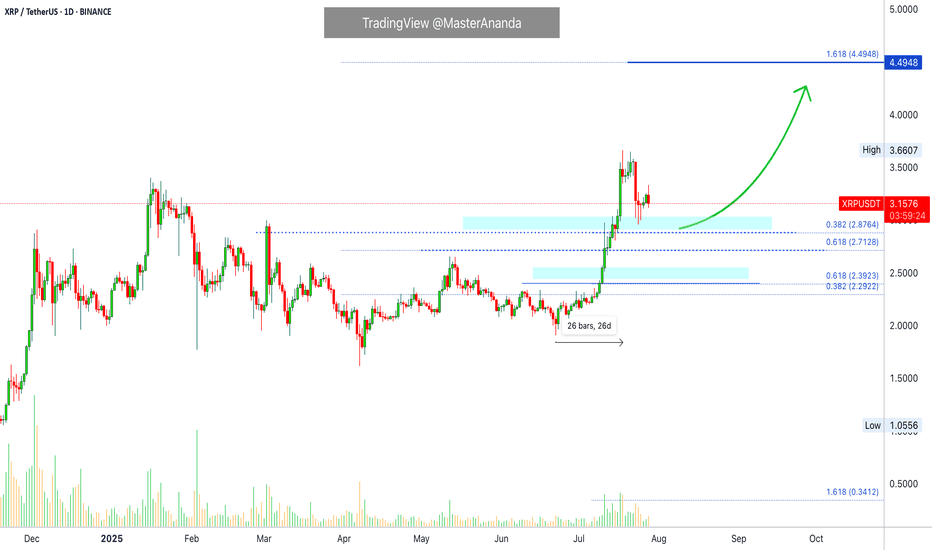

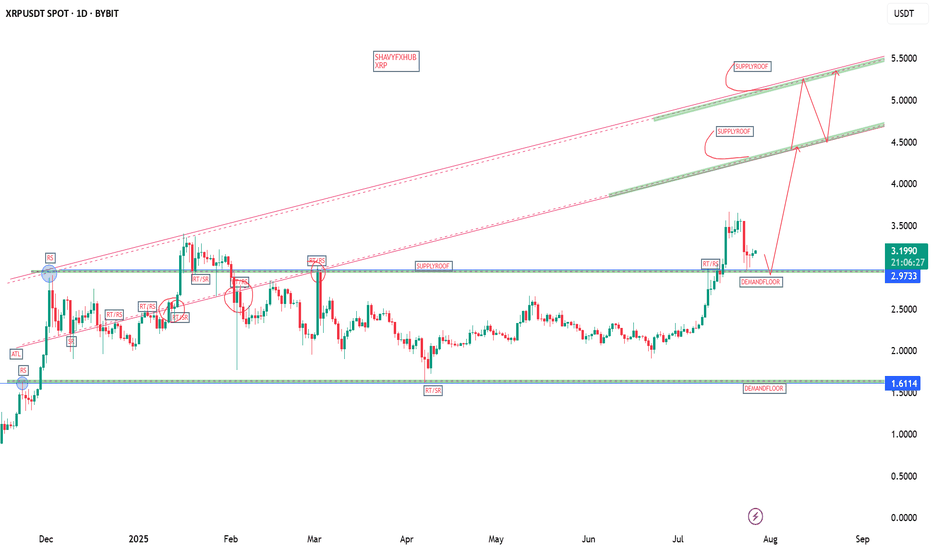

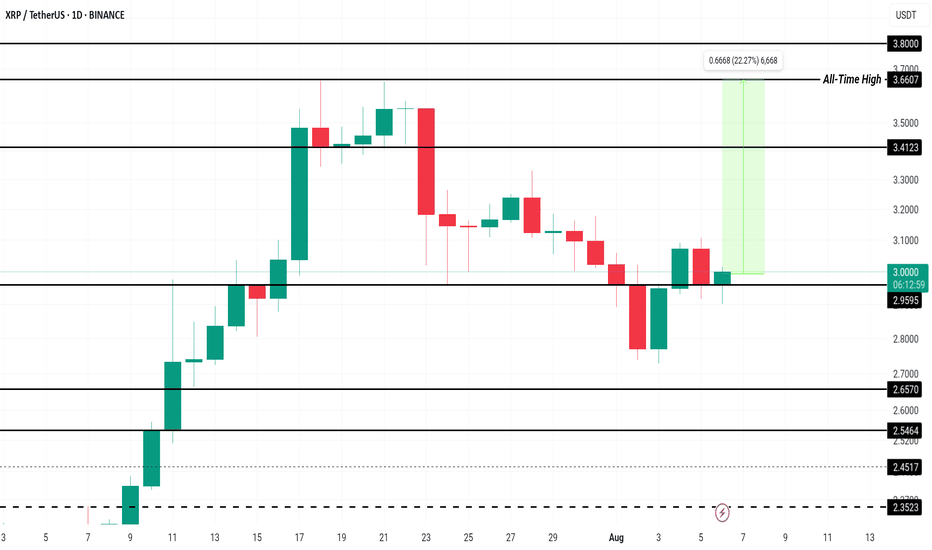

XRP Update · What To Expect Short-TermRetraces should be considered a buy opportunity. It is the only time when prices are not rising. Whenever there is a stop, a retrace, that is an opportunity to enter or buy more before the continuation of the bullish trend.

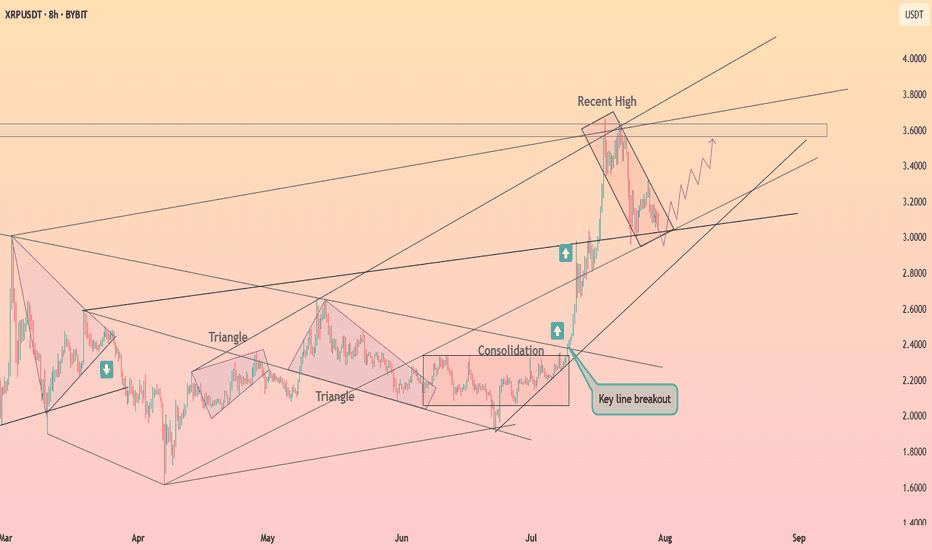

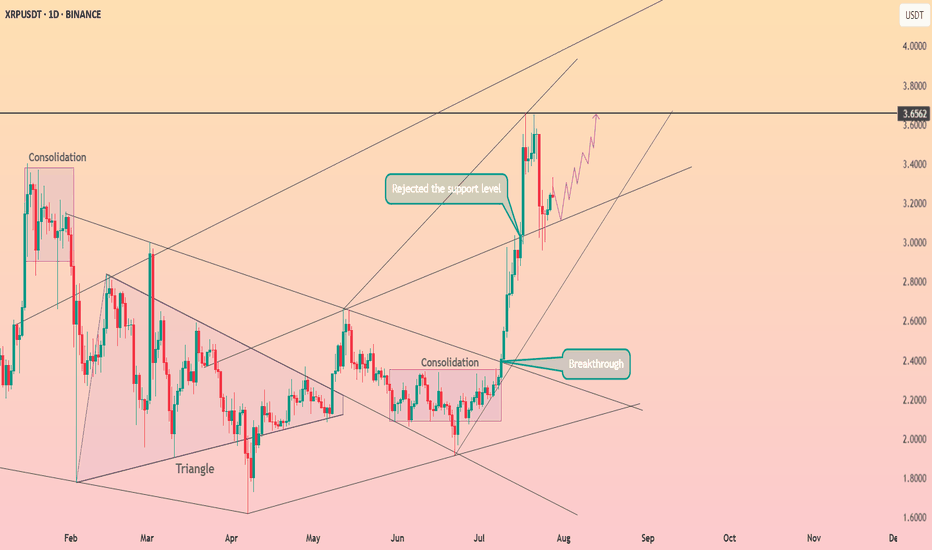

XRP started its latest major advance 22-June growing for 26 days straight peaking 18-July. there were only two red days in the entire move. This is certainly a strong advance and resulted in a new all-time high. More than 90% growth. After a strong move, there is always a pause, or correction or retrace.

