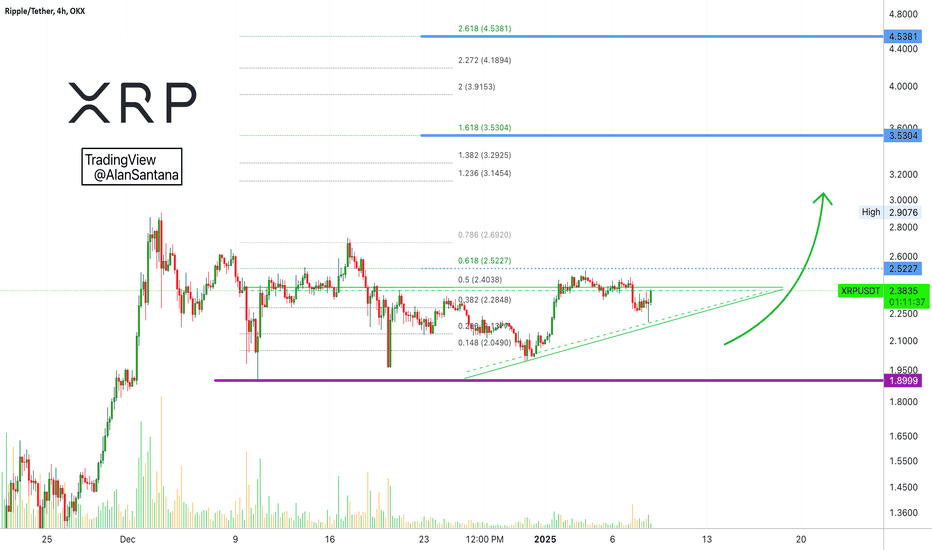

XRPUSDT Remains Intact. Or I should Say: Super StrongHigher lows since the 10th of December.

The last session produced a clear reversal signal in the form of DragonFly Doji.

This candlestick based signal is confirmed by the current session turning full green.

Additional bullish support comes from the fact that the recent drop was minimal and accompanied by no volume. Little bearish pressure.

I told you that XRP traders are very smart and they are not likely to sell knowing what is coming to this market. Knowing the massive potential they are likely to hold all the way up. And this is shown by the price action on this chart.

Bitcoin was shaken. The market as well as some whales were taking profits. This produced very little negative effect on XRPUSDT. Since XRP moved first and remains strong and ready to continue growing, we know the market will do the same.

This is just one more confirmation; we are bullish now, the market is bullish now, XRP is ready to grow. Look for higher and higher prices for months to come.

Thank you for reading and for your continued support.

You can choose to follow if you want to see, hear and feel more.

Namaste.

