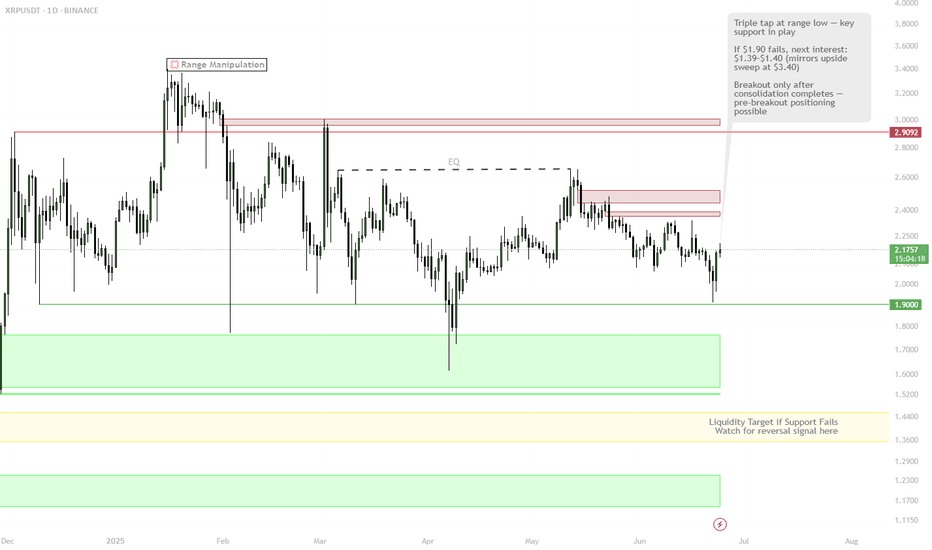

XRP — Triple Tap at Support or One More Low Before Lift-Off?🎯 BINANCE:XRPUSDT Trading Plan:

Scenario 1 (Support Holds):

Bullish above $1.90 — possible pre-breakout setup if structure improves

Look for volume/impulse above midrange to confirm move

Scenario 2 (Sweep Lower):

If $1.90 fails, set alerts at $1.39–$1.40 for reaction/reversal setup

Entry on strong reversal pattern at sweep zone

No Trade:

No action unless price at the range extremes or showing breakout structure

🔔 Triggers & Confirmations:

Only engage after confirmation: bullish SFP at $1.90 or $1.39–$1.40, or clear structure before breakout

📝 Order Placement & Management:

Buy: Only at $1.90 (on reclaim) or $1.39–$1.40 (on strong reversal)

Stop: Below range low ($1.90) or below sweep zone ($1.39)

Targets: $2.90 (range high), then $3.40 (liquidity sweep)

🚨 Risk Warning:

Wait for range extremes or breakout confirmation

Avoid chasing chop — patience until the setup is clean

XRPUSDT.3L trade ideas

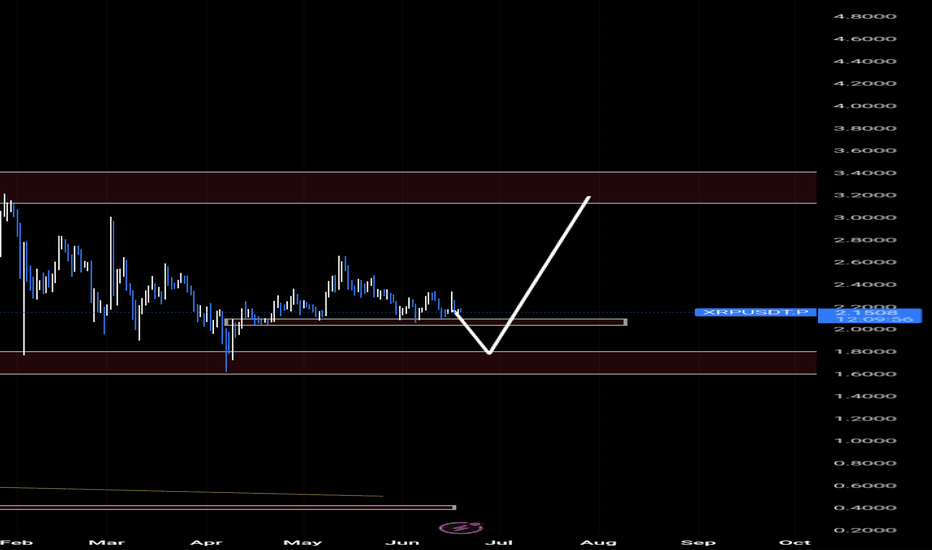

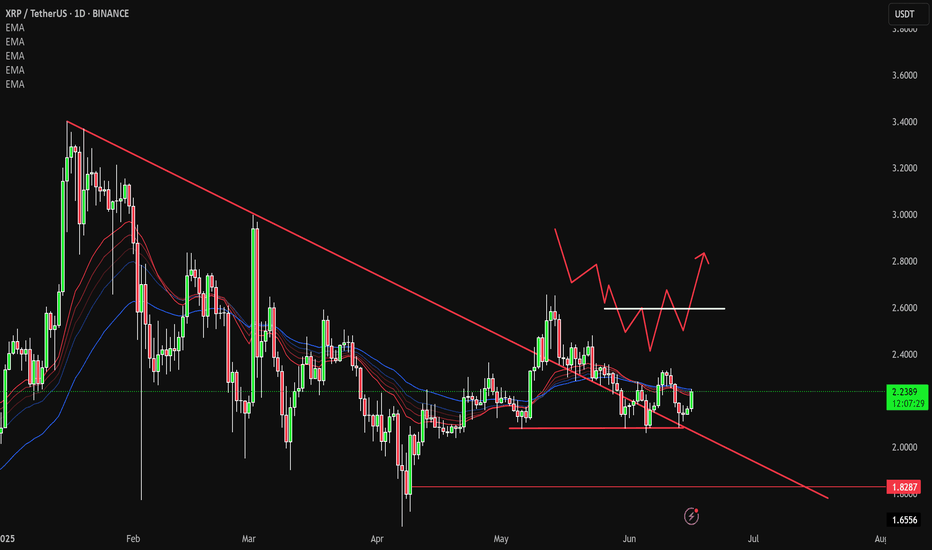

Possible outcome for $xrp 🚀 XRP Set for a Major Breakout: Bullish Outlook on XRP/USDT

The XRP/USDT chart on the daily timeframe presents an exciting bullish setup that could see XRP rally towards significant highs in the coming months. Let’s break down the key technical insights and what they could mean for traders and investors.

📊 Current Price Action

At the time of analysis, XRP is trading around $2.15. The price has been consolidating in a wide range after an explosive move that took XRP beyond the $3 mark earlier in the year. This consolidation reflects market indecision but also builds up potential energy for a strong directional move.

🏗 Key Levels

Support Zone: $1.70 - $1.85

This zone has been identified as a strong demand area where buyers previously stepped in, preventing further decline. The chart suggests XRP might revisit this area, forming a solid base before a rally.