A retrace can last a few days. Seeing this chart, here it can even last for weeks as I see no hurry on this chart. Prices can consolidate at support before the next advance. Some small swings are expected but nothing big and always knowing that the end result will be an advance going further toward $4.44. The bigger picture.

Do not try to SHORT within a retrace or even correction. It can lead to disaster. It is better to wait for support to show up and once confirmed buy LONG. The upside has no limitations while the downside is limited. It is harder and carries more risk, even more now that the market is bullish and people are starting to wake up. People can see the development of a major rise now, people are becoming aware and soon there will be a rush. This rush will fuel the next wave of growth.

XRP can consolidate for a little while after finding support before reaching higher. Market conditions remain strongly bullish for this pair. If support breaks, things can change.

Namaste.

XRPUSDT.P trade ideas

XRP Price Prediction: Is a Breakout to $15 Imminent? XRP Breakout Targets $15 — Analyst Says 'This Is Just The Start': Is XRP Set to Explode?

The cryptocurrency world is once again turning its attention to XRP, the token developed by Ripple Labs, as bullish analysts predict an imminent and explosive rally. After a strong run-up earlier in 2025, XRP has pulled back slightly and is now approaching a critical support zone. Some analysts are now calling for a $15 breakout target, even as the token hovers near $2.80, a level many see as a pivotal point for the next leg of the bull market.

Let's dive into the latest developments, technical analysis, and market sentiment surrounding XRP — and why some believe "this is just the start."

XRP Price Overview: Current Positioning

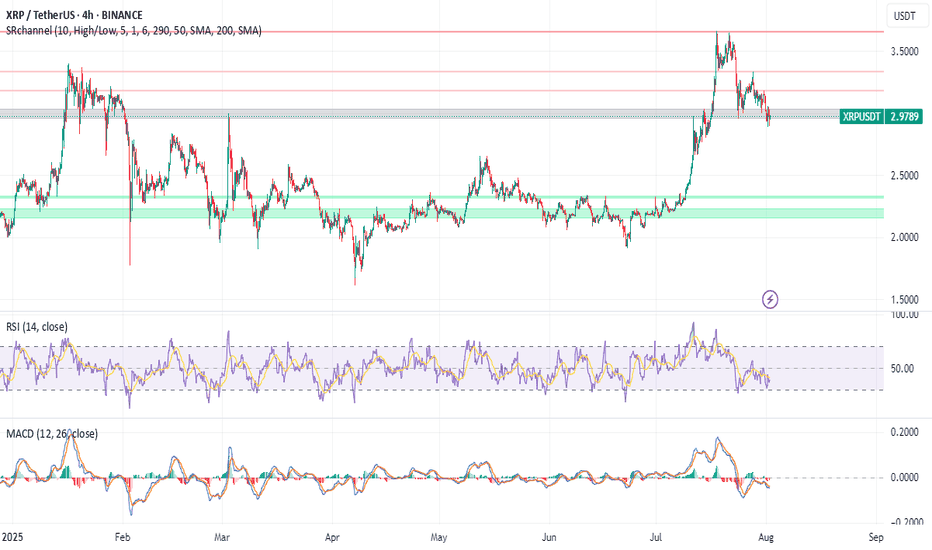

As of early August 2025, XRP is trading around the $2.85 mark, down from its recent high near $3.70. While this pullback may concern short-term traders, technical analysts argue that this retracement is healthy and necessary for the formation of a higher low, a common pattern in bullish market structures.

The key price levels to watch include a support zone between $2.80 and $2.95, resistance at $3.70, downside risk to $2.20 if $2.80 fails, and upside targets of $5 in the short term and $15 in the mid-term.

Why $2.80 Is So Important

The $2.80 support level is emerging as a make-or-break price zone. It aligns with multiple technical indicators including the 0.618 Fibonacci retracement from the previous rally, the Value Area High (VAH) from recent price accumulation zones, and Higher Time Frame (HTF) structure showing consistent support around this level in recent months.

If XRP manages to hold this level and establish a higher low, it could kick off a new bullish wave, potentially targeting $5 in the short term and beyond in the medium term.

Analysts Call for $15 XRP — Is It Possible?

Several key factors support the bull case. Institutional interest continues to grow as Ripple's partnerships with banks and financial institutions support long-term utility. Legal clarity has improved significantly after years of regulatory uncertainty, with the SEC lawsuit largely resolved, removing a major overhang. Technical indicators including bullish divergence on the RSI, MACD bullish crossover, and increasing volume all support upward momentum. Additionally, as Bitcoin stabilizes, funds are flowing into major altcoins, including XRP, as part of the typical altcoin rotation cycle.

August Rally Incoming? Bullish Divergence Signals 20% Upside

Technical analysts have identified a bullish divergence forming on the daily and 4-hour charts — a classic signal that often precedes a strong move upward. This divergence appears as the price makes lower lows while the RSI makes higher lows, suggesting momentum is shifting in favor of the bulls.

If confirmed, this divergence could catalyze a 20% rally in August, potentially pushing XRP back above $3.40 and testing the critical $3.70 resistance. A clean break above this level would likely open the floodgates for further gains.

$3.70: The Gatekeeper to Higher Highs

While there's excitement around the potential for XRP to hit $5 or even $15, the path forward must first go through $3.70. This resistance level has stalled price action multiple times in 2025 and will likely serve as a psychological and technical barrier.

Two scenarios are possible: a break above $3.70 would open the door to $5 and $7 targets quickly, while a rejection at $3.70 could lead to a pullback toward $2.20, especially if $2.80 fails.

Traders Hedge With New XRP Rival: Remittix

As XRP consolidates, some traders are diversifying their holdings into Remittix (RTX), a new cross-border payments token that promises enhanced scalability and compliance tools. RTX has gained traction recently, especially among DeFi-native traders seeking alternatives to XRP's centralized development model.

Remittix highlights include strong tokenomics with a deflationary model and staking rewards, a real-world use case targeting remittance markets in Asia and Africa, and a PayFi Wallet with beta slated for launch in Q3 2025, offering seamless integration with fiat on/off ramps.

While Remittix is gaining momentum, XRP's brand recognition, liquidity, and institutional partnerships still give it a significant edge in the payments space.

XRP Price Forecast: Short-Term and Long-Term Outlook

In the short term over the next 30 days, the bullish scenario involves holding $2.80 support, breaking $3.70, and rallying to $5. The bearish scenario would see XRP lose $2.80, drop to $2.20, and consolidate.

For the mid-term outlook in Q4 2025, if the bullish trend continues and macro conditions remain favorable, XRP could target $7 to $10 by the end of the year. In a full altseason scenario, $15 is not out of reach, according to some analysts.

Key Catalysts That Could Drive XRP Higher

Several catalysts could propel XRP higher. Institutional adoption continues to expand as Ripple's partnerships, especially in the Middle East and Asia-Pacific, lay the groundwork for long-term utility. CBDC integration presents another opportunity as Ripple works with multiple central banks on developing Central Bank Digital Currencies. Any progress here could significantly boost XRP's real-world use.

ETP listings could bring new inflows as XRP may benefit from exchange-traded products in Europe and Asia, especially if more crypto-based ETFs gain traction globally. The macro environment also favors growth, with a dovish Fed, weakening USD, and rising crypto adoption all creating a fertile environment for altcoins like XRP to thrive.

Community Sentiment: Is the XRP Army Ready?

The XRP community, also known as the XRP Army, remains one of the most passionate and active in the crypto space. Social media sentiment has turned increasingly bullish, with hashtags like #XRPToTheMoon and #XRP15 trending on X (formerly Twitter).

However, analysts caution against overexuberance, noting that market cycles can be volatile and unpredictable.

Risks to Watch

While the bullish case is compelling, it's important to consider the risks. Macro-economic shocks from a sudden shift in interest rates or recession fears could impact crypto markets broadly. Regulatory setbacks remain possible — although Ripple has gained legal clarity in the U.S., future regulations in Europe or Asia could cause volatility.