XRPUSDT.3L trade ideas

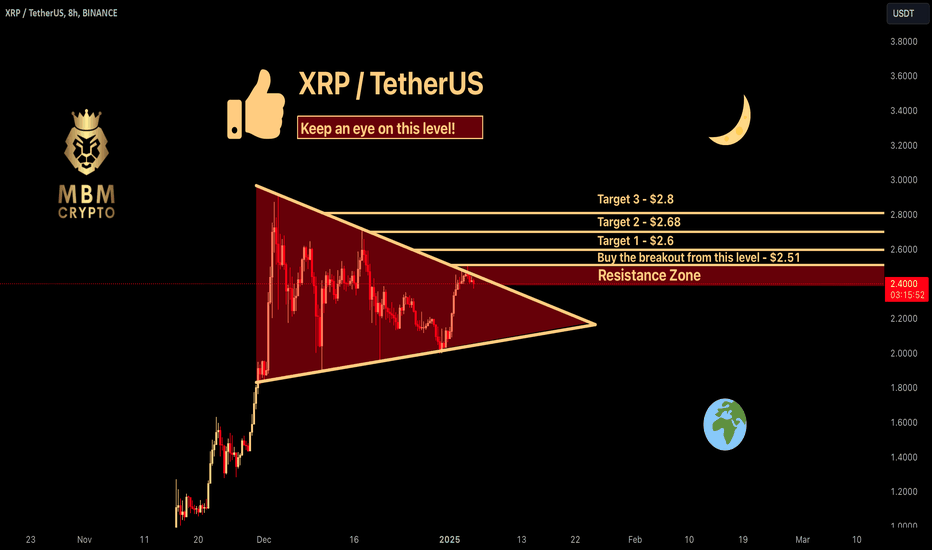

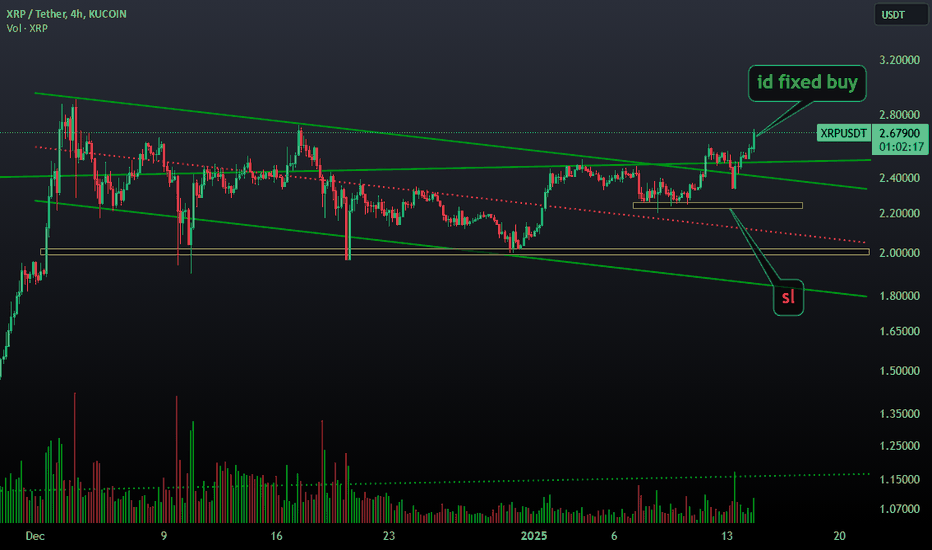

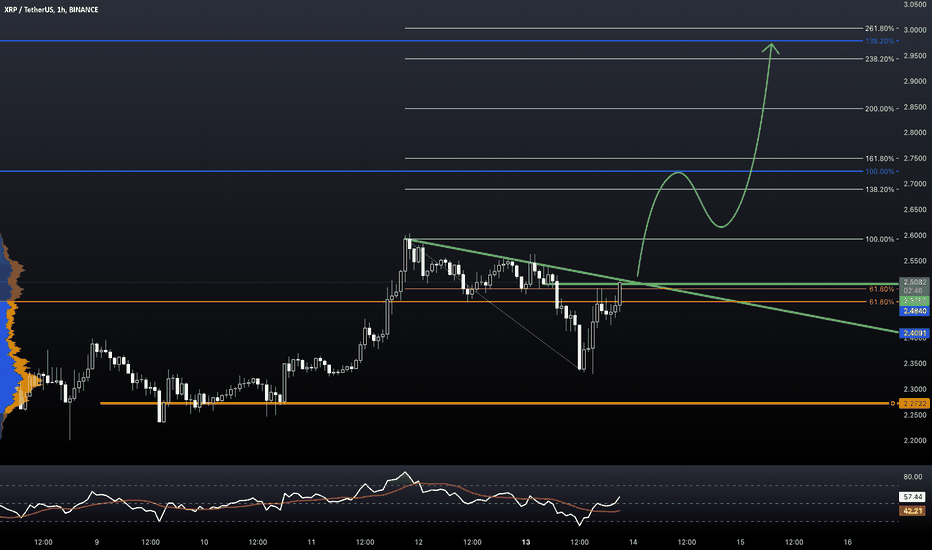

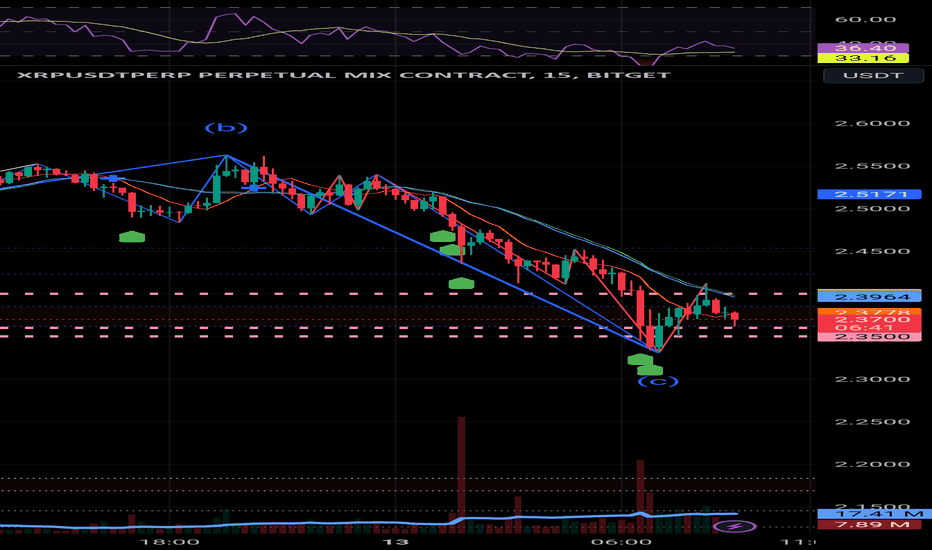

XRP: A new high is coming!Keep an Eye on XRP

Now is the time to watch XRP. If the price breaks to the upside, we could see a significant move that might take it above $3.

Trading Setup

If you’re considering trading XRP, here’s a quick setup that may help you.

The idea is: Buy when the price breaks above $2.51 and take profits at the levels shown in the chart.

Targets:

1. $2.6

2. $2.68

3. $2.8

-------------------------------------------

About our trades:

Our success rate is notably high, with 10 out of 11 posted trade setups achieving at least their first target upon a breakout price breach (The most on TW!). Our TradingView page serves as a testament to this claim, and we invite you to verify it!

i just short on XRP due to my personal trending line strategyAfter XRP failed to break its $2.6 trendline and broke its trendlines , It have to down to 2.4 for next target . Please note that this is just my personal experience and should not be used as a guide for you to trade based on a personal theory.

XRP to $4? Examining the Bullish Case and Key Resistance Levels

The information provided in this article is for informational purposes only and does not constitute investment advice. Please do your own research before making any investment decisions.

XRP, the cryptocurrency associated with Ripple Labs, has been a subject of much discussion and speculation in the crypto community. Its price movements have been closely watched by investors, especially in light of the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC).

Recent Price Action and Market Sentiment

Recently, XRP has shown signs of bullish momentum, leading to questions about its potential to break through key resistance levels. Several factors have contributed to this positive sentiment:

• Legal Developments: The ongoing legal battle with the SEC has been a major overhang on XRP's price. However, recent positive developments in the case have instilled confidence in investors.

