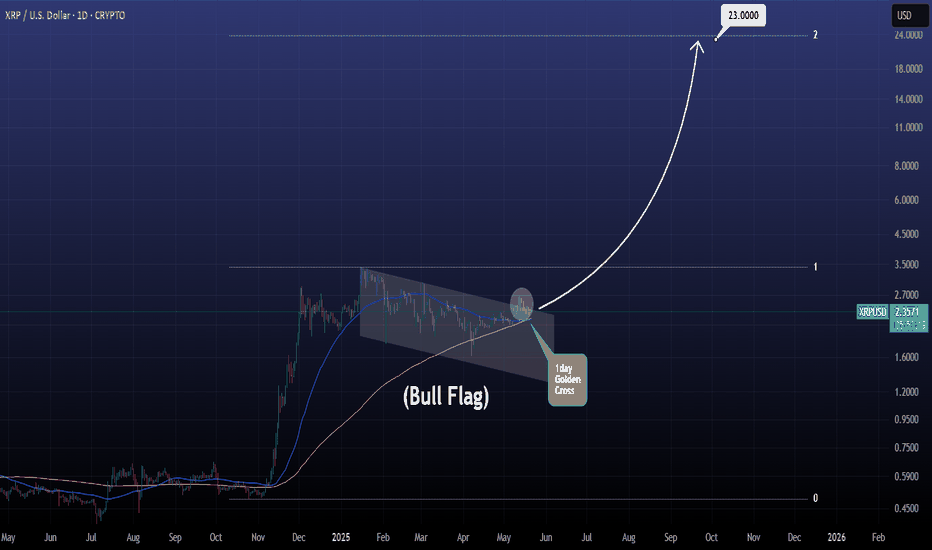

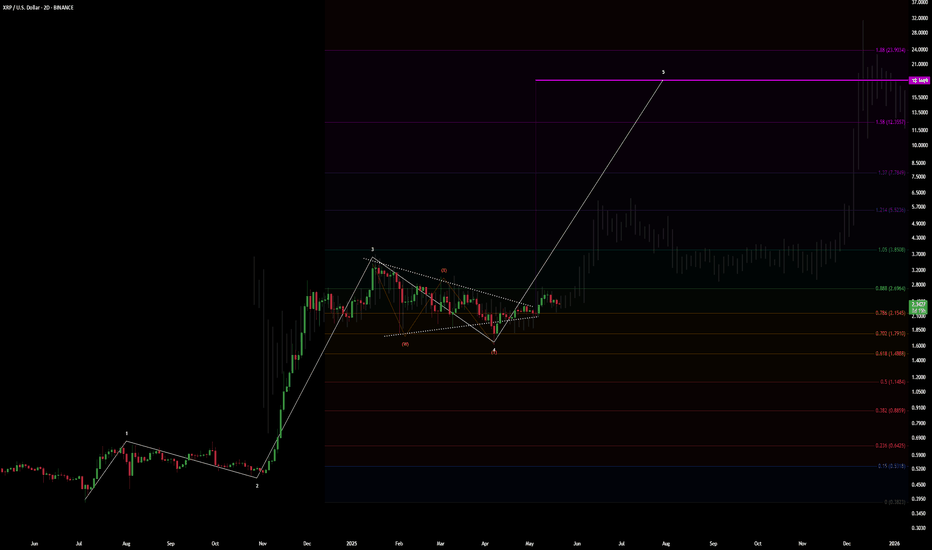

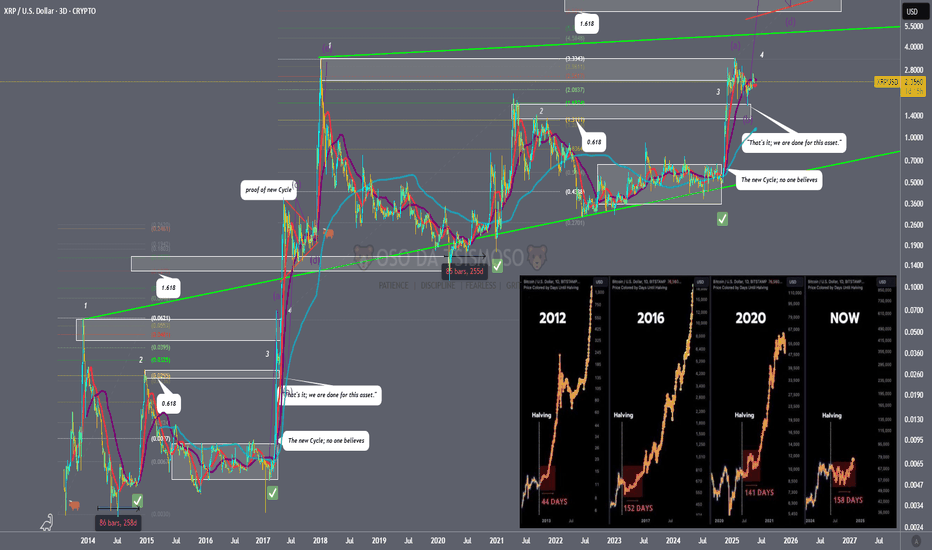

XRP ROAD TO $20+when we compare the move we had in 2017 with what XRP is doing now we see that we completed wave 1, we went to the ATH from '17-'18

wave 2 wicked to the top from '21

We turned that resistance into support

wave 3 to $12-$14 XRP is our next target

