XRPUSD.P trade ideas

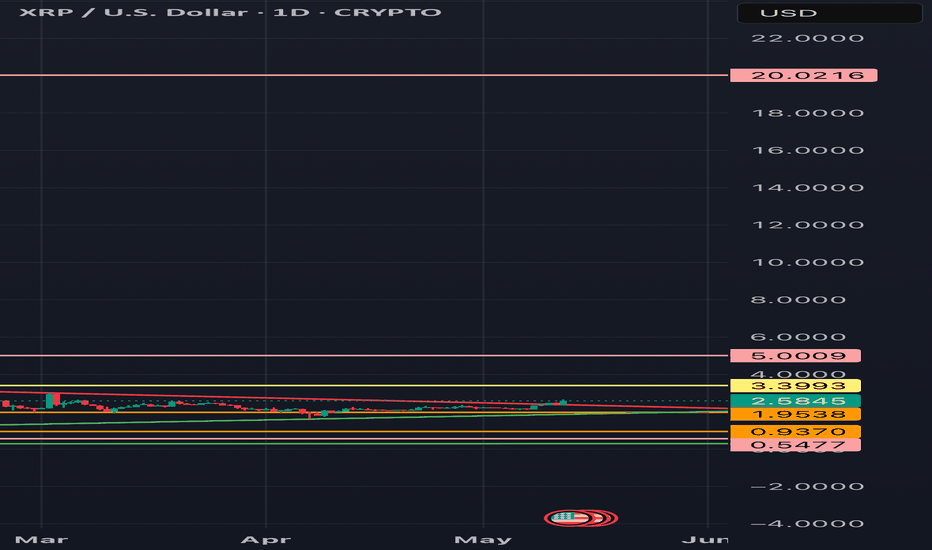

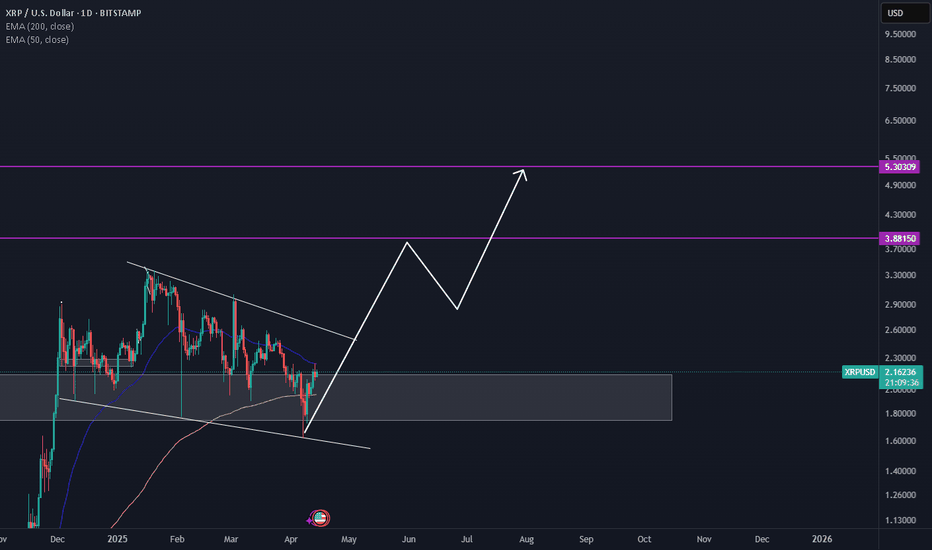

Weekly trading plan for XRPIn this idea I marked the important levels for this week and considered a few scenarios of price performance

It is better to consider the risks at local resistance and in case of correction we expect to see a reversal above the pivot point

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

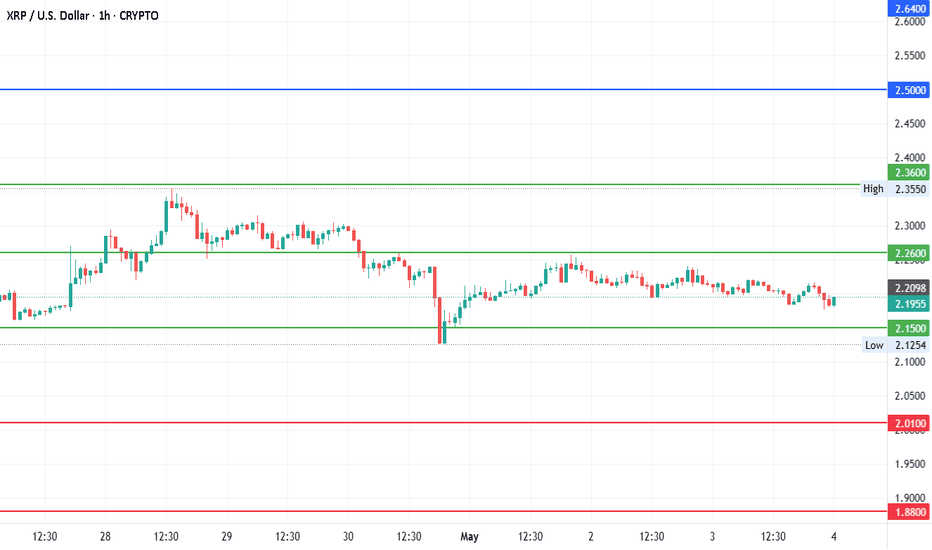

XRPUSD is moving within the 2.3500 - 2.6000 range👀 Possible scenario:

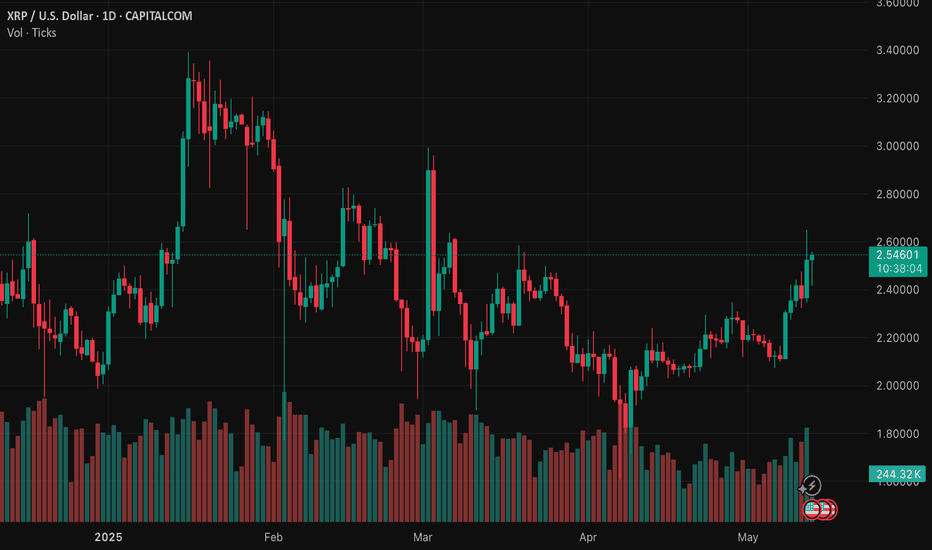

On May 12, XRP surged past $2.50, reaching a high of $2.6560 before pulling back. Despite dipping below $2.50 on May 13, bulls remain active above $2.40, with the price holding near $2.42. Whale Alert reported a massive 29.5M XRP transfer to Coinbase, worth over GETTEX:73M , suggesting potential sell pressure as the broader crypto rally cools.

XRP briefly overtook USDT on May 12 to become the third-largest crypto by market cap, holding the spot for over an hour before USDT reclaimed it. This surge, fueled by a 100%+ spike in trading volume, followed the SEC’s settlement with Ripple and reflects renewed interest in XRP.

✅Support and Resistance Levels

Support level is now located at 2.3500

Now, the resistance level is located at 2.6000.

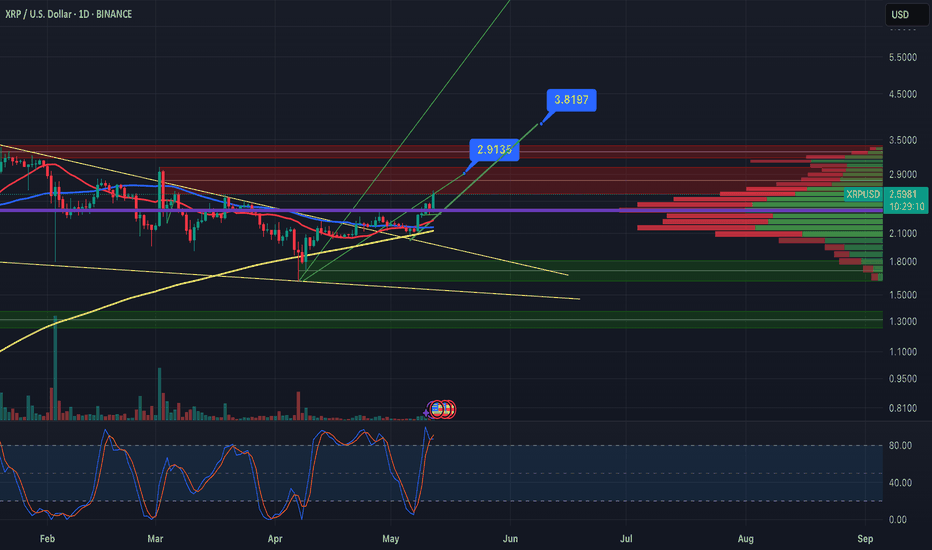

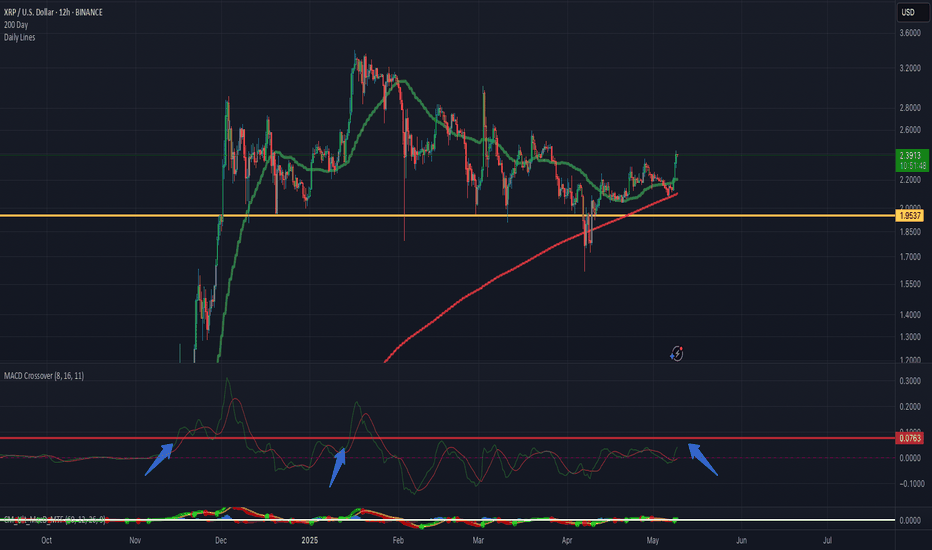

XRP Possible $2.00 Retest?With XRP riding up with the market we can see there’s some potential pullback zones still open for price to retest to hopefully shoot back upward. This is also greatly effected by the price staying above the trend line it just broke through.

MACD looks to be confirming a potential bull trend soon if it’s not shut down by market movers.

RSI looks to be decent sitting in neutral zone with plenty of gas to head back up.

EMAs have been steadily moving up showing a great support building up as price increases.