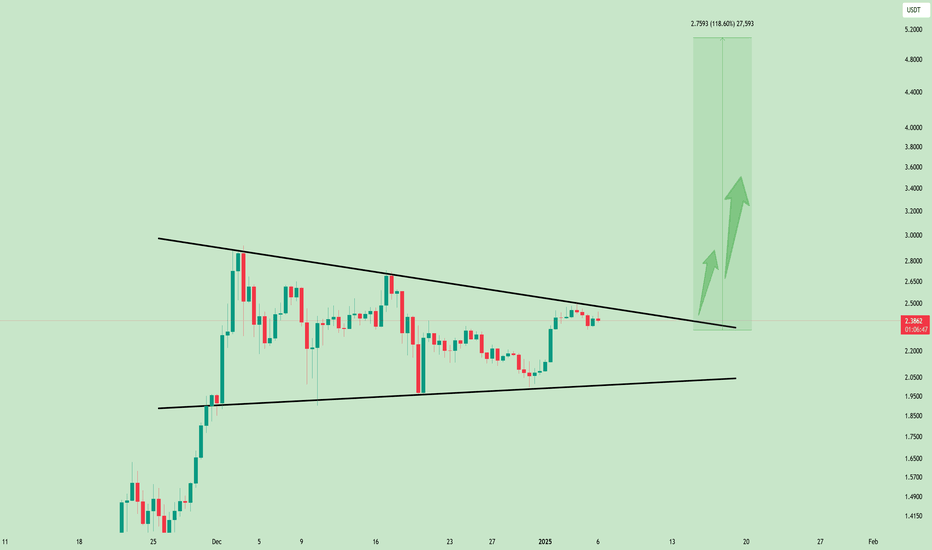

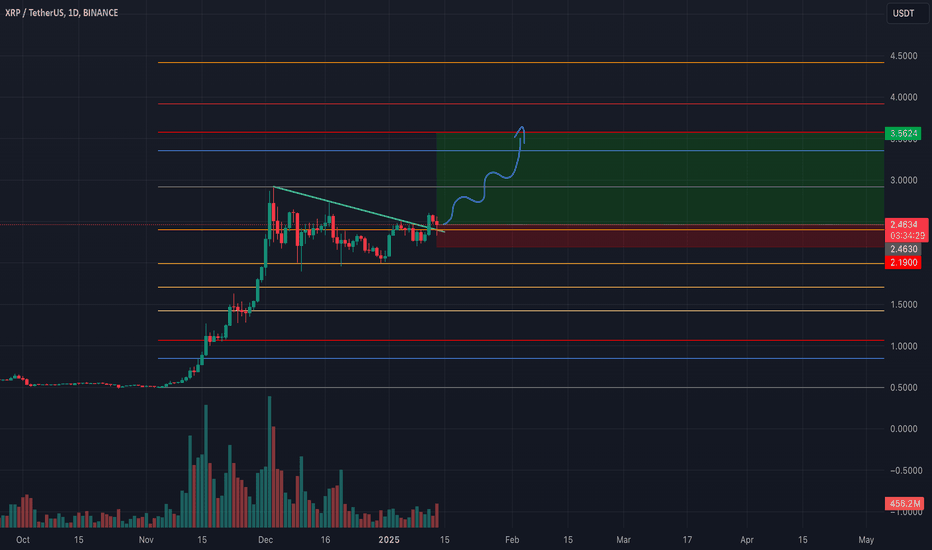

• Technical Analysis: From a technical analysis perspective, XRP has shown promising signs. It recently broke out of a symmetrical triangle pattern, which is often considered a bullish continuation indicator.

• Market Sentiment: The overall market sentiment towards XRP has improved, with many analysts predicting a potential price surge.

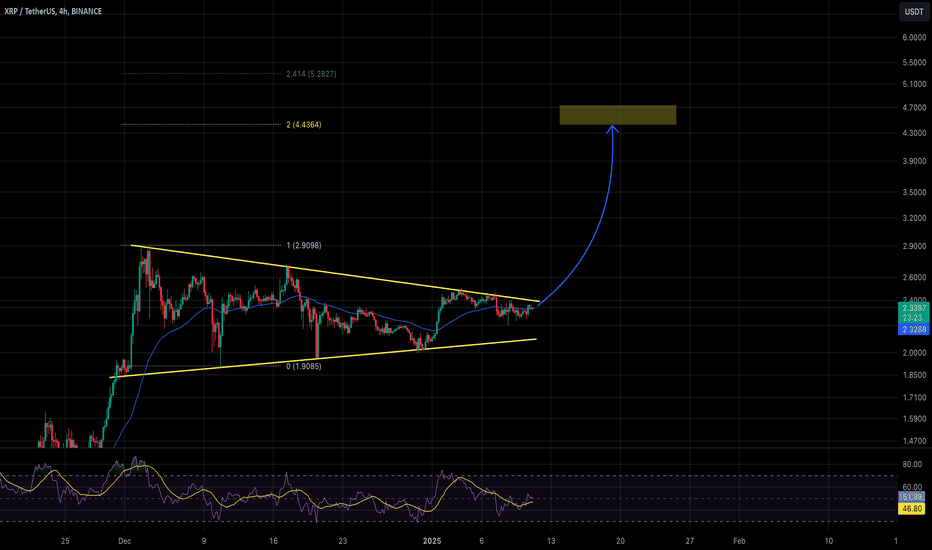

Technical Analysis and Price Targets

Technical analysts use various tools and patterns to predict future price movements. In the case of XRP, the breakout from the symmetrical triangle pattern suggests a potential price target of $4, representing a 60% increase from its current levels. This projection is calculated by adding the maximum height of the triangle to the breakout point.