Immediate Support: ~$2.00 - $2.05

There’s a minor support level here, but the major bullish reversal is expected closer to the deeper support zone.

Resistance Zone: $3.20 - $3.50

This is the target region for the next bullish leg. Historically, this area has capped XRP’s upward movements, but a breakout could open the door to higher prices.

🔑 Bullish Scenario

The chart outlines a potential move where XRP could: ✅ Dip into the lower support range between $1.70 and $1.85, trapping late sellers and inducing demand.

✅ From this accumulation zone, XRP could launch a powerful upward rally.

✅ The rally could target the $3.20-$3.50 resistance area — a key zone that aligns with prior highs.

💡 Why This Setup Looks Bullish

Clear structure of higher timeframe accumulation: The long consolidation phase suggests that XRP may be preparing for a large move, typical after prolonged sideways price action.

Liquidity grab potential: A dip below minor support would shake out weak hands, before a sharp reversal.

Room for upside: Once $3.20 is tested and broken, FOMO (fear of missing out) could drive prices higher, possibly beyond prior highs.

⚠ Risk to Monitor

While the setup points to a bullish move, traders should keep an eye on:

The strength of the $1.70-$1.85 zone. If this level fails, deeper downside could occur.

External factors such as regulatory news or broader crypto market sentiment that might impact XRP’s price action.

🌟 Conclusion

The XRP/USDT daily chart hints at an imminent bullish opportunity as price approaches a key support zone. If the outlined path unfolds, XRP could see significant upside towards the $3.20-$3.50 area in the coming months. For traders, patience and careful risk management at the support levels could position them to ride the next wave of XRP’s move.

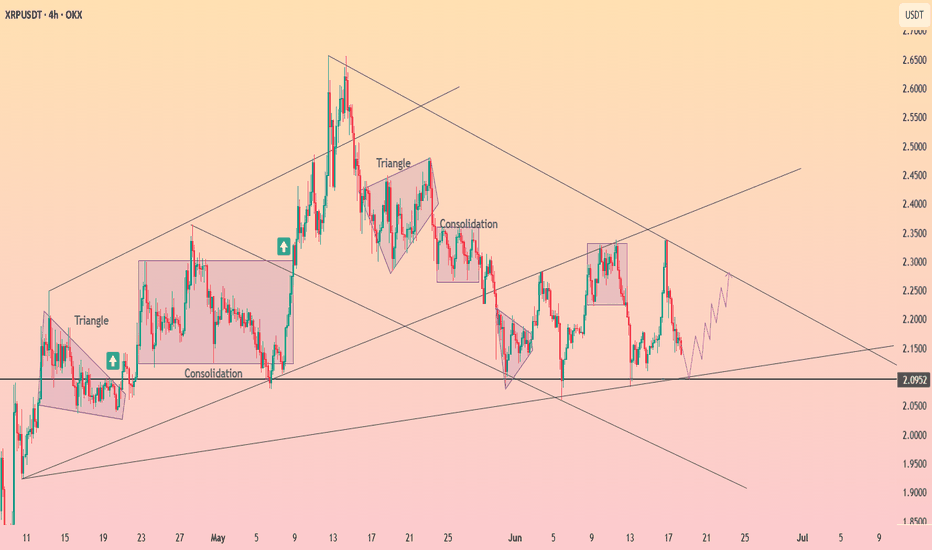

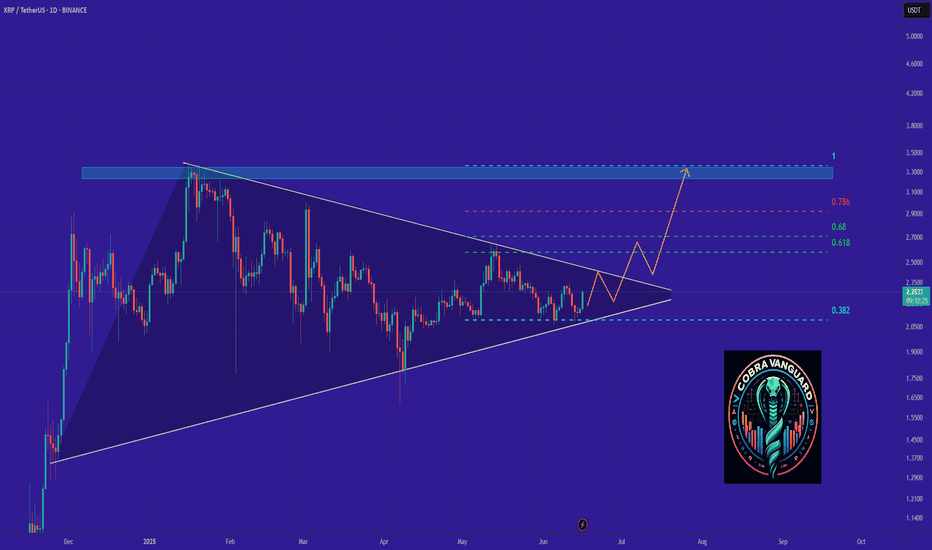

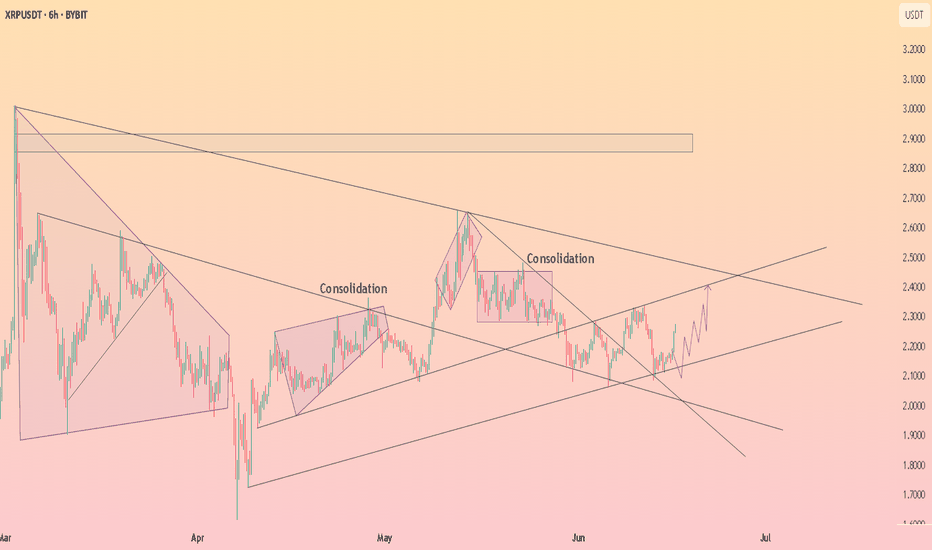

XRPUSDT Forming 2017-Style Flag — Major Breakout Loading! BINANCE:XRPUSDT is currently forming a classic bullish flag pattern, a setup that looks strikingly similar to what we saw back in 2017 before CRYPTOCAP:XRP went on a massive run. The price has been consolidating within a tight range, and this could be the calm before a powerful breakout.