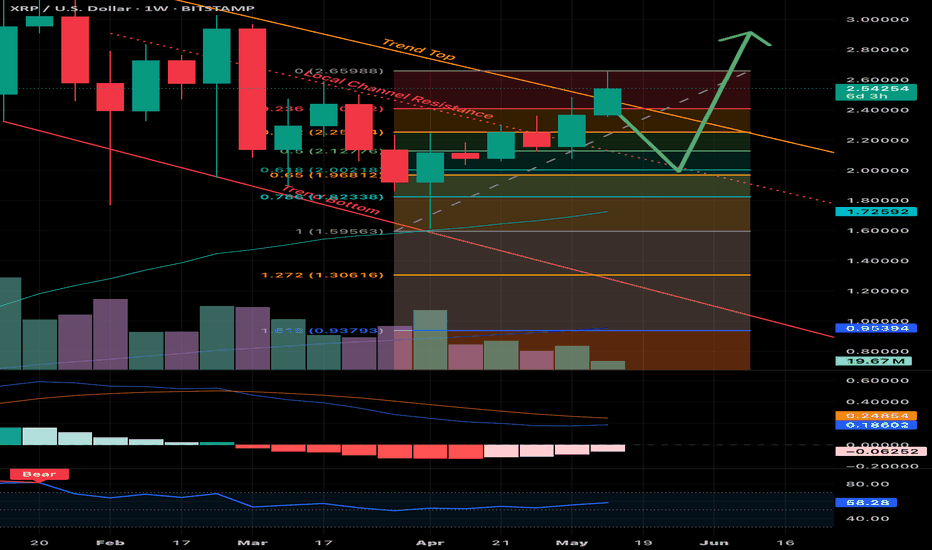

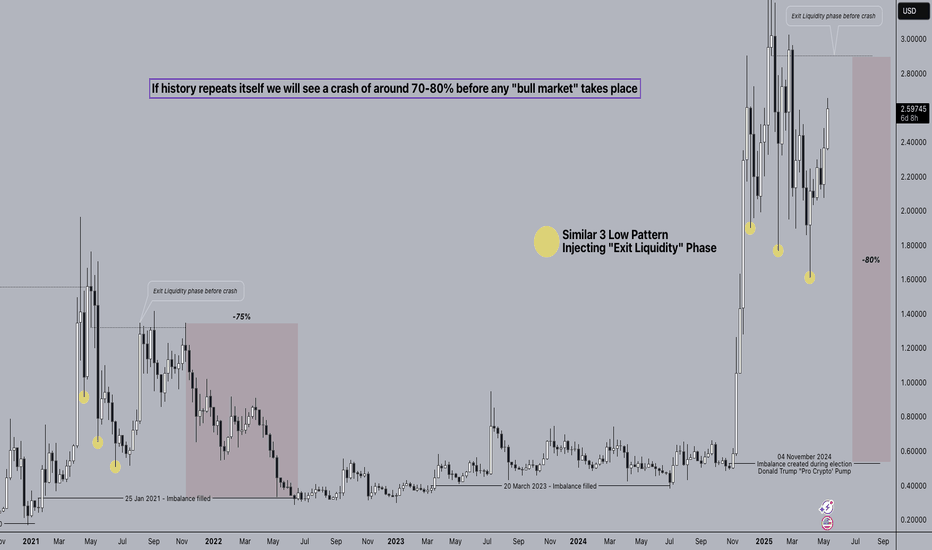

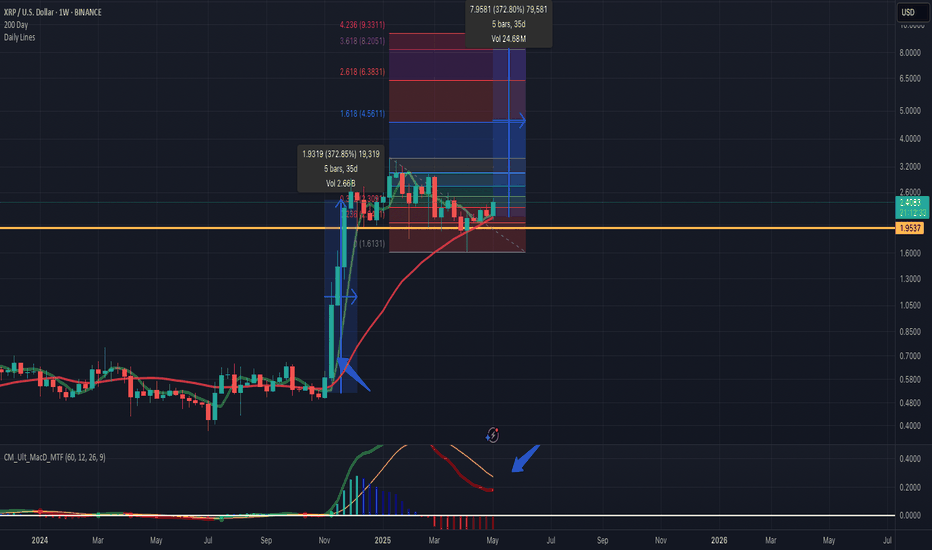

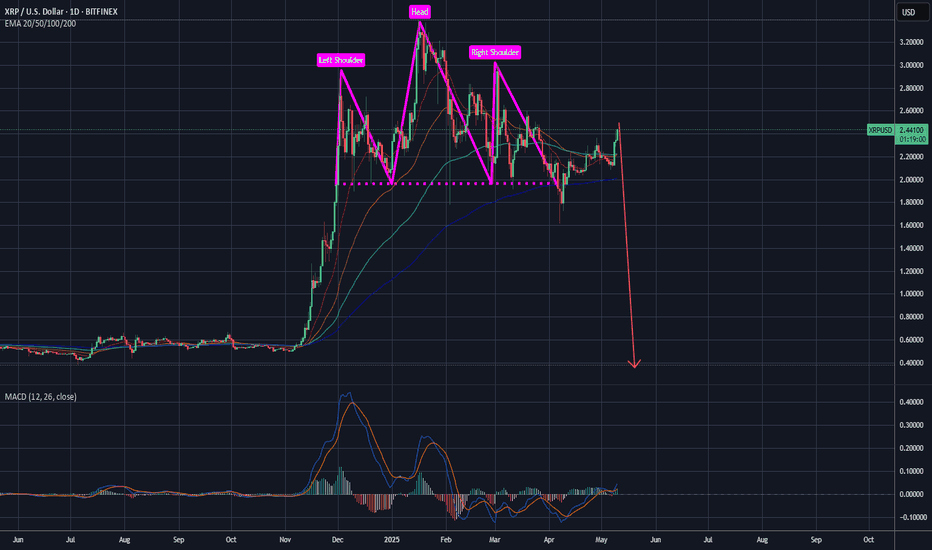

XRP to Crash Below $1 Again? Exit Liquidity Pattern RepeatingIf history repeats itself, we could see another -70% to -80% crash before any real bull market begins."

On this chart, I’ve highlighted what I call the Exit Liquidity Phase — a pattern where XRP forms 3 similar lows, then spikes up aggressively, only to trap late buyers. This engineered move creates liquidity for institutions to exit, leaving retail stuck holding the highs.

🟡 Yellow dots show:

Price forming familiar 3-low setups

A sharp pump acting as a liquidity grab

Followed by heavy markdowns (-75%, -80%)

We’ve seen this repeated pattern across prior market cycles — and 2025 is shaping up no differently:

The recent Trump “Pro Crypto” election pump created imbalance

We’re forming another 3-low structure

Liquidity is being built above — possibly setting up another distribution leg

📉 If this plays out like before, XRP may revisit older imbalances well below $1.00 before any sustainable upside.