invalidation would be when we close candles below $2

Still long for now

Time will tell

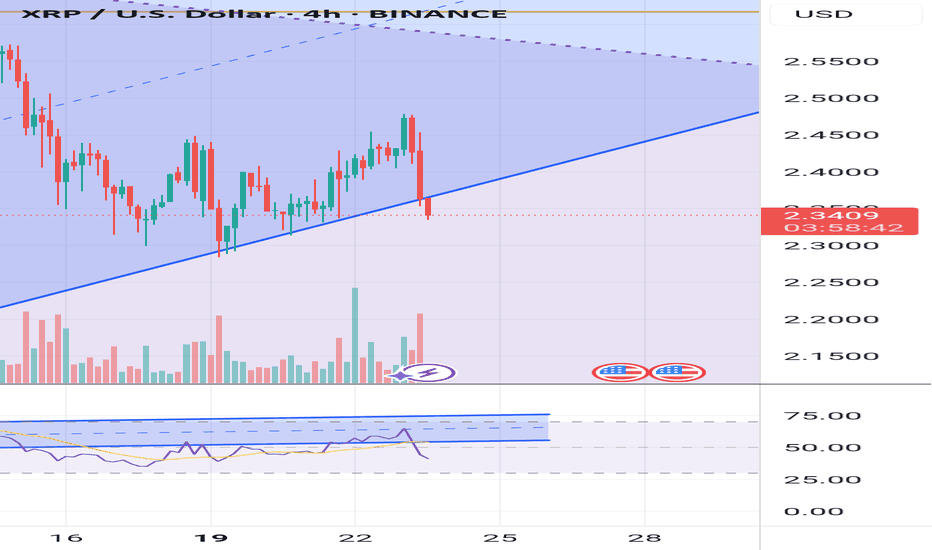

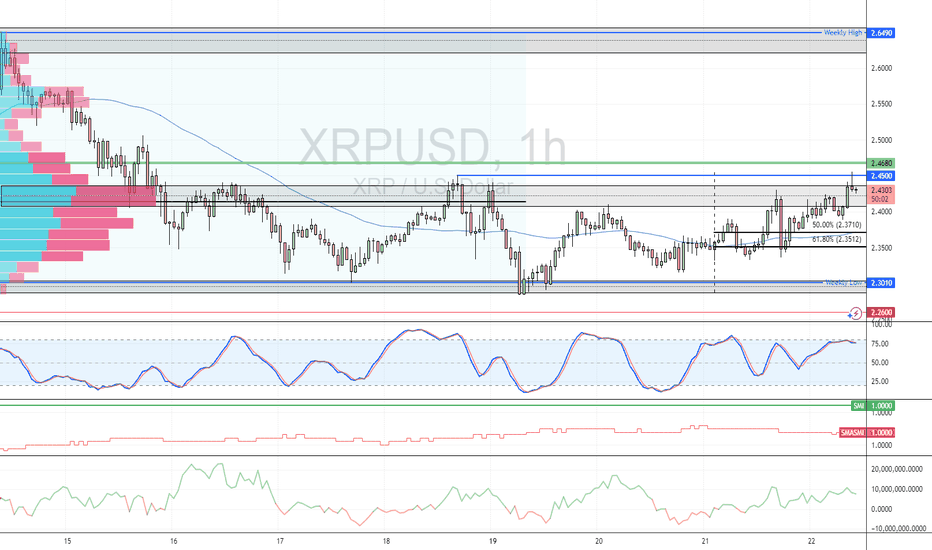

XRP (Ripple) is at a Critical Supply Zone: Will it Fall or Rise?FenzoFx—Ripple (XRP) is testing the resistance level, which expands from $2.40 to $2.46, with the Stochastic Oscillator hinting at an overbought market.