Network risks from any technical issues or security breaches could erode trust and trigger selloffs. Competition from new projects like Remittix, Stellar (XLM), and other payment-focused tokens could eat into XRP's market share.

Final Thoughts: Is XRP Set to Explode?

With XRP hovering near a critical support zone at $2.80, all eyes are on whether bulls can defend this level and push the token back into an uptrend. If successful, the next moves could be explosive, with analysts forecasting $5 in the short term and potentially $15 or higher before the end of 2025.

While risks remain, the technical setup, improving fundamentals, and renewed community optimism all point toward a bullish continuation — if key levels hold.

As always, investors should stay informed, manage risk, and avoid emotional decisions in this fast-moving market.

Summary

XRP currently trades around $2.85 with key support at $2.80 and major resistance at $3.70. Short-term targets point to $5 while mid-term projections suggest $10 to $15 is possible. Downside risk exists to $2.20 if support fails. Bullish catalysts include legal clarity, growing utility, and increasing adoption, while bearish risks encompass macro shocks, competition, and potential regulation.

Disclaimer

This article is for informational purposes only and is not financial advice. Cryptocurrency investments are highly volatile and involve significant risk. Always do your own research (DYOR) and consult with a financial advisor before making investment decisions.

#XRP Update #5 – July 29, 2025#XRP Update #5 – July 29, 2025

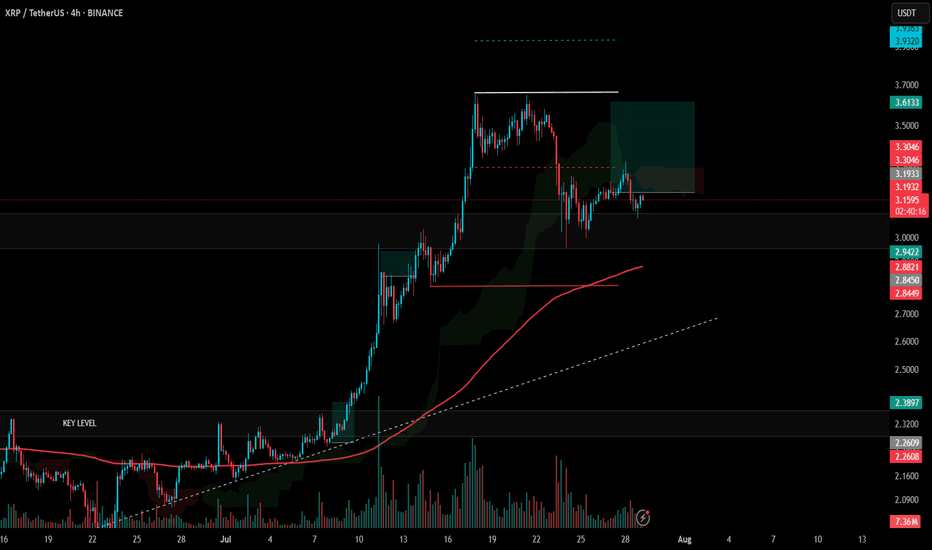

The long position we opened two days ago is still active, and as I mentioned earlier, I’m not planning to use a stop. In the previous trade, we took profit with 30% of our capital at the $3.33 level. Although there has been a pullback, I’m still holding the position. I have no intention of placing a stop and will continue by averaging down if necessary.

Currently, XRP has reacted from the K-Level zone. Its target is the $3.93 level, but the first major resistance it needs to break is at $3.66. I’m continuing to hold the position for now.

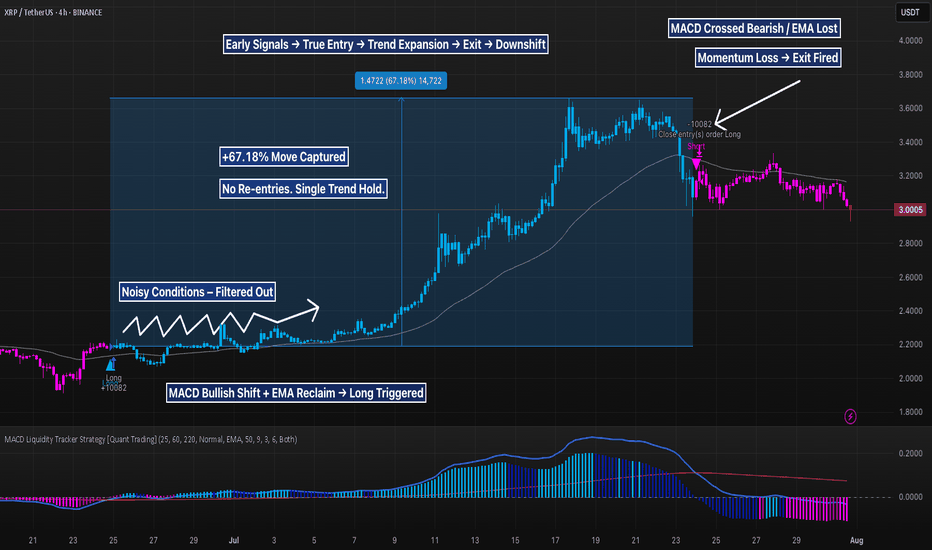

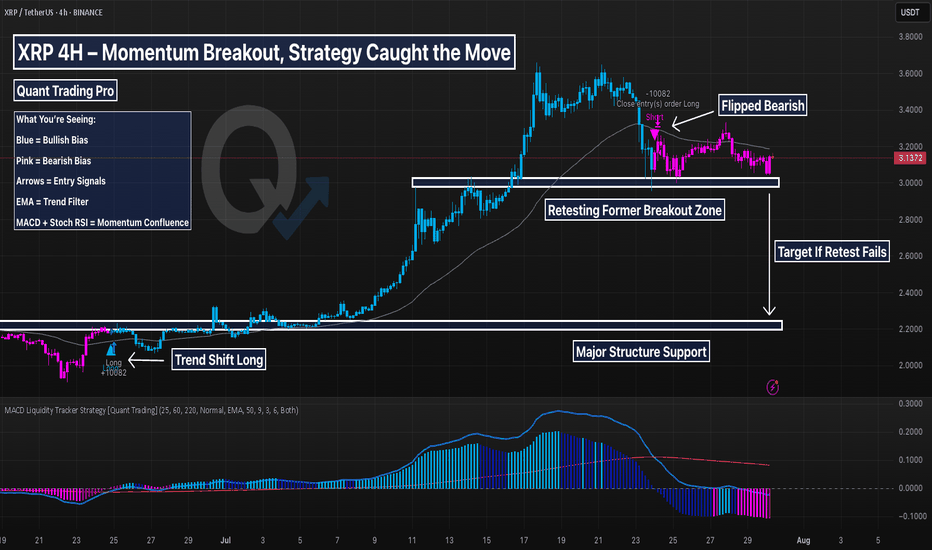

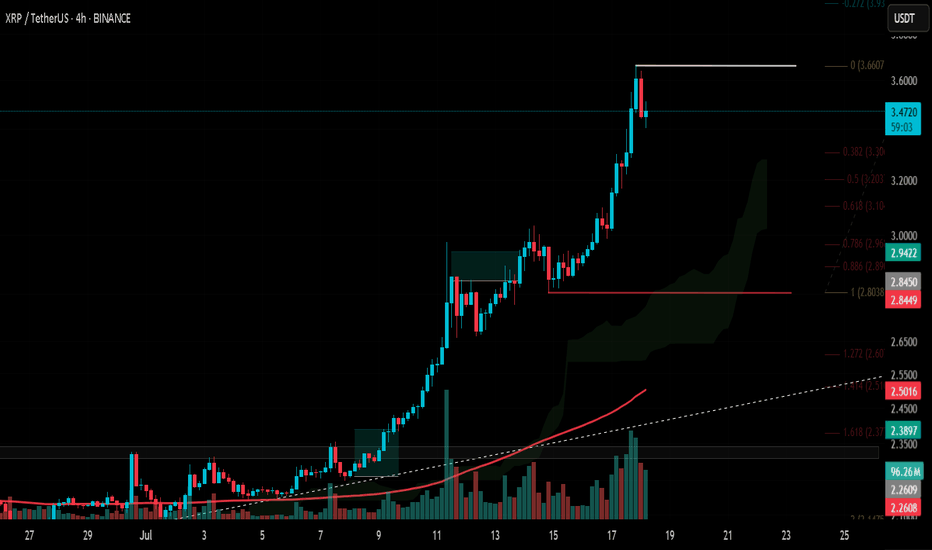

XRP 4H + 67% From MACD Trend Entry, But Is the Pullback Real?This XRP move was a masterclass in filtered momentum trading. The MACD Liquidity Tracker Strategy (Normal Mode) skipped early chop, then fired long once MACD aligned with a reclaim of the 60/220 EMAs — signaling a clean directional shift.