Back in 2017, a similar flag formation led to a parabolic uptrend once the resistance was broken. While history doesn’t repeat exactly, this pattern suggests the potential for a significant upside move if the breakout confirms. Traders and investors should keep a close eye on this structure — a breakout from this flag could reignite bullish momentum and open the door for a sharp rally.

This is a buy and hold scenario for those who believe in XRP’s potential, but remember — risk management is key. Always use a stop loss below the flag support to protect your capital. Momentum could build quickly, so stay alert and watch for volume confirmation on the breakout.

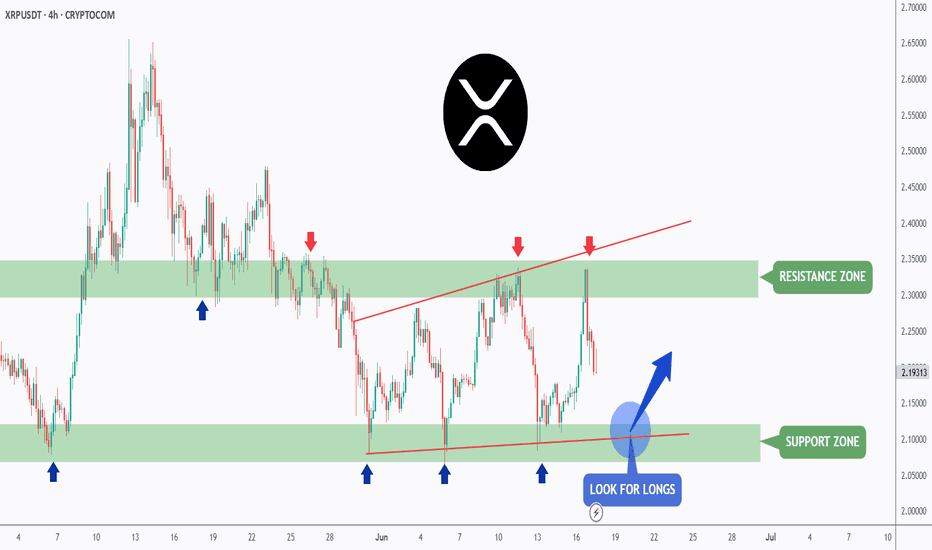

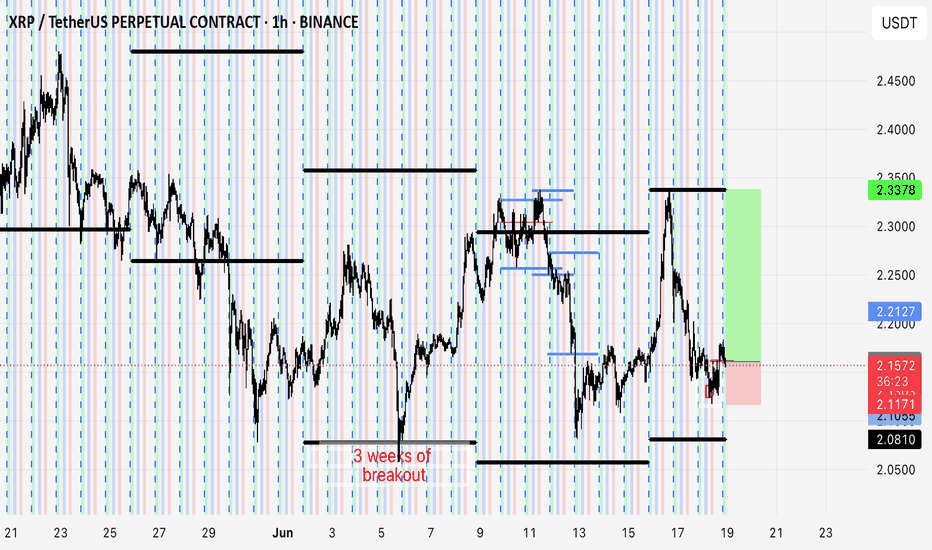

XRP - Trade The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been trading within a range between $2 and $2.35 in the shape of a flat rising broadening wedge pattern in red.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the green support and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

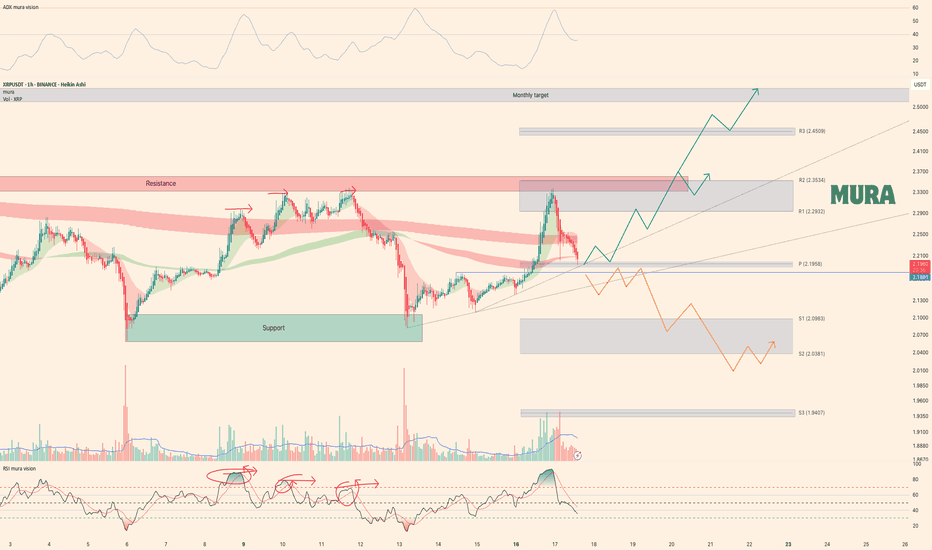

Weekly trading plan for XRP BINANCE:XRPUSDT Price has reached the weekly pivot point, so now it is important to understand the further reaction. Several trend lines can be seen on the chart. If the lower trend line and the level of 2.18 are broken, the price will probably continue its downward movement to the support zone, but it will already renew the local bottom.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