However, it's important to consider critical support and resistance levels. The upper trendline of the triangle, now acting as support, is near $2.37. A failure to sustain above this level could invalidate the bullish pattern, potentially leading to a pullback toward $2.30, which aligns with the 50-period exponential moving average (EMA).

Factors Influencing XRP's Price

Several factors could influence XRP's price in the near future:

• Resolution of the SEC Case: A favorable outcome in the SEC case could significantly boost XRP's price.

• Adoption and Partnerships: Increased adoption of XRP by financial institutions and new partnerships could drive demand and price appreciation.

• Market Trends: Overall market trends in the cryptocurrency market can also impact XRP's price.

Price Prediction

Considering the recent developments, technical analysis, and market sentiment, XRP has the potential to reach the $4 price target. However, this is not guaranteed, and the price could face resistance at various levels.

It's crucial to remember that the cryptocurrency market is highly volatile, and prices can fluctuate significantly in short periods. Therefore, it's essential to exercise caution and conduct thorough research before making any investment decisions.

Disclaimer:

The information provided in this article is for informational purposes only and does not constitute investment advice. Please do your own research before making any investment decisions.

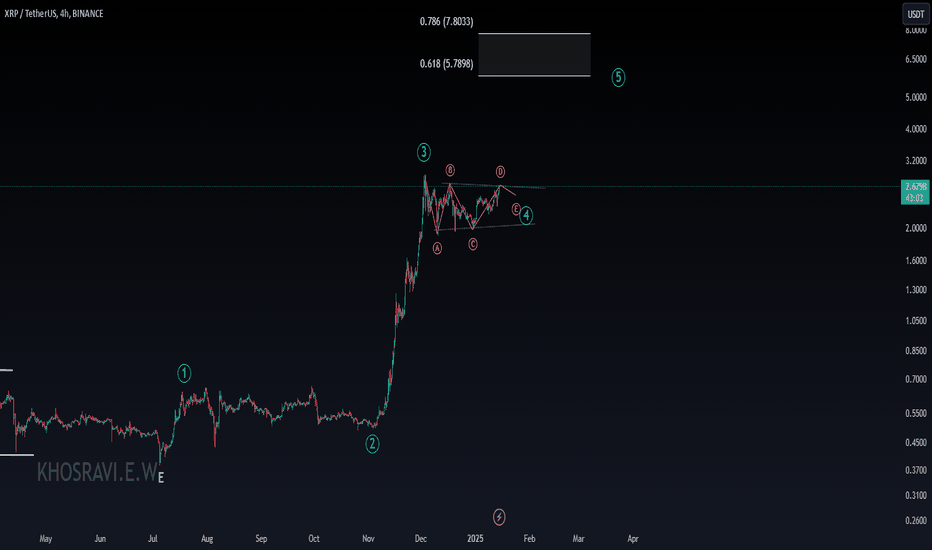

XRP is getting ready to conquer the peaks again!Ripple's CEO has met with a number of US officials, as well as Donald Trump! In addition, XRP is already being used by Bank of America and other large companies. The upcoming IPO will attract a lot of investors! I believe that the IPO will be the final factor and after that the fall will start. My first exit point is $4.4, the second is $5!

Kostenich Alex, Horban Brothers.