This isn’t fear — it’s pattern recognition. Watch how liquidity is engineered.

💬 What do you think?

Do you see the same trap unfolding, or do you believe the bull market has already begun?

#XRP #CryptoCrash #LiquidityTrap #SmartMoney #ExitLiquidity #CryptoAnalysis #PriceAction

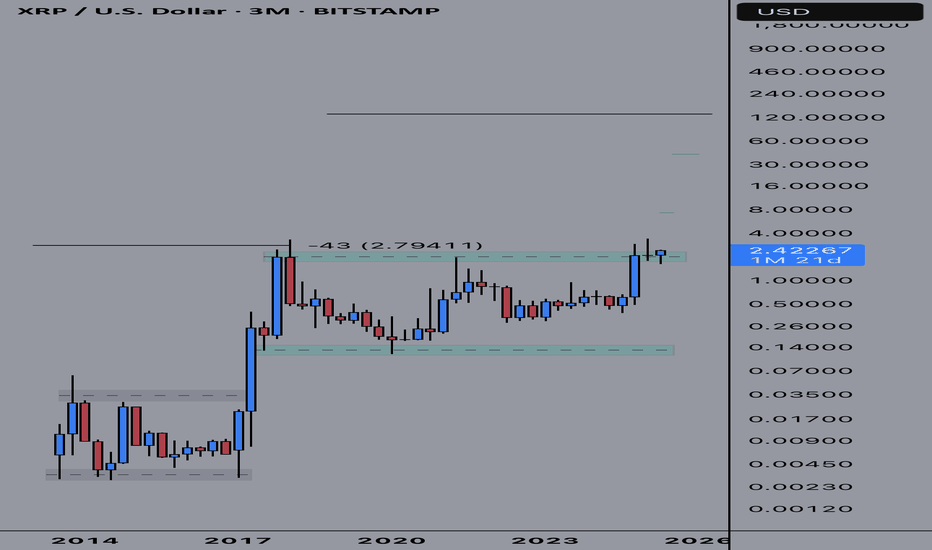

XRP MACRO STRUCTURE – “Exit Liquidity” Trap ModelIn this XRP macro view, we can see a repeating pattern across multiple market cycles:

🔶 Yellow dots highlight "exit liquidity" phases, where price aggressively pushes higher before a major crash.

This final pump draws in retail buyers chasing breakout highs, while institutions use that liquidity to offload positions.

🔁 The repetition of this pattern is notable:

Pre-crash surges into premium zones

Followed by a sharp markdown

Often returning to previous imbalanced zones (highlighted)

🧠 Key Observations:

The market tends to fill old imbalances before each major leg

Price action engineered liquidity traps are consistently placed before the markdown

These highs are often used to entice late buyers while larger players exit

📌 Study how liquidity is harvested, not just how price moves.

Let me know your thoughts below — do you think we’ll see this again?

#XRP #CryptoAnalysis #SmartMoney #LiquidityTraps #ExitLiquidity #PriceAction

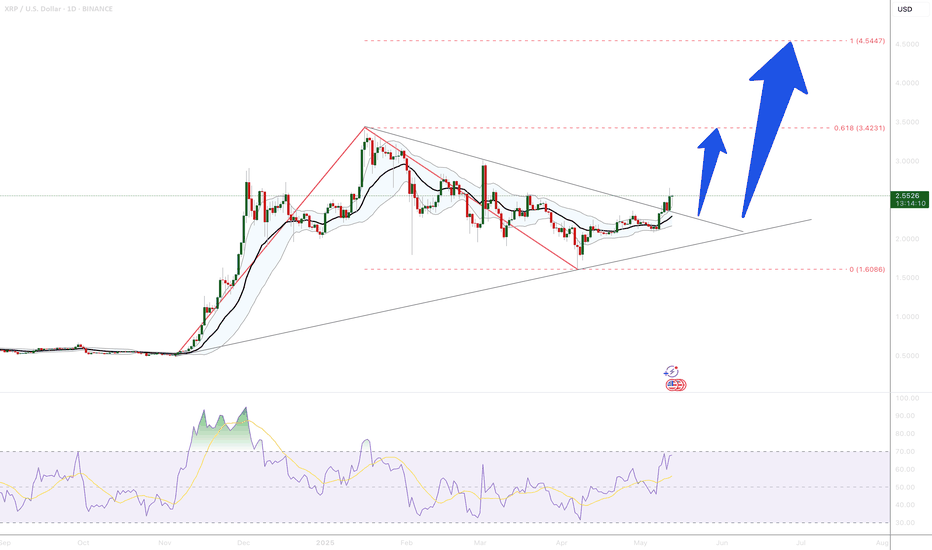

XRP Breaking UP Inevitable UP UP WE GOXRP is breaking up Structure going for the Previews All time Highs, ETF News on the way, End of SEC Law Suit, A lot of great news on the way will Launch this rocket 🚀🚀🚀 to the next level, Adoption by financial institutions. April Showers bring May Flowers Enjoy this once in a lifetime trip. I would like to read your Ideas in the comment section.

NOT FINANCIAL ADVICE.

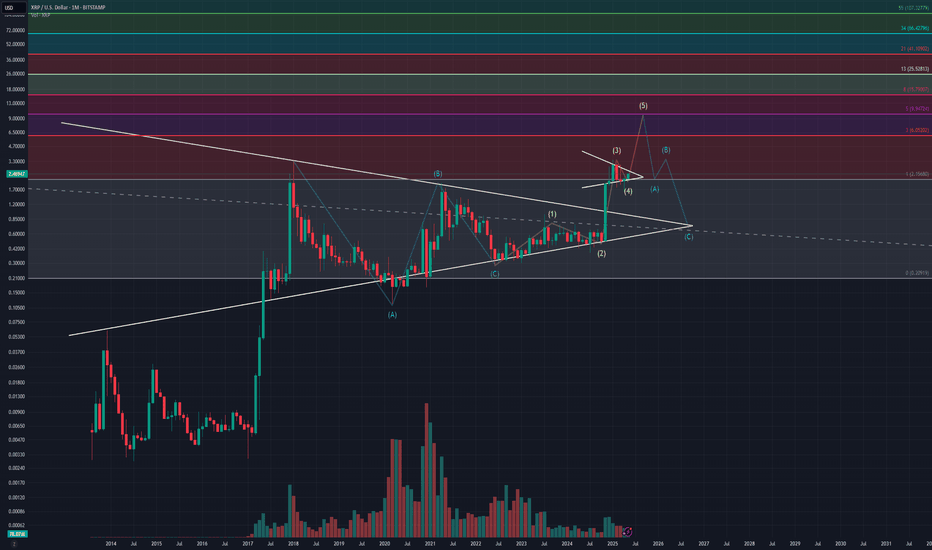

XRP to the moon - Where will the ATH finish?XRP is currently leading the market and is about to melt faces.