A new bearish wave could emerge if the resistance holds. In this scenario, the price could dip toward the 50.0% Fibonacci retracement level at $2.37, backed by the 50-SMA.

The bearish outlook should be invalidated if XRP/USD exceeds and stabilizes above $2.46.

Trade XRP/USD with low spread, no commission and no swap at FenzoFx.

XRP - JUST A FUN IDEAGood Morning,

Hope all is well. Although I do not believe in predicting the future (At least not long term), I thought it would be fun to evaluate XRP. If, if I was to take into account support and resistance zones, elliott wave theory, price movement levels this is most likely how it would turn out. As you can see XRP is about to finish a large bullish wave which started April, 07, 2025.

We have just experienced a pull-back in which I believe will lead to one more bullish movement upwards before correcting again into a slightly larger pull-back. After this move if we maintain all previous supports it would be highly likely that we hit the 4$ mark.

Buckle up lets see.

Thanks

XRPUSD Bull Flag broken. Can it go x10 from here?XRPUSD has broken above its Bull Flag, which has been the corrective pattern of the Trade War since January's High.

At the same time a 1day Golden Cross is being formed and if we get the same rally that was followed after the recent U.S. elections, the price may hit the 2.0 Fibonacci extension.

This represents a bold x10 move from here with a $23 target. Do you think that's plausible for this Cycle?

Follow us, like the idea and leave a comment below!!

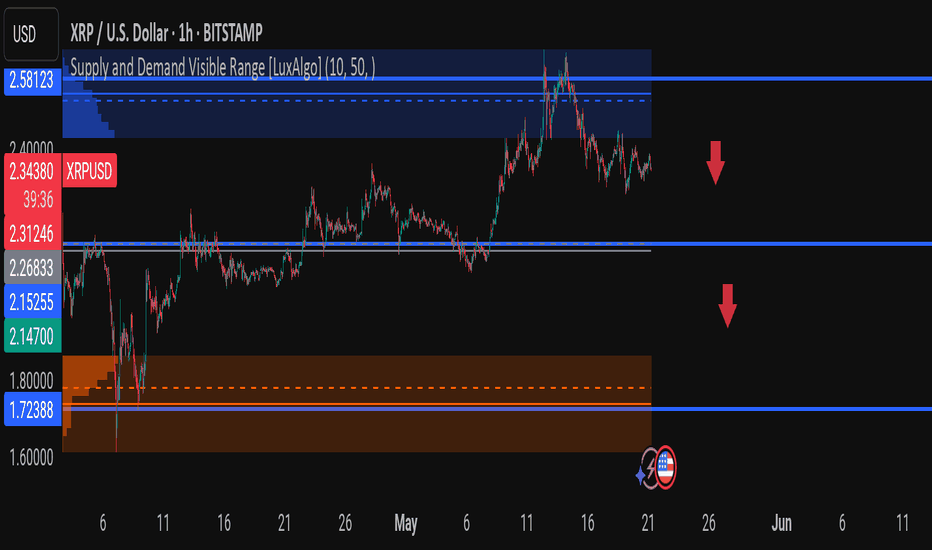

XRPUSD Just Hit a Major Wall—Is a Breakdown Imminent?XRPUSD is trading around $2.34, and it's bumping into heavy supply near $2.58—a zone where price previously reversed with force. This chart is screaming caution for late bulls.

What’s Happening?

$2.58 Supply Zone – Strong institutional sell zone. Price got sharply rejected here after a quick pump.

$2.31 - $2.26 Support Range – If broken, it opens the door to deeper drops.

$1.72 Demand Zone – High-volume area and potential bounce zone if the downtrend continues.

Why This Matters: XRP is forming lower highs after a supply zone rejection. If price fails to reclaim and close above $2.58, we could see a strong drop toward $2.15 or even $1.72.

My Game Plan:

Watching for a bearish confirmation below $2.30 to consider short entries.

Will look for buy setups only near the $1.72 demand zone or if price reclaims $2.58 convincingly.

What’s your XRP plan?

Are you loading up or waiting for the dip?