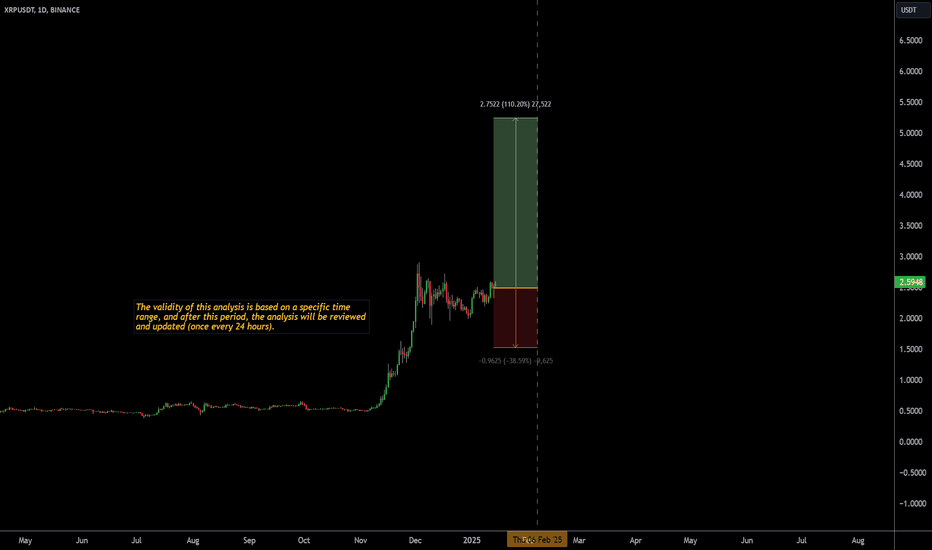

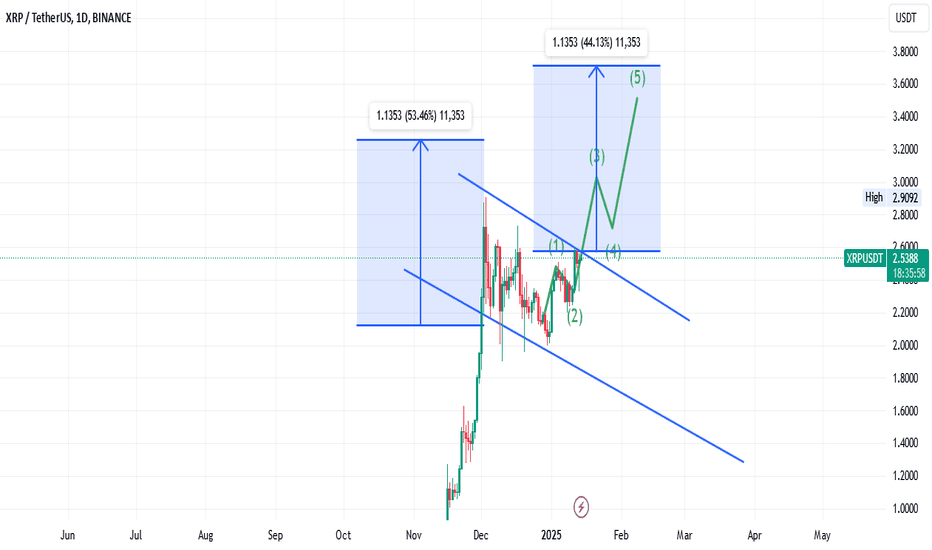

Ripple-XRPUSD Periodic Analysis (Issue 61)The analyst believes that the price of Ripple will increase in the next 24 Days. This prediction is based on quantitative analysis of the price trend..

Please note that the specified take-profit level does not imply a prediction that the price will reach that point. In this framework of analysis and trading, unlike the stop-loss, which is mandatory, setting a take-profit level is optional. Whether the price reaches the take-profit level or not is of no significance, as the results are calculated based on the start and end times. The take-profit level merely indicates the potential maximum price fluctuation within that time frame.