If it was to repeat the same as 2017/18 cycle it would be in the $40 zone but I don't see that happening this cycle.

Applying the grand fib - we can see perhaps $10-15 is where it tops out followed by a bear market to buy it for under $1 in the future bear market.

XRP DISTRUPTS AND TAKES ON HEALTHCARE!⚕️ Hey hey, hope everyone is doing well, before I start just want to give thanks as always, appreciate the support and let's keep at it.

⚕️ First thing right off the bat is a pretty exciting development I'd say! In a crazy development Wellgistics Health made the announcement to integrate and incorporate the use of XRP into their company and infrastructure utilizing the digital currency as a treasury reserve as well as a form of real-time payments.

⚕️ This is the first time we're seeing a publicly traded company, not to mention a healthcare company integrate XRP this much into their infrastructure and system in such a manner highlighting their faith and confidence in the asset, In the announcement they highlighted many benefits and incentives such as the speed, noting XRP's settlement time of just 3-5 seconds as compared to traditional methods such as ACH and wire transfers which can take days.

⚕️ I could continue listing but I'll share the bullet points they made:

Speed: XRP settles transactions in 3-5 seconds vs. 1-3 days for ACH or wire transfers, allowing for near real-time settlement among pharmacies, suppliers, and manufacturers.

Cost: Less than $0.0002 per transfer vs. $10-$30 for standard bank wires.

Transparency: All transactions are logged on the XRP Ledger for real-time compliance, rebate tracking, and auditability.

Scope: Supports global vendor payouts with significantly low foreign exchange and wire transfer fees.

Flexibility: Allows for XRP-backed lines of credit to support independent pharmacy liquidity.

⚕️Welligstics Health then went on to add and highlight the use cases across the ecosystem as they put it:

Real-time settlement between pharmacies, suppliers, and manufacturers

Smart rebates calculated automatically based on real-world data

XRP-backed credit lines to enhance liquidity for independent pharmacies

Global vendor payouts with near-zero foreign transaction and wire costs

Immutable compliance layer supporting DSCSA reporting and pricing validation

“We’re working to unlock capital velocity with surgical precision,” said Mark DiSiena, CFO of Wellgistics Health. “We believe that our XRP-powered infrastructure will allow us to run leaner, faster, and with more control than any of our peers in pharma infrastructure.”

⚕️ I'll share the reference to the announcement for any that want to read more on it but just off these points alone we can see just how much the benefit and incentive is for the company to incorporate XRP into their infrastructure which would put them ahead of the competition, essentially making them the first movers. No doubt others will be looking to Wellgistics Health to see the impact this makes in the next few months for the company, especially for their balance sheets and should things play out well I don't see why other companies won't follow in suit. So definitely excited by this development. Now we're seeing real utility kick in and XRP's purpose and use case being put to the test on a real scale.

⚕️ For reference NASDAQ:WGRX is essentially a middleman and provider that supports a wide range of categories and services in the pharmaceutical sector, the main being pharmaceutical distribution, prescription technology, as well as clinical fulfillment in which Wellgistics connects over 150 direct manufacturer contracts to a network of over 6,000 independent pharmacies nationwide. So we've basically got this huge player in the industry picking XRP as an alternative and essentially reworking their infrastructure completely around this digital asset. There's no doubt they did their due diligence and I'm sure the results will be noticeable for the quarterly reports, especially when you consider how much the company will save on transaction fees for a company that primarily deals in transactions the difference is incalculable to say in the least against traditional methods.

⚕️ Here's a reference link to the announcement as well for anyone who would like to read further into things.

www.globenewswire.com

⚕️ We've spoken many times on XRP and how it's real use case and utility has yet to really be put to the test so seeing this will really give us some good data and insight on the asset's real use case and what kind of role it'll play in the future, as I noted, I'm sure other companies will be looking as well to see how everything plays out and more than likely, we'll get positive results and start seeing other companies in other sectors begin to incorporate XRP into their own infrastructures.

⚕️ That's the wonderful thing, XRP doesn't just work for one sector or one company, it has so many use cases and utility it can be scaled in many ways for many industries and I think the next few years will have us seeing this come into play without a doubt and XRP's real utility and role taking place and shape. After all, we're still basically just starting off still funny as it may sound.

⚕️ For technical we'll keep things quick first using the charts below for reference:

⚕️ Used a Fibonacci Retracement picking our lowest and highest price points which honestly gave some pretty good insight, we can see just how accurate price action matches our Fib and those horizontal levels giving us a clear picture of things.

⚕️ For this chart I simply changed the Fib to blue and added in our ascending and descending channel's to simplify things, we had that ascending channel help Bull's keep pushing but once we lost that channel and hit the $2.5 resistance we can see just how quick traders we're to take profit and in turn we fall out that chanel and formed the current descending channel we're in.

⚕️ For the last chart we took away the Fib and this is the barebone of stuff. Can see how we moved up within this channel and then started retracing once we tested that horizontal resistance level at $2.48-5 putting us in our current position in which Bull's will have to keep price above that Fib. level of $2.32 which would help us avoid falling back into that descending channel and losing the 200 EMA. So basically if we stay within the channel we'll fall further and if we can break out of it and avoid losing that 200 EMA then we get another shot to retest $2.48.

⚕️ I have to run but If you've made it this far I appreciate it as always and hope the read was a productive update and informative, feel free to follow and keep tuned for more as always and don't just make it a good day, make it a great one.

Best regards,

~ Rock '

XRPUSD Bullish Trade Setup – Watching for 4H Retracement📊 Weekly Overview

XRPUSD has been rejecting the weekly support zone for several consecutive weeks, forming bullish candles that suggest growing buyer strength and potential upside continuation.

📉 Daily Chart Explanation

Price has broken above the daily 50EMA with a strong bullish momentum candle, indicating a shift in structure and reinforcing the bullish bias from higher timeframes.

⏱ 4H Chart Explanation

The 4H trend remains bullish, but no retracement has formed yet. I am anticipating a possible pullback in the coming sessions. Once a retracement occurs, I will wait for bullish confirmation—such as a trendline break or a reclaim of 50EMA—to look for a long opportunity.