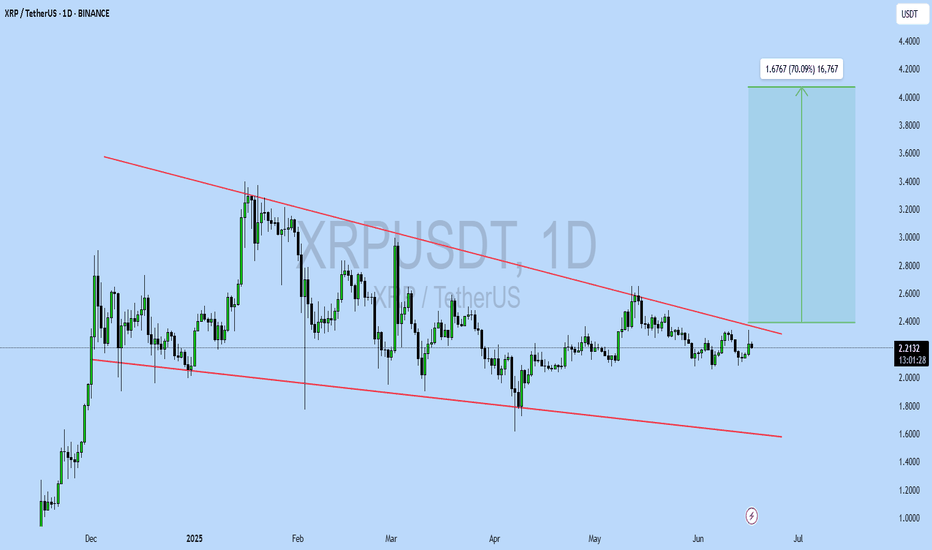

XRPUSDT UPDATEPattern: Falling Wedge

Current Price: $2.2130

Target Price: $4.00

Target % Gain: 70.09%

Technical Analysis: XRP is forming a falling wedge on the 1D chart. Price is approaching the resistance trendline with potential for breakout. Volume looks stable; a breakout above $2.40 may trigger bullish momentum.

Time Frame: 1D

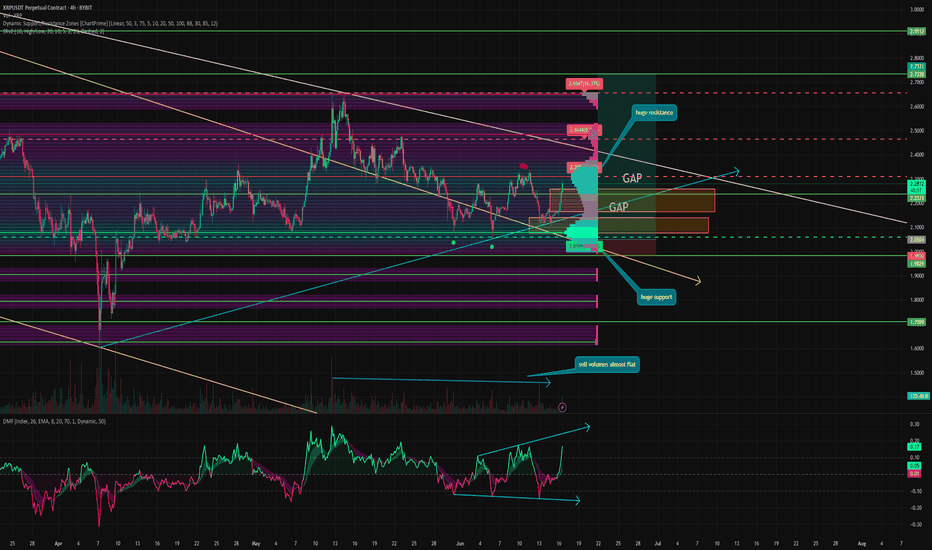

The FATE of XRP will soon be DECIDED🔥 Hello everyone! I haven't reviewed XRP because it's not the best token for trading. It's purely an institutional token.

But it's painting a very interesting picture. Let's take a closer look:

📊 XRP is trading in a key area of interest and is therefore currently sandwiched between two powerful levels: support at 2.08 and resistance at 2.31. In addition, the price has just broken out of a downward channel and needs time to consolidate above it.

During the last impulse, two gaps formed below: 2.14 - 2.07 and 2.25 - 2.16. And as we know, in 99% of cases, gaps close sooner or later.

XRP is now literally at a crossroads and needs a bullish catalyst to move higher. Because it doesn't need a catalyst to move lower.

⚙️ Metrics and indicators:

Volume - there is a slight divergence between sales volumes and price. But it is practically flat, which means that seller pressure is still high.

Money Flow - in strict harmony with the price. Money leaves during corrections and enters during growth. The asset is completely flat, awaiting news or activity in the market.

📌 Conclusion:

XRP currently looks as unattractive as possible for trades, which means it's the best time! The next direction of price movement will soon become clear, and it will be possible to open positions.

Personally, I am inclined to believe that in the short term, we will go lower, along with the entire market. We will fill the GAP's lower, we may test $2, and then we will go higher.

Also, don't forget that the deadline for XRP ETF applications expires in the summer. And the adoption of the ETF could be just the catalyst we need. And considering that this is an institutional asset:

➡️ as soon as inside information about adoption or non-adoption appears, it will be visible on the chart when all institutional insiders start taking positio ns.

➡️ XRP may see good liquidity inflows right away. No one is holding it as a semi-ETF, as was the case with Ethereum. No one will sell it.

So for now, I'm just sitting back and watching what happens.

Have a great week, everyone!