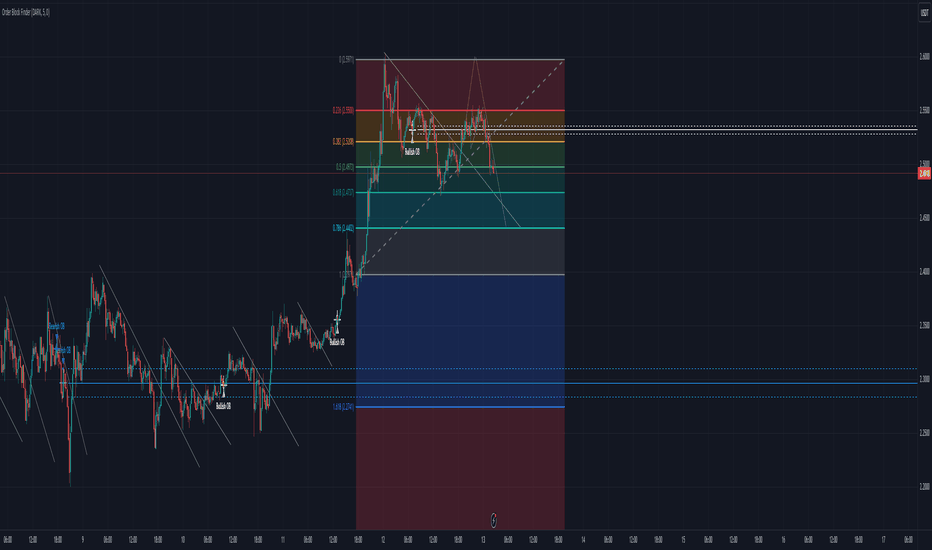

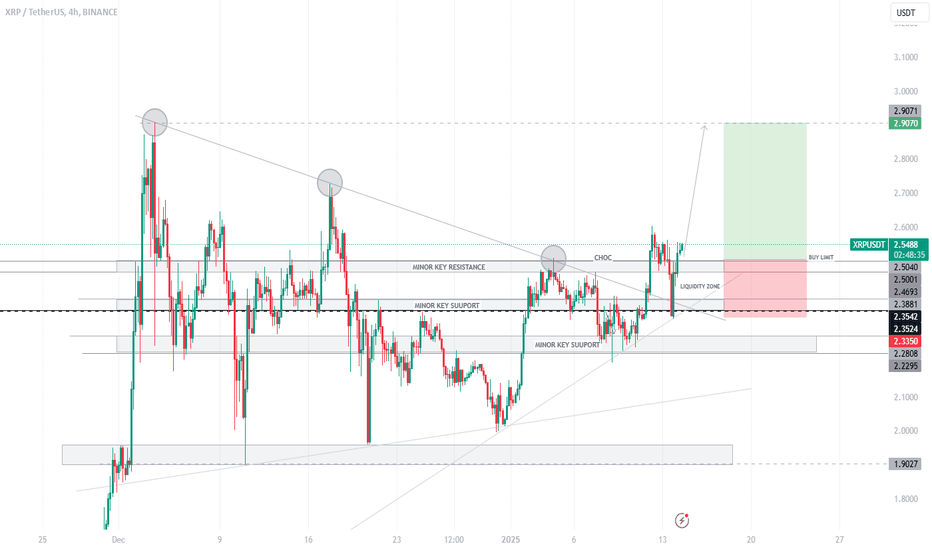

XRP/USDT 4H Timeframe AnalysisXRP/USDT 4H Timeframe Analysis

Trend Analysis

On the 4-hour timeframe, XRP/USDT is in an uptrend, forming a symmetrical triangle pattern. A downtrend line with three confirmed touches served as solid resistance, eventually breaking out and forming the symmetrical pattern.

Recently, the price broke above the minor key resistance at 2.4800, signaling bullish momentum. After accumulating buyers’ orders, the price briefly dipped to hunt liquidity below the minor resistance, where buyers had placed stop-losses.

Following the liquidity hunt, the price rebounded strongly, breaking above the minor resistance again. The current price action suggests potential bullish continuation, especially as the market reacts to news impacting XRP’s legal developments.

Price Action Expectation:

Our objective is to wait for a retest of the minor resistance (now turned support) at 2.5040.

Wait for the price to consolidate around this level, confirming strong buyer interest.

Monitor for a bullish reaction at the retest point, which validates the continuation of the uptrend.

After the retest, expect the price to rally toward the next significant resistance level.