#XRP #Ripple #XRPUSD #CryptoTrading #PriceAction #SupplyAndDemand #FrankFx

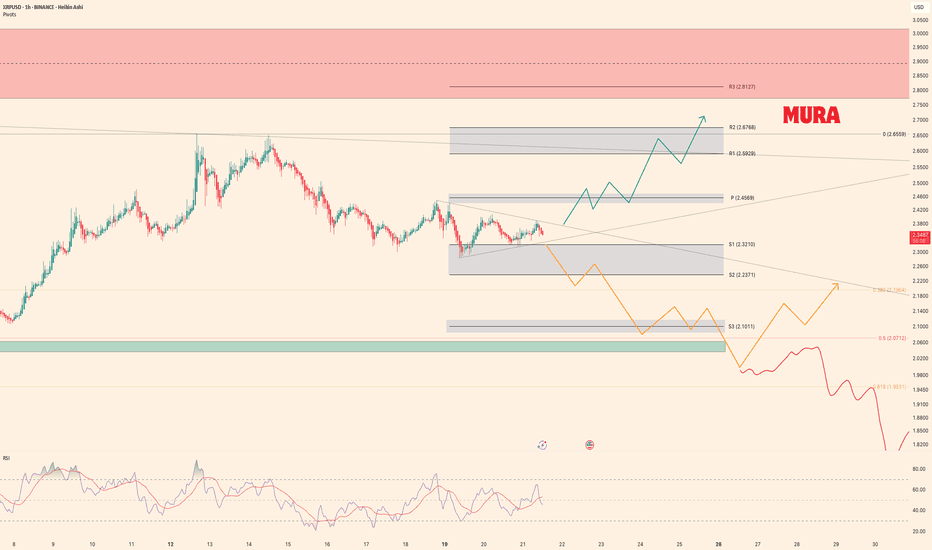

Weekly trading plan for XRPIn this idea I marked the important levels for this week and considered a few scenarios of price performance

It seems that the price is in a local triangle and if the descending trend line is broken we can expect growth to the resistance zone

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

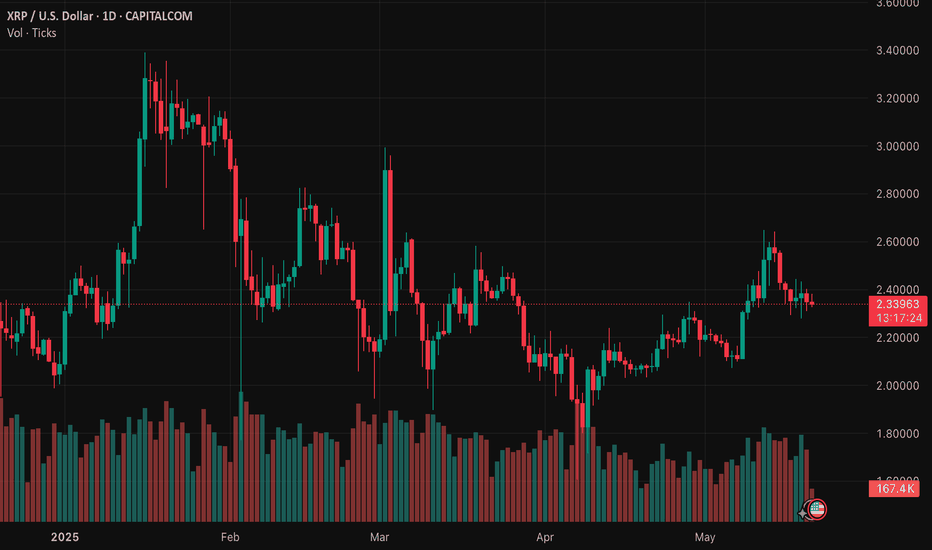

XRPUSD is moving within the 2.3050 - 2.4400 range👀 Possible scenario:

On May 21, XRP price dropped below the \$2.3350 level but has since started recovering and could soon attempt to break above $2.40.

On May 20, the SEC delayed 21Shares’ XRP ETF filing along with at least three other altcoin ETF applications, despite positive regulatory developments. Analysts remain confident the SEC will eventually approve these ETFs, noting that delays are common due to the slow pace of government processes. Despite setbacks, optimism persists as the SEC typically uses its full review period. Bloomberg analyst James Seyffart expects any early approvals by late June or July, but more likely in the fourth quarter when most deadlines occur.

✅Support and Resistance Levels

Now, the support level is located at 2.3050.

Resistance level is now located at 2.4400 .