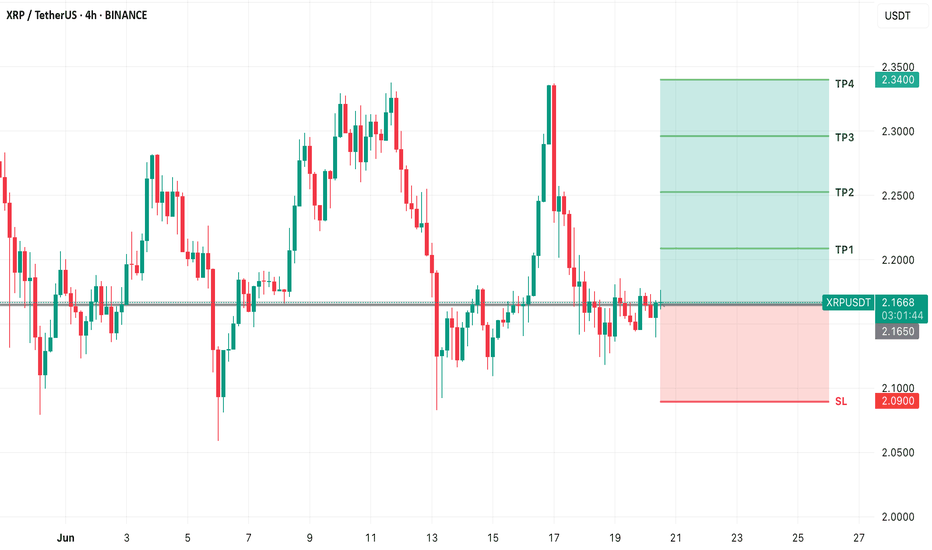

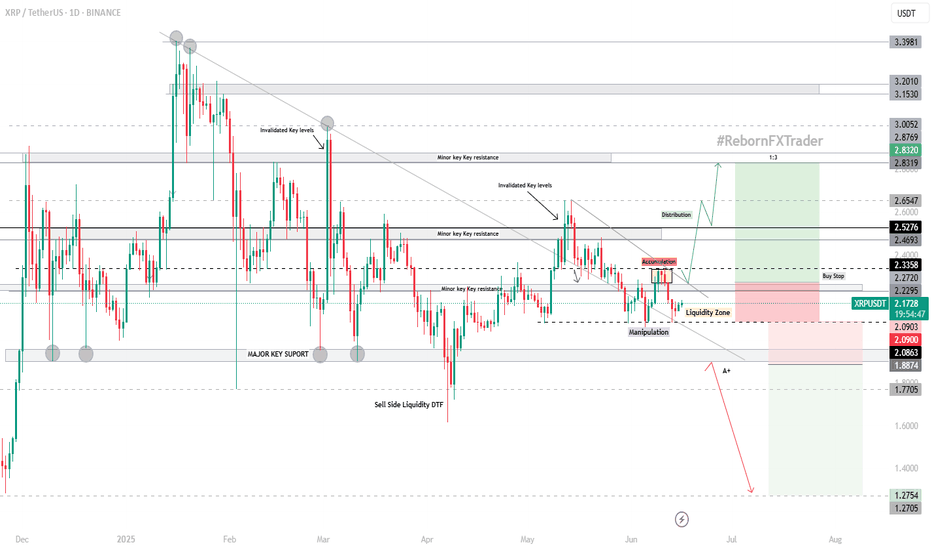

XRP/USDT Daily-Timeframe (DTF) Technical & Fundamental AnalysisXRP/USDT Daily-Timeframe (DTF) Technical & Fundamental Analysis

On June 12, Ripple and the SEC jointly petitioned Judge Torres to vacate the injunction on institutional XRP sales and reduce penalties. Legal analyst John Deaton estimates a 70% chance that the outcome will favor Ripple, which could unlock momentum toward the $3.55 high.

On Technical side XRP/USDT is consolidating within a descending triangle pattern, reflecting both indecision and potential breakout pressure. The price is currently ranging between 2.0800–2.3300, with several minor key levels recently invalidated , indicating liquidity grabs and a developing Accumulation-Manipulation phase common in smart money behavior.

We’ve identified a potential buy-side opportunity if the price breaks and closes above 2.2700, a key minor resistance level. The trendline has been respected with three confirmed touches, but price remains just outside it, suggesting that a breakout above the triangle and the 2.2700 zone could trigger a strong impulsive move toward the upside.

📊 Trade Setup

📍 Area of Interest (AOI): 2.2720 (Buy on DTF candle close above)

🛡 Stop-Loss: 2.0900 (Below the liquidity zone)

🎯 Take Profit: 2.8320 (Next minor resistance / ~1:3 RR)

This setup is supported by institutional accumulation behavior, with manipulation and invalidated key levels paving the way for a potential breakout and rally.

Fundamental Outlook

ISO 20022 Compliance Boost

Ripple’s Interledger Protocol (ILP) recently gained formal approval for ISO 20022, the global standard for financial messaging adopted by banks and SWIFT. This enhances RippleNet and XRP’s integration into the traditional financial system.

SWIFT Endorsement

SWIFT has officially endorsed ISO 20022-compatible digital assets, directly benefiting XRP and increasing its potential utility across cross-border payment systems.

ETF Momentum

According to Polymarket, there’s an 83% probability that a WisdomTree XRP spot ETF will be approved this year — a major step toward institutional exposure and credibility.

Geopolitical Recognition

In a surprising move, former President Trump included XRP among five digital assets proposed to be part of a U.S. “crypto reserve”, signaling growing mainstream and governmental recognition.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

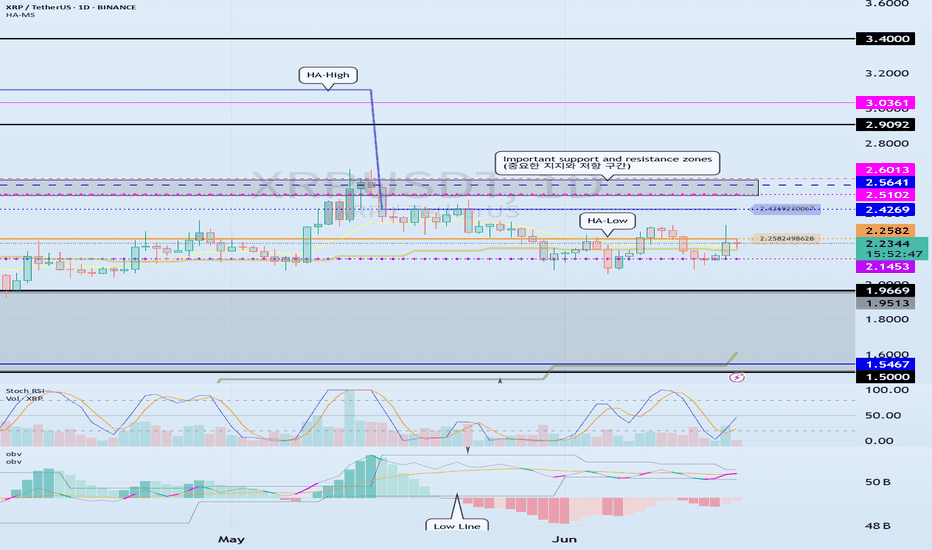

About the chart that shows a sideways movement...

Hello, traders.

If you "follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

When you study charts, you will realize how difficult it is to move sideways.

Therefore, depending on how long the sideways movement was before the big wave, the size of the wave is also predicted.

However, in the charts showing sideways movement, the price range and wave size are often known after the wave appears.

This shows that the location of the sideways movement and the size of the sideways wave are important.

-

Looking at the chart above, we can say that it is showing a sideways movement.

However, since the price is located at the lowest price range, it is better to exclude this chart.

The reason is that if it is showing a sideways movement at the lowest price range, it is likely that the trading volume has decreased significantly due to being excluded from the market.

This is because it is likely to take a long time to turn into an upward trend in this state.

-

Looking at the chart above, the price is showing a sideways movement while maintaining a certain interval after rising.

The sideways movement is about 31%, so it may be ambiguous to say that it is actually sideways.

However, if the price moves sideways while maintaining a certain interval after rising, it means that someone is trying to maintain the price.

Therefore, when it shows a movement that breaks through the sideways section, it should be considered that there is a possibility that a large wave will occur.

The wave can be either upward or downward.

Therefore, it is necessary to be careful not to jump into a purchase with the idea that it will definitely rise in the future just because it moves sideways.

A box section is set at both ends of the sideways section.

Therefore, it is recommended to proceed with a purchase in installments when it shows support after entering this box section.

In other words, it is important to check the support in the 1.5-1.9669 section or the 25641-2.6013 section.

You can see that the HA-Low indicator and the HA-High indicator are converging.

Therefore, if this convergence is broken, it is expected that a trend will be formed.

-

Like this, you should measure the price position of the sideways movement and the width of the sideways movement well and think in advance about whether to proceed with the transaction when it deviates from that range.

Otherwise, if you start trading after the wave has already started, you may end up giving up the transaction because you cannot overcome the wave.

Since it is not known when the movement will start once the sideways movement starts, individual investors easily get tired.