📌 Plan

Bias: Bullish

Entry: Wait for retracement to form and look for bullish confirmation (trendline break + strong bullish candle above 50EMA)

Targets:

First Target: Previous high

Second Target: Next resistance zone on Daily timeframe

Invalidation: Break below recent 4H swing low or failure to hold above 50EMA after pullback

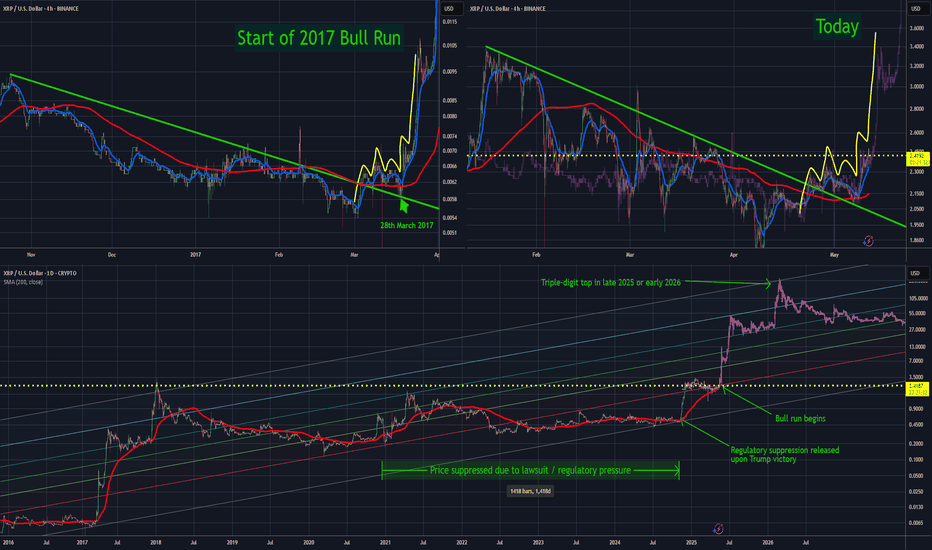

Thesis — How XRP Could Reach Triple Digits Within 12 MonthsAbout a month ago, I pointed out a pattern that preceded XRP’s explosive bull run in 2017. That same pattern is now playing out almost identically — and if the fractal continues to hold, XRP could be gearing up for another major move.

Frankly, the 4-hour chart is a near-mirror image of 2017’s setup. I’ve overlaid the original bar pattern onto today’s price action — the resemblance is hard to ignore.

If this plays out:

We could see a test of all-time highs within a week

Double-digit XRP by mid-year

Triple-digit XRP by late 2025 or early 2026

No guarantees, of course — but the structure is clear, and the setup is there.

For context, I view the November rally as XRP simply reverting to where it would have been had regulatory pressure not artificially suppressed the price. That move wasn’t the bull run — it was a reset.

Importantly, alt season still hasn’t kicked off (just look at BTC dominance), and XRP’s fundamentals are stronger than ever:

Lawsuit behind us

ETFs likely coming

Ongoing partnerships

Pro-crypto regulatory tone globally

Technically and fundamentally, XRP has never looked better.

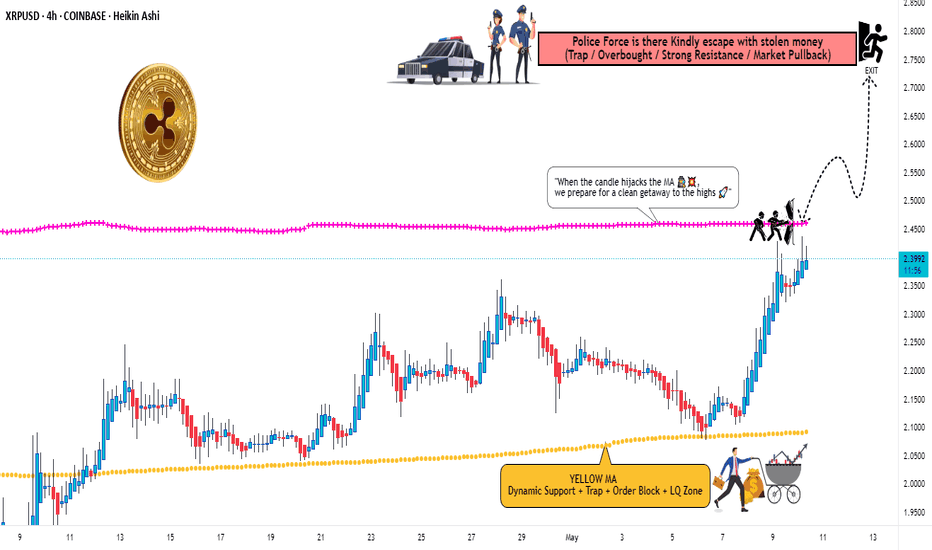

"Ripple" Crypto Heist - Bullish Breakout Plan!🌍 XRPUSD Crypto Heist Plan: Unleash the Thief Trading Style! 🤑💸🚀

Dear Market Mavericks & Crypto Bandits, 🏴☠️

Get ready to pull off the ultimate XRPUSD market heist with our Thief Trading Style, blending razor-sharp technical analysis and cunning fundamental insights! 📊🔥 Our mission? Storm the market, grab those bullish profits, and escape before the Dangerous Red Zone traps us in overbought chaos, consolidation, or a bearish reversal. 💥 Let’s outsmart the market and cash out like legends! 🏆🎉

📈 The Heist Blueprint: Long Entry Strategy

Entry Point 🚪:

The breakout is your signal! Wait for XRPUSD to smash through the Moving Average (MA) at 2.5000—that’s your green light for bullish glory! 🌟

Pro Tip:

Set Buy Stop Orders just above the MA for breakout confirmation.

OR place Buy Limit Orders at the most recent 15M/30M swing low/high for pullback entries.

Set an ALERT on your chart to catch the breakout in action! 🔔

Stop Loss (SL) 🛑:

Breakout traders: Hold off on setting your SL until the breakout confirms. Place it at the recent 4H swing low (2.3000) for swing/day trades.

Risk Management: Adjust SL based on your lot size, risk tolerance, and multiple orders. Play it smart—this is your safety net! ⚠️

Rebels beware: If you stray from the plan, you’re dancing with fire. Own the risk! 🔥

Take Profit (TP) 🎯:

Aim for 2.7500—our golden exit.