Trade Setup-

Trade Type: Buy Limit (Retest Entry)

Entry: 2.5040 (upon confirmation of the retest)

Stop Loss: 2.3350 (below the liquidity zone to avoid false breakouts)

Take Profit: 2.9070 (next significant resistance level)

This setup requires patience and discipline to ensure all conditions are met before entering the trade.

News Catalyst

The recent increase in buying pressure for XRP is attributed to a notable update regarding Ripple's legal battle with the SEC. A prominent lawyer's insights on the SEC’s appeal have boosted market sentiment, reinforcing confidence in Ripple's position. This news has supported XRP’s bullish momentum and aligns with the current technical outlook.

Conclusion:

XRP/USDT shows strong bullish potential supported by a clear breakout pattern and positive news sentiment. The strategy emphasizes disciplined execution and proper validation of the retest to confirm the setup.

Risk Management:

Maintain a 1:2+ risk-to-reward ratio to optimize trade outcomes.

Position size should align with your account equity to manage risk effectively.

Monitor liquidity zones closely to avoid premature stop-outs.

Trading involves significant risks and is not suitable for all investors. Always:

Seek advice from a financial professional if unsure about trading decisions.

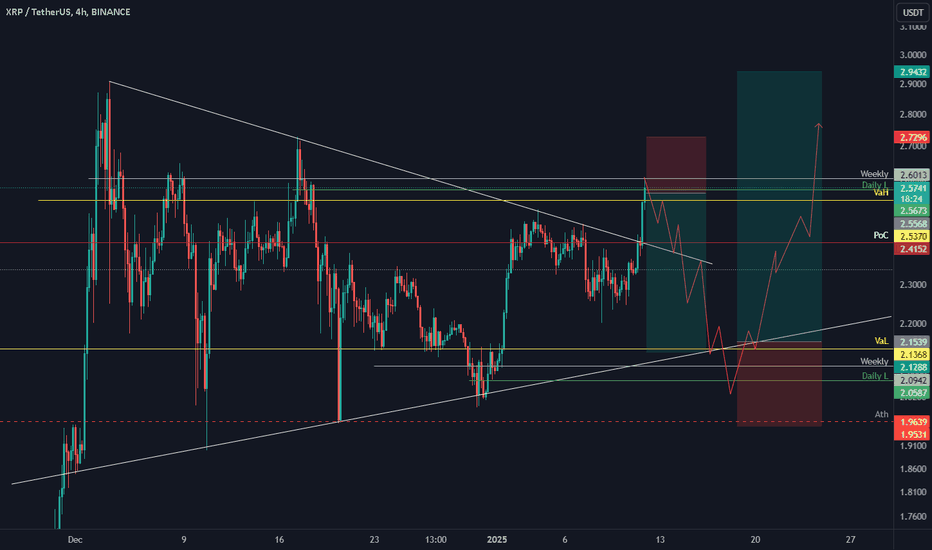

RIPPLE // countertrend breakThe market is at the countertrend break, daily fibo levels are the targets.

KEEP IT SIMPLE!

———

Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated.

Level colors:

Daily - blue

Weekly - purple

Monthly - magenta

H4 - aqua

Long trigger - green

Short trigger - red

———

Stay grounded, stay present. 🏄🏼♂️

<<please boost 🚀 if you enjoy💚

Short term TA for XRP XRP is currently consolidating within a narrow range between 2.37 and 2.38, following a recent upward move. While a decisive breakout above the 2.40 resistance level remains pending, this consolidation period could be interpreted as a sign of strength.

In the near term, a cautious outlook is warranted as the price has yet to confirm a sustained upward trajectory. However, the current price action may be indicative of accumulation and base-building, potentially setting the stage for a future advance.

Longer-term prospects for XRP appear positive, with the cryptocurrency demonstrating a consistent pattern of higher highs and higher lows. This suggests an underlying bullish trend, although patience may be required for further upside momentum to materialize.

Traders and investors are advised to closely monitor key indicators such as trading volume and momentum, as well as news and developments related to XRP, to gauge the likelihood of a breakout and subsequent price appreciation.