Calling It Early — Before the Crypto Gurus Even Notice!XRP/USD is giving us that candle retracement setup that I’ve been waiting on. Based on structure, it’s looking like a clean retest of $2.65 is right around the corner. 🔁📊

I’m not basing this off hype. This is pure chart behavior. The candles are showing strength, and the path is looking like it’ll sweep through this key level before pushing higher toward the previous ATH.

This is bullish momentum, not guesswork. You gotta see it to believe it.

🧠 Remember: Most people react to the news.

Smart traders react to the structure.

No doubt at all—

There can only be ONE... XRP the Standard. ⚖️🚀💥

ALTCOIN BOOM FOR RIPPLE XRP 2025-2026 PROPOSALThe RLUSD "Trojan Horse" Thesis XRP’s path to $33 hinges on RLUSD becoming the first stablecoin to merge institutional adoption with DeFi utility, creating an inescapable demand loop for XRP. Here’s why this is not just another stablecoin play:

1. RLUSD Is a Liquidity Nuclear Reactor for XRP Unlike Tether (USDT) or Circle (USDC), RLUSD isn’t designed to exist in isolation. Ripple’s patents confirm RLUSD will use XRP as collateral in its liquidity pools (e.g., 80% RLUSD / 20% XRP). This means:

Every 1B of RLUSD adoption requires 250M of XRP buys to collateralize pools (25% ratio). If RLUSD captures just 5% of Tether’s market cap ($112B), it would necessitate 14B in XRP demand – 4x XRP’s current market cap.

This collateral mechanism creates a self-reinforcing cycle: RLUSD adoption → XRP buys → price surge → RLUSD credibility ↑ → adoption ↑.

2. Regulatory Arbitrage: RLUSD as the “KYC Stablecoin” Ripple’s SEC settlement gives RLUSD a first-mover advantage as the only compliant stablecoin for banks. While Tether faces existential regulatory risk, RLUSD is pre-vetted:

Pre-integrated with RippleNet’s 400+ KYC’d institutions, bypassing adoption friction. Designed to comply with the EU’s MiCA and US’s Clarity for Payment Stablecoins Act (2024), making it the sole stablecoin legal in G20 jurisdictions.

Banks will prefer RLUSD over “risky” USDT for cross-border flows, forcing them to hold XRP as collateral. This turns XRP into a shadow reserve currency.

3. CBDC Interoperability: RLUSD as the Bridge Ripple’s CBDC partnerships (20+ governments) plan to use RLUSD as a “neutral layer” between sovereign digital currencies. For example:

A Japanese CBDC user sending to Brazil’s Drex would convert JPY → RLUSD → BRL via XRP-ledger, with RLUSD acting as the sanction-proof intermediary. This would require central banks to hold RLUSD (and thus XRP) as liquidity reserves, akin to IMF’s SDR basket.

No other stablecoin has this government-level pipeline—not even USDC.

4. Killing DeFi’s Liquidity Fragmentation RLUSD is being deployed on both XRPL and Ethereum, but with a twist: Ripple’s AMMs (Automated Market Makers) will prioritize XRP/RLUSD pairs across chains. This:

Forces DeFi protocols to hold XRP to access RLUSD liquidity (e.g., a DEX needs XRP to create RLUSD pools). Redirects stablecoin yield farming demand into XRP staking.

Result: RLUSD becomes the liquidity glue between TradFi and DeFi, with XRP as its backbone.

5. The “SWIFT Killer” Endgame SWIFT processes $40T/year but takes 3–5 days per transaction. Ripple’s RLUSD integration allows real-time FX swaps via XRP:

A French bank sends RLUSD to Mexico → XRP ledger instantly converts RLUSD to MXN at near-zero cost. This disintermediates correspondent banks and saves institutions SEED_TVCODER77_ETHBTCDATA:10B + annually in fees.

For this to work at scale, RLUSD liquidity pools must hold X,XXX,XXX,XXX in XRP – a demand shock no opponent can mathematically counter.

Xrp - Prepare for at least a +50% move!Xrp - CRYPTO:XRPUSD - will head much higher:

(click chart above to see the in depth analysis👆🏻)

Xrp has perfectly been respecting market structure lately and despite the significant volatility, the overall crypto market remains bullish. Especially Xrp is about to perform a bullish break and retest, which - if confirmed by bullish confirmation - could lead to a rally of about +50%.

Levels to watch: $3.0

Keep your long term vision!

Philip (BasicTrading)