Therefore, when the coin (token) you want to trade shows a sideways movement, it is recommended to increase the number of coins (tokens) corresponding to the profit while conducting short-term trading (day trading).

If you do this, you will naturally be able to see how the sideways waves change, and you will be able to hold out until a big wave starts.

I think there are quite a few people who are not familiar with day trading and say they will buy at once when the wave starts.

If you can hold out well against the wave, you will get good results, but there is a possibility that the trade will fail 7-8 times out of 10, so if possible, it is good to get used to the feeling by day trading coins (tokens) that show this sideways pattern.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

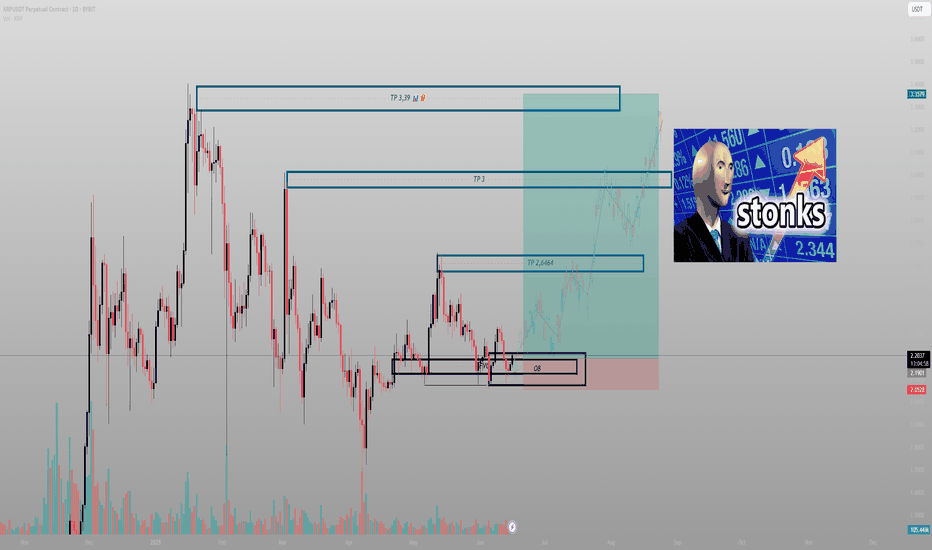

They called it consolidation. I called it accumulation.Price was coiled in a defined OB + FVG combo — building pressure while the rest of the market slept. The moment we swept the low into the Order Block, the trade became personal. This wasn’t noise — it was alignment.

Why I entered:

Daily FVG + OB overlap — textbook Smart Money entry zone

Volume spike at the OB low, signaling smart accumulation

Structural BOS confirmation on intraday after sweep

What followed was an impulsive push through inefficiencies, climbing level by level toward pre-defined liquidity pools.

Targets:

TP1: 2.6464 — rebalancing zone

TP2: 3.00 — clean inefficiency top

TP3: 3.39 — liquidity magnet

Trade thesis:

Entry was set between 2.05–2.10, stop placed with precision below the OB. No guessing. Just calculated structure + narrative.

I don’t chase moves. I let price come to my zone. And when it does, I strike with full conviction.

Final words:

“Your edge doesn’t scream. It sits quietly in imbalance — waiting.”

XRP BREAKING OUT!!!Looking at XRP I see price breaking out of the daily downtrend with a invert head and shoulders pattern. In my experience these patterns have strong impulses in crypto trading and I expect BTC ETH and XRP all to move up from these levels as we are already seeing breakouts to upside on lower timeframes too.

16.June (today) is also big for XRP and SEC case, so potential news regarding the case could attribute to XRP breakout and strong moves up.

Immediate resistance level at 2.60. IF broken, price would then go towards the 3 dollar mark. Must look out for potential profit taking in these levels and in current political sphere should not expect any explosive moves right away.

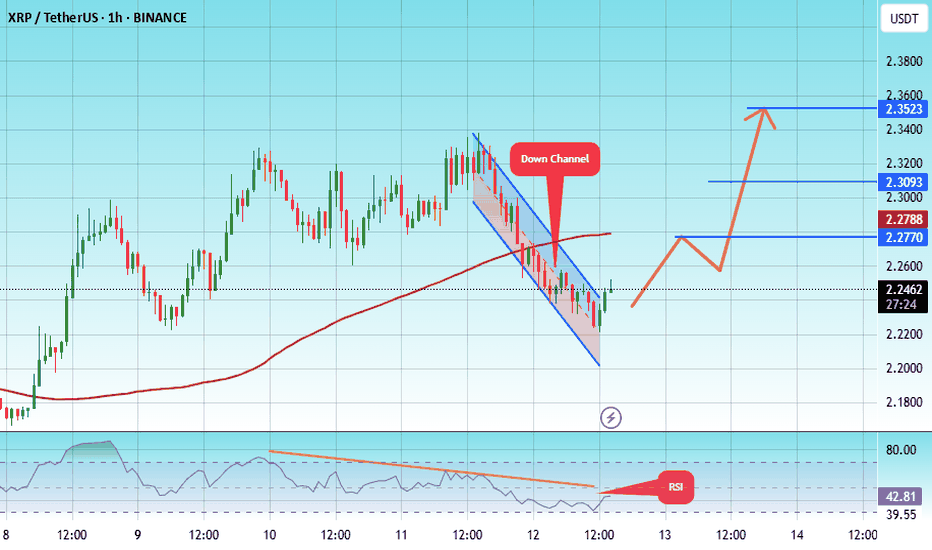

#XRP/USDT#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.21.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 2.24

First target: 2.27

Second target: 2.30

Third target: 2.35

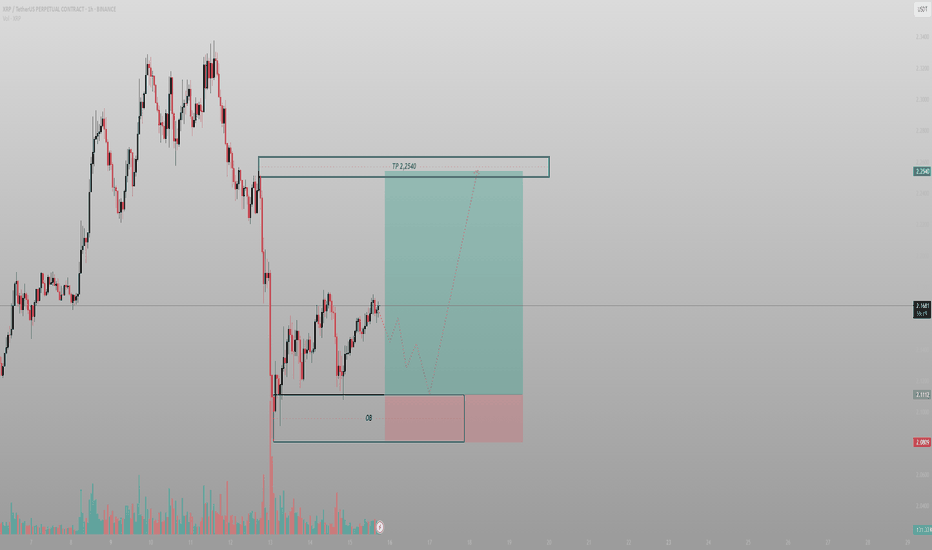

The OB is set. The move just hasn’t been claimed yetThis is structure, not speculation. XRP tapped the 1H Order Block, held its low, and began building compression. Price is coiling — not failing. That matters.