The strategy held through a +67.18% rally, exiting only when MACD flipped bearish and price lost EMA support. From ~$2.12 to ~$3.54, the move was captured in full with zero re-entries or second guessing.

Now price is under pressure, printing pink bars and sitting below both EMAs. The $2.90–$3.00 zone may determine if this is a healthy pullback — or the start of a reversal.

📊 MACD: 25 / 60 / 220

Trend Filter: 60/220 EMA

Mode: Normal | Timeframe: 4H

Educational chart. Drop your take.

XRP is testing a support ┆ HolderStatBYBIT:XRPUSDT recently broke out of a long consolidation and triangle setup, rallying into the 3.60 region. It is now forming a falling channel — a common bullish continuation pattern. Price must hold the 3.10–3.20 support area for a renewed move toward 3.80–4.00. The broader structure remains bullish until invalidated.

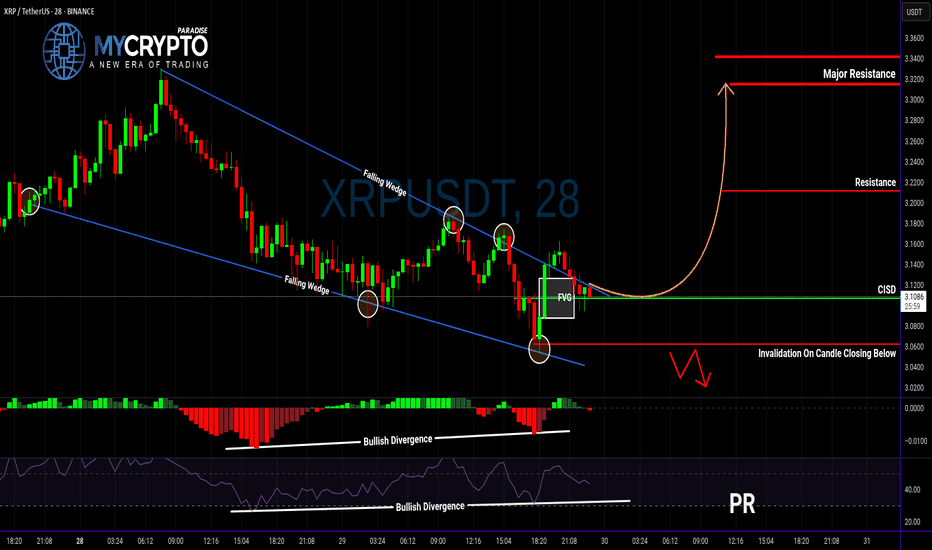

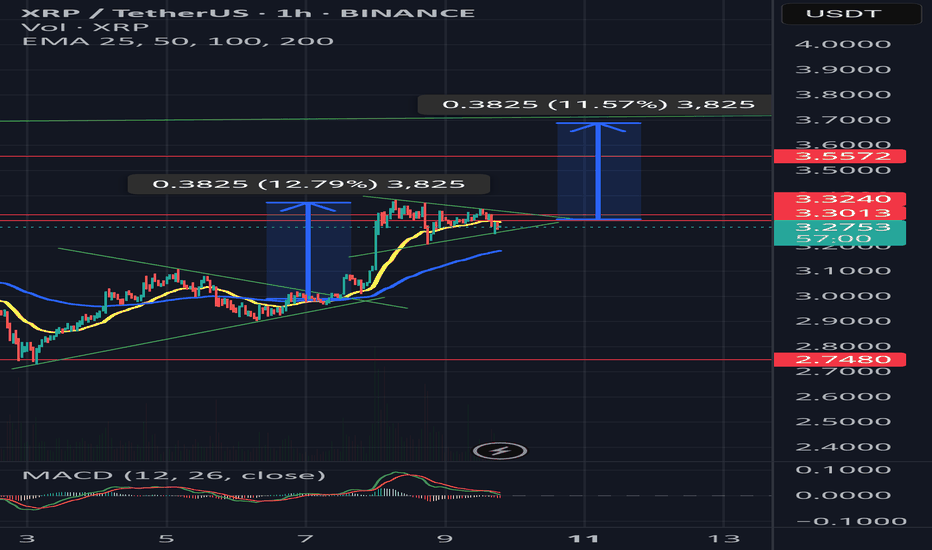

XRP Breakout Could Be a Trap… Or the Start of Something Big?Yello, Paradisers — are you about to buy into a fake breakout or position yourself right before a major move? Let’s break it down before emotions take over.

💎XRPUSDT has officially broken out of a falling wedge — a classic bullish reversal structure. What makes this breakout even more interesting is that it's supported by bullish divergence on both MACD and RSI, plus a Change In State of Delivery (CISD). All these technical signals combined significantly increase the probability of a bullish continuation.

💎Now, if you’re a disciplined trader looking for a safer entry with a higher risk-to-reward ratio, the smart move is to wait for a potential pullback to the CISD level. That would set up an opportunity offering a risk-to-reward of over 1:2.55 — not something you want to ignore.

💎But don’t get too comfortable…

💎If the price breaks down and closes below our invalidation level, the entire bullish idea is off the table. In that case, it’s wiser to stay patient and wait for clearer price action to develop. No emotional entries — only strategic moves.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. That’s how you’ll get inside the winner circle.

MyCryptoParadise

iFeel the success🌴

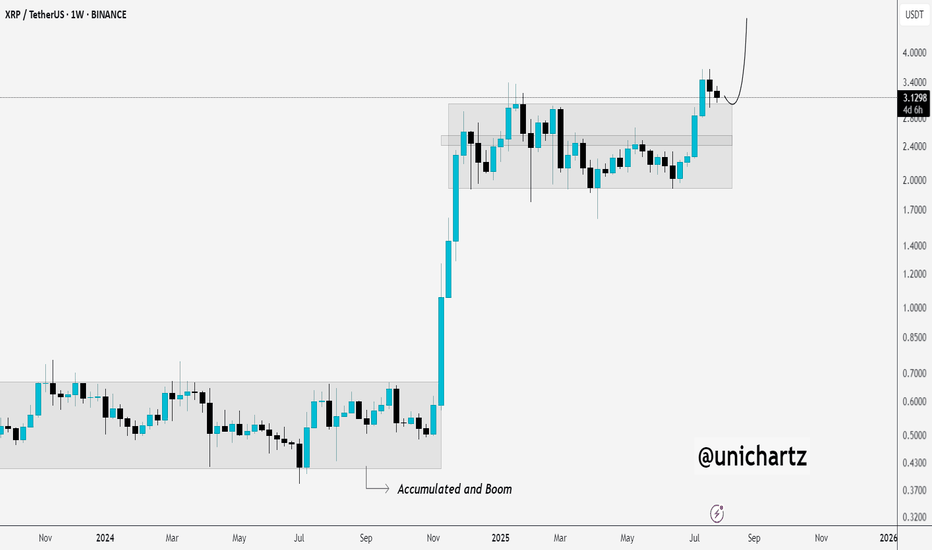

Healthy Retest After Explosive Move – XRP Eyes More UpsideCRYPTOCAP:XRP broke out of a long accumulation range and is now coming back to retest that breakout level, a classic and healthy move.

If this retest holds, we could see the next leg up kick off soon.

Accumulated. Broke out. Now confirming.

DYOR, NFA

XRP 4H – This Strategy Nailed the Breakout & Tracking SupportThis XRP chart is a textbook example of the MACD Liquidity Tracker Strategy in action. After flipping bullish in late June, the system triggered a clean long and stayed in the move for over 100% before flipping bearish near the local top.

The system didn’t chase or guess — it followed clear logic:

MACD momentum confirmed

Trend aligned with EMA

State flipped blue → long triggered

Exit near top when momentum shifted

Now, XRP is in a bearish state, retesting its prior breakout zone. The MACD histogram remains below zero, and price is below the trend filter — indicating caution. But this is exactly where strategy traders prep for reversals or continuation.