Escape Plan: If the market screams overbought or shows reversal signs, get out early! Don’t get caught in the Red Zone trap. 🚨

🧲 Scalpers’ Corner 👀

Scalp LONG only—ride the bullish waves! 🌊

Got big capital? Dive in now. Smaller stack? Join the swing traders for the full heist.

Use Trailing Stop-Loss to lock in gains and protect your loot. 💰

📡 Market Pulse: Why XRPUSD?

The XRPUSD market is in a neutral trend with a high probability of bullish momentum. Here’s the intel driving our heist:

Fundamentals: Dive into macroeconomic data, COT reports, geopolitical events, and news sentiment.

Intermarket Analysis: Watch correlated assets for clues.

Seasonal & Positioning Trends: Align with the market’s rhythm.

Future Targets: Check the Overall Score for a full breakdown! 👉🌏🔗

⚠️ Trading Alert: News & Risk Management 📰

News releases can flip the market like a switch! Protect your positions:

Avoid new trades during high-impact news.

Use Trailing SL to secure profits and minimize losses.

Stay sharp—volatility is our friend, but only if we’re prepared!

💪 Join the Heist & Boost the Plan!

Hit the Boost Button to supercharge our Thief Trading Style and make this heist legendary! 🚀 Every boost strengthens our crew, helping us plunder profits daily with ease. 💥 Let’s dominate the XRPUSD market together! 🤝

Stay tuned for the next heist plan! 🐱👤 Keep your charts locked, your alerts set, and your trading spirit wild. See you in the profits, bandits! 🤑🎉

#ThiefTrading #XRPUSD #CryptoHeist #TradingView #MakeMoney

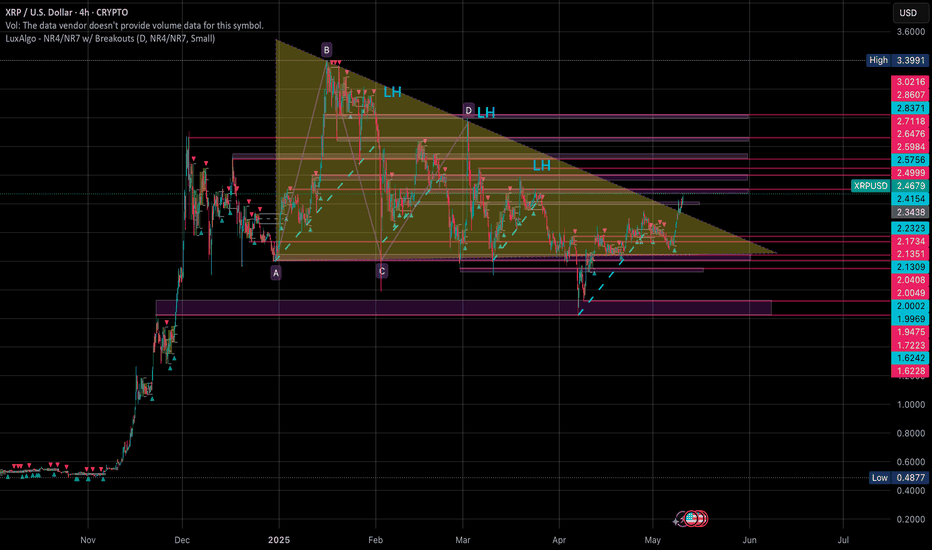

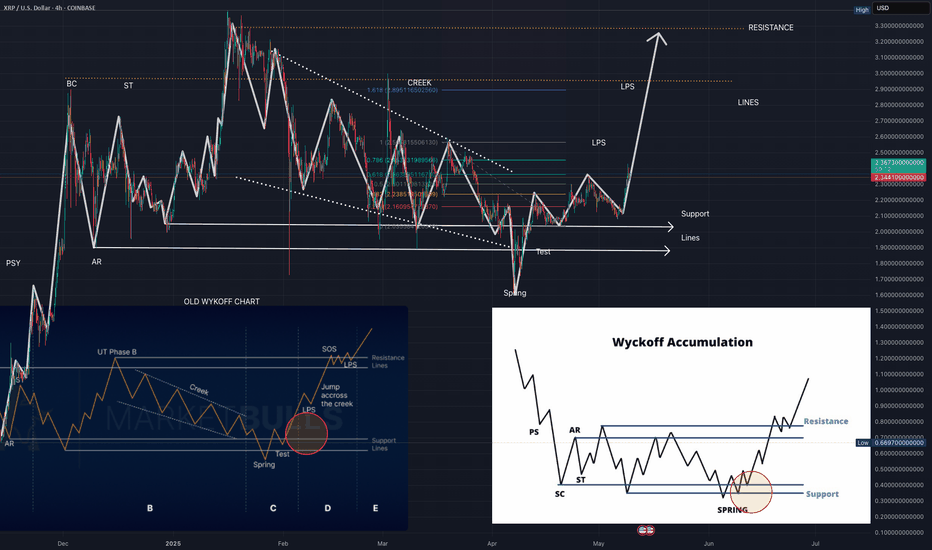

TA: XRP | Wyckoff Pattern Back on TrackSo, here’s the deal—weeks ago I called for a big breakout in XRP based on what looked like a textbook Wyckoff Accumulation pattern. Everything was lining up perfectly: we had the Preliminary Support (PSY), Automatic Rally (AR), Secondary Test (ST), and even a clean Spring. It all screamed “ready for liftoff.” But then… nothing happened.

That bugged me. The pattern looked so good, so why didn’t we break out?

After going back through the chart, I spotted what I missed: there was one last “Test” phase that hadn’t fully played out. This is a common step in Wyckoff where price revisits support to confirm that demand is truly in control. It’s easy to overlook, especially when the rest of the pattern looks complete.

Now that the Test has occurred and held, we’re finally seeing signs of strength again—back on track with Wyckoff expectations.

⸻

🔍 Quick Breakdown of the Chart (See Image Above):

We’re comparing XRP’s current 4H chart with two classic Wyckoff diagrams (bottom right and bottom left). Here’s what we’re seeing:

• PSY (Preliminary Support): Initial stop to the big drop, early buyers step in. ✅

• AR (Automatic Rally): Quick bounce after PSY. ✅

• ST (Secondary Test): Price dips again to test support. ✅

• Spring: The shakeout move—liquidity grab below support before the real move up. ✅

• Test: This is the step I originally missed. Price came back to re-test Spring zone to confirm strength. ✅

• LPS (Last Point of Support): Where price finds a stable footing before trending up. This is what we’re entering now. 🔥

⸻

🚀 What to Expect from Here:

• We’ve likely completed the full Wyckoff Accumulation.