The logic:

After the initial drop, price swept local lows into an untouched OB, then printed higher lows into a tighter range. That’s not weakness — that’s staging. Smart Money builds quietly. This is the echo of their positioning.

Above us sits a single, untested draw:

TP: 2.2540 — inefficiency fill, paired with external liquidity resting above last week's mid-range

Expecting one more dip into the OB is not only possible — it’s ideal. That’s where they’ll trap the impatient.

Execution:

Entry: 2.11–2.13 retest (into OB)

SL: Below 2.08

TP: 2.2540

No noise. No chasing. This is a campaign move — the kind that rewards precision, not emotion.

Final thought:

“I don’t trade the bounce. I trade the buildup before it’s even visible.”

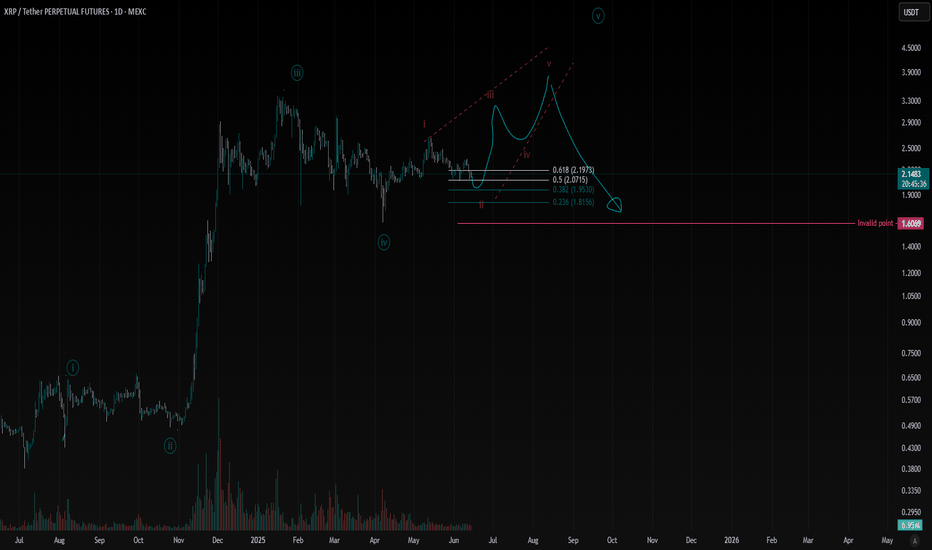

XRP's Ending Diagonal: Climactic Push Towards $3.5-$3.8?XRP: Ending Diagonal & Final Push ($3.5-$3.8 Target)

Hello TradingView,

My analysis suggests XRP is in its 5th Elliott Wave, unfolding as an Ending Diagonal. This pattern signals a climactic end to the current bullish cycle, often followed by a sharp reversal.

Key Levels:

Target: $3.50 - $3.80 (marked on chart). This aligns with the diagonal's upper trendline and Fibonacci extensions.

Invalidation: $1.5986 (marked in red). A decisive close below this level invalidates the diagonal structure.

Catalysts: Positive SEC lawsuit developments and Spot XRP ETF speculation provide fundamental tailwinds for this final push.

Outlook: Expect a significant correction after this diagonal completes near its target. Monitor $1.5986 closely.

Not financial advice. Trade wisely.

#XRP #Ripple #ElliottWave #EndingDiagonal #Crypto #TechnicalAnalysis #PriceTarget #Invalidation #Reversal #SEC #ETF #Blockchain #MarketAnalysis #Bullish #Altcoin #TradingStrategy

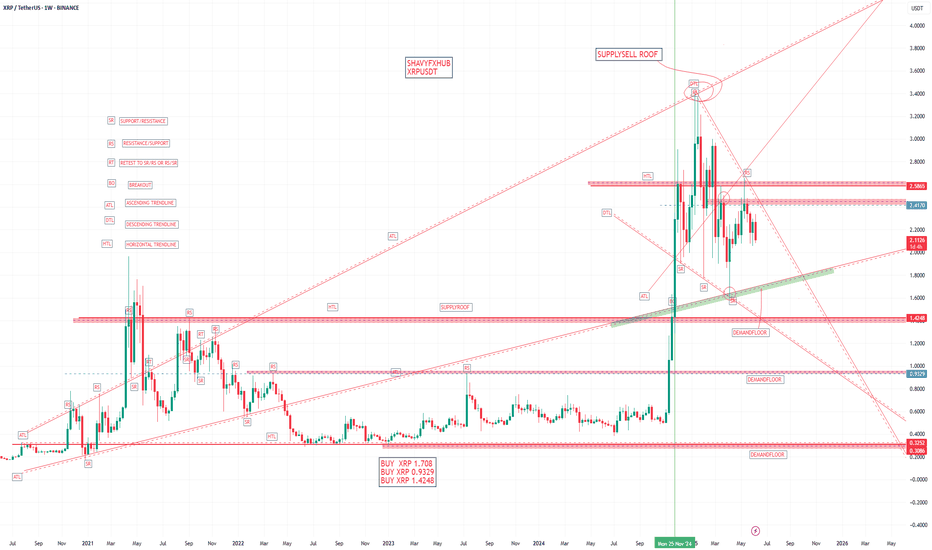

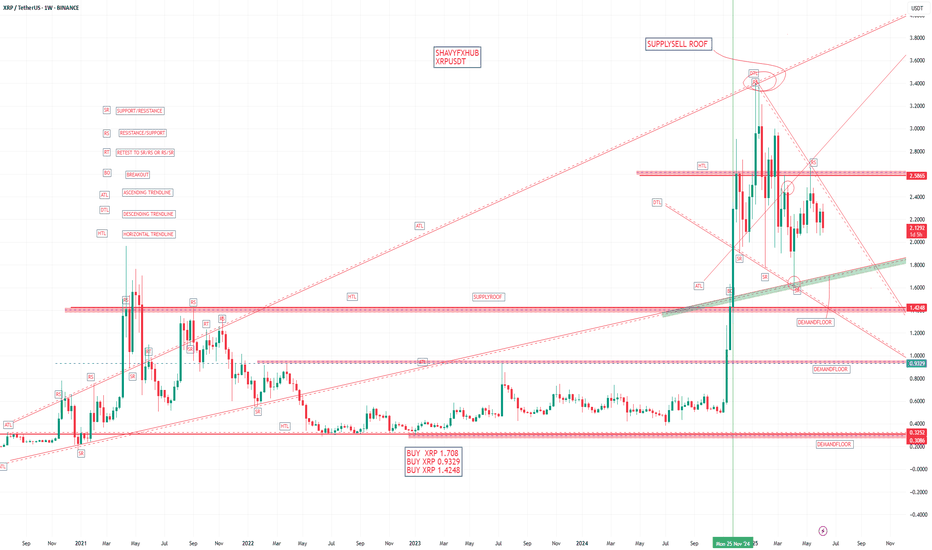

XRPXRP Fundamentals and key buy zone like the 0.9329,1.4248 and 1.708 zone will be watched

1. Regulatory Clarity and Legal Resolution

SEC Lawsuit Resolved: In May 2025, Ripple (the company behind XRP) reached a settlement with the U.S. SEC, reducing its fine and confirming that XRP is not a security for retail investors in the U.S. This has removed a major barrier for institutional adoption and market participation.