🔍 Highlights:

Clean +100% trend catch

Momentum shift = smooth exit

Currently respecting support = decision zone

Still in “wait” mode — no guessing

This system shines when volatility expands. Perfect for trend traders who want clarity and control — and ideal to backtest.

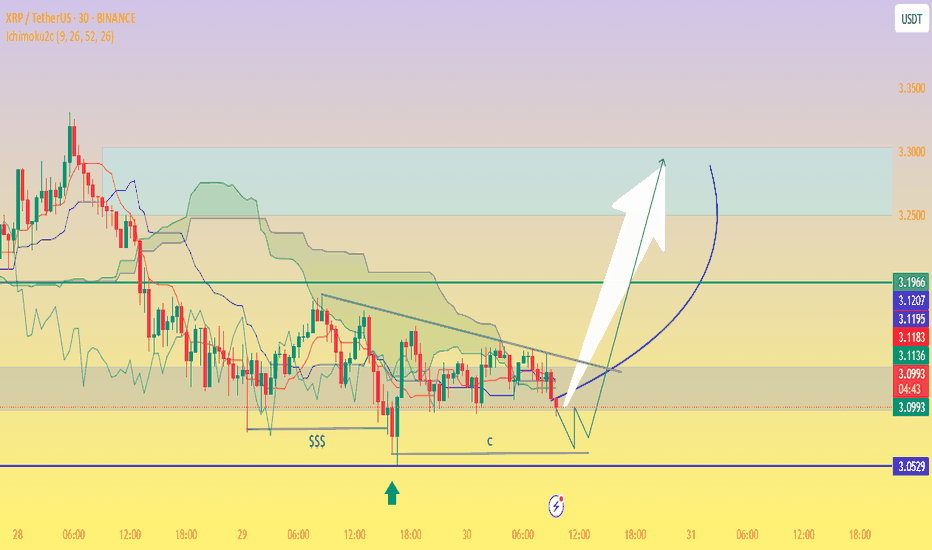

XRP/USDT Potential Reversal Zone — “Bottom Tested,Bullish Flag!📉 Chart Analysis Summary

The divided chart indicates XRP trading between a critical support zone near $3.05–$3.09 and overhead resistance around $3.19–$3.23, forming what could be a bullish pennant or descending wedge setup on the 30-minute timeframe:

Support Zone (~$3.05–$3.09):

Price retested this level multiple times (labeled as “$$$” and “c”), clearly identifying a demand zone.

Ichimoku cloud support lies nearby, adding technical relevance to the floor.

Resistance Trendline & Green Line (~$3.19–$3.23):

A descending trendline is visible, showing lower highs and building compression.

A breakout above this resistance zone is necessary to signal bullish continuation.

Projected Path:

The schematic arrow suggests a bounce off support, followed by consolidation, and then a breakout above resistance, targeting the $3.25–$3.30+ zone and potentially higher.

🔍 Context from Recent Market Commentary

Support Holding Above $3.11–$3.15: Analysts highlight strong support around $3.11–$3.15, where institutional and retail interest appears concentrated

TradingView

+13

TradingView

+13

CoinCentral

+13

.

Resistance & Consolidation at $3.30: While XRP briefly surpassed $3.30, it encountered rejection and remains rangebound. A confirmed break beyond this level could validate the bullish carry-forward

CryptoPotato

CoinDesk

.

Wave-Elliott Bull Case: Various Elliott Wave scenarios forecast targets as high as $5.25, $6.85, or even $10–$15 should Wave 5 materialize, though this depends on market strength and momentum

CoinCentral

.

✅ Trading Outlook

Bullish Scenario:

Bounce off $3.05–$3.15 support.

Break above $3.23–$3.30 resistance.

Potential upside targets:

Near term: $3.30–$3.40.

Medium term: $4.64 or $5–$6, with strong case for $6.85 if momentum and on-chain demand strengthen

CryptoPotato

+15

TECHi

+15

CoinGape

+15

.

Bearish Scenario:

Failure to hold $3.05–$3.11 risk retest toward $2.95 or lower zones ($2.30–$2.70)

TECHi

.

🧭 What to Watch

Key Level Role

$3.05–$3.11 Critical support/demand zone

$3.19–$3.23 Short‑term resistance/framing compression

~$3.30+ Confirm bullish breakout — key trigger for Wave 5 and higher targets

🧠 Overall Take

This chart is painting a classic consolidation near strong support with a visible descending upper boundary. If XRP holds the ~$3.05 zone and breaks above $3.23–$3.30 with conviction, it could initiate a bull move toward $3.40–$4.00, and potentially even $5–$6+ depending on volume and momentum.

However, breaks below $3.11 may open deeper downside risk. For many traders, this is a simple risk-reward setup: entry near the lower channel with a stop under $3.05 and initial profit targets at $3.30–$3.40.

XRP held the support line ┆ HolderStatBINANCE:XRPUSDT is holding above $0.685 support after a correction from recent highs. Price is stabilizing inside a horizontal channel, with buyers defending the bottom of the range. A clean push above $0.70 would reopen the path toward $0.75. The market is at a decision point with strong reactions at both ends of the range.

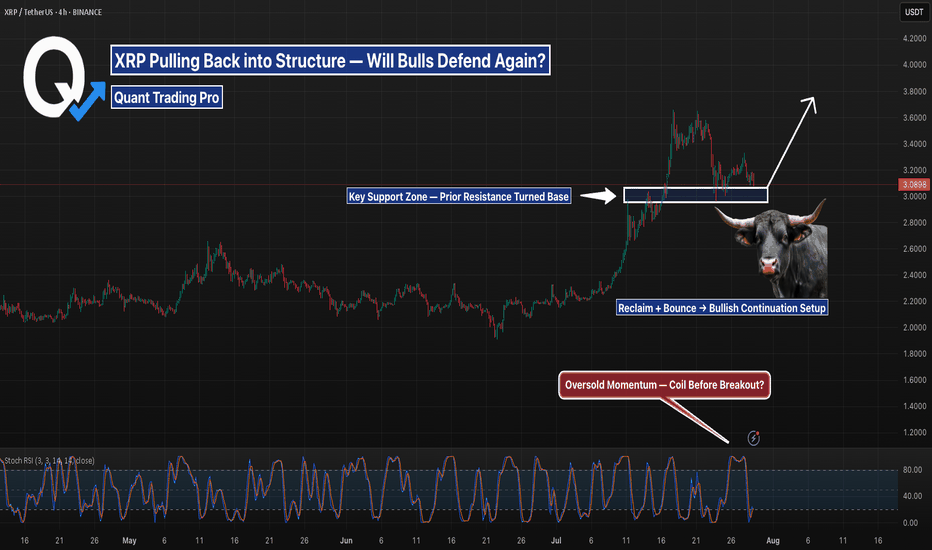

XRP 4H — Resistance Flipped to Support, Will Bulls Step In?XRP is pulling back into a key structure zone — the same area that acted as breakout resistance during the July rally is now being retested as support. With momentum resetting and price consolidating on top of this level, the next move could set the tone for the rest of August.

📊 Technical Breakdown:

Structure Retest:

Price is holding between ~$3.00–$3.15 — a major former resistance zone now acting as support after July’s vertical move. Buyers previously stepped in hard above $3.00, and this is the first proper retest since the breakout.

Stochastic RSI:

Deep in oversold territory on the 4H timeframe. Any bullish crossover from this zone would align with a bounce scenario from support.

Volume Context:

Declining volume on the pullback suggests a lack of aggressive selling — a common characteristic before continuation if the level holds.

🔍 What to Watch:

✅ Bullish Setup:

Hold and bounce from this support zone

Break above local highs at ~$3.45 could trigger fresh upside

❌ Invalidation:

Clean close below $3.00 support would shift structure short-term and suggest a deeper retracement (e.g. $2.75–2.85 zone)

XRP often moves in bursts — and this chart has the same setup vibes as the last big leg. If support holds here, don’t be surprised if it’s the ignition point for another breakout.