• Price is now forming LPS, a key zone before the markup phase (bullish breakout).

• Next target zones are around $2.50 → $3.00, as marked on the chart.

• If we break those resistance lines, we could see a strong upside continuation.

⸻

💬 Final Thoughts:

It’s easy to get tunnel vision when you’re looking at these patterns—especially something as nuanced as Wyckoff. But this was a good reminder for me (and hopefully you too) that patience and re-checking your work always pays off.

Now that we’ve accounted for the missing Test, I feel way more confident that this move is real.

Let’s see what XRP brings in the next few sessions.

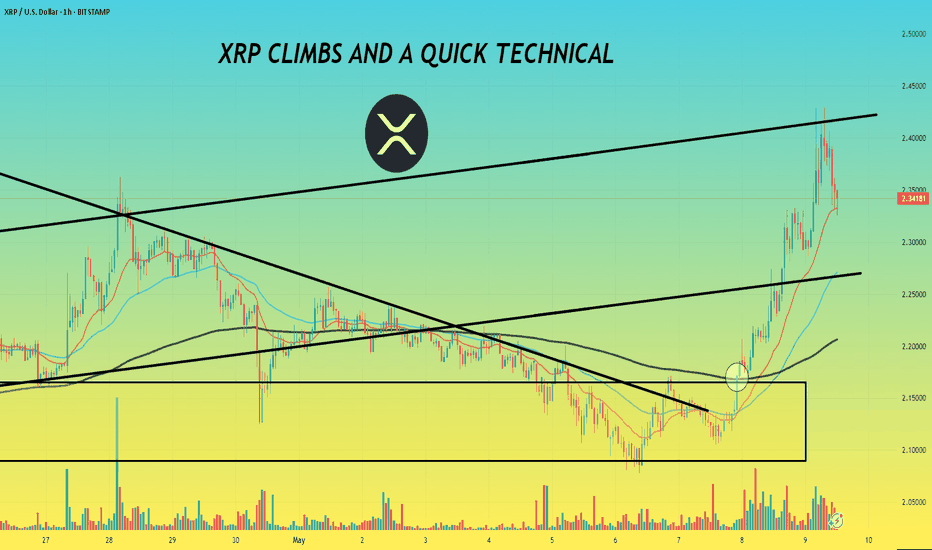

XRP CLIMBS AND A QUICK TECHNICAL🔥 Hey hey, hope all is well, been a few days and figured I'd chime in and we'd do a quick rundown on our technical and look into how our chart's currently playing out, this shouldn't take too long so feel free to join, thanks.

🔥 Right off the bad we can see how this sort of resistance level formed after we last got that channel rejection in April which ended up pushing us further down and down until bulls were able to break that level and get the much sought after breakout which in turn saw our 20,50 day EMA's finally converge which in turn led us to see bulls taking back that 200 EMA which only boosted things propelling us back up into our ascending channel.

🔥 We already know that ascending channel has been doing a lot for us the last few weeks, so it's fair to see that resistance hit again at $2.4 which in itself is a win considering we we're able to establish a higher high versus our last local high on the 28th in which the highest candle closed out at $2.33 so definitely gonna take this latest pull back up as a bullish win.

🔥 Main thing we'll have to watch for now is the bottom of our channel, we already know we'll likely see some price action start trading within the channel as both sides gear up for another tense battle but all of this is excluding a new exciting development for Ripple which I will get into with the next idea.

🔥 Just wanted to keep this idea simple and technical for our technical traders out there, watch that ascending channel and those EMA's. We've already discussed and focused on the fact that the EMA's are lagging indicators but the fact still stands they can give us good confirmation on the trend and it's direction so definitely keep those eyes peeled.

🔥 I've got to run but thanks for tuning in as always for a quick ta, really appreciate it and definitely keep tuned for that next idea with the new development, excited to post on that when I get back and as always, thanks for the support and let's keep our heads up.

Best regards,

~ Rock '

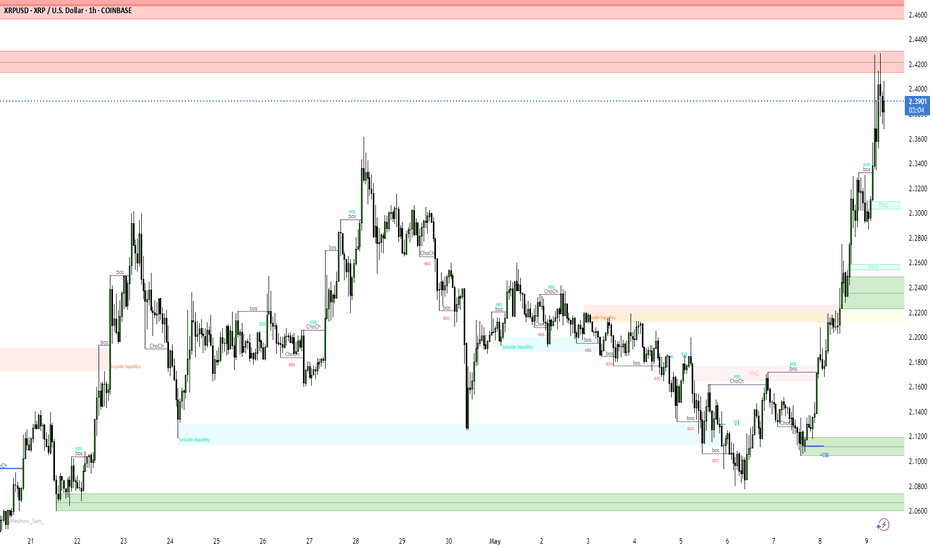

XRP Price Showing Support at Key LevelsXRP Price Action Update (Friday)

Chart Overview: We're analyzing the 1-hour chart. The orange lines represent weekly opens over the past few months, which have acted as support levels.

Support and Resistance: The price has consistently found support at key levels, currently holding around the $2.29 range. It's also above the weekly close target of $2.35-$2.36, aiming for the next target around $2.44.

Trend Reversal Potential: If the price can hold above the $2.44 level and move toward $2.59, it would indicate a trend reversal on the weekly chart, moving us out of the current downtrend.

Watch for Retracement: Expect a possible price retracement due to the large value gap. If there's no immediate retracement, it might happen over the weekend before continuing upward.

Break of Structure: The daily chart has shown a break of structure, which is a positive sign. Keep an eye on the key order block for further confirmation.