Crypto-Friendly Environment: The appointment of a pro-crypto SEC chairman and a more favorable regulatory climate under the current U.S. administration have further boosted confidence in XRP’s legal status and prospects.

2. Institutional and Product Developments

Spot ETF Speculation: There is strong market anticipation for an XRP spot ETF, with major asset managers (like BlackRock and Franklin Templeton) having filed applications. Analysts estimate a high probability of approval by the end of 2025, which could drive significant institutional inflows, similar to what was seen with Bitcoin and Ethereum ETFs.

RippleNet and XRPL Upgrades: Ripple is expanding its network and upgrading the XRP Ledger (XRPL) to support institutional use, including:

Ethereum compatibility (EVM sidechain)

On-chain lending and tokenization of real-world assets

Enhanced compliance and identity features for banks and regulated institutions

Liquidity pools and advanced asset recovery tools

These upgrades are designed to make XRPL a go-to platform for banks and large enterprises.

3. Use Case and Adoption

Cross-Border Payments: XRP is designed for fast, low-cost, and scalable cross-border transactions, positioning it as a competitor to traditional systems like SWIFT.

Partnerships: Ripple has established partnerships with hundreds of financial institutions globally, and is actively targeting the $7.5 trillion daily remittance market.

4. Technical Strength and Market Sentiment

Bullish Technicals: XRP has broken out of bearish patterns and is trading above key technical levels, with strong support from high trading volumes and institutional interest.

Price Predictions: Analyst forecasts for 2025 range from $2.85 (short-term) to $5.50 (year-end), with stretch targets as high as $10–$20 by 2030 if adoption accelerates and an ETF is approved.

5. Risks and Challenges

Market Volatility: XRP, like all cryptocurrencies, remains subject to high volatility and speculative trading.

Overbought Conditions: Technical indicators suggest potential for short-term pullbacks if the market becomes overheated.

Regulatory Delays: While the legal outlook has improved, any delays or rejections of ETF applications could trigger corrections.

Summary Table: XRP Fundamentals (2025)

Legal/Regulatory SEC lawsuit resolved; XRP not a security for retail; pro-crypto policy shift

Institutional Demand High, driven by ETF speculation and RippleNet upgrades

Technology Fast, low-cost, scalable; EVM compatibility; on-chain lending; tokenization

Adoption Growing, strong focus on cross-border payments and financial partnerships

Price Forecasts $2.85–$5.50 (2025), $10–$20 (2030, if adoption/ETF succeed)

Risks Market volatility, ETF approval uncertainty, possible short-term corrections

Conclusion

XRP’s fundamentals in 2025 are the strongest they have been in years, thanks to regulatory clarity, institutional interest, technological upgrades, and real-world adoption in global payments. The prospect of an XRP ETF and Ripple’s push for bank and enterprise integration are key drivers. However, investors should remain aware of volatility and regulatory risks

#xrp #btc #sol

XRPXRP Fundamentals and key buy zone like the 0.9329,1.4248 and 1.708 zone will be watched

1. Regulatory Clarity and Legal Resolution

SEC Lawsuit Resolved: In May 2025, Ripple (the company behind XRP) reached a settlement with the U.S. SEC, reducing its fine and confirming that XRP is not a security for retail investors in the U.S. This has removed a major barrier for institutional adoption and market participation.

Crypto-Friendly Environment: The appointment of a pro-crypto SEC chairman and a more favorable regulatory climate under the current U.S. administration have further boosted confidence in XRP’s legal status and prospects.

2. Institutional and Product Developments

Spot ETF Speculation: There is strong market anticipation for an XRP spot ETF, with major asset managers (like BlackRock and Franklin Templeton) having filed applications. Analysts estimate a high probability of approval by the end of 2025, which could drive significant institutional inflows, similar to what was seen with Bitcoin and Ethereum ETFs.

RippleNet and XRPL Upgrades: Ripple is expanding its network and upgrading the XRP Ledger (XRPL) to support institutional use, including:

Ethereum compatibility (EVM sidechain)

On-chain lending and tokenization of real-world assets

Enhanced compliance and identity features for banks and regulated institutions

Liquidity pools and advanced asset recovery tools

These upgrades are designed to make XRPL a go-to platform for banks and large enterprises.

3. Use Case and Adoption

Cross-Border Payments: XRP is designed for fast, low-cost, and scalable cross-border transactions, positioning it as a competitor to traditional systems like SWIFT.

Partnerships: Ripple has established partnerships with hundreds of financial institutions globally, and is actively targeting the $7.5 trillion daily remittance market.

4. Technical Strength and Market Sentiment

Bullish Technicals: XRP has broken out of bearish patterns and is trading above key technical levels, with strong support from high trading volumes and institutional interest.

Price Predictions: Analyst forecasts for 2025 range from $2.85 (short-term) to $5.50 (year-end), with stretch targets as high as $10–$20 by 2030 if adoption accelerates and an ETF is approved.

5. Risks and Challenges

Market Volatility: XRP, like all cryptocurrencies, remains subject to high volatility and speculative trading.

Overbought Conditions: Technical indicators suggest potential for short-term pullbacks if the market becomes overheated.

Regulatory Delays: While the legal outlook has improved, any delays or rejections of ETF applications could trigger corrections.

Summary Table: XRP Fundamentals (2025)

Legal/Regulatory SEC lawsuit resolved; XRP not a security for retail; pro-crypto policy shift

Institutional Demand High, driven by ETF speculation and RippleNet upgrades

Technology Fast, low-cost, scalable; EVM compatibility; on-chain lending; tokenization

Adoption Growing, strong focus on cross-border payments and financial partnerships

Price Forecasts $2.85–$5.50 (2025), $10–$20 (2030, if adoption/ETF succeed)

Risks Market volatility, ETF approval uncertainty, possible short-term corrections

Conclusion

XRP’s fundamentals in 2025 are the strongest they have been in years, thanks to regulatory clarity, institutional interest, technological upgrades, and real-world adoption in global payments. The prospect of an XRP ETF and Ripple’s push for bank and enterprise integration are key drivers. However, investors should remain aware of volatility and regulatory risks

#xrp #btc #sol