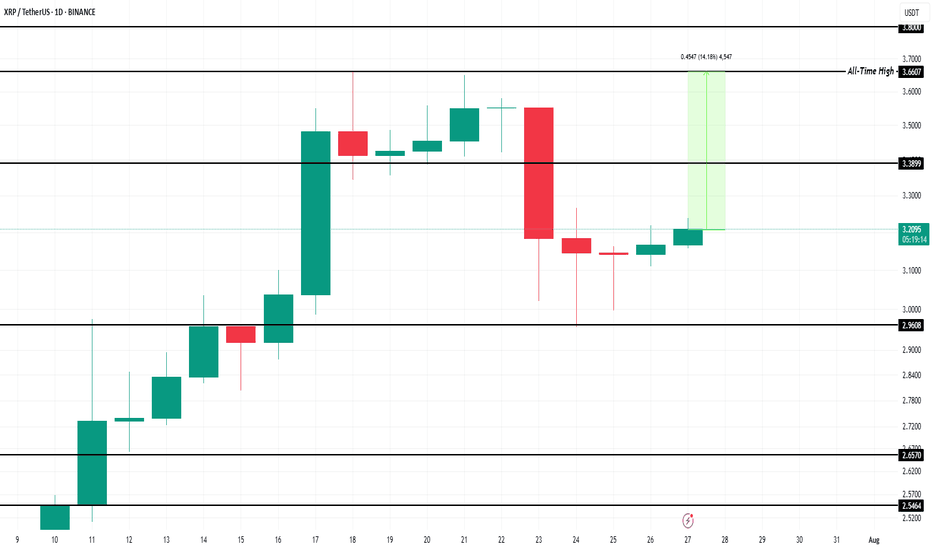

$500 Million XRP Accumulation To Drive 15% Price Rise to ATHBINANCE:XRPUSDT is currently trading at $3.20, which places it 14% away from reaching its ATH of $3.66. The support at $3.38 is crucial, and securing it could lead to further gains.

BINANCE:XRPUSDT has been seeing significant inflows in the past three days. Over 163 million XRP, worth around $519 million , have been accumulated by investors. This buying surge suggests that a wave of optimism is returning to the market, signaling that investors are positioning themselves for a potential price increase.

If BINANCE:XRPUSDT can reclaim support at $3.38 , it will be well-positioned to push past its ATH and reach new highs. This would mark a significant milestone for the altcoin, setting the stage for further price gains.

However, should the investor sentiment shift and selling pressure increase, BINANCE:XRPUSDT could face a decline. If the price falls below $3.00, it could slide to $2.96 or lower , invalidating the bullish thesis.

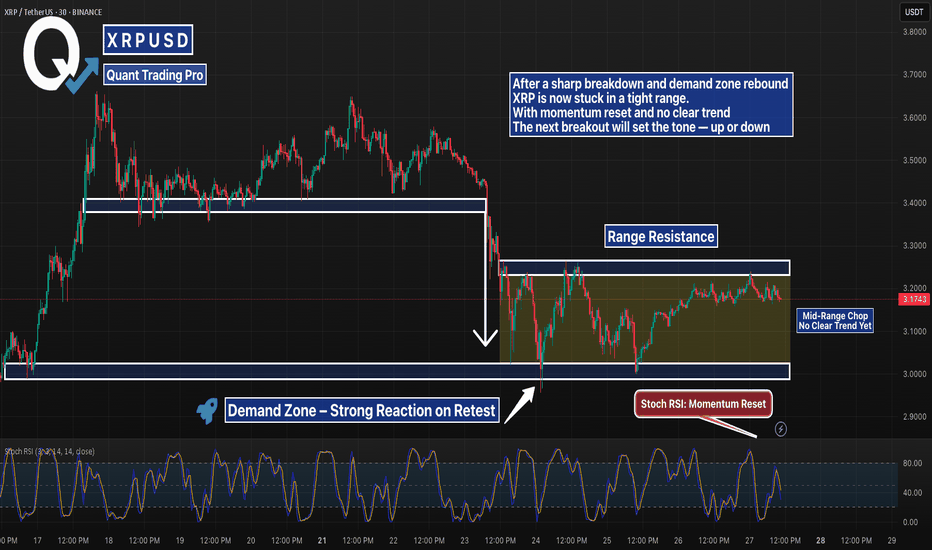

XRP Range-Bound After Breakdown — Compression Before Expansion?XRPUSDT 30m chart paints a neutral picture after a strong rejection from mid-range support last week. Price flushed into the $3.03 demand zone and bounced hard — but has since stalled and formed a tight sideways range between $3.03 and $3.25.

Momentum has reset (Stoch RSI near midline), and the market is clearly undecided. Structure currently favors neither bulls nor bears — and volume is thinning. Traders watching for a breakout from this compression box may catch the next directional move.

Key zones:

$3.25 = Range resistance

$3.03 = Demand zone

Mid-range chop = No-man’s land — best to wait for confirmation

Neutral bias until range breaks.

XRPThe primary regulatory catalyst boosting XRP's bullish outlook in 2025 is the resolution of Ripple Labs' long-standing lawsuit with the U.S. Securities and Exchange Commission (SEC). In March 2025, Ripple settled the case by agreeing to pay a $50 million fine, and crucially, it was clarified that XRP is not considered a security in the context of secondary market sales. This settlement removed years of significant regulatory uncertainty that had suppressed XRP's price and led exchanges to delist XRP. Following this resolution, major U.S. exchanges reinstated XRP trading, and institutional confidence in XRP surged, unlocking large-scale adoption and market participation by regulated investors.

Another key regulatory development providing bullish momentum is the passage of the GENIUS Act in the U.S. House of Representatives, approved around mid-July 2025. This legislation establishes a clearer federal framework for stablecoins and digital assets like Ripple's RLUSD stablecoin, further reducing regulatory risks and positioning XRP for broader mainstream utility and adoption.

In summary, the decisive legal settlement with the SEC and U.S. legislative progress (notably the GENIUS Act) have greatly clarified XRP's regulatory status, providing a green light for institutional entry through regulated channels such as exchange-traded funds (ETFs). The proliferation of XRP ETFs—including the approved ProShares XRP Futures ETF—amplifies this effect, enabling easier institutional and retail investment and fueling bullish price momentum

XRP Real-Life Use Cases in Finance

XRP REAL LIFE APPLICATION IN THE ECOSYSTEM.

1. Cross-Border Payments

XRP’s core financial use case is to act as a bridge for cross-border payments.

Traditional international money transfers often take days and involve high fees due to intermediary banks (the SWIFT system).

With XRP, financial institutions can instantly convert and transfer value across borders. Typical settlement times are 3–5 seconds, with transaction costs usually less than a cent.

Numerous global banks and remittance providers have adopted XRP and the RippleNet system to cut costs and provide real-time international payment services.

2. On-Demand Liquidity (ODL) & Liquidity Bridging

Banks and payment providers use XRP to manage liquidity.

With XRP as a bridge currency, financial institutions do not need to pre-fund nostro accounts in multiple countries. Instead, they can source liquidity ‘on demand’ using XRP, freeing capital and reducing operational costs.

On-demand liquidity flow improves cash efficiency and speeds settlements between a wide variety of global fiat currencies.

3. Micropayments

Due to low fees and fast settlement, XRP is suitable for micropayments.

This enables new use cases in digital content (e.g., pay-per-article, tipping creators) and gaming, where sending tiny amounts is otherwise unfeasible.

Such micropayment abilities open the door to innovative business models in finance and online services.

4. Tokenization and DeFi

The XRP Ledger supports tokenization of financial assets and decentralized finance (DeFi) use cases.

Financial firms can issue stablecoins or tokenized assets (including stocks, bonds, or other real-world assets) on-chain, fostering new kinds of investment products, automated trading, and settlement.

XRP’s ledger powers “sector-based index funds,” asset baskets, and other financial instruments, expanding real-world utility within decentralized finance.

5. Remittances

Remittance companies use XRP to offer faster and cheaper international transfers.

This is particularly valuable for migrant workers sending money home, reducing transaction times from days to seconds and cutting fees, thereby increasing the amount recipients receive.

6. Banking and Trade Finance

Some banks and trade finance platforms use XRP to improve operational efficiency.

By digitizing trade documentation and facilitating instant payments, XRP is helping modernize the traditionally slow and paperwork-heavy trade finance sector.

7. Collateral & Trading

XRP can be used as collateral in digital asset trading and arbitrage.

Traders and financial institutions leverage XRP for high-speed transfers between exchanges, using its liquidity to seize arbitrage opportunities and service margin calls rapidly.

Countries adopting XRP for real-life payments, especially cross-border transactions, include several key nations across Asia, the Middle East, and beyond. Here are some notable examples of countries actively integrating XRP into their financial systems and payment infrastructures as of 2025:

Japan: A pioneer in cryptocurrency adoption, Japan has multiple banks partnered with Ripple using XRP to streamline cross-border payments. The Bank of Japan and major institutions like SBI Holdings support XRP integration to provide faster, lower-cost international transactions across Asian markets.

United Arab Emirates (UAE): The UAE is proactively integrating blockchain technology, including XRP, with banks such as Zand Bank and fintech firms using Ripple’s platform for faster cross-border payments. Dubai’s financial initiatives leverage XRP to boost transaction efficiency within and beyond the region.

South Korea: Known for its vibrant tech ecosystem and supportive crypto regulations, South Korea has seen local banks experimenting with XRP to reduce international payment costs and increase speed, making it part of the broader fintech innovation landscape.

Mexico: Financial institutions in Mexico use XRP to improve remittances, especially those coming from the U.S., reducing processing time and fees significantly.

India: Given its large remittance market and fintech growth, India is exploring the use of XRP to address the need for low-cost, quick international payments.

Singapore: XRP adoption is growing here, with increasing numbers of users and integration of Ripple’s stablecoin RLUSD into payments.

United States: Some American banks and financial institutions are starting to integrate XRP for international payments, signaling growing institutional interest.

Canada: Banks like Canadian Imperial Bank of Commerce (CIBC) and remittance services use Ripple technology, including XRP, to enable faster cross-border money transfers.

Brazil: Various financial players collaborate with Ripple to modernize the country’s payment infrastructure using XRP.

United Kingdom: Institutions and fintech firms in the UK leverage Ripple’s technology for faster, cheaper international transactions.

Thailand and Sweden: Banks in these countries are partnering with Ripple to enhance their cross-border payment capabilities by leveraging XRP.

Egypt: Major banks are collaborating with Ripple to improve payment efficiency, including through XRP-based solutions.

In essence:

XRP directly addresses major friction points in global finance by cutting costs, increasing speed, and providing new ways for banks, companies, and individuals to move and manage money—all with increasing real-world adoption in cross-border payments, liquidity management, and digital asset innovation.

#XRP Update #3 – July 18, 2025#XRP Update #3 – July 18, 2025

XRP has surged roughly 28% in its latest impulsive move. Naturally, we now expect a correction phase. Potential retracement levels are:

Level 1: $3.30

Level 2: $3.20

Level 3: $3.10

Pullbacks to any of these levels should not be alarming — they are typical and healthy corrections.

I plan to go Long if XRP bounces from the first correction zone. However, at the moment, I’m just observing, as the current signals are not strong enough to justify entry.

It’s also important to note that there are heavy whale sell orders between XRP’s current price and the $4.00 zone. Breaking through this resistance will likely require strong buy-side volume from large players. Caution is advised.

XRPUSDT - Analysis for Immediate Long Entry1. Chart Analysis

First, let's confirm the technical setup on the daily chart.

The chart shows a powerful rally in July, peaking around $3.60. The price then entered a retracement phase, pulling back as expected.

It has now dropped to the $3.15 - $3.20 zone. As we identified, this level is critical. It was the peak of the rally in early March 2025. The price is currently testing this old resistance level, and we are looking for it to act as new support. The most recent daily candle is green and appears to be bouncing right off this level. This is a textbook "support and retracement" setup, making it a prime candidate for an immediate long market entry.

2. Sentiment and Fundamental Analysis

Now, let's see if the news supports our bullish technical outlook.

"Nasdaq Firm Files $50M Plan to Integrate XRP into Core Operations" (13 hours ago) & "Nasdaq-Listed Firm Bets on XRP for Payments, Treasury in SEC Filing" (2 hours ago): This is highly significant and bullish news. A publicly-traded company integrating XRP into its core operations and treasury with a $50M plan is a massive vote of confidence. It signals real-world adoption and institutional interest, which are powerful drivers for price.

"Wellgistics Taps XRP for Payments, Collateral, and Income Plans" (22 hours ago): Another concrete example of real-world utility. A logistics company using XRP for payments and collateral reinforces the core use case for the token. This is fundamentally bullish.

"XRP Golden Cross Confirmed: Could This Be the Spark for a Major Breakout?" (24 hours ago): A "Golden Cross" (when a short-term moving average crosses above a long-term one) is a classic technical buy signal that many traders follow. While it's a lagging indicator, news articles highlighting it can create bullish sentiment and attract more buyers.

"Ripple CEO Exposes DeFi Power Move as 35M XRP Suddenly Changes Hands" (17 hours ago): This headline is slightly ambiguous but points to significant on-chain activity and strategic moves by Ripple's leadership in the DeFi space. Large token movements often precede significant price action and suggest strategic positioning, which in this context, appears bullish.

Overall Sentiment: The sentiment is overwhelmingly bullish. The news is not just hype; it's focused on concrete, fundamental developments like institutional adoption (Nasdaq firm, Wellgistics) and treasury integration. This aligns perfectly with our bullish technical setup.

Decision:

Proceed with the long trade. The technicals and fundamentals are in strong alignment.

The Trade Plan: XRPUSDT (Long)

The plan is set. We're entering a long position with a market entry now, around $3.18.

Entry Reason: Entering a long position as the price retraces to a key historical resistance level ($3.15-$3.20) that is now acting as support. The entry is confirmed by a bounce on the daily chart and overwhelmingly positive news about institutional adoption and real-world utility.

Stop Loss (SL): $2.85

Reason: This level is safely below the current support zone and below the recent swing low of the pullback. A break below $2.90 would invalidate the "resistance-turned-support" thesis. Placing the SL at $2.85 gives the trade room to fluctuate without stopping us out prematurely.

Take Profit 1 (TP1): $3.65 (Moonbag Target)

Reason: This target is just above the most recent high. A move to this level would confirm the uptrend has resumed. It's a logical place to take initial profits as there may be some sellers at the previous peak.

Action: At TP1, we take some profit and move the trailing stop to our entry price (~$3.18) to make the remainder of the trade risk-free.

Take Profit 2 (TP2): $4.20

Reason: This is a key psychological level and corresponds to a standard Fibonacci extension target (1.272 extension) projected from the previous major swing. It represents a logical next stop for the rally.

Action: When TP2 is hit, move the trailing stop up to the TP1 level ($3.65) to lock in profits.

Take Profit 3 (TP3): $4.85

Reason: This level aligns with the 1.618 Fibonacci extension, a very common target in strong trends, and is approaching the major psychological number of $5.00.

Action: When TP3 is hit, move the trailing stop up to the TP2 level ($4.20).

Take Profit 4 (TP4): $5.50 (Final Target)

Reason: This is our optimistic final target. It represents a significant psychological milestone and a potential area for a major trend peak.

Action: Close all remaining positions.

Conclusion:

The XRPUSDT long trade is a high-quality setup where both technical and fundamental factors are aligned. The risk is well-defined, and the profit targets offer a strong reward potential. The plan is now in place.

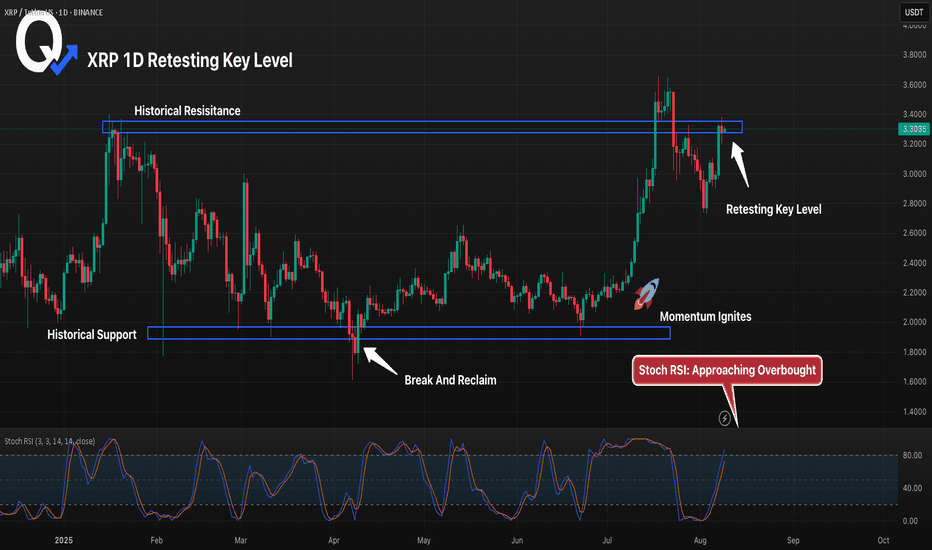

XRP 1D Retesting Key Level, Will Bulls Hold Above Historical ResXRP has broken and reclaimed a major historical support before rallying to retest the multi-year resistance near 3.30. Price is now pulling back into this zone, which will determine whether the breakout holds or fails. A successful retest could launch a push toward the July highs, while rejection here risks a drop back toward 3.07. Stoch RSI is nearing overbought, making this level even more critical for direction.

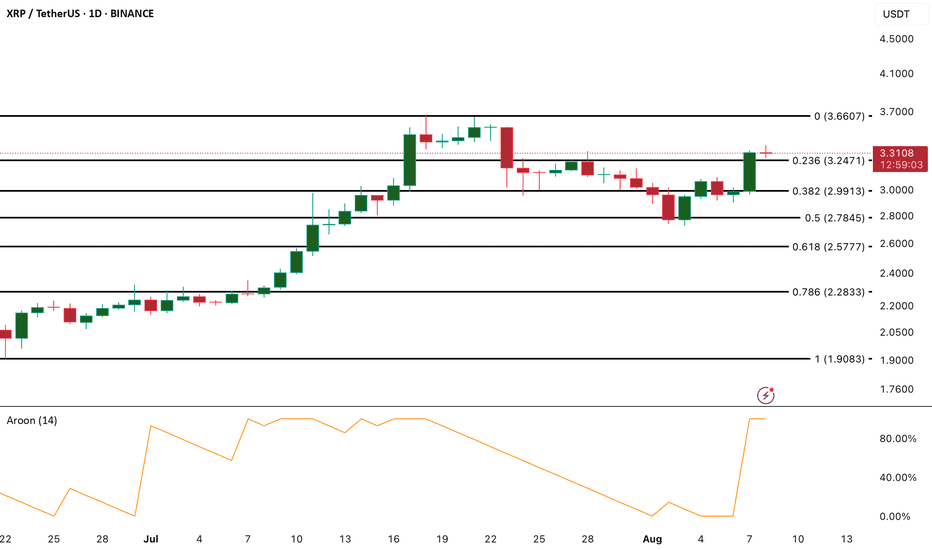

XRP Bulls Take Charge as Aroon Up Hits 100%On the daily chart, XRP’s bullish momentum is reinforced by its Aroon Up Line, which currently sits at a perfect 100%. This reading signals that the token’s recent rally is strong and supported by notable buy-side pressure.

The Aroon indicator tracks how recently an asset has set a new high or low, offering insight into trend strength and potential continuation.

With the Aroon Up holding at this peak level, XRP has recently reached a 17-day high and appears poised for further gains. Such a reading typically suggests that bullish momentum is firmly in control, increasing the likelihood of a sustained upward move in the sessions ahead.

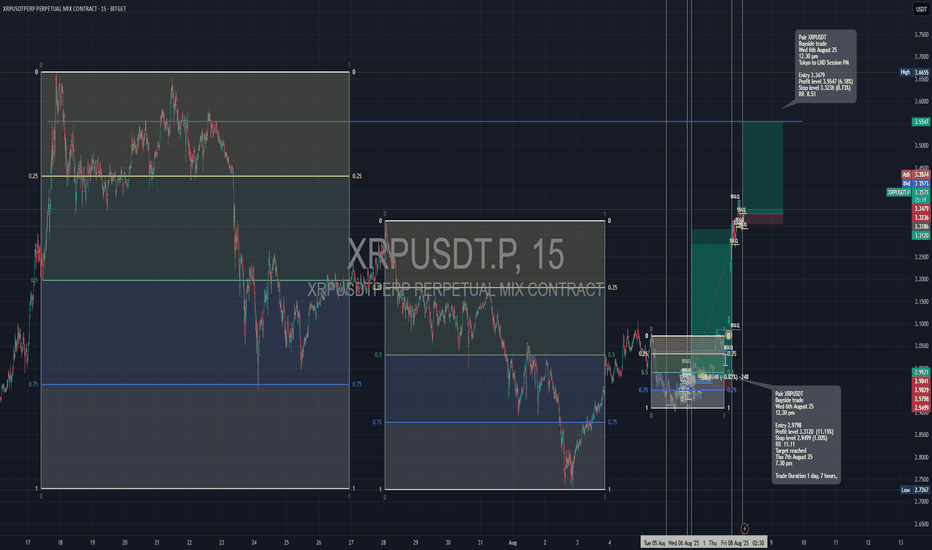

Long trade

Trade Journal Entry – XRPUSDT

Direction: Buyside trade

Date: Wednesday, 6th August 2025

Time: 12:30 PM (Tokyo to London Session PM)

Timeframe: 15-Min TF Entry

📊 Trade Details

Entry Price: 3.3479

Profit Target: 3.5547 (+6.18%)

Stop Loss: 3.3236 (−0.73%)

Risk-Reward Ratio: 8.51: 1

🧠 Context / Technical Notes

Price action shows a bullish structure following prior range accumulation.

Multiple higher timeframe fib ranges marked; entry taken within premium/discount zones. Current price reacting from a demand zone with liquidity sweep seen in the lower timeframe.

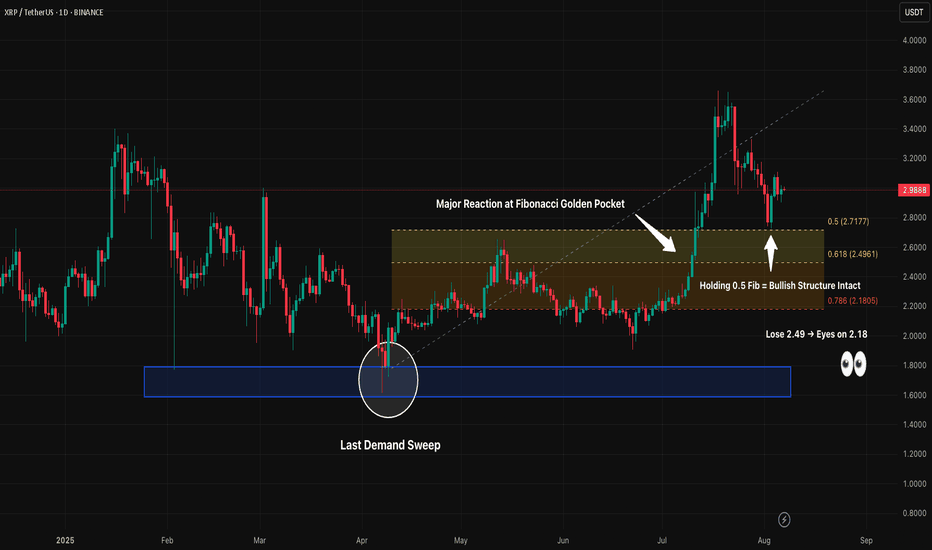

XRP 1D – Golden Pocket Bounce HoldingXRP just tapped the golden pocket zone (0.618 Fib) and bounced — and so far, the structure is holding like a champ.

The wick into demand back in March kicked off a full-blown rally, and now we’re seeing price respect that same move with a textbook Fibonacci retrace. This is where strong trends often reload.

If bulls hold the 0.5–0.618 range (2.71–2.49), this could be round two of the pump. A clean higher low is already in — now it's all about reclaiming momentum.

But if 2.49 breaks, we’re eyeing 2.18 fast.

🔥 What’s on the table:

– Golden Pocket = Bullish launch zone

– 0.5 Fib = Current support

– 0.618 Fib = Line in the sand

– 0.786 Fib = Trapdoor if we break down

– 3.6 = Target on reclaim

This is where serious moves begin. Don’t sleep

XRP Price Struggles as Key Holders’ Outflows Hit 7-Month HighBINANCE:XRPUSDT is currently priced at $2.99 , sitting just below the $2.95 resistance. The bearish market sentiment and outflows are evident, making it difficult for the altcoin to break through this resistance. A continuation of the current trend may lead to further downward pressure on the price.

BINANCE:XRPUSDT longer-term outlook is also influenced by its HODLer net position change, which has reached a seven-month low . The LTHs, who have a significant impact on the price of XRP, are seeing their positions decrease

BINANCE:XRPUSDT is likely to test the support of $2.65 in the coming days, unless investors shift their sentiment. If this support level fails to hold, XRP may experience further losses, putting additional strain on the altcoin and its investors.

To recover, BINANCE:XRPUSDT will need to reclaim $2.95 as support and break through the $3.00 mark . A successful breach of these levels could pave the way for a move towards $3.41, ultimately invalidating the current bearish outlook and offering hope for a potential recovery.